- How It Works

- PhD thesis writing

- Master thesis writing

- Bachelor thesis writing

- Dissertation writing service

- Dissertation abstract writing

- Thesis proposal writing

- Thesis editing service

- Thesis proofreading service

- Thesis formatting service

- Coursework writing service

- Research paper writing service

- Architecture thesis writing

- Computer science thesis writing

- Engineering thesis writing

- History thesis writing

- MBA thesis writing

- Nursing dissertation writing

- Psychology dissertation writing

- Sociology thesis writing

- Statistics dissertation writing

- Buy dissertation online

- Write my dissertation

- Cheap thesis

- Cheap dissertation

- Custom dissertation

- Dissertation help

- Pay for thesis

- Pay for dissertation

- Senior thesis

- Write my thesis

150 Original Accounting Research Paper Topics

Our academic experts understand how hard it can be to come up with original accounting research paper topics for assignments. Students are often dealing with multiple responsibilities and trying to balance numerous deadlines. Searching the web or class notes takes up a lot of time. Therefore, we have put together our list of 150 accounting research topics that students can choose from or gather inspiration from.

Managerial Accounting Topics for College Students

This area of study has tremendous upside as more businesses rely on managerial accountants to bring innovative changes to their organizations. Here is a list of topics for research paper in this area:

- Differences between financial accounting and managerial accounting.

- Managerial accounting in the 21 st century.

- The impact of managerial accounting in big businesses.

- The major components of activity-based costing.

- How managerial accounting affects international finance.

- The impact managerial accounting has on human resources.

- The major components of capital budgeting.

- How managerial accounting affects internal business decisions.

- Effective ways of adopting managerial accounting into small businesses.

- Differences between variable costing and absorption costing.

Accounting Blog Topics for Today’s Generation

The following collection can be considered accounting hot topics because they deal with the issues that are most important to today’s generation of accountants that utilize advanced software to keep businesses successful:

- Cost of manufacturing goods overseas.

- The cost of instituting anti-harassment programs.

- Inventory and cost of products sold in the U.S.

- Reinventing accounts payable processes.

- Using best practices to boost the bottom line.

- The cost of keeping human resources on staff.

- Simplifying procedures in accounts payable.

- The cost of updating internal systems with technology.

- The cost-effectiveness of employee training.

- Working capital increasing in large companies.

Advanced Accounting Topics

As students advance academically, they may want to consider these topics for research paper to earn higher scores in their classes. Here are some suggestions:

- How to run an efficient large accounting department.

- Red flags in outdated accounting processes.

- Identifying unconventional processes in payment processes.

- Utilizing paperless processes in small businesses.

- Applying EDP to accounts payable processes.

- The benefits of automating payables and receivables.

- Outsourcing procurement processes to save money.

- Automation to handle repetitive processes.

- The need for diversifying skills in accounting.

- The ways time affects seasonal cash flow.

Controversial Accounting Topics

Many accounting topics for research papers need to draw a reader’s attention right from the start. This list of topics is controversial and should accomplish just that:

- The impact the Jobs Act will have on large businesses.

- The positive effects tax cuts will have on small business.

- The risks of offshore accounting on U.S. businesses.

- The need to update software each year to avoid accounting problems.

- How small businesses are falling behind in accounting practices.

- The impact bonus depreciation allows businesses.

- Applying to government relief programs.

- Describe the role the internet has on accounting.

- The trustworthiness of online accounting programs.

- The negatives of auditing collusion.

Intermediate Accounting Topics

These accounting paper topics are meant for students that have acquired skills in writing but may not have developed the skills needed to write a top-notch paper quite yet. They should be easy to research given a proper planning period:

- Discuss why companies need to incorporate automated processes.

- The problems with ethics in accounting practices.

- Technology advancements that improve accounting accuracy.

- The problem with accuracy in decade-old software.

- Explain the best way to help accountants work manually.

- Describe the historical prospect of best accounting practices.

- The most effective way to become a certified accountant.

- Compare accounting systems that improve processes.

- The quick flow of data and the value on today’s accountants.

- The negatives that come from relying on accounting software.

Interesting Accounting Topics

Sometimes you need to consider accounting project topics that would be great for numerous situations. You may need to present before a class or write a paper for a discussion panel. These ideas may suit your needs:

- Explain the concept of accounting theory to practice.

- The theories behind normative accounting practices.

- The effect theories in accounting have on businesses.

- Challenges of taking theory to practice.

- The major changes in accounting practices over the last 25 years.

- The impact the internet has had on accounting ethics.

- Accounting practices in the 21 st century.

- The challenges of accounting technologies on fast-growing companies.

- The dangers the internet poses toward ethical accounting.

- Describe the difficulties that come from putting theories into practice.

Accounting Projects Topics for a Short Project

Some cost accounting topics are worthy of an audience but need to be completed within a tight deadline. These project ideas are easy to research and can be completed within one week:

- Use of efficient accounting software in tax season.

- Applicable Professional and Legal Standards.

- The difficulties in using offshore accounting.

- The most effective way of managing earnings.

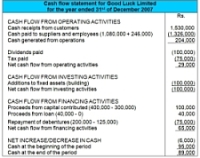

- The development of cash flow in the United Kingdom.

- The development of cash flow in the United States.

- The best way to manage personal finances.

- The effect financial markets have on personal spending.

- Debt management in large corporations.

- Accounting challenges during the pandemic.

Forensic Accounting Research Topics

This is another area of accounting that has a promising future for small to large businesses. Here are forensic accounting research paper topics you can use if you are interested in this booming segment:

- Methods for identifying instances of money laundering.

- The government’s right to search private accounts.

- The use of tax records to report possible crimes.

- Class action litigation cases in the United States.

- Court use of forensic accounting in criminal cases.

- Forensic accounting to develop better anti-fraud programs.

- A company’s reliance on forensic accounting to prevent theft.

- Establishing controls in emerging international markets.

- Forensic accountants and their role in court proceedings.

- Natural disaster and loss quantification practices.

Accounting Theory Topics for College

Good accounting thesis topics should mirror personally important issues. Essay ideas should reflect the things you want to learn more about and explore in-depth. Here is a list that may pique your interest:

- Impact of accounting research on financial practices.

- Scientific research studies in modern economies.

- Modern accounting concepts and applications.

- The change in accounting practices over the last two decades.

- Describe the components of Positive Theory.

- Marketplace discipline across major industries.

- Major accounting theories and techniques in big businesses.

- The use of technology to reduce accounting costs.

- Technology theory in the use of modern accounting.

- Risk management and the most effective theories.

Accounting Dissertation Topics for Grad Students

The following topic ideas delve into some serious issues in accounting and are much more difficult to handle. These should be approached with the utmost academic determination to earn a master’s or a Ph.D.:

- Compare accounting software versus manual accounting.

- Tax management procedures in the 21 st century.

- The risks of updated technology in small companies.

- The costs associated with broader health care in the workplace.

- The history of accounting in the 20 th century.

- The best method of managing debts without difficulties.

- Accounting problems caused by online transactions.

- Cryptocurrency and its impact on modern accounting practices.

