Real Estate | How To

How to Write a Real Estate Business Plan (+ Free Template)

Published June 30, 2023

Published Jun 30, 2023

REVIEWED BY: Gina Baker

WRITTEN BY: Jealie Dacanay

This article is part of a larger series on How to Become a Real Estate Agent .

- 1 Write Your Mission Statement

- 2 Conduct a SWOT Analysis

- 3 Set Specific & Measurable Goals

- 4 Plan Your Marketing Strategies & Tactics

- 5 Create a Lead Generation & Nurturing Strategy

- 6 Calculate Your Income Goal

- 7 Set Times to Revisit Your Business Plan

- 8 Why Agents Need a Real Estate Business Plan

- 9 Real Estate Business Plan Examples & Templates

- 10 Bottom Line

- 11 Frequently Asked Questions (FAQs)

A real estate business plan lays the groundwork and provides direction on income targets, marketing tactics, goal setting, lead generation, and an overview of your industry’s competition. It describes your company’s mission statement in detail and assesses your SWOT (strengths, weaknesses, opportunities, and threats) as an organization. Business plans should include measurable goals and financial projections that you can review periodically throughout the year to ensure you meet your goals.

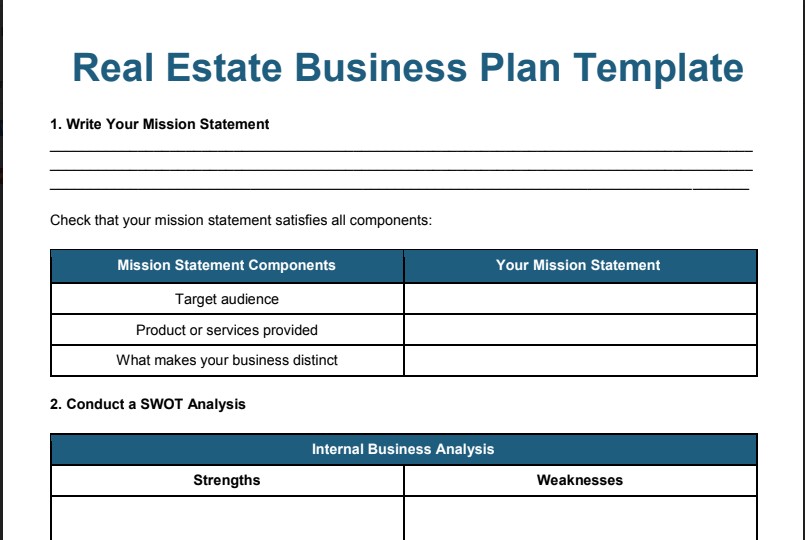

Continue reading to see real estate business plan examples and discover how to write a real estate business plan. Start by making your own by downloading and using the free real estate business plan template we’ve provided below.

FILE TO DOWNLOAD OR INTEGRATE

Real Estate Business Plan Template

Thank you for downloading!

💡Quick tip:

Market Leader provides a comprehensive paid inbound lead, automated marketing, and CRM solution to help agents acquire, engage, and nurture real estate leads.

Furthermore, Market Leader offers and guarantees you a number of exclusive seller and buyer leads in your target niche at a monthly rate.

1. Write Your Mission Statement

Every real estate agent’s business plan should begin with a mission statement, identifying your values and why your business exists. Your mission statement serves as the guide to achieving your ultimate business objective. When you create a solid clear mission statement, all other items identified in your realtor business plan should be aimed at fulfilling this statement.

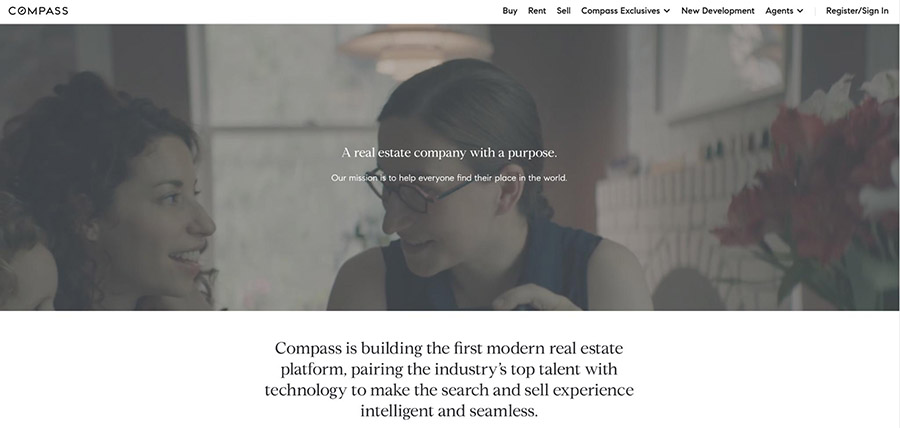

Compass’ mission statement: “Our mission is to help everyone find their place in the world.” (Source: Compass )

Your mission statement should identify your target audience, what product or service you provide, and what makes your business distinct. As seen in the example above, a powerful mission statement should be short and concise but sums up a business objective.

Let’s take Compass’ mission statement above as an example: “Our mission is to help everyone find their place in the world.” The statement identifies what the company offers, for what reasons, and who it benefits.

2. Conduct a SWOT Analysis

SWOT is an acronym that stands for a business’ strengths, weaknesses, opportunities, and threats. The primary objective of these four elements is to assess a business by evaluating internal and external factors that can drive decision-making and help you make more money . Conducting a SWOT analysis as you develop your business plan for real estate uncovers opportunities to differentiate yourself from the massive competition currently on the market.

Strengths & Weaknesses

Strengths and weaknesses are internal parts of your organization. Strengths identify what product or services you provide better than others, your access to resources, and items that benefit your customers. Weaknesses are items that need improvement, lack of resources, or what your competition does better. These are items within your control to change because you can convert a weakness into a strength.

See the example below if “Agent X” was doing their SWOT analysis:

Opportunities & Threats

External factors drive opportunities and threats and are areas you can take advantage of to benefit your business. Examples of opportunities can be shifts in the current marketplace, emerging trends you can capitalize on, features that competitors lack, or even changes with your competitors. Threats, on the other hand, are anything that can negatively impact your business. You don’t have control over changing the opportunities or threats, but you can develop a practice to anticipate and protect your business against the threats.

The opportunities and threats for “Agent X” would be:

When you complete your SWOT analysis, use it as a guide when creating strategies to meet your business objectives. To gain the most benefit from creating a SWOT analysis, make sure you are being realistic about your business and evaluating it in its present state. You don’t want to be unrealistic by listing strengths or opportunities that don’t exist yet, and you want to allocate time and money to the most impactful solution to your business issues.

If “Agent X” completed the above SWOT analysis, a few strategies they could derive would be:

- Incentivize agents to keep them at the brokerage for longer

- Implement a technology-based key machine to reduce lost keys and keep the team accountable

- Find a competitive advantage against competing brokerages and use that in marketing messages

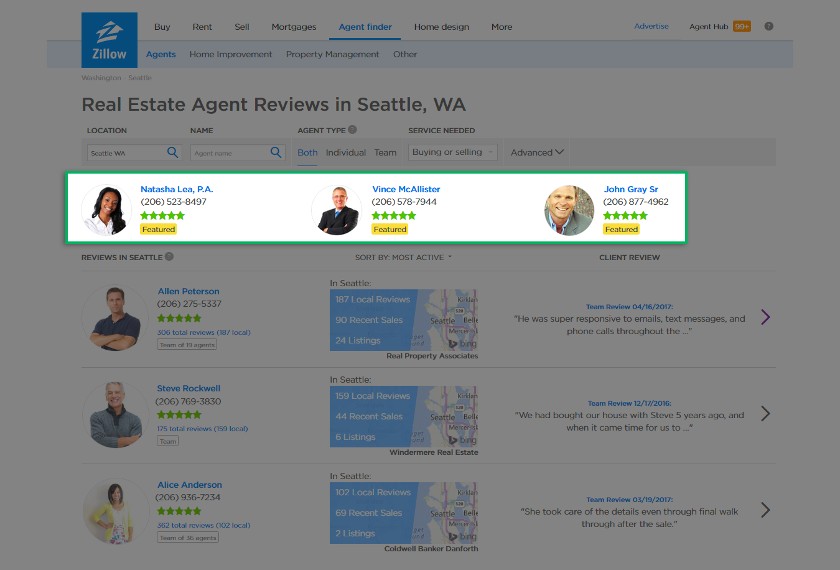

Zillow agent finder (Source: Zillow )

To help agents locate other brokerages operating in your preferred market, agents can use Zillow’s agent finder page as a research tool to see which agents or brokerages are operating in a specific area. You can find an agent by location, name, specialty, and language. Once you click on a Zillow profile , you can read their reviews, see their team members, contact and website information, and property listings. Take a deep dive into your competitor profiles and can use the information to implement strategies within your own business.

