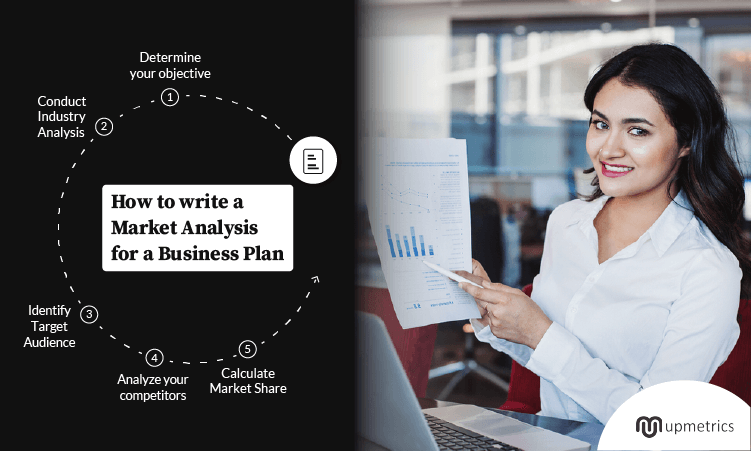

How to Conduct an Industry Analysis? Steps, Template, Examples

Appinio Research · 16.11.2023 · 39min read

Are you ready to unlock the secrets of Industry Analysis, equipping yourself with the knowledge to navigate markets and make informed strategic decisions? Dive into this guide, where we unravel the significance, objectives, and methods of Industry Analysis.

Whether you're an entrepreneur seeking growth opportunities or a seasoned executive navigating industry shifts, this guide will be your compass in understanding the ever-evolving business terrain.

What is Industry Analysis?

Industry analysis is the process of examining and evaluating the dynamics, trends, and competitive forces within a specific industry or market sector. It involves a comprehensive assessment of the factors that impact the performance and prospects of businesses operating within that industry. Industry analysis serves as a vital tool for businesses and decision-makers to gain a deep understanding of the environment in which they operate.

Key components of industry analysis include:

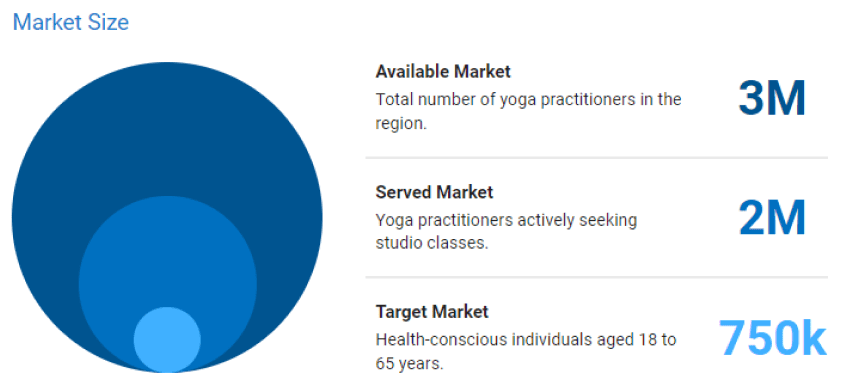

- Market Size and Growth: Determining the overall size of the market, including factors such as revenue, sales volume, and customer base. Analyzing historical and projected growth rates provides insights into market trends and opportunities.

- Competitive Landscape: Identifying and analyzing competitors within the industry. This includes assessing their market share , strengths, weaknesses, and strategies. Understanding the competitive landscape helps businesses position themselves effectively.

- Customer Behavior and Preferences: Examining consumer behavior , preferences, and purchasing patterns within the industry. This information aids in tailoring products or services to meet customer needs.

- Regulatory and Legal Environment: Assessing the impact of government regulations, policies, and legal requirements on industry operations. Compliance and adaptation to these factors are crucial for business success.

- Technological Trends: Exploring technological advancements and innovations that affect the industry. Staying up-to-date with technology trends can be essential for competitiveness and growth.

- Economic Factors: Considering economic conditions, such as inflation rates, interest rates, and economic cycles, that influence the industry's performance.

- Social and Cultural Trends: Examining societal and cultural shifts, including changing consumer values and lifestyle trends that can impact demand and preferences.

- Environmental and Sustainability Factors: Evaluating environmental concerns and sustainability issues that affect the industry. Industries are increasingly required to address environmental responsibility.

- Supplier and Distribution Networks: Analyzing the availability of suppliers, distribution channels, and supply chain complexities within the industry.

- Risk Factors: Identifying potential risks and uncertainties that could affect industry stability and profitability.

Objectives of Industry Analysis

Industry analysis serves several critical objectives for businesses and decision-makers:

- Understanding Market Dynamics: The primary objective is to gain a comprehensive understanding of the industry's dynamics, including its size, growth prospects, and competitive landscape. This knowledge forms the basis for strategic planning.

- Identifying Growth Opportunities: Industry analysis helps identify growth opportunities within the market. This includes recognizing emerging trends, niche markets, and underserved customer segments.

- Assessing Competitor Strategies: By examining competitors' strengths, weaknesses, and strategies, businesses can formulate effective competitive strategies. This involves positioning the company to capitalize on its strengths and exploit competitors' weaknesses.

- Risk Assessment and Mitigation: Identifying potential risks and vulnerabilities specific to the industry allows businesses to develop risk mitigation strategies and contingency plans. This proactive approach minimizes the impact of adverse events.

- Strategic Decision-Making: Industry analysis provides the data and insights necessary for informed strategic decision-making. It guides decisions related to market entry, product development, pricing strategies, and resource allocation.

- Resource Allocation: By understanding industry dynamics, businesses can allocate resources efficiently. This includes optimizing marketing budgets, supply chain investments, and talent recruitment efforts.

- Innovation and Adaptation: Staying updated on technological trends and shifts in customer preferences enables businesses to innovate and adapt their offerings effectively.

Importance of Industry Analysis in Business

Industry analysis holds immense importance in the business world for several reasons:

- Strategic Planning: It forms the foundation for strategic planning by providing a comprehensive view of the industry's landscape. Businesses can align their goals, objectives, and strategies with industry trends and opportunities.

- Risk Management: Identifying and assessing industry-specific risks allows businesses to manage and mitigate potential threats proactively. This reduces the likelihood of unexpected disruptions.

- Competitive Advantage: In-depth industry analysis helps businesses identify opportunities for gaining a competitive advantage. This could involve product differentiation, cost leadership, or niche market targeting .

- Resource Optimization: Efficient allocation of resources, both financial and human, is possible when businesses have a clear understanding of industry dynamics. It prevents wastage and enhances resource utilization.

- Informed Investment: Industry analysis assists investors in making informed decisions about allocating capital. It provides insights into the growth potential and risk profiles of specific industry sectors.

- Adaptation to Change: As industries evolve, businesses must adapt to changing market conditions. Industry analysis facilitates timely adaptation to new technologies, market shifts, and consumer preferences .

- Market Entry and Expansion: For businesses looking to enter new markets or expand existing operations, industry analysis guides decision-making by evaluating the feasibility and opportunities in target markets.

- Regulatory Compliance: Understanding the regulatory environment is critical for compliance and risk avoidance. Industry analysis helps businesses stay compliant with relevant laws and regulations.

In summary, industry analysis is a fundamental process that empowers businesses to make informed decisions, stay competitive, and navigate the complexities of their respective markets. It is an invaluable tool for strategic planning and long-term success.

How to Prepare for Industry Analysis?

Let's start by going through the crucial preparatory steps for conducting a comprehensive industry analysis.

1. Data Collection and Research

- Primary Research: When embarking on an industry analysis, consider conducting primary research . This involves gathering data directly from industry sources, stakeholders, and potential customers. Methods may include surveys , interviews, focus groups , and observations. Primary research provides firsthand insights and can help validate secondary research findings.

- Secondary Research: Secondary research involves analyzing existing literature, reports, and publications related to your industry. Sources may include academic journals, industry-specific magazines, government publications, and market research reports. Secondary research provides a foundation of knowledge and can help identify gaps in information that require further investigation.

- Data Sources: Explore various data sources to collect valuable industry information. These sources may include industry-specific associations, government agencies, trade publications, and reputable market research firms. Make sure to cross-reference data from multiple sources to ensure accuracy and reliability.

2. Identifying Relevant Industry Metrics

Understanding and identifying the right industry metrics is essential for meaningful analysis. Here, we'll discuss key metrics that can provide valuable insights:

- Market Size: Determining the market's size, whether in terms of revenue, units sold, or customer base, is a fundamental metric. It offers a snapshot of the industry's scale and potential.

- Market Growth Rate: Assessing historical and projected growth rates is crucial for identifying trends and opportunities. Understanding how the market has evolved over time can guide strategic decisions.

- Market Share Analysis: Analyzing market share among industry players can help you identify dominant competitors and their respective positions. This metric also assists in gauging your own company's market presence.

- Market Segmentation : Segmenting the market based on demographics, geography, behavior, or other criteria can provide deeper insights. Understanding the specific needs and preferences of various market segments can inform targeted strategies.

3. Gathering Competitive Intelligence

Competitive intelligence is the cornerstone of effective industry analysis. To gather and utilize information about your competitors:

- Competitor Identification: Begin by creating a comprehensive list of your primary and potential competitors. Consider businesses that offer similar products or services within your target market. It's essential to cast a wide net to capture all relevant competitors.

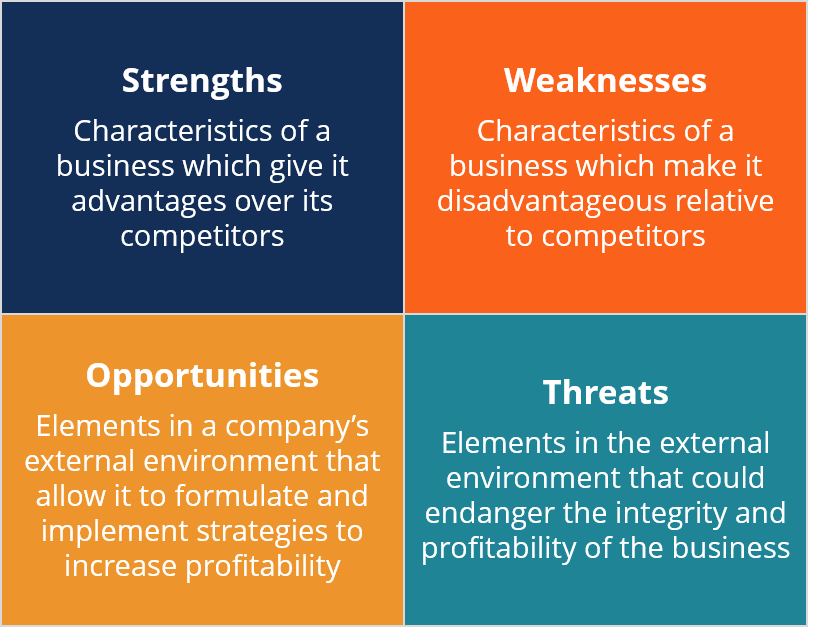

- SWOT Analysis : Conduct a thorough SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for each competitor. This analysis helps you identify their internal strengths and weaknesses, as well as external opportunities and threats they face.

- Market Share Analysis: Determine the market share held by each competitor and how it has evolved over time. Analyzing changes in market share can reveal shifts in competitive dynamics.

- Product and Pricing Analysis: Evaluate your competitors' product offerings and pricing strategies . Identify any unique features or innovations they offer and consider how your own products or services compare.

- Marketing and Branding Strategies: Examine the marketing and branding strategies employed by competitors. This includes their messaging, advertising channels, and customer engagement tactics. Assess how your marketing efforts stack up.

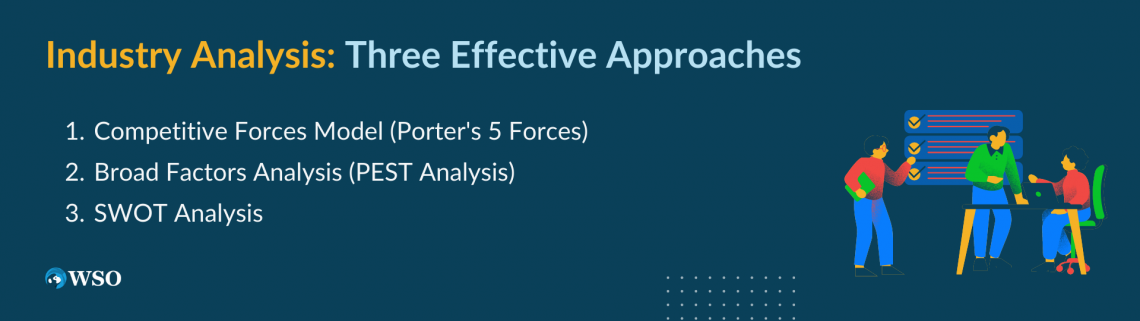

Industry Analysis Frameworks and Models

Now, let's explore essential frameworks and models commonly used in industry analysis, providing you with practical insights and examples to help you effectively apply these tools.

