Refine Your Search

- Aerospace 794

- Automotive 97564

- Commercial Vehicle 1648

- Govt/Defense 27

- Technical Paper / Journal Article 97564

Search Results

Modelling charging infrastructure in v2g scenario, definition of a rule-based energy management controller for the simulation of a plug-in hybrid vehicle using power and on-board measured data, a methodology to develop and validate a 75-kwh battery pack model with its cooling system under a real driving cycle., fuel cell fault simulation and detection for on board diagnostics using real-time digital twins, the influence of design operating conditions on engine coolant pump absorption in real driving scenarios., development of a soft-actor critic reinforcement learning algorithm for the energy management of a hybrid electric vehicle, design of a decentralized control strategy for cacc systems accounting for uncertainties, exploring methanol and naphtha as alternative fuels for a hybrid-ice battery-driven light-duty vehicle, automotive body coating annoying noise analysis and preventive approach based on maxwell viscoelastic model, study on the sound design of a sporty vehicle, comparing the nvh behaviour of an innovative steel-wood hybrid battery housing design to an all aluminium design, simulation and test methods on nvh performance of axle system, frequency response analysis of fully trimmed models using compressed reduced impedance matrix methodology, active vibration control of road noise path using piezoelectric stack actuators and filtered-x lms algorithm for electric vehicle applications, acoustic vs reliability. case study of automotive components undergoing vibration endurance tests, roadnoise reduction through component-tpa with test and simulation convergence using blocked force, tire noise synthesis from test stand measurements and cae full vehicle models, trim-structure interface modelling and simulation approaches for fem applications, efficient engine encapsulation strategy using poroelastic finite element simulation, coupled boundary element and poro-elastic element simulation approach to designing effective acoustic encapsulation for vehicle components.

- Original Article

- Open access

- Published: 30 December 2020

Sustainability in the automotive industry, importance of and impact on automobile interior – insights from an empirical survey

- Wanja Wellbrock 1 ,

- Daniela Ludin 1 ,

- Linda Röhrle 1 &

- Wolfgang Gerstlberger 2

International Journal of Corporate Social Responsibility volume 5 , Article number: 10 ( 2020 ) Cite this article

74k Accesses

11 Citations

32 Altmetric

Metrics details

Sustainability is currently one of the main issues in all media and in society as a whole and is increasingly discussed in science from different sides and areas. Especially for the automotive industry, sustainability becomes more and more important due to corporate scandals in the past and topics such as electric motors, lightweight construction and CO2 emission reduction are key issues. Although the focus is primarily on other components, the interior cannot be neglected either in terms of sustainability. Interior is the most frequently seen part of the car by the driver. Therefore, e.g. the use of natural fibres especially for premium brands can only be considered in connection with highest standards regarding practical and aesthetical aspects. Consequently, the following research question arises: How do the three pillars of sustainability (economical, ecological and social issues) influence interior development at premium brand manufacturers and how do customers accept sustainable solutions? The focus of the paper is exclusively on premium brands due to the higher spread of sustainability effects compared to volume brands. A quantitative study is carried out to determine the expectations on the customer side regarding more sustainability in the automotive industry in general and in the interior sector in particular and to derive corresponding challenges and potentials for original equipment manufacturers.

Introduction

Sustainability is regarded as the keyword of the twenty-first century and the importance of the topic is not yet sufficiently widespread (Mittelstaedt, Shultz II, Kilbourne, & Peterson, 2014 ). The associated topic of resource conservation, which has been important since the eighteenth century, is now more relevant than ever. Above all, the automotive industry, which is the most important branch of industry in terms of turnover and the growth engine for Germany, has to deal more intensively with sustainable development and the associated effects and challenges. Automotive manufacturers are under pressure to comply with both political guidelines and internal specifications, as well as with constantly changing individual customer wishes (Thun & Hoenig, 2011 ; Wallentowitz & Leyers, 2014 ).

For the automotive industry, topics such as electric motors and the associated optimization areas, lightweight construction and CO 2 emission reduction are key issues. Nevertheless, the car’s interior cannot be ignored. After all, the interior is the part of a car most frequently seen by the driver and must therefore be practical, aesthetically pleasing and at the same time weight saving. The use of natural fibres as alternative materials in the interior plays an important role and is a further step towards greater sustainability (Pischinger & Seiffert, 2016 ).

Consequently, the following central research question arises: How is the new development of the interior by premium brand manufacturers influenced by the three pillars of sustainability (economical, ecological and social issues) and what are the challenges for original equipment manufacturers (OEMs) and suppliers? The contribution focuses exclusively on the German premium manufacturers Audi, BMW, Mercedes-Benz and Porsche, since sustainability at these companies is already more integrated into the manufacturing process.

Based on a literature review on sustainability in the automotive industry, previous efforts to increase sustainability in the interior sector will be elaborated on. Subsequently, an empirical study is used to determine the expectations on the customer side regarding more sustainability in the automotive industry in general and in the interior sector in particular and to derive corresponding challenges and potentials for OEMs and suppliers.

Sustainability in the automotive industry

Long-term success in the automotive industry is primarily achieved through consistent innovation strategies, strong branding, global efficiency in the value chain and qualified and motivated employees. Research and development can be argued as the key to long-term success - after all, no other industry invests more than the automotive industry in this area. Currently, the automotive industry is arguably witnessing the greatest phase of upheaval in its history. Mega trends such as emission reduction, lightweight construction, automated driving, connectivity and mobility services have changed the landscape for good. In line with these trends, the supplier industry is also adapting and undergoing fundamental changes (Dannenberg, 2017 ; Koers, 2014 ; Pischinger & Seiffert, 2016 ).

The topic of sustainability in the automotive industry is also gaining more momentum in the scientific community. Nunes and Bennett, for example, carry out a fundamental comparison of environmental initiatives of automobile manufacturers, conclude that these are often still very vague, and require further concretization. Another criticism is that the focus is primarily on the ecological dimension (Nunes & Benett, 2010 ). Azevedo et al. develop a theoretical framework for analysing the influence of green and lean SCM practices on the sustainable development of automobile manufacturers. Ecological (e.g. CO 2 emissions), social (e.g. supplier screening) and economic (e.g. operating costs) aspects are considered as performance indicators (Avezedo, Carvaho, Duarte, & Cruz-Machado, 2012 ). Azevedo and Barros complement this with an analysis of a sustainable business model for the automotive industry that integrates all three dimensions of sustainability. This contribution also shows that there has been a clear improvement in sustainability performance in the automotive supply chain over the last decade (Avezedo & Barros, 2017 ). Sinha et al. emphasize that sustainability management in the automotive industry is only possible through a holistic process approach starting with the conception and continuing right up to the series production of the product. In addition to these rather conceptual contributions, several authors consider concrete materials about their sustainability potential for the automotive industry (Sinha et al., 2015 ). Kumar and Das consider, for example, the suitability of bio composites especially in the field of dashboards (Kumar & Das, 2016 ), whereas Dunne et al. focus primarily on the suitability of natural fibres (Dunne, Desai, Sadiku, & Jayaramudu, 2016 ). Hetterich et al. consider the specific attitude of motorists towards sustainable materials in the interior sector. The focus here is on the willingness of customers to actually pay more for renewable raw materials (Hetterich, Bonnemeier, Pritzke, & Georgiadis, 2012 ).

In sum, the issue of sustainability in the automotive industry may well be gathering momentum and scientific focus, but the interior design sector in particular has been largely neglected. A few papers focus on the topic of sustainable interior, but mostly with a strict technological view (e.g. Bergenwall, Chen, & White, 2012 ; Jasiński, James, & Kerry, 2016 ; Mayyas, Qattawi, Omar, & Shan, 2012 ; Mcauley, 2003 ; Sopher, 2008 ; You, Ryu, Oh, Yun, & Kim, 2006 ). Some others analyse the potential of sustainability as a customer requirement, but misses the focus on automotive interior (e.g. Biju, Shalij, & Prabhushankar, 2015 ; Hetterich et al., 2012 ; Moisescu, 2018 ; Panuju, Ambarwati, & Susila, 2020 ). The article attempts to close this gap.

Sustainability in the interior of automobiles

The widespread innovation efforts in the field of electric mobility and autonomous driving also offer the potential to rethink and redesign the car’s interior. The vehicle interior has to be transformed into an increasingly attractive living space. This can be achieved, for example, through attractive surfaces made of sustainable materials. The interior plays an increasingly important role in purchasing decisions. It arouses emotions, offers comfort, safety and functionality and radiates brand identity as a fusion (Laukart & Vorberg, 2016 ; Pein, Laukart, Feldmann, & Krause, 2006 ).

The interior of a vehicle can be divided into six assemblies: the cockpit, the seats, the door and side trim, the headliner, the luggage compartment and the floor trim. The developments in this area is a balancing act between the pressure to innovate and the need to keep costs down. (Dölle, 2013 ).

