How to Write a Resume for a Business Loan

- Small Business

- Money & Debt

- Business Loans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Add Notes to QuickBooks

How to write a 5-year business plan, reasons why a human resource manager would throw away a resume.

- How to Write a Letter From the Staff of a Company to a Bank Requesting a Loan

- How to Write a Good Interview Questionnaire

Establishing business credit is a long process, that often hinders companies seeking loans in the early phases of business. Many small business owners must use personal credit or income when filing for a small business loan, as lenders want to know if the business owner can make the company a success or repay the debt. In these cases, a business plan and a personal resume are required. Business loans are available through commercial banks or Small Business Administration (SBA) resources.

Write a business plan that summarizes the business operations. Include the products and services offered, marketing strategies and an analysis of competition. Provide a detailed analysis of revenues, major contracts and partners to demonstrate the viability of the business and explain why the loan is needed.

Write the objective of your resume, summarizing who you are and what you seek. To obtain a business loan, the objective isn't to land a job, it is to demonstrate to a lender that you are the person who will drive the company to success and are worthy of a loan. List the objective in its own section with "Objective" in bold letters.

Summarize your abilities and key qualifications in a second section. Create bullet points of qualifications such as business management, leadership, quantitative skills and interpersonal skills.

List all pertinent work and volunteer history you have in a third section. Managerial experience, years in the same industry or consulting with a particular company for an extended period of time all demonstrate how your previous experience will contribute to the new successful venture.

Organize the list in chronological order, with your most recent experience listed at the top. You don't need every job, just the ones that relate to the business venture or your function in the organization. List the job title, company, location and dates of hire with key responsibilities in bullet points underneath.

State your education in the last section. Write the degree, school and year you graduated.

- SBA: How to Apply for Financial Assistance

- Business.gov: Small Business Loans

- Rockport Institute: How to Write a Masterpiece of a Resume

- Include the resume as part of the business plan as an Appendix. A lender will need all the information from both the company and you to decide on a loan.

With more than 15 years of professional writing experience, Kimberlee finds it fun to take technical mumbo-jumbo and make it fun! Her first career was in financial services and insurance.

Related Articles

How to write a corporate executive bio, how to write a job self audit report, how to create a resume if you are self employed, how to write an accounting service proposal, how to show accounts receivable used as collateral, how to write a construction company profile, how to write a business letter asking for a trainer to come train your company on sexual harassment, how to record a loan receivable in quickbooks, how to start a dunkin' donuts, most popular.

- 1 How to Write a Corporate Executive Bio

- 2 How to Write a Job Self Audit Report

- 3 How to Create a Resume if You Are Self Employed

- 4 How to Write an Accounting Service Proposal

Home > Finance > Loans

How to Properly Write a Business Loan Request

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Have to submit a business loan request letter as part of your loan application? Not sure how to get started?

We don’t blame you. These kinds of letters aren’t as common as they used to be. While online lenders don’t usually ask for small-business loan requests, some traditional banks and credit unions still do. And if you apply for an SBA business loan (a loan backed by the US Small Business Administration), you’ll need a small-business loan request as part of your loan application package.

No matter which lender you’re applying with, this guide will help you write a strong business loan request letter―and to get the business loan you need.

How to write a business loan request letter

- Start with the easy stuff

- Write a brief summary

- Add information about your business

- Explain your financing needs

- Discuss your repayment plan

- Close the letter

1. Start with the easy stuff

Writing a loan request can feel overwhelming. After all, it’s not an everyday part of being a small-business owner. What do you say when applying for a bank loan? How do you write a business proposal for your loan application? What’s your lender even looking for in a business loan request letter?

That’s why we suggest starting your request writing process with the easy bits: formatting.

You’ll want to begin your business loan request with some pretty standardized formatting that includes your contact information, the date, your lender’s contact information, a subject line, and a greeting.

Typically, you’ll want to format the beginning of your small-business loan request roughly like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Obviously you can simply plug in the relevant information for most of this. Easy peasy, right?

You’ll really only have to come up with your own subject line and greeting. But don’t overthink it. Something like this will work just fine for your subject line:

- Re: [Your business’s name] business loan request for [loan amount]

Likewise, keep your greeting simple. “Dear [lender]” or “Dear [loan agent]” will do quite nicely.

Got all that? Then you’re ready to get into the actual loan request.

By signing up I agree to the Terms of Use.

2. Write a brief summary

Before you dive into the meat of your loan request, you should give a brief summary of your letter. Just write a short paragraph that says why you’re writing and what you want.

So you’ll probably want to include the following details:

- Business name

- Business industry

- Desired loan amount

- What you’ll use the loan for

No need to get fancy with this. You’re trying to condense the most important information into one or two sentences.

For example, your summary might look something like this:

- I’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. With this loan, [business name] would [describe your intended business loan use].

As you can see, you don’t need much detail here. You’re just giving the reader a quick overview of what’s to come.

And now that you’ve given them that preview, it’s time to get more in depth.

Remember, your lender isn’t here to grade your writing. Try to use good spelling, grammar, and punctuation―but don’t stress about crafting beautiful sentences.

3. Add information about your business

Your next section should add more detail about your business. You’ll want to include information like this:

- Business’s legal name (if different than name used)

- Business’s legal structure (LLC, partnership, S corp, sole proprietorship, etc.)

- Business’s purpose

- Business’s age (or date it began operating)

- Annual revenue

- Annual profit (if applicable)

- Number of employees

Now, keep in mind that you’re not trying to give your reader an encyclopedic history of your business. Instead, you’re trying to show that you have a well-established business―one that’s solid enough to deserve a business loan. So focus on relevant details that show your business’s maturity.

You can keep this section as short as a few sentences or as long as a few (brief) paragraphs. Just make sure you leave plenty of room for the next two sections.

4. Explain your financing needs

After discussing your business, it’s time to explain why you need a bank loan.

That means you’ll want to offer some details about how you plan to use your business financing. For example, you can talk about the employees you plan to hire, the building you want to expand, or whatever else you intend to do with your term loan .

Take note, though, that you also need to explain why your loan request makes sense. Because your lender doesn’t really care that you want a loan―it cares whether or not it makes sense to lend to you. You need to convince your lender that you have a good plan for your loan―one that will make it easy to repay the money you borrow.

Try to answer questions like these as you write this section:

- Why should your lender want to approve your loan application?

- What happens to your business if you get your small-business loan?

- What kind of growth will your business loan allow for?

Dig into your business plan and projections to find some good stats. Explain how hiring those additional employees will increase your revenue by a certain percentage or dollar amount. Break down how opening that add-on to your restaurant will allow you to seat a number of additional customers, and how much revenue you expect that to bring in.

The more specific you can get, the better. Because again, you’re trying to convince your lender that you’re borrowing as part of a thoughtful business plan ―not just because you want some cash.

And take your time with this part. In most cases, this section and the next one will form the meat of your business loan request letter.

As a rule, you should keep your business loan request letter to one page.

5. Discuss your repayment plan

By this point, your lender should understand what your business does and why a loan would help it grow. Now you need to prove to your lender that you can repay your small-business loan.

This doesn’t mean you have to show precise calculations breaking down your desired interest rate and monthly payment. (After all, your bank probably hasn’t even committed to a specific interest rate yet.)

Instead, talk about things like your business’s past finances, other existing debts, and any projections can you offer.

So if you have a profitable business, point that out, and discuss how that will free up cash flow to repay your loan. Offer summaries of profit-and-loss statements that show your business has been growing. Tell your lender how you’ll pay off that existing loan within a few months, so they don’t need to worry about it interfering with repayment of your new term loan.

Put simply, this is your chance to convince your lender of your creditworthiness. Especially if you have a slightly low credit score or some other concern, you want to use this section to show that you will absolutely repay your loan.

6. Close the letter

Finally, you can add a few finishing touches.

Usually you should close with a short paragraph or two that refers the reader to any attached documents (like financial statements) and asks them to review your loan application.

You may also want to include a sentence expressing willingness to answer any questions―or just saying you’re looking forward to hearing back.

Then end things with your signature, list any enclosed documents, and you’re done!

Well, sort of.

