Construction Business Plan Template

Written by Dave Lavinsky

Construction Business Plan

You’ve come to the right place to create your construction business plan.

We have helped over 100,000 entrepreneurs and business owners create business plans and many have used them to start or grow their construction companies.

Sample Construction Business Plan Outline

Below is a construction business plan example to help you create each section of your own construction business plan:

Executive Summary

Business overview.

VB Residential Construction Company is a startup construction company located in Milwaukee, Wisconsin. The company is founded by two cousins, Victor Martinez and Ben Schmidt. Together they have over 20 years of experience in constructing homes from design concept, remodeling and renovating homes. They are highly skilled in all aspects of construction and have garnered a positive reputation in the local construction community for their ethical practices and competitive skill set. Now that Victor and Ben have an extensive network of clients and contacts, they have decided to begin their own residential construction company.

Product Offering

The following are the services that VB Residential Construction Company will provide:

- Custom home building/design build

- Home remodeling and renovation

- Project Management

- Kitchen and bath construction

Customer Focus

VB Residential Construction Company will target those individuals and industry professionals requiring home construction services in Milwaukee, Wisconsin. Those individuals are landowners looking to develop homes on their lots, architects who have clients needing homes built, developers who have the vision but need a company to make it a reality, and households needing home remodeling services.

Management Team

VB Residential Construction Company will be led by Victor Martinez and Ben Schmidt. Together they have over twenty years of construction experience, primarily in residential builds, remodeling, and renovation. They both started at a young age working and learning from their fathers. When they graduated from high school, their fathers got them jobs at the construction company they were employed at. The four family members worked together for ten years at the construction company. The fathers recently decided they were going to retire from the industry which prompted Victor and Ben to branch out on their own and start their own residential construction company.

Success Factors

VB Residential Construction Company will be able to achieve success by offering the following competitive advantages:

- Friendly and knowledgeable contractors who are able to take any project from concept to reality.

- Unbeatable pricing – Clients will receive the best pricing in town for services on any project while maintaining the best quality and customer satisfaction.

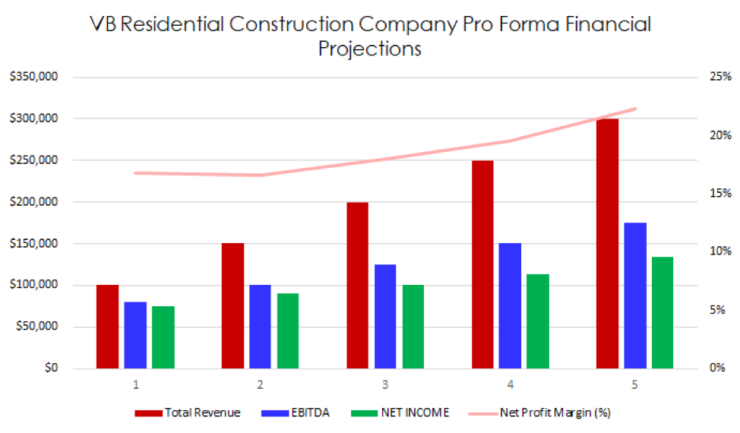

Financial Highlights

VB Residential Construction Company is seeking $200,000 in debt financing to launch its construction business. The funding will be dedicated towards securing a small office space, purchasing two trucks, and purchasing all the construction equipment and supplies. Funding will also be dedicated towards the advertising agency and three months of overhead costs to include payroll of the staff, rent, working capital, and monthly fees to the accounting and human resources firm. The breakout of the funding is below:

- Trucks: $40,000

- Construction equipment, supplies, and materials: $100,000

- Advertising agency in charge of promotions: $10,000

- Three months of overhead expenses (rent, payroll, HR and accounting firms): $40,000

- Working capital: $10,000

Company Overview

Who is vb residential construction company.

VB Residential Construction Company is a newly established contracting company located in Milwaukee, Wisconsin. Founded by cousins, Victor Martinez and Ben Schmidt, they have over 20 years experience in the construction industry. VB specializes in residential remodeling, kitchen and bath construction, as well as custom home building. VB Residential Construction Company also offers residential design, construction, and project management services. VB prides itself in delivering a level of expert craftsmanship to fulfill the vision for the client while exceeding expectations at exceptional value.

Company History

VB comes from the initials of the owners, Victor Martinez and Ben Schmidt, two cousins who have been working in the construction industry most of their lives. Both of their fathers spent decades as contractors and raised their sons working and learning the construction trade. The four have been working for another residential contractor in Milwaukee and have built and remodeled numerous homes for multiple builders and clients. Now that both of their fathers are retiring from the construction industry, Victor and Ben have decided to start their own residential construction company and use their years of experience, expertise, and contacts to be an independent residential contractor.

Since incorporation, VB Residential Construction Company has achieved the following milestones:

- Registered VB Residential Construction Company, LLC to transact business in the state of Wisconsin.

- Located a small office space to have a physical address for the company as well as a receptionist.

- Reached out to their numerous contacts to include real estate agents, developers, architects, and landowners to advise them on their upcoming construction company in order to start getting construction contracts.

- Began pricing out costs for trucks and necessary construction equipment.

- Began recruiting a team of contractors that cover different areas of construction to include mechanical, plumbing, electricians, and roofing.

The following will be the services VB Residential Construction Company will provide:

Industry Analysis

Revenue for the Construction industry is expected to continue growing over the five years as demand for new housing expands. Revenues are expected to reach $107 billion.

Relatively low interest rates, coupled with rising per capita disposable income, is expected to support individual investment in new homes, providing an opportunity for industry revenue growth over the next five years.

Per capita disposable income is expected to rise steadily over the next five years, while concurrently, unemployment will drop, proving favorable conditions for industry growth.

Housing starts are expected to rise an annualized 2.9% and this growth is projected to stem partly from forward-looking consumers that choose to purchase homes while interest rates are low. Relatively low housing stock and relatively low interest rates are expected to lead demand for industry services to increase over the next five years.

