| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

What Is A Balance Sheet? (Example Included)

Updated: Jun 1, 2024, 2:22pm

Table of Contents

What is a balance sheet, components of a balance sheet, how to balance a balance sheet, why is a balance sheet important, balance sheet example, frequently asked questions (faqs).

When you’re starting a company, there are many important financial documents to know. It might seem overwhelming at first, but getting a handle on everything early will set you up for success in the future. Today, we’ll go over what a balance sheet is and how to master it to keep accurate financial records.

A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. A balance sheet covers a company’s assets as defined by its liabilities and shareholder equity.

Balance Sheet Time Periods

When investors ask for a balance sheet, they want to make sure it’s accurate to the current time period. They might want to see a past balance sheet as well. It’s important to keep accurate balance sheets regularly for this reason.

Assets are any resources your company owns that holds value. When setting up a balance sheet, you should order assets from current assets to long-term assets. Long-term assets can’t be converted immediately into cash on hand. They’re important to include, but they can’t immediately be converted into liquid capital.

There are a few different types of assets to list that your company probably has on-hand:

- Liquid assets: Cash and cash equivalents, such as certificates of deposit (CDs)

- Accounts receivable (A/R): Money owed to your company

- Marketable securities: Liquid assets that are readily convertible into cash (generally reported under cash and cash equivalents)

- Inventory: Any products you have available for sale

- Prepaid expenses: Rent, insurance and contracts with vendors

These are examples of long-term assets:

- Investments or securities that can’t be liquidated within the next year

- Fixed assets: Land, machinery and buildings

- Intangible assets: Intellectual property, brand awareness and company reputation

Want more information? Here’s everything you need to know about assets .

Liabilities

A liability is money that your company owes to any outside entity. Liabilities refer to basic aspects of your business: taking in money, loans, providing services and everything else your business does.

Liabilities are categorized as current and long-term as well. Current liabilities are customer prepayments for which your company needs to provide a service, wages, debt payments and more.

On the other hand, long-term liabilities are long-term debts like interest and bonds, pension funds and deferred tax liability.

Shareholder Equity

Finally, shareholder equity refers to your company’s net assets. The shareholder equity comprises the following:

- Money generated by a company

- Money put into the business by its owners and shareholders

- Any other capital put into the business

You can calculate total equity by subtracting liabilities from your company’s total assets.

When creating a balance sheet, start with two sections to make sure everything is matching up correctly. On one side, you’ll have the business’s assets. On the other side, you’ll put the company’s liabilities and shareholder equity.

The numbers should match up exactly: the total assets must be equal to the liabilities and shareholder assets. If these numbers aren’t the same, there might be an issue with your calculations or a missing asset or liability. Before sharing with any possible investors, make sure to check over your balance sheet several times.

Balance sheets are important because they give a picture of your company’s financial standing. Before getting a business loan or meeting with potential investors, a company has to provide an up-to-date balance sheet. A potential investor or loan provider wants to see that the company is able to keep payments on time.

Department heads can also use a balance sheet to understand the financial health of the company. Looking at the balance sheet and its components helps them keep track of important payments and how much cash is available on hand to pay these vendors.

Overall, a balance sheet is an important statement of your company’s financial health, and it’s important to have accurate balance sheets available regularly.

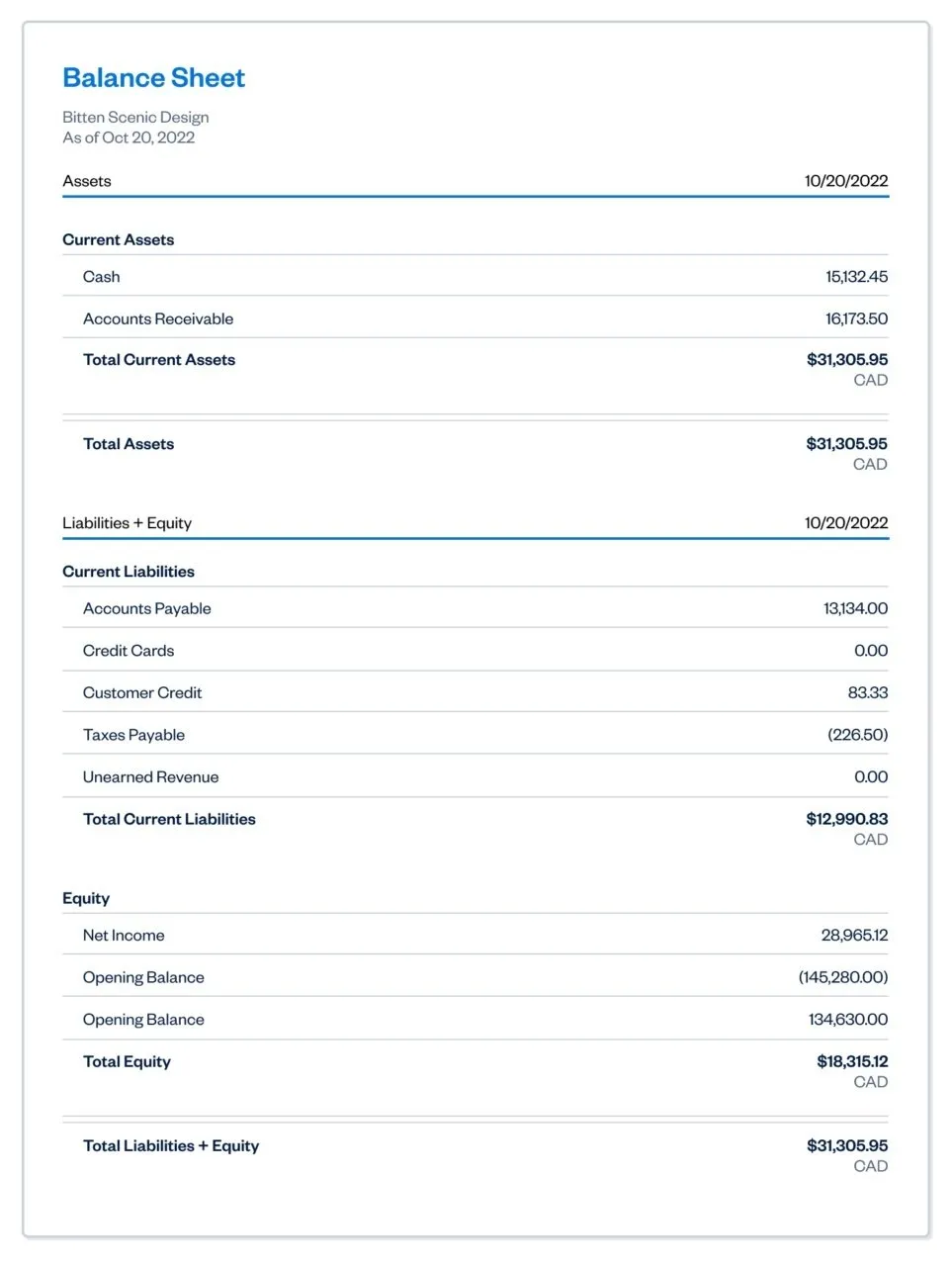

This is an example of a basic balance sheet and what’s included.