At this point, we strongly recommend you print off your business loan request letter and read it―out loud, if possible. This will help you catch any errors. Because no, your lender isn’t a writing teacher, but you still want to make a good impression.

Plus, if you make typos on something like your business name or desired loan amount, that inaccuracy could lead to confusion from your lender―slowing down your loan approval process.

Once you’ve proofread your loan request letter, you’re ready to submit it to your lender. With any luck, your thoughtful letter will help convince your lender to give you that loan you want.

Loan proposal letter template

So how do all those steps look when you put them together? Something like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Date

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Greeting

This first paragraph should summarize the rest of your letter. Keep it to just a couple sentences.

The next one to three paragraphs add more detail about your business. Include facts about its age, revenue, profit, employees, and other relevant information.

Then explain why you need financing and how you’ll use it to grow your business. This section can be a little longer (but remember your whole letter should fit on one page).

Next, talk about how your business will repay your loan. You may want to mention how financial documents show your business’s financial health, for example.

Finally, close with a short paragraph or two that list any enclosed documents and invite the lender to consider your loan application.

Printed name

List of enclosed financial documents

That’s not so hard, is it? With this basic business loan request letter template, you can easily write your own personalized business loan proposal.

The takeaway

So there you have it―that’s how to properly write a business loan request.

Get your formatting right, include a short summary, talk about your business, explain your loan needs, prove you can repay your loan, and close things off. (And don’t forget to proofread.)

We believe in you. You can write this thing.

And good luck getting your loan application approved!

Don’t just tell your lender you can repay your business loan―make sure you can with our business loan calculator .

Related reading

Best Small Business Loans

- How to Get a Small Business Loan in 7 Simple Steps

- 6 Most Important Business Loan Requirements

- How Long Does It Take To Get a Business Loan?

- Commercial Loan Calculator

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

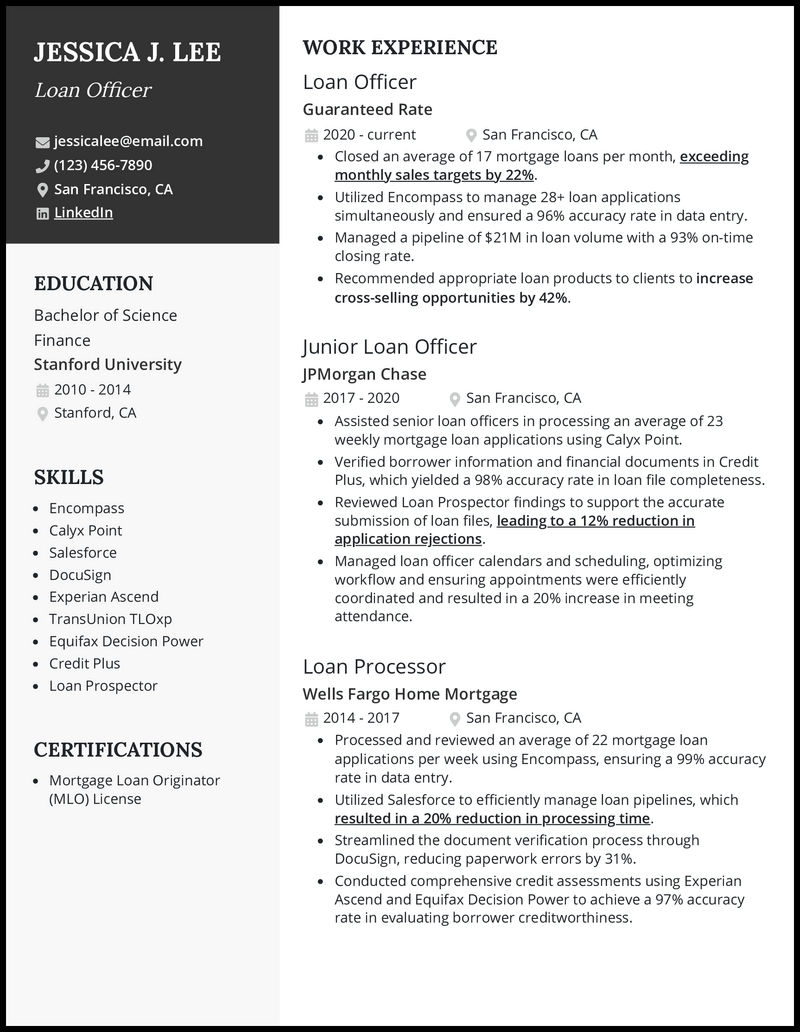

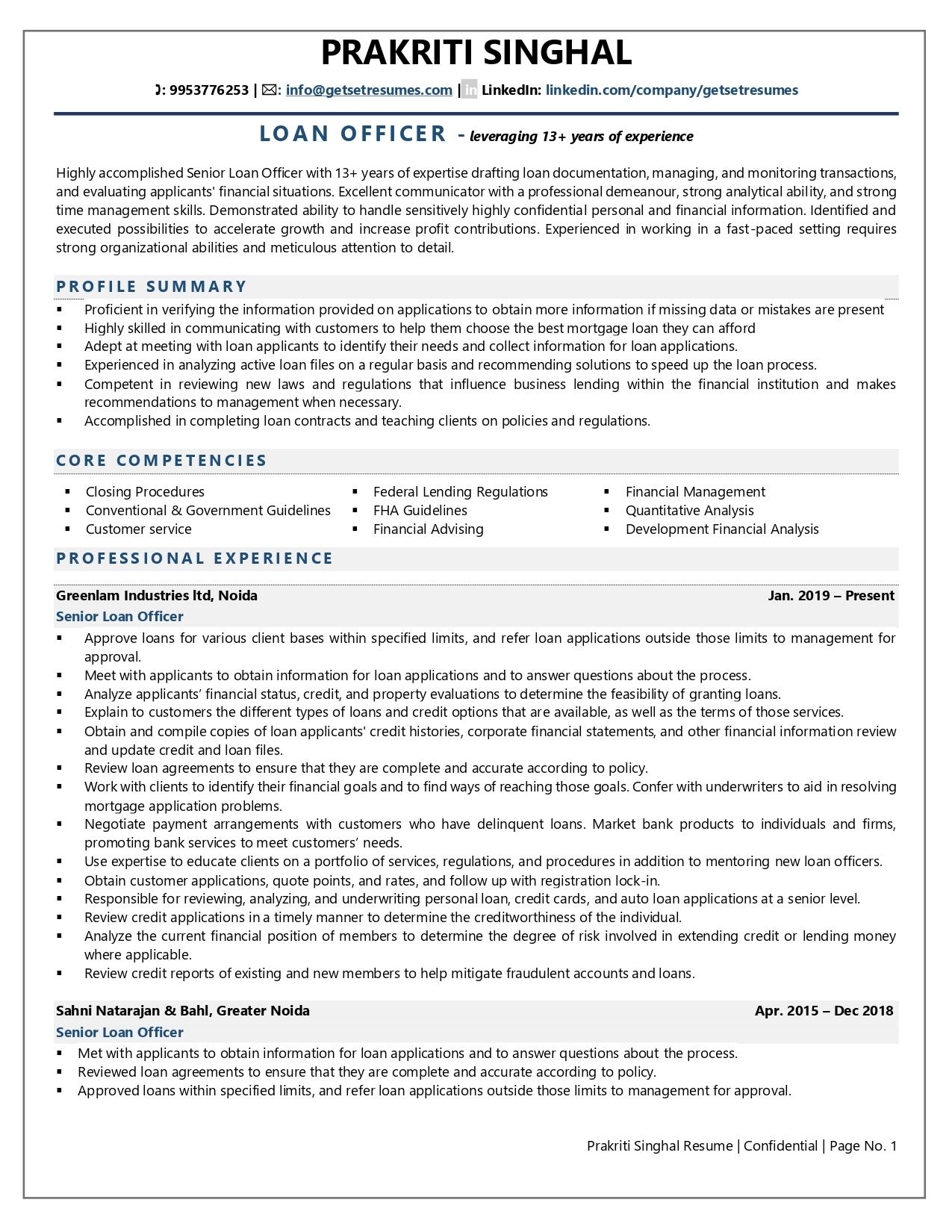

5 Loan Officer Resume Examples to Make the Cut in 2024

Loan Officer Resume

- Loan Officer Resumes by Experience

- Loan Officer Resumes by Role

- Write Your Loan Officer Resume

Anyone applying for a loan can use some helpful guidance along the way. You help with excellent client service, application evaluations, and creating effective data payment plans.

