- Search Search Please fill out this field.

- Assets & Markets

What Is an Option Assignment?

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-30f78c37d3174fe298f9407f0b5413e2.jpeg)

Definition and Examples of Assignment

How does assignment work, what it means for individual investors.

Morsa Images / Getty Images

An option assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price. Let’s explain what that means in more detail.

Key Takeaways

- An assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price.

- If you sell an option and get assigned, you have to fulfill the transaction outlined in the option.

- You can only get assigned if you sell options, not if you buy them.

- Assignment is relatively rare, with only 7% of options ultimately getting assigned.

An assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price. Let’s explain what that means in more detail.

When you sell an option to someone, you’re selling them the right to make you engage in a future transaction. For example, if you sell someone a put option , you’re promising to buy a stock at a set price any time between when the transaction happens and the expiration date of the option.

If the holder of the option doesn’t do anything with the option by the expiration date, the option expires. However, if they decide that they want to go through with the transaction, they will exercise the option.

If the holder of an option chooses to exercise it, the seller will receive a notification, called an assignment, letting them know that the option holder is exercising their right to complete the transaction. The seller is legally obligated to fulfill the terms of the options contract.

For example, if you sell a call option on XYZ with a strike price of $40 and the buyer chooses to exercise the option, you’ll be assigned the obligation to fulfill that contract. You’ll have to buy 100 shares of XYZ at whatever the market price is, or take the shares from your own portfolio and sell them to the option holder for $40 each.

Options traders only have to worry about assignment if they sell options contracts. Those who buy options don’t have to worry about assignment because in this case, they have the power to exercise a contract, or choose not to.

The options market is huge, in that options are traded on large exchanges and you likely do not know who you’re buying contracts from or selling them to. It’s not like you sell an option to someone you know and they send you an email if they choose to exercise the contract, rather it is an organized process.

In the U.S., the Options Clearing Corporation (OCC), which is considered the options industry clearinghouse, helps to facilitate the exchange of options contracts. It guarantees a fair process of option assignments, ensuring that the obligations in the contract are fulfilled.

When an investor chooses to exercise a contract, the OCC randomly assigns the obligation to someone who sold the option being exercised. For example, if 100 people sold XYZ calls with a strike of $40, and one of those options gets exercised, the OCC will randomly assign that obligation to one of the 100 sellers.

In general, assignments are uncommon. About 7% of options get exercised, with the remaining 93% expiring. Assignment also tends to grow more common as the expiration date nears.

If you are assigned the obligation to fulfill an options contract you sold, it means you have to accept the related loss and fulfill the contract. Usually, your broker will handle the transaction on your behalf automatically.

If you’re an individual investor, you only have to worry about assignment if you’re involved in selling options. Even then, assignments aren't incredibly common. Less than 7% of options get assigned and they tend to get assigned as the option’s expiration date gets closer.

Having an option assigned does mean that you are forced to lock in a loss on an option, which can hurt. However, if you’re truly worried about assignment, you can plan to close your position at some point before the expiration date or use options strategies that don’t involve selling options that could get exercised.

The Options Industry Council. " Options Assignment FAQ: How Can I Tell When I Will Be Assigned? " Accessed Oct. 18, 2021.

Trade Options With Me

For Your Financial Freedom

What is Options Assignment & How to Avoid It

If you are learning about options, assignment might seem like a scary topic. In this article, you will learn why it really isn’t. I will break down the entire options assignment process step by step and show you when you might be assigned, how to minimize the risk of being assigned, and what to do if you are assigned.

Video Breakdown of Options Assignment

Check out the following video in which I explain everything you need to know about assignment:

What is Assignment?

To understand assignment, we must first remember what options allow you to do. So let’s start with a brief recap:

- A call option gives its buyer the right to buy 100 shares of the underlying at the strike price

- A put option gives its buyer the right to sell 100 shares of the underlying at the strike price

In other words, call options allow you to call away shares of the underlying from someone else, whereas a put option allows you to put shares in someone else’s account. Hence the name call and put option.

The assignment process is the selection of the other party of this transaction. So the person that has to buy from or sell to the option buyer that exercised their option.

Note that an option buyer has the right to exercise their option. It is not an obligation and therefore, a buyer of an option can never be assigned. Only option sellers can ever be get assigned since they agree to fulfill this obligation when they sell an option.

Let’s go through a specific example to clarify this:

- The underlying security is stock ABC and it is trading at $100.

- Peter decides to buy 1 put option with a strike price of 95 as a hedge for his long stock position in ABC

- Kate sells this exact same option at the same time.

