- General SEO

- Keyword Research

- On-Page SEO

- Link Building

- Technical SEO

- Enterprise SEO

- General Marketing

- Content Marketing

- Affiliate Marketing

- Paid Marketing

- Video Marketing

Market Research: What It Is and How to Do It

- Linking websites 193

The number of websites linking to this post.

This post's estimated monthly organic search traffic.

In other words, it’s the process of understanding who your business is targeting so you can better position your marketing strategy.

In this guide, you’ll learn:

- The role of market research in a marketing strategy

- When to conduct market research

Types of market research

- Market research methods and their benefits

- How to conduct market research (example included)

- Market research tools and resources

What is the role of market research in a marketing strategy?

A marketing strategy is a business’s overall game plan for reaching consumers and turning them into customers.

The key word in the above definition is “game plan”. Entering a market with a product is like starting a new game. Since you’re new to the game, you don’t know the rules, and you don’t know who you’re playing against.

This is exactly where market research comes in . Market research allows you to discover the rules of the marketing game by understanding your target audience. Moreover, it allows you to understand who your opponent is by assessing the strengths and weaknesses of your competition.

Research is what marketing pros do to plan their moves, and outperform their competition. It’s also what marketing pros use to identify the strengths and weaknesses of their own marketing strategy .

But is market research the ultimate business oracle? Unfortunately no. Even companies that specialize in market research admit it - here’s a quote from one of them :

(…) it cannot be assumed that market research is an exact science, as it would be unrealistic and unreasonable to expect market researchers to predict the precise demand for a new concept, given that there are numerous variables that can impact demand outside of the market researchers’ remit.

That’s why market research with all of its significance is “only” a part of marketing, and it’s “only” an experiment. It’s up to you whether you will conduct your experiment, and when you will end it.

For example, Crystal Pepsi seemed very promising in the market research phase, yet it failed when released onto the market (a similar thing happened to New Coke). Xerox’s idea for a commercial photocopier was a no-go in the eyes of research analysts; Xerox did it anyway, and the rest is history.

When should you conduct market research?

Paul N. Hauge and Peter Jackson in their book “Do Your Own Market Research” point to three specific situations when market research is really useful:

- Setting goals . Knowing things like the size of the market, or defining your potential customers can help you set your sales goals.

- Problem-solving . Low sales? Low profitability? Market research will help you understand whether your problems are internal, like a low-quality product, or external, like aggressive competition.

- Supporting company growth. Understanding how and why consumers decide on products will help you decide what products to introduce to the market.

Another answer to the “when” is the importance of the decision that you need to make. The more important the marketing issue you’re tackling, the more market research comes in handy.

For example, launching a new car on the market is quite a big event, right? So maybe Ford could have avoided losing 350 million dollars with the Ford Edsel if they had done their research properly. I mean, with the right methods in place it shouldn’t be that hard to predict that consumers will deem the car overpriced and ugly.

That said, market research doesn’t always have to be a large, complex project. The relatively new trend of agile market research allows you to research the market regularly and in a cost-effective way. This is where you employ bite-size, iterative, and evolutionary methods to react to fast-changing circumstances and adapt to unknown market territories.

Furthermore, if you’re working in startup conditions, especially if you’re developing an innovative product, you may be interested in customer development . In this methodology market research is at its “agilest” and it’s tightly woven into the product development process.

Take Ahrefs for example. We stick to agile market research hacks anyone can use. As you will see later in the article, we use simple (but effective!) stuff like social media polls, crowdsourcing, in-house competitive analysis, or just tracking the pricing of our competitors.

Case in point, just recently we asked our fellow marketers on Twitter how they go about researching the market. It seems that market research comes in all shapes and sizes:

Have you ever performed “market research?“ What was it for? — Tim Soulo (@timsoulo) May 3, 2021

Just because somebody does market research in a certain way doesn’t mean that you need to copy that. You should know your options, and they start with the different types of market research.

Primary research

Whenever the research is done by you or on your behalf, and you need to create the data to solve a given problem, that is called primary market research.

Examples: Focus groups, interviews, surveys (more on those later in the article).

Key benefits: It’s specific to your brand and products or services, and you can control the quality of the data.

Secondary research

Whenever you’re using already existing data, such as that put together by other businesses and organizations, you’re doing secondary market research.

Examples: Second-party and third-party sources like articles, whitepapers, reports, industry statistics, already collected internal data.

Key benefits: Get a macro perspective of your marketplace, as secondary research includes other players in the market, and most probably utilizes a bigger set of data than your primary sources.

Primary research vs. secondary research

Primary and secondary market research are different but by no means opposite. It’s actually recommended to use both.

While primary sources will give you a focused, micro perspective of your business, secondary research will tell you how other businesses are doing and how your research findings compare to bigger research sample sizes.

Market research subtypes

A bit more theory for all you marketing geeks out there. Professional market researchers distinguish between the following primary and secondary market research subtypes:

- Qualitative research. Think interviews, open-ended questions, results expressed in words rather than numbers and graphs. This type of research is used to understand underlying reasons, opinions, and motivations.

- Quantitative research. Think surveys, polls, usually closed-ended questions, results expressed in numbers and statistics. This type of research is used to test or confirm hypotheses or assumptions by quantifying defined variables (such as opinions or behaviours) and generalizing results from larger data samples.

Overview of market research methods

Let’s go over some popular market research methods you can use yourself and/or outsource.

Internal data analysis

The data you’ve already collected in your company is an invaluable secondary research data source. The more time you’re in the business, the more data you have on your hands.

The best thing about your internal data is that it’s been put into practice in real-life market conditions, so you just need to find the patterns and draw conclusions.

Here are some internal data sources you can leverage :

- Website data (like Google Analytics)

- Past campaigns performance data

- Internal interviews with employees

Interviews allow for face-to-face discussions and are great for exploratory qualitative research.

In unstructured interviews, you have an informal, free-flowing conversation on a given set of topics.

In structured interviews, you prepare a detailed, rigorous interview protocol where you list every question you want to ask and you can’t divert from them.

You can also choose the “middle way” with semi-structured interviews which revolve around predefined themes or questions, but allow for open-ended discussion.

A word of advice here would be to always remain neutral and unbiased, even during unstructured interviews. Also, it’s helpful to perform a pilot test of the interview to quickly spot some defects of your protocol.

Recording the interview may influence the answers, so use it wisely.

Focus groups

Focus groups are where 5 to 10 people with common characteristics take part in an interactive discussion with a moderator. They’re used to learn how a particular group thinks about a given issue or to provide feedback on a product.

Now, you might know that Steve Jobs famously hated focus groups. He’s on record saying:

It’s really hard to design products by focus groups. A lot of times, people don’t know what they want until you show it to them.

If you’re trying to create a leapfrog product like the iPhone, there’s probably some validity to this statement. But most of us aren’t wrestling with that level of ambition. We just want to know if customers will like a proposed new feature or not. For this, focus groups are super useful.

Surveys involve polling your audience. They’re usually performed online for customer satisfaction and loyalty research, and are one of the most popular and cost-effective market research methods.

Some of the tried and tested use cases of online surveys are:

- Product feature desirability

- User satisfaction feedback

- Quantitative analysis of certain issue occurrences

- Identifying friction points in your customer journey

- Discovering the reasons to convert to or cancel your service

- During product onboarding to create a customer profile (and for marketing automation)

- Opinion about a recently made change

An interesting example of surveying the market is crowdsourcing . That’s what Ahrefs does to understand what features to build, how important they are, and what customers expect from them.

What’s unique about crowdsourcing is that it allows the users to add their own ideas, and upvote or comment on existing ideas rather than answer predetermined questions, so this method leaves less room for marketing myopia. You improve your business, and the users get a better product—everybody wins.

How we crowdsource ideas at Ahrefs

Social media is another great place to survey the marketplace.

How many of you have disavowed links in GSC this year? — Tim Soulo (@timsoulo) October 8, 2020

Market segmentation

Market segmentation is the practice of categorizing a market into homogeneous groups based on specific criteria, also called segmentation variables (like age, sex, company size, country, etc.).

If you think you’re building a product for everyone, think again. Not everyone will want to buy from you.

Smart companies pick their target audience carefully. They pinpoint groups of people or organizations that could be valuable customers for the business. That way they also discover their non-ideal customers and develop a plan to attract customer segments gradually.

Ever wondered why Procter and Gamble creates so many, often competing, brands? You guessed it: market segmentation. P&G simply divides and conquers. Different people have different needs, so they need different products (and possibly brands).

