- Translators

- Graphic Designers

Please enter the email address you used for your account. Your sign in information will be sent to your email address after it has been verified.

25 Thesis Statement Examples That Will Make Writing a Breeze

Understanding what makes a good thesis statement is one of the major keys to writing a great research paper or argumentative essay. The thesis statement is where you make a claim that will guide you through your entire paper. If you find yourself struggling to make sense of your paper or your topic, then it's likely due to a weak thesis statement.

Let's take a minute to first understand what makes a solid thesis statement, and what key components you need to write one of your own.

A thesis statement always goes at the beginning of the paper. It will typically be in the first couple of paragraphs of the paper so that it can introduce the body paragraphs, which are the supporting evidence for your thesis statement.

Your thesis statement should clearly identify an argument. You need to have a statement that is not only easy to understand, but one that is debatable. What that means is that you can't just put any statement of fact and have it be your thesis. For example, everyone knows that puppies are cute . An ineffective thesis statement would be, "Puppies are adorable and everyone knows it." This isn't really something that's a debatable topic.

Something that would be more debatable would be, "A puppy's cuteness is derived from its floppy ears, small body, and playfulness." These are three things that can be debated on. Some people might think that the cutest thing about puppies is the fact that they follow you around or that they're really soft and fuzzy.

All cuteness aside, you want to make sure that your thesis statement is not only debatable, but that it also actually thoroughly answers the research question that was posed. You always want to make sure that your evidence is supporting a claim that you made (and not the other way around). This is why it's crucial to read and research about a topic first and come to a conclusion later. If you try to get your research to fit your thesis statement, then it may not work out as neatly as you think. As you learn more, you discover more (and the outcome may not be what you originally thought).

Additionally, your thesis statement shouldn't be too big or too grand. It'll be hard to cover everything in a thesis statement like, "The federal government should act now on climate change." The topic is just too large to actually say something new and meaningful. Instead, a more effective thesis statement might be, "Local governments can combat climate change by providing citizens with larger recycling bins and offering local classes about composting and conservation." This is easier to work with because it's a smaller idea, but you can also discuss the overall topic that you might be interested in, which is climate change.

So, now that we know what makes a good, solid thesis statement, you can start to write your own. If you find that you're getting stuck or you are the type of person who needs to look at examples before you start something, then check out our list of thesis statement examples below.

Thesis statement examples

A quick note that these thesis statements have not been fully researched. These are merely examples to show you what a thesis statement might look like and how you can implement your own ideas into one that you think of independently. As such, you should not use these thesis statements for your own research paper purposes. They are meant to be used as examples only.

- Vaccinations Because many children are unable to vaccinate due to illness, we must require that all healthy and able children be vaccinated in order to have herd immunity.

- Educational Resources for Low-Income Students Schools should provide educational resources for low-income students during the summers so that they don't forget what they've learned throughout the school year.

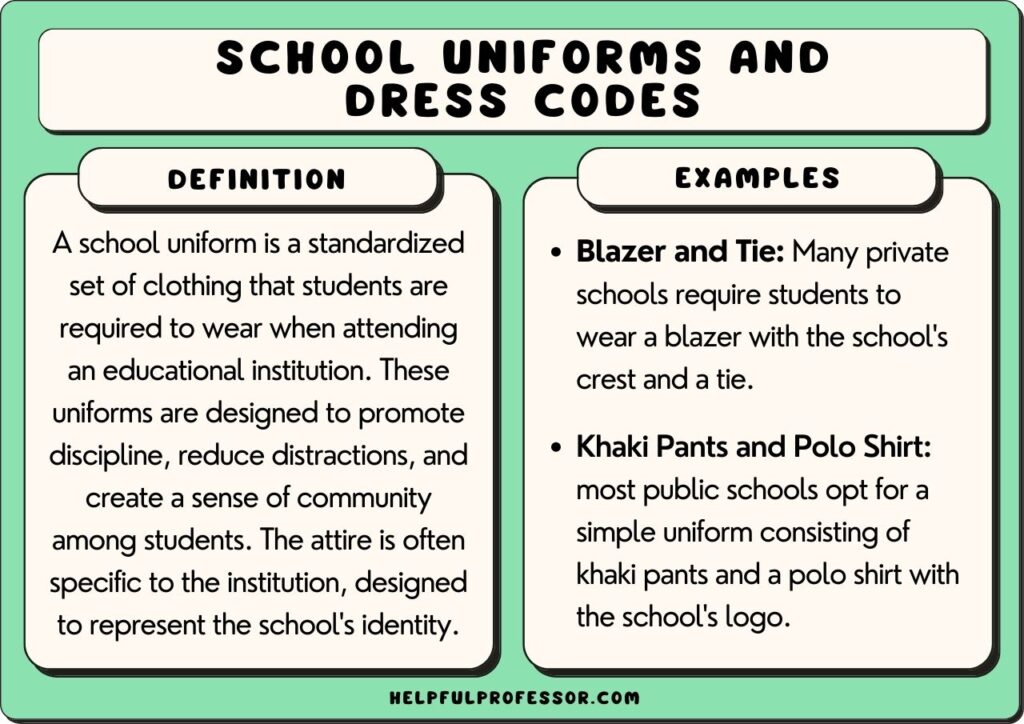

- School Uniforms School uniforms may be an upfront cost for families, but they eradicate the visual differences in income between students and provide a more egalitarian atmosphere at school.

- Populism The rise in populism on the 2016 political stage was in reaction to increasing globalization, the decline of manufacturing jobs, and the Syrian refugee crisis.

- Public Libraries Libraries are essential resources for communities and should be funded more heavily by local municipalities.

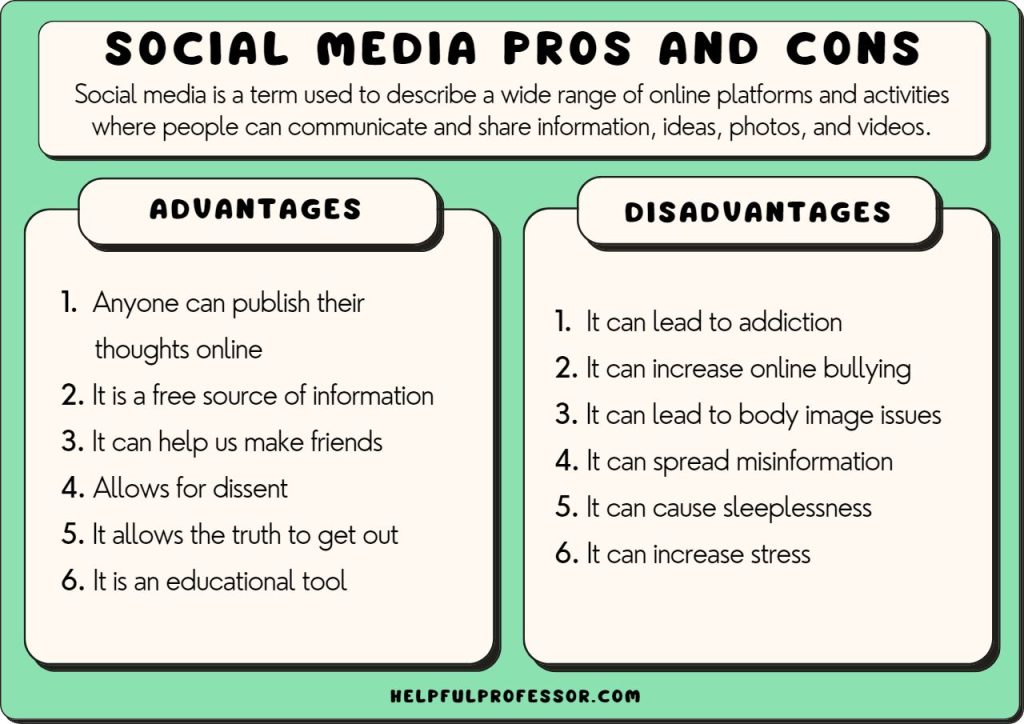

- Cyber Bullying With more and more teens using smartphones and social media, cyber bullying is on the rise. Cyber bullying puts a lot of stress on many teens, and can cause depression, anxiety, and even suicidal thoughts. Parents should limit the usage of smart phones, monitor their children's online activity, and report any cyber bullying to school officials in order to combat this problem.

- Medical Marijuana for Veterans Studies have shown that the use of medicinal marijuana has been helpful to veterans who suffer from Post-Traumatic Stress Disorder (PTSD). Medicinal marijuana prescriptions should be legal in all states and provided to these veterans. Additional medical or therapy services should also be researched and implemented in order to help them re-integrate back into civilian life.

- Work-Life Balance Corporations should provide more work from home opportunities and six-hour workdays so that office workers have a better work-life balance and are more likely to be productive when they are in the office.

- Teaching Youths about Consensual Sex Although sex education that includes a discussion of consensual sex would likely lead to less sexual assault, parents need to teach their children the meaning of consent from a young age with age appropriate lessons.

- Whether or Not to Attend University A degree from a university provides invaluable lessons on life and a future career, but not every high school student should be encouraged to attend a university directly after graduation. Some students may benefit from a trade school or a "gap year" where they can think more intensely about what it is they want to do for a career and how they can accomplish this.

- Studying Abroad Studying abroad is one of the most culturally valuable experiences you can have in college. It is the only way to get completely immersed in another language and learn how other cultures and countries are different from your own.

