Pledging Accounts Receivable

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on January 30, 2024

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Definition and explanation.

Pledging accounts receivable is essentially the same as using any asset as collateral for a loan. Cash is obtained from a lender by promising to repay.

If the loan is not repaid, the collateral will be converted to cash, and the cash will be used to retire the debt.

The receivables can be either an identified set of notes and accounts or a general group in which new ones can be added and old ones retired.

The collection of a pledged receivable has no impact on the loan balance.

The pledging agreement usually calls for the substitution of another receivable for the one collected.

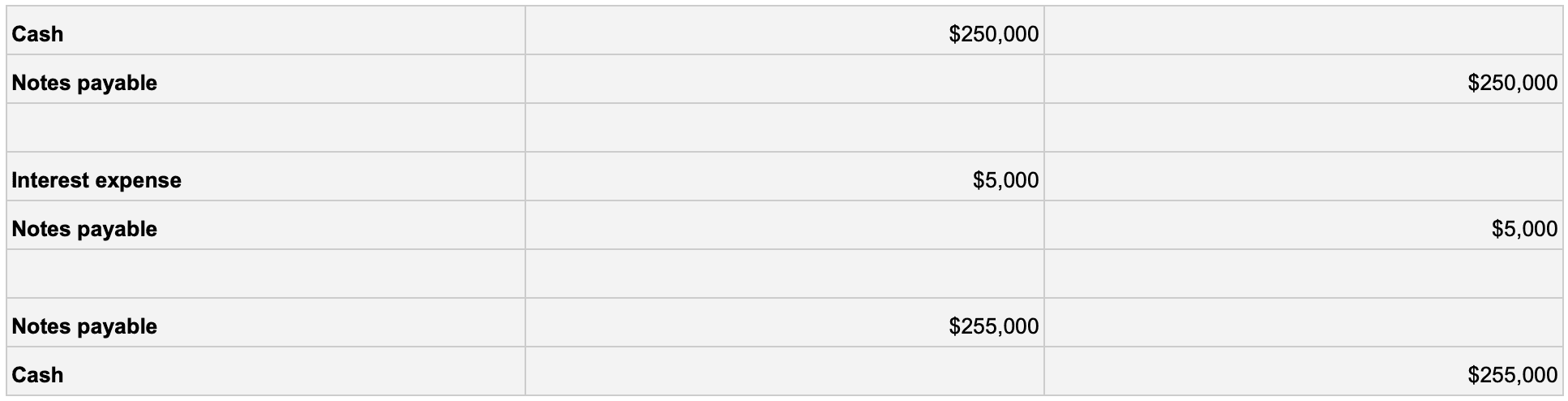

As an example, suppose that Sample Company borrows $80,000 on 31 December 2023, and agrees to pay back $81,600 on 1 April 2024.

Further, it pledges $100,000 of trade receivables for the loan. The company would make three journal entries as follows:

The last two entries can be combined, but they are shown separately here to facilitate a comparison of pledging with the other approaches.

The only financial statement disclosures provided for pledged receivables are notes or parenthetical comments.

A similar notation is provided for the notes payable .

Assignor Collects

As an alternative to pledging, the company may decide to assign its receivables to a lending institution.

Under this arrangement, the original holder essentially transfers title to the third party but agrees to collect the receivables and pay the cash to the factor .

Suppose that Sample Company obtains $80,000 cash on 31 December 2023 by assigning $100,000 of its trade receivables.

The company agrees to place the collections in a special restricted checking account from which it will repay the original $80 000 plus a $2,400 finance charge on April 1, 2024.

These journal entries would be made as follows:

To record partial collection of the assigned accounts :

To accrue the finance charge:

To reclassify the uncollected accounts and unrestricted cash:

The disclosures that would be provided on various balance sheet dates are shown in the following example, under the simplifying assumption that no other activity took place.

Notice that the payable to the factor is contra to the assigned accounts. Any restricted cash balance is, in turn, contra to the payable account.

Most arrangements of this type call for more frequent payments than the example shows.

The net result of the assignment is that Sample Company obtained $80,000 by giving up $82,400 of receivables.

Pledging Accounts Receivable FAQs

What is pledging accounts receivable.

Pledging Accounts Receivable means that a business gives up some of its rights to an asset in order to borrow money. For example, you could pledge your car title as collateral for a loan. If the loan isn't repaid, the lender can take possession of your car.

What are the journal entries for pledging accounts receivable?

There are no Special Journal entries required when you pledge your Accounts Receivable as collateral for a loan. The lender still has to approve giving up your Accounts Receivable before making the loan.

How are accounts receivable journal entries prepared?

Accounts Receivable are money owed to a company by their customers for products they've already received. Accounts are recorded in the balance sheet as assets.

What are the journal entries for assigning Accounts Receivable as collateral for a loan?

The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables. The assign Accounts Receivable account is credited because they still owe this money to their customers.

What are the main financial statements in an assignment of accounts receivable?

The three main Financial Statements in an assignment of Accounts Receivable are the income statement, balance sheet, and Cash Flow statement. The income statement and Cash Flow statements would report the repayments on the receivables.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Assignment of Accounts Receivable: Meaning, Considerations

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Investopedia / Jiaqi Zhou

What Is Assignment of Accounts Receivable?

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

The borrower pays interest, a service charge on the loan, and the assigned receivables serve as collateral. If the borrower fails to repay the loan, the agreement allows the lender to collect the assigned receivables.

Key Takeaways

- Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables.

- This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.

- Usually, new and rapidly growing firms or those that cannot find traditional financing elsewhere will seek this method.

- Accounts receivable are considered to be liquid assets.

- If a borrower doesn't repay their loan, the assignment of accounts agreement protects the lender.

Understanding Assignment of Accounts Receivable

With an assignment of accounts receivable, the borrower retains ownership of the assigned receivables and therefore retains the risk that some accounts receivable will not be repaid. In this case, the lending institution may demand payment directly from the borrower. This arrangement is called an "assignment of accounts receivable with recourse." Assignment of accounts receivable should not be confused with pledging or with accounts receivable financing .

An assignment of accounts receivable has been typically more expensive than other forms of borrowing. Often, companies that use it are unable to obtain less costly options. Sometimes it is used by companies that are growing rapidly or otherwise have too little cash on hand to fund their operations.

New startups in Fintech, like C2FO, are addressing this segment of the supply chain finance by creating marketplaces for account receivables. Liduidx is another Fintech company providing solutions through digitization of this process and connecting funding providers.

Financiers may be willing to structure accounts receivable financing agreements in different ways with various potential provisions.

Special Considerations

Accounts receivable (AR, or simply "receivables") refer to a firm's outstanding balances of invoices billed to customers that haven't been paid yet. Accounts receivables are reported on a company’s balance sheet as an asset, usually a current asset with invoice payments due within one year.

Accounts receivable are considered to be a relatively liquid asset . As such, these funds due are of potential value for lenders and financiers. Some companies may see their accounts receivable as a burden since they are expected to be paid but require collections and cannot be converted to cash immediately. As such, accounts receivable assignment may be attractive to certain firms.

The process of assignment of accounts receivable, along with other forms of financing, is often known as factoring, and the companies that focus on it may be called factoring companies. Factoring companies will usually focus substantially on the business of accounts receivable financing, but factoring, in general, a product of any financier.