Download Balance Sheet Example

In this example, the imagined company had its total liabilities increase over the time period between the two balance sheets and consequently the total assets decreased.

Bottom Line

A balance sheet is a financial document that you should work on calculating regularly. If there are discrepancies, that means you’re missing important information for putting together the balance sheet.

Why do we need a balance sheet?

The balance sheet is a report that gives a basic snapshot of the company’s finances. This is an important document for potential investors and loan providers.

How do I calculate a balance sheet?

The formula is very basic: total assets = total liabilities + total equity. If you have questions about the individual components of the balance sheet, you might have to consult a finance expert.

What is the best accounting software for small businesses?

There are a number of high-quality accounting software solutions available. The overall best include OnPay, Gusto and QuickBooks. To find out which is the right option for your business, check out our article detailing the best accounting software for small businesses .

- Best Accounting Software for Small Business

- Best Quickbooks Alternatives

- Best Online Bookkeeping Services

- Best Accounting Software for Mac

- Best Construction Accounting Software

- Best Free Accounting Software

- Best Accounting Software for Nonprofits

- Best Church Accounting Software

- Best Real Estate Accounting Software

- Best Receipt Scanner Apps

- FreshBooks Review

- Xero Review

- QuickBooks Online Review

- Kareo Review

- Zoho Books Review

- Sage Accounting Review

- Neat Review

- Kashoo Review

- QuickBooks Self-Employed Review

- QuickBooks For LLC Review

- FreshBooks vs. Quickbooks

- Quicken vs. Quickbooks

- Xero vs. Quickbooks

- Netsuite vs. Quickbooks

- Sage vs. Quickbooks

- Quickbooks Pro vs. Premier

- Quickbooks Online vs. Desktop

- Wave vs. Quickbooks

- Gusto vs. Quickbooks

- Zoho Books vs. Quickbooks

- What Is Accounting? The Basics

- How Much Does An Accountant Cost?

- How To Find A Small Business Accountant

- Bookkeeping vs. Accounting

- Small Business Bookkeeping for Beginners

- What is Bookkeeping?

- Accounts Payable vs. Accounts Receivable

- What is Cost Accounting?

Next Up In Business

- Best Accounting Software For Small Business

- 8 Types Of Accounting Explained

- Quicken Review

- NeatBooks Review

- Gusto vs. QuickBooks

- Quickbooks Online Vs. Desktop: What’s The Difference?

Best West Virginia Registered Agent Services Of 2024

Best Vermont Registered Agent Services Of 2024

Best Rhode Island Registered Agent Services Of 2024

Best Wisconsin Registered Agent Services Of 2024

Best South Dakota Registered Agent Services Of 2024

B2B Marketing In 2024: The Ultimate Guide

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Balance Sheet

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on March 17, 2023

Get Any Financial Question Answered

Table of contents, what is a balance sheet.

A balance sheet is a financial statement that shows the relationship between assets , liabilities , and shareholders’ equity of a company at a specific point in time.

Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity .

Balance sheets are useful tools for individual and institutional investors, as well as key stakeholders within an organization, as they show the general financial status of the company.

It is also possible to grasp the information found in a balance sheet to calculate important company metrics, such as profitability, liquidity, and debt-to-equity ratio.

However, it is crucial to remember that balance sheets communicate information as of a specific date. Naturally, a balance sheet is always based upon past data.

While stakeholders and investors may use a balance sheet to predict future performance, past performance does not guarantee future results.

In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years.

How Balance Sheets Work

A balance sheet is guided by the accounting equation:

Both parts should be equal to each other or balance each other out. This means that the assets of a company should equal its liabilities plus any shareholders’ equity that has been issued. Hence, a balance sheet should always balance.

For instance, if a company takes out a ten-year, $8,000 loan from a bank, the assets of the company will increase by $8,000. Its liabilities will also increase by $8,000, balancing the two sides of the accounting equation .

If the company takes $10,000 from its investors, its assets and stockholders’ equity will also increase by that amount.

The revenues of the company in excess of its expenses will go into the shareholder equity account.

These revenues will be balanced on the asset side of the equation, appearing as inventory, cash , investments , or other assets.

Components of a Balance Sheet

A balance sheet has three primary components: assets, liabilities, and shareholders’ equity.

Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash.

These can include cash, investments, and tangible objects.

Companies divide their assets into two categories: current assets and noncurrent (long-term) assets.

Current Assets

Current assets are typically those that a company expects to convert easily into cash within a year.

These assets include cash and cash equivalents, prepaid expenses, accounts receivable, marketable securities, and inventory.

Non-Current Assets

Noncurrent assets are long-term investments that the company does not expect to convert into cash within a year or have a lifespan of more than one year.

Noncurrent assets include tangible assets , such as land, buildings, machinery, and equipment.

They can also be intangible assets, such as trademarks, patents, goodwill, copyright , or intellectual property.

Liabilities

Liabilities are anything a company owes. These are loans, accounts payable, bonds payable, or taxes.

Like assets, liabilities can be classified as either current or noncurrent liabilities.

Current Liabilities

Current liabilities refer to the liabilities of the company that are due or must be paid within one year.

This may include accounts payables, rent and utility payments, current debts or notes payables, current portion of long-term debt, and other accrued expenses.

Noncurrent Liabilities

Noncurrent or long-term liabilities are debts and other non-debt financial obligations that a company does not expect to repay within one year from the date of the balance sheet.

This may include long-term loans, bonds payable, leases, and deferred tax liabilities.

Shareholder’s Equity

Shareholder’s equity is the net worth of the company and reflects the amount of money left over if all liabilities are paid, and all assets are sold.

Shareholders’ equity belongs to the shareholders, whether public or private owners.

Retained Earnings

Shareholders’ equity reflects how much a company has left after paying its liabilities.

If the company wanted to, it could pay out all of that money to its shareholders through dividends . However, the company typically reinvests the money into the company.

Retained earnings are the money that the company keeps.

Share Capital

Share capital is the value of what investors have invested in the company.

For instance, if someone invests $200,000 to help you start a company, you would count that $200,000 in your balance sheet as your cash assets and as part of your share capital.

Stocks can be common or preferred stocks .

Common stock is those that people get when they buy stock through the stock market . Preferred stock, on the other hand, provides the shareholder with a greater claim on the company’s assets and earnings.