Competitive analysis

Another powerful, yet often overlooked, market research method is the process of understanding one’s market environment. Seriously, if there’s only one thing you could do to learn what works and what doesn’t in your market, you should do a competitive analysis.

“Whenever we discuss building a certain feature, we would definitely research our competitors and see how they do it.” Tim Soulo, CMO

You’d be surprised by how much you can learn about and from your competition and how much of it can be done online. There are certain tried and tested techniques, hacks, and tools for this type of research, and you can find them in this guide .

Analyze commercial data

Secondary market research data is relatively affordable, fast to acquire, and easy to use. Think market reports, industry insights, and a ton of research data someone has already gathered and analyzed so you don’t have to.

The most reputable sources are Gartner , Forrester , and Pew . Apart from those, make sure to check if there is a trustworthy commercial data source specific to your niche.

Sites like G2, Capterra and Trust Pilot also count. Not only do they give you an overview of your industry, but you can also find some real gems in your users’ reviews and your competitors’ reviews as well. Ahrefs uses that data source regularly internally and externally, like for this section of our Ahrefs vs Semrush vs Moz landing page:

Benefits of market research - a comparison

Let’s quickly summarize the above 7 different methods of market research by their key benefits.

How to do market research process in 5 key steps

So now we know what market research is, why and when to do it, and we’ve learned about all of the important types and methods.

Let’s see how we can use that knowledge to conduct any type of market research in 5 steps. As an example of market research, I’ll tell you about some of my past experiences with a 3D printing company.

- Identify the market research problem

- Choose the sample and research method

- Collect the data

- Analyze the data

- Interpret and present conclusions

1. Identify the market research problem

This is where every research project starts. You will also find that market research, in general, follows the pattern of the scientific method . First, you need to establish what exactly you are researching.

Do you have a question about your business you want to answer? Maybe you see an opportunity in the market. Or maybe you’ve observed something curious about your product use and you have a hypothesis that you want to validate? State that in the first step of the market research process.

Let me share an example.

In the past, I ran marketing for a few companies, and one of them was a 3D printer manufacturer. Early on I stumbled upon two problems with that company.

First: one of our market segments was saturated with similar products of similar quality at significantly lower price (classic, right?). Second: more and more 3D printing manufacturers seemed to be drifting away from the hobby segment to tackle the professional segments with more expensive products, yet we remained in the hobby/DIY niche. So we were too expensive for hobbyists but too hobbyist for customers who could afford us.

The hypothesis that I wanted to verify was that if the marketplace was showing a trend towards more professional use cases of 3D printing, our company should follow that trend. In other words, I wanted to check the viability of shifting the brand positioning into the professional/premium sector.

2. Choose the sample and research method

We’ve already covered the main types and methods of market research. You should already have a good idea of the differences between primary and secondary research, or whether qualitative or quantitative methods would best suit your needs.

As for the sample of your research, this refers to the portion of the entire data source in question that you will use. For example, if you want to run a survey among your customers, the sample will refer to the selection of customers you will include in your survey. There are a few options for choosing a sample:

- Use the entire data source . Obviously, it’s not a sample per se. Nevertheless, if sending a survey to all of your customers is doable (and reasonable), this is a perfectly good choice.

- Choose a random sample. Systematic sampling is the easiest way to choose a random sample. This is where you select every x/nth individual for the sample, where x is the population, n is the sample. For example, if you want a sample size of 100 from a population of 1000, select every 1000/100 = 10th member of the population.

- Convenience sampling: choose respondents available and willing to take part in the survey.

- Purposive sampling: choose respondents that in your judgement will be representative or possess some other feature that is important to the research.

- Quota sampling: choose some arbitrary quota of respondents, e.g. 10 non-paying customers, 10 paying small companies and 10 paying large companies.

Back to our example. As a method for verifying my hypotheses, I chose a mix of:

- Surveys sent to all of our resellers. We wanted to see if they also had seen a paradigm shift in the market and what segment of clients they had encountered the most. We also wanted to know their perspective on the longevity of that trend, and whether they potentially be interested in a more premium version of our product.

- In-depth interviews on the phone with our resellers conducted by our sales team. We used purposive sampling here. Our sample comprised resellers with which we had the best relations (we knew they would be more eager to share).

- Competitive analysis. We were mostly interested in market players who tried to penetrate the professional/industrial segment, so this was our sample ( purposive sampling ). We were interested in stuff like: what features were they building into their 3D printers, what was their brand positioning, what was their pricing, what language they used to communicate with their target audience, etc.

- Wohler’s industry report, anything 3D printing from Gartner and the like, reports by 3D printing services providers, and basically any scrape of serious data we could find ( convenience sampling ).

- Internal data: customer satisfaction issues, and just general current customer profile based on Google Analytics and Facebook data.

3. Collect the data

Once you’ve got your problem, method, and sample nailed, all you need to do is to gather the data. This is the step where you send out your surveys, conduct your interviews, or reach out for industry insights.

A word of advice, choose your market research tool carefully; it will greatly influence the amount of work you will have with analyzing the data. For example, Google Forms automatically makes graphs out of quantifiable data (plus it’s free).

Here’s the data we collected for the 3D printing company:

- Reseller survey data (both quantitative and qualitative data).

- Reseller interview data (qualitative data).

- Customer satisfaction issues (qualitative data gathered through all customer support channels, we analysed about 200 issues and requests).

- Competitive analysis data (from about 10 competitors).

- We managed to gather 3 comprehensive, independent industry reports, a few smaller reports made by other 3D printing companies, and dozens of scrapes of data, like statistics and noteworthy insights. We pulled out data like: 3D printer manufacturer market share, market growth in time, market segmentation, key 3D printing applications, 3D printing adoption by region, key players’ sales numbers.

- Any demographic, sociographic and psychographic data on customers and website visitors we could find in our internal data.

4. Analyze the data

Now that you have your data collected, the next step is to look for patterns, trends, concepts, or often repeated words—all dependent on whether your method was qualitative or quantitative (or both).

Simple research performed on a small sample will be relatively easy to analyze, or even analyzed automatically, like with the aforementioned Google Forms. Sometimes you will have to use expensive and harder to master software like Tableau , NVivo , PowerBI , or SPSS . Or you can use Python or R for data analysis (if you have a data analyst or data scientist on board, you’re in luck).

Continuing the example: Google Forms made it easy for us to spot patterns in surveys since quantitative data was calculated automatically. The most time-consuming part was reading through all of the responses and manually looking for patterns (back then I wasn’t aware of any tool that could do the job). Both sales and marketing teams worked on analyzing some of the qualitative data to have more than one reference point.

When it comes to researching the competition, coming up with some kind of data structure makes the work more comprehensive (and saner). We put our competitors’ data in specific categories, like products & services (prices included), target market, benefits, values, and brand message. We also used something called a brand positioning map which looks like this:

Analyzing secondary data was probably the easiest part, as the data we needed was already prepared in ready-to-use graphs, statistics and insights. We just had to sift through the contents to look for answers to our questions.

5. Interpret and present conclusions

Analyzing the data is not enough. You need to compile your data in a communicative, actionable way for the decision makers. A good practice is to include in your report: all your information, a description of your research process, the results, conclusions, and recommended actions.

Summing up my 3D printing example, I hypothesised that our market was experiencing a major shift and that the company should follow that trend. The research we did verified that hypothesis positively:

- Our resellers were getting more and more inquiries about professional/industrial use cases and machines. As you can imagine, the budget of this kind of client was significantly higher than hobbyists but so were the expectations.

- Our resellers indicated that this phenomenon is here to stay. Moreover, they declared interest in a new 3D printer tailored to the needs of their more demanding clientele.

- Our customers were outgrowing their early-adopter habits and wanted something easier to use, something plug-and-play that just worked reliably. Tinkering with the printer was something only hardcore makers were interested in.

- The companies we were interested in had already started adapting to the professional/premium market both with their offer and smart marketing communication.

- We also found a ton of other interesting data that we used later on. For example, we found that apart from engineers and designers, an equally interesting segment was educational institutions.

Our initial market research lasted for about two months. We also came back to it whenever we had the chance (or the necessity) and reiterated it to see if we were on the right track.

Was it worth it? Let me tell you this: it saved the company. Our research showed us that this was the last call to reposition the brand and the product. Our original target segment was being gradually dominated by companies we couldn’t compete with.

It took us some time to get buy-in from key stakeholders and implement the conclusions throughout the whole company (eventually, we got it right). As a result, we increased sales, increased customer satisfaction and put ourselves on a more profitable growth track—a win-win for everyone. We even went as far as merging with another manufacturer to shorten the time to get to that sweet market spot.

