- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

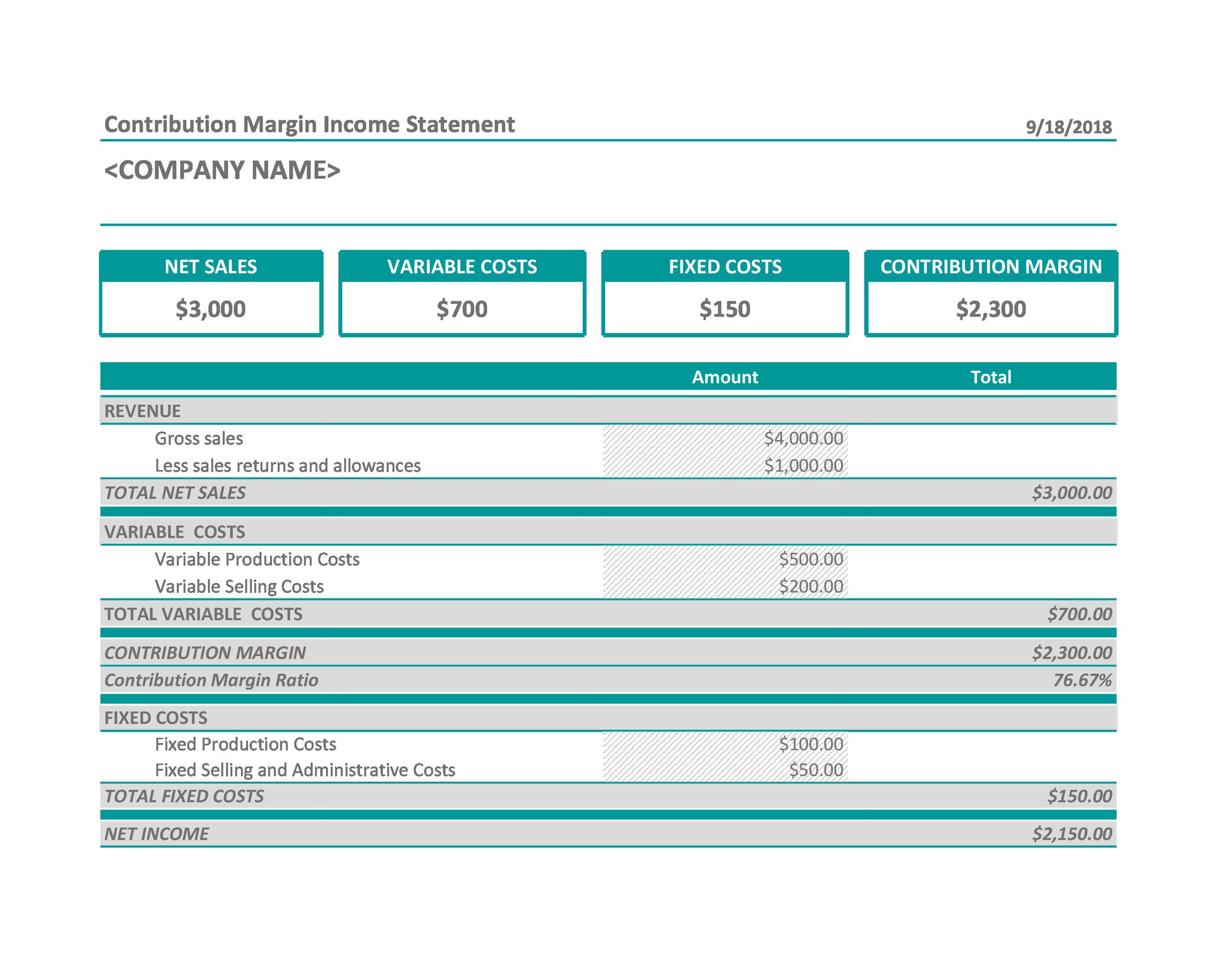

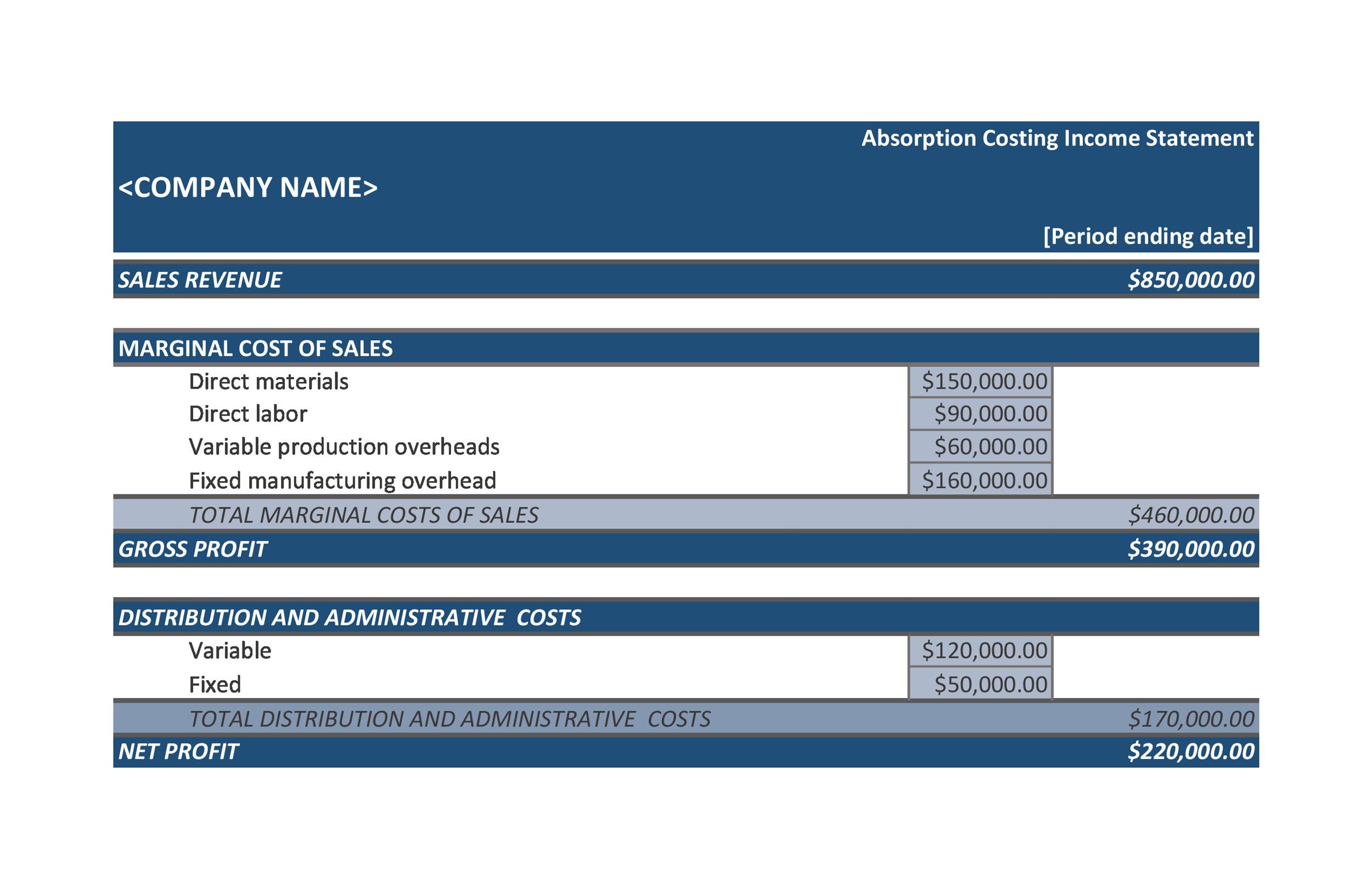

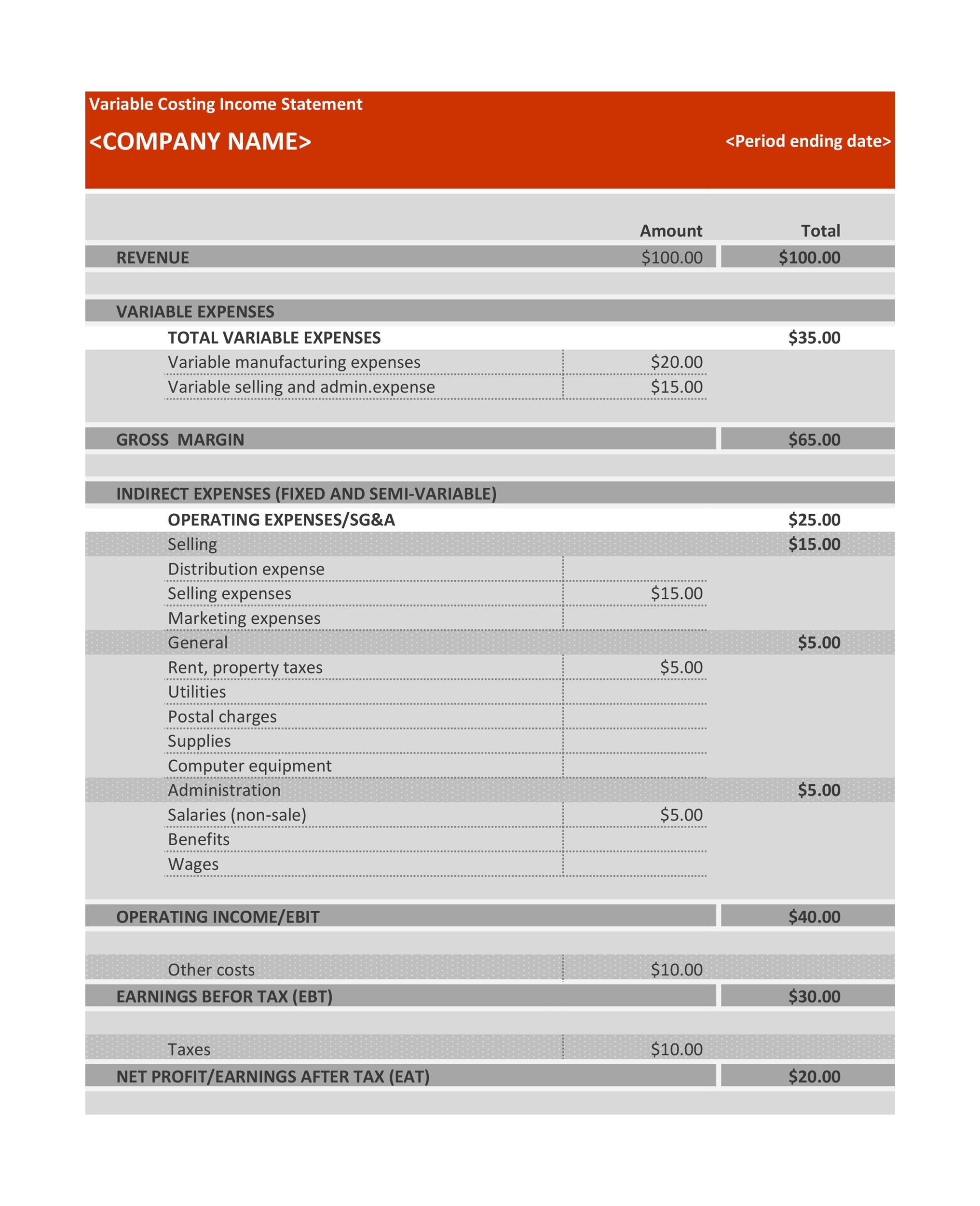

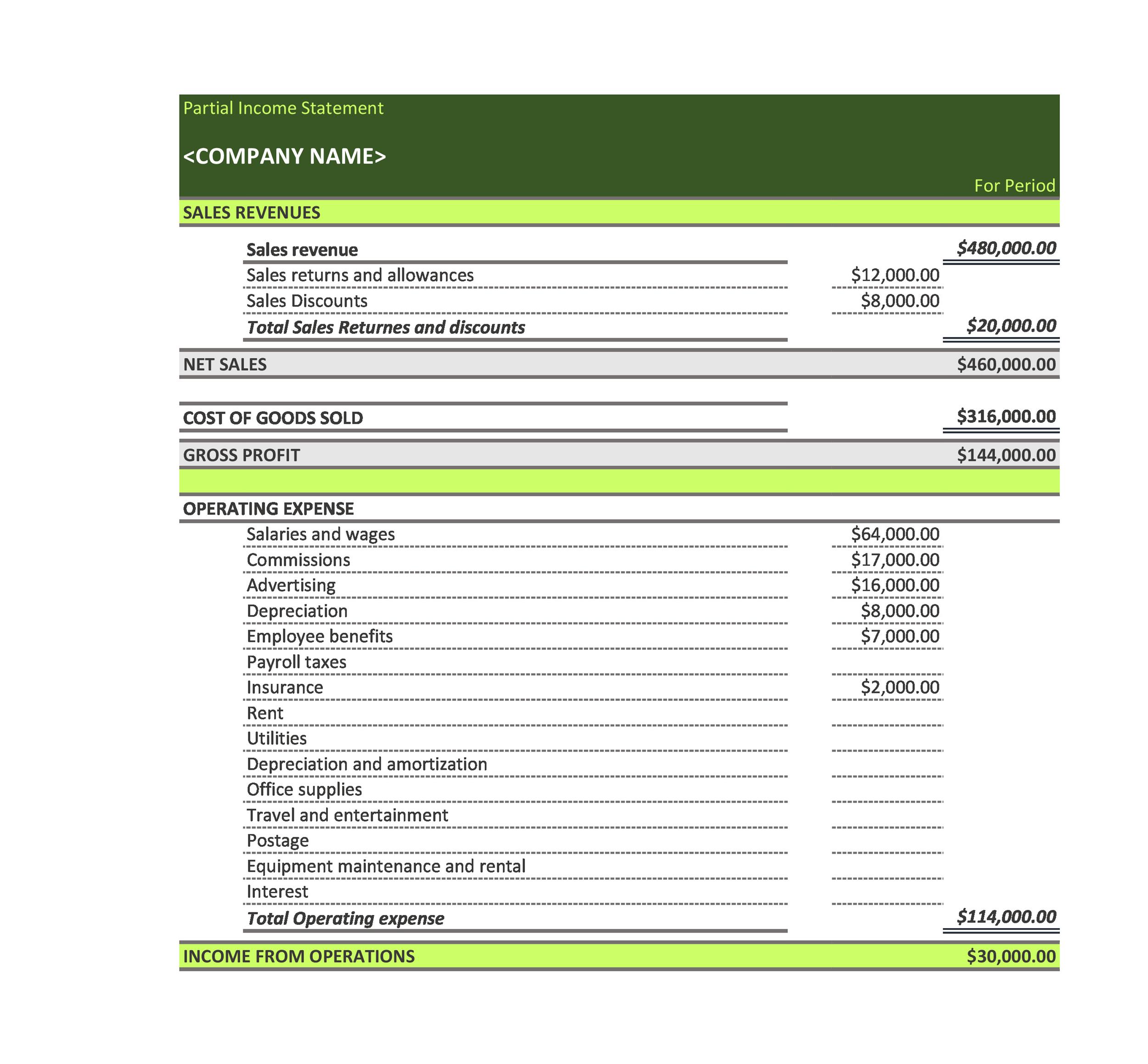

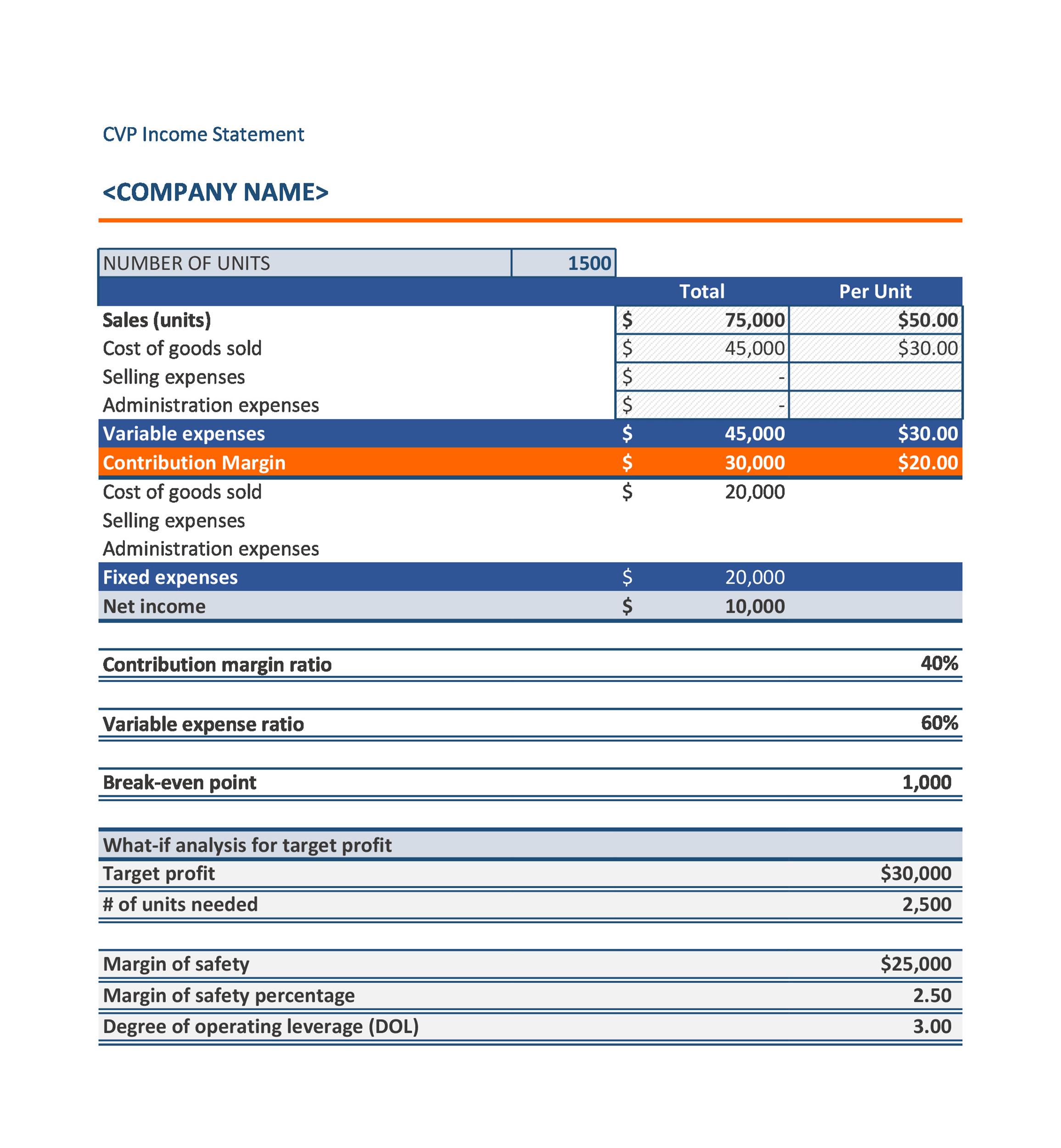

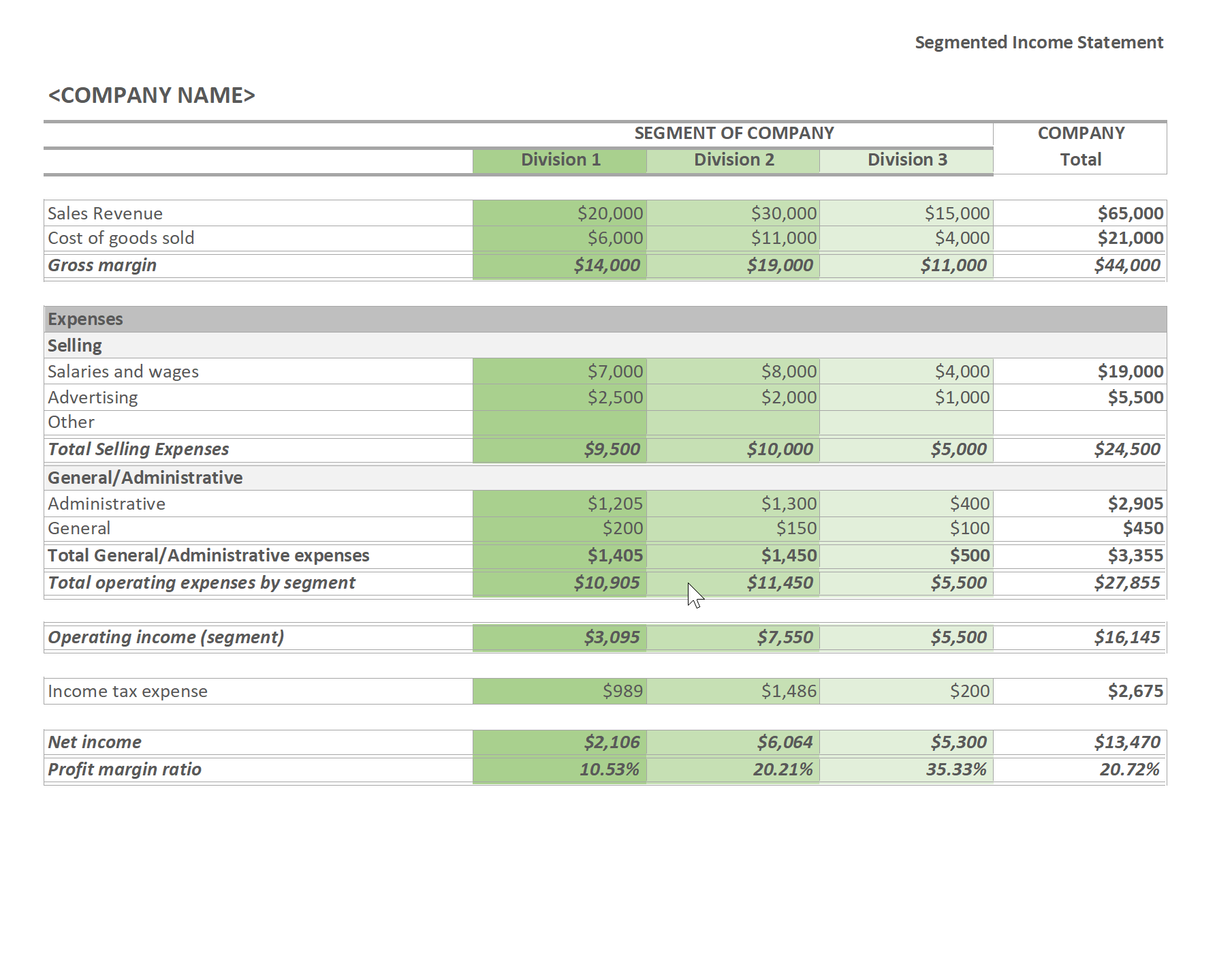

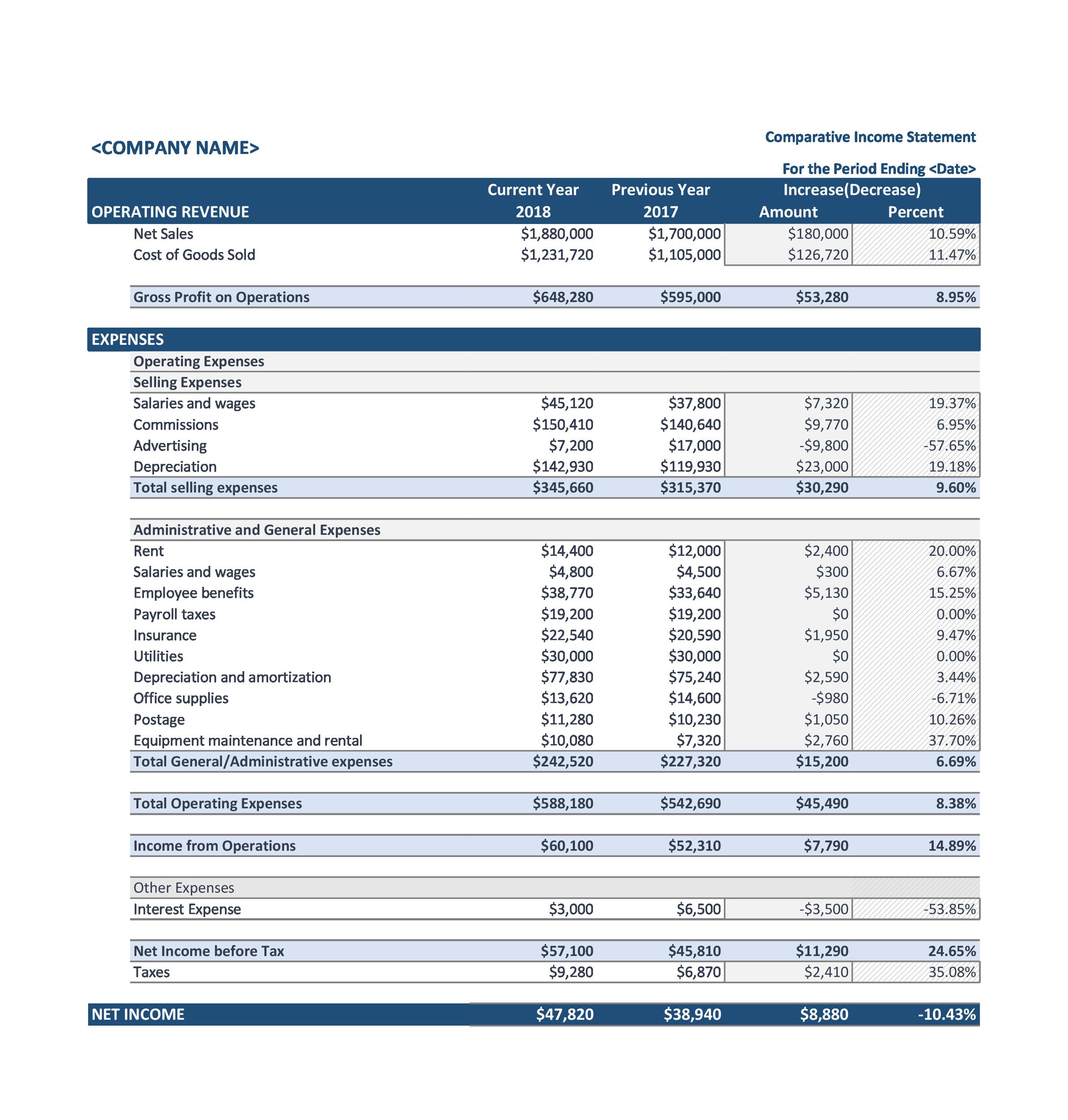

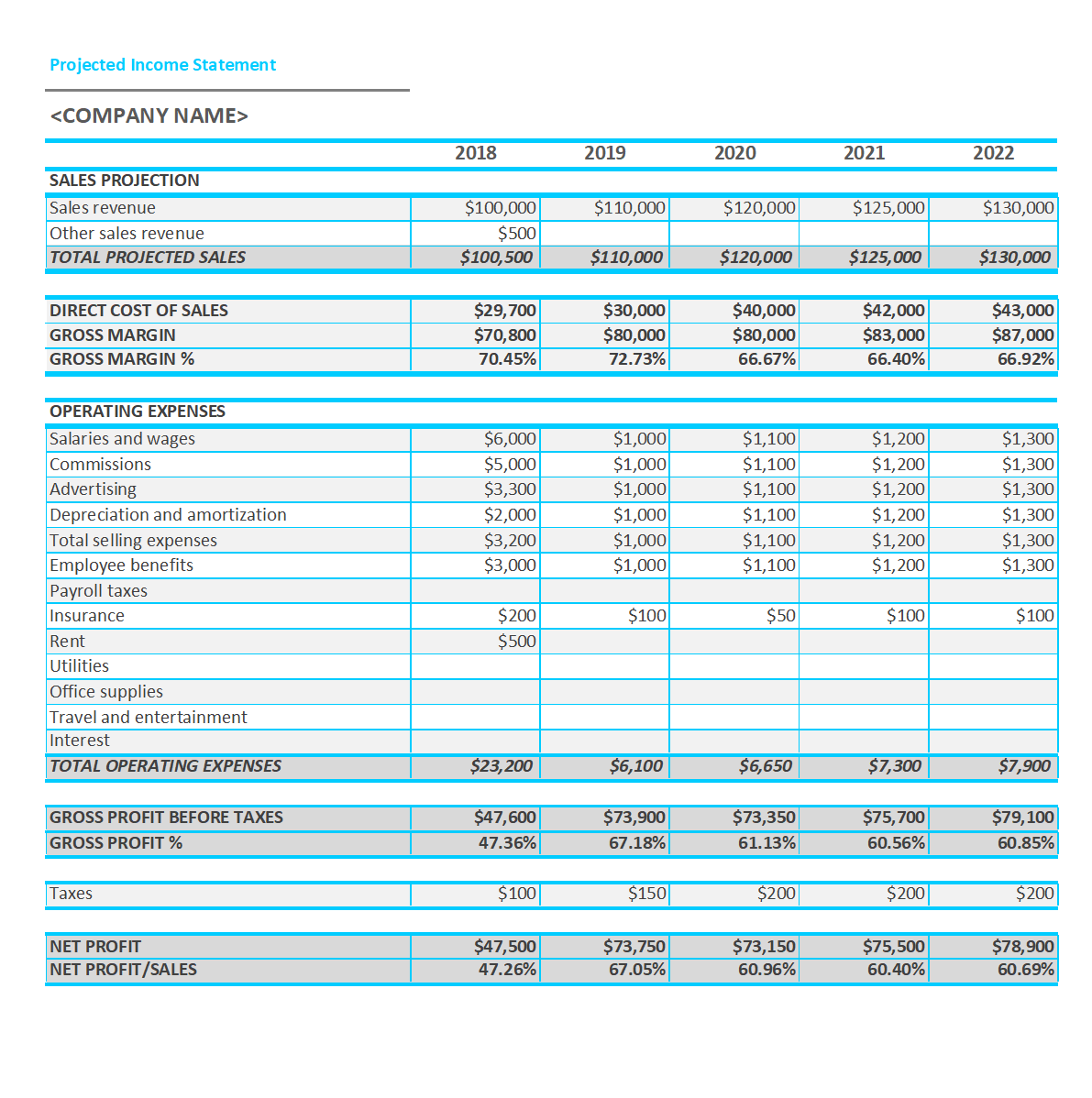

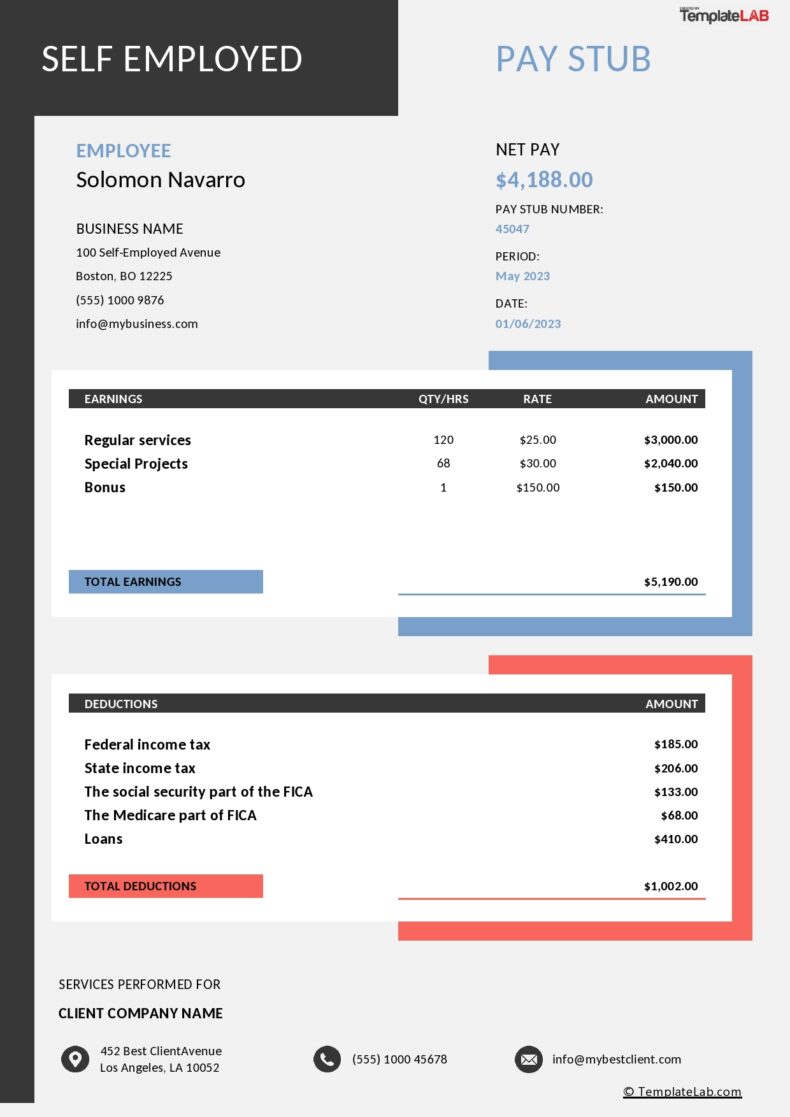

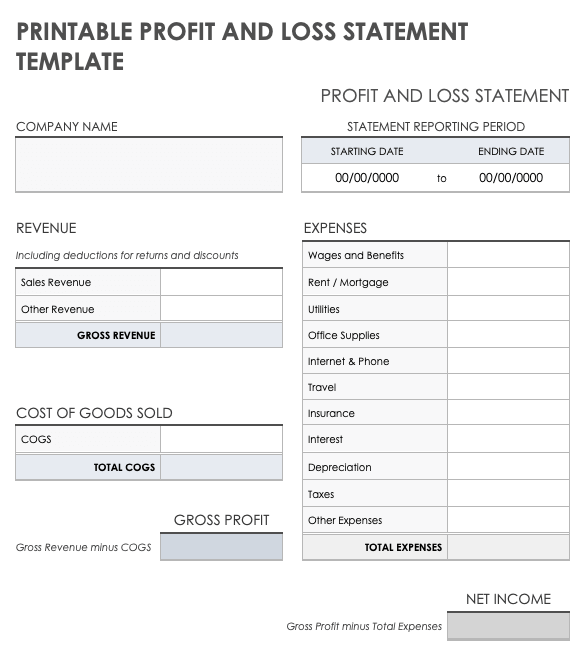

Income Statement Templates

Get in-depth insight of your business performance with income statement. download these easy to use example income statement templates..

What is Income Statement?

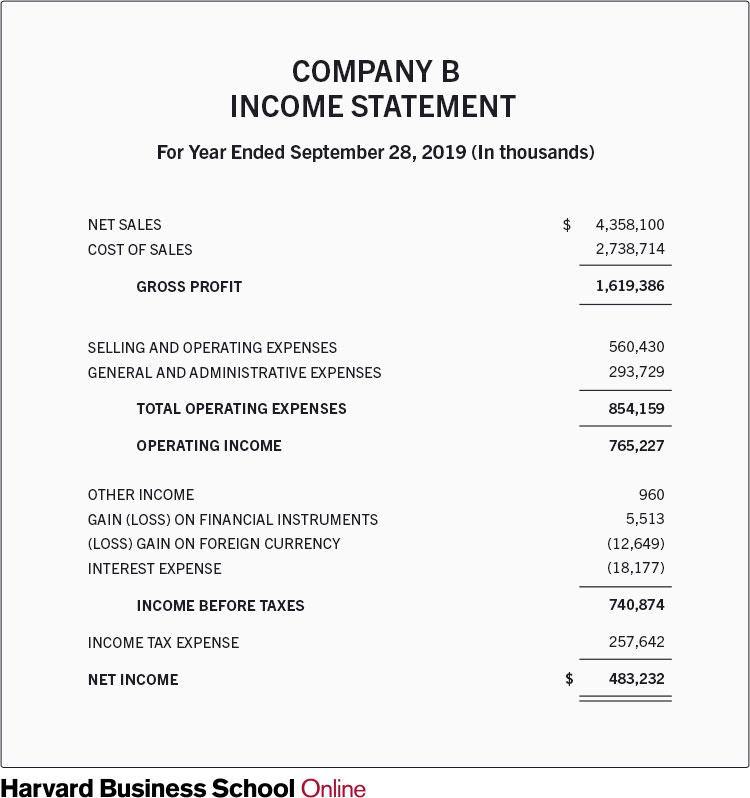

An income statement gives an overview of a company’s income and expenses. It is a type of financial statement used to evaluate the company’s performance in the short term. Since most other financial statements are prepared annually or biannually, an income statement is also created monthly or quarterly. An income statement is also called a profit and loss statement, earnings statement, or statement of operations.

An income statement helps managers and investors make decisions in the short term. It helps assess the company’s growth trajectory.

The income statement is primarily used for measuring profitability, not cash flow.

Why use an income Statement

An Income Statement is prepared monthly and quarterly. Unlike other financial statements and reports, the income statement gives business profitability information on a monthly basis. A monthly report can help identify immediate threats and opportunities and a business can avoid nose dive.

You can also use this income statement template in financial planning of your business plan . Having a template for income statement will save you time and hassle in writing your business plan .

Investors may also ask for income statements in addition to the balance sheet and other financial reports. The reason is the same as the income statement focuses more on the short term.

