- Publishing Policies

- For Organizers/Editors

- For Authors

- For Peer Reviewers

Factors Influencing Accounting Undergraduates’ Career Path: Evidence From Malaysia

This study examines factors that influence accounting undergraduates’ career path. The study uses questionnnaire survey for data collection purposes. The population of the study consists of accounting undergraduates from public and private universities. Simple random sampling was utilised to determine the respondents. Multiple regression was employed to determine factors influencing accounting undergraduates’ career path. The independent variables (predictors) were chosen based on previous literature. Results revealed that intrinsic motivation, influence of third party, career exposure and learning experience influenced accounting undergraduates’ career path, while extrinsic motivation did not influence their career path. The result suggests that accounting students’ decision on a career path is driven by interest and enjoyment of doing accounting, by advice from people they trust, by the exposure with practitioners and through knowledge gained during study, and not driven by wealth nor fame. Further, test of significant difference was administered to determine whether the students’ career path was the same across year of study. Result from the test concluded no significant difference was found across year of study. Results of the study provide crucial information to related parties to promote the accounting career by highlighting on non-extrinsic themes. Further, in line with MIA’s skill set requirements, institution of higher learning has to be proactive in updating and improving accounting undergraduates’ capabilities in line with industry needs. Keywords: Accounting education intrinsic & extrinsic motivation learning experience career path

Introduction

It is common for students who enrol to study in a particular field to not pursue a career in the same (similar) field. It is understandable that students may change their career intention after gaining further awareness and exposure all through their tertiary period. In the accounting field in particular, we see students shifting to other courses for various reasons; for instance, caused by inability to withstand the stress and difficulty of the course and its learning process. This phenomenon is becoming an issue, more so in Malaysia as we are short of qualified accountants (60,000 accountants by 2020) (Lee, 2018). Notwithstanding, brain drain to developed countries is also another issue faced. Thus, identifying factors influencing accounting undergraduates’ career path will enable related parties to motivate students to pursue accounting education and progress to the accounting profession.

Past studies claim that students who have high belief in accounting setting can offer a greater supply of work compared to other field of work ( Kochanek & Norgaard, 1985 ; Owusu et al., 2018 ; Paolillo & Estes, 1982 ; Wen et al., 2015 ). According to them, this judgement plays a critical role in the selection of accounting major. Previous researches in a Malaysian setting revealed that the accounting field is still favoured by the undergraduates ( Goon, 1975 ; Said et al., 2004 ). Goon ( 1975 ) for example, discovered that most of her respondents had selected accounting as a career. Further, Said et al. ( 2004 ) revealed that the accounting is ranked as the two most preferred professions of undergraduates. This study aims to investigate whether intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience influence accounting undergraduates’ career path. Further, this study looks at whether career path intention is significantly different across year of study.

Problem Statement

The decreasing popularity of the accounting profession as asserted by Russell et al. ( 2000 ) nearly 2 decades ago was due to dramatic change in the business landscape where technological development and competitiveness were very intense to which accounting education failed to adjust to. Further, over a decade ago, Smith ( 2005 ) claimed that the accounting profession had taken a back burner as a result of much “publicised financial frauds and irregularities” (p. 943).

Since then, the issue of accounting students changing courses, choosing to pursue other fields of study and not pursuing a career in accounting is quite common. These circumstances have partly affected the number of accountants being created in Malaysia. For instance, Mohd Khalid et al. ( 2018 ) discovered that approximately 75% of high school students who enrolled in accounting subject for SPM had the intention to pursue tertiary education in accounting after completion of their SPM. Further, Mohd Hanapiah et al. ( 2017 ) revealed that over 77% of accounting undergraduates intend to pursue a career in accounting after completing their tertiary education. Although the percentages are high, it is still insufficient to cover the demand for accountants in Malaysia.

And for the record, there are approximately 36,000 registered members of the Malaysian Institute of Accountants (MIA) currently (MIA, 2019), several thousand shorts of the 60,000 certified accountants required by 2020 (Lee, 2018); which is, incidentally, next year! This shortage is partly due to a steady stream of brain drain to Singapore and other neighbouring countries such as Vietnam, Cambodia and Hong Kong as well as other more developed countries that provide more lucrative incentive and compensation packages, whilst other reasons include a preference to opt for early retirement after marriage (Tan, 2018). Further, Lent et al. ( 1994 ) revealed that other influencing factors include intrinsic and extrinsic motivations, third party influence and career exposure

Research Questions

Further research is needed to determine students’ career path after completion of their tertiary education as there is still a need for qualified accountants in Malaysia. Thus, the research questions are:

1.Does intrinsic motivation, extrinsic motivations, third party influence, career exposure and learning experience influences accounting undergraduates’ career path?

2.Is there statistically significant difference in career path across year of study?

Research Objectives

1.To examine whether career path is influenced by intrinsic motivation, extrinsic motivations, influence of third party, career exposure and learning experience.

2.To ascertain whether there is significant difference in career path across year of study.

Purpose of the Study

The study refers career path as choice of profession that an undergraduate takes after the completion of his study. For an accounting undergraduate, this would mean a career path within the accounting field. A person plans his career path in the earliest part of his career journey ( Yusoff et al. 2011 ). Thus, the purpose of this study is to analyse factors influencing accounting undergraduates' career path.

The contribution of the research may give benefits of enriching the current literature, providing insight to practitioners and policy makers. For instance, the MIA may be able to review their standards in order to improve the number of certified accountants.

Review of literature

We will present previous literature at this point covering career paths (dependent variable) as well as intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience (Independent variables).

Career Path

Joseph et al. ( 2012 ) define career path as an occupation that a person holds throughout his life. According to Joseph et al. ( 2012 ), career choice may be shaped by a person’s characteristics. Personal experience in doing work is also considered as career path according to Yusoff et al. ( 2011 ).

Previous literature used SCCT extensively in career path research. For example, Schoenfeld et al. ( 2017 ) used the SCCT to test the association of self-efficacy and intention to become a CPA. Ng et al. ( 2017 ) had also used SCCT to examine whether intrinsic and extrinsic motivations, influence of third party and career exposure influenced accounting students’ career choice. Further, James ( 2008 ) used the SCCT to try to discover why accounting is not a popular career choice among African American students.

The current study refers career path (or career choice) as choice of profession that an undergraduate take after the completion of his study. For an accounting undergraduate, this would mean a career path within the accounting field. Some of the accounting career information that the undergraduate students should consider before making this decision includes education requirements, tax accounting salary, typical career advancement, and duties performed.

Factors influencing career path

The independent variables that will be tested with career path are intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience, similar to Ng et al. ( 2017 ). We included learning experience as an additional variable as it was also tested as a factor that affects career path in previous literatures. Table 01 depicts previous literature for the variables tested.

Theoretical Framework

The Social Cognitive Career Theory (SCCT) was used extensively by previous literature testing factors influencing undergraduate students’. SCCT by Lent et al ( 1994 ) stemmed from Bandura’s Social Cognitive Theory (1986) and was used to describe factors influencing career choice. SCCT is a framework that explains the process a person goes through in the pursuit of choosing a career. It relates both internal and external factors that may influence a person’s choice. There are three main variables in the SCCT namely: self-efficacy, outcome expectations and goals and these three variables are important to develop a person’s ability to achieve their outcome, however challenging it may be. In accomplishing tasks despite encountering countless obstacles, self-efficacy people tend to be the one placing great effort and accomplishing it ( Chantara et al., 2011 ).

Hypotheses Development

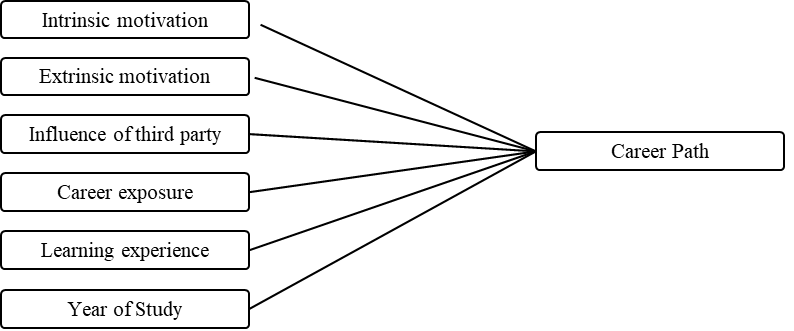

The hypotheses development for the variables are based on previous literature as per Table 01 and translated into a schematic diagram in Figure 01 .

