How Dell’s strategy transformed it from a doomed player to leading the data revolution

Table of contents, here’s what you’ll learn from dell's strategy study:.

- How to sustain your company’s growth beyond its initial success.

- How a sober bet for the future fuels your conviction to win.

- How to think long-term and not sacrifice your future for short-term benefits.

Dell Technologies is a multinational technology company that designs, develops, and sells a wide range of products and services, including personal computers (PCs), servers, data storage devices, network switches, software, and cloud solutions.

The general public owns 58% of Dell Technologies, while private equity firms and institutions own the rest. Michael Dell is the founder, chairman, and current CEO.

Dell's market share and key statistics:

- Brand value of $26,5 billion

- Net Worth of $28.7 billion as of Jan 13, 2023

- Annual revenue of $105.3 billion for 2022

- Total number of employees: 133.000

- Total assets worldwide: $93 billion in 2022

{{cta('e9abffcd-5522-40c9-be83-0e844633a49a')}}

Humble beginnings: How did Dell start?

The story of every company starts with the story of its founder.

Usually, a great company has a great founder story behind it. And Dell Technologies certainly has one. Michael Dell’s story goes hand in hand with the story of the company he founded. By understanding the story of Michael, we can understand the company’s initial advantages and opportunities it pursued.

And like every great tech company story, Dell’s story starts in a college dorm room.

From stamps to startups: Michael Dell's early years and the birth of Dell

Michael Dell founded the company in college, but his entrepreneurial journey started much earlier.

He had an early interest in technology and business, and by the age of 12, he was already buying and selling stamps and coins to make extra money. As a teenager, he worked summer jobs where he learned by trial and error how demand and supply worked, how to be efficient, how to segment the market, and determine the most profitable persona to sell.

By the time he graduated from high school, he had saved up enough money to buy his own BMW and his first personal computer, an Apple and later an IBM.

But he was curious about the inner workings of these machines and, to his parents' horror, he took them apart, learning about the different components and how they worked together. He soon made a crucial discovery. IBM DIDN’T manufacture its own parts. Instead, it sourced them from other companies. This sparked an idea in Michael's mind - he could build his own PCs using the same components but at a lower cost and higher quality.

That idea didn’t come out of the blue.

Michael Dell was constantly educating himself on computers, how to build them, how they worked, and how to code. He followed all computer magazines at the time and attended every event in his neighborhood to network and learn the latest about the industry. In high school, he was already an expert, modifying his own PC and, once the word spread, customizing the PCs of professionals.

His first customers were friends and acquaintances who were impressed by his knowledge and expertise. Michael quickly realized that there was a demand for customized computers that were not available in the market. He began assembling machines with increased storage capacity and memory at a fraction of the cost of buying from big brands like IBM.

Doctors and lawyers were among his early customers, and word-of-mouth about Michael's high-quality and affordable PCs spread quickly.

He eliminated the middleman by buying components directly and assembling the machines himself, which allowed him to offer lower prices and better performance. By the end of his first year in college, Michael had a vendor's license, he was winning bids against established companies in the industry, and he incorporated his first company, “ Dell Computer Corporation .”

Dell’s direct-to-consumer strategy & how its corporate culture was formed

The company was growing frightfully fast, forcing the team to constantly change and evolve its processes.

Before the company had its second birthday, they had moved to bigger offices three times to accommodate its increased inventory, growing telephone needs, and physical or electronic systems. However, the company was still a high-risk venture and had a small capacity for expensive mistakes.

In those early days, the challenges Dell faced formed its processes and the core traits of its culture that are present to this day:

- Practicality and reduced bureaucracy. They did some things unconventionally, like having salespeople set up their own computers. That way, they gained first-hand knowledge of the technology and the customer’s pain problems (customers and salespeople were uneducated on the technology, so they shared the same problems).

- A “can-do” and “I’ll-pitch-in” attitude. Employees took substantial liberties with their “responsibilities.” Engineers would help with the overloaded manufacturing line, everyone would answer phone calls, salespeople would fulfill orders while taking new ones, etc.

- A sense of making a difference. Money was tight, so Dell employees wouldn’t mind solving secondary “needs” with cheap solutions like using cardboard boxes to throw their trash because they didn’t have trash cans.

- Direct relationships with the customers. Maybe one of the most important aspects of Dell’s culture and strategy. The company was talking at the same time with prospects and current customers on the phone. That way, it got first-hand feedback on what the market was currently asking for and was enjoying or not enjoying. That gave birth to Dell’s “Direct Model.”

The company went to great lengths to build and maintain the direct model because it was one of its most important sources of competitive advantage. Where other companies had to guess what to build next, Dell was already on it because their customers were telling them.

There were clear advantages to the Direct model:

- Closed feedback loop. Dell was talking directly to prospects – no dealer costs – and had no need for inventory. Lower costs = lower prices = more customers. And with every new customer, Dell had another finger on the pulse of the market.

- A single salesforce. Focused solely on the end customer. There was no need to have salespeople to sell to dealers and then additional salespeople to sell to the customer.

- Specialization in sales. Dell sold to large corporations, and smaller customers, like SMBs, educational institutions, and individual consumers. But selling to these two different buyers, large corporations and SMBs, was incomparable. So, the company had different salespeople for different customer segments and thus offering the best customer support and experience.

But the model wasn’t without its disadvantages:

- The model wasn’t irreplicable. Dell was making IBM-compatible PCs and selling them directly to customers. This model wasn’t hard to replicate, and the market’s conditions favored the birth of competitors with the same model.

- Lack of credibility. It’s hard to make a $5,000 sale when the customer has never heard of you and you lack a physical store.

- Incompatibility. Dell’s PC had to be compatible with IBM’s. But they had multiple suppliers for their components and sometimes those components were incompatible. Designing high-quality machines that were outperforming and compatible with IBM’s was a challenge.

But these disadvantages didn’t stop the team. The company doubled down on customer support and service and developed a strong reputation around them. It advertised a 30-day money-back guarantee and educated its suppliers to make components based on Dell designs. They even started their first R&D attempts that gave them a 12-MHz that was faster than IBM’s latest model, cheaper, and got them on the cover of the most prestigious magazine in the industry, the PC Week .

Dell’s strategy was so effective that phone calls started coming in, urging them to accept capital and go public.

Only three years after the company’s birth in a college dorm room, Dell went public, raising $30 million with a market valuation of $85 million.

Key Takeaway #1: Build a coherent strategy beyond your initial differentiator to sustain growth

Most companies enjoy initial success due to an untapped opportunity in the market, from addressing a niche market to exploiting the weaknesses of major players.

But no company succeeds at growing beyond the limits of the initial opportunity if it doesn’t evolve and expand its competitive advantage. So when evaluating your next move, ask yourself:

- What is our current competitive advantage?

- How easily can our competition replicate it?

- How can we make it harder (if we can)?

- How can we expand our capabilities to strengthen our current competitive advantage?

- How can we develop new competitive advantages?

- What are the market trends and how can we adapt/take advantage of them before others?

The occasional bold move doesn’t hurt, either.

Recommended reading: 6 Competitive Analysis Frameworks: How to Leave Your Competition In the Dust

How Dell’s privatization led to a strategic triumph

In the first decade of the new millennium, the PC business was growing rapidly.

Computing power followed Moore’s Law and innovation cycles in hardware were less than 12 months long. At the same time, a new generation of software was spreading and the World Wide Web was expanding globally. Being a part of a growing industry, like the PC business back then, was lucrative. So naturally, many companies did well.

Dell was one of them. In 2000, the company became the world’s largest seller of PCs, having enjoyed a decade of skyrocketing sales.

However, in 2011, things changed. The PC global sales reached their peak and the next year was the first of an 8-year streak of decline that lasted until the pandemic hit.

That decline impacted Dell severely.