Visit Zillow

Read how our experts feel about this real estate lead generation company in our Zillow Premier Agent review .

3. Set Specific & Measurable Goals

You’re ready to set some business goals after clearly defining your mission statement and SWOT analysis. Goals can help set the tone to increase your performance and drive your business in the right direction. Your goals should have a definitive way to show progress, which can be a prime motivator to keep you on track to achieving them.

Each goal should follow a pattern to identify set criteria. This will ensure that your daily efforts are performed to meet business objectives within a set period. A way to do this is by using SMART goals:

Examples of SMART goals for agents or brokerages:

- Increase closed transactions by 20% to a total of 150 deals within the next year

- I will ask all closed clients for a referral and review within 30 days of closing the deal

Goals can be split into short-term and long-term goals. Short-term goal lengths vary between days and weeks but do not exceed six months. Short-term goals can also be worked on simultaneously with long-term goals. Long-term goals can take up to six months or more to complete and require careful planning and perseverance. A mix of short-term and long-term goals will help you maintain motivation.

All goals are equally important; however, success will stem from how you prioritize each one. Slowly add on additional goals as you have the capacity and feel comfortable with the current progress of your current set of goals. Without identifying your business goals, you’ll leave your results up to luck to attain your business objectives.

4. Plan Your Marketing Strategies & Tactics

Developing marketing strategies and tactics and implementing them help you identify and locate your current value proposition in the real estate industry, along with specific timelines for execution. In addition to determining your overall business objectives and goals, your marketing strategy and plan should include the following:

- Pinpoint general marketing goals

- Estimate projected marketing budget

- Know your geographic farm area data and identify your target niche audience

- Analyze market competition

- Identify your unique selling proposition

- Establish a timeline and set your plan in motion

- Track your progress and readjust as needed

While a marketing strategy identifies the overall marketing goals of your business, developing marketing tactics will help you achieve those individual goals. They can include referral business tactics, retention efforts, and ways to acquire new customers. For example, you can offer incentives to anyone who refers your business, or you can implement new email drip campaigns to help increase lead conversion rates.

These tactics should have set key performance indicators (KPIs) to help you evaluate your performance. For instance, a KPI you can set for your business could be that referral business should exceed 20% of your lead generation sources.

If you’re unsure how to put together your marketing plan, check out our article Real Estate Marketing Plan Template & Strategy Guide and download the free template to get started.

Postcard campaign example (Source: ProspectsPLUS! )

If direct mail is part of your promotion strategy, services like ProspectsPLUS! can help easily create and distribute mailers to a targeted area. It also has options for postcards , brochures, newsletters , flyers, and folders. You can also send mailers to prospective clients by geographic or demographic farm areas through its campaigns. Check out its templates and mailing options today.

Visit ProspectsPLUS!

Read how our experts feel about this real estate direct mail service in our ProspectsPLUS! review .

5. Create a Lead Generation & Nurturing Strategy

Having a successful lead generation strategy will help you maintain business growth. Lead generation can be performed organically and through paid advertisements to attract and convert prospective clients. In addition to generating leads, agents should have systems to manage, nurture, and re-engage with contacts to maximize opportunities.

Generating leads through a multipronged approach is the best way to maintain lead flow. Use organic strategies like hosting an open house, reaching out to your sphere of influence, and attending networking events. Employ paid generation strategies, such as purchasing leads from a lead generation company or setting up a website to funnel potential clients. Your marketing strategies will directly correlate with your lead generation strategies.

Every lead is an opportunity, even if they don’t immediately convert into a deal. Effectively nurturing leads can make sure no opportunity falls through the cracks. Agents can nurture leads by continuously engaging and developing relationships with prospective leads . It’s important to provide prospective clients with a constant flow of essential and relevant information, depending on where they are in the real estate buying or selling process.

Here are the top lead generation companies for real estate agents and brokers:

Engage more efficiently with buyer and seller leads using Market Leader’s new feature Network Boost. Network Boost has shown a 40% increase in agents successfully connecting with leads. Market Leader social media experts design highly targeted and optimized ads for your Instagram and Facebook. As visitors engage with your ads, they will be prompted to complete a form and funnel directly into your Market Leader client relationship manager (CRM). This will also trigger an automatic marketing campaign that nurtures your clients and lets you know they are ready to engage with you personally. Try Market Leader’s Network Boost today.

6. Calculate Your Income Goal

Your income goal is one of the most critical items to be included in your business plan. While this may be more difficult for new agents who are still learning the business, it’s still necessary to estimate the amount of money you will earn for the year. Work with an experienced agent or mentor to help you estimate your monetary goals. For professional agents, review your previous years to judge your income goals for the upcoming year.

To calculate your income goal and the amount of work you’ll need to complete to get to that goal, you’ll need to have some basic number estimates:

- Net income: The amount of money you will put in your pocket after commission splits with your real estate brokerage.

- Fee split with brokerage: This is the agreed-upon commission split you have with your brokerage for each completed transaction. For example, if you have a 70/30 split with your brokerage, you will collect 70% of the commission, and your brokerage will receive a 30% commission for each deal.

- Estimate of completed deals per year: You also want to estimate the number of deals you intend to complete yearly. Remember that some months will be busier than others, so make sure to account for holidays, weather, and your schedule.

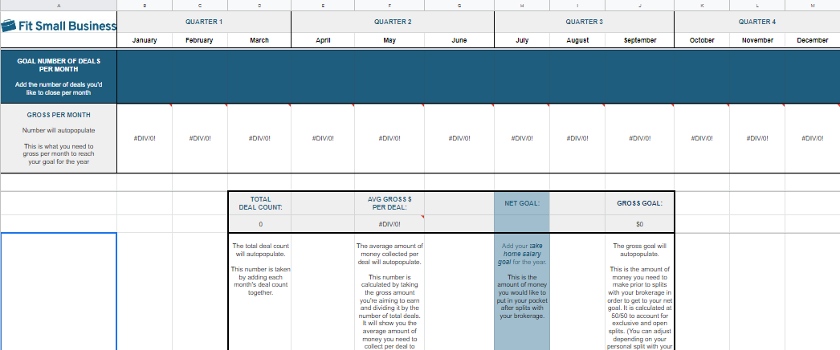

Real Estate Yearly Goal Calculator

By figuring out these numbers, you can give yourself a realistic number for your income goal. Compute the gross income commission (GCI) or amount of money you must make before the commission splits and the average profit per deal and month you’ll need to reach your goal.

For a more detailed breakdown of your yearly goal, download and use our yearly goal calculator. Input your information into the highlighted yellow boxes, and the spreadsheet will automatically calculate the GCI, total deal count, and gross income you’ll have to earn each month to reach your goal. Adjust the average gross commission per deal and brokerage split as necessary.

FitSmallBusiness Year Goal Calculator

For additional information on real estate agent salaries, review our article Real Estate Agent Salary: How Much Do Real Estate Agents Make?

