- Banking and Financial news

- Financial Analysis

- Foreign Exchange

- Indian Financial System

- Information Technology

- Investment and Insurance

- Loans and Advances

- Mortgage Laws

- Negotiable Instrument Act

- Risk Management

- What is Lead Bank Scheme?

- Loans and advances

Background:

In October 1969, the study group lead by Prof. D. R. Gadgil (Gadgil Study Group) recommended the adoption of an ‘ Area Approach ‘ to evolve plans and programmes for the development of an adequate banking and credit structure in the rural areas. Further, under the chairmanship of Shri F. K. F. Nariman (Nariman Committee) a committee of bankers on branch expansion programmes of public sector banks in its report (November 1969), endorsed the idea of an ‘Area Approach’ recommending that each bank should concentrate on certain districts where it should act as a ‘Lead Bank’ in order to enable the Public Sector Banks to discharge their social responsibilities. The Reserve Bank of India introduced the Lead Bank Scheme in December 1969 based on recommendations of the above committees with the objective of enhancing the flow of bank finance to the priority sector. Lead Bank Scheme was last reviewed by the High-Level Committee headed by Smt. Usha Thorat, the then Deputy Governor of the Reserve Bank of India in 2009. The Usha Thorat Committee held extensive discussions with various stakeholders viz. State Governments, banks, development institutions, academicians, NGOs, MFIs, etc. and noted that the Scheme has been useful in achieving its original objectives of improvement in branch expansion, deposit mobilisation and lending to the priority sector, especially in rural/semi-urban areas. There was an overwhelming consensus that the Scheme needs to continue. The Lead Bank guidelines were issued by RBI to SLBC Convenor banks and Lead Banks for implementation based on the recommendations of the High-Level Committee. Based on the recommendation of the “Committee of Executive Directors” of the Banks to study the efficacy of the Scheme, and suggestions of all stakeholders RBI issued certain ‘action points’ to SLBC Convenors/Lead Banks and NABARD on April 6, 2018.

The Lead Bank scheme envisages every district across the country shall be assigned to a commercial bank that has a major presence in that district to perform the role of Lead Bank. The assignment of lead bank responsibility to designated banks in every district is done by Reserve Bank of India under a procedure formulated under the scheme. The leader bank initially conducts basic surveys in their respective lead districts and prepares district credit plans linked with the development programme with special emphasis on the development of the rural and backward areas. It would identify the places suitable for branch expansion at unbanked centers with emphasis on deposit mobilization and credit deployment.

It is obligatory on the part of all the commercial banks to achieve a credit deposit ratio of 60% in respect of their rural and semi-urban branches separately on an all-India basis. However, they have to take care that a wide disparity in the ratios between different States / Regions is avoided in order to minimise regional imbalance in credit deployment. As an agenda item, Lead Banks review the performance of banks under the respective District Credit Plan (DCP). The DCP comprises the flow of credit to priority sector and weaker sections of the society, assistance under Government sponsored schemes, Grant of educational loans , Progress under SHG – bank linkage, SME financing & bottlenecks thereof, if any, etc.

Fora under the Lead Bank Scheme :

Block Level Bankers’ Committee (BLBC)

The Block Level Bankers’ Committee (BLBC) prepares the block-level credit plans and coordinates between credit institutions and field level development agencies at the block level. It reviews the implementation of the Block Credit Plan and also resolves operational problems in the implementation of the credit programmes of banks. The Lead District Manager (LDM) of the district is the Chairman of the Block Level Bankers’ Committee. All the banks operating in the block including the Small Finance Banks, Wholly Owned Subsidiaries (WOS) of Foreign Banks, RRBs, the District Central Co-operative Banks, Block Development Officer, technical officers in the block, such as extension officers for agriculture, industries and co-operatives are members of the Committee. BLBC meetings take place at the interval of once in a quarter. The meetings are attended by all the branch managers of the banks in the particular block and enrich the discussions with their valuable inputs. District Development Manager (DDM) of NABARD also attends the meeting to ensure better and more meaningful discussions for the development of the Block. Controlling Heads of the banks and Lead District Officer (LDO) of the Reserve Bank of India (RBI) selectively attends the BLBC meetings. Representatives of Panchayat Samitis are also invited to attend the meetings at half-yearly intervals so as to share their knowledge and experience on rural development in the credit planning exercise. Payments Banks should also be invited to attend the meetings.

