More Like this

Ten common causes of business failure.

Failure is a topic most of us would rather avoid. But ignoring obvious (and subtle) warning signs of business trouble is a surefire way to end up on the wrong side of business survival statistics.

What’s the survival rate of new businesses? Statistically, roughly 66 percent of new businesses survive two years or more, 50 percent survive at least four years, and just 40 percent survive six years or more. This is according to the study “Redefining Small Business Success” by the U.S. Small Business Administration.

Does Your Strategy Suck? Get this Free Guide to Find Out.

Learn how to avoid the most common pitfalls in strategic planning here .

With this information as a backdrop, we’ve put together a list of 10 common reasons businesses close their doors:

- Failure to understand your market and customers. We often ask our clients, “Where will you play and how will you win?”. In short, it’s vital to understand your competitive marketspace and your customers’ buying habits. Answering questions about who your customers are and how much they’re willing to spend is a huge step in putting your best foot forward.

- Opening a business in an industry that isn’t profitable. Sometimes, even the best ideas can’t be turned into a high-profit business. It’s important to choose an industry where you can achieve sustained growth. We all learned the dot-com lesson – to survive, you must have positive cash flow. It takes more than a good idea and passion to stay in business.

- Failure to understand and communicate what you are selling. You must clearly define your value proposition. What is the value I am providing to my customer? Once you understand it, ask yourself if you are communicating it effectively. Does your market connect with what you are saying?

- Inadequate financing . Businesses need cash flow to float them through the sales cycles and the natural ebb and flow of business. Running the bank accounts dry is responsible for a good portion of business failure. Cash is king, and many quickly find that borrowing money from lenders can be difficult.

- Reactive attitudes . Failure to anticipate or react to competition, technology, or marketplace changes can lead a business into the danger zone. Staying innovative and aware will keep your business competitive.

- Overdependence on a single customer. If your biggest customer walked out the door and never returned, would your organization be ok? If that answer is no, you might consider diversifying your customer base a strategic objective in your strategic plan.

- No customer strategy . Be aware of how customers influence your business. Are you in touch with them? Do you know what they like or dislike about you? Understanding your customer forwards and backwards can play a big role in the development of your strategy.

- Not knowing when to say “No.” To serve your customers well, you have to focus on quality, delivery, follow-through, and follow-up. Going after all the business you can get drains your cash and actually reduces overall profitability. Sometimes it’s okay to say no to projects or business so you can focus on quality, not quantity.

- Poor management. Management of a business encompasses a number of activities: planning, organizing, controlling, directing and communicating. The cardinal rule of small business management is to know exactly where you stand at all times. A common problem faced by successful companies is growing beyond management resources or skills.

- No planning. As the saying goes, failing to plan is planning to fail. If you don’t know where you are going, you will never get there. Having a comprehensive and actionable strategy allows you to create engagement, alignment, and ownership within your organization. It’s a clear roadmap that shows where you’ve been, where you are, and where you’re going next.

Running an organization is no easy task. Being aware of common downfalls in business can help you proactively avoid them. It’s a constant challenge. We know, but it’s also a continuous opportunity to avoid becoming one of the statistics.

36 Comments

This article is apt for everyone who’s planning to make a business, i admire this article so much ths more clear, understandable and realistic. I really appreciate this information, thanks for those people behind this informative thing. thumbs up!!!!!!!!!!

I have been looking at countless articles on why businesses fail. This one seems to make the most sense.

Thanks! David

Wonderful article thank to those behind this am really happy to read this article,u will be blessed in Jesus name (amen).

Awesome article

The article is very helpful and I have been assisted by it keep posting helpful thing.

I found this useful to us in Africa; especially Uganda

why is small business fail

Item number 8 is an eye opener for me thanks. More grace!

I found this useful to us in Africa; especially Uganda lol

mind opening article keep on posting

Cash flow or lack thereof is the #1 thing I evaluate when helping a company turn their business around. I am not disagreeing with any one of the 10 but unless you have enough cash you may not have enough runway to fix any one of the other 9 items to turn the situation around.

I thought I would have a look at the article and then add something that was missed as I have good understanding of these issues. Well darn and hats off Todd Ballowe. You have covered all the issues in a very tightly worded manner. Well done.

your article is good. keep on posting such important stuff. the information is helpful. thank you very much.

Right on point about why some businesses fail??

This is the richest article I have ever read while doing my research on the cause of business failure.

thank to the author, Keep up.

am very grateful about this article

The points are well put and straight to the point.

Thanks to the author we are now aware of whats causes our business to fail .

Sir/Madam! The article is fine. If you don’t mind, please specify the internal and external factors that influence a business to success or to failure. Because, in this modern world, specification i every field is appreciated. The tips are good, but quite mixed, please categorize them, thankyou

woo ,this article is awesome.I have found what i was looking for

what must a manager do to sustain a business growth?

this article is so helpful cause it contains sense why bussineses fail

Great article! Covered a lot of perspectives. Most owners believe that “knowledge is power” however they should understand that only “applied knowledge” is only the power that works! -great point. Came across a blog on Buymaster.co which really compliments and adds to this article. Take a look http://blog.buymaster.co/why-small-businesses-fail-or-fail-to-thrive/