7. Set Times to Revisit Your Business Plan

Business plans are only effective if you use them. A business plan is a roadmap for your business, and you’ll need to revisit it often to ensure you’re staying on track. It should be a constant resource to guide you through meeting your goals and business objectives, but it’s not necessarily set in stone if you need to make any changes.

Agents should revisit their business plans monthly to measure progress and make any changes to stay the course. If you find that you’re missing the times set for your goals, then you should continue to revisit your business plan regularly. Changing the business plan itself should occur annually once you can have a complete picture of your yearly performance. Evaluating the business plan can help you discover new strategies and ensure you have the appropriate resources for the upcoming year.

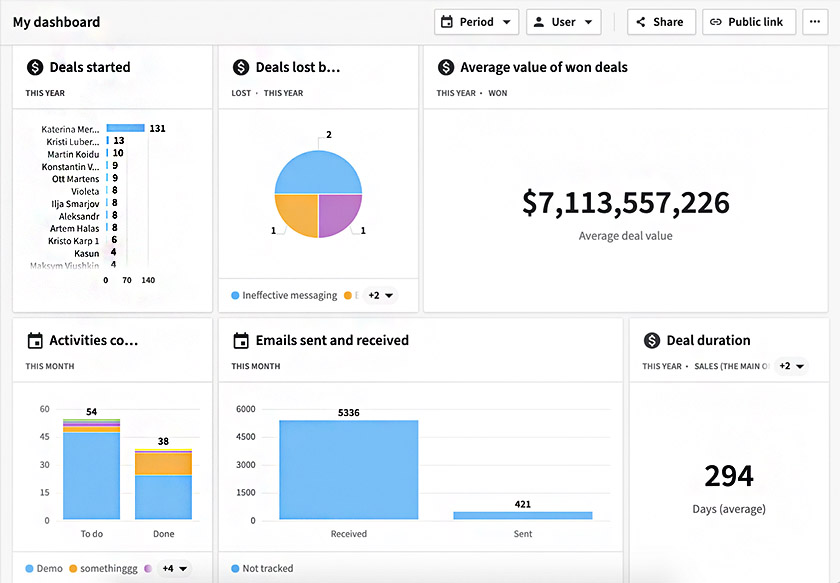

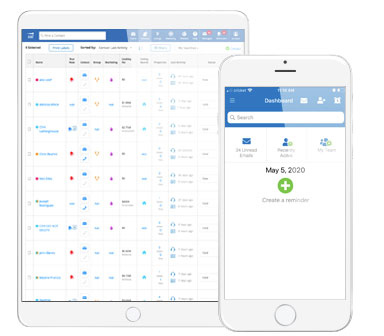

Overall status of sales activities in the dashboard (Source: Pipedrive )

Sales software like Pipedrive can help you track your overall business performance when revisiting your business plan. It presents company sales data in easy-to-visualize dashboards that track your business performance and contains forecasting tools to project future revenue. It can maintain company and team goals with progress tracking to keep goals top of mind.

Visit Pipedrive

Read how our experts feel about this real estate customer relationship manager (CRM) system in our Pipedrive review .

Why Agents Need a Real Estate Business Plan

A real estate business plan keeps you up to date on market developments and one step ahead of your competitors. It also enables you to test lead-generating tactics and create new marketing campaigns while keeping track of results over time. A solid business plan for a real estate agent presents the following:

- Where you are at the moment

- Where you would like to be

- How you’re going to get there

- How to evaluate and measure your performance

- When and when to correct the course

Real Estate Business Plan Examples & Templates

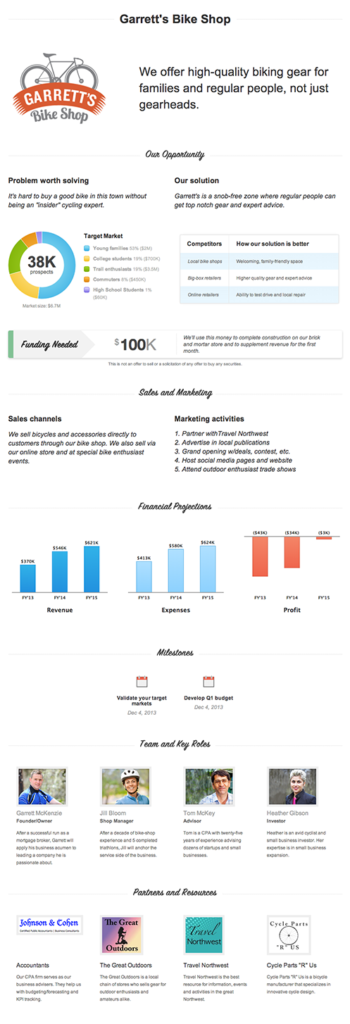

Real estate agents and brokerages don’t have to build their business plans from scratch, as many resources provide different examples. Business plan templates can also have different objectives. Some are used to secure financing or help you focus on lead generation, while others are single-page plans meant to get you started.

Here are five real estate business plan examples you can use to create yours:

Lead Generation & Income Plan

Market Leader business plan example (Source: Market Leader )

This business plan is from Market Leader, a third-party lead generation platform. It specializes in lead generation, marketing, and converting leads into customers with an attractive IDX (Internet Data Exchange) website and robust automation tools. Agents can also participate in purchasing leads through their lead products to receive a guaranteed number of leads per month.

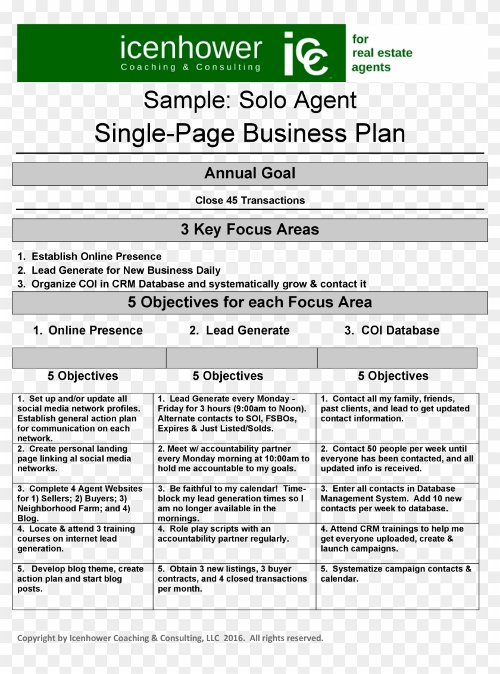

A Single-page Business Plan

Business plan for real estate (Source: PngFind )

Agents who are new to writing a business plan can start small. Business plans do not have to be multipage to be effective. This single-page business plan helps identify a single goal followed by three areas to focus on and five objectives for each focus area. As real estate agents begin to feel comfortable with goal setting and completion, they can continue to add to this single-page business plan with duplicate pages, identifying additional goals.

Business Plan for Real Estate Brokers

Real estate broker business plan (Source: AgentEDU )

This robust real estate broker business plan is designed to address organization and management goals. It contains pages identifying personnel information like title, job description, and salary. The business plan also encourages the broker to identify operational goals for future personnel changes. It’s best suited for a broker with a larger team to help drive operational change.