Looking back, no one from our close competitors survived. They didn’t adapt as we did, and we owed everything to market research.

Whatever you do, avoid these common market research mistakes :

- Poor sampling.

- Ambiguous questions.

- Leading or loaded questions (questions that show bias or contain controversial assumptions).

- Unclear or too many research objectives.

- Mixing correlation with causation.

- Ignoring competitive analysis.

- Allowing biases to influence your research ( confirmation bias being arguably the most common and the most dangerous one).

- Not tracking data on a regular basis.

Online market research tools and resources

Market research reaches back to the 1930s and it’s probably rooted even “deeper” than the 20th century. Everything you could do then you can do now better, faster and cheaper thanks to these online tools and resources.

SEO tools - research the market with Ahrefs

I’ve put together 3 quick wins that can help with your market research—and that’s only a taste of what you can do with Ahrefs.

1. Brand awareness

In the early 20th century, you’d have to hire market researchers to spend days or even weeks asking people “have you heard about brand X”. Today, you can simply look up the search volume for that brand.

So let’s say you run a drone manufacturing brand, and you want to check out your competitors’ brand awareness in France. Go to Ahrefs Keywords Explorer , input the names of the brands, select “France” as your market, and in a flash you get:

The branded keyword volume indicates the brand awareness of that brand in a particular market. You can also keep track of that data by performing this search regularly to see if there are significant changes over time (for example, impacted by a recent campaign).

2. Feature demand

The next game-changing feature for electric cars will concern batteries, charging time, and charging cost (and not autopilot). How do I know?

Well, I opened Ahrefs Keywords Explorer , typed in “electric cars”, and went to the Questions report to find out what people search for. This gave me an idea of what problems electric car owners have (and potential owners worry about). You can easily perform similar research for your niche.

3. Understand the language of your market

Gerald Zaltman in his popular book “How Customers Think” proposes the idea that one of the major erroneous assumptions of marketing is that consumers think in words.

On the other hand, when consumers Google something they have to think in words. And when we market to those consumers we have to think in words as well. The question is: which words?

Let’s say that you want to enter a new and innovative market in the USA, for example the synthetic fermentation-derived dairy industry, also called animal-free dairy.

To you, this set of words “animal-free dairy” may be the very center of your business and marketing efforts. But let’s see what other people think. Let’s use Keywords Explorer to see how many people search Google in the U.S. just for that phrase:

Whoops! Looks like your product category has disappointingly low awareness. Does this mean you’re doomed? Not necessarily.

Let’s try other words. Words that mean something different, but still closely related to your new product.

Now we’re onto something. People search for “vegan dairy” and “lactose free dairy” more often. Not the same, but closely related. Yet, look at the difference in search volume.

Words make a huge difference. And Google knows that.

The only reason you were able to put all of those three phrases in the same bucket was that you knew the connection between those words. The problem is that your target audience may not know that connection; they may not even know that this kind of product exists. This quick analysis of search volume shows that you may want to make that connection, for example with content marketing .

If you create content around related higher volume keywords, you can potentially get more organic traffic than simply focusing on the keyword designating your product category. Look, even though you might believe the main benefit of your animal-free product is something unrelated to lactose, e.g., cruelty-free production, you might want to address the problem of lactose intolerance to appeal to people with this condition.

But that’s not all. You may have noticed “low lactose cheese” in the bottom right corner. This refers to the nifty feature of Ahrefs’ Keyword Explorer called “Parent topic”. Parent topic indicates that Google sees a given keyword as part of a broader topic.

If we click on this Parent topic, we uncover even more search demand:

We can see that the search for the topic “low lactose cheese” exceeds the “vegan dairy” topic by almost 300% in the US. Also, uncovering that parent topic gave us 879 potential keyword ideas (some of them have even higher search volume, like “lactose free cheese”).

Want to discover even more topic associations? No problem. You can dive deeper into this research by using other features of Ahrefs’ Keyword explorer. For example,the Also rank for report allows you to see which other keywords (and topics) the top 100 ranking pages for your target keyword also rank for.

This market research quick-win ties into the broader topic of keyword research. If you want to uncover even more keyword ideas and learn how to analyze them, read our keyword research guide .

Source: https://hubspot.com

Customer Relationship Management software is used to manage and track interactions between a company and its customers and prospects. Usually, it works in tandem with sales or marketing automation software (or has integrations for them). If used properly, it is a true cornucopia of market insight.

As I pointed out earlier, it’s one of those primary data sources that you can leverage to discover patterns in your customer behaviour or characteristics. Popular choices are Hubspot, Salesforce, Intercom, but there is a ton of CRM software out there, so check out a software comparison like G2 to see what best suits your needs.

User feedback tools

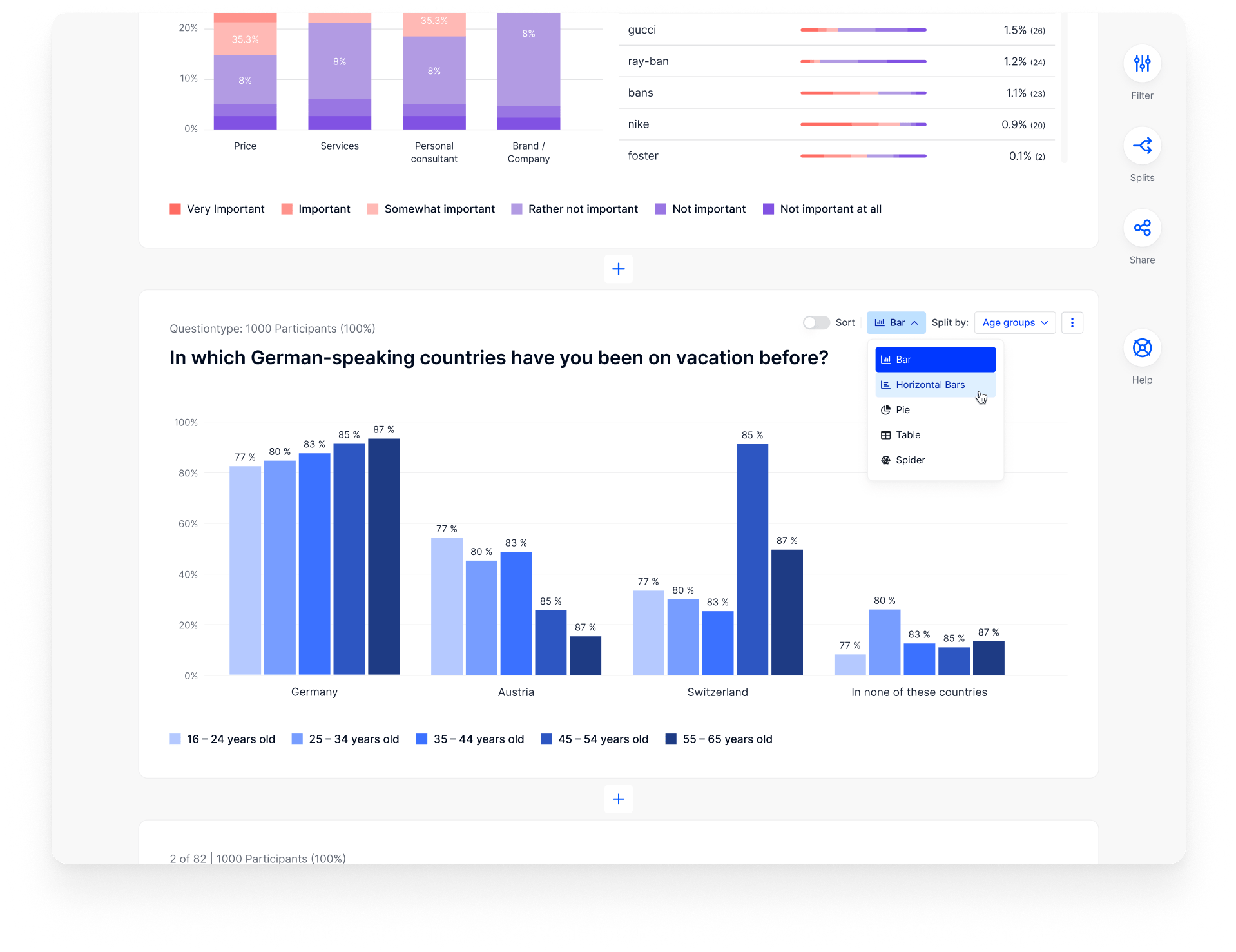

This type of tool allows you to carry out our aforementioned survey research method online.