thanks this artical is very helpful

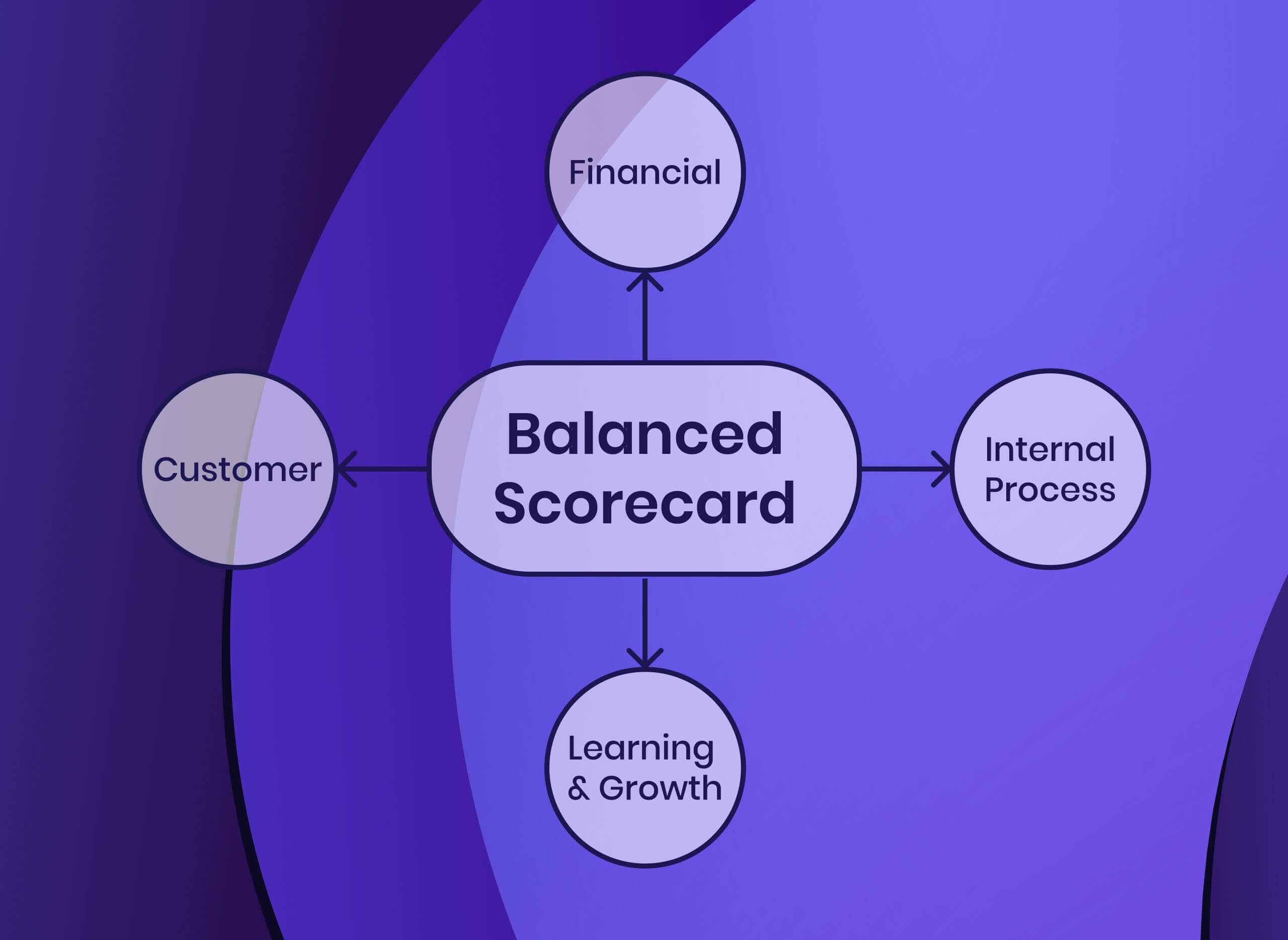

Wow , great article. it touches an interesting field that i’m studying “Strategic management Accounting” This field seeks to involve the marketing environment with accounting as the strategy to gain sustainable competitive Advantage in the market. Thus , this articles highlights the importance of strategic tools in the market.

I am just a new comer in business, but I think this article can be a help for me.

Its a nice article but its just that we read these kind of articles only after failing in business and there are mistakes that we do again and again..as much as your articles helps me to understand the common reasons for failure I would like to point out some major reasons in my own way:

1) Lack of Capital- This is by far the most major reason for any business to fail although I am not saying this is the only reason. But it is often seen that people have capital to start up a business but in a long run they are not able to fulfil the internal and external demands of the business like salaries of staff, rent, raw materials etc. 2) Lack of Managerial expertise: This is also a major reason. It is often seen first time entrepreneurs lack management skills like planning, organizing, controlling etc. 3) Competition: This also plays in the success or failure of any business. Before or even after starting a business one must know who there competitors are and what are there strategy like what is the price of the products that they are offering, similarly quality,finish etc. Know your competition. 4) Random: There are many other reasons like understanding the needs and mentality of the customer. Know their likes and dislikes, their paying capacity, handling raw materials, keeping proper money/cash flow and accounting the same at regular intervals, having an open thinking and attitude, and their could be many that might not be present in what all I have stated. Please do give a feedback on this one

i found this article very useful , i have 40 years experiance in managing various business . thank you

Thaxs I loved the article since it opens up peoples’ minds.

Must say, this is an excellent article.

Covers the most important point in perfect details with no extra fluff.

It’s a great article and very knowledgable here are some pointers hope this could help you 1) Lack of Capital- This is by far the most major reason for any business to fail although I am not saying this is the only reason. But it is often seen that people have capital to start up a business but in a long run they are not able to fulfil the internal and external demands of the business like salaries of staff, rent, raw materials etc. 2) Lack of Managerial expertise: This is also a major reason. It is often seen first time entrepreneurs lack management skills like planning, organizing, controlling etc. 3) Competition: This also plays in the success or failure of any business. Before or even after starting a business one must know who there competitors are and what are there strategy like what is the price of the products that they are offering, similarly quality,finish etc. Know your competition. 4) Random: There are many other reasons like understanding the needs and mentality of the customer. Know their likes and dislikes, their paying capacity, handling raw materials, keeping proper money/cash flow and accounting the same at regular intervals, having an open thinking and attitude, and their could be many that might not be present in what all I have stated. Please do give a feedback on this one https://www.meshcowork.com/en/blog/read/620446883/failure-in-entrepreneurship

Thanks I have enjoyed the article ,,, very sensitive to understand especially to students who study financial management

It’s really very helpful. Thanks for sharing this amazing strategy

Comments Cancel

Join 60,000 other leaders engaged in transforming their organizations., subscribe to get the latest agile strategy best practices, free guides, case studies, and videos in your inbox every week..

Leading strategy? Join our FREE community.

Become a member of the chief strategy officer collaborative..

Free monthly sessions and exclusive content.

Do you want to 2x your impact.

- Search Search Please fill out this field.

1. Financing Hurdles

2. inadequate management, 3. ineffective business planning, 4. marketing mishaps.

- Small Business Failure FAQs

- Small Business

- How to Start a Business

The 4 Most Common Reasons a Small Business Fails

Running a small business is not for the faint of heart

:max_bytes(150000):strip_icc():format(webp)/picture-53894-1440689455-5bfc2a8846e0fb00260af532.jpg)

Running a business is not for the faint of heart; entrepreneurship is inherently risky. Successful business owners must possess the ability to mitigate company-specific risks while simultaneously bringing a product or service to market at a price point that meets consumer demand levels.

While there are a number of small businesses in a broad range of industries that perform well and are continuously profitable, about 33% of small businesses fail in the first two years, around 50% go belly up after five years, and roughly 33% make it to 10 years or longer, according to the Small Business Administration (SBA) .

To safeguard a new or established business, it is necessary to understand what can lead to business failure and how each obstacle can be managed or avoided altogether. The most common reasons small businesses fail include a lack of capital or funding, retaining an inadequate management team, a faulty infrastructure or business model, and unsuccessful marketing initiatives.

Key Takeaways

- Running out of money is a small business’s biggest risk. Owners often know what funds are needed day to day but are unclear as to how much revenue is being generated, and the disconnect can be disastrous.

- Inexperience managing a business—or an unwillingness to delegate—can negatively impact small businesses, as can a poorly visualized business plan, which can lead to ongoing problems once the firm is operational.

- Poorly planned or executed marketing campaigns, or a lack of adequate marketing and publicity, are among the other issues that drag down small businesses.

A primary reason why small businesses fail is a lack of funding or working capital . In most instances a business owner is intimately aware of how much money is needed to keep operations running on a day-to-day basis, including funding payroll; paying fixed and varied overhead expenses, such as rent and utilities; and ensuring that outside vendors are paid on time; however, owners of failing companies are less in tune with how much revenue is generated by sales of products or services. This disconnect leads to funding shortfalls that can quickly put a small business out of operation.

A second reason is business owners who miss the mark on pricing products and services. To beat out the competition in highly saturated industries , companies may price a product or service far lower than similar offerings, with the intent to entice new customers.

While the strategy is successful in some cases, businesses that end up closing their doors are those that keep the price of a product or service too low for too long. When the costs of production, marketing, and delivery outweigh the revenue generated from new sales, small businesses have little choice but to close down.