:max_bytes(150000):strip_icc():format(webp)/Accounts_Recievable_Financing_Final_3-2-9d907a15511b455f94a1f064a1cc5ae8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Table of Contents

Pledge vs assignment of receivables.

Pledge Vs Assignment Of Receivables is a subject of growing interest among creditors and debtors alike. Both mechanisms allow for the transfer of rights to future payments, and both have their own unique benefits and drawbacks. Understanding the differences between these two options is essential not just for those who are directly involved in the transaction but also for any third parties that may be impacted.

What’s The Difference Between A Pledge And Assignment Of Receivables? We Break It Down For You.

Are you trying to determine the difference between a pledge and an assignment of receivables ? If so, you are not alone. Knowing the difference between a pledge and assignment of receivables can be difficult, but it doesn’t have to be. In this blog post, we’ll break down the differences between a pledge and assignment of receivables, so you can understand the difference between the two.

What Is A Pledge?

A pledge is a legal agreement in which a person or business pledges a particular asset as collateral for a loan. The pledged asset can be used as security for the loan and if the borrower defaults on their loan, the lender can take possession of the asset and use it to recover some or all of the debt.

Pledging an asset requires the borrower to give up ownership rights until the debt is paid in full, or the pledge is released by the lender. A pledge is often used when the borrower needs quick access to capital, but does not want to completely surrender ownership of the asset.

Live Chat Support

Pledge Vs Assignment Of Receivables:

The primary difference between a pledge and assignment of receivables is that a pledge involves giving up possession of an asset while an assignment of receivables involves assigning rights to receive payments from a debtor. When you pledge an asset, you are transferring title and possession to the lender while with an assignment of receivables, you are assigning your rights to collect payments from a debtor to the lender.

In both cases, you are taking on additional risk since you are no longer in control of the asset or receivables. However, with a pledge, you are taking on more risk because you are giving up ownership rights until the debt is paid in full. With an assignment of receivables, you are still in control of collecting payments from your debtors.

What Is An Assignment Of Receivables?

An assignment of receivables is a legal agreement that transfers the rights to receive payments from a debtor to another party, known as the assignee. The assignee becomes the new owner of the receivable, and is entitled to the payment from the debtor. This type of agreement can be used in many different financial scenarios, such as when a company needs to raise capital by selling off some of its receivables, or when a creditor wishes to secure debt repayment. In comparison to a pledge, an assignment of receivables is generally more involved and requires more paperwork, but it can also offer more legal protection than a pledge.

The Key Differences Between Pledges And Assignments Of Receivables

Pledges and assignments of receivables are two different financing tools used by businesses. While both are forms of secured financing, the major difference between them is in the structure of the agreement.

A pledge is a type of security interest that gives a creditor the right to take possession of an asset if the borrower defaults on their loan. It also allows the creditor to have a claim over a piece of property as collateral against repayment. This means that the creditor has rights to the pledged asset should the borrower not be able to meet their debt obligations.

On the other hand, an assignment of receivables involves transferring title or ownership of a certain amount of a company’s invoices to a third-party financier, such as a bank or factor, who will collect the payment on behalf of the company. The financier pays an advance to the company at a discount and then collects the full amount from the debtor. The financier bears the credit risk and any delays in collection of payments are the responsibility of the factor.

In summary, while both involve a security interest and provide capital to companies, pledges and assignments of receivables differ in terms of structure and level of risk assumed. Pledges grant creditors rights to an asset as collateral, whereas with assignments of receivables, third-party financiers bear the credit risk and any delays in collection of payments.

When Should You Use A Pledge Vs An Assignment Of Receivables?

Whether you choose to use a pledge or assignment of receivables depends on the specific needs of your situation. A pledge is often used in cases where the lender is seeking more assurance that the loan will be repaid, such as when there is a risk of the borrower not paying the loan back. When a pledge is used, the borrower has to give up possession and control of the assets pledged.

An assignment of receivables, on the other hand, is used when the lender wants to secure payment from a third-party rather than from the borrower directly. In this case, the borrower assigns the right to receive payments from the third-party to the lender in order to secure the loan. This means that if the third-party fails to make their payments, the lender can pursue legal action against them to recover their funds.

Hire Experts

When deciding between pledge vs assignment of receivables, it is important to consider your unique circumstances and goals. If you have a high risk of default, a pledge may be a better choice as it provides greater assurance of repayment. However, if you are looking to secure payment from a third-party, an assignment of receivables may be preferable. Ultimately, it is important to speak to a financial advisor or lawyer who can help you determine which option is best for your needs.

Facebook Twitter Telegram WhatsApp Email

What is Pledge Vs Assignment of Receivables?

Creating an Accounts Receivable Assigned Journal Entry is a good way to control cash flow and minimize your credit exposure by having a greater degree of control over your receivables. It allows you to reduce the time spent in account collection activities and increase cash flow more quickly.

What are the benefits of using Pledge Vs Assignment of Receivables?

Assignment of receivables is the process by which a company sells its debt receivable to a third party. This can involve setting up a special purpose entity and assigning the receivables to it as security for the sale. Assignment of receivables has benefits over pledge of assets because it allows access to cash immediately, in addition to providing certainty of payment.

What are the key considerations when choosing between Pledge Vs Assignment of Receivables?

The main consideration when choosing between Pledge Vs Assignment of Receivables is whether your company is willing and able to repay debt. If this is a concern, then you may want to consider an assignment of the receivables instead.

- Receivables

- Notes Receivable

- Credit Terms

- Cash Discount on Sales

- Accounting for Bad Debts

- Bad Debts Direct Write-off Method

- Bad Debts Allowance Method

- Bad Debts as % of Sales

- Bad Debts as % of Receivables

- Recovery of Bad Debts

- Accounts Receivable Aging

- Assignment of Accounts Receivable

- Factoring of Accounts Receivable

Assignment of accounts receivable is an agreement in which a business assigns its accounts receivable to a financing company in return for a loan. It is a way to finance cash flows for a business that otherwise finds it difficult to secure a loan, because the assigned receivables serve as collateral for the loan received.

By assignment of accounts receivable, the lender i.e. the financing company has the right to collect the receivables if the borrowing company i.e. actual owner of the receivables, fails to repay the loan in time. The financing company also receives finance charges / interest and service charges.

It is important to note that the receivables are not actually sold under an assignment agreement. If the ownership of the receivables is actually transferred, the agreement would be for sale / factoring of accounts receivable . Usually, the borrowing company would itself collect the assigned receivables and remit the loan amount as per agreement. It is only when the borrower fails to pay as per agreement, that the lender gets a right to collect the assigned receivables on its own.

The assignment of accounts receivable may be general or specific. A general assignment of accounts receivable entitles the lender to proceed to collect any accounts receivable of the borrowing company whereas in case of specific assignment of accounts receivable, the lender is only entitled to collect the accounts receivable specifically assigned to the lender.

The following example shows how to record transactions related to assignment of accounts receivable via journal entries:

On March 1, 20X6, Company A borrowed $50,000 from a bank and signed a 12% one month note payable. The bank charged 1% initial fee. Company A assigned $73,000 of its accounts receivable to the bank as a security. During March 20X6, the company collected $70,000 of the assigned accounts receivable and paid the principle and interest on note payable to the bank on April 1. $3,000 of the sales were returned by the customers.