Research Methods

This research uses primary data (questionnaire survey) as data collection method.

Population and Sampling

The target population for the study was accounting undergraduates. A total of 312 questionnaires collected were found to be usable from the 500 distributed. Convenience sampling was used for data gathering to ensure that comparisons can be made among the degree in accounting students from the first to the final year. It would be interesting to analyse responses of these students as first year students may be lacking in career path exposure than their senior counterparts.

Data Collection Procedures

Questionnaire survey is the primary source of data for this study. This type of data source is suitable for the study as it is a descriptive study that is designed to describe the characteristics of persons, events or situations ( Sekaran & Bougie, 2016 ), where the main objective of the research is to determine factors influencing accounting undergraduates’ career path.

The questionnaire survey for this study is adapted from Ng et al. ( 2017 ), and included one other independent variable, which is learning experience. The first part covers demographic data. The second part covers the independent variables and dependent variables consisting of 30 statements.

Pilot test was performed prior to questionnaire distribution to ensure the internal validity of the questionnaire, discard ambiguous questions so that respondents do not have any problems in answering the questions and accelerate data collection process ( van Teijlingen & Hundley, 2001 ). The questionnaire’s reliability was also tested even though the instrument utilised was adopted from previous literature and had gone through reliability testing. Reliability test administered to the data provided very good results, where the Alpha (Cronbach) for all variables were between .808 - .886, showing high level of internal consistency.

Variable Measurements

The questionnaire is divided into three sections: demographics, the dependent variable and the independent variables. The demographics comprise of age, gender and year of study. The variable measurement for both dependent and independent variables is based on a 5-point Likert scale (1 = Strongly Disagree to 5 = Strongly Agree). This type of measurement is used to measure the distance between any two points on the scale and it also has equal distance between numbers. Also, it does not pressure the respondents to take a stand on a particular issue but allows them to reply in a degree of agreement. In this situation, it makes easier to the respondent to answer the questions.

Statistical Tests

This study uses regression analysis and test of significant difference to achieve the aims of the study. For example, regression analysis is used to identify predictors (intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience) of accounting undergraduates’ career path. Meanwhile, test of significant difference is used to determine whether career path intention is the same across year of study.

This part of the study presents results from statistical analysis performed using SPSS Version 24. There are two objectives of the study. Firstly, the study aims to determine predictors of accounting undergraduates’ career path using multiple regression test. Secondly, the study aims to identify whether the accounting undergraduates’ career path is different across year of study. Test of significant difference is carried out to establish whether significant difference is present.

Demographics

Demographics of the 312 respondents are tabled below (see table 02 ). It provides the distribution of respondents based on gender, age and race. A majority of the respondents are female (at 71%). Approximately half of the respondents (50%) are within 18 to 23 years old and are in their third year of study (48%).

Normality Test

Shapiro-Wilk test was used to determine data distribution. Results indicate that the data were not normally distributed (p<0.01).

Correlations

Spearman’s correlation coefficient was used to determine association of dependent and independent variables as the data is non-normally distributed. Results provide evidence that all independent variables were significantly correlated with career path at the 0.01 level.

Multiple regression test

Multiple linear regression test was performed to determine predictors of career path among the independent variables. The test is administered to determine the predictors (i.e. Intrinsic and extrinsic motivations, influence of third party, career exposure and learning experience) that influence accounting undergraduates’ career path. However, it is important that the assumptions of multiple regression are to be complied with in order to ensure the appropriateness of the regression model.

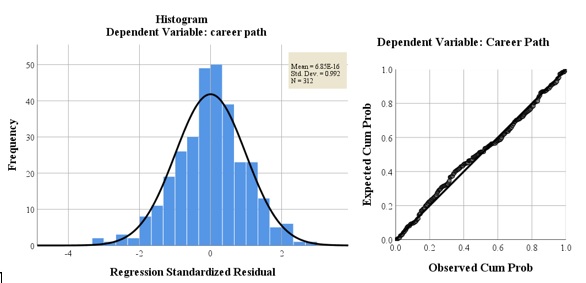

First, normality and linearity were inspected via the Histogram and Normal Probability Plot (refer Figure 02 ). We established that sample normality and linearity existed in the residuals, indicating normal and linear distribution.

Next, we determined that no multicollinearity problems were present in the residuals as the tolerance and VIF values observed were greater than 0.20 and less than 10 respectively ( Field, 2009 ). The Durbin-Watson test was also used to check for autocorrelation presence in the residuals. The test value of 1.788 indicates that no autocorrelation were present.

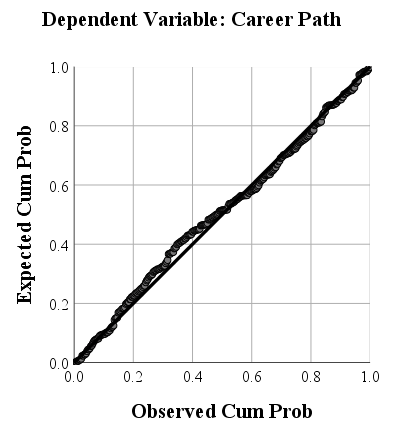

Finally, scatter plot of residuals in Figure 03 illustrates the residuals are roughly rectangular distributed, with scores concentrated along the 0 axis (red line). This ensures the homoscedasticity of the sample as the standardised residuals values are between -3.29 and +3.29 and considered to be acceptable ( Field, 2009 ).

In summary, based on the Table 03 we have fulfilled and complied with the regression assumptions throughout the analysis to ensure appropriateness of findings of the study. The results can be referred in Table 03 .

Table 04 depicts results of the multiple regression test determining predictors of career path. Results show that all variables except extrinsic motivation statistically significantly predicted career path at F(5, 306) = 48.864, p<0.000, R2 = .444. The R2 of .444 indicates that 44.4% of the outcome (career path) is accounted for by intrinsic motivation, influence of third party, career exposure and learning experience, while the other 56% by other factors.

Results for intrinsic motivation (b=.304, p<.000) and career exposure (b=.133, p<.05) were statistically significantly consistent with Ng et al. ( 2017 ), Lukman and Juniati (2016) and Țicoi and Albu ( 2018 ). Significant affect was also found on influence of third party with career path (b=.149, p<.000) consistent with Lukman and Juniati (2016) but was inconsistent with Ng et al. ( 2017 ). Further, learning experience was found to affect students’ career path (b=.230, p<.000), consistent with Sugahara et al. ( 2009 ). Thus, H1,3,4,5 are supported.

The non-significant result for extrinsic motivation (b=.105, p>.05) is consistent with studies by Dibabe et al. ( 2015 ), Ahmad et al. ( 2015 ), Ng et al. ( 2017 ) and Srirejeki et al. ( 2019 ) but not consistent with Țicoi and Albu ( 2018 ). Thus, H2 is rejected. The summary of hypotheses can be referred to in Table 04 .

The general form of the equation to predict career path from intrinsic motivation, influence of third party, career exposure and learning experience is:

Predicted Career Pathi = b0 = b1 intrinsic motivationi + b2influence of third partyi + b3career exposurei

+ b4learning experiencei

= .318 + (.340intrinsic motivationi) + (.149influence of third partyi) +

(.133career exposurei) + (.230learning experiencei)

The beta value in the equation implies that a 1 unit increase in intrinsic motivation will result in an increase in the intention to pursue an accounting career path (DV) by .34 unit, when influence from third party increases by 1 unit, the respondents’ intention on accounting career path will increase by .15 unit; when career exposure increase by 1 unit, respondents’ career path intention will increase by .13 unit and when learning experience increase by 1 unit, intention to pursue accounting career will increase by .23 of a unit.