Characteristics of natural fibre materials

Already in 2005, more than 30,000 tons of natural fibres were used in the automotive industry in Europe (Sullins, 2013 ). In 2015, the figure was already 50,000 tons, of which ten to 20% were European hemp fibres. Hemp belongs to the category of baste fibres, which are most frequently used in automotive components. Hemp, kenaf and flax are suitable alternatives to glass fibres because they are less expensive, have a lower density, a high strength and are more environmentally friendly. The use of natural fibres can result in cost savings of ten to 30% compared to glass fibers. Due to its strength, it can be used as a reinforcement for vehicle interior parts such as door panels. In addition, kenaf, which is cultivated mainly in China and Thailand, has one of the best CO 2 absorption rates in the plant world (Adekomaya, Jamiru, & Sadiku, 2016 ; Dunne et al., 2016 ; Suddell, 2008 ; Sullins, 2013 ; Verma, Gope, & Shandilya, 2012 ).

Another advantage is that the natural fibre-reinforced plastic does not splinter and can break without creating sharp edges. Its low weight and high load-bearing capacity are an advantage for lightweight construction and safety requirements and have a positive influence on crash management. Due to the positive cost performance ratio and the other advantages described, composite materials based on natural fibres have been used for several years for thermoplastics, thermosets and elastomers in automotive interiors. Well-known examples of this are doors made of flax or sisal fibres and polymeric binders such as polypropylene (thermoplastic) or polyurethane (Bjurenstedt & Lärneklint, 2004 ; Hull & Clyne, 1996 ; Laukart & Vorberg, 2016 ).

When selecting alternative materials, great care should be taken. For one, fibres from natural sources are not always more environmentally friendly than conventional fibres. Large amounts of water, pesticides, chemicals and energy are needed to prepare and dye the fabric during cotton degradation and processing. In addition, natural fibre reinforced plastics are neither as strong nor durable as metal or synthetic fibres, so they need to be replaced more frequently, resulting in increased energy consumption in the long term.

Whereas natural fibres were previously concealed behind a thick film lamination, they are now becoming more and more visually perceptible and are increasingly finding their way into the premium interior as a design element. At the same time, suppliers and vehicle manufacturers are in equal demand to conduct even more intensive research in the field of natural fibre-reinforced plastics and to bring technologies to series maturity that make it possible to further increase the proportion of natural fibres in vehicle interiors (Dunne et al., 2016 ).

Sustainability measures in the interior

The new hybrid materials and vehicle concepts pose a challenge for manufacturers and suppliers. The lightweight construction required for this should continue to offer the best surfaces in the interior since the appearance conveys a direct impression of quality, which is especially important for premium brands (Dunne et al., 2016 ; Hassan, Zulkifli, Ghazali, & Azhari, 2017 ; Karus & Kaup, 2002 ; Puglia, Biagiotti, & Kenny, 2005 ). Therefore, corresponding solutions with bio-composite materials are of great importance, as, for example, the supplier Dräxlmaier shows with his Kenaf door trim for the BMW i3 electric vehicle. The component is made exclusively of natural fibre-reinforced polypropylene with functional elements (Bröker & Ostner, 2017 ; Gelowicz, Günnel, Hammer, & Otto, 2017 ).

The use of natural fibre materials as a design element that underlines the sustainable character of a vehicle was not an option until now. They had not previously met the requirements of OEMs for a high-quality appearance and the technical process conditions of the manufacturers made it difficult to use the materials. After a long development period, the supplier Dräxlmaier and the manufacturer BMW have now joined forces to bring the innovation of visible natural fibres in the interior to series maturity. Requirements for design elements and weight reduction have been met and, at the same time, the materials are ecologically compatible. The “Fast Fibre Forming” developed by Dräxlmaier makes it possible to implement the “Visible Nature”. Panels are made of kenaf fibres and coated with a wafer-thin transparent plastic film. The purity of the plant material used ensures a particularly high-quality surface appearance compared to other natural raw material sources such as hemp or flax (Bröker & Ostner, 2017 ).

In the BMW i3, the visible door beams and the instrument panel cover are also made of the fibres of the tropical mallow plant Kenaf. The reasons for the selection are that Kenaf has a high degree of fineness and purity of the fibres compared to flax and hemp, which is essential for a high-quality surface. This is an elementary prerequisite because the design philosophy of BMW i vehicles combines a consistent focus on sustainability, which becomes visible and tangible in the interior, with simultaneous fulfilment of the OEM’s premium claim (Schmiedel, Barfuss, Nickel, & Pfeufer, 2014 ).

A further example is presented by Johnson Controls for the new BMW 3 Series with wood fibre components that not only relieve the burden on the environment but also reduce weight by 20% compared to solutions previously used (Focus, 2012 ).

The use of renewable and natural raw materials as a sustainable alternative to plastics is in direct harmony with the needs of the young generation. Yanfeng Automotive Interiors, for example, deliberately presents the recyclable, artistically designed natural fibre middle parts of the door panel in a natural look. According to Han Hendriks, Chief Technology Officer at Yanfeng, there is currently a shift towards more personalisation and individualisation. Drivers want to be sustainable and at the same time be safe and in touch with the spirit of the times (Yanfeng, 2017 ).

The supplier International Automotive Components (IAC) optimizes component designs for OEMs. A new product is the “Fibre Frame” technology. The natural fibre semi-finished product “EcoMatHot” replaces the classic material sheet steel in the mounting frame of the vehicle roof lining with panoramic or sliding roofs. The material consists of 70% renewable raw materials. A weight reduction of up to 50% is possible (Industrie, 2017 ).

In the future, it is expected that the use of renewable raw materials and recycled materials will continue to gain in importance. Visible components made of renewable materials will be found more frequently in the interior of the cars of tomorrow. In this context, the natural materials must be designed haptically and optically so that they can no longer appear only in laminated or mixed form with plastics (Focus, 2012 ).

Empirical study on customer expectations regarding sustainability aspects in interior design of cars

Based on the information from the previous chapters an empirical large-volume study is conducted to investigate the expectations and potentials that customers see in sustainability elements, particularly in the interior sector. The empirical survey focuses exclusively on customers of premium brands (Audi, BWM, Mercedes-Benz and Porsche), since sustainability measures are already more widespread in this area and customers have even higher expectations with regard to design and equipment (Skala-Gast, 2012 ).

Structure of the empirical study

The empirical study is based on an online survey with purposively selected persons from the Heilbronn University of Applied Sciences, the University of Stuttgart and the company Valeo Schalter und Sensoren in Bietigheim-Bissingen. The survey was conducted via Survey monkey. All persons with a minimum age of 18 years were contacted through the official university or company mailing lists and send on to the questionnaire’s homepage. Therefore, the participants were mainly students and employees of the above mentioned Universities and companies. The age limit has been set the minimum age to drive a car in Germany. One hundred forty-one participants fulfilled the desired characteristics, which can be divided in 100 male and 41 female test persons. With regard to premium brands, Audi and Mercedes-Benz each dominated with 34%, BMW followed with 25% and Porsche with almost 7 % of the participants.

The questionnaire consists of 23 questions developed by the authors, divided into three sections: “general sustainability”, “specific sustainability in the automotive industry and the interior” and “future expectations”.

Empirical results

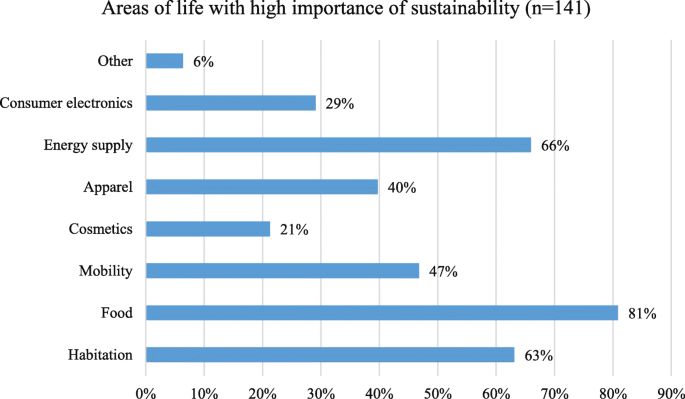

The participants of the study recognize the fundamental importance of sustainability. With the exception of two persons, all respondents attach fundamental importance to sustainability in different areas of life. For 81% the focus is on nutrition, followed by energy supply (66%) and living (63%). The area of mobility follows a little behind with 47% (see Fig. 1 ). This shows that a fundamental need for sustainability exists, but mobility is not the most important area.