Record the necessary journal entries by Company A.

Journal Entries on March 1

Initial fee = 0.01 × 50,000 = 500

Cash received = 50,000 – 500 = 49,500

The accounts receivable don't actually change ownership. But they may be to transferred to another account as shown the following journal entry. The impact on the balance sheet is only related to presentation, so this journal entry may not actually be passed. Usually, the fact that accounts receivable have been assigned, is stated in the notes to the financial statements.

Journal Entries on April 1

Interest expense = 50,000 × 12%/12 = 500

by Irfanullah Jan, ACCA and last modified on Oct 29, 2020

Related Topics

- Sales Returns

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Classifications

- Cost Accounting Systems

- Cost Behavior

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

- General Finance and Accounting

How Pledging Receivables Helps you Meet Financial Obligations and Working Capital Needs

- October 26th, 2023

- • 10 min read

In this article, you'll learn what pledging is in AR, the advantages of pledging receivables, how it differs from factoring accounts receivable, and more.

Plus, we'll share why AR automation is critical to obtaining receivables financing.

- Tweet this article

- Share this article on Facebook

- Share this article on LinkedIn

- Share this article

Key takeaways

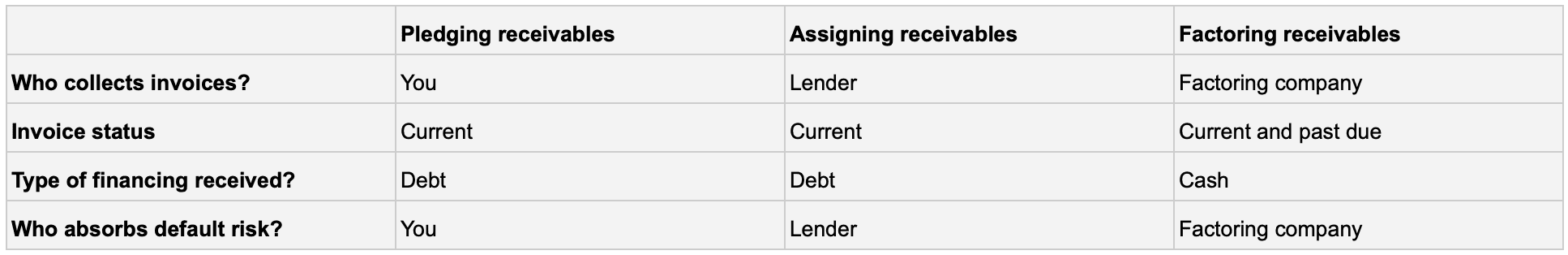

Accounts receivable is a great way to finance your business, and pledging receivables is one of multiple AR financing options.

Pledging receivables is different from invoice factoring and assignment since collection and default responsibilities vary.

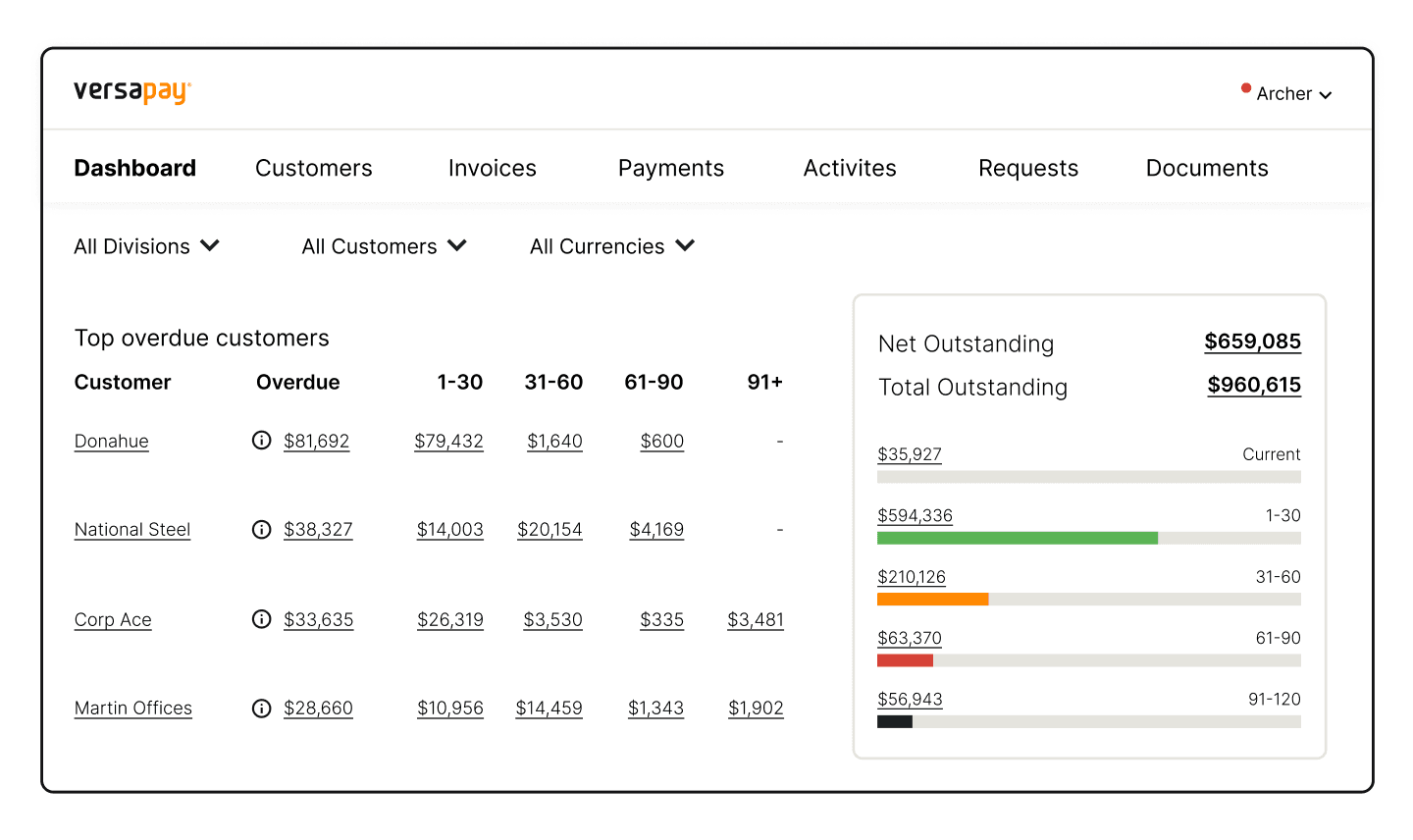

Accounts receivable data like invoice statuses, AR aging, and cash flow data analysis are critical to successfully raising funds from pledged receivables.

AR automation offers several advantages to companies financing working capital using their receivables.

Small to mid-sized businesses routinely use their accounts receivables (AR) to finance working capital and meet their financial obligations. Pledging receivables is one such option, but how do you know if this is the right choice for your company?

In this article, we cover what pledging receivables means, how it works, and how AR automation can help you figure out whether this is the right choice.

What's in this article:

What pledging receivables is →

The differences between pledging, assigning, and factoring accounts receivable →

The advantages of pledging receivables →

Why AR automation is key to obtaining receivables financing →

What is pledging receivables?