- Women's Body Image Magazines have done a lot in the last five years to include a more diverse group of models, but there is still a long way to go to promote a healthy woman's body image collectively as a culture.

- Cigarette Tax Heavily taxing and increasing the price of cigarettes is essentially a tax on the poorest Americans, and it doesn't deter them from purchasing. Instead, the state and federal governments should target those economically disenfranchised with early education about the dangers of smoking.

- Veganism A vegan diet, while a healthy and ethical way to consume food, indicates a position of privilege. It also limits you to other cultural food experiences if you travel around the world.

- University Athletes Should be Compensated University athletes should be compensated for their service to the university, as it is difficult for these students to procure and hold a job with busy academic and athletic schedules. Many student athletes on scholarship also come from low-income neighborhoods and it is a struggle to make ends meet when they are participating in athletics.

- Women in the Workforce Sheryl Sandberg makes a lot of interesting points in her best-selling book, Lean In , but she only addressed the very privileged working woman and failed to speak to those in lower-skilled, lower-wage jobs.

- Assisted Suicide Assisted suicide should be legal and doctors should have the ability to make sure their patients have the end-of-life care that they want to receive.

- Celebrity and Political Activism Although Taylor Swift's lyrics are indicative of a feminist perspective, she should be more politically active and vocal to use her position of power for the betterment of society.

- The Civil War The insistence from many Southerners that the South seceded from the Union for states' rights versus the fact that they seceded for the purposes of continuing slavery is a harmful myth that still affects race relations today.

- Blue Collar Workers Coal miners and other blue-collar workers whose jobs are slowly disappearing from the workforce should be re-trained in jobs in the technology sector or in renewable energy. A program to re-train these workers would not only improve local economies where jobs have been displaced, but would also lead to lower unemployment nationally.

- Diversity in the Workforce Having a diverse group of people in an office setting leads to richer ideas, more cooperation, and more empathy between people with different skin colors or backgrounds.

- Re-Imagining the Nuclear Family The nuclear family was traditionally defined as one mother, one father, and 2.5 children. This outdated depiction of family life doesn't quite fit with modern society. The definition of normal family life shouldn't be limited to two-parent households.

- Digital Literacy Skills With more information readily available than ever before, it's crucial that students are prepared to examine the material they're reading and determine whether or not it's a good source or if it has misleading information. Teaching students digital literacy and helping them to understand the difference between opinion or propaganda from legitimate, real information is integral.

- Beauty Pageants Beauty pageants are presented with the angle that they empower women. However, putting women in a swimsuit on a stage while simultaneously judging them on how well they answer an impossible question in a short period of time is cruel and purely for the amusement of men. Therefore, we should stop televising beauty pageants.

- Supporting More Women to Run for a Political Position In order to get more women into political positions, more women must run for office. There must be a grassroots effort to educate women on how to run for office, who among them should run, and support for a future candidate for getting started on a political career.

Still stuck? Need some help with your thesis statement?

If you are still uncertain about how to write a thesis statement or what a good thesis statement is, be sure to consult with your teacher or professor to make sure you're on the right track. It's always a good idea to check in and make sure that your thesis statement is making a solid argument and that it can be supported by your research.

After you're done writing, it's important to have someone take a second look at your paper so that you can ensure there are no mistakes or errors. It's difficult to spot your own mistakes, which is why it's always recommended to have someone help you with the revision process, whether that's a teacher, the writing center at school, or a professional editor such as one from ServiceScape .

Related Posts

How to Write a Definition Essay (Plus Topics You Can Use and a Sample Essay)

How to Write a Great Argumentative Essay

- Academic Writing Advice

- All Blog Posts

- Writing Advice

- Admissions Writing Advice

- Book Writing Advice

- Short Story Advice

- Employment Writing Advice

- Business Writing Advice

- Web Content Advice

- Article Writing Advice

- Magazine Writing Advice

- Grammar Advice

- Dialect Advice

- Editing Advice

- Freelance Advice

- Legal Writing Advice

- Poetry Advice

- Graphic Design Advice

- Logo Design Advice

- Translation Advice

- Blog Reviews

- Short Story Award Winners

- Scholarship Winners

Need an academic editor before submitting your work?

Essay Writing Guide

Thesis Statement Examples

Last updated on: Jun 10, 2023

The Art of Effective Writing: Thesis Statements Examples and Tips

By: Nova A.

13 min read

Reviewed By: Chris H.

Published on: Mar 5, 2019

Are you tired of struggling with weak and ineffective thesis statements for your academic papers?

Frustrated by the lack of clarity and direction in your writing?

It's time for a change!

Thesis statements are a very important part of essay writing .

In this blog, we will guide you through the process of crafting impactful thesis statements.

Get ready to captivate your readers with strong thesis statements that make a lasting impression.

Let's dive in!

On this Page

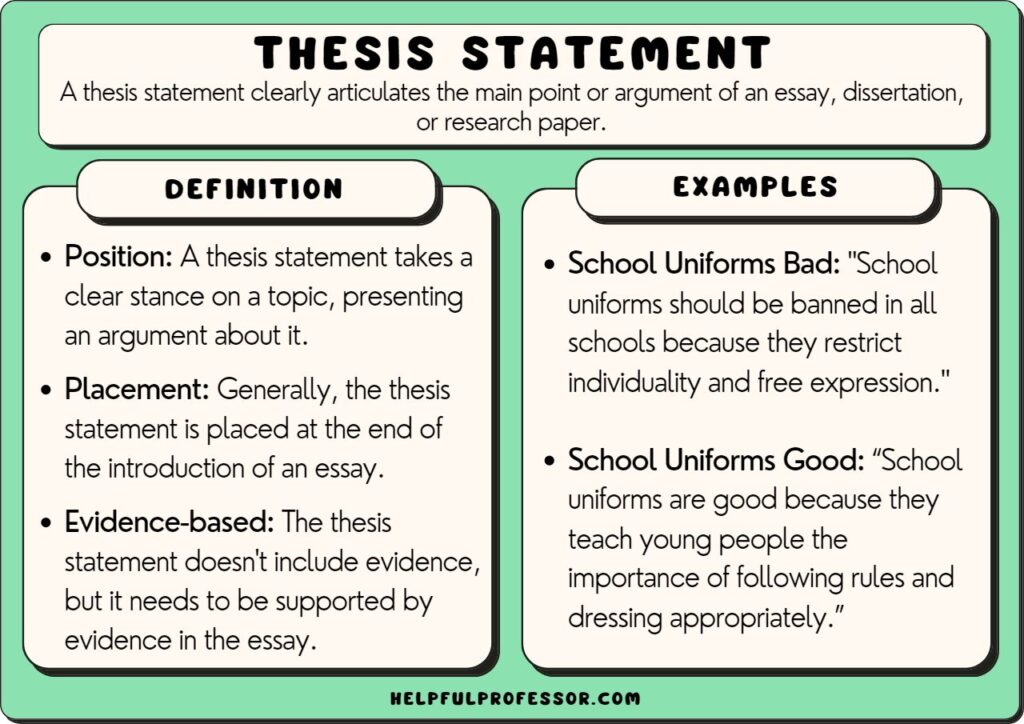

What is a Thesis Statement?

A thesis statement is the backbone of your academic paper. It serves as a concise summary of the main argument or point you will be making in your writing.

Think of it as the roadmap that guides your readers through your essay, providing a clear direction and focus.

A solid thesis statement should be:

- Clear and Specific: It should clearly state the main idea and focus of your paper, leaving no room for ambiguity.

- Argu able: A good thesis statement presents a debatable claim or position that invites discussion and analysis.

- Supported by Evidence: Your thesis statement should be supported by relevant evidence and logical reasoning throughout your paper.

- Relevant to Your Topic: It should directly address the main topic or issue you are exploring in your essay.

- Concise and Well-Structured: A strong thesis statement is usually one or two sentences long, clearly expressing the main point without unnecessary details.

If you want a detailed guide about crafting a thesis statement, you can read our thesis statement writing blog!

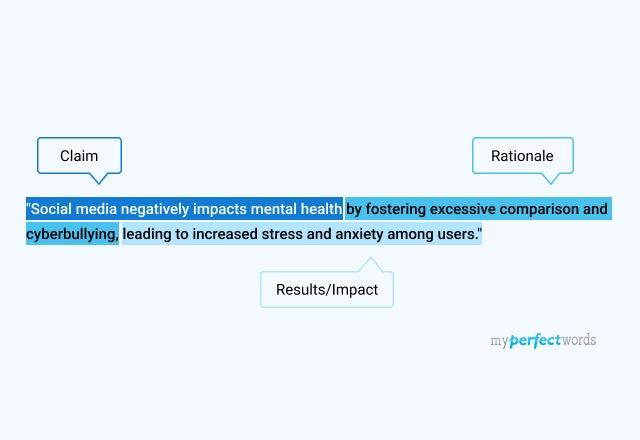

Thesis Statement: Bad vs. Good

The quality of a thesis statement can make or break your essay.

Let's explore the difference between bad and good thesis statements to understand how to create strong arguments that captivate your readers.

- Bad Thesis Statement Example: "A lot of people use social media."

- Good Thesis Statement Example: "The pervasive use of social media has transformed interpersonal communication, leading to both positive and negative impacts on personal relationships and societal dynamics."

