- Wealth Management

- IT Services

- Client Login

- (847) 247-8959

February 27, 2024

How to create a business budget: 8 simple steps.

No matter the size of your business, a business budget is vital to planning and guiding your business’s growth. By understanding the fixed expenses of a company and accounting for the ebb and flow of work, a proper business budget can help your business maintain itself through the year and create protection around unplanned expenses through well allocated funds. In this guide, we'll walk you through the process of creating a business budget, outlining essential steps to help you manage your finances effectively.

What Is a Business Budget?

A business budget is a financial plan outlining projected revenues and expenses for a business during a specific period of time (most typically a year, though there are often monthly or quarterly reexaminations). Although there are variables throughout the year, a complete and accurate budget will serve as a blueprint for businesses in managing income and expenditures, guiding decision-making processes, and ensuring financial stability.

What Should a Business Budget Include?

A comprehensive business budget’s purpose is to provide a business a holistic view of their financial health. When looking through bank statements, take note of those expenses that reoccur throughout the year and note those—as well as those unexpected expenses your company should instead anticipate. Key components to include are:

- Revenue Forecast: Anticipated income from sales, services, or other sources after deducting costs, taxes, and other fees.

- Fixed Operating Expenses: Costs associated with running the business, such as rent, utilities, salaries, and supplies.

- Capital Expenditures: Investments in assets like equipment, machinery, or property.

- Debt Service: Payments towards loans, credit lines, or other forms of debt.

- Taxes: Estimated tax liabilities, including income tax, sales tax, and payroll taxes.

- Contingency Funds: Reserves set aside for unexpected expenses or emergencies.

- Profit Targets: Desired levels of profitability, indicating the financial performance you aim to achieve.

Why Is Budgeting Important to a Business?

Budgeting plays a crucial role in the financial management of a business for several reasons:

- Resource Allocation: Helps allocate resources efficiently to prioritize essential activities and investments.

- Financial Control: Provides a framework for monitoring and controlling expenses to prevent overspending.

- Performance Evaluation: Facilitates performance measurement against predetermined targets, enabling timely corrective actions.

- Decision Making: Guides decision-making processes by providing insights into the financial implications of various options.

- Risk Management: Identifies potential risks and allows for proactive mitigation strategies to safeguard financial stability.

How Does Budgeting Help a Business?

Effective budgeting contributes to the success and sustainability of a business in numerous ways:

- Improved Cash Flow Management: Helps maintain adequate cash reserves to meet financial obligations and fund growth initiatives.

- Enhanced Profitability: Enables businesses to identify opportunities for revenue growth and cost optimization, leading to higher profitability.

- Better Resource Utilization: Ensures optimal utilization of resources by aligning expenditures with strategic priorities and operational needs.

- Increased Financial Transparency: Provides stakeholders with a clear understanding of the company's financial health and performance.

- Long-term Planning: Facilitates long-term planning by forecasting future financial requirements and setting achievable goals.

How to Create a Business Budget

Now that we’ve gone over the importance of a business budget, it’s time to understand the steps you need to take in order to create a comprehensive plan.

Gather Financial Information

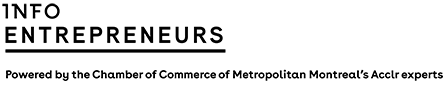

Start by compiling relevant financial data, including past income statements, balance sheets, and cash flow statements. Analyze historical trends to identify patterns and make informed projections for the upcoming period.

Determine Your Financial Goals

Define clear, measurable financial goals aligned with your business objectives. Whether it's increasing revenue, reducing costs, or improving profitability, setting specific targets will provide a roadmap for your budgeting process.

Identify Revenue Sources

Identify all potential sources of revenue, including sales, services, investments, and other income streams. Estimate the expected revenue for each source based on market trends, historical data, and sales forecasts.

Estimate Expenses

Next, list all anticipated expenses, categorizing them into fixed and variable costs. Fixed expenses, such as rent and salaries, remain constant regardless of business activity, while variable expenses, like supplies and utilities, fluctuate based on demand.

Factor in Contingencies & Emergency Funds

Allocate a portion of your budget for contingencies and emergency funds to cover unforeseen expenses or revenue shortfalls. Building a financial cushion will provide stability and resilience during challenging times.

Balance Your Budget

Balance your budget by ensuring that projected revenues exceed estimated expenses. If there's a deficit, identify areas where you can reduce costs or increase revenue to achieve equilibrium.

Monitor & Track Your Budget

Regularly monitor and track your budget against actual financial performance to identify variances and deviations. Use accounting software or spreadsheets to update your budget and make adjustments as needed to stay on course.

Review & Adjust Budget Regularly

Review your budget periodically, ideally on a quarterly or annual basis, to assess its effectiveness and relevance. Adjust your budget as necessary based on changing market conditions, business priorities, and performance trends.

Contact Mowery & Schoenfeld for Help with Business Budgeting

Creating and managing a business budget requires expertise and strategic planning. At Mowery & Schoenfeld, we specialize in helping businesses develop robust financial strategies to achieve their financial goals. Contact us today to learn how our team of experienced professionals can assist you with business budgeting and financial management.

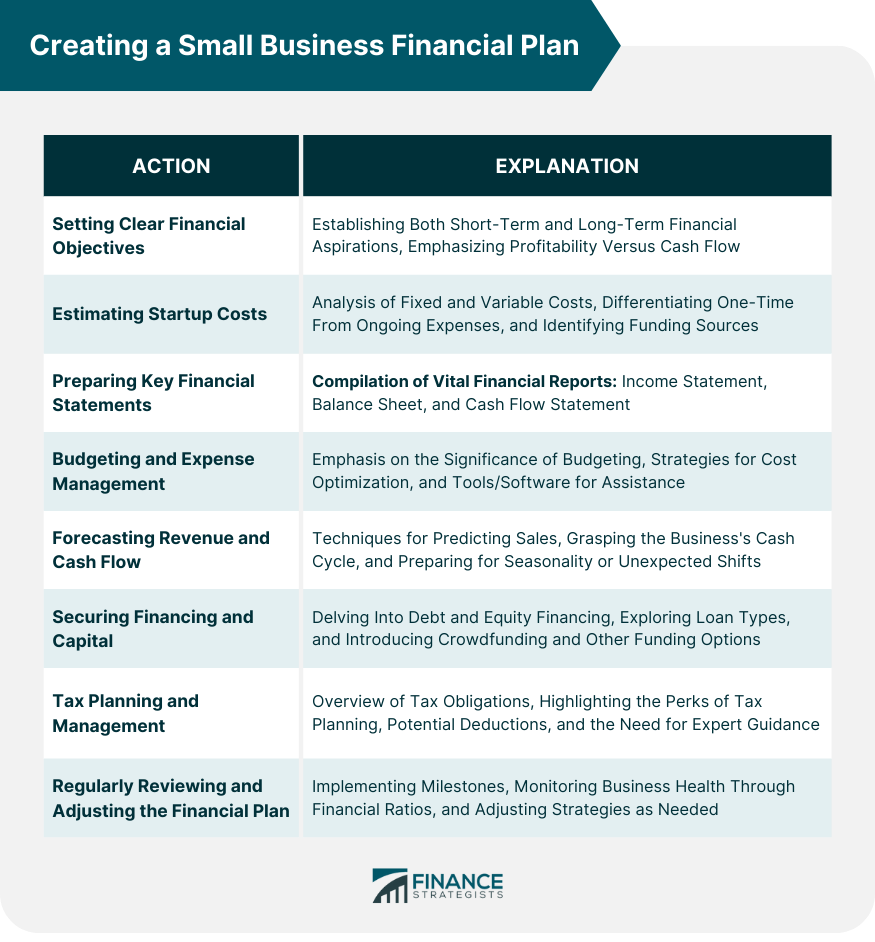

How to Write a Small Business Financial Plan

Noah Parsons

4 min. read

Updated April 22, 2024

Creating a financial plan is often the most intimidating part of writing a business plan.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