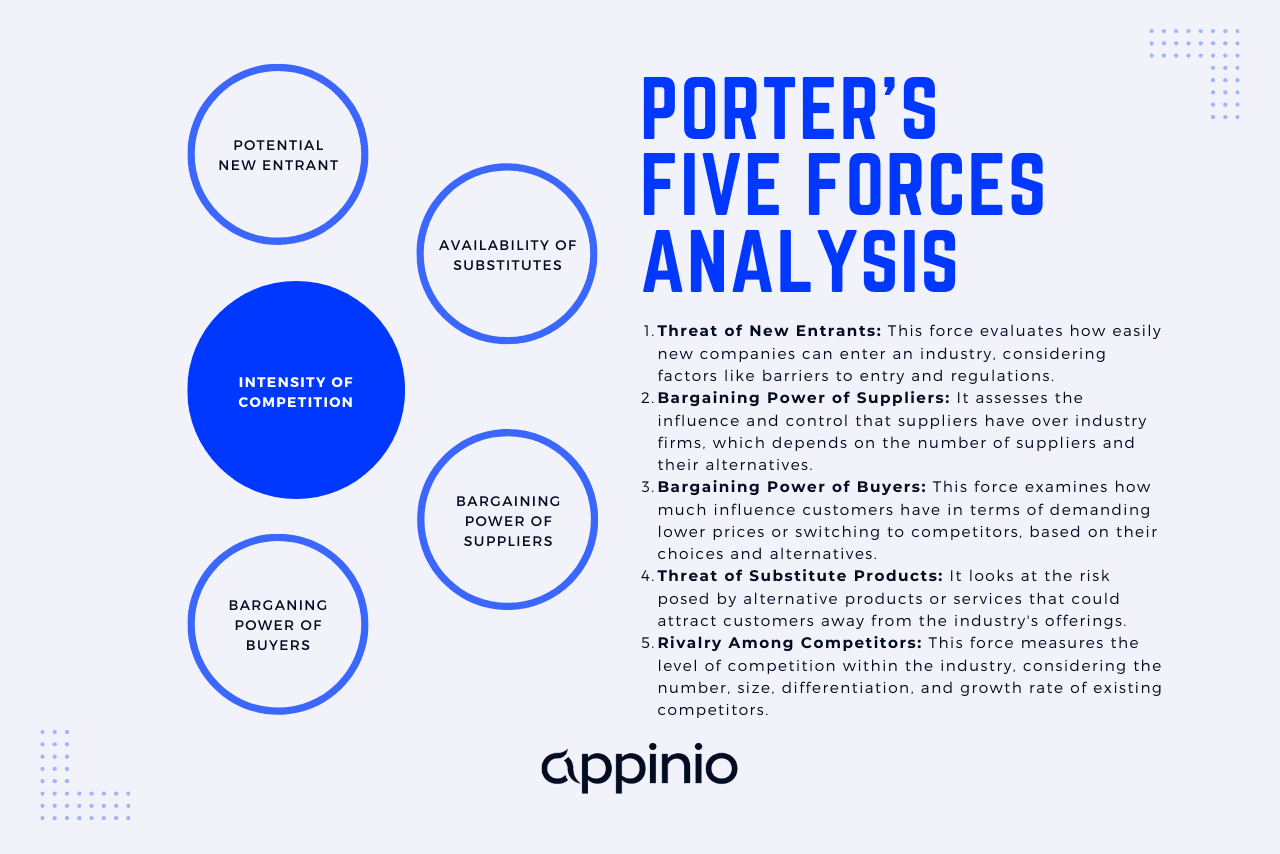

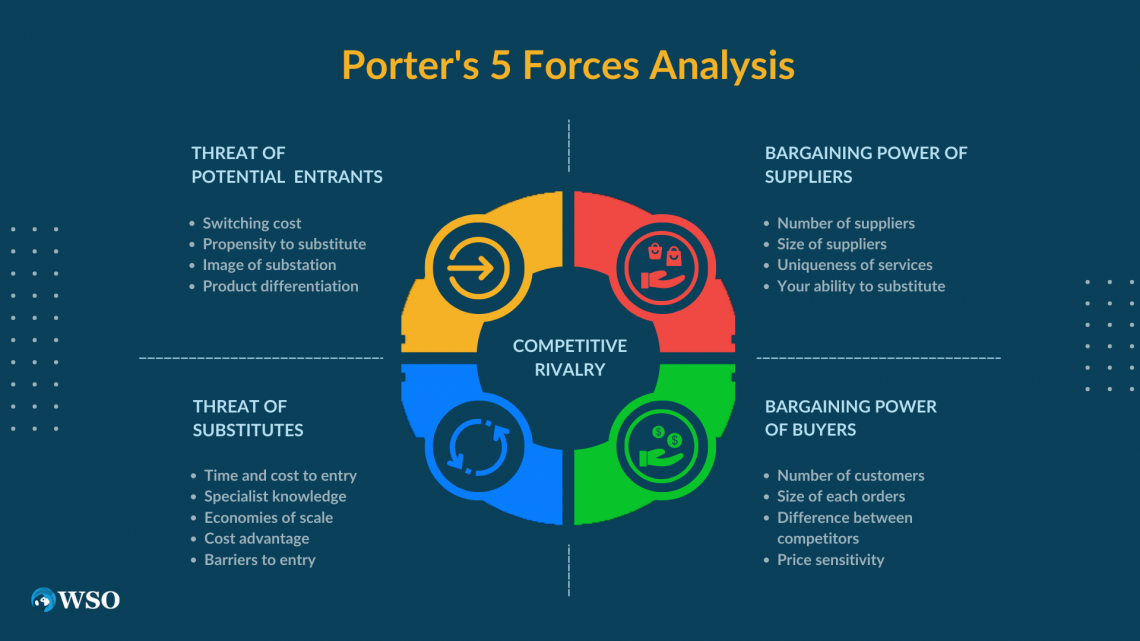

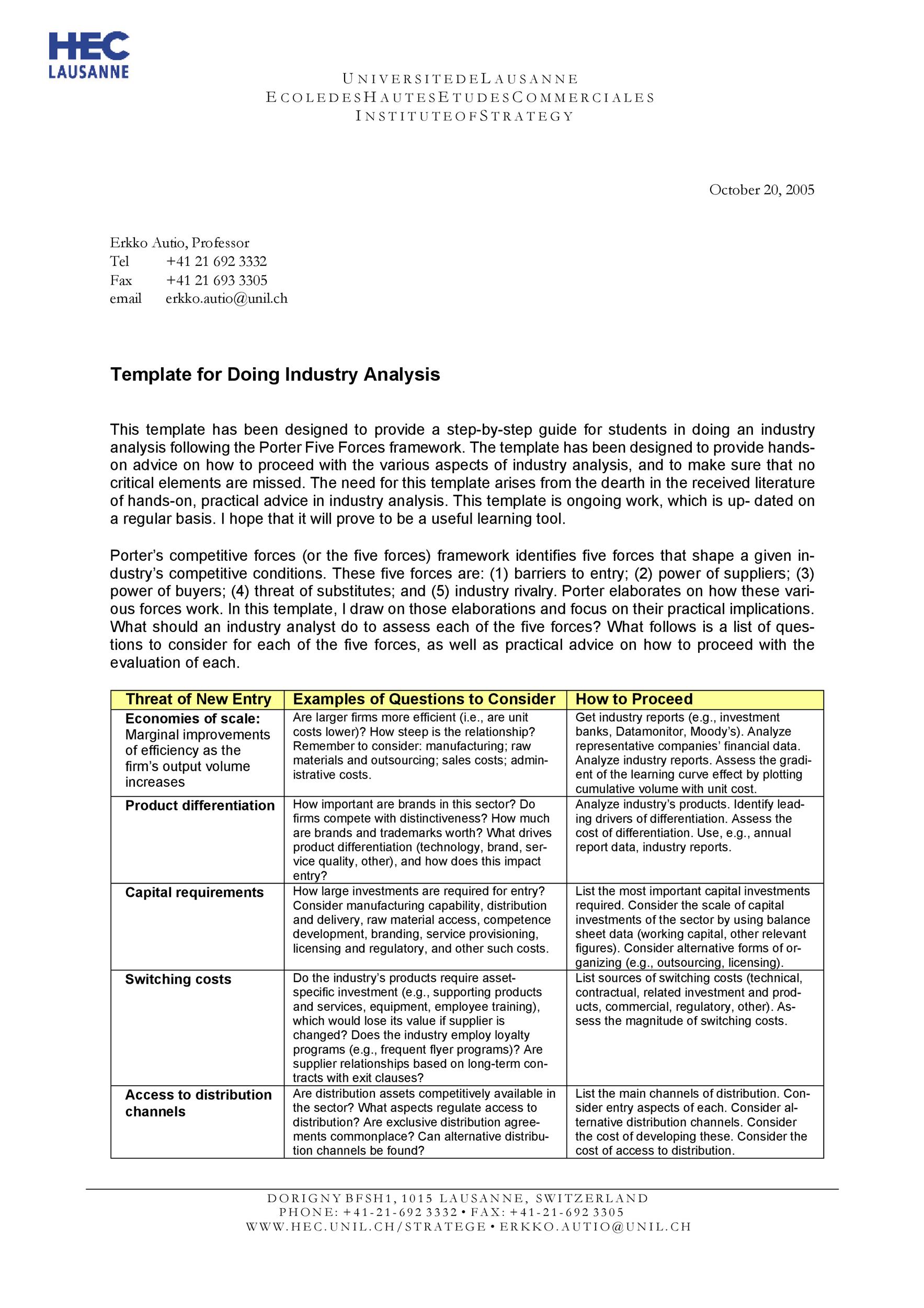

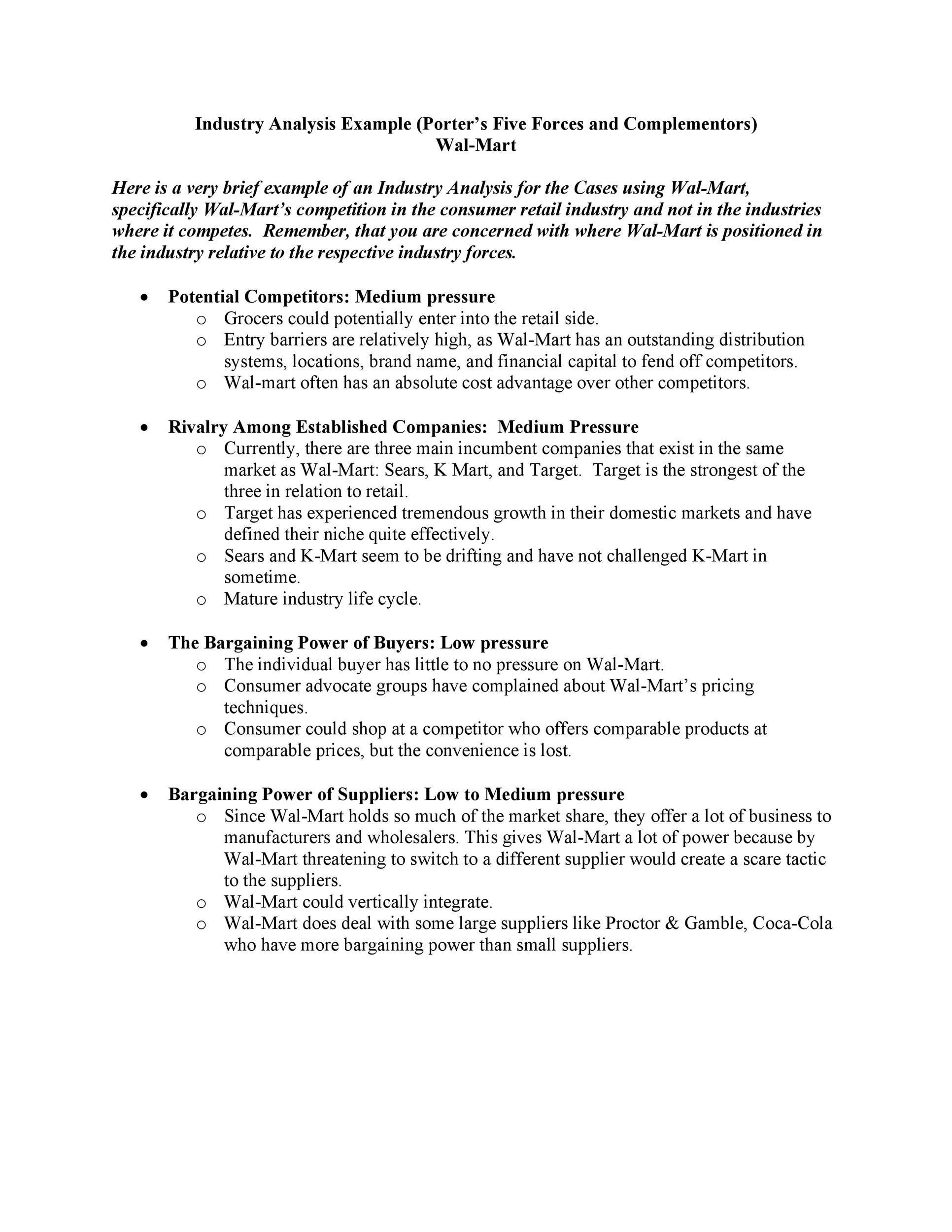

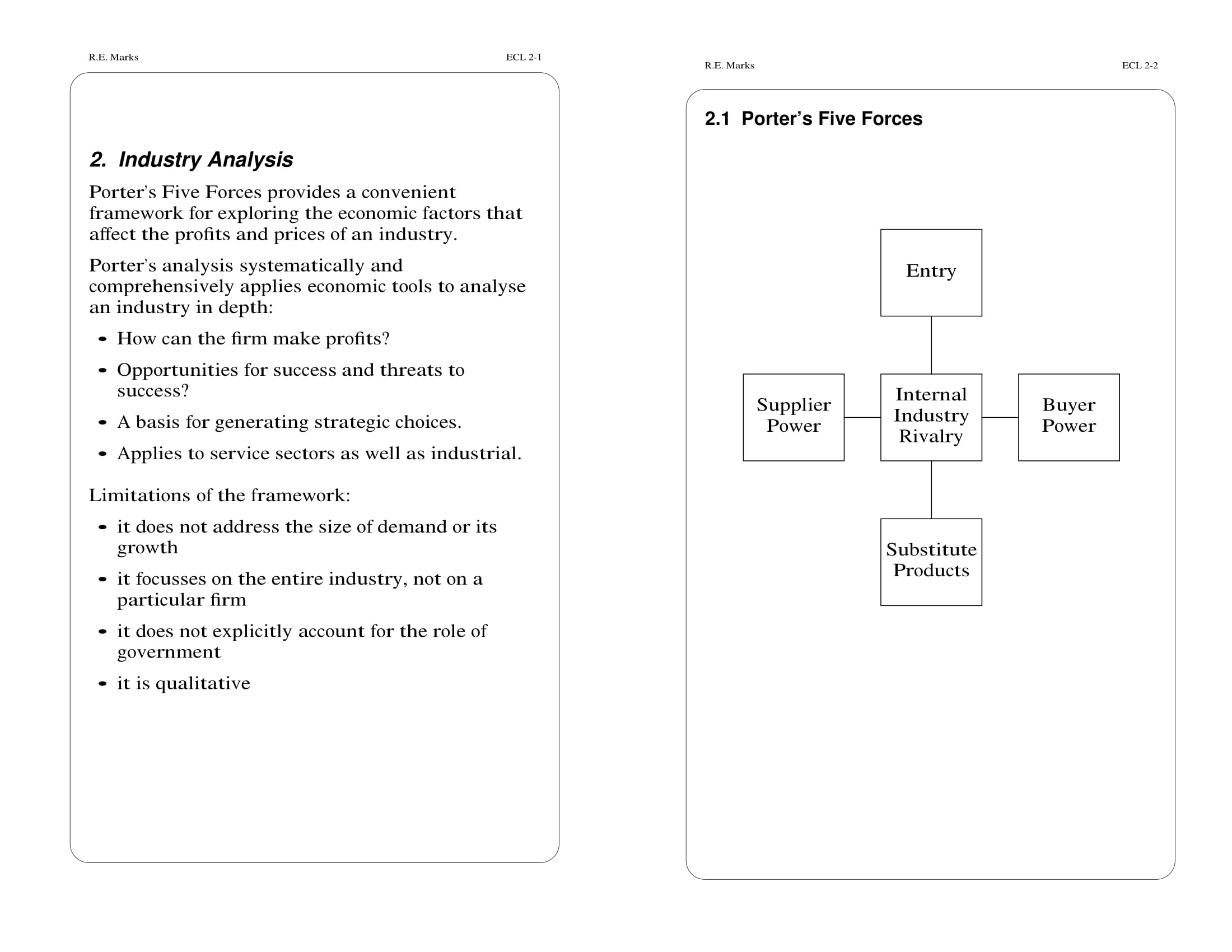

Porter's Five Forces Model

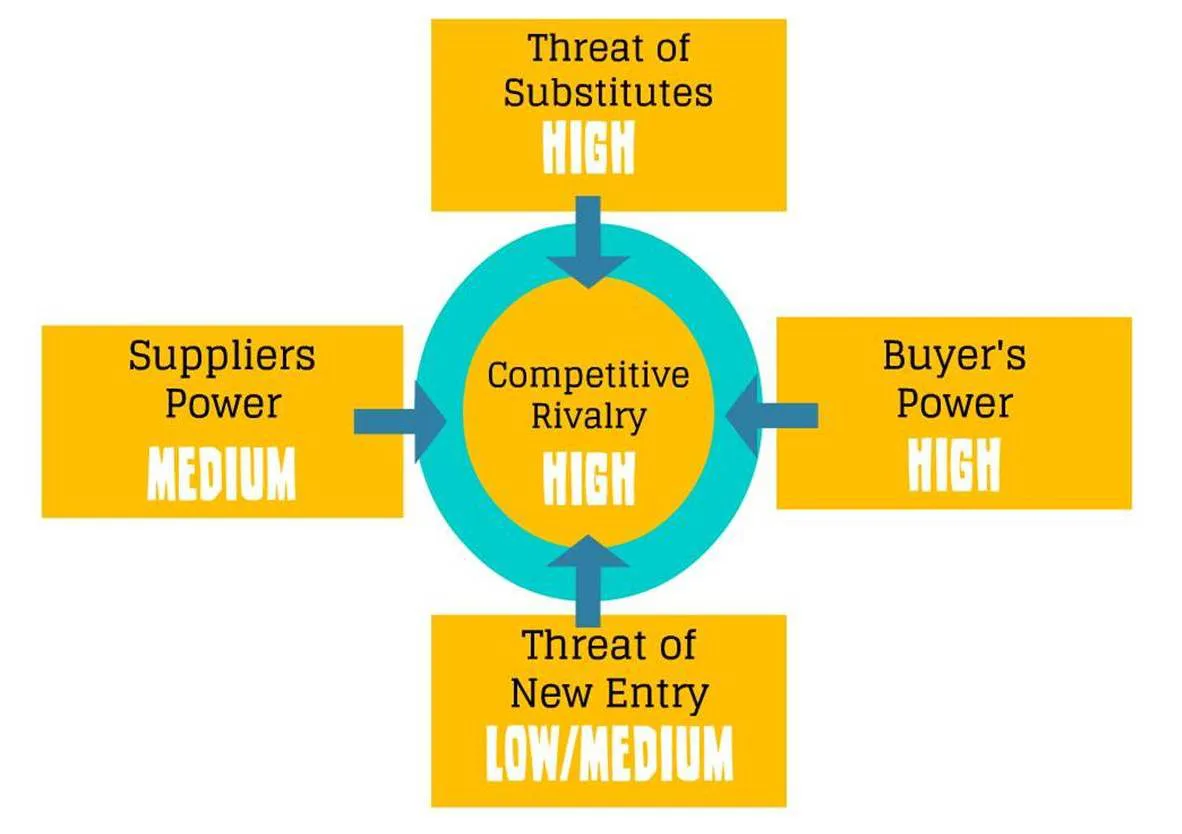

Porter's Five Forces is a powerful framework developed by Michael Porter to assess the competitive forces within an industry. This model helps you understand the industry's attractiveness and competitive dynamics.

It consists of five key forces:

- Threat of New Entrants: This force evaluates how easy or difficult it is for new companies to enter the industry. Factors that increase barriers to entry include high capital requirements, strong brand loyalty among existing players, and complex regulatory hurdles. For example, the airline industry has significant barriers to entry due to the need for large capital investments in aircraft, airport facilities, and regulatory approvals.

- Bargaining Power of Suppliers: This force examines the influence suppliers have on the industry's profitability. Powerful suppliers can demand higher prices or impose unfavorable terms. For instance, in the automotive industry, suppliers of critical components like microchips can wield significant bargaining power if they are few in number or if their products are highly specialized.

- Bargaining Power of Buyers: The bargaining power of buyers assesses how much influence customers have in negotiating prices and terms. In industries where buyers have many alternatives, such as the smartphone market, they can demand lower prices and better features, putting pressure on manufacturers to innovate and compete.