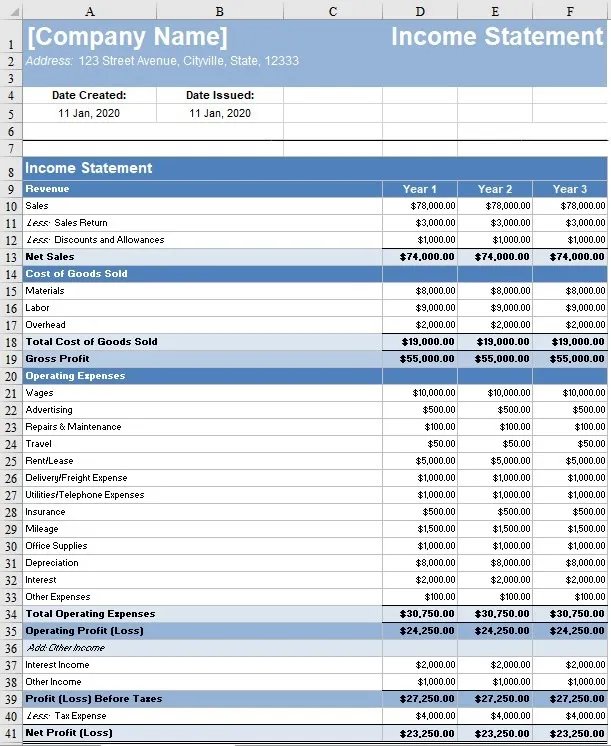

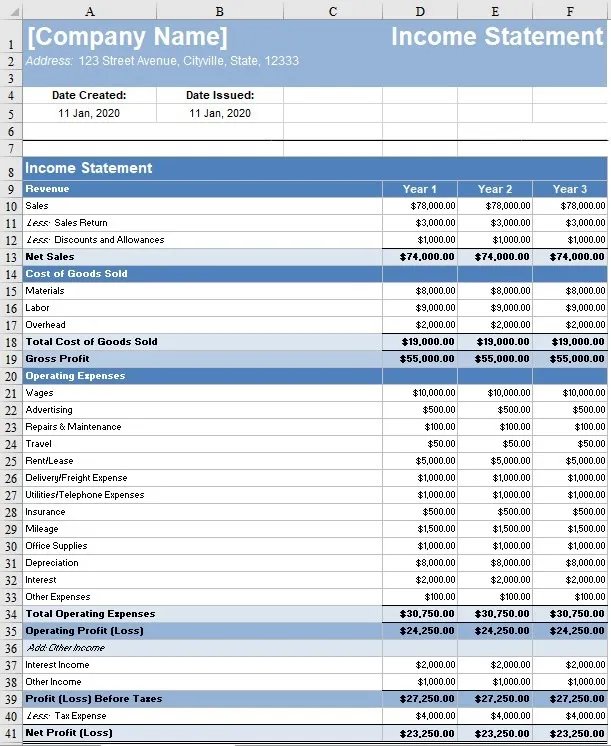

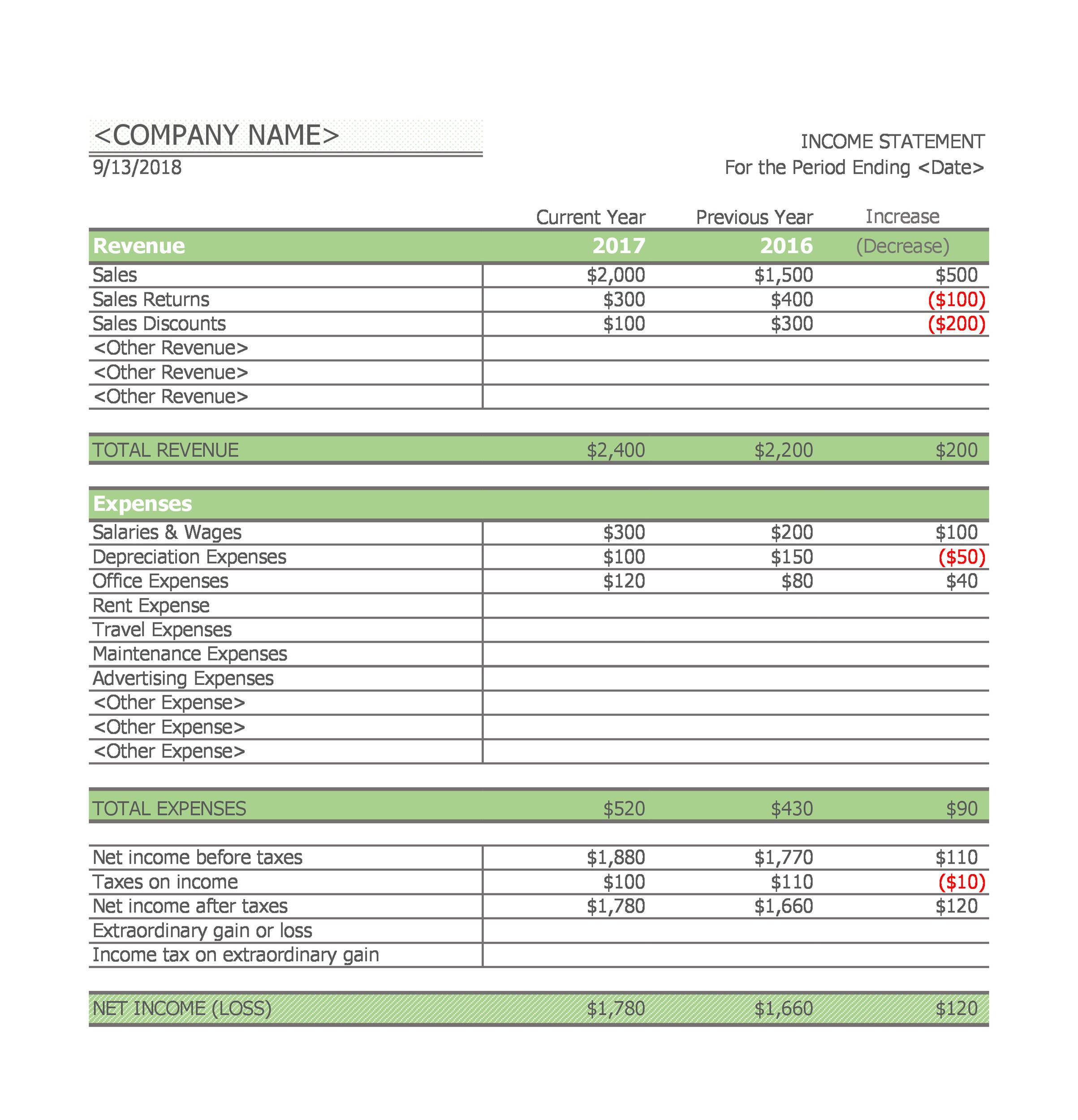

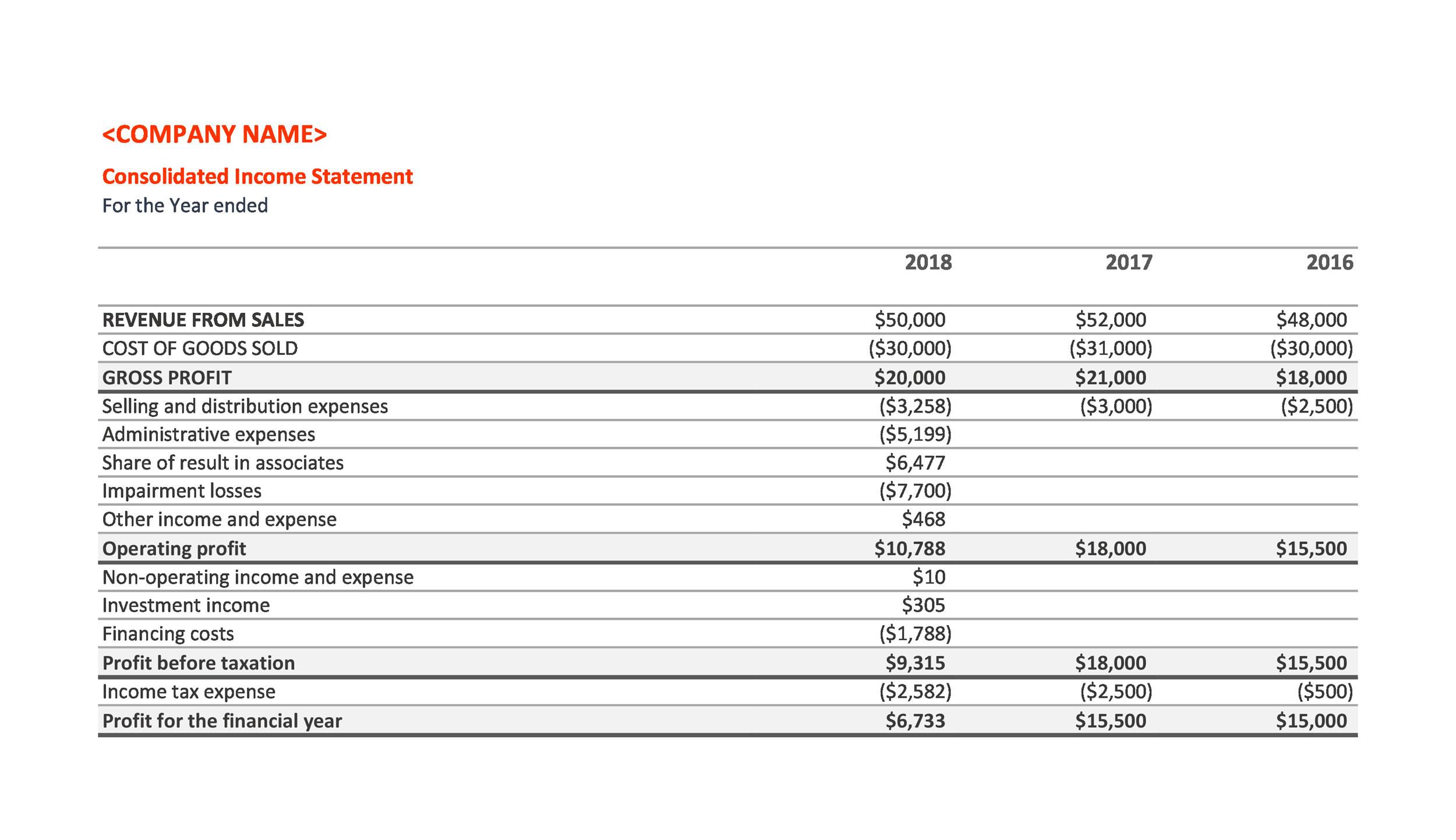

Income Statement Template for Business Plan

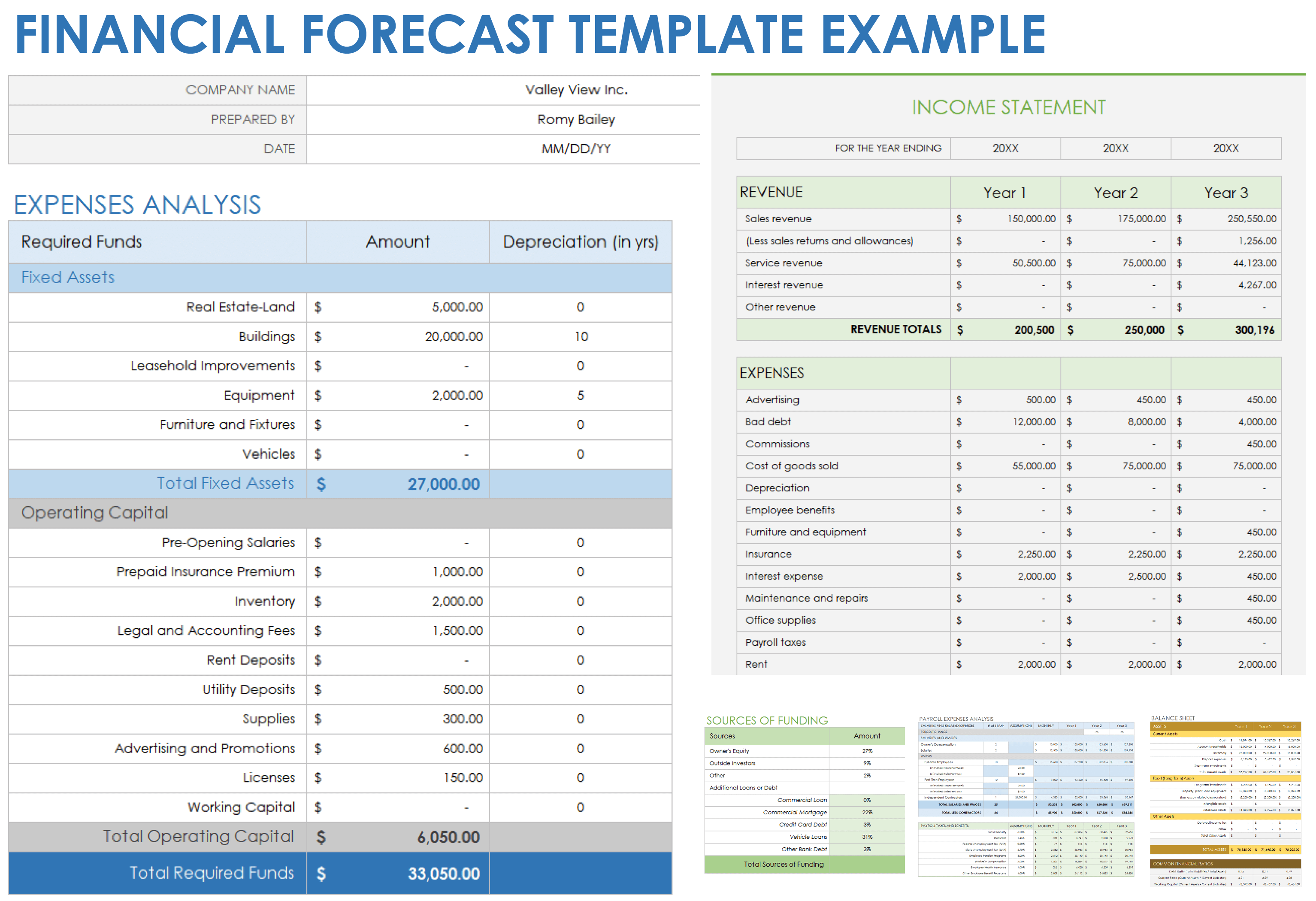

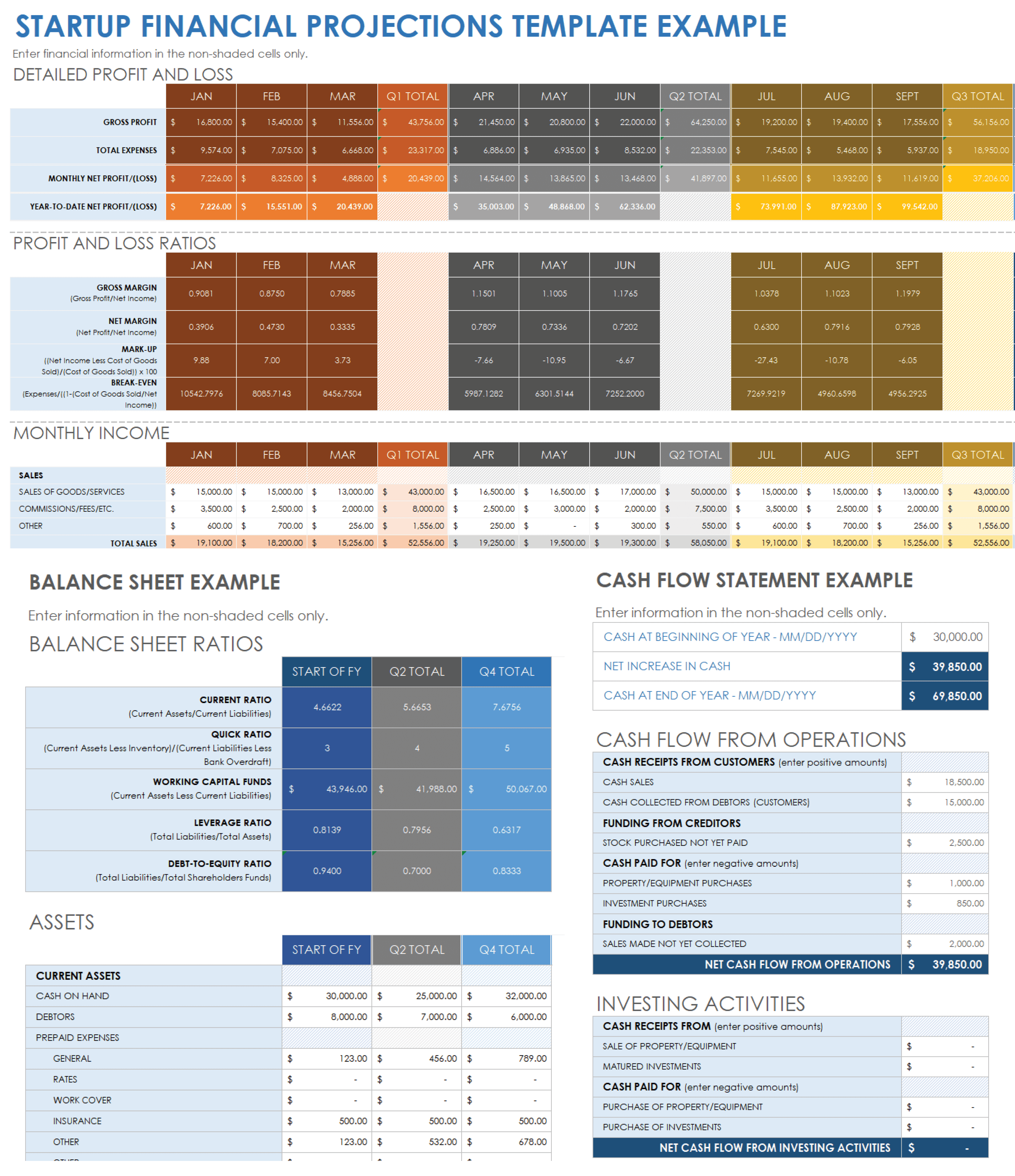

A forecast income statement is an essential part of a business plan. Along with cash flow statement and balance sheet, income statement makes the financial planning part of the business plan.

This income statement template for business plan can be used without any additional changes; download income statement template, populate it with forecast numbers and your income statement for business plan is ready.

Download Free Income Income Statement Templates

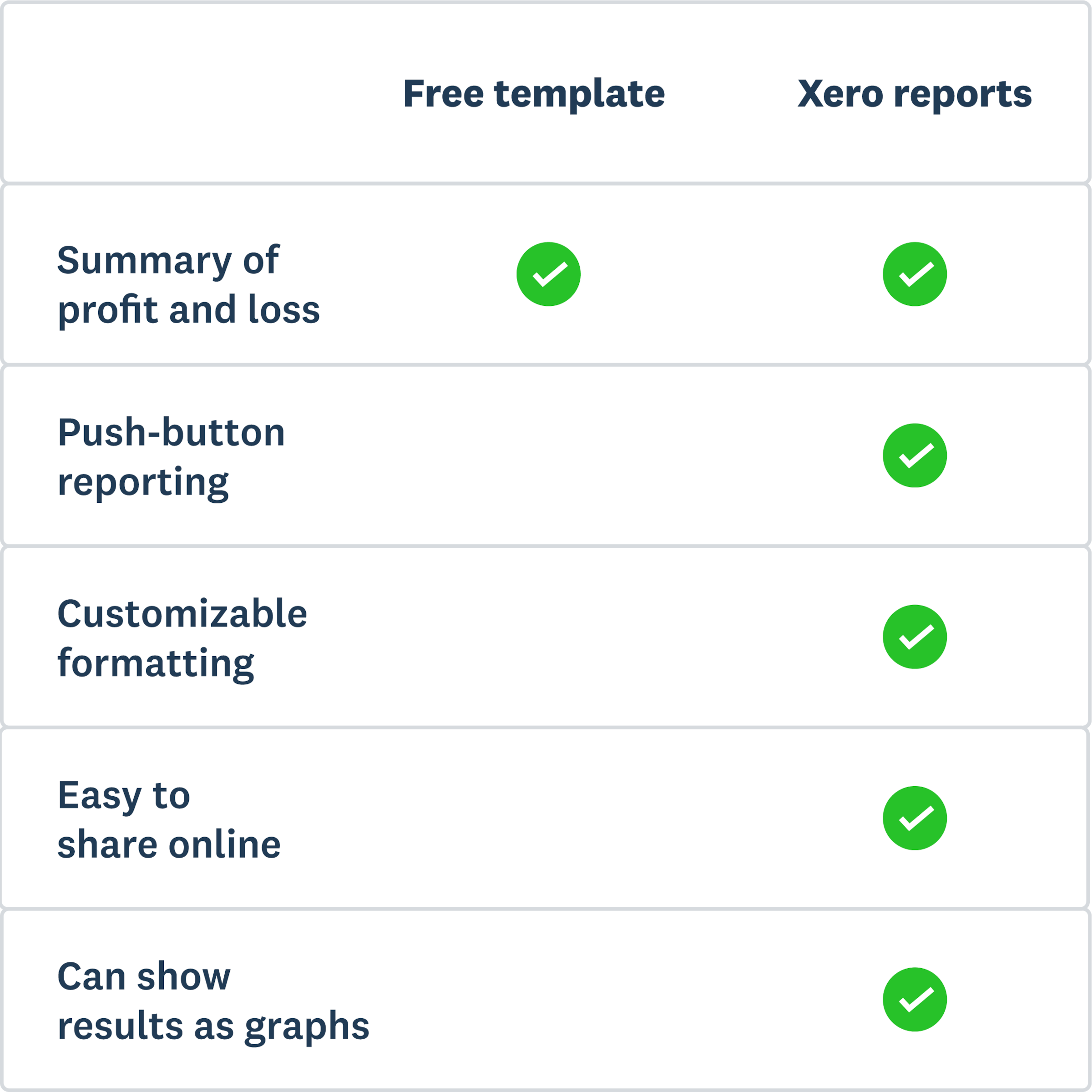

There are two basic types of income statements, Single-step income statements, and multi-step income statements. Here is a short side-by-side comparison of the two. When you are unsure about it, use Single Step Income Statement.