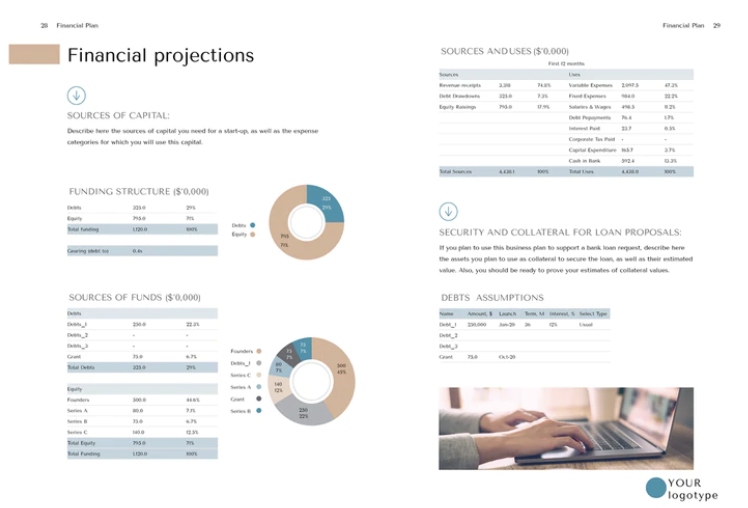

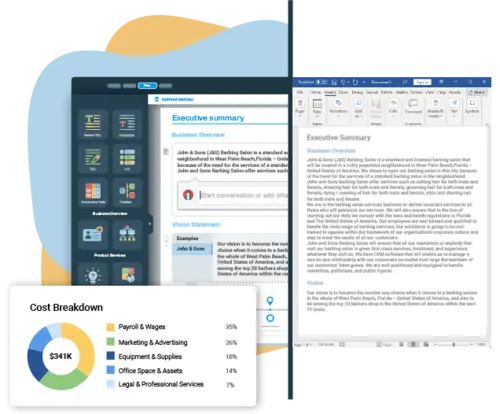

Business Plan With Detailed Financials

Example of real estate agent business plan template (Source: FinModelsLab )

This multipage business plan contains eye-catching graphics and detailed company financial information for real estate agents and brokers seeking funding from outside investors. One of the last sections of the business plan is a financial planning section geared toward showing how viable your business is through your provided income statements, cash flow, and balance sheet reports.

Real Estate Developers’ Business Plan

Realtor business plan template sample (Source: Upmetrics )

Upmetrics’ real estate business plan templates are easy to edit and share and contain professional cover pages to help agents convert their business ideas into actionable goals. The business plans from Upmetrics are geared toward agents looking to transition into real estate development. This plan includes vital sections important for a developer to analyze, such as building location, demand for housing, and pricing.

Real estate CRM (Source: Market Leader )

Market Leader’s business plan is centered around driving more business through lead generation. It helps agents understand their lead sources, average sales price, and how much commission was earned in a given year. It also allows agents to set income and transactional goals for the following year.

Visit Market Leader

Bottom Line

Whether you are a new real estate agent or looking to grow your brokerage, writing a real estate business plan template will help you define the steps needed to build a successful business . It serves as a guided roadmap to help you achieve your business goals, identify areas of improvement, and provide guidance in all aspects of your business, from marketing, operations, and finance to your products and services. Business plans can help determine if your business is viable and worth the financial investment.

Frequently Asked Questions (FAQs)

What is a real estate business plan.

A real estate business plan is a document that presents an outline of your organizational goals. A business plan lays out future company goals and structured procedures to achieve them. Business plans commonly contain plans for one to five years at a time, though they can differ from investor to investor.

A real estate business plan will put you in a position to succeed while also assisting you in avoiding potential pitfalls. It serves as a guide to follow when things go as expected and when they diverge from the initial plan of action. Also, a real estate business plan will ensure that investors know the steps they need to take to succeed.

How do I jump-start my real estate business?

It is important to note that starting a real estate business is not a simple task. Before launching a firm in any field, entrepreneurs should spend numerous hours researching and developing a solid business plan. As you start your real estate business, use the following tips as guidance:

- Think about your professional goals

- Conduct extensive research

- Organize your finances

- Create a business plan

- Establish an LLC

- Make a marketing plan

- Create a website

- Start campaigns

- Keep track of leads

- Develop a network of connections

How can I grow my real estate business?

You can use multiple strategies and ways to grow your real estate business. They include:

- Assess your current situation

- Invest in your professional growth

- Establish strategic alliances

- Take advantage of omnichannel marketing

- Start blogging

- Create consistent social media profiles and campaigns

- Improve your website

- Consider working with a marketing company

- Optimize your signs and direct mail

About the Author

Find Jealie On LinkedIn

Jealie Dacanay

Jealie is a staff writer expert focusing on real estate education, lead generation, marketing, and investing. She has always seen writing as an opportunity to apply her knowledge and express her ideas. Over the years and through her internship at a real estate developer in the Philippines, Camella, she developed and discovered essential skills for producing high-quality online content.

By downloading, you’ll automatically subscribe to our weekly newsletter.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- Coaching Team

- Investor Tools

- Student Success

- Real Estate Investing Strategies

Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

How To Write A Real Estate Business Plan

What is a real estate business plan?

8 must-haves in a business plan

How to write a business plan

Real estate business plan tips

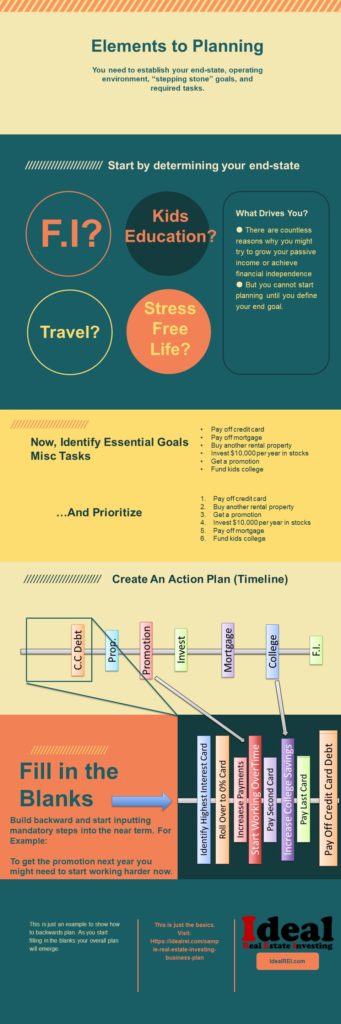

Success in the real estate investing industry won’t happen overnight, and it definitely won’t happen without proper planning or implementation. For entrepreneurs, a real estate development business plan can serve as a road map to all of your business operations. Simply put, a real estate business plan will serve an essential role in forming your investing career.

Investors will need to strategize several key elements to create a successful business plan. These include future goals, company values, financing strategies, and more. Once complete, a business plan can create the foundation for smooth operations and outline a future with unlimited potential for your investing career. Keep reading to learn how to create a real estate investment business plan today.

What Is A Real Estate Investing Business Plan?

A real estate business plan is a living document that provides the framework for business operations and goals. A business plan will include future goals for the company and organized steps to get there. While business plans can vary from investor to investor, they will typically include planning for one to five years at a time.

Drafting a business plan for real estate investing purposes is, without a doubt, one of the single most important steps a new investor can take. An REI business plan will help you avoid potential obstacles while simultaneously placing you in a position to succeed. It is a blueprint to follow when things are going according to plan and even when they veer off course. If for nothing else, a real estate company’s business plan will ensure that investors know which steps to follow to achieve their goals. In many ways, nothing is more valuable to today’s investors. It is the plan, after all, to follow the most direct path to success.

8 Must-Haves In A Real Estate Business Plan

As a whole, a real estate business plan should address a company’s short and long-term goals. To accurately portray a company’s vision, the right business plan will require more information than a future vision. A strong real estate investing business plan will provide a detailed look at its ins and outs. This can include the organizational structure, financial information, marketing outline, and more. When done right, it will serve as a comprehensive overview for anyone who interacts with your business, whether internally or externally.

That said, creating an REI business plan will require a persistent attention to detail. For new investors drafting a real estate company business plan may seem like a daunting task, and quite honestly it is. The secret is knowing which ingredients must be added (and when). Below are seven must-haves for a well executed business plan:

Outline the company values and mission statement.

Break down future goals into short and long term.

Strategize the strengths and weaknesses of the company.

Formulate the best investment strategy for each property and your respective goals.

Include potential marketing and branding efforts.

State how the company will be financed (and by whom).

Explain who is working for the business.

Answer any “what ifs” with backup plans and exit strategies.

These components matter the most, and a quality real estate business plan will delve into each category to ensure maximum optimization.