You can also see treasury stock on a balance sheet. This stock is a previously outstanding stock that is purchased from stockholders by the issuing company.

Example of a Balance Sheet

Below is an example of a balance sheet of Tesla for 2021 taken from the U.S. Securities and Exchange Commission .

As you can see, it starts with current assets, then the noncurrent, and the total of both.

Below the assets are the liabilities and stockholders’ equity, which include current liabilities, noncurrent liabilities, and shareholders’ equity.

For example, this balance sheet tells you:

- The reporting period ends December 31, 2021, and compares against a similar reporting period from the year prior.

- The assets of the company total $62,131, including $27,100 in current assets and $35,031 in noncurrent assets.

- The liabilities of the company total $30,548, including $19,705 in current liabilities and $10,843 in noncurrent liabilities.

- The company retained $331 in earnings during the reporting period, greatly less than the same period a year prior.

- Adhering to the accounting equation, a balance is obtained by the total assets of $62,131 and the combined total liabilities and stockholders’ equity which is $62,131.

It is crucial to note that how a balance sheet is formatted differs depending on where the company or organization is based.

How to Prepare a Balance Sheet

The balance sheet is prepared using the following steps:

Step 1: Determine the Reporting Date and Period

The balance sheet previews the total assets, liabilities, and shareholders’ equity of a company on a specific date, referred to as the reporting date.

Often, the reporting date will be the final day of the reporting period. Companies that report annually, like Tesla, often use December 31st as their reporting date, though they can choose any date.

There are also companies, like publicly traded ones, that will report quarterly. For this case, the reporting date will usually fall on the last day of the quarter:

- Q1: March 31

- Q2: June 30

- Q3: September 30

- Q4: December 31

However, it is common for a balance sheet to take a few days or weeks to prepare after the reporting period has ended.

Step 2: Identify Your Assets

You will need to tally up all your assets of the company on the balance sheet as of that date. This will include both current and noncurrent assets.

Assets are typically listed as individual line items and then as total assets in a balance sheet.

This will make it easier for analysts to comprehend exactly what your assets are and where they came from. Tallying the assets together will be required for final analysis.

Step 3: Identify Your Liabilities

Like assets, you need to identify your liabilities which will include both current and long-term liabilities.

Again, these should be organized into both line items and total liabilities. They should also be both subtotaled and then totaled together.

Step 4: Calculate Shareholders’ Equity

After you have assets and liabilities, calculating shareholders’ equity is done by taking the total value of assets and subtracting the total value of liabilities.

Shareholders’ equity will be straightforward for companies or organizations that a single owner privately holds.

The calculation may be complicated for publicly held companies depending on the various types of stock issued.

Line items in this section include common stocks, preferred stocks, share capital, treasury stocks, and retained earnings.

Step 5: Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

Adding total liabilities to shareholders’ equity should give you the same sum as your assets. If not, then there may be an error in your calculations.

Causes of a balance sheet not truly balancing may be:

- Errors in inventory

- Incorrectly entered transactions

- Incomplete or misplaced data

- Miscalculated loan amortization or depreciation

- Errors in currency exchange rates

- Miscalculated equity calculations

How to Analyze a Balance Sheet

Financial ratio analysis is the main technique to analyze the information contained within a balance sheet.

It uses formulas to obtain insights into a company and its operations.

Using financial ratios in analyzing a balance sheet, like the debt-to-equity ratio, can produce a good sense of the financial condition of the company and its operational efficiency.

It is crucial to remember that some ratios will require information from more than one financial statement, such as from the income statement and the balance sheet.

There are two types of ratios that use data from a balance sheet. These are:

Financial Strength Ratios

Financial strength ratios can provide investors with ideas of how financially stable the company is and whether it finances itself.

It also yields information on how well a company can meet its obligations and how these obligations are leveraged.

Financial strength ratios can include the working capital and debt-to-equity ratios.

Activity Ratios

Activity ratios mainly focus on current accounts to reveal how well the company manages its operating cycle .

These operating cycles can include receivables, payables, and inventory.

Examples of activity ratios are inventory turnover ratio, total assets turnover ratio, fixed assets turnover ratio, and accounts receivables turnover ratio.

These ratios can yield insights into the operational efficiency of the company.

Importance of a Balance Sheet

There are a few key reasons why a balance sheet is important. Here are a few of them:

Balance Sheets Examine Risk

A balance sheet lists all assets and liabilities of a company.

With this information, a company can quickly assess whether it has borrowed a large amount of money, whether the assets are not liquid enough, or whether it has enough current cash to fulfill current demands.

Balance Sheets Secure Capital

A lender will usually require a balance sheet of the company in order to secure a business plan.

Additionally, a company must usually provide a balance sheet to private investors when planning to secure private equity funding.

These are some of the cases in which external parties want to assess and check a company’s financial stability and health, its creditworthiness, and whether the company will be able to settle its short-term debts.

Balance Sheets are Needed for Financial Ratios

Business owners use these financial ratios to assess the profitability, solvency, liquidity , and turnover of a company and establish ways to improve the financial health of the company.

Some financial ratios need data and information from the balance sheet.

Balance Sheets Lure and Retain Talents

Good and talented employees are always looking for stable and secure companies to work in.

Balance sheets that are disclosed from public companies allow employees a chance to review how much the company has on hand and whether the financial health of the company is in accordance with their expectations from their employers.

Limitations of a Balance Sheet

Although balance sheets are important financial statements, they do have their limitations. Here are some of them:

Balance Sheets are Static

It may not provide a full snapshot of the financial health of a company without data from other financial statements.

In order to get a complete understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement.

Balance Sheets Have a Narrow Scope of Timing

The balance sheet only reports the financial position of a company at a specific point in time.

This may not provide an accurate portrayal of the financial health of a company if the market conditions rapidly change or without knowledge of previous cash balance and understanding of industry operating demands.

Balance Sheets May Be Susceptible to Errors and Fraud

The data and information included in a balance sheet can sometimes be manipulated by management in order to present a more favorable financial position for the company.

Businesses should be wary of companies that have large discrepancies between their balance sheets and other financial statements.

It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags.

Balance Sheets Are Subject to Several Professional Judgment Areas That Could Impact the Report

For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts.

A company should make estimates and reflect their best guess as a part of the balance sheet if they do not know which receivables a company is likely actually to receive.

Balance Sheets vs. Income Statements

Here are some key differences between balance sheets and income statements:

The Bottom Line

Balance sheets are important financial statements that provide insights into the assets, liabilities, and shareholders’ equity of a company.

It is helpful for business owners to prepare and review balance sheets in order to assess the financial health of their companies.

Balance sheets also play an important role in securing funding from lenders and investors. Additionally, it helps businesses to retain talents.