Create targeted, user-specific surveys and analyze answers with tools like Google Forms , SurveyMonkey , Typeform , or Qualaroo .

Sending out your typical email with a survey is not the only option, for example with Qualaroo you can display surveys:

- In your digital product

- In your SaaS product

- Inside your web app

- Inside your mobile app

- On your website

- On your mobile site

- On your prototypes.

- On most public URLs. Even competitor sites

Need more? No problem, check out SurveyMonkey’s Market Research solution . It taps into the agile market research models we’ve discussed. They’ve got 14 online solutions that help you stay on top of your game, including customer segmentation, monitoring market dynamics, brand, creative analysis, feature importance, finding the right price for your products, and more.

So you think you have a tough business challenge? This daring gentleman is trying to disrupt… eggs. Extremely hard, but doable with market research on his side.

Website/app analytics

Tracking your website or app traffic is absolute marketing basics. Just look at some data dimensions Google Analytics offers:

- Demographics

Sounds familiar? Yup, that sounds like good ol’ market segmentation. Here’s the best part: it’s free, quick to perform and it’s based on your primary data.

If you’ve never dug deeper into Google Analytics, or similar analytics software (e.g., Matomo , Woopra ) here are some questions that this marketing technology can answer for you:

- What do people search for once they’re on my site?

- What differentiates customers who have made a purchase from the ones that haven’t?

- What are my top countries by revenue?

- What are my best selling products?

If you’re already using Google Analytics, see if you’re not making these Google Analytics tracking mistakes.

User experience research tools

Commonly used by UX designers, but just listen to the value propositions of these tools:

- “See and hear real people using your website, online shop or app.” ( https://userpeek.com/ )

- “Real-time feedback. From real customers. Wherever you work. So you can create experiences that get real results.” ( https://www.usertesting.com/ )

- “Scalable & Customized User Research” ( https://www.userlytics.com/ )

- “Record video and audio of your users, so you see and hear their exact experience with your product.” ( https://www.loop11.com/ )

Again, sounds much like our market research methods, right? And it’s no joke, thousands of companies use these tools.

User experience research tools allow you to get user feedback and insights on your products, prototypes, websites, and apps.

Testing is based on tasks your test-takers perform. You can either use your own user base or define a custom base using their services. You’ll get written reports and even recorded videos that you can incorporate into your market research and make sure you’re properly taking advantage of that market opportunity.

Ad planning tools

That’s right—the Facebook, LinkedIn, and Twitter ad planner you already use for running ads can give you some insight into the numbers behind the market segments you’re interested in.

30+ males with higher education interested in technology gadgets? No problem. Female C-suite decision-makers from Europe? It’s all there.

Census data

The availability of this kind of data may vary based on your target market. For example, in the US the Census Bureau offers a free resource for searching the country’s census data. You can filter the data by topics, years, geography, surveys, or industry codes. You can also access premade interactive tables (which you can also download) or simply explore certain regions of the country using their maps.

Business intelligence tools

With business intelligence tools like Tableau , Looker or Sisense , you can connect to any data source to perform data cleaning, statistical operations, and data visualization. They are designed to allow you to glean insights into your data, and communicate effectively with your stakeholders. It’s like SQL combined with R, but you don’t need coding skills and you get a user-friendly interface.

Because these tools are overflowing with functionality and because they are usually pricey, they are overkill for small companies with basic market research needs. Often you will find that the tool that you are already using for your research method comes with some data analysis and visualization functions. And if not, you can always import your data to Excel or Google Docs and use Google Data Studio for a shareable interactive presentation.

Other noteworthy tools and services

- Think with Google

- Living Facts

Final thoughts

Market research is no easy feat. If you feel intimidated by it, you’re not the only one. But don’t shy away from it. The benefits of conducting even sporadic market research can have benefits for your business you simply can’t ignore. You won’t turn into a market research pro overnight, but the good news is you don’t have to. You can go the agile way (like Ahrefs), use affordable self-service online tools and resources, or you can even outsource your research. As long as you base your marketing game plan on valid data, you dramatically improve your chances for success.

Got questions? Ping me on Twitter .

How to Conduct a Market Analysis? (+ Examples)

Appinio Research · 04.10.2023 · 29min read

Are you ready to transform your business with the unparalleled advantages of market analysis? Discover how harnessing the power of data-driven insights can propel your decision-making and unlock exceptional growth opportunities.

In this guide, we delve deep into the art of market analysis, showing you how to gain a competitive edge, tailor your strategies with precision, and, ultimately, boost your success. Let's embark on this journey of discovery together.

What is Market Analysis?

Market analysis is the process of evaluating market conditions and dynamics to understand its potential and make informed decisions. It helps you answer crucial questions:

- Who are your customers?

- What are their needs and preferences?

- Who are your competitors?

- What market trends should you be aware of?

Market analysis is crucial because it empowers you to make data-driven choices, minimize risks, and maximize opportunities.

Why is Market Analysis Important?

Before diving into the analysis, you need to define your objectives. Common goals of market analysis include:

- Market Entry: Evaluating the feasibility of entering a new market.

- Product Development : Identifying market gaps for new product development.

- Competitor Analysis: Understanding your competition's strengths and weaknesses.

- Strategic Planning: Shaping your business strategies based on market insights.

Benefits of Effective Market Analysis

Conducting a thorough market analysis brings several benefits:

- Risk Mitigation: Minimize the risk of entering an unprofitable market.

- Resource Allocation: Optimize resource allocation for marketing and product development.

- Competitive Advantage: Gain a competitive edge by understanding your market better.

- Innovation: Identify opportunities for innovation and growth.

Now that you understand the importance of market analysis, let's move on to the practical steps involved.

How to Prepare for Market Analysis?

Before diving into market analysis, setting the stage for success is essential. Here are the key steps to prepare for market analysis:

- Set Clear Objectives: Define your specific goals and objectives for the analysis. Be clear about what you want to achieve. For example, if you're planning to enter a new market, your purpose might be to determine market demand and competition.

- Identify Target Audience: Knowing your audience is crucial. Identify the demographics, preferences, and behaviors of your target market. This information will guide your data collection methods.

- Gather Necessary Resources: Market analysis requires data, tools, and expertise. Ensure you have access to the resources you need. This might include budget allocation for research tools, hiring analysts, or outsourcing data collection.

- Consider Ethical Considerations: Ethical guidelines are paramount in market analysis. Ensure that your data collection methods and analysis processes adhere to ethical standards, respecting privacy and confidentiality.

With your preparations in place, you're ready to collect the data necessary for your market analysis.

Data Collection for Market Analysis

Accurate and relevant data is the lifeblood of market analysis. Here's how you can gather the information you need:

Primary Data Sources

Primary data refers to information collected directly from the source. You can obtain primary data through:

- Surveys: Conducting surveys to gather insights from your target audience.

- Interviews: Engaging in one-on-one interviews with industry experts or potential customers .

- Observations: Collecting data by observing customer behavior or market trends.

Secondary Data Sources

Secondary data is information that already exists and is collected by someone else. Sources of secondary data include:

- Market Reports: Industry-specific reports and publications.

- Government Data: Data provided by government agencies.

- Competitor Reports: Analyzing reports and information about your competitors.

Qualitative Data Collection Methods

Qualitative data provides in-depth insights into customer attitudes and behaviors. Qualitative methods include:

- Focus Groups: Gathering a small group of participants to discuss specific topics.

- In-Depth Interviews: Conducting in-depth interviews with individuals to explore their perspectives.

Quantitative Data Collection Methods

Quantitative data is numerical and can be analyzed statistically. Common quantitative methods include:

- Surveys: Creating structured questionnaires for large-scale data collection.

- Online Analytics: Analyzing website and social media metrics for user behavior.

With your data collected, it's time to move on to the next crucial step: analyzing and interpreting the data.

Market Research Techniques

Analyzing the data you've collected is where the real insights come to light. Let's explore various market research techniques that help you make sense of your data.

Surveys and Questionnaires

Surveys and questionnaires are powerful tools for collecting quantitative data. They allow you to gather structured responses from a large sample of participants. When designing surveys, consider:

- Question Types: Crafting survey questions that are clear and unbiased.

- Sampling Techniques: Ensuring your sample is representative of your target audience.

- Data Analysis: Applying statistical methods to analyze survey data.

Interviews provide qualitative data through in-depth conversations with individuals. Key considerations include:

- Interview Structure: Developing a structured interview guide.