Over the next few weeks, ABC’s price goes down to $90 and Peter decides to exercise his put option. This means that he uses his right to sell 100 shares of ABC for $95 per share. Now Kate is assigned these 100 shares of ABC which means she is obligated to buy them for $95 per share.

Peter now has 100 fewer shares of ABC in his portfolio, whereas Kate has 100 more.

This process is analog for a call option with the only difference being that Kate would be short 100 shares and Peter would have 100 additional shares of ABC in his portfolio.

Hopefully, this example clarifies what assignment is.

Who Can Be Assigned?

To answer this question, we must first ask ourselves who exercises their option? To do this, let’s quickly look at the different ways that you can close a long option position:

- Sell the option: Selling an option is probably the easiest way to close a long option position. Doing this will have no effect on the option seller.

- Let the option expire: If the option is Out of The Money , it would expire worthless and there would be no consequence for the option seller. If, on the other hand, the option is In The Money by more than $0.01, it would typically be automatically exercised . This would start the options assignment process.

- Exercise the option early: The last possibility would be to exercise the option before its expiration date. This, however, can only be done if the option is an American-style option. This would, once again, lead to an option assignment.

So as an option seller, you only have to worry about the last two possibilities in which the buyer’s option is exercised.

But before you worry too much, here is a quick fact about the distribution of these 3 alternatives:

Less than 10% of all options are exercised.

This means 90% of all options are either sold prior to the expiration date or expire worthless. So always remember this statistic before breaking your head over the risk of being assigned.

It is very easy to avoid the first case of being assigned. To avoid it, just close your short option positions before they expire (ITM). For the second case, however, things aren’t as straight forward.

Who Risks being Assigned Early?

Firstly, you have to be trading American-style options. European-style options can only be exercised on their expiration date. But most equity options are American-style anyway. So unless you are trading index options or other kinds of European-style options, this will be the case for you.

Secondly, you need to be an options seller. Option buyers can’t be assigned.

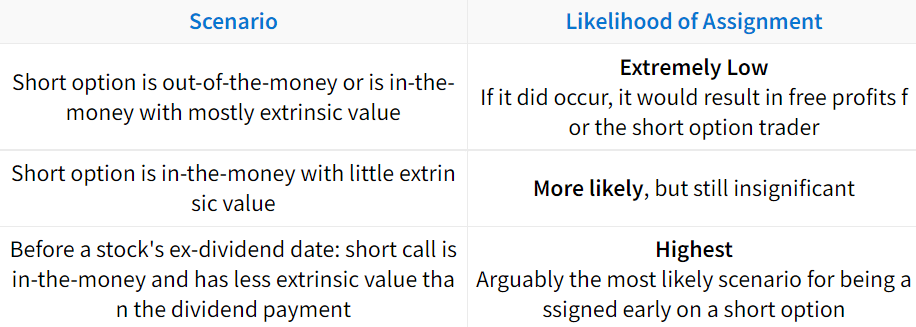

These two are necessary conditions for you to be assigned. Everyone who fulfills both of these conditions risks getting assigned early. The size of this risk, however, varies depending on your position. Here are a few things that can dramatically increase your assignment risk:

- ITM: If your option is ITM, the chance of being assigned is much higher than if it isn’t. From the standpoint of an option buyer, it does not make sense to exercise an option that isn’t ITM because this would lead to a loss. Nevertheless, it is possible. The deeper ITM the option is, the higher the assignment risk becomes.

- Dividends : Besides that, selling options on securities with upcoming dividends also increases your risk of assignment. More specifically, if the extrinsic value of an ITM call option is less than the amount of the dividend, option buyers can achieve a profit by exercising their option before the ex-dividend date.

- Extrinsic Value: Otherwise, keep an eye on the extrinsic value of your option. If the option has extrinsic value left, it doesn’t make sense for the option buyer to exercise their option because they would achieve a higher profit if they just sold the option and then bought or sold shares of the underlying asset. Typically, the less time an option has left, the lower its extrinsic value becomes. Implied volatility is another factor that influences extrinsic value.

- Puts vs Calls: This is more of an interesting side note than actual advice, but put options tend to get exercised more often than call options. This makes sense since put options give their buyer the right to sell the underlying asset and can, therefore, be a very useful hedge for long stock positions.

How can you Minimize Assignment Risk?

Since you now know what assignment is, and who risks being assigned, let’s shift our focus on how to minimize the assignment risk. Even though it isn’t possible to completely remove the risk of being assigned, there are things that you can do to dramatically decrease the chances of being assigned.

