Small Business Trends

25 businesses to start with no money.

Whether you’re interested in e-commerce, freelancing, or passive income ideas , there are opportunities that can be explored with minimal upfront investment. Read on to discover what kinds of businesses you can start without requiring a large investment.

How Can You Start Your Own Business With No Money?

| Step | Description |

|---|---|

| 1. Identify a business idea | - Research and explore home-based business ideas. - Evaluate the feasibility and potential of each idea. - Choose a business idea that aligns with your interests, skills, and market demand. - Consider the initial cost and resources required for each business idea. |

| 2. Conduct market research | - Investigate the market for your chosen business idea. - Understand customer preferences, needs, and behaviors. - Analyze competitors and identify gaps in the market. - Determine the demand for your product or service. - Use market research data to fine-tune your business plan and marketing strategies. |

| 3. Create a business plan | - Outline your business goals, objectives, and mission. - Identify the target market and define your value proposition. - Plan the business structure and legal requirements. - Determine the necessary skills and investments. - Develop a financial plan, including cost estimates and revenue projections. - Choose a suitable business name. |

| 4. Research investments needed | - Assess the financial requirements for starting the business. - Identify any licenses, permits, or insurance needed. - Explore potential funding sources, such as small business loans or angel investors. - Allocate funds for equipment, marketing, and initial operational expenses. |

| 5. Promote your business | - Develop a marketing strategy to reach your target audience. - Utilize online and offline marketing channels effectively. - Network with local business communities and potential customers. - Showcase your products or services through demos, samples, or promotions. - Build a customer base through quality service and engagement. |

Business Ideas You Can Start With No Money

1. landscaping business.

A landscaping business can be a great idea if you are looking for a business where you can interact with many people and set your own hours. You may need a little bit of upfront capital to get the right equipment and reliable transportation to get to and from job sites. However, many people already have these items covered. And there are minimal ongoing costs to consider. Landscaping is great if you’re looking for ideas that are not home-based and where there are minimal costs to get started.

2. Consulting Business

3. social media marketing, 4. house-sitting business.

Another business model to consider is starting a service business such as house sitting. You can take care of homes while people are away, including keeping an eye on utilities, collecting mail, and watering plants. There are minimal startup costs required to start a housesitting business, but it can be lucrative depending on the area you are in.

5. Freelance Writing

6. dog walking, 7. start your own online store, 8. freelance web design.

There are many other types of freelance services you can pursue besides writing, such as website design if you are able to take relevant training. In addition, you can offer your services to other business owners needing a web presence, including basic sites on platforms such as Squarespace, Wix, and others. You do not need a business license to operate a website development business, so it is easy to get started and very flexible.

9. Language Tutoring Business

10. sell online courses, 11. pet sitting or babysitting, 12. virtual assistant services.

If you thrive on being organized and efficient, you can offer your services as a personal assistant or virtual assistant. For example, you could network with real estate agents, business owners, and other professionals who need assistance getting organized and keeping their schedules on track. You can balance multiple clients and build your business as a virtual assistant.

More Business Idea Examples to Start With No Money

13. delivery services, 14. life coach, 15. accounting and bookkeeping services.

If you are skilled at balancing the books and keeping track of financials, consider offering your services to local business owners. You can start without needing money or office space and provide a helpful skill for businesses seeking additional financial help.

16. Podcaster

17. vlogger, 18. data entry provider, 19. translator.

Another option for those that speak multiple languages is to offer translation services. Translation services can be offered online or in person and can include services such as live translation, simultaneous translation, and document translation. There are many ways to start a translation business, depending on your level of skill and how much time you have with clients around the world.

20. Personal Fitness Trainer

21. handmade crafts seller, 22. event planning services, 23. resume writing and career coaching.

With a good understanding of what makes a resume stand out and how to coach individuals for job interviews, you can start a resume writing and career coaching business. This service can be offered entirely online, making it a feasible option with little to no startup cost.

24. Home Organizing Services

25. content creation for social media, what is the easiest business to start with no money, launching your dream business with zero capital: our metodology.

Starting a business with no money might sound like a daunting task, but with the right approach and a clear set of criteria, it’s entirely possible. In guiding entrepreneurs towards starting businesses with minimal or no initial investment, we use a specific set of criteria. These criteria help in identifying opportunities that rely more on skills, creativity, and innovation than on financial resources. Each criterion is rated on a scale from 1 to 5, where 1 indicates the least importance and 5 the highest importance:

Can You Start an Online Business With No Money?

What is the most profitable business model to start without capital, how much does it cost to start a business.

The amount of money needed to start a business will depend on the service or product being offered. Some service businesses such as landscaping, cleaning, or becoming a podcaster or Youtuber will require a small investment to get the necessary equipment. Some businesses may also require other certifications such as business licenses or liability insurance. Other types of businesses, such as writing or consulting, do not require much money to get started.

Frequently Asked Questions

What business ideas can you start with no money, are service-based businesses easier to start with no money, can you start a profitable business model without capital.

Absolutely, freelance services, such as writing or virtual assistance, offer profitable business models with no need for substantial capital. These ventures can be lucrative and efficient.

The initial cost to start a business varies based on the type of service or product offered. Some service businesses may require a small investment in equipment or certifications, while others require minimal capital to get started.

Conclusion: Thriving Beyond Financial Boundaries

The unique challenge of limited resources, entrepreneurship as a testament to ingenuity, leveraging constraints for innovation, the power of networking and time management, customer-centric approach in business, embracing the entrepreneurial spirit.

“I have earned $442,991 USD in just six months by building a dropshipping business that people loved”.

Up to 8 months off on annual plans

Want to find top products?

Enter your email and download

"The Art of Finding Winning Products"

By entering your email we'll also send you marketing emails related to Spocket, subject to our Privacy Policy . You can unsubscribe anytime.

Your eBook has been successfully downloaded

Small-scale business ideas without investment: explore 25 unique opportunities.

Taking the first step of your business journey from the comfort of your couch offers a unique sense of freedom and flexibility. Whether you're seeking a side hustle to boost your income or yearning to break free from the traditional nine-to-five, tons of small-scale business ideas without investment are just waiting to be explored.

...and we're revealing 25 unique business ideas here!

So, if you're in the following predicament:

'I want to start a business, but have no ideas'. ..you're in the right place. Let's dive straight in!

1. Dropshipping

If you've not heard of dropshipping before, here's a quick summary (spoiler: this is our favorite out of all the business ideas with zero investment in this list!):

In a nutshell, dropshipping is an online order fulfillment method where you don't have to purchase any inventory upfront. Instead, you only buy the product from your third-party dropshipping supplier once a customer purchases via your online store. Then, the dropshipping supplier picks, packs, and ships the order directly to your customer. As a result, you don't have to handle the inventory yourself.

Launching a small-scale dropshipping startup with zero investment is tricky but possible.

Utilize free hosting solutions like Infinity Free and set up your online store using a free eCommerce plugin like WooCommerce or OpenCart. There are also free domain name registrars like Freenom.com . Then, all that's left to do is find high-quality suppliers on dropshipping directories like AliExpress and start filling your e-store with products.

Yes, this takes lots of work, but with some tenacity, dropshipping on a budget could be a lucrative venture in the long term!

2. Start a Print-On-Demand Business

Print-on-demand (POD) is very similar to dropshipping (as mentioned above).

However, the critical difference is that you can customize products with your own design/engraving.

As such, print-on-demand lends itself to creatives wanting to sell products like apparel, accessories, home decor, and so on, with their unique twist stamped on them.

Starting a print-on-demand startup without investment requires creativity, resourcefulness, and strategic planning. However, it's certainly possible.

For example, Ecwid allows you to create a free online storefront (selling up to five products) and integrates seamlessly with Printful, a free print-on-demand service.