Areas of life with high importance of sustainability. Source: Own illustration

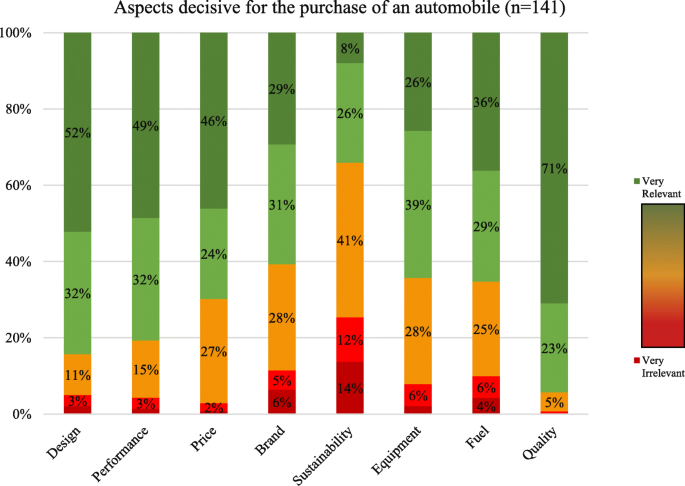

Regarding the question of which factors are decisive when buying a car, quality, price, performance and design are on the first ranks. Sustainability plays an important or even very important role for only 34% of the respondents, which is the lowest value of all factors (see Fig. 2 ). This result shows that sustainability is discussed regularly in the automotive industry, but at the same time, it has only a limited influence on customers’ purchasing decisions, especially in the premium segment.

Aspects decisive for the purchase of a passenger car. Source: Own illustration

The willingness to accept additional costs for sustainable materials in the car is also very indifferent. Almost half of the respondents (47.5%) are not prepared to accept higher costs for sustainability aspects in the car. This is quite a high number and shows the problem of automotive manufacturers to transfer additional costs to the customers.

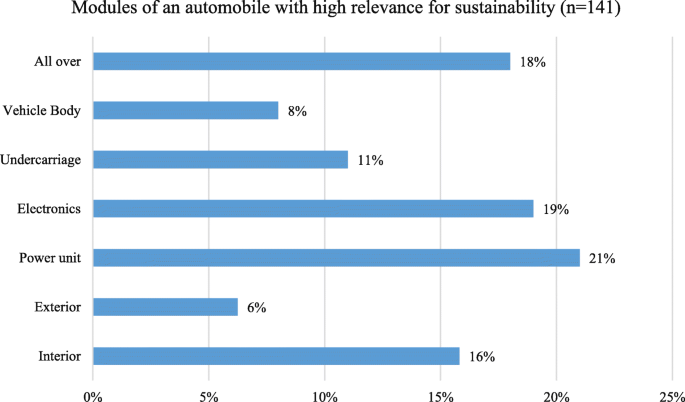

Looking at the single modules of an automobile, power unit (41%) and electronics (38%) receive the highest relevance for sustainability from the customer’s point of view. For almost 35%, sustainability is important in all areas of the automobile, whereas 30% highlight especially the interior sector (see Fig. 3 ). This result demonstrates that although the customer focuses on the sustainability of the interior, at first glance the drive system and electronics in particular have a higher sustainability potential from the customer’s point of view. The further investigations now relate exclusively to the interior.

Modules of an automobile with high relevance for sustainability. Source: Own illustration

A majority of 74% of the respondents agree that the OEM should place more emphasis on the selection of sustainable and natural materials in the interior. Only 7 % reject this, which represents a clear message to the OEM.

In order to control the customers’ design perception of natural materials in the interior, a picture of an untreated door panel was shown to the participants (see Fig. 4 ). The reaction to whether the test persons could imagine this in their automobile was very positive. 71% of the respondents could imagine such a door, if properties as haptics, appearance and economy are retained. Only 9 % of the respondents could not imagine such a door.

Untreated door panel with natural materials. Source: Dräxlmaier, 2018

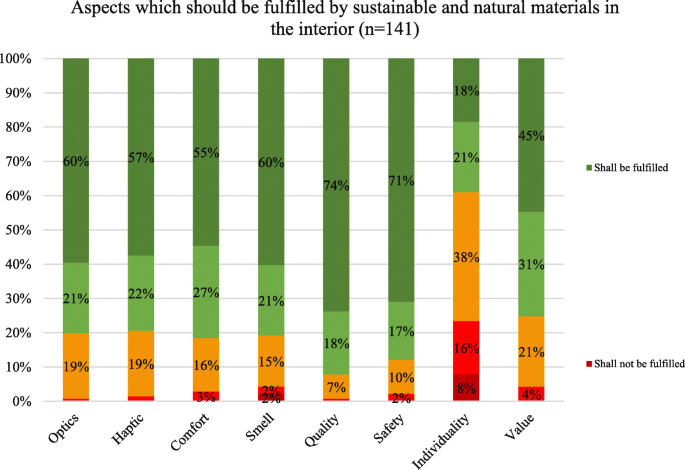

Looking at additional aspects, which should be fulfilled by sustainable and natural materials in the interior, quality (74%) and safety (71%) receive the highest percentages, followed by smell and optics (60%), haptics (57%) and comfort (55%). At the end of the scale, individuality only receives 18%, which is surprisingly low compared to the wide variety of variants in the automotive industry (see Fig. 5 ).

Aspects that should be fulfilled by sustainable and natural materials in the interior. Source: Own illustration

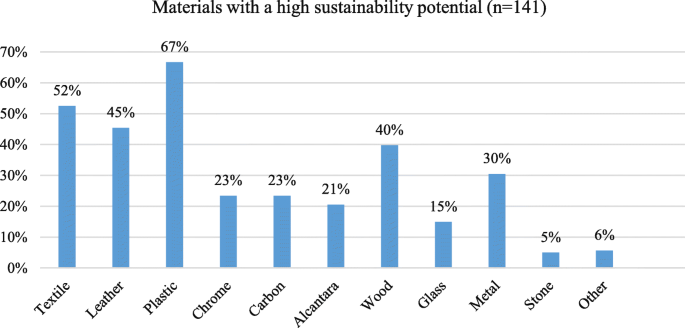

Looking at the individual types of material, it turns out that customers would like to see more sustainable implementations in the interior, particularly for plastics (67%), textiles (52%), leather (45%) and wood (40%) (see Fig. 6 ). Especially for the first three materials, sustainable solutions are already available, as described in the previous chapter.

Materials with a high sustainability potential. Source: Own illustration

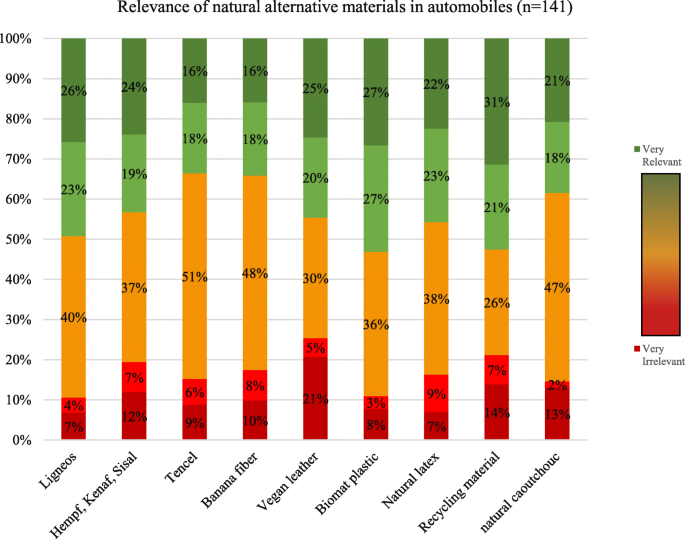

Regarding the variety of natural alternative materials, biomat-plastic (54%) and recycled material (52%) receive the highest percentages of people evaluating it as relevant or even very relevant for the interior sector. Overall, all known alternative materials such as ligneous, hemp, kenaf or sisal are well accepted by customers and the percentages for irrelevance are usually much lower for all materials (see Fig. 7 ).

Relevance of natural alternative materials in automobiles. Source: Own illustration

As an optional question, the participants were asked to decide which material they prefer for which interior component. The blue words are the result of the majority customer decision (see Fig. 8 ). The results show that the materials selected for the centre console, door trim and decorative elements are already sustainable. Other natural materials such as recycled material or natural rubber also achieve a high level of approval for individual interior components, although they do not yet represent a majority opinion.

Interior components with corresponding materials. Source: Barnes-Clay, 2012

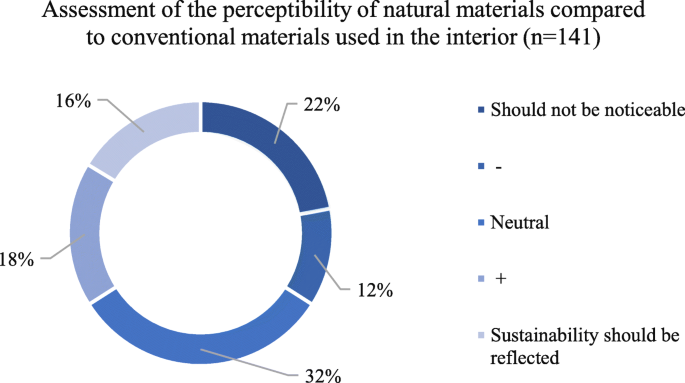

The question whether natural materials should be more noticeable in interior design compared to conventional materials also produced a mixed response. 34% of all participants highlight that natural materials should be noticeable, whereas the same percentage disagree with this statement (see Fig. 9 ). Therefore, a meaningful picture cannot be derived.