Navigating decline: Dell's strategy for a shrinking market

Dell was in deep trouble at the start of the previous decade:

- It had lost its position as a top PC seller in the US to its main competitor, HP.

- It came third in the global PC market share, behind HP and ACER.

Many believed that it was a dying company that would perish like Kodak or Motorola.

The PC market was shrinking and some experts were saying it was the beginning of its end. Dell was expected to be among the first casualties. The truth was that the PC industry wasn’t dying, but it was evolving – it was losing some of its traits and gaining new ones. The difference is subtle but also key. In a competitive arena, every alert player is aware of the market changes: declining sales, emerging trends, and other important facts. But how each player interprets them determines whether they’ll formulate a winning strategy or not.

The more substantial the changes, the more important the interpretation.

In 2012, the fact was that the PC business was declining. Every major player could see it with a single glance at their balance sheet. In Dell's case, the decline was even direr since its PC sales were down by double digits. The company desperately needed to turn things around. And only a bold strategic move could do that.

The company tried to bounce back up with some obvious but desperate moves:

- The introduction of the Streak “phablet.” An embarrassing attempt at creating a new product category between tablets and smartphones. Its design was bulky and its Android software unsuitable for the device, while its purpose was unclear to the consumer.

- Making Windows 8 its default operating system. Dell and Microsoft have been longtime partners, to the benefit of both companies. Unfortunately, their growing interdependence meant that when one failed, it dragged the other one down. Windows 8 failure dragged down Dell and further decreased its PC market share.

- Attempts to enter the tablet and smartphone markets: the “Venue” debacle. Dell was always viewed as a PC company, not a technology company, making it harder to expand to new categories. Its first smartphone, the Venue , ran on Windows Mobile and it never got any traction. As a result, the company abandoned the categories and, even today, it has less than negligible presence in these markets.

But where people saw a vulnerable company, Michael Dell saw an opportunity.

He had an assumption, a vision attached to it, and a plan to make it a reality. But he had no way to execute it with the company’s organizational structure at the time.

The obstacles to implementing Dell's competitive strategy

Dell’s strategy was to go on the offensive. He wanted the company to be highly aggressive by:

- Becoming competitive in the PC business again.

- Expanding its services and software solutions.

- Increasing its sales capacity.

Dell aimed to achieve these goals by investing heavily in R&D, gaining tighter control over its PC and server prices, and expanding its sales workforce. The idea was to fund new business capabilities in the software and services space from Dell's PC segment. That was a bold plan that involved a lot of changes and, thus, a lot of risks.

Dell’s strategy was essentially a business transformation proposal.

And although a lot of public companies have successfully gone through a transformation, none did it in such a short period of time without sacrificing the short-term faith of its shareholders. And that was exactly the problem.

The strategy was inherently risky – like every good strategy is – as it promised capital expenditure and an immediate decrease in profitability due to increased operating expenses. Things shareholders hate. And if shareholders aren’t happy with the company’s near-term returns, they start selling their shares, and the company loses its value and a good portion of its funding capabilities.

Short-term risk = lower share prices = less funding for the company

Thus, the strategy was impossible to execute without the support of the shareholders. So the company had only two options: gain the support of the shareholders or go private.

Dell chose to go private.

Dell's game-changing decision was based on a strategic bet

For a gigantic public company with a market cap of nearly $20 billion, going private is a tough decision and a complicated process.

But it was an unavoidable preliminary for the successful execution of Michael Dell’s plan. And the first step was to convince the board of the necessity of the transformation. After announcing his idea, the board started discussions with experts to evaluate the move, i.e. top consulting agencies and other independent third parties.

JP Morgan , Boston Consulting Group, Evercore, and Debevoise were some of the names involved. And they all shared the same view:

- The PC is dying.

- Funding a business transformation from a declining business is a bad idea (despite such successful attempts from IBM and BMW in the past).

The experts had a lot of facts and strong arguments to support their case. However, all of them were based on a single assumption: tablets and smartphones will replace the dying PC . The growth in those categories would entail a decline in the PC business. They believed the PC was about to be cannibalized.

Dell’s CEO disagreed. What was his assumption?

He believed that tablets and smartphones wouldn’t take away from PCs but rather add to it. He believed that the PC’s central role in productivity and business wasn’t going to be dethroned by the new shiny toys. People would buy and use tablets and smartphones, but PCs would remain their primary productivity tool.

And he would bet Dell’s future on it.

But he had to convince the board of directors first. At the start, conversations were happening in secret and things were moving slowly but steadily. But when the idea was leaked, two new problems presented themselves.

The first was Carl Icahn, who contested for the ownership of Dell. Carl Icahn is a self-proclaimed “activist investor” but others call him a “corporate raider.” The closer the go-private initiative was to happen, the more Carl Icahn fought for it. And he used every improper tool and method he could muster. The battle that followed between Carl and Michael delayed the deal and almost derailed it.

The second was Dell’s customers’ hesitation in doing business with the company. The rumors about the go-private initiative left the customers wondering about the future of Dell and doubted whether any kind of investment in it was worth it. They were suspending purchases and all Dell’s leadership could say was, “We don’t comment on rumors and speculations.”

The press had also concluded that the go-private initiative was a declaration of Michael Dell’s incompetence and a desperate attempt to keep Wall Street’s eyes away from its demise.

History would prove them wrong and crown Michael Dell victorious.

A new chapter: How Dell's go-private move set the stage for future success

The deal happened.

In February 2013, Michael Dell and the investment firm of Silver Lake took Dell private in a leveraged buyout of $24.4 billion, at $13.65 a share.

Despite all the time that passed until Dell could fully execute its strategy, the company didn’t remain idle. It had made several calculated moves to significantly reduce its dependence on the declining PC market before the deal conversations ever happened.

From 2007 to 2012, Dell spent north of $12.40 billion in key acquisitions to increase its enterprise software and hardware solutions, including cloud data storage and management. The acquisitions focused on areas like:

- Data storage

- Systems management

- Data management in healthcare

- Cutting edge software

The company had already started severing the connection between its financial health and its PC market share many years ahead of its privatization.

But after the buyout, it went all in. Speed and agility became its prominent advantages. Dell became, nearly overnight, a hungry, quick, and ready-to-attack-its-prey jackal. Whenever a new opportunity arose and people asked for resources to pursue it, leadership committed double the resources and said, "Go faster!"

For example, SMBs (small and medium businesses) presented a gigantic opportunity. So the company increased its sales workforce, retrained its existing salespeople, and hit endless SMB doors. They would enter a business selling their low-margin PCs and simultaneously become their trusted advisor on all things tech. Then they sold their whole portfolio of solutions.

And the morale of employees was off the charts. Leadership kept their promises on the changes and provided all the support their people needed to execute the plan.

In addition, people started viewing PC and smartphones as complementary, just as Dell expected.

Was Michael Dell’s bet a good one? Well…

45% of Dell’s revenue was generated from PC sales, but 80% or more of its profits were generated by its new solutions. Eight years after the privatization, the value of their equity had increased more than 625% and their enterprise value reached $100 billion.

We’re pretty confident that’s a yes.

Key Takeaway #2: Successful strategic bets require a sober conviction

Markets change and evolve all the time. The difference between players that emerge prosperous and those that struggle to fit in the new order of things isn’t the unique access to data.

No. Every alert player in your competitive zone has more or less the same access to market trends and changes. The difference lies in what you envision the future to be. That’s your bet.

That’s what a winning corporate strategy needs. And because bets are inherently risky, you require two things to place a successful bet:

- Sobriety to envision what the future of your industry will look like.

- Conviction to pursue that vision relentlessly.

Steering towards success: Dell's current strategy and the EMC merger

Michael Dell had foreseen the evolution of the technology industry since the 2000s.