Customer Analysis

Demographic profile of target market.

The precise demographics for Milwaukee, Wisconsin are:

| Total | Percent | |

|---|---|---|

| Total population | 590,157 | 100% |

| Male | 284,873 | 48.30% |

| Female | 305,284 | 51.70% |

| Under 5 years | 41,749 | 7.10% |

| 5 to 9 years | 43,509 | 7.40% |

| 10 to 14 years | 41,324 | 7.00% |

| 15 to 19 years | 43,301 | 7.30% |

| 20 to 24 years | 48,119 | 8.20% |

| 25 to 34 years | 106,407 | 18.00% |

| 35 to 44 years | 73,788 | 12.50% |

| 45 to 54 years | 64,669 | 11.00% |

| 55 to 59 years | 35,109 | 5.90% |

| 60 to 64 years | 27,995 | 4.70% |

| 65 to 74 years | 39,539 | 6.70% |

| 75 to 84 years | 17,394 | 2.90% |

| 85 years and over | 7,254 | 1.20% |

| Total housing units | 260,024 | 100% |

| Households | Families | Married Couples | Nonfamily Households | |

|---|---|---|---|---|

| Total | 7,510 | 5,081 | 4,210 | 2,429 |

| Income Breakdown | ||||

| Less than $10,000 | 8.6% | 6.1% | 3.8% | 15.0% |

| $10,000 to $14,999 | 6.2% | 1.7% | 1.4% | 14.9% |

| $15,000 to $24,999 | 12.6% | 8.5% | 7.6% | 21.9% |

| $25,000 to $34,999 | 13.9% | 11.8% | 10.6% | 18.8% |

| $35,000 to $49,999 | 14.5% | 15.6% | 15.1% | 12.0% |

| $50,000 to $74,999 | 21.2% | 26.1% | 26.8% | 11.1% |

| $75,000 to $99,999 | 9.9% | 12.0% | 14.0% | 4.1% |

| $100,000 to $149,999 | 8.9% | 12.3% | 13.7% | 1.5% |

| $150,000 to $199,999 | 2.6% | 3.9% | 4.4% | 0.0% |

| $200,000 or more | 1.6% | 2.1% | 2.5% | 0.7% |

Customer Segmentation

VB Residential Construction Company will primarily target the following customer profiles:

- Households in search of home remodeling services

- Landowners who would like to build homes on their lots

- Architects who have clients that need home building or remodeling services

- Developers who have already partnered with landowners and/or architects and are in search of a residential contractor

Competitive Analysis

Direct and indirect competitors.

VB Residential Construction Company will face competition from other companies with similar business profiles. A description of each competitor company is below.

JM Remodeling

JM Remodeling has been in business in Milwaukee, Wisconsin since 1990. They are a full-service design and build company. JM Remodeling specializes in residential and commercial restoration and renovation including custom carpentry, kitchens, bathrooms, roofing, siding, dormers, additions, home gyms, home offices, porches and decks, and mechanical services. JM Remodeling carries a staff of plumbers, electricians, journeymen carpenters, restoration specialists, roofers, siders, sheet metal workers, and expert estimators. JM Remodeling also has an apprenticeship program to train employees within the company. They are licensed, bonded and insured and also part of the National Association of Remodeling Industry (NARI). JM Remodeling also provides warranties on all their services. The work is guaranteed by labor warranties, factory warranties, and extended warranties.

Cream City Construction

Cream City Construction has more than 50 years experience in home design, remodeling and renovation in the Greater Milwaukee area and Southeastern Wisconsin. The home remodeling services they provide are additions, whole house remodeling, kitchens, bathrooms, lower levels, master suites and historic renovations. Cream City Construction is a design build company that works with the client to create the design plans, generate project costs, and build the project.

Cream City Construction is owned and managed by Todd Badovski and Jim Grote. Together they have decades of experience and have spent years refining the skills required to run a high end, quality driven remodeling company. The majority of their projects come from repeat business or referrals from clients delighted with their previous service. Cream City Construction is also a member of the National Association of Remodeling Industry (NARI) as well as the Historic Milwaukee Incorporated.

Sazama Design Build Remodel, LLC

Former restaurant owner Don Sazama established Sazama Design Build Remodel, LLC in 1987 after becoming a Master Carpenter. He wanted to merge his passions of business and design and expand his skills in carpentry and architecture. Don’s firm has completed over 700 homes and won 11 awards from the Milwaukee Home and Living magazine. Sazama Design Build Remodel builds homes that are modern and luxurious and have completed many large remodels of bathroom and kitchen renovations. Sazama likes to collaborate with firms such as Ivy Interiors and an award-winning landscape designer, Gingko Leaf Studio. Sazama Design Build Remodel can build and design all aspects of a home – from a home office, outdoor entertaining area, serene spas, and inviting kitchens. The team at Sazama is able to do a historic renovation, build or renovate into something modern and posh, or keep it traditional.

Competitive Advantage

VB Residential Construction Company will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

VB Residential Construction Company will offer the unique value proposition to its clientele:

- Highly trusted and professional contractors with over 20 years of experience remodeling, renovating, and building homes.

- Unbeatable pricing to its clients – VB Residential Construction Company does not mark up its services at a large percentage. They will offer the lowest prices in town.

Promotions Strategy

The promotions strategy for VB Residential Construction Company is as follows:

Word of Mouth/Referrals

Victor and Ben have built up an extensive list of contacts over the years providing home construction services for numerous highly satisfied clients. Most of the clients are repeat customers and have also referred them to other associates for home projects. These referrals and repeat customers are very likely to use VB Residential Construction Company instead of the previous construction company Victor and Ben were employed at.

Professional Associations and Networking

VB Residential Construction Company will become a member of construction and professional associations such as the National Association of Remodeling Industry (NARI) and the Milwaukee Chamber of Commerce. VB will also become a member in associations where other builders, developers, and architects are a part of. They will focus their networking efforts on expanding their client network.