District Consultative Committee (DCC):

District Consultative Committee (DCC) is constituted by bankers as well as Government agencies/departments at the district level. The forum facilitates coordination in implementing various developmental activities under the Lead Bank Scheme in the district. The District Collector is the Chairman of the DCC meetings. Reserve Bank of India, NABARD, all the commercial banks including Small Finance Banks Wholly Owned Subsidiaries (WOS) of Foreign Banks, RRBs, Payments Banks, co-operative banks including the District Central Cooperative Bank (DCCB), various State Government departments and allied agencies are the members of the DCC. The Lead District Manager (LDM) convenes the DCC meetings at the quarterly intervals. The Director of Micro, Small and Medium Enterprises Development Institute (MSME-DI) in the district is an invitee in districts where MSME clusters are located to discuss issues concerning MSMEs. The lead district officer represents RBI. Although DCC meetings are likely to address the problems particular to the concerned districts, they invariably discuss some of the important areas which are common to all districts. Their main agenda will be review the progress made under financial inclusion plan (FIP),the specific issues hindering and enabling IT enabled financial inclusion, issues to facilitate ‘enablers’ and remove/minimise ‘impeders’ for banking development for inclusive growth, monitoring initiatives for providing ‘Credit Plus’ activities by banks and State Governments such as setting up of Financial Literacy Centres (FLCs) and RSETI type Training Institutes for providing skills and capacity building to manage businesses, scaling up financial literacy efforts to achieve financial inclusion, review of performance of banks under District Credit Plan (DCP), flow of credit to priority sector and weaker sections of the society, doubling of farmers’ income by 2022, assistance under government-sponsored schemes, grant of educational loans, progress under SHG – bank linkage, SME financing & bottlenecks thereof, if any, Timely submission of data by banks, review of relief measures (in case of natural calamities wherever applicable). DCC should give adequate feedback to the SLBC on various issues that need to be discussed on a wider platform so that these receive adequate attention at the State Level.

State Level Bankers’ Committee (SLBC):

The State Level Bankers’ Committee (SLBC)/Union Territory Level Bankers’ Committee (UTLBC) coordinates the activities of the financial institutions and Government departments in the State/Union Territory under the Lead Bank Scheme. The quarterly meetings are chaired by the Chairman/ Managing Director/ Executive Director of the Convenor Bank and co-chaired by the Additional Chief Secretary or Development Commissioner of the State concerned. In cases where the Managing Director/Chief Executive Officer/Executive Director of the SLBC Convenor Bank is unable to attend SLBC Meetings, the Regional Director of the RBI shall co-chair the meetings along with the Additional Chief Secretary/Development Commissioner of the State concerned. A High Level of participation in SLBC/UTLBC meetings ensures an effective and desired outcome with meaningful discussion on issues of public policy of both the Government of India and the Reserve Bank of India.

Agenda for SLBC Meetings:

The main agenda for SLBC meeting will be the review of financial inclusion initiatives, expansion of banking network and Financial Literacy, status of opening of banking outlets in unbanked villages, CBS-enabled banking outlets at the unbanked rural centres (URCs), review of Operations of Business Correspondents – hurdles/issues involved, progress in increasing digital modes of payment in the State, provision of continuous connectivity with sufficient bandwidth, resolving connectivity issues/ connectivity options (Bharat Net, VSAT, etc.), installation of ATMs and PoS machines and status of implementation of e-receipts and e-payments in the State, status of rollout of Direct Benefit Transfer in the State, Aadhaar seeding and authentication, review of inclusion of Financial Education in the School Curriculum, financial literacy initiatives by banks (particularly digital financial literacy), creating awareness about various schemes, subsidies, facilities e.g. crop insurance, renewable energy, review of efforts towards end to end projects involving all stakeholders in the supply chain etc. The meeting also deliberate and review the credit disbursement by banks particularly lending towards DAY-NRLM, DAY-NULM, MUDRA , Stand-Up India , PMEGP , MSMEs , affordable housing, KCC , the grant of education loans, crop insurance under PMFBY , progress under SHG-bank linkage programme, etc. and impact of these schemes.

Service area approach (SAA) is a developed version of the ‘area approach’ structure of the Lead Bank Scheme. Under SAA plan each commercial bank / RRB branch in a rural and semi-urban area is designated to serve 15 to 25 villages for the planned and orderly development of the areas. The designated branch of a bank has to meet the banking needs of its service area vis-à-vis forge effective linkages between bank credit, production, productivity, and an increase in income levels of the villages.

Related post:

What is SHG bank linkage programme?

Author: Surendra Naik

Related posts.