A company vision statement is essentially your mission statement and values. While these may not be the first step in planning your company, a vision will be crucial to the success of your business. Company values will guide you through investment decisions and inspire others to work with your business time and time again. They should align potential employees, lenders, and possible tenants with the motivations behind your company.

Before writing your company vision, think through examples you like both in and out of the real estate industry. Is there a company whose values you identify with? Or, are there mission statements you dislike? Use other companies as a starting point when creating your own set of values. Feel free to reach out to your mentor or other network connections for feedback as you plan. Most importantly, think about the qualities you value and how they can fit into your business plan.

Goals are one of the most important elements in a successful business plan. This is because not only do goals provide an end goal for your company, but they also outline the steps required to get there. It can be helpful to think about goals in two categories: short-term and long-term. Long-term goals will typically outline your plans for the company. These can include ideal investment types, profit numbers, and company size. Short-term goals are the smaller, actionable steps required to get there.

For example, one long-term business goal could be to land four wholesale deals by the end of the year. Short-term goals will make this more achievable by breaking it into smaller steps. A few short-term goals that might help you land those four wholesale deals could be to create a direct mail campaign for your market area, establish a buyers list with 50 contacts, and secure your first property under contract. Breaking down long-term goals is a great way to hold yourself accountable, create deadlines and accomplish what you set out to.

3. SWOT Analysis

SWOT stands for strengths, weaknesses, opportunities, and threats. A SWOT analysis involves thinking through each of these areas as you evaluate your company and potential competitors. This framework allows business owners to better understand what is working for the company and identify potential areas for improvement. SWOT analyses are used across industries as a way to create more actionable solutions to potential issues.

To think through a SWOT analysis for your real estate business plan, first, identify your company’s potential strengths and weaknesses. Do you have high-quality tenants? Are you struggling to raise capital? Be honest with yourself as you write out each category. Then, take a step back and look at your market area and competitors to identify threats and opportunities. A potential threat could be whether or not your rental prices are in line with comparable properties. On the other hand, a potential opportunity could boost your property’s amenities to be more competitive in the area.

4. Investment Strategy

Any good real estate investment business plan requires the ability to implement a sound investment strategy. If for nothing else, there are several exit strategies a business may execute to secure profits: rehabbing, wholesaling, and renting — to name a few. Investors will want to analyze their market and determine which strategy will best suit their goals. Those with long-term retirement goals may want to consider leaning heavily into rental properties. However, those without the funds to build a rental portfolio may want to consider getting started by wholesaling. Whatever the case may be, now is the time to figure out what you want to do with each property you come across. It is important to note, however, that this strategy will change from property to property. Therefore, investors need to determine their exit strategy based on the asset and their current goals. This section needs to be added to a real estate investment business plan because it will come in handy once a prospective deal is found.

5. Marketing Plan

While marketing may seem like the cherry on top of a sound business plan, marketing efforts will actually play an integral role in your business’s foundation. A marketing plan should include your business logo, website, social media outlets, and advertising efforts. Together these elements can build a solid brand for your business, which will help you build a strong business reputation and ultimately build trust with investors, clients, and more.

First, to plan your marketing, think about how your brand can illustrate the company values and mission statement you have created. Consider the ways you can incorporate your vision into your logo or website. Remember, in addition to attracting new clients, marketing efforts can also help maintain relationships with existing connections. For a step by step guide to drafting a real estate marketing plan , be sure to read this guide.

6. Financing Plan

Writing the financial portion of a business plan can be tricky, especially if you are starting your business. As a general rule, a financial plan will include the income statement, cash flow, and balance sheet for a business. A financial plan should also include short and long-term goals regarding the profits and losses of a company. Together, this information will help make business decisions, raise capital, and report on business performance.

Perhaps the most important factor when creating a financial plan is accuracy. While many investors want to report on high profits or low losses, manipulating data will not boost your business performance in any way. Come up with a system of organization that works for you and always ensure your financial statements are authentic. As a whole, a financial plan should help you identify what is and isn’t working for your business.

7. Teams & Small Business Systems

No successful business plan is complete without an outline of the operations and management. Think: how your business is being run and by whom. This information will include the organizational structure, office management (if any), and an outline of any ongoing projects or properties. Investors can even include future goals for team growth and operational changes when planning this information.

Even if you are just starting or have yet to launch your business, it is still necessary to plan your business structure. Start by planning what tasks you will be responsible for, and look for areas you will need help with. If you have a business partner, think through your strengths and weaknesses and look for areas you can best complement each other. For additional guidance, set up a meeting with your real estate mentor. They can provide valuable insights into their own business structure, which can serve as a jumping-off point for your planning.

8. Exit Strategies & Back Up Plans

Believe it or not, every successful company out there has a backup plan. Businesses fail every day, but investors can position themselves to survive even the worst-case scenario by creating a backup plan. That’s why it’s crucial to strategize alternative exit strategies and backup plans for your investment business. These will help you create a plan of action if something goes wrong and help you address any potential problems before they happen.

This section of a business plan should answer all of the “what if” questions a potential lender, employee, or client might have. What if a property remains on the market for longer than expected? What if a seller backs out before closing? What if a property has a higher than average vacancy rate? These questions (and many more) are worth thinking through as you create your business plan.

How To Write A Real Estate Investment Business Plan: Template

The impact of a truly great real estate investment business plan can last for the duration of your entire career, whereas a poor plan can get in the way of your future goals. The truth is: a real estate business plan is of the utmost importance, and as a new investor it deserves your undivided attention. Again, writing a business plan for real estate investing is no simple task, but it can be done correctly. Follow our real estate investment business plan template to ensure you get it right the first time around:

Write an executive summary that provides a birds eye view of the company.

Include a description of company goals and how you plan to achieve them.

Demonstrate your expertise with a thorough market analysis.

Specify who is working at your company and their qualifications.

Summarize what products and services your business has to offer.

Outline the intended marketing strategy for each aspect of your business.

1. Executive Summary

The first step is to define your mission and vision. In a nutshell, your executive summary is a snapshot of your business as a whole, and it will generally include a mission statement, company description, growth data, products and services, financial strategy, and future aspirations. This is the “why” of your business plan, and it should be clearly defined.

2. Company Description

The next step is to examine your business and provide a high-level review of the various elements, including goals and how you intend to achieve them. Investors should describe the nature of their business, as well as their targeted marketplace. Explain how services or products will meet said needs, address specific customers, organizations, or businesses the company will serve, and explain the competitive advantage the business offers.

3. Market Analysis

This section will identify and illustrate your knowledge of the industry. It will generally consist of information about your target market, including distinguishing characteristics, size, market shares, and pricing and gross margin targets. A thorough market outline will also include your SWOT analysis.

4. Organization & Management

This is where you explain who does what in your business. This section should include your company’s organizational structure, details of the ownership, profiles on the management team, and qualifications. While this may seem unnecessary as a real estate investor, the people reading your business plan may want to know who’s in charge. Make sure you leave no stone unturned.

5. Services Or Products

What are you selling? How will it benefit your customers? This is the part of your real estate business plan where you provide information on your product or service, including its benefits over competitors. In essence, it will offer a description of your product/service, details on its life cycle, information on intellectual property, as well as research and development activities, which could include future R&D activities and efforts. Since real estate investment is more of a service, beginner investors must identify why their service is better than others in the industry. It could include experience.

6. Marketing Strategy

A marketing strategy will generally encompass how a business owner intends to market or sell their product and service. This includes a market penetration strategy, a plan for future growth, distribution channels, and a comprehensive communication strategy. When creating a marketing strategy for a real estate business plan, investors should think about how they plan to identify and contact new leads. They should then think about the various communication options: social media, direct mail, a company website, etc. Your business plan’s marketing portion should essentially cover the practical steps of operating and growing your business.