Print Advertising/Billboard

VB Residential Construction Company will invest in professionally designed print ads to display in programs or flyers at industry networking events. They will also invest in two billboards to display in highly trafficked areas of town.

Website/SEO Marketing

VB Residential Construction Company will utilize the same advertising company that designed their print ads and billboards to also design their website. The website will be well organized, informative, and list all their services that VB is able to provide. The website will also list their contact information and a gallery of pictures that show their previous projects. The advertising company will also manage VB’s website presence with SEO marketing tactics so that anytime someone types in the Google or Bing search engine “Milwaukee residential contractor”, “contractor near me”, or “residential contractor near me”, VB Residential Construction Company will be listed at the top of the search results.

The pricing of VB Residential Construction Company will be moderate and on par with competitors so customers feel they receive value when purchasing their services.

Operations Plan

The following will be the operations plan for VB Residential Construction Company.

Operation Functions:

- Victor Martinez and Ben Schmidt will be the owners and managers of the company. They will oversee all staff, contractors, and subcontractors. They will also act as project managers for every job they receive and handle all pricing and bids to the client.

- Victor and Ben will employ a team of contractors under them that will have an array of skill sets. The contractors will be trained and experienced either in plumbing, mechanical, electrical, roofing, or siding. Not all contractors need to be certified in all trades, but they need to be certified in at least one of the trades.

- Office manager/assistant to be located at the small office. This person will handle all incoming calls, assist with visiting clients, bookkeeping and maintain files.

- Victor and Ben will utilize a third-party human resources company to handle all hiring, onboarding, payroll, and benefits for the staff. The HR company will also handle all employee issues.

- Victor and Ben will also pay a third-party accounting firm to manage all the high level accounting and tax payments.

Milestones:

VB Residential Construction Company will have the following milestones complete in the next six months.

3/1/202X – Finalize contract to lease small office space

3/15/202X – Execute advertising agency contract 4/1/202X – Begin networking and placing bids for construction jobs

5/1/202X – Begin recruiting and hiring team of contractors

5/15/202X – Purchase all necessary construction equipment, supplies, and trucks

6/1/202X – Start on first official job as VB Residential Construction Company

Victor and Ben are highly skilled at project management and residential construction. They are also both certified in plumbing, electrical, and mechanical. In the next few years, they will be certified as Master Carpenters.

Financial Plan

Key revenue & costs.

The revenue drivers for VB Residential Construction Company are the upcharge they will charge to the clients for their services. VB will purchase or subcontract a service at cost and will charge a 15% markup in order to obtain the markup fee. 15% is below the normal 25%-30% that other competing residential contractors charge.

The cost drivers will be the overhead costs required in order to maintain a construction company. The expenses will be the costs to purchase and maintain construction equipment and trucks, payroll and overhead costs for the staff, and rent and utilities. Other expenses will be the cost for the advertising agency, accounting firm, human resources firm, and membership association fees.

Funding Requirements and Use of Funds

VB Residential Construction Company is seeking $200,000 in debt financing to launch its construction business. The funding will be dedicated towards securing a small office space, purchasing two trucks, and purchasing all the construction equipment and supplies. Funding will also be dedicated towards the advertising agency and three months of overhead costs to include payroll of the staff, rent, and monthly fees to the accounting and human resources firm. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Initial Monthly Average Contract Amount: $20,000

- Growth in Average Monthly Contracts: 10%

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Construction Business Plan FAQs

What is a construction business plan.

A construction business plan is a plan to start and/or grow your construction business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your construction business plan using our Construction Business Plan Template here .

What Are the Main Types of Construction Companies?

Construction companies can be classified according to the type of constructions that they perform. Some are small renovation contractors, others are new home builders and others are commercial construction companies.

What Are the Main Sources of Revenues and Expenses for a Construction Company?

Construction companies get their primary source of revenue from individual contracts for new homes, remodeling projects or commercial projects.

The key expenses for construction companies are office space rent, salaries and wages, and equipment costs.

How Do You Get Funding for Your Construction Business Plan?

There are many options for financing a construction company like SBA loans, commercial loans, personal loans, or line of credit. There are also equipment funding opportunities that cover expenses associated with necessary tools, machinery and other equipment. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Construction Business?

Starting a construction business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Construction Business Plan - The first step in starting a business is to create a detailed construction business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your construction business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your construction business is in compliance with local laws.

3. Register Your Construction Business - Once you have chosen a legal structure, the next step is to register your construction business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your construction business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Construction Equipment & Supplies - In order to start your construction business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your construction business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful construction business:

- How to Start a Construction Business

Where Can I Get a Construction Business Plan PDF?

You can download our free construction business plan template PDF here . This is a sample construction business plan template you can use in PDF format.

Other Business Plan Templates

Food Truck Business Plan Template

Event Venue Business Plan Template

- Business plans

Construction Company Business Plan

Used 4,997 times

The objectives and tactics of a construction company are described in a business plan for a construction company. For the creation of your business plan, use this Construction Company Business Plan Template.

e-Sign with PandaDoc

Created by:

[Sender.FirstName] [Sender.LastName]

[Sender.Company]

INTRODUCTION

This business plan is for a construction company that will offer a wide range of services to residential, commercial, and industrial clients. The company will be owned and operated by [Sender.FirstName] [Sender.LastName] , who has (insert number) years of experience in the construction industry.

COMPANY DESCRIPTION

[Sender.Company] will be located in [Sender.City] , [Sender.State] and will serve the surrounding area. The company will be registered as a(n) (LLC/Corporation) and will have (insert number) employees at the start, including the owner. The company will offer a range of services, including new construction, renovations, and repairs for residential, commercial, and industrial clients. The company will also offer project management and design services.

MARKET ANALYSIS

The construction industry is expected to grow at a rate of (percentage) over the next five years. The demand for construction services is driven by population growth, economic development, and the need to update and improve existing buildings. [Sender.Company] will target residential, commercial, and industrial clients in the [Sender.City] area, focusing on high-quality workmanship and customer satisfaction.