- Listening Skills: Active listening to uncover valuable insights.

- Transcribing and Coding: Transcribing interviews and coding responses for analysis.

Focus Groups

Focus groups involve small group discussions, providing rich qualitative data. To conduct effective focus groups:

- Moderation Skills: Skillfully moderating group discussions.

- Participant Selection: Recruiting diverse participants for varied perspectives.

- Thematic Analysis: Identifying themes and patterns in focus group discussions.

Observational Research

Observational research involves watching and recording customer behavior.

- Research Setting: Choosing the right environment for observations.

- Data Recording: Accurate and detailed recording of observations.

- Interpretation: Interpreting observed behaviors in the context of your objectives.

Competitor Analysis

Competitor analysis involves evaluating your rivals to understand their strengths and weaknesses.

- Identifying Competitors: Determine who your main competitors are.

- Competitive Metrics: Choose relevant metrics to assess competition.

- Benchmarking: Comparing your performance against competitors.

By mastering these market research techniques, you'll be well-prepared to extract valuable insights from your data. The next step is to interpret these insights effectively.

Data Analysis and Interpretation

Analyzing and interpreting data is the heart of market analysis. This process involves converting raw data into actionable insights.

Data Cleaning and Preparation

Data can be messy, and cleaning and preparing it for analysis is essential. This involves:

- Data Cleaning: Removing outliers, errors, and inconsistencies.

- Data Transformation: Converting data into a consistent format.

- Data Validation: Ensuring data accuracy and completeness.

Descriptive Analysis

Descriptive analysis involves summarizing and visualizing data to understand its basic characteristics. Techniques include:

- Summary Statistics: Calculating measures like mean, median, and standard deviation.

- Data Visualization: Creating charts and graphs to represent data visually.

- Data Distribution Analysis: Understanding how data is distributed.

Statistical Analysis

Statistical analysis allows you to draw meaningful conclusions from your data. Techniques include:

- Hypothesis Testing: Testing hypotheses to make data-driven decisions.

- Regression Analysis: Examining relationships between variables.

- Segmentation Analysis: Grouping data for more targeted insights.

Identify Trends and Patterns

Identifying trends and patterns in your data helps you make predictions and formulate strategies.

- Time Series Analysis: Analyzing data over time to identify trends.

- Pattern Recognition: Spotting recurring patterns in customer behavior.

- Predictive Modeling: Using data to make future predictions.

Armed with these analytical skills, you can effectively uncover valuable insights that inform your business decisions.

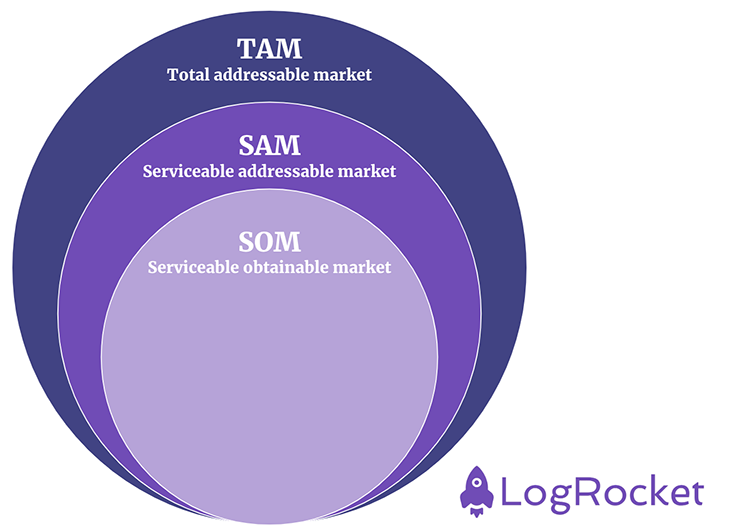

Market Segmentation

Market segmentation is crucial in understanding your audience better and tailoring your strategies accordingly.

What is Market Segmentation?

Market segmentation involves dividing your market into distinct groups based on shared characteristics. This is significant because it allows you to:

- Target Specific Audiences: Tailor your marketing efforts to specific segments.

- Personalize Products: Customize products and services to meet segment needs.

- Optimize Resource Allocation: Allocate resources more efficiently by focusing on high-potential segments.

Types of Market Segmentation

There are various ways to segment a market, including:

- Demographic Segmentation : Dividing based on age, gender, income, etc.

- Psychographic Segmentation : Grouping by lifestyles, values, and attitudes.

- Geographic Segmentation: Segmenting by location or region.

- Behavioral Segmentation: Dividing based on buying behavior and preferences.

Targeting Specific Market Segments

After segmentation, you must target your chosen segments effectively. This involves:

- Positioning: Crafting a unique value proposition for each segment.

- Messaging: Tailoring your marketing messages to resonate with each segment.

- Product Development: Adapting products to meet segment-specific needs.

By understanding your market segments, you can connect with your audience on a deeper level and increase your chances of success.

SWOT Analysis

A SWOT analysis is a valuable tool for assessing your business's internal strengths and weaknesses, as well as external opportunities and threats.

Identify and leverage your strengths, such as:

- Unique Products: What sets your products apart from the competition?

- Skilled Workforce: Highlight the expertise of your team.

- Strong Brand: Emphasize your brand reputation and recognition.

Acknowledge and address your weaknesses, including:

- Limited Resources: Recognize budget constraints or resource shortages.

- Market Share: Assess areas where competitors outperform you.

- Operational Challenges: Identify internal issues that need improvement.

Opportunities

Exploit opportunities in your market, such as:

- Market Growth: Explore emerging markets and trends.

- Partnerships: Seek collaboration with complementary businesses.

- New Technologies: Embrace innovations that can improve your operations.

Mitigate potential threats, such as:

- Competition: Analyze the competitive landscape and potential disruptors.

- Economic Trends: Consider how economic fluctuations may affect your business.

- Regulatory Changes: Stay updated on industry regulations and compliance.

Conducting a SWOT analysis helps you develop strategies that capitalize on strengths, mitigate weaknesses, seize opportunities, and guard against threats.

How to Conduct Competitive Market Analysis?

Competitive market analysis is a critical component of your overall market analysis strategy. Understanding who your competitors are, analyzing their strengths and weaknesses, and conducting competitive benchmarking are essential steps to gain a strategic advantage in your market.

1. Identify Key Competitors

Identifying your key competitors is the first step in a competitive market analysis. Key competitors are those businesses that directly compete with you for the same target audience or market share. Here's how to identify them:

- Market Research : Conduct thorough market research to identify businesses offering similar products or services in your industry or niche.

- Customer Feedback: Listen to your customers. Often, they will mention your competitors when discussing alternatives or choices.

- Industry Associations: Explore industry associations, directories, or trade publications to find a list of competitors.

- Online Search: Use search engines and social media platforms to discover businesses that appear in similar search results or target similar keywords.

Once you have identified your key competitors, you can move on to a more in-depth analysis of their strengths and weaknesses.

2. Analyze Competitor Strengths and Weaknesses

Analyzing competitor strengths and weaknesses provides valuable insights into their strategies and helps you identify opportunities and threats. Here's how to conduct this analysis effectively:

Product or Service Offering

- Strengths: Determine what your competitors excel at regarding product quality, features, and innovation.

- Weaknesses: Identify areas where their products or services fall short compared to yours.

Pricing Strategies

- Strengths: Analyze whether competitors offer competitive pricing or unique pricing models.

- Weaknesses: Look for instances where their pricing may be less competitive or prohibitive.

Market Share and Customer Base

- Strengths: Assess the size of their customer base and market share in your industry.

- Weaknesses: Investigate whether they have any vulnerabilities or dependencies on a specific customer segment.

Marketing and Branding

- Strengths: Analyze their marketing strategies, branding efforts, and customer engagement tactics.

- Weaknesses: Identify any gaps or areas where their marketing efforts may be less effective.

Customer Reviews and Feedback

- Strengths: Look for positive customer reviews and feedback to understand what your competitors are doing well.

- Weaknesses: Pay attention to negative reviews and areas where customers express dissatisfaction.

This analysis will help you identify areas where you can differentiate yourself and gain a competitive edge. It also enables you to anticipate how competitors might respond to your strategies.

3. Competitive Benchmarking

Competitive benchmarking involves comparing your performance and strategies against those of your key competitors. It allows you to set performance goals, identify best practices, and continuously improve.

- Select Key Metrics: Choose the key performance metrics that matter most to your business. These could include revenue growth, customer acquisition costs, customer satisfaction scores, or market share.

