- Lock down package via Mudra Bank

- How do apply for a mudra loan?

- ICICI Bank Mudra Loan

- State Bank Of India Pradhan Mantri MUDRA Loan Yojana (SBI)

Bank of Baroda, Mudra Loan

Online Mudra Loan

Project report for Mudra Loan

Page Contents

- 1 How to make Project Report For Mudra Loan?

- 2 What is Project Report for mudra loan?

- 3 How much loan require & Why?

- 4 What is Mudra loan project report?

- 5 Project report is mandatory for mudra loan?

- 6 What is the cost of Project report?

How to make Project Report For Mudra Loan?

If you are planning to start a business and require mudra loan from Mudra Bank, you need a perfect project report. We will help you to prepare your documents before applying for Mudra loan. Mudra loan is a collateral-free loan and the bank wants to ensure that the applicant can repay the loan or not.

Few banks are providing online emudra loans via its own website instantly like State bank of India etc. SBI has launched a emudra website for Mudra loan. Via that website, you can easily apply for mudra bank loan. It is really easy and prompt but you will get here only SHISHU loan which is up to 50,000.

For another kind of Mudra bank loan you have to prepare lots of documents like KYC, Project report, Quotation, GST Number, Registration number, etc.

KYC is Know Your Customer policy and bank always demand your KYC before starting the process. In KYC you require your PAN Card, Aadhaar Card, Voter I Card etc.

What is Project Report for mudra loan ?

The major part of Mudra loan or other business loan is “Project Report”. A Project report will help to understand the nature of your business, process, procurement, job opportunities, profitability & ROI. It will clear that how much you are prepared or sincere for your startups.

The project report should be clear, meaningful and understandable because it will represent you in your absence. Its report should be in detail with facts and statics with growth. Incomplete project reports or mysterious data may be a cause of rejection and rejection will reduce your CIBIL score.

A project report for Mudra loan contains lots of things like your personal, educational and professional details. Bank may ask about the experience of that field and several other questions related to field, experience to check eligibility.

How much loan require & Why?

Bank will check your investment part deeply and ask why you require that much amount? How are you calculate it? That time if you have a project report, you can tell them the entire investment part & cost of machinery or resource. Your preparation will help you to become the most eligible candidate and the bank will clear your application for mudra loan.

During the application of a mudra bank loan, you should check your documents properly & deeply, you’re all personal, educational, address details should be match word by word because bank’s executives will check all details deeply and if they will get any issue in documents, they will hold your application and ask for updated documents.

The final and crucial part of the project report is costing & quotation because when you will prepare the project report you should have the cost of required machinery & other resources. You should have three quotations of each machinery & other resources (Amount may differ of each quotation) to make it more professional and authentic. I suggest you submit a genuine quotation of each vendor with a GST number because the bank may visit the vendor location to check authenticity.

We suggest you submit authentic and genuine documents for a mudra bank loan because if the bank will find any discrepancy in your documents they may reject your application & it will hit your CIBIL score and you know that all banks always check cibil score to disburse any kind of loan.

If you are confused and need professionals for your project report. You can contact us we will help you. You can contact us at mudrakibaat (at) gmail.com. We will provide you a professional report at nominal charges. Our team will talk to you get all the information to prepare mudra loan project report on your behalf.

What is Mudra loan project report?

Project report is mandatory for mudra loan, what is the cost of project report, related posts, canara bank mudra loan.

Mudra loan support

Project Report Bank

Project Report for Mudra Loan

Whether you want to start a new business or a project or you want to expand your existing business, finance is the blood of any business. When you have a great idea, but no money to execute it, you can look for loans from banks and financial institutions.

There are many requirements to get a loan from a bank and these requirements vary from bank to bank and according to the amount and type of loan you are looking for. In this article, we are going to discuss how the project report can be prepared for loan.

Mudra loans, like any other commercial loan, require the submission of a project report for lending under the Tarun or Kishore category. Loans under the Shishu scheme are the most readily available loans for small businesses and borrowers are generally not required to present project reports with applications.

A project report is a document that describes the business. It provides a detailed cost-benefit analysis of the proposed expenditure for which a business loan is sought. It provides the audience of the report with a detailed idea of the project cost, scale of activities (proposed and existing), existing debt (if any), revenue estimates, and more.

The project report should be complete and with valid data so that it can be easily accepted and approved for approval of loans under PMMY.

Our experts can prepare an excellent project report for Mudra loan, click here for more details and message us on what’s no. 9993234091.

How to create a Mudra Loan Project Report?

Table of Contents

- 1 How to create a Mudra Loan Project Report?

- 2 Why do I need a project report for a Mudra loan? What is the role of the project report in Mudra loan approval?

- 3 What are the benefits of the project report for the Mudra loan?

- 4 Can the project report prepared by https://projectreportbank.com/ be used for the MUDRA loan?

- 5 Which business projects are covered under the Mudra loan?

- 6 Frequently Asked Questions on Mudra Loan Project Report

- 7 Is it easy to get the Mudra Loan Project Report Download?

- 8 Can I get the Mudra Loan Project Report sample pdf?

- 9 Where can I get the Mudra Loan Project Report format in the doc?

- 10 How to get the loan form of Mudra Loan?

- 11 Where can I get the Mudra Loan form?

- 12 Is a guarantor needed for the Mudra Loan?

- 13 Can I get a Mudra Loan if I am not in India?

- 14 Can I get a Mudra Loan for a small-scale Business?

- 15 Do I need to pay any processing fees for the Mudra loan?

- 16 I am 18 years old, Can I apply for Mudra Loan?

- 17 Can I open a grocery store from Mudra Loan?

- 18 Is there any format for the Mudra Loan Project Report?

- 19 From where can I avail Mudra Loan?

- 20 Who can avail of a Mudra Loan?

- 21 What is the interest rate for Mudra Loan?

- 22 Is the rate of interest for Mudra Loan low?

- 23 How do I write a project report to avail loan?

- 24 How can I write a business project report?

- 25 How to create a project report on MSME Loan?

- 26 What are the components of the Mudra Loan Project report?

- 27 What is the Mudra Loan Project Report Model?

A project report for a bank loan is a document that gives details about a business or project for which finance is being sought. It contains details about the economic, financial, managerial, technical aspects or business of the project.

a. Business / Project Summary: It talks about what the business or project is, about the need for finance, etc.

b. Business Prospects and Prospects: Explain the scope of the project, the current situation and prospects. It is about the financial and technical feasibility of the project.

c. Details about promoters and other important officers: Profile, educational qualification, details of promoters and key personnel experience.

d. Required Resources: Machinery, Infra, knowhow etc.: Explain the cost and capacity as well as the infrastructure and technical requirements of the project.

e. Details about targets and prospective customers: Explain the project’s consumer profile about the possibilities of scaling and targeting customers.

f. Investment Requirement: Specify details about the required investment along with specifications. This is essentially the cost of the project.

g. Sources of Finance: How essential funds are being sourced. Details about ownership and external funds.

h. Project financial statement: It includes financial statements such as balance sheet, profit and loss account.

i. Financial Estimates: Quantitative projection on income, sources of funds, expenditure, and application of funds.

j. Ratio analysis: Financial statements need to be calculated and analyzed through key ratios and their implications.

k. Fund Flow Statement: Details about funds from where it is sourced and the application of funds.

l. Brief analysis: analysis of the broken point of the project, this is feasibility in terms of cost and benefit

m. Conclusion: Findings about the project, its weaknesses, strengths, opportunities and threats.

The above is not an exhaustive list of project reports required by the lenders. Many lenders may have specific requirements related to the project report and may also be sought with the help of a professional in preparing the project report.

The main requirement in this regard is that the project report should be complete and factual otherwise it may lead to rejection of the loan application. This in turn will harm the credit score of the applicant. Therefore, project reports should be made with the utmost care and following the necessary lender guidelines.

Lenders will examine the project report with a fine comb and therefore all the details provided by the applicants can be verified by experts.

Why do I need a project report for a Mudra loan? What is the role of the project report in Mudra loan approval?

Thus, a project report for bank lending is required to avail funds and loans from financial institutions and banks.

Every businessman is always ready to expand his business for which he needs money. The funding will come from banks NBFCs or private equity funding. Now, to obtain funds from banks as well as other financial institutions, every entrepreneur needs to prepare a detailed business plan which is also known as a bank loan project report for feasibility report or feasibility report.

When an entrepreneur imagines a business idea, he thinks a lot about its feasibility. However, if he does not write the same and makes a detailed calculation of the costs and benefits involved, he cannot guess whether it is feasible and the idea is eventually dropped. Therefore, it is always appropriate to prepare a detailed business plan or project report to understand whether it is practical or not.

Failure to present a clear-cut project report can result in rejection by the bank and then you will have to reapply or reconsider the information entitled in the report. So, if you have any doubts or any questions regarding the preparation of the project report of the bank loan, then contact us through the Whats app or email.