Printful offers over 300 customizable products for you to choose from and sell on your own online store. Then, when a shopper makes a purchase, Printful prints and ships the order directly to your customers.

Where graphic design is concerned, you can use free software like Canva to get the ball rolling!

3. Freelance Writing

Freelance writing can be both fulfilling and financially rewarding. Depending on your experience, you could turn your pen to writing blog posts, ebooks, email campaigns, website copy , ad copy, etc.

To kickstart this venture, leverage zero-cost platforms like Medium, LinkedIn, or your own blog to showcase your writing skills and compile samples to show potential clients.

There are also tons of freelance writer job boards out there. For instance, ProBlogger - when gigs come up that you like the sound of, apply for them offering your services. It's a competitive field, but the more you put yourself out there, the more likely you are to build your client roster.

4. Virtual Assistant

Virtual assistants (VAs) offer administrative and organizational support to businesses remotely. For example, responding to customer support emails, social media management, data entry, etc.

If you like the sound of becoming a virtual assistant, first, you need to identify which services you could provide and then clearly define the scope of your offerings. Organize your skills and experience into attractive packages, highlighting the value you bring clients.

Handy hack: Leverage free tools like Google Workspace to manage your email, calendar, and document collaboration. Trello is also useful for task management, and Canva is helpful for graphic design.

5. Proofreading

This side hustle is an excellent string to your bow if you're also considering launching a freelance writing or virtual assistant business. After all, it stands to reason that proofreading and writing go hand in hand.

Of course, you'll need to boast excellent attention to detail and exceptional spelling and grammar knowledge to excel in this venture.

Pro Tip: Use free grammar and spelling tools like Grammarly to help correct spelling and grammar mistakes in your clients' work.

6. Social Media Management

As a freelance Social Media Manager, yes, you guessed it, you help businesses manage their social media presence.

Do you have experience building a social media following? How about running social media campaigns or creating engaging content? If yes, this could be a viable avenue for you.

To hit the ground running, you'll need to determine your target market and the specific social media management services you'll offer, for example, content creation, scheduling, analytics reporting, strategy, etc.

Pro Tip: Use free social media tools like Buffer or Later to schedule posts, manage multiple accounts, and analyze performance.

7. Freelance Graphic Designer

Freelance graphic designers create visual content for clients, such as logos, social media assets, email banners, etc.

If you have graphic design experience (or are creative by nature!), you could monetize this by offering design services.

To kickstart a freelance graphic design business without a budget, we recommend utilizing free design tools like Canva or Snappa. Although free platforms like these have limitations (compared to premium software like Adobe Creative Suite), they offer an excellent starting point.

Pro Tip: Use a free platform like Behance to compile and showcase your graphic design portfolio to potential clients.

8. Online Tutoring

If you have teaching experience (or are an industry expert), consider turning your hand to online tutoring.

What subjects are you knowledgeable about? Do you have experience in academic subjects like English or science? Perhaps you're bilingual and could school students in a second language? Or maybe you're proficient in a musical instrument, possibly a guitar, and you could teach that?

To jump-start your online tutoring business, utilize free communication and screen-sharing tools like Zoom to conduct your tutoring sessions. There are also plenty of platforms like Tutor.com and Preply where you can register your tutoring services. Platforms like this are excellent for extending your reach without spending a penny!

9. Sell Handmade Crafts

Do you have a knack for creating beautiful crafts? For example, handmade jewelry? Candles? Artwork? If so, monetize your hobby by selling these goods on platforms like Etsy, eBay, Facebook Marketplace, etc.

Pro Tip: Keep an eye out for free opportunities to showcase your crafts at local markets. This works wonders for engaging with local customers, building your brand locally, and reducing advertising costs.

10. Start Your Own Blog

Do you have specialist knowledge about a particular niche, industry, or hobby? Perhaps tech? Fashion ? House renovations? Cooking? You name it, whatever you're passionate about, consider launching a blog and monetizing it through ads, affiliate marketing, and sponsored content.

Generating an income from your blog takes time and effort; however, with perseverance, there's no reason your blog couldn't succeed.

To get started with zero investment, use a free blogging platform like Blogger and promote your blog on social media. Share content frequently and engage with your audience to increase your blog's visibility.

Pro Tip: Learn the basics of SEO and optimize your blog accordingly; this is crucial for driving organic traffic.

11. Affiliate Marketing

Affiliate marketing can overlap with a few other options on this list—predominantly blogging, vlogging, influencer marketing, and podcasting—mainly because affiliate links are often embedded in blog posts, vlog descriptions, social media posts, email newsletters, etc.

However, as it's such a popular income stream, we thought it deserved its own section.

For the uninitiated, affiliate marketing is a performance-based marketing strategy in which a business rewards you, the 'affiliate,' with a commission for each sale/lead/click you achieve (the exact nature of your affiliate marketing arrangement will vary depending on the agreement you have with the business you're an affiliate for).

Affiliates typically give their followers/prospects an affiliate link containing a unique tracking code that's assigned to them. Then, when someone clicks on the link and performs the desired action, i.e., purchases/clicks/signs-up, this action is traceable via the link, and the marketer is renumerated accordingly.

12. Language Translation

Do you speak another language? If so, you could put that skill to good use by offering translation services.

There are a few online translation marketplaces out there where you can register your services, such as Gengo and OneHourTranslation.com .

Aside from that, we recommend launching a website using a free website builder like Weebly to advertise and showcase your language expertise and any specialized areas you work in.

13. Event Planning Services

Do you have any experience in events management? You may have previously worked as a personal or executive assistant and want to flex your organizational skills. Or are you the go-to person for organizing get-togethers for your family and friends?

If any of these apply, an event planning business could be your venture of choice.

It would be great if you already had a few events you could add to your portfolio. Did you plan the office Christmas party? Did you organize your own wedding? Did you throw a big surprise birthday party for a loved one?

Whatever your experience, be sure to shout about it and showcase your expertise on socials, your website, and free business listings like Yelp and Yell .

14. Software Training

Businesses use all manner of software to keep operations flowing. However, some team members are more adept at picking up said software than others. This is especially true of larger organizations that regularly recruit considerable waves of new employees. These workers, of course, need training, which takes time.

So, if you're proficient in a specialized software program like QuickBooks, HubSpot, Google Analytics, etc., you could run workshops or private sessions for companies looking for a quick and easy way to familiarize their employees with their ever-growing tech stack.

15. Bookkeeping

This might be surprising, but you don't need to be a qualified accountant to become a bookkeeper.

So, suppose you have a head for numbers and have experience executing basic accounting tasks. In that case, there's no reason why you couldn't offer bookkeeping services to small businesses.

More specifically, you could help with the following:

- Keep the company's preferred accounting software and filing systems updated

- Issue financial statements

- Prepare tax returns

- Create balance sheets

- Process payroll

...These are just a few examples, but hopefully, you get the gist.

Pro Tip: If you want to pursue bookkeeping and are based in the US, you'll likely need to establish an LLC.

Again, we encourage you to use social media to promote your services. Take inspiration from Zeal Bookkeeping . They're a great example of using Instagram Reels to establish themselves as an authority in their niche.

16. Vlogger

Like blogging, Vlogging is somewhat of a slow burner, so don't expect to make money overnight. However, if you're passionate about a specific topic and enjoy being in front of the camera, then vlogging could be a great business idea!

To begin with, all you need is your smartphone and access to free video-editing software like Canva.

Then, as your business grows and you have more money to invest, we recommend upgrading to a more professional camera, AV equipment, and premium video-editing software like Adobe Premiere Pro.