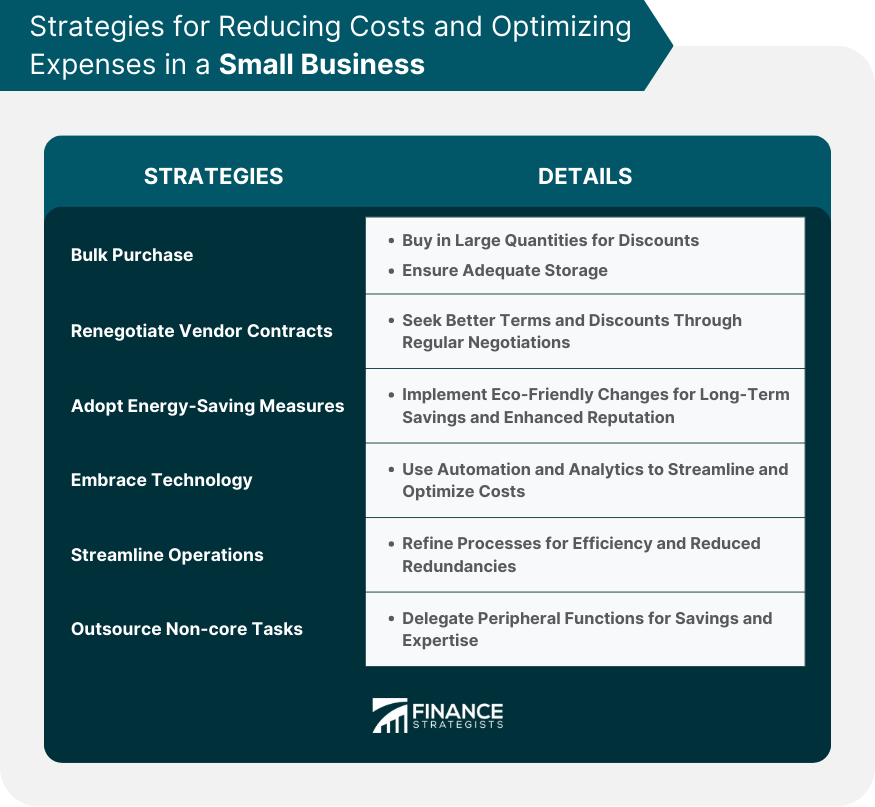

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

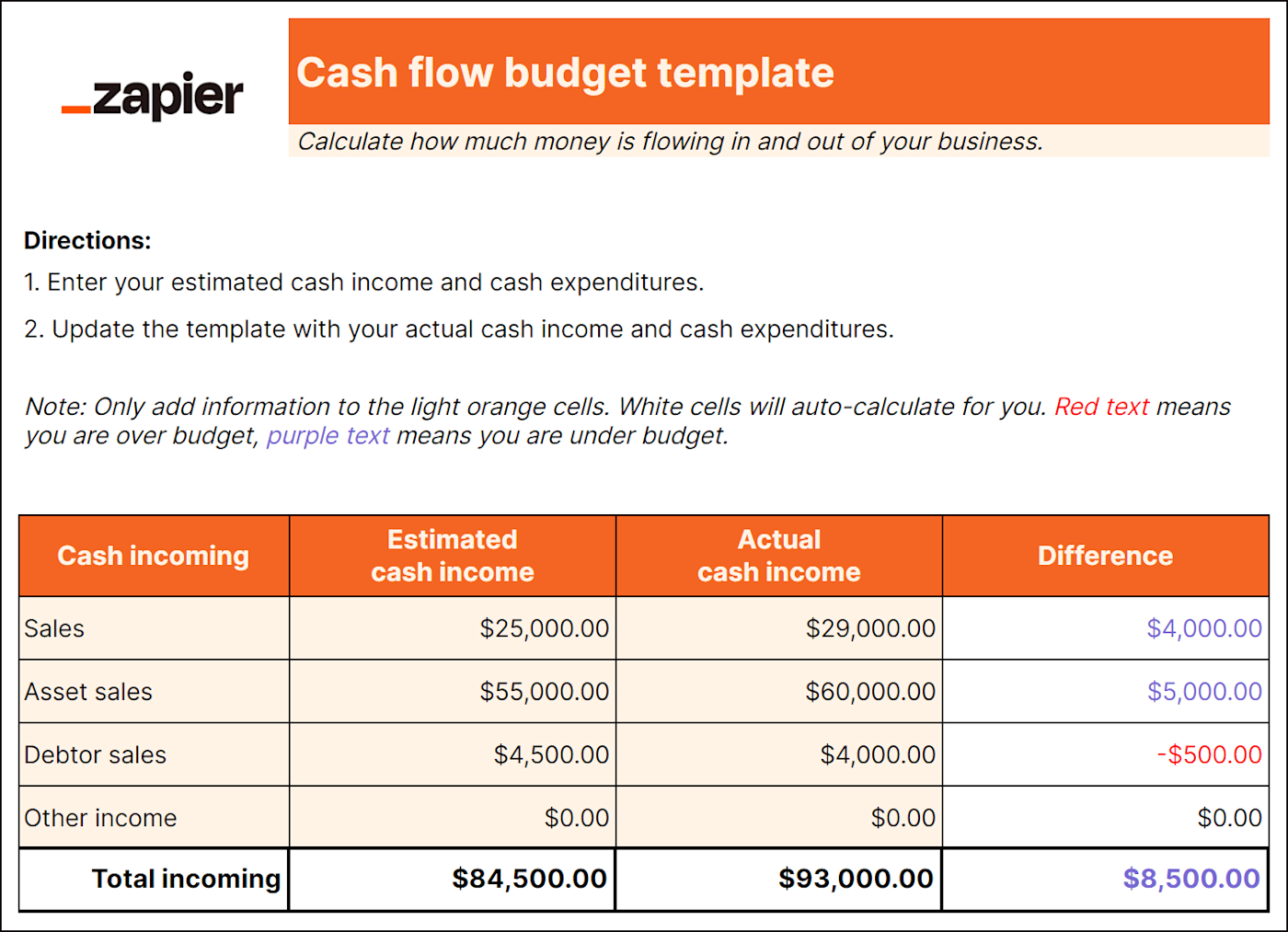

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

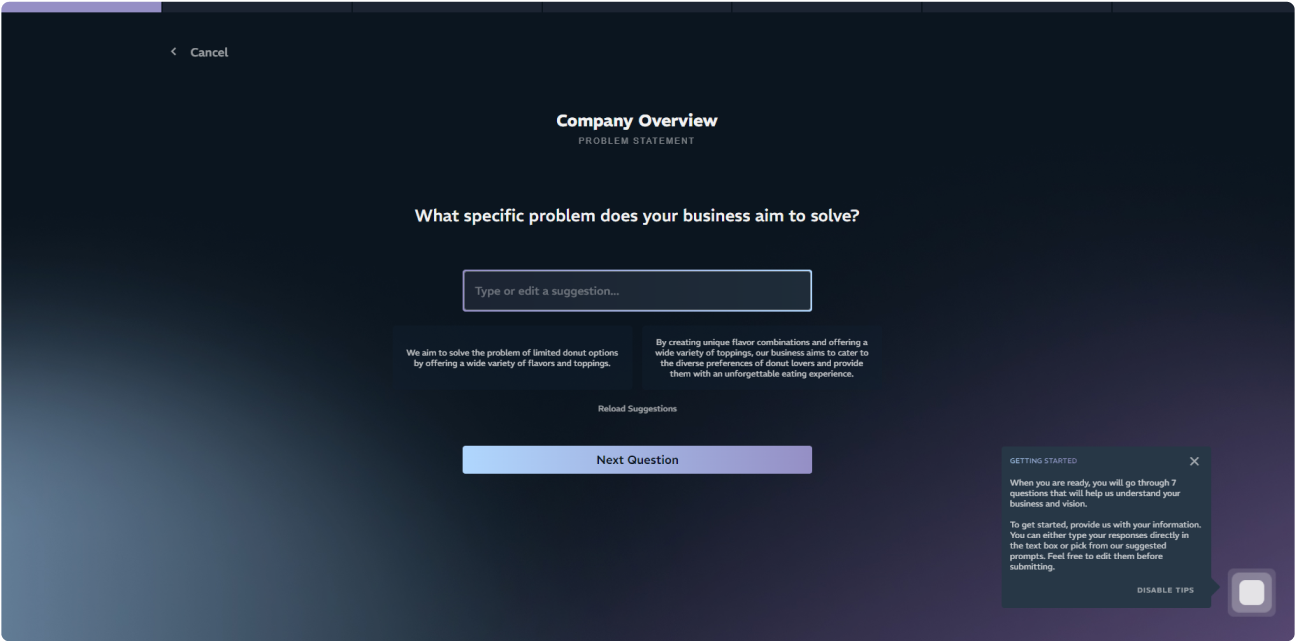

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

6 Min. Read

How to Write Your Business Plan Cover Page + Template

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

How to Set and Use Milestones in Your Business Plan

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to create a business budget

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Small business loans

- • Bad credit loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

Key takeaways

- A business budget is a financial plan that helps estimate a company's revenue and expenses, making it an essential tool for small businesses

- The steps to creating a business budget include choosing budget and accounting software, listing expenses and forecasting revenue

- If a business finds itself in a budget deficit, strategies such as cutting costs, negotiating with suppliers and diversifying revenue streams can help

As a small business owner, keeping your finances organized through a business budget is crucial to running a successful company.

Business budgeting involves creating a financial plan that estimates future revenue and expenses to make informed financial decisions, which can ultimately move the needle on your business’s financial goals and help it grow in profitability.

What is a business budget?

A business budget is a financial plan that outlines the company’s current revenue and expenses. The budget also forecasts expected revenue that can be used for future business activities, such as purchasing equipment. It sets targets for your business’s revenue, expenses and profit and helps you determine if you’ll have more money coming in than you pay out.

A business budget is an essential tool that helps you make wise business decisions. Without it, it’s difficult to gauge your business’s financial health.

What is the difference between a cash flow statement and a business budget?

A cash flow statement (CFS) is a financial document that summarizes the movement of cash coming in and going out of a company. The CFS gauges how effectively a company manages its finances, including how it manages debt responsibilities and funds day-to-day operations.

It’s similar to a business budget in that you can see expenses and revenue. But while a budget gives a moment-in-time snapshot of your business’s financial performance compared to forecasts, the cash flow statement focuses on the actual inflows and outflows of money through your business.

Follow these steps to ensure a well-developed budget, from understanding your expenses to generating revenue and adjusting expenses to balance the budget.

1. Choose a budget and accounting software

First, you’ll want to store your expense and revenue information with accounting software to help you track your numbers and generate reports. Some software may also help you assign categories to the transactions, identify tax deductions and file taxes. Quickbooks is an example of accounting software.

Some business bank accounts also have accounting software built in, helping you stay organized by keeping your accounting and banking in one place.

2. List your business expenses

The next step in creating a small business budget is to list all your business expenses. Here are the types of expenses you want to include in your budget:

- Fixed expenses: Fixed expenses cost a fixed amount monthly or within the assessed period. Those costs include rent, insurance, salaries and loan payments.

- Variable expenses: Variable expenses can change monthly or over time, making them trickier to budget. This might include materials, direct labor, utility bills or marketing expenses.

- Annual or one-time costs: Some costs only occur a few times per year, while others you’ll only pay for as needed, such as buying new equipment. You still want to budget for these expenses by allocating a portion of your weekly or monthly budget toward one-time expenses.

- Contingency funds: Unexpected business costs can throw a wrench in your budget if not planned for. Such costs could include emergency repairs, necessary equipment purchases, sudden tax increases or unforeseen legal fees. To plan for these costs, you can create a contingency or emergency fund that’s separate from your operational budget.

- Maintenance costs: To allocate funds for maintenance costs, begin by including regular inspections and maintenance in your budget. Then, make sure to leave room for changes and unexpected maintenance costs.

3. Forecast your revenue

To estimate your future revenue, start by deciding on a timeline for your forecast. A good place to start is the previous 12 months. Your accounting software may also include revenue forecasting as one of its features, which can automate this step for you.

The timeline and your recent past growth can help you understand how much revenue you’ll generate in the future. Consider external factors that could drive revenue growth, such as planned business activities like expansion, marketing campaigns or new product launches.

You’ll also want to think about anything that might slow your growth. Many businesses experience seasonal fluctuations, which can impact your budget if you don’t plan for it. To account for these changes, list the minimum expenses required to keep your business running. Use your financial statements to understand these costs, and consider averaging out irregular expenses over the year to avoid surprises.

Ideally, your business should build a cash reserve during profitable periods to cover expenses during slower seasons. If necessary, consider various financing options, such as a business credit card or line of credit, that you can draw from to manage cash flow during peak or off times.

4. Calculate your profits

The next step in creating a business budget is to calculate your business profits. You can look at your total profits by calculating revenue minus expenses. That way, you see how much money you have to work with, called your working capital .

You should also understand your profit margins for each of your products and services, which can help you set prices or decide whether to offer a new product or service.

How to calculate your profit margins

To find out your gross profit margin, you’ll first need to calculate the gross profit. To calculate your business’s gross profit, subtract the cost of goods sold (COGS) from your total revenue. COGS includes all the expenses related to producing your products and services.

Once you have the gross profit, use the gross profit margin formula: (Revenue – COGS) / Revenue x 100. This will give you a percentage that shows how much profit you gain from that particular product after accounting for the product’s costs.

5. Make a strategy for your working capital

Knowing what to do with extra revenue, which is your working capital, is crucial for managing your business finances and growth. Here’s how to get started with a financial strategy that propels your business goals forward:

- Set spending limits for different categories in your budget. When listing your expenses, you should have set a dollar amount for each category. You can estimate this by a monthly average or a general forecasted amount.

- Set realistic short- and long-term goals. These goals will motivate you to stick to your budget and guide your spending decisions.

- Compare your actual spending with your net income and priorities. Look at the areas you’re spending and consider whether you need to reallocate money to different categories. Consider separating expenses into business needs and extras.

- Adjust your budget and actual spending. Adjust your spending to ensure you do not overspend and can allocate money towards your goals. If you need to cut spending, consider the categories that are extras, such as types of marketing that you don’t know will generate a return on investment.

6. Review your budget and forecasts regularly

Finally, review your budget regularly. By frequently checking in on your budget, you can identify any discrepancies between your planned and actual expenses and adjust accordingly. This allows you to proactively handle any financial issues that may arise rather than reacting to them after they’ve become a problem.

Regular reviews also allow you to refine your budgeting process and improve its accuracy over time. Keep in mind that your budget is not set in stone but rather a tool to guide your financial decisions and help you achieve your business goals.

What to do if you have a deficit in your business budget

Finding a deficit in your small business budget can be alarming, but there are several strategies you can employ to handle this situation.

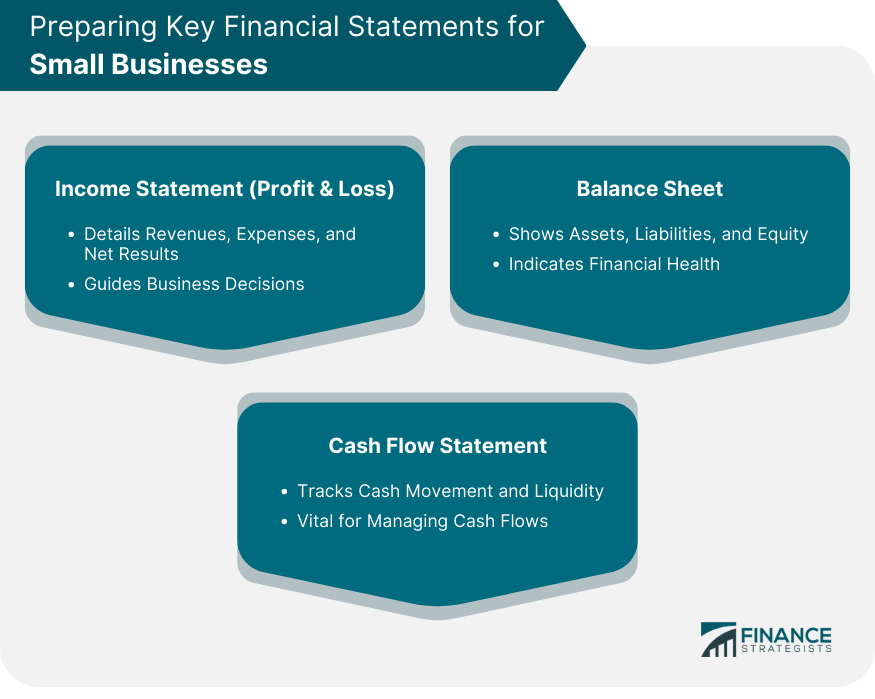

- Do a cash flow analysis. Begin by doing a cash flow analysis to review what your business is earning and spending money on. Identify potential problems and adjust the budget as needed to prevent overspending.

- Cut nonessential business costs. Cutting spending may involve eliminating nonessential costs and transferring funds from other categories to overspent categories. Your goal is a balanced or profitable budget.

- Negotiate with suppliers. Be transparent in your communications with suppliers and explain your quality standards and why you’re seeking cost reduction. Explore options for cost reduction that do not compromise quality, such as process improvements or ordering in larger quantities.

- Create a lean business model. By removing anything that doesn’t benefit your customer, your business can potentially save time and resources. Lean business models focus on continually improving processes and customer experience without adding additional resources, time or funds.

- Add revenue and diversify revenue streams. Raising revenue requires a realistic plan with measurable goals to increase sales and overall business income. You can also consider other products and services you could offer that would make your business profitable.

- Use financing to cover temporary gaps. Applying for a small business loan can help pay bills during an unplanned shortfall. Since this will add an expense to your budget, make sure you can handle the loan repayments and your regular expenses.

- Plan for a deficit. In some cases, a planned budget deficit might be a strategic decision, such as investing in new opportunities that promise long-term benefits.

Bottom line

Having a well-developed business budget is crucial for making informed decisions. You can effectively manage your small business’s finances by tracking and analyzing your business’s inflows and outflows, forecasting your expected revenue and adjusting your budget to stay balanced.

Even in the face of a budget deficit, there are various strategies you can use to keep your business profitable, including negotiating costs with your suppliers, assessing your business operations and offering new products and services.

With a solid business budget in place, you can confidently navigate financial challenges and drive long-term success for your small business.

Frequently asked questions

What are the benefits of a business budget, what are the components of a business budget, how do you calculate fixed and variable costs in a business budget.

Related Articles

How to get an equipment loan

How to finance a small business for the holidays

How to start a small business

How to build business credit: 7 steps

- Building Your Site

- Promote Your Site

- Entrepreneurship

- Design & Inspiration

- Tips & Tricks

Step-by-Step Guide to Creating a Business Budget Plan

A well-structured business budget plan is crucial for success. It serves as a financial stability and growth roadmap, allowing companies to allocate resources wisely and make informed decisions. Understanding the basics of business budgeting is essential for any entrepreneur or business owner looking to create a solid financial plan to help them achieve their goals.