- Forecasting jobs in the field of accounting.

- The danger technology poses to the accounting industry.

Current Accounting Topics for College

If you don’t have enough time to research current topics in accounting, these ideas will help you save time. There are plenty of online resources discussing current issues and you can also find information in the library:

- Compare and contrast different cryptocurrencies.

- The definition of a successful and modern business account.

- Non-profit organizations and tax reductions.

- Sports accounting in today’s world of social media.

- The financial benefits of having a second stream of revenue.

- Financial stock management of overall earnings.

- The relationship between corporate donations and accounting.

- Minimizing risks in big and small-sized businesses.

- The impact that tax deductions have on big businesses.

- Financial strategies to ensure employee retention.

Hot Topics in Accounting for a Graduate Level Course

These are the topics you should be considered for a graduate-level course if you want to make a great impression on the professor. Just be sure to do your due diligence and research your selected topic thoroughly:

- The instances of “cooking books” in the 21 st century.

- The best approach to update accounting systems.

- Fraud cases currently in the United States.

- The importance of forensic accountants in fraud cases.

- The reasons account reports have government regulations.

- The benefits of incorporating computerized accounting.

- The need for companies to make changes to accounting departments.

- Evolving accounting practices that reduce the risk of theft.

- The effects offshore gambling has had on accounting.

- Privacy protocols to keep accounting practices secret.

Financial Accounting Topics Being Discussed Today

Topics in accounting are rooted in financial processes that date back centuries. Yet, there are still many innovative ideas that drive business success. Consider these topics for an essay on issues that are current for today’s world:

- The evolution of accounting practices over the last century.

- The biggest ethical concerns about accounting.

- Minimizing taxes when you are a small company.

- Accounting software that will cut company costs.

- The best way to lower taxes through accounting practices.

- Describe the way managerial accounting is affected by international markets.

- Explain the major factors of management earnings.

- The most accurate way to figure out the estimated tax on a company’s earnings.

- The quickest way to become a certified accountant.

- Describe how culture influences accounting practices.

Accounting Information Systems Research

The next set of topics are great for anyone wanting to combine accounting with technology. We put together this set to generate interest in this area:

- The ways small businesses can benefit from advanced technologies.

- Describe how IT affects financial analysis for reporting.

- Explain how companies use AIS to collect and store data.

- Explain the 10 elements used to understand AIS.

- Rank the best accounting information systems.

- The future of AIS in small business financial practices.

- Explain how AIS eliminates the use of balance sheets.

- AIS technologies save money in large businesses.

- The future of AIS in small to mid-size businesses.

- Describe the role of AIS in modern business.

Accounting Presentation Topics for College

These presentation topics cover a wide range of areas that are perfect for diverse interests. At the college level, students must conduct a lot of academic research to guarantee they have all the most relevant information needed to present on a great topic:

- Describe how forensic accounting can reduce risk to small businesses.

- Describe the challenges value and cost that managers deal with.

- The biggest changes to accounting practices in the 21 st century.

- The benefits of having separate controlling accounts.

- The rapid flow of data and the importance of modern accountants.

- Describe how forensic accountants conduct their investigations.

- The most likely causes of financial instability in small businesses.

- Explain the factors one must consider before investing.

- Describe the differences between financial and management accounting.

- Describe the impact of new taxation policies on managerial accounting.

What do you think of our accounting research topics? These are available for free and can be shared with other students. If you need a custom list of accounting topics, our academic experts can take your assignment details and provide you with original and simple accounting research topics to facilitate your project and help you earn a top grade. We can also provide you with writing, editing, and proofreading services to ensure your assignment is error-free and gets you the highest score possible.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Comment * Error message

Name * Error message

Email * Error message

Save my name, email, and website in this browser for the next time I comment.

As Putin continues killing civilians, bombing kindergartens, and threatening WWIII, Ukraine fights for the world's peaceful future.

Ukraine Live Updates

We use cookies to give you the best experience possible. By continuing we’ll assume you’re on board with our cookie policy

- A Research Guide

- Research Paper Topics

120 Accounting Research Paper Topics

How to choose a topic for accounting research paper:, common accounting research paper topics:.

- The impact of financial reporting standards on corporate governance

- The role of accounting information systems in enhancing decision-making processes

- The effect of tax policies on corporate financial reporting

- The relationship between corporate social responsibility and financial performance

- The role of auditing in detecting and preventing financial fraud

- The impact of international financial reporting standards on multinational corporations

- The role of accounting in measuring and managing business risks

- The effect of accounting information quality on investment decisions

- The relationship between corporate governance and financial performance

- The role of accounting in sustainability reporting and environmental management

- The impact of fair value accounting on financial statement quality

- The effect of accounting conservatism on earnings management

- The relationship between corporate governance and earnings management

- The role of accounting in detecting and preventing money laundering

- The impact of accounting regulations on small and medium-sized enterprises (SMEs)

Financial Accounting Research Paper Topics:

- The impact of International Financial Reporting Standards (IFRS) on financial statement quality

- The role of financial accounting in corporate governance

- The effect of fair value accounting on financial reporting quality

- The relationship between financial accounting information and stock market performance

- The impact of accounting conservatism on financial statement credibility

- The role of financial accounting in detecting and preventing corporate fraud

- The effect of corporate social responsibility reporting on financial performance

- The role of financial accounting in assessing the financial health of nonprofit organizations

- The impact of accounting information systems on financial reporting efficiency

- The relationship between financial accounting information and managerial decision-making

- The effect of accounting standards on the comparability of financial statements across countries

- The role of financial accounting in measuring and reporting intangible assets

- The impact of financial accounting regulations on small and medium-sized enterprises (SMEs)

- The relationship between financial accounting information and credit risk assessment

- The effect of earnings management on financial statement reliability

Accounting Theory Research Paper Topics:

- The role of accounting theory in financial decision-making

- The impact of international accounting standards on financial reporting quality

- The relationship between accounting theory and corporate governance

- The role of accounting theory in sustainability reporting

- The influence of behavioral biases on accounting decision-making

- The implications of fair value accounting on financial statement reliability

- The role of accounting theory in detecting and preventing financial fraud

- The impact of accounting theory on the valuation of intangible assets

- The relationship between accounting theory and earnings management

- The role of accounting theory in measuring and reporting corporate social responsibility

- The implications of accounting theory on the recognition and measurement of financial instruments

- The influence of accounting theory on the disclosure of related party transactions

- The role of accounting theory in assessing the effectiveness of internal controls

- The impact of accounting theory on the recognition and measurement of revenue

- The relationship between accounting theory and the adoption of new technologies in financial reporting

Accounting Management Research Paper Topics:

- The impact of technology on accounting management practices

- The role of ethics in accounting management decision-making

- The effectiveness of internal controls in preventing fraudulent activities

- The influence of corporate governance on accounting management practices

- The role of financial reporting in enhancing transparency and accountability

- The impact of globalization on accounting management strategies

- The relationship between accounting management and sustainable development

- The role of management accounting in strategic decision-making

- The effectiveness of cost accounting techniques in improving profitability

- The impact of taxation policies on accounting management practices

- The role of budgeting and forecasting in financial management

- The influence of cultural factors on accounting management practices

- The effectiveness of performance measurement systems in evaluating managerial performance