Test of significant difference

Kruskal-Wallis test was conducted to examine any significant difference in preference of career path across year of study. The test result found no significant difference in career path across year of study (retaining the null hypothesis at p>.05). Thus, H6 is rejected. The finding is consistent with Ahmad et al. ( 2015 ) but is contradictory to findings by Russell et al. ( 2000 ), Marriott and Marriott ( 2003 ) and Danziger and Eden ( 2007 ) who revealed that students’ attitudes towards accounting changed as they advance in their studies. The result corresponds with the earlier regression results indicating that accounting undergraduates will be motivated to choose accounting as a career when their level of self-efficacy increases in line with the SCCT theory.

The study has two objectives (1) to examine factors influencing accounting undergraduates’ career path, (2) to determine whether the accounting undergraduates’ career path is the same across year of study. Multiple regression test indicates that the predictors of career path are intrinsic motivation, influence of third party, career exposure and learning experience. Results imply that the greater the intrinsic motivation, the more encouragement given by third party, further career exposure and the longer duration the of study, the higher the chances of them choosing the accounting career path.

The result also reveals that accounting undergraduates do not consider extrinsic motivation (such as high salary, status, etc) as an important aspect when choosing a career path, contrary to findings over a decade ago ( Jackling & Keneley, 2009 ; Tan & Laswad, 2006 ). The present findings provide a signal to parties involved to find new “selling points” of the accounting profession that are more appealing and can draw more interests to promoting the accounting career path. The MIA, practitioners and professional bodies have to play their parts to create more career exposures via seminars, events and roadshows as these may create more awareness and interests for the profession as early as during the school years.

Further, MIA strongly supports the adoption of technology in the advent of Industrial Revolution 4.0 (IR 4.0), as iterated by the CEO of MIA in her recent speech, “future accountants must be equipped with technological skills, communications and soft skills, critical thinking, strategic and analytical skills, and resilience as well as flexibility” ( Mahzan, 2019, p. 12 ). This means that an increase in self-efficacy via intrinsic motivation through skill enhancement, as well as influence of third party (subjective norms) and more learning experience under their belts, more accounting undergraduates’ may intend to choose an accounting career path in the future.

The decreasing popularity of the accounting profession as asserted by Russell et al. ( 2000 ) nearly 2 decades ago was also due to dramatic change in the business landscape where technological development and competitiveness were very intense to which accounting education failed to adjust to. Over a decade ago, Smith ( 2005 ) claimed that the accounting profession had taken a back burner as a result of much “publicised financial frauds and irregularities” (p. 943). Thus, the accounting fraternity has to regain the public’s trust through highlighting intrinsic advantages of being an accountant and depicting a “virtue-based professional identity” ( Lopez & Perry, 2018 ).

The limitation of this study is the sample size. Although assumptions of linear regression has been faithfully adhered to, the regression model may only be applicable in a Malaysian perspective for it to be generalised. Thus, future research may endeavour to improve the model in other settings. Further, as the study’s four predictors were only able to account for 44% of career path intention, other predictors such as cost of the program or duration of study, may be introduced for future research.

Acknowledgments

We would like to extend our appreciation to the students who have helped us in collecting data for our study.

- Ahmad, Z., Ismail, H., & Anantharaman, R. N. (2015). To be or not to be: an investigation of accounting students’ career intentions. Education+ Training, 57(3), 360-376.

- Ahmed, K., Alam, K. F., & Alam, M. (1997). An empirical study of factors affecting accounting students' career choice in New Zealand. Accounting Education, 6(4), 325-335.

- Baldwin, B. A., & Howe, K. R. (1982). Secondary-level study of accounting and subsequent performance in the first college course. Accounting Review, 619-626.

- Byrne, M., Willis, P., & Burke, J. (2012). Influences on school leavers’ career decisions–Implications for the accounting profession. The International Journal of Management Education, 10(2), 101-111.

- Chantara, S., Kaewkuekool, S., & Koul, R. (2011). Self-determination theory and career aspirations: A review of literature. Institutions, 7, 9.

- Danziger, N., & Eden, Y. (2007). Gender-related differences in the occupational aspirations and career-style preferences of accounting students: A cross-sectional comparison between academic school years. Career Development International, 12(2), 129-149.

- Dibabe, T. M., Wubie, A. W., & Wondmagegn, G. A. (2015). Factors that affect students’ career choice in accounting: A case of Bahir Dar University students. Research Journal of Finance and Accounting, 6(5), 146-153.

- Field, A. (2009). Discovering Statistics Using SPSS (3rd ed.). SAGE Publication Ltd.

- Goon, A. C. (1975). Career aspirations among the Secondary Urban School students. Unpublished dissertation.

- Hejazi, R., & Bazrafshan, A. (2013). The survey of graduated accounting students’ interest in management accounting: evidence of Iran. Open Journal of Accounting, 2(03), 87.

- Jackling, B., & Keneley, M. (2009). Influences on the supply of accounting graduates in Australia: a focus on international students. Accounting & Finance, 49(1), 141-159.

- James, K. L. (2008). Barriers to accounting as a career choice for African-American students. Research in Higher Education Journal, 1, 58-67.

- Joseph, D., Boh, W. F., Ang, S., & Slaughter, S. A. (2012). The career paths less (or more) traveled: A sequence analysis of IT career histories, mobility patterns, and career success.

- Keef, S. P. (1992). The effect of prior accounting education: some evidence from New Zealand. Accounting Education, 1(1), 63-68.

- Kochanek, R. F., & Norgaard, C. (1985). Student perceptions of alternative accounting careers--Part I. The CPA Journal (pre-1986), 55(000005), 36.

- Lee, M. K. (2018, March 1). The drive to double Malaysia's accountancy profession by 2020. Accounting & Business Magazine (Malaysia Edition). https://www.accaglobal.com/content/accaglobal/in/en/member/member/accounting-business/2018/03/practice/malaysia-2020.html

- Lent, R. W., Brown, S. D., & Hackett, G. (1994). Toward a unifying social cognitive theory of career and academic interest, choice, and performance. Journal of vocational behavior, 45(1), 79-122.

- Lopez, K. J., & Perry, S. M. (2018). The Importance of Virtue Ethics and the Role of Salience in the Accounting profession. Southern Journal of Business and Ethics, 10. https://www.questia.com/library/journal/1P4-2228578036/the-importance-of-virtue-ethics-and-the-role-of-salience

- Mahzan, N. (2019). Educating Future Accountants. Keynote address at The Kaplan Forum. Kuala Lumpur: Malaysian Institute of Accountants.

- Malaysian Institute of Accountants. (2019). Membership classification. https://www.mia.org.my/v2/membership/services/statistics/classification.aspx

- Marriott, P. R. U., & Marriott, N. (2003). Are we turning them on? A longitudinal study of undergraduate accounting students' attitudes towards accounting as a profession. Accounting education, 12(2), 113-133.

- Mohd Hanapiah, M. A. A, Joon, M. I., Abdul Razak, N. A., & Vijayandran, S. (2017). An empirical study of factors affecting accounting students' career choice in Malaysia. Unpublished manuscript. Universiti Tenaga Nasional, Malaysia.

- Mohd Khalid, F., Abdul Rauf, F. H., Ahmad Fuad, N. F., Saaibon, S., Mohd Asri, N. A., & Sharom, N. D. (2018). Factors Influencing High School Students to Major in Accounting. Global Business and Management Research, 10(3), 605.

- Myburgh, J. E. (2005). An empirical analysis of career choice factors that influence first-year accounting students at the University of Pretoria: a cross-racial study. Meditari Accountancy Research, 13(2), 35-48.

- Ng, Y. H., Lai, S. P., Su, Z. P., Yap, J. Y., Teoh, H. Q., & Lee, H. (2017). Factors influencing accounting students’ career paths. Journal of Management Development, 36(3), 319-329.

- Owusu, G. M., Essel-Anderson, A., Ossei Kwakye, T., Bekoe, R. A., & Ofori, C. G. (2018). Factors influencing career choice of tertiary students in Ghana: A comparison of science and business majors. Education+ Training, 60(9), 992-1008.

- Paolillo, J. G., & Estes, R. W. (1982). An empirical analysis of career choice factors among accountants, attorneys, engineers, and physicians. Accounting Review, 785-793.

- Porter, J., & Woolley, D. (2014). An examination of the factors affecting students’ decision to major in accounting. International Journal of Accounting and Taxation, 2(4), 1-22.