- Threat of Substitutes: This force considers the availability of substitute products or services that could potentially replace what the industry offers. For example, the rise of electric vehicles represents a significant threat to the traditional gasoline-powered automotive industry as consumers seek eco-friendly alternatives.

- Competitive Rivalry: Competitive rivalry assesses the intensity of competition among existing firms in the industry. A highly competitive industry, such as the smartphone market, often leads to price wars and aggressive marketing strategies as companies vie for market share.

Example: Let's consider the coffee shop industry . New entrants face relatively low barriers, as they can set up a small shop with limited capital. However, the bargaining power of suppliers, such as coffee bean producers, can vary depending on the region and the coffee's rarity. Bargaining power with buyers is moderate, as customers often have several coffee shops to choose from. Threats of substitutes may include energy drinks or homemade coffee, while competitive rivalry is high, with numerous coffee chains and independent cafes competing for customers.

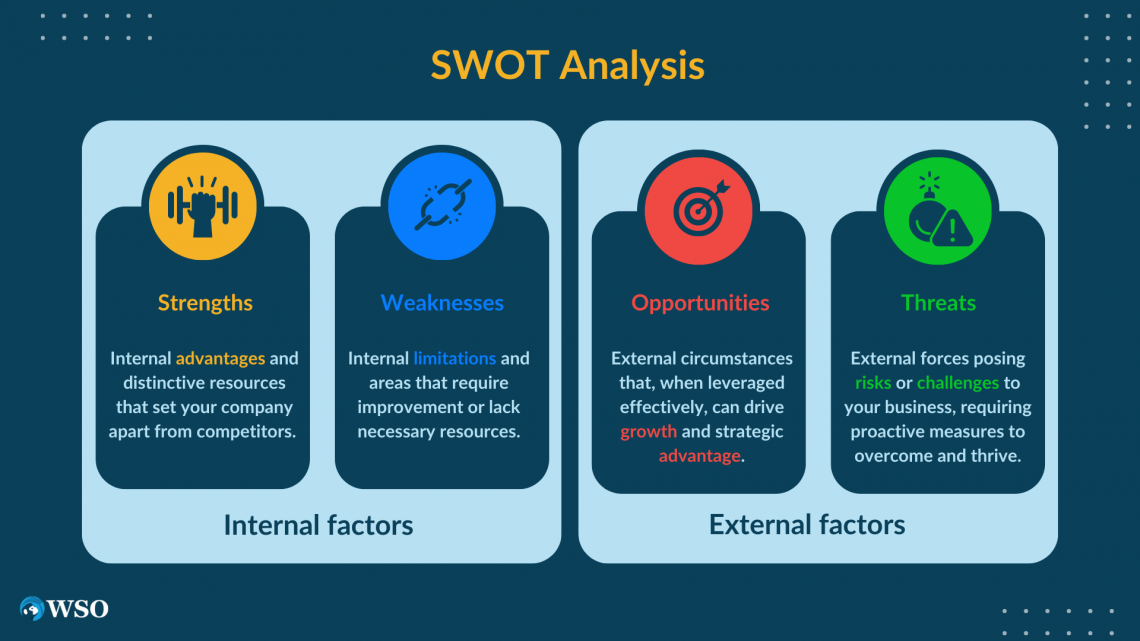

SWOT Analysis

SWOT Analysis is a versatile tool used to assess an organization's internal strengths and weaknesses, as well as external opportunities and threats. By conducting a SWOT analysis, you can gain a comprehensive understanding of your industry and formulate effective strategies.