Not the specifics, but the trend of PCs and hardware becoming less relevant – or at least less profitable – and software, the cloud, and back-end taking the front seat. He realized (from very early on) that servers and storage management would become a huge concern for large enterprises building (or upgrading) their IT infrastructure.

Dell anticipated the market’s needs by making a simple observation: the quantity of data in the world expanded exponentially and the traditional way of data management would require server performance that wasn’t physically possible to achieve. But he knew there was a solution underway: virtualization – software that mimics the computer, creating virtual mainframes within the physical mainframe.

That’s why the company had started investing in these technologies since 2001.

Achieving synergy: Dell's competitive strategy and the merger with EMC and VMware

Dell, EMC, and VMware are three major players in the technology industry with distinct but complementary offerings.

EMC had a successful product in networked information storage systems, i.e. a database management system for enterprises.

VMware was pioneering in virtualization, allowing users to run multiple operating systems on the same device.

Dell had an established distribution network and a series of back-end solutions that could expand and fit well with the former technologies.

The relationship between these three companies started in 2001. Dell and EMC entered a strategic alliance to rule a market of $100 billion worth by 2005.

%20(1).jpg)

For EMC, the alliance was a one-stone-three-birds initiative. First, it offered a lucrative distribution channel to customers their competitors were already targeting. Second, it ensured Dell wouldn’t partner with a competitor. And third, it reduced its supply costs for components.

For Dell, it also had a threefold benefit. First, It added high-performing products to a rapidly growing business. Second, it gave it an important customer – EMC was using Dell’s servers. And third, it allowed Dell to infiltrate deeper into enterprise data centers.

A strategic alliance that gave both Dell and EMC a competitive edge.

Then EMC bought VMware. That gave the company massive capabilities around cloud infrastructure services ending up being a very lucrative move. Dell, which had invested in VMware back in 2002, saw a massive opportunity to acquire the new EMC.

So Dell and EMC first began discussions of a potential partnership back in 2008, but the idea was ultimately shelved due to the financial crisis. However, in 2014, Dell revisited the idea as both companies had grown and become leaders in their respective industries.

Dell saw the potential for a merger as the two companies' services would bring significant value to their customers when combined. EMC's CEO, Joe Tucci, agreed with this assessment, but they still had to convince EMC's board. EMC was publicly held while Dell was private, and as soon as the idea was on the table, Dell found itself competing with two other interested parties, Cisco Systems and HP. In fact, HP nearly succeeded in acquiring EMC.

It failed due to a financial disagreement. So Dell jumped on the opportunity.

By then, EMC had grown tremendously and had eliminated any short- to mid-term potential start-up disruptors by acquiring them. EMC’s three businesses were uniquely complementary to Dell’s solutions:

- EMC Information structure , a leader in the data storage system market.

- VMware , the undisputed leader in virtualization.

- Pivotal , a start-up with a platform to develop cloud software.

However, the acquisition was a tough process. EMC had grown to a market cap of over $60 billion. It was impossible for Dell to fund an acquisition. Instead, the two companies merged.

The merger happened through a complex but effective financial plan, and the synergies created by the combined company increased revenue significantly. A year after the merger was initiated, the added revenue was well above expectations. This allowed Dell to pay down a significant portion of its debt and improve its financial standing and investment rating. The success of the merger led the company to simplify its structure and align the interests of the stakeholders of the three companies.

In 2018, Dell went public again as a very different entity than its first IPO, uniquely equipped to lead the 5-S sectors: services, software, storage, servers, and security.

What is Dell’s business strategy’s primary focus today?

Dell aspires to become a leading player in the data era by providing a wide range of solutions, products, and services.

Excluding VMware, Dell is divided into two main business segments supported by its financial subsidiary:

- The Infrastructure Solutions Group ISG helps customers with their digital transformation by providing multi-cloud and big data solutions that are built on modern data center infrastructure. These solutions are designed to work in multi-cloud environments and can handle workloads in public and private clouds as well as on-premise.

- The Client Solutions Group CSG focuses on providing solutions for clients such as laptops, desktops, and other end-user devices.

- Dell Financial Services DFS supports Dell businesses by providing financial options and services to customers according to the company’s flexible consumption models. Through DFS, the company tries to tailor its financial options to each customer’s way of consuming Dell’s solutions.

Dell's core offerings include servers, storage solutions, virtualization software, and networking solutions. The company is constantly investing in research and development, sales and other key areas to improve its products and solutions and to drive long-term growth.

Its primary strategic priorities are:

- Improving and modernizing its current offerings in the markets it operates in.

- Expanding into new growth areas such as Edge computing, telecommunications, data management, and as-a-service consumption models.

And its plan involves several key initiatives :

- Developing its flexible consumption models and as-a-Service options to customers to meet their financial needs and expectations.

- Building momentum in recurring revenue streams through multi-year agreements.

- Investing in R&D to develop scalable technology solutions and incorporating AI and machine-learning technology. Since its Fiscal year 2020, the R&D budget is consistently at least $2.5 billion. Most of it goes towards developing the software that powers its solutions.

- Collaborating with a global network of technology companies for product development and integration of new technologies.

- Investing in early-stage, privately-held companies through Dell Technologies Capital.

Although Dell has a coherent strategy to achieve its objectives, competition isn’t idle nor trivial in the core competitive arenas. The company faces a significant risk that includes:

- Failure to achieve intended benefits regarding the VMware spin-off.

- Competition providing products and services that are cheaper and perform better.

- Delays in products, components, or software deliveries from single-source or limited-source suppliers.

- Inability to effectively execute its business strategy (transitioning sales capabilities, expanding solutions capabilities through acquisitions, etc.) and implement its cost efficiency measures.

The technological advances are rapid, and players are in a constant race to innovate not only on the technologies they provide but on their business models and all of their services and solutions. Emerging players and strategic relationships between competitors could easily shift the competitive landscape before the company finds a way to react.

Key Takeaway #3: When making transformational decisions, prioritize thinking long-term

A major acquisition, or a merger, between industry leaders is a bet on the industry’s future.

If you believe in the bet long-term, don’t sacrifice a good move for short-term returns, as HP did with EMC. Instead, do your due diligence in the consideration phase:

- Consider real alternatives.

- Understand deeply how the capabilities of both companies will be improved.

- Validate your assumptions with current market needs and trends.

- Move faster than the competition.

Why is Dell so successful?

One of the key reasons Dell has been so successful is Michael Dell’s intuition and strategic instinct.

He demonstrated a consistent ability to take an accurate pulse of the market, make a winning bet and chase it relentlessly by performing a business transformation. Additionally, Dell never lost one of its core strategic strengths: building strong relationships with its customers by providing excellent customer support and tailored solutions to meet their unique needs. The company has also been successful in streamlining its operations and supply chain, which has allowed it to offer competitive prices and high-quality products.

Dell puts the customer first and makes strategic pivots with perfect timing.

How Dell’s vision guides its steps

According to Dell’s annual report, its vision is:

“To become the most essential technology company for the data era. We seek to address our customers’ evolving needs and their broader digital

transformation objectives as they embrace today’s hybrid multi-cloud environment.”

And their two strategic priorities, growing core offerings and pursuing new opportunities, are their roadmap to achieving it.

Growth by numbers

- Harvard Business School →

- Faculty & Research →

- November 2020 (Revised July 2022)

- HBS Case Collection

Dell Technologies: Bringing the Cloud to the Ground

- Format: Print

- | Language: English

- | Pages: 23

About The Authors

Navid Mojir

V. Kasturi Rangan

Related work.