Have you properly evaluated your top skills ? Can you present them effectively with your current resume template ?

Banks rely on loan officers to approve clients for the right types of loans and funding, so they’ll want to ensure you have the right skills for the job. You can use our loan officer resume examples as an easy template for success in the hiring process.

or download as PDF

Why this resume works

- Even the best and brightest in the world can’t practice as a mortgage loan officer without a Mortgage Loan Originator (MLO) license. Before you do anything, add your MLO to your loan officer resume in order to be seriously considered for future roles.

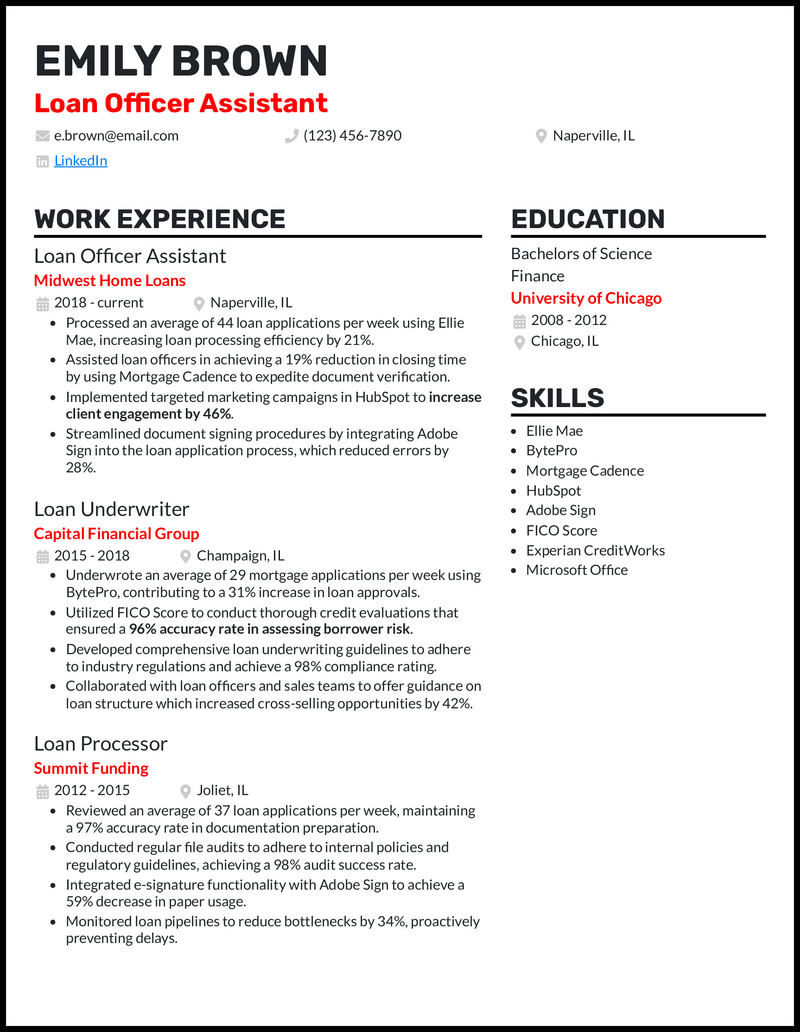

Loan Officer Assistant Resume

- Show potential employers that you have an affinity for money math by showcasing your finance degree on your loan officer assistant resume.

Entry Level Loan Officer Resume

- You want to specify insights or skills gained from these educational experiences, solidifying your potential to add value to the hiring company. Conclude with a compelling career objective that emphasizes your ambitions for the role and company.

Commercial Loan Officer Resume

- Detailing how you trimmed loan processing time by an exact number of days or increased revenue by a specific dollar amount illuminates your ability to deliver tangible business outcomes, painting a picture of your potential value to the prospective employer.

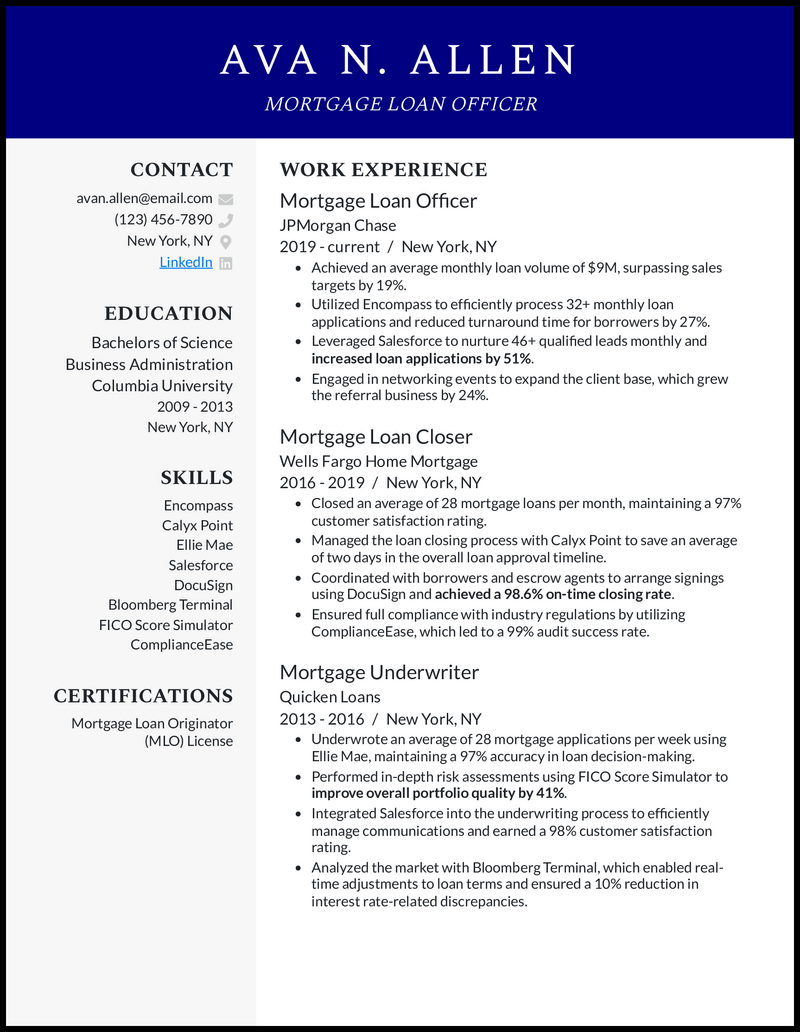

Mortgage Loan Officer Resume

- Showing a progression in the business from underwriter to closer to officer on your mortgage loan officer resume emphasizes your strong foundation to recruiters.

Related resume examples

- Bank Teller

- Investment Banking

- Account Manager

- Financial Analyst

Create a Tailored Loan Officer Resume for Each Job Description

When applying to banks and lending offices, you’ve probably noticed each company has its own unique specialties and needs from loan officers. That’s why you must tailor the skills you list for each job you apply to, not only when writing a cover letter , but also in your resume.

For instance, if you were applying to a bank needing a loan officer specializing in mortgage loans, you could include skills like property evaluations and FHA loans.

Need some ideas?

15 best loan officer skills

- Mortgage Loans

- Portfolio Management

- Experian CreditWorks

- Client Relations

- Microsoft Office

- Bloomberg Terminal

- Commercial Loans

- Financial Analysis

- Team Collaboration

- Regulatory Compliance

- TransUnion TLOxp

Your loan officer work experience bullet points

You’ll have caught the hiring manager’s attention with top skills like regulatory compliance and portfolio management listed on your resume. The next step is to show them what you’ve achieved while using those abilities as a loan officer.

A great way to optimize is by using metrics-based examples to help illustrate what you achieved.

Also, try to keep each example short and simple to make your impact clear, just like you’d do when outlining essential financial information for clients.

Here are some great metrics hiring managers will love to see on loan officer resumes.