- Destination West Bengal |

- SLBC Details |

- Banking at a Glance |

- Background Paper Quarterly |

- Performance of Banks |

- Information Centre |

- Financial Inclusion |

- Online Data System

An official website of the United States government

Here's how you know

The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

What the New Overtime Rule Means for Workers

One of the basic principles of the American workplace is that a hard day’s work deserves a fair day’s pay. Simply put, every worker’s time has value. A cornerstone of that promise is the Fair Labor Standards Act ’s (FLSA) requirement that when most workers work more than 40 hours in a week, they get paid more. The Department of Labor ’s new overtime regulation is restoring and extending this promise for millions more lower-paid salaried workers in the U.S.

Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid.

Some workers are specifically exempt from the FLSA’s minimum wage and overtime protections, including bona fide executive, administrative or professional employees. This exemption, typically referred to as the “EAP” exemption, applies when:

1. An employee is paid a salary,

2. The salary is not less than a minimum salary threshold amount, and

3. The employee primarily performs executive, administrative or professional duties.

While the department increased the minimum salary required for the EAP exemption from overtime pay every 5 to 9 years between 1938 and 1975, long periods between increases to the salary requirement after 1975 have caused an erosion of the real value of the salary threshold, lessening its effectiveness in helping to identify exempt EAP employees.

The department’s new overtime rule was developed based on almost 30 listening sessions across the country and the final rule was issued after reviewing over 33,000 written comments. We heard from a wide variety of members of the public who shared valuable insights to help us develop this Administration’s overtime rule, including from workers who told us: “I would love the opportunity to...be compensated for time worked beyond 40 hours, or alternately be given a raise,” and “I make around $40,000 a year and most week[s] work well over 40 hours (likely in the 45-50 range). This rule change would benefit me greatly and ensure that my time is paid for!” and “Please, I would love to be paid for the extra hours I work!”

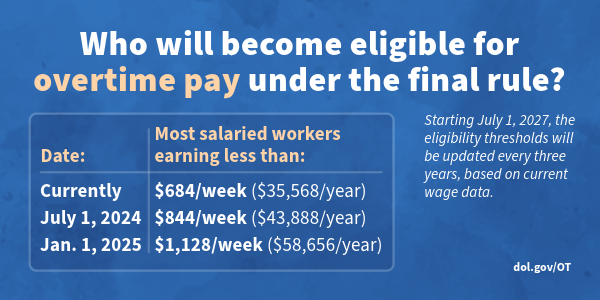

The department’s final rule, which will go into effect on July 1, 2024, will increase the standard salary level that helps define and delimit which salaried workers are entitled to overtime pay protections under the FLSA.

Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most salaried employees.

The rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the FLSA if certain requirements are met) from $107,432 per year to $132,964 per year on July 1, 2024, and then set it equal to $151,164 per year on Jan. 1, 2025.

Starting July 1, 2027, these earnings thresholds will be updated every three years so they keep pace with changes in worker salaries, ensuring that employers can adapt more easily because they’ll know when salary updates will happen and how they’ll be calculated.

The final rule will restore and extend the right to overtime pay to many salaried workers, including workers who historically were entitled to overtime pay under the FLSA because of their lower pay or the type of work they performed.

We urge workers and employers to visit our website to learn more about the final rule.

Jessica Looman is the administrator for the U.S. Department of Labor’s Wage and Hour Division. Follow the Wage and Hour Division on Twitter at @WHD_DOL and LinkedIn . Editor's note: This blog was edited to correct a typo (changing "administrator" to "administrative.")

- Wage and Hour Division (WHD)

- Fair Labor Standards Act

- overtime rule

SHARE THIS:

- Crossword Tips

Clue: City 200 miles south of Moscow

Referring crossword puzzle answers, likely related crossword puzzle clues.

- Russian city

- Pitcher Hershiser

- City on the Oka

- Sportscaster Hershiser

- Hurler Hershiser

- City south of Moscow

- Turgenev's birthplace

- Baseball's Hershiser

- Soviet city

Recent usage in crossword puzzles:

- New York Times - Sept. 29, 1981

- New York Times - March 23, 1971

- Submit Post

- Union Budget 2024

- Notifications

Formation of new district in Tamil Nadu –Assignment of Lead Bank Responsibility

Reserve Bank of India

RBI/2021-22/22 FIDD.CO.LBS.BC.No.09/02.08.001/2021-22

April 20, 2021

The Chairmen / Managing Directors & Chief Executive Officers All Lead Banks

Madam/ Dear Sir,

Formation of new district in the State of Tamil Nadu – A ssignment of Lead Bank Responsibility

The Government of Tamil Nadu vide Gazette Notifications G.O.Ms. No.797 dated December 28, 2020 had notified the formation of a new district in the State of Tamil Nadu. It has been decided to assign the lead bank responsibility of the new district as under:

2. Further, the District Working Code of the new district has also been allotted for the purpose of BSR reporting by banks.