Here's a table comparing the characteristics of a bad thesis statement versus a good thesis statement:

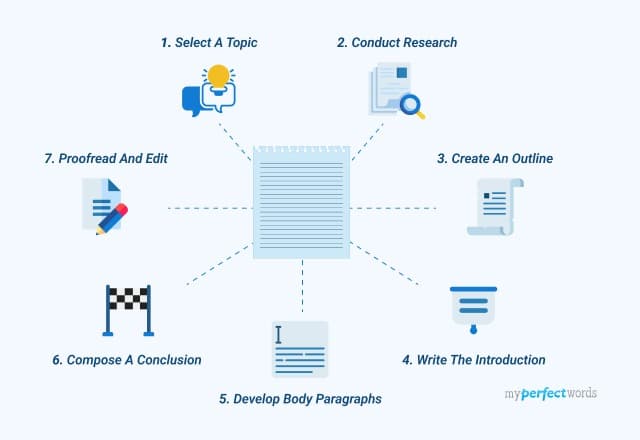

How to Write a Thesis Statement Examples

Writing a strong thesis statement is crucial for academic writing. It establishes the purpose of your essay and gives your readers a clear direction to follow.

To help you become proficient in this skill, let's examine some examples.

How to Start a Thesis Statement Example

When starting a thesis statement, it's essential to identify the main topic or issue you will be discussing.

For example, if your essay focuses on the impact of social media on society, a strong starting thesis statement could be:

Introductory Paragraph with Thesis Statement Example

In the introductory paragraph, the thesis statement should be prominently featured to provide a clear preview of the main argument.

For instance, if you are writing an essay about the benefits of exercise, your introductory paragraph could begin with a compelling thesis statement like this:

Topic Sentence and Thesis Statement Example

The topic sentence sets the tone for the paragraph and connects it to the thesis statement.

Consider an essay exploring renewable energy sources. A topic sentence that aligns with the thesis statement could be:

Thesis Statement Example for Different Types of Essays

The thesis statement plays a crucial role in setting the tone and focus of your essay. Depending on the type of essay you are writing, the structure and content of your thesis statement may vary.

Let's explore some examples of thesis statements for different types of essays to understand how they differ in their approach and purpose:

Argumentative Essay

In an argumentative essay , your thesis statement should clearly present your position on a controversial topic. It should provide a preview of your main arguments.

Persuasive Essay

In a persuasive essay , your thesis statement aims to convince the reader of your viewpoint or opinion on a particular issue.

Expository Essay

In an expository essay , your thesis statement should provide an informative explanation or analysis of a topic.

Comparative Essay

In a comparative essay, your thesis statement highlights the similarities and differences between two or more subjects.

Analytical Essay

In an analytical essay , your thesis statement presents an analysis or interpretation of a literary work, artwork, or phenomenon.

Informative Essay

In informative essays , the goal is to educate and inform your readers about a specific topic. It should be without expressing a personal opinion or taking a stance.

Thesis Statement for Informative Speech

An informative speech discussing the impact of plastic pollution on marine ecosystems, highlighting environmental consequences and proposing sustainable solutions.

Thesis Statement for Literary Analysis

In this literary analysis essay , explore themes of perseverance and the struggle between man and nature.

Thesis Statement for Cause and Effect Essay

Examine the cause and effect of social media addiction among teenagers, in this cause-and-effect essay example.

Thesis Statement for Narrative Essay

In this narrative essay thesis statement example, discover valuable life lessons about perseverance, self-discovery, and the beauty of nature.

Example of Thesis Statement for Personal Essay

In personal essays, the thesis statement often reflects the central message or main idea that you want to convey about your personal experiences or reflections.

Good Thesis Statement Examples

A good thesis statement is the backbone of a well-structured and compelling essay. It presents a clear and concise argument or main point and sets the direction for your writing. Let's explore some examples of good thesis statements to understand what makes them effective:

High School Thesis Statement Example

Problem thesis statement example, thesis statement example about education, thesis statement example in research paper, thesis statement example about covid-19, tips for writing an effective thesis statement.

Crafting a strong thesis statement is essential for a well-structured and focused essay. Here are some tips to help you write an effective thesis statement in an essay:

- Be Clear and Specific: Clearly state your main argument or claim in a concise manner. Avoid vague or general statements that lack clarity.

- Make it Arguable: Your thesis statement should present a debatable position that invites discussion and analysis. Avoid stating obvious or indisputable facts.

- Tailor it to Your Essay: Your thesis statement should reflect the purpose and scope of your essay. Ensure that it directly addresses the main topic and focus of your writing.

- Provide a Roadmap: Your thesis statement should act as a roadmap for your readers, outlining the main points or arguments that will be discussed in your essay.

- Support with Evidence: Your thesis statement should be supported by relevant evidence, facts, or examples throughout your essay. Ensure that you can back up your claims.

- Revise and Refine: Don't be afraid to revise and refine your thesis statement as you develop your essay. It's normal for it to evolve and become more refined as your understanding of the topic deepens.

- Keep it Concise: Aim for a thesis statement that is clear, focused, and concise. Typically, it should be one or two sentences that capture the main point of your essay.

- Consider Counterarguments: Anticipate counterarguments and address them in your thesis statement. This demonstrates a thoughtful and nuanced understanding of the topic.

- Stay Relevant: Ensure that your thesis statement directly relates to the main topic and purpose of your essay. Avoid going off-topic or introducing unrelated ideas.

If you need more guidance, check out this descriptive video!

All in all, this blog has provided you with everything to get started with your thesis statement. However, if you still need any help, taking assistance from professional essay writers is a good option.

We, at 5StarEssays.com will help you with your ‘ write my essay ’ needs.

Feel free to contact us for placing your order today!

Frequently Asked Questions

What are the 3 parts of a thesis statement.

A thesis statement is made up of the following 3 parts.

- Your opinion

- And your reasons

No thesis statement is complete without these three parts and this is why it is important to add all three to your statement.

Can a thesis statement be a question?

No, a thesis statement could not be a question. A thesis statement should be debatable and inform the readers about the main points of the essay or paper. A question could not do it.

Can a thesis statement be 2 sentences long?

Yes, a thesis statement could be 2 lines or even longer. The length of the thesis statement depends on the length and depth of your work’s subject.

Marketing, Law

As a Digital Content Strategist, Nova Allison has eight years of experience in writing both technical and scientific content. With a focus on developing online content plans that engage audiences, Nova strives to write pieces that are not only informative but captivating as well.

Was This Blog Helpful?

Keep reading.

- How to Write an Essay - A Complete Guide with Examples

- Writing a 500 Word Essay - Easy Guide

- What is a Topic Sentence - An Easy Guide with Writing Steps & Examples

- A Complete Essay Outline - Guidelines and Format

- 220 Best Transition Words for Essays

- Essay Format: Detailed Writing Tips & Examples

- How to Write a Conclusion - Examples & Tips

- Essay Topics: 100+ Best Essay Topics for your Guidance

- How to Title an Essay: A Step-by-Step Guide for Effective Titles

- How to Write a Perfect 1000 Word Essay

- How To Make An Essay Longer - Easy Guide For Beginners

- Learn How to Start an Essay Effectively with Easy Guidelines

- Types of Sentences With Examples

- Hook Examples: How to Start Your Essay Effectively

- Essay Writing Tips - Essential Do’s and Don’ts to Craft Better Essays

- How To Write A Thesis Statement - A Step by Step Guide

- Art Topics - 200+ Brilliant Ideas to Begin With

- Writing Conventions and Tips for College Students

People Also Read

- classification essay topics

- persuasive speech topics

- speech writing

- book report outline

- research paper outline

Burdened With Assignments?

Advertisement

- Homework Services: Essay Topics Generator

© 2024 - All rights reserved

Thesis Statements

What this handout is about.

This handout describes what a thesis statement is, how thesis statements work in your writing, and how you can craft or refine one for your draft.

Introduction

Writing in college often takes the form of persuasion—convincing others that you have an interesting, logical point of view on the subject you are studying. Persuasion is a skill you practice regularly in your daily life. You persuade your roommate to clean up, your parents to let you borrow the car, your friend to vote for your favorite candidate or policy. In college, course assignments often ask you to make a persuasive case in writing. You are asked to convince your reader of your point of view. This form of persuasion, often called academic argument, follows a predictable pattern in writing. After a brief introduction of your topic, you state your point of view on the topic directly and often in one sentence. This sentence is the thesis statement, and it serves as a summary of the argument you’ll make in the rest of your paper.

What is a thesis statement?

A thesis statement:

- tells the reader how you will interpret the significance of the subject matter under discussion.

- is a road map for the paper; in other words, it tells the reader what to expect from the rest of the paper.

- directly answers the question asked of you. A thesis is an interpretation of a question or subject, not the subject itself. The subject, or topic, of an essay might be World War II or Moby Dick; a thesis must then offer a way to understand the war or the novel.

- makes a claim that others might dispute.

- is usually a single sentence near the beginning of your paper (most often, at the end of the first paragraph) that presents your argument to the reader. The rest of the paper, the body of the essay, gathers and organizes evidence that will persuade the reader of the logic of your interpretation.

If your assignment asks you to take a position or develop a claim about a subject, you may need to convey that position or claim in a thesis statement near the beginning of your draft. The assignment may not explicitly state that you need a thesis statement because your instructor may assume you will include one. When in doubt, ask your instructor if the assignment requires a thesis statement. When an assignment asks you to analyze, to interpret, to compare and contrast, to demonstrate cause and effect, or to take a stand on an issue, it is likely that you are being asked to develop a thesis and to support it persuasively. (Check out our handout on understanding assignments for more information.)