- Russell, K. A., Kulesza, C. S., Albrecht, W. S., & Sack, R. J. (2000). Charting the course through a perilous future. Management Accounting Quarterly, 2(1), 4-11.

- Said, J., Ghani, E. K., Hashim, A., & Mohd Nasir, N. (2004). Perceptions towards accounting career among Malaysian undergraduates. Journal of Financial Reporting and Accounting, 2(1), 17-30.

- Schoenfeld, J., Segal, G., & Borgia, D. (2017). Social cognitive career theory and the goal of becoming a certified public accountant. Accounting Education, 26(2), 109-126.

- Sekaran, U., & Bougie, R. (2016). Research methods for business: A skill building approach. John Wiley & Sons.

- Smith, G. (2005). Reversing the decreasing trend of students majoring in accounting. Managerial Auditing Journal, 20(9), 936-944.

- Solikhah, B. (2014). An application of Theory of Planned Behavior towards CPA career in Indonesia. Procedia-Social and Behavioral Sciences, 164, 397-402

- Srirejeki, K., Supeno, S., & Faturahman, A. (2019). Understanding the Intentions of Accounting Students to Pursue Career as a Professional Accountant. Binus Business Review, 10(1), 11-19.

- Sugahara, S., Hiramatsu, K., & Boland, G. (2009). The factors influencing accounting school students' career intention to become a Certified Public Accountant in Japan. Asian Review of Accounting, 17(1), 5-22.

- Tan, L. M., & Laswad, F. (2006). Students' beliefs, attitudes and intentions to major in accounting. Accounting Education: an international journal, 15(2), 167-187.

- Tan, R. (2018, August 7). Retaining talent despite shortage of accountants. The Star Online. https://www.thestar.com.my/business/smebiz/2018/08/07/retaining-talent-despite-shortage-of-accountants-silver-award-winner-for-best-employer-in-soba-2017

- Țicoi, C. F., & Albu, N. (2018). What factors affect the choice of accounting as a career? The case of Romania. Accounting & Management Information Systems/Contabilitate si Informatica de Gestiune, 17(1).

- Umar, I. (2014). Factors influencing students’ career choice in accounting: The case of Yobe State University. Research Journal of Finance and Accounting, 5(17), 59-62.

- van Teijlingen, E. R., & Hundley, V. (2001). The importance of pilot studies. Social Research Update, 35. http://sru.soc.surrey.ac.uk/SRU35.html

- Wen, L., Hao, Q., & Bu, D. (2015). Understanding the intentions of accounting students in China to pursue certified public accountant designation. Accounting Education, 24(4), 341-359.

- Yusoff, Y., Omar, Z.A., Awang, Y., Yusoff, R., & Jusoff, K. (2011). Does knowledge on professional accounting influence career choice? World Applied Sciences Journal, 12, 57-60.

Copyright information

About this article

Publication date.

30 December 2020

Article Doi

https://doi.org/10.15405/epsbs.2020.12.05.26

978-1-80296-099-0

European Publisher

Print ISBN (optional)

Edition number.

1st Edition

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Khalid, F. M., & Abdul Rauf, F. H. (2020). Factors Influencing Accounting Undergraduates’ Career Path: Evidence From Malaysia. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 246-258). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.26

We care about your privacy

We use cookies or similar technologies to access personal data, including page visits and your IP address. We use this information about you, your devices and your online interactions with us to provide, analyse and improve our services. This may include personalising content or advertising for you. You can find out more in our privacy policy and cookie policy and manage the choices available to you at any time by going to ‘Privacy settings’ at the bottom of any page.

Manage My Preferences

You have control over your personal data. For more detailed information about your personal data, please see our Privacy Policy and Cookie Policy .

These cookies are essential in order to enable you to move around the site and use its features, such as accessing secure areas of the site. Without these cookies, services you have asked for cannot be provided.

Third-party advertising and social media cookies are used to (1) deliver advertisements more relevant to you and your interests; (2) limit the number of times you see an advertisement; (3) help measure the effectiveness of the advertising campaign; and (4) understand people’s behavior after they view an advertisement. They remember that you have visited a site and quite often they will be linked to site functionality provided by the other organization. This may impact the content and messages you see on other websites you visit.

Literature reviews of qualitative accounting research: challenges and opportunities

Qualitative Research in Accounting & Management

ISSN : 1176-6093

Article publication date: 28 February 2023

Issue publication date: 4 May 2023

This paper aims to identify specific challenges and opportunities when crafting literature reviews of qualitative accounting research. In addition, it offers potential remedies to frequent challenges when conducting such reviews.

Design/methodology/approach

This piece is based on recent methodological advice on conducting literature reviews and my own experience when conducting and publishing reviews that primarily cover qualitative accounting research.

The author chart three typical advantages and three typical use cases of literature reviews of qualitative accounting research, as well as the typical process steps and outputs of such reviews. Along with these process steps, The author identifies three overarching specific challenges when conducting such reviews and discusses potential remedies. Overall, this paper suggests that literature reviews of qualitative accounting research feature idiosyncratic challenges but offer specific opportunities at the same time.

Originality/value

To the best of the authors’ knowledge, this paper is among the first to offer advice on the specific challenges and opportunities when conducting literature reviews of qualitative accounting research.

- Literature review

- Systematic review

- Systematicity

- Qualitative research

- Accounting research

Hiebl, M.R.W. (2023), "Literature reviews of qualitative accounting research: challenges and opportunities", Qualitative Research in Accounting & Management , Vol. 20 No. 3, pp. 309-336. https://doi.org/10.1108/QRAM-12-2021-0222

Emerald Publishing Limited

Copyright © 2023, Martin R.W. Hiebl.

Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial & non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode .

1. The increasing relevance of review-centric works in and beyond accounting research

The volume of research published in academic journals and other outlets has significantly increased over the past few decades ( Booth et al. , 2021 ; Kraus et al. , 2021 ), and business research, including accounting research, is no exception ( Andiola et al. , 2017 ; Dyckman and Zeff, 2015 ; Kraus et al. , 2020 ; Kunisch et al. , 2018 , 2023 ; Paul and Criado, 2020 ; Snyder, 2019 ; Zeff, 2019 ). Hence, researchers, especially junior scholars such as PhD students, may find it difficult to stay up-to-date in their area of interest and recognize which relevant and interesting research questions remain to be answered ( Petticrew and Roberts, 2012 ; Kraus et al. , 2021 ). To help master such challenges and avoid “reinventing the wheel”, the importance of sound literature reviews has recently risen ( Massaro et al. , 2016 ).

Methodological advice on how to conduct literature reviews in business-related disciplines has long lagged behind the much faster growth in published reviews ( Breslin et al. , 2021 ; Kraus et al. , 2020 ; Kunisch et al. , 2018 , 2023 ). More recently, several works on mastering review methods and generating impactful literature reviews have been published. Such advice includes the general potential of certain kinds of review-centric works ( Aguinis et al. , 2023 ; Antons et al. , 2021 ; Cronin and George, 2023 ; Hoon, 2013 ; Jones and Gatrell, 2014 ; Kraus et al. , 2022 ; Paul and Criado, 2020 ; Rousseau et al. , 2008 ; Snyder, 2019 ; Tranfield et al. , 2003 ), theorizing through literature reviews ( Breslin and Gatrell, 2023 ; Hoon, 2013 ; Hoon and Baluch, 2020 ; Post et al. , 2020 ), involving practitioners in crafting literature reviews ( Sharma and Bansal, 2020 ), the performativity of reviews in shaping and developing academic fields ( Gond et al. , 2020 ) and questions on the individual steps when conducting literature reviews ( Anderson and Lemken, 2023 ; Hiebl, 2021 ; Rojon et al. , 2021 ; Simsek et al. , 2021 ; Villiger et al. , 2021 ). Most of these works have focused on general business and management research. While the number of published literature reviews in accounting journals has increased in recent years, and entire review-centric special issues have been or are about to be published in these journals (e.g. in the European Accounting Review and Journal of International Accounting, Auditing and Taxation ), specific advice on crafting reviews of accounting research remains scarce.