What are the benefits of the project report for the Mudra loan?

Mudra loans are mainly for people setting up small businesses and hence the government has ensured that there is not much delay in disbursement of Mudra loans. Once the project report is submitted for the Mudra Bank loan, there is hardly a small phase for approval and disbursement of the loan.

What is the project report for the Mudra loan?

The major part of a Mudra Loan or other business loan is the “Project Report”. A project report will help you understand the nature of your business, procurement, process, job opportunities, profitability and ROI. This will clarify how ready or honest you are for your startup.

The project report should be clear, meaningful and understandable as it will represent you in your absence. Its report should be in detail with facts and figures along with development. Incomplete project reports or mysterious data may cause rejection and rejection will lower your CIBIL score.

A project report for a Mudra loan includes many things like your personal, educational and professional details. The bank can ask about the experience of that field and many other questions related to the field, experience to check eligibility.

Is a project report mandatory for a Mudra loan?

No, there is no requirement for a project report for the Shishu loan but the Tarun and Kishore project report is mandatory to understand the business process.

What if my Mudra Loan project report gets rejected?

If in any way the project report submitted for a bank loan is rejected by the bank, the business firm applying for the loan can prepare the report of any other project and apply the project report to any other bank or financial institution. It is important to note that this may not be the only reason for the rejection of a loan.

Is there a specific format for making a project plan report for the Mudra loan?

No, there is no fixed or bank-approved format for project planning for the Mudra Bank loan. However, some information, such as market size and technical aspects, can be added to the Mudra loan project plan.

Who prepares the project report?

Project reports can be prepared by business entrepreneurs or they can hire the services of our website www.projectreportbank.com for the PMMY Project Report .

Does the bank verify the information given to me in the Mudra Loan application?

Of course! Before issuing a loan to a business, the bank verifies the financial statements and other information presented in the project report. Therefore, it is advised that banks prepare a clean project report for the loan with all the necessary details regarding the financial projects of the business. However, the data provided in the financial projections are based only on a base decision basis and cannot be verified, bankers need to examine the feasibility of the assumptions made.

Need to sign Mudra Project Report for Bank loan/seal by CA?

No, CA is not required to be signed or stamped for submission of the Mudra Loan Project Report in the bank, it is a plan or future data submitted by an entrepreneur to the bank or institution where the loan is applied for.

Can the project report prepared by https://projectreportbank.com/ be used for the MUDRA loan?

Yes, the Project Report for Mudra Loan is prepared by our expert. You can use our Mudra Loan Project Report to apply.

Why is a professionally created project report required?

A project report is a foundation document for analyzing the future performance of an entity and is a very important document for forming an opinion about the future of the company or business entity.

- To avail of working capital loans, term loans and other loans from banks or financial institutions.

- To make a presentation to get the equity participation of the investor.

- To structure/restructure the firm’s bank lending / financial and business strategies.

- For buy, to start or to start a new business.

- To properly dispose of an existing business.

- Also, to assess the value of the project or business.

Which business projects are covered under the Mudra loan?

Mudra loans are extended for various purposes resulting in employment generation and income generation. Loans are mainly extended to:

- Business loans for traders, sellers, shopkeepers and other service sector activities

- Working capital loan through MUDRA card

- Equipment Finance for Micro Units

- Transport Vehicle Loans – For Business Use Only

- Loans for agricultural-related non-agricultural income-generating activities, e.g. Beekeeping, Fisheries. Poultry, etc.

- Tractors, tillers as well as two-wheelers are used for commercial purposes only.

Following is a list of activities that can be covered under the MUDRA loan:

1) Transport Vehicle

Purchase of transport vehicles for transportation of goods and passengers such as auto-rickshaws, small freight transport vehicles, e-rickshaws, 3-wheelers, taxis, etc. Tractor trolleys, tractors, and power tillers that are only necessary for industrial purposes are also liable for PMMY assistance. Two-wheelers that are running for industrial purposes are not covered in PMMY.

2) Community, social and personal service activities

Salons, gymnasiums, beauty parlours, boutiques, dry cleaning, sewing shops, bicycle and motorcycle repair shops, DTP and photocopying, medical shops, facilities, courier agents, etc.

3) Food Products Sector

Activities such as pickling, papad making, jam/jelly making, agricultural produce protection at the village level, sweets shops, small serving food stalls and daily catering/canteen services, cold storage, cold chain vehicles, ice making units, biscuits, ice cream units, bread and bun making , etc.

4) Textile Product Area / Activity

Handloom, khadi activity, powerloom, brocade and zardozi work, traditional embroidery and hand work, traditional dyeing and printing, weaving, garment design, computerized embroidery, cotton weaving, sewing and other textile non-garment products such as vehicles Accessories, bags, furnishing of goods, etc.

5) Business loans for merchants and shopkeepers

Financial assistance for lending to individuals for their shops/business and business activities/ service enterprises and non-farm income generating activities, which are activities with a size of beneficiary loan up to 10 lakhs per enterprise/borrower.

6) Equipment Finance Scheme for Micro Units

With a beneficiary loan size of up to 10 lakhs, micro-enterprises can be started by purchasing machinery and equipment.

7) Activities allied to agriculture

‘Activities allied to agriculture’, e.g. Beekeeping, Poultry, Fisheries, Livestock farming, Sorting, Grading, Aggregation Agro industries, Agri-clinics, Fisheries, Agribusiness centres, Food and agro-processing, etc. (excluding land improvement, crop loans, such as canals, wells, and irrigation) and supporting services that foster livelihoods or generate income would be covered under the PMMY.

Frequently Asked Questions on Mudra Loan Project Report

Is it easy to get the mudra loan project report download.

If you want to avail the Mudra Loan in agisting of time you need to prepare a project report. If you want to get a Mudra loan then you need to prepare a project report. If you do not know how to prepare it, you can use our services. We will make the project report available to you for download in a very short time.

Can I get the Mudra Loan Project Report sample pdf?

It is not that difficult to get the Mudra Loan Sample PDF. Our website gives you instant access to the project reports of MUDRA loans. You can send us a request on WhatsApp to get a sample project report

Where can I get the Mudra Loan Project Report format in the doc?

If you are looking forward to availing a Mudra loan, you can take the help of our experts in preparing the project report. You can request us on WhatsApp to make the project report available in doc format.

How to get the loan form of Mudra Loan?

You can download it online free of cost or get one from the branches of all the banks.

Where can I get the Mudra Loan form?

The Mudra loan form is available in all the bank branches in India. PM has allowed all the banks to provide you facility of Mudra Loan so you can get the loan form from any Indian bank.

Is a guarantor needed for the Mudra Loan?

No, I do not need a guarantor for Mudra Loan. You don’t even require an upper age limit to acquire this loan.

Can I get a Mudra Loan if I am not in India?

You can still get a Mudra Loan. Contact the nearest branch of the bank and get it done.

Can I get a Mudra Loan for a small-scale Business?

Yes, you can get a mudra loan for a small-scale industry in India but it is usually less than 10 lack rupees.

Do I need to pay any processing fees for the Mudra loan?

You need not pay any processing fees when you apply for a Mudra loan online.

I am 18 years old, Can I apply for Mudra Loan?

If you are 18 years you can avail Mudra Loan. Anyone below 18 years of age cannot get it. Using this money you can become an entrepreneur.

Can I open a grocery store from Mudra Loan?

With a Mudra loan, you can avail yourself of money of amount 10 lakhs. So you can instantly start a grocery store with a Mudra loan in your village or city.

Is there any format for the Mudra Loan Project Report?

As there is no exact format for the Mudra Loan project report. But you need to include everything related to your planned business plan to avail Mudra Loan. You can thus check out the procedure to avail of Mudra Loan on our website.

From where can I avail Mudra Loan?

Mudra Loans are given by all the eligible financial bodies in India as directed by the Reserve Bank Of India be it a public or a private bank. For example, all the nationalized, cooperative and rural banks can give you Mudra Loan.

Who can avail of a Mudra Loan?

Mudra loans can be availed by all individuals and startup companies on a small scale and medium scale. Business owners, manufacturers, artisans, vegetable and fruit sellers etc can also avail of the Mudra Loan.

What is the interest rate for Mudra Loan?

The interest rate of Mudra Loan is expected to be lower than the interest rate of other loans.

Is the rate of interest for Mudra Loan low?

The rate of interest of Mudra Loan is low in comparison to other types of bank loans.

How do I write a project report to avail loan?

The sequence to write the project report for a loan is below. Business background Client profile The short and long-term objectives Analysis of market Assessment of market Financial and operational plan

How can I write a business project report?

Using the keys to an effective business report below, you can write a business project report. Handover the project report on time. The report is expected to be there on time and delay defeats the purpose of the report. Providing complete but incorrect information is bad and the loan may not approve. You must not try to cover up the negative news as the details should be made transparent. Stay proud of your team and its achievements.

How to create a project report on MSME Loan?