- Gather Data: Collect data on these selected metrics for both your business and your competitors. This data can come from public sources, industry reports, or your own internal records.

- Analyze and Compare: Compare your performance against that of your competitors using the selected metrics. Pay close attention to areas where you outperform them and areas where you lag behind.

- Identify Best Practices: Identify the strategies and practices that contribute to your competitors' success. Learn from their best practices and consider implementing similar strategies in your business.

- Set Improvement Goals: Based on your analysis, set specific improvement goals for your business. These goals should be realistic and aligned with your overall business objectives.

- Monitor Progress: Regularly monitor your progress toward achieving your improvement goals. Adjust your strategies and tactics as needed to stay competitive.

Competitive benchmarking is an ongoing process. By continuously assessing your performance compared to your competitors, you can adapt and refine your strategies to maintain a competitive advantage in the market.

How to Conduct Comparative Market Analysis?

Comparative market analysis involves assessing your market position, understanding competitor strategies and performance, and identifying opportunities for growth. Let's explore each aspect in more detail.

What is Comparative Analysis in Market Research?

Comparative analysis involves examining your business in relation to your competitors and the overall market. It helps you:

- Gain Perspective: Understand where your business stands in the market landscape.

- Identify Trends: Recognize industry trends and shifts.

- Spot Opportunities: Discover areas where your business can excel or innovate.

To conduct an effective comparative analysis:

- Collect Data: Gather data on your business, competitors, and the market as a whole.

- Use Key Metrics: Focus on key performance metrics relevant to your industry.

- Benchmark Against Competitors: Compare your performance against that of your direct competitors.

Analyzing Competitor Strategies and Performance

Analyzing competitor strategies and performance is a critical aspect of comparative analysis. Here's how to go about it:

1. Competitor Strategies

Product and Service Strategies: Examine their product/service offerings and pricing strategies.

- Marketing and Promotion: Analyze their marketing campaigns, messaging, and customer engagement tactics.

- Distribution Channels: Understand how they reach and distribute products or services to customers.

- Innovation: Identify areas where they innovate or introduce new features.

2. Financial Performance

- Revenue and Growth: Assess their revenue figures and growth rates over time.

- Profit Margins: Analyze their profit margins and how they compare to industry standards.

- Investment and Funding: Explore whether they have secured significant investments or funding.

3. Customer Engagement

- Customer Base: Understand the size and composition of their customer base.

- Customer Satisfaction: Look for indicators of customer satisfaction, such as reviews or feedback.

4. Market Presence

Market Share: Determine their market share in your industry or niche.

Geographic Reach: Explore the regions or markets they serve.

Identifying Market Position and Opportunities

Identifying your market position and opportunities is the ultimate goal of comparative market analysis. Here's how to accomplish this:

1. Market Position

- Relative Strengths: Determine where your business excels compared to competitors.

- Areas of Improvement: Identify areas where you lag and need improvement.

- Market Niche: Define your unique value proposition and niche within the market.

2. Opportunities

- Competitive Gaps: Recognize gaps in the market that your business can fill.

- Unmet Customer Needs: Explore customer needs that competitors are not effectively addressing.

- Emerging Trends: Stay alert to emerging industry trends and adapt your strategies accordingly.

3. Strategic Planning

- Strategy Development: Formulate strategies that capitalize on your strengths and address weaknesses.

- Innovation: Consider innovative approaches to differentiate your business.

- Risk Mitigation: Develop plans to mitigate risks associated with market dynamics.

By conducting a comprehensive comparative market analysis, you gain a deeper understanding of your competitive landscape, enabling you to make informed decisions, refine your strategies, and seize growth opportunities effectively. This process should be ongoing, as the market is dynamic and ever-changing.

Competitive Market Analysis vs. Comparative Market Analysis

While these approaches share some similarities, they serve distinct purposes and offer unique insights. Let's explore the key differences and applications of each.

Competitive Market Analysis

Objective: Competitive Market Analysis primarily focuses on assessing your direct competitors and understanding their strategies, strengths, weaknesses, and overall market position. Its main goal is to help you gain a competitive edge by learning from and responding to your rivals effectively.

Key Aspects:

- Competitor-Centric: It revolves around thoroughly examining specific competitors that directly impact your business.

- Strategy-Oriented: The emphasis is on understanding your competitors' strategies, pricing models, product offerings, and marketing tactics.

- Market Positioning: It helps you define your position in relation to your immediate competitors and identify areas for differentiation.

- Direct Impact: Competitive Market Analysis is often employed for short-term decision-making, such as refining marketing strategies or adjusting pricing to respond to competitor moves.

Comparative Market Analysis

Objective: Comparative Market Analysis takes a broader perspective by evaluating your business within the context of the entire market. It aims to provide a comprehensive view of your market's dynamics, trends, and opportunities, helping you make informed, long-term strategic decisions.

- Market-Centric: It considers a broader view of the market, including competitors, potential entrants, and industry dynamics.

- Trend Analysis: Comparative Market Analysis looks at industry trends, market growth, consumer behavior, and emerging technologies that may impact your business.

- Strategic Insights: It provides strategic insights that extend beyond immediate competition, helping you identify opportunities for market expansion, diversification, or innovation.

- Long-Term Planning: This approach is suitable for long-term strategic planning, such as entering new markets, launching new products, or adapting to evolving market conditions.

How to Choose the Right Approach?

The choice between Competitive Market Analysis and Comparative Market Analysis depends on your specific business goals and the depth of insights you seek:

- Use Competitive Market Analysis when you need to closely monitor and respond to specific competitors' actions, refine short-term strategies, or differentiate your offerings within a crowded market segment.

- Opt for Comparative Market Analysis when you are making long-term strategic decisions, considering market expansion, or seeking to innovate based on broader industry trends. This approach provides a holistic view that extends beyond immediate competitors.

In practice, many businesses find value in combining elements of both approaches to gain a comprehensive understanding of their market environment. The key is to align your analysis with your strategic objectives and adapt your approach as your business evolves.

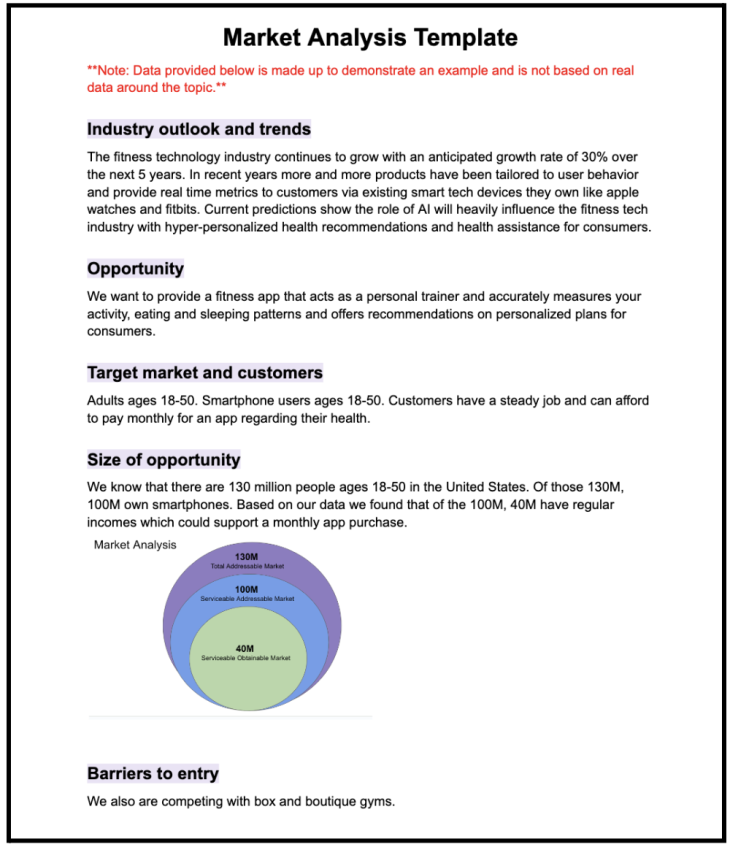

Market Analysis Template

A well-structured market analysis template is invaluable for streamlining the market research process, ensuring you cover all essential aspects and gather data systematically. Let's explore the components of an effective market analysis template and how to customize it to your specific needs.

How to Create a Structured Market Analysis Framework?

A comprehensive market analysis template typically includes the following sections:

1. Market Overview

- Market Size: Describe the current size and potential growth of the market.

- Market Segmentation: Identify key segments within the market.

- Market Trends: Highlight recent trends and developments.