In fact, the most notable exception that has – to the best of my knowledge – received widespread attention is the article by Massaro et al. (2016) on conducting structured reviews of accounting research. However, given the general nature of the work by Massaro et al. (2016) , it cannot delve into all the strands of accounting research. These strands and methodological traditions come with their own peculiarities and informal rules of the game that are often inaccessible to junior scholars ( Brennan, 2019 ; Dai et al. , 2019 ; Humphrey and Lee, 2004 ; Malmi, 2010 ). For this reason, Andiola et al. (2017) highlight specific challenges when reviewing behavioral accounting research.

Likewise, my experience of publishing several review papers in accounting journals tells me that crafting reviews that primarily cover qualitative accounting research comes with its challenges. For instance, qualitative accounting studies usually feature thick descriptions of accounting phenomena and their embedding in social and organizational contexts ( Lukka and Modell, 2017 ; Messner et al. , 2017 ). In particular, research case studies of accounting phenomena usually feature detailed accounts of the events that took place in the case organization ( Lee and Humphrey, 2017 ). Compared with quantitative research papers, which usually compress accounting and related phenomena into variables that can be included in statistical analyses ( Messner et al. , 2017 ), the findings sections of qualitative accounting studies are often more extensive. Such extensive descriptions in qualitative accounting research come with the challenge that several elements or aspects of their findings might be extracted and included in a literature review. Likewise, the findings of qualitative accounting studies might be read with a different theory than originally intended by the authors ( Huber, 2022 ). The author of a literature review might, thus, reinterpret the original findings ( Hoon, 2013 ). Such reinterpretation is not possible when reviewing quantitative accounting research because the measurement of phenomena in such work is usually tightly linked to the theoretically derived hypotheses ( Smith, 2019 ). At the same time, covering qualitative research in reviews of accounting research is probably more relevant than in many other fields of business research, as quantitative and qualitative methods are applied more evenly in accounting research, especially in Australia, Europe and several emerging countries ( Hopper and Bui, 2016 ; Hopper et al. , 2009 ; Massaro et al. , 2016 ; Ndemewah and Hiebl, 2022 ).

To help scholars – especially those relatively new to accounting research or reviews thereof – avoid some of the lessons that I have learned through trial and error, I highlight some of the challenges when crafting literature reviews of qualitative accounting research and offer potential solutions to overcome them in this qualitative insights piece. For this purpose, I first distinguish between three potential advantages and three basic use cases of reviews of qualitative accounting research in Section 2. This section aims to highlight important choices, including the extent of an author’s criticism of the literature and the decision on whether to publish the review as a standalone paper. These choices guide the later process of crafting a review of qualitative accounting research, which is detailed in Section 3. Section 3 also discusses the degree of systematicity found in contemporary literature reviews. Along these process steps, I then highlight three important challenges when reviewing qualitative accounting research and offer potential solutions in Section 4. Section 5 concludes with implications for future reviews of qualitative accounting research.

To discuss these choices and challenges in reviews of qualitative accounting research, I draw on related advice from other disciplines and my own experience. Hence, the following advice comes with the limitation that parts of it are subjective. I nevertheless hope that it is useful to account researchers interested in crafting reviews of qualitative accounting research.

2. Three potential advantages and three basic use cases of reviews of qualitative accounting research

Literature reviews can be classified in various ways ( Booth et al. , 2021 ; Cronin and George, 2023 ; Fan et al. , 2022 ; Kraus et al. , 2022 ; Paul and Criado, 2020 ; Snyder, 2019 ). Many of these classifications include choices on the kind of topic addressed in a literature review and the scholarly advantages to be gained. Importantly, these choices on the topic and desired advantages of a literature review inform the rest of the literature review process ( Hiebl, 2021 ; Tranfield et al. , 2003 ), which is why I first discuss three potential advantages of literature reviews in Section 2.1, followed by three use cases in Section 2.2.

2.1 Three potential advantages of literature reviews

Analyzing a certain strand of the literature may result in finding that it is incomplete and has missed several important aspects of the phenomenon. The advantage of such an analysis is pointing out future research avenues worthy of further inquiry ( Locke and Golden-Biddle, 1997 ). Many reviews covering qualitative accounting research follow this approach, as their main purpose is to analyze a certain domain of accounting research and suggest aspects of the domain that still need (more) research attention ( Hopper et al. , 2009 ; Ndemewah et al. , 2019 ). An advantage of such reviews might also be that they tie together research that has been published in several research fields and outlets ( Ndemewah et al. , 2019 ; Nguyen et al. , 2018 ). Based on such reviews, research on a certain domain of accounting might, thus, be synthesized more comprehensively and missing knowledge on the topic identified.

A strand of the literature may be viewed as inadequate in that certain perspectives, frameworks or theories have been insufficiently incorporated or used in a field. The advantage of such a literature review, thus, lies in suggesting alternative ways to analyze a phenomenon or field of study, which may suggest a different future direction ( Hoon and Baluch, 2020 ; Jones and Gatrell, 2014 ). Thus, such reviews tend to carry a more critical stance when analyzing the literature. An example heavily drawing on qualitative accounting research is the review by Hardies and Khalifa (2018) . These authors review gender in accounting research and identify “two persistent pitfalls” (p. 385) in this literature, and thus, portray large parts of it as inadequate . Another example is the review by Wolf et al. (2020) , who review the literature on the roles and identities of management accountants and conclude that this research strand has not yet made sufficient use of the “identity concept” (p. 312).

A literature review may find that a certain strand of the literature is incommensurate in that it has not only overlooked certain perspectives or theories (as in the “inadequate” category above) but also made claims that are just wrong. In this case, a literature review may identify the misguided perspective and try to correct the errors made ( Locke and Golden-Biddle, 1997 ). Reviews following this approach are the most critical of the current literature and not as numerous as reviews using the two advantages above. An example of this type of review might be the recent work by Modell (2022b) . Modell (2022b) reviews institutional research on management accounting and concludes that parts of this literature show no progress and even some degenerative tendencies in continuing to draw on one-sided views that predominantly focus on either human agency or structures to explain institutional processes around management accounting. In line with the incommensurate category proposed by Locke and Golden-Biddle (1997) , Modell (2022b) also suggests ways in which these shortcomings in institutional research on management accounting can be rectified.

While Locke and Golden-Biddle (1997) analytically separate these three advantages of scholarly engagement with the prior literature, it seems fair to assume that a literature review must achieve at least one of these advantages and may pertain to several at the same time.

Regardless of the specific scholarly advantages of a literature review, we can further distinguish two ways in which literature reviews are integrated into the research process: they can result in standalone papers and/or inform a broader research project that may, for instance, be geared toward further empirical, formal/analytical or conceptual work ( Andiola et al. , 2017 ; Booth et al. , 2021 ; Jesson et al. , 2011 ; Petticrew and Roberts, 2012 ). In fact, Petticrew and Roberts (2012) argue that a literature review should be conducted at the start of any research project, particularly PhD theses, to avoid overlooking research relevant to the project at hand. In the following, I mostly use examples of literature reviews published as standalone papers, as these examples can be more easily traced by the reader. Reviews informing a broader research project may be less restricted by page count and the usual setup of the review than their counterparts published as standalone papers. However, aside from that, the following issues to be considered when crafting literature reviews of qualitative accounting research should pertain to both types of reviews.

Publishing a literature review as a standalone paper has several advantages. For instance, review articles are appealing to authors and editors of accounting journals because they usually attract higher citation rates than other research articles ( Dechow et al. , 2020 ; Guffey and Harp, 2016 ). In addition, review articles can help sharpen an author’s profile in the research community and associate the author’s name with a specific domain, theory or method.