The Importance of Business Budget Planning

Business budget planning is not just about crunching numbers; it's about setting clear financial goals and outlining strategies to achieve them. It provides a framework for managing expenses, maximizing revenue , and ensuring the long-term sustainability of a company. Without a well-thought-out budget plan, businesses may struggle to stay afloat in today's competitive market.

Understanding the Basics of Business Budget

At its core, a business budget is an estimate of future income and expenses based on historical data and current trends. It involves identifying all sources of revenue and categorizing various types of expenses, including fixed costs (rent, salaries) and variable costs (utilities, marketing). Understanding these fundamental concepts is essential for creating an effective budget plan.

Benefits of Creating a Business Budget Plan

The benefits of creating a business budget plan are manifold. It clarifies where money is being spent and helps identify areas where costs can be reduced or investments can be made to drive growth. Additionally, having a well-structured budget plan can instill confidence in stakeholders, such as investors or lenders who want to see evidence of sound financial management .

Now that we've laid the groundwork for understanding the importance of business budget planning and its basics, let's delve deeper into the process by assessing your financial situation and setting achievable goals.

Assessing Your Financial Situation

Sarah Horsman Template from Strikingly

Now that you understand the importance of business budget planning, it's time to assess your financial situation. This involves analyzing your current revenue and expenses, identifying fixed and variable costs, and projecting future income and expenses.

Analyzing Current Revenue and Expenses

You must clearly understand your current revenue and expenses to create a business budget plan that works for your company . This involves looking at your sales figures, incoming cash flow, and all the money going out of your business. By analyzing these numbers, you can gain valuable insights into where your money is coming from and where it's going.

Identifying Fixed and Variable Costs

When creating a business budget plan, it's crucial to distinguish between fixed and variable costs. Fixed costs, such as rent or salaries, remain constant regardless of your level of production or sales. Variable costs, like raw materials or shipping expenses, fluctuate with production levels or sales volume. Identifying these costs will help you make more accurate financial projections.

Projecting Future Income and Expenses

Looking ahead is an essential part of business budget planning. You can anticipate potential financial challenges or opportunities by projecting future income and expenses based on historical data and market trends. This will enable you to make informed decisions about resource allocation and strategic investments.

Remember that creating a business budget plan is not just about crunching numbers; it's about setting the stage for sustainable growth and success in the long run.

Setting Financial Goals

Now that you understand the basics of business budget planning, it's time to set your financial goals . Establishing short-term and long-term objectives can create a roadmap for your business's financial success. Whether increasing revenue or reducing expenses, having clear goals will guide your budgeting decisions.

Establishing Short-term and Long-term Objectives

To effectively create a business budget plan, it's crucial to establish both short-term and long-term financial objectives. Short-term goals could include reducing overhead costs by a certain percentage within six months, while long-term goals might involve doubling your annual revenue within three years. These objectives provide direction for allocating funds and making strategic financial decisions.

Allocating Funds for Growth and Expansion

One of the key benefits of creating a business budget plan is the ability to allocate funds for growth and expansion. Whether you're looking to invest in new equipment, expand your product line, or open additional locations, setting aside funds in your budget allows you to pursue these opportunities without compromising your financial stability .

Planning for Contingencies and Emergencies

In business, unexpected events can have a significant impact on your finances. Planning for contingencies and emergencies is essential when creating a business budget plan. You can protect your business from potential financial hardships by setting aside a portion of your budget for unforeseen circumstances, such as economic downturns or equipment breakdowns.

Creating the Budget Plan

Now that you understand the importance of business budget planning, it's time to create a solid business budget plan. When choosing the right budgeting method, consider your company's size, industry, and financial goals. Whether it's zero- or activity-based budgeting, select a method that aligns with your business objectives and ensures accurate financial management .

Choosing the Right Budgeting Method

Selecting the right budgeting method is crucial for effective business budget planning. Zero-based budgeting involves justifying every expense from scratch, while activity-based budgeting focuses on cost allocation based on activities. Whichever method you choose, ensure it aligns with your company's financial objectives and provides a clear resource allocation roadmap.

Allocating Funds to Different Departments

When creating a business budget plan, allocating funds to different departments is essential based on their specific needs and priorities. Consider departmental goals, operational requirements, and revenue generation potential when distributing financial resources. This approach ensures each department has the necessary funds to function effectively within the business framework.

Monitoring and Adjusting the Budget as Needed

Once you've allocated funds to different departments in your business budget plan, monitoring and adjusting the budget as needed is essential. Regularly review your financial performance against the set targets and adjust based on changing market conditions or internal dynamics. Flexibility ensures that your business remains agile and responsive to evolving economic landscapes.

By carefully choosing the right budgeting method, allocating funds to different departments thoughtfully, and monitoring and adjusting the budget as needed, you can create a robust business budget plan that sets your company up for long-term success in managing its finances effectively.

Implementing the Budget Plan

Quantum Template from Strikingly

Now that you have created a solid business budget plan, it's time to implement it. This step involves communicating the budget to key stakeholders, training employees on budgetary guidelines, and integrating the budget into daily operations.

Communicating the Budget to Key Stakeholders

It is crucial to inform all relevant stakeholders about the business budget plan. This includes shareholders, managers, and other decision-makers who must know the financial goals and constraints. Clear communication will ensure everyone is on the same page and can work towards common objectives.

Training Employees on Budgetary Guidelines

Employees play a vital role in adhering to the budget plan. Providing them with comprehensive training on budgetary guidelines will help them understand their responsibilities in managing costs and staying within allocated funds. This will empower them to make informed decisions that align with the company's financial objectives.

Integrating the Budget into Daily Operations

Incorporating the business budget plan into daily operations requires a strategic approach. It involves aligning all activities with the financial goals outlined in the budget, ensuring that resources are utilized efficiently, and making adjustments as needed to stay within budgetary limits. This integration fosters a culture of financial responsibility throughout the organization.

By effectively implementing your business budget plan through clear communication, employee training, and seamless integration into daily operations, you can set your company up for financial success while achieving your long-term objectives.

Tracking and Evaluating Performance

Monitoring Budget Variance and Deviations

Once you have implemented your business budget plan, it's crucial to regularly monitor the budget variance and identify any deviations from the projected expenses and revenue. This will help you understand where adjustments need to be made and where you may exceed or fall short of your financial goals.

Conducting Regular Financial Reviews

Regular financial reviews are essential for evaluating the performance of your business budget plan. By conducting these reviews, you can assess whether your actual income and expenses align with what was projected in the budget. This will allow you to make informed decisions on where to allocate funds or where to cut back to stay on track with your financial objectives.

Making Informed Decisions Based on Budget Analysis

Analyzing the data from your business budget plan is key to making informed decisions for your company's future. By understanding how well your budget is performing, you can strategically plan for growth, expansion, and any potential contingencies or emergencies that may arise.

Continuously tracking and evaluating the performance of your business budget plan is vital for maintaining financial stability and achieving long-term success. By closely monitoring variance, conducting regular reviews, and making informed decisions based on budget analysis, you can ensure that your business stays on track toward its financial goals.

Tips for Successfully Implementing Your Business Budget Plan: Striking a Balance Between Dreams and Dollars

Every business owner knows the importance of a budget—it's the roadmap to financial stability and growth. But crafting a brilliant budget is only half the battle. The real test lies in implementation. How do you translate those meticulously planned numbers into tangible results? Here are some key tips to ensure your business budget plan becomes a reality, not just a document gathering dust on a shelf:

1. Set SMART Goals

Your budget shouldn't exist in a vacuum. It should be tightly woven into your business goals. But instead of vague aspirations, set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound . This clarity provides a clear direction for allocating resources and tracking progress.

2. Foster Collaboration

Budgeting isn't a solo act. Involve key stakeholders in the process, from department heads to team members. This collaborative approach fosters buy-in, ensures everyone understands their role in achieving financial goals, and harnesses diverse perspectives for smarter decision-making.

3. Embrace Transparency

Open communication is crucial. Share the budget with relevant team members, not just financial experts. This transparency builds trust, empowers employees to make informed decisions, and encourages a culture of financial responsibility.

4. Track and Monitor

Don't let your budget become a static document. Regularly track actual spending against the planned figures. Identify any discrepancies, analyze the causes, and make adjustments as needed. This active monitoring allows you to course-correct before small deviations snowball into major issues.

5. Leverage Technology

Strikingly Landing Page

- Easy to use. Strikingly is a user-friendly platform that is easy to use, even for those without experience in website design .

- Affordable. Strikingly offers a variety of affordable plans to fit any budget.

- Mobile-friendly. Strikingly's websites are mobile-friendly, so you can reach your customers wherever they are.

Strikingly Website on a Mobile Device

- SEO-friendly. Strikingly's websites are SEO-friendly so that you can improve your website's ranking in search results.

Strikingly is a valuable tool to help businesses create and manage their online presence . Strikingly's features can also be helpful for businesses when creating a business budget plan.

6. Review and Adapt

The business landscape is dynamic. Be prepared to adapt your budget as circumstances change. Regularly review your plan, considering market shifts, new opportunities, and unforeseen challenges. A flexible approach ensures your budget remains relevant and responsive to the ever-evolving environment.

7. Celebrate Successes

Don't forget to celebrate your wins! Recognizing positive financial milestones and acknowledging the collective effort motivates everyone and reinforces the importance of adhering to the budget plan.

8. Build a Culture of Accountability

Create a culture where all share financial responsibility. Hold yourself and your team accountable for staying within budget limits. This fosters a sense of ownership and promotes responsible financial behavior across the organization.

9. Communicate Effectively

Regularly communicate budget updates, performance metrics, and any necessary adjustments to the team. This transparency keeps everyone informed, engaged, and empowered to contribute to the business's financial success.

10. Continuously Improve

Never stop learning and evolving. Regularly evaluate your budgeting process, identify areas for improvement, and implement new strategies to optimize your financial management. Remember, a successful budget is a living document, constantly adapting and growing alongside your business.

By following these tips and embracing tools like Strikingly , you can transform your business budget plan from a theoretical framework into a powerful tool for driving growth and achieving your financial aspirations. Remember, successful budgeting is a journey, not a destination. It requires ongoing commitment, collaboration, and a continuous focus on improvement. So, embark on your financial journey confidently and watch your business reach new heights of success.

A well-structured business budget plan can lead to long-term financial stability and growth. It helps identify areas for cost savings, allocate funds for expansion, and plan for contingencies, ultimately leading to improved profitability and sustainability for your business.

Remember that creating a well-structured business budget plan is crucial for the success and sustainability of your business. By following these steps and incorporating these tips into your planning process, you can ensure that your business is on the path to financial success and growth.

Trusted by millions of entrepreneurs & creatives.

How to Create a Small Business Budget in 5 Simple Steps

Want to protect the financial health of your small business? You need a business budget. Here's how to create one.

When you build a business, there are a lot of things to stay on top of, from marketing and finding new clients to building a website and establishing your digital presence. But there’s one element that you want to stay on top of from the very beginning—and that’s your business budget.

Having a detailed and accurate budget is a must if you want to build a thriving, sustainable business. But how, exactly, do you create one? What are the steps for business budget planning?

As a small business owner, let’s take a look at how to create a business budget in five simple, straightforward steps.

What’s a Business Budget—and Why Is It Important?

Before we jump into creating a business budget, let’s quickly cover what a business budget is—and why it’s so important for small businesses.

A business budget is an overview of your business funds. It outlines key information on both the current state of your finances (including income and expenses) and your long-term financial goals. Because your budget will play a key role in making sound financial decisions for your business, it should be one of the first tasks you tackle to improve business success.

And, as a financially savvy owners, you’ll also want to have a budget in place to help you:

- Make sound financial decisions. In many ways, your business budgets are like a financial road map. It helps you evaluate where your business finances currently stand—and what you need to do to hit your financial goals in the future for business growth.

- Identify where to cut spending or grow revenue. Your business budgets can help you identify areas to decrease your spending or increase your revenue, which will increase your profitability in the process, outline unexpected costs, and help your sustain your business goals.

- Land funding to grow your business. If you’re planning to apply for a business loan or raise funding from investors, you’ll need to provide a detailed budget that outlines your income and expenses.

Now that you understand why budget creation is so important to your business decisions, let’s jump into how to do it.

Business Budget Step 1: Tally Your Income Sources

First things first. When building a small business budget, you need to figure out how much money your business is bringing in each month and where that money is coming from – this will hep create an operating budget based on your business income.

Your sales figures (which you can access using the Profit & Loss report function in FreshBooks) are a great place to start. From there, you can add any other sources of income for your business throughout the month.

Your total number of income sources will depend on your business model.

For example, if you run a freelance writing business, you might have multiple sources of income from:

- Freelance writing projects

- A writing course you sell on your website

- Consulting with other writers who are starting small businesses

Or, if you run a brick-and-mortar retail business, you may only have one source of income from your store sales.

However many income sources you have, make sure to account for any and all income that’s flowing into your business—then tally all those sources to get a clear picture of your total monthly income to build your master business budget template.

Business Budget Step 2: Determine Fixed Costs

Once you’ve got a handle on your income, it’s time to get a handle of your costs—starting with fixed costs.