How do I create a thesis?

A thesis is the result of a lengthy thinking process. Formulating a thesis is not the first thing you do after reading an essay assignment. Before you develop an argument on any topic, you have to collect and organize evidence, look for possible relationships between known facts (such as surprising contrasts or similarities), and think about the significance of these relationships. Once you do this thinking, you will probably have a “working thesis” that presents a basic or main idea and an argument that you think you can support with evidence. Both the argument and your thesis are likely to need adjustment along the way.

Writers use all kinds of techniques to stimulate their thinking and to help them clarify relationships or comprehend the broader significance of a topic and arrive at a thesis statement. For more ideas on how to get started, see our handout on brainstorming .

How do I know if my thesis is strong?

If there’s time, run it by your instructor or make an appointment at the Writing Center to get some feedback. Even if you do not have time to get advice elsewhere, you can do some thesis evaluation of your own. When reviewing your first draft and its working thesis, ask yourself the following :

- Do I answer the question? Re-reading the question prompt after constructing a working thesis can help you fix an argument that misses the focus of the question. If the prompt isn’t phrased as a question, try to rephrase it. For example, “Discuss the effect of X on Y” can be rephrased as “What is the effect of X on Y?”

- Have I taken a position that others might challenge or oppose? If your thesis simply states facts that no one would, or even could, disagree with, it’s possible that you are simply providing a summary, rather than making an argument.

- Is my thesis statement specific enough? Thesis statements that are too vague often do not have a strong argument. If your thesis contains words like “good” or “successful,” see if you could be more specific: why is something “good”; what specifically makes something “successful”?

- Does my thesis pass the “So what?” test? If a reader’s first response is likely to be “So what?” then you need to clarify, to forge a relationship, or to connect to a larger issue.

- Does my essay support my thesis specifically and without wandering? If your thesis and the body of your essay do not seem to go together, one of them has to change. It’s okay to change your working thesis to reflect things you have figured out in the course of writing your paper. Remember, always reassess and revise your writing as necessary.

- Does my thesis pass the “how and why?” test? If a reader’s first response is “how?” or “why?” your thesis may be too open-ended and lack guidance for the reader. See what you can add to give the reader a better take on your position right from the beginning.

Suppose you are taking a course on contemporary communication, and the instructor hands out the following essay assignment: “Discuss the impact of social media on public awareness.” Looking back at your notes, you might start with this working thesis:

Social media impacts public awareness in both positive and negative ways.

You can use the questions above to help you revise this general statement into a stronger thesis.

- Do I answer the question? You can analyze this if you rephrase “discuss the impact” as “what is the impact?” This way, you can see that you’ve answered the question only very generally with the vague “positive and negative ways.”

- Have I taken a position that others might challenge or oppose? Not likely. Only people who maintain that social media has a solely positive or solely negative impact could disagree.

- Is my thesis statement specific enough? No. What are the positive effects? What are the negative effects?

- Does my thesis pass the “how and why?” test? No. Why are they positive? How are they positive? What are their causes? Why are they negative? How are they negative? What are their causes?

- Does my thesis pass the “So what?” test? No. Why should anyone care about the positive and/or negative impact of social media?

After thinking about your answers to these questions, you decide to focus on the one impact you feel strongly about and have strong evidence for:

Because not every voice on social media is reliable, people have become much more critical consumers of information, and thus, more informed voters.

This version is a much stronger thesis! It answers the question, takes a specific position that others can challenge, and it gives a sense of why it matters.

Let’s try another. Suppose your literature professor hands out the following assignment in a class on the American novel: Write an analysis of some aspect of Mark Twain’s novel Huckleberry Finn. “This will be easy,” you think. “I loved Huckleberry Finn!” You grab a pad of paper and write:

Mark Twain’s Huckleberry Finn is a great American novel.

You begin to analyze your thesis:

- Do I answer the question? No. The prompt asks you to analyze some aspect of the novel. Your working thesis is a statement of general appreciation for the entire novel.

Think about aspects of the novel that are important to its structure or meaning—for example, the role of storytelling, the contrasting scenes between the shore and the river, or the relationships between adults and children. Now you write:

In Huckleberry Finn, Mark Twain develops a contrast between life on the river and life on the shore.

- Do I answer the question? Yes!

- Have I taken a position that others might challenge or oppose? Not really. This contrast is well-known and accepted.

- Is my thesis statement specific enough? It’s getting there–you have highlighted an important aspect of the novel for investigation. However, it’s still not clear what your analysis will reveal.

- Does my thesis pass the “how and why?” test? Not yet. Compare scenes from the book and see what you discover. Free write, make lists, jot down Huck’s actions and reactions and anything else that seems interesting.

- Does my thesis pass the “So what?” test? What’s the point of this contrast? What does it signify?”

After examining the evidence and considering your own insights, you write:

Through its contrasting river and shore scenes, Twain’s Huckleberry Finn suggests that to find the true expression of American democratic ideals, one must leave “civilized” society and go back to nature.

This final thesis statement presents an interpretation of a literary work based on an analysis of its content. Of course, for the essay itself to be successful, you must now present evidence from the novel that will convince the reader of your interpretation.

Works consulted

We consulted these works while writing this handout. This is not a comprehensive list of resources on the handout’s topic, and we encourage you to do your own research to find additional publications. Please do not use this list as a model for the format of your own reference list, as it may not match the citation style you are using. For guidance on formatting citations, please see the UNC Libraries citation tutorial . We revise these tips periodically and welcome feedback.

Anson, Chris M., and Robert A. Schwegler. 2010. The Longman Handbook for Writers and Readers , 6th ed. New York: Longman.

Lunsford, Andrea A. 2015. The St. Martin’s Handbook , 8th ed. Boston: Bedford/St Martin’s.

Ramage, John D., John C. Bean, and June Johnson. 2018. The Allyn & Bacon Guide to Writing , 8th ed. New York: Pearson.

Ruszkiewicz, John J., Christy Friend, Daniel Seward, and Maxine Hairston. 2010. The Scott, Foresman Handbook for Writers , 9th ed. Boston: Pearson Education.

You may reproduce it for non-commercial use if you use the entire handout and attribute the source: The Writing Center, University of North Carolina at Chapel Hill

Make a Gift

Reference management. Clean and simple.

How to write a thesis statement + examples

What is a thesis statement?

Is a thesis statement a question, how do you write a good thesis statement, how do i know if my thesis statement is good, examples of thesis statements, helpful resources on how to write a thesis statement, frequently asked questions about writing a thesis statement, related articles.

A thesis statement is the main argument of your paper or thesis.

The thesis statement is one of the most important elements of any piece of academic writing . It is a brief statement of your paper’s main argument. Essentially, you are stating what you will be writing about.

You can see your thesis statement as an answer to a question. While it also contains the question, it should really give an answer to the question with new information and not just restate or reiterate it.

Your thesis statement is part of your introduction. Learn more about how to write a good thesis introduction in our introduction guide .

A thesis statement is not a question. A statement must be arguable and provable through evidence and analysis. While your thesis might stem from a research question, it should be in the form of a statement.

Tip: A thesis statement is typically 1-2 sentences. For a longer project like a thesis, the statement may be several sentences or a paragraph.

A good thesis statement needs to do the following:

- Condense the main idea of your thesis into one or two sentences.

- Answer your project’s main research question.

- Clearly state your position in relation to the topic .

- Make an argument that requires support or evidence.

Once you have written down a thesis statement, check if it fulfills the following criteria:

- Your statement needs to be provable by evidence. As an argument, a thesis statement needs to be debatable.

- Your statement needs to be precise. Do not give away too much information in the thesis statement and do not load it with unnecessary information.

- Your statement cannot say that one solution is simply right or simply wrong as a matter of fact. You should draw upon verified facts to persuade the reader of your solution, but you cannot just declare something as right or wrong.

As previously mentioned, your thesis statement should answer a question.

If the question is:

What do you think the City of New York should do to reduce traffic congestion?

A good thesis statement restates the question and answers it:

In this paper, I will argue that the City of New York should focus on providing exclusive lanes for public transport and adaptive traffic signals to reduce traffic congestion by the year 2035.

Here is another example. If the question is:

How can we end poverty?

A good thesis statement should give more than one solution to the problem in question:

In this paper, I will argue that introducing universal basic income can help reduce poverty and positively impact the way we work.

- The Writing Center of the University of North Carolina has a list of questions to ask to see if your thesis is strong .

A thesis statement is part of the introduction of your paper. It is usually found in the first or second paragraph to let the reader know your research purpose from the beginning.

In general, a thesis statement should have one or two sentences. But the length really depends on the overall length of your project. Take a look at our guide about the length of thesis statements for more insight on this topic.

Here is a list of Thesis Statement Examples that will help you understand better how to write them.

Every good essay should include a thesis statement as part of its introduction, no matter the academic level. Of course, if you are a high school student you are not expected to have the same type of thesis as a PhD student.

Here is a great YouTube tutorial showing How To Write An Essay: Thesis Statements .