The Small Business Administration (SBA) helps small businesses find loans for different needs, offering a variety of loan programs.

Small companies in the startup phase can face challenges in terms of obtaining financing in order to bring a new product to market, fund an expansion, or pay for ongoing marketing costs. While angel investors, venture capitalists, and conventional bank loans are among the funding sources available to small businesses, not every company has the revenue stream or growth trajectory needed to secure major financing from them. Without an influx of funding for large projects or ongoing working capital needs, small businesses are forced to close their doors.

To help a small business manage common financing hurdles, business owners should first establish a realistic budget for company operations and be willing to provide some capital from their own coffers during the startup or expansion phase.

It is imperative to research and secure financing options from multiple outlets before the funding is actually necessary. When the time comes to obtain funding, business owners should already have a variety of sources they can tap for capital.

Another common reason small businesses fail is a lack of business acumen on the part of the management team or business owner. In some instances, a business owner is the only senior-level person within a company, especially when a business is in its first year or two of operation.

While the owner may have the skills necessary to create and sell a viable product or service, they often lack the attributes of a strong manager and don't have the time to successfully oversee other employees. Without a dedicated management team, a business owner has greater potential to mismanage certain aspects of the business, whether it be finances, hiring, or marketing.

Most small businesses start out with the entrepreneur's savings or money from friends and family and then look for outside financing to grow.

Smart business owners outsource the activities they do not perform well or have little time to successfully carry through. A strong management team is one of the first additions a small business needs to continue operations well into the future. It is important for business owners to feel comfortable with the level of understanding each manager has regarding the business’ operations, current and future employees, and products or services.

Small businesses often overlook the importance of effective business planning prior to opening their doors. A sound business plan should include, at a minimum:

- A clear description of the business

- Current and future employee and management needs

- Opportunities and threats within the broader market

- Capital needs, including projected cash flow and various budgets

- Marketing initiatives

- Competitor analysis

Business owners who fail to address the needs of the business through a well-laid-out plan before operations begin are setting up their companies for serious challenges. Similarly, a business that does not regularly review an initial business plan—or one that is not prepared to adapt to changes in the market or industry—meets potentially insurmountable obstacles throughout the course of its lifetime.

To avoid pitfalls associated with business plans, entrepreneurs should have a solid understanding of their industry and competition before starting a company. A company’s specific business model and infrastructure should be established long before products or services are offered to customers, and potential revenue streams should be realistically projected well in advance. Creating and maintaining a business plan is key to running a successful company for the long term.

Business owners often fail to prepare for the marketing needs of a company in terms of capital required, prospect reach, and accurate conversion-ratio projections. When companies underestimate the total cost of early marketing campaigns , it can be difficult to secure financing or redirect capital from other business departments to make up for the shortfall.

Getting your company's name in front of your customers is a crucial aspect of any early-stage business. It is necessary for companies to ensure that they have established realistic budgets for current and future marketing needs.

Similarly, having realistic projections in terms of target audience reach and sales conversion ratios is critical to marketing campaign success. Businesses that do not understand these aspects of sound marketing strategies are more likely to fail than companies that take the time to create and implement cost-effective, successful campaigns.

What Is the Small Business Failure Rate?

Approximately 33% of small businesses fail in the first two years, 50% fail within five years, and 33% make it to 10 years and further.

What Are Some Signs That Your Business Is Failing?

Signs that a business is failing include small levels or lack of cash, inability to pay back loans on time, inability to pay suppliers on time, customers that pay late, loss of clientele, and an unclear business strategy.

Small Business Administration. " Frequently Asked Questions ," Page 2.

- How to Grow a Successful Business 1 of 28

- The Basics of Financing a Business 2 of 28

- Factor Definition: Requirements, Benefits, and Example 3 of 28

- How Much Working Capital Does a Small Business Need? 4 of 28

- How to Sell Stock in Your Company 5 of 28

- How SBA Loans Can Help Your Small Business 6 of 28

- 4 Steps to Getting a Small Business Loan Without Collateral 7 of 28

- 5 Biggest Challenges Facing Your Small Business 8 of 28

- Simple Ways to Keep Your Business Going in Hard Times 9 of 28

- 7 Popular Marketing Techniques for Small Businesses 10 of 28

- Small Business Is All About Relationships 11 of 28

- Balance Sheet vs. Profit and Loss Statement: What’s the Difference? 12 of 28

- Lines of Credit: When to Use Them and When to Avoid Them 13 of 28

- How to Accept Credit Card Payments 14 of 28

- Using a Business Credit Card 15 of 28

- best business credit cards 16 of 28

- These Are the 5 Best Bank Accounts for Your Small Business (April 2024) 17 of 28

- The Cost of Hiring a New Employee 18 of 28

- Raise vs. Bonus for Your Small Business Employees 19 of 28

- Outsourcing: How It Works in Business, With Examples 20 of 28

- Commercial Health Insurance: Definition, Types, and Examples 21 of 28

- Best Health Insurance Companies for Small Businesses for 2024 22 of 28

- Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) 23 of 28

- Best Small Business Insurance Companies for April 2024 24 of 28

- Best Professional Liability Insurance 25 of 28

- Don't Get Sued: 5 Tips to Protect Your Small Business 26 of 28

- The 5 Licenses and Permits You Need for Your Home-Based Business 27 of 28

- The 4 Most Common Reasons a Small Business Fails 28 of 28

:max_bytes(150000):strip_icc():format(webp)/GettyImages-658078463-3052d9b5cffe4f3395d20219805c550a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Just in Time for Spring 🌻 50% Off for 3 Months. BUY NOW & SAVE

50% Off for 3 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

20 reasons why small businesses fail and how to avoid them.

The failure rate of small businesses is significant—as many as 45% of start-ups don’t survive the first 5 years. 1 Exploding Topics, Startup Failure Rate Statistics . So why do so many businesses fail? The primary causes of business failure are cash flow problems, poor financial planning, and a lack of market awareness.

We’ll explore 20 reasons why small businesses fail so you can avoid common pitfalls and develop a strategy to help your business grow and thrive.

Key Takeaways

- Most small businesses fail within the first 10 years.

- Common financial reasons include poor pricing strategies, insufficient funds, and cash flow.

- Creating a clear business plan can help small business owners avoid common failures.

- Understanding your target market is key to creating a good business strategy.

Table of Contents

- Lack of Planning

- Choice of Location

- Lack of Research

- No Business Plan

- Poor Pricing Strategy

- Insufficient Funds

- Cash Flow Problems

- Poor Debt Management

- Dependence on One Customer

- Inadequate Profit

- Competition

- Lack of Market Demand

- Unexpected Growth

- Lack of Experience

- Ignoring Customer Needs

- Poor Management

- Ineffective Marketing

- Lack of Innovation

- Forgetting the Customer

- Ineffective Leadership

- Frequently Asked Questions

1. Lack of Planning

A clear vision is key to successfully running your small business. Start by setting research-backed goals for your company: what benchmarks do you want to reach in your 1st year? In your 5th year?

Setting timelines helps you keep on track with your goals and helps you make adjustments if you find you’re not where you want to be. Create a strategy for your business growth and set up check-in points.

For example, check in every 2 months to make sure you’re on track to reach your goals. This gives you a chance to follow up with what’s working well and change anything that needs to be modified to help you stay on track.