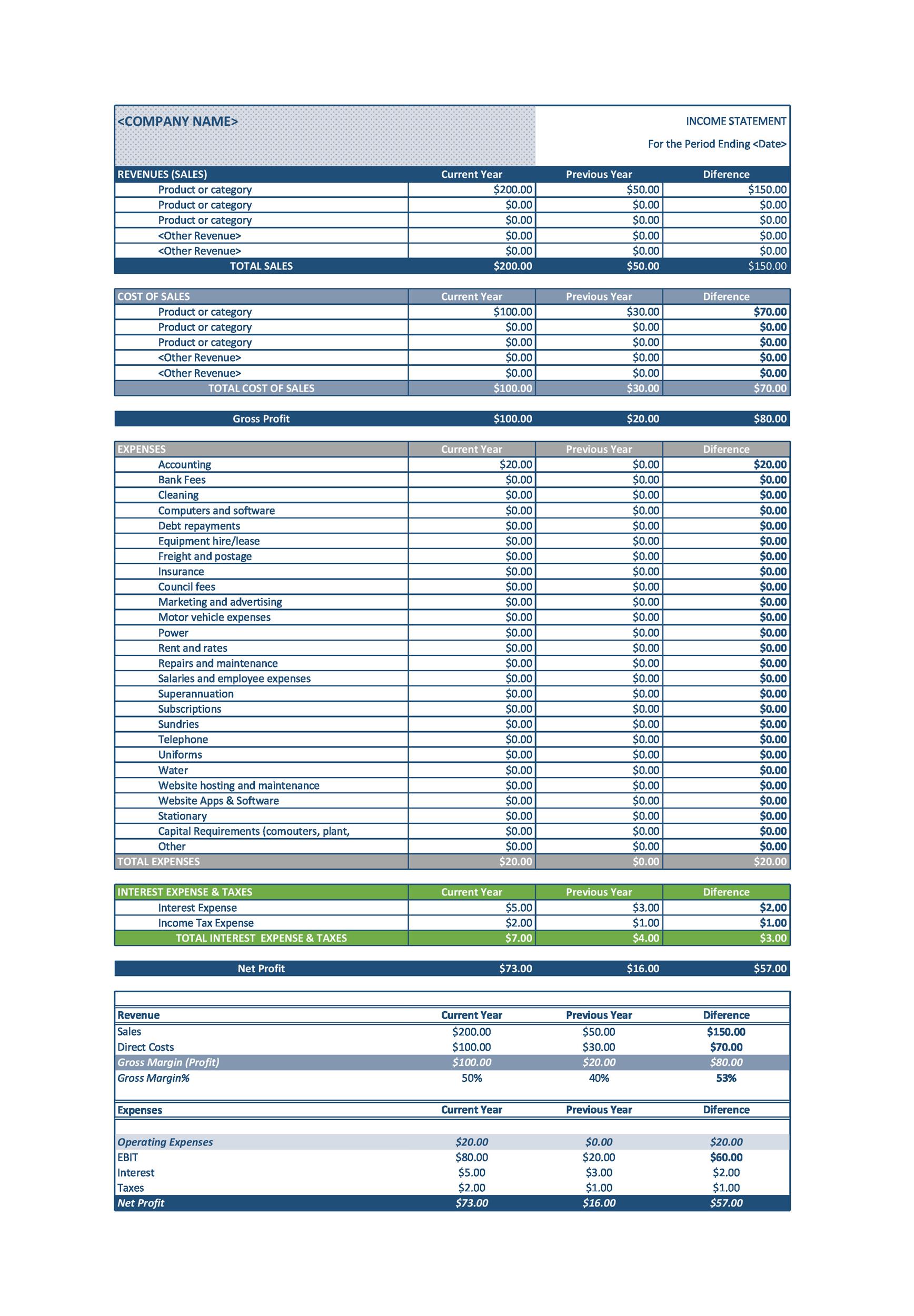

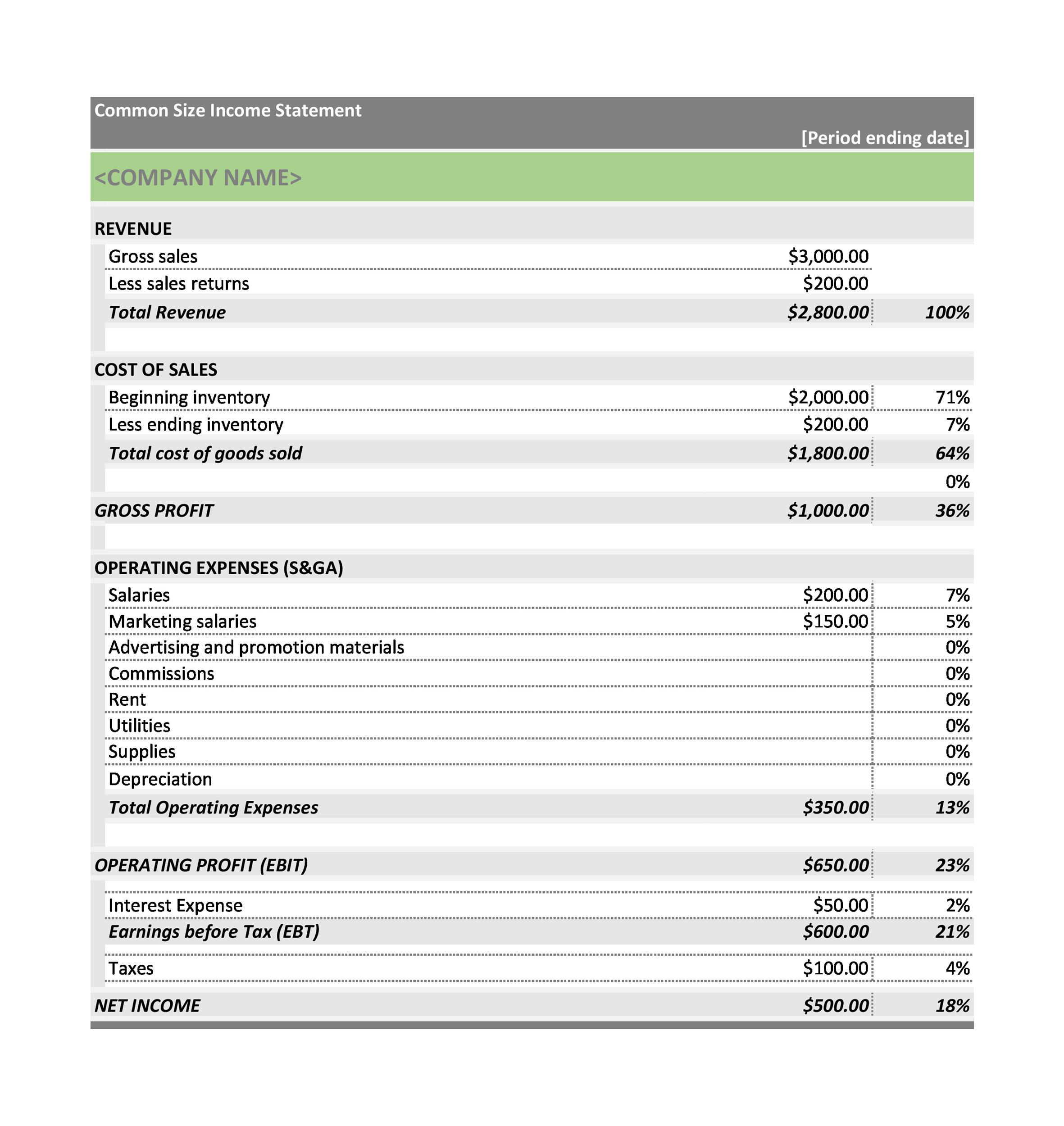

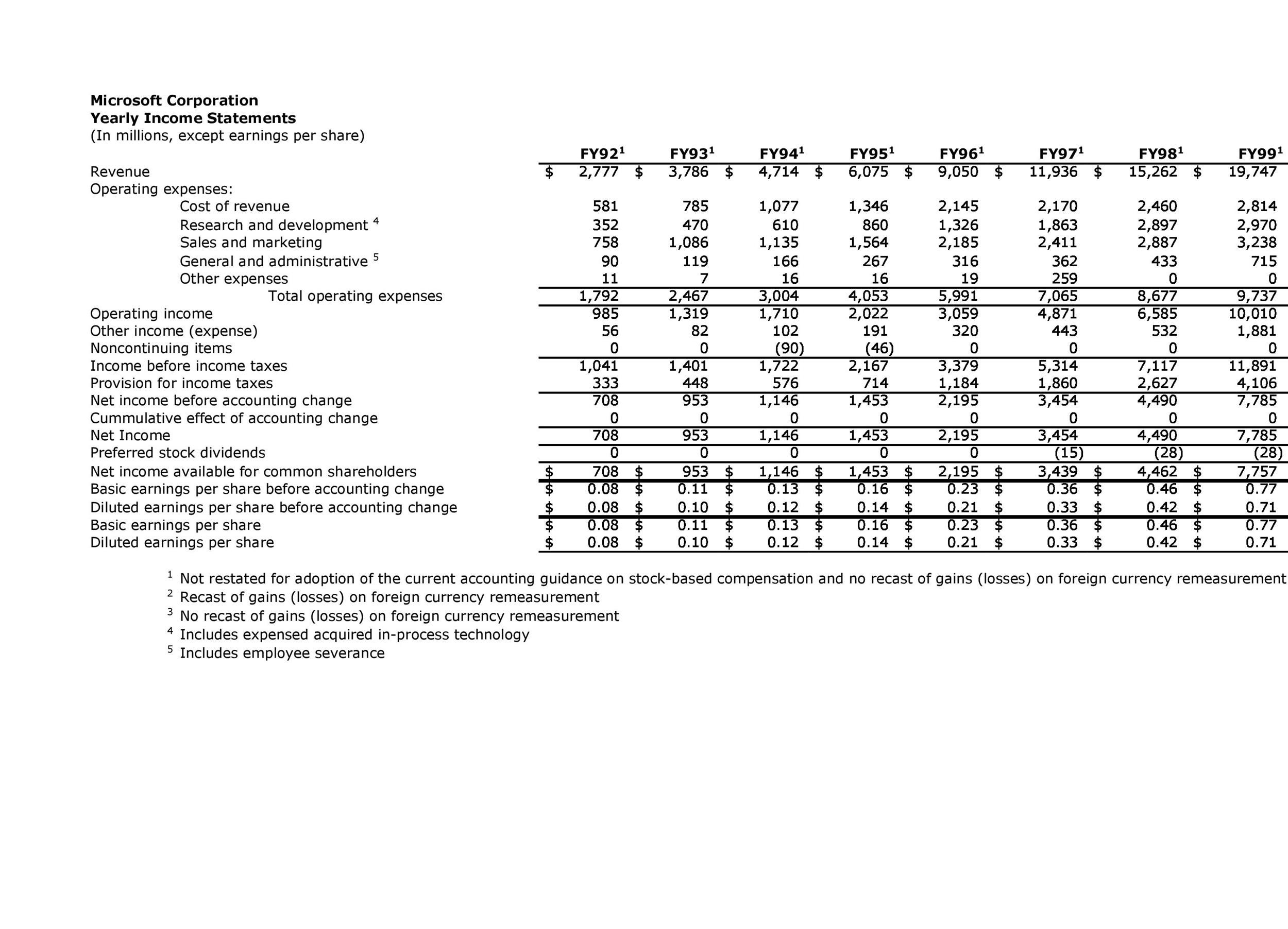

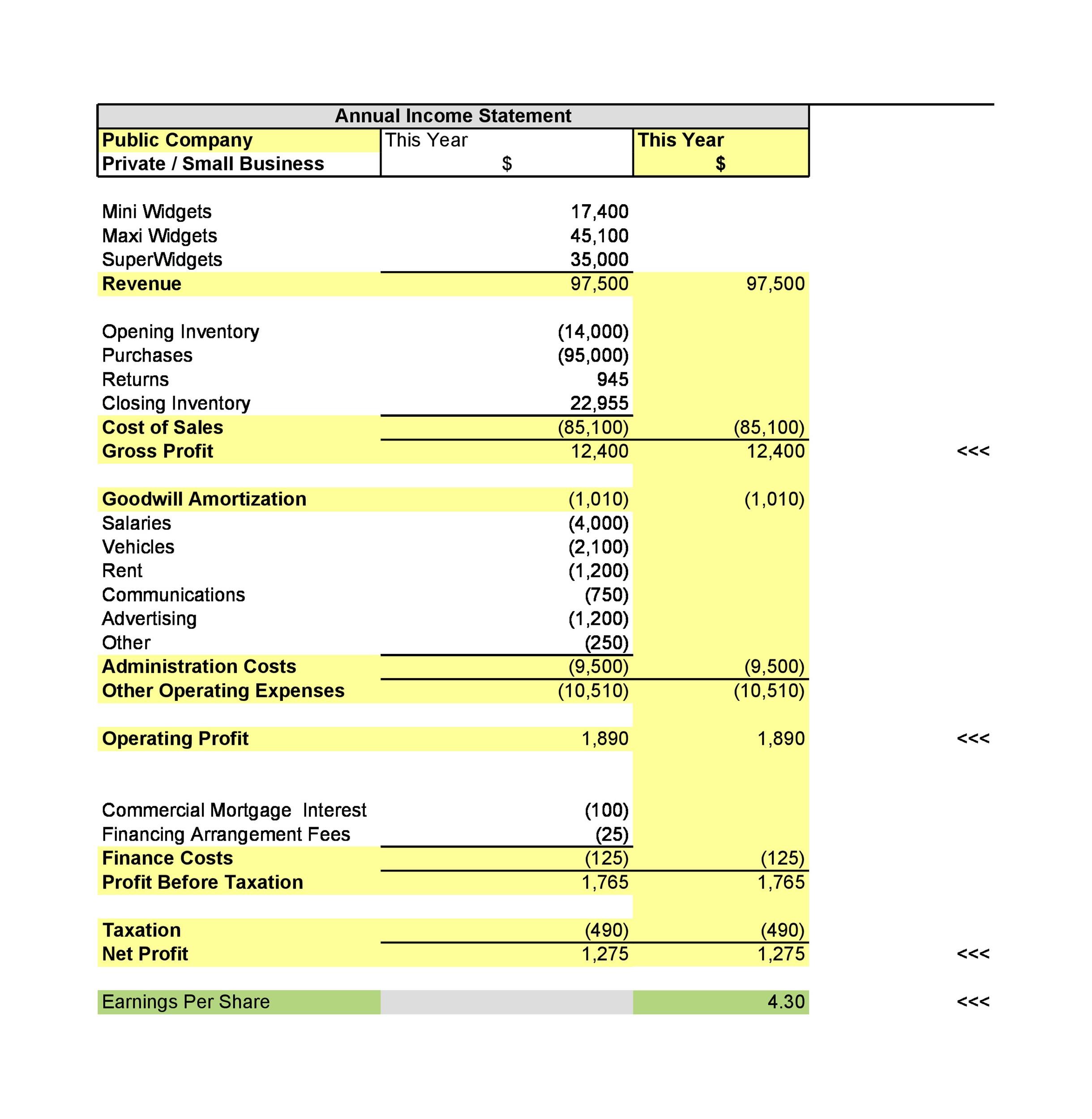

We have prepared these three income statement templates. You can also download income statement excel format. You can also use the income statement template for business plan.

Basic Single Step Income Statement

Traditional Income Statement

Multi-step income statement

Download single or simple income statement template in excel format here. Put in your business numbers in the templates and see how your business is doing!

Download Single Step Income Statement Template Excel

Traditional income statement is easy to use. Download the traditional income statement template and make financial statement for your business.

Download Traditional Income Statement Template

Multi Step Income Statement gives an in-depth analysis of your business. Download this free multi step income statement template to look closely into your business performance.

Download Multi Step Income Statement Template

Comparison of Single Step Income Statement vs Multi Step Income Statement

A single step income statement is prepared with simple accounting equation that subtracts ‘losses and expenses’ from ‘revenues and gains’. Whereas the multi step income statements also include the the expenses and revenues from non-operational resources and follows a three step approach to calculate net income. An example of income statement will include all the list items mentioned here.

| Single Step Income Statement | MutilStep Income Statement |

|---|---|

| Net Sales | Net Sales |

| Cost of Sales | Materials and Production |

| Gross Income | Marketing and Administrative |

| Selling, General and Administrative (SG&A) | Research and Development Expenses |

| Operating Income | Other Income and Expenses |

| Other Income and Expenses | Pretax Income |

| Pretax Income | Net Income |

| Net Income after tax | ------------------ |

Income Statement Formula

In one line, the income statement formula is:

“ total revenues – total expanses= Net income”

An income statement gives a comparison and overview of the company’s revenue and expenses. It helps understand the business growth trajectory in the short term.

If your business’s revenues are greater than the expenses, your company is making a profit. Whereas, if your expenses are more than your revenues, your company needs to look closely into the income statement and take the necessary steps for making it profitable again.

The income statement displays the net profitability of a business. It serves as a tool for investors and owners and it shows the company’s profitability.

An income statement is a better financial report for checking the performance of a business in the short run.

What goes on an income statement?

For most businesses, the income statement items will be different. However, the structure stays the same. Most templates can be used for any industry after a few changes. You will find these list items on any income statement example.

- Cost of Goods Manufactured

- Gross Margin

- Amortization

- Depreciation

- Rent expense

- Salaries and Wages

- Phone and internet

- Operating Income (EBIT)

- Interest Expense

- Earnings Before Tax (EBT)

How to Prepare an Income Statement?

We have provided simple income statement templates and you can use them as guidelines for preparing an income statement. Our templates are compatible with Microsoft Excel; you can download and use them for your business.

The following steps will be helpful for you in preparing an income statement.

1. Select a Reporting Period

An income report shows revenues and expenses for a certain time period. You can choose any time period from one month to many years.

Mostly income statement is created on a monthly, quarterly, bi-annually, or yearly basis. Most companies create monthly income statements to keep a close eye on their performance.

2. Prepare a Trial Balance Report

You will need to create a standard trial balance report for creating an income report. A trial balance report gives end balance numbers for each account which is necessary for the income statement. If you are using an accounting tool, you can easily prepare and print out the trial balance report in a few clicks.

3. Calculate Revenue

Next, you will need to calculate all the revenues your firm has earned in the selected time period. Revenues will include everything you have earned from selling your goods or services in the reporting period, whether you have received the payment or not.

4. Calculate Cost of Goods Sold

Cost of goods sold includes the labor cost, materials cost, and overhead costs you have made in offering your goods or services.

From your trial balance, add the ‘cost of goods sold items and put the number on the income statement below revenue line items.

5. Calculate Gross Margin

Subtract ‘cost of goods sold’ from ‘Revenues’ and you will have your Gross Margin number.

6. Include Operating Expenses

Take all the operating expenses line items from your trial balance and put the final number in ‘selling and administrative expanses’ in the income statement.

7. Calculate your Income

When you take out the ‘selling and administrative’ expanses from ‘Gross Income’, you will get your income before taxes.

8. Include Income Tax

Find your state’s tax rate, multiply it with your pretax income and you will get the income amount you will have to pay. The income tax number will go below the pretax income in the income statement.

Pro Tips: learn how to to calculate income tax with our income tax calculator .

9. Calculate Net Income

Take out the income tax from pretax income and you will get your net income. Your net income will give you an overview of your business performance and profitability.

10. Finalize the Income Statement

Add the ‘Income Statement’ in the header of the income statement report for easier identification. Your income statement is complete now.

In case you are using income statement template in a business plan, you will put the expected, forecast numbers in the template to prepare the income statement.

Need help creating other essential business reports?

Download our 15+ designer approved business templates for free and make your clients feel impressed.

Frequently Asked Questions

A Profit and loss statement (P&L statement) is also called an income statement. An income statement or P&L statement is the summary of revenues, expenses, cost of goods sold, administrative expenses, and taxes for a specific time period.

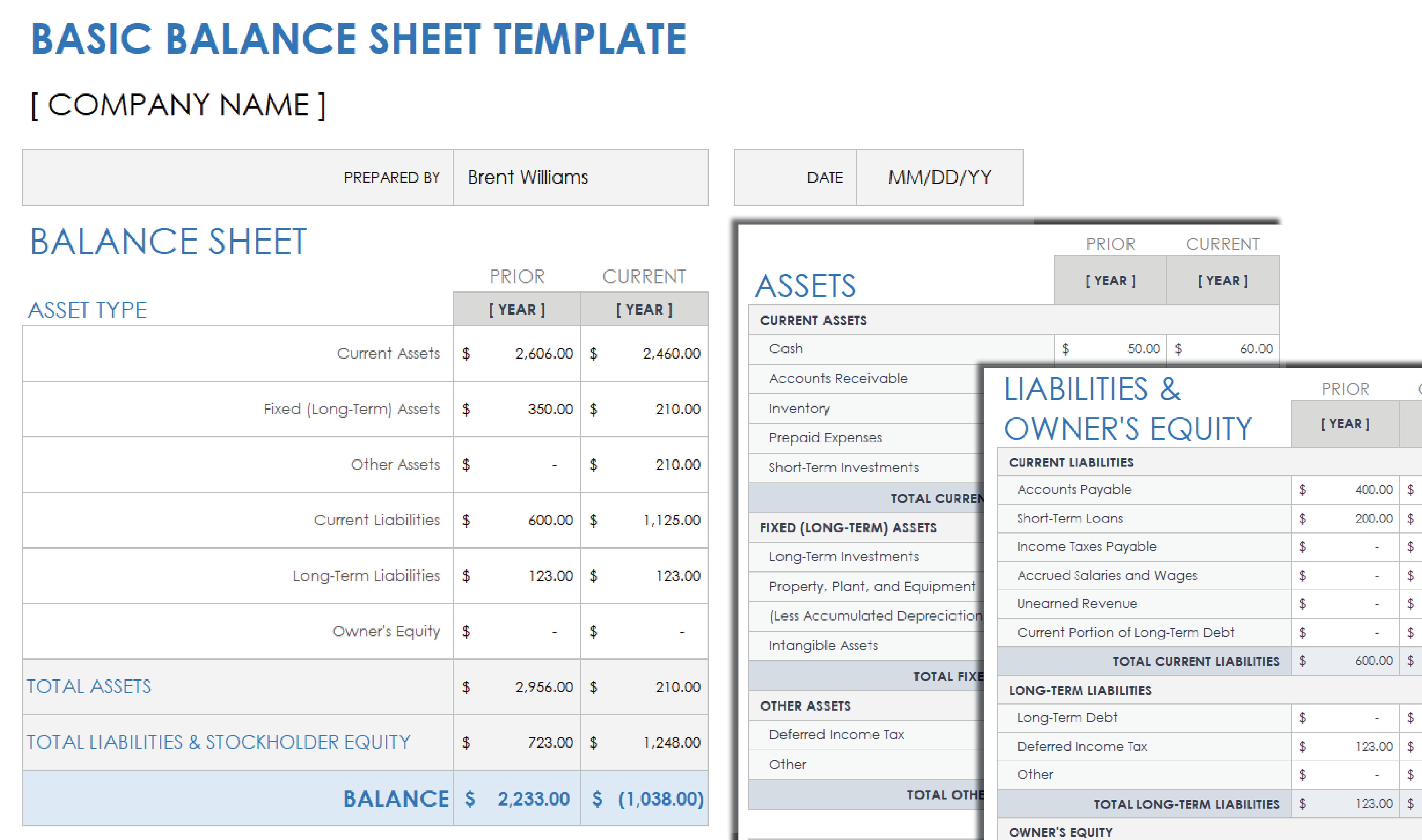

Income statement and balance sheet are not the same. Both of these reports give important information about the business; an income statement gives a profit and loss assessment of a business while balance sheets tell about the financial situation of a business at a certain point in time.

Income statement can be prepared for both cash and accrual-based accounting. However, the revenues and expenses calculation method will be different as we will only be recording the revenues received and expenses made.

Income Statement shows the current profitability of a business. It details the revenues and expenses of a business. The income statement can be negative if the expenses and costs are more than the total revenue.

An income statement includes the following expenses.

Cost of goods sold- the expenses you incur for the materials and labor.

Selling, General and Administrative Expanses-this head include all indirect expenses, advertising expenses, overhead expenses, rentals, etc.

Depreciation and Amortization- Depreciation shows the decrease in the value of tangible assets like machinery, automobiles, etc; amortization is the decrease in the value of intangible assets like patents and trademarks.

Research and Development-If your business has a research and development facility, you will need to add these costs to the income statement.

There are two basic types of income statements; single-step income statements and multistep income statements. A multistep income statement has more details and includes incomes and expenses.

Get in Touch

Contact us today for a free consultation, related articles, quick links.

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- Write Your Business Plan | Part 1 Overview Video

- The Basics of Writing a Business Plan

- How to Use Your Business Plan Most Effectively

- 12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 3 Key Things You Need to Know About Financing Your Business

- 12 Ways to Set Realistic Business Goals and Objectives

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- Write Your Business Plan | Part 2 Overview Video

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- Write Your Business Plan | Part 3 Overview Video

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- Write Your Business Plan | Part 4 Overview Video

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- Write Your Business Plan | Part 5 Overview Video

- What Equipment and Facilities to Include in Your Business Plan

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

How to Write an Income Statement for Your Business Plan Your income statement shows investors if you are making money. Here's everything you'll need to create one.

By Eric Butow Edited by Dan Bova Oct 27, 2023

Key Takeaways

- An income statement is your business's bottom line: your total revenue from sales minus all of your costs.

Opinions expressed by Entrepreneur contributors are their own.

This is part 3 / 12 of Write Your Business Plan: Section 5: Organizing Operations and Finances series.