- August 2021

- Faculty Research

- Dell Technologies: Bringing the Cloud to the Ground By: Navid Mojir and V. Kasturi Rangan

Brought to you by:

Dell Technologies: Bringing the Cloud to the Ground

By: Navid Mojir, V. Kasturi Rangan

The case tells the story of Dell Technologies and its efforts to revitalize its value proposition and escape a commodity trap by acquiring EMC for $67 billion-the largest tech acquisition in history.…

- Length: 23 page(s)

- Publication Date: Nov 5, 2020

- Discipline: Marketing

- Product #: 521036-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

The case tells the story of Dell Technologies and its efforts to revitalize its value proposition and escape a commodity trap by acquiring EMC for $67 billion-the largest tech acquisition in history. It also shows the deeply intertwined connections between a company's business strategy and its go-to-market operations. Michael Dell founded Dell Inc. in 1984 to assemble PCs. The company quickly became the market share leader by the end of the century. By 2008 (before the recession), Dell had expanded into servers, networking and storage, as well as services. Still, the hardware market was beginning to commoditize, with the trend accelerating after the recession. EMC, founded in 1979, had a similar story. It became the dominant player in data storage through early 2000 only to find that new technologies and nimble competitors were putting its business under severe commodity pressure by the turn of the century. Thus in 2015, when Dell made a $67 billion acquisition of EMC, many knowledgeable IT industry observers found it hard to comprehend the logic of two commodity/hardware players coming together. By then, most enterprises, large and small, were eyeing digital transformation. Cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud seemed to be serving their needs. Thus Michael Dell had to carefully construct a strategic position for the newly constituted Dell company in the rapidly evolving IT market space. In addition, Dell and EMC also had to decide how to merge their Go-to-Market operations to gain the synergies promised by the merger. Dell had over 365,000 customers and EMC nearly 430,000. Dell had 17,000 salespeople and EMC, 7,000. Each had over 10,000 channel partners. Adding a wrinkle to the merger was a third actor, VMware, an independently listed cloud software company, 80% owned by the new Dell Technologies entity. Integrating their software capability would be an exciting opportunity and a challenge.

Nov 5, 2020 (Revised: Jul 29, 2022)

Discipline:

Industries:

Information technology industry

Harvard Business School

521036-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- Crew Login Forgotten Password

Enter your details below for the race of your life

Select a race

Dell Brand awareness, Business development, Experiential / Engagement, Media

- Use the extreme conditions of the Clipper Race to demonstrate the extraordinary capabilities of Dell Rugged’s PC product range, showcasing its capabilities in the harshest conditions on the planet.

- To drive awareness of the Latitude Rugged portfolio and showcase the range to partners, customers and press through a series of activations and events.

- Utilise Race Crew as Dell ambassadors, supplying reviews and content which provides engaging narrative whilst highlighting the durability and capabilities of the Latitude Rugged range.

- Dell ambassador Race Crew Samantha Harper and Marek Omilian provided regular content in the form of blogs, videos and images from the boats. Dell used the blogs across their customer insights channels, helping to tell the story of how the on board Rugged devices survive in the toughest environment and extreme conditions, whilst also being an engaging journey for followers.

- New business leads were generated for Dell as a direct result of the Derry-Londonderry event. These included new business with Costa Crociere Spa, ECA Services and the UK Ministry of Defence who showed keen interest in some of the OEM [Original Equipment Manufacturer] maritime solutions.

- Wide spread pick up from industry press following Dell’s global yacht tours and sail days included features in ComputerWorld, Windows Central, CBINEWS.com and Sail-World.

- In New York Clipper Race CEO William Ward joined Craig Brandt, Marketing Director at Dell, for a number of interviews in which the partnership and the critical role Dell Rugged plays throughout the race’s operations were central to discussions. Coverage included features with Techstation and PC Mag, the video of the PC Mag interview was posted on their YouTube page (link here ).

- Clipper Race Chairman Sir Robin Knox-Johnston was a guest speaker on the Dell Technologies Luminaires podcast where he spoke about the Clipper Race, how sailing technology has changed and how it plays a vital role in the Clipper Race race today, including the positive effect that the inclusion of Dell Rugged technology has had on reliable communications and operational cost saving. The podcast regularly receives approx 15k downloads per episode.

- Over the course of the Clipper 2017-18 Race representatives from the Clipper Race attended several Dell press and customer events, offering the opportunity for Dell customers and members of the media to learn about the partnership, and how the Dell Rugged products perform on-board faced with such extreme environments.

South Africa

- The Dell Latitude Rugged team in South Africa hosted an engaging press event to showcase the portfolio and demonstrate its capabilities to partners.

- During the event, press had the opportunity to learn about the products, hear from Clipper Race Crew Dell ambassadors who shared their experiences of using Dell Latitude Rugged products on board, and listened to Clipper Race Chairman and Founder, Sir Robin Knox-Johnston speak about the operational benefits of using the Dell products, and how technology has evolved throughout the history of the race.

- After the event, Dell took the opportunity to showcase the products on-board one of the twelve Clipper 70 racing yachts. Attendees had the opportunity to climb on-board to learn about life and usage of the Dell Latitude Rugged laptops from the Race Crew and Skipper.

- Dell leveraged its partnership during the stopover in Qingdao to drive awareness of the Latitude Rugged portfolio to its Asian market.

- The Dell Latitude Rugged team in China demonstrated the capabilities of the range by submerging a Dell Rugged laptop inside a water tank showcasing that it was still fully functional afterwards.

- Dell Rugged Clipper Race Crew Ambassadors Samantha Harper [Dare To Lead] and Marek Omilian [Visit Seattle], shared their experiences of using Dell Latitude Rugged products on board during the racing. Press also heard from Clipper Race Chairman and Founder, Sir Robin Knox-Johnston, who spoke about the benefits of the products and how changes in technology over the past twenty years have affected race operations and experience.

- Dell utilised the Clipper Race stopover in New York, USA, to promote its Dell Rugged products to industry leaders and trade journalists through a series of events, sail days and talks.

- The Clipper Race fleet in Manhattan, New York, provided a unique backdrop for a Dell product showcase event where the team boldly demonstrated the extreme capabilities of the Rugged range by freezing a Rugged laptop inside a yacht shaped ice sculpture, successfully proving it would still work in such conditions.

- After a welcome address from Damon Munzy, Corporate Communications for Dell, Craig Brandt, Dell Rugged Product Marketing Director, used the Clipper Race to speak about the Rugged range and its proven resilience in extreme conditions.

- Then, before taking Dell’s guests for a private yacht tour, Qingdao Skipper Chris Kobusch and the Clipper Race Crew Dell ambassadors took part in a Q and A session to share their individual experiences of using the Dell Rugged equipment on board.

Derry-Londonderry

- Dell Rugged took the opportunity to hold a customer and partner event during the stopover in Derry-Londonderry where the latest Dell Rugged/OEM, featuring IoT Technology specific to the Marine industry, were showcased to guests from across the EMEA including representatives from Costa Crociere, Safehaven Marine and the UK Ministry of Defence and Royal Navy.

- The two-day event included talks from Clipper Race Co-Founder and Chairman Sir Robin Knox-Johnston, Trevor Austin from the UK’s Ministry of Defence and Dan Eden from Dell EMC. The talks were followed by a private yacht tour on-board a Clipper 70, which gave guests an opportunity to explore the yachts ahead of their sailing experience the following day. It also gave guests the chance to see the extreme capabilities of the Dell Rugged range first-hand as the products were demonstrated and put through a series of endurance tests.

Our Rugged products are designed to deal with the most extreme environments and being on these Clipper Race ocean racing yachts is about as harsh as it gets, so it is a perfect environment to test out these products.

Your Browser is Out of Date

Nytro.ai uses technology that works best in other browsers. For a full experience use one of the browsers below

Case Studies

Case studies related to Dell Technologies solutions for SAP

Customer stories

Read about customer success stories with Dell Technologies solutions for SAP.