- Abandoned loan rate: When you approve someone for a loan, you want them to go through with the deal rather than going elsewhere, so banks will want to bring on loan officers who can sell clients on the benefits of working with their organization.

- Customer satisfaction: When you meet with clients, it’s important to provide them with friendly and helpful service, so banks will always be concerned about satisfaction scores.

- ROI: Every bank will want to know the expected returns you can achieve after loan approvals.

- Net charge-off rate: When you approve loans, you want to ensure the customer can pay it off, so reducing net charge-off rates is an excellent sign of quality performance.

See what we mean?

- Reviewed Loan Prospector findings to support the accurate submission of loan files, leading to a 12% reduction in application rejections.

- Utilized Encompass to efficiently process 32+ monthly loan applications and reduced turnaround time for borrowers by 27%.

- Leveraged Salesforce to nurture 46+ qualified leads monthly and increased loan applications by 51%.

- Engaged in networking events to expand the client base, which grew the business referrals by 24%.

9 active verbs to start your loan officer work experience bullet points

3 ways to optimize a loan officer resume if you lack experience.

- When you don’t have much work experience as a loan officer, you still will have many transferable skills you can apply from other fields you’ve worked in. For instance, jobs involving customer service or data analysis would apply well to show you’re detail-oriented for a financial position while providing an outstanding client experience.

- Your bachelor’s degree in finance, business administration, or other related fields will have provided you with many abilities that have prepared you to succeed. For instance, you could explain how you received a 96% overall grade on a class project where you made a detailed analysis of end-of-year income statements.

- A resume objective will help showcase your top financial skills and connect with hiring managers on why you want the job. For instance, you could explain how you’re a motivated financial professional who is eager to apply your two years of portfolio management experience to help clients get the best results when applying for loans.

3 Tips to Elevate Your Loan Officer Resume When You Have Experience

- Limiting your resume to three or four jobs is optimal if you’ve worked in many financial positions. You should list your most recent jobs and those most relevant to key skills the company is looking for, like mortgage loans or Experian CreditWorks.

- Showcasing some impressive experiences right away can impress hiring managers in financial positions. For instance, you could explain how you’ve managed a portfolio of accounts valued at $2.1 million over your 11-year career while limiting net charge-off rates to just 1.2% during that time.

- When you have experience, you’ll have much more data you can include about ROI and customer satisfaction scores. Ensure your work experience examples have data points about what you’ve helped banks or lenders achieve.

You should limit your loan officer application to a one-page resume . If you’re struggling to narrow it down, consider ways to narrow in on essential company needs. For instance, commercial lenders would be very interested in your portfolio analysis and business evaluation skills.

Every bank and lending organization operates a bit differently, so it is important to customize your resume each time. That way, skills like Quickbooks or credit analysis that a company is looking for will stand out to hiring managers while reviewing your resume.

Action words like “reviewed” or “analyzed” are a great way to make what you achieved sound more impactful. For instance, you could say you “analyzed credit profiles of loan applicants in Equifax Decision Power to boost approval quality, leading to a 54% decrease in net charge-off rates.”

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Commercial loan officer Resume Sample

Boost your odds of landing your desired job and ignite your resume with our exceptional Commercial loan officer CV. Whether you prefer to use it as is or tailor it to your unique qualifications, our HR-approved resume builder makes the process seamless. Simplify your journey towards your dream job today.

Related resume guides and samples

How to write a powerful advertising manager resume?

How to write an irresistible brand ambassador manager resume?

How to write a content manager resume

How to write an impactful digital marketing resume?

How to write a job-winning event coordinator resume?

How to write a great marketing assistant resume?

How to write a great marketing manager resume

How to write an effective public relations resume

Commercial loan officer Resume Sample (Full Text Version)

David martinez.

Experienced commercial loan expert excelling in credit assessment and portfolio management. Seeking a dynamic commercial loan officer role to leverage my extensive 10+ years of industry expertise and enhance a respected financial institution's achievements.

- GPA 4.0 (Top 1% of the Program)

- The 2012 Academic Excellence Award winner

Work Experience

- Developed and maintained relationships with local businesses, resulting in a 15% increase in loan portfolio within the first year of employment.

- Provided exceptional customer service by promptly addressing client inquiries and concerns, resulting in a 90% client retention rate.

- Analyzed and evaluated financial statements, credit histories, and cash flow projections to assess creditworthiness and determine optimal loan structures for commercial clients.

- Actively sought out and pursued new business opportunities, including networking with industry professionals and attending trade shows, resulting in a substantial increase in loan portfolio and revenue.

- Collaborated with internal teams, such as loan processors and credit analysts, to streamline loan processing time by 25%, improving overall customer satisfaction.

- Cultivated and maintained relationships with a portfolio of clients, resulting in a 15% increase in loan volume and a 10% growth in client base.

- Analyzed financial statements, credit histories, and collateral to assess creditworthiness and mitigate potential risks, leading to a reduction in loan delinquencies by 20%.

Certificates

As a Commercial Loan Officer, your role involves facilitating loans for businesses and commercial entities. You evaluate loan applications, assess the creditworthiness of applicants, and analyze financial information to determine the risk associated with each loan. Your responsibilities include building and maintaining relationships with clients, explaining loan terms and conditions, and ensuring compliance with lending regulations. You collaborate with underwriters and credit analysts to make informed lending decisions and contribute to the financial success of both your organization and the businesses you serve. Strong financial acumen, communication skills, and knowledge of lending practices are crucial in this role.

Tomáš Ondrejka

Tomas is the CMO and co-founder of Kickresume, the company that has already helped nearly 4,000,000 job seekers land their dream jobs. Although these days his role revolves mostly around Kickresume's marketing strategy, he still likes to share his extensive knowledge of resumes and personal branding with job seekers around the world. Also, due to the nature of his work, he consumes an unhealthy resume-related content on daily basis.

Edit this sample using our resume builder.

Let your resume write itself — with ai..

Similar job positions

Content Manager Marketing Assistant Brand Ambassador Manager Events Coordinator / Planner Digital Marketing Advertising Manager Marketing Manager Public Relations (PR)

Related marketing / PR resume samples

Related marketing / PR cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

- Resume Templates Simple Professional Modern Creative View all

- Resume Examples Nurse Student Internship Teacher Accountant View all

- Resume Builder

- Cover Letter Templates Simple Professional Modern Creative View all

- Cover Letter Examples Nursing Administrative Assistant Internship Graduate Teacher View all

- Cover Letter Builder

- Resume Examples

- Loan Officer

Loan Officer resume examples & templates

Loan officer job market and outlook

A great loan officer resume is like a great loan application: It ticks all the boxes and makes a compelling case. When you begin applying for your next loan officer job, you need exactly that to get that coveted interview.

.jpg)

Get on your way to your desired new banking position with Resume.io. Our extensive resources include resume guides and resume examples for 300+ professions, plus an easy-to-use resume builder. With our assistance, you can create an application that will pay off.

This resume guide and the resume example it contains will cover the following topics:

What does a loan officer do?

- How to write a loan officer resume (tips and tricks)

- The best format for a loan officer resume

- Advice on each section of your resume (summary, work history, education, skills)

- Professional resume layout and design hints.

Loan officers are responsible for making decisions about lending money to applicants. That entails interviewing applicants, evaluating application paperwork, and recommending whether or not to extend a loan offer. They are part salespeople, part finance expert.

Commercial banks, credit unions, mortgage companies and other financial institutions all employ loan officers. Some loan officers assist potential real estate buyers in the application process to ensure that they qualify and receive a mortgage. They also decide the amount of money that applicants may borrow.

Loan officers also advise borrowers on financial matters such as loan processing procedures and repayment plans. They are responsible for obtaining and evaluating credit histories and other important financial information pertinent to the loan evaluation process and ensure that all loan agreements are in accordance with the financial institution’s policy.

The job market for loan officers depends upon the market in which they work. Commercial and industrial (C&I) and business loan applications are on the upswing, Reuters reported, although the need for loan officers is expected to remain flat with a 1% growth rate, well below the average for all professions.

The housing market is hot as well, but a lack of inventory and rising interest rates will flatten growth, Freddie Mac predicts. That trend adds to the flat market for loan officers.