- Strengths: These are the internal attributes and capabilities that give your business a competitive advantage. For instance, if you're a tech company, having a talented and innovative team can be considered a strength.

- Weaknesses: Weaknesses are internal factors that hinder your business's performance. For example, a lack of financial resources or outdated technology can be weaknesses that need to be addressed.

- Opportunities: Opportunities are external factors that your business can capitalize on. This could be a growing market segment, emerging technologies, or changing consumer trends.

- Threats: Threats are external factors that can potentially harm your business. Examples of threats might include aggressive competition, economic downturns, or regulatory changes.

Example: Let's say you're analyzing the fast-food industry. Strengths could include a well-established brand, a wide menu variety, and efficient supply chain management. Weaknesses may involve a limited focus on healthy options and potential labor issues. Opportunities could include the growing trend toward healthier eating, while threats might encompass health-conscious consumer preferences and increased competition from delivery apps.

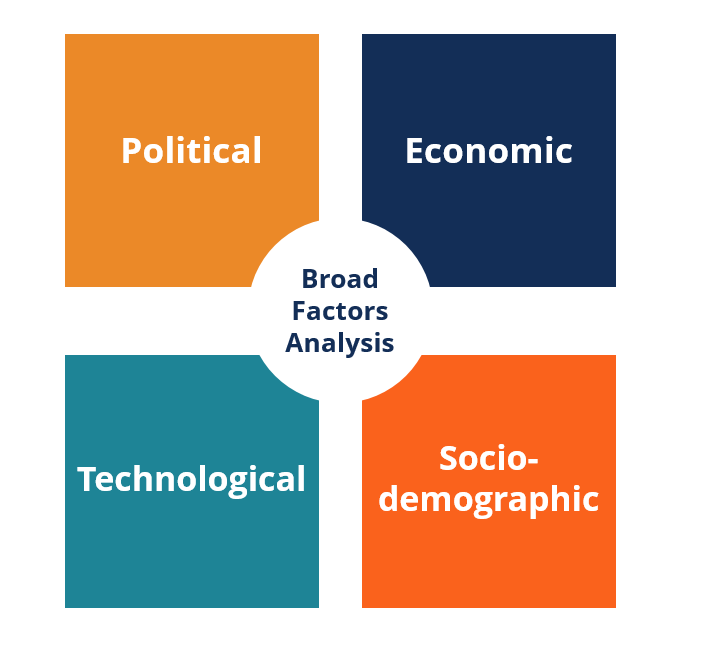

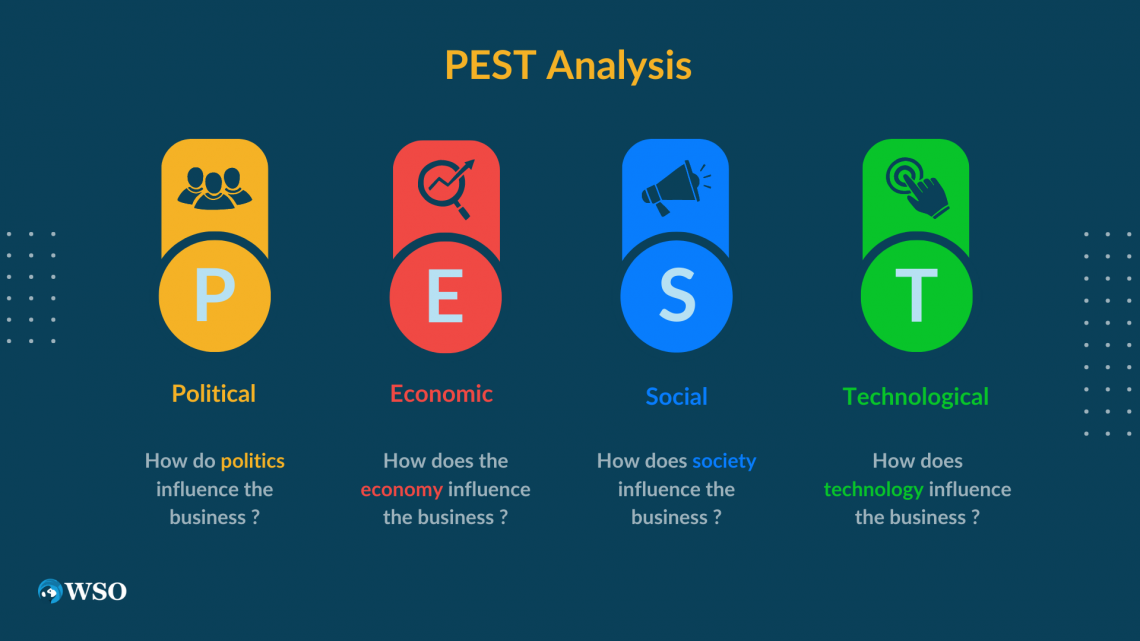

PESTEL Analysis

PESTEL Analysis examines the external macro-environmental factors that can impact your industry. The acronym stands for:

- Political: Political factors encompass government policies, stability, and regulations. For example, changes in tax laws or trade agreements can affect industries like international manufacturing.

- Economic: Economic factors include economic growth, inflation rates, and exchange rates. A fluctuating currency exchange rate can influence export-oriented industries like tourism.

- Social: Social factors encompass demographics, cultural trends, and social attitudes. An aging population can lead to increased demand for healthcare services and products.

- Technological: Technological factors involve advancements and innovations. Industries like telecommunications are highly influenced by technological developments, such as the rollout of 5G networks.

- Environmental: Environmental factors cover sustainability, climate change, and ecological concerns. Industries such as renewable energy are directly impacted by environmental regulations and consumer preferences.

- Legal: Legal factors encompass laws, regulations, and compliance requirements. The pharmaceutical industry, for instance, faces stringent regulatory oversight and patent protection laws.

Example: Consider the automobile manufacturing industry. Political factors may include government incentives for electric vehicles. Economic factors can involve fluctuations in fuel prices affecting consumer preferences for fuel-efficient cars. Social factors might encompass the growing interest in eco-friendly transportation options. Technological factors could relate to advancements in autonomous driving technology. Environmental factors may involve emissions regulations, while legal factors could pertain to safety standards and recalls.

Industry Life Cycle Analysis

Industry Life Cycle Analysis categorizes industries into various stages based on their growth and maturity. Understanding where your industry stands in its life cycle can help shape your strategies.

- Introduction: In the introduction stage, the industry is characterized by slow growth, limited competition, and a focus on product development. New players enter the market, and consumers become aware of the product or service. For instance, electric scooters were introduced as a new mode of transportation in recent years.

- Growth: The growth stage is marked by rapid market expansion, increased competition, and rising demand. Companies focus on gaining market share, and innovation is vital. The ride-sharing industry, exemplified by companies like Uber and Lyft, experienced significant growth in this stage.

- Maturity: In the maturity stage, the market stabilizes, and competition intensifies. Companies strive to maintain market share and differentiate themselves through branding and customer loyalty programs. The smartphone industry reached maturity with multiple established players.

- Decline: In the decline stage, the market saturates, and demand decreases. Companies must adapt or diversify to survive. The decline of traditional print media is a well-known example.

Example: Let's analyze the video streaming industry . The introduction stage saw the emergence of streaming services like Netflix. In the growth stage, more players entered the market, and the industry saw rapid expansion. The industry is currently in the maturity stage, with established platforms like Netflix, Amazon Prime, and Disney+ competing for market share. However, with continued innovation and changing consumer preferences, the decline stage may eventually follow.

Value Chain Analysis

Value Chain Analysis dissects a company's activities into primary and support activities to identify areas of competitive advantage. Primary activities directly contribute to creating and delivering a product or service, while support activities facilitate primary activities.

- Primary Activities: These activities include inbound logistics (receiving and storing materials), operations (manufacturing or service delivery), outbound logistics (distribution), marketing and sales, and customer service.

- Support Activities: Support activities include procurement (acquiring materials and resources), technology development (R&D and innovation), human resource management (recruitment and training), and infrastructure (administrative and support functions).

Example: Let's take the example of a smartphone manufacturer. Inbound logistics involve sourcing components, such as processors and displays. Operations include assembly and quality control. Outbound logistics cover shipping and distribution. Marketing and sales involve advertising and retail partnerships. Customer service handles warranty and support.

Procurement ensures a stable supply chain for components. Technology development focuses on research and development of new features. Human resource management includes hiring and training skilled engineers. Infrastructure supports the company's administrative functions.

By applying these frameworks and models effectively, you can better understand your industry, identify strategic opportunities and threats, and develop a solid foundation for informed decision-making.

Data Interpretation and Analysis

Once you have your data, it's time to start interpreting and analyzing the data you've collected during your industry analysis.

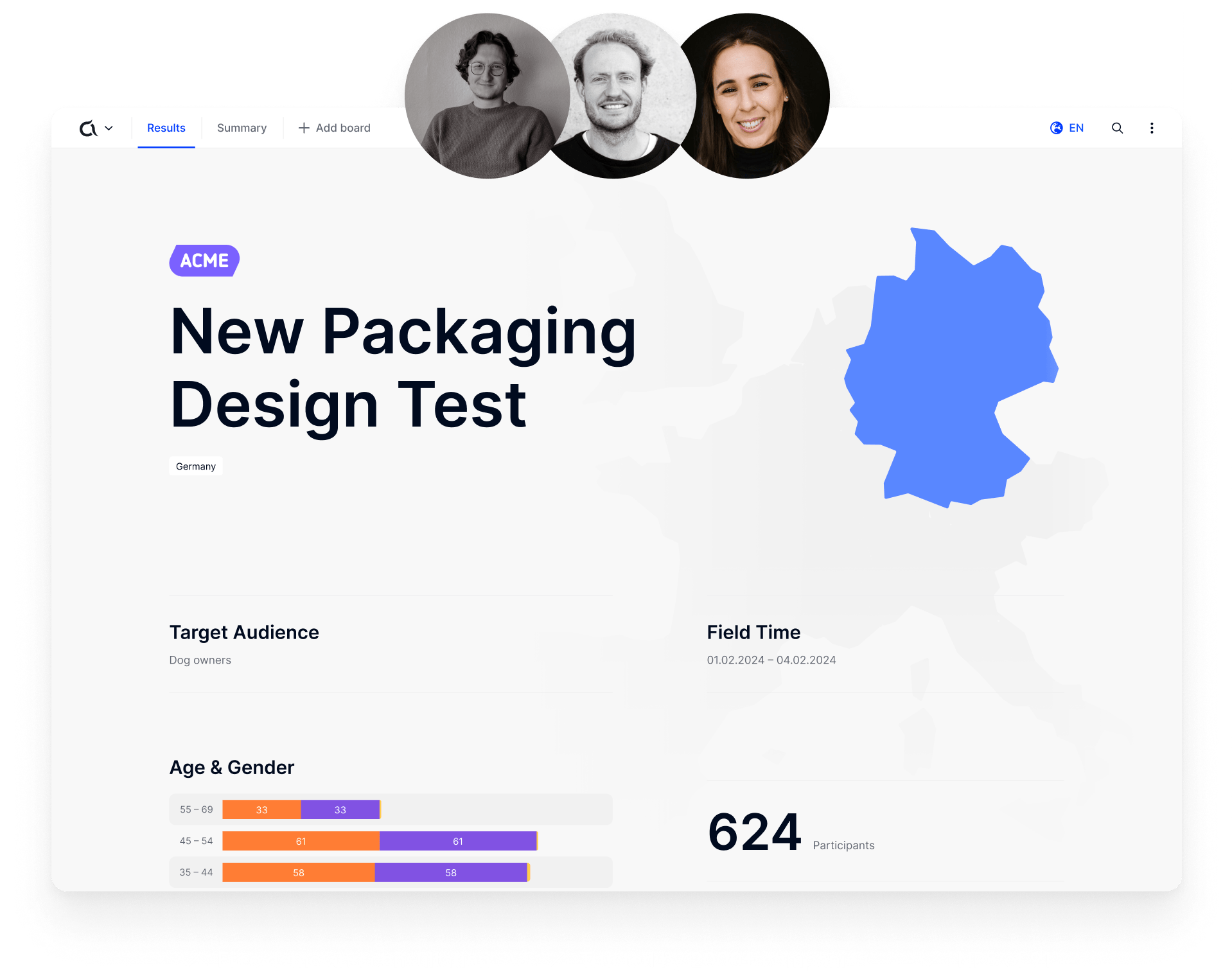

You can unlock the full potential of your data with Appinio 's comprehensive research platform. Beyond aiding in data collection, Appinio simplifies the intricate process of data interpretation and analysis. Our intuitive tools empower you to effortlessly transform raw data into actionable insights, giving you a competitive edge in understanding your industry.