Your fixed costs are any expenses that stay the same from month to month. This can include expenses like rent, certain utilities (like internet or phone plans), website hosting, and payroll costs.

Review your expenses (either via your bank statements or through your FreshBooks reports) and see which costs have stayed the same from month to month. These are the expenses you’re going to categorize as fixed costs.

Once these costs are determined, add them together to get your total fixed and variable costs expense for the month.

TIP: If you’re just starting your business and don’t have financial data to review, make sure to use projected costs. For example, if you’ve signed a lease for office space, use the monthly rent you will pay moving forward.

Business Budget Step 3: Include Variable Expenses

Related articles.

Variable costs don’t come with a fixed price tag—and will vary each month based on your business performance and activity. These can include things like usage-based utilities (like electricity or gas), shipping costs, sales commissions, or travel costs.

Variable expenses will, by definition, change from month to month. When your profits are higher than expected, you can spend more on the variables that will help your business scale faster. But when your profits are lower than expected, consider cutting these variable costs until you can get your profits up.

At the end of each month, tally these expenses. Over time, you’ll get a sense of how these expenses fluctuate with your business performance or during certain months, which can help you make more accurate financial projections and budget accordingly.

Business Budget Step 4: Predict One-Time Spends

Many of your business expenses will be regular expenses that you pay for each month, whether they’re fixed or variable costs. But there are also costs that will happen far less frequently. Just don’t forget to factor those expenses when you create a budget as well.

If you know you have one-time spends on the horizon (for example, an upcoming business course or a new laptop), adding them to your budget can help you set aside the financial resources necessary to cover those expenses—and protect your business from unexpected costs in the form of a sudden or large financial burden.

On top of adding planned one-time spends to your budget, you should also add a buffer to cover any unplanned purchases or expenses, like fixing a damaged cell phone or hiring an IT consultant to deal with a security breach. That way, when an unexpected expense pops up (and they always do), you’re prepared!

Business Budget Step 5: Pull It All Together

You’ve gathered all of your income sources and all of your revenue and expenses. What’s next? Pulling it all together to get a comprehensive view of your financial standing for the month.

On your businesses master budget, you’ll want to tally your total income and your total expenses (i.e., adding your total fixed costs, variable expenses, cost of goods, and one-time spends)—then compare cash flow in (income) to cash flow out (expenses) to determine your overall profitability.

Having a hard time visualizing what a business budget looks like in action? Here’s an operating budget example to give you an idea of what your new business budget might look like each month:

A Client Hourly Earnings: $5,000 B Client Hourly Earnings: $4,500 C Client Hourly Earnings: $6,000 Product Sales: $1,500 Loans: $1,000 Savings: $1,000 Investment Income: $500

Total Income: $19,500

Fixed Costs

Rent: $1,000 Internet: $50 Payroll costs: $5,000 Website hosting: $50 Insurance: $50 Government and bank fees: $25 Cell phone: $50 Accounting services : $100 Legal services: $100

Total Fixed Costs: $6,425

Variable Expenses

Sales commissions: $2,000 Contractor wages: $500 Electricity bill: $125 Gas bill: $75 Water bill: $125 Printing services: $300 Raw materials: $200 Digital advertising costs: $750 Travel and events: $0 Transportation: $50

Total Variable Expenses: $4,125

One-Time Spends

Office furniture: $450 Office supplies for new location: $300 December business retreat: $1,000 New time tracking software: $500 Client gifts : $100

One-Time Spends: $2,350

Expenses: $12,900

Total Income ($19,500) – Total Expenses ($12,900) = Total Net Income ($6,600)

Above all, once you have a clear sense of your profitability for the month, you can use it to make the right financial decisions for your small business moving forward.

For example, if you realize you’re in the red and spending more than you earn, you might cut your spending and focus on finding new clients . Alternatively, if your income is significantly higher than your expenses, you might consider investing your profits back into your business (like investing in new software or equipment).

Use Your Business Budget to Stay on Track

Putting in the work to create a budget for your small business may seem like a hassle. But while it takes a bit of time and energy, it’s worth the extra effort. Thorough business budgeting gives you the financial insights you need to make the right decisions for your business to grow, scale, and prosper in the future.

This post was updated in October 2023

Written by Deanna deBara , Freelance Contributor

Posted on June 20, 2017

Freshly picked for you

Thanks for subscribing to the FreshBooks Blog Newsletter.

Expect the first one to arrive in your inbox in the next two weeks. Happy reading!

Free Business Budget Templates for Any Company

By Andy Marker | February 23, 2017

- Share on Facebook

- Share on LinkedIn

Link copied

Creating a budget is always a good idea, but it’s even more crucial when you run a business. Failure to properly budget can seriously impact your bottom line, and even jeopardize the success of your enterprise. By making and following a budget, you can better control costs, avoid overspending, and plan to meet financial goals.

Of course, you’ll also need to document and track your budget. Using business budgeting worksheets for this purpose can help you:

- Set and achieve profit goals

- Track revenue, expenses, and cash flow

- Cut unnecessary spending

- Properly allocate revenue to other areas of the business

- Prepare for busy seasons and slowdowns

- Plan for required purchases, such as equipment and materials

- Gauge the positive impact of budget changes

- Secure funding from current and potential investors or financial institutions

- Keep colleagues and coworkers informed on the financial health of the business

- Project startup costs, monthly operational expenses, and revenue needed to break even

To help you get started, we’ve created a variety of business budget templates for Excel that you can use for any organization - from startup companies to established enterprises. Download the template that best fits your needs, and start planning for financial success.

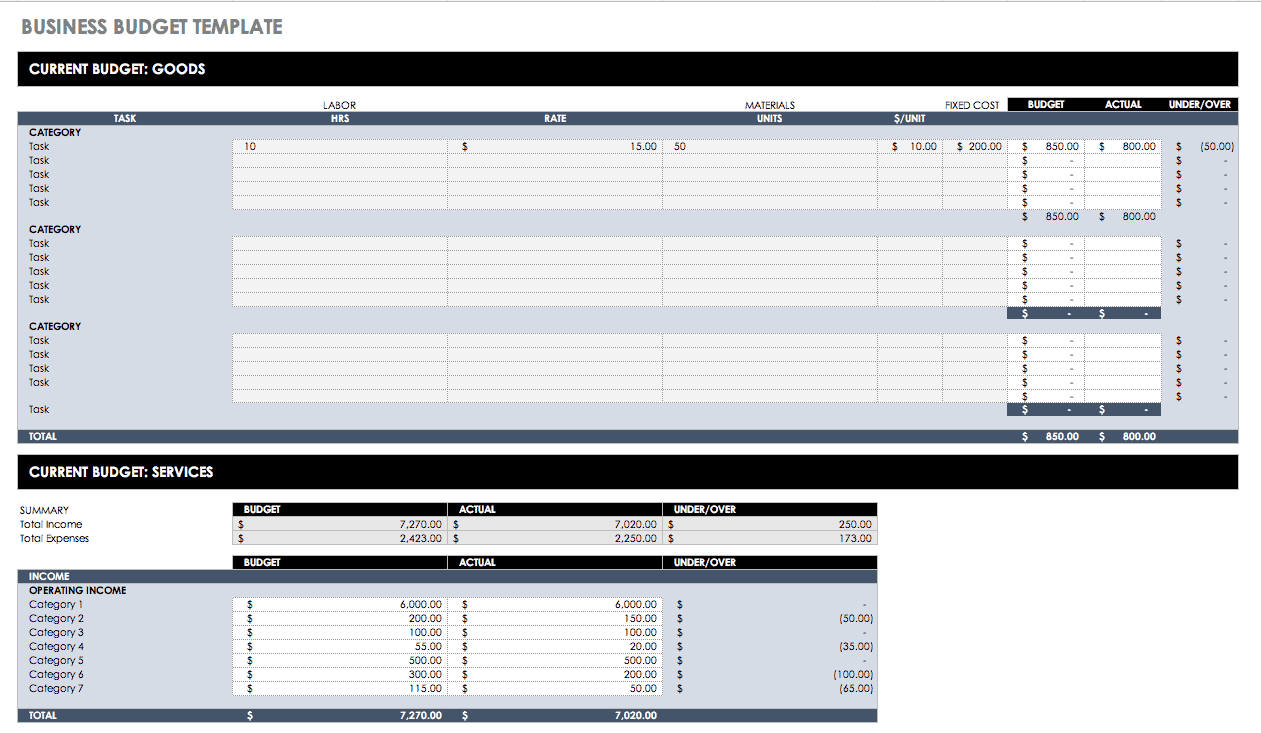

Business Budget Template

Download Excel Template

Try Smartsheet Template

Use this basic business budgeting template to track monthly income and expenses for companies of any size. This template has separate sheets to create budgets for either services- or goods-based businesses. Income and expenses are also broken down by category to provide a closer look at where company funds are made and spent.

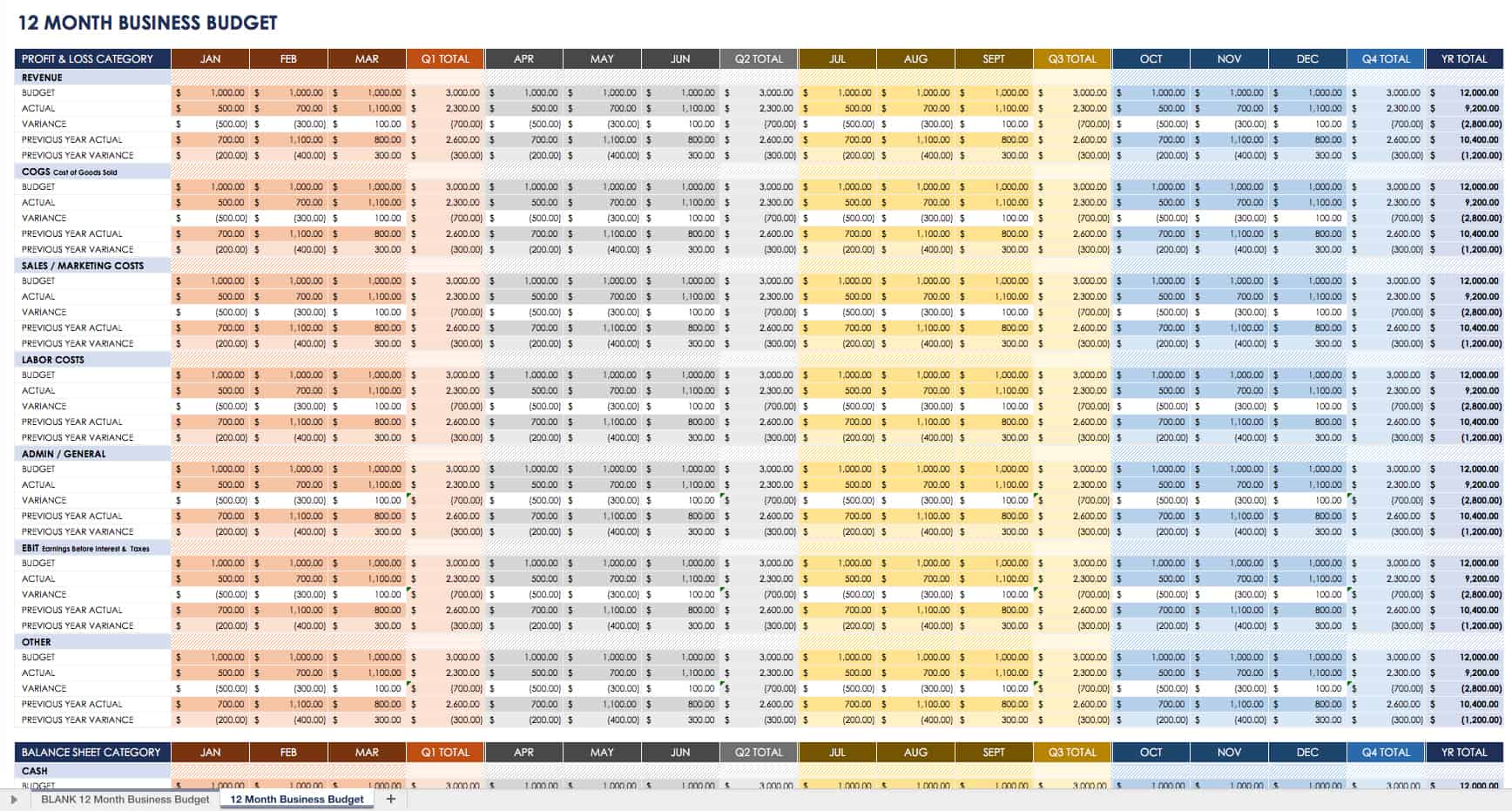

12-Month Business Budget Template

For a more detailed view of your company’s financials over time, use this business budgeting spreadsheet. Enter your revenue and expense estimations for each month and the entire year. Then, add your actual income and expenditures month by month to see how closely you’re meeting your budget (the accuracy of your estimates). Income and expense categories are broken out, so you can clearly see where funds are going to and coming from.