At the same time, the decision on whether a literature review should or could be published as a standalone paper rests not only on these considerations but also on several additional factors. Among these factors, to be publishable in an academic journal, a literature review needs to cover a field in which “a number of conceptual and empirical articles have amassed without previous review efforts or a synthesis of past works” ( Short, 2009 , p. 1312). We currently lack meta-analytic information on where such a “critical mass” ( Short, 2009 , p. 1316) lies for reviews of (qualitative) accounting research. For reviews of management research that are published in the most-cited specialist journals for such reviews, we know that they cover about 140 articles each on average and 30–50 articles as a minimum ( Hiebl, 2021 ). Compared with reviews of (mostly) qualitative accounting research, we can infer that the standards in the latter field differ little from the above numbers. The critical mass for a standalone review article in accounting journals seems to start at about 30 articles, too ( Damayanthi and Gooneratne, 2017 ; Modell, 2022a ), but most such works cover larger review samples [ 2 ] of approximately 50–90 articles ( Englund et al. , 2011 ; Englund and Gerdin, 2014 ; Fiandrino et al. , 2022 ; Hardies and Khalifa, 2018 ; Hiebl, 2018 ; Hopper et al. , 2009 ; Parker and Northcott, 2016 ; Weigel and Hiebl, 2022 ), and some cover over 100 ( Baldvinsdottir et al. , 2011 ; Modell, 2022b ; Ndemewah and Hiebl, 2022 ; Repenning et al. , 2022 ; van der Stede et al. , 2005 ). Methodological literature reviews of accounting research may even cover several hundred articles; however, at the same time, they usually feature a narrower focus on the applied methodological issues ( Dai et al. , 2019 ; Feldermann and Hiebl, 2020 ).

Together with the three potential advantages of literature reviews, the right-hand box of Figure 1 includes the two main publication forms of reviews. This figure does not intend to provide a step-by-step guide of how to perform a literature review of qualitative accounting research. In fact, the advantages, use cases and process steps included in Figure 1 do not necessarily only apply to literature reviews of qualitative (accounting) research; but the terminology (e.g. method theory, domain theory) used in this figure and the rest of this paper are mostly taken from the qualitative accounting research literature. I use these steps, use cases and advantages when later highlighting some of the specific challenges of reviews of qualitative accounting research (Section 4). Figure 1 , thus, aims to provide readers with a map to locate the typical issues I discuss when crafting a review of qualitative accounting research and summarize the main use cases and potential advantages of such reviews.

2.2 Three potential use cases for literature reviews

reviews that cover a certain domain within accounting research;

reviews that focus on the application of a certain method theory in accounting research; and

reviews that examine a specific research method as applied in accounting research.

Just like the three potential advantages of literature reviews, these three use cases are summarized in Figure 1 .

The first use case is related to what Lukka and Vinnari (2014 , p. 1309) term the “domain theory” of a field within accounting research: “A domain theory refers to a particular set of knowledge on a substantive topic area situated in a field or domain”. They contrast a domain theory with a method theory, the latter being defined as “a meta-level conceptual system, or theoretical lens, which originates from another field such as organization studies or sociology” ( Lukka and Vinnari, 2014 , p. 1312) and is more related to the second use case of a literature review sketched above. Lukka and Vinnari (2014) further note that a “method theory offers a vocabulary and syntax, often also substantive propositions, which are, at least with adaptations, applicable to another disciplinary domain” (p. 1312), such as accounting research. To illustrate their argument, they draw on a review of the use of actor network theory (i.e. the method theory in focus) in management accounting research. They conclude that most prior studies in this field have exclusively contributed to the domain of management accounting research, with only a small fraction contributing to actor network theory more generally. However, even if researchers are only aiming to contribute to a particular domain theory of a field within accounting research, they need to know the current state of that domain theory to properly reflect and frame their contribution to prior knowledge. And such prior knowledge can be identified by means of a literature review ( Lukka and Vinnari, 2014 ). Likewise, Mahama and Khalifa (2017 , p. 324) argue that for qualitative accounting research based on interviews, the literature review forms the basis of deriving interview questions and later “determining whether new knowledge is generated from the interview data, thereby paving the way for the researcher to claim empirical contribution”.

Examples for use case (i) that covered a certain domain within accounting research and covered qualitative accounting research include reviews on the role of emotions ( Repenning et al. , 2022 ), gender ( Hardies and Khalifa, 2018 ), technology ( Garanina et al. , 2021 ; Rikhardsson and Yigitbasioglu, 2018 ) and trust ( Baldvinsdottir et al. , 2011 ); reviews of certain accounting practices and principles ( Fiandrino et al. , 2022 ; Hoque, 2014 ; Nguyen et al. , 2018 ) and the roles of accountants ( Wolf et al. , 2020 ); and reviews of accounting research in certain countries or regions ( Hopper et al. , 2009 ; Ndemewah and Hiebl, 2022 ), certain industries ( Gooneratne and Hoque, 2013 ; Ndemewah et al. , 2019 ) and types of organizations ( D’Andreamatteo et al. , 2022 ; Kapiyangoda and Gooneratne, 2021 ; Weigel and Hiebl, 2022 ). All these reviews have focused on a certain substantive topic within accounting research or, in the words of Lukka and Vinnari (2014) , a certain domain of accounting research. These use case (i) literature reviews may provide authors with the largest set of choices. As detailed below, such domain theory reviews can include either research items from only accounting journals or content from other sources; they may or may not be informed by a guiding theory and may include both qualitative and nonqualitative empirical papers. This, therefore, necessitates the inclusion of papers resting on various methodologies and underlying research paradigms (cf. Modell, 2010 ), which may pose an additional challenge for authors of such reviews.

In turn, other reviews have been less concerned with specific accounting phenomena and more interested in the application of a certain method theory to accounting research. Reviews following use case (ii) are similar to the above example of Lukka and Vinnari (2014) , who use the application of actor network theory in management accounting research to illustrate the differences between domain and method theory. Further examples of use case (ii) that have mostly focused on qualitative accounting research are reviews of the use of Gidden’s structuration theory in accounting research ( Englund et al. , 2011 ; Englund and Gerdin, 2014 ) and reviews of accounting research drawing on the concepts of institutional work ( Modell, 2022a ), institutional theory ( Modell, 2022b ) and institutional logics ( Damayanthi and Gooneratne, 2017 ). These reviews all critically analyze how a certain method theory has been applied in and has contributed to the development of accounting research. To provide such a critical analysis, the researcher usually needs to have a very good understanding of the current state of this theory, not just within accounting research, but ideally across all relevant fields to compare the application of a method theory in accounting research with the more general state-of-the-art on this theory.

In contrast to use case (i) reviews, use case (ii) reviews usually only include research from accounting journals in their sample and clearly focus on a specific theory. Hence, authors have less variability in use case (ii) reviews than in use case (i) reviews. This lower variability also pertains to the papers to be included in use case (ii) reviews. While empirical accounting research papers that adopt the same kind of theory may be based on various research methods, many use case (ii) literature reviews ( Damayanthi and Gooneratne, 2017 ; Englund et al. , 2011 ; Englund and Gerdin, 2014 ; Modell , 2022a, 2022b ) are exclusively based on qualitative empirical accounting research, which does not come with the potential challenge of bridging the underlying research paradigms of the research items in the review sample.

In addition to focusing on a certain domain or method theory, Aguinis et al. (2023) highlight that many impactful literature reviews of management research focus on methodological issues – just as the present paper does [ 3 ]. Systematic “methodological literature reviews”, and thus, use case (iii) for literature reviews, typically examine a specific research method applied to a certain field, systematically identify the challenges and shortcomings in its current application and often end with suggestions or best practices on how these methods should be used in the future ( Aguinis et al. , 2023 ; Kreamer et al. , 2021 ). While not yet frequent, some methodological literature reviews of accounting research are available ( Bedford and Speklé, 2018 ; Hiebl and Richter, 2018 ; Nitzl, 2016 ; van der Stede et al. , 2005 ), and a small number of systematic reviews of qualitative methods in accounting research also exist ( Dai et al. , 2019 ; Feldermann and Hiebl, 2020 ; Parker and Northcott, 2016 ) [ 4 ]. Such reviews may be specifically helpful and impactful if researchers have seen relatively new methods or noticed shortcomings or open questions with existing research methods applied in qualitative accounting research. Methodological reviews may, thus, chart ways in which researchers can use new methods and avoid methodological pitfalls.

Similar to use case (ii) reviews, these use case (iii) reviews usually focus solely on the accounting literature and typically only include research published in accounting journals in their review samples. Unlike the first two use cases, use case (iii) reviews are rarely informed by a specific theory and are naturally bound to the specific method adopted by the research items in the review sample. Unlike the other two use cases, the methodological choices taken are often more of interest to the review authors than the findings of the papers for use case (iii) reviews. Such reviews may, therefore, predominantly extract the necessary information from the methods sections of the research items in the review sample ( Dai et al. , 2019 ; Feldermann and Hiebl, 2020 ).