The first thing would be to avoid selling options on securities with upcoming dividend payments. Before putting on a position, simply check if the underlying security has any upcoming dividend payments. If so, look for a different trade.

If you ever are in the position that you are short an option and the ex-dividend of the underlying security is right around the corner, compare the size of the dividend to the extrinsic value of your option. If the extrinsic value is less than the dividend amount, you really should consider closing the position. Otherwise, the chances of being assigned are high. This is especially bad since being short during a dividend payment of a security will force you to pay the dividend.

Besides avoiding dividends, you should also close your option positions early. The less time an option has left, the lower its extrinsic value becomes and the more it makes sense for option buyers to exercise their options. Therefore, it is good practice to close your (ITM) short option positions at least one week before the expiration date.

The deeper an option is ITM, the higher the chances of assignment become. So the just-mentioned rule is even more important for deep ITM options.

If you don’t want to indefinitely close your position, it is also possible to roll it out to a later expiration cycle. This will give you more time and add extrinsic value to your position.

FAQs about Assignment

Last but not least, I want to answer some frequently asked questions about options exercise and assignment.

1. What happens if your account does not have enough buying power to cover the assigned position?

This is a common worry for beginning options traders. But don’t worry, if you don’t have enough capital to cover the new position, you will receive a margin call and usually, your broker will just automatically close the assigned shares immediately. This might lead to a minor assignment fee, but otherwise, it won’t significantly affect your account. Tatsyworks, for example, charges an assignment fee of only $5.

Check out my review of tastyworks

2. How does assignment affect your P&L?

When an option is exercised, the option holder gains the difference between the strike price and the price of the underlying asset. If the option is ITM, this is exactly the intrinsic value of the option. This means that the option holder loses the extrinsic value when he exercises his/her option. That’s also why it doesn’t make sense to exercise options with a lot of extrinsic value left.

This means that as soon as the option is exercised, it is only the intrinsic value that is relevant for the payoff. This is the same payoff as the option at its expiration date.

So as an options seller, your P&L isn’t negatively affected by an assignment. Either it stays the same or it becomes slightly better due to the extrinsic value being ignored.

As an example, if your option is ITM by $1, you will lose up to $100 per option or $1 per share that you are assigned. But this does not account for the extrinsic value that falls away with the exercise of the option. So this would be the same P&L as at expiration. Depending on how much premium you collected when selling the option, this might still be a profit or a minor loss.

With that being said, as soon as you are assigned, you will have some carrying risk. If you don’t or can’t close the position immediately, you will be exposed to the ongoing price fluctuations of that security. Sometimes, you might not be able to close the new position immediately because of trading halts, or because the market is closed.

If you weren’t planning on holding that security, it is a good idea to close the new position as soon as possible.

Option spreads such as vertical spreads, add protection to these price fluctuations since you can just exercise the long option to close the assigned share position at the strike price of the long option.

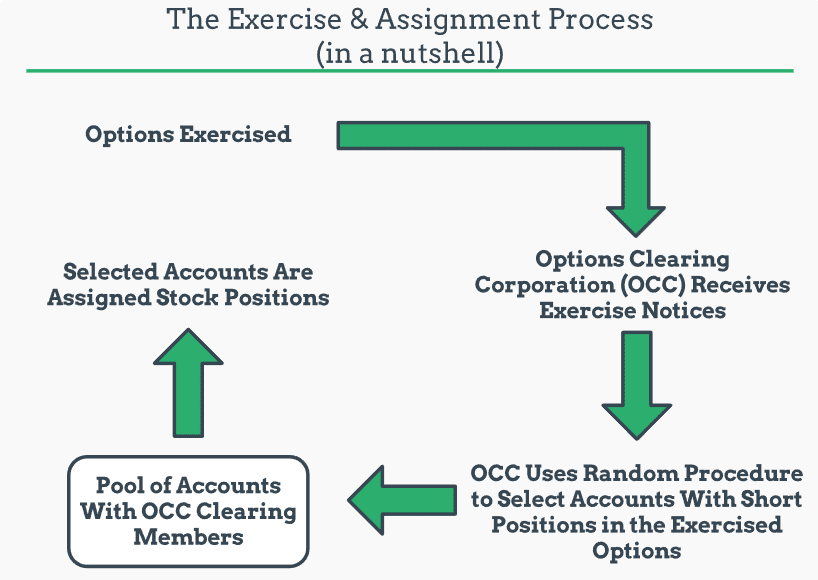

3. When an option holder exercises their option, how is the assignment partner chosen?

This is usually a random process. As soon as an option is exercised, the responsible brokerage firm sends a request to the Options Clearing Corporation (OCC). They send back the requested shares, whereafter they randomly choose another brokerage firm that currently has a client that is short the exercised option. Then the chosen broker has to decide which of their clients is assigned. This choice is, once again, random or a time-based priority system is used.