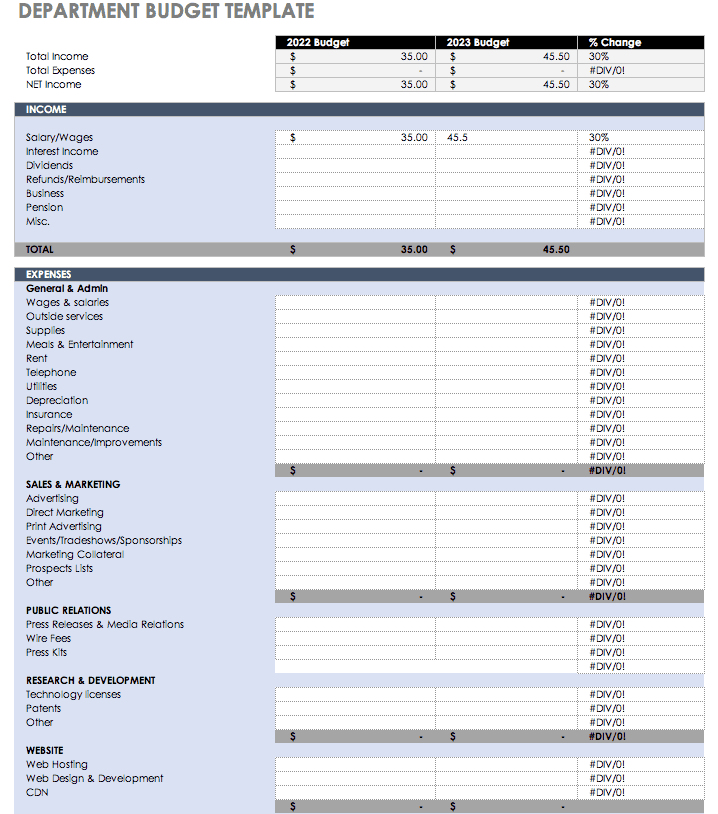

Department Budget

To make sure your department is staying within its allotted budget, use this Excel business budget template. It allows you to plot yearly income and expenses for a company or academic department, and compare the percentage change year over year. View revenue and expense subtotals by category to see where you can make cuts, and identify any surpluses.

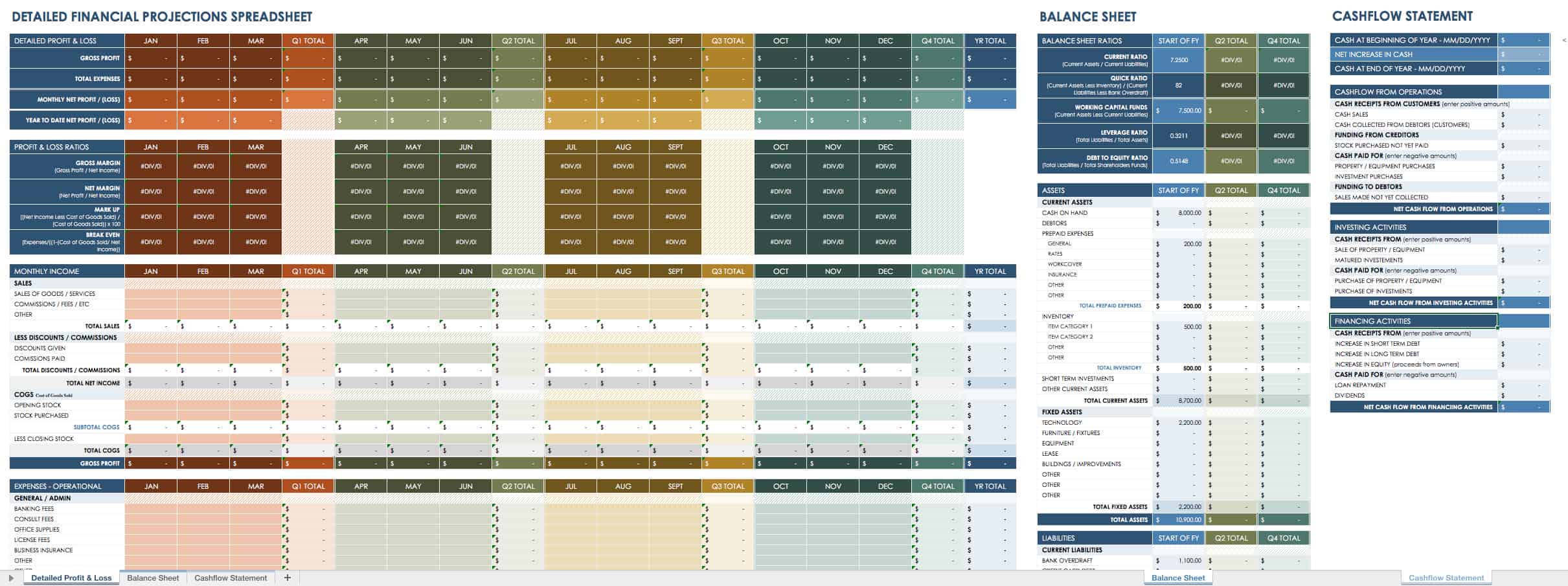

Detailed Financial Projections Spreadsheet

For larger, more complex businesses, you need more comprehensive business budget plans. This detailed spreadsheet tracks all the information you need to make important financial decisions — from startup costs to sales and operating expense forecasts. Estimate and track payroll costs, accounts payable and receivable, the cost of goods sold, lines of credit, and monthly fixed costs. You can also compare year-end totals against one another.

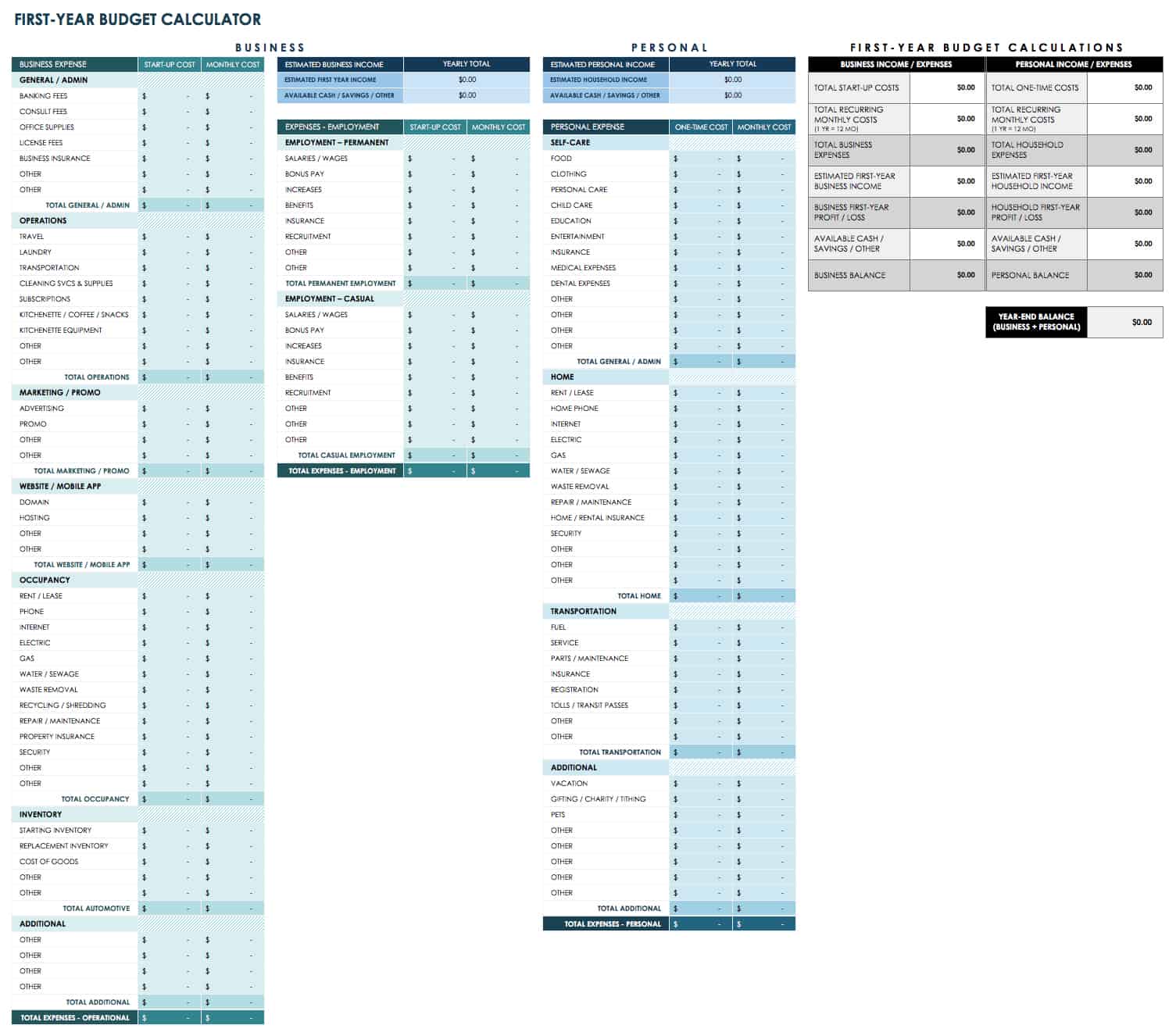

First-Year Budget Calculator

If you’re getting ready to launch a startup, a small business budget template can be a useful tool. This basic calculator can help you quickly gauge costs for your new venture and estimate your first-year business income. It also includes a column for plotting monthly personal expenses, along with available cash from savings and other sources. This way, you can estimate the amount you’ll need to get your new business off the ground.

Professional Business Budget Template

Download Professional Business Budget Template

Excel | Smartsheet

This comprehensive budget template is ideal for larger, more established businesses: it offers one sheet for estimated expenditures (labor costs, office expenses, marketing spending, travel fees, etc.), and another sheet to plot expenses that accrue. It also allows you to track expense variances and offers charts for analyzing how closely your business is adhering to its budget.

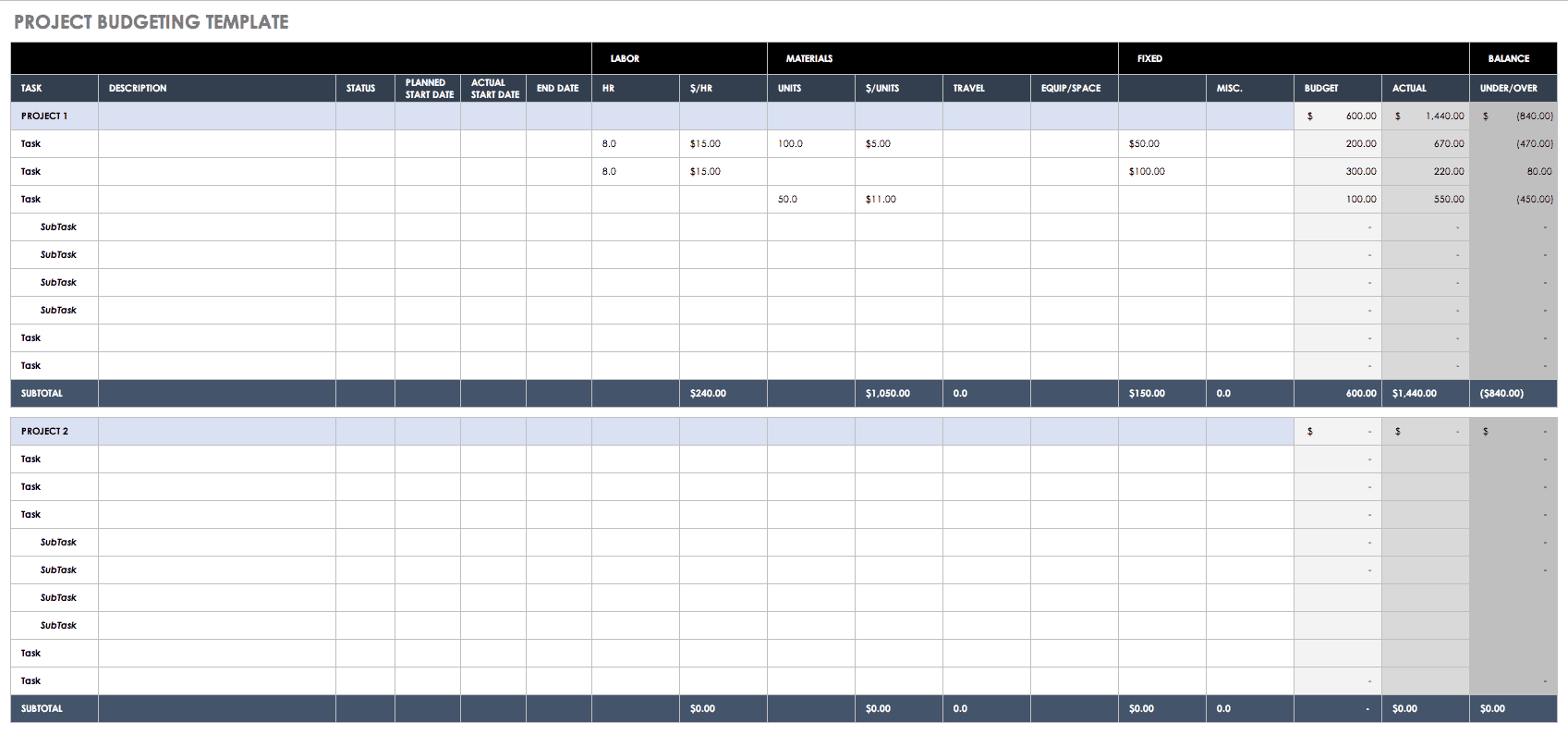

Project Budget Template

Download Excel Template

Need to create a specific, detailed budget for a particular job? This business budget worksheet can help you track income and expenses at the individual project level. Calculate labor, materials, and fixed costs for individual tasks across different categories, and compare estimated against actual expenses and revenues. Keep per-project spending under control with this business budget spreadsheet.