- Skip to Content

- Skip to Main Navigation

- Skip to Search

Indiana University Bloomington Indiana University Bloomington IU Bloomington

- Mission, Vision, and Inclusive Language Statement

- Locations & Hours

- Undergraduate Employment

- Graduate Employment

- Frequently Asked Questions

- Newsletter Archive

- Support WTS

- Schedule an Appointment

- Online Tutoring

- Before your Appointment

- WTS Policies

- Group Tutoring

- Students Referred by Instructors

- Paid External Editing Services

- Writing Guides

- Scholarly Write-in

- Dissertation Writing Groups

- Journal Article Writing Groups

- Early Career Graduate Student Writing Workshop

- Workshops for Graduate Students

- Teaching Resources

- Syllabus Information

- Course-specific Tutoring

- Nominate a Peer Tutor

- Tutoring Feedback

- Schedule Appointment

- Campus Writing Program

Writing Tutorial Services

How to write a thesis statement, what is a thesis statement.

Almost all of us—even if we don’t do it consciously—look early in an essay for a one- or two-sentence condensation of the argument or analysis that is to follow. We refer to that condensation as a thesis statement.

Why Should Your Essay Contain a Thesis Statement?

- to test your ideas by distilling them into a sentence or two

- to better organize and develop your argument

- to provide your reader with a “guide” to your argument

In general, your thesis statement will accomplish these goals if you think of the thesis as the answer to the question your paper explores.

How Can You Write a Good Thesis Statement?

Here are some helpful hints to get you started. You can either scroll down or select a link to a specific topic.

How to Generate a Thesis Statement if the Topic is Assigned How to Generate a Thesis Statement if the Topic is not Assigned How to Tell a Strong Thesis Statement from a Weak One

How to Generate a Thesis Statement if the Topic is Assigned

Almost all assignments, no matter how complicated, can be reduced to a single question. Your first step, then, is to distill the assignment into a specific question. For example, if your assignment is, “Write a report to the local school board explaining the potential benefits of using computers in a fourth-grade class,” turn the request into a question like, “What are the potential benefits of using computers in a fourth-grade class?” After you’ve chosen the question your essay will answer, compose one or two complete sentences answering that question.

Q: “What are the potential benefits of using computers in a fourth-grade class?” A: “The potential benefits of using computers in a fourth-grade class are . . .”

A: “Using computers in a fourth-grade class promises to improve . . .”

The answer to the question is the thesis statement for the essay.

[ Back to top ]

How to Generate a Thesis Statement if the Topic is not Assigned

Even if your assignment doesn’t ask a specific question, your thesis statement still needs to answer a question about the issue you’d like to explore. In this situation, your job is to figure out what question you’d like to write about.

A good thesis statement will usually include the following four attributes:

- take on a subject upon which reasonable people could disagree

- deal with a subject that can be adequately treated given the nature of the assignment

- express one main idea

- assert your conclusions about a subject

Let’s see how to generate a thesis statement for a social policy paper.

Brainstorm the topic . Let’s say that your class focuses upon the problems posed by changes in the dietary habits of Americans. You find that you are interested in the amount of sugar Americans consume.

You start out with a thesis statement like this:

Sugar consumption.

This fragment isn’t a thesis statement. Instead, it simply indicates a general subject. Furthermore, your reader doesn’t know what you want to say about sugar consumption.

Narrow the topic . Your readings about the topic, however, have led you to the conclusion that elementary school children are consuming far more sugar than is healthy.

You change your thesis to look like this:

Reducing sugar consumption by elementary school children.

This fragment not only announces your subject, but it focuses on one segment of the population: elementary school children. Furthermore, it raises a subject upon which reasonable people could disagree, because while most people might agree that children consume more sugar than they used to, not everyone would agree on what should be done or who should do it. You should note that this fragment is not a thesis statement because your reader doesn’t know your conclusions on the topic.

Take a position on the topic. After reflecting on the topic a little while longer, you decide that what you really want to say about this topic is that something should be done to reduce the amount of sugar these children consume.

You revise your thesis statement to look like this:

More attention should be paid to the food and beverage choices available to elementary school children.

This statement asserts your position, but the terms more attention and food and beverage choices are vague.

Use specific language . You decide to explain what you mean about food and beverage choices , so you write:

Experts estimate that half of elementary school children consume nine times the recommended daily allowance of sugar.

This statement is specific, but it isn’t a thesis. It merely reports a statistic instead of making an assertion.

Make an assertion based on clearly stated support. You finally revise your thesis statement one more time to look like this:

Because half of all American elementary school children consume nine times the recommended daily allowance of sugar, schools should be required to replace the beverages in soda machines with healthy alternatives.

Notice how the thesis answers the question, “What should be done to reduce sugar consumption by children, and who should do it?” When you started thinking about the paper, you may not have had a specific question in mind, but as you became more involved in the topic, your ideas became more specific. Your thesis changed to reflect your new insights.

How to Tell a Strong Thesis Statement from a Weak One

1. a strong thesis statement takes some sort of stand..

Remember that your thesis needs to show your conclusions about a subject. For example, if you are writing a paper for a class on fitness, you might be asked to choose a popular weight-loss product to evaluate. Here are two thesis statements:

There are some negative and positive aspects to the Banana Herb Tea Supplement.

This is a weak thesis statement. First, it fails to take a stand. Second, the phrase negative and positive aspects is vague.

Because Banana Herb Tea Supplement promotes rapid weight loss that results in the loss of muscle and lean body mass, it poses a potential danger to customers.

This is a strong thesis because it takes a stand, and because it's specific.

2. A strong thesis statement justifies discussion.

Your thesis should indicate the point of the discussion. If your assignment is to write a paper on kinship systems, using your own family as an example, you might come up with either of these two thesis statements:

My family is an extended family.

This is a weak thesis because it merely states an observation. Your reader won’t be able to tell the point of the statement, and will probably stop reading.

While most American families would view consanguineal marriage as a threat to the nuclear family structure, many Iranian families, like my own, believe that these marriages help reinforce kinship ties in an extended family.

This is a strong thesis because it shows how your experience contradicts a widely-accepted view. A good strategy for creating a strong thesis is to show that the topic is controversial. Readers will be interested in reading the rest of the essay to see how you support your point.

3. A strong thesis statement expresses one main idea.

Readers need to be able to see that your paper has one main point. If your thesis statement expresses more than one idea, then you might confuse your readers about the subject of your paper. For example:

Companies need to exploit the marketing potential of the Internet, and Web pages can provide both advertising and customer support.

This is a weak thesis statement because the reader can’t decide whether the paper is about marketing on the Internet or Web pages. To revise the thesis, the relationship between the two ideas needs to become more clear. One way to revise the thesis would be to write:

Because the Internet is filled with tremendous marketing potential, companies should exploit this potential by using Web pages that offer both advertising and customer support.

This is a strong thesis because it shows that the two ideas are related. Hint: a great many clear and engaging thesis statements contain words like because , since , so , although , unless , and however .

4. A strong thesis statement is specific.

A thesis statement should show exactly what your paper will be about, and will help you keep your paper to a manageable topic. For example, if you're writing a seven-to-ten page paper on hunger, you might say:

World hunger has many causes and effects.

This is a weak thesis statement for two major reasons. First, world hunger can’t be discussed thoroughly in seven to ten pages. Second, many causes and effects is vague. You should be able to identify specific causes and effects. A revised thesis might look like this:

Hunger persists in Glandelinia because jobs are scarce and farming in the infertile soil is rarely profitable.

This is a strong thesis statement because it narrows the subject to a more specific and manageable topic, and it also identifies the specific causes for the existence of hunger.

Produced by Writing Tutorial Services, Indiana University, Bloomington, IN

Writing Tutorial Services social media channels

What are your chances of acceptance?

Calculate for all schools, your chance of acceptance.

Your chancing factors

Extracurriculars.

How to Write a Strong Thesis Statement: 4 Steps + Examples

What’s Covered:

What is the purpose of a thesis statement, writing a good thesis statement: 4 steps, common pitfalls to avoid, where to get your essay edited for free.

When you set out to write an essay, there has to be some kind of point to it, right? Otherwise, your essay would just be a big jumble of word salad that makes absolutely no sense. An essay needs a central point that ties into everything else. That main point is called a thesis statement, and it’s the core of any essay or research paper.

You may hear about Master degree candidates writing a thesis, and that is an entire paper–not to be confused with the thesis statement, which is typically one sentence that contains your paper’s focus.

Read on to learn more about thesis statements and how to write them. We’ve also included some solid examples for you to reference.

Typically the last sentence of your introductory paragraph, the thesis statement serves as the roadmap for your essay. When your reader gets to the thesis statement, they should have a clear outline of your main point, as well as the information you’ll be presenting in order to either prove or support your point.

The thesis statement should not be confused for a topic sentence , which is the first sentence of every paragraph in your essay. If you need help writing topic sentences, numerous resources are available. Topic sentences should go along with your thesis statement, though.

Since the thesis statement is the most important sentence of your entire essay or paper, it’s imperative that you get this part right. Otherwise, your paper will not have a good flow and will seem disjointed. That’s why it’s vital not to rush through developing one. It’s a methodical process with steps that you need to follow in order to create the best thesis statement possible.

Step 1: Decide what kind of paper you’re writing

When you’re assigned an essay, there are several different types you may get. Argumentative essays are designed to get the reader to agree with you on a topic. Informative or expository essays present information to the reader. Analytical essays offer up a point and then expand on it by analyzing relevant information. Thesis statements can look and sound different based on the type of paper you’re writing. For example:

- Argumentative: The United States needs a viable third political party to decrease bipartisanship, increase options, and help reduce corruption in government.