Assessment of the perceptibility of natural materials in the interior. Source: Own illustration

The participants also answered the question whether the usage of natural materials in the interior is a long-term mega trend or only a short-term fashion trend. Only 51% of the respondents assume it a long-term mega trend, whereas the other half expect only a short fashion trend without long-lasting influence on the automotive industry. Therefore, this question can also be said to paint a much-divided picture.

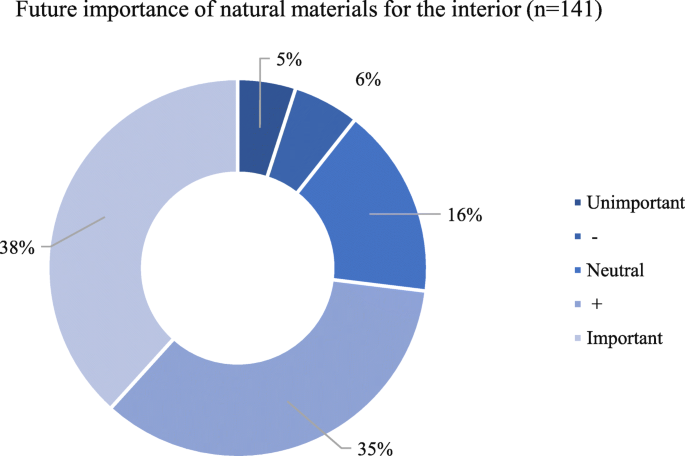

The final topic is the future relevance of sustainable materials in the interior. Nearly 75% of the respondents rate the future relevance as very high or at least high, thus prophesizing an increase in meaning and relevance in the coming years (see Fig. 10 ).

Future importance of natural materials for the interior ( n = 141). Source: Own illustration

Overall, it can certainly be seen that the issue of sustainability is present in people’s awareness. A tendency towards greater openness for new, more sustainable materials among customers of premium automobiles is recognizable. The priority for customers is that sustainability is taken into account in manufacturing and production, but not to the detriment of appearance, feel, comfort or price.

Discussion of the results

While there is an agreement in business practice that sustainability is not just a short-term fashion trend, but also a permanent indicator, this is not fully backed up by the empirical results. Only 50% of the respondents agree with this statement. The cost factor, which, according to the OEM, would have to be compensated, is an obstacle for approximately 50% of the customers. This means that for every second respondent a conflict of objectives with the OEM exists.

All participants principally agree that sustainability should play an overall role in the automobile and should not be restricted to individual areas. Although the majority of respondents chose the modules power unit and electronics, the category “everywhere” follows close behind in terms of importance. Therefore, the interior as a single module has to be integrated into the overall automotive design.

The customers also highlight that all traditional criteria connected to automobiles – especially appearance, haptics, comfort, smell, quality, safety and value – must also be fulfilled in a sustainable interior. At this point, manufacturers often see a problem. Natural materials fulfil certain properties, but others sometimes not. Consequently, manufacturers need to look more closely at this issue in order to satisfy the wishes of their customers.

As seen in the empirical study, the majority of participants can imagine a centre console made of ligneous wood or a door panel made of natural fibres such as hemp or kenaf. In addition, the topic of recycling is important for the customers. Therefore, the manufacturers should begin to work on innovative solutions regarding this topic.

The majority of customers also see an increase in the importance of sustainability for the interior on the horizon. It is therefore crucial for manufacturers to be innovative, show initiative, take advantage of emerging market opportunities and to act proactively. The focus should be on achieving first mover advantages, and it is crucial for OEMs to maintain their position as technology leaders and premium manufacturers, both in Germany and beyond. Therefore, it is imperative that premium manufacturers concentrate on the existing mega-trend of sustainability (Gelowicz et al., 2017 ; Schade, Zanker, Kühn, & Hettesheimer, 2014 ; Skala-Gast, 2012 ) and especially take more efforts on sustainable automotive interior solutions. However, all against the background that costumers accept compromises in comfort, practicality and price only to a very limit extend.

Referring to previous research in this area, the paper adds new insights to the topic of customer requirements regarding automotive sustainability in general and sustainable automotive interior in detail. The main result of the paper is to provide further details on the connection between sustainability and customer comfort in the automobile industry and to confront the needs of the customers with the challenges of the companies. This made an important contribution to the research field sustainability in the automotive industry.

The automotive industry is a prime example of small steps bringing change and contributing to a more environmentally friendly world. Suppliers are working with manufacturers to find solutions for a more sustainable interior and the importance of implementing sustainability along the entire supply chain is also well known to those involved. As a result, technological progress and the refinement of processes for the development of natural fibre products make it possible to replace products that currently pollute the environment more simply and cost-effectively with more environmentally friendly products, and at the same time to produce them in a more environmentally friendly way (Dunne et al., 2016 ; Hetterich et al., 2012 ).

This article focuses exclusively on premium manufacturers and their customers. The further research project will analyse whether there are significant differences when it comes to volume manufacturers. Furthermore, no distinction has been made between age, gender and automotive brand. Another limitation is the purposive sample of the study. The participants were mainly students, which cannot be taken as an average of the population. All of these will be explored in further research activities.

Availability of data and materials

The datasets used and/or analysed during the current study are available from the corresponding author on reasonable request.

Abbreviations

Original Equipment Manufacturers

International Automotive Manufacturers

Adekomaya, O., Jamiru, T., & Sadiku, R. (2016). A review on the sustainability of natural fiber in matrix reinforcement – A practical perspective. Journal of Reinforced Plastics and Composites , 35 (1), 3–7.

Article Google Scholar

Avezedo, S., & Barros, M. (2017). The application of the triple bottom line approach to sustainability assessment. The case study of the UK automotive supply chain. Journal of Industrial Engineering and Management , 10 (2), 286–322.

Avezedo, S., Carvaho, H., Duarte, S., & Cruz-Machado, V. (2012). Influence of green and lean upstream supply chain management practices on business sustainability. IEEE Transaction on Engineering Management , 59 (4), 753–765.

Barnes-Clay, T. (2012). Review: Lexus GS 450H hybrid. http://bloodsweatandfashion.com/lexus-gs-450h/ . Accessed 29 Aug 2018.

Google Scholar

Bergenwall, A. L., Chen, C., & White, R. E. (2012). TPS's process design in American automotive plants and its effects on the triple bottom line and sustainability. International Journal of Production Economics , 140 (1), 374–384.

Biju, P. L., Shalij, P. R., & Prabhushankar, G. V. (2015). Evaluation of customer requirements and sustainability requirements through the application of fuzzy analytic hierarchy process. Journal of Cleaner Production , 108 , 808–817.

Bjurenstedt, A., & Lärneklint, F. (2004). 3D biocomposite for automotive interior parts . Lulea: Lulea University of Technology.

Bröker, T., & Ostner, D. (2017). Innere Leichtigkeit. Automobil Industrie , 62 (8), 94–95.

Dannenberg, J. (2017). Auf Einkaufstour. Automobil Industrie , 62 (6), 8–12.

Dölle, J. E. (2013). Lieferantenmanagement in der Automobilindustrie. Struktur und Entwicklung der Lieferantenbeziehungen von Automobilherstellern . Wiesbaden: Springer.

Book Google Scholar

Dräxlmaier (2018). Türverkleidungen. Innovativ und nachhaltig. https://www.draexlmaier.com/produkte/interieur/tuerverkleidungen/ . Accessed 29 Aug 2018.

Dunne, R., Desai, D., Sadiku, R., & Jayaramudu, J. (2016). A review of natural fibres, their sustainability and automotive applications. Journal of Reinforced Plastic & Composites , 35 (13), 1041–1050.

Focus (2012). Natürliche Sache. https://www.focus.de/auto/news/oeko-materialien-im-auto-innenraum-natuerliche-sache-aid-758345.html . Accessed 29 Aug 2018.

Gelowicz, S., Günnel, T., Hammer, H., & Otto, C. (2017). Mehr als Werkstoffe. Automobil Industrie , 62 (5), 34–37.

Hassan, F., Zulkifli, R., Ghazali, M. J., & Azhari, C. H. (2017). Kenaf fiber composite in automotive industry: An overview. International Journal on Advanced Science, Engineering and Information Technology , 7 (1), 315–321.

Hetterich, J., Bonnemeier, S., Pritzke, M., & Georgiadis, A. (2012). Ecological sustainability. A customer requirement? Evidence from the automotive industry Journal of Environmental Planning and Management , 55 (9), 1111–1133.