You can post your vlogs to YouTube, TikTok , and Instagram and upload them to your website. As previously mentioned in this round-up, Weebly is a free website platform, so that's worth considering. However, it imposes a video upload limit, so you may quickly outgrow it.

Once established, you can monetize your venture by offering advertising space on your website, inserting affiliate links in your videos/video descriptions, attracting video sponsors, and/or registering an account on a funding platform like Patreon .

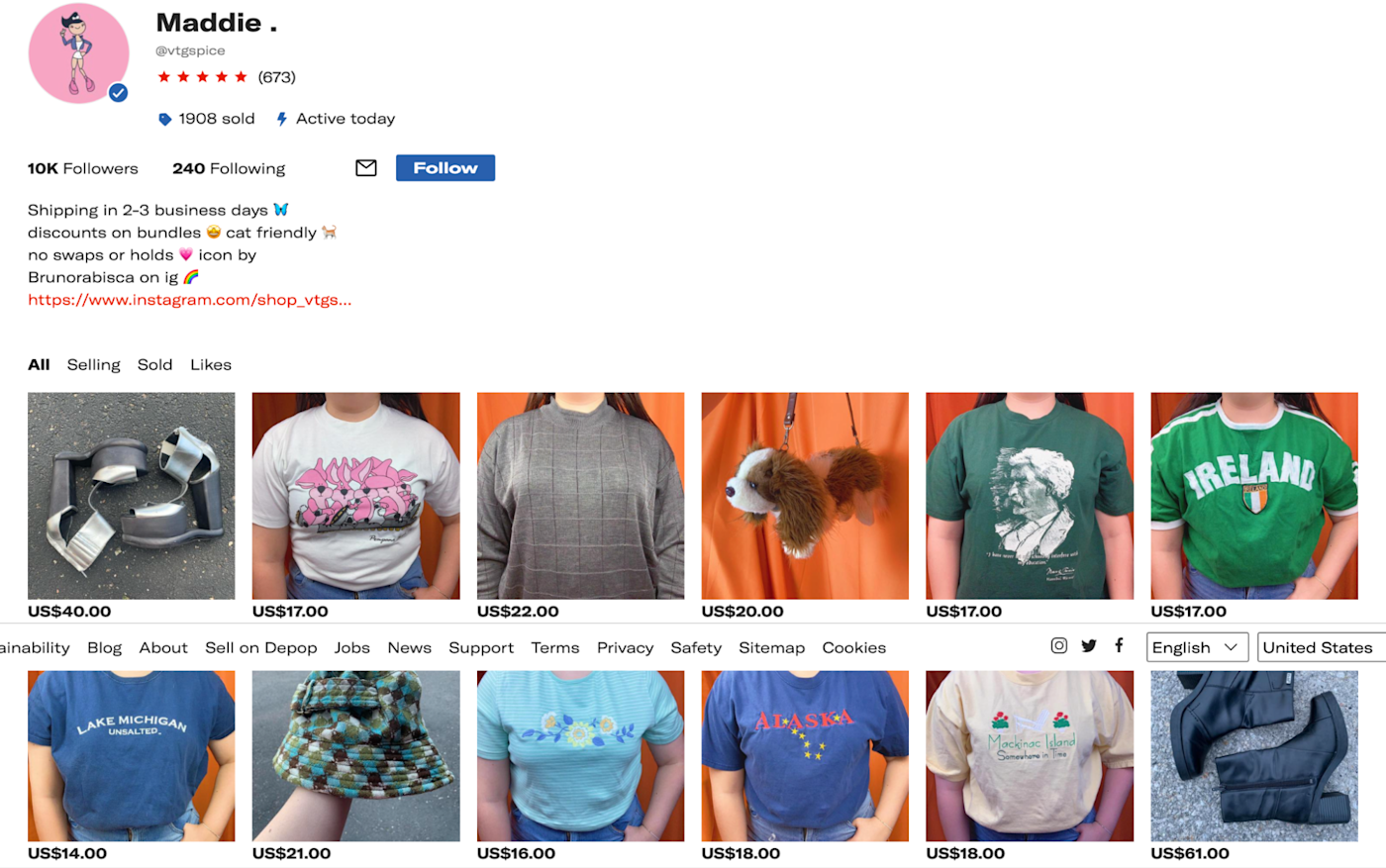

17. Sell Used Items

The worldwide secondhand market is forecast to almost double by 2027, totaling a staggering $350 billion , so as no investment businesses go, selling secondhand goods could be a lucrative option!

So, suppose you enjoy thrifting and have an eye for designer gear. Why not head to your local charity shops, collect boujey items, and then sell them for profit via your own website or on specialized marketplaces like Poshmark and Mercari ?

18. Sell Photos Online

Selling photos online is competitive. However, that shouldn't stop you from submitting your pictures to well-known marketplaces like Adobe Stock , iStockPhoto , or Shutterstock .

Stock photo websites will license your photos to anyone looking to use them commercially and give you a revenue cut.

19. Become a Virtual Personal Trainer

Personal training is a $14 billion industry . If you have qualifications and experience as a PT, market your personal training packages on social media (particularly Instagram) to target people interested in home workouts. For inspiration, study Courtney Black's journey - she's absolutely smashed it!

20. Freelance Web Development/UX Designer

Creating stunning websites has never been more straightforward, thanks to website platforms like Wix and Squarespace.

However, despite these platforms' intuitive interfaces, some businesses have a precise vision they can only achieve with coding know-how.

In addition, businesses are always looking for ways to boost website conversions. So, if you have UX design and development experience, you could also upsell these services to your clients.

Pro Tip: If you're the creme de la creme of web developers, it's worth applying to Toptal . They only work with the top 3% of web-developing talent and aim to connect freelancers with global clients, potentially leading to a steady stream of work for you.

21. Self-publish Kindle books

Have you secretly always wanted to be an author? Thanks to Kindle, you could transform that dream into a reality. As a self-published author on Kindle , you can earn up to 70% royalties on your books.

22. Podcasting

As with blogging or vlogging, consider launching a podcast if you have expertise in a specific niche . Again, podcasting is a slow-burning revenue stream, so don't expect to make money overnight. However, the more content you create, distribute, and repurpose, the higher your chances for growth.

23. Become an Influencer

Suppose you're launching a blog, vlog, or podcast. In that case, you may find that becoming a social media influencer goes hand in hand with these endeavors with the more content you distribute on your socials.

However, if becoming an influencer is your primary aim, you have to choose your niche first. Beauty ? Fitness? Cooking? Whatever it is, pick something you're passionate about. When motivation is lacking, being passionate about the content you're creating will make it easier to get to work!

With that said, here are a few tips for building a following:

- Jump on social media trends relevant to your niche

- Use trending audio clips

- Post regularly

- Discuss issues your target audience actually wants to hear about.

Once you've started to amass a following, you can begin charging for sponsored content.

24. Resume Writing

Job seekers often apply for hundreds of jobs each week. However, resumes aren't a one-size-fits-all deal. Usually, job seekers need varying resumes emphasizing their different skills depending on what the role they're applying for requires of them.

This is where a resume writer comes in handy. So, if you understand what makes an engaging resume, consider offering this service.

Here are just a few ways to market your resume-writing business with zero budget:

- Create a portfolio website (and add client testimonials as you receive them)

- Advertise through social media

- Start a blog about resume advice and related topics

25. Freelance Data Analyst

It's not enough for entrepreneurs to be passionate about their business; they need data to back up their decisions. However, data analysis takes time and skill, which is often best outsourced to the pros.

So, if you're a talented data analyst looking for the best business without investment , going freelance could be the right move for you.

Ensure you have a concise and compelling value proposition on your website that explains what you do, how you do it, and how you differentiate yourself (preferably backed up by results you've achieved for previous clients). This will go a long way to building trust with prospective clients.