- Informative: The Libertarian party has thrown off elections before by gaining enough support in states to get on the ballot and by taking away crucial votes from candidates.

- Analytical: An analysis of past presidential elections shows that while third party votes may have been the minority, they did affect the outcome of the elections in 2020, 2016, and beyond.

Step 2: Figure out what point you want to make

Once you know what type of paper you’re writing, you then need to figure out the point you want to make with your thesis statement, and subsequently, your paper. In other words, you need to decide to answer a question about something, such as:

- What impact did reality TV have on American society?

- How has the musical Hamilton affected perception of American history?

- Why do I want to major in [chosen major here]?

If you have an argumentative essay, then you will be writing about an opinion. To make it easier, you may want to choose an opinion that you feel passionate about so that you’re writing about something that interests you. For example, if you have an interest in preserving the environment, you may want to choose a topic that relates to that.

If you’re writing your college essay and they ask why you want to attend that school, you may want to have a main point and back it up with information, something along the lines of:

“Attending Harvard University would benefit me both academically and professionally, as it would give me a strong knowledge base upon which to build my career, develop my network, and hopefully give me an advantage in my chosen field.”

Step 3: Determine what information you’ll use to back up your point

Once you have the point you want to make, you need to figure out how you plan to back it up throughout the rest of your essay. Without this information, it will be hard to either prove or argue the main point of your thesis statement. If you decide to write about the Hamilton example, you may decide to address any falsehoods that the writer put into the musical, such as:

“The musical Hamilton, while accurate in many ways, leaves out key parts of American history, presents a nationalist view of founding fathers, and downplays the racism of the times.”

Once you’ve written your initial working thesis statement, you’ll then need to get information to back that up. For example, the musical completely leaves out Benjamin Franklin, portrays the founding fathers in a nationalist way that is too complimentary, and shows Hamilton as a staunch abolitionist despite the fact that his family likely did own slaves.

Step 4: Revise and refine your thesis statement before you start writing

Read through your thesis statement several times before you begin to compose your full essay. You need to make sure the statement is ironclad, since it is the foundation of the entire paper. Edit it or have a peer review it for you to make sure everything makes sense and that you feel like you can truly write a paper on the topic. Once you’ve done that, you can then begin writing your paper.

When writing a thesis statement, there are some common pitfalls you should avoid so that your paper can be as solid as possible. Make sure you always edit the thesis statement before you do anything else. You also want to ensure that the thesis statement is clear and concise. Don’t make your reader hunt for your point. Finally, put your thesis statement at the end of the first paragraph and have your introduction flow toward that statement. Your reader will expect to find your statement in its traditional spot.

If you’re having trouble getting started, or need some guidance on your essay, there are tools available that can help you. CollegeVine offers a free peer essay review tool where one of your peers can read through your essay and provide you with valuable feedback. Getting essay feedback from a peer can help you wow your instructor or college admissions officer with an impactful essay that effectively illustrates your point.

Related CollegeVine Blog Posts

Developing a Thesis Statement

Many papers you write require developing a thesis statement. In this section you’ll learn what a thesis statement is and how to write one.

Keep in mind that not all papers require thesis statements . If in doubt, please consult your instructor for assistance.

What is a thesis statement?

A thesis statement . . .

- Makes an argumentative assertion about a topic; it states the conclusions that you have reached about your topic.

- Makes a promise to the reader about the scope, purpose, and direction of your paper.

- Is focused and specific enough to be “proven” within the boundaries of your paper.

- Is generally located near the end of the introduction ; sometimes, in a long paper, the thesis will be expressed in several sentences or in an entire paragraph.

- Identifies the relationships between the pieces of evidence that you are using to support your argument.

Not all papers require thesis statements! Ask your instructor if you’re in doubt whether you need one.

Identify a topic

Your topic is the subject about which you will write. Your assignment may suggest several ways of looking at a topic; or it may name a fairly general concept that you will explore or analyze in your paper.

Consider what your assignment asks you to do

Inform yourself about your topic, focus on one aspect of your topic, ask yourself whether your topic is worthy of your efforts, generate a topic from an assignment.

Below are some possible topics based on sample assignments.

Sample assignment 1

Analyze Spain’s neutrality in World War II.

Identified topic

Franco’s role in the diplomatic relationships between the Allies and the Axis

This topic avoids generalities such as “Spain” and “World War II,” addressing instead on Franco’s role (a specific aspect of “Spain”) and the diplomatic relations between the Allies and Axis (a specific aspect of World War II).

Sample assignment 2

Analyze one of Homer’s epic similes in the Iliad.

The relationship between the portrayal of warfare and the epic simile about Simoisius at 4.547-64.

This topic focuses on a single simile and relates it to a single aspect of the Iliad ( warfare being a major theme in that work).

Developing a Thesis Statement–Additional information

Your assignment may suggest several ways of looking at a topic, or it may name a fairly general concept that you will explore or analyze in your paper. You’ll want to read your assignment carefully, looking for key terms that you can use to focus your topic.

Sample assignment: Analyze Spain’s neutrality in World War II Key terms: analyze, Spain’s neutrality, World War II

After you’ve identified the key words in your topic, the next step is to read about them in several sources, or generate as much information as possible through an analysis of your topic. Obviously, the more material or knowledge you have, the more possibilities will be available for a strong argument. For the sample assignment above, you’ll want to look at books and articles on World War II in general, and Spain’s neutrality in particular.

As you consider your options, you must decide to focus on one aspect of your topic. This means that you cannot include everything you’ve learned about your topic, nor should you go off in several directions. If you end up covering too many different aspects of a topic, your paper will sprawl and be unconvincing in its argument, and it most likely will not fulfull the assignment requirements.

For the sample assignment above, both Spain’s neutrality and World War II are topics far too broad to explore in a paper. You may instead decide to focus on Franco’s role in the diplomatic relationships between the Allies and the Axis , which narrows down what aspects of Spain’s neutrality and World War II you want to discuss, as well as establishes a specific link between those two aspects.

Before you go too far, however, ask yourself whether your topic is worthy of your efforts. Try to avoid topics that already have too much written about them (i.e., “eating disorders and body image among adolescent women”) or that simply are not important (i.e. “why I like ice cream”). These topics may lead to a thesis that is either dry fact or a weird claim that cannot be supported. A good thesis falls somewhere between the two extremes. To arrive at this point, ask yourself what is new, interesting, contestable, or controversial about your topic.

As you work on your thesis, remember to keep the rest of your paper in mind at all times . Sometimes your thesis needs to evolve as you develop new insights, find new evidence, or take a different approach to your topic.

Derive a main point from topic

Once you have a topic, you will have to decide what the main point of your paper will be. This point, the “controlling idea,” becomes the core of your argument (thesis statement) and it is the unifying idea to which you will relate all your sub-theses. You can then turn this “controlling idea” into a purpose statement about what you intend to do in your paper.

Look for patterns in your evidence

Compose a purpose statement.

Consult the examples below for suggestions on how to look for patterns in your evidence and construct a purpose statement.

- Franco first tried to negotiate with the Axis

- Franco turned to the Allies when he couldn’t get some concessions that he wanted from the Axis

Possible conclusion:

Spain’s neutrality in WWII occurred for an entirely personal reason: Franco’s desire to preserve his own (and Spain’s) power.

Purpose statement

This paper will analyze Franco’s diplomacy during World War II to see how it contributed to Spain’s neutrality.

- The simile compares Simoisius to a tree, which is a peaceful, natural image.

- The tree in the simile is chopped down to make wheels for a chariot, which is an object used in warfare.

At first, the simile seems to take the reader away from the world of warfare, but we end up back in that world by the end.

This paper will analyze the way the simile about Simoisius at 4.547-64 moves in and out of the world of warfare.

Derive purpose statement from topic

To find out what your “controlling idea” is, you have to examine and evaluate your evidence . As you consider your evidence, you may notice patterns emerging, data repeated in more than one source, or facts that favor one view more than another. These patterns or data may then lead you to some conclusions about your topic and suggest that you can successfully argue for one idea better than another.

For instance, you might find out that Franco first tried to negotiate with the Axis, but when he couldn’t get some concessions that he wanted from them, he turned to the Allies. As you read more about Franco’s decisions, you may conclude that Spain’s neutrality in WWII occurred for an entirely personal reason: his desire to preserve his own (and Spain’s) power. Based on this conclusion, you can then write a trial thesis statement to help you decide what material belongs in your paper.

Sometimes you won’t be able to find a focus or identify your “spin” or specific argument immediately. Like some writers, you might begin with a purpose statement just to get yourself going. A purpose statement is one or more sentences that announce your topic and indicate the structure of the paper but do not state the conclusions you have drawn . Thus, you might begin with something like this:

- This paper will look at modern language to see if it reflects male dominance or female oppression.

- I plan to analyze anger and derision in offensive language to see if they represent a challenge of society’s authority.

At some point, you can turn a purpose statement into a thesis statement. As you think and write about your topic, you can restrict, clarify, and refine your argument, crafting your thesis statement to reflect your thinking.

As you work on your thesis, remember to keep the rest of your paper in mind at all times. Sometimes your thesis needs to evolve as you develop new insights, find new evidence, or take a different approach to your topic.