3. There is no change in the lead bank responsibilities of the erstwhile district and of other districts in the State of Tamil Nadu.

Yours faithfully,

(Sonali Sen Gupta) Chief General Manager-in-Charge

- RBI Notifications

- « Previous Article

- Next Article »

Join Taxguru’s Network for Latest updates on Income Tax, GST, Company Law, Corporate Laws and other related subjects.

- Join Our whatsApp Channel

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: 743498e81900e0e3d8ba1ee62ad1f6b1

Subscribe to Our Daily Newsletter

Latest posts.

Live Webinar with Book on Section 43B(h) (Financial Fitness)

Incorrect Section Mention No Ground for Income Tax Addition Deletion: ITAT Mumbai

Land classification dispute with NHAI: HC directs filing of Appeal instead of Writ

Dispute over Section 19 Pre-deposit in MSME Act: HC dismisses Commercial Court’s Order

Parties Cannot Assume Arbitrator Disqualification Without Allowing Rebuttal: HC

Producers not liable if content shown in Movie trailer not included in film: SC

Overstatement of profits: NFRA imposes Rs. 5 Lakh Penalty on Auditors of Vikas WSP Limited

Heavy penalty cannot be imposed for lapsed e-way bill during transit

Petitioner as a registered person Must Continuously Monitor GST Portal: Madras HC

CBDT Extends Due Dates: Form No. 10A/10AB Filing upto 30th June, 2024

Featured posts.

Complexities of sending goods for Job work- Filing of Form GST ITC- 04

RBI Bars Kotak Bank from Onboarding New Online Customers & Issuing New Credit Cards

Arrest & Bail Under GST

GST Case Law Compendium – April 2024 Edition

FAQ On Reporting of Share Market Transaction in Income Tax Return

Notifications

2. There is no change in the Lead Banks of the other districts in the state of Assam.

Yours faithfully,

(Nisha Nambiar) Chief General Manager-in-Charge

IMAGES

VIDEO

COMMENTS

The assignment of Lead Bank responsibility to designated banks in every district is done by the Reserve Bank of India following a detailed procedure formulated for this purpose. As on March 31, 2022, 12 public sector banks and one private sector bank have been assigned Lead Bank responsibility in 734 districts of the country.

Effective Date: The reassignment of lead bank responsibilities is slated to take effect from April 01, 2024. This gives the concerned parties time to prepare for the transition and ensures a smooth transfer of responsibilities. 3. Impact on Banking Landscape: Such reassignments can have significant implications for the banking landscape of the ...

This development prompted the RBI to assign lead bank responsibilities for effective financial management and governance. ... Assignment of Lead Bank Responsibility. The Government of Madhya Pradesh has notified formation of two new districts, viz., Pandhurna vide Gazette Notification No. F-Rev-6-0029-2023-VII-Sec-7 dated October 5, 2023 and ...

• Assignment of Lead Bank Responsibility - The assignment of Lead Bank responsibility to designated banks in every district is done by the Reserve Bank of India following a detailed procedure formulated for this purpose. • Doubling of Farmers' Income by 2022 - Several steps have been taken towards attaining this objective including ...

The assignment of Lead Bank responsibility to designated banks in every district is done by the Reserve Bank of India following a detailed procedure formulated for this purpose. As on March 31, 2023, 12 public sector banks and one private sector bank have been assigned Lead Bank responsibility in 760 districts of the country.

The assignment of lead bank responsibility to designated banks in every district is done by Reserve Bank of India under a procedure formulated under the scheme. The leader bank initially conducts basic surveys in their respective lead districts and prepares district credit plans linked with the development programme with special emphasis on the ...

The assignment of lead bank responsibility to designated banks in every district is done by Reserve Bank of India following a detailed procedure formulated for this purpose. As on June 30, 2014, 25 public sector banks and one private sector bank have been assigned lead bank responsibility in 671 districts of the country.

The assignment of lead bank responsibility to designated banks in every district is done by Reserve Bank of India following a detailed procedure formulated for this purpose. As on June 30, 2014, 25 public sector banks and one private sector bank have been assigned lead bank responsibility in 671 districts of the country.