The average base salary for a loan officer is $48,960, with a range of less than $34,000 to more than $75,000, Payscale reports, but most employers offer commissions and bonuses that increase income.

How to write a loan officer resume

Before a client starts an application, they need to know what documents are necessary. Likewise, before you begin writing your loan officer resume, you need to know what sections it includes. Your CV should contain the following elements:

- The resume header

- The resume summary (aka profile or personal statement)

- The employment history section

- The resume skills section

- The education section

One more important tip on writing your resume: Remember that your loan officer resume is not a single document, but one you should adjust to speak directly to each different employer.

Choosing the best resume format for a loan officer

Application documentation follows a strict format and your loan officer resume should as well. Unless your career falls outside a typical path, we recommend the reverse chronological resume format. Recruiters and Applicant Tracking Systems (ATS) favor this style, in which you list your jobs from most recent on back.

Avoid using the functional resume format since it is usually reserved for highly technical or scientific skills. Depending on your work history, you may also consider one of the alternative or hybrid options we offer.

Pass the ATS test

ATS applications are used by most HR departments to scan and sort resumes. If you apply online, you are using an ATS to do so. The ATS takes the data from your loan officer resume and puts it into the HR system. It then uses algorithms to rank resumes based partly on keywords and phrases linked to the specific job.

To maximize your chances of getting seen by a person, incorporate keywords and phrases from the job listing into your resume.

Resume summary example: lend an air of confidence

The summary of your loan officer resume should confidently present your value as an employee. You have about four lines, to describe your customer service style and career standing. The main idea of this section is to sell your prospective employer on what you can do for them.

A great example to include in your summary, or profile, is the data pointing to your increase in good loans or, conversely, how you reduced unpaid loans. Although recruiters are more likely to look at your most recent position first, if they are sold on your experience, they will scan up to the top to read your profile.

Our summary resume sample below is a good guide, but if you want more ideas for this section – the only one using complete sentences – see our related banking and finance resume examples. We offer a general banker resume sample and a loan process resume example. If you are looking for career advancement ideas, try our financial analyst resume sample or our financial advisor resume sample.

Experienced and attentive Loan Officer with several years of experience providing excellent customer service to clients seeking loans. Adept at thoroughly analyzing the financial status of clients and helping them to apply for and obtain the best loans for their lifestyle. Bringing forth a track record of increasing client satisfaction ratings, while working in accordance with all company policies. Ambitious and driven to reach new levels of success.

Employment history sample: bank on your experience

It’s time to get to the meat of your loan officer resume. The employment history section details not what you have done, but how successful you have been in each role. Your prospective employer needs help and it’s your job to show how you fit the bill.

How did you save your employers money? Were you able to bring in more clients? What is your pull-through rate? Answer these questions in the bullet items for each job title.

| Write this | Not this |

Loan Officer, Weichert Companies, Richmond September 2015 - September 2019

- Formed positive and trustworthy relationships with clients as we explored financial options that best suited their needs.

- Evaluated the loan and credit needs of clients, taking into consideration all aspects of their financial background in relation to policies and regulations.

- Worked collaboratively with loan team regarding the conditions of loans and rates.

Loan Officer, Clear Water Bank, Alexandria August 2013 - August 2015

- Assessed loan requests and evaluated the needs of clients seeking loans.

- Respected the confidentiality and privacy of a client's finances and handled loan rejections with professionalism and helpfulness.

- Carefully reviewed all loan agreements to ensure their compliance with policies.

- Worked collaboratively with loan team to ensure the accurate assessment of loan conditions.

- Remained informed and up to date on finance knowledge by attending conferences and reading related publications.

- Worked to provide optimal customer service on a daily basis.

Receptionist, Clear Water Bank, Richmond July 2011 - July 2013

- Greeted patrons and clients with a friendly and helpful attitude.

- Organized calendars and files, and developed a system of documentation for the files of clients.

CV skills example: appraise your attributes

Honing the skills section of your loan officer CV requires an examination of your attributes plus analysis of the specific skills your targeted employer seeks. Not all jobs are the same, so be careful that you choose the 4-7 top skills you have that match the role.

Loan officers need hard skills such as knowledge of financial software and analysis and soft skills such as sales ability and attention to detail. Start out by creating a master list of all your hard and soft skills. Then, choose those most relevant to each position.

- Analytical Thinker

- Financial Software

- Excellent Communication Skills

- Customer Service

Loan officer resume education example

In general, loan officers are required to have a bachelor’s degree, preferably in a related field such as finance or economics. Your education section comprises a listing of your academic achievements.

In addition to all your degrees and certifications, you may also include any industry honors or distinctions, but eliminate your high school diploma if you have earned higher than a bachelor's degree.

Bachelor of Finance, George Mason University, Fairfax August 2007 - May 2011

High School Diploma, Roosevelt High School, Yonkers September 2002 - May 2006

Resume layout and design: value the first impression

As a salesperson, you know that first impressions can make or break your business. The layout and design of your loan officer resume create that first impression during your job search. Since financial industries are mostly conservative, your best bet here is to keep your document neat and legible. To present a professional image, follow these guidelines:

- Use easy-to-read fonts such as Georgia , Helvetica or Arial

- Choose a serif type for headings and a sans serif for body type, or vice versa

- Leave margins of at least half an inch

- Keep you body type at 11 points

- Avoid more than a splash of color

Choose from among our expertly-tested resume templates to get you started. Your time is too valuable to get bogged down in formatting when you could be applying for your next, great job.

Key takeaways for a loan officer resume

- Loan officers combine the customer-service orientation of salespeople with the business savvy of finance experts.

- Although the loan industry is picking up, the demand for loan officers will remain flat.

- Your summary can make all the difference in whether you get the interview.

- Check out our adaptable loan processor resume sample for more ideas on getting started.

Beautiful ready-to-use resume templates

Commercial Loan Officer Resume Sample

The resume builder.

Create a Resume in Minutes with Professional Resume Templates

Work Experience

- BB&T’s Leadership Program graduate or equivalent program at another financial institution, PSS III, Managing Interpersonal Relationships, Leadership Management

- Experience in managing a commercial loan portfolio with a proven track record in sales ability/aptitude and business development

- Demonstrated skills in organization, flexibility in scheduling and resourcefulness are required

- Travel to develop and maintain customer base, ability to produce various documents on industry-related software required

- Excellent verbal, written and interpersonal communication and skills

- Excellent PC skills, including word processing and spreadsheets via Microsoft Office products as well as custom applications systems

- Good credit knowledge of Bank’s credit underwriting policies and approval process for assigned loan

- BB&T’s Leadership Development Program graduate or equivalent program at another financial institution

- Interviews loan applicant and requests necessary information required to complete the loan application process

- Requests applicant credit reports, background checks, reference checks, and other information pertinent to loan applicant's evaluation. Analyzes applicant financial status, credit, and property evaluation to determine feasibility of granting loan

- Corresponds with or interviews applicant and/or creditors to resolve questions regarding application information

- Compiles loan package, submits to loan committee for approval when appropriate, and facilitates negotiation of loan structure, with applicant, including fees, loan repayment options and other credit terms

- Approves loan within specified limits or refers loan to loan committee for approval

- Identifies and analyzes potential loan markets to develop prospects for commercial loans

- Adheres to policies and procedures and makes proactive business decisions that limit the organization’s financial, regulatory, legal and reputational risks. Risk and compliance accountability in the employee’s purview is strong; adverse findings in audit, compliance, regulatory, quality control, loan and other reviews are minimal

- Participates in developing lending and deposit business for the company. Calls on clients to expand existing business; calls on prospects seeking opportunities to expand the company's client base

- Participated in company-sponsored and CRA activities that serve to support the mission and values of the organization, or devote time to an outside organization that respectably represents involvement of our staff members in the community and establishes a valuable partnership with our company. Actively seek out and pursue CRA eligible loans for BSJ. Additional Responsibilities

- Proven sales experience in commercial lending or insurance

- Established track record in an outbound or inbound originations environment

- Present loan recommendations to appropriate approval authorities (Internal Loan Committee and Director’s Loan Committee)