The decision on which of the three use cases to pursue in a literature review is driven by several factors, including personal interest in certain domains, theories and research methods in accounting research. Nevertheless, from my personal observations, some tendencies can be identified. The literature review sections of doctoral theses are often geared toward the domain of accounting research in which the thesis is positioned, and thus, use case (i) ( Batt, 2020 ; Braumann, 2017 ; Löhlein, 2015 ; Weigel, 2020 ), although exceptions do exist, including those more geared toward the method theories applied in accounting research, and thus, use case (ii) ( Janka, 2019 ). By contrast, all the examples of use case (ii) reviews noted above ( Damayanthi and Gooneratne, 2017 ; Englund et al. , 2011 ; Englund and Gerdin, 2014 ; Modell , 2022a, 2022b ) are (co-)authored by senior scholars. In addition, these reviews often portray the current application of certain method theories in accounting research as inadequate or even incommensurate and are, thus, critical. While not relying on a full analysis of all available use case (ii) reviews, this observation may imply that this type of literature review rests on extended experience with a certain theory, and thus, having deep insights into the strengths, weaknesses and shortcomings of its application in accounting research. Similarly, the available examples of methodological reviews of accounting research (see above), and thus, use case (iii) have mostly been (co-)authored by experienced scholars. Just as with use case (ii), this observation may indicate that to conduct such methodology-oriented reviews, authors might benefit from having practical experience of a certain method to provide authentic recommendations for its future application in accounting research. However, less experienced researchers need not necessarily shy away from use cases (ii) and (iii). As some of the aforementioned examples show ( Damayanthi and Gooneratne, 2017 ; Feldermann and Hiebl, 2020 ), junior researchers can still collaborate with more experienced researchers to conduct impactful reviews according to the latter two use cases.

Regardless of which use case is pursued, my experience of crafting, supervising and reviewing literature reviews is that authors usually decide upfront which use case to follow because all three use cases usually lead authors in different directions. Put differently, the choice of the use case and central topic of the literature review shapes the remainder of the review process ( Booth et al. , 2021 ; Hiebl, 2021 ; Simsek et al. , 2021 ; Tranfield et al. , 2003 ). This process is detailed next.

3. Process and systematicity of literature reviews

identify a review topic;

search for and select the relevant literature;

analyze the relevant literature; and

report the review findings.

Traditionally, literature reviews published in accounting journals, but also those in other social science disciplines, have often been opaque in terms of the second and third steps; they only motivated a topic and reported their findings. That is, they provided a critique of the literature and suggestions on how to move on without disclosing which methodological steps they had taken to select and analyze the literature. Such reviews are now often referred to as “traditional reviews” and contrasted with “systematic reviews” ( Booth et al. , 2021 ; Jesson et al. , 2011 ; Knoll et al. , 2018 ; Kraus et al. , 2020 ).

The main [ 5 ] differences between these two types of reviews are summarized in Table 1 , along with the four process steps of reviews mentioned above. The most significant difference between traditional and systematic reviews could be that systematic reviews follow a clear review protocol that defines the inclusion and exclusion criteria for the research items to be included in the review and transparently report how the literature was searched and selected. Thus, just like empirical research papers, systematic reviews usually carry a method section, too, where the researcher discloses the steps taken to arrive at and analyze a review sample ( Booth et al. , 2021 ; Tranfield et al. , 2003 ). This way, it should become clear on what basis – and, in particular, on which selected research items – the review’s findings were created. Ideally, readers – and journal editors and reviewers before them – should be able to fully trace the methodological steps taken by the literature review’s authors to arrive at their findings ( Hiebl, 2021 ). It is then possible to assess whether the review sample may be biased or important parts of the literature uncovered. Hence, just as with empirical articles, methodological transparency is usually the key ingredient for systematic reviews ( Aguinis et al. , 2018 ). In turn, the main criticism of traditional reviews is that their selection and analysis of the reviewed literature is opaque and may be selective and biased ( Knoll et al. , 2018 ; Kraus et al. , 2020 ).

At least for review articles published in premier management journals, systematic reviews have become the new norm ( Breslin et al. , 2021 ; Hiebl, 2021 ; Rojon et al. , 2021 ). Hence, there are a few strong reasons for authors to produce a methodologically opaque traditional review. Indeed, methodological reviews in accounting research [i.e. those following use case (iii)] have long been more transparent in their focus, search and selection of research items ( Dai et al. , 2019 ; Hiebl and Richter, 2018 ; Nitzl, 2016 ; Van der Stede et al. , 2005 ). Likewise, more recently published literature reviews strongly relying on qualitative accounting research mostly feature at least a short section on the main search strategies and sampling criteria ( Modell , 2022a, 2022b ; Ndemewah and Hiebl, 2022 ; Repenning et al. , 2022 ; Wolf et al. , 2020 ). Hence, authors of reviews of qualitative accounting may be advised to present some of the methodological details on how they identified the research items and selected the inclusion and exclusion criteria for crafting their final review sample. If reporting these details would take up too much space in the main review article, many publishers nowadays offer online appendices where additional and more technical details can be reported (for examples, see Ndemewah and Hiebl, 2022 ; Tank and Farrell, 2022 ; Weigel and Hiebl, 2022 ).

To be able to report these details of the literature search, authors of literature reviews are advised to establish a clear search strategy with defined inclusion and exclusion criteria and document their search in detail. Some recent advice on sample selection as part of literature reviews presents details on the choices that can be rendered and documented when searching the literature ( Hiebl, 2021 ; Simsek et al. , 2021 ). In the accounting literature, some recent literature reviews also report in detail on their search procedures and provide examples of the choices to think about and data to document during the search process (see the online supplemental materials published along with Ndemewah and Hiebl, 2022 ; Tank and Farrell, 2022 ; Weigel and Hiebl, 2022 ).

When it comes to specific literature reviews of qualitative empirical research, several names for such literature reviews have been coined, such as “meta-syntheses” ( Hoon, 2013 ), “qualitative research synthesis” ( Denyer and Tranfield, 2006 ), “critical interpretive synthesis”, “meta-ethnography” and “meta-narrative mapping” ( Dixon-Woods, 2011 ; Dixon-Woods et al. , 2006 ). While the features of these techniques differ (slightly), Dixon-Woods (2011 , p. 337) argues that these approaches are “all, practically, very similar, but have different names and slightly different variants”. She further notes that they can all be organized on a spectrum from more traditional literature reviews to more systematic reviews ( Dixon-Woods, 2011 ). We can, thus, broadly conclude that techniques to cover qualitative research in literature reviews show different degrees of “systematicity” ( Simsek et al. , 2021 ; see also Rojon et al. , 2021 ) and range from less to more systematic approaches (see the left-hand box in Figure 1 ). I return to this issue as one of the challenges in reviews covering qualitative accounting research, which is discussed in more detail in the next section. Figure 1 summarizes the three typical use cases discussed in Section 2.2, the typical process steps presented in this section, and the typical advantages of literature reviews explained in Section 2.1.

4. Challenges, potential solutions and opportunities for reviews of qualitative accounting research

As indicated above, I now detail three specific challenges pertinent to literature reviews of qualitative accounting research – from my own experience. In this qualitative insights piece, I cannot cover all the potential challenges when conducting and publishing literature reviews more generally [ 6 ]. The following should, thus, not be read as an exhaustive list of such challenges and potential solutions but rather as a subjective list of those challenges specific to literature reviews of qualitative accounting research, especially when trying to publish such reviews as standalone papers in well-regarded accounting journals. I discuss these challenges as they typically occur during the process of conducting literature reviews, as displayed in Figure 1 . Section 4.1 addresses the general setup and chosen research question(s) to be addressed by a literature review (process Step 1), Section 4.2 addresses the search for and selection of relevant research items (process Step 2) and Section 4.3 addresses teasing out an original contribution from such reviews (process Steps 3 and 4).