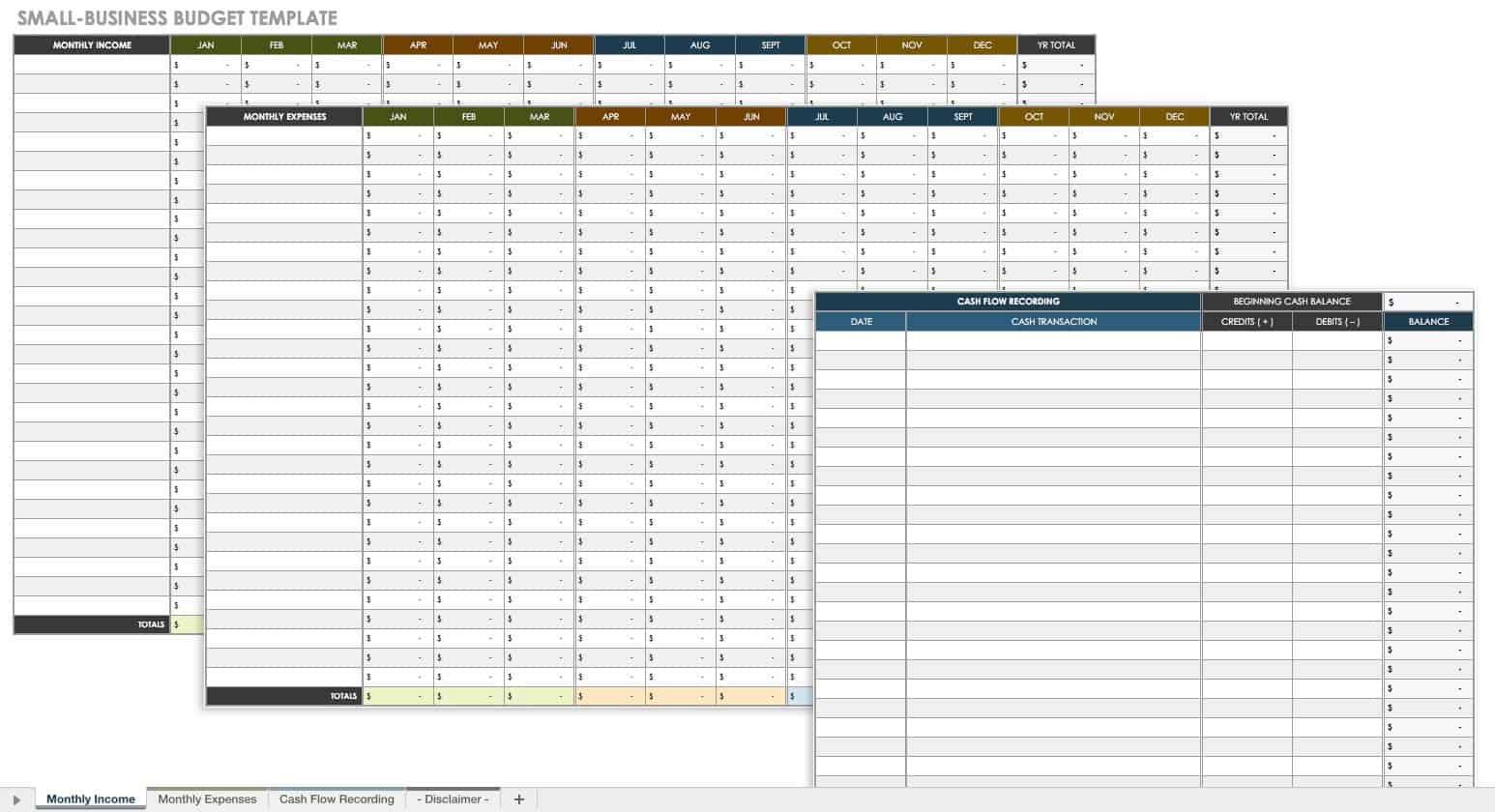

Small Business Budget Template

If you run a small business or are self-employed, use this small business budget template to track and manage your finances. This basic budget planner has one sheet for tracking income sources, one for expense types, and another for cash transactions. Easily track monthly income and expenses and calculate total profits.

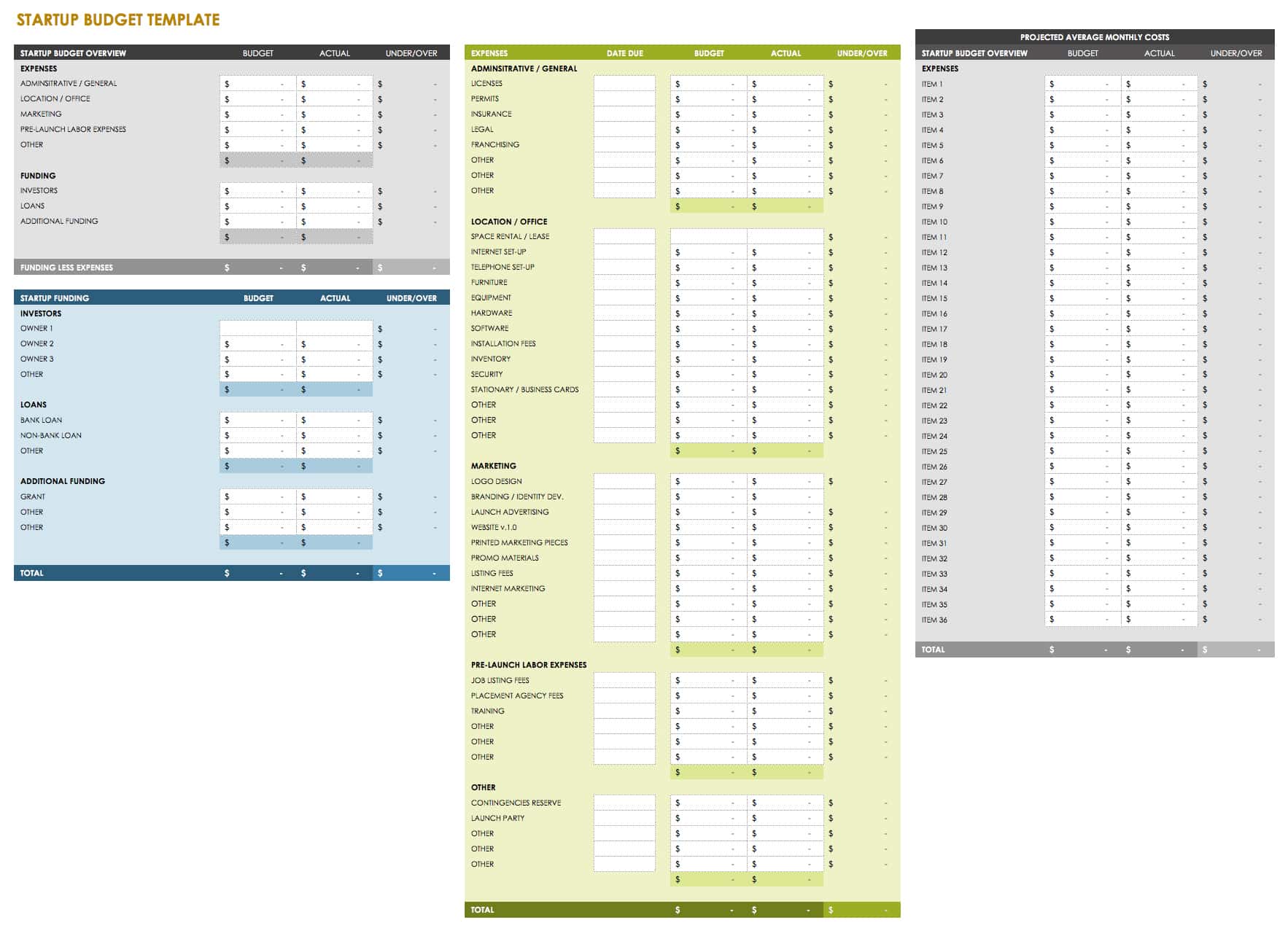

Start-up Budget Template

Download Start-up Budget Template

Are you opening a new business? Using small business budgeting templates can help you manage finances properly from day one. If you plan effectively, you’ll lay a strong economic foundation for your company as it grows. This small business budget template allows you to track estimated versus actual funding sources and amounts, determine pre-opening costs, and calculate ongoing expenses so you’ll know how much income you need to come out ahead.

What’s in a Business Budget?

According to the U.S. Small Business Administration (SBA), a business budget should contain the following information:

- Expected sales and revenues

- Fixed costs (those that don’t depend on sales, such as rent and business license expenses)

- Variable costs (items related to sales, such as materials and production expenses)

- Semi-variable costs (those that may or may not change depending on sales, such as wages and marketing fees)

- Profits (expected sales and income minus costs)

You may also choose to include additional information in your budget, depending on your business size and the level of financial information you want to track. For example, if you run a startup, you may want to include data on the total cost of getting your business up and running, as well as the amounts and sources of investor funding. If you have a large enterprise with multiple branch offices, you may want to create separate sheets for each location, as well as for the company’s overall budget.

How to Create a Business Budget Plan

When creating your initial budget, you can use a business budget template to help calculate revenues, expenses, and profits. You may also choose to purchase business budget software to create a more detailed plan. Whatever method you choose, follow these basic steps when forming a budget:

- Gather historical information: If you have an established business, collect historical data on operating expenses, salaries, sales, and revenues over time. If you’re starting a new business, look for financial information on a business similar to yours (in size and type) and use it as a benchmark.

- Estimate sales and set profit goals: Calculate the sales you expect to make during different times of the year, factoring in holidays, office or plant closures, and seasonal booms and lulls. Set profit goals, and make realistic revenue projections for the year and into the future.

- Determine fixed and variable costs: Calculate all the fixed costs involved in operating your business such as rent, insurance, and business licenses. Also determine estimates for your variable costs, including materials and equipment, labor, salaries for company executives, employee benefits, and training and travel expenditures.

- Calculate your profit margin: To determine how much profit you expect the business to make, subtract your expenses from estimated sales and revenues. Include the total cost of goods sold (the total amount it costs to produce your product or service), and factor in other costs like shipping, equipment, and materials for your office or production facility.

- Adjust your budget over time: Continually update your budget over time to see how your estimates compare with actual sales and expenses. If you’re not making a profit, try adjusting your budget to increase revenues and decrease overhead costs.

Discover a Better Way to Manage Business Expenses and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Business Budget: What is it & Why is it important?

According to a survey conducted by Clutch , 61 percent of small businesses have not created a formal budget. Without a budget, you may not understand how your business is performing.

Creating a budget helps you understand how much money you have, how much you have spent, and how much money you will need in the future. A budget can drive important business decisions like cutting down on unwanted expenses, increasing staff, or purchasing new equipment. If you end up with insufficient money, the budget can guide you in altering your business plan or prioritizing your spending on activities.

With the right budgeting plan, you can keep your business out of debt or find ways to reduce the debt it is currently facing. A comprehensive budget can even be used for obtaining business loans from banks or other financial institutions.

In this guide, you will learn about the importance of a business budget, the components of a good budget, and the different types of budgets.

So, what exactly is a business budget?

A business budget is a spending plan for your business based on your income and expenses. It identifies your available capital, estimates your spending, and helps you predict revenue.

A budget can help you plan your business activities and can act as a yardstick for setting up financial goals. It can help you tackle both short-term obstacles and long-term planning.

Different types of budgets

Your final budget is usually a combination of inputs from several other budgets that are prepared at a departmental level. Let’s look at the different types of budget and how they contribute to drafting a business plan.

1. Master budget

A master budget is an aggregation of lower-level budgets created by the different functional areas in an organization. It uses inputs from financial statements, the cash forecast, and the financial plan. Management teams use master budgets to plan the activities they need to achieve their business goals. In larger organizations, the senior management is responsible for creating several iterations of the master budget before it is finalized. Once it has been reviewed for the final time, funds can be allocated for specific business activities.

Smaller businesses often use spreadsheets to create their master budgets, but replacing the spreadsheets with efficient budgeting software typically reduces errors.

2. Operating budget

An operating budget shows a business’s projected revenue and the expenses associated with it for a period of time. It’s very similar to a profit and loss report. It includes fixed cost, variable cost, capital costs, and non-operating expenses. Although this budget is a high-level summary report, each line item is backed up with relevant details. This information is useful for checking whether the business is spending according to its plans.

In most organizations, the management prepares this budget at the beginning of each year. The document is updated throughout the year, either monthly or quarterly, and can be used as a forecast for consecutive years.

3. Cash budget

A cash flow budget gives you an estimate of the money that comes in or goes out of a business for a specific period in time. Organizations create cash budgets using inferences from sales forecasts and production, and by estimating the payables and receivables.

The information in this budget can help you evaluate whether you have enough liquid cash for operating, whether your money is being used productively, and whether there is and whether you are on track to earn a profit .

4. Financial budget

Businesses draft this budget to understand how much capital they’ll need and at what times for fulfilling short-term and long-term needs. It factors in assets, liabilities, and stakeholder’s equity—the important components of a balance sheet , which give you an overall idea of your business health.