Hull, D., & Clyne, T. W. (1996). An introduction to composite materials , (2nd. ed., ). Great Britain: Cambridge solid state science series.

Industrie, A. (2017). Optimierte, leichtere Komponenten. Automobil Industrie , 62 (5), 52.

Jasiński, D., James, M., & Kerry, K. (2016). A comprehensive framework for automotive sustainability assessment. Journal of Cleaner Production , 135 , 1034–1044.

Karus, M., & Kaup, M. (2002). Natural fibres in the European automotive industry. Journal of Industrial Hemp , 7 (1), 119–131.

Koers, M. (2014). Industrie und Politik. Zusammenspiel als Basis profitablen Wachstums in der Automobilindustrie. In B. Ebel, & M. B. Hofer (Eds.), Automotive Management. Strategie und Marketing in der Automobilwirtschaft , (2nd ed., pp. 177–188). Berlin et al.: Springer.

Kumar, N., & Das, D. (2016). Fibrous biocomposites from nettle (Giardinia diversifolia) and poly (lactic acid) fibers for automotive dashboard panel application. Composites Part B Engineering , 130 (1), 54–63.

Laukart, G., & Vorberg, T. (2016). Fahrzeuginnenausstattung. In S. Pischinger, & U. Seiffert (Eds.), Vieweg Handbuch Kraftfahrzeugtechnik , (8th ed., pp. 714–727). Wiesbaden: Springer.

Mayyas, A., Qattawi, A., Omar, M., & Shan, D. (2012). Design for sustainability in automotive industry: A comprehensive review. Renewable and Sustainable Energy Reviews , 16 (4), 1845–1862.

Mcauley, J. W. (2003). Global sustainability and key needs in future automotive design. Environmental Science & Technology , 37 (23), 5414–5416.

Mittelstaedt, J. D., Shultz II, C. J., Kilbourne, W. E., & Peterson, M. (2014). Sustainability as megatrend. Two schools of macromarketing thought. Journal of Macromarketing , 34 (3), 253–264.

Moisescu, O. I. (2018). From perceptual corporate sustainability to customer loyalty: A multi-sectorial investigation in a developing country. Economic Research-Ekonomska Istraživanja , 31 (1), 55–72.

Nunes, B., & Benett, D. (2010). Green operations inititiatives in the automotive inudstry. Benchmarking An International Journal , 17 (3), 396–420.

Panuju, A. Y. T., Ambarwati, D. A. S., & Susila, M. D. (2020, May). Implications of automotive product sustainability on young customers’ purchase intention in developing countries: An experimental approach. IOP Conference Series: Materials Science and Engineering , 857 (1), 012024.

Pein, M., Laukart, V., Feldmann, D. G., & Krause, D. (2006). Concepts for energy absorbing support structures and appropriate materials. In Proceedings of the 22nd International Congress of Aeronautical Sciences .

Pischinger, S., & Seiffert, U. (2016). Ausblick. Wo geht es hin. In S. Pischinger, & U. Seiffert (Eds.), Vieweg Handbuch Kraftfahrzeugtechnik , (8th ed., pp. 1391–1393). Wiesbaden: Springer.

Chapter Google Scholar

Puglia, D., Biagiotti, J., & Kenny, J. M. (2005). A review on natural fibre-based composites—Part II: Application of natural reinforcements in composite materials for automotive industry. Journal of Natural Fibers , 1 (3), 23–65.

Schade, W., Zanker, C., Kühn, A., & Hettesheimer, T. (2014). Sieben Herausforderungen für die deutsche Automobilindustrie. Strategische Antworten im Spannungsfeld von Globalisierung, Produkt- und Dienstleistungsinnovationen bis 2030 . Baden-Baden: Edition sigma.

Schmiedel, I., Barfuss, G. S., Nickel, T., & Pfeufer, L. (2014). Einsatz sichtbarer Naturfasern im Fahrzeuginterieur. Automobiltechnische Zeitschrift , 116 (6), 34–37.

Sinha, P., Muthu, S. S., Taylor, I., Schulze, R., Beverley, K., Day, C., & Tipi, N. (2015). Systems thinking in designing automotive textiles. Textiles and Clothing Sustainability , 1 (6), 1–13.

Skala-Gast, D. (2012). Zusammenhang zwischen Kundenzufriedenheit und Kundenloyalität. Eine empirische Analyse am Beispiel der deutschen Automobilindustrie . Wiesbaden: Springer.

Sopher, S. R. (2008). Automotive interior material recycling and design optimization for sustainability and end of life requirements. Society of plastics engineers (SPE)-global plastic and environment conference (GPEC). 2008.

Suddell, B. (2008). Industrial fibres: Recent and current developments. In Proceedings of the symposium on natural fibres, Rome, Italy, 20 October 2008 , (pp. 71–82).

Sullins, T. L. (2013). Biocomposite material evaluation and processing for automotive interior components . Birmingham: University of Alabama.

Thun, J.-H., & Hoenig, D. (2011). An empirical analysis of supply chain risk management in the German automotive industry. International Journal of Production Economics , 131 (1), 242–249.

Verma, D., Gope, P. C., & Shandilya, A. (2012). Coir fibre reinforcement and application in polymer composites: A review. Journal of Materials and Environmental Science , 4 (2), 263–276.

Wallentowitz, H., & Leyers, J. (2014). Technologietrends in der Fahrzeugtechnik. Dimensionen, Verläufe und Interaktionen. In B. Ebel, & M. B. Hofer (Eds.), Automotive Management. Strategie und Marketing in der Automobilwirtschaft , (2nd ed., pp. 29–56). Berlin et al.: Springer.

Yanfeng (2017). Naturfasertechnologie von Yanfeng Automotive Interiors trifft den Zeitgeist. https://www.yfai.com/de/naturfasertechnologie-von-yanfeng-automotive-interiors-trifft-den-zeitgeist . Accessed 29 Aug 2018.

You, H., Ryu, T., Oh, K., Yun, M. H., & Kim, K. J. (2006). Development of customer satisfaction models for automotive interior materials. International Journal of Industrial Ergonomics , 36 (4), 323–330.

Download references

Acknowledgements

Not applicable.

Authors‘information

Prof. Dr. Wanja Wellbrock is a professor for procurement management at Heilbronn University. His main research areas are supply chain management, strategic procurement management, sustainability and big data applications in cross-company value chains. He is the author of various English- and German-language publications and project manager of several practice-oriented research projects in these areas. Prof. Dr. Wanja Wellbrock gained practical experience in management positions in the automotive and aviation industries as well as in management consulting.

Since 2015, Prof. Dr. Daniela Ludin holds the professorship for general business administration at the Heilbronn University of Applied Sciences in the Faculty of Management and Sales on the Schwäbisch Hall campus. To anchor the principle of sustainability as a central moment in her courses is one of her main targets. Since 2017, Prof. Dr. Daniela Ludin is responsible for the Bachelor’s degree programm Management & Procurement Management (B.A. MBW); since 2019 also fort he Bachelor‘s degree programm Sustainable Procurement Management (B.A. NBW). Since 2015, Prof. Dr. Daniela Ludin is also a member of the Council for Sustainable Development at Heilbronn University, which she has also chaired as Sustainability Officer at Heilbronn University since 2019. Before her time at Heilbronn University, Prof. Dr. Daniela Ludin worked from 2009 to 2015 at the Rottenburg University of Applied Sciences with a professorship for law, environmental and forest policy. Her main research areas are sustainable procurement management, sustainable mobility, sustainable consumption, sustainable financial products and sustainable data management.

Prof. Dr. Wolfgang Gerstlberger is currently Professor of Operations Management at the Tallinn University of Technology (Estonia). Previously, he was Associate Professor for Innovation Management at the University of Southern Denmark in Odense and Endowed Professor for Innovation Management and SME Research at the International University Institute of the Technical University of Dresden. Professor Gerstlberger completed his doctorate and habilitation in the field of general business administration at the University of Kassel. In addition, he has led and carried out numerous innovation and sustainability projects for companies, the EU, associations and public administration organizations as a freelancer. His current research interests are in the areas of sustainable innovation and operations management, digitization and sustainable logistics.

Linda Röhrle finished her Bachelor degree in Management and Procurement Management at the Heilbronn University of Applied Sciences.

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and affiliations.

Heilbronn University of Applied Sciences, Campus Schwäbisch Hall, Faculty of Management and Sales, Heilbronn, Germany

Wanja Wellbrock, Daniela Ludin & Linda Röhrle

Department of Business Administration, Tallinn University of Technology, School of Business and Governance, Tallinn, Estonia

Wolfgang Gerstlberger

You can also search for this author in PubMed Google Scholar

Contributions

Wanja Wellbrock and Linda Röhrle analyzed and interpreted the survey data. Daniela Ludin performed the general sustainability background and Wolfgang Gerstlberger the sustainability aspects regarding automotive interior. All authors were major contributors in writing the manuscript. All authors read approved the final manuscript.