Whether it's assessing market trends, evaluating the competitive landscape, or understanding customer behavior, Appinio offers a holistic solution to uncover valuable findings. With our platform, you can make informed decisions, strategize effectively, and stay ahead of industry shifts.

Experience the ease of data collection and interpretation with Appinio – book a demo today!

Get a free demo and see the Appinio platform in action!

1. Analyze Market Size and Growth

Analyzing the market's size and growth is essential for understanding its dynamics and potential. Here's how to conduct a robust analysis:

- Market Size Calculation: Determine the total market size in terms of revenue, units sold, or the number of customers. This figure serves as a baseline for evaluating the industry's scale.

- Historical Growth Analysis: Examine historical data to identify growth trends. This includes looking at past year-over-year growth rates and understanding the factors that influenced them.

- Projected Growth Assessment: Explore industry forecasts and projections to gain insights into the expected future growth of the market. Consider factors such as emerging technologies, changing consumer preferences, and economic conditions.

- Segmentation Analysis: If applicable, analyze market segmentation data to identify growth opportunities in specific market segments. Understand which segments are experiencing the most significant growth and why.

2. Assess Market Trends

Stay ahead of the curve by closely monitoring and assessing market trends. Here's how to effectively evaluate trends within your industry.

- Consumer Behavior Analysis: Dive into consumer behavior data to uncover shifts in preferences, buying patterns, and shopping habits. Understand how technological advancements and cultural changes influence consumer choices.

- Technological Advancements: Keep a keen eye on technological developments that impact your industry. Assess how innovations such as AI, IoT, blockchain, or automation are changing the competitive landscape.

- Regulatory Changes: Stay informed about regulatory shifts and their potential consequences for your industry. Regulations can significantly affect product development, manufacturing processes, and market entry strategies.

- Sustainability and Environmental Trends: Consider the growing importance of sustainability and environmental concerns. Evaluate how your industry is adapting to eco-friendly practices and how these trends affect consumer choices.

3. Evaluate Competitive Landscape

Understanding the competitive landscape is critical for positioning your business effectively. To perform a comprehensive evaluation:

- Competitive Positioning: Determine where your company stands in comparison to competitors. Identify your unique selling propositions and areas where you excel.

- Market Share Analysis: Continuously monitor market share among industry players. Identify trends in market share shifts and assess the strategies that lead to such changes.

- Competitive Advantages and Weaknesses: Analyze your competitors' strengths and weaknesses. Identify areas where you can capitalize on their weaknesses and where you need to fortify your own strengths.

4. Identify Key Success Factors

Recognizing and prioritizing key success factors is crucial for developing effective strategies. To identify and leverage these factors:

- Customer Satisfaction: Prioritize customer satisfaction as a critical success factor. Satisfied customers are more likely to become loyal advocates and contribute to long-term success.

- Quality and Innovation: Focus on product or service quality and continuous innovation. Meeting and exceeding customer expectations can set your business apart from competitors.

- Cost Efficiency: Strive for cost efficiency in your operations. Identifying cost-saving opportunities can lead to improved profitability.

- Marketing and Branding Excellence: Invest in effective marketing and branding strategies to create a strong market presence. Building a recognizable brand can drive customer loyalty and growth.

5. Analyze Customer Behavior and Preferences

Understanding your target audience is central to success. Here's how to analyze customer behavior and preferences:

- Market Segmentation: Use market segmentation to categorize customers based on demographics, psychographics , and behavior. This allows for more personalized marketing and product/service offerings.

- Customer Surveys and Feedback: Gather customer feedback through surveys and feedback mechanisms. Understand their pain points, preferences, and expectations to tailor your offerings.

- Consumer Journey Mapping: Map the customer journey to identify touchpoints where you can improve engagement and satisfaction. Optimize the customer experience to build brand loyalty.

By delving deep into data interpretation and analysis, you can gain valuable insights into your industry, uncover growth opportunities, and refine your strategic approach.

How to Conduct Competitor Analysis?

Competitor analysis is a critical component of industry analysis as it provides valuable insights into your rivals, helping you identify opportunities, threats, and areas for improvement.

1. Identify Competitors

Identifying your competitors is the first step in conducting a thorough competitor analysis. Competitors can be classified into several categories:

- Direct Competitors: These are companies that offer similar products or services to the same target audience. They are your most immediate competitors and often compete directly with you for market share.

- Indirect Competitors: Indirect competitors offer products or services that are related but not identical to yours. They may target a slightly different customer segment or provide an alternative solution to the same problem.

- Potential Competitors: These companies could enter your market in the future. Identifying potential competitors early allows you to anticipate and prepare for new entrants.

- Substitute Products or Services: While not traditional competitors, substitute products or services can fulfill the same customer needs or desires. Understanding these alternatives is crucial to your competitive strategy.

2. Analyze Competitor Strengths and Weaknesses

Once you've identified your competitors, you need to analyze their strengths and weaknesses. This analysis helps you understand how to position your business effectively and identify areas where you can gain a competitive edge.

- Strengths: Consider what your competitors excel at. This could include factors such as brand recognition, innovative products, a large customer base, efficient operations, or strong financial resources.

- Weaknesses: Identify areas where your competitors may be lacking. Weaknesses could involve limited product offerings, poor customer service, outdated technology, or financial instability.

3. Competitive Positioning

Competitive positioning involves defining how you want your business to be perceived relative to your competitors. It's about finding a unique position in the market that sets you apart. Consider the following strategies:

- Cost Leadership: Strive to be the low-cost provider in your industry. This positioning appeals to price-conscious consumers.

- Differentiation: Focus on offering unique features or attributes that make your products or services stand out. This can justify premium pricing.

- Niche Market: Target a specific niche or segment of the market that may be underserved by larger competitors. Tailor your offerings to meet their unique needs.

- Innovation and Technology: Emphasize innovation and technology to position your business as a leader in product or service quality.

- Customer-Centric: Prioritize exceptional customer service and customer experience to build loyalty and a positive reputation.

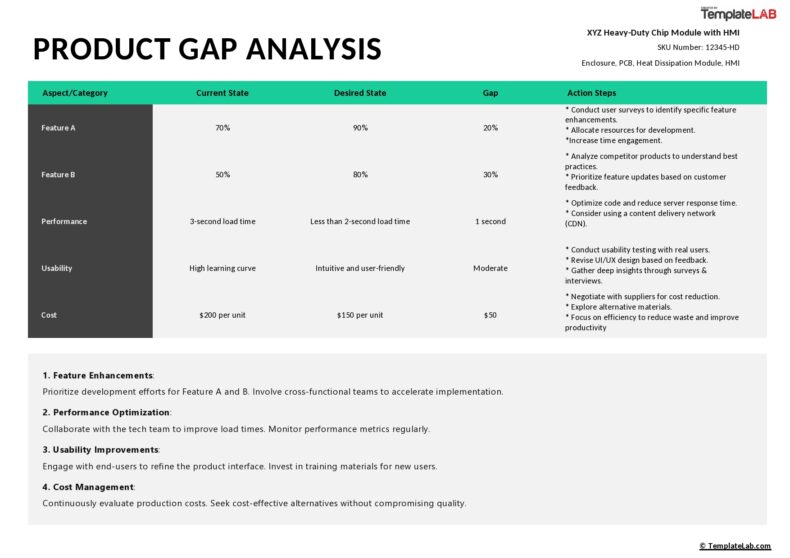

4. Benchmarking and Gap Analysis

Benchmarking involves comparing your business's performance and practices with those of your competitors or industry leaders. Gap analysis helps identify areas where your business falls short and where improvements are needed.

- Performance Benchmarking: Compare key performance metrics, such as revenue, profitability, market share, and customer satisfaction, with those of your competitors. Identify areas where your performance lags behind or exceeds industry standards.

- Operational Benchmarking: Analyze your operational processes, supply chain, and cost structures compared to your competitors. Look for opportunities to streamline operations and reduce costs.

- Product or Service Benchmarking: Evaluate the features, quality, and pricing of your products or services relative to competitors. Identify gaps and areas for improvement.

- Marketing and Sales Benchmarking: Assess your marketing strategies, customer acquisition costs, and sales effectiveness compared to competitors. Determine whether your marketing efforts are performing at a competitive level.

Market Entry and Expansion Strategies

Market entry and expansion strategies are crucial for businesses looking to enter new markets or expand their presence within existing ones. These strategies can help you effectively target and penetrate your chosen markets.

Market Segmentation and Targeting

- Market Segmentation: Begin by segmenting your target market into distinct groups based on demographics , psychographics, behavior, or other relevant criteria. This helps you understand the diverse needs and preferences of different customer segments.

- Targeting: Once you've segmented the market, select specific target segments that align with your business goals and capabilities. Tailor your marketing and product/service offerings to appeal to these chosen segments.

Market Entry Modes

Selecting the proper market entry mode is crucial for a successful expansion strategy. Entry modes include:

- Exporting: Sell your products or services in international markets through exporting. This is a low-risk approach, but it may limit your market reach.

- Licensing and Franchising: License your brand, technology, or intellectual property to local partners or franchisees. This allows for rapid expansion while sharing the risk and control.

- Joint Ventures and Alliances: Partner with local companies through joint ventures or strategic alliances. This approach leverages local expertise and resources.

- Direct Investment: Establish a physical presence in the target market through subsidiaries, branches, or wholly-owned operations. This offers full control but comes with higher risk and investment.

Competitive Strategy Formulation

Your competitive strategy defines how you will compete effectively in the target market.

- Cost Leadership: Strive to offer products or services at lower prices than competitors while maintaining quality. This strategy appeals to price-sensitive consumers.

- Product Differentiation: Focus on offering unique and innovative products or services that stand out in the market. This strategy justifies premium pricing.

- Market Niche: Target a specific niche or segment within the market that is underserved or has particular needs. Tailor your offerings to meet the unique demands of this niche.

- Market Expansion : Expand your product or service offerings to capture a broader share of the market. This strategy involves diversifying your offerings to appeal to a broader audience.

- Global Expansion: Consider expanding internationally to tap into new markets and diversify your customer base. This strategy involves thorough market research and adaptation to local cultures and regulations.

International Expansion Considerations

If your expansion strategy involves international markets, there are several additional considerations to keep in mind.

- Market Research: Conduct in-depth market research to understand the target country's cultural, economic, and legal differences.

- Regulatory Compliance: Ensure compliance with international trade regulations, customs, and import/export laws.

- Cultural Sensitivity: Adapt your marketing and business practices to align with the cultural norms and preferences of the target market.

- Localization: Consider adapting your products, services, and marketing materials to cater to local tastes and languages.

- Risk Assessment: Evaluate the political, economic, and legal risks associated with operating in the target country. Develop risk mitigation strategies.

By carefully analyzing your competitors and crafting effective market entry and expansion strategies, you can position your business for success in both domestic and international markets.

Risk Assessment and Mitigation

Risk assessment and mitigation are crucial aspects of industry analysis and strategic planning. Identifying potential risks, assessing vulnerabilities, and implementing effective risk management strategies are essential for business continuity and success.

1. Identify Industry Risks

- Market Risks: These risks pertain to factors such as changes in market demand, economic downturns, shifts in consumer preferences, and fluctuations in market prices. For example, the hospitality industry faced significant market risks during the COVID-19 pandemic, resulting in decreased travel and tourism .

- Regulatory and Compliance Risks: Regulatory changes, compliance requirements, and government policies can pose risks to businesses. Industries like healthcare are particularly susceptible to regulatory changes that impact operations and reimbursement.

- Technological Risks: Rapid technological advancements can disrupt industries and render existing products or services obsolete. Companies that fail to adapt to technological shifts may face obsolescence.

- Operational Risks: These risks encompass internal factors that can disrupt operations, such as supply chain disruptions, equipment failures, or cybersecurity breaches.

- Financial Risks: Financial risks include factors like liquidity issues, credit risk , and market volatility. Industries with high capital requirements, such as real estate development, are particularly vulnerable to financial risks.

- Competitive Risks: Intense competition and market saturation can pose challenges to businesses. Failing to respond to competitive threats can result in loss of market share.

- Global Risks: Industries with a worldwide presence face geopolitical risks, currency fluctuations, and international trade uncertainties. For instance, the automotive industry is susceptible to trade disputes affecting the supply chain.