4.1 Skepticism about evidence-based reviews

theory discovery;

theory refinement; and

theory testing.

Theory refinement and theory testing studies start from one or several existing theoretical ideas and test and refine them by drawing on data ( Hoon, 2013 ; Keating, 1995 ; Sutton and Staw, 1995 ). Such data can be empirical data or a body of published work, as is typical in literature reviews ( Hoon and Baluch, 2020 ; Post et al. , 2020 ). By contrast, theory discovery studies “map novel, dynamic, and/or complex phenomena ignored or inadequately explained by existing theories” ( Keating, 1995 , p. 69). Hence, such studies do not adopt a certain theoretical lens to start with but rather develop theory inductively based on the available data. Again, such data could be empirical or extracted from a review sample ( Breslin and Gatrell, 2023 ; Cronin and George, 2023 ; Hoon, 2013 ).

In the management literature, such inductive theory discovery reviews are often rooted in evidence-based thinking, and they focus on analyzing empirical research items without a particular informing theory ( Leuz, 2018 ; Rousseau et al. , 2008 ; Tranfield et al. , 2003 ). Because such evidence-based reviews focus on a phenomenon observed in organizational practice or a related question, they would mostly apply to use case (i) reviews of a certain domain of accounting research. Authors of evidence-based reviews usually collect all relevant research items that can shed light on the phenomenon ( Kunisch et al. , 2023 ; Rousseau et al. , 2008 ) – without defining in advance on which theoretical basis the research items must rest to qualify for inclusion in the review sample. Researchers may then inductively – and thus, without a predefined theoretical framework in mind – analyze the review sample. The theoretical contribution of such theory discovery or evidence-based literature reviews could be, for instance, to identify emerging themes that are later developed into a more formal theory, to create a new perspective of the phenomenon in question or to propose a framework that identifies so-far unexamined relationships from a cross-analysis of a review sample ( Breslin and Gatrell, 2023 ; Cronin and George, 2023 ; Hoon, 2013 ; Hoon and Baluch, 2020 ). Take, for example, Aguinis and Glavas’ (2012) review of the corporate social responsibility literature. While Aguinis and Glavas (2012) do not cite “evidence-based thinking” as their guiding paradigm, they also do not commit to a particular theory a priori but rather incorporate research findings from different areas of management to inductively develop a theoretical framework that can guide future research. Through this evidence-based approach, they have been able to synthesize research findings from different levels of analysis (i.e. institutional, organizational and individual) that were previously largely disconnected.

However, my experience is that accounting scholars are skeptical about literature reviews of accounting research that follow such an evidence-based route without starting from a predefined theory. Put in Keating’s (1995) theory development categories, qualitative accounting researchers seem to prefer theory refinement and, potentially to a lesser degree, theory testing reviews of the literature but are rarely open to theory discovery reviews. This may be problematic, as theory-led reviews may reinforce existing theory and be less open to alternative and novel theoretical explanations of phenomena that do not fit existing theories [ 7 ]. As argued by Adams et al. (2017) , this may be less problematic for phenomena that have been intensively researched and existing theories tested extensively. However, for less mature and more emerging phenomena, theoretical explanations may be unavailable. In such situations, evidence-based reviews that are not (mis-)guided by existing theory may help discover theory ( Adams et al. , 2017 ). The integration of different strands of the literature resting on different theoretical paradigms may, however, be hampered if the review examines the phenomenon in question from a predefined theoretical viewpoint only, a practice sometimes observed in qualitative accounting research.

For instance, in the first two versions of a recently published review paper I co-authored ( Ndemewah and Hiebl, 2022 ), we tried to convince the reviewers that we followed evidence-based thinking in the paper and would, thus, rather not use a predefined theoretical lens to analyze our review sample. In our view, such an evidence-based approach was warranted because we sought to integrate largely disjointed research findings that were originally based on very different theoretical assumptions. In addition, we did not originally intend this review to analyze whether these existing research findings fit into predefined theoretical categories. However, we could not convince the editor or the reviewers with this approach. Only when we changed this argument and identified two opposing theoretical positions as being dominant in our review sample and letting these guide the analysis of our results were the reviewers more convinced and recommended minor revisions or acceptance right away. This is not to say that the reviewers or we were wrong; we just started from different epistemological positions. Similar to many systematic reviews of management research, our starting position could be coined as “empiricist” or “evidence-based”, whereas the reviewers were probably more focused on the broader theoretical threads and explanations behind our review findings (cf. Modell, 2017 ). The latter, more theory-led view may have the advantage that the underlying theory can be used as an organizing framework to analyze the findings gathered in the review sample, which may be especially useful for junior scholars because an informing theory provides them with a basic template of the relationships to be analyzed based on a specific theory. Another potential benefit of this theory-led approach is that an alternative theory may be suggested, and the current state of the field may be portrayed as inadequate or even incommensurate, as detailed in Section 2.

While most experienced qualitative accounting researchers may be aware of the latter benefits of theory-led use case (i) reviews, few, in my experience, are open to more inductive, evidence-based reviews of a certain domain of accounting research. Thus, most qualitatively oriented literature reviews of accounting research that are published in well-regarded journals rather adopt a guiding theory and try to distill how the reviewed research items may confirm or challenge prior work that has adopted the same or a similar theoretical lens. This is different to my experience of quantitatively oriented literature reviews of accounting research ( Hiebl, 2014 ; Hiebl and Richter, 2018 ; Lavia López and Hiebl, 2015 ; Plöckinger et al. , 2016 ) in which fellow accounting researchers seem more open to evidence-based reviews.

Thus, after several failures and my apparent inability to convince qualitatively oriented reviewers of the value of evidence-based reviews and inductively generated review findings, I have concluded that – for the time being – I could either not try publishing review articles covering qualitative accounting research or just submit to the conventions of the field [ 8 ]. I concede that this position may come across as overly instrumental and as blindly submitting to the rules of the current publish-or-perish culture ( Becker and Lukka, 2022 ; van Dalen and Henkens, 2012 ; Weigel and Müller, 2020 ). However, since I had a non-tenured co-author on board in the above example ( Ndemewah and Hiebl, 2022 ), to submit to the conventions of the field, as I did not want my beliefs to get in the way of my co-author’s career prospects.

Just as the short history of this published review paper ( Ndemewah and Hiebl, 2022 ) shows, the final literature review (e.g. as published in a standalone paper or PhD thesis) may differ significantly from earlier versions. The published paper appears to have followed a straightforward linear process: select a topic to review, focus on one or two central theories, analyze the underlying literature with these theories in mind, and then report on the results. However, junior scholars should not let themselves be blinded by the published paper: the underlying engagement with the literature and theory is often much less straightforward. That is, just as with empirical qualitative research papers, researchers often play around with different theoretical angles to make sense of data – the review sample in the case of a literature review – and then select the theory that seems most promising for making a certain argument and getting this argument published ( Ahrens, 2022 ; Huber, 2022 ). Alternatively, if authors have analyzed a review sample and concluded that available theories may be inadequate for fully grasping the phenomenon in question, they could then opt for a more evidence-based or theory discovery type of review ( Breslin and Gatrell, 2023 ). In any case, it seems hard to decide whether a literature review should be more theory-led or more evidence-based before a full analysis of the review sample. Only after this analysis has generated sufficient knowledge of the available literature can authors decide how to frame and present their review results.

As indicated above, the observations shared in this section especially relate to use case (i), namely, literature reviews that cover a certain domain of accounting research leaning heavily toward qualitative research methods. That is, I have not experienced such theory issues for the use case (iii), namely, methodological literature reviews ( Feldermann and Hiebl, 2020 ; Hiebl and Richter, 2018 ), including one focusing on qualitative accounting research ( Feldermann and Hiebl, 2020 ). The reason is probably that reviewers do not expect much theory guidance in methodologically oriented reviews, although we did present some underlying theory in the mentioned methodological review paper, too ( Feldermann and Hiebl, 2020 ). By contrast, for the use case (ii), the application of a method theory is at the core of the review, and thus, focusing on a predefined theoretical lens to analyze the review sample is an inherent ingredient of such reviews.

4.2 Sample selection and comprehensiveness of review samples

4.2.1 comprehensiveness of review samples..