Are You Ready to Launch Your Zero-Investment Business?

After reading this blog post, we hope you have a better idea of your options for launching a business without investment.

If we had to pick a favorite opportunity on this list, it would, of course, be dropshipping.

Dropshipping isn't a get-rich-quick scheme, but you could kickstart a lucrative business with time, research, and perseverance. In fact, the global dropshipping market is forecast to reach $1,253 billion by 2030 - so now's the time to jump on the bandwagon. If you have any questions about how Spcoket could help you launch your own dropshipping business, contact us today!

That's all from us; let us know in the comments below which business with zero investment idea you like the look of, and don't forget to tell us how you get on!

Frequently Asked Questions About 0 Investment Business Ideas

We hope we've provided enough information to inspire you to research some of the above zero investment business ideas further.

But in case you have a few unanswered questions, we'll endeavor to answer some of the most frequently asked questions on the subject:

What Are the Best Business Ideas Without Investment?

The best zero investment businesses from home will vary from entrepreneur to entrepreneur, depending on their expertise, skills, and experience.

Most of the above ideas center around your knowledge and passions. So, a good starting point is to list everything you know a lot about and then see where your talents best align.

What Are the Best Business Ideas for Students Without Investment?

Students need to balance their coursework with their jobs, so running a business where you can set your own hours would be a convenient way to generate income while studying.

That said, students usually need to generate income quickly. This discounts some of the business ideas mentioned above, like dropshipping, print-on-demand, blogging, podcasting, etc., as these tend to take a while to 'take off.'

Alternatively, students might be better suited to online tutoring (especially if they've already achieved good grades). They might also want to consider launching their own freelancing business, especially if that's something they're studying—for example, offering graphic design, writing, or other marketing services.

What Are the Best Online Business Ideas Without Investment?

Fortunately, you can execute most of the above business ideas from home. You just need an internet connection to hit the ground running. As mentioned above, examine your interests, passions, and hobbies and then marry them to a potential business venture. For example, are you an avid yogi? If so, you could look into launching a dropshipping store selling yoga equipment and apparel.

What Are the Best Part-Time Business Ideas Without Investment?

First, you need to determine what you mean by 'best.' For instance, are you looking to work on a side hustle that might not pay immediate dividends, like launching a dropshipping or print-on-demand store, but might prove fruitful in the future?

Or do you want to start making money a bit quicker? If so, offering a freelance service in an area you already specialize in might be a better bet.

In either case, calculate how much time you can dedicate to your business, assess your skills, passions, and goals, and then use these insights to fuel your venture.

Rosie Greaves is a professional content strategist specializing in all things digital marketing, B2B, and lifestyle. In addition to Spocket, you can find her published on Reader's Digest, E-commerce Platforms, and Judicious Inc.

Get 14-day instant access to Spocket at no cost.

Related blogs.

Top 10 Book Recommendations for Entrepreneurial Success

Bootstrap Business Launch Guide 2024: How to Start and Scale with Minimal Capital

Proven Strategies to Earn $2000 Monthly with Affiliate Marketing

.webp)

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Best Business To Start With Little Money In 2024

Updated: Feb 4, 2024, 3:18pm

Table of Contents

20 businesses to start for under $1,000, business formation resources, frequently asked questions (faqs).

Whether the economy is slow, inflation is high or a recession is in full swing, you may be looking to make some extra cash. You may find some of the best businesses to start with little money are easier to get going than you think. For less than $1,000, you could have a side hustle that can help offset extra costs or rising prices.

1. Bookkeeping Service

Technically, you only need a high school diploma to work as a bookkeeper, so this small business idea is accessible to anyone. You can take courses at a local community college or find online classes to learn what to do as a bookkeeper and earn a certificate.

Finding contract work as a bookkeeper will require you to put in a bit of effort marketing yourself on sites including Upwork, social media or even traditional methods, such as putting an ad in your local newspaper. Generally, you can charge $20 to $60 per hour, depending on your location and your experience.

What you need: Accounting software, limited liability company (LLC) business license, professional liability insurance, professional website

Approximate cost: $300 (to start); $75 per month (ongoing costs)

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

$0 + State Fee

On Formations' Website

2. Tutoring Business

Another great choice that doesn’t require higher education (though it helps) is to work as a tutor in any subject in which you’re an expert. As long as you have a high school diploma, you can work with students who are struggling in particular topics. Where you work is up to you and the student (and their parents); you can teach students in your home or go to their house or a library to work together.

To get your name out there, consider using social media to spread word of mouth that you’re available; join Facebook and Nextdoor groups to connect with families locally. Create a website that includes a calendar where students or parents can book a time with you. The average price range for tutoring varies, but $20 to $100 is standard.

What you need: A website, LLC business license, home office

Approximate cost: $250; $30 per month (ongoing costs)

3. Consulting Business

Similar to a tutor, a consultant is an expert in their field. The biggest differences are as a consultant, you’re likely to be hired by a professional or a business to help guide them. Typically, consultants have a college degree and plenty of experience (or experience that equates to a degree).

Networking is going to be your best bet for landing contracts as a consultant. Use professional social media, such as LinkedIn, go to local networking events for professionals and stay in touch with former colleagues. You should keep your personal website updated with contact information for your consulting business . Consultant fees vary wildly, depending on your area of expertise, so your rate may be $100 per hour or $500 per hour.

What you need: Professional business cards, a website, LLC business license

Approximate cost: $500; $30 per month (ongoing costs)

4. Delivery Service

If you’re looking to make extra cash after you get off work or you’re in between jobs, working for a delivery service, such as Uber, Lyft, Grubhub or DoorDash can help. While it isn’t necessary to form an LLC for your side gig, it might be worth it for protecting your personal liability. Plus, there are a lot of monthly costs (maintenance, insurance, fuel) that you could write off on your taxes.

The good news is that all you need to work for a ride-sharing service or food delivery service is a vehicle, time, a mobile phone and a clean driving record. You don’t even have to invest in marketing yourself. You could make around $400 per week driving 20 hours, according to Uber.

What you need: Vehicle, clean driving record, driver’s license, mobile phone, car insurance

Approximate cost: $500 monthly (assuming average car lease, insurance, mobile phone and car maintenance costs)

5. Online Store

Many people start an online store with just one product. You don’t need to have any technical skill or specialized training to be successful as an online seller, but it is a good idea to have some marketing and sales experience. To start, you need to find a product or products you want to sell, a great business name and a website.

You’ll need to get a domain name, build a website and then market your products. It’s probably one of the more involved businesses to start, but if you’re successful, it could replace your full-time job. Keep in mind that an online store comes with a lot of ongoing costs, from keeping your website up and running digital ads to email marketing and transaction fees.

What you need: An e-commerce website, products to sell, professional email address, domain name, business license, payment processor, sales tax ID

Approximate cost: $500; $50 per month (ongoing costs)

$17 per month

On Wix's Website

$1.95 per month

Customizable templates, easy grag-and-drop technology, SSL certificate

On Web.com's Website

Squarespace

$23 per month

On Squarespace's Website

6. Pool Cleaning Service

In warm climates, it’s common for houses to have pools, and pools need servicing year round. You will need some knowledge about pool chemicals and how to properly treat a pool to keep it clean, but you should be able to educate yourself on this. At the very least, you’ll need basic math skills to figure out how much of a chemical is needed for different sizes of pools.

Getting started with a pool cleaning service requires you to get equipment, chemicals and have a vehicle to transport those things from pool to pool. You can market yourself on sites, such as Angi and Thumbtack, or go hyperlocal with Nextdoor or Facebook groups. Typically, pool businesses charge $80 to $150 per month, which includes weekly services for each pool.