- The role of risk management in accounting management decision-making

- The impact of artificial intelligence and automation on accounting management processes

Accounting Ethics Research Paper Topics:

- The role of ethics in financial reporting: A comprehensive analysis

- Ethical considerations in auditing practices: A critical review

- The impact of ethical leadership on ethical decision-making in accounting firms

- Ethical challenges in the use of artificial intelligence in accounting

- The role of ethics in corporate governance and its impact on financial performance

- Ethical issues in tax planning and avoidance strategies

- The ethical implications of creative accounting practices

- The role of ethics in whistleblower protection and reporting mechanisms

- Ethical considerations in the use of big data analytics in auditing

- The impact of ethical training programs on accountants’ ethical behavior

- Ethical dilemmas in the adoption of International Financial Reporting Standards (IFRS)

- The role of ethics in sustainability reporting and corporate social responsibility

- Ethical challenges in the digitalization of accounting processes

- The influence of cultural factors on ethical decision-making in accounting

- Ethical considerations in the use of fair value accounting and its impact on financial statements

Forensic Accounting Research Paper Topics:

- The role of forensic accounting in detecting financial fraud

- Investigating the effectiveness of forensic accounting techniques in preventing corporate scandals

- Analyzing the impact of forensic accounting on financial statement accuracy

- The use of forensic accounting in uncovering money laundering schemes

- Evaluating the role of forensic accountants in identifying and preventing insider trading

- Assessing the effectiveness of forensic accounting in detecting and preventing bribery and corruption

- The role of forensic accounting in uncovering fraudulent financial reporting

- Investigating the use of forensic accounting in identifying and recovering assets in bankruptcy cases

- Analyzing the impact of forensic accounting on the detection and prevention of Ponzi schemes

- The use of forensic accounting in investigating and prosecuting white-collar crimes

- Evaluating the role of forensic accountants in assessing damages in litigation cases

- Assessing the effectiveness of forensic accounting in detecting and preventing tax evasion

- The role of forensic accounting in uncovering fraudulent insurance claims

- Investigating the use of forensic accounting in assessing the financial health of organizations

- Analyzing the impact of forensic accounting on the credibility and reliability of financial statements

Tax Accounting Research Paper Topics:

- The impact of tax reform on small businesses

- Tax planning strategies for multinational corporations

- The role of tax incentives in promoting renewable energy investments

- Tax implications of cryptocurrency transactions

- The effectiveness of tax audits in detecting tax evasion

- Tax implications of e-commerce and online sales

- The impact of tax policy on income inequality

- Tax considerations for real estate investments

- The role of tax havens in international tax planning

- Tax implications of cross-border mergers and acquisitions

- The impact of tax policy on foreign direct investment

- Tax implications of intellectual property rights and royalties

- The role of tax accounting in corporate social responsibility

- Tax considerations for non-profit organizations

- The impact of tax policy on small business growth and entrepreneurship

Contemporary Accounting Research Paper Topics:

- The impact of artificial intelligence on financial reporting and auditing

- Corporate social responsibility reporting and its influence on investor decision-making

- The role of big data analytics in detecting and preventing financial fraud

- The effect of blockchain technology on the accounting profession

- Sustainability accounting and its implications for corporate performance measurement

- The role of accounting information systems in enhancing organizational decision-making

- The challenges and opportunities of implementing International Financial Reporting Standards (IFRS) in emerging economies

- The impact of tax policy changes on corporate financial reporting and tax planning strategies

- The role of forensic accounting in investigating and preventing white-collar crimes

- The influence of cultural factors on financial reporting practices in multinational corporations

- The role of accounting in measuring and managing intangible assets

- The effect of corporate governance mechanisms on financial reporting quality

- The impact of digitalization on the future of auditing and assurance services

- The role of accounting in measuring and disclosing climate-related risks and opportunities

- The effect of financial reporting transparency on firm valuation and investor confidence

- Writing a Research Paper

- Research Paper Title

- Research Paper Sources

- Research Paper Problem Statement

- Research Paper Thesis Statement

- Hypothesis for a Research Paper

- Research Question

- Research Paper Outline

- Research Paper Summary

- Research Paper Prospectus

- Research Paper Proposal

- Research Paper Format

- Research Paper Styles

- AMA Style Research Paper

- MLA Style Research Paper

- Chicago Style Research Paper

- APA Style Research Paper

- Research Paper Structure

- Research Paper Cover Page

- Research Paper Abstract

- Research Paper Introduction

- Research Paper Body Paragraph

- Research Paper Literature Review

- Research Paper Background

- Research Paper Methods Section

- Research Paper Results Section

- Research Paper Discussion Section

- Research Paper Conclusion

- Research Paper Appendix

- Research Paper Bibliography

- APA Reference Page

- Annotated Bibliography

- Bibliography vs Works Cited vs References Page

- Research Paper Types

- What is Qualitative Research

Receive paper in 3 Hours!

- Choose the number of pages.

- Select your deadline.

- Complete your order.

Number of Pages

550 words (double spaced)

Deadline: 10 days left

By clicking "Log In", you agree to our terms of service and privacy policy . We'll occasionally send you account related and promo emails.

Sign Up for your FREE account

Questions? Call us:

Email:

- How it works

- Testimonials

Essay Writing

- Essay service

- Essay writers

- College essay service

- Write my essay

- Pay for essay

- Essay topics

Term Paper Writing

- Term paper service

- Buy term papers

- Term paper help

- Term paper writers

- College term papers

- Write my term paper

- Pay for term paper

- Term paper topic

Research Paper Writing

- Research paper service

- Buy research paper

- Research paper help

- Research paper writers

- College research papers

- Write my research paper

- Pay for research paper

- Research paper topics

Dissertation Writing

- Dissertation service

- Buy dissertation

- Dissertation help

- Dissertation writers

- College thesis

- Write my dissertation

- Pay for dissertation

- Dissertation topics

Other Services

- Custom writing services

- Speech writing service

- Movie review writing

- Editing service

- Assignment writing

- Article writing service

- Book report writing

- Book review writing

Popular request:

100 original accounting research topics.

October 29, 2020

The recommended process for coming up with a research topic in any field is straightforward. 1) You should brainstorm several ideas; 2) You should choose a topic that interests you; 3) You should choose a topic that is original, and 4) You should choose a topic you know you can research and write about given any surrounding constraints. It sounds easy enough but unsurprisingly most students around the world struggle to come up with just the right topic to do their research project on.

Choosing best accounting research topics

This list of 100 accounting research topics is a great starting point. Not only is the list curated by our leading academic experts , but it also represents the latest accounting topics in the field. Have a look at our selection and see if you feel inspired to come up with some ideas of your own, or simply select a handful of accounting research topics to help you narrow down your search for the perfect project.

Simple Accounting Research Topics

- How do financial balance sheets help keep accounts in good standing?

- Are the current standards of accounting ideal for today’s world?

- What is the value of live information to accountants?

- Why do companies have such a need for up-to-date accounting software?