2. Choice of Location

Business location is one of the most important decisions you can make when setting up a new small business. If you provide in-person goods or services, you need to make sure that there’s enough local demand to support your business.

Businesses like bakeries and shops often rely on foot traffic for success, so visibility is key. Other industries like lawn care require you to commute to your customers, so you’ll want to pick a central location to minimize transportation costs.

If you offer remote services, location is still important—if you have some flexibility, consider how business taxes vary between states and municipalities.

It’s also important to consider how you might expand in the future. If you see yourself opening up a second location, look for an area that has room to accommodate your future business growth.

3. Lack of Research

Understanding your industry, competitors, and target market is key to business success and survival. Research common pitfalls in your industry so you can understand the specific challenges your company might face.

It’s also important to learn about your competitors. See how your services and prices compare to theirs, and consider whether you can offer any niche contributions to set your business apart.

Learn what customers are looking for from your company so you can deliver tailored experiences. Some demands are evergreen (constant), while others vary with market trends—research can help you determine and predict market trends so you can stay on top of your customers’ needs.

4. No Business Plan

In addition to your overall vision for your company, you’ll need to create a clear and actionable business plan. This helps communicate your vision to investors and other team members. There are many resources available to help you create a business plan, including business plan templates .

Your business plan should include:

- A description of your company and what you offer

- A market analysis including threats and opportunities

- Competitor analysis

- Marketing plan, including target customer profile

- Budget and projected cash flow

- Scalable growth plan

You’ll want to regularly revisit this business plan and review the success of each strategy. If you find anything that’s not serving your business, catching that early and making the right adjustments can be the difference between failure and success.

5. Poor Pricing Strategy

Setting the right price is a delicate challenge, but it’s essential for surviving as a small business. You need to price high enough that you cover your costs and make a profit, but low enough that it’s still accessible to a large customer base.

Start by understanding the costs involved in delivering your product or service. Calculate all the materials and labor costs, then factor in your profit margin .

Next, compare your prices against competitors. When you first start out, you may not be able to match the prices and profits of more established companies. If you find your prices are significantly higher, you might need to decrease your profit margin slightly.

Remember that even if you can’t exactly match your competitors, there are other strategies you can use to distinguish your business—competitor prices are a guideline, not a hard rule.

6. Insufficient Funds

Financing is a common challenge for new businesses, and it’s important to ensure you have sufficient funds right from the start. There are a range of financing options you can consider, from small business loans to investor support. Research all your options and compare how they’ll support you in the short and long term.

It’s also important to effectively manage your finances once you’ve acquired start-up capital . Make sure you understand all of your business costs including licenses, materials, taxes, and labor. Balance that against your projected profits to make sure you’ll be able to stay operative through the first few challenging years.

7. Cash Flow Problems

Financial management isn’t just about the big picture—it’s also about the way your business spends cash in day-to-day business operations. Make sure you keep track of all the ways your company spends money, from larger costs like rent and labor to everyday transportation costs.

It’s easy to get caught up in things like marketing and product development and run out of cash flow early on. Make sure you have a clear budget that you review regularly to ensure you have sufficient cash flow to manage your business.

8. Poor Debt Management

There’s more to small business financing than just start-up capital and cash flow: you’ll also want to stay on top of any debt and ensure your credit remains strong. If not managed carefully, these challenges can easily spiral out of control and sink a small business.

It’s not uncommon for new entrepreneurs to assume some debt as a new business—you might have taken a start-up loan as part of your initial process. However, that debt can become problematic if you’re not making enough profit to consistently make your payments.

One of the most common signs of impending debt issues for small businesses is delaying bill payments. If you find that your business is struggling to meet bills, debt , or credit card payments, it’s time to do a close examination of your finances and cash flow to see where you might be able to cut costs and get on top of any financing issues before they become a larger problem.

9. Dependence on One Customer

Building customer relationships is important, but it can be risky to become too reliant on just one customer. Even if that customer represents a large share of your current profit, there’s never a guarantee that they’ll be able to sustain your company.

Once you’ve found a great customer, analyze how you won that customer and see how you can apply those strategies to finding new customers. Consider what that client was looking for and how they found your company so you can understand what worked well in your next marketing campaigns .

Build a customer profile and focus your marketing on reaching clients who fit that profile. See if they tend to live in a certain area, frequent a certain job or social media platform, or search for particular keywords. Try to diversify your customer base so you aren’t reliant on just one client for your business survival.

10. Inadequate Profit

Most small businesses have low profits in their first few years, but there’s a point where those profits can become too low to survive. If you find that your profits aren’t enough to cover your expenses , it’s time to think about profit maximization strategies.

One of the first things to examine when you’re facing inadequate profit is your current cost management. Are there any areas where costs can be cut? Consider whether there are more affordable manufacturers, equipment options, or business spaces available to you.

You can also examine your pricing strategies. If you start by pricing low and you’re selling a large volume but still not making a good profit, your prices may be priced too low. Calculate how much you would have to raise your prices to make enough profit, and test out slightly higher prices to see how customers respond.

11. Competition

Even if you offer great products and services, it can still be hard to survive if you’re facing a lot of competition. Conduct a market analysis to see how many competitors are in your industry and area, what products they offer, and how their prices compare to yours.

Once you have a thorough understanding of your competitors, you can devise strategies to set yourself apart. This can include everything from offering competitive prices to providing a higher-quality product. You can also explore marketing strategies or consider how you can offer a slightly different product to fill a market niche.

12. Lack of Market Demand

Even the best businesses can fail if there’s no demand for their product. Market demand also fluctuates, so what’s in demand today can change by tomorrow. Keeping track of market trends and demand can help you stay ahead of the curve with what your company offers.

Start by assessing what’s currently in demand and how you can pitch your product to meet that demand. As customer needs evolve, you may need to slightly alter your products to adapt to changing customer needs.

13. Unexpected Growth

Growing your business is a hallmark of success, but it can also pose risks if you expand too rapidly without a clear plan. Unexpected growth can lead to over-extending your resources, overworking employees, and losing track of customers.

To prevent fallout from unexpected growth, it’s essential to have a scalable business plan. Make sure you can still deliver high-quality goods and services as you expand, so your customers stay satisfied. Keep track of how much money and labor you’re expending on new services so you can bring on new employees as you grow.

It’s all about striking a balance—you want to make sure you hire enough talent to keep up with growth but avoid hiring too early in case your growth slows down. Tracking your expenditures in relation to growth is the best way to create a plan for the future.

14. Lack of Experience

Successful business owners need vision and passion, but they also need experience to translate into their goals into a successful company. Lack of experience and industry knowledge can hold your business back, so it’s important to build a dedicated management team with a thorough understanding of the market.

A business mentor can help you manage the small business owner aspects of your company. Look for someone with experience managing their own business who can advise you on things like developing a business plan , hiring the right talent, and pitching to investors.

It’s also important to bring on experts in your industry. Look for experienced financial advisors who can guide you through developing your financial strategies. You’ll build experience as you grow, but it’s a good idea to bring in experts for specific jobs like marketing and accounting.

15. Ignoring Customer Needs

The best source for understanding market demand is customers themselves. Responding to feedback helps you build strong relationships with your existing customers and helps you understand what you need to do to gain more customers.