2. Assess Business Vulnerabilities

- SWOT Analysis: Revisit your SWOT analysis to identify internal weaknesses and threats. Assess how these weaknesses may exacerbate industry risks.

- Financial Health: Evaluate your company's financial stability, debt levels, and cash flow. Identify vulnerabilities related to financial health that could hinder your ability to withstand industry-specific challenges.

- Operational Resilience: Assess the robustness of your operational processes and supply chain. Identify areas where disruptions could occur and develop mitigation strategies.

- Market Positioning: Analyze your competitive positioning and market share. Recognize vulnerabilities in your market position that could be exploited by competitors.

- Compliance and Regulatory Adherence: Ensure that your business complies with relevant regulations and standards. Identify vulnerabilities related to non-compliance or regulatory changes.

3. Risk Management Strategies

- Risk Avoidance: In some cases, the best strategy is to avoid high-risk ventures or markets altogether. This may involve refraining from entering certain markets or discontinuing products or services with excessive risk.

- Risk Reduction: Implement measures to reduce identified risks. For example, diversifying your product offerings or customer base can reduce dependence on a single revenue source.

- Risk Transfer: Transfer some risks through methods such as insurance or outsourcing. For instance, businesses can mitigate cybersecurity risks by purchasing cyber insurance.

- Risk Acceptance: In cases where risks cannot be entirely mitigated, it may be necessary to accept a certain level of risk and have contingency plans in place to address potential issues.

- Continuous Monitoring: Establish a system for continuous risk monitoring. Regularly assess the changing landscape and adjust risk management strategies accordingly.

4. Contingency Planning

Contingency planning involves developing strategies and action plans to respond effectively to unforeseen events or crises. It ensures that your business can maintain operations and minimize disruptions in the face of adverse circumstances. Key elements of contingency planning include:

- Risk Scenarios: Identify potential risk scenarios specific to your industry and business. These scenarios should encompass a range of possibilities, from minor disruptions to major crises.

- Response Teams: Establish response teams with clearly defined roles and responsibilities. Ensure that team members are trained and ready to act in the event of a crisis.

- Communication Plans: Develop communication plans that outline how you will communicate with employees, customers, suppliers, and other stakeholders during a crisis. Transparency and timely communication are critical.

- Resource Allocation: Determine how resources, including personnel, finances, and equipment, will be allocated in response to various scenarios.

- Testing and Simulation: Regularly conduct tests and simulations of your contingency plans to identify weaknesses and areas for improvement. Ensure your response teams are well-practiced and ready to execute the plans effectively.

- Documentation and Record Keeping: Maintain comprehensive documentation of contingency plans, response procedures, and communication protocols. This documentation should be easily accessible to relevant personnel.

- Review and Update: Continuously review and update your contingency plans to reflect changing industry dynamics and evolving risks. Regularly seek feedback from response teams to make improvements.

By identifying industry risks, assessing vulnerabilities, implementing risk management strategies, and developing robust contingency plans, your business can navigate the complexities of the industry landscape with greater resilience and preparedness.

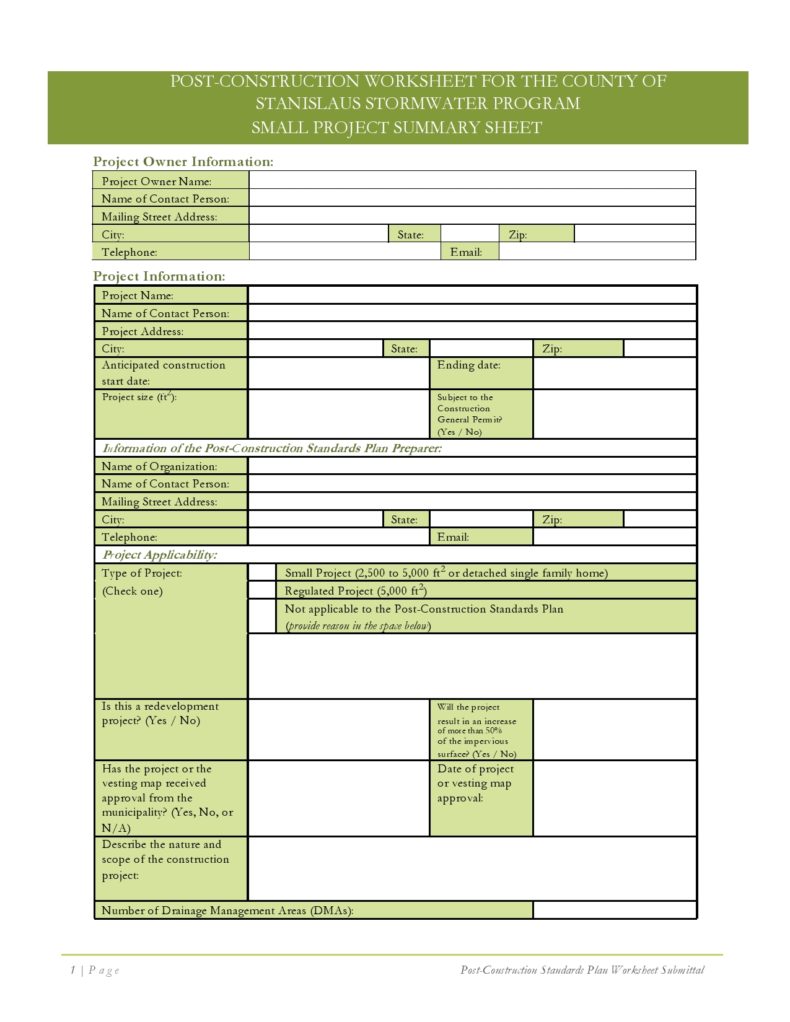

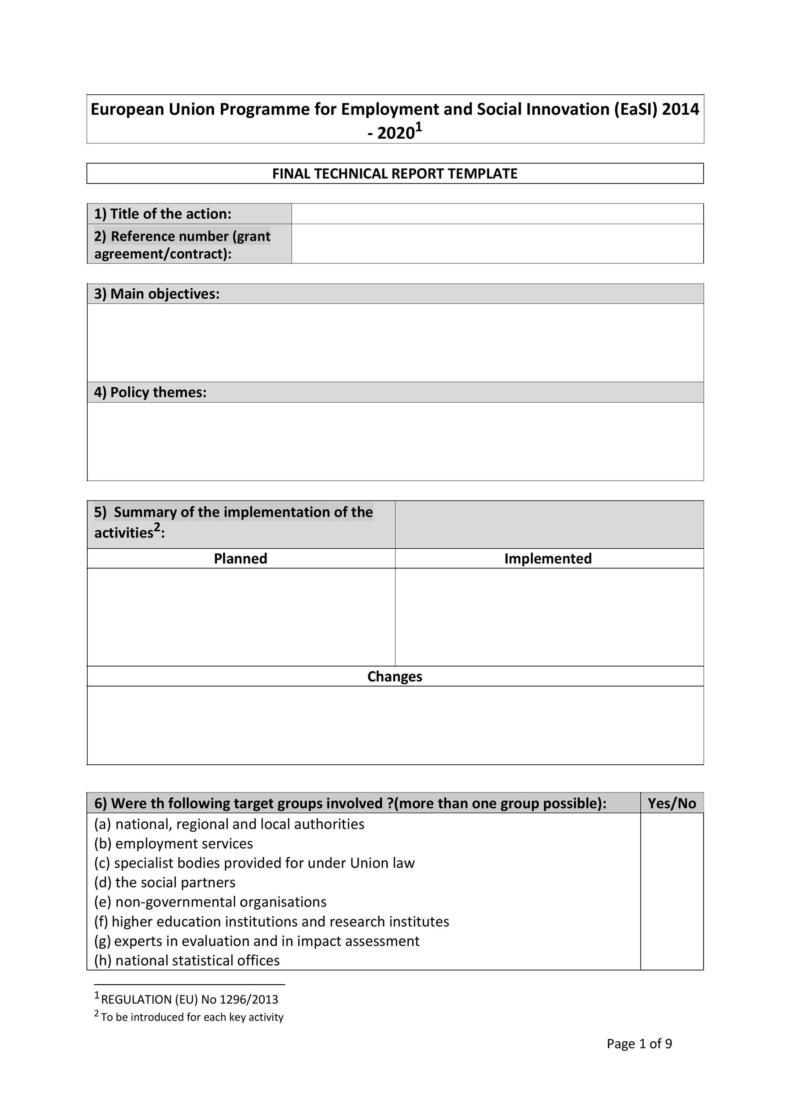

Industry Analysis Template

When embarking on the journey of Industry Analysis, having a well-structured template is akin to having a reliable map for your exploration. It provides a systematic framework to ensure you cover all essential aspects of the analysis. Here's a breakdown of an industry analysis template with insights into each section.

Industry Overview

- Objective: Provide a broad perspective of the industry.

- Market Definition: Define the scope and boundaries of the industry, including its products, services, and target audience.

- Market Size and Growth: Present current market size, historical growth trends, and future projections.

- Key Players: Identify major competitors and their market share.

- Market Trends: Highlight significant trends impacting the industry.

Competitive Analysis

- Objective: Understand the competitive landscape within the industry.

- Competitor Identification: List direct and indirect competitors.

- Competitor Profiles: Provide detailed profiles of major competitors, including their strengths, weaknesses, strategies, and market positioning.

- SWOT Analysis: Conduct a SWOT analysis for each major competitor.

- Market Share Analysis: Analyze market share distribution among competitors.

Market Analysis

- Objective: Explore the characteristics and dynamics of the market.

- Customer Segmentation: Define customer segments and their demographics, behavior, and preferences.

- Demand Analysis: Examine factors driving demand and customer buying behavior.

- Supply Chain Analysis: Map out the supply chain, identifying key suppliers and distribution channels.

- Regulatory Environment: Discuss relevant regulations, policies, and compliance requirements.

Technological Analysis

- Objective: Evaluate the technological landscape impacting the industry.

- Technological Trends: Identify emerging technologies and innovations relevant to the industry.

- Digital Transformation: Assess the level of digitalization within the industry and its impact on operations and customer engagement.

- Innovation Opportunities: Explore opportunities for leveraging technology to gain a competitive edge.

Financial Analysis

- Objective: Analyze the financial health of the industry and key players.

- Revenue and Profitability: Review industry-wide revenue trends and profitability ratios.

- Financial Stability: Assess financial stability by examining debt levels and cash flow.

- Investment Patterns: Analyze capital expenditure and investment trends within the industry.

Consumer Insights

- Objective: Understand consumer behavior and preferences.

- Consumer Surveys: Conduct surveys or gather data on consumer preferences, buying habits , and satisfaction levels.

- Market Perception: Gauge consumer perception of brands and products in the industry.

- Consumer Feedback: Collect and analyze customer feedback and reviews.

SWOT Analysis for Your Business

- Objective: Assess your own business within the industry context.

- Strengths: Identify internal strengths that give your business a competitive advantage.

- Weaknesses: Recognize internal weaknesses that may hinder your performance.

- Opportunities: Explore external opportunities that your business can capitalize on.

- Threats: Recognize external threats that may impact your business.

Conclusion and Recommendations

- Objective: Summarize key findings and provide actionable recommendations.

- Summary: Recap the most critical insights from the analysis.

- Recommendations: Offer strategic recommendations for your business based on the analysis.

- Future Outlook: Discuss potential future developments in the industry.

While this template provides a structured approach, adapt it to the specific needs and objectives of your Industry Analysis. It serves as your guide, helping you navigate through the complex landscape of your chosen industry, uncovering opportunities, and mitigating risks along the way.

Remember that the depth and complexity of your industry analysis may vary depending on your specific goals and the industry you are assessing. You can adapt this template to focus on the most relevant aspects and conduct thorough research to gather accurate data and insights. Additionally, consider using industry-specific data sources, reports, and expert opinions to enhance the quality of your analysis.

Industry Analysis Examples

To grasp the practical application of industry analysis, let's delve into a few diverse examples across different sectors. These real-world scenarios demonstrate how industry analysis can guide strategic decision-making.

Tech Industry - Smartphone Segment

Scenario: Imagine you are a product manager at a tech company planning to enter the smartphone market. Industry analysis reveals that the market is highly competitive, dominated by established players like Apple and Samsung.

Use of Industry Analysis:

- Competitive Landscape: Analyze the strengths and weaknesses of competitors, identifying areas where they excel (e.g., Apple's brand loyalty ) and where they might have vulnerabilities (e.g., consumer demand for more affordable options).