5. Labor budget

For any business that is planning on hiring employees to achieve its goals, a labor budget will be important. It helps you determine the workforce you will require to achieve your goals so you can plan the payroll for all of those employees. In addition to planning regular staffing, it also helps you allocate expenses for seasonal workers.

6. Static budget

As the name suggests, this budget is an estimate of revenue and expenses that will remain fixed throughout the year. The line items in this budget can be used as goals to meet regardless of any increases or decreases in sales. Static budgets are usually prepared by nonprofits, educational institutions, or government bodies that have been allocated a fixed amount to use for their activities in each area.

Components of a budget

If you are starting a new business, the first budget you create might be a challenge, but it is a good learning experience and a good way to understand what works best for your business. The best place to start is getting to know your budget components. Initially you may need to make several assumptions to get your budget started.

1. Estimated revenue

This is the money you expect your business to make from the sale of goods and services. There are two main components of estimated revenue: sales forecast and estimated cost of goods sold or services rendered. If your business is more than a year old, then your experience will guide you in estimating these components. If your business is new, you can check the revenue of similar local businesses and use those figures to conservatively create some estimated revenue numbers. But whether your business is new or old, it is important to stay realistic to avoid over-estimating.

2. Fixed cost

When your business pays the same amount regularly for a particular expense, that is classified as a fixed cost . Some examples of fixed costs include building rent, mortgage/utility payments, employee salaries, internet service, accounting services, and insurance premiums. Factoring these expenses into the budget is important so that you can set aside the exact amount of money required to cover these expenses. They can also be a good reference point to check for problems if your business finances aren’t going as planned.

3. Variable costs

This category includes the cost of goods or services that can fluctuate based on your business success. For example, let us assume you have a product in the market that is gaining popularity. The next thing you would like to do is manufacture more of that product. The costs of the raw materials required for production, the distribution channels used for supplying the product, and the production labor will all change when you increase production, so they will all be considered variable expenses.

4. One-time expenses

These are one-off, unexpected costs that your business might incur in any given year. Some examples of these costs include replacing broken furniture or purchasing a laptop.

Since it is difficult to predict these expenses, there is no certain way to estimate for them. But it’s wise to set aside some cash for this category to stay prepared.

5. Cash flow

This is the money that travels in and out of the business. You can get an idea of it from your previous financial records and use that information to forecast your earnings for the year you’re budgeting for. You’ll want to pay attention not only to how much money is coming in, but also when. If your business has a peak season and a dry season, knowing when your cash flow is highest will help you plan when to make large purchases or investments.

The final budget component is profit, which is a number you arrive at by subtracting your estimated cost from revenue. An increase in profit means your business is growing, which is a good sign. Once you have projected how much profit you are likely to make in a year, you’ll be able to decide how much to invest in each functional area of your organization. For example, will you use your profit to invest in advertising or marketing to drive more sales?

A budget is a road map for your business. It helps you predict cash flow, identify functional areas that need improvement, and run your operations smoothly. Successful businesses invest a lot of time and effort into creating realistic budgets, because they’re an efficient way of tracking the extent to which the business has achieved its goals. Creating a budget can get a bit overwhelming for new businesses as there are no previous figures to guide their budget estimates, but with some estimates based on the performance of competitors and an understanding of the components of a budget, you can complete your first budget and have a good road map for future budgets.

Related Posts

- Cash Flow Statement - Definition and Importance

- How to Create a Business Budget for Your Small Business

- Income statement - Definition, Importance and Example

Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

may I have more materials for budgeting?

Hey Patricia,

While we appreciate suggestions from our readers, we just wanted to let you know there’s more coming up on budgeting. However, besides this article, there’s another one on – How to create a business budget for your small business. Hope it’s insightful.

Has helped me learn a few things about types of budgets

I love this article. It is very helpful. I am interested in knowing which budgeting softwares are efficient when you say,” Smaller businesses often use spreadsheets to create their master budgets, but replacing the spreadsheets with efficient budgeting software typically reduces errors.” I am looking for one software for my company!

Thank you. Respectfully,

Hi Nilamba!

Budgeting is one of the important features in Zoho Books.

A few key highlights of Zoho Books include: 1. Management of vendors and customers. 2. Creating Estimates, Sales orders and Invoices. 3. Managing your Expenses, Bills, Purchase Orders. 4. Collaborative Client Portal through which your clients can easily view all their transactions and also make payments. 5. Integrations with other Zoho apps. 6. Integrations with Online payment gateways 7. Automated Bank feeds. 8. Exhaustive Reports and much more… It is available as a mobile app on Android, iOS and Windows as well. Please do write to us at [email protected] and we will be happy to explain how Zoho Books will be a great fit for your business.

Thanks you for the level of understanding on this topic but I need new materials as technology advance.

Thank you for the information, it’s great help.

Excellent and easily elaborated..

You might also like

Switch to smart accounting. try zoho books today.

Business growth

Business tips

7 free small business budget templates for future-proofing your finances

As a small business owner, you're likely balling with a lot more than your personal checking account. If you don't properly manage your business finances, there's more on the line than an overdraft fee—you now have an entire organization to account for.

Small business budgets are necessary to balance revenue, estimate how much you'll spend, and project financial forecasts, so you can stay out of the red and keep your business afloat.

But creating a small business budget template isn't a small task. Since I don't have a business to run, I did the heavy lifting for you—check out these free, downloadable templates for your small business budgeting.

Table of contents:

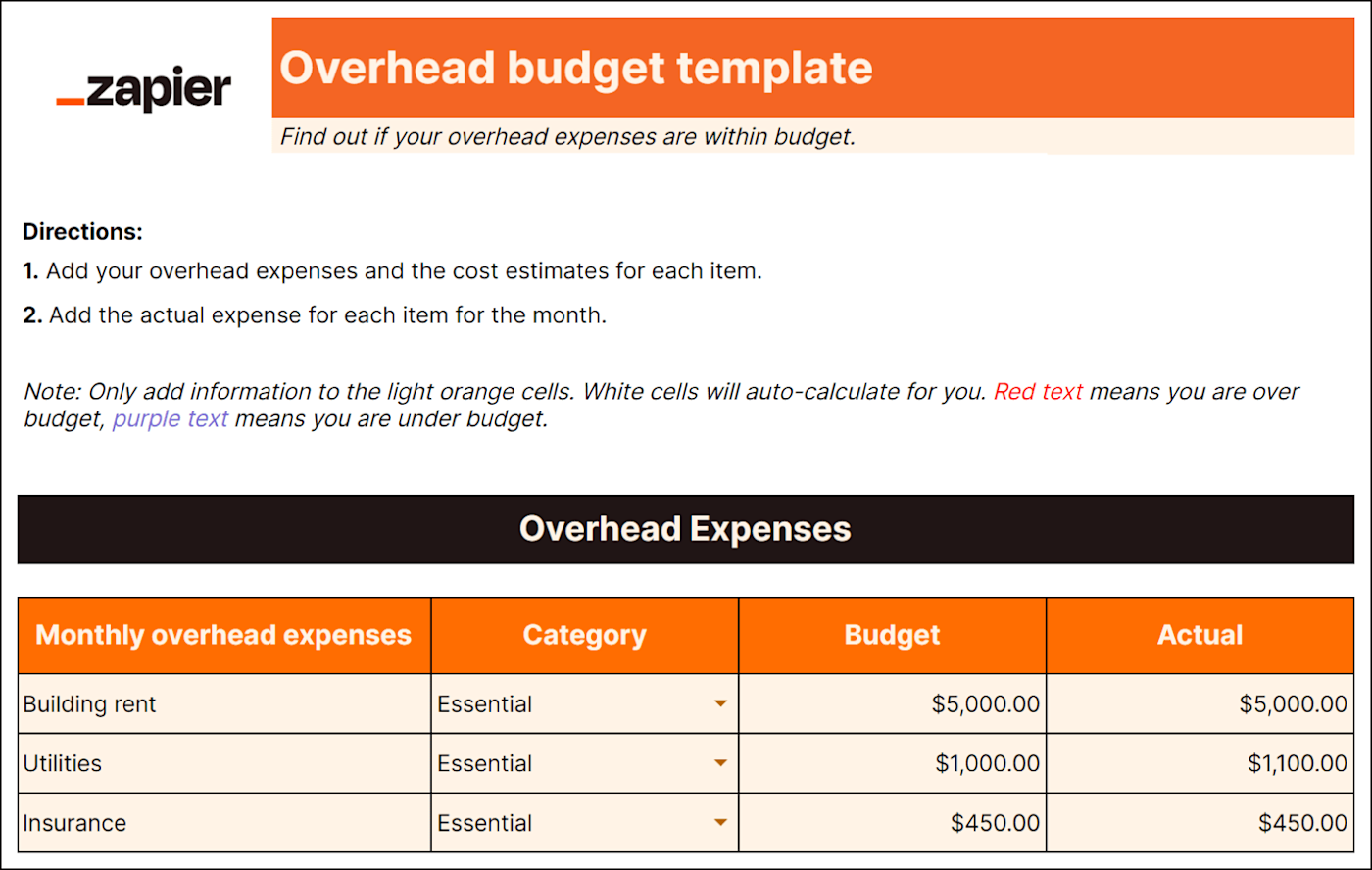

2. Overhead budget template

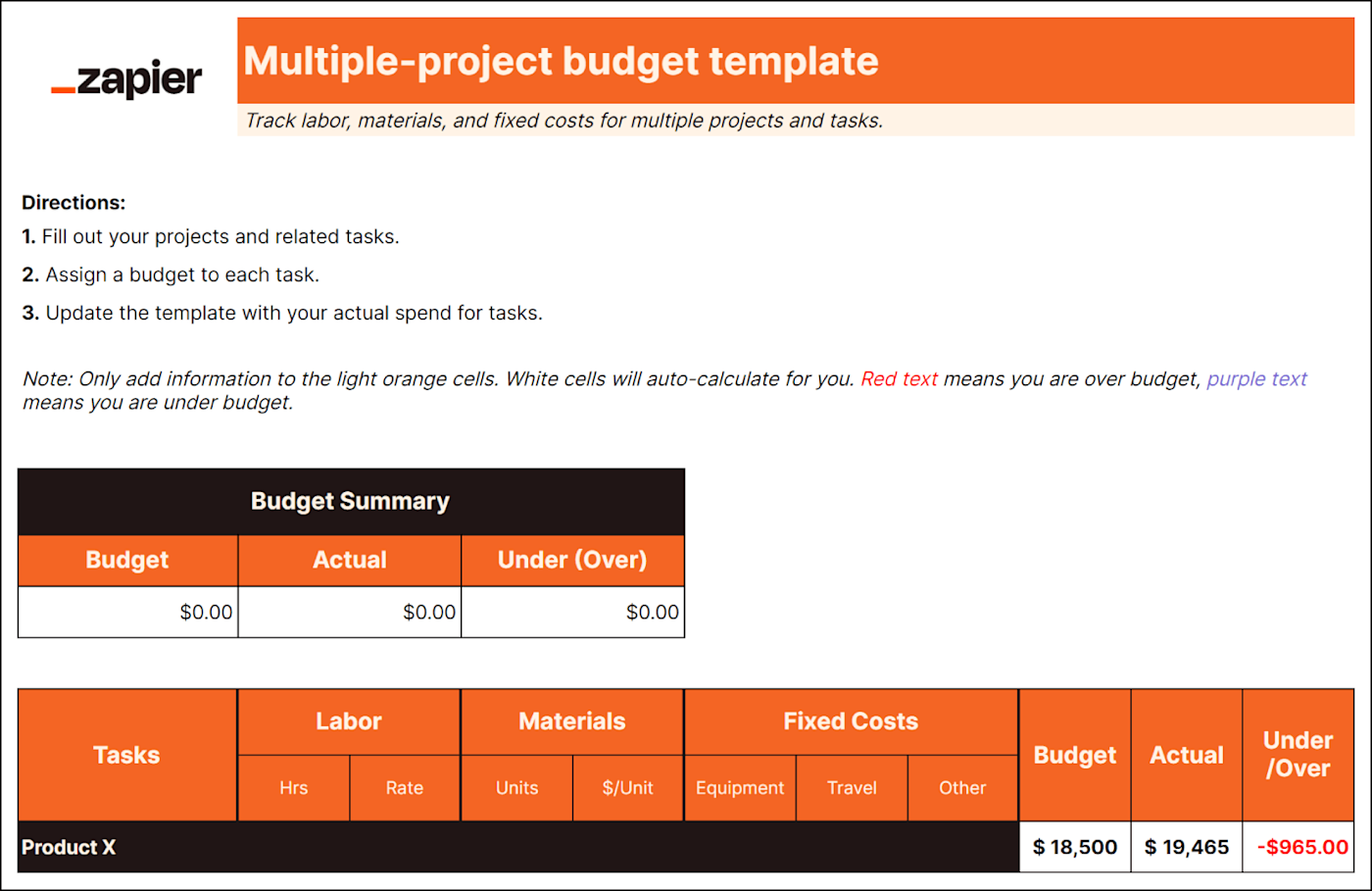

3. multiple-project budget template.