Although balance sheets are important, they do have their limitations, and business owners must be aware of them.

Some of its limitations are that it is static, has a narrow scope of timing, and is subject to errors and frauds.

A balance sheet is also different from an income statement in several ways, most notably the time frame it covers and the items included.

It is important to understand that balance sheets only provide a snapshot of the financial position of a company at a specific point in time.

In order to get a more accurate understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement.

Balance Sheet FAQs

What is included in the balance sheet.

Balance sheets include assets, liabilities, and shareholders' equity. Assets are what the company owns, while liabilities are what the company owes. Shareholders' equity is the portion of the business that is owned by the shareholders.

Who prepares the balance sheet?

The balance sheet is prepared by the management of the company. The auditor of the company then subjects balance sheets to an audit. Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper. On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant.

What is the balance sheet formula?

The balance sheet equation is: Assets = Liabilities + Shareholders' Equity

What is the purpose of the balance sheet?

The balance sheet is used to assess the financial health of a company. Investors and lenders also use it to assess creditworthiness and the availability of assets for collateral.

How often are balance sheets required?

Balance sheets are typically prepared at the end of set periods (e.g., annually, every quarter). Public companies are required to have a periodic financial statement available to the public. On the other hand, private companies do not need to appeal to shareholders. That is why there is no need to have their financial statements published to the public.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Are Bonds Current Assets?

- Are Buildings Noncurrent Assets?

- Are Construction Works-In-Progress a Current Asset?

- Are Debt Investments Current Assets?

- Are Fixed Assets Current Assets?

- Are Intangible Assets Current Assets?

- Are Investments Current Assets?

- Are Marketable Securities Current Assets?

- Are Office Supplies a Current Asset?

- Are Supplies a Current Asset?

- Components of the Balance Sheet

- Current Liabilities on the Balance Sheet

- Difference Between Trial Balance and Balance Sheet

- Effects of Transactions on a Balance Sheet

- Functions and Limitations of Balance Sheet

- Is a Loan a Current Asset?

- Is a Patent a Noncurrent Asset?

- Is Accounts Payable a Current Asset?

- Is Accounts Receivable a Current Asset?

- Is Accounts Receivable a Material Component of a Company’s Total Current Assets?

- Is Accumulated Depreciation a Current Asset?

- Is Bank a Current Asset?

- Is Cash a Current Asset?

- Is Current Assets the Same as Total Assets?

- Is Deferred Tax a Current Asset?

- Is Depreciation a Current Asset?

- Is Equipment a Current Asset?

- Is Fixed Deposit a Non Current Asset?

- Is Goodwill a Current Asset?

- Is Interest Receivable a Current Asset?

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

How to write a balance sheet for a business plan

Table of Contents

What is a balance sheet?

Elements of a balance sheet, liabilities, how to write a balance sheet, manage your business finances with countingup.

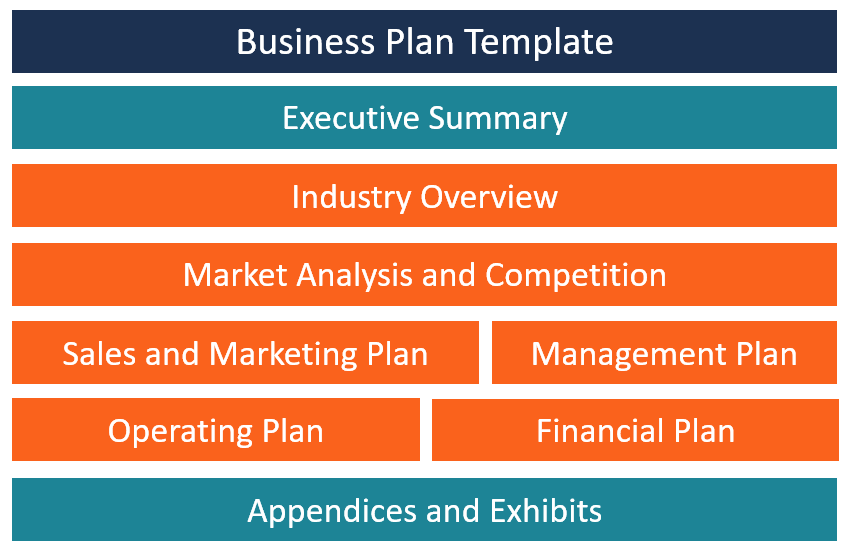

A balance sheet is one of three major financial statements that should be in a business plan – the other two being an income statement and cash flow statement .

Writing a balance sheet is an essential skill for any business owner. And while business accounting can seem a little daunting at first, it’s actually fairly simple.

To help you write the perfect balance sheet for your business plan, this guide covers everything you need to know, including:

- What are assets?

- What are liabilities?

- What is equity?

A balance sheet is a financial statement that shows a business’ “book value”, or the value of a company after all of its debts are paid.

For those inside the business, it provides valuable financial insights, allowing the owners to assess their current financial situation and plan for the future.

For external investors, a balance sheet lets them know whether it’s a worthwhile investment.

Putting a balance sheet together isn’t all that difficult. You just need to know the value of three things:

- Owner’s equity

Once you know these three figures, there’s just a little bit of maths – nothing too scary though.

Assets are items or resources that have financial value. They might be physical items, machinery and vehicles, or they could be intangible items, like copyrights or brand identity .

Assets are separated into two groups based on how quickly you can turn them into cash. There are current assets and fixed assets.

Current assets are things that are fairly simple to value and sell, such as:

- Stock and inventory

- Cash in the bank

- Money owed to you (through unpaid invoices )

- Customer deposits

- Office furniture, equipment or supplies

- Phones or laptops

- Even relatively trivial items like a coffee machine or pool table

Fixed assets are valuable items that take much longer to sell, such as:

- Property or buildings

- Specialised equipment for your business operations

- Investments

- Vehicles

On your balance sheet, the asset column is the simplest. All you need to do is list each item your business owns, along with their individual values, in a separate column. Then, add up the values to get a total at the bottom.

Liabilities are the funds that you owe to other people, banks, or businesses. They can be:

- A business loan (the total, not the monthly payment amount)

- A mortgage or rent payment on a property

- Supplier contracts you owe

- Your accounts payable total

- Other financial obligations, such as paying wages or freelancers for support

- Taxes you’ll owe to HMRC

List these in the same way you did with your assets – on a spreadsheet with their values in a separate column.

When you know the value of your assets and liabilities, working your equity is simple – it’s just the total value of your assets, minus the total value of your liabilities.

Record the owner’s equity in the same column as your liabilities. When you add them all up, it should be the same value as your assets.

After you’ve totalled up your assets, liabilities, and owner’s equity, all that’s left to do is fill in your balance sheet.