- Actively seeks out, identifies and solicits commercial loan business consistent with the bank’s objectives to increase the commercial loan portfolio

- Conduct business development calls as defined in the bank’s business development call program

- Manages individual loan portfolio through aggressive collection techniques and restructuring of problem loans to minimize loss of principal and interest

- Reviews existing loan portfolio for documentation exceptions and periodic financial statements to maintain established quality standards consistent with bank policy

Professional Skills

- Strong commerical real estate financial underwriting skills

- Demonstrated sales and business development skills

- Strong commercial real estate project due dilligence skills

- Ability and willingness to learn on the job and improve commercial lending-related skills

- Good analytical, credit analysis and loan structuring skills

- Capital markets experience with non-bank lending platforms

- Adaptability: Adapt positively to change; manage competing demands and effectively handle changes, delays and/or unexpected events with a positive attitude

How to write Commercial Loan Officer Resume

Commercial Loan Officer role is responsible for credit, analysis, lending, scheduling, finance, retail, training, reporting, insurance, travel. To write great resume for commercial loan officer job, your resume must include:

- Your contact information

- Work experience

- Skill listing

Contact Information For Commercial Loan Officer Resume

The section contact information is important in your commercial loan officer resume. The recruiter has to be able to contact you ASAP if they like to offer you the job. This is why you need to provide your:

- First and last name

- Telephone number

Work Experience in Your Commercial Loan Officer Resume

The section work experience is an essential part of your commercial loan officer resume. It’s the one thing the recruiter really cares about and pays the most attention to. This section, however, is not just a list of your previous commercial loan officer responsibilities. It's meant to present you as a wholesome candidate by showcasing your relevant accomplishments and should be tailored specifically to the particular commercial loan officer position you're applying to. The work experience section should be the detailed summary of your latest 3 or 4 positions.

Representative Commercial Loan Officer resume experience can include:

- Two to five years of similar or related experience, including time spent in preparatory positions

- Professional experience in Commercial Lending required

- Working knowledge of MS Office, including Word and Excel

- Prepare initial sizing and underwriting on new loan opportunitites

- Maintain an ongoing relationship with existing customer base

- Assist with loan closing documentation and execution

Education on a Commercial Loan Officer Resume

Make sure to make education a priority on your commercial loan officer resume. If you’ve been working for a few years and have a few solid positions to show, put your education after your commercial loan officer experience. For example, if you have a Ph.D in Neuroscience and a Master's in the same sphere, just list your Ph.D. Besides the doctorate, Master’s degrees go next, followed by Bachelor’s and finally, Associate’s degree.

Additional details to include:

- School you graduated from

- Major/ minor

- Year of graduation

- Location of school

These are the four additional pieces of information you should mention when listing your education on your resume.

Professional Skills in Commercial Loan Officer Resume

When listing skills on your commercial loan officer resume, remember always to be honest about your level of ability. Include the Skills section after experience.

Present the most important skills in your resume, there's a list of typical commercial loan officer skills:

- At least five years of experience in commercial lending

- Commercial lending or sales experience

- Prioritize work and juggle multiple simultaneous projects

- Valid driver’s license and personal transportation

- Prioritize, meet deadlines, and handle multiple tasks simultaneous in a fast-paced, diverse, and growth-oriented environment

- Related CRE experience

List of Typical Experience For a Commercial Loan Officer Resume

Experience for vp, commercial loan officer resume.

- Disclosure requirements are completed within Federal Time Limitations

- Examines and evaluates applicant’s credit and financial history. This duty is performed daily, about 10% of the time

- Takes applications for commercial loan business. Reviews customer financial condition and assesses the customer’s ability to re-pay the loan. Makes underwriting decisions within approval authority. Completes or directs completion of all loan documents and closes loans

- Participates in developing lending and deposit business for the company. Calls on clients to expand existing business; calls on prospects seeking opportunities to expand the company’s client base

- Monitors existing loan portfolio to maintain a high-quality asset base. Maintains up-to-date client files including current balance sheets, profit & loss statements, cash flow projections and all loan documentation

Experience For Senior Commercial Loan Officer Resume

- Assists customers with any loan-related questions and concerns

- Makes calls independently

- Ethical Behavior: Model high standard of honesty, integrity, trust, and openness. Understand and follow through with appropriate standards of conduct and moral judgment; willing to act outside the norm when needed to adhere to ethical principles. Communicate and demonstrate actions in a consistent manner. Respect others, regardless of individual capabilities, agendas, opinions or needs

- Negotiation: Negotiate with, convince, or influence others to take a course of action in order to achieve a specific result. Use appropriate interpersonal styles and communication methods to gain acceptance of an idea, plan, activity or product. Bring conflicts and disagreements into the open, when appropriate, and attempt resolution collaboratively through building consensus

List of Typical Skills For a Commercial Loan Officer Resume

Skills for vp, commercial loan officer resume.

- Assisting in sales process and new client acquisition

- Generous employee benefits, including immediate vesting of 401K match and tuition reimbursement

- The ability to develop new business through direct sale and marketing of the Bank's lending programs

- Self-motivated and independent with the ability to multi task, balance a demanding work load and meet critical deadlines

- Personal and professional honesty, integrity and respect for all co-workers and Members

- Ability and willingness to work both independently and as part of an established team

Skills For Senior Commercial Loan Officer Resume

- Participation in sponsored and community-centered events

- Works independently to develop new business with prospects that have moderate and large complex credit needs

- Maintains established market presence

- Gathers related financial and general business information, participates in credit decision process and communicates with prospects to close sales

- Develops commercial business generally of moderate size and complexity as defined by the organization

- Develops broader knowledge base of commercial and other Company products and services, including loan policy, documentation, structuring and regulatory requirements

- Credit exposure & experience (up to 1 year)

- Maintain a high level of confidentiality and integrity

- Communicate verbally with personnel at all levels within and outside the organization

Skills For Commercial Loan Officer, Senior Resume

- Fully understand, analyze and structure various types of commercial loan requests

- Financial analysis work in commercial real estate

- Professionalism: Exhibit a professional manner in dealing with others; work to develop and maintain cooperative and positive working relationships; represent the bank in a positive manner; maintain credibility with others

- Quality Management: Adhere to guidelines, protocol, policies, and procedures and supervisory directives; improve and promote work quality; demonstrate accuracy, thoroughness, and attention to detail; strive to achieve strong results

- Planning and Organization: Prioritize, organize and plan work; use time efficiently; and achieve results within time frames. Complete work in a timely, accurate manner and be conscientious about assignments and deadlines

- Judgment/Problem Solving: Display ability and willingness to make sound decisions; identify and resolve problems in a timely and positive manner; exhibit sound judgment; appropriately handles both routine and non-routine situations

- Mathematical skills: Ability to apply accounting, scheduling and budgeting, measurement and calculation math skills associated with lending activities for purposes of data analysis. Comfortable working with a variety of lending formulas and industry specific equations and formulas with accuracy

- Networking: Build networks of useful relationships necessary to achieve positive results. Know how organizations work; cognizant of different roles and positions of power, and utilize this information to influence outcomes. Know how to work with people and organizations in order to reach successful outcomes

Skills For Commercial Loan Officer, OSF Resume

- Understanding of banking regulations which impact commercial and real estate lending

- Thorough understanding of accounting principles and how to apply them in assessing cash flow for the department’s more complex transactions

- Thorough understanding of finance, including calculation of payments, rate, amortization, future value, and present value

- Knowledge of commercial real estate and/or construction lending

- Thorough knowledge of commercial loan documentation and general commercial loan underwriting principles

- Represent Zions Bank in the community and respective marketing areas for the development and growth of new loan business

- Initiative: Identify and seize opportunities; display an independent, energetic enthusiasm and readiness to undertake or experiment to improve the organization

Skills For Senior Commercial Loan Officer, OSF Resume

- Be bonded required

- Develop and service new customers

- Strong skills in accurately assessing borrower’s cash flow, evaluating the business, the individual, and the global cash flow on both a historical and pro forma basis

- Excellent skills in assessing borrower’s global cash flow on both a historical and pro forma basis, utilizing business tax returns and individual tax returns