2. Competitive Landscape

- Competitor Identification: List your main competitors and potential disruptors.

- Competitor Analysis: Evaluate their strengths, weaknesses, opportunities, and threats (SWOT).

- Competitive Advantage: Explore ways in which your business can gain a competitive edge.

3. Target Market Analysis

- Customer Personas: Develop detailed customer personas based on demographics, behavior, and preferences.

- Customer Needs: Understand your target audience's specific needs and pain points.

- Market Demand: Assess the demand for your products or services within your target market.

4. SWOT Analysis

- Strengths: Identify your business's internal strengths and advantages.

- Weaknesses: Acknowledge areas where your business may be vulnerable.

- Opportunities: Explore external factors that can be leveraged for growth.

- Threats: Recognize potential challenges and external risks.

5. Trends and Forecast

- Market Trends: Analyze current trends and their potential impact on your business.

- Market Forecast: Make data-driven predictions about the future of the market.

- Emerging Technologies: Assess how emerging technologies may influence your industry.

How to Utilize Template for Efficient Market Analysis?

Templates not only save time but also ensure that you cover all critical aspects of market analysis. To effectively utilize a template:

1. Identify Relevant Sections

Review the template to identify sections that are relevant to your specific market analysis objectives. Not all sections may be necessary for every analysis.

2. Customize Sections

Tailor each section to your business and market. For example:

- In the "Market Overview" section , provide market data specific to your industry or region.

- In the "Competitive Landscape" section , focus on competitors directly impacting your business.

3. Collect Data Methodically

Use the template as a guide to collect data methodically. It ensures that you gather the right information in a structured manner.

4. Analyze and Interpret Data

After collecting data, analyze and interpret it within the context of each section of the template.

This step provides actionable insights.

5. Draw Conclusions and Recommendations

Utilize the insights gained from your analysis to draw conclusions and formulate recommendations that address your initial market analysis objectives.

6. Report Compilation

Compile the information from your template into a well-organized market analysis report that can be easily shared with stakeholders, investors, or team members.

How to Customize the Market Analysis Template?

Market analysis templates should not be rigid but rather adaptable to meet your unique requirements.

- Additional Sections: If your analysis requires sections not covered in the template, feel free to add them. For example, you might include a section on environmental or sustainability factors.

- Data Sources and Tools: Specify the data sources and analysis tools you'll use for each section. This ensures transparency and accountability in your analysis process.

- Visual Elements: Incorporate charts, graphs, and visual representations where relevant. Graphic elements can make complex data more digestible.

- Timelines and Milestones: If your market analysis is part of a larger project or business plan, include timelines and milestones to track progress.

- Appendices: Consider including appendices with supplementary materials such as raw data, survey questionnaires, or detailed calculations to support your analysis.

Market Analysis Examples

To gain a deeper understanding of how market analysis is applied in real-world scenarios, let's explore a variety of detailed examples that showcase different aspects of this crucial business practice.

Example 1: Entering a New Market

Scenario: Imagine you are the marketing manager of a well-established electronics company considering expansion into a new geographic market. Let's call it Market X.

Market Analysis Objective: Your goal is to assess the feasibility and potential success of entering Market X.

Data Collection and Analysis

- Market Research: Begin by collecting data on Market X, such as population demographics, economic indicators, and consumer behavior.

- Competitor Analysis: Identify and analyze competitors already operating in Market X. Assess their market share, product offerings, pricing strategies, and customer reviews.

- Consumer Surveys: Conduct surveys in Market X to understand consumer preferences, needs, and willingness to adopt your products.

- Regulatory Environment: Investigate the regulatory framework in Market X, including import/export regulations, industry standards, and compliance requirements.

Findings and Insights

- Market Potential: Through extensive data analysis, you discover that Market X has a growing population with a high demand for electronics, indicating market potential.

- Competitive Landscape: You identify several established competitors, but their product offerings are limited in comparison to your company's range.

- Consumer Preferences: Survey results reveal a preference for high-quality, durable electronics aligning with your product portfolio.

- Regulatory Insights: Understanding the regulatory environment helps you plan for compliance, ensuring a smooth market entry.

Recommendations

Based on your analysis, you can make informed recommendations:

- Market Entry Strategy: Develop a comprehensive market entry strategy tailored to Market X, including distribution channels and pricing strategies.

- Product Localization: Customize certain product features to align with local preferences and regulatory requirements.

- Competitive Edge: Leverage your wider product range as a competitive advantage.

Example 2: Product Launch Strategy

Scenario: You work for a startup that has developed an innovative health and fitness wearable device. Your goal is to create an effective product launch strategy.

Market Analysis Objective: Understand your target market, competition, and market trends to launch the wearable successfully.

- Target Audience Profiling: Create detailed customer personas based on demographics, interests, and health and fitness habits.

- Competitor Analysis: Examine the market for similar wearable devices, assessing their features, pricing, and customer reviews.

- Market Trends and Consumer Behavior: Analyze market trends related to health and fitness, wearable technology adoption, and consumer preferences.

- Market Size and Growth: Determine the size of the wearable technology market and its growth rate.

- Target Audience: Detailed personas reveal that your primary customer segments include health-conscious individuals, athletes, and tech enthusiasts.

- Competition: While there are competitors in the market, a gap exists for a wearable that combines health monitoring with advanced fitness tracking.

- Market Trends: Trends show an increasing demand for health-related wearables due to a growing focus on fitness and well-being.

- Market Size: The market is substantial and expected to grow steadily over the next few years.

- Product Features: Focus your product's features on health monitoring and advanced fitness tracking to cater to the identified target segments.

- Pricing Strategy: Set a competitive yet profitable price point for your wearable.

- Marketing Campaign: Develop a marketing campaign highlighting the unique features of your wearable and its benefits for health-conscious consumers, athletes, and tech enthusiasts.

Example 3: Competitive Analysis for an E-commerce Startup

Scenario: You're part of a startup team launching an e-commerce platform that sells handmade artisanal products. You need to understand the competitive landscape to formulate a successful business strategy.

Market Analysis Objective: Gain insights into the e-commerce market for handmade products and identify opportunities for differentiation.

- Competitor Identification: Identify existing e-commerce platforms specializing in handmade products.

- Product Range and Quality: Assess the variety and quality of products offered by competitors.

- Pricing Strategies: Analyze pricing strategies and discount offers of competitors.

- Customer Reviews: Study customer reviews and ratings for competing platforms.

- Competitor Landscape: You discover several established e-commerce platforms in the handmade product niche, but none seem to offer a comprehensive range of unique artisanal items.

- Product Quality: Competitors mainly offer mass-produced items with limited emphasis on craftsmanship and uniqueness.

- Pricing: Pricing strategies appear to be competitive, but customer reviews indicate a desire for more affordable options.

- Product Curation: Focus on curating a selection of high-quality, truly artisanal products to differentiate your platform.

- Competitive Pricing: Offer competitive pricing while maintaining the unique value proposition of handmade items.

- Customer Engagement: Implement strategies to engage customers and gather feedback for continuous improvement.

These examples illustrate how market analysis informs critical business decisions. Whether entering a new market, launching a product, or competing in e-commerce, a data-driven approach empowers you to make informed choices and increase your chances of success.

Remember that market analysis is an ongoing process, and staying updated with evolving market dynamics is essential for long-term success.

Market analysis is your secret weapon for success in the ever-evolving business landscape. By understanding your market, customers, and competition, you gain the knowledge to make informed decisions, identify growth opportunities, and stay ahead of the curve.

Remember, market analysis is not a one-time task; it's an ongoing journey. Continuously gather data, adapt your strategies, and embrace the power of real-time insights. With the right tools and knowledge, you have the potential to turn market analysis into a dynamic force that propels your business to new heights.

How to Conduct Market Analysis in Minutes?

Looking to supercharge your market analysis? Look no further than Appinio , the real-time market research platform changing the game. With Appinio, you can harness the power of real-time consumer insights to make data-driven decisions that drive your business forward.

- Lightning-Fast Insights: Say goodbye to waiting weeks for market research results. Appinio delivers answers to your burning questions in minutes.

- Instant Decision-Making: With real-time consumer insights at your fingertips, you can make informed decisions on the fly, giving your business a competitive edge.

- User-Friendly and Intuitive: Market research doesn't have to be a daunting task. Appinio's user-friendly platform makes it easy for anyone to access and interpret valuable data.

Say goodbye to the old stigma of market research being boring, intimidating, and overpriced. It's time to unlock the power of real-time insights and drive your success.

Get free access to the platform!