What you need: Pool equipment, chemicals, small business insurance, LLC formation, invoicing software, vehicle

Approximate cost: $750; $100 per month (ongoing costs)

7. Graphic Design Services

If you have some digital artistic skill, you can start a graphic design business from home. You’ll have to find clients, but you can do so through websites including Fiverr or Upwork. Alternatively, you can rely on networking and word of mouth, so try social media or get some professional business cards to hand out when the topic comes up.

In addition to graphic design software, such as Adobe Photoshop or Canva, you should create a portfolio website to show off your design skills. You can choose to create a personal website or a business site to sell services—either is fairly affordable if you choose one of the best website builders with the features you need. Graphic design can bring in about $25 per hour.

What you need: A website, graphic design software, business cards, business license

8. Pet Sitting Business

Turn your love of animals into a business that can make you a bit of money. Lots of people need pet sitting services from time to time and you can open your home to dogs, cats, birds and other animals that need someone to care for them. You may need to learn some specialized training, such as animal CPR and how to administer medicine to different types of pets.

Make sure you get some pet sitter insurance to protect yourself and pet-proof your home. There are a few ways to get your name out there including putting up posters around your neighborhood or joining a site, such as Care.com or Rover.com. If you’re a renter, this isn’t a side gig you can likely do, by the way.

What you need: Home with a yard, pet sitter insurance, flyers, a website

Approximate cost: $350; $60 per month (ongoing costs)

9. Property Management

There are a few ways you can get into property management: find part-time work as a property manager or start your own property management business. It doesn’t have to be a business in which you own the property you manage, rather you can offer your services as a liaison to connect contractors with residents or do the work yourself.

Although no degree is required, in some states you must be licensed to work as a property manager, so do the research before you jump into this line of work. You could offer your services to homeowners who want to rent out their houses or those who are using a service, such as Airbnb or Vrbo.

What you need: A license (possibly), business license, a website, business cards

Approximate cost: $700; $30 per month (ongoing costs)

10. Personal Trainer

If you have a knack for nutrition and physical fitness, you could turn that into a career or a side hustle. People often look for personal trainers to help them get into shape and you don’t necessarily need an advanced degree to pursue this job. It can help to have a degree in sport science or certificate in fitness (there are multiple certificates out there you can earn).

You can start this business with little money—especially as it pertains to ongoing costs. You should strongly consider filing for an LLC and getting personal trainer business insurance to protect your assets. How much you spend on marketing depends on the route you want to take. Use social media, content marketing, email marketing or run digital ads to get the word out and start making $20 or more per hour.

What you need: Certifications, LLC formation, a website, email marketing software, personal trainer insurance

Approximate cost: $850; $60 per month (ongoing costs)

11. Auto Detailing or Mobile Car Wash

A great weekend business to start with little money is a mobile car wash service. All you need to procure is a wet/dry vacuum, a pressure washer, a buffer, cleansers and microfiber towels. Aside from the equipment list, you should consider getting car detailing business insurance.

You’re going to need to spread the word about your mobile business, so it’s a good idea to submit your business information to Google Business Profile, Bing Places and other local directories. Make sure you have a website with at least your contact information, but you can also set up a website with appointments to make it easier for customers to book with you.

What you need: Car wash equipment, a website, small business insurance, LLC formation

Approximate cost: $800; $60 per month (ongoing costs)

12. Dropshipping Business

If starting an online store seems like a big investment of time and money, consider starting a dropshipping business . Dropshipping doesn’t require you to keep stock on hand or in warehouses—you simply purchase items at a discount as you sell them and the manufacturer or supplier ships products on your behalf.

You can create a website to showcase the products you want to sell or choose a marketplace, such as Amazon or eBay. It’s still important to put in the time and effort to be successful, and most of this will be by way of marketing, choosing the right items to sell and creating the listings.

What you need: Dropshipping supplier, a website, business license, sales tax ID, payment processor

Approximate cost: $100; $30 per month (ongoing costs)

13. Virtual Assistant

A lot of professionals hire virtual assistants (VAs) to help them organize emails and documents, schedule appointments and other administrative work they don’t have time for themselves. You can often find part-time work as a VA to make a bit of extra money on the side (or full time if you want). Consider joining a virtual assistant service to get placed with a company if you don’t want to work independently.

You don’t necessarily need experience to find work as a VA, but it helps to have good organizational and communication skills. If you’ve worked previously as an administrative assistant, a VA position could work well for you and you get to work from home. The average rate for a VA is usually around $15 to $20 per hour.

What you need: A computer, a good internet connection, a website

Approximate cost: $550; $130 per month (ongoing costs)

14. Staffing Business

Staffing businesses serve as the middleman between employers and prospective employees. They help businesses find great candidates, and in return, businesses pay the staffing agency a referral fee (often as a percentage of the new hire’s annual salary). It could be ideal for those that are well-connected with a large professional network and who enjoy talking to people. It is also a business that can be started at home for those focusing on filling fully remote positions.

While those that operate staffing agencies typically come from a background in staffing or human resources, it is possible to start a staffing business without prior experience. However, as with anything, do expect a steeper learning curve if you do not have experience in the field as you will need to learn about the industry from landing clients and attracting candidates to contracts and billing.

What you need: You may need licenses and permits (varies by state), business insurance, website, internet

Approximate cost: $700

15. Tour Provider

The minimum requirements to become a tour guide include a high school diploma and an intimate knowledge of the area (or nearby area) in which you live. Tour guides don’t always drive clients around, but it’s a good idea to have a vehicle and a driver’s license. There’s such a thing as walking tour guides in areas known for hiking and such.

Many local tour guides start off on their own and post listings on tour guide websites with their rates. You can also find websites that will do marketing for you for a small fee. To get started, research your area to find out whether you need a license to work as a tour guide. As a tour guide, you can usually make $20 to $50 per hour, depending on your area.

What you need: A license (maybe), a car and driver’s license (optional), liability insurance, marketing materials, a website

Approximate cost: $250; $60 per month (ongoing costs)

16. Website Design Agency

If you have experience designing websites (and even if you don’t), you can turn it into extra cash (or a full-time job). Find one of the best web hosts to get a low rate and create multiple websites. Alternatively, you could choose a website builder to help you create a website quickly.

It’s a good idea to learn how to use graphic design software, WordPress, coding (HTML and CSS) and some search engine optimization (SEO) tools . Marketing is a big part of being a website designer, so be sure to use sites, such as Fiverr, Upwork and online directories, to spread the word about your services. A website designer can make around $20 to $50 per hour.

What you need: A website, web host or site builder, subscription to graphic design software

Approximate cost: $200; $90 per month (ongoing costs)

17. Professional Cleaning Service

Housekeepers are often in need by busy professionals, people moving out of a rental and families. You don’t need much to get started, but you will need a strong work ethic, transportation and your own cleaning supplies and equipment. Check local laws to see if you need a business license to operate.

If you plan to do the work yourself, you don’t have to register a business, but it’s a good idea to have an LLC at least because it can protect your personal assets should anything go wrong. Liability insurance is more of a necessity in the event anyone is injured on the job. House cleaners make around $15 to $25 per hour.

What you need: Cleaning supplies, vacuum cleaner and other cleaning equipment, vehicle, business license (maybe), business registration, a website, business liability insurance

Approximate cost: $750; $60 per month (ongoing costs)

18. Open an Etsy Shop

Lots of people have talents and skills that translate into goods to sell. You can turn your hobby into a money-making business with very little money to start. Whether you crochet or knit, paint or sculpt or print fun T-shirts, you can sell homemade goods on Etsy.

Etsy doesn’t charge you anything to start a shop, but it does charge you per listing and fees when you make a sale. How much you can make with an Etsy shop depends on what you’re selling and how popular your items are. It’s also difficult to say how much it will cost you to get started because it depends on the price of your materials.