Financial data is always at the back of the business plan, but that doesn't mean it's any less important than up-front material such as the description of the business concept and the management team. Astute investors look carefully at the charts, tables, formulas, and spreadsheets in the financial section because they know that this information is like the pulse, respiration rate, and blood pressure in a human being. It shows the condition of the patient. In fact, you'll find many potential investors taking a quick peek at the numbers before reading the plan.

Related: How to Make Realistic Financial Forecasts

Financial statements come in threes: income statement, balance sheet, and cash flow statement. Taken together they provide an accurate picture of a company's current value, plus its ability to pay its bills today and earn a profit going forward. This information is very important to business plan readers.

Why You Need an Income Statement

In his article, How to Do a Monthly Income Statement Analysis That Fuels Growth , Noah Parsons writes: "In short, you use your income statement to fuel a greater analysis of the financial standing of your business. It helps you identify any top-level issues or opportunities that you can then dive into with forecast scenarios and by looking at elements of your other financial documentation.

Related: How to Make a Balance Sheet

You want to leverage your income statement to understand if you're performing better, worse or as expected. This is done by comparing it to your sales and expense forecasts through a review process known as plan vs actuals comparison. You then update projections to match actual performance to better showcase how your business will net out moving forward."

What Is In an Income Statement

An income statement shows whether you are making any money. It adds up all your revenue from sales and other sources, subtracts all your costs, and comes up with the net income figure, also known as the bottom line.

Related: How to Make a Cash Flow Statement

Income statements are called various names—profit and loss statement (P&L) and earnings statement are two common alternatives. They can get pretty complicated in their attempt to capture sources of income, such as interest, and expenses, such as depreciation. But the basic idea is pretty simple: If you subtract costs from income, what you have left is profit.

To figure out your income statement, you need to gather a bunch of numbers, most of which are easily obtainable. They include your gross revenue, which is made up of sales and any income from interest or sales of assets; your sales, general, and administrative (SG&A) expenses; what you paid out in interest and dividends, if anything; and your corporate tax rate. If you have those, you're ready to go.

Related: Tips and Strategies for Using the Balance Sheet as Your Franchise Scorecard

Sales and Revenue

Revenue is all the income you receive from selling your products or services as well as from other sources such as interest income and sales of assets.

Gross Sales

Your sales figure is the income you receive from selling your product or service. Gross sales equals total sales minus returns. It doesn't include interest or income from sales of assets.

Interest and Dividends

Most businesses have a little reserve fund they keep in an interest-bearing bank or money market account. Income from this fund, as well as from any other interest-paying or dividend-paying securities they own, shows up on the income statement just below the sales figure.

Related: How to Measure Franchise Success With Your Income Statement

Other Income

If you finally decide that the branch office out on County Line Road isn't ever going to turn a decent profit, and you sell the land, building, and fixtures, the income from that sale will show up on your income statement as "other income." Other income may include sales of unused or obsolete equipment or any income-generating activity that's not part of your main line of business.

Costs come in all varieties—that's no secret. You'll record variable costs, such as the cost of goods sold, as well as fixed costs—rent, insurance, maintenance, and so forth. You'll also record costs that are a little trickier, the prime example being depreciation.

Related: How to Use Financial Ratios to Understand the Health of Your Business

Cost of Goods Sold

Cost of goods sold, or COGS, includes expenses associated directly with generating the product or service you're selling. If you buy smartphone components and assemble them, your COGS will include the price of the chips, screen, and other parts, as well as the wages of those doing the assembly. You'll also include supervisor salaries and utilities for your factory. If you're a solo professional service provider, on the other hand, your COGS may amount to little more than whatever salary you pay yourself and whatever technology you may use for your business.

Related: My Company Hears Hundreds of Pitches Every Year — Here's What Investors Are Actually Looking For.

Sales, General, and Administrative Costs

You have some expenses that aren't closely tied to sales volume, including salaries for office personnel, salespeople compensation, rent, insurance, and the like. These are split out from the sales-sensitive COGS figure and included on a separate line.

Depreciation

Depreciation is one of the most baffling pieces of accounting wizardwork. It's a paper loss, a way of subtracting over time the cost of a piece of equipment or a building that lasts many years even though it may get paid for immediately.

Related: 10 Mistakes to Avoid When Pitching Investors (Infographic)

Depreciation isn't an expense that involves cash coming out of your pocket. Yet it's a real expense in an accounting sense, and most income statements will have an entry for depreciation coming off the top of pretax earnings. It refers to an ongoing decrease in asset value.

If you have capital items that you are depreciating, such as an office in your home or a large piece of machinery, your accountant will be able to set up a schedule for depreciation. Each year, you'll take a portion of the purchase price of that item off your earnings statement. Although it hurts profits, depreciation can reduce future taxes.

Paying the interest on loans is another expense that gets a line all to itself and comes out of earnings just before taxes are subtracted. This line doesn't include payments against the principal. Because these payments result in a reduction of liabilities—which we'll talk about in a few pages in connection with your balance sheet—they're not regarded as expenses on the income statement.

Related: How to Craft a Business Plan That Will Turn Investors' Heads

The best thing about taxes is that they're figured last, on the profits that are left after every other thing has been taken out. Tax rates vary widely according to where your company is located, how and whether state and local taxes are figured, and your special tax situation. Use previous years as a guidepost for future returns. If you are just opening your business, work carefully with your accountant to set up a system whereby you can pay the necessary taxes at regular intervals.

Buzzword: EBIT

EBIT stands for earnings before interest and taxes. It is an indicator of a company's profitability, calculated as revenue minus expenses, excluding tax and interest.

Related: Don't Make This Huge Mistake on Your Financial Model

Important Plan Note

Don't confuse sales with receipts. Your sales figure represents sales booked during the period, not necessarily money received. If your customers buy now and pay later, there may be a significant difference between sales and cash receipts.

More in Write Your Business Plan

Section 1: the foundation of a business plan, section 2: putting your business plan to work, section 3: selling your product and team, section 4: marketing your business plan, section 5: organizing operations and finances, section 6: getting your business plan to investors.

Successfully copied link

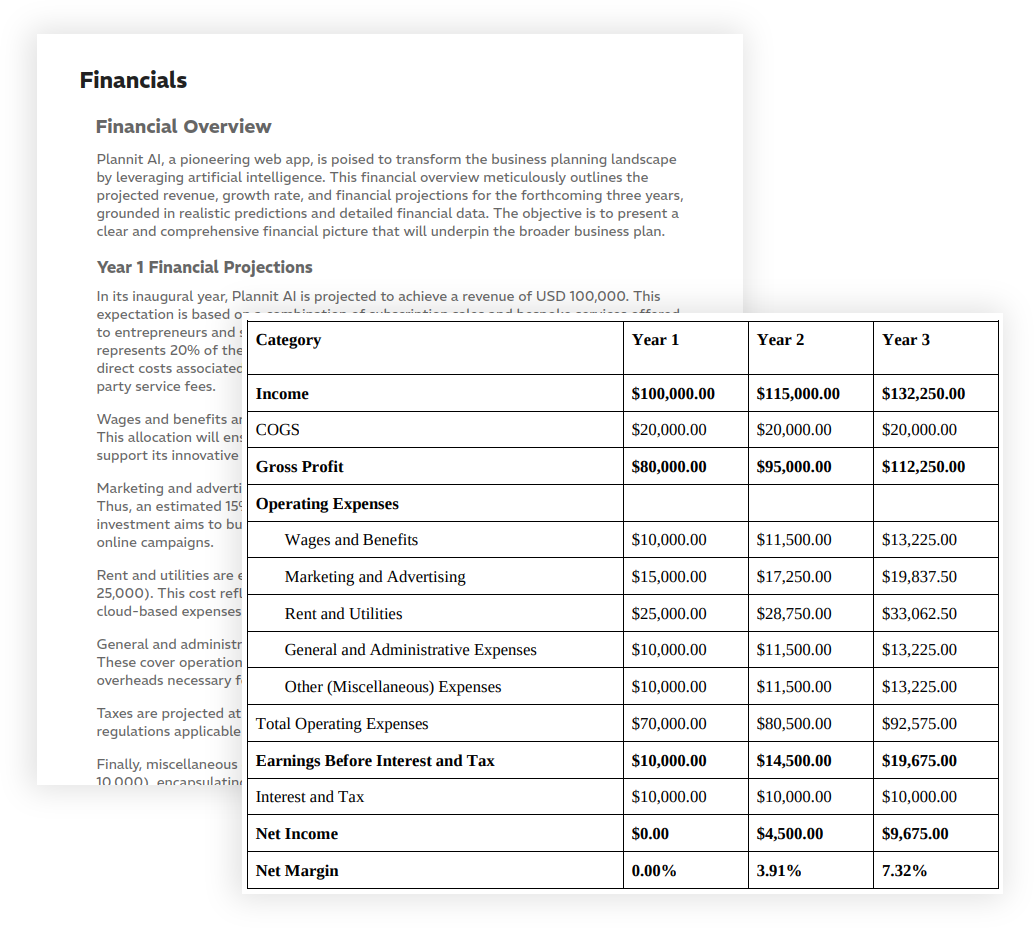

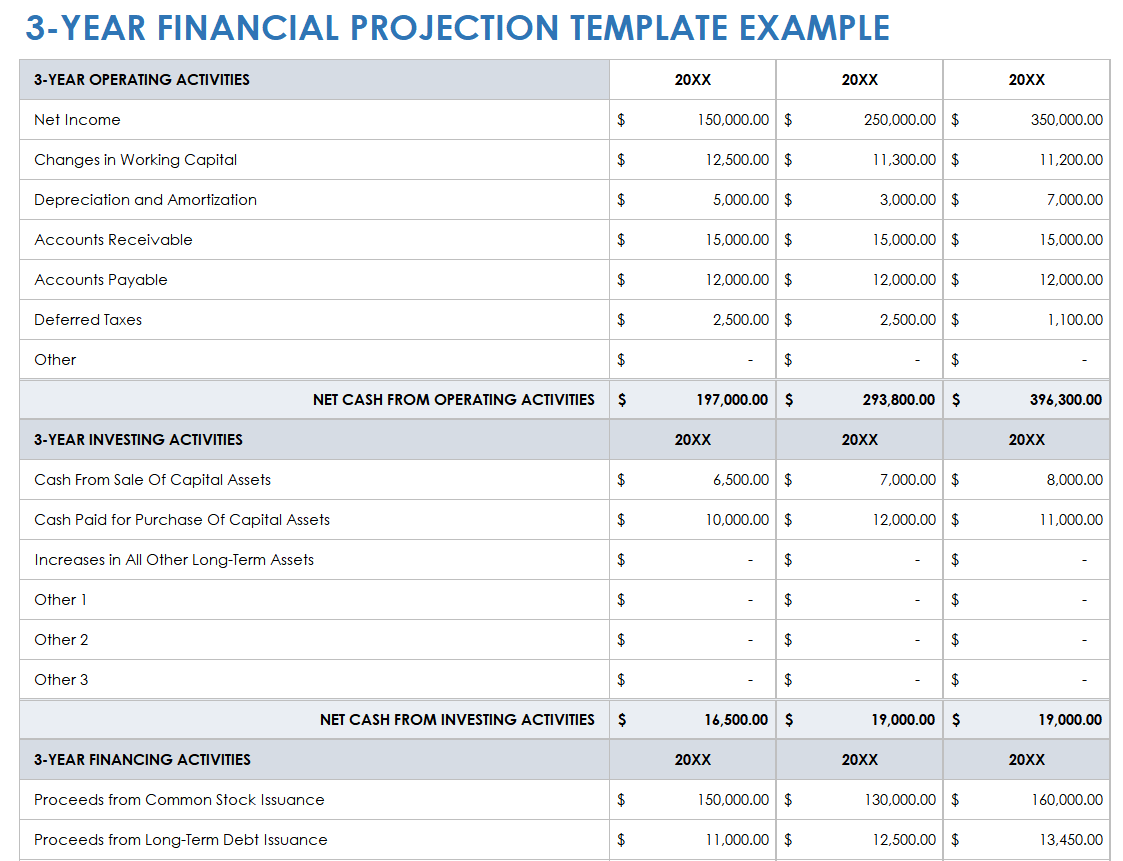

Financial Projections for Your Business Plan

Take Your Business Plan to the Next Level

Financial projections are a crucial part of any business plan. Plannit AI’s financial projections and income statement generator simplifies the process, allowing entrepreneurs to create accurate, detailed financial forecasts with ease. This feature streamlines the process of generating your initial financial information.

Comprehensive Financial Overview

Our algorithms merge seamlessly with the GPT-4 engine to learn from your revenue model, business information and financial inputs, to automatically generate a comprehensive financial overview for your business plan. This includes an in-depth look at the projected growth rate of the company, the expected revenue, and the anticipated expenses.

10x More Powerful AI

We utilize the GPT-4 engine at our own expense to ensure that you have access to the most powerful AI in the industry. This allows us to provide you with the most accurate and detailed financial overview possible.

Simplified User Experience

Answer a few additional questions to allow us to calculate your financial projections and generate an income statement for your business plan. All in under 30 seconds.

Detailed 3-Year Income Statement

Based on your revenue model, your business information and your financial inputs, we generate a detailed 3-year income statement for your business plan, formatting your vision into dollars.

Create Your Business Plan Today

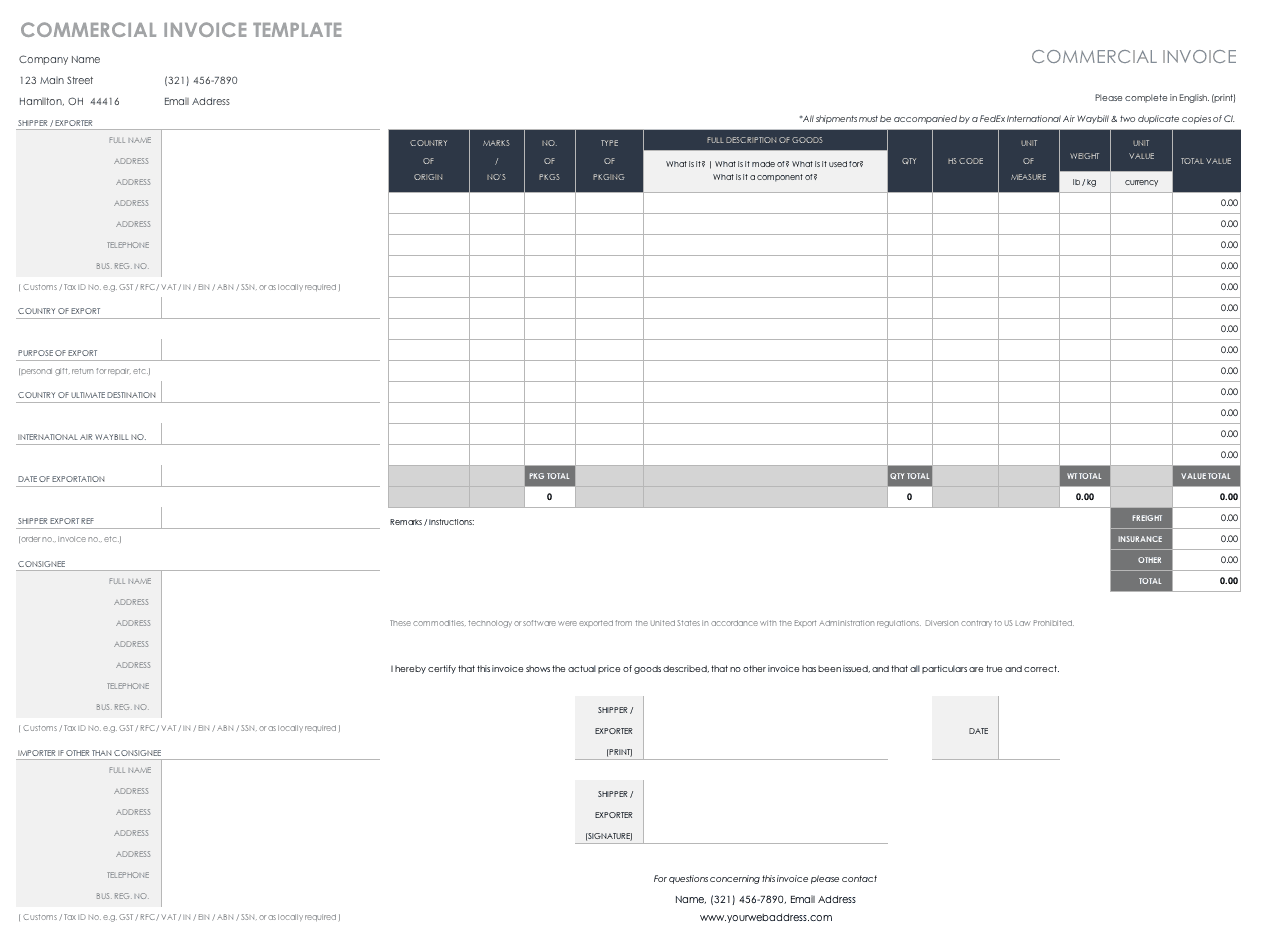

Simple Income Statement Template (In Excel)

When creating your business plan, you’ll need to include a comprehensive income statement. An income statement, also commonly referred to as a profit and loss statement, is essentially a snapshot of your business’s profitability or the profits generated from operations over a certain period of time. It contains the company’s revenues, total operating expenses, and net income over a specific time period.

This information is important to potential lenders or investors, as it will show them how the company is performing. It can also help identify areas of improvement and track income and expenses over time. So if you’re in the midst of creating your business plan, you need to include an income statement to show investors and other shareholders the state of your finances.

What is a Pro Forma Income Statement?

A pro forma income statement is an advance income statement projection that is used to estimate a company’s financial performance in the future. It is prepared before the actual income statement is finalized and takes into account changes in market conditions, as well as any planned investments or expenses. The pro forma statement contains estimated figures that are not yet finalized, allowing businesses to plan ahead and make more informed decisions when it comes to their finances.

The pro forma statement typically includes projected sales revenues and expenses, such as costs of goods sold, operating expenses, and interest expenses. The goal of a pro forma income statement is to provide companies with an idea of how their business will perform financially in the future so they can adjust their budget according to the estimated outcomes. A pro forma can also be used to compare different scenarios and forecast potential challenges or opportunities for a business moving forward.

In addition, a pro forma statement can be used by investors as a tool for analyzing a company’s performance over time, as well as its ability to meet short-term goals or take on new projects. This allows investors to gain insights that are not easily visible when solely focusing on historical data points or industry averages. By taking into account current trends and accurate assumptions about the future, a pro forma provides valuable information that can help investors make better investment decisions.

Why You Need an Income Statement For Your Business

There are several reasons why your business needs an income statement:

- Helps you get funding: First and foremost, an income statement is essential for obtaining financing from potential investors. Without an income statement in your business plan, it is almost impossible to receive funding for your business, as investors will want to know exactly how much money your business has earned or lost in order to make an investment decision. By having a clear and up-to-date profit and loss statement in your business plan, you can provide potential investors with the vital information they will need in order to make an informed decision.

- Helps monitor financial performance: An income statement provides owners and investors with important insights into a business’s financial performance over a given period of time. This allows the owner to track revenue and expenses, as well as any gross profit or loss that may have been incurred throughout the year. These insights can then be used to make better business decisions in the future, such as hiring additional staff or investing in new equipment.

- Improves decision-making: By having an income statement in place, a business is able to make more informed decisions on how to best allocate its resources. This can be especially helpful when attempting to determine the impact that certain expenses may have on a company’s bottom line. With the help of an income statement, businesses can better understand which investments or expenditures are necessary for the long-term health of the organization.

- Completes your business plan: You need a business plan for several reasons, including raising capital, obtaining a loan, or even just formalizing your business concept. An income statement is an essential component of any business plan, as it provides investors, lenders, and other shareholders with the necessary information to make an informed decision about your business.

Finish Your Financial Model and Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your financial model and business plan?

Components of a Simple Small Business Income Statement

When working on your income statement, there are several essential components that you need to include to get an accurate picture of your financials. These components include:

Revenue is the amount of money your business earns from its sales. This includes all income generated through the sale of products and services, as well as any other fees your company may collect.

Expenses are all costs associated with running a business. These business expenses include things like labor costs, materials, rent or utilities, marketing expenses, insurance costs, taxes and any other operating expenses specific to your type of business.

Cost of Goods Sold (COGS)

Cost of goods sold (COGS) refers to the amount of money spent on producing the goods or services that your company sells. This includes all direct expenses associated with the production and delivery of products and services, such as the cost of raw materials, labor costs, and shipping and handling fees.

Non-Operating Income And Expenses

Non-operating income and expenses refer to sources of income or costs that are not directly related to the core operations of your business. This could include things like interest income, dividends, or gains from investments. It could also include any non-operational expenses such as legal fees or accounting services.

Gains And Losses

Gains and losses refer to amounts earned or spent outside of the core operations of your business. This could include any gains or losses due to currency exchange rates, investments, or other activities not related to the day-to-day running of your business.

The net income is calculated by subtracting total expenses from total revenues. This number will tell you whether or not your business has earned a net profit or incurred a loss in the given period of time. It’s important to note that in some cases, there may be additional expenses, such as depreciation charges, that should be taken into account when calculating net income.

Get our free income statement template download to help you create your own.

Download our Sample Income Statement

How To Create a Basic Income Statement For Small Businesses

Now that you know what you need to include in your income statement, you’re ready to create one. Creating an income statement for your small business is quite simple. All you need is a simple spreadsheet, like Microsoft Excel, to get started. Below are the steps you should take to create your income statement:

- Choose Your Period: First, you have to decide on the time frame for your income statement. This could be monthly, quarterly, or annually.