- Spread, analyze, underwrite, structure, negotiate and close the more complex transactions that the department encounters

- Work independently on multiple projects simultaneously with limited oversight to meet the expectations of multiple advisors, client loan closing deadlines, and the requirements of Bank management and Bank regulators

Skills For VP / Commercial Loan Officer Resume

- Generate and service a wide variety of Commercial Real Estate loans

- Interview clients for various loan needs

- Monitor credit performance and take necessary actions as needed

- Develops new commercial DDA relationships and cross-sell other bank products and services

- Refer clients and prospects to “non-bank” investment, insurance and mortgage related services

- Experience in analyzing business financial statements and real estate project related data, negotiating loan terms and structuring all types of commercial loans

- Services existing portfolio as assigned

- Approves loans in compliance with lending authority as designated in the Loan Policy

Skills For Agribusiness Commercial Loan Officer Resume

- Coordinate deposit corss-selling with deposit specialists and TM

- Maintain a working knowledge of all bank products and services

- Identify and develop profitable relationships with potential new customers by participating in civic and community activities

- Be proactive in identifying potential business opportunities outside the Commercial Department and refer to appropriate department or officer

- Highly motivated with ability to work in a fast-paced environment

- Underwrite and evaluate more complex loan transactions. Write or oversee preparation of accurate credit approval presentations (CAPs) by analyzing and interpreting financial information and tax returns on prospective and existing borrowers, to include global cash flow on a historical and pro forma basis

- Assess the general creditworthiness of prospective borrowers and determine whether the transaction merits moving forward through the full underwriting process

Skills For Senior Agribusiness Commercial Loan Officer Resume

- Communicate and follow up with clients, advisors, and prospects with questions about financial aspects of the transaction, and negotiate the structure with the client/prospect

- Make recommendations to appropriate approval authorities, including Internal Loan Committee, and Directors Loan Committee, and exercise individual lending authority when applicable.(Estimated at $50,000 to $100,000)

- Coordinate loan closings by overseeing Loan Ops, Credit Analysts, Advisor, Client, Title Companies, Appraisers, Legal Counsel, and others involved in the closing process

- Develop local business if deemed necessary by Management

- Although no formal supervisory responsibility exist from a direct report standpoint, the incumbent assists in the ongoing training of the credit analysts and loan operations specialists by providing some direction, guidance, and coaching to them when editing Spreads, CAPs, Annual Reviews, and reviewing loan documentation

- Develops a customer portfolio to include commercial loans, construction loans, lines of credit, consumer loans as needed and deposit products

- Attends loan committee as required, with ability to provide structural feedback to the committee

Skills For Commercial Loan Officer Resume

- Processes loan maturities and renewals

- Prepares, with the assistance of the Credit Department, loan presentations as necessary and present to Loan Committee

- Works closely with Loan Assistant to properly document and maintain loan and collateral files

- Works with Cash Management Sales Officer to cross sell cash management products

- Represents the Bank at various after hours functions to further the Bank’s reputation and reach in the community

- Performs job functions in compliance with all company policies, federal and state rules and regulations as applicable to the position, including, but not limited to BSA/AML, OFAC, and GLBA/privacy rules

- Screen new loan opportunities

- Work with Asset Management team to monitor loan pools

- Maintain an aggressive customer call schedule

- Assist and respond to new loan requests within in, a timely manner, by either approving, declining (if within lending limitations) or submitting recommendation to loan committee

- Make sure details on loan documentation are complete and correct prior to closing to insure accuracy and are in compliance with state and federal regulations, bank policy, and compliance regulations

- Monitor loan delinquency and proactively identify credit problems. Take preemptive measures by managing loan accounts for current documentation, performance and total bank relationship. Respond promptly to exception and compliance error reporting to prevent or minimize potential losses

Related to Commercial Loan Officer Resume Samples

Commercial officer resume sample, loan officer resume sample, major gifts officer resume sample, fiscal analyst resume sample, risk governance resume sample, house officer resume sample, resume builder.

- Loan Officer Resume Example

Resume Examples

- Common Tasks & Responsibilities

- Top Hard & Soft Skills

- Action Verbs & Keywords

- Resume FAQs

- Similar Resumes

Common Responsibilities Listed on Loan Officer Resumes:

- Analyze financial data and credit reports to determine loan eligibility

- Negotiate loan terms and conditions with borrowers

- Prepare loan applications and submit to underwriting for approval

- Monitor loan applications throughout the approval process

- Communicate with borrowers and other parties to ensure timely completion of loan documents

- Maintain accurate records of loan applications and documents

- Ensure compliance with all applicable laws and regulations

- Provide customer service to borrowers throughout the loan process

- Develop and maintain relationships with referral sources

- Stay up to date on industry trends and changes in regulations

- Generate new business through marketing and networking activities

- Provide guidance and advice to borrowers on loan options and repayment plans

Speed up your resume creation process with the AI-Powered Resume Builder . Generate tailored achievements in seconds for every role you apply to.

Loan Officer Resume Example:

- Generated $5M in new business through networking and referral sources, exceeding quarterly sales goals by 25%.

- Negotiated loan terms and conditions with borrowers, resulting in a 15% increase in loan approvals and a 10% decrease in delinquency rates.

- Analyzed financial data and credit reports to determine loan eligibility, maintaining a 95% accuracy rate and ensuring compliance with all applicable laws and regulations.

- Developed and implemented a new loan application process, reducing processing time by 30% and increasing customer satisfaction scores by 20%.

- Maintained accurate records of loan applications and documents, resulting in a 98% audit compliance rate and avoiding any regulatory fines.

- Provided guidance and advice to borrowers on loan options and repayment plans, resulting in a 90% customer retention rate and positive feedback from borrowers.

- Monitored loan applications throughout the approval process, ensuring timely completion of loan documents and reducing loan processing time by 25%.

- Stayed up to date on industry trends and changes in regulations, implementing new compliance procedures and avoiding any regulatory violations.

- Provided exceptional customer service to borrowers throughout the loan process, resulting in a 95% customer satisfaction rate and positive feedback from borrowers.

- Sales and networking skills

- Loan negotiation and structuring

- Financial analysis and credit assessment

- Regulatory compliance and risk management

- Process improvement and efficiency

- Record keeping and documentation

- Customer service and relationship management

- Loan product knowledge and advising

- Industry trend analysis and adaptability

- Time management and organization

- Communication and interpersonal skills

- Problem-solving and decision-making

Top Skills & Keywords for Loan Officer Resumes:

Hard skills.

- Credit Analysis

- Loan Origination and Processing

- Financial Analysis and Underwriting

- Risk Assessment and Mitigation

- Compliance and Regulatory Knowledge

- Loan Documentation and Closing

- Customer Service and Relationship Management

- Sales and Business Development

- Mortgage Industry Knowledge

- Loan Structuring and Pricing

- Loan Portfolio Management

- Communication and Interpersonal Skills

Soft Skills

- Attention to Detail and Accuracy

- Customer Service and Relationship Building

- Analytical and Problem-Solving Skills

- Time Management and Prioritization

- Adaptability and Flexibility

- Sales and Marketing Skills

- Decision Making and Strategic Planning

- Teamwork and Collaboration

- Conflict Resolution and Negotiation

- Empathy and Customer-Centric Mindset

- Trustworthiness and Ethics

Resume Action Verbs for Loan Officers:

- Facilitated

- Collaborated

- Strategized

- Communicated

- Coordinated

Generate Your Resume Summary

Resume FAQs for Loan Officers:

How long should i make my loan officer resume, what is the best way to format a loan officer resume, which keywords are important to highlight in a loan officer resume, how should i write my resume if i have no experience as a loan officer, compare your loan officer resume to a job description:.

- Identify opportunities to further tailor your resume to the Loan Officer job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Complete the steps below to generate your free resume analysis.

Related Resumes for Loan Officers:

Loan processor, bank teller, financial analyst, junior financial analyst, senior financial analyst, risk management, finance manager, investment banker.