MARKETING STRATEGY

[Sender.Company] will use a combination of traditional and digital marketing techniques to reach potential clients. This will include advertising in local newspapers and industry publications, as well as utilizing social media platforms and email marketing to promote services and specials. The company will also rely on word-of-mouth referrals from satisfied customers.

[Sender.Company] will have a team of skilled contractors and tradespeople who will be responsible for completing projects promptly and professionally. The company will have a project manager who will oversee all projects and ensure that they are completed to the highest standards. The company will maintain a well-stocked warehouse with a variety of construction materials and equipment to ensure that projects can be completed efficiently.

FINANCIAL PLAN

[Sender.Company] will generate revenue through the sale of construction services to residential, commercial, and industrial clients. The company will also generate revenue through the sale of construction materials and equipment. The company will have operating expenses, including payroll, rent, utilities, and insurance. The company expects to generate (Amount) in revenue in the first year, with a projected growth rate of (Percentage) per year.

[Sender.Company] is well-positioned to take advantage of the growing demand for construction services in the [Sender.City] area. With a team of experienced contractors, a focus on high-quality workmanship, and a commitment to customer satisfaction, the company is confident that it will be successful in the competitive construction market.

[Client.FirstName] [Client.LastName]

Care to rate this template?

Your rating will help others.

Thanks for your rate!

Useful resources

- Featured Templates

- Sales Proposals

- NDA Agreements

- Operating Agreements

- Service Agreements

- Sales Documents

- Marketing Proposals

- Rental and Lease Agreements

- Quote Templates

- Business Proposals

- Agreement Templates

- Purchase Agreements

- Contract Templates

BUSINESS STRATEGIES

How to create a construction business plan

- Jeremy Greenbaum

- Sep 7, 2023

When it comes to starting a construction business, a strong foundation is everything. Just like laying the groundwork for a sturdy building, creating a business plan acts as the bedrock for your business's future success.

A construction business plan is a document that outlines the goals, objectives, strategies and operational details for a construction company. It serves as a roadmap to guide you and your stakeholders through the process of starting a business in the construction industry.

By systematically detailing the elements of your business, a construction business plan provides a clear and organized framework for achieving success in the competitive construction market.

Need a way to get your construction business online? How to make a website with Wix’s website builder .

Crafting a thorough construction business plan is crucial for establishing a clear path and securing the success of your venture. Here are the six key components of a construction business plan:

Executive summary

Business name and domain name

Market analysis and research

Operations plan, marketing and advertising plan, financial plan, 01. executive summary.

The executive summary is a concise overview of your entire construction business plan. It provides readers with a snapshot of your company's goals, strategies, market positioning and financial projections. While placed at the beginning of the plan, it's often written after the rest of the plan has been developed. A clear executive summary should capture the essence of your construction business and pique the reader's interest, encouraging them to delve deeper into the plan.

Example of an executive summary for a construction business: "Construction Innovators Inc. is a forward-thinking construction company specializing in sustainable building solutions. With a commitment to quality, innovation and customer satisfaction, we aim to revolutionize the construction landscape. Our expertise ranges from residential developments to commercial spaces, offering eco-friendly designs that meet modern demands. By leveraging cutting-edge technology and a skilled workforce, we're positioned to drive industry advancements while achieving substantial growth. Through strategic partnerships and a customer-centric approach, Construction Innovators Inc. is poised to create a lasting impact in the construction sector."

02. Business name and domain name

Selecting the right business name is crucial for establishing a strong brand identity in the construction industry. A memorable and relevant name can build trust and recognition. Similarly, choosing an appropriate domain name for your business website is essential for online visibility. To generate name ideas, consider using business name generators , incorporating industry-related terms or creative words that reflect your company's values.

Be inspired: Construction business name ideas , Contractor business name ideas

When choosing a domain name , ensure it's easy to spell, memorable and closely related to your company name. Check for its availability and avoid using hyphens or complicated spellings. A well-chosen domain name contributes to your online credibility and enhances discoverability.

Once you’ve landed on a name, take the proper steps to register your business .

03. Market analysis and research

Incorporating a market analysis within your construction business plan is pivotal to understanding your target market, competitors and industry trends. Comprehensive market research helps identify gaps in the market, customer preferences and potential challenges. This knowledge forms the foundation of a robust business strategy that positions your construction company effectively.

04. Operations plan

The operations plan outlines the practical aspects of running your construction business. This section details the physical location, facilities, equipment and staffing requirements. For instance, specifying the type of projects you'll undertake, the scale of operations and the necessary tools and machinery highlights the resources needed to deliver quality services.

05. Marketing and advertising plan

A well-defined marketing and advertising plan is essential for promoting your construction business. Consider strategies like digital marketing, social media engagement, content marketing and attending industry events to showcase your expertise. Tailor your campaigns to showcase your projects, expertise and commitment to customer satisfaction. Building a positive online reputation and leveraging word-of-mouth referrals are key components of marketing a construction business.

Remember that no matter how you choose to promote your business, you’ll want to maintain a consistent brand image. Think about what steps you need to take to build up your visual identity; check out these construction logo ideas and try a logo maker to make your construction logo and construction slogan .

06. Financial plan

The financial plan outlines the monetary aspects of your construction business. It includes details about how you plan on raising money for your business , projected revenues, expenses and profitability timelines. Make sure to define how your construction company will be initially funded, whether through personal investment, loans or investors. Accurate financial projections demonstrate your understanding of the industry and reassure stakeholders about the viability of your business.

A well-structured construction business plan like the one detailed above will provide you with a comprehensive roadmap for launching and growing your construction business successfully. Each section is necessary and contributes to your holistic understanding of your business's vision, strategies and potential for success.

Construction business plan examples: InnovativeBuild Solutions Inc.