- Gather Your Data: The next step is to collect all of your data for the given period. This includes sales and revenue figures, as well as costs associated with running your business, such as expenses, COGS, and non-operating income and expenses.

- Arrange Your Spreadsheet: Before inputting your data, you need to organize your income statement so that it’s easy to read and understand. That means creating separate categories, such as revenue, expenses, gains and losses, etc. and putting them in separate columns or rows.

- Input Formulas: Once you have your spreadsheet organized, you need to input formulas to calculate total revenue, total expenses, net income, and other components of your statement. It’s easiest to do this before inputting all your data.

- Input Your Data: Once you have everything organized into categories, it’s time to enter your data into the spreadsheet. It’s best to start with one category at a time. For example, first, input all your revenue data, then move on to expenses, etc.

- Calculate Your Net Income: Once all of your data is entered in, you can calculate your net income by subtracting total expenses from total revenue. This will give you an accurate picture of how your business has performed over the given period of time.

- Save & Review: Once you’ve calculated your net income, save the spreadsheet and review it to ensure that all of your numbers are accurate. You’ll want to save this as your own income statement template so you can use it again in the future. It is recommended that you update your income statement at least once a year.

Other Financial Statements

The income statement is not the only financial statement that is important for your small business. Other financial statements, such as a balance sheet and cash flow statement, are also essential to understanding the company’s financial health.

The balance sheet is a snapshot of the financial position of your business at a given point in time, showing assets, liabilities, and capital. It’s a useful tool for understanding the overall financial situation of your business. It’s very similar to the income statement, but the difference is that the balance sheet shows a static point in time, whereas the income statement shows the financials over a period of time.

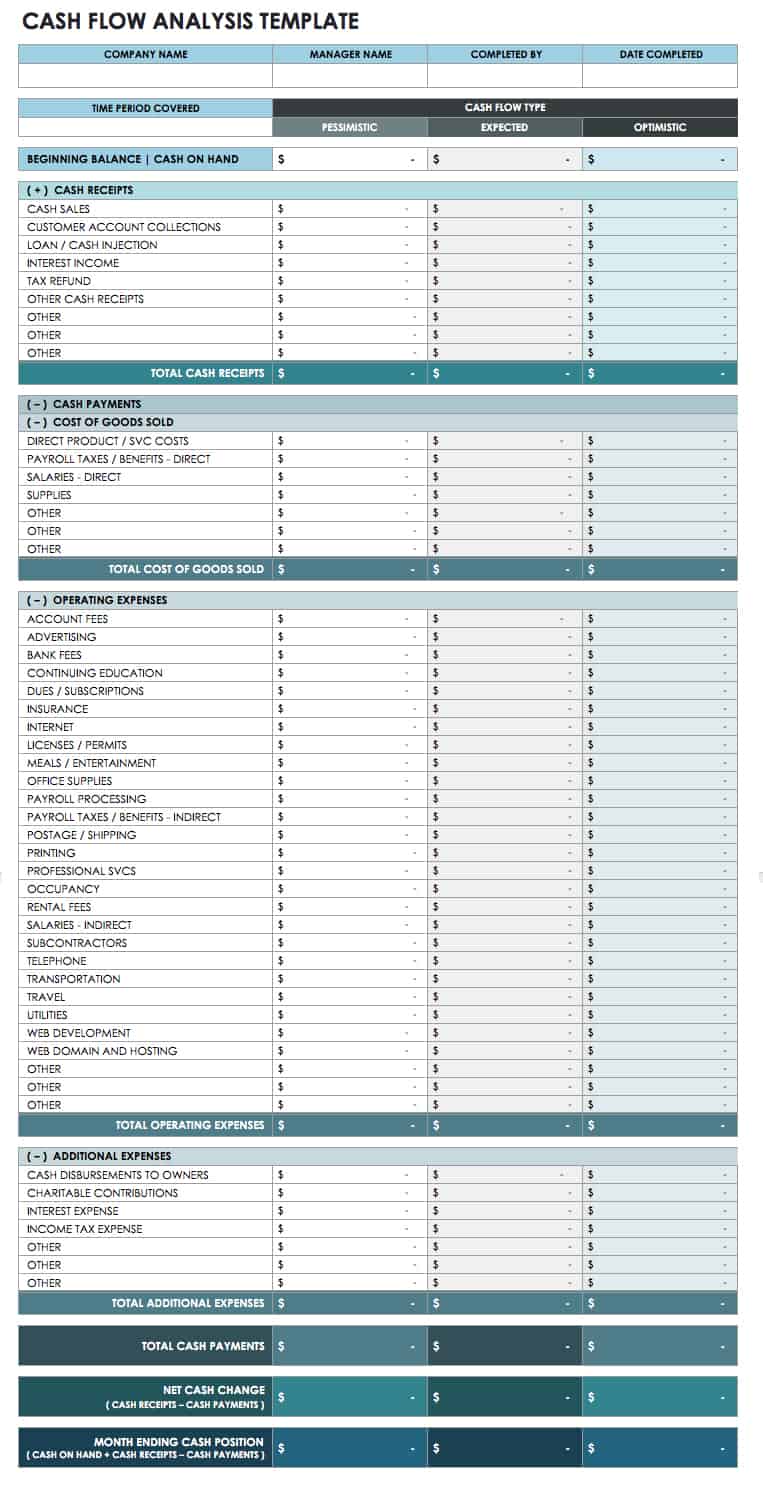

The cash flow statement is another important financial document that tracks the flow of money into and out of your business. It shows how much cash has been generated, as well as how much is being spent. This document can be used to understand the financial health of your business and make sound decisions about investing and other financial activities. However, unlike the income statement or balance sheet, it does not track any non-cash transactions such as depreciation, investment gains, or other activities not related to the day-to-day running of your business.

OR, Let Us Develop Your Financial Model For You

Since 1999, Growthink has developed financial models for thousands of companies that have gone on to achieve tremendous success.

Click here to see how Growthink’s financial modeling services can create your financial plan for you.

Original text

Access our collection of user-friendly templates for business planning, finance, sales, marketing, and management, designed to assist you in developing strategies for either launching a new business venture or expanding an existing one.

You can use the templates below as a starting point to create your startup business plan or map out how you will expand your existing business. Then meet with a SCORE mentor to get expert business planning advice and feedback on your business plan.

If writing a full business plan seems overwhelming, start with a one-page Business Model Canvas. Developed by Founder and CEO of Strategyzer, Alexander Osterwalder, it can be used to easily document your business concept.

Download this template to fill out the nine squares focusing on the different building blocks of any business:

- Value Proposition

- Customer Segments

- Customer Relationships

- Key Activities

- Key Resources

- Key Partners

- Cost Structure

- Revenue Streams

For help completing the Business Model Canvas Template, contact a SCORE business mentor for guidance by phone