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

11.04.2024 | 34min read

What is Data Analysis? Definition, Tools, Examples

09.04.2024 | 29min read

What is a Confidence Interval and How to Calculate It?

05.04.2024 | 28min read

What is Field Research? Definition, Types, Methods, Examples

What is Market Research Analysis? Definition, Steps, Benefits, and Best Practices

By Nick Jain

Published on: September 8, 2023

Table of Contents

What is Market Research Analysis?

Market research analysis steps, market research analysis benefits, 15 market research analysis best practices.

Market research analysis is defined as the systematic process of collecting, processing, interpreting, and evaluating data related to a specific market, industry, or business environment. Its primary purpose is to gain insights into various aspects of the market, including consumer behavior, market trends, competitive landscape, and other relevant factors. Market research analysis aims to provide businesses with actionable information that can inform their decision-making processes and strategies.

Here are the key components and objectives of market research analysis:

- Data Collection: The process begins with gathering data from a variety of sources. This data can be classified into two main categories:

Primary Data: Data collected directly from original sources, such as surveys, interviews, focus groups , observations, and experiments.

Secondary Data: Existing data collected by third parties, such as market reports, government publications, industry publications, and academic studies.

- Data Processing: Once collected, the data is processed to ensure its accuracy and reliability. This step involves cleaning the data to remove errors or inconsistencies and structuring it in a way that is suitable for analysis. Data processing may also involve data coding, categorization, and transformation.

- Data Analysis: The heart of market research analysis involves examining and interpreting the data to extract meaningful insights. Various analytical techniques and statistical tools are used to identify patterns, relationships, trends, and correlations within the data. This analysis supports businesses in making knowledgeable decisions.

- Competitive Analysis: Assessing the competitive landscape is an essential aspect of market research analysis. This includes studying competitors’ strengths, weaknesses, strategies, market share, and customer perceptions. Understanding the competitive environment is crucial for shaping a company’s strategy and positioning in the market.

- Consumer Behavior Analysis: Understanding how consumers think, feel, and act is a central objective of market research analysis. It involves identifying consumer preferences, purchasing habits, motivations, and pain points. This information helps businesses tailor their products, services, and marketing efforts to meet customer needs effectively.

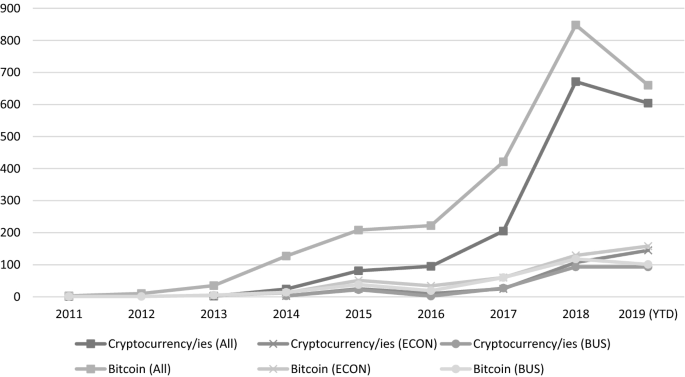

- Market Trends Identification: Market research analysis helps businesses stay updated on the latest market trends, industry developments, and emerging technologies. Recognizing these trends allows companies to adapt, innovate, and remain competitive in their respective markets.

- Strategic Decision-Making: Ultimately, the goal of market research analysis is to provide actionable insights that inform strategic decision-making. These decisions can relate to product development, pricing strategies, marketing campaigns, market entry or expansion, and more.

- Risk Mitigation: By understanding market dynamics and potential challenges, businesses can proactively identify and mitigate risks. This reduces the likelihood of unexpected setbacks and allows for more effective crisis management.

Market research analysis is a vital tool that helps businesses gather and interpret data to make informed decisions, mitigate risks, identify opportunities for growth, and stay competitive in their respective markets. It plays a pivotal role in shaping business strategies and ensuring that resources are allocated effectively to achieve business objectives.

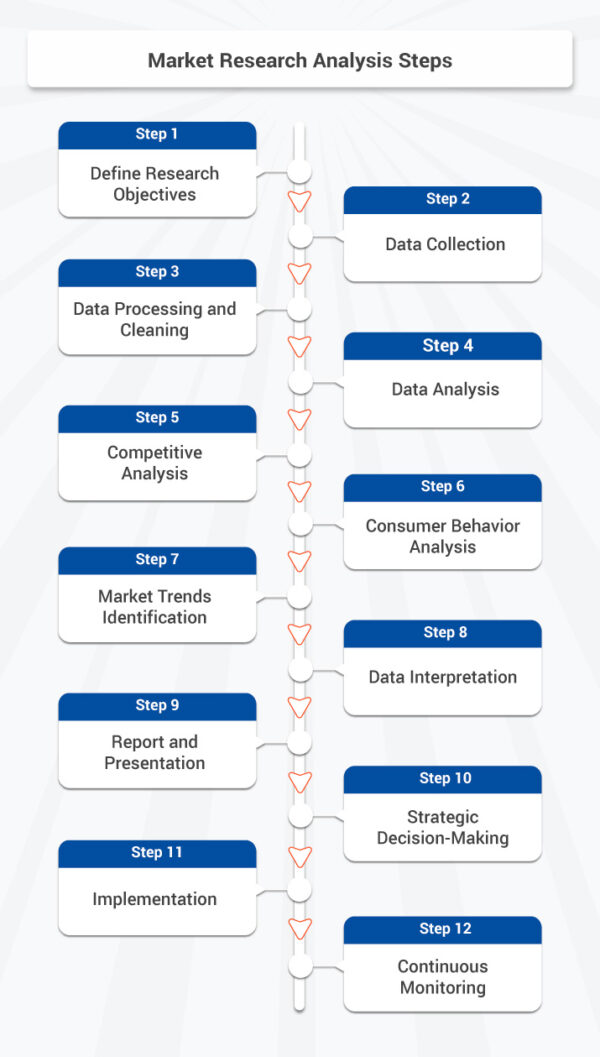

Market research analysis involves a series of systematic steps to gather, process, and interpret data to gain insights into a specific market or industry. These steps are crucial for making informed business decisions and developing effective strategies. Here are the key steps in the market research analysis process:

Step 1: Define Research Objectives

Precisely outline the goals and objectives of your market research . What specific insights or data are you aiming to acquire? What are your research questions? Understanding your objectives is essential for guiding the entire process.

Step 2: Data Collection

Collect relevant data from various sources. This can include primary data (directly collected from surveys, interviews, focus groups , observations, etc.) and secondary data (existing data from reports, publications, databases, etc.). Make certain that your data-gathering approaches are in harmony with your research objectives.

Step 3: Data Processing and Cleaning

Clean and preprocess the collected data to ensure its accuracy and reliability. This step may involve removing duplicate records, correcting errors, and organizing the data for analysis.

Step 4: Data Analysis

Perform data analysis using appropriate techniques and tools. Common analytical methods include statistical analysis, regression analysis, trend analysis, customer segmentation, and sentiment analysis. The objective is to derive significant insights from the data.

Step 5: Competitive Analysis

Assess the competitive landscape by studying your competitors. Analyze their strengths, weaknesses, market share, strategies, and customer perceptions. Recognize potential opportunities and vulnerabilities within the competitive landscape.

Step 6: Consumer Behavior Analysis

Examine consumer behavior by analyzing data related to preferences, purchasing habits, motivations, and demographics. Gain insights into what drives consumer decisions and how they interact with your products or services.

Step 7: Market Trends Identification

Identify and analyze current market trends, industry developments, and emerging technologies. Stay up-to-date with changes in the market that could impact your business.

Step 8: Data Interpretation

Interpret the outcomes of your data analysis within the framework of your research goals. What do the findings mean for your business? Are there actionable insights that can inform your decisions?

Step 9: Report and Presentation

Create a comprehensive report or presentation that summarizes your research findings. Use clear visuals, charts, and graphs to convey the information effectively. Include recommendations and insights that can guide decision-making.

Step 10: Strategic Decision-Making

Use the insights gained from your market research analysis to make informed strategic decisions. These decisions can relate to product development, pricing strategies, marketing campaigns, market entry or expansion, and more.

Step 11: Implementation

Put your strategic decisions into action. Implement the changes and strategies based on your market research analysis. Continuously track progress and adapt your approach as necessary.

Step 12: Continuous Monitoring

Market research analysis is an ongoing process. Continuously monitor market conditions, consumer behavior, and competitive developments to stay adaptable and responsive to changes in the market.