Additional Real Estate Business Plan Tips

A successful business plan is no impossible to create; however, it will take time to get it right. Here are a few extra tips to keep in mind as you develop a plan for your real estate investing business:

Tailor Your Executive Summary To Different Audiences: An executive summary will open your business plan and introduce the company. Though the bulk of your business plan will remain consistent, the executive summary should be tailored to the specific audience at hand. A business plan is not only for you but potential investors, lenders, and clients. Keep your intended audience in mind when drafting the executive summary and answer any potential questions they may have.

Articulate What You Want: Too often, investors working on their business plan will hide what they are looking for, whether it be funding or a joint venture. Do not bury the lede when trying to get your point across. Be clear about your goals up front in a business plan, and get your point across early.

Prove You Know The Market: When you write the company description, it is crucial to include information about your market area. This could include average sale prices, median income, vacancy rates, and more. If you intend to acquire rental properties, you may even want to go a step further and answer questions about new developments and housing trends. Show that you have your finger on the pulse of a market, and your business plan will be much more compelling for those who read it.

Do Homework On The Competition: Many real estate business plans fail to fully analyze the competition. This may be partly because it can be difficult to see what your competitors are doing, unlike a business with tangible products. While you won’t get a tour of a competitor’s company, you can play prospect and see what they offer. Subscribe to their newsletter, check out their website, or visit their open house. Getting a first-hand look at what others are doing in your market can greatly help create a business plan.

Be Realistic With Your Operations & Management: It can be easy to overestimate your projections when creating a business plan, specifically when it comes to the organization and management section. Some investors will claim they do everything themselves, while others predict hiring a much larger team than they do. It is important to really think through how your business will operate regularly. When writing your business plan, be realistic about what needs to be done and who will be doing it.

Create Example Deals: At this point, investors will want to find a way to illustrate their plans moving forward. Literally or figuratively, illustrate the steps involved in future deals: purchases, cash flow, appreciation, sales, trades, 1031 exchanges, cash-on-cash return, and more. Doing so should give investors a good idea of what their deals will look like in the future. While it’s not guaranteed to happen, envisioning things has a way of making them easier in the future.

Schedule Business Update Sessions: Your real estate business plan is not an ironclad document that you complete and then never look at again. It’s an evolving outline that should continually be reviewed and tweaked. One good technique is to schedule regular review sessions to go over your business plan. Look for ways to improve and streamline your business plan so it’s as clear and persuasive as you want it to be.

Reevauating Your Real Estate Business Plan

A business plan will serve as a guide for every decision you make in your company, which is exactly why it should be reevaluated regularly. It is recommended to reassess your business plan each year to account for growth and changes. This will allow you to update your business goals, accounting books, and organizational structures. While you want to avoid changing things like your logo or branding too frequently, it can be helpful to update department budgets or business procedures each year.

The size of your business is crucial to keep in mind as you reevaluate annually. Not only in terms of employees and management structures but also in terms of marketing plans and business activities. Always incorporate new expenses and income into your business plan to help ensure you make the most of your resources. This will help your business stay on an upward trajectory over time and allow you to stay focused on your end goals.

Above all else, a real estate development business plan will be inspiring and informative. It should reveal why your business is more than just a dream and include actionable steps to make your vision a reality. No matter where you are with your investing career, a detailed business plan can guide your future in more ways than one. After all, a thorough plan will anticipate the best path to success. Follow the template above as you plan your real estate business, and make sure it’s a good one.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

NAR Settlement: What It Means For Buyers And Sellers

What is the assessed value of a property, what is bright mls a guide for agents and investors, how to pass a 4 point home inspection, defeasance clause in real estate explained, what is the federal funds rate a guide for real estate investors.

Real Estate Investment Business Plan Template

Written by Dave Lavinsky

Real Estate Investment Business Plan

Over the past 20+ years, we have helped over 5,000 entrepreneurs and business owners create business plans to start and grow their real estate businesses. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a real estate investing business plan step-by-step so you can create your plan today.

Download our Ultimate Real Estate Investment Business Plan Template here >

What is a Real Estate Business Plan?

A successful business plan provides a snapshot of your real estate business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why Successful Real Estate Investors Use a Business Plan

If you’re looking to start a real estate business or grow your existing business you need a business plan. A solid business plan will help guide your business strategy, your investment strategy and your decision-making. Having a comprehensive business plan is crucial for several reasons:

- To Secure Financing : Most lenders and investors want to see a well-reasoned business plan before they consider funding your real estate venture. Your plan should convince them that you fully understand your market, have a viable strategy and have a management team that can execute. These factors in your plan give investors the confidence that they’ll receive an adequate return on their investment, and make lenders feel that you’ll be able to pay their loan back with interest.

- To Identify Business Goals and Objectives : A business plan helps you to clearly define what you want to achieve with your real estate business over the next five years. These objectives include financial goals, such as revenue targets, or operational goals, such as property acquisition rates.

- To Understand the Market : Conducting market research and including this in your business plan gives you a deeper understanding of the real estate market you’re entering, including potential challenges and real estate investment opportunities. This knowledge helps you craft better marketing, operational, financial and strategic decisions.

- To Plan for Growth : Your business plan should outline the milestones you expect to achieve over the coming months and years. This helps keep you and your team focused and less prone to become distracted with new opportunities that may push you in the wrong direction.

- To Manage Risk : By identifying potential risks in your business plan, you can devise strategies to mitigate them. This proactive approach can save your business from potential pitfalls in the future.

In summary, developing a strategic business plan is a key step for real estate investors who want to launch or expand their business successfully. Your plan will improve and lay out your strategy and keep you focused so you can flawlessly execute it.

Finish Your Business Plan Today!

How to write a business plan for a real estate investment company.

A detailed real estate investment business plan should include 10 sections as follows:

Executive Summary

Company analysis, industry analysis, customer analysis, competitive analysis, marketing plan, operations plan, management team, financial plan.

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of real estate investing business you are operating and the status; for example, are you a startup, do you have a business that you would like to grow, or are you operating a chain of real estate investment companies?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the real estate industry. Discuss the type of real estate investment business you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing strategies. Identify the key team members, and offer an overview of your financial plan.

In your company analysis, you will provide a company description of the real estate investment business you are operating.

For example, you might operate one of the following types: Real estate investment companies do two basic things: invest in real estate and trade in real estate.

- Real estate investment is a long-term investment wherein you purchase real estate with the intent of keeping properties to rent out.

- Real estate trading is a short-term investment, wherein you buy a property that needs fixing up and flip it for a higher price soon after.

In addition to explaining the type of real estate investment company you operate, the Company Analysis section of your real estate business plan needs to provide background on the business. Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new store openings, etc.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

In your industry analysis, you need to provide an overview of the real estate investing business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the real estate investment industry educates you. It helps you understand the target market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, if there was a trend towards increasing foreclosures in a particular city, it would be helpful to ensure your plan calls for an increased focus in this real estate market.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your real estate investing business plan:

- How big is the real estate investment industry (in dollars)?

- Is the real estate market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the target market for your real estate investment business. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

The customer analysis section of your real estate investing business plan must detail the customers you serve and/or expect to serve. The following are examples of customer segments: mortgage holders, home buyers, renters, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of real estate investment business you operate. Clearly first-time home buyers would want different pricing and product options, and would respond to different marketing efforts than banks.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most real estate investment businesses primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Real Estate Investment Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Real Estate Investment Business Plan Template you can finish your plan in just 8 hours or less!

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other real estate investment businesses.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes property management companies, realtors, and DIY home fixer-uppers. You need to mention such competition to show you understand that not everyone who purchases or leases real estate uses a real estate investment business to do so.

With regards to direct competition, you want to detail the other real estate investment businesses with which you compete. Most likely, your direct competitors will be real estate investment businesses located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What products do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your competitive advantages. For example:

- Will you specialize in a particular real estate type or market?

- Will you provide services that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your real estate?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a real estate investing business, your marketing plan should include the following:

Product : in the product section you should reiterate the type of real estate investment company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, will you offer residential properties, or commercial properties?

Price : Document the prices you will offer and how they compare to your competitors. In this section, you are presenting the types of real estate you offer and the current price ranges.

Place : Place refers to the location of your business. Document your location and mention how the location will impact your success. For example, is your real estate investment business located in a market with a high foreclosure rate, or with a low inventory of office space. Discuss how your location might provide a steady stream of customers.

Promotions : Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Social media advertising

- Local radio advertising

- Banner ads at local venues

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your real estate investment business such as finding properties to acquire, marketing completed properties, overseeing renovations, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to flip your 25th house, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch in a new market.

While the earlier sections of your real estate business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your real estate investment business, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt. For example, let’s say you signed a commercial tenant that needs an extensive build out, that would cost you $50,000 to complete. Well, in most cases, you would have to pay that $50,000 now for materials, equipment rentals, employee salaries, etc. But rent will not cover build-out costs for 180 days. During that 180 day period, you could run out of money.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a real estate investment business:

- Location build-out including design fees, construction, etc.

- Renovation costs

- Cost of depreciation

- Payroll or salaries paid to staff

- Business insurance

- Property management software

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your store design blueprint or location lease.

Free Business Plan Template for Real Estate Investors

You can download our real estate investment business plan PDF template here.

Real Estate Investment Business Plan Summary

Putting together a business plan for your real estate investment company will improve your company’s chances of success. The process of developing your plan will help you better understand the real estate investment market, your competition, and your customers. You will also gain a marketing plan to better attract and serve customers, an operations plan to focus your efforts, and financial projections that give you goals to strive for and keep your company focused.

Growthink’s Ultimate Real Estate Business Plan Template is the quickest and easiest way to complete a business plan for your real estate investing business.

Additional Resources For Starting a Real Estate Investment Business

- How To Find Investment Opportunities

- Estimating Rehab Costs for Real Estate Investors

- How To Become a Real Estate Investor

- How To Start a Real Estate Investment Business

- Real Estate Investor Marketing Strategies

Don’t you wish there was a faster, easier way to finish your Real Estate Investment business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

How to Write a Real Estate Investment Business Plan: Complete Guide

- Tweet Share Share

Last updated on December 19, 2023

Building an investing business without a real estate investment business plan is sort of like riding a bike without handlebars.

You might be able to do it… but why would you?

It’s far easier and more practical to set out on your venture with a business plan that outlines things like your lead-flow, where you’ll find funding, and which market(s) you’ll operate.

Plus, according to Entrepreneur, having a business plan increases your chances of growth by 30%.

Download Now: Free marketing plan video and a downloadable guide

So don’t skip this critical first step.

Here’s how to do it.

Real Estate Investment Business Plan Guide

In this article we’re going to discuss:

- What is a real estate investment business plan?

- Create your mission and vision

- Run market analysis

- Choose your business model(s)

- Determine your business goals

- Find funding / Cash buyers

- Identify lead-flow source

- Gather property analysis information

- Create your brand

- Set growth milestones

- Plan to Delegate

What is a Real Estate Investment Business Plan and Why Does it Matter?

A real estate investment business plan is a document that outlines your goals, your vision, and your plan for growing the business .

It should detail the real estate business model you’re going to pursue, your chosen method for lead-gen, how you’ll find funding, and how you plan to close deals.

The kit and caboodle.

It shouldn’t be overly complicated.

Whether this real estate investment business plan is only for your personal use or to present to someone else, simplicity is best. Be thorough, be clear, but don’t over-explain what you’re going to do.

As far as why you should have a business plan, consider that it gives you a 30% better chance of growing your business.

Also, consider that setting out without a plan would be like — full of unexpected twists and turns — is that something you want to do?

Probably not.

It’s worth taking a few days or weeks to put together a business plan, even if it’s just for your own sake. By the time you’re complete, you’ll have greater confidence in the business you’re setting out to build.

And an entrepreneur’s confidence is everything.

How to Create Your Real Estate Investment Business Plan

Now we get into the nitty-gritty.

How do you create your real estate investment business plan? Here are the 10 steps!

1. Create Your Mission & Vision

This can be considered your “summary” section. You might not think that you need a mission statement or vision for your real estate business.

And you don’t.

We know a lot of real estate investors (many of our members, in fact) don’t have a clear mission or vision that they’ve outlined — and they’re successful regardless.

But if you’re just getting started…

Then we think it’s a worthwhile use of your time.

Because if you don’t know why you’re going to build your real estate investing business, if you don’t see what purpose it serves on a personal and professional level, then it’s not going to be very exciting to you.

You can either use this time to create a mission for your business… or a mission statement for you as it relates to growing your business (depending on your goals).

For instance…

- Our mission is to create affordable house opportunities in the Roseburg, Oregon community.

- Our mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Or you could go a more personal route…

- My mission is to create a business that supports my family.

- My mission is to build a company that gives me more time for what matters most to me.

Or you could do both…

- My mission is to create a business that supports my family, and my business’ mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Either way, it’s good to think about this before getting started.

Because if you know why you’re going to build your business — and if, ideally, that reason resonates with you — then you’ll be more excited and determined to work hard toward your goals.

It is also an excellent opportunity to outline the core values you’ll adhere to within your business as Brian Rockwell does on his website …

With this information in hand, you’re ready to move on to the next step.

2. Run Competitive Market Analysis

Which market are you going to operate in?

That might be an easy question to answer — if you’re just going to operate in the town where you live, fair enough.

But it’s worth keeping in mind that today’s technology has made it possible to become a real estate investor in any market from pretty much any location (remotely).

So if the market you’re in is lacking in opportunity, then you might consider investing elsewhere.

How do you know which market to choose?

Here are the 10 top real estate markets for investors, according to our own Carrot member data of over 7000 accounts, based on lead volume…

- Atlanta, GA

- Houston, TX

- Chicago, IL

- Charlotte, NC

- New York, NY

- Los Angeles, CA

- Orlando, FL

- Philadelphia, PA

- Phoenix, AZ

And here are the top 20 states…

- North Carolina

- Pennsylvania

- Oregon

That’ll give you some ideas.

But what makes a market good or bad for real estate investors? Here are some metrics to pay attention to when you’re doing your research.

- Median Home Value — This will tell you how much the average home sells for in the market, which will impact whether you’ll be willing to operate there. Because obviously, you want to play with numbers that feel reasonable to you.

- Median Home Value Increase Year Over Year — Ideally, you want to invest in a market where homes are appreciating every year. And a positive increase in this metric is a good sign that the properties you invest in will continue to increase in value.

- Occupied Housing Rate — A high housing occupancy rate means it’s easy to find tenants, and there’s a healthy demand for housing. That’s a good sign.

- Median Rent — This is the average cost of rent in the market and will give you a good idea of how much you’ll be able to charge on any rentals you own.

- Median Rent Increase Year Over Year — If you’re going to buy rentals, it’s a good sign if rental costs increase every year.

- Population Growth — When the population grows, it creates demand for housing, both rentals and on the MLS. That’s a good sign for a real estate investor.

- Job Growth — Job growth is a sign of a healthy economy and indicates that you’ll have an easier time capitalizing on your real estate investments.

Fortunately, all of this research is super easy to do on Google.

You can just type in the market and the metric in Google and you’ll get meaningful results.

Thank god for technology.

Want more freedom & impact?

From Mindset to Marketing, join our CEO as he unlocks the best stories, tactics, and strategies from America’s top investors and agents on the CarrotCast . If you want to grow your business, you need to check it out!

3. Choose Your Business Model(s)

There’s not just one real estate business model .

There are many.

And the market you’re in — as well as your business goals — will determine which business model you choose.

Here’s a brief overview of each…

- Wholesaling — Is a prevalent business model in the real estate world. Wholesalers find deals and flip them to other cash buyers for an assignment fee, typically somewhere between $5,000 to $10,000. It’s low risk and requires little capital upfront (you can get started with as little as $2,000).

- Wholetailing — Wholetailing is a mix between wholesaling and house flipping. A wholetailer will find a deal, do some very minor repairs (if any), and sell the house on the MLS themselves. It results in large profits with far less work. But wholetail deals are hard to come by.

- BRRRR — This stands for Buy, Rehab, Rent, Refinance, Repeat. It’s a long-term process for buying and holding rental properties. It’s a great way to build net worth and create generational wealth.

- Flipping — House flipping is the most popularized real estate investing method. It consists of purchasing distressed properties, fixing them up, and selling them at a good profit on the MLS, often making upwards of $100,000 per deal. However, this method involves much more risk than the other methods and each deal takes a lot longer to complete.

If you’re just getting started, then we recommend choosing just one business model and doing that until you’ve mastered it.

Down the road, you will likely want to use multiple business models.

We know the most successful real estate investors are wholesalers, wholesalers, flippers, and they own some rental properties.

That allows them to make the most of every opportunity that comes their way.

But again… to start, just choose one.

4. Determine Your Business Goals

At this point, you should have a pretty clear idea of why you’re going to build your real estate investing business.

Are you going to build it because you want to make an impact in your community? Because you want more financial freedom? Because you want more time freedom?

All of the above?

Whatever the case, now it’s time to set some goals related to your mission for the business.

Remember the SMART acronym for goal setting…

Start by thinking about how much money you’d like to make per month — this should be the first income threshold that you’re excited to hit.

Let’s pretend you said $10,000 per month.

Okay, now take a look at your business model. How many properties do you need to have cash-flowing to hit that number? How many deals do you have to do per month? How many flips?

Try to be as realistic with your numbers as possible.

Here are some baselines to consider for the different business models at the $10k/month threshold…

- Wholesaling – 2-3 Deals Per Month

- Wholetailing – 2-3 Deals Per Month

- BRRRR – $1 Million in Assets

- Flipping – 1-2 Flips Per Year

Now you have a general idea of the results you’ll need to hit your first income threshold.

But we haven’t talked about overhead costs.

How much will you need to spend to get those results?

Your answer to that question will be influenced by the market analysis you already did. But it’s pretty standard for the price of finding a deal to hover around $2,000 for a real estate investor (if you’re doing your own advertising).

So now you’re spending $2,000 per deal, or whatever your specific number is. That’s going to have an impact on how much money you’re making. So now we can adjust your goals to be more realistic for hitting that $10k per month marker…

- Wholesaling – 4-5 Deals Per Month

- Wholetailing – 4-5 Deals Per Month

- BRRRR – $1.5 Million in Assets

- Flipping – 2-3 Flips Per Year

The idea here is to figure out how many deals you’ll have to do per month to hit your income goals.

Then work that back into figuring out how much you’ll need to spend every month to realistically and predictably hit your goals.

At $2k per deal and intending to hit $10k/month, here’s what your deal-finding costs might look like…

- Wholesaling – 4-5 Deals Per Month – $8k-$10k/month

- Wholetailing – 4-5 Deals Per Month – $8k-$10k/month

- BRRRR – $1.5 Million in Assets – $6k-$8k/month

- Flipping – 2-3 Flips Per Year – $4k-$6k/month

That should give you a baseline.

How do those numbers look?

If they feel too high for you right now, lower your initial goal — you want to make your first goal something that you know you can accomplish.

Then, as you gain experience, you can increase your goals and make more money down the road.

Free Real Estate Marketing Plan Template

Take our short survey to find out where you struggle most with your online marketing strategy. Generate your free marketing plan video and downloadable guide to increase lead generation and conversion, gain momentum, and stand out in your market:

Download your marketing plan template here.

5. Find Funding / Cash Buyers

Are you going to fund your own deals or find private investors ? Or maybe you’re going to get a business loan from a bank?

If you’re just starting as a wholesaler or wholetailer, then it’s recommended funding your own first few deals — that should only cost $2,000 to $5,000… and why overcomplicate things in the beginning when you’re still trying to learn the ropes?

However, as a wholesaler or wholetailer, you’ll still need to find some cash buyers.

Here’s a great video that’ll teach you how to do that…

To consistently grow your cash buyer list (which is an important part of the wholesaling and wholestailing business model), we also recommend creating a buyer website like this…

Learn more about creating your cash buyer website with Carrot over here .

To scale, you might seek out other sources of funding.

Here are some options…

- Bank Loan — Getting a loan from a bank might be the most straightforward strategy if you’re just getting started. But keep in mind that the requirements for a loan on an investment property will be more stringent than the requirements were for your primary residence mortgage. And the interest rate will likely be higher as well. For that reason, you might seek out some of the other options.

- Hard Money — Hard money loans come from companies that specifically serve real estate investors. They are easier and faster to secure than a bank loan and hard money lenders typically base their approval of the loan on the quality of the investment property rather than the investor’s financial standing.

- Private Money — Whereas a hard money loan comes from a company; a private money loan comes from an individual with a good chunk of capital they’re looking to invest. That could be a friend, family member, coworker, and acquaintance. Interest rates and terms on these loans are typically very flexible and the interest rate is usually quite good. Private money is an excellent option for real estate investors looking to scale their business.

But before you seek out funding from those sources, get clear on what exactly you’re going to use those funds for.

Finding funding is even more critical. In fact — if you’re flipping properties or using the BRRRR method.

(It’s a key part of the BRRRR method)

You’ll likely want to use hard money or private money to fund your deals as you grow your business.

But how do you find and secure those loans?

Hard money lenders are easy to find — just Google for hard money lenders in your area and call the companies that pop up to get more details.

Private money (which usually has more favorable terms than hard money) is a bit trickier to find but not at all impossible.

To find private money lenders, you can…

- Tell Friends & Family — This should be the first thing you do. Tell everyone you can about the business you’re building and the returns you can offer investors. Then ask them if they know anyone who might be interested in investing.

- Network — After you’ve exhausted all your friends and family, make a point of getting to know people everywhere you go. The easiest way to do this is to wear branded clothing so people ask about what you do. Talk to people at coffee shops, grocery stores, movie theaters, and anywhere else that you frequent. You never know who you might meet.

- Attend Foreclosure Auctions — Foreclosure auctions are jam-packed with people who have cash-on-hand to buy properties. These people might also be interested in investing in your real estate endeavors. Or they might know where to find private money. Either way, it’s in your interest to build relationships with these people. Attend foreclosure auctions and bring some business cards.

Here are some tips on finding private money lenders…

6. Identify Lead-Flow Source

Now let’s talk about how you will generate a consistent flow of motivated leads for your business.

Because no matter which of the business models you’ve chosen… you’re going to need to find motivated sellers.

And you’re going to need to find those people every single month.

There are essentially two parts to a successful lead generation strategy for real estate investing business.

Both pieces are critical…

- The Short Term — We call this “hamster-wheel marketing” because it requires you to keep working and spending money to generate leads. Examples include Facebook ads, direct mail, bandit signs, cold calling, driving for dollars, and other tit-for-tat strategies that will burn you out if you’re not careful.

- The Long Term — We call this “evergreen marketing” because it requires an upfront investment… but that investment pays off for years and years to come. Examples include increasing brand awareness for your business in your target market(s) and improving your website’s SEO , so that motivated sellers find you .

Short-term tactics are critical when you’re first starting — in fact, they are likely going to be your only source of leads for at least the first few months.

Here are some more details on the most popular and effective methods…

- Tax default mailing lists

- Vacant house lists

- Expired listing lists

- Pre-foreclosure lists

- Out-of-state landlord lists

- Cold Calling — This might be more uncomfortable than stubbing your toe on a piece of furniture, but it can still be effective for finding motivated sellers. We have an article all about colding calling — it even has scripts for you to use.

- Facebook Ads — Facebook ads is another excellent method for generating leads so long as you have a high-converting website to send them to . If you don’t, get yourself a Carrot website . Each Carrot site is built to convert. Here are some more details about running successful ads on Facebook for your real estate investing business.

- Google Ads — Google Ads is one of the most popular platforms for real estate professionals needing to provide quick results with a minimal to high investment depending on markets.