4. Startup budget template

5. Labor budget template

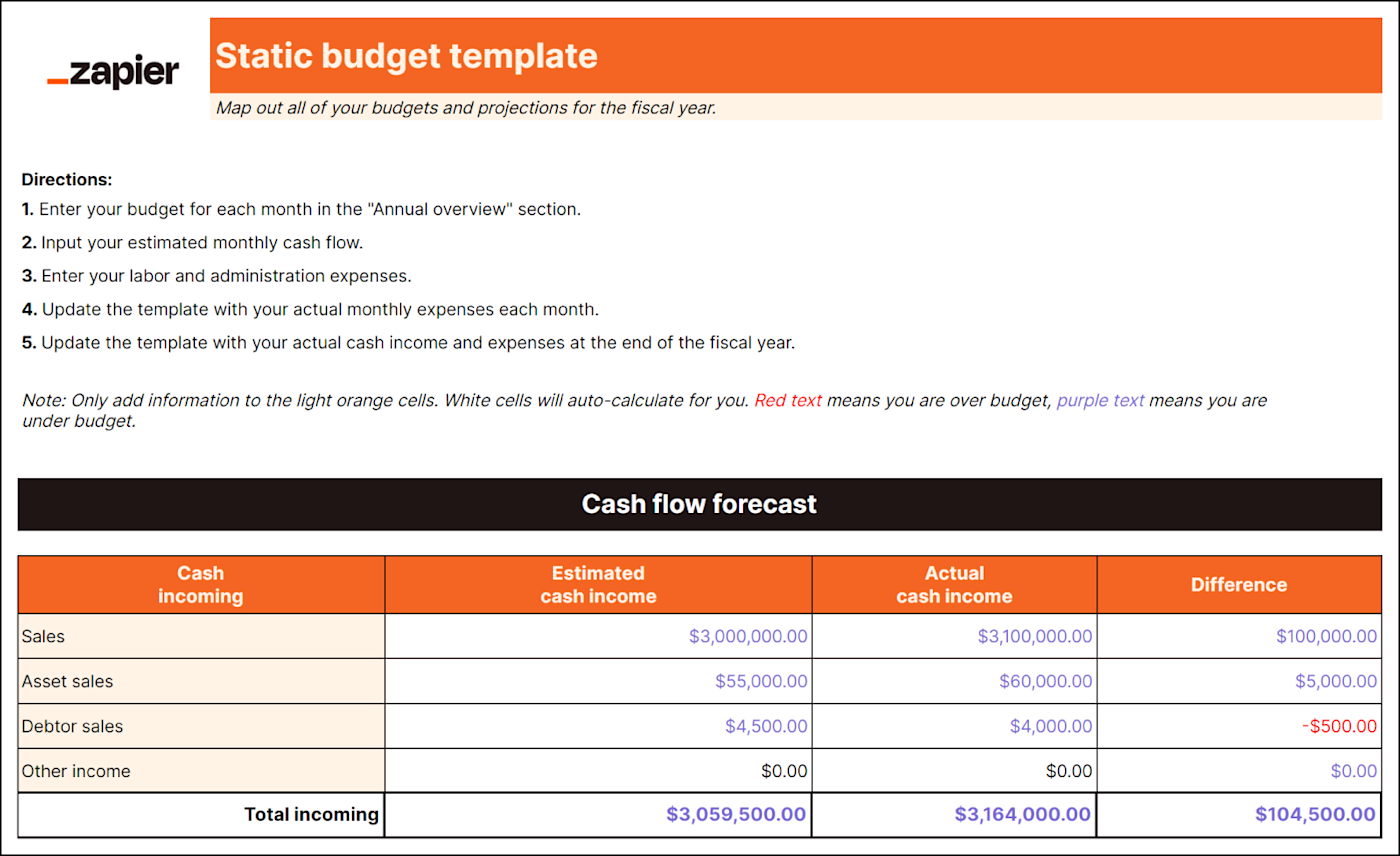

6. cash flow budget template, 7. administrative budget template, periodic budget reviews, how to design your small business budget plan, small business budget faq, 1. static budget template.

Best for: Multiple departments or revenue streams; Industries with complex operations

A static budget combines all the function-specific budgets a business uses into one. Typically, a static budget includes the following items (plus any other budgets your business might use):

Cash flow projections: Estimations of how much money will flow into and out of your business. They also help you decide when, how, and what you should spend money on.

Total expected spending: All estimated expenses, including labor and administrative costs.

By integrating all of your budgets and projections, the static budget provides a full picture of your business's estimated expenses and financial strategy for the upcoming fiscal year.

Best for: Service-based businesses

It's easy to forget about expenses that aren't directly tied to production, like delivery charges or utilities. But these costs exist (and can add up quickly), so you need an overhead budget. A detailed overhead budget template will include:

Administration expenses

It compares your budgeted amount to actual figures (warning: it may be a rude awakening) and can help improve accuracy for future financial planning.

Predicting overhead spending helps you plan how to use other funds more practically too—if you know how much you'll spend on overhead, you can make better business decisions. For example, you'd know whether you can afford to invest money into other initiatives like adding a delivery service or upgrading equipment.

Best for: Project-based industries

If you're managing multiple projects like website development or event planning, each with its own budget and expenses, you need a multiple-project budget to help keep your head on straight. This type of budget will help you track the following items per project:

Product-by-product COGS (cost of goods sold)

Labor costs

Equipment and resource costs

Indirect project expenses like travel

A multiple-projects budget establishes estimates for everything you need to get projects across the finish line. It also lets you track costs to ensure you're not spending more than you accounted for in the budget.

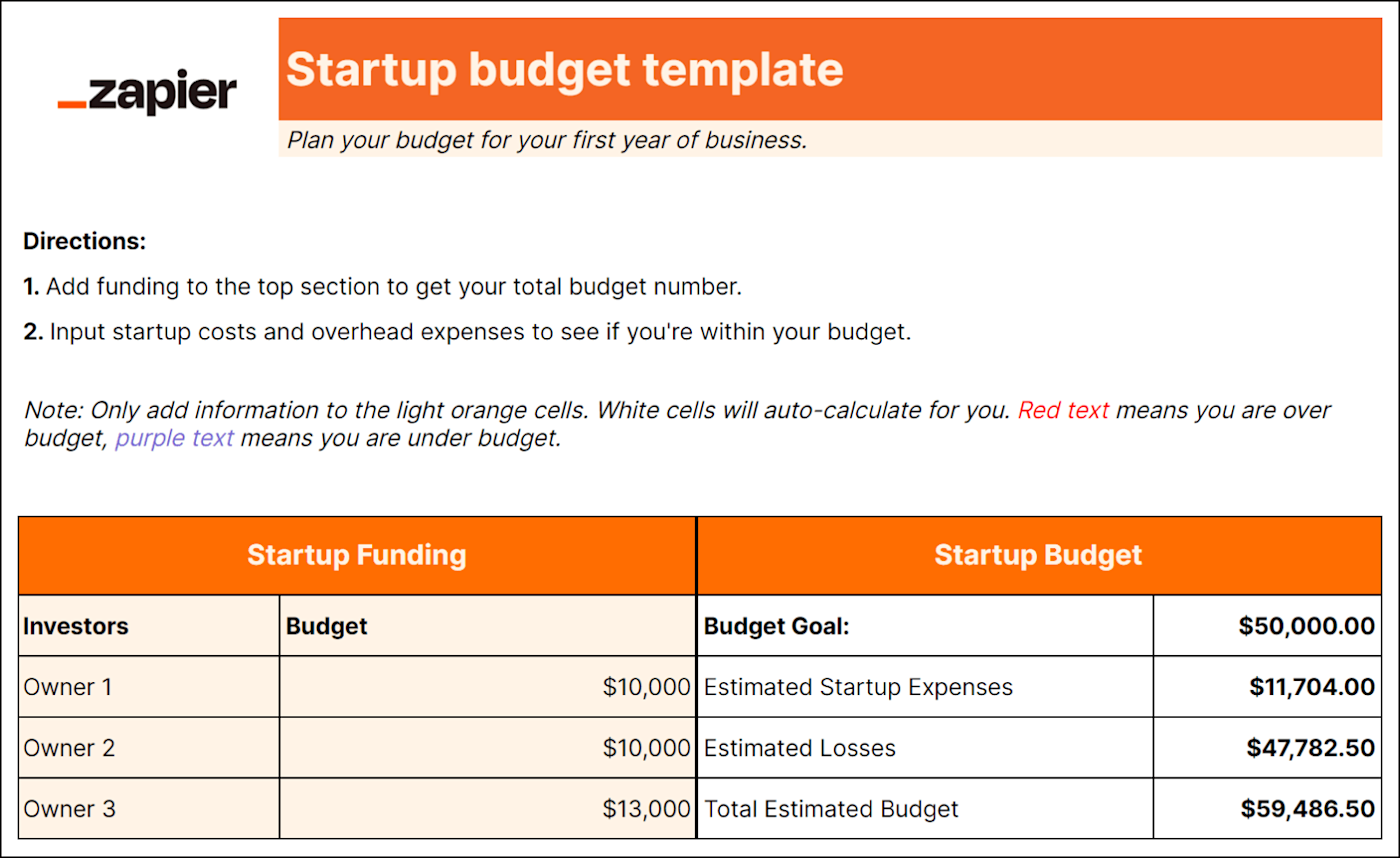

4. Startup budget template

Best for: New small businesses and startups

Startups need to ensure financial success from the get-go, so they can reinvest profit into the business and potentially attract more investors.

But unlike established small businesses, you don't have past financial data to base expenses on. That's why you need a startup budget to focus on expenses for your first year of business, including items like:

Funding from investors and loans

Licensing and permits

Logo and website design

Website domain

Business software

Security installation

Overhead expenses

Capital expenses

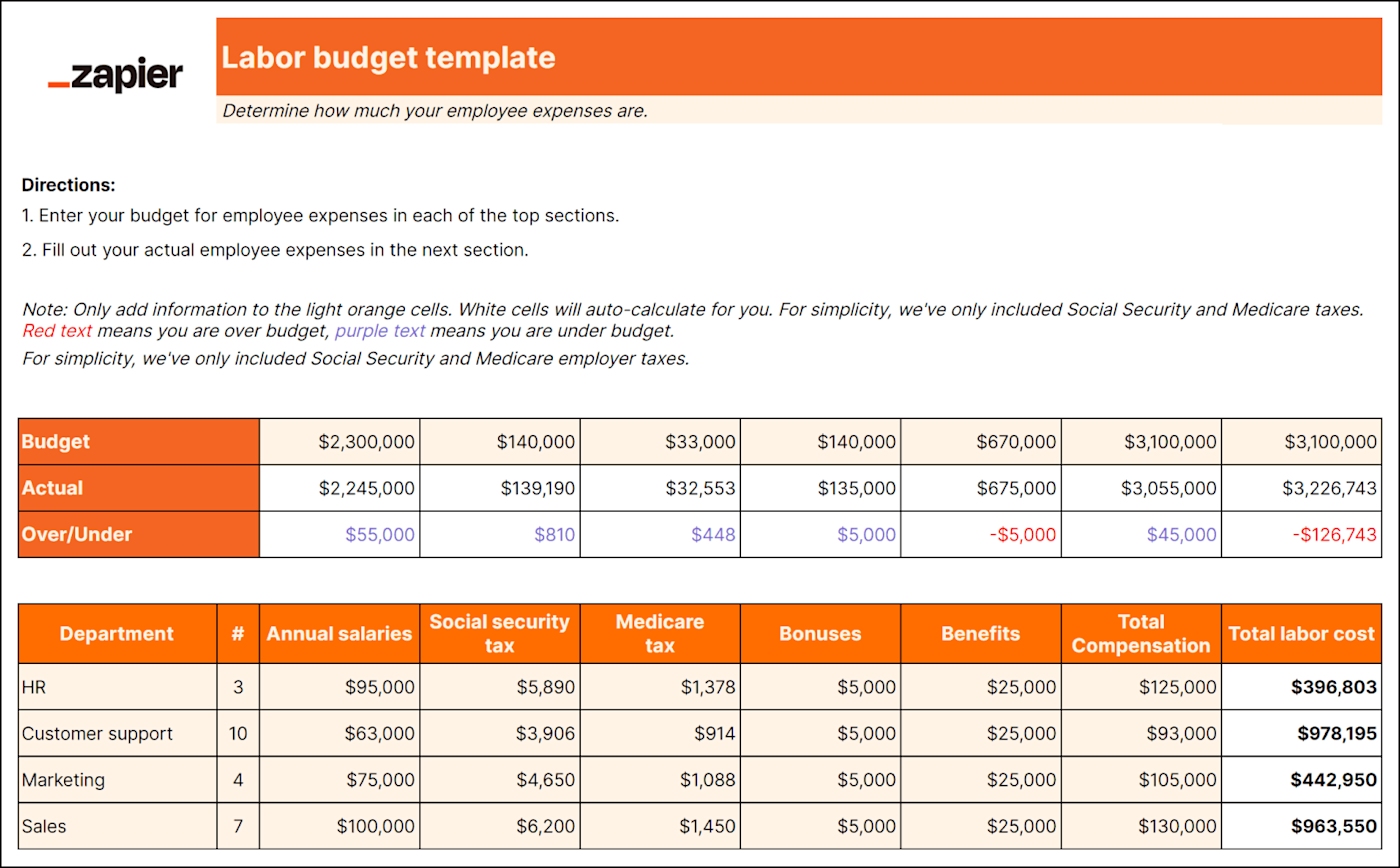

Best for: Larger businesses with lots of employees

Unless you're a one-person show, you'll need a labor budget. And even if you are a one-person show, it's good to know if you can afford to pay yourself. A labor budget breaks down all employee-related costs like:

Payroll taxes

Contract labor