- What are the biggest dilemmas in the ethics of accounting?

Great Topics for Accounting Research Papers

- What are some of the reasons accountants lie in their books?

- What are the greatest risks that come with software design?

- Why should financial reporting have government regulations?

- What is the most effective method to update accounting systems?

- What were the reasons that Goldman Sachs was accused of fraud?

Current Accounting Topics for High School

- Is it better to conduct manual accounting or computerized accounting?

- As technology evolves should companies make accounting changes?

- What are the risks one takes in using online accounting?

- Is internet-based accounting software safe for businesses?

- How has offshore gambling changed how we look at accounting?

Hot Topics in Accounting for High School

- Should companies keep their methods of accounting a secret?

- What are the latest developments in software companies should look for?

- How does modern technology help or harm accounting?

- What are the biggest ethical questions in regards to accounting?

- How did best practices for accounting develop over time?

Controversial Accounting Topics for Every Level

- How can large corporations reduce the amount of taxes they pay?

- What are some of the ways companies avoid financial fraud?

- Is offshore accounting safe for small businesses with limited budgets?

- What are the current accounting best practices for small businesses?

- How can small businesses minimize taxes legally through accounting?

Simple Accounting Research Topics for Intro Courses

- Can the right type of software help a business cut costs?

- Is having an accounting department only needed for big companies?

- What advances in accounting software are the most impactful?

- What are the historical prospects that created today’s accounting practices?

- What are the accounting principles of managing long-term debt?

Advanced Accounting Topics for College Students

- Is it important to report finances to gain the confidence of customers?

- What are some of the things companies can do to make their accounts transparent?

- What are the differences between European and Islamic banking practices?

- Why is it necessary to use on-site training to learn accounting software?

- What are the best accounting systems available today?

Managerial Accounting Topics for Research Paper

- Would financial statements look the same without accounting standards?

- What are some of the most popular perspectives of management earnings?

- How do international markets affect managerial accounting?

- What are the most important concepts of earnings management?

- What risks do advanced technologies mean for the field of accounting?

Ph.D. Research Topics in Accounting and Auditing

- How do long-term debts affect small businesses?

- What are some of the easiest ways for accounts to rise in their companies?

- What are the risks of collusion between accounting and an auditor?

- What are the best finance practices for entrepreneurial internet businesses?

- When is the right time for people to hire personal financial experts?

Ph.D. Research Topics in Accounting

- How can accounting software be used to improve a small business’s productivity?

- How are small businesses able to compete financially with large businesses?

- What is the major problem with applying theory to practical accounting?

- What are the best ways of ensuring accounting decisions are sound decisions?

- In what ways can businesses avoid growing debt over the years?

Accounting Research Paper Topics Ideas

- In what ways is financial accounting changing as new technologies arise?

- In what ways does culture affect theories in accounting?

- What does one have to do to become a certified accountant?

- What were the causes of the 2008 global financial crisis?

- How does one figure out the estimated tax on company earnings?

Accounting Thesis Topics for Graduate Students

- What are the negatives of a growing number of accounting graduates around the world?

- What influences do large corporations have on accounting theories?

- What are the best training programs for accounting at the corporate level?

- How safe is mobile accounting technology for personal use?

- What kind of restraints does developing economies have on capital budgeting?

Great Accounting Presentation Topics

- What are the major causes of financial instability among big businesses?

- What are the biggest problems with normative theories in accounting?

- What are the most significant changes in accounting practices in the last 20 years?

- What does the trend of analyzing text in financial statements mean for reporting?

- What is the relationship between CEO qualities and a company’s stock performance?

More Managerial Accounting Research Topics

- Should small to mid-size companies have separate controlling accounts?

- What are the most popular accounting theories used in big business?

- In what ways are IRR, ROI, and payback effect techniques for capital budgeting?

- Why must a manager make the accounting-related decision for planning and organizing projects?

- What are the biggest problems of value and cost managers must face?

Forensic Accounting Research Topics

- Can forensic accounting help reduce risks to small businesses?

- What is the main role of a forensic accountant?

- How is forensic accounting making the auditing process easier?

- What are the essential skills that are necessary to enter forensic accounting?

- How do forensic accountants conduct their investigations?

Managerial Accounting Topics for Grad Students

- What are the fundamental differences between management accounting and financial accounting?

- To what extent should managers play a role in account auditing?

- How have new taxation policies affected managerial accounting?

- Why is the quality of human resource management so important in auditing firms?

- How does double-entry accounting affect the way managers lead organizations?

Simple Accounting Research Topics for a Short Project

- In what ways has Covid-19 impacted the health sector in the U.S.?

- What is meant by the term “asset-liability management”?

- How is the retail sector affected by specialist accounting?

- What is the importance of audits for non-profit organizations?

- How can small businesses utilize specialized accountants to keep finance on track?

Accounting Topics for Research Paper in College

- What factors should you consider if you intend to invest in financial markets?

- What tax reform initiatives would help small businesses in the U.S.?

- How is the rapid flow of data important for modern accountants?

- How much do fraud cases rely on financial ratios?

- How can financial ratios be used to foresee the likelihood of bankruptcy?

Great Accounting Topics for Research Papers

- How is traditional auditing different from risk-based auditing?

- How do fair value measurements present challenges to external audits?

- Can high school courses in accounting lead to better financial management for young adults?

- Will electronic bookkeeping make accountants irrelevant?

- How do small retail businesses in the US maintain their accounts?

Accounting Topics for Research Term Papers

- In what ways are financial disclosures in online finance programs putting users at risk?

- What are the biggest limitations of finding a reliable accounting system for online sales?

- What is the best method for monitoring liquid assets?

- What are the major factors that go into a valuation for mergers and acquisitions?

- What are the most sophisticated aspects of traditional accounting?

What did you think of our accounting research paper topics? We know it can be time-consuming and difficult to brainstorm your ideas, so we encourage you to choose a topic from the list above or check out our business research topics . If you have an assignment that requires you to write on something specific, then we can create a custom list of 5 or 10 ideas in a matter of hours. You know longer have to fret about coming up with the perfect financial accounting topics. Just contact us anytime and we will put you in touch with an academic expert who can create a list for you or help you with other parts of the assignment writing process.

Take a break from writing.

Top academic experts are here for you.

- How To Write An Autobiography Guideline And Useful Advice

- 182 Best Classification Essay Topics To Learn And Write About

- How To Manage Stress In College: Top Practical Tips

- How To Write A Narrative Essay: Definition, Tips, And A Step-by-Step Guide

- How To Write Article Review Like Professional

- Great Problem Solution Essay Topics

- Creating Best Stanford Roommate Essay

- Costco Essay – Best Writing Guide

- How To Quote A Dialogue

- Wonderful Expository Essay Topics

- Research Paper Topics For 2020

- Interesting Persuasive Essay Topics

- Search Search Please fill out this field.

- Corporate Finance

What Is Accounting Theory in Financial Reporting?

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Investopedia / Xiaojie Liu

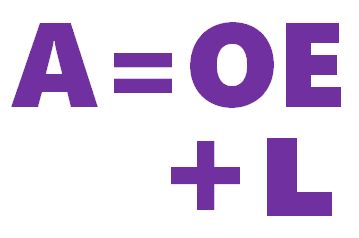

What Is Accounting Theory?