Using a spreadsheet, record your assets on the left and your liabilities and owner’s equity on the right.

For example, here’s what a balance sheet might look like for a painter and decorator:

If you’ve recorded everything correctly, both sides should have the same total. Whenever you make a change, the balance sheet will change, but it should still be balanced.

For example, let’s say our painter and decorator sold their equipment. In that case, they’d lose an asset worth £200, but they’d also gain £200 in cash, so the asset total would stay the same.

Alternatively, let’s say they lost the equipment altogether and got no money for it. In that case, they’d lose £200, leaving their asset total at £5,600. Then, they’d have to adjust the other side, so it remains balanced, like this:

If your two totals are not balanced, it’s most likely for one of these reasons:

- Incomplete or missing information

- Incorrect data entry

- A mistake in exchange rates

- And inventory miscount

Basically, if things don’t look right, try not to panic. It’s normally a simple mistake, so go over the figures again and you’ll find the culprit.

The trickiest part of writing a balance sheet for a business plan is accurately recording financial information.

With the Countingup business current account, you’ll have access to a digital record of all your transactions in one simple app, giving you all the financial information you’ll need for a business plan.

Start your three-month free trial today.

Find out more here .

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

Business insurance from superscript.

We’re partnered with insurance experts, Superscript to provide you with small business insurance.

How to register a company in the UK

There are over five million companies registered in the UK and 500,000 new

How to set up a TikTok shop (2024)

TikTok can be an excellent platform for growing a business, big or small.

Best Side Hustle Ideas To Make Extra Money In 2024 (UK Edition)

Looking to start a new career? Or maybe you’re looking to embrace your

How to throw a launch party for a new business

So your business is all set up, what next? A launch party can

How to set sales goals

Want to make manageable and achievable sales goals for your business? Find out

10 key tips to starting a business in the UK

10 things you need to know before starting a business in the UK

How to set up your business: Sole trader or limited company

If you’ve just started a business, you’ll likely be faced with the early

How to register as a sole trader

Running a small business and considering whether to register as a sole trader?

How to open a Barclays business account

When starting a new business, one of the first things you need to

6 examples of objectives for a small business plan

Your new company’s business plan is a crucial part of your success, as

How to start a successful business during a recession

Starting a business during a recession may sound like madness, but some big

Understanding a Balance Sheet (With Examples and Video)

Frances McInnis

Reviewed by

May 3, 2024

This article is Tax Professional approved

Balance sheets can help you see the big picture: the net worth of your small business, how much money you have, and where it’s kept. They’re also essential for getting investors, securing a loan , or selling your business.

So you definitely need to know your way around one. That’s where this guide comes in. We’ll walk you through balance sheets, one step at a time.

I am the text that will be copied.

What is a balance sheet?

The balance sheet is one of the three main financial statements , along with the income statement and cash flow statement .

While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. It incorporates every journal entry since your company launched. Your balance sheet shows what your business owns (assets), what it owes (liabilities) , and what money is left over for the owners ( owner’s equity ).

Because it summarizes a business’s finances, the balance sheet is also sometimes called the statement of financial position. Companies usually prepare one at the end of a reporting period, such as a month, quarter, or year.

The purpose of a balance sheet

Because the balance sheet reflects every transaction since your company started, it reveals your business’s overall financial health. Investors, business owners, and accountants can use this information to give a book value to the business, but it can be used for so much more.

At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments.

The information in your company’s balance sheet can help you calculate key financial ratios, such as the debt-to-equity ratio, a metric which shows the ability of a business to pay for its debts with equity (should the need arise). Even more immediately applicable is the current ratio : current assets / current liabilities. This will tell you whether you have the ability to pay all your debts in the next 12 months.

You can also compare your latest balance sheet to previous ones to examine how your finances have changed over time. You’ll be able to see just how far you’ve come since day one.

A simple balance sheet template

You can download a simple balance sheet template here . You record the account name on the left side of the balance sheet and the cash value on the right.

What goes on a balance sheet

At a high level, a balance sheet works the same way across all business types. They are organized into three categories: assets, liabilities, and owner’s equity.

Let’s start with assets—the things your business owns that have a dollar value.

List your assets in order of liquidity , or how easily they can be turned into cash, sold or consumed. Bank accounts and other cash accounts should come first followed by fixed assets or tangible assets like buildings or equipment with a useful life longer than a year. Even intangible assets like intellectual properties, trademarks, and copyrights should be included. Anything you expect to convert into cash within a year are called current assets.

Current assets include:

- Money in a checking account

- Money in transit (money being transferred from another account)

- Accounts receivable (money owed to you by customers)

- Short-term investments

- Prepaid expenses

- Cash equivalents (currency, stocks, and bonds)

Long-term assets (or non-current assets), on the other hand, are things you don’t plan to convert to cash within a year.

Long-term assets include:

- Buildings and land

- Machinery and equipment (less accumulated depreciation )

- Intangible assets like patents, trademarks, copyrights, and goodwill (you would list the market value of what fair price a buyer might purchase these for)

- Long-term investments

Let’s say you own a vegan catering business called “Where’s the Beef”. As of December 31, your company assets are: money in a checking account, an unpaid invoice for a wedding you just catered, and cookware, dishes and utensils worth $900. Here’s how you’d list your assets on your balance sheet:

| ASSETS | |

|---|---|

| Bank account | $2,050 |

| Accounts receivable | $6,100 |

| Equipment | $900 |

| Total assets | $9,050 |

Liabilities

Next come your liabilities—your business’s financial obligations and debts.

List your liabilities by their due date. Just like assets, you’ll classify them as current liabilities (due within a year) and non-current liabilities (the due date is more than a year away). These are also known as short-term liabilities and long-term liabilities.

Your current liabilities might include:

- Accounts payable (what you owe suppliers for items you bought on credit)

- Wages you owe to employees for hours they’ve already worked

- Loans that you have to pay back within a year

- Credit card debt

And here are some non-current liabilities:

- Loans that you don’t have to pay back within a year

- Bonds your company has issued

Returning to our catering example, let’s say you haven’t yet paid the latest invoice from your tofu supplier. You also have a business loan, which isn’t due for another 18 months.

Here are Where’s the Beef’s liabilities:

| LIABILITIES | |

|---|---|

| Accounts payable | $150 |

| Long-term debt | $2,000 |

| Total liabilities | $2,150 |

Equity is money currently held by your company. This category is usually called “owner’s equity” for sole proprietorships and “stockholders’ equity” or “shareholders’ equity” for corporations. It shows what belongs to the business owners and the book value of their investments (like common stock, preferred stock, or bonds).

Owners’ equity includes:

- Capital (the amount of money invested into the business by the owners)

- Private or public stock

- Retained earnings (all your revenue minus all your expenses and distributions since launch)

Equity can also drop when an owner draws money out of the company to pay themself, or when a corporation issues dividends to shareholders.