Pledging receivables is placing a portion of your accounts receivable as collateral for a loan with a bank or lender. You can pledge receivables that are not past due as collateral.

Lenders will review your cash flow data and assess default risks before accepting your AR as collateral. This makes maintaining accurate collections and AR data critical when pledging receivables.

What happens when you pledge accounts receivable?

Companies looking to pledge their receivables usually reach out to lenders specializing in this form of financing. These lenders will ask for documents like:

Credit policy terms

AR aging data

Collections data

Customer credit profiles

After scrutinizing these data, the lender will offer a loan based on the value of the receivables and an interest rate. The amount the lender offers depends on factors like the probability of collecting on an invoice and the age of a receivable.

Presenting AR data in a well-organized format helps lenders understand your policies easily and increases the likelihood of you receiving more for your receivables. Typically, lenders offer between 70 to 80% of outstanding receivables.

Note that lenders hold your receivables as collateral when you pledge them. You're still responsible for collecting outstanding invoices. You (the company) bear default risk fully when pledging receivables .

How lenders evaluate your accounts receivable data

Loan underwriters review several AR-related datasets before deciding how much to loan a business. Most lenders offer between 70 to 80% of your outstanding receivables, as mentioned previously. However, much depends on the lender's underwriting limits and the state of your accounts receivable.

For instance, some lenders might review your AR aging tables and offer an amount that is a portion of outstanding invoices less than 45 days old. Others might extend that term to 60 days.

Once approved, lenders will charge you a service fee and present interest rates and other terms like the loan's duration. Interest rates depend on your industry and customer credit profile. While no reliable benchmarks exist, you can expect interest rates to track broad business financing rates.

The lender's policies are outside your control, but you can increase the odds of a positive result by ensuring you do the following:

Present AR data in an easily understood format.

Have supplementary evidence like delivery slips or sales contracts on hand.

Organize AR data to show an order-to-cash (O2C) audit trail .

Present customer-level collections data.

Present collection efficiency metrics like days sales outstanding ( DSO) and collection effectiveness index (CEI) as part of your dashboards.

Organize trade references and customer credit data in easily understood formats.

An example of pledging receivables

Once the lender approves the loan and you finalize terms, you'll have to record it on your books. Here's an example of the impact pledging receivables makes on your journal entries.

Loan amount—$250,000

Receivables pledged—$300,000

Interest rate—5%

4 differences between pledging, assigning, and factoring accounts receivable

Pledging receivables is similar to assigning or factoring them, but the devil is in the details. Here are the most important differences between these AR financing options you must understand.

What are the advantages of pledging receivables?

Like every financing option, pledging receivables offers your business a few advantages. Here are the most important ones to understand:

Pledging receivables is a relatively easy financing option.

Pledging receivables gives you more cash.

Pledging receivables does not impact customer relationships.

Pledging receivables forces AR process standardization.

Pledging receivables is a relatively easy financing option

Unlike other financing options such as business loans, securing a loan by pledging receivables is relatively easy. A big reason is receivables are assets lenders can quantify with a good degree of accuracy.

For instance, a lender can look at your DSO to approximate when your invoices will clear. They can look at your AR aging record to calculate how much cash your company will receive over the next month or quarter. They can look at your collection effectiveness index and calculate the probability of collecting outstanding invoices.

These numbers give lenders a good deal of confidence when lending money, making it relatively easy for you to secure working capital .

Pledging receivables can give you more cash

Pledging receivables might give you more cash upfront compared to invoice factoring. While much depends on your industry and customer credit quality, the interest rate a lender charges you could be lower than a factoring company's discount rate.

This gives you more cash upfront to finance your business, extending your liquidity runway.

Pledging receivables does not impact customer relationships

When you pledge your receivables, you retain control over collections and customer communication. Compare this to invoice factoring and assignments where a third party absorbs collections risks, and the impact on customer relationships is evident.

For instance, a long-time customer might suffer from a temporary cash-flow hole, preventing them from paying you. A factoring company is unlikely to prioritize your history with that customer, choosing to collect cash as quickly as possible.

This situation could leave a bad impression on the customer, reducing the likelihood of them returning to you when circumstances improve.

Pledging receivables forces AR process standardization

Pledging receivables, like all forms of AR financing, creates debt you must manage well. The process forces your finance department to collaborate and present data in an easily understood format.

For example, you must present customer credit data and your credit policy. Your AR team must work with sales to understand customer credit terms and refer to internal systems to validate invoice statuses and history.

Your team is more likely to rely on standardized processes, as a result, since an ad-hoc process will lead to inadequate or disorganized information, leading to lenders rejecting your application—an outcome no one wants.

Why accounts receivable automation is key to obtaining receivables financing

Accounts receivable data is the key to successfully pledging receivables. If you're processing a good deal of invoices each month—the average mid-sized company processes 2,433 invoices monthly —a manual AR process will likely leave you behind, unable to cope with lender requirements.

Here's how AR automation can help you secure receivables financing:

Quick insights into AR data

Lenders need visibility into your AR data to understand aging timelines and credit risk. Automation helps you create these reports quickly and present real-time information. Automation also eliminates errors caused by manual work , reducing the time it takes you to present data and secure financing.

Frees AR’s time to analyze cash flow

Figuring out when you need financing is a critical task. Given the expense associated with AR financing, analyzing your cash flow is a critical AR task. Automation frees your AR team's time, giving them more space to dig deeper into cash flow bottlenecks .

☝︎ Hear from Versapay’s CFO , Russell Lester, on what you can do to enhance AR performance, now and in the future.

The result is greater AR efficiency you can rely on to plan financing ahead of time.

Guarantees AR data accuracy

Automation dramatically reduces invoice processing costs since you'll avoid common errors like incorrect pricing, discounts, or credit terms. You can trust your data and rely on it to create accurate working capital projections.

You'll avoid late payments and always have an accurate cash flow picture.

Pledging receivables is a great way to secure financing for your business, but make sure you organize your AR data in an easy-to-understand format.

Collaborative AR automation platforms help you centralize your data for quick cash flow insights and eliminate errors that increase expenses. Learn how Versapay's AR automation platform can help you accelerate cash flow and increase AR efficiency.

About the author

Vivek Shankar

Vivek Shankar is a content writer specializing in B2B fintech and technology. He is ambivalent about the Oxford comma and covers the institutional finance markets for industry trade publications. An avid traveler and storyteller, Vivek previously worked in the financial sector as a data analyst.

Always stay up-to-date

Join the 50,000 accounts receivable professionals already getting our insights, best practices, and stories every month.

Accounting for Pledge Receivable in Financial Management

Explore the intricacies of recording pledge receivables and their impact on financial statements across different sectors.

Financial management often grapples with the complexities of accounting for various types of receivables. Among these, pledge receivable is a unique category that requires careful consideration due to its implications on an organization’s financial health and reporting accuracy.

Pledge receivable represents commitments made by donors or patrons to contribute a certain amount of funds to an entity, typically observed in non-profit organizations but also relevant across different industries. The importance of accurately recording these pledges cannot be overstated as they play a significant role in budgeting, planning, and strategic decision-making processes.