InnovativeBuild Solutions Inc. is a dynamic construction company poised to transform the industry through cutting-edge technologies and sustainable practices. Our mission is to redefine construction by delivering innovative, eco-friendly solutions that meet modern demands. With a team of seasoned professionals and a commitment to excellence, we're confident in our ability to leave a lasting mark on the construction landscape. From residential projects to commercial spaces, InnovativeBuild Solutions Inc. is dedicated to shaping a more sustainable future.

Company name and domain name

Company name: InnovativeBuild Solutions Inc.

Domain name: www.innovativebuildsolutions.com

Market analysis: Through thorough research, we've identified a growing demand for environmentally-conscious construction solutions. Our target market includes forward-thinking homeowners, businesses seeking sustainable spaces and local governments promoting eco-friendly infrastructure.

Competitive analysis: We've assessed key competitors in our region, analyzing their strengths and weaknesses. This research allows us to identify gaps in the market and opportunities to differentiate ourselves.

Location: InnovativeBuild Solutions Inc. will be headquartered in a strategic urban location that offers easy access to construction sites and client meetings.

Premises: Our office space will be designed with sustainability in mind, incorporating energy-efficient features and eco-friendly materials.

Equipment: We'll invest in state-of-the-art construction equipment to ensure efficient project execution and maintain high standards of quality.

Staffing: Our team will consist of experienced architects, engineers, project managers and skilled laborers who share our passion for innovation and sustainability.

Digital marketing: We'll leverage digital platforms to showcase our projects, share industry insights and engage with our target audience. Social media, content marketing and email campaigns will be integral to our strategy.

Networking: Participating in industry events and local networking opportunities will help us establish connections and build relationships within the construction community.

Project showcase: Our website will feature a portfolio of completed projects, highlighting our expertise and the value we bring to clients.

Initial funding: We will secure a combination of personal investments and a small business loan to cover startup expenses, equipment purchase and initial project costs.

Projected revenues:

Year 1: $800,000

Year 2: $1,200,000

Year 3: $1,800,000

Expenses: Operating expenses, employee salaries, material costs and marketing investments have been carefully estimated based on industry standards.

Profitability: We aim to achieve profitability by the end of Year 2, driven by increased project volume and strong client relationships.

Benefits of creating a construction business plan

Creating a comprehensive and clear construction business plan is of paramount importance when starting a business. This plan acts as a foundation upon which all activities and decisions are built, fostering a focused and well-structured approach. It offers several key benefits:

Clear vision: A well-defined business plan will help you clarify your vision for your company. It outlines the company's mission, goals and values, providing a cohesive and unified direction for the entire team.

Strategic decision-making: The plan serves as a strategic tool that assists in making informed decisions. It allows you to anticipate challenges, assess risks and identify opportunities within the construction industry.

Resource allocation: A comprehensive plan provides insights into the required resources, both financial and human. This helps in budgeting, estimating costs and allocating resources efficiently.

Target market: Through market research and analysis, the plan outlines the ideal target market and customers. This understanding enables tailored marketing efforts, leading to better customer acquisition.

Competitive edge: A thorough analysis of competitors and the market landscape allows you to identify gaps and opportunities that can be exploited for a competitive advantage.

Funding: When seeking funding from investors or lenders, a well-structured business plan demonstrates the viability and profitability of the construction business. It instills confidence and attracts potential financial support.

Long-term growth: By outlining strategies for business growth, the plan provides a roadmap for expansion, diversification and adapting to evolving industry trends.

Regardless of what type of business you’re starting, it’s essential to incorporate a business website into your plan. A website acts as a virtual storefront, showcasing your company's portfolio, services and testimonials. It enhances brand credibility and accessibility, allowing potential clients to learn about your business and contact you easily.

Learn more: How to make a construction website

Got your eye on another business type?

How to start an online business

How to start a consulting business

How to start a fitness business

How to start a fitness clothing line

How to start a makeup line

How to start a candle business

How to start a clothing business

How to start an online boutique

How to start a T-shirt business

How to start a jewelry business

How to start a subscription box business

How to start a beauty business

How to start a landscaping business

How to start a food business

How to start a vending machine business

How to start a coaching business

How to start a gym business

How to start a trucking business

How to start a flower business

How to start a car wash business

How to start a food prep business

How to start a DJ business

How to start a pool cleaning business

How to start a baking business

How to start an eCommerce business

How to start a dropshipping business

How to start a farming business

How to start a plumbing business

How to start a rental property business

Looking to start a business in a specific state?

How to start a business in Arizona

How to start a business in South Carolina

How to start a business in Virginia

How to start a business in Michigan

How to start a business in California

How to start a business in Florida

How to start a business in Texas

How to start a business in Wisconsin

Want to create another type of business plan?

How to create a real estate business plan

How to create a flower business plan

How to create an eCommerce business plan

How to create a medical supply business plan

How to create a car wash business plan

How to create a contractor business plan

How to create a DJ business plan

How to create a dog walking business plan

How to create a clothing line business plan

How to create a painting business plan

How to create a plumbing business plan

How to create a rental property business plan

How to create a bar business plan

How to create a photographer business plan

How to create a cleaning business plan

How to create a restaurant business plan

How to create a coffee shop business plan

Related Posts

How to create a cleaning business plan (+ example)

How to create a catering business plan

Was this article helpful?

- Get Started

Home >> #realtalk Blog >> Manage a business >> The Ins and Outs of …

The Ins and Outs of Writing a Construction Business Plan (Free Template)

By Homebase Team

A strong foundation is essential for a construction job—and starting a construction business. And how do you do that? By setting up your business for success with a solid construction business plan.

Read on to learn about why you need a construction business plan, how to create one in six easy steps, and a free template to get you started.

What’s a business plan for a construction company?

A business plan is a document that outlines a company’s business activities, goals, and how its activities will help achieve its objectives. It documents a business’s market research, financial projections, mission statement, and offerings.

Every construction business can benefit from a business plan, whether you’re established or just starting. A construction business plan can help you secure funding, document your business model, forecast future business demands, and function as a guiding light for you and your team.