For Where’s the Beef, let’s say you invested $2,500 to launch the business last year, and another $2,500 this year. You’ve also taken $9,000 out of the business to pay yourself and you’ve left some profit in the bank.

Here’s a summary of Where’s the Beef’s equity:

| EQUITY | |

|---|---|

| Capital | $5,000 |

| Retained earnings | $10,900 |

| Drawing | -$9,000 |

| Total equity | $6,900 |

The balance sheet equation

This accounting equation is the key to the balance sheet:

Assets = Liabilities + Owner’s Equity

Assets go on one side, liabilities plus equity go on the other. The two sides must balance—hence the name “balance sheet.”

It makes sense: you pay for your company’s assets by either borrowing money (i.e. increasing your liabilities) or getting money from the owners (equity).

A sample balance sheet

We’re ready to put everything into a standard template ( you can download one here ). Here’s what a sample balance sheet looks like, in a proper balance sheet format:

Nice. Your balance sheet is ready for action.

Great. Now what do I do with it?

Because the balance sheet reflects every transaction since your company started, it reveals your business’s overall financial health. At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments.

You can also compare your latest balance sheet to previous ones to examine how your finances have changed over time. You’ll be able to see just how far you’ve come since day one. If you need help understanding your balance sheet or need help putting together a balance sheet, consider hiring a bookkeeper .

Here’s some metrics you can calculate using your balance sheet:

- Debt-to-equity ratio (D/E ratio): Investors and shareholders are interested in the D/E ratio of a company to understand whether they raise money through investment or debt. A high D/E ratio shows a business relies heavily on loans and financing to raise money.

- Working capital : This metric shows how much cash you would hold if you paid off all your debts. It signals to investors and lenders how capable you are to pay down your current liabilities.

- Return on Assets: A formula for calculating how much net income is being earned relative to the assets owned. The more income earned relative to the amount of assets, the higher performing a business is considered to be.

Next, we’ll cover the three most important ratios that you can calculate using your balance sheet: the current ratio, the debt-to-equity ratio, and the quick ratio.

The current ratio

Can your company pay its debts? The current ratio measures the liquidity of your company—how much of it can be converted to cash, and used to pay down liabilities. The higher the ratio, the better your financial health in terms of liquidity .

The ratio for finding your current ratio looks like this:

Current Ratio = Current Assets / Current Liabilities

You should aim to maintain a current ratio of 2:1 or higher. Meaning, your company holds twice as much value in assets as it does in liabilities. If you had to, you could pay off all the money you owe two times over.

Once you drop below a current ratio of 2:1, your liquidity isn’t looking so good. And if you dip below 1:1, you’re entering hot water. That means you don’t have enough liquidity to pay off your debts.

You can improve your current ratio by either increasing your assets or decreasing your liabilities.

The quick ratio

Also called the acid test ratio, the quick ratio describes how capable your business is of paying off all its short-term liabilities with cash and near-cash assets. In this case, you don’t include assets like real estate or other long-term investments. You also don’t include current assets that are harder to liquidate, like inventory. The focus is on assets you can easily liquidate.

Here’s how you get the quick ratio:

Quick Ratio = (Cash and Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

If your ratio is 1:1 or better, you’re sitting pretty. That means you’ve got enough quick-to-liquidate assets to cover all your short term liabilities in a pinch.

The debt-to-equity ratio

Similar to the current ratio and quick ratio, the debt-to-equity ratio measures your company’s relationship to debt. Only, in this case, the key value is your total equity.

This ratio tells you how much your company depends upon equity to keep running versus how much it depends on outside lenders. It’s calculated like this:

Debt to Equity Ratio = Total Outside Liabilities / Owner or Shareholders’ Equity

Generally speaking, a 2:1 ratio is considered acceptable. If the ratio gets bigger, you start running into trouble. It means your business relies heavily on debt to keep running, which turns off investors. The higher the ratio, the higher the chance that, in the event you need to pay off your debt, you’ll use up all your earnings and cash flows—and investors will end up empty-handed.

Examples of balance sheet analysis

We’ll do a quick, simple analysis of two balance sheets, so you can get a good idea of how to put financial ratios into play and measure your company’s performance.

Annie’s Pottery Palace, a large pottery studio, holds a lot of its current assets in the form of equipment—wheels and kilns for making pottery. Accounts receivable play a relatively minor role.

Liabilities are few—a small loan to pay off within the year, some wages owed to employees, and a couple thousand dollars to pay suppliers.

Annie’s is a single-member LLC—there are no shareholders, so her equity includes only her initial investment, retained earnings, and Annie’s draw($4,000).

Ratio analysis:

Current ratio: 22,000 / 7,000 = 3.14:1

Annie’s current ratio is very healthy. If necessary, her current assets could pay off her current liabilities more than three times over.

Quick ratio: 6,000 / 7,000 = 0.85:1

Her quick ratio isn’t looking so hot, though. Annie’s currently sitting just below 1:1, meaning she wouldn’t be able to quickly pay off debt.

Debt-to-equity ratio: 7,000 / 15,000 = 0.46:1

Annie’s debt-to-equity looks good. She’s got more than twice as much owner’s equity than she does outside liabilities, meaning she’s able to easily pay off all her external debt.

Final analysis:

Annie is able to cover all of her liabilities comfortably—until we take her equipment assets out of the picture. Most of her assets are sunk in equipment, rather than quick-to-cash assets. With this in mind, she might aim to grow her easily liquidated assets by keeping more cash on hand in the business checking account.

That being said, her owner’s equity is more than capable of covering her debt, so this problem shouldn’t be difficult to fix. It would be wise for Annie to take care of it before applying for loans or bringing on investors.

Example balance sheet analysis: Bill’s Book Barn LTD.

A lot of Bill’s assets are tied up in inventory—his large collection of books. The rest mostly consists of long-term investments and intangible assets. (Bill’s Book Barn is famous among collectors of rare fly-tying manuals; a business consultant valued his list of dedicated returning customers at $10,000.)

He doesn’t have a lot of liabilities compared to his assets, and all of them are short-term liabilities. Meaning, he’ll need to pay off that $17,000 within a year.

Finally, since Bill is incorporated, he has issued shares of his business to his brother Garth. Currently, Garth holds a $12,000 share in the business, a little shy of half its total equity.

Ratio analysis

Current ratio: 30,000 / 17,000 = 1.76:1

Since long-term investments and intangible assets are tough to liquidate, they’re not included in current assets—meaning Bill has $30,000 in assets he can more or less easily use to cover his liabilities. His ratio of 1.76:1 isn’t great—it doesn’t leave much wiggle room if he wants to pay off his liabilities. But it isn’t terrible, either—he’s just shy of a healthy 2:1 ratio.