Assignment of Lead Bank Responsibility. The Government of Madhya Pradesh has notified formation of two new districts, viz., Pandhurna vide Gazette Notification No. F-Rev-6-0029-2023-VII-Sec-7 dated October 5, 2023 and Maihar vide Gazette Notification No. F-Rev-6-0030-2023-VII-Sec-7 dated October 05, 2023. Accordingly, it has been decided to ...

In view of the assignment of lead bank responsibility in the 11 districts of metropolitan areas of Delhi, the lead bank responsibility of the erstwhile district Delhi (Rural) assigned to State Bank of India is treated as withdrawn. SBI is expected to extend necessary support for smooth transition of lead bank responsibility in districts of Delhi.

2. It has been decided to assign the lead bank responsibility of the new district Prabudh Nagar to Punjab National Bank. There is no change in the lead bank responsibilities of other districts in the State. 3. The newly formed district Prabudh Nagar has been allotted District working code 315 for the purpose of reporting. Yours faithfully,

RBI/2011-12/417 RPCD.CO.LBS. BC.No. 61/02.08.01/2011-12 The Chairmen/CMD All Lead Banks Dear Sir/Madam, Assignment of Lead Bank responsibility- Newly formed district of Bhim Nagar in the State of Uttar Pradesh The Government of Uttar Pradesh vide their Gazette Notification No. 2876/1-5-2011-154/2011-R-5 dated September 28, 2011 has advised about the constitution of a new district viz. Bhim Nagar

Introduction: The Reserve Bank of India (RBI) has issued a crucial notification, RBI/2023-24/82, dated November 10, 2023, addressing the formation of 19 new districts in the state of Rajasthan. The notification outlines the assignment of Lead Bank Responsibility for these newly created districts, effective from August 7, 2023. 1.

The employee primarily performs executive, administrative or professional duties. While the department increased the minimum salary required for the EAP exemption from overtime pay every 5 to 9 years between 1938 and 1975, long periods between increases to the salary requirement after 1975 have caused an erosion of the real value of the salary ...

Assignment of Lead Bank Responsibility . The Government of Rajasthan has notified formation of 19 new districts in the state of Rajasthan vide Gazette Notifications No.9 (18) Raj-1/2022 (1-14) dated August 5, 2023 (effective from August 7, 2023). Accordingly, it has been decided to designate Lead Banks of the new districts as below:

Formation of new districts in the State of Assam - Assignment of Lead Bank Responsibility. The Government of Assam vide Gazette Notifications dated January 25, 2016, February 26, 2016 and August 5, 2016 had notified the creation of eight new districts in the State of Assam. It has been decided to assign the lead bank responsibility of the new ...

Bank owners have repeatedly accused Voronin of attempting an illegal seizure on their assets. In addition, Dorofeev knows Voronin well. In late 2000s, they went from St. Petersburg to Moscow together; in the period from 2010 to 2012, they both headed the departments of the FSB Economic Security Service.

Recent usage in crossword puzzles: New York Times - Sept. 29, 1981; New York Times - March 23, 1971

April 20, 2021. Madam/ Dear Sir, Formation of new district in the State of Tamil Nadu -Assignment of Lead Bank Responsibility. The Government of Tamil Nadu vide Gazette Notifications G.O.Ms. No.797 dated December 28, 2020 had notified the formation of a new district in the State of Tamil Nadu. It has been decided to assign the lead bank ...

Hi there! I'm Jenya, Customer Support Team Lead at Manyсhat, a marketing chatbot platform that helps businesses build meaningful communications with their customers on Facebook, Instagram, and WhatsApp.<br><br>I'm responsible for the Management of the team:<br>⚈ Agents' performance evaluation and growth <br>⚈ Hiring and onboarding new team members <br>⚈ Organising work process <br ...

Assignment of Lead Bank Responsibility . As per the Gazette of IndNotification datedia February 22, 2017, the merger of Associate ... The comes into Ordereffect onApril 1, 2017. 2. Therefore, it has been decided to assign the lead bank responsibility of districts hitherto held by the Associate banks toState Bank of India. Accordingly, lead bank ...

On 22 March 2024, a terrorist attack which was carried out by the Islamic State (IS) occurred at the Crocus City Hall music venue in Krasnogorsk, Moscow Oblast, Russia.. The attack began at around 20:00 MSK (), shortly before the Russian band Picnic was scheduled to play a sold-out show at the venue. Four gunmen carried out a mass shooting, as well as slashing attacks on the people gathered at ...

Assignment of Lead Bank Responsibility. The Government of Assam has notified formation of a new district, viz., Hojai in the state of Assam vide Gazette Notification ECF.No.367433/28 dated September 07, 2023. Accordingly, it has been decided to designate the Lead Bank of the new district as below: