- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

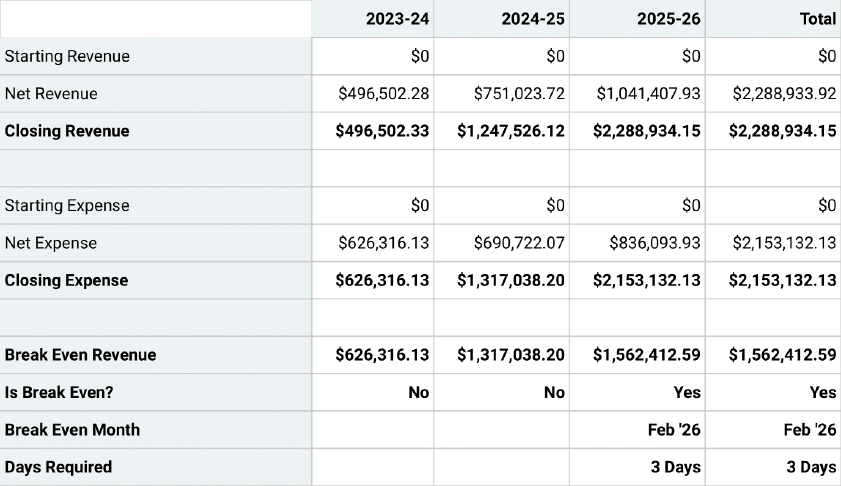

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

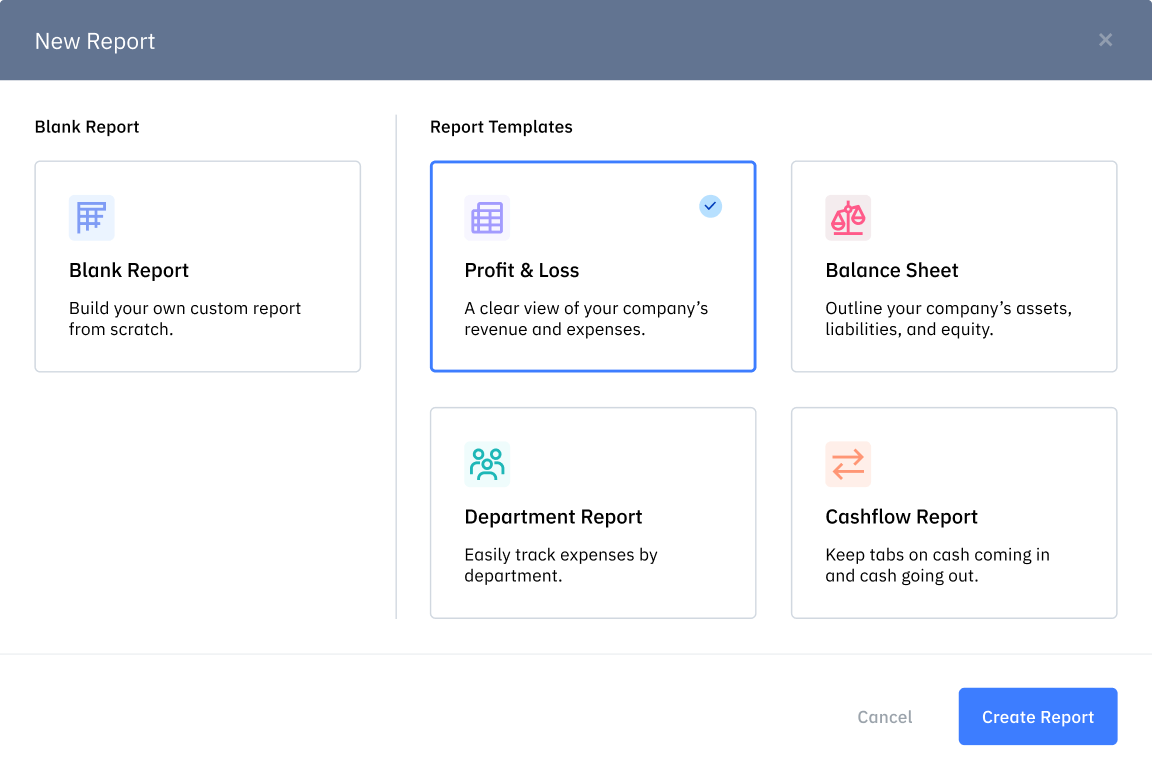

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

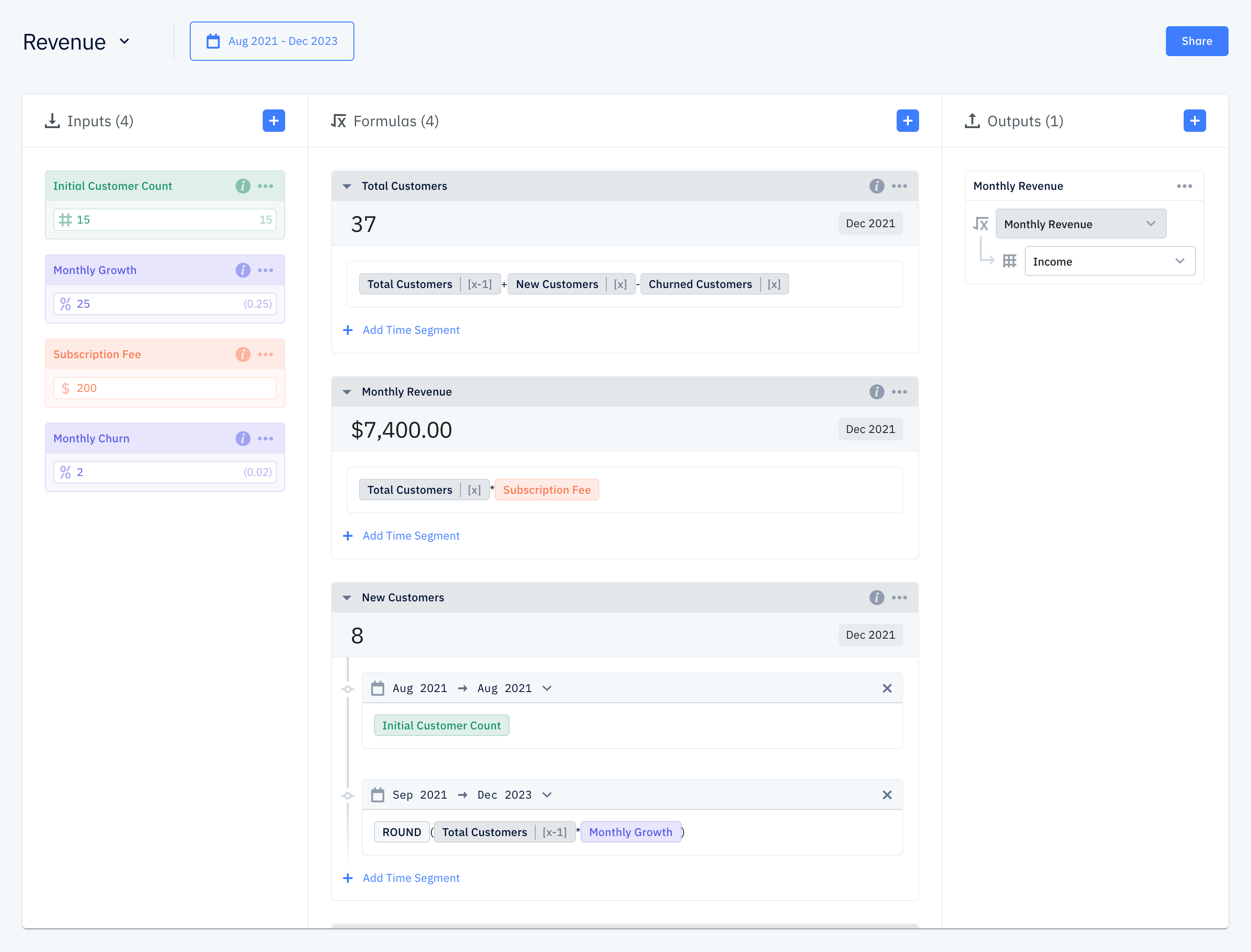

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

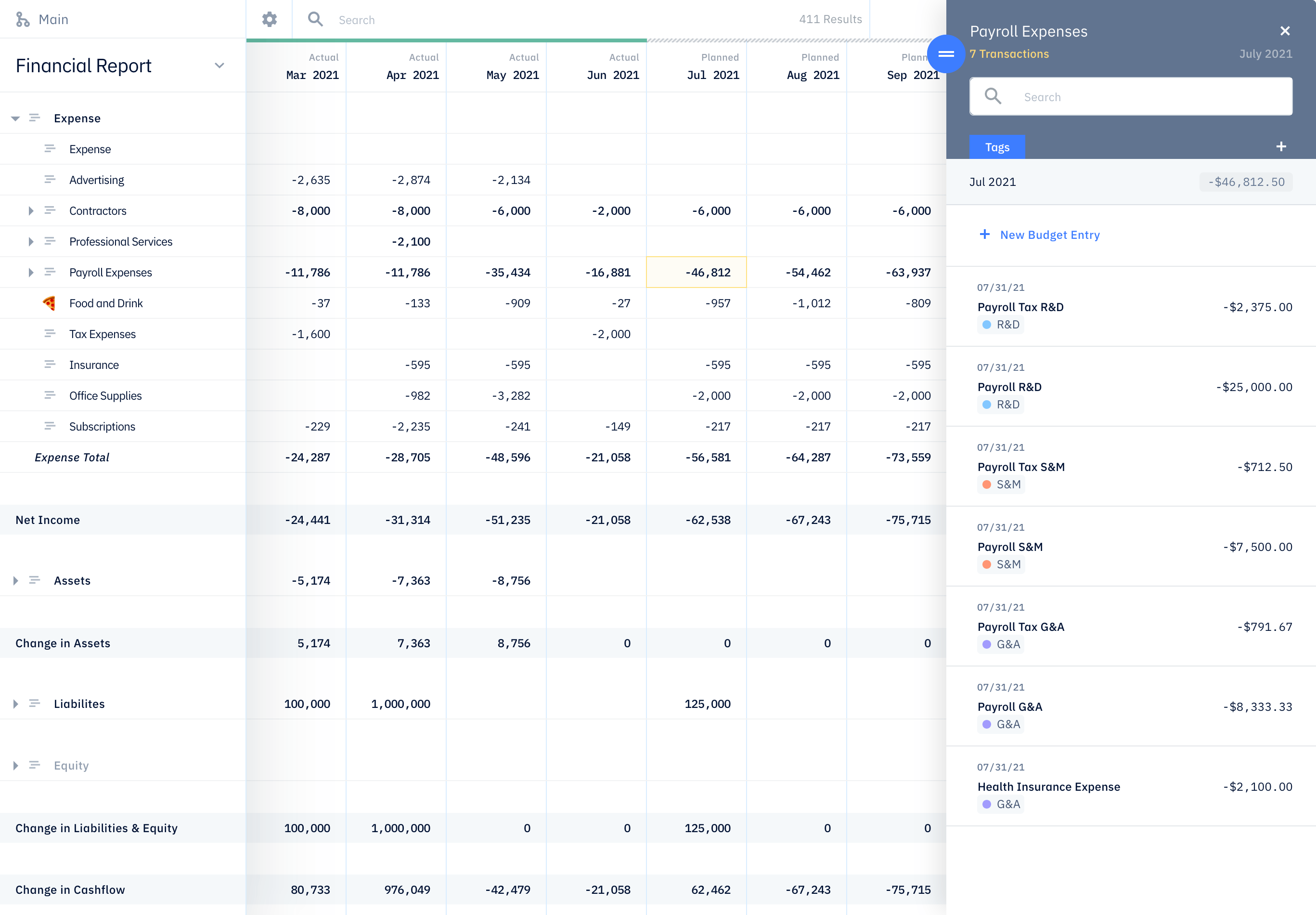

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

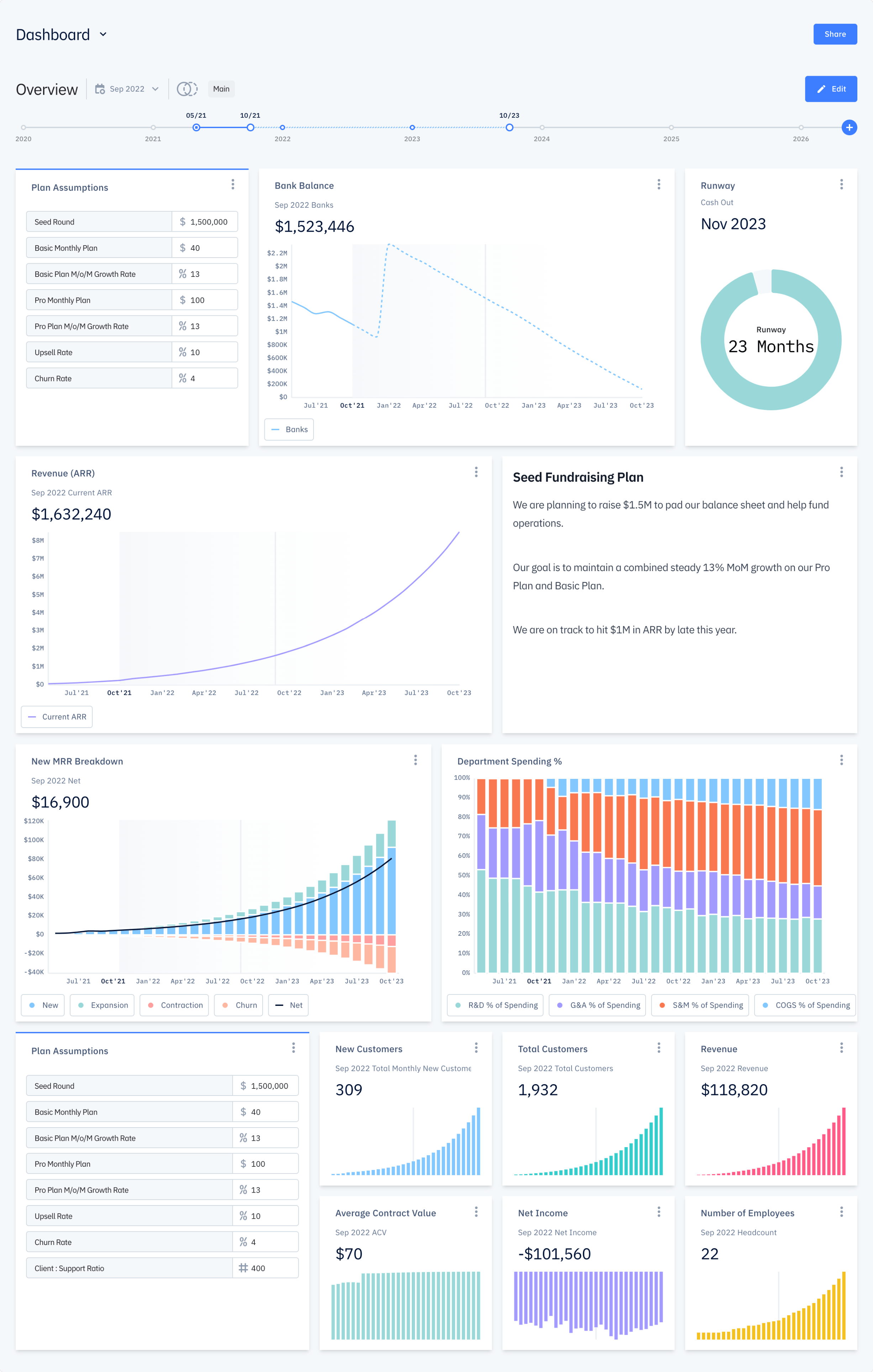

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

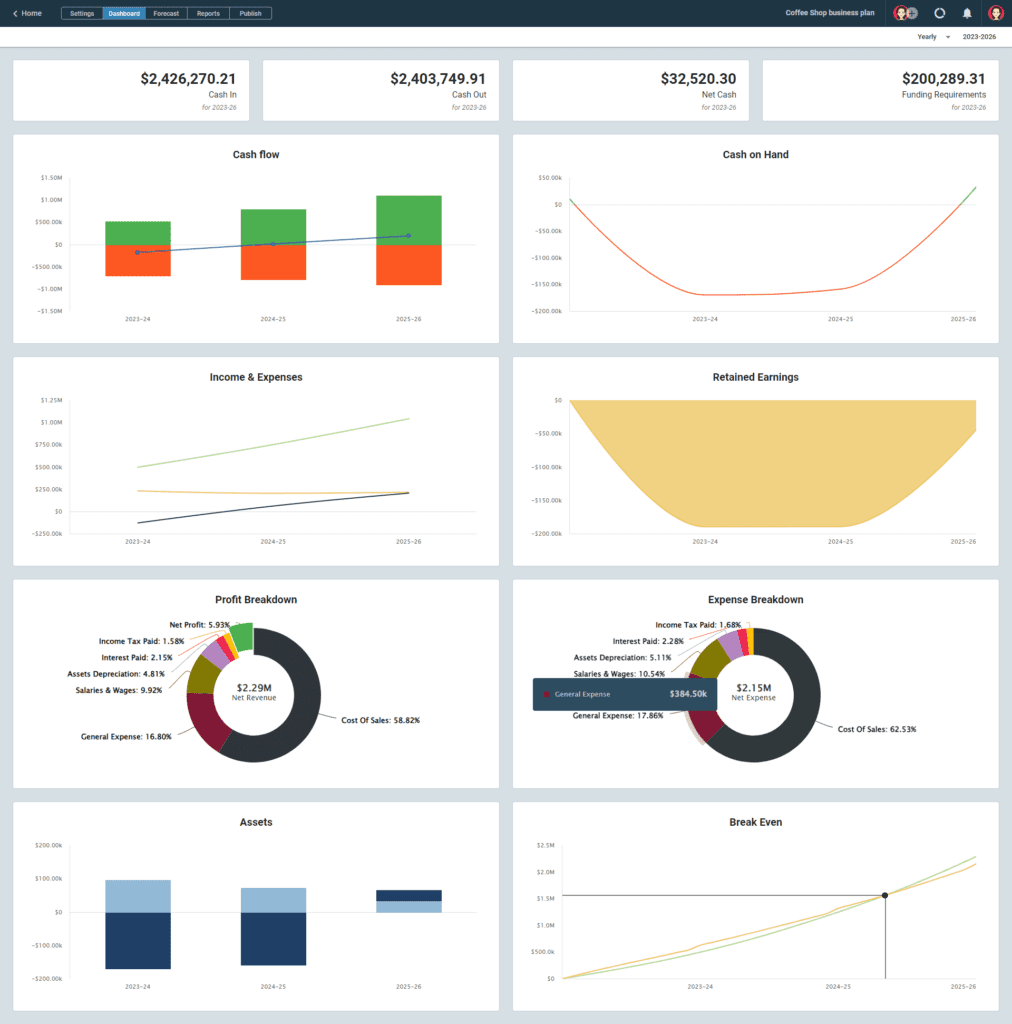

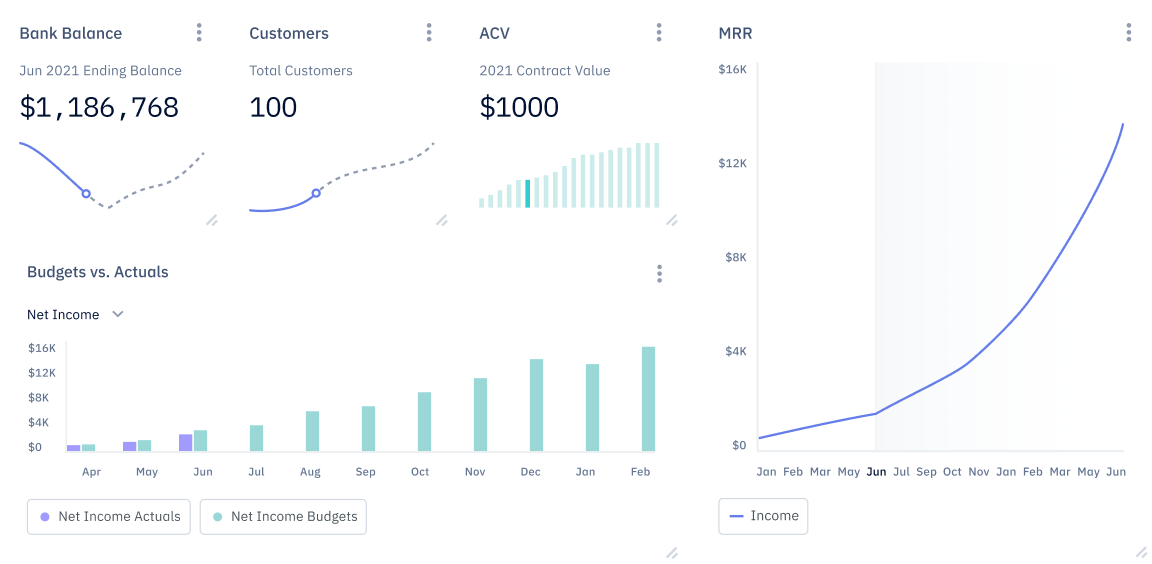

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

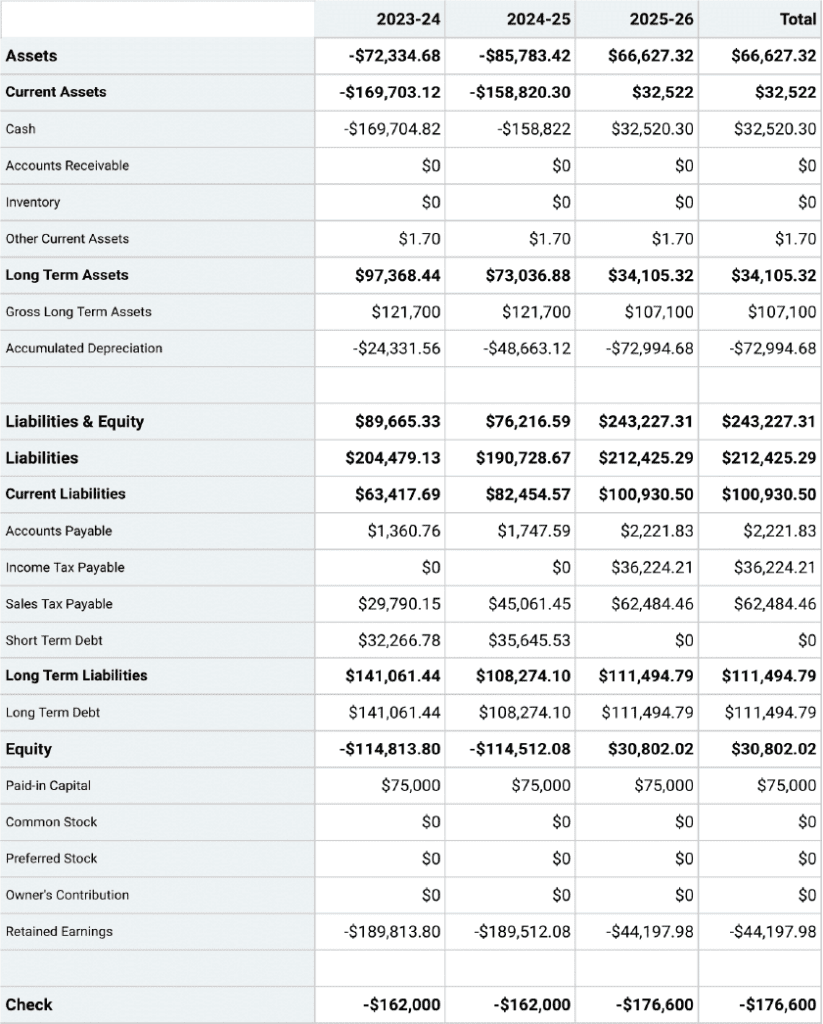

Projected Balance Sheet

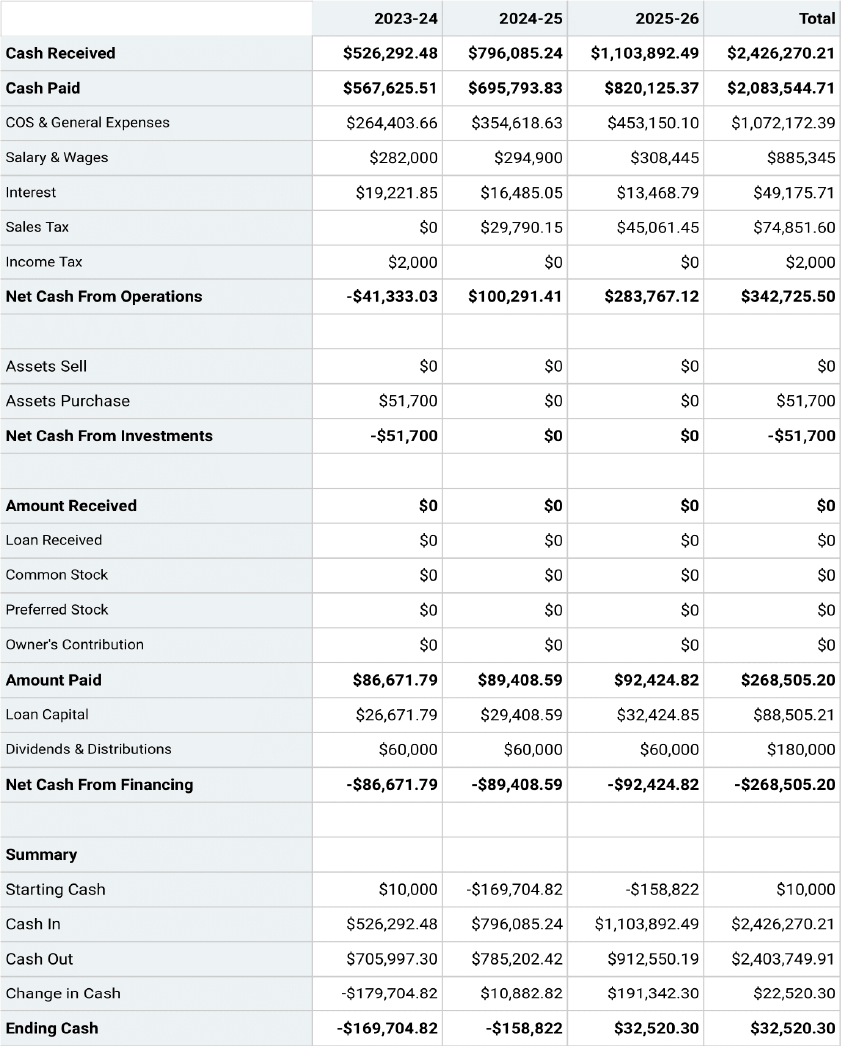

Projected Cash-Flow Statement

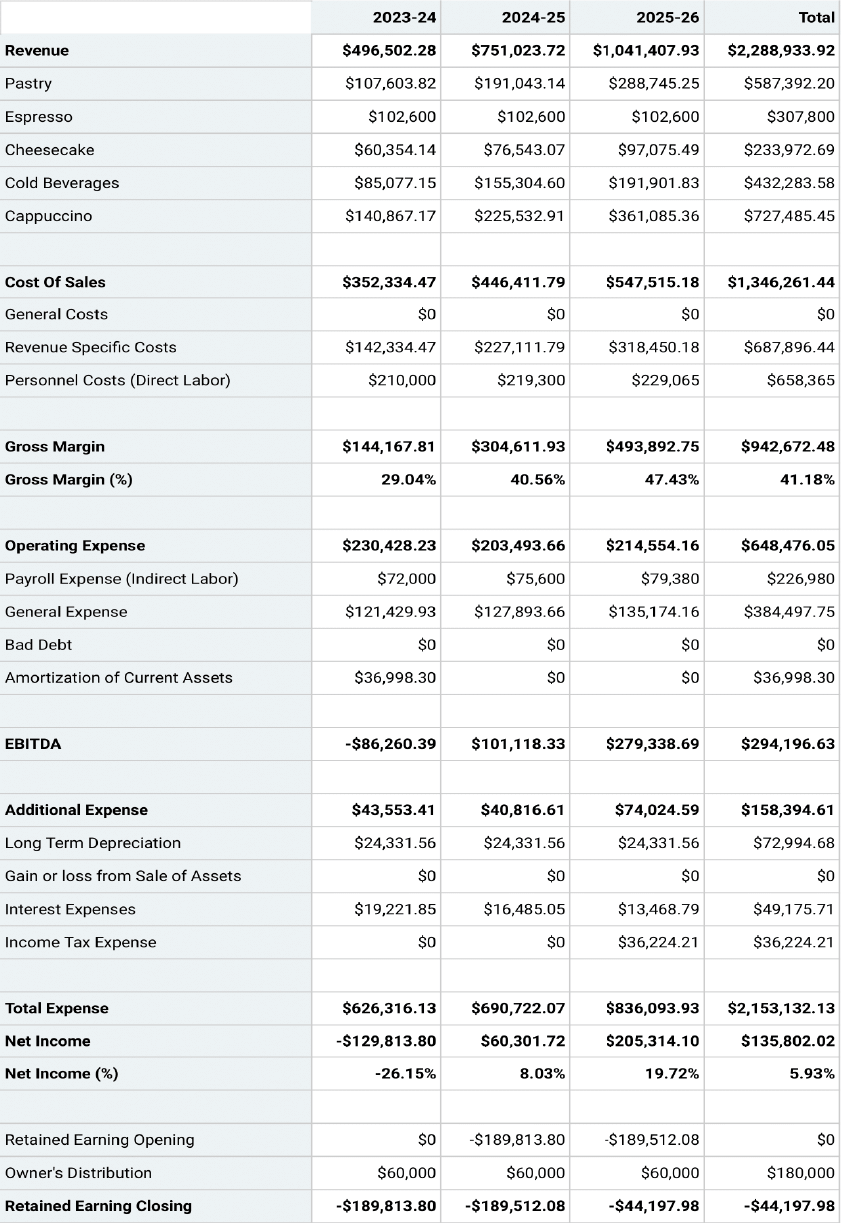

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Simple Business Plan Template for Startups, Small Businesses & Entrepreneurs

Financial plan, what is a financial plan.

A business’ financial plan is the part of your business plan that details how your company will achieve its financial goals. It includes information on your company’s projected income, expenses, and cash flow in the form of a 5-Year Income Statement, Balance Sheet and Cash Flow Statement. The plan should also detail how much funding your company needs and the key uses of these funds.

The financial plan is an important part of the business plan, as it provides a framework for making financial decisions. It can be used to track progress and make adjustments as needed.

Why Your Financial Plan is Important

The financial section of your business plan details the financial implications of running your company. It is important for the following two reasons:

Making Informed Decisions

A financial plan provides a framework for making decisions about how to use your money. It can help you determine whether or not you can afford to make a major purchase, such as a new piece of equipment.

It can also help you decide how much money to reinvest in your business, and how much to save for paying taxes.

A financial plan is like a roadmap for your business. It can help you track your progress and make adjustments as needed. The plan can also help you identify potential problems before they arise.

For example, if your sales are below your projections, you may need to adjust your budget accordingly.

Your financial plan helps you understand how much outside funding is required, when your levels of cash might fall low, and what sales and other goals you need to hit to become financially viable.

Securing Funding

This section of your plan is absolutely critical if you are trying to secure funding. Your financial plan should include information on your revenue, expenses, and cash flow.

This information will help potential investors or lenders understand your business’s financial situation and decide whether or not to provide funding.

Include a detailed description of how you plan to use the funds you are requesting. For example, what are the key uses of the funds (e.g., purchasing equipment, paying staff, etc.) and what are the future timings of these financial outlays.

The financial information in your business plan should be realistic and accurate. Do not overstate your projected revenues or underestimate your expenses. This can lead to problems down the road.

Potential investors and lenders will be very interested in your future projections since it indicates whether you will be able to repay your loans and/or provide a nice return on investment (ROI) upon exit.

Financial Plan Template: 4 Components to Include in Your Financial Plan

The financial section of a business plan should have the following four sub-sections:

Revenue Model

Here you will detail how your company generates revenues. Oftentimes this is very straightforward, for instance, if you sell products. Other times, your answer might be more complex, such as if you’re selling subscriptions (particularly at different price/service levels) or if you are selling multiple products and services.

Financial Overview & Highlights

In developing your financial plan, you need to create full financial forecasts including the following financial statements.

5-Year Income Statement / Profit and Loss Statement

An income statement, also known as a profit and loss statement (P&L), shows how much revenue your business has generated over a specific period of time, and how much of that revenue has turned into profits. The statement includes your company’s revenues and expenses for a given time period, such as a month, quarter, or year. It can also show your company’s net income, which is the amount of money your company has made after all expenses have been paid.

5-Year Balance Sheet

A balance sheet shows a company’s financial position at a specific point in time. The balance sheet lists a company’s assets (what it owns), its liabilities (what it owes), and its equity (the difference between its assets and its liabilities).

The balance sheet is important because it shows a company’s financial health at a specific point in time. A strong balance sheet indicates that a company has the resources it needs to grow and expand. A weak balance sheet, on the other hand, may indicate that a company is struggling to pay its bills and may be at risk of bankruptcy.

5-Year Cash Flow Statement

A cash flow statement shows how much cash a company has on hand, as well as how much cash it is generating (or losing) over a specific period of time. The statement includes both operating and non-operating activities, such as revenue from sales, expenses, investing activities, and financing activities.

While your full financial projections will go in your Appendix, highlights of your financial projections will go in the Financial Plan section.

These highlights include your Total Revenue, Direct Expenses, Gross Profit, Other Expenses, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), and Net Income projections. Also include key assumptions used in creating these future projections such as revenue and cost growth rates.

Funding Requirements/Use of Funds

In this section, you will detail how much outside funding you require, if any, and the core uses of these funds.

For example, detail how much of the funding you need for:

- Product Development

- Product Manufacturing

- Rent or Office/Building Build-Out

Exit Strategy

If you are seeking equity capital, you need to explain your “exit strategy” here or how investors will “cash out” from their investment.

To add credibility to your exit strategy, conduct market research. Specifically, find other companies in your market who have exited in the past few years. Mention how they exited and the amounts of the exit (e.g., XYZ Corp. bought ABC Corp. for $Y).

Business Plan Financial Plan FAQs

What is a financial plan template.

A financial plan template is a pre-formatted spreadsheet that you can use to create your own financial plan. The financial plan template includes formulas that will automatically calculate your revenue, expenses, and cash flow projections.

How Can I Download a Financial Plan Template?

Download Growthink’s Ultimate Business Plan Template which includes a complete financial plan template and more to help you write a solid business plan in hours.

How Do You Make Realistic Assumptions in Your Business Plan?

When forecasting your company’s future, you need to make realistic assumptions. Conduct market research and speak with industry experts to get a better idea of the key trends affecting your business and realistic growth rates.

You should also use historical data to help inform your projections. For example, if you are launching a new product, use past sales data to estimate how many units you might sell in Year 1, Year 2, etc.

Learn more about how to make the appropriate financial assumptions for your business plan.

How Do You Make the Proper Financial Projections for Your Business Plan?

Your business plan’s financial projections should be based on your business model and your market research. The goal is to make as realistic and achievable projections as possible.

To create a good financial projection, you need to understand your revenue model and your target market. Once you have this information, you can develop assumptions around revenue growth, cost of goods sold, margins, expenses, and other key metrics.

Once you have your assumptions set, you can plug them into a financial model to generate your projections.

Learn more about how to make the proper financial projections for your business plan.

What Financials Should Be Included in a Business Plan?

There are a few key financials that should be included in a traditional business plan format. These include the Income Statement, Balance Sheet, and Cash Flow Statement.

Income Statements, also called Profit and Loss Statements, will show your company’s expected income and expense projections over a specific period of time (usually 1 year, 3 years, or 5 years). Balance Sheets will show your company’s assets, liabilities, and equity at a specific point in time. Cash Flow Statements will show how much cash your company has generated and used over a specific period of time.

Growthink's Ultimate Business Plan Template includes a complete financial plan template to easily create these financial statements and more so you can write a great business plan in hours.

BUSINESS PLAN TEMPLATE OUTLINE

- Business Plan Template Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

- 10. Appendix

- Business Plan Summary

Other Helpful Business Planning Articles & Templates

4 Steps to Creating a Financial Plan for Your Small Business

When it comes to long-term business success, preparation is the name of the game. And the key to that preparation is a solid financial plan that sets forth a business’s short- and long-term financial goals and how it intends to reach them. Used by company decision-makers and potential partners, investors and lenders, alike, a financial plan typically includes the company’s sales forecast, cash flow projection, expected expenses, key financial metrics and more. Here is what small businesses should understand to create a comprehensive financial plan of their own.

What Is a Financial Plan?

A financial plan is a document that businesses use to detail and manage their finances, ensure efficient allocation of resources and inform a plethora of decisions — everything from setting prices, to expanding the business, to optimizing operations, to name just a few. The financial plan provides a clear understanding of the company’s current financial standing; outlines its strategies, goals and projections; makes clear whether an idea is sustainable and worthy of investment; and monitors the business’s financial health as it grows and matures. Financial plans can be adjusted over time as forecasts become replaced with real-world results and market forces change.

A financial plan is an integral part of an overall business plan, ensuring financial objectives align with overall business goals. It typically contains a description of the business, financial statements, personnel plan, risk analysis and relevant key performance indicators (KPIs) and ratios. By providing a comprehensive view of the company’s finances and future goals, financial plans also assist in attracting investors and other sources of funding.

Key Takeaways

- A financial plan details a business’s current standing and helps business leaders make informed decisions about future endeavors and strategies.

- A financial plan includes three major financial statements: the income statement, balance sheet and cash flow statement.

- A financial plan answers essential questions and helps track progress toward goals.

- Financial management software gives decision-makers the tools they need to make strategic decisions.

Why Is a Financial Plan Important to Your Small Business?

A financial plan can provide small businesses with greater confidence in their short- and long-term endeavors by helping them determine ways to best allocate and invest their resources. The process of creating the plan forces businesses to think through how different decisions could impact revenue and which occasions call for dipping into reserve funds. It’s also a helpful tool for monitoring performance, managing cash flow and tracking financial metrics.

Simply put, a financial plan shows where the business stands; over time, its analysis will reveal whether its investments were worthwhile and worth repeating. In addition, when a business is courting potential partners, investors and lenders, the financial plan spotlights the business’s commitment to spending wisely and meeting its financial obligations.

Benefits of a Financial Plan

A financial plan is only as effective as the data foundation it’s built on and the business’s flexibility to revisit it amid changing market forces and demand shifts. Done correctly, a financial plan helps small businesses stay on track so they can reach their short-term and long-term goals. Among the benefits that effective financial planning delivers:

- A clear view of goals and objectives: As with any type of business plan, it’s imperative that everyone in a company is on the same financial page. With clear responsibilities and expected results mapped out, every team member from the top down sees what needs to be done, when to do it and why.

- More accurate budgets and projections: A comprehensive financial plan leads to realistic budgets that allocate resources appropriately and plan for future revenue and expenses. Financial projections also help small businesses lay out steps to maintain business continuity during periods of cash flow volatility or market uncertainty.

- External funding opportunities: With a detailed financial plan in hand, potential partners, lenders and investors can see exactly where their money will go and how it will be used. The inclusion of stellar financial records, including past and current liabilities, can also assure external funding sources that they will be repaid.

- Performance monitoring and course correction: Small businesses can continue to benefit from their financial plans long after the plan has been created. By continuously monitoring results and comparing them with initial projections, businesses have the opportunity to adjust their plans as needed.

Components of a Small Business Financial Plan

A sound financial plan is instrumental to the success and stability of a small business. Whether the business is starting from scratch or modifying its plan, the best financial plans include the following elements:

Income statement: The income statement reports the business’s net profit or loss over a specific period of time, such a month, quarter or year. Also known as a profit-and-loss statement (P&L) or pro forma income statement, the income statement includes the following elements:

- Cost of goods sold (COGS): The direct costs involved in producing goods or services.

- Operating expenses: Rent, utilities and other costs involved in running the business.

- Revenue streams: Usually in the form of sales and subscription services, among other sources.

- Total net profit or loss: Derived from the total amount of sales less expenses and taxes.

Balance sheet: The balance sheet reports the business’s current financial standing, focusing on what it owns, what it owes and shareholder equity:

- Assets: Available cash, goods and other owned resources.

- Liabilities: Amounts owed to suppliers, personnel, landlords, creditors, etc.

Shareholder equity: Measures the company’s net worth, calculated with this formula:

Shareholder Equity = Assets – Liability

The balance sheet lists assets, liabilities and equity in chart format, with assets in the left column and liabilities and equity on the right. When complete — and as the name implies —the two sides should balance out to zero, as shown on the sample balance sheet below. The balance sheet is used with other financial statements to calculate business financial ratios (discussed soon).

Balance Sheet

Cash flow projection: Cash flow projection is a part of the cash flow statement , which is perhaps one of the most critical aspects of a financial plan. After all, businesses run on cash. The cash flow statement documents how much cash came in and went out of the business during a specific time period. This reveals its liquidity, meaning how much cash it has on hand. The cash flow projection should display how much cash a business currently has, where it’s going, where future cash will come from and a schedule for each activity.

Personnel plan: A business needs the right people to meet its goals and maintain a healthy cash flow. A personnel plan looks at existing positions, helps determine when it’s time to bring on more team members and determines whether new hires should be full-time, part-time or work on a contractual basis. It also examines compensation levels, including benefits, and forecasts those costs against potential business growth to gauge whether the potential benefits of new hires justify the expense.

Business ratios: In addition to a big-picture view of the business, decision-makers will need to drill down to specific aspects of the business to understand how individual areas are performing. Business ratios , such as net profit margin, return on equity, accounts payable turnover, assets to sales, working capital and total debt to total assets, help evaluate the business’s financial health. Data used to calculate these ratios come from the P&L statement, balance sheet and cash flow statement. Business ratios contextualize financial data — for example, net profit margin shows the profitability of a company’s operations in relation to its revenue. They are often used to help request funding from a bank or investor, as well.

Sales forecast: How much will you sell in a specific period? A sales forecast needs to be an ongoing part of any planning process since it helps predict cash flow and the organization’s overall health. A forecast needs to be consistent with the sales number within your P&L statement. Organizing and segmenting your sales forecast will depend on how thoroughly you want to track sales and the business you have. For example, if you own a hotel and giftshop, you may want to track separately sales from guests staying the night and sales from the shop.

Cash flow projection: Perhaps one of the most critical aspects of your financial plan is your cash flow statement . Your business runs on cash. Understanding how much cash is coming in and when to expect it shows the difference between your profit and cash position. It should display how much cash you have now, where it’s going, where it will come from and a schedule for each activity.

Income projections: Businesses can use their sales forecasts to estimate how much money they are on track to make in a given period, usually a year. This income projection is calculated by subtracting anticipated expenses from revenue. In some cases, the income projection is rolled into the P&L statement.

Assets and liabilities: Assets and liabilities appear on the business’s balance sheet. Assets are what a company owns and are typically divided into current and long-term assets. Current assets can be converted into cash within a year and include stocks, inventory and accounts receivable. Long-term assets are tangible or fixed assets designed for long-term use, such as furniture, fixtures, buildings, machinery and vehicles.

Liabilities are business obligations that are also classified as current and long-term. Current liabilities are due to be paid within a year and include accrued payroll, taxes payable and short-term loans. Long-term liabilities include shareholder loans or bank debt that mature more than a year later.

Break-even analysis: The break-even point is how much a business must sell to exactly cover all of its fixed and variable expenses, including COGS, salaries and rent. When revenue exceeds expenses, the business makes a profit. The break-even point is used to guide sales revenue and volume goals; determination requires first calculating contribution margin , which is the amount of sales revenue a company has, less its variable costs, to put toward paying its fixed costs. Businesses can use break-even analyses to better evaluate their expenses and calculate how much to mark up its goods and services to be able to turn a profit.

Four Steps to Create a Financial Plan for Your Small Business

Financial plans require deliberate planning and careful implementation. The following four steps can help small businesses get started and ensure their plans can help them achieve their goals.

Create a strategic plan

Before looking at any numbers, a strategic plan focuses on what the company wants to accomplish and what it needs to achieve its goals. Will it need to buy more equipment or hire additional staff? How will its goals affect cash flow? What other resources are needed to meet its goals? A strategic financial plan answers these questions and determines how the plan will impact the company’s finances. Creating a list of existing expenses and assets is also helpful and will inform the remaining financial planning steps.

Create financial projections

Financial projections should be based on anticipated expenses and sales forecasts . These projections look at the business’s goals and estimate the costs needed to reach them in the face of a variety of potential scenarios, such as best-case, worst-case and most likely to happen. Accountants may be brought in to review the plan with stakeholders and suggest how to explain the plan to external audiences, such as investors and lenders.

Plan for contingencies

Financial plans should use data from the cash flow statement and balance sheet to inform worst-case scenario plans, such as when incoming cash dries up or the business takes an unexpected turn. Some common contingencies include keeping cash reserves or a substantial line of credit for quick access to funds during slow periods. Another option is to produce a plan to sell off assets to help break even.

Monitor and compare goals

Actual results in the cash flow statement, income projections and relevant business ratios should be analyzed throughout the year to see how closely real-life results adhered to projections. Regular check-ins also help businesses spot potential problems before they can get worse and inform course corrections.

Three Questions Your Financial Plan Should Answer

A small business financial plan should be tailored to the needs and expectations of its intended audience, whether it is potential investors, lenders, partners or internal stakeholders. Once the plan is created, all parties should, at minimum, understand:

How will the business make money?

What does the business need to achieve its goals?

What is the business’s operating budget ?

Financial plans that don’t answer these questions will need more work. Otherwise, a business risks starting a new venture without a clear path forward, and decision-makers will lack the necessary insights that a detailed financial plan would have provided.

Improve Your Financial Planning With Financial Management Software

Using spreadsheets for financial planning may get the job done when a business is first getting started, but this approach can quickly become overwhelming, especially when collaborating with others and as the business grows.

NetSuite’s cloud-based financial management platform simplifies the labor-intensive process through automation. NetSuite Planning and Budgeting automatically consolidates real-time data for analysis, reporting and forecasting, thereby improving efficiency. With intuitive dashboards and sophisticated forecasting tools, businesses can create accurate financial plans, track progress and modify strategies in order to achieve and maintain long-term success. The solution also allows for scenario planning and workforce planning, plus prebuilt data synchronization with NetSuite ERP means the entire business is working with the same up-to-date information.

Whether a business is first getting started, looking to expand, trying to secure outside funding or monitoring its growth, it will need to create a financial plan. This plan lays out the business’s short- and long-term objectives, details its current and projected finances, specifies how it will invest its resources and helps track its progress. Not only does a financial plan guide the business along its way, but it is typically required by outside sources of funding that don’t invest or lend their money to just any company. Creating a financial plan may take some time, but successful small businesses know it is well worth the effort.

#1 Cloud Accounting Software

Small Business Financial Plan FAQs

How do I write a small business financial plan?

Writing a small business financial plan is a four-step process. It begins with creating a strategic plan, which covers the company’s goals and what it needs to achieve them. The next step is to create financial projections, which are dependent on anticipating sales and expenses. Step three plans for contingencies: For example, what if the business were to lose a significant client? Finally, the business must monitor its goals, comparing actual results to projections and adjusting as needed.

What is the best financial statement for a small business?

The income statement, also known as the profit and loss (P&L) statement, is often considered the most important financial statement for small businesses, as it summarizes profits and losses and the business’s bottom line over a specific financial period. For financial plans, the cash flow statement and the balance sheet are also critical financial statements.

How often should businesses update their financial plans?

Financial plans can be updated whenever a business deems appropriate. Many businesses create three- and five-year plans and adjust them annually. If a market experiences a large shift, such as a spike in demand or an economic downturn, a financial plan may need to be updated to reflect the new market.

What are some common mistakes to avoid when creating a small business financial plan?

Some common mistakes to avoid when creating a small business financial plan include underestimating expenses, overestimating revenue, failing to plan for contingencies and adhering to plans too strictly when circumstances change. Plans should be regularly updated to reflect real-world results and current market trends.

How do I account for uncertainty and potential risks in my small business financial plan?

Small businesses can plan for uncertainty by maintaining cash reserves and opening lines of credit to cover periods of lower income or high expenses. Plans and projections should also take into account a variety of potential scenarios, from best case to worst case.

What is a typical business financial plan?

A typical business financial plan is a document that details a business’s goals, strategies and projections over a specific period of time. It is used as a roadmap for the organization’s financial activities and provides a framework for decision-making, resource allocation and performance evaluation.

What are the seven components of a financial plan?

Financial plans can vary to suit the business’s needs, but seven components to include are the income statement, operating income, net income, cash flow statement, balance sheet, financial projections and business ratios. Various financial key performance indicators and a break-even analysis are typically included as well.

What is an example of a financial plan?

A financial plan serves as a snapshot of the business’s current standing and how it plans to grow. For example, a restaurant looking to secure approval for a loan will be asked to provide a financial plan. This plan will include an executive summary of the business, a description and history of the company, market research into customer base and competition, sales and marketing strategies, key performance indicators and organizational structure. It will also include elements focusing on the future, such as financial projections, potential risks and funding requirements and strategies.

Financial Management

Small Business Financial Management: Tips, Importance and Challenges

It is remarkably difficult to start a small business. Only about half stay open for five years, and only a third make it to the 10-year mark. That’s why it’s vital to make every effort to succeed. And one of the most fundamental skills and tools for any small business owner is sound financial management.

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

Business Financial Plan Example: Strategies and Best Practices

Any successful endeavor begins with a robust plan – and running a prosperous business is no exception. Careful strategic planning acts as the bedrock on which companies build their future. One of the most critical aspects of this strategic planning is the creation of a detailed business financial plan. This plan serves as a guide, helping businesses navigate their way through the complex world of finance, including revenue projection, cost estimation, and capital expenditure, to name just a few elements. However, understanding what a business financial plan entails and how to implement it effectively can often be challenging. With multiple components to consider and various economic factors at play, the financial planning process may appear daunting to both new and established business owners.

This is where we come in. In this comprehensive article, we delve into the specifics of a business financial plan. We discuss its importance, the essential elements that make it up, and the steps to craft one successfully. Furthermore, we provide a practical example of a business financial plan in action, drawing upon real-world-like scenarios and strategies. By presenting the best practices and demonstrating how to employ them, we aim to equip business owners and entrepreneurs with the tools they need to create a robust, realistic, and efficient business financial plan. This in-depth guide will help you understand not only how to plan your business finances but also how to use this plan as a roadmap, leading your business towards growth, profitability, and overall financial success. Whether you're a seasoned business owner aiming to refine your financial strategies or an aspiring entrepreneur at the beginning of your journey, this article is designed to guide you through the intricacies of business financial planning and shed light on the strategies that can help your business thrive.

Understanding a Business Financial Plan

At its core, a business financial plan is a strategic blueprint that sets forth how a company will manage and navigate its financial operations, guiding the organization towards its defined fiscal objectives. It encompasses several critical aspects of a business's financial management, such as revenue projection, cost estimation, capital expenditure, cash flow management, and investment strategies.

Revenue projection is an estimate of the revenue a business expects to generate within a specific period. It's often based on market research, historical data, and educated assumptions about future market trends. Cost estimation, on the other hand, involves outlining the expenses a business anticipates incurring in its operations. Together, revenue projection and cost estimation can give a clear picture of a company's expected profitability. Capital expenditure refers to the funds a company allocates towards the purchase or maintenance of long-term assets like machinery, buildings, and equipment. Understanding capital expenditure is vital as it can significantly impact a business's operational capacity and future profitability. The cash flow management aspect of a business financial plan involves monitoring, analyzing, and optimizing the company's cash inflows and outflows. A healthy cash flow ensures that a business can meet its short-term obligations, invest in its growth, and provide a buffer for future uncertainties. Lastly, a company's investment strategies are crucial for its growth and sustainability. They might include strategies for raising capital, such as issuing shares or securing loans, or strategies for investing surplus cash, like purchasing assets or investing in market securities.

A well-developed business financial plan, therefore, doesn't just portray the company's current financial status; it also serves as a roadmap for the business's fiscal operations, enabling it to navigate towards its financial goals. The plan acts as a guide, providing insights that help business owners make informed decisions, whether they're about day-to-day operations or long-term strategic choices. In a nutshell, a business financial plan is a key tool in managing a company's financial resources effectively and strategically. It allows businesses to plan for growth, prepare for uncertainties, and strive for financial sustainability and success.

Essential Elements of a Business Financial Plan

A comprehensive financial plan contains several crucial elements, including:

- Sales Forecast : The sales forecast represents the business's projected sales revenues. It is often broken down into segments such as products, services, or regions.

- Expenses Budget : This portion of the plan outlines the anticipated costs of running the business. It includes fixed costs (rent, salaries) and variable costs (marketing, production).

- Cash Flow Statement : This statement records the cash that comes in and goes out of a business, effectively portraying its liquidity.

- Income Statements : Also known as profit and loss statements, income statements provide an overview of the business's profitability over a given period.

- Balance Sheet : This snapshot of a company's financial health shows its assets, liabilities, and equity.

Crafting a Business Financial Plan: The Steps

Developing a business financial plan requires careful analysis and planning. Here are the steps involved:

Step 1: Set Clear Financial Goals

The initial stage in crafting a robust business financial plan involves the establishment of clear, measurable financial goals. These objectives serve as your business's financial targets and compass, guiding your company's financial strategy. These goals can be short-term, such as improving quarterly sales or reducing monthly overhead costs, or they can be long-term, such as expanding the business to a new location within five years or doubling the annual revenue within three years. The goals might include specific targets such as increasing revenue by a particular percentage, reducing costs by a specific amount, or achieving a certain profit margin. Setting clear goals provides a target to aim for and allows you to measure your progress over time.

Step 2: Create a Sales Forecast

The cornerstone of any business financial plan is a robust sales forecast. This element of the plan involves predicting the sales your business will make over a given period. This estimate should be based on comprehensive market research, historical sales data, an understanding of industry trends, and the impact of any marketing or promotional activities. Consider the business's growth rate, the overall market size, and seasonal fluctuations in demand. Remember, your sales forecast directly influences the rest of your financial plan, particularly your budgets for expenses and cash flow, so it's critical to make it as accurate and realistic as possible.

Step 3: Prepare an Expense Budget

The next step involves preparing a comprehensive expense budget that covers all the costs your business is likely to incur. This includes fixed costs, such as rent or mortgage payments, salaries, insurance, and other overheads that remain relatively constant regardless of your business's level of output. It also includes variable costs, such as raw materials, inventory, marketing and advertising expenses, and other costs that fluctuate in direct proportion to the level of goods or services you produce. By understanding your expense budget, you can determine how much revenue your business needs to generate to cover costs and become profitable.

Step 4: Develop a Cash Flow Statement

One of the most crucial elements of your financial plan is the cash flow statement. This document records all the cash that enters and leaves your business, presenting a clear picture of your company's liquidity. Regularly updating your cash flow statement allows you to monitor the cash in hand and foresee any potential shortfalls. It helps you understand when cash comes into your business from sales and when cash goes out of your business due to expenses, giving you insights into your financial peaks and troughs and enabling you to manage your cash resources more effectively.

Step 5: Prepare Income Statements and Balance Sheets

Another vital part of your business financial plan includes the preparation of income statements and balance sheets. An income statement, also known as a Profit & Loss (P&L) statement, provides an overview of your business's profitability over a certain period. It subtracts the total expenses from total revenue to calculate net income, providing valuable insights into the profitability of your operations.

On the other hand, the balance sheet provides a snapshot of your company's financial health at a specific point in time. It lists your company's assets (what the company owns), liabilities (what the company owes), and equity (the owner's or shareholders' investment in the business). These documents help you understand where your business stands financially, whether it's making a profit, and how your assets, liabilities, and equity balance out.

Step 6: Revise Your Plan Regularly

It's important to remember that a financial plan is not a static document, but rather a living, evolving roadmap that should adapt to your business's changing circumstances and market conditions. As such, regular reviews and updates are crucial. By continually revisiting and revising your plan, you can ensure it remains accurate, relevant, and effective. You can adjust your forecasts as needed, respond to changes in the business environment, and stay on track towards achieving your financial goals. By doing so, you're not only keeping your business financially healthy but also setting the stage for sustained growth and success.

Business Financial Plan Example: Joe’s Coffee Shop

Now, let's look at a practical example of a financial plan for a hypothetical business, Joe’s Coffee Shop.

Sales Forecast

When constructing his sales forecast, Joe takes into account several significant factors. He reviews his historical sales data, identifies and understands current market trends, and evaluates the impact of any upcoming promotional events. With his coffee shop located in a bustling area, Joe expects to sell approximately 200 cups of coffee daily. Each cup is priced at $5, which gives him a daily sales prediction of $1000. Multiplying this figure by 365 (days in a year), his forecast for Year 1 is an annual revenue of $365,000. This projection provides Joe with a financial target to aim for and serves as a foundation for his further financial planning. It is worth noting that Joe's sales forecast may need adjustments throughout the year based on actual performance and changes in the market or business environment.

Expenses Budget

To run his coffee shop smoothly, Joe has identified several fixed and variable costs he'll need to budget for. His fixed costs, which are costs that will not change regardless of his coffee shop's sales volume, include rent, which is $2000 per month, salaries for his employees, which total $8000 per month, and utilities like electricity and water, which add up to about $500 per month.

In addition to these fixed costs, Joe also has variable costs to consider. These are costs that fluctuate depending on his sales volume and include the price of coffee beans, milk, sugar, and pastries, which he sells alongside his coffee. After a careful review of all these expenses, Joe estimates that his total annual expenses will be around $145,000. This comprehensive expense budget provides a clearer picture of how much Joe needs to earn in sales to cover his costs and achieve profitability.

Cash Flow Statement

With a clear understanding of his expected sales revenue and expenses, Joe can now proceed to develop a cash flow statement. This statement provides a comprehensive overview of all the cash inflows and outflows within his business. When Joe opened his coffee shop, he invested an initial capital of $50,000. He expects that the monthly cash inflows from sales will be about $30,417 (which is his annual revenue of $365,000 divided by 12), and his monthly cash outflows for expenses will amount to approximately $12,083 (his total annual expenses of $145,000 divided by 12). The cash flow statement gives Joe insights into his business's liquidity. It helps him track when and where his cash is coming from and where it is going. This understanding can assist him in managing his cash resources effectively and ensure he has sufficient cash to meet his business's operational needs and financial obligations.

Income Statement and Balance Sheet

With the figures from his sales forecast, expense budget, and cash flow statement, Joe can prepare his income statement and balance sheet. The income statement, or Profit & Loss (P&L) statement, reveals the profitability of Joe's coffee shop. It calculates the net profit by subtracting the total expenses from total sales revenue. In Joe's case, this means his net profit for Year 1 is expected to be $220,000 ($365,000 in revenue minus $145,000 in expenses).

The balance sheet, on the other hand, provides a snapshot of the coffee shop's financial position at a specific point in time. It includes Joe's initial capital investment of $50,000, his assets like coffee machines, furniture, and inventory, and his liabilities, which might include any loans he took to start the business and accounts payable.

The income statement and balance sheet not only reflect the financial health of Joe's coffee shop but also serve as essential tools for making informed business decisions and strategies. By continually monitoring and updating these statements, Joe can keep his finger on the pulse of his business's financial performance and make necessary adjustments to ensure sustained profitability and growth.

Best Practices in Business Financial Planning

While crafting a business financial plan, consider the following best practices:

- Realistic Projections : Ensure your forecasts are realistic, based on solid data and reasonable assumptions.

- Scenario Planning : Plan for best-case, worst-case, and most likely scenarios. This will help you prepare for different eventualities.

- Regular Reviews : Regularly review and update your plan to reflect changes in business conditions.

- Seek Professional Help : If you are unfamiliar with financial planning, consider seeking assistance from a financial consultant.

The importance of a meticulously prepared business financial plan cannot be overstated. It forms the backbone of any successful business, steering it towards a secure financial future. Creating a solid financial plan requires a blend of careful analysis, precise forecasting, clear and measurable goal setting, prudent budgeting, and efficient cash flow management. The process may seem overwhelming at first, especially for budding entrepreneurs. However, it's crucial to understand that financial planning is not an event, but rather an ongoing process. This process involves constant monitoring, evaluation, and continuous updating of the financial plan as the business grows and market conditions change.

The strategies and best practices outlined in this article offer an invaluable framework for any entrepreneur or business owner embarking on the journey of creating a financial plan. It provides insights into essential elements such as setting clear financial goals, creating a sales forecast, preparing an expense budget, developing a cash flow statement, and preparing income statements and balance sheets. Moreover, the example of Joe and his coffee shop gives a practical, real-world illustration of how these elements come together to form a coherent and effective financial plan. This example demonstrates how a robust financial plan can help manage resources more efficiently, make better-informed decisions, and ultimately lead to financial success.

Remember, every grand journey begins with a single step. In the realm of business, this step is creating a well-crafted, comprehensive, and realistic business financial plan. By following the guidelines and practices suggested in this article, you are laying the foundation for financial stability, profitability, and long-term success for your business. Start your journey today, and let the road to financial success unfold.

Related blogs

Stay up to date on the latest investment opportunities

.png)

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.

Coming up with your financial projections may be a bit trickier if you are a startup. After all, you have nothing to go off of. Come up with a reasonable monthly goal based on things like your industry, competitors, and the market. Hint : Look at your market analysis section of the business plan for guidance.

A financial statement details your business’s finances. The three main types of financial statements are income statements, cash flow statements, and balance sheets.

Income statements summarize your business’s income and expenses during a period of time (e.g., a month). This document shows whether your business had a net profit or loss during that time period.

Cash flow statements break down your business’s incoming and outgoing money. This document details whether your company has enough cash on hand to cover expenses.

The balance sheet summarizes your business’s assets, liabilities, and equity. Balance sheets help with debt management and business growth decisions.

If you run a startup, you can create “pro forma financial statements,” which are statements based on projections.

If you’ve been in business for a bit, you should have financial statements in your records. You can include these in your business plan. And, include forecasted financial statements.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business , to learn more about the different types of financial statements for your business.

Potential investors want to know when your business will reach its break-even point. The break-even point is when your business’s sales equal its expenses.

Estimate when your company will reach its break-even point and detail it in the financial section of business plan.

If you’re looking for financing, detail your funding request here. Include how much you are looking for, list ideal terms (e.g., 10-year loan or 15% equity), and how long your request will cover.

Remember to discuss why you are requesting money and what you plan on using the money for (e.g., equipment).

Back up your funding request by emphasizing your financial projections.

Last but not least, your financial section should also discuss your business’s exit strategy. An exit strategy is a plan that outlines what you’ll do if you need to sell or close your business, retire, etc.

Investors and lenders want to know how their investment or loan is protected if your business doesn’t make it. The exit strategy does just that. It explains how your business will make ends meet even if it doesn’t make it.

When you’re working on the financial section of business plan, take advantage of your accounting records to make things easier on yourself. For organized books, try Patriot’s online accounting software . Get your free trial now!

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Financial Planning Business Plan

Start your own financial planning business plan

Grizzly Bear Financial Managers

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">, opportunity.

There are people in the Portland Oregon who are in need of investing advice, and those that are in need of estate planning help.

Grizzly Bear Financial Managers is a comprehensive financial planning and estate planning consultancy. Grizzly’s services are comprehensive in terms of offered products (mutual funds, equities, estate planning) and depth of research. Although it costs a fair amount of money for Grizzly to do an in-depth amount of research into prospective investments as well as possible options for the client, this up-front cost will be eclipsed by a long-term relationship that is likely to be established out of earned respect.

Grizzly Bear Financial Managers will be marketing their services to two different groups of people, those in need of investing advice, and those that are in need of estate planning help. These two groups will be targeted through networking activities and public seminars. Grizzly’s competitive advantage of thoroughness of services offered as well as in-depth research will turn prospective clients into long-term customers.

Competition

The buying patterns of consumers are more often than not based on networking or who the person knows. This is because the industry of financial planning is so populated it is quite hard to make a decision for choosing a service provider. Since many/most people after a certain age have at least visited a financial planner it is not difficult to get a referral for a planner.

Grizzly Bear Financial Managers’ mission is to provide comprehensive financial planning services for our customers. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed the expectations of our customers.

Expectations

Grizzly will reach profitability by month eight and will have modest profits by the end of year three.

Financial Highlights by Year

Financing needed.

Meghan will be putting in $23,000 to start this business.

Problem & Solution

Problem worth solving, our solution.

Grizzly Bear Financial Managers serves the Portland Metropolitan area. Grizzly will be generating new clients through a combination of networking and monthly public seminars that introduces otherwise unreachable segments of the population. Besides the seminars developing new business, it is also a way that Grizzly can give back to the community.

Target Market

Market size & segments.

Market Segmentation

Grizzly Bear Financial Managers will target two different groups of customers. Both groups will be from the middle to upper-middle class socio-economic groups.

- Middle-aged people in need of estate planning . This group is making plans for their estate and are in need of advice on how to structure their estate. They might have already made arrangements for their estate and wish to modify them, or be starting from scratch.

- Middle-aged people interested in investing . This group is interested in some sort of investing, whether it is mutual funds, stocks, bonds, treasury notes, etc. They may have already done some investing, but want to change their risk profile or take a different approach. This might also be their first time investing and want expert advice.

Target Market Segment

Grizzly Bear Financial Managers has chosen these two groups because they both have money to invest and most need assistance in determining how to invest or how to structure their estate.

These groups will be targeted through two methods. The first is old fashioned networking. Meghan made a lot of different contacts in her pursuit for her MBA. In addition to networking her contacts from school, Meghan will also network using her social contacts.

Meghan will also be targeting these groups through the production of public seminars on estate planning and investing. These seminars typically take place in a public area such as a library hall. The seminars provide a basic level of knowledge. The seminar is not meant to substitute Meghan’s services, they are meant to whet people’s appetites for more information. The real reason for the seminars is to get a diverse crowd of people interested in Meghan and the services she offers, creating new business.

Current Alternatives

Competition comes from many different sources:

- Independent financial planners : these are often most like Grizzly Bear Financial Managers. They do not belong to a larger company and they are not affiliated with any type of company, mutual fund, or otherwise.

- Financial planners that are part of a larger organization : American Express, Charles Schwaab, and Merrill Lynch. While these planners might offer good advice, they are often biased, having a financial interest in the companies that they sell equity in.

- Tax and estate planning attorneys : professionals with a legal background who offer similar financial services, sometimes as a sideline to their practice of law.

- True niche players who only are stock brokers or who only do estate planning : while these people probably have very detailed information about their area of specialization, estate planning or financial planning often requires a breadth of knowledge in many areas.

Our Advantages

Grizzly Bear Financial Managers’ competitive advantage is their comprehensive approach to research and services provided. It is Meghan’s philosophy that she can develop more value for her customers by investing more time up front while researching different options. Most planning firms will do adequate research in terms of looking into different options, certainly enough to meet due diligence requirements. While this is sufficient for some, Meghan adheres to the philosophy that its is better to invest the time upfront in support of the customers. This will then pay off in the future by developing long lasting relationships. This attention to detail and thoroughness will certainly be appreciated by clients who are trusting their financial future to Meghan.

Keys to Success

Our keys to success are:

- To create a service-based company whose primary goal is to exceed customer’s expectations.