Accounting for Pledge Receivable

The process of accounting for pledge receivable involves a series of steps that ensure these promises are captured in financial records in a manner that reflects their economic impact. This process is governed by specific accounting standards and principles that dictate how and when these pledges should be recognized, presented, and differentiated based on their conditions.

Recognition Criteria

The recognition of pledge receivable hinges on the guidelines set forth by the Financial Accounting Standards Board (FASB) in the United States, specifically within the Accounting Standards Codification (ASC). According to ASC 958-605, pledges must be recognized when they meet the criteria of being verifiable, measurable, and probable of collection. Verifiability requires that there is sufficient documentation to substantiate the pledge, while measurability ensures that the amount can be quantified with reliability. The probability of collection assesses the likelihood that the pledged amount will indeed be received, considering the donor’s creditworthiness and past payment history. When these conditions are met, the pledge can be recorded as an asset on the balance sheet and as revenue in the statement of activities.

Financial Statement Presentation

Once a pledge is deemed recognizable, it must be presented in the financial statements in a manner that provides clear information to users. Pledges receivable are typically classified as assets and can be further categorized as current or non-current based on the expected timing of fulfillment. Current pledges are those expected to be collected within one year, while non-current pledges are due beyond that timeframe. The presentation should also distinguish between restricted and unrestricted pledges, as this affects how the funds can be used and reported. For instance, restricted pledges may be tied to specific projects or purposes and are reported separately from unrestricted funds, which can be used at the organization’s discretion.

Conditional vs. Unconditional Pledges

A critical distinction in the accounting of pledges is between conditional and unconditional pledges. An unconditional pledge is a promise to give that depends only on the passage of time or demand for payment. In contrast, a conditional pledge depends on the occurrence of a specified future and uncertain event to bind the promisor. According to ASC 958-605, an unconditional pledge should be recognized when the aforementioned recognition criteria are met. However, a conditional pledge should not be recognized as revenue or as an asset until the conditions are substantially met. This distinction is crucial as it affects the timing of revenue recognition and the portrayal of an organization’s financial position.

Timing and Financial Ratios

The timing of pledge recognition can significantly influence an organization’s financial ratios, which are key indicators of financial health used by stakeholders to assess performance and stability. For example, the recognition of a large pledge as revenue can inflate the current period’s income, affecting profitability ratios such as the net margin. Conversely, recording a pledge as an asset increases the entity’s receivables, which impacts liquidity ratios like the current ratio. It is important for financial managers to consider the timing of these recognitions and their effect on financial ratios, as they can influence lending decisions, grant eligibility, and the perceptions of donors and investors regarding the organization’s financial management.

Pledge Receivable in Non-Profits

Non-profit organizations often rely on pledges as a significant source of funding. These promises of future donations can be a lifeline for many such entities, enabling them to plan and execute their missions effectively. Unlike commercial entities, non-profits must navigate the unique challenge of accounting for donations that may be received over extended periods and are often earmarked for specific uses.

The management of pledges receivable in non-profits is nuanced, as it involves not only financial reporting but also donor relations and trust. Non-profits must ensure that they maintain transparency with their donors regarding how pledges are recorded and used. This transparency is not just a matter of ethical practice but also a regulatory requirement, as non-profits are subject to audits and must adhere to the principles of accountability.

The strategic impact of pledges on a non-profit’s operations is profound. Pledges can enable organizations to embark on long-term projects and initiatives that would otherwise be unfeasible. They provide a sense of financial security and predictability, which is particularly important for non-profits that may not have a steady stream of income. However, this also means that non-profits must be adept at forecasting and adjusting their financial strategies based on the reliability of these pledges.

Non-profits also face the task of cultivating and maintaining relationships with donors, which is intertwined with how pledges are managed. The stewardship of donor relations requires a careful balance between recognizing the generosity of pledges and the practical aspects of accounting for them. This involves regular communication with donors, providing updates on the organization’s work, and demonstrating the impact of their contributions.

Pledge Receivable in Various Industries

While non-profits are the most common entities associated with pledge receivables, this financial aspect also permeates various other industries. Each sector faces unique challenges and opportunities in managing these types of receivables, which can be integral to their financial strategies and operational success.

Higher Education

Institutions of higher education frequently engage in fundraising campaigns, where pledges play a central role. Universities and colleges often receive pledges from alumni, corporations, and philanthropists to support scholarships, capital projects, and endowments. The accounting for these pledges must be meticulous, as the amounts can be substantial and the terms often span multiple fiscal years.

The recognition and reporting of these pledges are subject to the same FASB standards as non-profits. However, higher education institutions may also need to consider the impact of pledges on their endowment funds and the associated spending policies. Pledges that contribute to endowments are subject to specific disclosure requirements, and the institutions must manage the expectations of both donors and beneficiaries regarding the timing and use of the funds. Additionally, the volatility of pledges, which can be affected by economic cycles and donor preferences, requires these institutions to maintain robust forecasting and financial planning processes.

Healthcare Organizations

Healthcare organizations, particularly those with non-profit status, encounter pledge receivables in the form of commitments from individuals, foundations, and corporations. These pledges can be directed towards research, facility improvements, equipment acquisition, or community health initiatives. The management of these pledges is critical, as healthcare organizations must balance immediate patient care needs with long-term development goals.

The accounting treatment of pledges in healthcare requires careful consideration of the conditions attached to the donations. For instance, a pledge for a new wing in a hospital may be contingent upon the organization raising additional funds or achieving certain operational milestones. Recognizing such pledges too early could misrepresent the organization’s financial position. Healthcare financial managers must also be adept at navigating the complexities of restricted versus unrestricted funds, ensuring that the organization complies with donor restrictions and reporting requirements.

Charitable Foundations

Charitable foundations, which often act as intermediaries between donors and beneficiary organizations, handle pledge receivables as part of their core operations. These foundations must account for pledges both as receivables from donors and as future grants payable to other entities. The dual role of foundations in the pledge process adds a layer of complexity to their financial management.

The recognition of pledges in charitable foundations must be precise to maintain the integrity of their financial statements and the trust of their stakeholders. Foundations must monitor the conditions of pledges closely, as these can affect the timing of fund availability and the subsequent distribution to beneficiaries. Additionally, foundations must be transparent in their reporting to ensure that donors understand how their pledges are being managed and allocated, which is essential for sustaining long-term donor relationships and ensuring the continuity of funding for their philanthropic activities.

Understanding the Trial Balance and Balance Sheet: A Comparative Analysis

Balancing promotional expenses in financial reporting, you may also be interested in..., the role of normal account balances in accurate bookkeeping, cost classification insights for financial professionals, advance payment accounting and financial impacts, accounting for pass-through expenses under gaap standards.

- Search Search Please fill out this field.

- Building Your Business

- Business Financing

Using Accounts Receivable To Finance Your Business

An alternative to bank financing for your small business

2 Methods of Accounts Receivable Financing

Pledging accounts receivable, factoring accounts receivable, frequently asked questions (faqs).

Westend61 / Getty Images

Using your accounts receivable, or your customers’ credit accounts, to obtain financing for your small business is another method of raising money for working capital needs. Both accounts receivable financing and inventory financing are usually used for quick, short-term loans when it is not possible to obtain a short-term loan from a bank or other financial institution. Both are used to raise working capital or the money you use for your daily operations. Here's how it works.