The first step is to describe the objective and then think about the purpose of the project report. Next, you must try to understand the target audience and create a formal project report for the stakeholders. Format the report carefully. Present the data and facts effectively. The report structure should be effective. The project report should be easily readable.

What are the components of the Mudra Loan Project report?

Following are the components of the project report Mudra Loan. Objective Area of Expertise Budget Details of tools Commercial details Profile of Company Order details Employee information Logistics Advertising Marketing

What is the Mudra Loan Project Report Model?

MUDRA is financial help that is given by banks to support and protect small-scale businesses and encourage entrepreneurs in the country, To avail Mudra loan, you need to create a project report that provides all the details about your business. It is called the Mudra loan project report model. This helps you to get finance from banks very quickly and you can easily start your new startup in India. The most important information relating to your business like company background, profit, number of employees, return of interest etc should be included in the project report for Mudra Loan. Hiding facts and providing false information or misrepresenting data can lead to reducing your credit score. It is thus advised to include personal and professional details that are genuine to get attractive Mudra Loans.

Official Website of Loan Scheme:- https://www.mudra.org.in/

Also, Read our article on:-

- Bank of India Mudra Loan Scheme

- Mudra Loan Scheme Purpose, Features, and Offerings

- Bank of Baroda Mudra Loan Scheme

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Are you sure you want to sign out?

Eligibility, application process, documents required.

- Frequently Asked Questions

Sources And References

Something went wrong. please try again later., you need to sign in before applying for schemes, it seems you have already initiated your application earlier. to know more please visit, check eligibility, ministry of finance, pradhan mantri mudra yojana.

- Public Sector Banks

- Private Sector Banks

- State operated cooperative banks

- Rural banks from regional sector

- Micro Finance Institution (MFI)

- Non-Banking Finance Company (NBFC)

- Small Finance Banks (SFBs)

- Other financial intermediary approved by Mudra Ltd. as member financial institutions

Interest rate

Upfront fee/processing charges.

- Shishu: Covering loans upto Rs.50,000/-.

- Kishore: Covering loans above Rs.50,000/- and upto Rs. 5 lakhs.

- Tarun: Covering loans above Rs. 5 lakhs and upto Rs. 10 lakhs.

Eligible borrowers

- Individuals

- Proprietary concern.

- Partnership Firm.

- Private Ltd. Company.

- Public Company.

- Any other legal forms.

- Address Proof

- Passport size photograph

- Applicant Signature

- Proof of Identity / Address of Business Enterprises

After Successful Registration

For shishu loan.

- Proof of Identity – Self- attested copy of Voter’s ID Card / Driving Licence / PAN Card / Aadhaar Card / Passport / Photo IDs issued by Govt. authority etc.

- Proof of Residence: Recent telephone bill / electricity bill / property tax receipt (not older than 2 months) / Voter’s ID Card / Aadhar Card / Passport of Individual / Proprietor / Partners Bank passbook or latest account statement duly attested by Bank Officials / Domicile Certificate / Certificate issued by Govt. Authority / Local Panchayat / Municipality etc.

- Applicant’s recent coloured Photograph (2 copies) not older than 6 months.

- Quotation of Machinery / other items to be purchased.

- Name of supplier / details of machinery / price of machinery and / or items to be purchased.

- Proof of Identity / Address of the Business Enterprise – Copies of relevant Licences / Registration Certificates / Other Documents pertaining to the ownership, identity of address of business unit, if any.

For Kishore and Tarun Loan

- Proof of Identity - Self attested copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card/Passport.

- Proof of Residence - Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card & Passport of Proprietor/Partners/Directors.

- Proof of Identity/Address of the Business Enterprise -Copies of relevant licenses/registration certificates/other documents pertaining to the ownership, identity and address of business unit.

- Applicant should not be defaulter in any Bank/Financial institution.

- Statement of accounts (for the last six months), from the existing banker, if any.

- Last two years balance sheets of the units along with income tax/sales tax return etc. (Applicable for all cases from Rs.2 Lacs and above).

- Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs.2 Lacs and above).

- Sales achieved during the current financial year up to the date of submission of application.

- Project report (for the proposed project) containing details of technical & economic viability.

- Memorandum and Articles of Association of the company/Partnership Deed of Partners etc.

- In absence of third party guarantee, Asset & Liability statement from the borrower including Directors & Partners may be sought to know the net-worth.

Is Khadi Activity Eligible Under PMMY Loans?

Yes. MUDRA loans are applicable for any activity which results in income generation. As Khadi is one of the eligible activities under Textile sector and in case MUDRA loans are taken for income generation, the same can be covered.

Are MUDRA Loans Available For Purchase Of CNG Tempo/Taxi?

MUDRA loans would be available for purchase of CNG Tempo/Taxi, in case the applicant intends to use the vehicle for commercial purposes.

I Have A Savings Bank Account With the Bank, Would Loan Under MUDRA Be Available Based On The SB Account?

Yes. The applicant can approach the branch and apply for the loan in the format being provided by the said lending institution. The terms and conditions of the loan will be governed by the policies of the lending institution, based on the broad guidelines of RBI. The loan amount will be decided by the requirement of the proposed income generating activity and the repayment terms will be decided by the anticipated cash flow from the activity.

Under PMMY-Shishu Loans, What Is The Turn Around Time For Processing The Loan Proposal?

As per Banking Codes and Standard Board of India (BCSBI), set up by RBI, loan applications should be disposed off for credit limit up to Rs.5 lakh within 2 weeks.

Is It Required To Submit Income Tax Returns For The Preceding 2 Years For Availing Loan Of Rs. 10 Lakh Under PMMY?

Generally, IT returns are not insisted for small value loans. However, the requirement of documents will be advised by the concerned lending institutions based on their internal guidelines and policies.

Scheme Brochure

Scheme FAQs

News and Updates

No new news and updates available

Quick Links

- Screen Reader

- Accessibility Statement

- Terms & Conditions

Useful Links

Get in touch

4th Floor, NeGD, Electronics Niketan, 6 CGO Complex, Lodhi Road, New Delhi - 110003, India

support-myscheme[at]digitalindia[dot]gov[dot]in

(011) 24303714

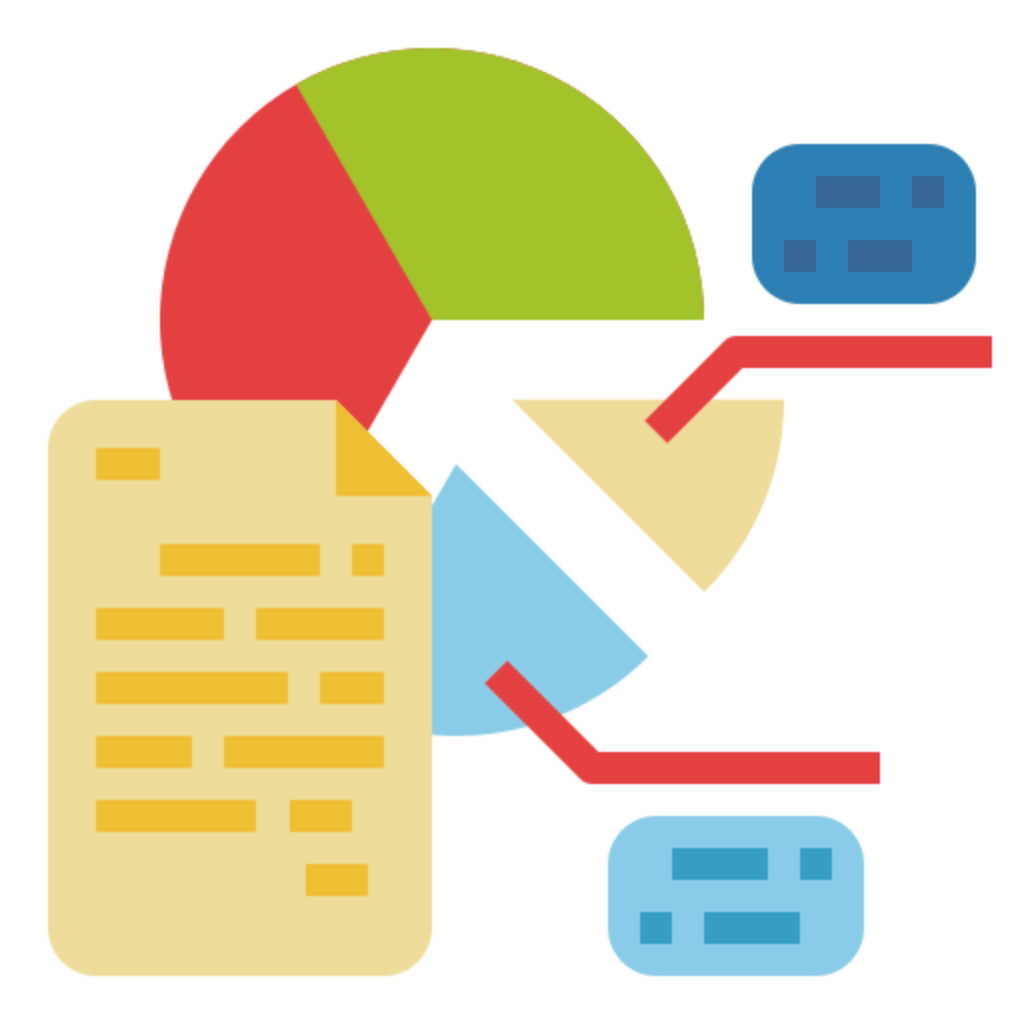

Sample project report for Mudra Loan

Project Report is required to get financing from financial institutes. Project report is essential document that promoters have to write and provide to banks. Based on project report, banks analyse the business and decide on loan sanctioning. For, taking loan financial projection is as important as existence of business.