The benefits of having a construction business plan

Most businesses start with a business plan—it’s a natural way to get your thoughts onto paper and organize them into actionable steps. Business plans can take a lot of time, but when done right, your business plan can function as your manual to move your business forward.

If you’re still unsure whether your construction business needs a business plan, these four benefits might help you decide.

Apply for funding

You’ll need a business plan if you’re looking for a business loan or planning to apply for business grants. Most financial lenders won’t even consider giving you a business loan without a well-thought-out business plan. A business plan is a way for lenders to gauge the risk level they’re taking if they lend your business money.

Your business plan should show lenders how to use their money and how to pay it back. It also allows you to build confidence in your ability to run a business from an organizational standpoint.

Attract top talent

Hiring the right people is important for any business, but it can make or break a construction business. Giving potential hires a complete understanding of your vision for your construction company can be the difference between finding the right employees versus the right now employees.

Creating a business plan will give you a clear vision for your company that you’ll easily be able to communicate to any potential hires.

Understand your competition

Industry and competitor research and analysis are a big part of creating a business plan. You might start your business plan thinking you know exactly what makes you stand out, but then again, you might not. Researching who your competitors are and what they do helps you solidify how your business can be differentiated from your peers.

Finding what’s unique to your business is a huge factor in outbooking other local construction businesses.

Gives you clarity

Trying to get your business off the ground can feel like you get lost in the weeds of it all. Creating a business plan can help you clarify key elements of your company. A business plan gives you the big picture and lets you identify the priorities and milestones you need to focus on for your business.

How to write a business plan for a construction company

Writing a business plan for your construction company is essential in building your business. Whether you’re looking for funding or you’re looking for clarity, a business plan can help set you on the right path. Here are six key components of a successful construction business plan.

1. Executive summary

An executive summary is an overview of your construction business plan. Think of it as the CliffsNotes version of your business plan—it gives readers the basics of your business’s goals, financial projections, strategies, and more. This should be the first section of your business plan, but it’s usually the last thing you write because your plan informs it.

An excellent executive summary reflects your construction business and should excite the reader about your company and its potential.

2. Company description

The company overview and description section is the second section in your construction business plan. This section outlines vital details about your company, like your location, the size of the business, what you do, and what you hope to do in the future.

When writing your company description, try to include the following information:

- The official company name

- Type of business structure (sole proprietorship, LLC, corporation, etc.)

- Names of the owners/management team

- The business location

- A company history that outlines when the business started, why you created it, and what it does

- Mission and vision statements

3. Market analysis

A robust market analysis gives you the foundation to create a strong construction business plan with the best chance at success. Market research is the best way to test whether your business will succeed. It can help you mitigate risks, give insights into customer preferences, and even help you decide on location and pricing.

There are two main types of market research: primary and secondary. Primary research is gathered directly from consumers—think surveys, interviews, and focus groups you administer. Secondary research is compiled from external sources—think government census data, polling results, and research conducted by third parties.

Both primary and secondary are great on their own; together, they’ll give you a fuller picture.

4. Operations plan

There are a lot of moving parts that go into running a construction business. The operations plan lets you lay out all those parts and explain how you’ll run your company. This includes everything from your physical location, facilities, staffing needs, and equipment you’ll require. You can outline the types of projects your construction business will undertake, how many projects you’ll take on at once, and what resources you’ll need to deliver quality service at that scale.

5. Marketing and advertising strategies

Use the marketing and advertising strategies section of your construction business plan to highlight how you plan to promote your business. This section can outline all of the strategies you plan to use and can include a rough budget of what you plan to spend on marketing and advertising. Consider social media , digital marketing, content marketing, SEO, and local marketing strategies.

6. Financial projections

The financial projections section includes details about how you’re funding your business, projected revenues and expenses, and profitability projections. Accurate financial projections give potential lenders and investors confidence in your understanding of the industry and the viability of your business.

Quick tips for writing a construction business plan

Now that you’ve got everything needed to start writing your business plan, here are five quick tips to help your writing process. These are big-picture ideas that you can use to get the most out of your construction business plan:

- Get to the point: Use clear, concise language to get your point across. Skip the jargon and ensure someone outside the construction industry understands what you write.

- Use data when you can: It’s great to have supporting data points to back you up when you’re talking about the industry and market.

- Write for your audience: Who are you writing for? Investors? Employees? Shareholders? Lenders? When you clearly define your audience, you can write in a way that resonates.

- Research, and then research some more: What you have to say about your industry is important, but having facts backed by research is even more powerful and convincing.

- Use it: Don’t let your business plan just be another PDF collecting metaphorical dust on your desktop. Use it to inform your decisions and guide you and your team through the years. And update it when needed!

Free construction business plan template

Ready to get started on your construction business plan? Our free construction business plan template can help you write a business plan with all the elements needed for success.

Download your free construction business plan template now

Build a better business with the right tools

If you know one thing, it’s that the quality of your tools can make or break a project. The same is true for the tools you use in your business.

With Homebase , you get everything you need to take control of your construction business . Built for teams like yours, Homebase helps you schedule your team , track their hours , and run payroll even if you’re all on different job sites.

Homebase is the all-in-one management app that simplifies running your construction business. Get started for free .

Construction business plan FAQs

Why should you create a business plan for your construction company even if you aren’t looking for financing.

You should create a business plan for your construction company even if you aren’t looking for financing, because it can help you understand your business and competitors and give potential hires confidence in your business.

What’s the best way to create your construction business plan?

The best way to create a construction business plan is to use a business plan template. You can download your free construction business plan template above.

Remember: This is not legal advice. If you have questions about your particular situation, please consult a lawyer, CPA, or other appropriate professional advisor or agency.

Related posts

June 26, 2024

How to Start a Construction Business in 8 Easy Steps

Being able to build something from the ground up is an incredible skill: a skill you can monetize into your…

Subscribe to our newsletter

Looking for ways to stay up to date on employment laws and small business news?