Accounting theory is a set of assumptions, frameworks, and methodologies used in the study and application of financial reporting principles. The study of accounting theory involves a review of both the historical foundations of accounting practices , as well as the way in which accounting practices are changed and added to the regulatory framework that governs financial statements and financial reporting.

Key Takeaways

- Accounting theory provides a guide for effective accounting and financial reporting.

- Accounting theory involves the assumptions and methodologies used in financial reporting, requiring a review of accounting practices and the regulatory framework.

- The Financial Accounting Standards Board (FASB) issues generally accepted accounting principles (GAAP) which aim to improve comparability and consistency in accounting information.

- Accounting theory is a continuously evolving subject, and it must adapt to new ways of doing business, new technological standards, and gaps that are discovered in reporting mechanisms.

Understanding Accounting Theory

All theories of accounting are bound by the conceptual framework of accounting. This framework is provided by the Financial Accounting Standards Board (FASB), an independent entity that works to outline and establish the key objectives of financial reporting by businesses, both public and private. Further, accounting theory can be thought of as the logical reasoning that helps evaluate and guide accounting practices. Accounting theory, as regulatory standards evolve, also helps develop new accounting practices and procedures.

Accounting theory is more qualitative than quantitative, in that it is a guide for effective accounting and financial reporting.

The most important aspect of accounting theory is usefulness. In the corporate finance world, this means that all financial statements should provide important information that can be used by financial statement readers to make informed business decisions. This also means that accounting theory is intentionally flexible so that it can produce effective financial information, even when the legal environment changes.

In addition to usefulness, accounting theory states that all accounting information should be relevant, reliable, comparable, and consistent. What this essentially means is that all financial statements need to be accurate and adhere to U.S. generally accepted accounting principles (GAAP) . Adherence to GAAP allows the preparation of financial statements to be both consistent to a company's past financials and comparable to the financials of other companies.

Finally, accounting theory requires that all accounting and financial professionals operate under four assumptions. The first assumption states that a business is a separate entity from its owners or creditors. The second affirms the belief that a company will continue to exist and not go bankrupt. The third assumes that all financial statements are prepared with dollar amounts and not with other numbers like units of production. Finally, all financial statements must be prepared on a monthly or annual basis.

Special Considerations

Accounting as a discipline has existed since the 15th century. Since then, both businesses and economies have greatly evolved. Accounting theory is a continuously evolving subject, and it must adapt to new ways of doing business, new technological standards, and gaps that are discovered in reporting mechanisms.

For example, organizations such as the International Accounting Standards Board help create and revise practical applications of accounting theory through modifications to their International Financial Reporting Standards (IFRS). Professionals such as Certified Public Accountants (CPAs) help companies navigate new and established accounting standards.

Financial Accounting Standards Board. " About the FASB ." Accessed April 17, 2021.

International Financial Reporting Standards Foundation. " Who We Are ." Accessed April 17, 2021.

- Accounting Explained With Brief History and Modern Job Requirements 1 of 51

- What Is the Accounting Equation, and How Do You Calculate It? 2 of 51

- What Is an Asset? Definition, Types, and Examples 3 of 51

- Liability: Definition, Types, Example, and Assets vs. Liabilities 4 of 51

- Equity Meaning: How It Works and How to Calculate It 5 of 51

- Revenue Definition, Formula, Calculation, and Examples 6 of 51

- Expense: Definition, Types, and How Expenses Are Recorded 7 of 51

- Current Assets vs. Noncurrent Assets: What's the Difference? 8 of 51

- What Is Accounting Theory in Financial Reporting? 9 of 51

- Accounting Principles Explained: How They Work, GAAP, IFRS 10 of 51

- Accounting Standard Definition: How It Works 11 of 51

- Accounting Convention: Definition, Methods, and Applications 12 of 51

- What Are Accounting Policies and How Are They Used? With Examples 13 of 51

- How Are Principles-Based and Rules-Based Accounting Different? 14 of 51

- What Are Accounting Methods? Definition, Types, and Example 15 of 51

- What Is Accrual Accounting, and How Does It Work? 16 of 51

- Cash Accounting Definition, Example & Limitations 17 of 51

- Accrual Accounting vs. Cash Basis Accounting: What's the Difference? 18 of 51

- Financial Accounting Standards Board (FASB): Definition and How It Works 19 of 51

- Generally Accepted Accounting Principles (GAAP): Definition, Standards and Rules 20 of 51

- What Are International Financial Reporting Standards (IFRS)? 21 of 51

- IFRS vs. GAAP: What's the Difference? 22 of 51

- How Does US Accounting Differ From International Accounting? 23 of 51

- Cash Flow Statement: What It Is and Examples 24 of 51

- Breaking Down The Balance Sheet 25 of 51

- Income Statement: How to Read and Use It 26 of 51

- What Does an Accountant Do? 27 of 51

- Financial Accounting Meaning, Principles, and Why It Matters 28 of 51

- How Does Financial Accounting Help Decision-Making? 29 of 51

- Corporate Finance Definition and Activities 30 of 51

- How Financial Accounting Differs From Managerial Accounting 31 of 51

- Cost Accounting: Definition and Types With Examples 32 of 51

- Certified Public Accountant: What the CPA Credential Means 33 of 51

- What Is a Chartered Accountant (CA) and What Do They Do? 34 of 51

- Accountant vs. Financial Planner: What's the Difference? 35 of 51

- Auditor: What It Is, 4 Types, and Qualifications 36 of 51

- Audit: What It Means in Finance and Accounting, and 3 Main Types 37 of 51

- Tax Accounting: Definition, Types, vs. Financial Accounting 38 of 51

- Forensic Accounting: What It Is, How It's Used 39 of 51

- Chart of Accounts (COA) Definition, How It Works, and Example 40 of 51

- What Is a Journal in Accounting, Investing, and Trading? 41 of 51

- Double Entry: What It Means in Accounting and How It's Used 42 of 51

- Debit: Definition and Relationship to Credit 43 of 51

- Credit: What It Is and How It Works 44 of 51

- Closing Entry 45 of 51

- What Is an Invoice? It's Parts and Why They Are Important 46 of 51

- 6 Components of an Accounting Information System (AIS) 47 of 51

- Inventory Accounting: Definition, How It Works, Advantages 48 of 51

- Last In, First Out (LIFO): The Inventory Cost Method Explained 49 of 51

- The FIFO Method: First In, First Out 50 of 51

- Average Cost Method: Definition and Formula with Example 51 of 51

:max_bytes(150000):strip_icc():format(webp)/gaap.asp-Final-1380c0fa5b37436f80cd02334ca213a9.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Accounting Theory Essays (Examples)

Agency Theory

Tearney, M. G., & Dodd, J. (2009). Accounting theory. H. I. Wolk (Ed.). New York: Sage.

Impact Of Agency Theory

Net worth theory and corporate fraud, the cost effectiveness in cloud computing within an accounting organization.