Quick ratio: 7,000 / 17,000 = 0.41:1

Bill’s quick ratio is pretty dire—he’s well short of paying off his liabilities with cash and cash equivalents, leaving him in a bind if he needs to take care of that debt ASAP.

Debt-to-equity ratio: 17,000 / 15,000 = 1.13:1

Once we take into account his $13,000 owner’s draw, Bill’s owner’s equity comes to just $15,000, shy of his $17,000 in debt. Remember, an acceptable debt-to-equity ratio is 2:1. Bill is falling short of acceptable; if he had to pay off all his debts quickly, his equity wouldn’t cover it, and he’d need to dip into his company’s income. That makes his business unattractive to potential investors. Unless he changes course, Bill will have trouble getting financing for his business in the future.

Summary Analysis

Bill’s ratios don’t look great, but there’s hope. If he starts liquidating some of his long-term investments now, he can bump his current ratio up to 2:1, meaning he’d be in a healthy position to pay off liabilities with his current assets.

His quick ratio will take more work to improve. A lot of Bill’s assets are tied up in inventory. If he could convert some of that inventory to cash, he could improve his ability to pay of debt quickly in an emergency. He may want to take a look at his inventory, and see what he can liquidate. Maybe he’s got shelves full of books that have been gathering dust for years. If he can sell them off to another bookseller as a lot, maybe he can raise the $10,000 cash to become more financially stable.

Finally, unless he improves his debt-to-equity ratio, Bill’s brother Garth is the only person who will ever invest in his business. The situation could be improved considerably if Bill reduced his $13,000 owner’s draw. Unfortunately, he’s addicted to collecting extremely rare 18th century guides to bookkeeping. Until he can get his bibliophilia under control, his equity will continue to suffer.

Balance sheets can tell you a lot of information about your business, and help you plan strategically to make it more liquid, financially stable, and appealing to investors. But unless you use them in tandem with income statements and cash flow statements, you’re only getting part of the picture. Learn how they work together with our complete guide to financial statements .

Related Posts

Ecommerce Accounting 101

Your PayPal account is blowing up. Now, are your books balanced?

Best Free Accounting Software for Small Businesses

Accounting software can be your secret weapon when it comes to managing your small business finances. But you don't have to spend big for features you won't use.

How to Create a Financial Forecast

A financial forecast tries to predict what your business will look like (financially) in the future—which is key for uncertain, economic times.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Amazon Prime Day

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

What is a balance sheet and why is it important?

Cnbc select talks about what a balance sheet is and it's utility as a financial statement.

A balance sheet is a versatile document that offers a snapshot of a company's or individual's finances at a given point in time. Businesses can use balance sheets to develop plans for the future and present a picture of their financial health to investors or other outside entities. You can also generate a personal balance sheet to get a concise view of your assets and liabilities. Here, CNBC Select explains what a balance sheet is, how to create one and how it can be useful to both companies and individuals.

What we'll cover

What is a balance sheet.

- How a balance sheet works

Why balance sheets are important

How to make a personal balance sheet, bottom line.

A balance sheet, also known as a statement of net worth , is a summary of a company's financial status at a specific point in time. It presents all assets and liabilities, as well as any investments from shareholders. It is one of the three primary financial statements all companies are required to have by law, along with an income statement and a statement of cash flows.

Because it uses archival data, a balance sheet only presents a snapshot of a company's financial situation. While it's a critical tool, it can't guarantee future performance.

How does a balance sheet work?

A balance sheet uses a formula that equates a company's assets with its liabilities plus its shareholder equity. The equation should always be in "balance," with the two sides equal. Here's what each aspect of the balance sheet equation represents:

- Assets: Assets are resources with quantifiable value, such as cash, inventory or money the company is owed. They are often split into current assets — bank accounts, inventory and other things that could easily be converted into cash — and fixed assets — buildings, machinery, long-term loans to customers and other things that will stay on the books longer. (Intellectual property can also be included as a fixed asset.)

- Liabilities: Essentially the opposite of an asset, a liability is something the company owes, usually a sum of money. They are divided into short-term liabilities — like salaries, rent and money owed to other companies — and long-term liabilities , like mortgages, larger loans and long-term leases.

- Shareholder equity: This is a company's net worth — essentially what would be left if the business had to liquidate its assets and pay off all its debts. It most commonly takes the form of stocks and retained earnings (money the company earned but hasn't distributed to investors), but also includes any capital investments. Analysts and investors can use shareholder equity to judge a company's financial well-being.

While there can be nuances regarding the classification of certain assets or liabilities, a balance sheet is still a good way to determine a company's financial health at a given point in time.

In a corporation, a balance sheet lets stakeholders know if the business is solvent, meaning the value of its assets is higher than the total of its liabilities. It can also pinpoint areas where the company is underperforming.

Externally, a balance sheet lets potential investors, clients and other businesses know if a company is solvent. Did it borrow more money than it should have? Are its liabilities higher than the industry average? Is the available cash on hand higher or lower than normal? While you'll most often hear about balance sheets in the context of business, they can also help individuals take stock of their finances and make informed purchasing and investing decisions.

You can also use a balance sheet to quickly determine several key financial measurements:

- The current ratio , the current assets divided by current liabilities, illustrates a company's ability to pay off debts over the next 12 months.

- A quick ratio indicates a company's ability to pay off debt right away. It's determined by dividing liquid assets (cash/cash equivalents + short-term investments + accounts receivable) by current liabilities. The quick ratio is often the same as the current ratio.

- There is also the debt-to-equity ratio , or "risk ratio." It's a company's total liabilities divided by its total equity. This metric reveals how much of a business is financed by debt. If a company is highly leveraged, it can make it hard to get additional financing.

The formula for a personal balance sheet is similar to one for a business, only without shareholder equity. Essentially, your net worth is equal to your assets minus your liabilities, or debts. To create a personal balance sheet, start by collecting relevant financial records from your bank, investment companies and creditors. Using a personal finance app, such as You Need A Budget (YNAB) , can be helpful during this kind of deep dive. YNAB syncs with your bank and investment accounts, allowing you to assign funds to different life categories to better help you visualize your finances.

You Need a Budget (YNAB)

34-day free trial then $99 per year or $14.99 per month (college students who provide proof of enrollment get 12 months free)

Standout features

Instead of using traditional budgeting buckets, users allocate every dollar they earn to something (known as the "zero-based budgeting system" where no dollar is unaccounted for). Every dollar is assigned a "job," whether it's to go toward bills, savings, investments, etc.

Categorizes your expenses

Links to accounts.