ABC Trading Company

8TH CROSS, NO.786, MG ROAD, India Marg, Marrenhalli, Bangalore 560001

This Project Report has been designed to show future vaibility of oprations. It is a Proprietorship concern promoted by Narendra Rajiv Gandhi.

Now it is proposed to avail financial assistance from a financial institute. Hence this Project Report is presented.

INDEX OF CONTENT

Profit and loss statement, balance sheet, cash-flow statement.

- Depreciation Statement

- Borrowing and Interest Statement

Break Even Analysis

Debt service coverage ratio, analysis of return on investment.

| PARTICULARS | Operating Years | ||||

|---|---|---|---|---|---|

| 2020 Audited | 2021 Provisional | 2022 | 2023 | 2024 | |

| Revenue from Operations | 403.1 | 575.3 | 634.84 | 792.3 | 988.13 |

| Total Income (a) | 403.1 | 575.3 | 634.84 | 792.3 | 988.13 |

| Cost of Operations | 354.25 | 506.3 | 553.52 | 691.89 | 864.87 |

| Employee Cost | 9.14 | 20.84 | 14.28 | 17.85 | 22.31 |

| Power & Fuel | 3.52 | 2.87 | 5.5 | 6.88 | 8.59 |

| Depreciation | 1.01 | 0.78 | 0.63 | 0.5 | 0.41 |

| Marketing Expenses | - | - | - | - | - |

| Interest on Borrowings | 7.08 | 5.67 | 10.75 | 8.03 | 5.32 |

| Other Expenses | 10.52 | 13.98 | 16.44 | 20.55 | 25.68 |

| Income Tax | - | - | - | - | - |

| Total Expenses (b) | 385.52 | 550.44 | 601.12 | 745.7 | 927.18 |

| Profit/-Loss after Tax (a-b) | 17.58 | 24.86 | 33.72 | 46.6 | 60.95 |

*Note: First operating year is for 12.0 months.

| PARTICULARS | Operating Years | ||||

|---|---|---|---|---|---|

| 2020 Audited | 2021 Provisional | 2022 | 2023 | 2024 | |

| Promoter's Capital | 36.55 | 26.07 | 36.55 | 36.55 | 36.55 |

| Profit & Loss Reserves | 17.58 | 42.44 | 76.16 | 122.76 | 183.71 |

| Borrowing from Financial Institutes | 54.47 | 43.58 | 82.69 | 61.8 | 40.91 |

| Other Loans | 76.53 | 121.42 | 52.27 | 21.21 | 64.96 |

| Creditors | 114.35 | 173.18 | 150.0 | 180.0 | 200.0 |

| Other Current Liabilites | - | - | - | - | - |

| LIABILITIES | 299.48 | 406.69 | 397.67 | 422.32 | 526.13 |

| Fixed Assets | 4.83 | 4.05 | 3.42 | 2.92 | 2.51 |

| Cash & Bank Balances | 4.49 | 17.81 | 7.88 | 20.45 | 12.69 |

| Debtors | 203.8 | 264.9 | 250.0 | 230.0 | 300.0 |

| Inventory | 84.15 | 115.6 | 132.53 | 165.4 | 206.28 |

| Investments & Deposits | - | - | - | - | - |

| Other Current Assets | 2.21 | 4.33 | 3.84 | 3.55 | 4.65 |

| ASSETS | 299.48 | 406.69 | 397.67 | 422.32 | 526.13 |

| PARTICULARS | Operating Years | ||||

|---|---|---|---|---|---|

| 2020 Audited | 2021 Provisional | 2022 | 2023 | 2024 | |

| Profit from Operations | 17.58 | 24.86 | 33.72 | 46.6 | 60.95 |

| Depreciation | 1.01 | 0.78 | 0.63 | 0.5 | 0.41 |

| Cash from Borrowings | - | - | 50.0 | - | - |

| Cash by Promoters (Capital) | 36.55 | -10.48 | 10.48 | 0.00 | 0.00 |

| TOTAL OF A | 55.14 | 15.16 | 94.83 | 47.10 | 61.36 |

| Fixed Assets | - | - | - | - | - |

| Repayment of Borrowings | - | 10.89 | 10.89 | 20.89 | 20.89 |

| Change in working capital | 99.28 | -9.05 | 93.87 | 13.64 | 48.23 |

| TOTAL OF B | 99.28 | 1.84 | 104.76 | 34.53 | 69.12 |

| Net Cash Generated (A-B) | -44.14 | 13.32 | -9.93 | 12.57 | -7.76 |

| Opening Cash Balance | -48.63 | 4.49 | 17.81 | 7.88 | 20.45 |

| Closing Cash Balance | 4.49 | 17.81 | 7.88 | 20.45 | 12.69 |

Assets and Depreciation Statement

| PARTICULARS | Operating Years | ||||

|---|---|---|---|---|---|

| 2020 Audited | 2021 Provisional | 2022 | 2023 | 2024 | |

| Opening WDV | 4.5 | 3.82 | 3.25 | 2.76 | 2.35 |

| Cost of Asset | - | - | 0.0 | - | - |

| Depreciation Rate | 15.0% | 15.0% | 15.0% | 15.0% | 15.0% |

| Depreciation | 0.68 | 0.57 | 0.49 | 0.41 | 0.35 |

| Closing WDV | 3.82 | 3.25 | 2.76 | 2.35 | 2.0 |

| Opening WDV | 0.76 | 0.46 | 0.28 | 0.17 | 0.1 |

| Cost of Asset | - | - | 0.0 | - | - |

| Depreciation Rate | 40.0% | 40.0% | 40.0% | 40.0% | 40.0% |

| Depreciation | 0.3 | 0.18 | 0.11 | 0.07 | 0.04 |

| Closing WDV | 0.46 | 0.28 | 0.17 | 0.1 | 0.06 |

| Opening WDV | 0.33 | 0.3 | 0.27 | 0.24 | 0.22 |

| Cost of Asset | - | - | 0.0 | - | - |

| Depreciation Rate | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% |

| Depreciation | 0.03 | 0.03 | 0.03 | 0.02 | 0.02 |

| Closing WDV | 0.3 | 0.27 | 0.24 | 0.22 | 0.2 |

| Opening WDV | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| Cost of Asset | - | - | 0.0 | - | - |

| Depreciation Rate | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| Depreciation | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Closing WDV | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| Total Depreciation | 1.01 | 0.78 | 0.63 | 0.5 | 0.41 |

| Closing Balance | 4.83 | 4.05 | 3.42 | 2.92 | 2.51 |

Borrowings Statement

| PARTICULARS | Operating Years | ||||

|---|---|---|---|---|---|

| 2020 Audited | 2021 Provisional | 2022 | 2023 | 2024 | |

| Opening Balance (A) | 54.47 | 54.47 | 43.58 | 82.69 | 61.8 |

| Borrowing (B) | - | - | 50.0 | - | - |

| Repayment of Borrowings (C) | - | 10.89 | 10.89 | 20.89 | 20.89 |

| Interest Payment | 7.08 | 5.67 | 10.75 | 8.03 | 5.32 |

| Closing Balance (A+B-C) | 54.47 | 43.58 | 82.69 | 61.8 | 40.91 |

| PARTICULARS | Operating Years | ||||

|---|---|---|---|---|---|

| 2020 Audited | 2021 Provisional | 2022 | 2023 | 2024 | |

| Revenue from Operations | 403.1 | 575.3 | 634.84 | 792.3 | 988.13 |

| A. Operating Revenue | 403.1 | 575.3 | 634.84 | 792.3 | 988.13 |

| Cost of Operations | 354.25 | 506.3 | 553.52 | 691.89 | 864.87 |

| Employee Cost | 9.14 | 20.84 | 14.28 | 17.85 | 22.31 |

| Power & Fuel | 3.52 | 2.87 | 5.5 | 6.88 | 8.59 |

| Marketing Expenses | - | - | - | - | - |

| Other Expenses | 10.52 | 13.98 | 16.44 | 20.55 | 25.68 |

| B. Operating Expenses | 377.43 | 543.99 | 589.74 | 737.17 | 921.45 |

| Depreciation | 1.01 | 0.78 | 0.63 | 0.5 | 0.41 |

| Finance Cost | 7.08 | 5.67 | 10.75 | 8.03 | 5.32 |

| C. Fixed Expenses | 8.09 | 6.45 | 11.38 | 8.53 | 5.73 |

| D. Contribution (A-B) | 25.67 | 31.31 | 45.10 | 55.13 | 66.68 |

| E. PV Ratio (D/A*100) | 0.06 | 0.05 | 0.07 | 0.07 | 0.07 |

| F. Break Even Value (C/E) | 134.83 | 129.00 | 162.57 | 121.86 | 81.86 |

| G. Cash Break Even Value (Without Depreciation) | 118.00 | 113.40 | 153.57 | 114.71 | 76.00 |