Listen to customer feedback on pricing, services, accessibility, and any other concerns they may have. In some cases, you may not be able to accommodate every suggestion, but it’s helpful to respond and then do a cost-benefit analysis and see how making the recommended changes might impact your business.

If you feel like you’re not receiving customer feedback, consider reaching out. Comment and feedback forms after a completed order can be a helpful tool for gaining market analysis in real-time.

16. Poor Communication

Having a clear vision that you can communicate to investors and customers is important, but it’s just as key to having strong communication inside your business. When your team doesn’t understand your business goals, it’s harder for everyone to collaborate efficiently.

If you’re operating your small business as a partnership, it’s fine to have different skill sets, but you need to be on the same page about vision and goals. Creating a business plan collaboratively can help ensure you agree on the primary strategies for your company.

Weak communication can lower morale and productivity and prevent your business from growing effectively. Consider making a modified version of your business plan that you can share with your employees. This can include an overview of your business goals and strategies to help everyone get on the same page.

17. Ineffective Marketing

Even with great products, your business can’t succeed unless you effectively reach your target market. Ineffective marketing strategies can hold you back from connecting with customers, while great marketing helps you reach new audiences and grow your business.

It’s important to have a targeted campaign with a clear focus. Start by identifying your target customers and learning about how they interact with local businesses. This helps you determine where to place ads, what to offer, and how to speak to potential customers.

Make sure your marketing strategy has a way to track results. That could include tracking impacts and clicks, measuring follow-through, and consulting with new customers to discover how they found your business so you can build on your most effective strategies.

18. Lack of Innovation

A great product at the start of your business may not remain competitive as the market changes. Innovation is essential for ensuring your business stays relevant and continues to be successful.

This doesn’t mean you have to drop products if they’re still performing well, but it’s a good idea to consider how you can improve or develop new products if you have the capital to spend on development. This helps you stay ahead of the curve in a changing market.

Even with evergreen products, your business practices can still become stagnant. You’ll need to find new marketing strategies to reach new customers so that you can have a continuous revenue stream. Innovation spans all components of your business, from product development to new marketing methods.

19. Forgetting the Customer

Even if a product seems great to you, remember that in the end, it’s about the customer and how the product will meet their needs. Focus on learning about what the customer is looking for—what’s missing from current products, and how can your business satisfy that need.

If customers offer feedback, try to learn from that and incorporate it where possible. This can involve product innovation or customer service relationships. Customers will remember a great product, but they’ll also remember a personable and helpful business interaction.

Check-in with customers to make sure they’re fully satisfied with their experience. One way to do this is to send a follow-up email or form after their purchase. You can incentivize feedback by offering a small discount for filling out the form—this also encourages customers to return to your business.

20. Ineffective Leadership

While a great team and expert advice are important in supporting your business, it’s ultimately up to you to lead your company forward. If you’re burnt out or losing track of your vision, your team won’t know where to follow.

Strong leadership helps cultivate a positive company culture, a motivated team, and great client relationships. Your employees take their cue from you, so make sure to set a strong model for interacting with customers.

Creating a good company culture starts with forging strong employer-employee relationships. Get to know your employees, their goals, and their challenges at work so you can help them perform their best. When you create a work environment that’s supportive and growth-oriented, it encourages your team to deliver their best work and help build your business.

The reasons why small businesses fail can include everything from poor pricing strategies to ineffective marketing. Learning how to recognize problems like poor management and inexperience can help you identify issues in your company before they impact your success.

Understanding and recognizing why small businesses fail can help you create strategies to avoid common pitfalls. Tools like FreshBooks accounting software can also help you manage your expenses and avoid problems like insufficient cash flow. Try FreshBooks free to discover an easy tool to help your small business thrive.

FAQs on Reasons Why Small Businesses Fail

Is it true that 90% of startups fail.

Yes, ultimately about 90% of startups fail. A few fail in the first year, and most new businesses fail in the first 2 to 5 years. After 5 years, businesses that survive tend to see a small rise in profits and growth.

Why are small businesses declining?

Some of the biggest reasons why small businesses decline are market competition, lack of demand, and lack of financing. In many cases, larger and more established companies make it difficult for new small businesses to enter the market.

What is the biggest problem facing small businesses today?

One of the biggest problems currently facing small businesses is inflation. High inflation rates mean higher input costs for products, and usually also mean employees will seek higher salaries. It can also mean higher interest rates when trying to secure a first business loan.

Why are small businesses failing in today’s economy?

Many small businesses are failing in today’s economy because they lack planning and financial preparation. While market competition and funding pose challenges to business owners, these can be overcome with financial preparedness and a clear business plan.

Article Sources:

- Exploding Topics, Startup Failure Rate Statistics .

Sandra Habiger, CPA

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

9 Major Reasons Why Businesses Fail by Year 2 and How to Avoid Them

Posted january 28, 2021 by jake pool.

According to the Bureau of Labor Statistics, over thirty percent of private companies fail within two years.

Of course, there are external factors that businesses have no control over. Sadly, the COVID-19 Pandemic is a prime example of one. Since such events are unavoidable, let’s focus on internal factors that companies can act on.

9 common issues to avoid when running your business

As a new business owner, what are the traps to avoid from the start? And what can you do to stay in business? By understanding the following pitfalls you can hopefully avoid them and keep your business running smoothly for far longer than 5 years. Let’s dive in.

1. Insufficient funds due to weak forecasting

Without a doubt, poor financial forecasting is the main reason businesses fail.

It is relatively easy to plan fixed costs such as rent, payroll, utilities, hardware, etc. Entrepreneurs should vet this out extensively when writing their initial business plan.

However, it can be more challenging to forecast revenue generated from sales . Many new business owners are overoptimistic in their planning and vision. This results in an inability to amortize (pay off) an initial investment. Thus, the business fails.

Similarly, companies may be tempted to launch their product or services at a cheap price to be competitive. While it can work in the short-term, it’s not a sustainable business model. Once you start with a low price, it’s difficult to increase.

Goals should be ambitious, but attainable. And the budget should reflect accordingly.

2. The business lacks value

The success of any business hinges of its value. It might sound obvious, but it’s not that easy. As a business owner (or future), you probably think your product or service is great. But it’s not enough.

Before launching a business, always do extensive research (there is a lot of data available) on your target audience. Benchmarking and surveys are also a must.

Here are some generic survey questions to ask:

- Would you talk about this product or service with others?

- Have you ever heard of a similar product or service?

- How much would you pay for this product or service?

If your product is only valuable to you or a small group, or it doesn’t offer more value than your competition, it’s time to rethink things.

3. Inadequate business plan

As mentioned in the first point, budgeting is a key element of a business plan . But it’s not the only factor within the plan that will break a business.

A good business plan should include:

- A comprehensive description of the business

- Workforce needs and compliance (current and future)

- SWOT analysis

- Benchmarking Analysis

- Marketing Plan

But a solid initial business plan isn’t enough. Business owners should review and modify it regularly to keep with the pace of the industry and assess internal goals.

Many failed businesses in this scenario end up listed on business marketplaces like UpFlip because there are entrepreneurs out there equipped to change a poor business plan.

4. No connection with the target audience

The first questions any business owner should ask are — Do I know my target audience and do I understand what they need and want?