- Market Trends: Identify trends like the growing demand for sustainable technology and 5G connectivity, guiding product development and marketing strategies.

- Regulatory Factors: Consider regulatory factors related to intellectual property rights, patents, and international trade agreements that can impact market entry and operations.

- Outcome: Armed with insights from industry analysis, you decide to focus on innovation, emphasizing features like eco-friendliness and affordability. This niche approach helps your company gain a foothold in the competitive market.

Healthcare Industry - Telehealth Services

Scenario: You are a healthcare entrepreneur exploring opportunities in the telehealth sector, especially in the wake of the COVID-19 pandemic. Industry analysis is critical due to rapid market changes.

- Market Size and Growth: Evaluate the growing demand for telehealth services, driven by the need for remote healthcare during the pandemic and convenience factors.

- Regulatory Environment: Understand the evolving regulatory landscape, including changes in telemedicine reimbursement policies and licensing requirements.

- Technological Trends: Explore emerging technologies such as AI-powered diagnosis and remote monitoring that can enhance service offerings.

- Outcome: Industry analysis underscores the potential for telehealth growth. You adapt your business model to align with regulatory changes, invest in cutting-edge technology, and focus on patient-centric care, positioning your telehealth service for success.

Food Industry - Plant-Based Foods

Scenario: As a food industry entrepreneur , you are considering entering the plant-based foods market, driven by increasing consumer interest in health and sustainability.

- Market Trends: Analyze the trend toward plant-based diets and sustainability, reflecting changing consumer preferences.

- Competitive Landscape: Assess the competitive landscape, understanding that established companies and startups are vying for market share.

- Consumer Behavior: Study consumer behavior, recognizing that health-conscious consumers seek plant-based alternatives.

- Outcome: Informed by industry analysis, you launch a line of plant-based products emphasizing both health benefits and sustainability. Effective marketing and product quality gain traction among health-conscious consumers, making your brand a success in the plant-based food industry.

These examples illustrate how industry analysis can guide strategic decisions, whether entering competitive tech markets, navigating dynamic healthcare regulations, or capitalizing on shifting consumer preferences in the food industry. By applying industry analysis effectively, businesses can adapt, innovate, and thrive in their respective sectors.

Conclusion for Industry Analysis

Industry Analysis is the compass that helps businesses chart their course in the vast sea of markets. By understanding the industry's dynamics, risks, and opportunities, you gain a strategic advantage that can steer your business towards success. From identifying competitors to mitigating risks and formulating competitive strategies, this guide has equipped you with the tools and knowledge needed to navigate the complexities of the business world.

Remember, Industry Analysis is not a one-time task; it's an ongoing journey. Keep monitoring market trends, adapting to changes, and staying ahead of the curve. With a solid foundation in industry analysis, you're well-prepared to tackle challenges, seize opportunities, and make well-informed decisions that drive your business toward prosperity. So, set sail with confidence and let industry analysis be your guiding star on the path to success.

How to Conduct Industry Analysis in Minutes?

Introducing Appinio , the real-time market research platform that transforms how you conduct Industry Analysis. Imagine getting real-time consumer insights in minutes, putting the power of data-driven decision-making at your fingertips. With Appinio, you can:

- Gain insights swiftly: Say goodbye to lengthy research processes. Appinio delivers answers fast, ensuring you stay ahead in the competitive landscape.

- No research degree required: Our intuitive platform is designed for everyone. You don't need a PhD in research to harness its capabilities.

- Global reach, local insights: Define your target group precisely from over 1200 characteristics and access consumer data in over 90 countries.

Get free access to the platform!

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

26.06.2024 | 35min read

Brand Development: Definition, Process, Strategies, Examples

18.06.2024 | 7min read

Future Flavors: How Burger King nailed Concept Testing with Appinio's Predictive Insights

18.06.2024 | 32min read

What is a Pulse Survey? Definition, Types, Questions

How to Conduct an Industry Analysis

8 min. read

Updated March 18, 2024

I bet you agree: You need to know the industry you want to start a business in, and the kind of business you want to start, before you can start it.

Industry analysis is part of good management. That’s not just for the business planning, but rather for business survival, beginning to end. Most of the people who successfully start their own business have already had relevant business experience before they start, most often as employees.

But in this article, I focus on how to consolidate and formalize that industry knowledge into a formal business plan .

Although all business owners need to know their industry, the documented details and explanations are mainly for when you’re writing a business plan you need to show to outsiders, like bank lenders or investors . You’ll need to do some industry analysis so you’re able to explain the general state of your industry, its growth potential, and how your business model fits into the landscape.

And if your business plan is more of an internal strategic roadmap, you should still be very sure—whether you have to prove it to others or not—that you know your market, even if you don’t do a formal industry analysis. Whether you’re a service business, manufacturer, retailer, or something else, you want to know your industry inside and out.

- What to cover in your industry analysis

Whether you write it all out in a formal business plan or not, when you’re doing your industry analysis, you’re looking at the following:

- Industry participants

- Distribution patterns

- Competition and buying patterns

Everything in your industry that happens outside of your business will affect your company. The more you know about your industry, the more advantage and protection you will have.

A complete business plan discusses:

- General industry economics

- Participants

- Factors in the competition

- And whatever else describes the nature of your business to outsiders

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

A note on finding industry information

The internet has had an enormous impact on the state of business information. Finding information isn’t really the problem anymore, after the information explosion and the huge growth in the internet beginning in the 1990s and continuing in the 21st century.

Even 10 or 15 years ago, dealing with information was more a problem of sorting through it all than of finding raw data. That generality is truer every day. There are websites for business analysis, financial statistics, demographics, trade associations, and just about everything you’ll need for a complete business plan.

You should know who else sells in your market. You can’t easily describe a type of business without describing the nature of the participants. There is a huge difference, for example, between an industry like broadband television services, in which there are only a few huge companies in any one country, and one like dry cleaning, in which there are tens of thousands of smaller participants.

This can make a big difference to a business and a business plan. The restaurant industry, for example, is what we call “pulverized,” meaning that it, like the dry cleaning industry, is made up of many small participants. The fast-food business, on the other hand, is composed of a few national brands participating in thousands of branded outlets, many of them franchised .

Economists talk of consolidation in an industry as a time when many small participants tend to disappear and a few large players emerge. In accounting, for example, there are a few large international firms whose names are well-known, and tens of thousands of smaller firms. The automobile business is composed of a few national brands participating in thousands of branded dealerships, and in computer manufacturing, for example, there are a few large international firms whose names are well-known, and thousands of smaller firms.

Products and services can follow many paths between suppliers and users.

Explain how distribution works in your industry:

- Is this an industry in which retailers are supported by regional distributors, as is the case for computer products, magazines, or auto parts?

- Does your industry depend on direct sales to large industrial customers?

- Do manufacturers support their own direct sales forces, or do they work with product representatives?

Some products are almost always sold through retail stores to consumers, and sometimes these are distributed by distribution companies that buy from manufacturers. In other cases, the products are sold directly from manufacturers to stores. Some products are sold directly from the manufacturer to the final consumer through mail campaigns, national advertising, or other promotional means.

In many product categories, there are several alternatives, and distribution choices are strategic.

Amazon made direct delivery a huge competitive advantage, especially in its earlier years. Doordash and competitors chose to be intermediaries between restaurants and customers, and several businesses offer prepackaged meal ingredients delivered with instructions for finishing the preparations in the consumers’ kitchens. Now major grocery chains offer grocery delivery. Red Box made a strategy of DVDs in kiosks. An entire industry of food delivery options gives consumers choices like restaurant meals or fresh meals ingredients being delivered. Many products are distributed through direct business-to-business (B2B) sales and in long-term contracts such as the ones between car manufacturers and their suppliers of parts, materials, and components. In some industries, companies use representatives, agents, or commissioned salespeople.

Technology can change the patterns of distribution in an industry or product category. The internet, for example, changed options for software distribution, books, music, and other products. Cable communication first, and more recently streaming, changed the options for distributing video products and video games. Some kinds of specialty items sell best with late-night infomercials on television, but others end up working on the web instead of television.

Distribution patterns may not be as critical to most service companies, because distribution is normally about physical distribution of specific physical products such as a restaurant, graphic artist, professional services practice, or architect.

For a few services, the distribution may still be relevant. A phone service, cable provider, or an internet provider might describe distribution related to physical infrastructure. Some publishers may prefer to treat their business as a service, rather than a manufacturing company, and in that case distribution may also be relevant.

It is essential to understand the nature of competition in your market. This is still in the general area of describing the industry or type of business.

Explain the general nature of competition in this business, and how the customers seem to choose one provider over another:

- What are the keys to success?

- What buying factors make the most difference—is it price? Product features? Service? Support? Training? Software? Delivery dates?

- Are brand names important?

In the computer business, for example, competition might depend on reputation and trends in one part of the market, and on channels of distribution and advertising in another. In many business-to-business industries, the nature of competition depends on direct selling, because channels are impractical.

Price is vital in products competing with each other on retail shelves, but delivery and reliability might be much more important for materials used by manufacturers in volume, for which a shortage can affect an entire production line.

In the restaurant business, for example, competition might depend on reputation and trends in one part of the market, and on location and parking in another.

In many professional service practices, the nature of competition depends on word of mouth, because advertising is not completely accepted. Is there price competition between accountants, doctors, and lawyers? How powerful are the insurance decisions in medicine, like in or out of network? How do people choose travel agencies or florists for weddings? Why does someone hire one landscape architect over another? Why choose Starbucks, a national brand, over the local coffee house? All of this is the nature of competition.

The key to your specific industry analysis is a collection of decisions and educated guesses you’ll probably have to make for yourself. There are few pat answers. Maybe it’s easy parking, a great location, great reviews on Amazon or Yelp, or recommendations on social media. You can’t necessarily look this up. It’s the kind of educated guessing that makes some businesses more successful than others.

- Main competitors

Do a very complete analysis of your main competitors. Make a list, determining who your main competitors are. What are the strengths and weaknesses of each?

Consider your competitors’:

- Financial position

- Channels of distribution

- Brand awareness

- Business development

- Technology, or other factors that you feel are important

- In what segments of the market do they operate? What seems to be their strategy? How much do they impact your products, and what threats and opportunities do they represent?

Finding competitive information

Competitive research starts with a good web search. Look up competitors’ websites and social media, then search for mentions, reviews, announcements, and even vacancies and job search information. An amazing array of competitive information is posted in plain sight, where anybody can find it.

From, there, for a good review of additional sources of information, I suggest Practical Market Research Resources for Entrepreneurs , also here on Bplans.

Competitive matrix

A lot of businesses organize competitive analysis into a competitive matrix. The standard competitive matrix shows how different competitors stack up according to significant factors.

Some people also use a SWOT analysis to think about competition in terms of opportunities and threats, the “OT” of SWOT. Opportunities and threats are generally taken as externals, which would include competition, so it’s valuable to run a SWOT analysis on your business to help figure this out.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

3 Min. Read

How to Use TAM, SAM, SOM to Determine Market Size

10 Min. Read

How to Create a Detailed User or Buyer Persona

9 Min. Read

How to Write a Customer Analysis

7 Min. Read

Target Market Examples

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Industry Analysis – Definition, Types, Examples & How-to Guide

Studying the market trends and the competition level is important for businesses because it helps them to lay out their future strategies. Therefore, they use various tools and methods to achieve their goals. Industry analysis is the same process. Today, we’ll discuss industry analysis, its types, examples, and guide.

Table of Contents

What is Industry Analysis?

Industry analysis is a market evaluation tool that businesses and companies use to comprehend and analyze the degree of competition in a certain industry. It helps you to understand the market position of the industry. Like the external factors impacting the industry, credit system, technological changes and how shaping the future, other competitive developing industries, competition level within the industry, and statistics of supply and demand.

Industry analysis helps an entrepreneur or a startup company to comprehend the position of a business relevant to the other competitive businesses in the industry. Most importantly, it helps you to recognize the upcoming threats and opportunities and how you can handle them with your strong points. The only way to survive in today’s business environment is to distinguish yourself from the competitors within the industry.

Types of Industry Analysis

Businesses and companies use three main tools and methods to perform industry analysis, and they’re as follows;

Competitive Force Model (Porter’s Five Forces)

Michael Porter introduced this model in the 1980s and it goes by the name of Porter’s 5 Forces. It analyzes the five forces impacting the industry. They are as follows;

- The intensity of Industry Rivals. The businesses operating in the same industry and their market share makes them industry rivals. Some of the factors that make the competition intense are; increasing fixed cost, lower differentiation, and high exit cost.