| PARTICULARS | Operating Years | ||||

|---|---|---|---|---|---|

| 2020 Audited | 2021 Provisional | 2022 | 2023 | 2024 | |

| Profit after Tax | 17.58 | 24.86 | 33.72 | 46.6 | 60.95 |

| Depreciation | 1.01 | 0.78 | 0.63 | 0.5 | 0.41 |

| Finance Cost | 7.08 | 5.67 | 10.75 | 8.03 | 5.32 |

| A. Total | 25.67 | 31.31 | 45.10 | 55.13 | 66.68 |

| Loan Repayment | - | 10.89 | 10.89 | 20.89 | 20.89 |

| Finance Cost | 7.08 | 5.67 | 10.75 | 8.03 | 5.32 |

| B. TOTAL | 7.08 | 16.56 | 21.64 | 28.92 | 26.21 |

| Debt Service Coverage Ratio (A/B) | 3.63 | 1.89 | 2.08 | 1.91 | 2.54 |

Return on Investment = (Average Return/Capital Employed)*100 Return = Profit before tax + Depreciation + Financing Cost Capital Employed = Capital + Borrowings

| PARTICULARS | Operating Years | ||||

|---|---|---|---|---|---|

| 2020 Audited | 2021 Provisional | 2022 | 2023 | 2024 | |

| Profit before tax | 17.58 | 24.86 | 33.72 | 46.60 | 60.95 |

| Depreciation | 1.01 | 0.78 | 0.63 | 0.5 | 0.41 |

| Interest | 7.08 | 5.67 | 10.75 | 8.03 | 5.32 |

| Return | 25.67 | 31.31 | 45.10 | 55.13 | 66.68 |

Here is the sample Project Report in pdf which you can download. You can download this sample project report in PDF.

Project Report or financial projection report is prepared after considering possible results from business operations. Promoter has to prepare this document for getting loans from banks.

You can prepare project report using banking91 project report writing tool . Project report tool by banking91 helps you to prepare report which is accurate and covers all ratios required by banks. Futher, this report is not only accepted by all banks but also recommended by all banks including private and public sector banks.

You can also download project report format in excel .

Comments: 1

I generated project report using banking91 and banks accepted this report. I applied for 5 lakh loan and bank have given the money. This format is great and creating project report using banking91 tool is very easy. I will recommend to use this tool. Thanks to CA Pulkit Sharma for launching project report making tool and help us get loans.

Related Topics

- Project Report for Bank Loan

- Corporate Social Responsibility In the Banking Sector

- Fixed Deposits Explained

- Demat Account explained

- Changes in EPF

- Fraud Registry by RBI

- Commercial Papers explained

- Bank Currency Chest

- Foreign Education Loan

- New Fund Offer (NFO)

Project Report for Bank Loan in 5 minutes

Generate Accurate and globally accepted project report for financing

GENERATE PROJECT REPORT

Banking91.com helps you to prepare Project Report and Credit Monitoring Arrangement (CMA data) report. Automate your tasks and prepare accurate and globally accepted reports.

- Prepare Project Report

- Prepare CMA Data Report

- Loan EMI Calculator

- IFSC Search

- Refund Policy

Address: #77, Shivnagar 1, Murlipura, Jaipur - 302039

- © 2024 Banking91.com

Sharda Associates

Project Report For MUDRA Loan

(Get an accurate & bankable Project Reports for MUDRA Loan.)

MUDRA is a lending program designed to support small businesses financially through the PMMY Scheme . In order to support banks that lend to micro and small business units engaged in production, commerce, and service operations, the Government of India (GoI) formed the Micro Units Development & Refinance Agency Ltd (MUDRA).

The applicant must deliver a project report in order to be granted a MUDRA loan. The project report for a MUDRA loan must briefly mention important information about your company, such as the firm’s history, nature, raw material procurement, size of the personnel, profit, and return on investment.

Mudra Loan Eligibility

As part of the Pradhan Mantri Mudra Yojana (PMMY) initiative, the Indian government developed Mudra Loans to help small business owners finance their operating costs and satisfy their financial demands.

Anyone who runs or owns a small business is eligible to apply for a Mudra Loan.

- The owner should be at least 18 years old, with a maximum age limit of 65 years for Mudra Loans.

- The loan limit must be less than ten lakh rupees.

- It should not be a farming-related small/micro business.

Why Choose Sharda Associates For Your Project Reports?

We‘re not only providing a project report, we‘re delivering an accurate document. Our project reports are accepted worldwide by Banks, NBFCs, Government Agencies, Angel Investors and Venture Capitalists.

Unlimited Revisions

You can make unlimited edits according to your needs without paying any single rupee. We help you to achieve all your targets through unlimited revisions.

Fast Delivery

You will get the best reports in least possible time. All the reports are customized reports, which are tailor made as per your requirements.

Competitive Price

Comparing the content quality & knowledge we put on our paper, our service fee are 60% lesser than other competitors.

Sample Report

(Click To View Sample Report)

If you need more details or have any query, tap the call button or Whatsapp us at

Generate Project Report In Just 3 Steps

Call us or leave a mail

You can reach us by calling on +91 7987021896 or mail us at [email protected] .

Submit your details

Our personal executive will contact you within 24 Hours and will get all the required details needed for project report.

Get your report in just 24 hours

Relax or carry on with other important work. We will deliver the report on the date that we agreed upon.

Why You need Project Report For MUDRA Loan?

The Pradhan Mantri Mudra Yojana’s Mudra loan program aims to aid small companies by providing them with financial assistance (PMMY). A government-sponsored initiative called the Micro Units Development & Refinance Agency ( MUDRA ) provides funding of up to INR 10 lakhs to persons who want to start new enterprises or expand their existing ones that are involved in manufacturing, trading, and service-related industries.

Loan under MUDRA

In accordance with the funding requirements and stage of the firm, MUDRA divides the loan programme into three general categories:

1. Shishu: Loan of upto Rs.50,000

2. Kishor: Loans of above Rs.50,000 to Rs.5 lakhs.

3. Tarun: Loans of above Rs.5 lakhs to Rs.10 lakhs.

Get MUDRA Project Report

Contents of MUDRA Loan Project Report

Our detailed project report will include the following details. Our Mudra loan project report is professionally crafted and completely complies with both the banks’ Guidelines and the Govt. Of India

A project report well prepared increases the possibility for sanctioning loan. If you need project report for your business Contact us.

Our Project report broadly includes:

• Introduction

• Business Profile

• Market Potential

• Assumptions and Presumptions

• Estimations and projections

• Technical aspects

• Operational aspects

• Financial aspects

• Profitability and Ratio Analysis

(15-30Pages)

The MUDRA project report is valid for bank loan application up to INR 10 Lakhs. We ensure that the project report covers all the aspects and is fully complied with the guidelines issued by Government and Bank.

Still confused? Start your business with few of the projects listed here:

• Project Profile on Flour Mill

• Project Profile on Manufacturing of Palm Plate

• Project Profile on Papad Manufacturing

• Project Profile on Roasted Rice Flakes

• Project Report on Foot Wear

• Project Report on Note Book Manufacturing

• Project Report on Pickle Unit

• Project Report on Readymade Garments

• Project Report on Wooden Furniture Manufacturing Unit

• Rubberized Coir Manufacturing Project

• Sanitary Napkin Manufacturing Project

• Toilet Soap Manufacturing Unit

• Banana Fibre Extraction and weaving

• Computer Assembling

• Dairy Products

• General Engineering Workshop

• Light Engineering

• Manufacturing of Paper Napkins

• Manufacturing of Paper Products (Paper Cups)

• Metal Based Industries: Agricultural Implements, Cutleries & Hand Tools

• Project Profile on Bakery Products

• Project Profile on Desiccated Coconut Powder

• Project Profile on Steel Furniture

• Project Profile on Curry and Rice Powder

• Project Profile on Detergent Power and Cakes

• Tomato Sauce Manufacturing Unit

You cannot copy content of this page

WhatsApp us

Get the Tata Capital App to apply for Loans & manage your account. Download Now

- Personal Loan

- Business Loan

- Vehicle Loan

- Loan Against Securities

- Loan Against Property

- Education Loan

- Credit Cards

- Microfinance

- Rural Individual Loan New

Personal loan starting @ 10.99% p.a

- Instant approval

- Overdraft Facility

All you need to know

- Rates & Charges

- Documents Required

Personal loan for all your needs

Overdraft Loan

Personal Loan for Travel

Personal Loan for Medical

Personal Loan for Marriage

Personal Loan for Home Renovation

- Personal Loan EMI Calculator

Pre-payment Calculator

Eligibility Calculator

Check Your Credit Score

Higher credit score increases the chances of loan approval. Check your CIBIL score today and get free insights on how to be credit-worthy.