Key Takeaways

- Accounts receivable financing is a way for you to finance your small business.

There are two methods of accounts receivable financing: pledging and factoring.

- Interest rates are usually higher on this type of financing than on a traditional bank loan.

- Accounts receivable financing may not be ideal for long-term business financing needs.

Accounts receivable financing can be used as an alternative to bank financing. Commercial finance companies often offer accounts receivable financing to small businesses. Sometimes, commercial banks or other financial institutions will also offer accounts receivable financing. Interest rates are usually higher on this type of financing than on a traditional bank loan.

Pledging, or assigning, accounts receivable means that you essentially use your accounts receivable as collateral to obtain cash. The lender has the receivables as security, but you, as the business owner, are still responsible for the collection of the debts from your customers.

A lender looks at the aging schedule of your business firm’s accounts receivables in determining which ones to accept as collateral. Usually, the lender only accepts those receivables that are not overdue. Overdue accounts don’t make good collateral. Also, if a customer has credit terms extended to them that the lender thinks are too long, the lender may not accept those particular receivables either.

After examining a company’s receivables for overdue accounts and terms the lender doesn’t like, the lender then determines what amount of the company’s receivables they will accept.

After that, the lender will typically adjust that amount for returns and allowances. At that point, it will decide what percentage of the value of the acceptable receivables it will loan and make the loan to your small business. The percentage it will loan is usually around 75% or 85%.

If a business defaults on the accounts receivable financing loan, the lender will take over the company’s accounts receivables and collect on the debts themselves.

Factoring your accounts receivables means that you actually sell them, as opposed to pledging them as collateral, to a factoring company . The factoring company gives you an advance payment for accounts you would have to wait on for payment. The advance payment is usually 70% to 90% of the total value of the receivables. After charging a small fee to the company, usually 2% or 3%, the remaining balance is paid after the full balance is paid to the factor.

Factoring is a relatively expensive source of financing, but the cost is lowered because the factoring company takes on all the risk of default by the customer.

Factoring is important in the retail industry in the U.S. Many small businesses in a huge variety of industries use this form of financing when they need short-term working capital loans.

Sometimes using accounts receivable financing is all that stands between your small business and bankruptcy , particularly during a recession or other types of tough times for your business. Don’t hesitate to use it for your working capital needs if you need to. It may not be acceptable financing, however, for longer-term business financing needs.

What is accounts receivable financing?

Accounts receivable financing is when a business pledges its accounts receivable—the money it is still owed from customers and clients—as collateral to obtain a loan from a lender. There are two kinds: pledging, which means you put up the accounts receivable as collateral, and factoring, where you actually sell them to a company that pays you upfront the money you'd normally wait for from customers.

What is invoice financing?

Invoice financing is just another name for accounts receivable financing, which is when you pledge your invoices as collateral or sell them to a company so that you can get a short-term loan for your business. Your invoices are money that is still owed to you, so instead of you waiting on that money to come in, you exchange it for money now from a lender.

Office of the Comptroller of the Currency. " Accounts Receivable and Inventory Financing ."

Comptroller of the Currency, Administrator of National Banks. " Accounts Receivable and Inventory Financing ."

Universal Funding. " Invoice Factoring Rates ."

J&D Financial. " Factoring Rates for Our Services ."

The Difference Between Assignment of Receivables & Factoring of Receivables

- Small Business

- Money & Debt

- Business Bank Accounts

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Decrease Bad Debt Expenses to Increase Income

What does "paid on account" in accounting mean, what is a financing receivable.

- What Do Liquidity Ratios Measure?

- What Are Some Examples of Installment & Revolving Accounts?

You can raise cash fast by assigning your business accounts receivables or factoring your receivables. Assigning and factoring accounts receivables are popular because they provide off-balance sheet financing. The transaction normally does not appear in your financial statements and your customers may never know their accounts were assigned or factored. However, the differences between assigning and factoring receivables can impact your future cash flows and profits.

How Receivables Assignment Works

Assigning your accounts receivables means that you use them as collateral for a secured loan. The financial institution, such as a bank or loan company, analyzes the accounts receivable aging report. For each invoice that qualifies, you will likely receive 70 to 90 percent of the outstanding balance in cash, according to All Business . Depending on the lender, you may have to assign all your receivables or specific receivables to secure the loan. Once you have repaid the loan, you can use the accounts as collateral for a new loan.

Assignment Strengths and Weaknesses

Using your receivables as collateral lets you retain ownership of the accounts as long as you make your payments on time, says Accounting Coach. Since the lender deals directly with you, your customers never know that you have borrowed against their outstanding accounts. However, lenders charge high fees and interest on an assignment of accounts receivable loan. A loan made with recourse means that you still are responsible for repaying the loan if your customer defaults on their payments. You will lose ownership of your accounts if you do not repay the loan per the agreement terms.

How Factoring Receivables Works

When you factor your accounts receivable, you sell them to a financial institution or a company that specializes in purchasing accounts receivables. The factor analyzes your accounts receivable aging report to see which accounts meet their purchase criteria. Some factors will not purchase receivables that are delinquent 45 days or longer. Factors pay anywhere from 65 percent to 90 percent of an invoice’s value. Once you factor an account, the factor takes ownership of the invoices.

Factoring Strengths and Weaknesses

Factoring your accounts receivables gives you instant cash and puts the burden of collecting payment from slow or non-paying customers on the factor. If you sell the accounts without recourse, the factor cannot look to you for payment should your former customers default on the payments. On the other hand, factoring your receivables could result in your losing customers if they assume you sold their accounts because of financial problems. In addition, factoring receivables is expensive. Factors charge high fees and may retain recourse rights while paying you a fraction of your receivables' full value.

- All Business: The Difference Between Factoring and Accounts Receivable Financing

Related Articles

The advantages of selling accounts receivable, buying accounts receivable, difference between payables and receivables in accounting, the role of factoring in modern business finance, the prevention of dilution of ownership, how to remove an empty mailbox in outlook, the importance of factoring in business, how to factor inventory, setting up webmail on mail for the imac, most popular.

- 1 The Advantages of Selling Accounts Receivable

- 2 Buying Accounts Receivable

- 3 Difference Between Payables and Receivables in Accounting

- 4 The Role of Factoring in Modern Business Finance

Assignment of Accounts Receivable

The financial accounting term assignment of accounts receivable refers to the process whereby a company borrows cash from a lender, and uses the receivable as collateral on the loan. When accounts receivable is assigned, the terms of the agreement should be noted in the company's financial statements.

Explanation

In the normal course of business, customers are constantly making purchases on credit and remitting payments. Transferring receivables to another party allows companies to reduce the sales to cash revenue cycle time. Also known as pledging, assignment of accounts receivable is one of two ways companies dispose of receivables, the other being factoring.

The assignment process involves an agreement with a lending institution, and the creation of a promissory note that pledges a portion of the company's accounts receivable as collateral on the loan. If the company does not fulfill its obligation under the agreement, the lender has a right to collect the receivables. There are two ways this can be accomplished:

General Assignment : a portion of, or all, receivables owned by the company are pledged as collateral. The only transaction recorded by the company is a credit to cash and a debit to notes payable. If material, the terms of the agreement should also appear in the notes to the company's financial statements.