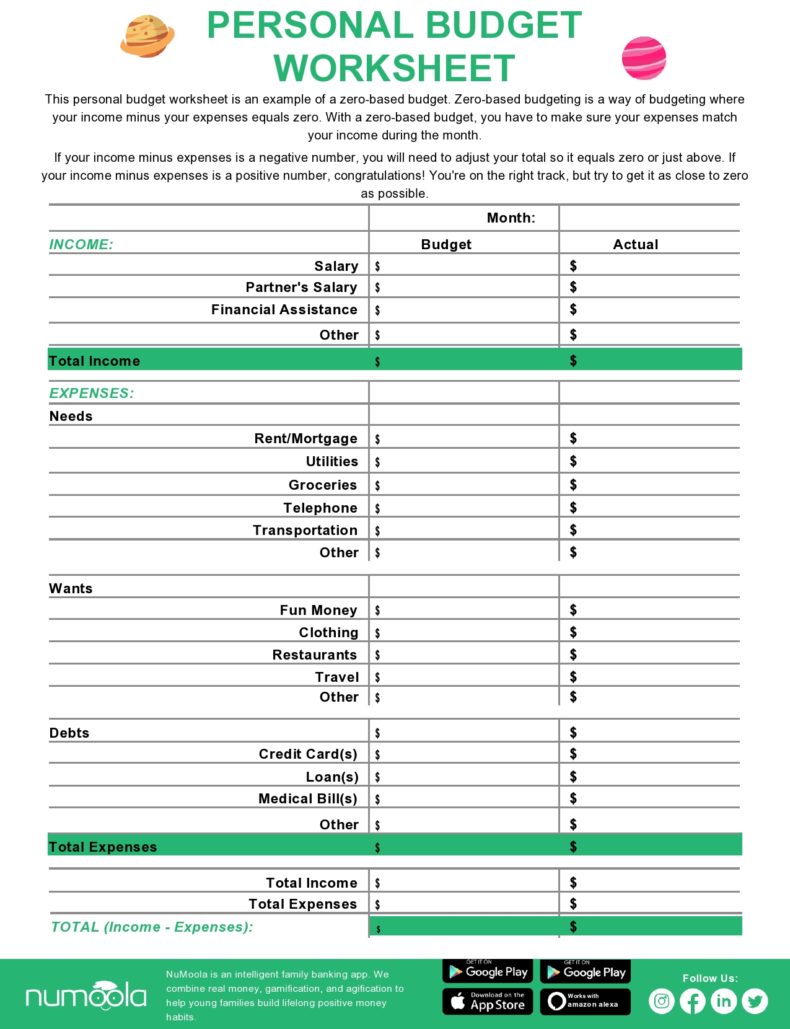

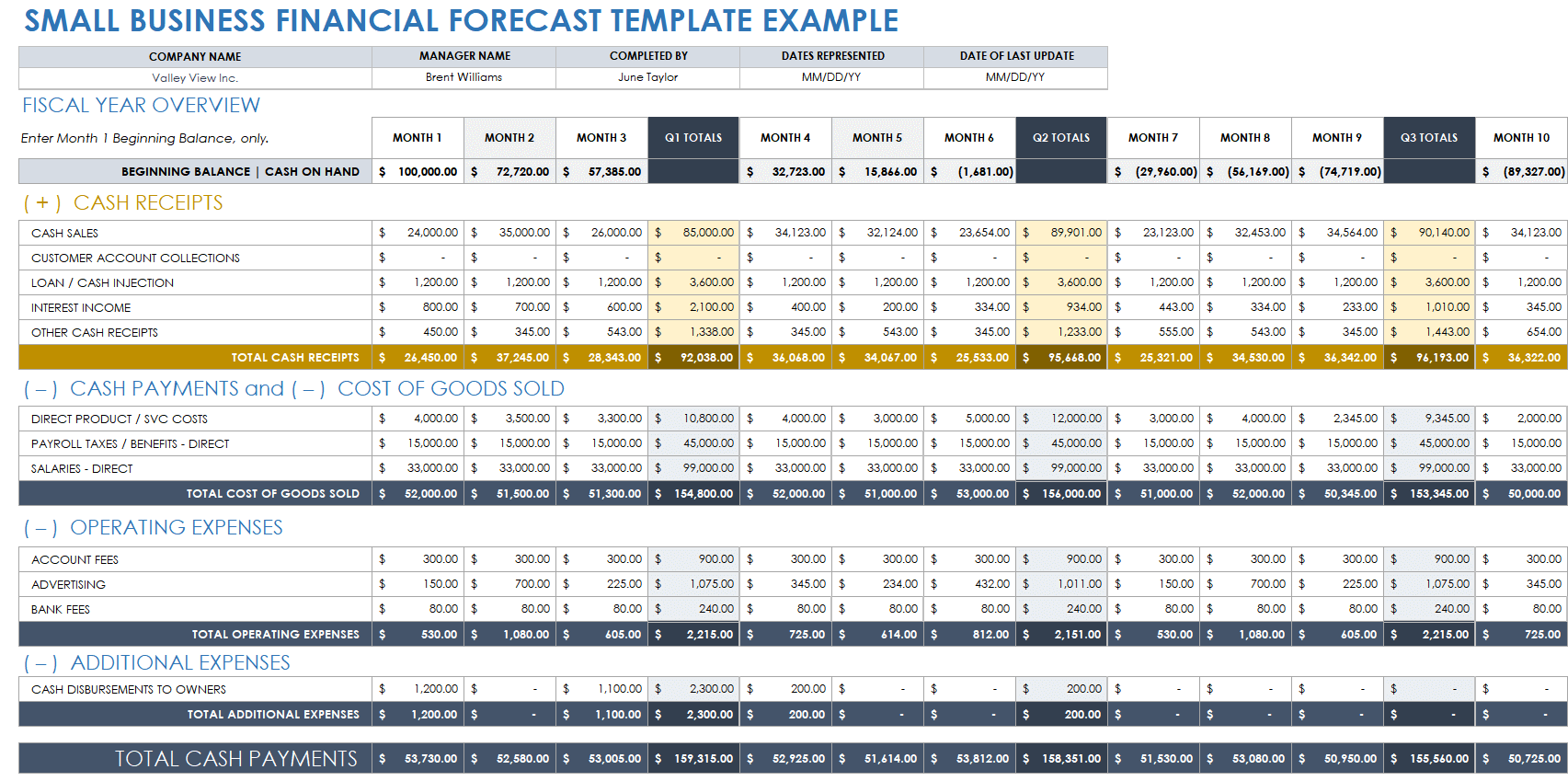

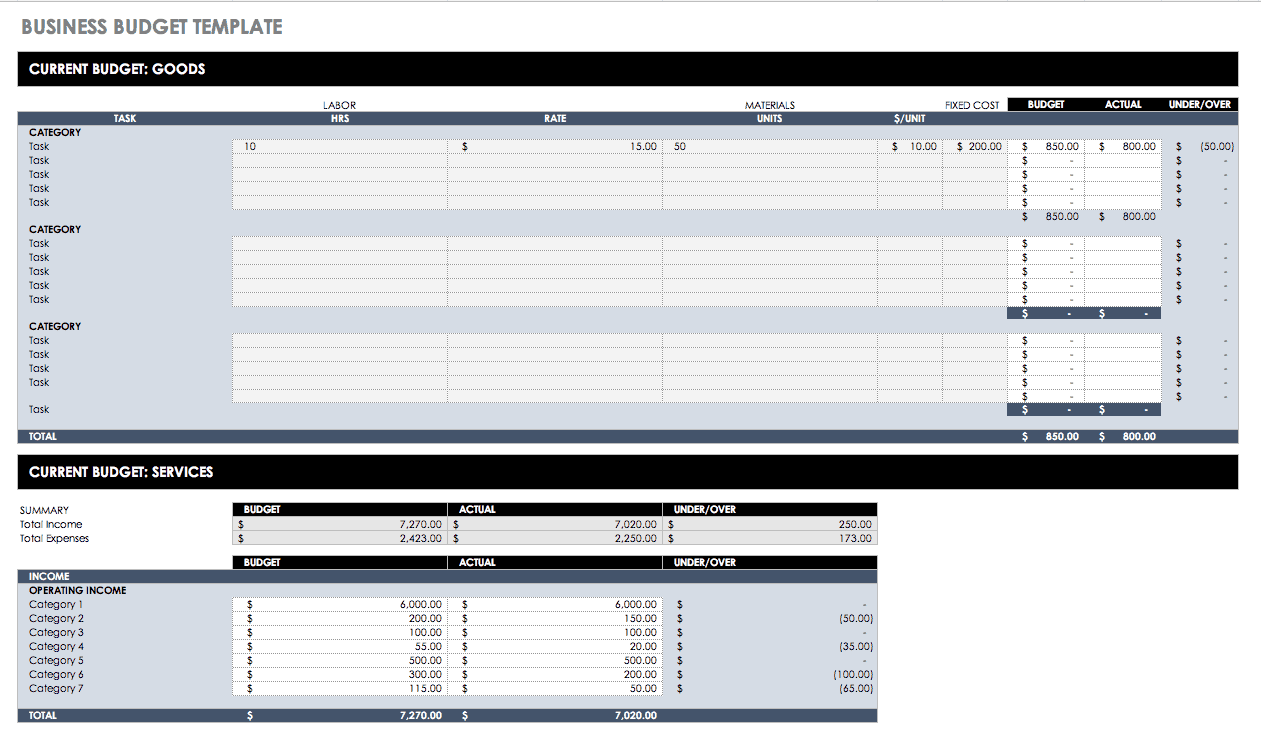

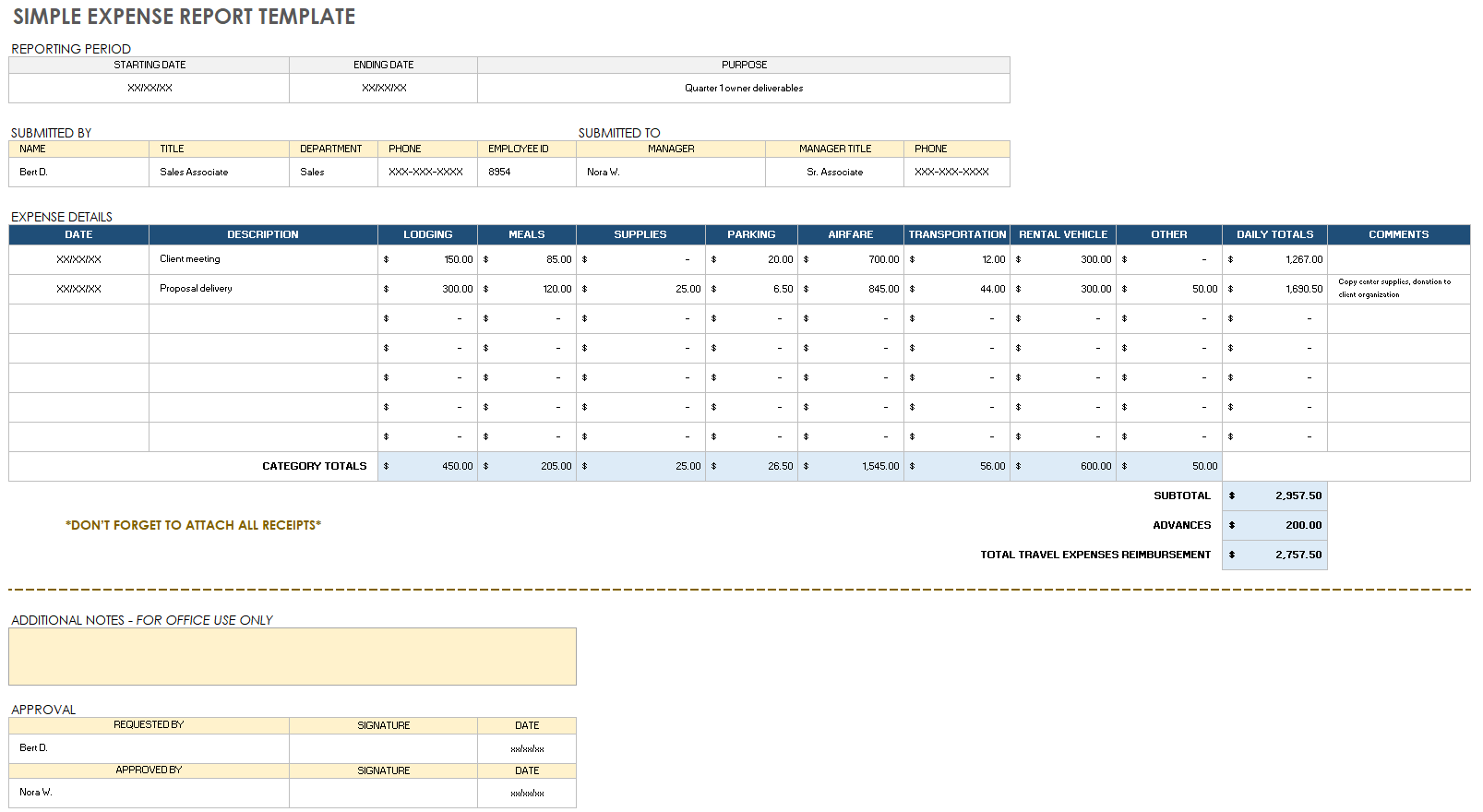

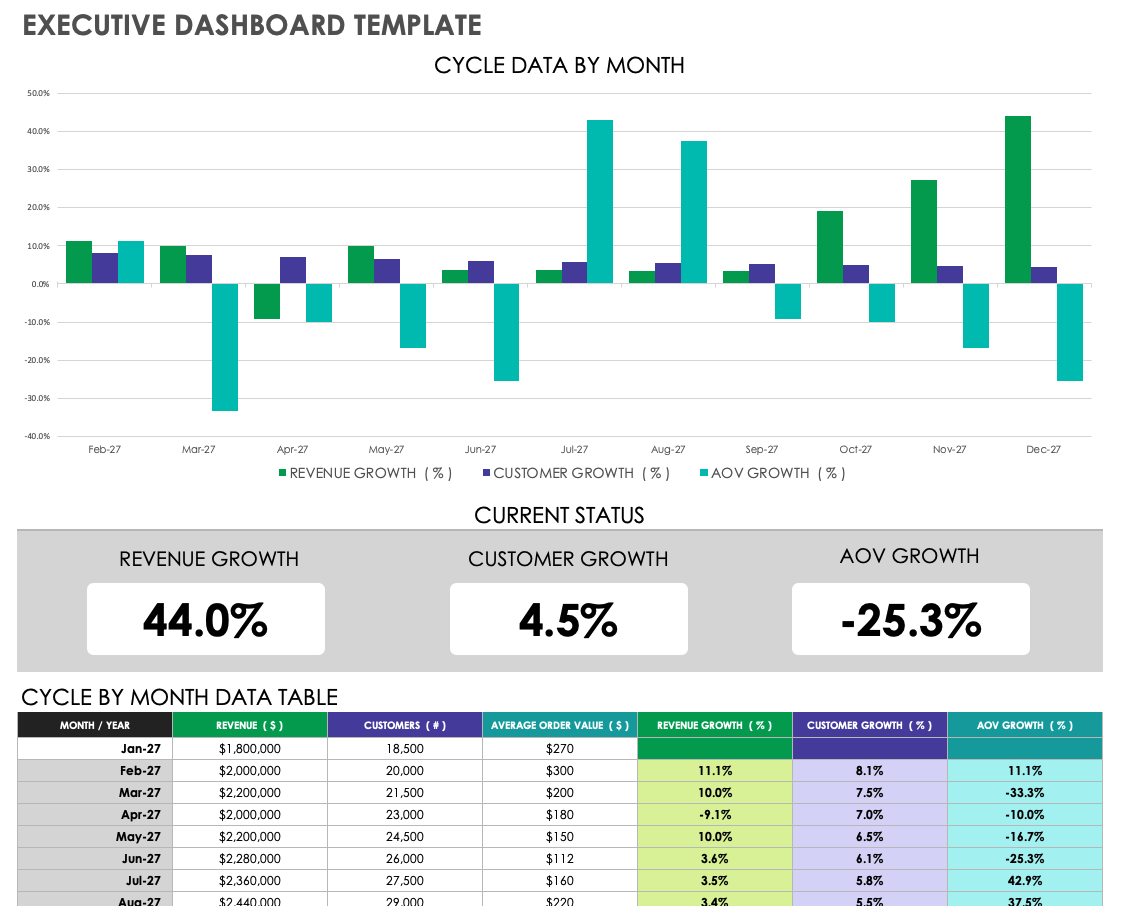

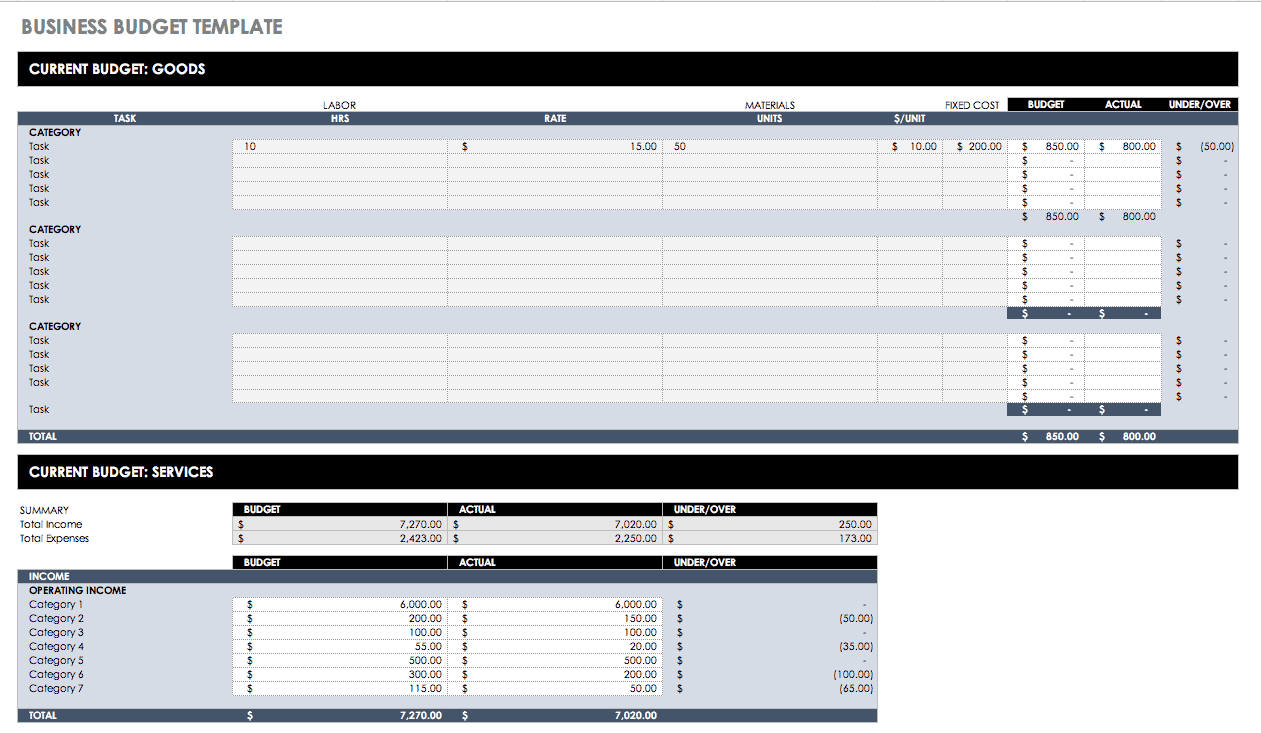

From creating a startup budget to managing cash flow for a growing business, keeping tabs on your business’s finances is essential to success. The templates below will help you monitor and manage your business’s financial situation, create financial projections and seek financing to start or grow your business.

This interactive calculator allows you to provide inputs and see a full estimated repayment schedule to plan your capital needs and cash flow.

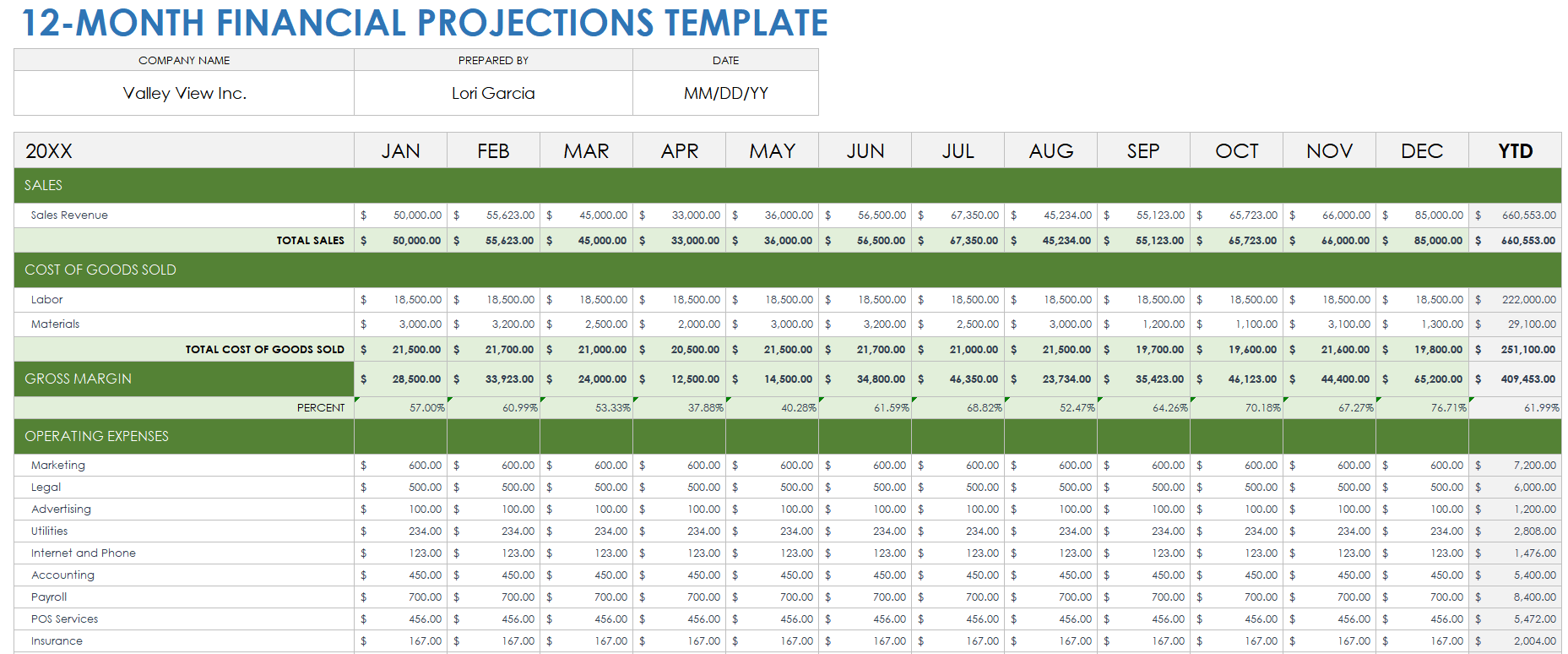

A 12-month profit and loss projection, also known as an income statement or statement of earnings, provides a detailed overview of your financial performance over a one-year period. This projection helps you anticipate future financial outcomes by estimating monthly income and expenses, which facilitates informed decision-making and strategic planning.

If you’re trying to get a loan from a bank, they may ask you for a personal financial statement. You can use this free, downloadable template to document your assets, liabilities and net worth.

A Personal Financial Statement is a snapshot of

Marketing helps your business build brand awareness, attract customers and create customer loyalty. Use these templates to forecast sales, develop your marketing strategy and map out your marketing budget and plan.

How healthy is your business? Are you missing out on potential growth opportunities or ignoring areas of weakness? Do you need to hire employees to reach your goals? The following templates will help you assess the state of your business and accomplish important management tasks.

Whether you are starting your business or established and looking to grow, our Business Healthcheck Tool will provide practical information and guidance.

Learn how having a SCORE mentor can be a valuable asset for your business. A SCORE mentor can provide guidance and support in various areas of business, including finance, marketing, and strategy. They can help you navigate challenges and make important decisions based on their expertise and experience. By seeking out a SCORE mentor, you can gain the guidance and support you need to help grow your business and achieve success.

SCORE offers free business mentoring to anyone that wants to start, currently owns, or is planning to close or sell a small business. To initiate the process, input your zip code in the designated area below. Then, complete the mentoring request form on the following page, including as much information as possible about your business. This information is used to match you with a mentor in your area. After submitting the request, you will receive an email from your mentor to arrange your first mentoring session.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

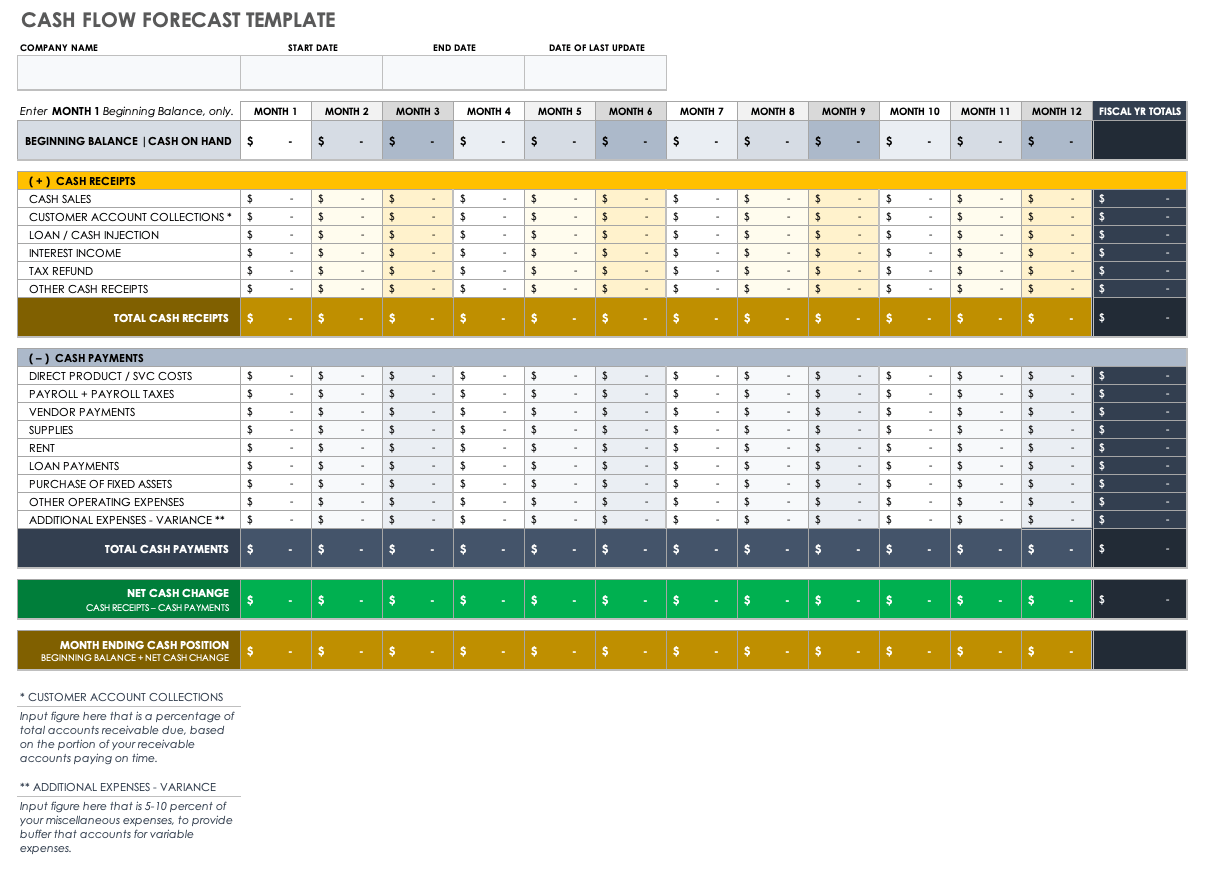

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.

The balance sheet reports your business's net worth at a particular point in time. It summarizes all the financial data about your business in three categories:

- Assets: Tangible objects of financial value that are owned by the company.

- Liabilities: Debt owed to a creditor of the company.

- Equity: The net difference when the total liabilities are subtracted from the total assets .

The relationship between these elements of financial data is expressed with the equation: Assets = Liabilities + Equity .

For your business plan , you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. A business typically prepares a balance sheet once a year.

Once your balance sheet is complete, write a brief analysis for each of the three financial statements. The analysis should be short with highlights rather than an in-depth analysis. The financial statements themselves should be placed in your business plan's appendices.

Falling leaves. Falling prices 🍂 70% Off for 3 Months. Buy Now & Save

70% Off for 3 Months Buy Now & Save

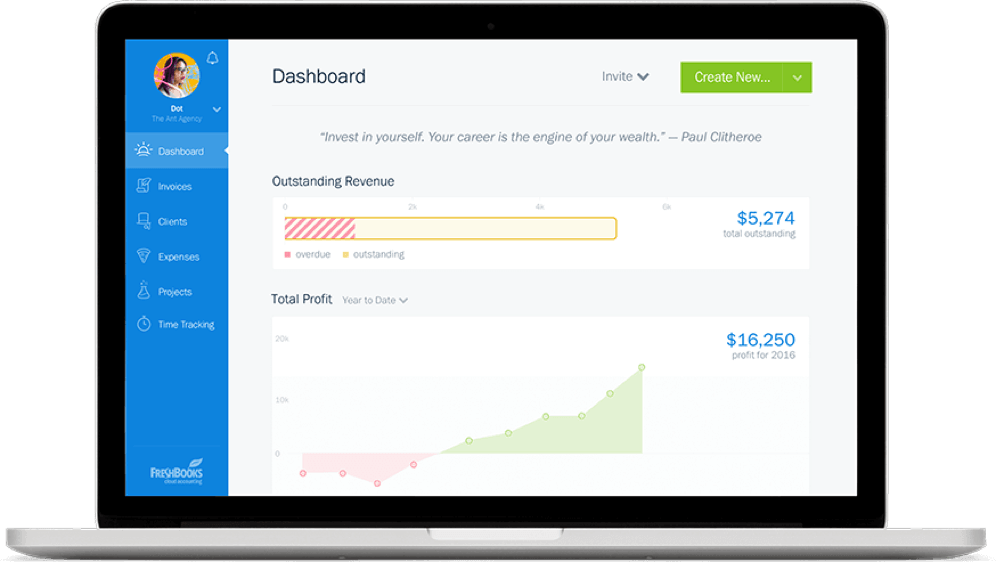

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

Free Income Statement Template

As a business owner, you know how important it is to keep your numbers in check. Knowing how much revenue is coming in, how much money is going out, and how much profit you are making is essential to making smart business decisions.That’s why you need an accounting system that helps you stay organized. With the free Income Statement template from FreshBooks, you have everything you need to track your income and more.

Simply download the template in your chosen format, customize and save. You’ll have a complete sheet to save for your records and a simple way to stay on top of your numbers.

Get a Free Invoice Statement Template

If you want your business to thrive, you’ll need a straightforward way to track ytehour numbers. Good news is, the free invoice statement template from FreshBooks is here to help you get a grasp on your bookkeeping.

You can download your free income statement template in the format that suits you best. If you like using spreadsheets, you can use the free Microsoft Excel or Google Sheets invoice statement to get started.

With the free income statement excel template, you’ll gain access to a helpful income statement formula. This can be hugely rewarding if you don’t have the time or means to structure one yourself.

The blank income statement has customizable fields for you to plug in your revenue and expenses. From there, you can calculate your profit or loss for the given period. A profit or loss statement is a crucial component of understanding a company’s financial health and can assist when making important decisions on how to run a business.

Some business owners even create monthly income, quarterly or yearly statements. No matter how often you want to calculate your profit or loss, the FreshBooks income statement example will be a helpful resource for you.

Available for download in .DOC, .PDF, .WORD, Google Docs and Google Sheets.

Featured In

Want to learn more about growing your business, track your income with freshbooks.

Take bookkeeping into your own hands with FreshBooks income statements.

Free Income Statement Example

Download As:

What is an Invoice Statement?

Why use an income statement.

- How Do I Fill In an Invoice Statement?

Frequently Asked Questions

Benefits of freshbooks accounting, get started with freshbooks.

An invoice statement is an accounting report that is used to list your net income or business expenses, which would be either profit or loss. This statement is also commonly referred to as a “profit and loss report” or “P&L” statement.

You can generate an invoice statement whenever you choose, but they are typically used to report your business’s financial activity during a designated accounting period, such as per month, quarter, or year.

The invoice statement template serves as a great guideline to make sure you’re including all of the proper information on your income and expense statement.

“I’ve been using FreshBooks for 6 years and love how the design, functionality, and platform has grown with me.”

Kathleen Shannon

Co-Host of Being Boss

Are you ready to take control of your business accounting? The cloud accounting software from FreshBooks will get you there. Create invoices and other business reports with ease as you take your accounting on the go.

Access FreshBooks from your smartphone, tablet, or laptop as long as you have a wifi connection. Accounting has never been more convenient.

“FreshBooks has helped me to simplify my bookkeeping without the stress”

The success of your business depends on you making informed decisions. That’s why having your business financials organized and on-hand is one of the best things you can do to get started on the right track.

An income statement will show you exactly what your net profit is and will help you determine whether you need to decrease your costs or increase your revenue to stay in the black. Sound simple? Use the FreshBooks income and expense template to get started.

Take Control of Your Accounting with FreshBooks

How do i fill in an income statement.

Want to create your own Income Statement in minutes? Simply download the financial statement template and follow the steps below to get started.

Choose a File Format

Choose one of our invoice statement template formats.

Download Template

Once you’ve chosen which template to use, download it to your device.

Add Your Branding

Add your business name and logo at the top. Change the fonts to match your branding.

Fill in Revenue

Create revenue subcategories. Fill them in and calculate total revenue.

Fill in Expenses

Customize the expense subcategories and fill them in. Calculate the total costs.

Calculate Net Income

Determine whether you’ve made a profit or a loss. Subtract expenses from revenue.

Check Out Our Other Accounting Sheets

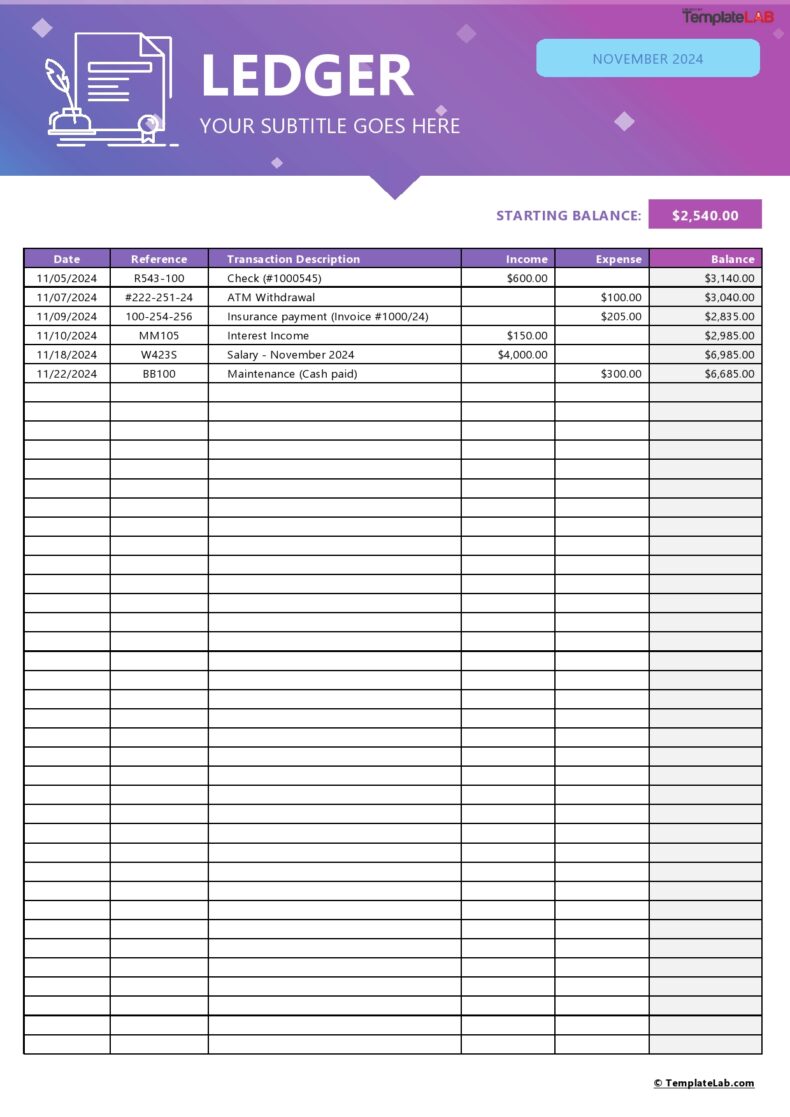

There is more to accounting than determining if you’ve turned a profit. You need to see where each dollar has come from or gone to. That’s why FreshBooks provides a number of other sample accounting sheets.