Compose a draft thesis statement

If you are writing a paper that will have an argumentative thesis and are having trouble getting started, the techniques in the table below may help you develop a temporary or “working” thesis statement.

Begin with a purpose statement that you will later turn into a thesis statement.

Assignment: Discuss the history of the Reform Party and explain its influence on the 1990 presidential and Congressional election.

Purpose Statement: This paper briefly sketches the history of the grassroots, conservative, Perot-led Reform Party and analyzes how it influenced the economic and social ideologies of the two mainstream parties.

Question-to-Assertion

If your assignment asks a specific question(s), turn the question(s) into an assertion and give reasons why it is true or reasons for your opinion.

Assignment : What do Aylmer and Rappaccini have to be proud of? Why aren’t they satisfied with these things? How does pride, as demonstrated in “The Birthmark” and “Rappaccini’s Daughter,” lead to unexpected problems?

Beginning thesis statement: Alymer and Rappaccinni are proud of their great knowledge; however, they are also very greedy and are driven to use their knowledge to alter some aspect of nature as a test of their ability. Evil results when they try to “play God.”

Write a sentence that summarizes the main idea of the essay you plan to write.

Main idea: The reason some toys succeed in the market is that they appeal to the consumers’ sense of the ridiculous and their basic desire to laugh at themselves.

Make a list of the ideas that you want to include; consider the ideas and try to group them.

- nature = peaceful

- war matériel = violent (competes with 1?)

- need for time and space to mourn the dead

- war is inescapable (competes with 3?)

Use a formula to arrive at a working thesis statement (you will revise this later).

- although most readers of _______ have argued that _______, closer examination shows that _______.

- _______ uses _______ and _____ to prove that ________.

- phenomenon x is a result of the combination of __________, __________, and _________.

What to keep in mind as you draft an initial thesis statement

Beginning statements obtained through the methods illustrated above can serve as a framework for planning or drafting your paper, but remember they’re not yet the specific, argumentative thesis you want for the final version of your paper. In fact, in its first stages, a thesis statement usually is ill-formed or rough and serves only as a planning tool.

As you write, you may discover evidence that does not fit your temporary or “working” thesis. Or you may reach deeper insights about your topic as you do more research, and you will find that your thesis statement has to be more complicated to match the evidence that you want to use.

You must be willing to reject or omit some evidence in order to keep your paper cohesive and your reader focused. Or you may have to revise your thesis to match the evidence and insights that you want to discuss. Read your draft carefully, noting the conclusions you have drawn and the major ideas which support or prove those conclusions. These will be the elements of your final thesis statement.

Sometimes you will not be able to identify these elements in your early drafts, but as you consider how your argument is developing and how your evidence supports your main idea, ask yourself, “ What is the main point that I want to prove/discuss? ” and “ How will I convince the reader that this is true? ” When you can answer these questions, then you can begin to refine the thesis statement.

Refine and polish the thesis statement

To get to your final thesis, you’ll need to refine your draft thesis so that it’s specific and arguable.

- Ask if your draft thesis addresses the assignment

- Question each part of your draft thesis

- Clarify vague phrases and assertions

- Investigate alternatives to your draft thesis

Consult the example below for suggestions on how to refine your draft thesis statement.

Sample Assignment

Choose an activity and define it as a symbol of American culture. Your essay should cause the reader to think critically about the society which produces and enjoys that activity.

- Ask The phenomenon of drive-in facilities is an interesting symbol of american culture, and these facilities demonstrate significant characteristics of our society.This statement does not fulfill the assignment because it does not require the reader to think critically about society.

Drive-ins are an interesting symbol of American culture because they represent Americans’ significant creativity and business ingenuity.

Among the types of drive-in facilities familiar during the twentieth century, drive-in movie theaters best represent American creativity, not merely because they were the forerunner of later drive-ins and drive-throughs, but because of their impact on our culture: they changed our relationship to the automobile, changed the way people experienced movies, and changed movie-going into a family activity.

While drive-in facilities such as those at fast-food establishments, banks, pharmacies, and dry cleaners symbolize America’s economic ingenuity, they also have affected our personal standards.

While drive-in facilities such as those at fast- food restaurants, banks, pharmacies, and dry cleaners symbolize (1) Americans’ business ingenuity, they also have contributed (2) to an increasing homogenization of our culture, (3) a willingness to depersonalize relationships with others, and (4) a tendency to sacrifice quality for convenience.

This statement is now specific and fulfills all parts of the assignment. This version, like any good thesis, is not self-evident; its points, 1-4, will have to be proven with evidence in the body of the paper. The numbers in this statement indicate the order in which the points will be presented. Depending on the length of the paper, there could be one paragraph for each numbered item or there could be blocks of paragraph for even pages for each one.

Complete the final thesis statement

The bottom line.

As you move through the process of crafting a thesis, you’ll need to remember four things:

- Context matters! Think about your course materials and lectures. Try to relate your thesis to the ideas your instructor is discussing.

- As you go through the process described in this section, always keep your assignment in mind . You will be more successful when your thesis (and paper) responds to the assignment than if it argues a semi-related idea.

- Your thesis statement should be precise, focused, and contestable ; it should predict the sub-theses or blocks of information that you will use to prove your argument.

- Make sure that you keep the rest of your paper in mind at all times. Change your thesis as your paper evolves, because you do not want your thesis to promise more than your paper actually delivers.

In the beginning, the thesis statement was a tool to help you sharpen your focus, limit material and establish the paper’s purpose. When your paper is finished, however, the thesis statement becomes a tool for your reader. It tells the reader what you have learned about your topic and what evidence led you to your conclusion. It keeps the reader on track–well able to understand and appreciate your argument.

Writing Process and Structure

This is an accordion element with a series of buttons that open and close related content panels.

Getting Started with Your Paper

Interpreting Writing Assignments from Your Courses

Generating Ideas for

Creating an Argument

Thesis vs. Purpose Statements

Architecture of Arguments

Working with Sources

Quoting and Paraphrasing Sources

Using Literary Quotations

Citing Sources in Your Paper

Drafting Your Paper

Generating Ideas for Your Paper

Introductions

Paragraphing

Developing Strategic Transitions

Conclusions

Revising Your Paper

Peer Reviews

Reverse Outlines

Revising an Argumentative Paper

Revision Strategies for Longer Projects

Finishing Your Paper

Twelve Common Errors: An Editing Checklist

How to Proofread your Paper

Writing Collaboratively

Collaborative and Group Writing

25 Thesis Statement Examples

A thesis statement is needed in an essay or dissertation . There are multiple types of thesis statements – but generally we can divide them into expository and argumentative. An expository statement is a statement of fact (common in expository essays and process essays) while an argumentative statement is a statement of opinion (common in argumentative essays and dissertations). Below are examples of each.

Strong Thesis Statement Examples

1. School Uniforms

“Mandatory school uniforms should be implemented in educational institutions as they promote a sense of equality, reduce distractions, and foster a focused and professional learning environment.”

Best For: Argumentative Essay or Debate

Read More: School Uniforms Pros and Cons

2. Nature vs Nurture

“This essay will explore how both genetic inheritance and environmental factors equally contribute to shaping human behavior and personality.”

Best For: Compare and Contrast Essay

Read More: Nature vs Nurture Debate

3. American Dream

“The American Dream, a symbol of opportunity and success, is increasingly elusive in today’s socio-economic landscape, revealing deeper inequalities in society.”

Best For: Persuasive Essay

Read More: What is the American Dream?

4. Social Media

“Social media has revolutionized communication and societal interactions, but it also presents significant challenges related to privacy, mental health, and misinformation.”

Best For: Expository Essay

Read More: The Pros and Cons of Social Media

5. Globalization

“Globalization has created a world more interconnected than ever before, yet it also amplifies economic disparities and cultural homogenization.”

Read More: Globalization Pros and Cons

6. Urbanization

“Urbanization drives economic growth and social development, but it also poses unique challenges in sustainability and quality of life.”

Read More: Learn about Urbanization

7. Immigration

“Immigration enriches receiving countries culturally and economically, outweighing any perceived social or economic burdens.”

Read More: Immigration Pros and Cons

8. Cultural Identity

“In a globalized world, maintaining distinct cultural identities is crucial for preserving cultural diversity and fostering global understanding, despite the challenges of assimilation and homogenization.”

Best For: Argumentative Essay

Read More: Learn about Cultural Identity

9. Technology

“Medical technologies in care institutions in Toronto has increased subjcetive outcomes for patients with chronic pain.”

Best For: Research Paper

10. Capitalism vs Socialism

“The debate between capitalism and socialism centers on balancing economic freedom and inequality, each presenting distinct approaches to resource distribution and social welfare.”

11. Cultural Heritage

“The preservation of cultural heritage is essential, not only for cultural identity but also for educating future generations, outweighing the arguments for modernization and commercialization.”