What you need: Materials for items, marketing plan

Approximate cost: $0 to $999 (this really depends on how much your materials cost)

19. Lawn Care and Gardening Service

A popular business to start with little money is a landscaping business. It’s a good idea to have some experience mowing lawns, clipping hedges, gardening and using a weed whacker. The equipment you’re going to use likely requires you to have a truck to haul it from yard to yard, so this idea is best for you if you already have one.

To start, you’ll have to invest in a lot of pricey equipment, but you can likely find used pieces to lower the cost. Insurance is necessary, and you should register your business to protect your personal assets. Keep in mind you’ll need to pay for fuel, maintenance and marketing as ongoing costs. Landscapers’ rates usually range from $20 to $40 per hour.

What you need: Equipment, truck, business insurance, LLC formation, website

Approximate cost: $999; $100 per month (ongoing costs)

20. In-Home Caregiver

Although most caregivers work for agencies, you can work as an independent caregiver. In most states, you need certification, but it usually isn’t necessary to be a certified nursing assistant (CNA). Your duties are likely to include shopping, light housework, cooking and transportation to appointments, for example.

At the very least, you’ll need a high school diploma, a valid driver’s license, a clean driving record and CPR certification. You should have transportation for a lot of the tasks you’re likely to do. Hourly rates for independent caregivers usually average out to $30 per hour.

What you need: CPR certification, business insurance, registered business, vehicle

Approximate cost: $150; $60 per month (ongoing costs)

Start A Limited Liability Company Online Today with ZenBusiness

Click to get started.

Whenever you start a business, there are a few things you need to do first to protect your personal and business assets. Setting up a limited liability company (LLC) is a good first step. Registering your business makes you more legit in the eyes of clients, too.

All new business owners should have a website with important information, including contact email address and phone number and a description of what they do. Some businesses would do well to find a website builder that lets clients book appointments from their site.

For more information about forming a business check out the following guides:

- How to start a business

- How to start a sole proprietorship

- How to set up an LLC in seven steps

- Best Businesses To Start With $10k

Bottom Line

Starting any new business is not an easy endeavor, but it doesn’t have to be a huge financial investment. The best business to start with little money is one you already have experience doing, whether it’s mowing yards, designing websites or helping students with a subject in which you’re an expert.

What is the cheapest business type to start?

Any business that you can do from home with the equipment you already have. If you have a computer and a fast internet connection, a virtual assistant, website designer or a tutor could be good picks. If you have reliable transportation, it opens up even more businesses that could be viable and cheap to start, such as a mobile car wash or house cleaning service.

What can I sell to earn money?

You can make some quick cash by selling items in your home you no longer need. Consider taking clothes to a consignment store, jewelry pieces to a jewelry store, along with selling furniture and collectible items.

What is the easiest home business to start?

Some of the easiest home businesses to start include a dog walking business, an Etsy store and a tutoring business. All three of those businesses have low startup costs and low ongoing costs.

What is the most profitable small business?

Profitable small businesses are those that have low overhead and high hourly rates. Consultants, information technology (IT) technicians and freelance accounting are all fairly profitable small businesses.

- Best LLC Services

- Best Registered Agent Services

- Best Trademark Registration Services

- Top LegalZoom Competitors

- Best Business Loans

- Best Business Plan Software

- ZenBusiness Review

- LegalZoom LLC Review

- Northwest Registered Agent Review

- Rocket Lawyer Review

- Inc. Authority Review

- Rocket Lawyer vs. LegalZoom

- Bizee Review (Formerly Incfile)

- Swyft Filings Review

- Harbor Compliance Review

- Sole Proprietorship vs. LLC

- LLC vs. Corporation

- LLC vs. S Corp

- LLP vs. LLC

- DBA vs. LLC

- LegalZoom vs. Incfile

- LegalZoom vs. ZenBusiness

- LegalZoom vs. Rocket Lawyer

- ZenBusiness vs. Incfile

- How To Start A Business

- How to Set Up an LLC

- How to Get a Business License

- LLC Operating Agreement Template

- 501(c)(3) Application Guide

- What is a Business License?

- What is an LLC?

- What is an S Corp?

- What is a C Corp?

- What is a DBA?

- What is a Sole Proprietorship?

- What is a Registered Agent?

- How to Dissolve an LLC

- How to File a DBA

- What Are Articles Of Incorporation?

- Types Of Business Ownership

Next Up In Business

- Best Online Legal Services

- How To Write A Business Plan

- Member-Managed LLC Vs. Manager-Managed LLC

- Starting An S-Corp

- LLC Vs. C Corp

- How Much Does It Cost To Start An LLC?

- How To Get A Certificate Of Good Standing In Your State

Best West Virginia Registered Agent Services Of 2024

Best Vermont Registered Agent Services Of 2024

Best Rhode Island Registered Agent Services Of 2024

Best Wisconsin Registered Agent Services Of 2024

Best South Dakota Registered Agent Services Of 2024

B2B Marketing In 2024: The Ultimate Guide

Amy Nichol Smith spent more than 20 years working as a journalist for TV and newspapers before transitioning to software and hardware product reviews for consumers and small businesses. She has been featured in publications such as L.A. Times, Tom's Guide, Investopedia and various newspapers across the U.S.

- Artificial Intelligence (AI)

- Web Scraping

- For Small Business

21 Zero Investment Business Ideas You Can Start With No Money in 2024

- November 26, 2023

- by Tom Wells

As a serial entrepreneur and small business consultant who has helped over 200 entrepreneurs kickstart their zero-investment businesses, I strongly believe that lack of capital should not stop you from pursuing your entrepreneurial aspirations.

The rise of the internet, the gig economy and innovative business models have paved the way for multiple zero-investment business ideas across diverse domains.

In this comprehensive guide, I will share 21 thoroughly researched business concepts you can launch with little to no money based on your skills and interests. Each section outlines key opportunities, startup steps, and tips to set you up for success.

So let‘s get started, shall we?

1. Dropshipping

The global dropshipping market is projected to grow at 16.4% CAGR to reach $591.77 billion by 2027 ( Statista ).

Dropshipping allows anyone to run an ecommerce store without managing inventory. As the store owner, you just process customer orders and forward them to your suppliers for fulfillment.

Getting Started

- Choose a dropshipping supplier and integrate their catalog into your online store

- Drive traffic to your store via marketing and partnerships

- Focus on providing stellar customer service

Tips for Success

- Select suppliers carefully – assess reliability, shipping times, locations covered etc.

- Build a brand that resonates with your target audience

- Ensure complete transparency and set realistic delivery timelines

My Experience I run a dropshipping store selling fitness equipment and activewear in the US. I onboarded suppliers from China and regularly engage customers via emailers and loyalty programs. Despite logistical challenges, dropshipping provides immense fulfillment in positively impacting lives.

2. Blogging

There are over 600 million blogs on the internet and nearly 77% of internet users read blogs ( Review42 ).

Blogging unleashes your creative and intellectual freedom to share your unique experiences and expertise. Choose from an array of monetization approaches – affiliate marketing, sponsored posts, online courses etc.

- Select blogging software like WordPress or Medium

- Create compelling content showcasing your signature voice/style

- Implement SEO best practices to amplify reach

- Establish a regular content production rhythm

- Interlink posts for better discoverability

- Actively engage with readers via comments/emails

My Experience I started my blog focused on mindfulness and mental health 5 years back while working a full-time job. Despite struggling initially, I persisted and now earn a consistent 6-figure annual income from my blog and related digital products.

3. Online Courses & Workshops

The global e-learning market is projected to be valued at $457B by 2026 as per HolonIQ.