Specific Assignment : the lender and borrower enter into an agreement that identifies specific accounts to be used as collateral. The two parties will also outline who will attempt to collect the receivable, and whether or not the debtor will be notified.

In the case of specific assignment, if the company and lender agree the lending institution will collect the receivables, the debtor will be instructed to remit payment directly to the lender.

The journal entries for general assignments are fairly straightforward. In the example below, Company A records the receipt of a $100,000 loan collateralized using accounts receivable, and the creation of notes payable for $100,000.

In specific assignments, the entries are more complex since the receivable includes accounts that are explicitly identified. In this case, Company A has pledged $200,000 of accounts in exchange for a loan of $100,000.

Related Terms

Contributors

Moneyzine Editor

- Trade Finance

- Letters of Credit

- Trade Insurance & Risk

- Shipping & Logistics

- Sustainable Trade Finance

- Incoterms® Rules 2020

- Research & Data

- Conferences

- Purchase Order Finance

- Stock Finance

- Structured Commodity Finance

- Receivables Finance

- Supply Chain Finance

- Bonds and Guarantees

- Find Finance Products

- Get Trade Finance

- Incoterms® 2020

- Letters of Credit (LCs)

Receivables Finance And The Assignment Of Receivables

Tfg legal trade finance hub, receivables finance and the assignment of receivables.

A receivable represents money that is owed to a company and is expected to be paid in the future. Receivables finance, also known as accounts receivable financing, is a form of asset-based financing where a company leverages its outstanding receivables as collateral to secure short-term loans and obtain financing.

In case of default, the lender has a right to collect associated receivables from the company’s debtors. In brief, it is the process by which a company raises cash against its own book’s debts.

The company actually receives an amount equal to a reduced value of the pledged receivables, the age of the receivables impacting the amount of financing received. The company can get up to 90% of the amount of its receivables advanced.

This form of financing assists companies in unlocking funds that would otherwise remain tied up in accounts receivable, providing them with access to capital that is not immediately realised from outstanding debts.

FIG. 1: Accounts receivable financing operates by leveraging a company’s receivables to obtain financing. Source: https://fhcadvisory.com/images/account-receivable-financing.jpg

Restrictions on the assignment of receivables – New legislation

Invoice discounting products under which a company assigns its receivables have been used by small and medium enterprises (SMEs) to raise capital. However, such products depend on the related receivables to be assignable at first.

Businesses have faced provisions that ban or restrict the assignment of receivables in commercial contracts by imposing a condition or other restrictions, which prevents them from being able to use their receivables to raise funds.

In 2015, the UK Government enacted the Small Business, Enterprise and Employment Act (SBEEA) by which raising finance on receivables is facilitated. Pursuant to this Act, regulations can be made to invalidate restrictions on the assignment of receivables in certain types of contract.

In other words, in certain circumstances, clauses which prevent assignment of a receivable in a contract between businesses is unenforceable. Especially, in its section 1(1), the Act provides that the authorised authority can, by regulations “make provision for the purpose of securing that any non-assignment of receivables term of a relevant contract:

- has no effect;

- has no effect in relation to persons of a prescribed description;

- has effect in relation to persons of a prescribed description only for such purposes as may be prescribed.”

The underlying aim is to enable SMEs to use their receivables as financing to raise capital, through the possibility of assigning such receivables to another entity.

The aforementioned regulations, which allow invalidations of such restrictions on the assignment of receivables, are contained in the Business Contract Terms (Assignment of Receivables) Regulations 2018, which will apply to any term in a contract entered into force on or after 31 December 2018.

By virtue of its section 2(1) “Subject to regulations 3 and 4, a term in a contract has no effect to the extent that it prohibits or imposes a condition, or other restriction, on the assignment of a receivable arising under that contract or any other contract between the same parties.”

Such regulations apply to contracts for the supply of goods, services or intangible assets under which the supplier is entitled to be paid money. However, there are several exclusions to this rule.

In section 3, an exception exists where the supplier is a large enterprise or a special purpose vehicle (SPV). In section 4, there are listed exclusions for various contracts such as “for, or entered into in connection with, prescribed financial services”, contracts “where one or more of the parties to the contract is acting for purposes which are outside a trade, business or profession” or contracts “where none of the parties to the contract has entered into it in the course of carrying on a business in the United Kingdom”. Also, specific exclusions relate to contracts in energy, land, share purchase and business purchase.

Effects of the 2018 Regulations

As mentioned above, any contract terms that prevent, set conditions for, or place restrictions on transferring a receivable are considered invalid and cannot be legally enforced.

In light of this, the assignment of the right to be paid under a contract for the supply of goods (receivables) cannot be restricted or prohibited. However, parties are not prevented from restricting other contracts rights.

Non-assignment clauses can have varying forms. Such clauses are covered by the regulations when terms prevent the assignee from determining the validity or value of the receivable or their ability to enforce it.

Overall, these legislations have had an important impact for businesses involved in the financing of receivables, by facilitating such processes for SMEs.

Digital platforms and fintech solutions: The assignment of receivables has been significantly impacted by the digitisation of financial services. Fintech platforms and online marketplaces have been developed to make the financing and assignment of receivables easier.

These platforms employ tech to assess debtor creditworthiness and provide efficient investor and seller matching, including data analytics and artificial intelligence. They provide businesses more autonomy, transparency, and access to a wider range of possible investors.

Securitisation is an essential part of receivables financing. Asset-backed securities (ABS), a type of financial instrument made up of receivables, are then sold to investors.

Businesses are able to turn their receivables into fast cash by transferring the credit risk and cash flow rights to investors. Investors gain from diversification and potentially greater yields through securitisation, while businesses profit from increased liquidity and risk-reduction capabilities.

References:

https://www.tradefinanceglobal.com/finance-products/accounts-receivables-finance/ – 28/10/2018

https://www.legislation.gov.uk/ukpga/2015/26/section/1/enacted – 28/10/2018

https://www.legislation.gov.uk/ukdsi/2018/9780111171080 – 28/10/2018

https://www.bis.org/publ/bppdf/bispap117.pdf – Accessed 14/06/2023

https://www.investopedia.com/terms/a/asset-backedsecurity.asp – Accessed 14/06/2023

https://www.imf.org/external/pubs/ft/fandd/2008/09/pdf/basics.pdf – Accessed 14/06/2023

International Trade Law

1 | Introduction to International Trade Law 2 | Legal Trade Finance 3 | Standard Legal Charges 4 | Borrowing Base Facilities 5 | Governing law in trade finance transactions 6 | SPV Financing 7 | Guarantees and Indemnities 8 | Taking security over assets 9 | Receivables finance and the assignment of receivables 10 | Force Majeure 11 | Arbitration 12 | Master Participation Agreements 13 | Digital Negotiable Instruments 14 | Generative AI in Trade Law

Access trade, receivables and supply chain finance

Contact the trade team, speak to our trade finance team, want to learn more about trade finance download our free guides.

Learn more about Legal Structures in Trade Finance

Digital Negotiable Instruments

Electronic Signatures

Force Majeure

Master Risk Participation Agreements In Trade Finance

What is a Creditor?

What is a debtor (debitor).