Enabling the Intelligent Enterprise

Modernizing IT for SAP S/4HANA running on SUSE Linux Enterprise with Intel-based Dell infrastructure

Smart Cities and Communities

GDT Smart City Solutions on Intel-based Dell infrastructure

The marketplace for case solutions.

Dell Online – Case Solution

"Dell Online" case study discusses the company Dell Computer Corporation which commenced its virtual presence for its PCs in 1996. The following year, the corporation had garnered a $3 million per day sales rate. This case study looks into the moves of Dell Computer Corporation which eventually led to its success. It discusses how the company can maintain and improve such leverage for the succeeding years.

V. Kasturi Rangan and Marie Bell Harvard Business Review ( 502S31-PDF-SPA ) August 09, 2002

Case questions answered:

Case study questions answered in the first solution:

- Analyze the success and failure of Dell Online.

- Provide your recommendations on how to better improve the company’s services.

Case study question answered in the second and third solutions:

- What type of case was this? Based on the type of case, write a well-constructed analysis and response.

Not the questions you were looking for? Submit your own questions & get answers .

Dell Online Case Answers

You will receive access to three case study solutions! The second and third solutions are not yet visible in the preview.

Extended 5 C’S Analysis for Dell Online

The 5 C’s Analysis for Dell Online is used to analyze the five key areas in marketing before making any decision. They are the Company, Customers, Competitors, Collaborators, and Climate.

They are used to create a well-defined marketing strategy. This will help Dell make an informed evaluation regarding the introduction of their product into the online market.

Dell was founded in 1983 by Michael Dell, with the typical college dropout story. Michael Dell used his free time to upgrade IBM-compatible hard disks. Two years later, it grew to a size of $6 million and eventually started manufacturing its own PCs. The company became inherently successful and became the national supplier of Fortune 500 companies with a size of $500 million.

Over the next few years, the success grew, but with it came bigger issues, such as retail channels, which resulted in an operating loss in the financial year 1993. Just three years later, they turned from an operating loss to $710 million in profit with the introduction of a superior product in terms of quality, service, and much more. The Latitude product also won numerous prizes and awards, which further improved its brand name and recognition.

Over the years, Dell has introduced new and more innovative products to keep up with the changing demand. They have managed to do this by keeping a small inventory on standby and using lean productions of distribution such as Just in Time. Moreover, this has allowed them to offer their customers the option to customize the products to their specifications.

With the rise of the internet, E-Commerce has become an increasingly important section for most businesses, and Dell has moved with the changing needs and introduced a new department, Dell Online. This change has allowed them to gain unparalleled advantages in the form of higher customers, lower customer accusation costs, and wider market reach, to name a few.

Through the scope of this report, with the help of the case and marking tools such as Extended 5 C’s, SWOT, Hofstede’s dimensions, STP, and Marketing Mix (4 P’s), I will effectively evaluate every aspect of the shift to online and suggest the best overall strategy for Dell Online. Due to this, Dell Online is an evaluation case and will be treated accordingly.

The market for PCs in the US was about $85 Billion in 1997, with Dell owning a 10% market share. There are three groups of Dell’s customers. They are the Transactional, Relationship, and the Mix. These groups consist of 2 main groups: the Transactional and The Relationship. Both groups have distinctly different needs and wants and come under different product categories.

The Mix consists of those customers who fall under both the product categories.

Note: This will be discussed more in-depth in the segmentation section of the STP Analysis (to minimize repetitions).

Competitors Analysis

The competition in the PC market can be categorized as an oligopoly because the few big players dominate the market share. The top 10 players take up 65% of the market share. Due to the increased popularity of the product in the market and increased new entrants, price competition rose. This caused the smaller firms with higher cost structures to find it harder to compete and left the big ten players in the market with the major section of the market.

Dell’s biggest competition and the current market leader is Compaq, which owns a market share of 18% of the $85 Billion US market for PCs. However, Dell is benefiting from lean production methods such as Just-in-Time production, which helps them reduce inventory and warehousing costs and allows them to change with the market demand.

Since competitors such as Compaq and IBM have an inventory of 2 months at any given time, Dell’s computer system and features are usually two months ahead of its main competitors.

In the relationship segment, Dell’s biggest competitors are Compaq, IBM, and HP, amongst others. Furthermore, one of Compaq’s value-added resellers, Vanstar, offers’ additional services such as on-site services, installations, etc. Due to the high success of Dell’s customizable segment, competitors such as Compaq are trying to enter this segment. However, it still has some issues which could be used by Dell to capitalize further.

Lastly, with the increasing preference for portable devices, the laptop market is becoming increasingly saturated. Laptops are priced at a premium and are usually bought in bulk for offices and schools. Dell has recently entered this market, which is dominated by Compaq, Hewlett-Packard, and IBM, with these three brands owning 54% of the market share.

Collaborators/Distribution network

When entering a market or introducing a product, it is crucial to take steps to increase awareness of it in the market and successfully distribute it to the necessary customer segments. That is where collaborators or retailers enter. Initially, Dell had some issues with its distribution network, which led to quality issues.

However, Dell survived that by increasing its importance on a good distribution network. Right now, Dell uses five main distribution networks: Dell Direct, Retail, Indirect through Value-Added Resellers, Indirect through national resellers, and online mediums. All of these channels are vital to Dell’s success as they target the different segments already existing in the market.

Dell Direct – This channel focuses on the made-to-order aspect offered by Dell, which helps customers customize their products to their specifications. Moreover, they were able to predict customer needs and offer that through customization. This has no middlemen as it is made and operated by Dell itself. This helps Dell gain higher margins and lower overall costs in the form of shelving space, calls, etc.

The 15% margin that the distributors receive will become the extra profit for Dell. Moreover, this segment is targeted toward most of the consumer segments due to the customization options available. Lastly, this channel has a market share of 19% of the US PC market.

Retail shops – This consists of shops like Best Buy, Circuit City, and CompUSA. This consists of three middlemen. The products go from the manufacturers to the National Retail Chain of the shops mentioned before. They then go to the distribution center and then finally to the retail stores. This distributer usually sold products to individual customers and small businesses, which means that this was targeted toward the Transactional customer segment. 30% of the market in the US for PCs was sold through this channel.

Indirect through Value-added Resellers – Next is the VARs, which consist of companies like Ingram Micro, which has a 54% market share at $12 Billion. Tech Data, which has a 21% market share at $4.6 Billion, and Merisel, which has a 25% market share at $5.5 Billion. Altogether, they supply 100,00 units. This section consists of 2 middlemen. The products go from the manufacturers to the National distributors and then to the Value-added Resellers. They have already established networks through which they push the product to hold 15% of the US PC market share and focus on specialized software and services. This shows that this section targets the blend of the Relationship segment and the Transactional segment.

Indirect through National Resellers – This is the last channel in the traditional direct and indirect sections. This consists of companies like Vanstar, which has a market share of 28.5% at $2.2 Billion. CompuCom Systems at 26% at $2 Billion, and MicroAge with a market share of 45.5% at $3.5 Billion. This also has two middlemen. However, it can go through different systems based on the needs of the national reseller and then either the wholly-owned sales and service center or the Franchised sales and service center. This section usually takes care of the big orders of 100 computers, which allows them to further customize the products. This channel is used for The Relationship customer segment, where customer knowledge is high and the volume is also high. Lastly, this channel conducts 33% of the US PC market business.

Online – The last channel is the online channel that Dell has just introduced. This channel has no middlemen and connects the customer directly to the manufacturer, which is Dell. This channel also benefits from the no middlemen aspect of the Direct Dell channel. This channel is part of the previous channels and essentially connects them into one channel for all the customer’s needs. Therefore, there is no estimate of how the online market dominates much market share.

Moreover, they adopted the Just-in-Time production method, which helped them reduce costs in terms of transportation costs, Warehousing costs, and Inventory costs, amongst others. Additionally, this helped them stay on top of the demand and offer the Dell Direct model, where they allowed customers to customize their products to their specifications.