Corresponding author

Correspondence to Wanja Wellbrock .

Ethics declarations

Competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Wellbrock, W., Ludin, D., Röhrle, L. et al. Sustainability in the automotive industry, importance of and impact on automobile interior – insights from an empirical survey. Int J Corporate Soc Responsibility 5 , 10 (2020). https://doi.org/10.1186/s40991-020-00057-z

Download citation

Received : 10 September 2020

Accepted : 13 December 2020

Published : 30 December 2020

DOI : https://doi.org/10.1186/s40991-020-00057-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Sustainability

- Automotive industry

The Evolution of Artificial Intelligence in the Automotive Industry

Ieee account.

- Change Username/Password

- Update Address

Purchase Details

- Payment Options

- Order History

- View Purchased Documents

Profile Information

- Communications Preferences

- Profession and Education

- Technical Interests

- US & Canada: +1 800 678 4333

- Worldwide: +1 732 981 0060

- Contact & Support

- About IEEE Xplore

- Accessibility

- Terms of Use

- Nondiscrimination Policy

- Privacy & Opting Out of Cookies

A not-for-profit organization, IEEE is the world's largest technical professional organization dedicated to advancing technology for the benefit of humanity. © Copyright 2024 IEEE - All rights reserved. Use of this web site signifies your agreement to the terms and conditions.

- Portal Login

Publications

The Center for Automotive Research is involved in the research of significant issues that relate to the future direction of the global automotive industry. As a nonprofit research organization, and in cooperation with study funders, most CAR research is released publicly through this website.

More Publications

See publications sorted by:

Partner Whitepaper: Automotive Digital Transformation in Uncertain Times

Partner Whitepaper: Automotive Digital Transformation in Uncertain Times The automotive industry is experiencing a profound CASE (Connected, Autonomous, Shared, and Electrified) driven transformation, leading to changes in virtually every aspect of the business. In addition to this CASE-related disruption, several macro factors add to the overall uncertainty, requiring a rethinking…

Read More | Download Now

Impact of 2023 UAW-Detroit Three National Contracts on the U.S. Auto Industry Whitepaper

Impact of 2023 UAW-Detroit Three National Contracts on the U.S. Auto Industry Whitepaper On October 30, 2023, General Motors (GM) and the United Auto Workers (UAW) reached a tentative agreement, bringing an end to the longest UAW strike against an automaker since 1998. Lasting 46 days from September 15 to…

The Electric Vehicle Battery and Circular Economy Observations

The Electric Vehicle Battery and Circular Economy Observations Recycling, Jobs, R&D & Scope 3 Carbon Emissions The concept of a circular economy for Lithium-Ion batteries (LiBs), along with its drivers, barriers and enablers has been studied recently (NREL 2021) with a view to inform public policy at the federal, state,…

Analog AM Band Interference in Electric Vehicles

There is an effort in the US Congress to require automakers to maintain AM radio in all vehicles, including new electric vehicles (EVs). However, the nature of EVs and their operating conditions, including acceleration and deceleration, pose a challenge to ensuring electromagnetic compatibility (EMC) with the analog AM band radio….

Economic Contribution Study of Hyundai Motor America’s U.S. Operations

The purpose of this study is to estimate Hyundai Motor America’s (HMA’s) and its independent dealer network’s employment and economic contribution to the United States and the economies of the seven states in which HMA and HMA dealer networks have significant automotive footprints. This study also estimates the economic contribution…

Escalating Need for Auto Supply Chain Action to Align with Paris and Limit Warming to 1.5*C

While sustainability in the automotive industry is not new, it is becoming an increasingly vital part of doing business for many. In recent years, the industry has been coping with supply chain disruptions resulting from the pandemic and ongoing parts and semiconductor shortages. However, amid these enduring challenges, sustainability has…

Assessment of Costs Associated with the Implementation of the Federal Trade Commission Notice of Proposed Rulemaking (RIN 2022-14214), CFR Part 463

The Federal Trade Commission (FTC) published a proposed Motor Vehicle Dealers Trade Regulation Rule (16 C.F.R. § 463) (“Trade Rule”) on July 13, 2022. In the Trade Rule, the FTC solicited “comments from the public to improve [benefit or cost] estimates before the promulgation of any final Rule.” In response…

State of ADAS, Automation, and Connectivity

Vehicles are currently in a new stage of evolution that includes advanced driver assist, connectivity, and automation. Due to the evolving nature of the technology and shifting consumer preferences, the timing and pathway for implementation of these technologies is still uncertain. While these new technologies are still evolving, an understanding…

The Inflation Reduction Act: Clean Vehicle Credits

On August 16, President Biden signed the Inflation Reduction Act (IRA) of 2022 into law. The law will, among many things, allocate nearly $370 billion to climate and energy-focused investments and incentives. The IRA resulted from a hard-fought effort that created a complex regulation. One of the many things the…

From Internal Combustion to Battery Electric Vehicles: Enabling Digital Manufacturing – Whitepaper

Today’s automotive industry faces a historical shift from internal combustion engine (ICE) vehicles to battery electric vehicles (BEV). This shift is profound, dramatically altering the structure of the automotive value chain and the vehicle manufacturing process. This conversion occurs as the industry undergoes a digital transformation. The ICE to BEV…

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Wiley - PMC COVID-19 Collection

An impact study of COVID ‐19 on six different industries: Automobile, energy and power, agriculture, education, travel and tourism and consumer electronics

Janmenjoy nayak.

1 Aditya Institute of Technology and Management, Computer Science and Engineering, Srikakulam Andhra Pradesh, India

Manohar Mishra

2 Department of Electrical and Electronics Engineering, Institute of Technical Education and Research, Siksha O Anusandhan University, Bhubaneswar Odisha, India

Bighnaraj Naik

3 Department of Computer Application, Veer Surendra Sai University of Technology, Sambalpur Odisha, India

Hanumanthu Swapnarekha

4 Department of Information Technology, Veer Surendra Sai University of Technology, Sambalpur Odisha, India

Korhan Cengiz

5 Department of Electrical—Electronics Engineering, Trakya University, Edirne Turkey

Vimal Shanmuganathan

6 Department of Information Technology, National Engineering College, Kovilpatti Tamil Nadu, India

Associated Data

The recent outbreak of a novel coronavirus, named COVID‐19 by the World Health Organization (WHO) has pushed the global economy and humanity into a disaster. In their attempt to control this pandemic, the governments of all the countries have imposed a nationwide lockdown. Although the lockdown may have assisted in limiting the spread of the disease, it has brutally affected the country, unsettling complete value‐chains of most important industries. The impact of the COVID‐19 is devastating on the economy. Therefore, this study has reported about the impact of COVID‐19 epidemic on various industrial sectors. In this regard, the authors have chosen six different industrial sectors such as automobile, energy and power, agriculture, education, travel and tourism and consumer electronics, and so on. This study will be helpful for the policymakers and government authorities to take necessary measures, strategies and economic policies to overcome the challenges encountered in different sectors due to the present pandemic.

1. INTRODUCTION

In the city of Wuhan, South China, numbers of unidentified pneumonia cases were reported in the last week of December 2019. The Centers for Disease Control (CDC) has declared the unknown pneumonia as novel coronavirus pneumonia on 7 January 2020 (Lu et al., 2020 ). Later, novel coronavirus pneumonia was renamed as SARS‐CoV‐2 (Severe Acute Respiratory Syndrome Coronavirus 2) by the International Committee on Taxonomy of Viruses (Huang et al., 2020 ; Lai et al., 2020 ). On 11 February 2020 the disease was declared as COVID‐19 by the World Health Organization (WHO, 2020 ). The WHO asserted the outbreak of COVID‐19 as pandemic on 11 March 2020 as the number of cases other than the China escalated more than two million in different regions of the world. The number of new cases being reported within China, where the virus first appeared, is declining sharply, while the number of new cases outside of China continues to climb. As of 22 September 2020, there have been 31,507,723 confirmed cases of COVID‐19 worldwide, with 969,812 confirmed deaths. In the United States and India, where tests are now being administered more frequently, the number of confirmed cases is rising exponentially. Figure 1 depicts the top 10 countries in the world having highest number of confirmed cases as on 3 August 2020.