Online courses are an impactful way to share your knowledge or expertise with students around the world. With platforms like Teachable and Podia, you can publish courses without any investment.

- Outline course curriculum & structure

- Record lectures and create reference guides

- List your course on e-learning marketplaces

- Offer bite-sized and visually engaging content

- Actively respond to student feedback

- Onboard guest instructors to widen scope

My Experience As a university professor, I have taught over 7000 students globally via my flagship online course "Data Science Masterclass with Python". The flexible format and diverse backgrounds of students makes this immensely fulfilling.

- Search Search Please fill out this field.

Overcome the Challenges

- Develop a Low-Cost Idea

- The Role of Budgeting

- Financing Options

Bootstrapping Techniques

Leverage free resources, network and collaborate.

- Build an Online Presence

The Bottom Line

- Small Business

- How to Start a Business

Starting a Business With No Money: How to Begin

Master the art of bootstrapping and creative financing

:max_bytes(150000):strip_icc():format(webp)/20171019_172018-5a12f5cdbeba3300373b7964-3d8c34a5e28d41cdb3c4e2df355329f4.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin CURRENT ARTICLE

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

Starting a business often requires significant planning, particularly in determining how much capital you’ll need to launch. While it’s feasible to start a business with minimal or no initial funding, this approach can pose significant challenges.

If your goal is to grow a business on a tight budget, it’s important to understand all of your available options.

Key Takeaways

- Starting a business with no money is challenging but achievable.

- Exploring creative financing options and ways to bootstrap a business can help you raise the capital you need to get started.

- While borrowing is an option, it’s crucial to assess its affordability in relation to your projected revenues.

An undeniable truth about starting a business is that money matters.

According to the U.S. Bureau of Labor Statistics (BLS) , nearly half of all startups fail within their first five years, primarily due to financial issues. SCORE reports that 82% of small business failures stem from cash flow problems, often linked to inadequate funding.

Furthermore, a survey by Skynova, which focuses on helping small businesses manage finances, revealed that 47% of startup founders attribute their failure to insufficient funding, while 44% reported simply running out of cash.

Starting a business with no money or minimal capital can significantly restrict your ability to grow and expand in the early stages. For example, a lack of funds makes it challenging to:

- Hire employees or support staff

- Purchase necessary inventory or supplies

- Advertise and market your business

The impact of limited funds varies depending on the type of business you intend to start. If you’re working with a minimal budget , it’s worth considering which types of businesses can be launched with zero investment.

It’s crucial to conduct thorough market research before starting a business. Identify your competitors and determine how you’ll reach your target customers. Consider gathering feedback from potential customers through focus groups or social media interactions.

Whether you’re starting a new small business or looking to expand an existing one, the U.S. Small Business Administration ’s (SBA’s) digital learning platform offers plenty of resources to educate yourself on entrepreneurial best practices and financing options, from its SBA Learning Center to its Investing in America program. Visit SBA.gov for more information.

Develop a Low-Cost Business Idea

Some businesses cost more to start than others. For example, you may need $100,000 or more to open a restaurant, while you may be able to get a food truck up and running for as little as $40,000.

When you have little to no startup capital, the best businesses to consider are those with minimal initial costs. Many such businesses can be operated from home using just your laptop and an internet connection.

Here are some low-cost business ideas to explore:

- Content creation for online businesses

- Freelance writing or blogging

- Virtual assistant business

- Social media manager or consultant

- Online course creator or online tutor

- Online bookkeeper

- Dropshipping

- eBay reseller

- Creating content on YouTube or TikTok

- Graphic designer

- Video editing

These are all businesses that you could run from home without having to spend a lot of money. Additionally, there are offline opportunities that require no startup cash, such as dog walking, pet sitting, local tutoring, or teaching art or music. These businesses may allow you to leverage your skills to earn an income with little to no money down.

Before launching a regulated business like a home day care or bakery, ensure compliance with local laws and regulations to operate legally and meet health, safety, and zoning standards, which can help you avoid fines and legal issues. Contact your local Chamber of Commerce, Small Business Development Center (SBDC), or a business attorney for more specific advice.

The Critical Role of Budgeting

When starting a business, creating a detailed budget is crucial. Your budget serves as a financial guide to help you understand your costs when getting your business off the ground.

What your business budget looks like initially can depend on what kind of business you’re starting. For instance, startup costs for a low-cost, home-based business will generally be lower compared with those for a brick-and-mortar establishment.

To prepare a small business budget before launching, tally up all expected costs, including:

- Purchasing inventory or supplies

- Renting or leasing a business space

- Buying equipment

- Marketing or advertising expenses

- Hiring staff

Ensure that your budget provides a clear and realistic view of your anticipated spending. Compare this with your projected sales or revenue to understand your potential cash flow or earnings.

Remember, budgeting is an ongoing process. Review your budget monthly to monitor cash flow and keep expenses low, especially during the early stages of your business to help maximize financial stability.

Creative Financing Options

There are a number of ways to finance a new business without having to spend any money yourself. Comparing different options can help you decide what might be right for you. Consider the following options:

- Small business grants : These grants provide money to support entrepreneurship, and unlike loans, they don’t need to be paid back. The SBA supports a number of grant programs, including ones for minority-owned, women-owned , and veteran-owned businesses.

- Crowdfunding : This option allows people to contribute money to campaigns in small amounts in order to help entrepreneurs launch their businesses. Some of the most popular platforms for seeking support include GoFundMe, Indiegogo, and Kickstarter.

- Microloans : If you’re comfortable borrowing to fund your new business, you might consider a microloan. The SBA’s microloan program allows you to borrow up to $50,000 to start a business (although the average microloan is around $13,000). You can repay it over a period of up to six years, with interest rates ranging from 8% to 13%.

- Credit cards : Business credit cards offer a revolving line of credit, making it easier to manage the expenses needed to start or operate your business. They can be easier to qualify for than loans. Depending on the card you choose, you might earn rewards such as cash back, points, or travel miles on your purchases.

- Peer-to-peer (P2P) lending : Peer-to-peer loans let you borrow money directly from individual investors instead of traditional financial institutions. These investors collectively fund loans, which borrowers repay with interest over time. The interest rates and terms of these loans are typically based on your credit score.

Traditional small business loans might be harder to get if you’re still in the beginning stages of starting a business. Lenders typically require you to have one to two years of operating history and a minimum level of revenue to qualify. Working on establishing business credit could help you to qualify for loans later, once your business is up and running.

Before launching a crowdfunding campaign for your new business, make sure you’re aware of the platform’s fees and policies for campaigns that don’t meet their funding targets. High fees can diminish the total amount you collect, and some platforms might mandate returning the funds to contributors if the funding goal isn’t achieved.

Bootstrapping simply means using the resources you have at hand to fund your business. Choosing to bootstrap a business could help you avoid taking on debt, but whether it’s realistic can depend on your financial situation.

Some of the ways to bootstrap a business include:

- Using funds in personal savings accounts or a certificate of deposit (CD)

- Borrowing against your 401(k)

- Taking an early withdrawal from an individual retirement account (IRA)

- Pulling equity out of your home

- Selling things you don’t need for cash

- Putting together a fundraiser locally to ask for donations

- Asking friends and family for a loan

Each of these options has pros and cons. For instance, borrowing against your 401(k) or taking money from an IRA can shortchange your retirement savings since the funds you take out won’t benefit from compounding interest . Additionally, you could be subject to a 10% early withdrawal penalty on distributions.

Taking a home equity loan or line of credit carries its own risks. If the business fails, you’ll still be responsible for paying back what you’ve borrowed. Should you default on a home equity loan or line of credit, your home could end up in foreclosure . The bottom line is that before you bootstrap, it’s important to look at both the advantages and disadvantages of doing so.