Climate/Context

The climate and context are also important factors when making any decision. Analyzing the environment around the area is a good measure of understanding how customers make decisions.

Dell was initially established in the US market, but with the scope of the internet and their online website, they are…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

Dell: All in on Neurodiversity Hiring and Pushing for Scale

For the company that helped democratize the PC and continues to shape our digital future, diversity and inclusion are critical to success. Because Dell continually faces a tight tech labor market and a constant drive to innovate, expanding the talent pipeline to bring in traditionally underrepresented groups is a cornerstone of the business.

Noting the rise of the Autism @ Work movement, Dell jumped at the chance to launch a neurodiversity hiring program of their own. To start, Dell EMC, out of the Hopkinton, Massachusetts office, partnered with a local, disability services provider who then—based on reputation and consultation with other technology companies—suggested collaboration with the Neurodiversity in the Workplace team.

After in-depth conversations with Dell leadership, including Diversity and Inclusion and Talent Acquisition, we helped cultivate strong executive sponsorship for the program. This buy-in allowed Neurodiversity in the Workforce to develop and deploy a robust, customized curriculum and training program. Together we implemented an alternative hiring process allowing candidates to showcase technical skills, professional development and job coaching for new hires, and education and support for managers.

Dell’s enthusiastic embrace of neurodiversity—the community’s genuine support in the context of an open, accepting environment—provided fertile ground for the program to flourish. The initiative was launched in the spring of 2018, and it’s been attracting top-tier talent ever since.

Employees welcomed through Dell’s neurodiversity hiring program have significantly lower turnover rates than the industry average. They’ve also made advances in efficiency and innovation, in part by identifying new ways to automate time-consuming processes.

Perhaps the biggest testament to the program is its growth, from the east coast all the way to Round Rock. Dell is now looking to scale, and planning for larger and larger hiring cohorts. Along the way, they’ve inspired other businesses to embrace neurodivergent talent, including VMware, now a partner of ours as well. By embedding neurodiversity into their talent acquisition pipeline, Dell is weaving inclusion into the fabric of the organization.

Dell’s brand is built on a commitment to creating technologies that drive human progress, in the pursuit of a more innovative, inclusive, and sustainable world. Neurodiversity in the Workplace is proud to work alongside a company that’s all in on neurodiversity hiring as a foundation for shared success.

PRESS COVERAGE

- NY Times: In a Tight Labor Market, a Disability May Not e a Barrier

- Catalyst: Why Dell Is Making Neurodiverse Hiring A Priority

- Reuters: Autism in the workplace: A spectrum of hiring choices

RESOURCES FOR:

"O ur team is closer together, our team is more focused, our team has a better way of doing things than we had done prior to the program participation. "

Lincoln Financial Group : Transforming talent acquisition by embracing neurodiversity

Employer case study >>

Meet William Gilreath: Perseverance pays off at VMware

Employee case study >>

neu-ro-di-ver-si-ty

The wide range of brain differences that naturally occur in the human population, resulting in varied cognitive, social, and behavioral traits. Neurodiversity encompasses all types of brains, from neurotypical to neurodivergent.

Job Application

Slick College Tips

College tips, tricks, and general information

Dell Case Study – Analysis – Internal Challenges

This post analyzes a Dell case study. The analysis explores several challenges that Dell is facing introduces a number of solutions.

Introduction

Dell is a multinational company based in Texas. Dell offers computers and related products together with repairs and support.

Dell’s products adapt to many market sectors including students, gamers, programmers, businesses, etc. Dell positions itself firmly in both hardware and software industries by using its core competencies. Dell offers reliable, cost-effective and customizable computer products to all its customers worldwide.

Dell transformed consumers’ shopping experience with its mass customization strategy. Dell has continued the same strategy for years and left a door of opportunity open for HP. In 2006 Dell faced many unfortunate incidents: some rechargeable battery packs had the potential to self-ignite, very low earning reports and analysts gave Dell a very negative outlook for coming years. Recently Hewlett Packard (HP) has taken a big market share from Dell. HP as well as Sony, Lenexa, Apple, and other competitors are continuously evolving and becoming a bigger threat to Dell. Competitors can take more market share over time. They can also try to beat Dell’s core competencies and take it out of the market.

Internally Dell is also facing some challenges. The employees at Dell are not completely satisfied, turnover seems to be a growing problem. Other companies are recruiting talented employees from Dell. If all these employees are quitting, then Dell will have to look for new talents. Recruiting new employees is not only time consuming, but also very costly. The fact that employees are not satisfied with the company is a result of other internal problems: company culture issues. There is no deep connection between Dell and its employees.

Main Challenge

Dell is losing market share in its industry. Strong competitors are becoming bigger threats. Competitors are an external challenge that could be overcome by enforcing Dell’s core competencies. Dell has many competitors and some of them have very attractive value propositions. Dell has lost its attractiveness toward clients and may continue to do so due to the decay in the company’s values and objectives. The core problem is that Dell has failed to demonstrate stakeholders its desire for innovation and continuous improvement. The employees are working toward making processes cheaper and not towards new technologies. In general, the culture in the workplace is in decline. Employees do not find the workplace suited for a technology company.

Other stakeholders have also seen a similar picture in these past years. Dell has continued with the same strategy, without getting major advancements in the market. Dell has released products that fail the minimum requirements and that are also a potential hazard to the users. It has also reduced revenue significantly, reducing shareholder’s interest. Dell has not been keeping up with competition and has not been improving over time. All the issues in the problem are completely or in part due to the core problem inside the company.

Several solution paths can be taken to solve the core problem, some of these are the following:

1-Dell could come up with another marketing strategy only focusing on a specific aspect of their company. They could focus more on software or customer service for example.

2-Dell could continue with their high customization strategy, but increase the desire for innovation. They can continue evolving their core competencies and add new ones along the way, focusing on continuous improvements. They need to focus on the stakeholders working in the company too, spread the company’s culture and objective.

3-They could also adopt their competitor’s new strengths and try to implement them. They would have to figure out how to adapt them in their own way and be creative.

Solution Analysis

If Dell decides to go for solution 1, it will have to become more competent in the specific competency. Even though Dell is part of the hardware and software industry, if it inclines more, either way, it will need to develop new skills. These skills will be gain over time but could cost time and money. If Dell focuses on a specific part of its business, it will be so much easier to manage and promote. The biggest problem in this solution is the timeline. Competitors will continue taking away market share if Dell does not act quickly.

Solution 3 is also a fair solution. Competitors are definitely doing something right, and possibly better than Dell. Dell could focus on researching those aspects and learning from competitors. Some of their strategies may be public information, but most of them will be confidential. This could be an issue because Dell won’t be able to get the whole picture without all the information.

Expanding on Solution 2

Solution 2 can solve the core problem more efficiently. The company should continue developing its core competency since for years its competency has to lead them to success. The difficulty is that Dell has to accelerate the creative process and focus more on developing its core competency.

Dell has to start from the core of the company: the employees. Talented workers are hard to find. Dell needs committed employees that will discover new technologies and processes. Having a high commitment to the company is usually a product of great company culture and outstanding work environment.

Following this solution, Dell won’t have to reduce the services and products they provide. Earnings are distributed among all the offered services and products. Dell’s customers are interested in specific ones that adapt to their needs, taking products or services out can be a big risk.

Following solution number 2 customers and communities will definitely get benefits; they will be able to have access to more reliable services and products. Technology is evolving, businesses need to be on top of the game with their tools, computer equipment is nowadays a must-have and Dell can offer them high-quality products. Environmentally, this strategy won’t produce many changes, but definitely Dell cannot increase environmental impact or pollutants trying to develop better products, because the communities will get affected.