Top 10 countries with highest number of confirmed cases

The outbreak of COVID‐19 pandemic, which is labelled as black swan event (Burch et al., 2016 ), has not only caused an adverse impact on the health of the people all over the world but also effected the socio‐economic activities of the countries all over the world. To flatten the curve of pandemic, the governments of almost 162 countries have announced strict shutdown of national and international borders, travel restrictions and lockdown measures ( https://www.aljazeera.com/news/2020/03/coronavirus-travel-restrictions-border-shutdowns-country-200318091505922.html ). Therefore, the markets of the world's largest economic countries and others are operating in a fear of disruption of global financial markets. The major areas such as global supply chains, trade, agriculture industry, automotive industry, electronic industry, travel, transportation and tourism industry, and so on have been severely disrupted because of the outbreak of COVID‐19. The economy of various other sectors such as aviation industry, entertainment industry, sports industry, and so on has also been severely hampered all over the world due to lockdown. In India, first case was reported in the last week of January 2020. The number of confirmed COVID‐19 cases started escalating from the second week of March 2020. As India is a developing country, the health system will be demolished if the number of cases increases exponentially. Therefore, to inhibit the spread of the coronavirus, the government of India has announced strict 3 week lockdown form 25 March 2020. Due to the lockdown, a large number of migrant workers all over the country left with no job or income. As all the activities in the country have been interrupted rigidly, a serious disruption has encountered in the supply chain mechanism of all the sectors. This unplanned and unusual lockdown is also having serious effect on the country economy which is already on downward trajectory since the financial year of 2018–2019. Therefore, it is necessary to report the impact of this pandemic on different industrial sectors. This will be helpful for the policymakers and government authorities to take necessary measures, strategies and economic policies to overcome the challenges encountered in different sectors due to the present pandemic.

In this paper, the effect of COVID‐19 on six different major affected sectors such as automobile, power and energy, electronics, travel, tourism and transportation, agriculture and education have been emphasized. We also emphasized on the analysis of issues and challenges encountered in these sectors by projecting how the changes in the economy has occurred in these sectors due to the COVID‐19. Further, it is also specified the strategies taken by the government to provide support to the life of the migrant workers and to overcome the recession encountered in different sectors.

The rest of the paper is standardized in the following way. Section 2 illustrates the impact of COVID‐19 on the areas of the automobile industry. It also focuses on the various issues and challenges in the automobile industries and strategies taken to overcome these challenges. The consequences of COVID‐19 on Power and Energy sector and the measures taken by the policy makers to overcome the imbalance encountered in this sector has been illustrated in Section 3 . The COVID‐19 effect on the consumer electronics and in the supply chain of electronics has been described in Section 4 . Section 5 describes how the COVID‐19 impacts the public transportation, travel and tourism sector. The effect of COVID‐19 on various sectors of the agriculture and measures taken to meet the challenges encountered in the pandemic has been explained in Section 6 . The impact of COVID‐19 on sectors and sub sectors of the education system and the measures taken by the universities of different countries and Indian education system to meet the challenges occurred in education system has been presented in Section 7 . Section 8 explains about the impact of COVID‐19 on publishing sector. Section 9 explains the critical analysis of COVID‐19 effect on the economy of different sectors. It also describes the analysis of other sectors that have been affected due to the pandemic of COVID‐19. It also provides an overview of impact of COVID‐19 on the GDP (gross domestic product) of Indian economy and the unemployment problem. Finally, the conclusion of the paper has been described in Section 10 .

2. IMPACT OF COVID ‐19 IN AUTOMOBILE INDUSTRY

The COVID‐19 epidemic has pushed the global economy and humanity into a disaster. In the attempt to control this pandemic, the governments of all the countries have imposed a nationwide lockdown. Although the lockdown may have assisted in limiting the spread of the disease, it has brutally affected the country, unsettling complete value‐chains of most important industries. The epidemic is having a foremost impact on all features of industries which includes the automobile sector, with key manufactures either completely close following the orders passed by local governments or running an organization with least staff at manufacture units to remain their personnel secure. Over the last 12–18 months, the automobile field had already undergone significant delay due to structural modification openings with the goods and services tax, axle‐load reforms, shift to shared mobility, liquidity crunch, and so on industries had faced major effect and has roughly been at a complete idle since 24 March due to the COVID‐19's lockdown. Extended truncation of customer demand due to the lockdown is observed drastically distressing auto manufacturers. The majority of the companies are starving the support of R&D (Research and development) to maintain core functions and potentially getting back the growth made on mobility technologies as well as alternate fuels.

Some research literatures have explained the consequences of the COVID‐19 on the automobile industry. Rajamohan et al. ( 2020 ) has conducted a study on how the stock market particularly the National Stock Exchange of automobile sector has been distressed due to COVID‐19. The results reveal that higher value equities have been sold at depreciation value. Moreover, lower returns have been reported for the returns of the automobile sector index. Hence, from the results it can be concluded that COVID‐19 pandemic has created a significant effect on the stock exchange of the automobile industry. A hybrid model named as SEM‐Logit model was proposed by Yan et al. ( 2020 ) to explore the consumer decision making as well as the factors affecting the purchase of automobile during pandemic. The proposed model was used to investigate the effect of social‐demographics, epidemic‐related and psychological latent variables on the purchase decision making process of the automobiles. The results reveal that pandemic has generated an adverse effect on the purchase of the automobiles. The factors such as household income, travel vulnerabilities and epidemic severity in local regions have influenced the purchase decision making process of individuals. Further, study is used to assist the policy makers in implementing significant measures to overcome the present crisis in the automobile purchase.

2.1. Area under automobile industry and the COVID‐19 impact

The impact of COVID‐19 has affected several fields and some of them are mentioned in Figure 2 .

Impact on automobile industry fields due to COVID‐19

2.1.1. Auto dealers

Auto dealers have faced major problems. There are presently 15,000 above auto dealers which include two, three, and four wheelers across India. They were not able to transport vehicles for the lockdown period. Auto dealers have informed 30–45 days of completed goods record, likely to be greatly low‐priced prior to post lockdown. In the next 6 months, it is predictable that there will be finishing off at least 8%–10% of these dealerships.

2.1.2. Auto suppliers

Auto suppliers have a high reliance on immigrant labour, whose absence is anticipated to additional delay restoration post lockdown, ensuing in a domino consequence on the complete assessment chain. Suppliers are facing the challenges of liquidity that may yield to fading market circumstances, causing extensive trouble across the whole manufacturing network.

2.1.3. Finance companies

These financial companies are likely to face the burden, since loan evasions are expected to increase, and new loans are likely to fall, given complexities in deciding customers' credit value. The impact of the COVID‐19 is expected to put tension on used‐cars, mobility solutions, and aftermarket service suppliers, whose financial support relays on violent growth projections.

2.1.4. Sales

COVID‐19 affected automobile new vehicle sales very badly especially in the month of February 2020. Like, in China new sales of vehicles have fallen by 92% in February. Also, in European countries total vehicle sales were dropped by 7.4% when compared to that of sales in last year. Also, in country like India, many automobile industries such as TVS, Mahindra have stopped their production sales due to lockdown and likewise many sectors have been affected.

2.2. Issues of the automotive sector due to COVID ‐19

The automotive sector is on the front line due to the interrupt caused by the epidemic to trade as usual and throws the financial position into indecision. A few major affected areas are home and key manufacturing hubs to foremost links in the total supply chain sectors. Distinctive emergency plans helped allowing functional effectiveness by following measures like power outages, cyber incidents, and natural disasters, and so on. The situation is mobbing fastly due to the widespread effects. The key areas of these issues include crisis handling and response, workforce, supply chain, finance and liquidity, tax and trade, and strategy.

2.2.1. Crisis management and response

Cautious circumstances planning are vital. The change in the epidemic's epicentre to North America and Europe highlights the necessity for automotive companies to stay living in their responses to the disaster. Companies not only should consider the impact of the epidemic across a variety of critical fields but also should acquire the explosive economic, strategy, and financial market terrain into account.

2.2.2. Workforce

As per the Bureau of Labor Statistics, Automakers and their suppliers have used more than one million people in the United States. This welfare of employees should be the major concern for corporate leaders. If the pandemic widens and a huge percentage of the employees get sick, it could severely reduce the capability of the manufacture. So, clear, apparent, and appropriate communications to workers are vital, predominantly when the number of detailed cases spikes due to enhanced access to testing.

2.2.3. Operations and supply chain

The impact of COVID‐19 on the supply chain of automotive may be considerable. Some countries such as Japan, China, and South Korea that have seriously been affected by the spread of this virus, accounted for a major share of inclusive auto manufacturing. Automakers with overall supply chains are expected to observe two tier as well as three tier dealers who are mostly affected by epidemic related disturbances. Some steps are considering enhancing lines of communication and chain visibility to identify the potential problems better in early and work on remediation plans.

2.2.4. Finance and liquidity

The quick exploitation of the COVID‐19 epidemic has corresponded with the final weeks of the initial quarter. For companies in Spain, Italy, and France which are in dominant regions has led to functional disturbances that deferred their capability to conclude financial statements. Moreover, a few automotive companies are gradually more distressed about the prospect that the financial impact of the epidemic may generate triggering actions for the recoverability of receivables, reform events, long‐lasting quality impairments, and liquidity issues. Condensed productivity of the funding team could create a substantial rise in the amount of work to be acquired through in the imminent weeks. The majority of the suppliers, as well as multinational companies, should cautiously consider their money, liquidity, and operational capital policies in light of the epidemic's impact on the world and credit markets.