Starting a business is no easy task, and you may need some help along the way. You could hire a business coach, but that requires money, so it’s helpful to know where you can find small business resources for free.

Here are some of the places you can look to get free help when starting a business.

- SBA : As mentioned above, the SBA offers a number of resources to help small business owners, including the SBA loan program as well as educational articles covering how to start a business.

- Small Business Development Centers : SBDCs are local organizations that assist small business owners with things like planning, accessing capital, and scaling for growth.

- SCORE: SCORE is a network of mentors who help small business owners find success. Entrepreneurs can connect with a SCORE mentor to get help with planning and starting a business, growing a business, or exiting a business when they’re ready to move on.

- U.S. Department of Veterans Affairs : The VA offers support to veterans who are interested in starting small businesses. That includes access to educational resources and training for would-be business owners.

- National Women’s Business Council : The National Women’s Business Council is committed to helping women entrepreneurs succeed. Specifically, that centers on helping women in science, technology, engineering, and math (STEM) get the capital they need to start their businesses.

You can also check for free resources locally. For instance, your local chamber of commerce might sponsor free workshops or seminars aimed at helping budding entrepreneurs. You can also look for local nonprofits that serve the small business community.

If you’re starting a business with no money, there’s one more free resource you can utilize. Social media can be an effective way to market your new business without spending a dime on advertising. It may take a little longer to build an audience if you’re not actively spending on ads, but it’s a zero-cost way to spread the word about your business.

The Federal Trade Commission (FTC) enforces specific advertising and marketing regulations that business owners must follow to avoid penalties. Legally, all advertising claims must be truthful, non-deceptive, and supported by evidence. Also, certain products or services may be subject to more specific rules.

You might be starting a business on your own, but if you want it to grow, it can be helpful to focus on building the right connections. That’s where networking and collaborating come in.

Having a sizable network could benefit you in different ways. For example, you might have a connection who could introduce you to someone who’s interested in investing in your business. Or you might be offered an opportunity to promote your business on someone’s podcast or YouTube channel, which is a great way to get free exposure.

In terms of how you build your network, it can depend on what type of business you have. If you’re starting a brick-and-mortar business, for instance, then you might want to look for connections locally first. That might include joining your local chamber of commerce or small business development council.

If you’re starting an online business, then you could use online resources to connect. LinkedIn could be a good place to start your networking efforts. You can also branch out to other social media platforms to forge professional relationships with business owners or influencers in your niche.

Build a Robust Online Presence

With 67% of the world’s population using the internet and 85% of Americans getting online every day, it makes sense to establish a virtual presence for your business. This can include setting up a website or blog, launching a YouTube channel, getting active on TikTok, or building a presence on Facebook, X, or Instagram .

One of the best things about using social media to market a new business is that it doesn’t have to cost anything. While you could spend money on ads, it’s free to create profiles on social media platforms. If you’re interested in setting up a website or blog for your business, platforms like Wix allow you to do that for free.

If you want to build an online presence without spending money, you can certainly do so. It’s also important, however, to think about which channels will offer the best return on investment for your time. Understanding where your potential customers gravitate when they’re online can help you identify which social media channels are worth targeting.

Can I Start a Business With $0?

It’s possible to start a business with $0 (or close to it) if you’re choosing something that utilizes the skills and resources already available to you. For example, if you’re interested in getting paid to write, you could start a freelance business from home and all you would need are a laptop and an internet connection.

What Is the Best Business to Start With No Money?

The best business to start with no money is the one that allows you to use your skills, knowledge, and resources in a way that produces maximum return and maximum enjoyment. If you love dogs, for example, then starting a dog-walking or pet-sitting business could be a good fit, and it doesn’t require a lot of money.

What Is the Easiest Business to Own?

The easiest business to own is one that generates passive income . Passive income is money that you earn without having to do a lot of ongoing work. For example, blogging can provide a passive income if you’re making money from affiliate marketing or online ads. You could also make passive income by selling digital products that you only have to create once, such as printables, journals, or ebooks.

It’s possible to start a business with no money if you have an organized plan and strategy . Knowing what you’ll need to do to get your business started is the first step. Once your business is up and running, you can explore the best ways to grow it in order to achieve the level of success you desire. That might include applying for small business loans , which can help you to scale and expand.

CO— by U.S. Chamber of Commerce. “ Top 3 Reasons Why Small Businesses Fail and How to Avoid Them .”

Skynova. “ Why Startups Failed in 2022 .”

U.S. Small Business Administration. “ SBA Learning Platform .”

Square. “ How Much Does It Cost to Start a Food Truck in 2024? Here Are 10 Ways to Save .”

U.S. Small Business Administration. “ Grants .”

U.S. Small Business Administration. “ Microloans .”

Internal Revenue Service. “ Retirement Topics: Exceptions to Tax on Early Distributions .”

Federal Trade Commission, Consumer Advice. “ Home Equity Loans and Home Equity Lines of Credit .”

U.S. Small Business Administration. “ Small Business Development Centers (SBDC) .”

SCORE. “ Homepage .”

U.S. Department of Veterans Affairs. “ Get Support for Your Veteran-Owned Small Business .”

National Women’s Business Council. “ Homepage .”

Federal Trade Commission. “ Advertising and Marketing Basics .”

Statista. “ Number of Internet and Social Media Users Worldwide as of April 2024 .”

Zippia. “ How Many People Use the Internet? ”

:max_bytes(150000):strip_icc():format(webp)/GettyImages-160482280-4cd73169d1fa4cd8b746f58f132dc47a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

64 Best Small Business Ideas To Start in 2024

Looking to launch a new business in 2024? Discover the best small business ideas for your niche, budget and skill set to jumpstart your entrepreneurial journey.

Thinking about starting a business this year? Whether you're diving into full-time entrepreneurship or planning a side hustle , this list of more than 60 small business ideas is for you.

Each idea below is selected for its practicality, flexibility, and proven potential for success.

Whether you start a clothing line, pet service, or wellness brand, put your spin on one of these businesses to unlock financial growth in 2024.

Qualities of a good small business idea

Your small business idea should fit your budget, skills, and schedule. It should also meet a market need and have the potential to generate sustainable, long-term profit.

Here's a closer look at what makes a strong small business idea:

Market demand

Good small business ideas solve clear problems for specific groups of people. Before moving forward with an idea, research your target market , customer needs, and competitors' solutions. Study your industry's market trends , customer surveys, and sales data to see what consumers and businesses are doing.

Competitive advantage

How you meet market demand also matters. Competitive businesses often have original approaches that set them apart. This could be a new product, a unique selling proposition , or a competitive pricing strategy. Analyze your competitors to understand their strengths and weaknesses, and develop a business plan that capitalizes on any gaps.

Scalability

Scalability is about the potential for growth and expansion. Can your business idea grow without hitting geographical, financial, or market limits? Many scalable businesses leverage ecommerce platforms to reach global audiences without a physical investment.

Low barrier to entry

Businesses are easier to start when they have lower initial costs, fewer regulatory requirements, less need for specialized training, and minimal technology needs. For example, business ideas like creating freelance content or opening a dropshipping store require minimal setup and no upfront capital.

Profitability

Ultimately, a small business idea needs to make money . Try to estimate potential profits and build a financial model based on predicted sales and operational costs.

Sustainability

Will your small business be part of a growing industry or a trend that's already peaked? Will your operations align with environmental , social, and regulatory expectations? Sustainable businesses not only benefit from increased consumer trust but also set themselves up for long-term success.

Best small business ideas

By using your existing skills and some readymade online tools, it's easier than you might think to launch a small business. Here are some small business ideas that you can start today.

1. T-shirt designer