If you can’t answer those questions, it’s time to conduct more surveys and research. Otherwise, there is a disconnect, and the business will ultimately suffer and fail. It seems like a bold statement, but the biggest part of a purchasing decision is emotion.

Your product or service may have wonderful features and even value, but if it doesn’t connect with your target audience on an emotional level, it will fail.

For example:

If you run an office furniture business, obviously, the technical aspects of your premiere desk chair would be a sales point. But sturdy wheels and a comfortable backrest won’t differentiate you from the competition.

Yes, you sell a chair. But also sell the idea of success, professionalism, or even luxury. The target audience must connect with your product on those levels. Otherwise, the business won’t stand out.

5. Competition is too stiff

Even with a comprehensive benchmarking analysis in the initial business plan, competition can evolve quickly. In many industries, there are new players every day in their respective markets.

To avoid failure, benchmarking must be a continuous effort. If your competitors are too big, it’s in the business’s interest to find a niche or some form of added value to your products or services.

Take TOMS Shoes , for instance. They broke into the highly competitive world of mid-level shoe sales by offering a socially conscious selling point to the value of their shoes. For every purchase, they give a pair of shoes to a child.

Note how their model also connects with their target audience at an emotional level.

6. Poor management

The success of a business comes from the top down.

Small business owners are often the only managers within a company. While it may work sometimes, it’s advisable to form a proper management team or at least hire a general manager.

Business owners don’t always have the necessary skills or time to be a good manager. Poorly managing or overlooking certain aspects of the business like human resources, marketing, or accounting can have a disastrous effect.

It’s important to learn to delegate to avoid wearing too many hats.

If you don’t have the money or infrastructure to hire full-time help (or in-house), think about outsourcing certain management tasks to a qualified freelancer via Upwork or a similar platform.

Otherwise, someone who can manage the company will soon take over.

7. Lack of a company culture

There is no happy company without happy employees. You may have a great business model and entrepreneurial skills, but the success of the company also depends on the staff.

It’s key to outline and implement a strong company culture from the beginning. And make sure that the people hired align with it.

Once in place, feed and maintain the culture mentality. Otherwise, you risk issues with high turnover. This has led to the internal collapse of many businesses in a shorter time span than two years.

8. Ineffective sales funnel

Getting leads is essential for any company, but your leads are worthless if they don’t convert. Many new companies focus on collecting data and leads and fail to nurture them properly.

To avoid bloating your sales pipeline , you need an effective sales funnel from beginning to end (and beyond!). It could vary depending on the industry, but be sure to nurture your leads as long as needed to complete the sale.

In the ideal sales funnel, leads convert when ready and become ambassadors of the brand. With a quality, automated system, you can sit back and watch it happen.

Here are a few ideas on nurturing leads:

- Send industry-related freebies (How-to Guides, Tools, White papers)

- Share relevant blog articles based on interest (personalization)

- Wish them a Happy Birthday! (Gift, Voucher)

- Set up a referral program with incentives

- Engage with leads on social media

- Use chatbot technology to answer FAQs when unavailable

- Newsletters (Old fashioned, but efficient!)

In other words, create and maintain a relationship even after the sale!

9. Bad marketing

In the early stages of a business, marketing is crucial. The key is to find the right balance between a reasonable budget and efficiency. Fortunately, this is possible thanks to digital marketing.

The two biggest advantages to investing in digital marketing campaigns are cost efficiency and measurable results (as opposed to traditional marketing methods such as print or tv advertising).

When setting up a marketing campaign, define the target audience, budget, and a realistic conversion rate. Again, if you need help, think about outsourcing for Google Ads or social media campaigns .

Many companies fail because of an inefficient marketing plan that allocates funds to ineffective channels or to ineffective content. And when it’s too late, it’s difficult to redirect funds to make up for the loss.

Awareness is key

As stated, some external factors that negatively affect a business are unavoidable, but there are many internal factors business owners can act upon to prevent failure. The first two years are critical to creating a perennial business.

Be aware of these reasons and don’t become a statistic!

Like this post? Share with a friend!

Posted in Management

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

6 Reasons Why Small Businesses Fail and How to Avoid Them

7 min. read

Updated October 29, 2023

Roughly 20% of small businesses fail in their first year, according to recent U.S. Bureau of Labor Statistics data . About 50% fail in the first five years, and only one-third of new businesses are able to survive for 10 years. Research by the Small Business Administration found that about 1 in 12 businesses close in America every year.

If you’re a small business owner, another way to think about these statistics is that 80% of small businesses will survive their first year. Over five years, you have a roughly even chance of survival or failure. Looking out 10 years, you have a one-in-three chance of enduring.

What are the reasons businesses fail to thrive, given a 50/50 chance of survival and assuming a product or service for which there’s a demand? Let’s discuss six reasons businesses fail and some ways you can avoid business failure.

- 1. Leadership Failure

Your business can fail if you exhibit poor management skills, which can be evident in many forms. You will struggle as a leader if you don’t have enough experience making management decisions, supervising a staff, or the vision to lead your organization.

Perhaps your leadership team is not in agreement on how the business should be run. You and your leaders may be arguing with each other publicly, or contradicting each other’s instructions to the staff. When problems requiring strong leadership occur, you may be reluctant to take charge and resolve the issues while your business continues to slip toward failure.

How to Avoid Leadership Failure: Dysfunctional leadership in your business will trickle down and affect every aspect of your operation, from financial management to employee morale, and once productivity is hindered, failure looms large on the horizon.

Learn, study, find a mentor, enroll in training, conduct personal research—do whatever you can to enhance your leadership skills and knowledge of the industry. Examine other business and leadership best practices and see which ones you can apply to your own.

2. Lacking Uniqueness and Value

You may have a great product or service for which there is strong demand, but your business is still failing. It may be that your approach is mediocre or you lack a strong value proposition. If there’s strong demand, you probably have a lot of competitors and are failing to stand out in the crowd.

How to Avoid Value Proposition Failure: What sets your business apart from competitors? How do you conduct business in a way that is totally unique? What are your competitors doing better than you are? Develop a customized approach or service package that no one else in your industry is using so you can present it as a strong value proposition that attracts attention and interest.

This is how you build a brand . Your brand is the image your customers recognize and associate with your business. Your brand identity, including your logo, tagline, colors, and all the visible aesthetics and business philosophies that represent your company should be supported by your value proposition. It should separate you from the pack and present your individual perspective to your customers. Do everything you can to present that unique value proposition to your market so you can capture a market share and begin building your conversion rates.

To publicize your brand and set yourself apart, you will also need to step up your marketing plan and use as many venues as possible to present your brand to the public. You may be far better than your competitors but that won’t make any difference if your prospects don’t even know you’re in the game. Use social media, word of mouth, cold calling, direct mail, and other tried-and-true marketing techniques. Ensure you have a well-optimized online presence, develop lead generation and contact information capture techniques such as offering high-quality content on your site, a subscriber newsletter, and information giveaways.

3. Not in Touch with Customer Needs

Your business will fail if you neglect to stay in touch with your customers and understand what they need and the feedback they offer. Your customers may like your product or service but, perhaps they would love it if you changed this feature or altered that procedure. What are they telling you? Have you been listening? Or is the market declining? Are they even still interested in what you’re selling? These are all important questions to ask and answer. Maybe you’re offering a product or service that is fallen well below trend.