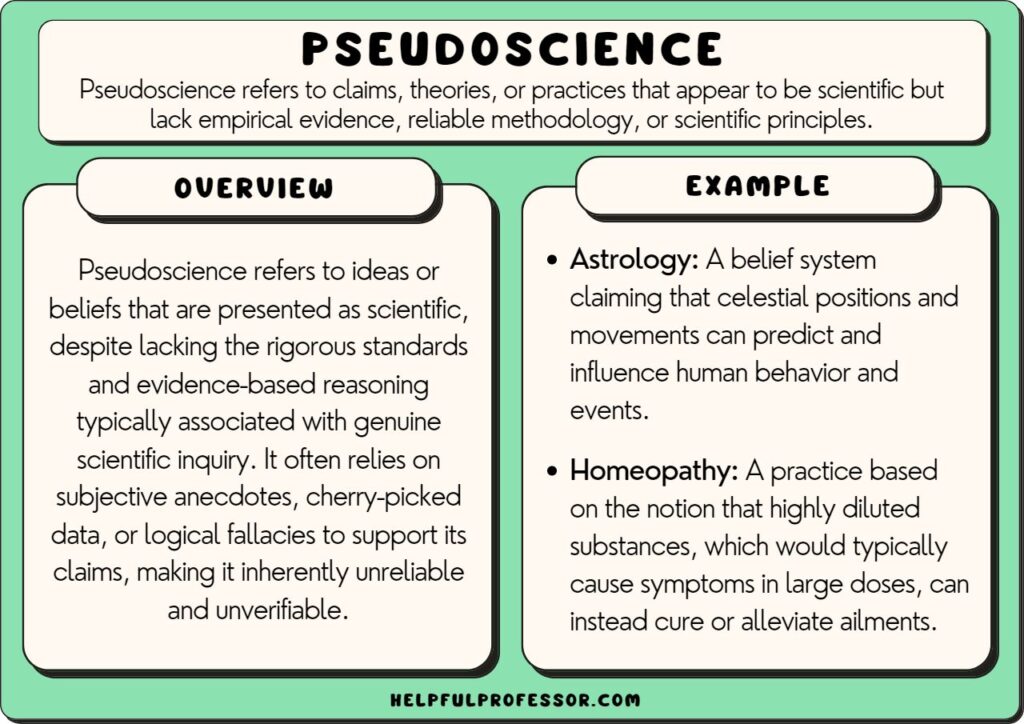

12. Pseudoscience

“Pseudoscience, characterized by a lack of empirical support, continues to influence public perception and decision-making, often at the expense of scientific credibility.”

Read More: Examples of Pseudoscience

13. Free Will

“The concept of free will is largely an illusion, with human behavior and decisions predominantly determined by biological and environmental factors.”

Read More: Do we have Free Will?

14. Gender Roles

“Traditional gender roles are outdated and harmful, restricting individual freedoms and perpetuating gender inequalities in modern society.”

Read More: What are Traditional Gender Roles?

15. Work-Life Ballance

“The trend to online and distance work in the 2020s led to improved subjective feelings of work-life balance but simultaneously increased self-reported loneliness.”

Read More: Work-Life Balance Examples

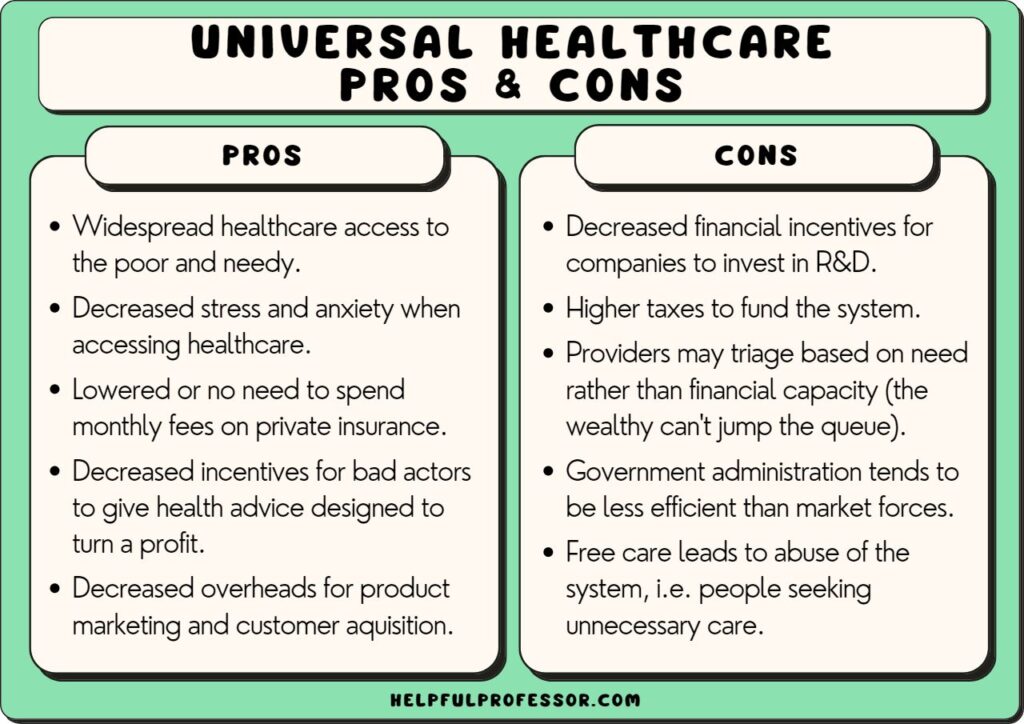

16. Universal Healthcare

“Universal healthcare is a fundamental human right and the most effective system for ensuring health equity and societal well-being, outweighing concerns about government involvement and costs.”

Read More: The Pros and Cons of Universal Healthcare

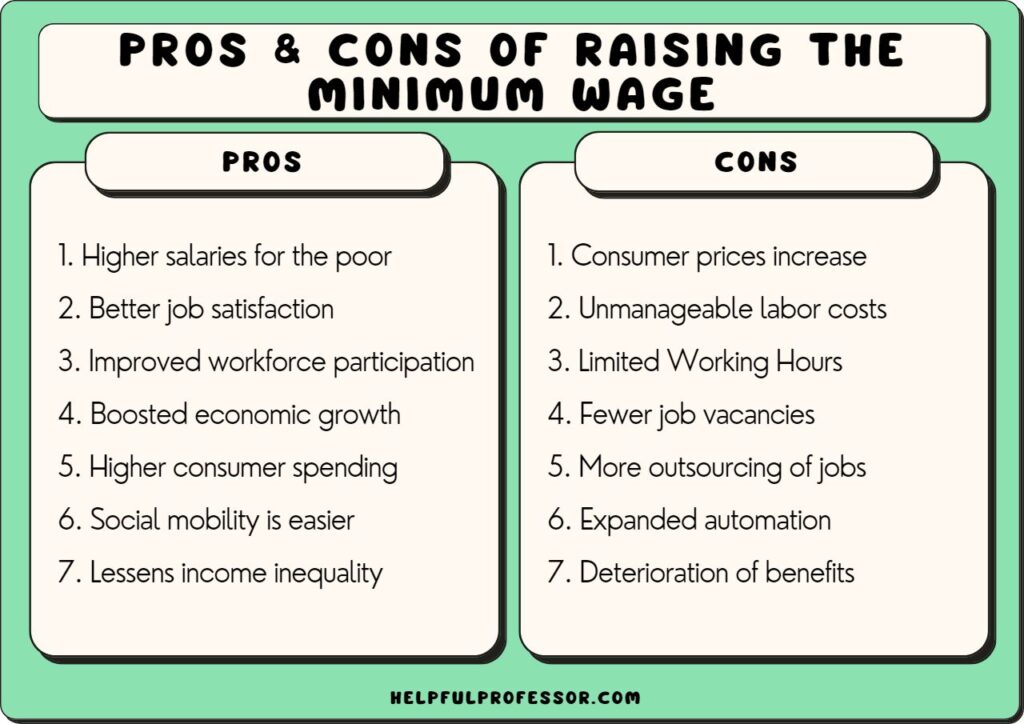

17. Minimum Wage

“The implementation of a fair minimum wage is vital for reducing economic inequality, yet it is often contentious due to its potential impact on businesses and employment rates.”

Read More: The Pros and Cons of Raising the Minimum Wage

18. Homework

“The homework provided throughout this semester has enabled me to achieve greater self-reflection, identify gaps in my knowledge, and reinforce those gaps through spaced repetition.”

Best For: Reflective Essay

Read More: Reasons Homework Should be Banned

19. Charter Schools

“Charter schools offer alternatives to traditional public education, promising innovation and choice but also raising questions about accountability and educational equity.”

Read More: The Pros and Cons of Charter Schools

20. Effects of the Internet

“The Internet has drastically reshaped human communication, access to information, and societal dynamics, generally with a net positive effect on society.”

Read More: The Pros and Cons of the Internet

21. Affirmative Action

“Affirmative action is essential for rectifying historical injustices and achieving true meritocracy in education and employment, contrary to claims of reverse discrimination.”

Best For: Essay

Read More: Affirmative Action Pros and Cons

22. Soft Skills

“Soft skills, such as communication and empathy, are increasingly recognized as essential for success in the modern workforce, and therefore should be a strong focus at school and university level.”

Read More: Soft Skills Examples

23. Moral Panic

“Moral panic, often fueled by media and cultural anxieties, can lead to exaggerated societal responses that sometimes overlook rational analysis and evidence.”

Read More: Moral Panic Examples

24. Freedom of the Press

“Freedom of the press is critical for democracy and informed citizenship, yet it faces challenges from censorship, media bias, and the proliferation of misinformation.”

Read More: Freedom of the Press Examples

25. Mass Media

“Mass media shapes public opinion and cultural norms, but its concentration of ownership and commercial interests raise concerns about bias and the quality of information.”

Best For: Critical Analysis

Read More: Mass Media Examples

Checklist: How to use your Thesis Statement