About the Author

Trade Finance Global (TFG) assists companies with raising debt finance. While we can access many traditional forms of finance, we specialise in alternative finance and complex funding solutions related to international trade. We help companies to raise finance in ways that is sometimes out of reach for mainstream lenders.

- Staff Directory

- Records Retention

- Client Portal

- 14 July 2021

- Articles, Featured, Home, Non-Profit

PLEDGES RECEIVABLE: HOW TO ACCOUNT FOR PLEDGES & BEQUESTS

When a donor promises to make a contribution at a later date, your non-profit likely welcomes it. But such pledges can come with complicated accounting issues.

What are Pledges Receivable?

Pledges receivable allows non-profit organizations to recognize and account for revenue that donors have promised to give in the form of donations at some point in the future. The way that nonprofits account for these kinds of promises depends heavily on whether they’re considered “conditional” or “unconditional”.

Accounting for Conditional vs. Unconditional Promises

For example, a donor makes a pledge in April 2018 to contribute $10,000 in January 2019. You generally will create a pledge receivable and recognize the revenue for the April 2018 financial period. When the payment is received in January 2019, you will apply it to the receivable. No new revenue will result in January because the revenue already was recorded.

Of course, you cannot create a pledge receivable and recognize the revenue unless the donor has made a firm commitment and the pledge is unconditional. Several factors might indicate an unconditional pledge. For example:

- The promise includes a fixed payment schedule.

- The promise includes words such as “pledge,” “binding,” and “agree.”

- The amount of the promise can be determined.

Conditional promises, on the other hand, could include a requirement that your organization completes a particular project before receiving the contribution or that you send a representative to an event to receive the check-in person. Matching pledges are conditional until the matching requirement is satisfied, and bequests are conditional until after the donor’s death.

You generally should not recognize revenue on conditional promises until the conditions have been met. Your accounting department will require written documentation to support a pledge before recording it, such as a signed agreement that clearly details the terms of the pledge, including the amount and timing.

Should You Apply Discounts to Pledges?

Pledges must be recognized at their present value, as opposed to the amount you expect to receive in the future. For a pledge that you will receive within a year, you can recognize the pledged amount as the present value. If the pledge will be received further in the future, though, your accounting department will need to calculate the present value by applying a discount rate to the amount you expect to receive.

The discount rate is usually the market interest rate or the interest rate a bank would charge you to borrow the amount of the pledge. Additional entries will be required to remove the discount as time elapses.

Word of Caution

Proper accounting for pledge receivables can be tricky. But if you do not record them in the right financial period, you could run into audit issues and even put your funding in jeopardy. At KPM, we have a team of accountants who specialize in non-profit accounting . Contact us today to see how we can help you.

Related Articles

Identifying when outsourcing payroll management is valuable for your organization, overtime rule update: employer guide, valuation challenges in family-owned entities, talk with the pros.

Our CPAs and advisors are a great resource if you’re ready to learn even more.

- France (FR)

- Germany (DE)

- Netherlands

United Kingdom

- United States

The Business Contract Terms (Assignment of Receivables) Regulations 2018: still more to do?

The Business Contract Terms (Assignment of Receivables) Regulations 2018 (the " Regulations ") are now in force. The Regulations are intended to make it easier for small businesses to access receivables-based finance by making ineffective any prohibitions, conditions and restrictions on the assignment of receivables [1] arising under contracts for the supply of goods, services or intangible assets.

The Regulations have a somewhat chequered history. The Law Commission advocated legislation to limit the effectiveness of anti-assignment clauses in 2005, however, the proposal failed to gain momentum and lay dormant for more than a decade. Draft legislation finally appeared in 2017, but was withdrawn following criticism by the Loan Market Association and others. The final form of the Regulations addresses some of the criticisms, but adds complexity in what is already a complex area of the law.

The Effect of the Regulations

A term in a contract to which the Regulations apply is ineffective to the extent that it prohibits or imposes a condition or other restriction on the assignment of a receivable arising under that contract or another contract between the same parties. That does not necessarily mean that the term will be entirely void as a result: contractual prohibitions on assignment often do not distinguish between the right to performance of the contract and the right to be paid amounts arising under it. Prohibitions of this type will remain effective to prevent an assignment of the right to performance, even if they are ineffective to prevent the assignment of receivables arising under the contract.

The Regulations provide that a term which prevents an assignee from determining the validity or the value of the receivable or restricts its ability to enforce the receivable will be deemed to be a condition or other restriction on assignment. This, for example, includes provisions which prevent an assignee from obtaining particulars and evidence of any potential defence or set-off by a party to the contract. Therefore, the Regulations permit disclosure of matters which might otherwise be caught by confidentiality provisions in the underlying contract.

When do the Regulations apply?

Subject to specified exceptions, the Regulations apply to any contract entered into on or after 31 December 2018.

Certain types of contract are excluded from the Regulations. For example, the Regulations do not apply :

- to contracts for certain prescribed financial services or to other specific types of contract, including those in relation to real estate, certain derivatives, certain project finance and energy agreements and operating leases.

- to contracts entered into in connection with the acquisition, disposal or transfer of an ownership interest in all or part of a business, firm or undertaking, provided the relevant contract includes a statement to that effect. The need for such a statement applies even where the purpose of the contract is obvious on its face.

- where one or more of the parties is a consumer, or where none of the parties has entered into the contract in the course of carrying on a business in the UK.

The Regulations do not apply if the supplier is a "large enterprise" or a "special purpose vehicle" (the " SME Test ") at the time of the assignment. For this purpose, a special purpose vehicle is a firm that carries out a primary purpose in relation to the holding of assets (except trading stock) or financing commercial transactions, which in either case involves it incurring a liability of £10m or more.

The question of whether a limited company is a "large enterprise" depends in part on turnover, balance sheet total and number of employees assessed by reference the most recent annual accounts filed by the company or its parent prior to the assignment. Therefore, at the time the supplier and the debtor enter into a contract, they will not necessarily know whether a contractual prohibition on the assignment of receivables will be effective.

The definition of a "large enterprise" may be difficult to apply in some circumstances and to some entities. For example, the Regulations imply that limited partnerships are included in scope and some commentators argue that in this situation it would be the general partner entity which would be assessed under the SME Test, however, this is not expressly provided for by the Regulations.

If another governing law is imposed by a party wholly or mainly for the purpose of enabling it to evade the operation of the Regulations, the Regulations state that they will nevertheless have effect. Aside from the practical difficulty in determining whether the choice of law was imposed for this purpose, the effect of this provision is not entirely clear. Under Rome I, the law governing an assigned claim determines its assignability and the relationship between the assignee and the debtor [2] . Therefore, the fundamental question of whether the debtor should pay the supplier or the assignee remains determined by the governing law of the contract, but subject it seems (at least as far as the English courts are concerned) to the mandatory provisions of the Regulations.

The Regulations only affect prohibitions, restrictions and conditions on assignment contained in the contract under which the receivable arises or another contract between the same parties. For example, they would not restrict the effectiveness of a negative pledge or a restriction on the disposal of receivables contained in a financing document with a third party lender.

The term "assignment" is not defined in the Regulations and, assuming it has its normal legal meaning, does not include the creation of a charge or trust. Therefore, it appears that the Regulations do not apply to the creation of a charge or a trust.

What if the Regulations do not apply?