Home Loan with instant approval starting @ 8.75% p.a

- Easy repayment

- Home Loan Online

- Approved Housing Projects

Home Loan for all your needs

- Home Extension Loan

Affordable Housing Loan

Plot & Construction Loan

- Balance Transfer

Home Loan Top Up

- Calculators

- Home Loan EMI Calculator

- PMAY Calculator

Balance Transfer & Top-up Calculator

- Area Conversion Calculator

- Stamp Duty Calculator

Register as a Selling Agent. Join our Loan Mitra Program

Business loan to suit your growth plan

- Collateral-free loans

- Customized EMI options

Business loan for all your needs

- Machinery Loan

Small Business Loan

EMI Calculator

- GST Calculator

- Foreclosure Calculator

Looking for Secured Business Loans?

Get secured business loans with affordable interest rates with Tata Capital. Verify eligibility criteria and apply today

Accelerate your dreams with our Vehicle Loans

- Flexible Tenures

- Competitive interest rates

Explore Used Car Loans

- Used Car Loan

Loan On Used Car

Explore New Car Loans

New Car Loan

Explore Two Wheeler Loans

- Two Wheeler Loan

Used Car EMI Calculator

Two Wheeler EMI Calculator

Get upto 95% of your car value and book your dream car

A loan upto ₹5,00,000 to own the bike of your choice

Avail Loan Against Securities up to ₹40 crores

- Quick access to finance

- Zero foreclosure charges

Explore Loan Against Securities

Loan against Shares

Loan against mutual funds

- Loan Against Securities Calculator

Avail Loan Against Property up to ₹ 7.5 Crores

- Loan against property

- Business loan against property

- Mortgage loan against property

- EMI Options

Loans for all your needs

Secured Micro LAP

Empowering Rural India with Microfinance loans

- Quick processing

Want To Know More?

Avail a Rural Individual Loan

- Working Capital Loans

- Cleantech Finance

Structured Products

- Equipment Financing & Leasing

Construction Financing

- Commercial Vehicle Loan

- Explore all Business Loans

Digital financial solutions to aid your growth

- Simple standard documentation process

- Quick disbursal

Most Popular products

Channel Financing

Invoice Discounting

Purchase Order Funding

Working Capital Demand Loan

Sub Dealer Loan

Pioneering Climate Finance through innovative solutions

Most popular products

Project & structured design

Debt Syndication

Financial Advisory

Cleantech Advisory

Financing solutions tailored to your business needs

- Quick approvals

- Flexible payment options

Our Bestselling Products

Structured Investment

Letter of Credit

Lease Rental Discounting

Avail Term Loans up to Rs. 1 Crore

- Customise loan tenures as per your needs

- Get your loan processed, sanctioned and funds disbursed digitally

- Equipment Finance

Avail Digital Equipment Loans up to Rs. 1 Crore

- Attractive ROIs

- Customizable Loan tenure

Equipment Leasing

Avail Leasing solutions for all asset classes

- Up to 100% financing

- No additional collateral required

Ensure your business’ operational effeciency with ease

- Wide range of equipments covered

- Minimum paperwork

- Construction Finance

- Construction Equipment Finance

New Commercial Vehicle Financing

- First time user

- Retail and strategic Clients

- Used Commercial Vehicle Financing

Moneyfy by Tata Capital

A personal finance app, your one-stop shop for comprehensive financial needs - SIP, Mutual Funds, Loans, Insurance, Credit Cards and many more

- 100% digital journey

- Start investing in SIP as low as Rs 500

SIP Calculator

Investment Calculator

- Mutual Funds

- Fixed Deposit

Wealth Services by Tata Capital

Personalised Wealth Services for exclusive customers delivered by a team of experts from a suite of product offerings

- Inhouse research & reports

- Exclusive Privileges & Offers

Financial Goal Calculator

Retirement Calculator

- Download forms

Protect your family against unforeseen risks

Avail any of the Insurance policies online in just a few clicks

Bestselling insurance solutions

Motor Insurance

Life Insurance

Health Insurance

Home & Travel Insurance

Wellness Insurance

Protection Plan & other solutions

Retirement Solutions & Child Plan

Quick Links for loans

- Used Car Loans

Quick Links for insurance

- Car Insurance

- Bike Insurance

Saving & Investments

Medical Insurance

Cardiac Insurance

Cancer care Insurance

Other Insurance

- Wellness solutions

- Retirement Solution Plans

- Child Plans

- Home Insurance

- Travel Insurance

- Mutual Fund

Choose from our list of insurance solutions

Retirement Solutions & Child Plans

Quick Links for Loans

- Loan against Property

Cancer Care Insurance

Offers & Updates

Download the Moneyfy App

Be investment ready in minutes

Take a Tata Capital Home Loan

Lowest interest rates starting at 8.75%*

Apply for a Tata Card

Get benefits worth Rs. 18,000*

Sign in to unlock special offers!

You are signed in to unlock special offers!

- Retail Customer Login

- Corporate Customer Login

- My Wealth Account

- Dropline Overdraft Loan

Quick Links for Insurance

- Term insurance

- Savings & investments

- Medical insurance

- Cardiac care

- Cancer care

Personal loan

- Rate & Charges

Loan Against Shares

Loan Against Mutual Funds

Avail a Rural Individual Loan

EMI Calculators

Used Commercial Vehicle finance

Compound Interest Calculator

Home Insurance & Travel Insurance

Menu

- Loan for Home

- Loan for Business

- Loan for Education

- Loan for Vehicle

- Personal Use Loan

- Loan for Travel

- Loan for Wedding

- Capital Goods Loan

- Home Repair Loan

- Medical Loan

- Loan on Property

- Loan on Securities

- Wealth Services

- What’s Trending

- RBI Regulations

- Equipment Lease

- Circulating Capital Loan

- Construction Loan

- Leadership Talks

- Dealer Finance

- Shubh Chintak

- Coronavirus

- Government Updates

- Lockdown News

- Finance Solutions

Tata Capital > Blog > Loan for Business > Mudra loan for New Business

Mudra loan for new business.

India is home to the world’s third-largest startup ecosystem. New businesses and start-ups are an important pillar of our growing economy. However, often a major roadblock in starting a business is access to adequate funding due to which, innumerable good businesses don't go beyond the ideation phase.

The government recognised this problem and introduced one-of-a-kind Mudra loans under the Pradhan Mantri Mudra Yojana (PMMY). Mudra loans empower entrepreneurs to realise their business ideas and enrich the nation.

Do you have a fantastic business idea but are perplexed about funding? Read on to find out how Mudra loans can help your business take off.

What are Mudra Loans for New Business?

Mudra stands for Micro Units Development Refinance Agency. Under the PMMY, small and micro-enterprises can avail loans up to Rs. 10 Lakhs.

These loans are provided by commercial banks, cooperative banks, non-banking financial institutions (NBFCs), regional rural banks (RRBs), microfinance institutions (MFIs) and small finance banks (SFBs) to eligible enterprises. The government provides funding to these institutions against the loans they provide.

Individuals, MSMEs or enterprises engaged in manufacturing, service or trading sectors can avail Mudra loans for startups. Here's a quick summary of how mudra loans work:

1. The government allocates a yearly sum to the above-mentioned financial institutions through intermediary units like Micro Units Development and Refinance Agency bank.

2. New businesses can then avail funds from these financial institutions with low interest and zero collateral if they meet the eligibility criteria.

3. Aspiring entrepreneurs who are unable to secure loans through traditional banking channels are also eligible for a competitive loan under this scheme.

What are the Different Modes of Funding Under the New Business Loan PM Yojana?

There are two modes of funding available for your new business under the PMMY scheme.

1. Funding Through Micro Credit Scheme

If you’re planning to start a small business with a low investment, you can consider taking a loan under this category. A maximum loan amount of Rs. 1 Lakh is available. This loan is available to individuals, self-help groups and joint liability groups.

2. Funding through Banks and NBFCs

Through this mode, startups and new businesses can obtain three kinds of mudra loans under pm yojana for new business loans:

1. Shishu Loans

Shishu loan is a perfect Mudra loan for startups. If you’re starting a new business, you can avail a loan of up to Rs. 50000 under this category for a maximum loan tenure of 6 years.

If you are applying for a Mudra Shishu loan, you need to prepare and submit a future earning potential plan for your business. You can also choose your preferred lender.