Homebase makes managing hourly work easier for over 100,000 local businesses. With free employee scheduling , time tracking , and team communication , managers and employees can spend less time on paperwork and more time on growing their business.

- Hiring & onboarding

- Team communication

- Employee happiness

- HR & compliance

- Integrations

- Food & beverage

- Beauty & wellness

- Medical & veterinary

- Home & repair

- Hospitality & leisure

- Education & caregiving

- Contact sales

- Become a Partner

- Careers – We’re hiring!

- #realtalk Blog

How To Write a Winning Construction Company Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for construction company businesses who want to improve their strategy or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the key elements that every construction company business owner should include in their business plan.

Download the Ultimate Construction Business Plan Template

What is a construction company business plan.

A construction company business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will succeed, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Construction Company Business Plan?

A construction company business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Construction Company Business Plan

The following are the key components of a successful construction company business plan:

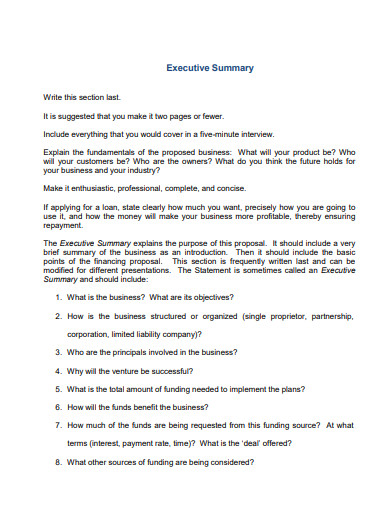

Executive Summary

The executive summary of a construction company business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your construction company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your construction business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your construction firm, mention this.

You will also include information about your chosen construction company business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of a construction company business plan. Conduct thorough market research to determine industry trends and document the size of your market. Questions to answer include:

- What part of the construction industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, a construction company business’ customers may include:

- Businesses (e.g., office complexes, restaurants, retail stores)

- General contractors

- Other construction companies

As you conduct your customer analysis, keep in mind that your target customers may not be aware of your company or product right away. You will need to have a marketing strategy to reach them and get them interested.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or construction company services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or you may promote your construction company business via word-of-mouth.

Operations Plan

This part of your construction company business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present. Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a construction company business include reaching $X in sales. Other examples include hiring a certain number of employees, signing up a certain number of customers, or completing a certain number of projects.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific construction industry. Include brief biography sketches for each team member. Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix). This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Construction Company

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Construction Company

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup construction business.

Sample Cash Flow Statement for a Startup Construction Company

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

Finish with an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your construction company. It not only outlines your business vision but also provides a step-by-step process of how you will accomplish it.

A well-written business plan is an essential tool for any construction company. The tips we’ve provided in this article should help you write a winning business plan for your construction company.

Finish Your Construction Business Plan in 1 Day!

Other helpful articles.

Best Marketing Strategies & How To Write a General Contractor Marketing Plan + Template

How To Write a Winning Apartment Construction Business Plan + Template

How To Write a Winning Concrete Construction Business Plan + Template

Construction Bidding: How to Create Winning Bids & Proposal + Template

How To Write a Winning Electrical Construction Business Plan + Template

How To Write a Winning Civil Engineer Business Plan + Template

Construction Contracts Agreements You Need + Template

How To Write a Winning General Contractor Business Plan + Template

How To Write a Winning Home Builder Business Plan + Template

How To Write a Winning Landscape Construction Business Plan + Template

How to Write a Winning Residential Construction Business Plan + Template

How to Write a Winning Road Construction Business Plan + Template

- Sample Business Plans

- Construction, Architecture & Engineering

Construction Company Business Plan

Growing a construction company is much more difficult and taxing than completing projects.

From acquiring a new project to meeting deadlines, managing the budget, and many more things in between- you will find yourself drowning in responsibilities when you start a construction company.

A construction business plan can come to your rescue in such burdensome situations. If prepared well, it can become a reference point for your company as it continues to grow.

Confused about how to write a business plan?

Well, this article will serve you perfectly. It will help you understand the contents of the business plan and offer a sample template for your construction company.

So let’s build a solid construction company business plan with this detailed guide.

Let’s dive right in.

Why do you need a construction company business plan?

Apart from the fact that investors and banks would ask for a business plan when you seek funding, here are a few more reasons you need a business plan.

- A business plan offers a roadmap to your business. It acts as a guiding block that has answers to all your how, when, where, and what.

- It helps in determining the exact target market for your business and formulating strategies to cater accordingly.

- There are millions of construction companies competing in the industry. You can identify your strengths through a business plan and design a competitive edge to stand apart.

- A well-rounded plan prepares you for emergencies that may arise in your business by making a plan for every situation.

- A whole lot of business processes repeat every day. A business plan helps bring consistency by establishing SOPs for various business activities.

And of course, you get your desired funding with a solid business plan that vouches for the potential of your construction company.

Key components of a construction business plan

Writing a business plan gets much easier with a structurally defined flow. Well, let’s have a look at key components that a construction company business plan must have.

Executive Summary: A brief summary of an entire business plan that will encourage the readers to read further.

Company Overview: A brief company description including every detail from company structure to its mission statement and future goals.

Market Analysis: A thorough analysis of the construction industry and your target market. It also includes sections for competitor analysis, future market trends, and scope of growth.

Construction Services: Outline the construction services that your company will offer. Highlight any additional services that will make you a distinct player.

Marketing and Sales Strategy: It includes a strategic plan to achieve success through marketing and sales. Determine the best course of action for your business.

Management Team: Introduce key personnel in managerial and leadership roles. Discuss their roles, qualifications, experience, and expertise.

Operations Plan: A detailed plan that streamlines the everyday operations right from construction methods to hiring employees.

Financial Plan: A financial plan highlights the prominent figures and key reports of your construction company by making necessary financial projections.

Let’s dive further into these topics and get a detailed understanding of writing your business plan.

How to create a construction company business plan?