- Profit and Loss Templates

- Expense Report Templates

- Simple Balance Sheet Templates

- General Ledger Templates

- Income Statement Templates

- Billing Statement Templates

- Bank Reconciliation Templates

Income statements are used to compare your revenue to your expenses to determine if you have made a profit or a loss. Creating income statements will help you track your income, net profit and more to keep you organized.

When creating your own income statement, you’ll want to include a breakdown of your revenue, expenses, and net income.

The income and expense statement template from FreshBooks includes blank, easy-to-use fields for all of the information that you need to include.

Net income is calculated by subtracting expenses from income. If the number is positive, you have a profit and if it’s negative, you have a loss.

Most definitely. FreshBooks has other free resources, such as general ledger templates, expense reports and more.

Our free accounting resources, including the free income statement format, are designed for business owners looking to take a do-it-yourself approach to accounting. But the FreshBooks cloud accounting software is a much more powerful and efficient resource that’s designed to help businesses save money and time on their bookkeeping.

The resources that are included in the FreshBooks cloud accounting software are a lifesaver for business owners who want a thorough understanding of their company’s finances. Keeping your accounts organized is a fundamental part of any healthy business plan, and that’s where a practical, fully customizable bookkeeping resource comes in.

FreshBooks offers cleverly-designed accounting reporting features that can help any business easily keep track of their finances, including their revenue and losses. You’ll gain unlimited access to practical financial templates that are the backbone of business planning and will help you keep track of your critical business activities.

If you’re looking for more free templates to help keep your business running as smoothly as possible, check out some of the other free templates on the FreshBooks website.

An income statement or balance sheet is a necessary financial document that tracks how much money is coming in and out of a business, and with the free balance sheet template from FreshBooks, every dollar will be accounted for.

A small business income statement showcases a company’s revenue and expense over the course of a specific time frame. FreshBooks provides a specialized small business income statement template, perfect for any small business owner who requires accuracy and is looking for efficiency in their accounting.

Take control of your finances and automate your bookkeeping with FreshBooks. You can get back to business and start running your company the way it deserves.

Ready to automate your bookkeeping?

Detailed Reports

Cloud storage, automated invoicing, co-working portal, accounting on the go, no binding contracts.

If you’re ready to take control and automate your bookkeeping, it is time to sign up for FreshBooks. Try risk-free for 30 days.

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

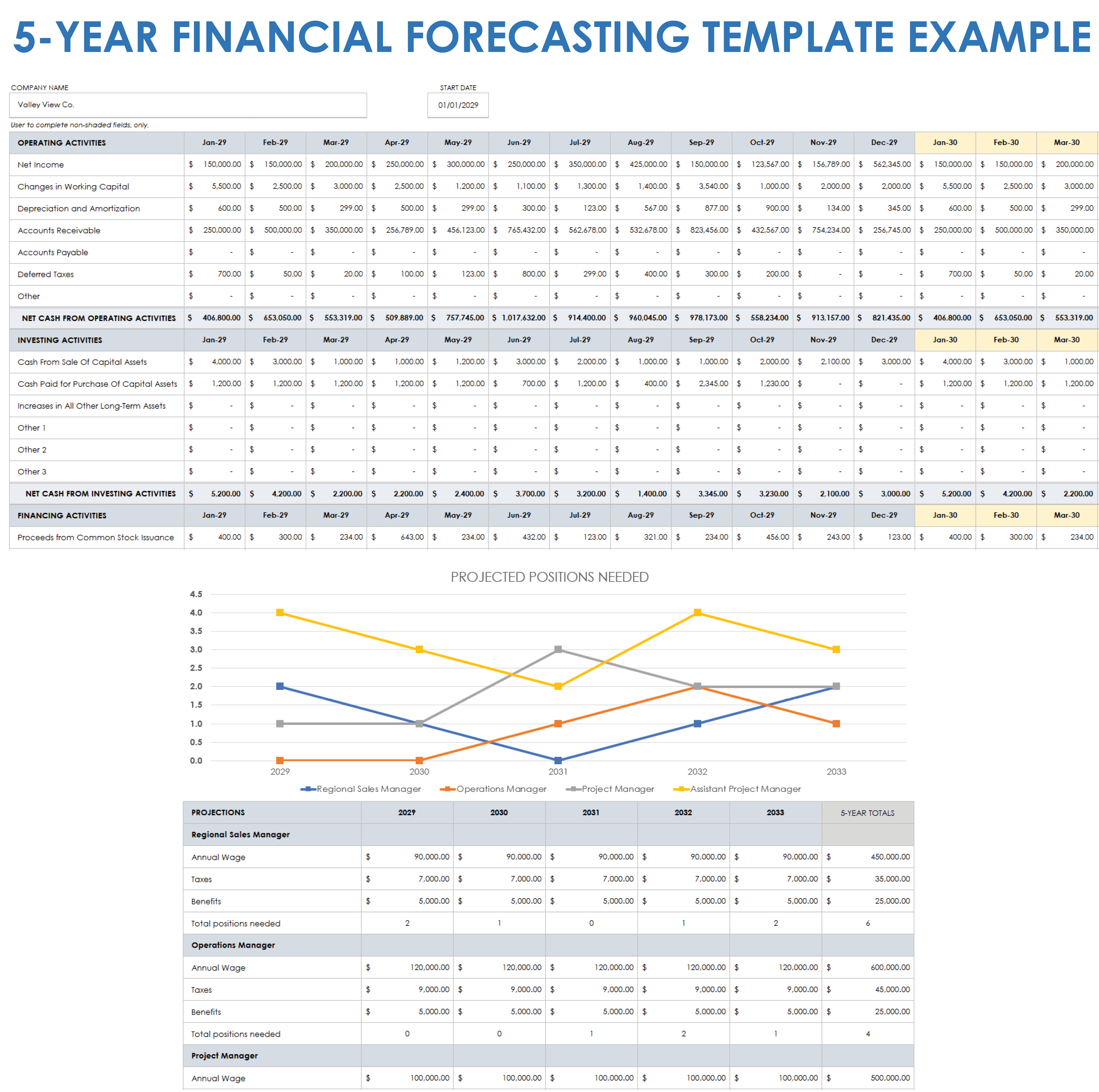

How To Create Financial Projections for Your Business Plan

Building a financial projection as you write out your business plan can help you forecast how much money your business will bring in.

Planning for the future, whether it’s with growth in mind or just staying the course, is central to being a business owner. Part of this planning effort is making financial projections of sales, expenses, and—if all goes well—profits.

Even if your business is a startup that has yet to open its doors, you can still make projections. Here’s how to prepare your business plan financial projections, so your company will thrive.

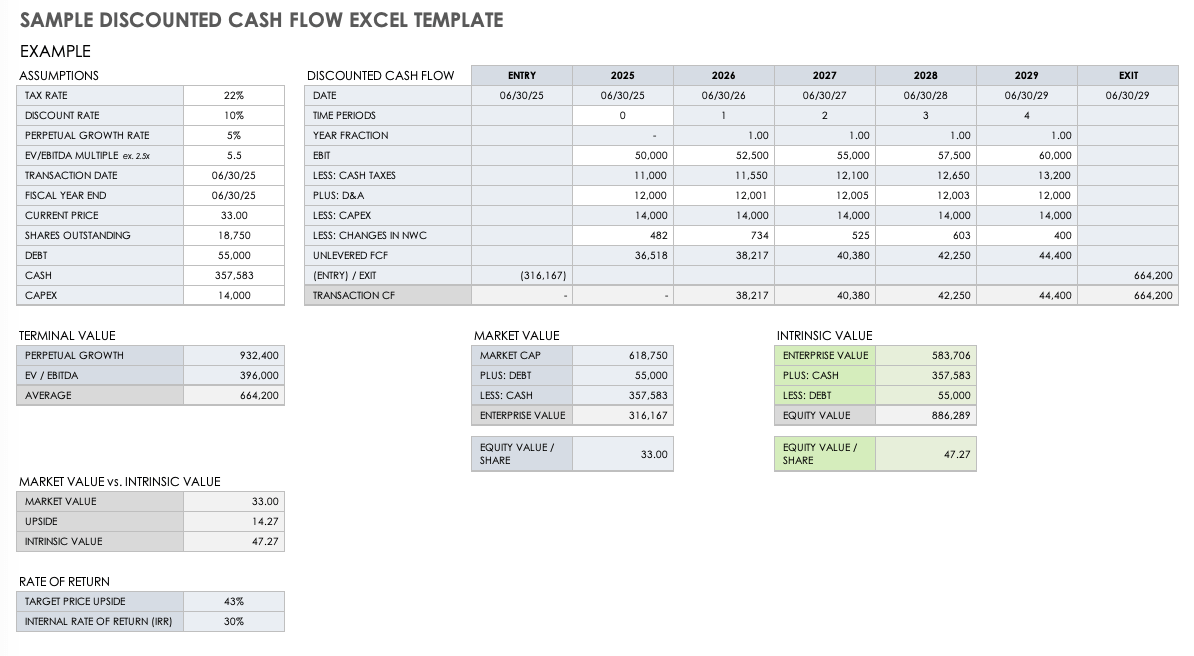

What are business plan financial projections?

Business plan financial projections are a company’s estimates, or forecasts, of its financial performance at some point in the future. For existing businesses, draw on historical data to detail how your company expects metrics like revenue, expenses, profit, and cash flow to change over time.

Companies can create financial projections for any span of time, but typically they’re for between one and five years. Many companies revisit and amend these projections at least annually.

Creating financial projections is an important part of building a business plan . That’s because realistic estimates help company leaders set business goals, execute financial decisions, manage cash flow , identify areas for operational improvement, seek funding from investors, and more.

What are financial projections used for?

Financial forecasting serves as a useful tool for key stakeholders, both within and outside of the business. They often are used for:

Business planning

Accurate financial projections can help a company establish growth targets and other goals . They’re also used to determine whether ideas like a new product line are financially feasible. Future financial estimates are helpful tools for business contingency planning, which involves considering the monetary impact of adverse events and worst-case scenarios. They also provide a benchmark: If revenue is falling short of projections, for example, the company may need changes to keep business operations on track.

Projections may reveal potential problems—say, unexpected operating expenses that exceed cash inflows. A negative cash flow projection may suggest the business needs to secure funding through outside investments or bank loans, increase sales, improve margins, or cut costs.

When potential investors consider putting their money into a venture, they want a return on that investment. Business projections are a key tool they will use to make that decision. The projections can figure in establishing the valuation of your business, equity stakes, plans for an exit, and more. Investors may also use your projections to ensure that the business is meeting goals and benchmarks.

Loans or lines of credit

Lenders rely on financial projections to determine whether to extend a business loan to your company. They’ll want to see historical financial data like cash flow statements, your balance sheet , and other financial statements—but they’ll also look very closely at your multi-year financial projections. Good candidates can receive higher loan amounts with lower interest rates or more flexible payment plans.

Lenders may also use the estimated value of company assets to determine the collateral to secure the loan. Like investors, lenders typically refer to your projections over time to monitor progress and financial health.

What information is included in financial projections for a business?

Before sitting down to create projections, you’ll need to collect some data. Owners of an existing business can leverage three financial statements they likely already have: a balance sheet, an annual income statement , and a cash flow statement .

A new business, however, won’t have this historical data. So market research is crucial: Review competitors’ pricing strategies, scour research reports and market analysis , and scrutinize any other publicly available data that can help inform your projections. Beginning with conservative estimates and simple calculations can help you get started, and you can always add to the projections over time.

One business’s financial projections may be more detailed than another’s, but the forecasts typically rely on and include the following:

True to its name, a cash flow statement shows the money coming into and going out of the business over time: cash outflows and inflows. Cash flows fall into three main categories:

Income statement

Projected income statements, also known as projected profit and loss statements (P&Ls), forecast the company’s revenue and expenses for a given period.

Generally, this is a table with several line items for each category. Sales projections can include the sales forecast for each individual product or service (many companies break this down by month). Expenses are a similar setup: List your expected costs by category, including recurring expenses such as salaries and rent, as well as variable expenses for raw materials and transportation.

This exercise will also provide you with a net income projection, which is the difference between your revenue and expenses, including any taxes or interest payments. That number is a forecast of your profit or loss, hence why this document is often called a P&L.

Balance sheet

A balance sheet shows a snapshot of your company’s financial position at a specific point in time. Three important elements are included as balance sheet items:

- Assets. Assets are any tangible item of value that the company currently has on hand or will in the future, like cash, inventory, equipment, and accounts receivable. Intangible assets include copyrights, trademarks, patents and other intellectual property .

- Liabilities. Liabilities are anything that the company owes, including taxes, wages, accounts payable, dividends, and unearned revenue, such as customer payments for goods you haven’t yet delivered.

- Shareholder equity. The shareholder equity figure is derived by subtracting total liabilities from total assets. It reflects how much money, or capital, the company would have left over if the business paid all its liabilities at once or liquidated (this figure can be a negative number if liabilities exceed assets). Equity in business is the amount of capital that the owners and any other shareholders have tied up in the company.

They’re called balance sheets because assets always equal liabilities plus shareholder equity.

5 steps for creating financial projections for your business

- Identify the purpose and timeframe for your projections

- Collect relevant historical financial data and market analysis

- Forecast expenses

- Forecast sales

- Build financial projections

The following five steps can help you break down the process of developing financial projections for your company:

1. Identify the purpose and timeframe for your projections

The details of your projections may vary depending on their purpose. Are they for internal planning, pitching investors, or monitoring performance over time? Setting the time frame—monthly, quarterly, annually, or multi-year—will also inform the rest of the steps.

2. Collect relevant historical financial data and market analysis

If available, gather historical financial statements, including balance sheets, cash flow statements, and annual income statements. New companies without this historical data may have to rely on market research, analyst reports, and industry benchmarks—all things that established companies also should use to support their assumptions.

3. Forecast expenses

Identify future spending based on direct costs of producing your goods and services ( cost of goods sold, or COGS) as well as operating expenses, including any recurring and one-time costs. Factor in expected changes in expenses, because this can evolve based on business growth, time in the market, and the launch of new products.

4. Forecast sales

Project sales for each revenue stream, broken down by month. These projections may be based on historical data or market research, and they should account for anticipated or likely changes in market demand and pricing.

5. Build financial projections

Now that you have projected expenses and revenue, you can plug that information into Shopify’s cash flow calculator and cash flow statement template . This information can also be used to forecast your income statement. In turn, these steps inform your calculations on the balance sheet, on which you’ll also account for any assets and liabilities .

Business plan financial projections FAQ

What are the main components of a financial projection in a business plan.

Generally speaking, most financial forecasts include projections for income, balance sheet, and cash flow.

What’s the difference between financial projection and financial forecast?

These two terms are often used interchangeably. Depending on the context, a financial forecast may refer to a more formal and detailed document—one that might include analysis and context for several financial metrics in a more complex financial model.

Do I need accounting or planning software for financial projections?

Not necessarily. Depending on factors like the age and size of your business, you may be able to prepare financial projections using a simple spreadsheet program. Large complicated businesses, however, usually use accounting software and other types of advanced data-management systems.

What are some limitations of financial projections?

Projections are by nature based on human assumptions and, of course, humans can’t truly predict the future—even with the aid of computers and software programs. Financial projections are, at best, estimates based on the information available at the time—not ironclad guarantees of future performance.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The point of sale for every sale.

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

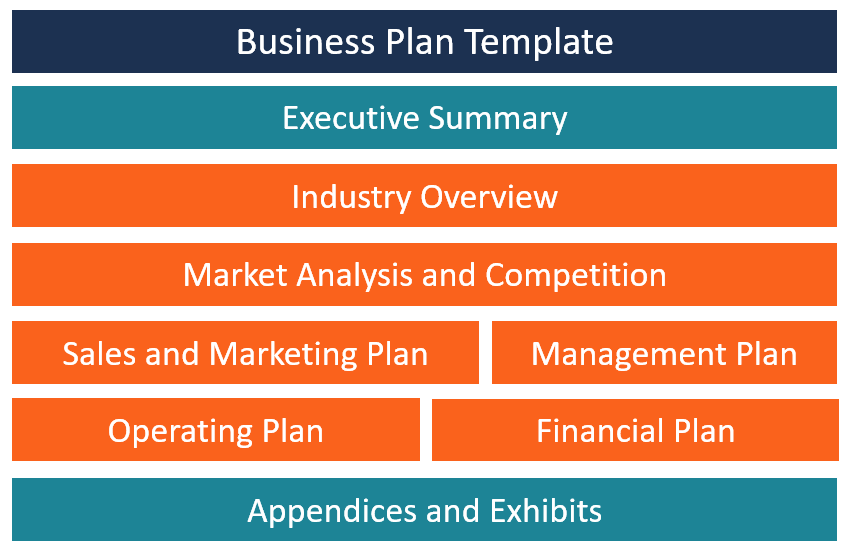

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

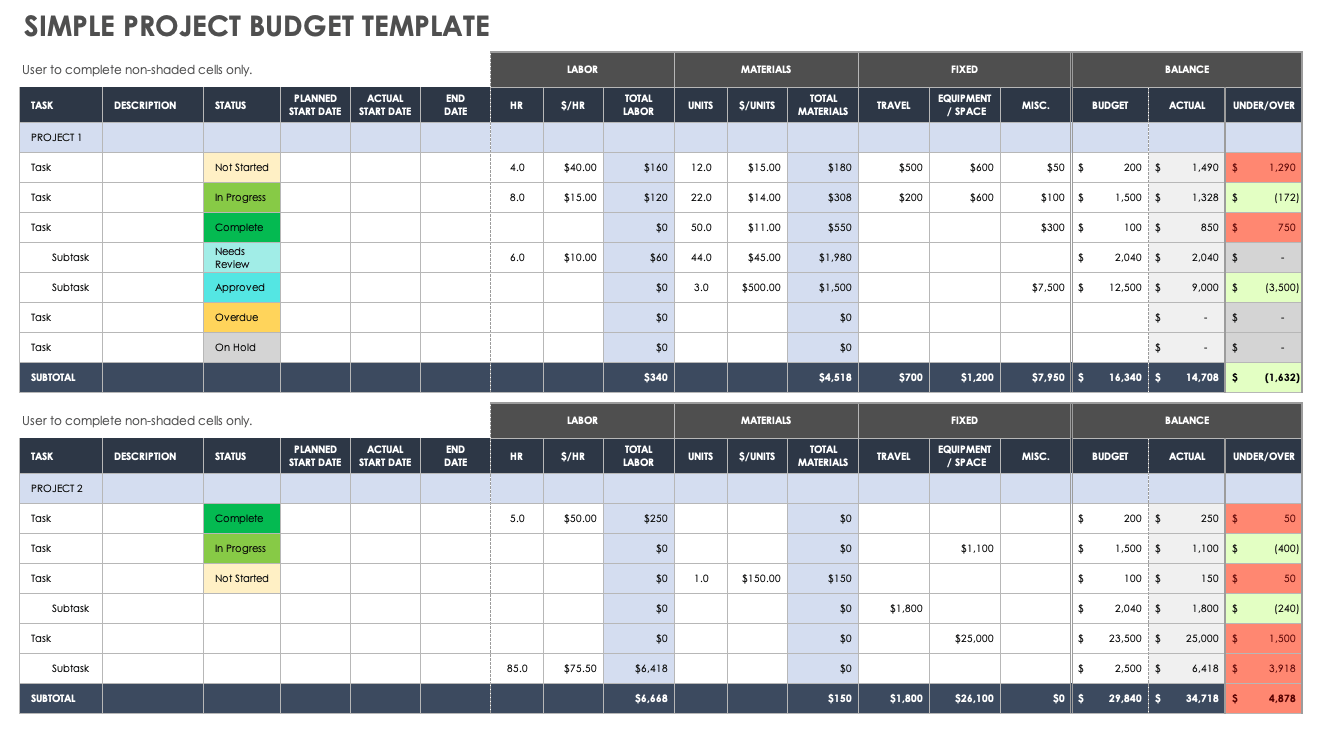

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- TemplateLab