Yes, bank and credit cards

Availability

Offered in both the App Store (for iOS) and on Google Play (for Android)

Security features

Encrypted data, accredited data centers, third-party audits and more

Terms apply.

Now, tally up your assets. This includes money in checking accounts , savings accounts and retirement funds, as well as your car or home (if you own them outright) and valuables like jewelry, art or collectibles. Then work on identifying your liabilities, or outstanding debts. Common ones include mortgages, student loans, car payments and credit card bills.

Once you've listed both, subtract your liabilities from your assets. The resulting figure is your net worth. If the amount is lower than you would like, or even negative, remember that this is just a snapshot of your current status. You now have information that can help you address your financial situation.

For instance, if you see you've accumulated a substantial amount of credit card debt , you could consider applying for a balance transfer credit card like the Wells Fargo Reflect® Card , which has a 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. Balance transfers made within 120 days qualify for the intro rate, BT fee of 5%, min: $5. If you kept up with payments, you could chip away at your debt without being buried under a high interest rate.

Wells Fargo Reflect® Card

Welcome bonus.

0% intro APR for 21 months from account opening on purchases and qualifying balance transfers.

Regular APR

18.24%, 24.74%, or 29.99% Variable APR

Balance transfer fee

5%, min: $5

Foreign transaction fee

Credit needed.

Excellent/Good

See rates and fees . Terms apply.

Who needs a balance sheet?

A balance sheet is a key financial tool for business owners, executives, analysts and anyone who wants a clear picture of a company's current monetary position.

What does a balance sheet show?

A balance sheet gives an overview of a company's financial position by taking stock of what it owns, what it owes and the value of its equity.

What doesn't appear on a balance sheet?

There are a few things a balance sheet won't show you, including cash flow, profits and losses and the fair market value of assets such as land.

Can a balance sheet be negative?

A balance sheet can contain negative values, most commonly when a business is spending more than it is making. But the basic formula — assets = liabilities + shareholders' equity — should always balance out.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Businesses use balance sheets to indicate their financial standing. They can also be used by individuals or households to get a high-level view of their current wealth and identify areas for improvement.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of financial products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- Nationwide home insurance: Affordable rates, riders for earthquake and flood damage Liz Knueven

- Best homeowners insurance companies in Texas for 2024 Liz Knueven

- Discover home equity loan review: Low rates, no fees Kelsey Neubauer

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Balance Sheet: Definition, Uses and How to Create One

Billie Anne is a freelance writer who has also been a bookkeeper since before the turn of the century. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Partner and a Mastery Level Certified Profit First Professional. She is also a guide for the Profit First Professionals organization. In 2012, she started Pocket Protector Bookkeeping, a virtual bookkeeping and managerial accounting service for small businesses.

Rick VanderKnyff leads the news team at NerdWallet. Previously, he has worked as a channel manager at MSN.com, as a web manager at University of California San Diego, and as a copy editor and staff writer at the Los Angeles Times. He holds a Bachelor of Arts in communications and a Master of Arts in anthropology.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The balance sheet summarizes your business's financial status as of a certain date. It follows the accounting equation: Assets = Liabilities + Owner's equity. In non-accounting terms, the balance sheet tells you what your business owns (assets), what it owes (liabilities), and what the owner's stake in the business is (equity).

If you think of your financial statements as the story of your business, then the balance sheet serves as the CliffsNotes version of that story. Every transaction in your business impacts the balance sheet in some way.

» MORE: Nine basic accounting concepts every business owner should know

advertisement

QuickBooks Online

What does a balance sheet include?

The balance sheet includes three broad categories of information:

Liabilities.

Owner's equity.

Assets are the things your business owns. Most balance sheets break down assets into two subcategories.

Current assets are cash, cash equivalents, and things that can be easily converted into cash within the next 12 months. Your bank accounts, petty cash, accounts receivable (amounts customers owe to you), and inventory are all examples of current assets.

Fixed assets are things your business owns that aren't likely to be converted into cash (sold) within a 12-month period. This includes land, buildings, heavy equipment, vehicles, and long-term loans to customers. Some businesses also have intangible assets, like trademarks and patents, listed under fixed assets on their balance sheets.

Liabilities

Liabilities are amounts your business owes to others. As with assets, most balance sheets break down liabilities into two subcategories.

Current liabilities are amounts you are likely to pay within the next 12 months. This includes amounts due to vendors for utilities and inventory (accounts payable), credit card balances, sales tax and payroll taxes you've collected but not yet submitted to the government, and the portion of loan balances due within the next 12 months. In addition, if you have a line of credit for your business, that will usually be listed as a current liability on your balance sheet.

Long-term liabilities are amounts due in the future beyond the next 12 months. This would include the mortgage on your building, vehicle loans, and long-term leases.

Equity balances out the difference between assets and liabilities. It is your stake in the business. You can also look at equity as the amount the business owes to you.

Equity consists of:

Contributions you have made to the business (startup cash you invested, additional paid-in capital, etc.)

Retained earnings (amounts you have left in the business over time.)

Capital and preferred stock, if your business has other shareholders.

The current year's net income (from your profit and loss statement).

Let's look back at the accounting equation the balance sheet follows:

Assets = Liabilities + Equity.

Another way to look at this equation is

Assets - Liabilities = Equity.

In other words, equity is what is left for the business owner after all the liabilities are paid from the business's assets. Equity will be negative if a business's liabilities exceed its assets. This means the business owner might have to use their own money to pay the business's debts if it closes immediately. Negative equity can also negatively impact the selling price of the business.

» MORE: Best accounting software for small businesses

What does a balance sheet exclude?

The balance sheet excludes detailed information about the business's income and expenses. Instead, this detail is included in the business's profit and loss statement.

But remember: Every transaction in your business impacts the balance sheet in some way. Your business's income and expenses are summarized on the balance sheet as Net Income under the Equity section.

Looking for accounting software?

See our overall favorites, or choose a specific type of software to find the best options for you.

on NerdWallet's secure site

How can you make a balance sheet?

If your business is new and simple, you can create a manual balance sheet using the accounting formula. First, list your current bank account balances (assets), subtract any loans or amounts due to others (liabilities), and what is left is your equity in the business.

However, most businesses must rely on their accounting software to create an accurate balance sheet. The balance sheet is a standard report in all double-entry bookkeeping software.

To create a balance sheet in your accounting software, go to the reports section and look for financial reports. Since it is a common financial statement, the balance sheet should appear near the top of the list, often right after the profit and loss (or income) statement.

Some accounting software prompts you to enter a date range for the balance sheet report. This isn't wrong, per se, but it can be confusing. Unlike the profit and loss statement, which only shows information for a certain period, the balance sheet shows information as of a specific date. And that information includes a financial summary of your business from its start through the "as of" date on the balance sheet.

The purpose of the balance sheet