How to Avoid Losing Touch with Customers: A successful business keeps its eye on the trending values and interests of its existing and potential customers. Survey customers and do market research and find out what their interests are and keep abreast of changes and trends using customer relationship management (CRM) tools. Effective use of CRM can help keep your business from failing.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

4. Unprofitable Business Model

Akin to leadership failure is building a company on a business model that is not sound, operating without a business plan , and pursuing a business for which there is no proven revenue stream. The business idea may be good but failure may come in the implementation of the idea if there are no strategic guidelines in place.

How to Build a Good Business Model: Research and review the way other businesses in the industry operate. Develop a complete business plan that includes financial forecasting based on predictable revenue, strategic marketing, and challenge management solutions to overcome potential obstacles and competitor activities. Create a milestone chart with specific tasks and objectives assigned along the timeline so you can measure success, solve problems as they occur, and stay on track. A sound business model that incorporates best practices can help your business avoid failure.

5. Poor Financial Management

SmallBizTrends.com, a business news resource, offers this infographic which states that 40 percent of small businesses make a profit, 30 percent come out even, and the remaining 30 percent lose money.

You must know, down to the last dime, where the money in your business is coming from and where it’s going in order for your business to succeed. Your business can also fail if you lack a contingency funding plan, a reserve of money you can call upon in the event of a financial crisis. Sometimes people start businesses with a dream of making money but don’t have the skill or interest to manage cash flow , taxes, expenses, and other financial issues. Poor accounting practice puts a business on a path straight to failure.

How to Avoid Financial Mismanagement: Use professional business accounting software like QuickBooks or Xero to keep records of all financial transactions, including every expenditure and all revenues received, and use this information to generate income statements (profit and loss statements). Even better if you use a business dashboard tool like LivePlan that makes it easy to monitor your financials. This is valuable information that you need to run your business, know where you stand at all times, and keep it operating in the black. If you lack skill in financial management, consider hiring a small business advisor and professional bookkeeper or certified public account to help manage your financial affairs.

6. Rapid Growth and Over-expansion

Every now and then a business startup grows much faster than it can keep up with. You open a website with a trending product and suddenly you are inundated with orders you are not able to fill. Or perhaps the opposite is true. You are so convinced that your product is going to take the world by storm that you invest heavily and order way too much inventory and now you can’t move it. These are both additional paths to business failure.

How to Avoid Growth and Expansion Problems. Business growth and expansion take as much careful and strategic planning as managing day-to-day operations. Even well-established and successful commercial franchises such as fast-food restaurants and convenience stores conduct careful research and planning before opening a new location. They measure local and regional demographics and spending trends, future development plans for the area, and other pertinent issues before they move forward. You must do the same for your business to avoid failure.

Conduct thorough research to ensure the time is right and the funding is available for expansion. Make sure the initial business is stable before expanding to an additional location. Don’t order inventory you’re not sure you can sell but have a plan already in place to fill orders quickly should the demand present itself. The key to successful growth and expansion—and avoiding business failure—is strategic planning.

- Avoiding business failure starts with planning

If 50% of new businesses fail, then 50% of new businesses can succeed. Starting a business is an exciting endeavor that requires a clearly defined product or service and a strong market demand for it. Whether you desire to start a new business or you’re already running a business, you must understand that success depends on careful strategic planning and sound fiscal management that begin prior to startup and continue throughout the life of the business.

Clarify your ideas and understand how to start your business with LivePlan

Mike Kamo is the VP of marketing for Strideapp. Stride is a Cloud-based CRM and mobile app that helps small- to medium-sized agencies manage and track leads, as well as close more deals.

.png?format=auto)

Table of Contents

- 2. Lacking Uniqueness and Value

- 3. Not in Touch with Customer Needs

- 4. Unprofitable Business Model

- 5. Poor Financial Management

- 6. Rapid Growth and Over-expansion

Related Articles

7 Min. Read

How to Think About (and Reduce) Risk When Starting Your Own Business

6 Min. Read

Ask the Experts: Things I Wish I’d Known Before Starting a Business

Top 8 Reasons to Start a Business in a Recession

10 Min. Read

14 Tips for Starting a Successful Business

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Build plans, manage results, & achieve more

Learn about the AchieveIt Difference vs other similar tools

We're more than just a software, we're a true partner

- Strategic Planning

- Business Transformation

- Enterprise PMO

- Project + Program Management

- Operational Planning + Execution

- Integrated Plan Management

- Federal Government

- State + Local Government

- Banks + Credit Unions

- Manufacturing

Best practices on strategy, planning, & execution

Real-world examples of organizations that have trusted AchieveIt

Ready-to-use templates to take planning to the next level

Research-driven guides to help your strategy excel

Pre-recorded & upcoming webinars on everything strategy & planning

- *NEW!* Podcast 🎙️

Strategic Planning Failure: Why It Happens and How to Avoid It

RELATED TAGS:

blog , Strategic Planning

There are more than 30 million small businesses in the U.S. If I asked you to divide these companies into categories based on annual revenue, how many would fall into the $1-10 million revenue tier? How about $10-50 million or above $50 million?

These businesses comprise only about 4% of those in the U.S. The remaining 96% have less than $1 million in annual revenue. Unfortunately, only a small number of them will grow into the next tier. In fact, it’s so hard to move between categories, there are only 17,000 businesses with more than $50 million in annual revenue. Only 17,000 out of more than 30 million!

It leads you to wonder — why do some companies struggle while others blast through the ceiling and achieve phenomenal growth? What are common barriers that prevent companies from achieving this level of growth? The secret often lies in strategic planning.

In this article:

Top 28 Fatal Strategic Planning Program Flaws

How to overcome strategic planning failure.

- Start Executing Your Strategic Plan With AchieveIt

For some companies, strategic planning seems to be a rhetorical exercise in which everyone fills out a form at the beginning of each year listing the things they are going to accomplish. The forms are assembled into a tidy document and updated quarterly. It’s all very task-oriented. And while, yes, strategic plans contain tasks, without goals, objectives, and strategies to provide context, the tasks are meaningless. A strategic plan without measurable objectives is no strategic plan at all.

Successful strategic planning means business elements are working together agreeably to contribute to these goals. For strategic planning to be successful, you need to understand the factors that play a role in strategic plan failure. We’ve gathered a list of the top 28 reasons why strategic plans fail.

1. Premature Upscaling

Pushing your business outside of its limit is known as premature upscaling and may occur if you are impatient to implement a business venture, project, or strategy. Preparing your team to take on any kind of expansion before anticipating possible consequences can lead to disaster. Managing the effectiveness of your strategic plan means not taking it beyond the reality of what your business can handle.

A practical internal organization should focus on a steady upscale by defining specialized roles, strengthening management structure, planning, forecasting, and sustaining culture.

2. Poor Managerial Skills or Lack of Leadership

Managers and leaders can heavily influence productivity, revenue, innovation, and turnover. Management that contributes to a lack of trust or low expectations can decrease employees’ motivation or performance, which can affect strategic planning. Managers can assist in creating a proactive environment by learning from their failures and encouraging experimentation. Promoting open communication and exchange of ideas may also help with improvement opportunities.

Managers should be aware that employees may not always come to them when problems arise, so anticipating problems and engaging with employees to create solutions for strategic plans lets your team know they are a priority. Having suitable leadership can ensure your team’s commitment and buy-in to the process.