Prabhu, C. S. R. (2015). E-governance: concepts and case studies. New Delhi: PHI Learning Pvt. Ltd.

Shareholder Vs Stakeholder Theory

Putka, G. (2019). Insiders are selling. Retrieved from https://www.washingtonpost.com/business/economy/company-insiders-are-selling-stock-during-buyback-programs-and-making-additional-profits-when-stock-prices-jump-and-its-legal/2019/11/06/fc592f58-e493-11e9-a331-2df12d56a80b_story.html

Capital Structure Analysis

How interest rates compare over the last decade within the united, challenges in management facing transformational leaders service, advantages and disadvantages of interrelationships between organizational.

Cunliffe, A. L., & Luhman, J. T. (2012). Key concepts in organization theory. New York: Sage.

Elon Musk And Power At Tesla

Related topics.

- Social Control Theory

- Attachment Theory

- Personality Theory

- Leadership Theory

- Management Theory

- Conflict Theory

- Labeling Theory

- Psychoanalytic Theory

- Strain Theory

Category Topics

- Nursing Theory

- Rational Choice Theory

- Existentialism

- Game Theory

- Change Theory

- Organization Theory

- Human Relations

- Motivation Theories

Improve your studying and writing skills

We have over 150,000+ study documents to help you.

Join thousands of other students and

"spark your studies"..

Study Guides

Writing Guides

Studying / Writing Tools

Customer Service

Your customer service team resolved my issue in minutes!

Study Spark - providing your mind the spark it needs to help improve your grades.

©2020 Study Spark LLC.

Studyspark.com uses cookies to offer our users the best experience. By continuing, you are agreeing to receive cookies. Privacy Policy

Accounting Theory: Research, Regulation and Accounting Practice

Pacific Accounting Review

ISSN : 0114-0582

Article publication date: 19 September 2008

Vosslamber, R. (2008), "Accounting Theory: Research, Regulation and Accounting Practice", Pacific Accounting Review , Vol. 20 No. 3, pp. 284-286. https://doi.org/10.1108/01140580810920263

Emerald Group Publishing Limited

Copyright © 2008, Emerald Group Publishing Limited

Accounting theory tends to be one of the less popular undergraduate accounting papers. Most accounting students can prepare and interpret financial data; but many struggle to grasp “abstract” concepts and then discuss and write about them. However, any prospective member of the New Zealand Institute of Chartered Accountants must grapple with theory if they wish to join.

A well‐written text can be a lifeline for students, many of whom will be confronting philosophical concepts for the first time. Anyone writing such a text must balance several conflicting pressures: the text must simplify and clarify without being simplistic or misleading; the author may present his or her own views, but must not ignore or unduly disparage alternatives; and the text must cover the field without swamping the reader. But perhaps above all, the writer must convince the student that theory is important, relevant, and worthy of study. Gaffikin clearly believes that this is so, concluding his preface, “This book draws attention to some of the many different dimensions accounting theorists must recognise if they are to provide a responsible accounting practice” (p. xi).

The ten chapters of the text are divided into five parts. Part 1 is entitled “The need for theory in accounting”. Theory plays a particular role: “Generally speaking, theories provide the reasoned basis for actions – for practice” (p. 4). Gaffikin then provides thumbnail discussions of basic concepts: ontology, epistemology, methodology and methods, before endeavouring to provide a historical sketch of the development of Western knowledge in the space of a dozen or so pages. Having provided this context and certain tools used in theory and theory construction, Gaffikin suggests that “it is possible to make a more rigorous and informed assessment of theories in accounting, which is the aim of any course in accounting” (p. 19).

Part 2, entitled “Developing the boundaries of accounting theory”, moves from theory in general, to accounting theory more specifically. Chapter 2 commences with Pacioli and ends around 1970. The discussion highlights the normative basis of accounting research prior to about 1970, as illustrated by the search by professional bodies and accounting theorists (e.g. Chambers and Mattessich) for accounting principles. This period is characterised by a “scientific”, hypothetico‐deductive approach to theory construction, and by the publication of various statements on accounting theory (e.g. ASOBAT, SATTA).

Chapter 3 continues the story from 1970. In contrast to the normative deductivism that preceded it, this period is characterised as the age of induction, of neo‐empiricism. Gaffikin suggests that Capital Markets Research, and more particularly Positive Accounting Theory, came to dominate accounting theorising. This dominance is attributed to increased availability of computing power, and “the power contained and exercised by a certain group of accounting institutions” (p. 68).

The final three parts might be considered to be applications of accounting theory in three areas. Part 3 considers accounting regulation. Despite having previously suggested that, “In some respects regulation can be viewed as a substitute for theory” (p. xi), Gaffikin now melds regulation with theory – chapter 4 being headed “Regulation as accounting theory”. Chapters 5 and 6 go on to discuss the practice of standard setting (including the conceptual framework project), and accounting in the context of globalisation.

Part 4 extends the boundaries of accounting to include alternative approaches to accounting theory development, the role of ethics, and Corporate Social Responsibility and environmental accounting. Part 5 looks to the future and asks whether accounting is merely a craft at the whim and fancy of its practitioners, or instead a professional practice that will truly serve the interest of the societies in which it operates (p. 220).

Gaffikin's work is a useful attempt to offer a coherent and concise explanation of the basis for theory and its relation to accounting practice that he suggests most accounting theory books fail to provide. Its length is ideal for an upper level undergraduate course. Each chapter could stand alone, or be used as the reading for a particular lecture or session. However, in part because of the succinctness of the work, a number of issues ought to be borne in mind.

First, the book is likely to be useful for a range of readers, but may not be suitable in all circumstances. An undergraduate with little or no practical accounting experience, and (all too often) no knowledge of history and philosophy, may struggle with aspects of this book. The discussion of the key concepts of ontology, epistemology and methodology (pp. 6‐8) may be too scant for such a reader.

Further, the pages are packed with proper nouns and acronyms derived not just from accounting, but from philosophy and history. Numerous specific personages and theories are mentioned with limited explanation. As an example, a table is presented listing 12 varieties of language or linguistic paradigms from Analytical Linguistics to Theory of Signs (Table 10.1) without an explanation of each paradigm or indication of relevance.

Conversely, someone wishing to dig deeper may be similarly frustrated by a lack of depth and the need to locate the sources for certain quotes themselves (for example, direct quotes from the writings of Milton Friedman (p. 41) and Plato (p. 179)).

In short, the text may not be a one‐stop shop; but as a complement to lectures and tutorials, or as a reference, it certainly has a place.

Second, even after nearly 300 pages, it is still not clear that there is such a thing as accounting theory. Theory, yes, and accounting, yes – but is there a discrete body of knowledge that might be labelled accounting theory? How much, if any, of the book would have had to be changed if the work had been entitled Management theory, or, for that matter, Chemical theory?

Further, should we speak of accounting theory? Gaffikin himself suggests that there can be no one theory of accounting (p. 239).