A poorly written plan serves no purpose. However, with this step-by-step guide on writing construction company business plan, you will uncover every detail that goes into making a fantastic and purpose-serving business plan.

1. Write an executive summary

The executive summary is a concise yet insightful description of your entire business plan.

This one-page document summarizes the most important questions that a reader might have and offers a peek into what they are about to uncover. Investors take a brief glance at your executive summary before deciding whether to proceed further or not.

An executive summary must outline the following details of your construction business in persuasive consecutive paragraphs.

- The exact business opportunity

- The target market

- The problem and the solution to it

- Products and services offered by you

- Market size and growth potential

- Financial highlights

- Management team

Maintain a personal storytelling tone while writing this section and encapsulate every minute detail that can make a difference.

But wait, don’t start writing yet. Write your executive summary only after you are done writing an entire plan. This will help you summarize effectively.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Prepare a company overview section

This section of a business plan will focus entirely on the details of your construction company.

From the type of construction company to the construction company’s goals- everything in this section is about your company description.

To begin with, highlight the type of construction business you will start. For instance, a residential construction company, general contracting company, industrial construction company, or specialty trade construction.

Clarify, if this will be a new business or an extension of existing business. If the business is already operating, offer a brief description of the business history.

After that, highlight the business structure of your construction company. Are you going to be a sole trader or start a limited liability company (LLC) or a limited partnership firm? The business structure you choose will decide how the finances and taxes will work in your business.

Now, this section is your chance to weave magical stories around your construction company. Present the mission statement, company’s objectives, and future goals over here.

For instance,

Mission statement : Syncore aims to become a trusted name for sustainable residential construction projects in Arizona by 2028. With our commitment to the highest quality standards, we will penetrate the market with our premium budgeted solutions.

Business goals :

- Onboarding and signing 15 construction projects in a span of 6 months.

- Generating revenue of $2 million by 2025.

Like this, you will write this entire section in parts by offering a brief overview of your construction business.

3. Conduct a competitive and market analysis

In this section of a business plan, you begin with industry analysis and then narrow it down to your particular market segment. This is important to show your potential investors that there are promising opportunities in this market.

Using market research practices determine the target market for your construction business. Create a buyer persona to identify what your ideal customer will look like.

Further, highlight your competitors in this competitive construction industry. Using SWOT analysis and PESTEL, determine the strengths and weaknesses of competing construction companies. In this section, you will also highlight your strengths to gain a competitive edge over existing players.

Don’t limit your market study to merely understanding the current scenarios. Extend the research and identify future trends and growth possibilities in your targeted market.

If you are a residential construction company focused on sustainable building practices, you must include the following details in your market analysis section.

- How large is the construction industry?

- What segment of the construction market will you capture?

- Who will avail of the construction services?

- What is the spending capacity of your target customers?

- Who are the top competing construction companies?

- What are the emerging trends in the industry and how will you leverage those?

- What is the growth potential of your target market?

Focus on quality market research as this will form the base of your further projections and strategies.

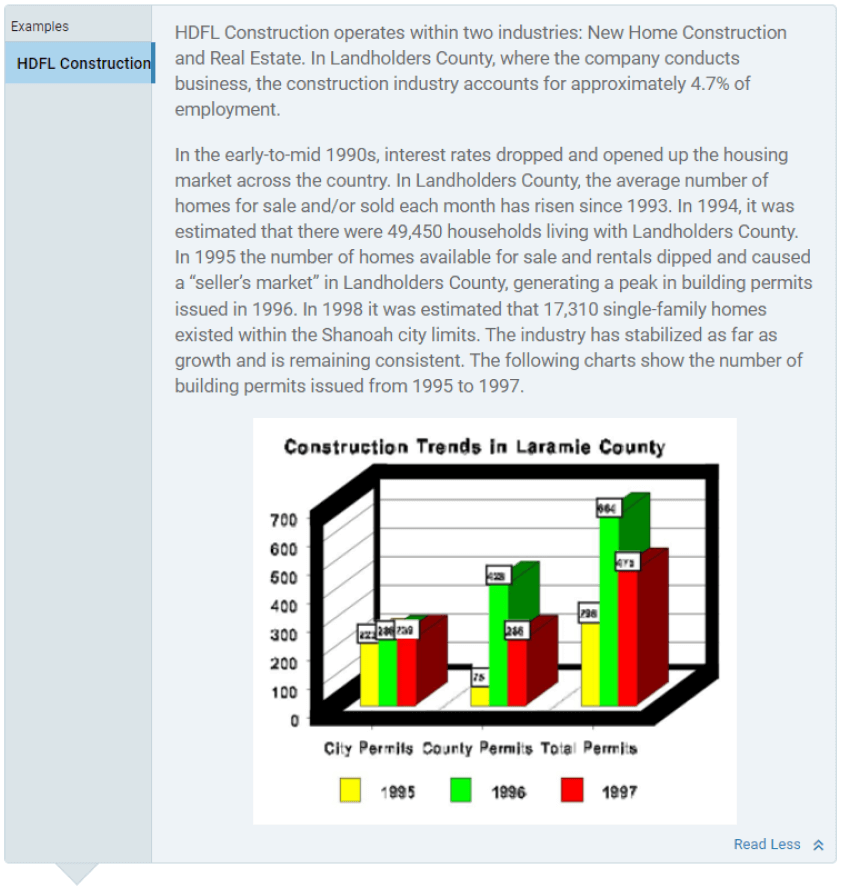

This screenshot of the construction business plan example highlights only the market size for HDFL construction. You can also include details like competitors analysis, growth potential, and market trends here.

4. Describe your construction service offerings

What construction services will you offer your potential clients?

Offer a detailed answer to this question, as you write a business plan section for service offerings.

Overall, this section should highlight every service offering that will bring you money. This could include services like,

- General contracting services

- Design and Engineering

- Construction

- Renovation and remodeling

- Project management

- Specialty services i.e. concrete work, HVAC installation, Roofing services

- Maintenance and repairs