The competition was tough in the past and will continue to be. It will be expected that competitors will bring new strategies and new products to the market. Dell has been at the top of the market share for years and hopefully enforcing its competencies and following solution 2 will help it defend its position.

Implementation

To execute the solution Dell should have the core problem clear and start by making a program with employees. Dell has to be aware of the challenges it is facing and why does it need to focus on improving the competencies and innovations. The best start will be a program for employees to clarify the company’s culture, objectives and also threats. At the same time, Dell will offer employees a more dynamic and open work environment to incentivize creativity and growth. Once the company is working towards the improvement of services/ products they can start advertising to the public and showing their improvements. Using its core competency (custom-built computer services) will help attack customers since many of the customers have been loyal to the company for years. Also, among its competitors, Dell is experienced and still owns a big percent of the market share.

The part involving employees and inside the company training has to be implemented now. Employees may take some time to be able to assimilate the changes and start working towards the new objectives. On the other hand innovation and custom build, computer improvement can take some more time.

The optimal outcome is that Dell will win back the market share it lost and continue growing. Dell will then become more profitable and also be able to keep stakeholders satisfied with the company. Turnover among employees should be reduced and motivation increased.

To measure the success of the solution, some factors can be measured directly: net income, market share, and sales. These parameters should increase; it won’t be difficult to measure since it is quantitative information. Employee satisfaction is measurable in opinion surveys and turnover rates.

Contingency Plan

In the case there is no difference after the solution has been executed, Dell could implement solution 3 as a contingency plan. The other companies will be more experienced in the matter, but Dell could possibly still get some benefit from inspiring some of their work in other competitors. Competition is very hard, and sometimes it can lead to ethically questionable practices. Companies can go into battles to prove their products are superior. Even Dell could follow one of these practices because they are very strong in the market and the may get external support. On the other hand, following any unethical practice could lead to long-lasting mistrust.

Privacy Overview

- Guidelines to Write Experiences

- Write Interview Experience

- Write Work Experience

- Write Admission Experience

- Write Campus Experience

- Write Engineering Experience

- Write Coaching Experience

- Write Professional Degree Experience

- Write Govt. Exam Experiences

DELL EMC Interview Experience for Remote Systems Engineer

- TCS Interview Experience for System Engineer

- TCS Interview Experience For System Engineer

- Siemens Interview Experience | Set 2 (For System Engineer)

- Dell Interview Experience for Software Engineer

- Qualcomm Interview Experience for ML and System Engineer

- DELL Interview Experience for Platform Engineer

- TCS Interview Experience for System Engineer (On-Campus) 2023

- Cohesity Interview Experience for Systems Reliability Engineer(SRE)

- Dell Interview Experience | Set 5 (For Platform Software Engineer)

- Infosys Interview Experience for Systems Engineer

- Dell Interview Experience for Software Engineer-1 (On-Campus)

- Infosys Interview Experience For System Engineer

- TCS Interview Experience for Assistant System Engineer

- TCS Interview Experience for Associate Systems Engineer (Off-Campus)

- Infosys Interview Experience for System Engineer

- ServiceNow Interview Experience for Software Engineer

- INFYTQ Interview Experience for System Engineer 2022

The entire hiring process consisted of 6 rounds.

First Round: This was the online exam. We had 15 Aptitude and 35 Technical MCQ. The Aptitude Section was easy and the technical sections included questions from Basic Computer Architecture, Storage Network Architectures, and Redundant Array of Independent Disks concepts. It also included a few OS and Computer Networks related problems.

Second Round: This was an Elevator pitch round. In this round, we have to speak for 2 minutes. 1 minute to talk about Self-Introduction and motivation to join Dell Technologies. The other 1 minute for a topic which the panel members would give. The topics were really generic and, on a few occasions, students were asked to talk about their favorite subject. The panel consisted of 2 members. I was given the topic “Go Green Initiative”.

Third Round: This was a Use Cases round where the students are mailed a Mock Customer problem statement 15 minutes prior to the round. The mailed pdf document consists of all the instructions along with Glossary, Assessment Statement and finally, we have to make a PPT for supporting our Sales Pitch keeping in mind all the business rules mentioned in the instructions. The round lasts for 1.5 hours after which we have to submit our PPTs to a Google link. The PPT should have 3 slides, First slide should be about the Customer (Market share, Number, and Figures), 2nd Slide should have the Asset/Customer Inventory Report (Use bar graphs, tables, chart) and the products which might be an Opportunity of Sale for us, 3rd slide should consist of Solution or the approach which we take in convincing the customer using the resources provided to us, such as Demos, Proof of Concept (POC)., etc.

Fourth Round: This was Solution Defense Round, in this round we have to present our Sales Pitch to the Panel consisting of three members from the Dell Presales Business Unit. Lots of questions are asked per slide based on decisions we make and the way of PPT presentation which we put forward, starting from the Customer information to Solution which we present to panel. This round also consists of few Technical questions from the topics which are mentioned in the first paragraph of the article. The interviewers don’t follow a constant pattern for questioning students with regards to Technical questions but, yet its in the best interest of candidates to prepare for them as well. Towards the end, one of the panel members explains to us the role and responsibilities of the job position.

Fifth Round: This is the Managerial Interview, which consisted of two-panel members. They asked about me and my family. Most of the questions were focused on my characteristics and reaction to a certain situation in which I am put. Though, the primary questions they asked were:

- Why do you think you will be fit for such a role?

- Where do you see yourself in 5 years?

- What are your plans for higher studies?

- What makes you unique from other candidates who are lined up for this job?

The main focus was on a candidate’s personality and the way I reacted if the questions are structured differently. The panel members were very polite and the interview ended on a positive note.

Sixth Round: This was the HR interview, the interviewer asked me about my motivation for doing projects and about my Community Outreach Programs which I had undertaken during my college life. The questions also included the responsibilities which I had undertaken professionally in academics or extra-curricular activities. The interviewer also talked about my parents and the people who I idolize in life. Similarly, many questions were personal life based and the Interview process was complete.

Overall, the hiring process was a fresh experience and all the panelists across the rounds were very friendly and polite.

Please Login to comment...

Similar reads.

- Experiences

- Interview Experiences

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

- Open access

- Published: 06 May 2024

Mid-term outcomes of laparoscopic vaginal stump?round (Kakinuma method) and stump?uterosacral (Shull method) ligament fixation for pelvic organ prolapse: a retrospective comparative study