3. Zero Succession Plan

Many strategic plans are not executed well because the business doesn’t have a succession plan. A succession plan ensures the necessary resources and skills are available when needed for a business plan or transition. The absence of succession planning may leave your business exposed to inefficient replacement options for positions that need to be filled, as well as fewer training and opportunities for your hard-working employees.

Businesses with a strong succession plan may see more resolved conflicts, effective decision-making and a boost in employees’ qualifications to take over specific roles.

4. Overwhelming Strategic Plan

A strategic plan that is too overwhelming may be just as ineffective as having no plan at all. Too many vague goals or action steps — such as “growth” or “increased revenue” — can create confusion and dilute specific instructions or paths to accomplishment. This lack of precision could make employees less likely to make progress on goals. A strategic plan can also seem overwhelming if it aims to accomplish too many objectives at once, making it more difficult to translate them into useful measures.

Creating a specific plan with goals and means of achieving them may reduce the likelihood of concerns or the need for clarification in the future. Using specific objectives can help you develop a reasonable timeline for intended success. It may also assist your employees in feeling confident in their respective roles and positions.

5. Unrealistic Goals: All Vision, No Direction

Setting unrealistic goals may explain why your business strategy fails. Unrealistic, immeasurable, or unquantifiable aspirations can be difficult to put into action and contribute to a lack of organizational focus because employees may find it unmanageable to meet the requirements. Employees are more motivated by challenging but attainable and incremental goals that align with business resources and productivity.

Aside from envisioning your goals, you need a plan for implementing them. So, after ensuring all the essential elements of your mission are accounted for in your goals, develop a plan for implementing them. This ensures your plan has a focused vision and a sense of direction.

6. Focus on Structural Changes

A business that puts too much focus on structural changes may lose the opportunity to direct its energy toward decision-making and meeting goals. Rather than building new structures, it is important to work on developing effective processes for strategies. Structural changes may bring about more issues and conflicts that take away attention and time from the strategies that can help your business succeed.

There are often limits to structural changes in organizational design, as it can take a long time to get everyone on board with the process to run smoothly.

7. Lack of Empowerment

The formulation and execution of your business strategy may depend heavily on your employee’s confidence and positive thinking. Empowered employees may feel more motivated to collaborate and achieve a goal, which can have a direct impact on your strategic planning success. Leaders who implement empowerment may see an increase in connection and creativity. Developing an inspiring and innovative environment can increase adaptation to different work styles, which may lead to success.

8. Wrong Timing

A solid business plan considers when the time is right to administer action. Your business strategy may be equipped with the proper resources, planning, goals, and actionable measures. But if the timing in your market or industry is not optimal, it may be wise to contemplate implementing it at a different time. The timing of your project often directly relates to success , so finding the ideal moment to bring your plan to life is important.

9. Short-Term Planning and Losing Sight of Goals

In the hustle of day-to-day operations, employees may easily lose sight of the mission. This attention can hinder short-term goal planning when your employees only focus on daily activities rather than their purpose in the overall goal.

Before establishing your business strategy, think about the big picture and general direction of where you want to grow. If you don’t set long-term goals, you may lose the ability to envision sustainability. Setting long-term plans and objectives can improve your short-term goals’ structures because you may be able to narrow the focus toward what you are trying to achieve.

Most of the time, your business’s short-term goals will be very different compared to its long-term strategy, so you and your team should revisit goals regularly to keep everyone on track. Planning for your business’s future and adapting your daily actions to your strategic plan’s goals can strengthen your employees’ ability to maintain a broader perspective.

10. Choosing the Wrong People or Relying Too Much on External Consultants

In any business, the employees and team members are the most important asset. Every business strategy, plan, and execution stage requires different skills, personalities, and capabilities. Choosing the wrong people to fill specific roles in your business plan may decrease productive methods and success.

A team of external consultants is almost always a good idea for collaborating on a business plan and ensuring success because strategic management decisions can be very challenging. However, strictly relying on external consultants, meaning those who are not a part of your business, may lead you to lose sight of your business goals and purpose. After all, no one knows your business better than the people involved in your internal organization.

The external structure, also known as the environmental subsystem, should interconnect with the internal structure of your business to maintain consistency and work to improve intended progress. Internal consultants may be more beneficial for your business, depending on the size of your project or business plan. They may have a better idea of how to allocate resources and take a specific approach.

11. Lack of Communication or Lack of Clarity on Actions Required

When strategies fail, it is often because of a lack of communication. Communication keeps everyone on the same page. To communicate effectively, you must understand what information is relevant and important when notifying your team of updates, issues, or changes on a project.

In businesses where a lack of communication contributes to the limitations of strategic planning, employees may feel confused about their roles and responsibilities. They may also feel disconnected when attempting to collaborate, which can lead to poor execution and confusion on context and outcomes. A method of storytelling can be effective in this case to put facts, strategies, missions, or operational planning directives into a structure that people can relate to and understand.

Another crucial part of communication is accountability. Around 91% of employees would say effective accountability implementation is one of their company’s top leadership development needs. Clearly communicating what employers are accountable for is essential, considering 60% of workers report higher levels of mistrust with leadership when faced with a lack of communication surrounding accountability.

12. Inadequate Monitoring

Monitoring the development of planning and progress for any strategy can keep you aware of when changes need to be made. Determine which factors will have a significant impact on the success of your business to create a timeline of when critical tasks need to be completed. Proper monitoring allows for the opportunity to notice alternative solutions and predict long-term performance. Keeping your strategies and objectives on track may help prevent problems and enable you to revise or update plans as necessary.

Monitoring your financial key performance indicators (KPIs) is another great way to be proactive and add value to your daily activities.

13. No Progress Reporting

Reporting progress is another effective means of communication that contributes to staying on track with meeting your goals. A progress report updates the right people on the status of certain projects or task completion. Without it, there can be confusion and concern surrounding productivity.

Progress reporting can also provide an overview of your team’s accomplishments and areas that need improvement. Constructing a regular analysis of your team’s performance, spending and profits can provide insight into how you compare with competitors.

14. Lack of Alignment

Strategic alignment means that all crucial elements of a business are working together to support long-term goals. If employee performance is not aligned with your company goals and important strategic plans, it may present another obstacle to success. Misalignment in your business can create a disruption in focus, unclear goals, and conflicting tasks.

Employees need to understand how their responsibilities fit into the success of a strategic plan or mission. Creating clear, established intentions may help you develop alignment with what your business aims to accomplish.

15. Strategy You Can’t Execute

Before wasting time, energy, and resources on a strategic plan, consider if it is truly worth executing. Vague ideas or goals won’t usually produce anything successfully, so analyze your plan to see if it is capable of creating real change. Your strategy should be flexible and leave little opportunity for disruption.

Your business may be too focused on seeing rapid results that it may not take the time to develop capabilities and innovation techniques. A worthy, solid strategy will take time to develop and may even require fundamental changes to your business.

16. Unforeseen External Circumstances

Unpredictable occurrences should, ironically, be expected. If your company is not comfortable with confronting unforeseen external circumstances, it may explain why your strategies fail. Learning to anticipate risks or unfavorable opportunities can strengthen your ability to prepare a more secure strategy in the future. It is wise for your business to continually adapt its resources to suit a changing environment.