2. Kishore Loans

Under Pradhan Mantri loan scheme for new business, Mudra Kishore loans are the next offering. Mudra Kishore loans can be useful for you in a variety of circumstances, from managing working capital expenses and paying off creditors, to accessing funds to survive tough business conditions.

Under the Mudra Kishore loan, you can avail a loan amount from Rs. 50,000 to Rs. 5 lakhs. The interest rate is capped at 12% maximum, and you can repay the loan in 3-5 years. You need to submit a report on the economic sustainability of your business while applying.

3. Tarun Loans

Last in Mudra loan for startups are Tarun loans. Under this, you can obtain a loan ranging from Rs. 5 Lakhs to Rs. 10 Lakhs. You are eligible for this loan only if your business is generating an income.

The repayment tenure is flexible for Mudra Tarun loans with a maximum tenure of 6 years. Certain business sectors such as food products, textiles, and agriculture allied businesses get preference for Mudra Tarun loans. You need to submit a well-documented business plan while applying.

What are The Benefits of Mudra Loans for New Businesses?

Mudra loans offer a range of benefits for your new business.

1. No Processing Charges

You don’t have to worry about any pre-loan processing charges while applying of Mudra loans.

2. No Collateral

Mudra loans are collateral-free business loans. If you want to start a business, you can easily access the necessary funds without worrying about a collateral.

3. Flexible Repayment

You can repay the loan in flexible instalments, depending on your business finances and cash flow availability. This allows you to focus on business growth.

4. Low Interest Rates

The interest rates for Mudra loans under Pradhan Mantri loan scheme for new businesses is lower than those available through traditional loans. With lower interest to pay, you can better manage your business finances.

5. Increased Accessibility

Often in small towns and rural areas, traditional lending institutions like banks are not available. Mudra loans are available through various institutions like MFIs, SFBs, NBFCs etc. You can access Mudra loans through them even in the remote areas of the country.

6. Wide range of Loan Amounts

Under the new business loan PM Yojana, a high Mudra loan amount is available ranging from Rs. 50,000-10,00,000. Your business ideas are no longer constrained by a small range of loan amounts.

What are the Mudra Loan Eligibility Documents for New Businesses?

Here is the list of documents you need to apply for a Mudra loan:

1. Aadhar/PAN/Passport for identity proof

2. Current passport size photographs

3. Documents of any previous loan taken

4. Documents like educational documents and bank account statements for credibility

5. Balance sheet of your business for Kishore and Tarun loans

6. A well-documented business plan for Tarun loans

How to Apply for a Mudra Loan?

Follow these steps to apply for a Mudra loan for new business:

1. Evaluate your business idea and decide the mode of funding through mudra loan.

2. If you choose funding through banks or NBFCs, decide the category (Shishu, Kishore, Tarun) for Mudra loan.

3. Keep the required Mudra loan eligibility documents for new business ready.

4. You can apply directly to the lending institutions mentioned above that provide Mudra loans. Fill in the forms provided and submit the required documents.

5. You can also apply online through the Mudra loan website. Fill out and upload the forms along with the required documents.

6. Once the documents are verified by the relevant lending institution and the loan is approved, the loan amount will be credited to your bank account.

Looking for an Alternative to Mudra Loan?

New businesses and startups are the power horses of any economy. Mudra loans are introduced to remove the bottleneck of funding for new businesses. If you have a business idea in the non-agriculture sector, you can take advantage of the various benefits offered by a Mudra loan.

For new businesses, an alternative to a Mudra loan is a business loan by Tata Capital. With online application process via the Tata Capital App and

website, fast application approval and flexible repayment schedule, Tata Capital’s business loans are designed to make new businesses grow and prosper.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Most Viewed Blogs

Importance of Credit Facility in Business

Top 10 Profitable Big Business Ideas In India

Best Low-Investment Business Ideas In 2024

Different Types of Business Loans & How to Choose the Right Business Loan for Your Needs

The Latest Trends in Business Loans

How To Start A Dropshipping Business In India

10 Zero Investment Online Business Ideas In India

10 Profitable Agricultural Business Ideas for Farmers and Entrepreneurs

How To Start Organic Farming in India

How to Start Scrap Business in India?

Trending Blogs

Types of Business Loans in India

5 Ways To Get A MSME Loan Without Collateral

Know More About Startup Loan

Working Capital Meaning – Importance & Advantages

- Business Loan EMI Calculator

Used Car Loan EMI Calculator

Two Wheeler Loan EMI Calculator

Loan Against Property Calculator

- Media Center

- Branch Locator

- Tata Capital Housing Finance Limited

- Tata Securities Limited

Tata Mutual Fund

Tata Pension Fund

Important Information

- Tata Code of Conduct

- Master T&Cs’ Tata Capital Limited

- Master T&Cs' Tata Capital Financial Services Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited

- Vendor Feedback Form

- Rate History

- Ways to Service

- Our Partners

- Partnership APIs

- SARFAESI – Regulatory Display - Tata Capital Limited

- SARFAESI – Regulatory Display - Tata Capital Housing Finance Limited

Investor Information

- Tata Capital Limited

Our Private Equity Funds

- Tata Capital Healthcare Fund

- Tata Opportunities Fund

- Tata Capital Growth Fund

Amalgamated Companies

- Archived Documents of Tata Capital Financial Services Limited

- Archived Documents of Tata Cleantech Capital Limited

Top Branches

Most important terms & conditions - home loans.

Download in your preferred language

Policies, Codes & Other Documents

- Tata Code Of Conduct

- Audit Committee Charter

- Affirmative Action Policy

- Whistleblower Policy

- Code of Conduct for Non-Executive Directors

- Remuneration Policy

- Board Diversity Policy

- Code of Corporate Disclosure Practices and Policy on determination of legitimate purpose for communication of UPSI

- Anti-Bribery and Anti-Corruption Policy

- Vigil Mechanism

- Composition Of Committees

- Notice Of Hours Of Work, Rest-Interval, Weekly Holiday

- Fit & Proper Policy

- Policy For Appointment Of Statutory Auditor

- Policy On Related Party Transactions

- Policy For Determining Material Subsidiaries

- Policy On Archival Of Documents

- Familiarisation Programme

- Compensation Policy for Key Management Personnel and Senior Management

- Fair Practice Code - Micro Finance

- Fair Practice Code

- Internal Guidelines on Corporate Governance

- Grievance Redressal Policy

- Privacy Policy on protecting personal data of Aadhaar Number holders

- Dividend Distribution Policy

- List of Terminated Vendors

- Policy for determining Interest Rates, Processing and Other Charges

- Policy specifying the process to be followed by the Investors for claiming their Unclaimed Amounts

- NHB registration certificate

- KYC pamphlet

- Fair Practices Code

- Most Important Terms & Conditions - Home Equity

- Most Important Terms & Conditions - Offline Quick Cash

- Most Important Terms & Conditions - Digital Quick Cash

- Most Important Terms & Conditions - GECL

- Most Important Terms & Conditions - Dropline Overdraft

- GST Details

- Customer Grievance Redressal Policy

- Recovery Agents List

- Legal Disclaimer

- Privacy Commitment

- Investor Information And Financials

- Guidelines On Corporate Governance

- Anti-Bribery & Anti-Corruption Policy

- Whistle Blower Policy

- Policy Board Diversity Policy and Director Attributes

- TCHFL audit committee Charter

- Code of Conduct For Non-Executive Directors

- Code of Corporate Disclosure Pracrtices and policy On determination of Legitimate purpose

- List of Terminated Channel Partners

- Policy On Resolution Framework 2.0

- RBI Circular On Provisioning

- Policy for Use of Unparliamentary Language by Customers

- Policy for Determining Interest Rates and Other Charges

- Additional Facility

- Compensation Policy For Key Management Personnel And Senior Management

- Guidelines for release of property documents in the event of demise of Property Owners who is a sole or joint borrower

- Prevention Of Money Laundering Policy

- Policy For Accounting Of Tax In Respect Of The Tax Position Under Litigation

- Cyber Security Policy

- Conflict Of Interest Policy

- Policy For Outsourcing Of Activities

- Surveillance Policy

- Anti-Bribery And Anti-Corruption Policy

- Code Of Conduct For Prevention Of Insider Trading

Tata Capital Solutions & Services

- Loans for You

- Loans for Business

- Overdraft Personal Loan

- Wedding Loan

- Travel Loan

- Home Renovation Loan

- Personal Loan for Govt employee

- Personal Loan for Salaried

- Personal Loan for Women

- Small Personal Loan

- Required Documents

- Application Process

- Affordable Housing

- Business Loan for Women

- MSME/SME Loan

Vehicle Loans

More Products

- Emergency Credit Line Guarantee Scheme (ECLGS)

- Credit Score

- Rural Individual Loans

- Structured Loans

- Commercial Vehicle Finance

- Personal Loan Pre Payment Calculator

- Personal Loan Eligibility Calculator

- Balance Transfer & Top-Up Calculator

- Home Loan Eligibility Calculator

- Business Loan Pre Payment Calculator

- Loan Against Property EMI Calculator

- Used car Loan EMI Calculator

- Two wheeler Loan EMI Calculator

- APR Calculator

- Personal Loan Rates And Charges

- Home Loan Rates And Charges

- Business Loan Rates And Charges

- Loan Against Property Rates And Charges

- Used Car Loan Rates And Charges

- Two Wheeler Loan Rates and Charges

- Loan Against Securities Rates And Charges

Uh oh, something went wrong

Please try again later.