Certainly these concerns could be raised against any accounting theory text. However, it comes to the fore in this work, as unlike other standard texts on accounting theory (e.g. Godfrey, J., Hodgson, A., Holmes, S., and Targa, A. (2006), Accounting Theory , Milton, John Wiley & Son, Queensland), theory is not set side‐by‐side with the practice of accountants specific to their discipline (e.g. the preparation of financial statements). By isolating the discussion of theory from the everyday world of accounting, there is a real danger of driving in further the already sharp wedge between academia and practice.

However, this might be seen as an advantage of this text: in avoiding discussion of specific accounting applications, it may encourage a focus on theory per se – something that is seriously lacking in much accounting pedagogy today.

Third, Gaffikin concludes that: “accountants need to be aware of social, political, legal and linguistic considerations and not just serve the economic interests of a few members of society” (p. 239). However one is tempted to ask, “Why not?” How does one move from accounting theory and practice (the “what is”) to accounting ethics (the “what ought to be”)? The explication of this link is missing in this text.

Michael Gaffikin set himself an ambitious task, and in measure has succeeded. The individual chapters of Accounting theory: Research, Regulation and Accounting Practice provide a useful springboard for discussions of and instruction in accounting theory. Hopefully, as they draw attention to the role and nature of accounting theory, responsible accounting practice will be promoted.

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- Call to +1 844 889-9952

Accounting Theory and Analysis

As a long-time scholar, I never stop to ponder on a large number of accounting regulations in the present time. To begin with, accounting standards are directives in financial accounting. This directive dictates the manner in which firms present and prepare their financial statements. The financial statements in question include assets and liabilities, income and expenses among other financial statements.

Different nations have different accounting regulations based on their legal systems. There are a variety of accepted accounting principles in the world. For instance, the GAAP is broadly used in the U.S., but it is likely to be phased out by the International accounting standards. At times curiosity makes scholars earn knowledge that is not easily accessible. That said the same curiosity will make the reader learn that this work proves the fact that there are many accounting regulations in the current world.

In the current world of trade, it is improbable that the United States businesses have possible acquisition candidates, suppliers or customers that prepare their financial statements while considering the IFRS guidelines. The degree of regulations has led to a disparity in the international standards of accounting. For instance, reversal write-downs are prohibited under GAAP while it is permitted in special cases under IFRS. Another distinction is that the IFRS gives room for the valuation of property using the fair value concept while the GAAP only allows valuations based on the historic concept.

Another difference is that the FASB’s GAAP centers on the provision of lists of detailed guidelines that have to be followed in the preparation of financial statements. Some believe that a variety of accountants like using rule-based guidelines as in the deficiency of the same rules could make them face lawsuits. This owes to the fact that their judgments may be wrong thus making their financial statements incorrect. The understanding that accounting is a social-technical profession and not merely a subject of technical interests has led to increasing attention on the significance of professional decisions.

The existence of a set of exhaustive guidelines can lower doubt and raise accuracy hence eliciting insistent reports to the administration. Nonetheless, the obscurity of the same principles may result in unwanted difficulty in the preparation of financial statements. For instance, the United States FASB promulgated 148 accounting standards, whereas the IFRS developed 41 standards.

The United States accounting guidelines witnessed hard times in the Enron accounting scandal. The scandal Arthur Andersen designed accepted financial instruments that fulfilled the required guidelines but had a wrong motive. The international accounting guidelines are applicable and simple. Famous in his homeland, George Soros stated: “the regulations alone are not sufficient as one has to be principled”. He further added “The United States accounting system to needs to be based on rules. Nonetheless, the accounting rules alone are not sufficient because it results in unwanted actions. Although Europe also appears to be like the United States in terms of accounting scandals, such a problem would never exist in their land.

International accounting works provide a variety of categories of accounting modes and classification of accounting values, principles and standards. Though these categories are based on changing elements of prejudice such as cultural values, legal system, measurement traits and significance of tax regulations, most classes involve criteria linked to the use of certification. For instance,5 differentiates national accounting modes by, “the degree to which standards or law recommends in detail and eliminate judgment”. Furthermore, the extent of professional decision is involved in other elements of isolation such as dimensions and recognition criteria. For instance, state accounting modes with a tough concentration on fair value styles in their recognition and dimensional criteria are expected to involve the application of the professional decisions to a greater magnitude than nations that firmly adhere to the historical cost concept.

Professional opinion is a crucial factor in both, traditional accounting and IFRS standards. Nonetheless, worldwide accounting books that frequently depend on unsophisticated classifications of accounting mode fail to stress the vitality of professional opinion in accounting models. In fact, most texts emphasize the legalistic and prescriptive nature of accounting. This insight that accounting calls for limited professional opinion are emphasized by highlighting the close rapport involving income taxation and financial reporting as established the traditional concentration on the historic cost concept. As a matter of fact, international accounting books supply only unsophisticated opinions into the exercise of expert opinion in accounting. This largely partakes to an insight that accounting only calls for limited judgment and interpretation by auditors and accountants.

In conclusion, the question that lingers in the minds of several experts is whether it is necessary to have accounting regulations. George Soros stated: “the regulations alone are not sufficient as one has to be principled”. As proved above, these regulations safeguard accountants from lawsuits, especially if their judgment is deemed wrong. Nonetheless, the Enron scandal calls for high ethical standards in the accounting profession. This is because the guidelines may be fulfilled with wrong intent leading to a scandal. Furthermore, as illustrated in this text, the use of professional opinion is crucial.

Ahmed, Naseem. Financial Accounting: A simplified Approach. Atlantic: Atlantic Publishers, 2008.

Belkaoui, Ahmed Riahi. Accounting Theory. New York: CengageBrain, 2004.

Bhattacharyya K Asish. Essentials of Financial Accounting. Disney: PHI Learning, 2006.

Buttler, Cormac. Accounting for Financial Instruments. New York: Willey, 2009.

Collings, Steve. “ Accountants Facing Regulation Overload “. AccountingWEB. 2010. Web.

Griffin, Michael. “Regulations As Accounting Theory.” Faculty of Commerce – Accounting & Finance Working Paper no. 9. (2005). Web.

Higson, Andrew. Corporate Financial Reporting: Theory and Practice. New York: Sage, 2003.

Niskanen, William. After Enron: Lessons for Public policy. Maryland: Rowmab and Littlefield, 2007.

Cite this paper

Select style

- Chicago (A-D)

- Chicago (N-B)

BusinessEssay. (2022, November 26). Accounting Theory and Analysis. https://business-essay.com/accounting-theory-and-analysis/

"Accounting Theory and Analysis." BusinessEssay , 26 Nov. 2022, business-essay.com/accounting-theory-and-analysis/.

BusinessEssay . (2022) 'Accounting Theory and Analysis'. 26 November.

BusinessEssay . 2022. "Accounting Theory and Analysis." November 26, 2022. https://business-essay.com/accounting-theory-and-analysis/.

1. BusinessEssay . "Accounting Theory and Analysis." November 26, 2022. https://business-essay.com/accounting-theory-and-analysis/.

Bibliography

BusinessEssay . "Accounting Theory and Analysis." November 26, 2022. https://business-essay.com/accounting-theory-and-analysis/.