- Toshiyuki Kakinuma 1 ,

- Kaoru Kakinuma 1 ,

- Kyouhei Ueyama 1 ,

- Takumi Shinohara 1 ,

- Rora Okamoto 1 ,

- Ken Imai 1 ,

- Nobuhiro Takeshima 1 ,

- Kaoru Yanagida 1 &

- Michitaka Ohwada 1

BMC Surgery volume 24 , Article number: 137 ( 2024 ) Cite this article

96 Accesses

Metrics details

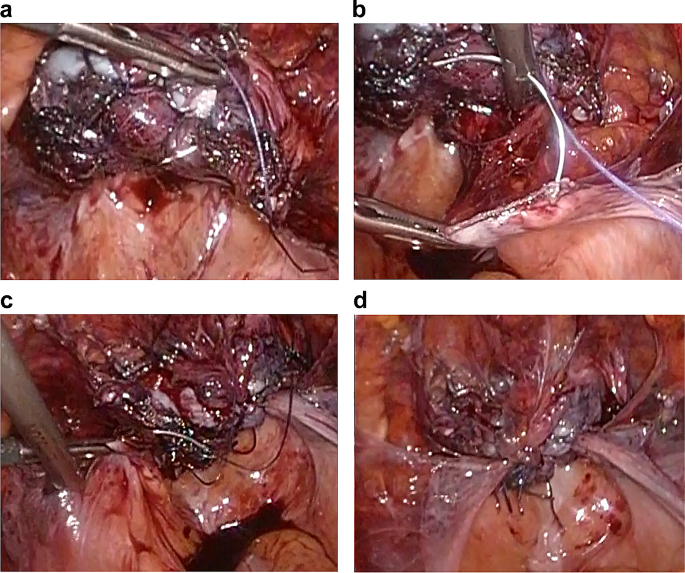

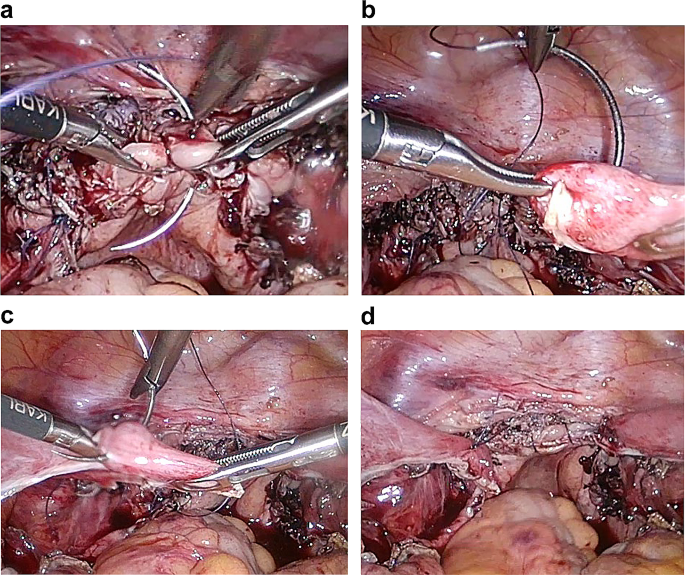

Laparoscopic sacrocolpopexy (LSC) and robot-assisted sacrocolpopexy (RSC) using mesh are popular approaches for treating pelvic organ prolapse (POP). However, it is not uncommon that native tissue repair (NTR) should be presented as an option to patients who are expected to have extensive intraperitoneal adhesion or patients for whom LSC or RSC is difficult owing to various risk factors. Laparoscopic vaginal stump–uterosacral ligament fixation (Shull method) has been introduced as a method for NTR in case of POP. However, effective repair using this surgical procedure may not be possible in severe POPs. To solve the problems of the Shull method, we devised the laparoscopic vaginal stump–round ligament fixation (Kakinuma method) in which the vaginal stump is fixed to the uterine round ligament, a histologically strong tissue positioned anatomically higher than the uterosacral ligament. This study aimed to retrospectively and clinically compare the two methods.

Of the 78 patients who underwent surgery for POP between January 2017 and June 2022 and postoperative follow-up for at least a year, 40 patients who underwent the Shull method (Shull group) and 38 who underwent the Kakinuma method (Kakinuma group) were retrospectively analyzed.

No significant differences were observed between the two groups in patient background variables such as mean age, parity, body mass index, and POP-Q stage. The mean operative duration and mean blood loss in the Shull group were 140.5 ± 31.7 min and 91.3 ± 96.3 ml, respectively, whereas the respective values in the Kakinuma group were 112.2 ± 25.3 min and 31.4 ± 47.7 ml, respectively. Thus, compared with the Shull group, the operative duration was significantly shorter ( P < 0.001) and blood loss was significantly less ( P = 0.003) in the Kakinuma group. Recurrence was observed in six patients (15.0%) in the Shull group and two patients (5.3%) in the Kakinuma group. Hence, compared with the Shull group, recurrence was significantly less in the Kakinuma group ( P = 0.015). No patients experienced perioperative complications in either group.

Conclusions

The results suggest that the Kakinuma method can serve as a novel and viable NTR procedure for POP.

Peer Review reports

Pelvic organ prolapse (POP) is the abnormal positioning of pelvic organs in which pelvic organs, such as the bladder, uterus, rectum, and vaginal wall, drop and prolapse through the vaginal opening owing to a decrease in the supporting ability of pelvic floor muscles. Lifestyle habits that cause abdominal pressure, such as aging, childbirth, intense exercise, labor, and constipation, and decrease in female hormones are reportedly involved [ 1 , 2 , 3 ]. These factors cause the loosening of pelvic floor muscles and endopelvic fascia, leading to the abnormal positioning of pelvic organs, often manifesting as pelvic floor hernia.

According to an epidemiological survey in the United States and a European country, 44% of parous women had POP [ 4 ] and 11% had received surgery for POP or urinary incontinence by the age of 80 years [ 5 , 6 ]. A more recent epidemiological survey has reported an even higher percentage; 20% of women had received these surgeries by the age of 80 years [ 7 ]. According to a report in Japan, POP was observed in approximately 17% of women aged 21–84 years [ 8 ]. As the mean life expectancy of women has increased in recent years, this disease is expected to increase in the future. POP tends to occur among women in middle and advanced age, and it greatly deteriorates their quality of life (QOL).

The treatment of POP aims to resolve serious symptoms, such as lower urinary tract symptoms, sexual dysfunction, and a feeling of organ prolapse, and improve the QOL by correcting organ positioning. Surgical therapy is selected when pessary insertion causes complications, such as vaginal ulcers, or when QOL does not improve after conservative therapy [ 9 ]. Conventionally, anterior/posterior colporrhaphy has long been performed as a surgical intervention after vaginal total hysterectomy. However, this surgical procedure is associated with issues, such as a high recurrence rate and the lack of consideration for postoperative sexual function [ 5 , 10 , 11 , 12 ].

With the recent introduction of mesh surgery (Tension-free vaginal mesh: TVM), surgical interventions for POP have advanced dramatically. However, the use of surgical mesh received a warning from the United States Food and Drug Administration (FDA) as it was associated with various problems, such as postoperative infection and dyspareunia owing to mesh detachment, erosion, and hardening [ 13 ]. Moreover, mesh surgery is difficult owing to risk factors, for patients who are expected to have extensive intraperitoneal adhesion and those with increased susceptibility to infection. These factors pose a high risk for developing erosion and infections as mesh-specific complications. As a result, active interest in native tissue repair (NTR) has been revived. The NTR procedures include vaginal stump–uterosacral ligament fixation (Shull method) reported by Shull et al. in which the vaginal canal axis is reconstructed without a mesh as in laparoscopic sacrocolpopexy (LSC) [ 14 ]. However, effective repair may not be achievable by simply fixing the vaginal stump and the uterosacral ligament in severe POPs in which the vaginal canal is long or when the uterosacral ligament is overextended or weakened.

To solve this problem, we have devised and reported laparoscopic vaginal stump–round ligament fixation (Kakinuma method) as a new NTR procedure for patients with POP [ 15 ]. The uterine round ligament is a histologically strong tissue positioned anatomically even higher than the uterosacral ligament. Moreover, when the uterine round ligament is overextended, adjustment can be easily made by resecting the extended round ligament so that the vaginal stump is raised 4–5 cm from the vaginal opening before it is fixed and sutured to the uterine round ligament.

This study aimed to retrospectively and clinically compare the conventional Shull method and the Kakinuma method as NTR procedures in patients with POP.

This study was approved by the Ethics Committee of the International University of Health and Welfare (approval number: 21-B-463). Treatment was provided to all the patients after obtaining their informed consent via an adequate informed consent process. Of a total of 78 patients who underwent surgical treatment for the diagnosis of POP between January 2017 and June 2022 and follow-up observation for at least 12 months after surgery, 40 patients who underwent the Shull method (Shull group) and 38 patients who underwent the Kakinuma method (Kakinuma group) were retrospectively analyzed. Surgical outcomes were examined based on their medical records, including age, gravida and parity, comorbidities, POP-Q stage (Table 1 ) [ 16 ], operative duration, blood loss, intraoperative complications, and incidence of recurrence.