Navigation Hindi

- Subsidiaries

- Corporate Governance

- Investor Relations

- SBI In the News

- Grahak Setu

Language Selector

- Customer Care

- Net Banking

PMMY - MSME Loan / SME Loan Government Schemes | SBI - Business

- Eligibility

- Terms And Conditions

Success Stories

Pradhan Mantri MUDRA Yojana (PMMY)

Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Hon’ble Prime Minister on April 8, 2015 for providing loans upto 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs. The borrower can approach any of the lending institutions mentioned above or can apply online through JanSamarth portal ( www.Jansamarth.in ). Under the aegis of PMMY, MUDRA has created three products namely 'Shishu', 'Kishore' and 'Tarun' to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth.

For more details click here

- Nature of Facility : Working Capital and Term Loan

- Purpose : Business purpose, capacity expansion, modernization

- Target Group : Business Enterprises in Manufacturing, Trading and Services sector including allied agricultural activities.

- Maximum loan amount : Upto Rs 10 lacs

- Loans upto Rs.50,000 are categorised as SHISHU

- Loans from Rs.50,001 to Rs.500,000 are categorised as KISHORE

- Loans from Rs.500,001/- to Rs.10,00,000/- are categorised as TARUN

- Upto Rs. 50,000/- Nil

- Rs. 50,001 to Rs. 10 lacs: 20%

- Pricing : Competitive Pricing Linked to EBLR

- TL/Dropline OD - below Rs. 5 lakh : Max. 5 years including maximum moratorium period of upto 6 months.

- TL/Dropline OD - From Rs. 5 lakh to Rs. 10 lakh : Max. 7 years including maximum moratorium period of up to 12 months.

- Nil for Shishu and Kishore to MSE Units

- For Tarun: 0.50%(plus applicable tax) of Loan amount

Customers can login and apply for Mudra loans on following Bank specific URL. https://jansamarth.in/apply/sbi

Eligibility Criteria

- Existing & New units

Other Conditions

- The loans under Mudra Scheme are guaranteed by Credit Guarantee for Micro Units (CGFMU) and the same is provided through National Credit Guarantee Trustee Company (NCGTC).

- The guarantee cover is available for five years and hence for advances granted under Mudra Scheme the maximum period is 60 months.

- Leads are now available in Udyami Mitra Portal (www.udyamimitra.in). Site can be accessed by Branches with Username and Password

- All Branches to issue MUDRA RuPay Card for all the eligible CC accounts.

- MUDRA SCHEME DESI TOYS SUCCESS STORY

- MUDRA SCHEME ART INNOVATION SUCCESS STORY

- SUCCESS STORIES OF NACHIYARKOIL BRANCH

- Success stories OF SINGJAMEI BRANCH

Last Updated On : Tuesday, 23-04-2024

- Interest Rates

8.50%* p.a. onwards

w.e.f. 05.04.2024

*T&C Apply.

11.35% p.a.*

less than Rs.10 Cr. w.e.f 15.10.22

Rs.10 Cr. and above w.e.f 15.10.22

Starts From 8.95%*

SBI Realty Gold Loan

SBI Gold Loan

*T & C Apply

Starts From 7.90%

SBI Personal Gold Loan

Loan amount up to Rs. 3 lakhs

> Rs. 3 lakhs & up to Rs. 5 lakhs

Balance below Rs. 10 crs

Balance Rs. 10 crores and above

8.15% p.a.*

(On Applying through YONO)

2 years to less than 3 year

5 years and up to 10 years

11.25% p.a.

w.e.f 15.06.2024

Quick Links

- Doorstep Banking Services

- Tools & Calculators

- Unauthorized Digital Transaction Reporting

SME Government Schemes

Prime Minister Employment Generation Programme (PMEGP)

More Information

Stand-Up India Scheme Facilitates....

Credit Guarantee Fund Trust For Micro And Small Enterprises (CGTMSE)

- Terms and Conditions

SIA is Typing...

character(s) remaining

Was this helpful ?

Thank you for sharing your feedback!

Your feedback matters.

(Please enter your 10 digit Indian mobile Number)

What is a Mudra Loan? Features, Eligibility & More

Everything you need to know about mudra loan.

Micro Units Development and Refinance Agency (MUDRA) loans are micro-loans that are available under the Pradhan Mantri Mudra Yojana (PMMY). MUDRA loans are targeted to aid and relieve the MSME sector by freeing them from the inconvenience of liquidity crunch.

These loans are readily made available to the concerned persons, and they are largely accessible by connecting the lending partners all across India. The type of loans under this scheme can be widely categorised into three major types on the basis of requirements like the quantum of loan and business stage

The maximum loan that can be provided under the Pradhan Mantri Mudra Yojana is around ₹ 10,00,000 and it is applied under the 'Tarun Scheme'.

An Introduction to the Project Report and its Contents

Just like any other business loan, MUDRA loans also require the borrowers to show a project report during the time of their loan application submission. The project report is an extremely important document that is required to initiate the loan application and sanction process.

The project report has to be furnished to apply for a MUDRA loan under the 'Tarun' or 'Kishore' category. The loans under the 'Shishu' scheme are most likely to be available easily to small business owners and they do not generally require the borrowers to provide a detailed project report along with their loan application.

What is a Project Report?

A project report is a document that offers a detailed account of the business proposal. It also provides the cost-benefit analysis, project implication of the proposed expenditure, and overheads for which the loan is sought.

Project report gives an overview of the project concept, scale of its activities, existing debts, project revenue, and more. The project report has to be precise and must contain valid data so that it can be easily approved and accepted by the loan authorities.

To initiate the application to obtain a MUDRA loan, the major contents in any project report that are needed are the cost of benefit analysis of the proposed expenditure, a detailed account of the business and entrepreneur, and more.

So, below mentioned are the major contents that a project report must essentially have-

- General business profile or information such as the area of products/ Business, services, achievements, duration of the existence, etc.

- The central aim, budget, and target of the proposed business enterprises and investment for the same.

- Details of the plant, machinery, equipment, and other accommodations required for initiating the business proposal or sustenance.

- Business quotation and detailed business plan from at least two sellers/ vendors specialised in the same sector.

- Types of business development and manufacturing processes that are involved in the execution of the proposed plans.

- Partner details, transportation cost, marketing, and promotional activities , strategies, and other requisites that are involved in the business of product development.

- Information about the third party participant or investors involved in project execution.

- Business revenue projections and conclusion of the report.

The aforementioned is a list of project report contents that are required by the lenders. Many loan lenders have specific requirements in terms of accepting the project reports. However, the main requisite with respect to MUDRA loan is the project report that has to be accurate and factual, or it may lead to the rejection of the whole loan application. This can also eventually affect the credit score of the borrower therefore project report has to be made with due concern and as per the guidelines.

Advantages of MUDRA Loan

Some of the most crucial advantages of MUDRA loan are mentioned below-

- The borrower gets easier access to the loan worth ₹10,00,000

- Collateral free loan

- Minimum interest rate as compared to the business loan products and other proposals.

- Comfortable repayment duration up to 5 years (or more in specific cases).

- Flexible repayment options as per the terms and conditions of the money lender.

- A revised definition of the sector (MSME) that offers a wide scope of eligibility under the scheme of MUDRA loan thereby supporting more businesses.

- Interest subvention of around 2% to 'Shishu Loan' under PMMY

A Glance at MUDRA Loan

The Pradhan Mantri Mudra Yojana was launched in 2015 with an objective to offer credit up to rupees 10 lakhs to small and medium entrepreneurs. This scheme acts as a regulator for the micro-finance institutions (Mafia).

MUDRA Yojana targets skilled workers, educated professionals, and entrepreneurs and ensures their interests. This scheme is specially designed to encourage and promote the axis of financial amenities to non-corporate small business sectors (NCSBS) that can turn them into the driving forces for Employment generation and GDP growth.

The MUDRA loan is offered under the Pradhan Mantri Mudra Yojana (PMMY) to the non-corporate micro and small businesses and non-farming enterprises. These bodies can avail of a loan up to 10 lakhs under the development of the micro-unit and refinance agency Ltd scheme. This loan is accessible in three broad categories i.e. Shishu, Kishore, and Tarun for signifying the stage of business growth, developing and funding the requirements of the beneficiary business/ entrepreneur, and to offer a reference point for the next phase of their business growth.

The features of the MUDRA loan scheme