- Comparison Between Sifchain Finance and Republic Note

- The Use of Technology in Finance

- Foreign Exchange Rates: AUD and USD

- Behavioral Finance: The Role of Psychology

- Factors Affecting the Efficiency of Financial Institutions in the UAE

- Finance: Business Sustainability

- Insurance Industry Between the US and UK

- Financial Markets in Domestic and International Economy

- The Traditional Method of Cost Absorption

- An Islamic Banking Perspective of Loans and Interests

Accounting Theory Essays

Accounting theory and applications, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essay Examples >

- Essays Topics >

- Essay on Accounting

Free Research Paper On Accounting Theory

Type of paper: Research Paper

Topic: Accounting , Books , Theory , Economics , Finance , Discipline , Literature , Business

Words: 2000

Published: 01/20/2020

ORDER PAPER LIKE THIS

Introduction

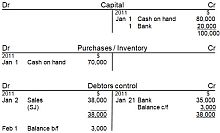

Accounting is viewed by many people as a cold, dry, and highly analytical discipline. As a discipline, accounting offers precise answers, which are either correct or incorrect. The answers provided by accounting may be true or false (Richard, 2011, p.6). For instance, let us take two companies which are similar in the value of their inventory and cost of goods sold calculated using different accounting methods. Company A uses last in first out (LIFO) method while company B uses first in first out (FIFO) method, and in the process, give results that are totally different but equally correct. Considering that both methods provide correct answers, it is difficult to know which method is precise. On the other hand, one might say that the choice one makes when selecting an inventory method is merely an “accounting construct”, it is essential to note that most of the games that accountants play are solely of interest to them and they have nothing to do with the real world (Gaffikin, 2005). According to research, this assertion is considered to be wrong. Considering the LIFO and FIFO example, it is essential to understand that this argument has essential income tax ramifications in countries like the US (Richard, 2011, p.6). Considering LIFO, a more rapid write-off of a company’s current inventory costs weighed against revenues, and assuming that inventory prices are rising, will generally provide income taxes that are lower (Maharshi University, 2004, p.7). In that case, it is essential to note that, accounting construct has an essential social reality, and not only in terms of income tax payment. Accounting is thought of as the language of business throughout the world. In that case, the language of accounting is regarded as a means of communication of feelings or ideas by using conventionalized gestures, signs, marks and articulated vocal sounds. In the same way, the language of accounting is used by many people to communicate matters which relate to various business aspects (Maharshi University, 2004, p.7). The reason why accounting has an essential social reality is because individual enterprise keeps their business separately. The fact that accounting is regarded to have an essential social reality possesses various questions about the social consequences that are associated with accounting numbers. The question that many people ask is: ‘Is it difficult to measure economic reality accurately?’ This question can only by answered by understanding the concepts that exist within accounting theory. This paper provides a general understanding of accounting theory in different perspectives. The paper also provides a critical perspective of accounting theory, which might provide a vivid reason as to why it is difficult to measure economic reality accurately.

Accounting Definition

As a definition, accounting is regarded as the process required to measure and record financial values of assets and liabilities of a company as well as monitoring the value of assets as they change with time (Gaffilkin, 2005). In accounting terms, a business is mostly referred to as an individual. The term ‘asset’ is used to refer to the things with a positive financial value and those that belong to the business. Liabilities, on the other hand, are the business belongings with a negative financial value. Understanding accounting theory requires one to firmly understand its assets, liabilities as well as other things, which include the business equity and the information that is projected in the accounting balance sheet (Gaffilkin, 2005). In that case, the role of accounting is that of communicating the outcome of operations of a business. Accounting manages to communicate the operations by accepting its definition. Practically, accounting is regarded as the art of record keeping, summarizing and classifying records in a manner that is significant and in terms of transactions, events and money. Regarded as the art of recording, accounting requires putting what is being communicated into writing or in printed form. Therefore, the transactions of financial characters needed to be recorded and maintained in the form of cash books, journals, day books and memoranda (Gaffilkin, 2005). Record keeping is not only used to ensure that all business operations that are associated with the organization finances are recorded, but they also used to ensure that these financial activities are recorded in the right manner. For instance, when a company’s executive needs to travel with his work, he might ask the company’s cashier for advanced funds, which are needed to meet his travel expenses. On the receipt, which is created from the executive memo, the cashier is expected to prepare a voucher, which is done and handed over to the executive to sign before the cash is handed over to the executive. This transaction is mostly recorded in the cashbook as well as the travel advances accounts of the ledger (Gaffilkin, 2005).

Accounting Theory and Various Contributions

Defining accounting is essential but not enough to understand why this theory is essential. It is, therefore, essential to venture further into the construct of accounting to understand various aspects of accounting theory. The Egyptians are considered among the first people to implement accounting in their activities. The Egyptians, who are known for their glorious appearance in the commercial market in the past, derived their first norm of trade from the intercourse with other ingenious people (Belkaoui, 2004, p.5). From the consequence of trading with other ingenious people, the Egyptians received their first form of accountantship, which was regarded as the natural way of communicating to all the cities found within the Mediterranean (Belkaoui, 2004, p.5). During the time when the Western empire was overrun by the Barbarians, and the countries that were composed took the opportunity of asserting their own independence, commerce was filed quickly after liberty (Belkaoui, 2004, p.3). Immediately, Italy, which was formally regarded as the court of the universe, was transformed to the seat of trade. While this seat of trade was not entered in the business of exchange, which was created by the help of Lomberds, it helped to connect all trade cities within the European Union. In the process, this connection helped to create the first method of keeping accounts, which was done by double entry, and was later referred to as the Italian book keeping (Belkaoui, 2004, p.3). Although the Italian double entry book keeping was not the first accounting concept, it greatly contributed to accounting theory which is currently being implemented in most academic fields and institutions. Another contribution to accounting theory was done by Luca Pacioli in 1494. Known as a Franciscan friar, Pacioli is mostly associated with the introduction of double entry book keeping accounting method, which was among the first accounting methods (Belkaoui, 2004, p.3). In 1494, Pacioli published his first book, which described double entry book keeping. Pacioli’s treatise of book keeping method was done to reflect Venice practices, which at the time became known as the Method of Venice or what many people came to know as the “Italian method” (Belkaoui, 2004, p.5). It is essential to note thatPacioli did not invent double entry book keeping method, but provided a vivid description of what was being practiced in Italy to be used for academic purposes (Belkaoui, 2004, p.5). According to Pacioli, the aim of devising the book keeping method was to enable the trader to obtain information regarding his assets and liabilities (Gaffilkin, 2005). In this method, both debt and credit were used as entries to secure what came to be known as double entry. In his assertion, all entries needed to be doubled, which meant that, if one made one creditor, he needed to create a debtor (Gaffilkin, 2005). With this notion, three books were needed, which are a memorandum, a ledger and a journal. The entries required for these books were found to be quite descriptive. Research suggests that double entry method not only required the name of the buyers or sellers recorded, but the description of the goods with their weight, price, measurements and size were included (Gaffilkin, 2005). Therefore, while the accounting theory is considered essential in the current accounting practices, the concepts embedded in the theory dates back several centuries. Various contributions have made this theory more appropriate, which makes them appropriate for all forms of organizations.

Critical Perspective of Accounting Theory