- The threat of Potential Entrants. The entrance of the new business in the industry makes the business environment competitive. If the entrance is easier, then it makes the business environment risky. If the entrance is difficult, then they could enjoy benefits for a long time.

- Bargaining Power of Supplier. If a business depends on the supplies of suppliers, then they would have a significant influence over your businesses. It could directly impact the price and quality of your product.

- Bargaining Power of Buyer. Here the customers have more negotiating power over the business. They would demand discounts, better quality, and economical price. It usually happens when there are more competitors in the industry.

- Threats of Substitute Products. It’s when competitive businesses are offering similar substitute products of the other industry. A business usually has to face competitors from various industries and they impact your revenue stream. However, the substitute’s products are of two types; same product features with the higher price and same product features with lower price.

SWOT Analysis

SWOT analysis comprises strengths, weaknesses, opportunities, and threats, and its analysis studies the impact on the business. It further consists of two parts;

- Internal Factors. The strengths and weaknesses fall under the category of internal factors. They exist within any business and continue to play their role.

- External Factors. The opportunities and threats are the external factors. They tell us the impact of potential happenings and how the company should react. Now it depends on the management whether it has the ability to exploit the opportunities and ignore threats.

PESTLE Analysis

PESTLE analysis comprises six macro-environmental factors like political, economical, social, technological, legal, and environmental factors.

- Political. Political factors mean government regulations, trade policies, tariffs, and the country’s overall stable environment.

- Economical. Economical factors include revenue, GDP, net income, import and exports, taxation, unemployment, growth rate, interest rate, and many other factors.

- Social. The social factor comprises fashion, trends, shopping, attitude and behavior, demography, healthy standards, and cultures.

- Technological. Technological factors consist of research and development, latest innovation and creativity, internet, and digital tech trends.

- Legal. Legal factors comprise labor laws, regulations, minimum wage, employment contracts, paychecks, leaves, and other issues.

- Environmental. The environmental factor comprises environmental issues like deforestation, pollution, carbon emission, soil degradation, and others.

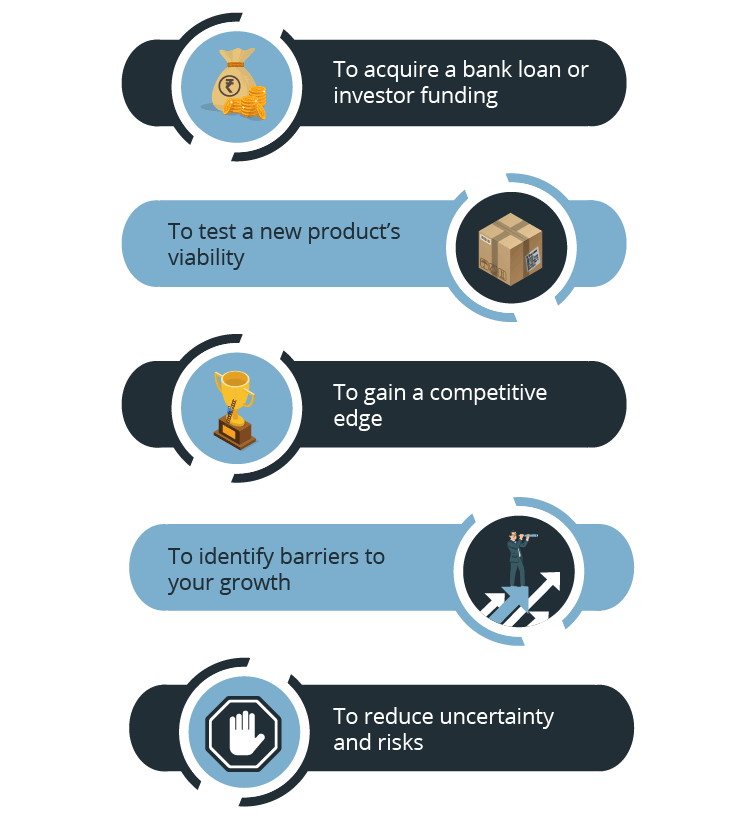

Reasons to Perform an Industry Analysis

Industry analysis allows you to have an insight into the competitive business environment. The weaknesses of your competitors would be your strong suits. You can integrate such information to make the marketing plan to grow your business.

The result of industry analysis provides you an insight into the future growth of your business. If the report tells you upcoming threats, then you can take preventive measures to avoid them.

The analysis confirms and ensures the credibility of your business, and it would help you attract investors. It means that you’re familiar with competitors and knows what your customers want.

How to Perform Industry Analysis Effectively

Review available documented/reports.

You should take some time to find and study already published reports relevant to your industry. You would probably find a well-detailed report, and studying it would answer your questions. It doesn’t mean that you should completely rely on such published reports.

Therefore, you should choose the most report of your industry. It’s because trends and statistics change over time. If you rely on the old report, it won’t give you conclusive results.

Carefully Choose the Industry You Analyze

You must select the most relevant industry for your business. It’s because every industry has got many sub-categories. For instance, a chemical industry would have sub-categories of pesticides, organic, inorganic, and so on.

Come up with the Supply and Demand of Industry

Supply and demand play a significant role in controlling the market. You should study the past trends and product and product scenarios, and the findings would help you to predict the future.

Know Your Competitors

You should consider studying your competitors and their expectations and plans from the market. Porter’s 5 forces model would help you in this regard.

Follow Recent Developments in the Industry

Most importantly, you should study the macro-environmental factors that could impact your industry. Like the technological development, the latest tech trends, and technology innovation would impact many businesses worldwide.

Focus on dynamics of the Industry

The industry analysis should focus on the particular industry in question and understand the various dynamics of the industry. It should be direct, to the point, and in-depth. For instance, if your focus industry is aluminum, then you should be aware of the per capita consumption within the industry along with production and total consumption.

Examples and Templates of Industry Analysis

If you want to study the industry analysis of other businesses relevant to the industry as an example, it’s because it helps business owners to understand the position of their business. It answers them that how they can get a competitive edge over competitors.

- Industry Analysis Example, Templates, and Reports

Advantages of Industry Analysis

- It helps you to touch the unexplored opportunities

- It helps startup companies to know the position of their business relevant to the competitors

- Its focus is to point out the opportunities and threats

- It helps you to find out those points that could provide you the best results

- It helps you to develop a competitive strategy that would defend you in the competition

- It helps you to evaluate the profitability of the relevant industries

Disadvantages of Industry Analysis

- Misinterpretation of the statistics and data could lead you to make the wrong decision

- It’s a one-sided approach and it doesn’t guarantee success

- If inflation decreases the sale and company’s revenue stream, it would badly impact the report

- Season factors usually have a good and bad impact on the business, if the interpreter doesn’t consider these factors, it would impact the conclusions.

About The Author

Ahsan Ali Shaw

Industry Analysis In A Business Plan

Industry Analysis In A Business Plan –

Some decisions require a lot of thinking. You cannot just adopt “Rocks, Scissors, and Paper” to decide in such cases. Many reviews, analyses, and debates are behind such vital decisions. The same is the situation of Luke and his wife, Daisy. They have made this big decision to buy a new home. They have analyzed various areas and bungalows and buildings, and flats. Finally, they have shortlisted a small house and are about to do the paperwork. Luke has analyzed all the positives of that area and nearby amenities. Daisy, on the other hand, is having a hard time. Since it is the most significant decision for her after her marriage, she has been going nuts. She is having nightmares of all the possible things that can go wrong with the house and the new place.

Start Your Free Personal Development Course

Effective resume making, job hunting, campus recruitment training & others

But nothing went wrong in their case, and they lived happily in the new home. As an intelligent person, Luke had done some proper analysis and predictions. He made calculations of the possibilities and prospects of that area and came up with a positive outlook. Impressive right? But do you want to know a little secret?

Luke has some fantastic analytical skills . So the question is, from where did he get such skills? Is it hereditary? Or has he developed it over time?

How do you think Luke was able to buy such a magnificent new home? The answer is that Luke is a big fan of Warren Buffet. He has been investing in the stock market for a long time and doing well. Before investing in any company, Luke analyzed that sector and industry well. He came up with his industry analysis report and decided whether to invest in that sector or the company. So let’s use Luke’s analytical skills and get insights into what industry analysis is in a business plan and how to perform the same. So let’s learn the basics of Industry analysis.

What is Industry Analysis In A Business Plan?

Before starting with the actual meaning of the industry analysis in a business plan, first, let’s understand what an Industry is.

The industry is a collection of Competitors producing a similar product or offering similar services to their customers.

So the next question is, why are we studying that industry?

To ensure it is the best or worst industry to enter or invest in.

Industry analysis in a business plan is a tool that enables a company to understand its position relative to other companies that produce similar products or services like it. While considering the strategic planning process, a company must understand the overall industry’s forces. Thus, industry analysis techniques in a business plan enable businesses to identify threats and opportunities. It helps them focus their resources on developing unique capabilities to gain a competitive advantage .

Understanding the industry and forecasting its trends and directions, they need to react and control their portion in the industry.

Major elements

1. Understanding the underlying forces at work

- Competition intensifying

- Changing customers’ needs and taste

- Technological innovation

- Globalization

- Entry of major competitors

- Sudden regulation or deregulation

2. Understanding the attractiveness of the industry

- Whether it is feasible to enter or invest in that industry.

3. Understanding the critical industry analysis factors that determine success within the industry.

Importance

- It is an important element of any investment that one wants to make.

- To succeed, business owners need to analyze that industry.

- Important for positioning the company in the niche market

- It aids the companies in identifying potential opportunities.

- It helps in analyzing the threats.

- Assists in analyzing the fit between internal management preferences and the business environment.

- Facilitates mitigating the risk of entering an extremely competitive business.

Ways to perform

- One way to perform the industry analysis in a business plan is to do the ratio analysis and comparisons. Ratios are ascertained by dividing one business variable by another. By comparing the company ratio with that of the industry, a business owner can understand where his business stands concerning the industry average.

Michael E. Porter developed another model for analyzing the industry in his classic book Competitive Strategy: Techniques for Analyzing Industries and Competitors (1980). His model shows that rivalry among the firms in an industry depends upon the following five forces:

The Threat of New Entry

The threat of new entrants refers to the entry of new competitors in the industry. Naturally, a profitable industry will attract more competitors looking to achieve profits. If the entry barriers in the industry are low, it may pose a significant threat to the firms already competing in that market.

Bargaining power of the Supplier

Supplier power refers to the pressure suppliers can exert on businesses by raising prices, lowering quality, or reducing product availability to intimidate buyers. All of these things directly cost the buyer.

Bargaining power of the Buyer

It refers to the pressure the buyers can exert on businesses to ensure higher quality products, better customer service, and lower prices. Strong buyers can make the industry more competitive, thus decreasing the profit for the seller.

Competitive Rivalry

It is the extent to which the competitive firms within an industry can bully each other, thus decreasing profits. Fierce competition may lead to stealing profits and market share amongst competitors.

Threat of Substitution

It is the availability of a substitute product that the buyers can find instead of a core selling product.

Industry Analysis 3 Steps

# Gathering the Data

- The Scope of the Research

Define the industry where you would like to perform industry analysis research activities. It can be a broad industry or a niche industry.

- Research your industry

Information sources that will help you conduct your industry analysis in a business plan are different for every business. For example, you might need local information, which you can get from your local chamber of commerce. Or you can find your industry analysis information on government websites. You can also find out government statistics or other commercial statistics. You may have to conduct some internet searches to track down the information.

If the information is difficult to obtain at one particular site, you’ll have to extrapolate information from different sources to get the information you’re seeking. Start finding the data from the government or other websites where accurate data is available. Check academic databases for any published information on your area of interest.

- Compile relevant data using the sources above.

Make notes of annual revenues, the number of companies involved, and workforce statistics of the desired industry. Find statistics about the size of the customer base and buying trends.

- Description of the Industry

Start your industry analysis report with a general description of the industry. Include one or two paragraphs about the industry’s size, products, and geographic concentration.

- Describe the company

Include information about the company that you may want to research. Fill in all the general and relevant information about the company.

- Competitor Analysis

Understand the competitors and mention relevant statistical information about their revenues, profit, etc. Describe their product range if possible. Mention their strategies and forth-coming products.

GDP and Inflation effects

Mention how much the sector has been contributing to the GDP and how it has been affected by the rising inflation. Give an outlook on the same.

Try to understand the answers to the following industry analysis questions.

What are the industry’s foremost economic characteristics?

To answer this question, you can acquire data about the industry from governmental census data or sites such as Yahoo.com or other data-intensive web locations.