2.2.5. Strategy

The epidemic of COVID‐19 along with the resultant economic ambiguity may expect reduced customer requirements in the short term, probably leading to dampened sales of a new vehicle as well as delayed payments on additional maintenance. The interruption of the automobile supply chain may entrap cash that might be utilized to present employee relief and support functions. Because of the reasons, intent cash might be inactive in the market for an extensive era of time, new strategies can be arranged to assist in alleviating the sliding impact.

Moreover, many challenges (Accenture, 2020 ) part from the above mentioned strategies have been mentioned in Table 1 .

Various challenges of auto‐mobile industry

3. IMPACT ON POWER AND ENERGY INDUSTRY

The COVID‐19 pandemic has been continuously affecting the energy sectors like other aspect of life. Maintaining the continuity of power flow to different industry needs as well as satisfying the need of consumers viewpoint during the COVID‐19 crises is a severe challenge for the power and utility companies (Mylenka, 2020 ). The protection and distance protocols have forced for the reduction of worker in this sector; additionally, the necessities of strict hygiene have a direct effect on the field worker and operation. Moreover, the decreased demand has made its own technical challenges where the system engineers taking to achieve the supply voltage as well as reactive levels to duck the risk such as reactive shutdowns at distribution levels. Therefore, the power utility company should ensure some advanced strategies for the sudden decision making. So, it is essential for the utility companies and the governments to work coordinately to regulate the power supply affordably, sustainably and securely. One study shows that Power and energy industry has been harmfully impacted. In Italy 20% reduction in demand and values are being witnessed. In India, presently power demand has decreased by 25%–30% (Khanna, 2020 ).

The following are the few literatures that present how the power sector has been affected because of the present pandemic. An analysis hourly demand of electricity for the province of Ontario was performed by Abu‐Rayash and Dincer ( 2020 ) to determine the effect of the COVID‐19 pandemic on the dynamics of the energy sector. The analysis shows that in the month of April, there is a decline of 14% in the overall electricity demand of the province. Mostly, huge reductions in the daily demands of electricity was noticed on weekends. Further, the analysis of hourly electricity demands displays a clear flattening curve specifically in the peak hours of morning and evening, that is, between 7 AM to 11 AM and 5 PM to 7 PM at the time of pandemic. Moreover, the reduction in the GHG emissions by 40,000 tonnes of CO 2 e in the month of April results in the savings of $131,844. Finally, this analysis serves to devise the changes in the lifestyle options and choices in the short‐term and long‐term future electricity demands. An assessment of the power system scenarios implemented globally together with the socio‐economic and technical consequences because of lockdown have been scrutinized by Senthilkumar et al. ( 2020 ). It has been noticed from the primary analysis that because of the lockdown there was a drop in the demand of the commercial load while the demand for residential load expanded to the maximum. Further, this study examined distinct issues and challenges experienced by various utilities of the power system in India. Moreover, the actions implemented by the power sector for smooth running of the power system in India was also presented in the study. Lastly, this study presents a set of suggestions that may assist the government authorities and policymakers all over the world to cope up with the present and future unpredicted crisis in the power system. Zhong et al. ( 2020 ) have presented an analytical study on the effect of COVID‐19 pandemic on the power sector. Initially, an analysis of the electricity demand and supply has been performed due to the reduction in total electricity consumption because of the lockdown restrictions in different regions of the country. From the analysis, it has been noticed that the contribution of renewable energy has been raised against the reduction of the power generation. Further, an analysis of the challenges to be faced in the operation and control of power system has been presented due to the enhanced uncertainty of load, altered power balance and issues of voltage violation. Next, an investigation of market price performance has been carried out to cope up the challenges of the deterioration of electricity prices in major markets and financial problems. Finally, the external factors occurred due to pandemic such as diminished emissions and recovery of environmental conditions temporarily has been explained. Aruga et al. ( 2020 ) have suggested an autoregressive distributed lag (ARDL) model to analyse the consequences of COVID‐19 pandemic on energy consumption in India during the lockdown. The proposed model was basically used to determine whether the COVID‐19 infection produces a positive impact on consumption of energy during lockdown period and whether this positive impact remains same or vary among distinct average income levels. From the analysis, it is noticed that higher income levels have a quick restore from COVID‐19 crisis when compared with poor income regions such as Eastern and North‐Eastern part. Further, this study recommends the significance of implementing special economic aid and measures for the poorer income regions to overcome the damage during COVID‐19 crisis and to restore their energy consumption levels to the levels prior to COVID‐19 crisis.

In general, the effect of the current COVID‐19 virus on the power sector can be studied through Figure 3 with the following sub‐section.

Impacted area of power and energy sector of COVID‐19

3.1. Development of new power infrastructure and energy facilities

The ‘Expanding the infrastructure’ is very common to each and every industry, and the energy industry is one of them. However, as the impact of pandemic is spread all over the world, the source of capital investment has been highly affected, and therefore, many power companies have decided to stop or reduce their capital outflow where possible. For example, DSOs (the ‘Distribution System Operator’, whose role is to transformed the power sector to make it more flexible, reduced the load on the network through penetrating new renewable sources, leverage data to increase re‐penetration) are postponing the majority of opened projects, due to a significant reduction in the purchasing of goods and services. Moreover, the less‐critical investments have been postponed. Therefore, the accomplishment of investment schedules by transmission system operators (TSOs) and DSOs is similar in jeopardy (Mylenka, 2020 ).

3.2. Default of payment

The defaulters of bill payment have been increasing with a cascaded manner. In many countries, the customers have been informed by their respective energy regulators and government authorities to prolong the payment of energy utility bills. Even if there is extensive lenience of non‐payment by end‐users, legislators did not openly describe if indulgence regarding disbursement would be approved further along with the supply‐chain'. Up to now, not a single official of the Energy Community have clearly sharp who will endure the outlays of sponsoring this debit. The waiving of interest, lockdown and prohibitions on cutting off will most likely enhance costs for DSOs. In addition to this, their profits will be reduced and, if the disaster remains, their economic position will be worsened. As a result, the negative impact of cash flow and short‐term liquidity of DSOs will be unavoidable. If the situation persists than the maintenance cost for regular operation will also be affected within a couple of months (Mylenka, 2020 ).

3.3. Impact on renewable energy sector

The renewable energy sector is currently the heart of power and energy industry. This sector has been badly affected due to the current pandemic. For example, India imports approximately 80% of its solar‐photovoltaic (SPV) cells necessity from the China. In this regards, Indian companies are facing indecisively concerning the receiving of SPV panels from China. Moreover, India imports other clean energy equipment's such as wind turbines and batteries from China and Europe. The delay in supply of these clean energy utensils ahead of the existing inventory with the productions is impacting well‐timed completion of renewable energy project give rise to in adverse situation. India single‐handedly 3000 MW of SPV and wind energy projects encounter suspensions, owing to the CIVID‐19 lockdown. Moreover, the planet's top manufacturer of rechargeable batteries was incompetent to accomplish the experiments of new‐fangled prototypes of rechargeable batteries because of the COVID‐19, and this has led to a deduction in the supply capacities of rechargeable batteries for the European market (Khanna, 2020 ).

3.4. Maintenance

Maintenance of energy and power sector is being too difficult in this pandemic situation, as the systematic maintenance deeds and field‐worker/technicians are constrained to a least, with mended and restoration being prioritized. Portable mediation crews have been started as a standby for field workers. The QoS, in spite of this, may be at danger if scheduled cares and maintenance facility are suspended for too long. However, a few documents have analysed that the availability of vital parts, tools, and equipment used for the maintenance workers are not a worry situation in the current timing, but there is a peril to network and staff safety if supplies are not restored in time.

3.5. Response of policymakers, regulators, and market participants

Role of policy‐makers and energy regulators have to ensure the energy security in this pandemic period. They need to address all the challenges associated to provide all the necessary services reliably. For instance, Europe's energy regulators have taken some exceptional actions to guarantee a secure and consistent energy supply by assuring vital amenity (e.g., gas, heating and power). In addition to this, they have taken some measures intended to ease financial needs of customers who face monetary difficulties during lock‐down (Mylenka, 2020 ). Some other countries have also taken several measures to backing the renewable energy sectors. For example, Poland's administration has formed an act named as Anti‐Crisis Shield Act, which offers the President of the Energy Regulatory Authority with the right to increase time limit for renewable energy manufacturers for initiation of trades inside the auction system.

Similarly, the DSOs have employed numerous administrative actions associated with the security of workforces, guaranteeing maintenance deeds, acquiring supplies, and so on. The safety and security of report centres is safeguarded through: (i) remote units in report centres with sufficient back‐up squads on stand‐by; (ii) limited admission to report centres and to stand‐by parts; (iii) engaging the retired staff as standby units owing to decrease the load on key staff.

4. IMPACT ON COVID ‐19 ON ELECTRONICS INDUSTRY