- • Consistently exceeded individual targets by closing an average of 25 loans monthly, totaling over $7.5 million in loan value

- • Improved client satisfaction ratings by 20% through meticulous follow-ups and personalized financial advice

- • Streamlined application verification processes resulting in a 15% decrease in approval turnaround time

- • Initiated a partnership with 10 new realtors, expanding the company's referral network substantially

- • Spearheaded a cross-departmental task force to resolve occupancy fraud issues, reducing related cases by 30%

- • Mentored a team of 5 junior loan advisors, fostering a collaborative environment that boosted team efficiency

- • Managed 150+ loan files, leading to a $50 million portfolio with a less than 1% default rate

- • Implemented an automated documentation tracking system, enhancing operational productivity by 25%

- • Trained new staff on loan origination software, contributing to a 10% increase in team performance

- • Negotiated with lenders to secure favorable loan terms for clients, saving them an average of $5,000 per loan

- • Orchestrated the timely processing and approval of loans, beating industry standard closing times by 5 days

- • Assisted in the closing of over 200 mortgage loans totaling approximately $30 million in my first year

- • Performed in-depth analysis on applicants' financial statuses, reducing loan default risk by 20%

- • Developed a comprehensive customer follow-up strategy that improved repeat client rate by 15%

- • Collaborated with loan officers to identify and resolve documentation issues promptly

5 Loan Officer Resume Examples & Guide for 2024

Your loan officer resume must clearly highlight your experience in the financial industry. It should showcase your proficiency in evaluating loan applications and understanding credit reports. Ensure you include your knowledge of compliance with financial regulations on your resume. Demonstrate your ability to build and maintain relationships with clients to foster trust and repeat business.

All resume examples in this guide

Resume Guide

Resume Format Tips

Resume Experience

Skills on Resume

Education & Certifications

Resume Summary Tips

Additional Resume Sections

Key Takeaways

As a loan officer, your resume may struggle to showcase your ability to build strong client relations amidst strict financial regulations. Our guide provides tailored strategies to highlight your interpersonal skills and regulatory expertise, giving you the edge in a competitive job market.

- Format your loan officer resume to ensure that it balances professionalism with creativity, and follows the best practices.

- Match the loan officer job requirements by including industry keywords on your resume.

- Use various resume sections to showcase your skills and achievements to answer why you're the best candidate for the loan officer role.

Take inspiration from leading loan officer resume examples to learn how to tailor your experience.

- Management Accounting Resume Example

- Financial Consultant Resume Example

- Actuary Resume Example

- Finance Executive Resume Example

- Payroll Director Resume Example

- Hotel Accounting Resume Example

- Finance Coordinator Resume Example

- Accounts Receivable Resume Example

- Bookkeeper Resume Example

- Corporate Financial Analyst Resume Example

Best practices for the look and feel of your loan officer resume

Before you even start writing your loan officer resume, first you need to consider its layout and format .

What's important to keep in mind is:

- The reverse-chronological resume is the most widely used format to present your experience, starting with your latest job.

- Your loan officer resume header needs to include your correct, professional contact details. If you happen to have a professional portfolio or an updated LinkedIn profile, include a link to it.

- Ensure your resume is no longer than two pages - you don't have to include irelevant experience on your resume just to make it look longer.

- Unless specified otherwise, submit your resume in the most popular format, the PDF one, as this will ensure your loan officer resume isn't altered.

Upload & Check Your Resume

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Loan Officer resume sections to answer recruiters' checklists:

- Header to help recruiters quickly allocate your contact details and have a glimpse over your most recent portfolio of work

- Summary or objective to provide an overview of your career highlights, dreams, and goals

- Experience to align with job requirements and showcase your measurable impact and accomplishments

- Skills section/-s to pinpoint your full breadth of expertise and talents as a candidate for the Loan Officer role

- Education and certifications sections to potentially fill in any gaps in your experience and show your commitment to the industry

What recruiters want to see on your resume:

- Demonstrated knowledge of lending laws and regulations

- History of achieving sales targets and cultivating client relationships

- Experience with loan underwriting, approval, and processing procedures

- Proficiency in banking software and loan servicing platforms

- Strong analytical skills and attention to detail for risk assessment

Writing your loan officer resume experience

Within the body of your loan officer resume is perhaps one of the most important sections - the resume experience one. Here are five quick tips on how to curate your loan officer professional experience:

- Include your expertise that aligns to the job requirements;

- Always ensure that you qualify your achievements by including a skill, what you did, and the results your responsibility led to;

- When writing each experience bullet, ensure you're using active language;

- If you can include a personal skill you've grown, thanks to your experience, this would help you stand out;

- Be specific about your professional experience - it's not enough that you can "communicate", but rather what's your communication track record?

Wondering how other professionals in the industry are presenting their job-winning loan officer resumes? Check out how these loan officer professionals put some of our best practices into action:

- Managed a portfolio of over 250 mortgage loans, ensuring compliance with lending regulations and maintaining a less than 0.5% default rate.

- Developed and maintained relationships with local real estate agents, resulting in a 20% increase in referred loan applications.

- Utilized advanced mortgage loan software to streamline application processes, which improved customer satisfaction scores by 15%.

- Successfully closed an average of $50 million in residential loans annually, consistently meeting and exceeding sales targets by at least 10%.

- Mentored and trained a team of junior loan officers on client engagement strategies and loan processing efficiencies.

- Advised clients on complex loan structures, leading to securing high-value loans for premium property investments.

- Specialized in FHA and VA loans, aiding over 300 military families in obtaining affordable financing for their homes.

- Implemented a customer follow-up system which increased repeat customer rate by 30% within a 3-year period.

- Negotiated loan terms with prospective clients, effectively reducing risk for the lender while increasing approval rates by 25%.

- Orchestrated the integration of AI-driven risk assessment tools which reduced the loan processing time by 40%.

- Spearheaded a digital marketing campaign for loan products that amplified online applications by 50% within six months.

- Forge strategic partnerships with fintech companies, enhancing our technology stack and offering competitive loan products.

- Championed the launch of a new commercial loan program that delivered $100 million in loans within the first year.

- Analyzed and interpreted complex financial data to present loan opportunities to the credit committee, achieving a 90% approval rate.

- Collaborated with underwriters to tailor loans to clients' specific circumstances, thus expanding the commercial loan portfolio by 35%.

- Revamped underwriting criteria in alignment with market changes, which preserved loan quality during an economic downturn.

- Grew personal loan book of business by 50% in four years through effective networking and client satisfaction initiatives.

- Initiated a financial literacy workshop for first-time homebuyers that strengthened community relations and led to a 15% uptick in approved loans.

- Instrumental in a project that automated the appraisal review process, which cut operational costs by 20% while maintaining loan quality.

- Facilitated inter-departmental cooperation to ensure seamless loan processing, resulting in a customer satisfaction score increase from 85% to 95%.

- Oversaw a cross-selling strategy that boosted ancillary financial product sales by 40%, deepening customer relationships and retention.

- Piloted a regional initiative to promote HELOC products that grew the home equity line portfolio by $25 million.

- Conducted thorough market analysis to identify and capitalize on refinancing opportunities, leading to a 60% increase in refinance loan volume.

- Credited for designing loan structures that accommodated high-net-worth clients' unique financial needs, attracting a new segment of clientele.

Quantifying impact on your resume

- Include the total value of loans you have managed to highlight experience with significant sums of money.

- Detail the percentage growth in loan applications or approvals year-over-year to demonstrate sales and marketing success.

- List the number of clients you've managed or advised to showcase customer service and relationship management abilities.

- Mention the reduction in processing time for loan applications you've achieved through efficiency improvements.

- Quantify the decrease in default rates under your management to prove effective risk analysis and management.

- Cite specific rankings or awards you've earned for your performance to establish a track record of excellence.

- State the number of cross-sells or up-sells you've accomplished to display your ability to contribute to business growth.

- Record the scale of the portfolios you've worked with by providing average loan sizes to underline industry expertise.

Action verbs for your loan officer resume

No relevant experience - what to feature instead

Suppose you're new to the job market or considering a switch in industry or niche. In such cases, it's common to have limited standard professional experience . However, this isn't a cause for concern. You can still craft an impressive loan officer resume by emphasizing other sections, showing why you're a great fit for the role:

- Emphasize your educational background and extracurricular activities to demonstrate your industry knowledge;