4. How does assignment work for index options?

As there aren’t any shares of indexes, you can’t directly be assigned any shares of the underlying asset. Therefore, index options are cash-settled. This means that instead of having to buy or sell shares of the underlying, you simply have to pay the difference between the strike price and the underlying trading price. This makes assignment easier and a lot less likely among index options.

Note that ETF options such as SPY options are not cash-settled. SPY is a normal security with openly traded shares, so exercise and assignment work just like they do among equity options.

I hope this article made you realize that assignment isn’t as bad as it might seem at first. It is just important to understand how the options assignment process works and what affects the likelihood of being assigned.

To recap, here’s what you should to do when you are assigned:

if you have enough capital in your account to cover the position, you could either treat the new position as a normal (stock) position and hold on to it or you could close it immediately. If you don’t have a clear trading plan for the new position, I recommend the latter.

If, on the other hand, you don’t have enough buying power, you will receive a margin call from your broker and the position should be closed automatically.

Assignment does not have any significant impact on your P&L, but it comes with some carrying risk. Options spreads can offer more protection against this than naked option positions.

To mitigate assignment risk, you should close option positions early, always keep an eye on the extrinsic value of your option positions, and avoid upcoming dividend securities.

And always remember, less than 10% of options are exercised, so assignment really doesn’t happen that often, especially not if you are actively trying to avoid it.

For the specifics of how assignment is handled, it is a good idea to contact your broker, as the procedures can vary from broker to broker.

Thank you for taking the time and reading this post. If you have any questions, comments, or feedback, please let me know in the comment section below.

22 Replies to “What is Options Assignment & How to Avoid It”

hi there well seems like finally there is one good honest place. seem like you are puting on the table the whole truth about bad positions. however my wuestion is when can one know where to put that line of limit. when do you recognise or understand that you are in a bad position? thanks and once again, a great site.

Well If you are trading a risk defined strategy the point would be at max loss and not too much time left until expiration. For undefined risk strategies however it can be very different. I would just say if you don’t have too much time until expiration and are far from making money you should use some common sense and admit that you are wrong.

What would happen in the event of a crash. Would brokers be assigning, options, cashing out these shares, and making others bankrupt. Well, I guessed I sort of answered my own question. Its not easy to understand, especially not knowing when this would come up. But seems like you hit the important aspects of the agreement.

Actually I wouldn’t imagine that too many people would want to exercise their options in case of a market ctash, because they probably wouldn’t want to hold stocks in this risky and volatile environment.

And to the part of the questions: making others bankrupt. This really depends on the situation. You can’t get assigned more stock than your option covers. This means as long as you trade with reasonable position sizing nothing too bad can happen. Otherwise I would recommend to trade with defined risk strategies so your maximum drawdown is capped.

Thanks for writing about assignment Louis. After reading the section how assignment works, I feel I am somewhat unclear about how assignment works when the exerciser exercises Put or Call option. In both cases, if the underlying is an index, is the settlement done through the margin account money? Would you be able to provide a little more detail of how exercising the option (Put vs Call) would work in case of an underlying stock vs Index.

Thank you very much in advance

Thanks for the question. Indexes can’t be traded in the same way as stocks can. That’s why index options are settled in cash. If your index option is assigned, you won’t have to buy or sell any shares of the underlying index at the strike price because there exist no shares of indexes. Instead, you have to pay the amount that your index option is ITM to the exerciser of your option. Let me give you an example: You are short a call option with the strike price of 1000. The underlying asset is an index and it’s price is 1050. This means your call option is 50 points ITM. If someone exercises your long call option, you will have to pay him/her the difference between the strike price and the underlying’s price which would be 50 (1050-1000). So the main difference between index and stock options is that you don’t have to buy/sell any shares of the underlying asset for index options. I hope this helps. Please let me know if you have any other questions or comments.

Can the same logic be applied for ETFs as it does Indexes? For example, if I trade the SPY ETF, would it be settled in cash?

Thanks! Johnson

Hi Johnson, Exercise and assignment for ETFs such as SPY work just like they do for equities. ETFs have shares that are openly traded, whereas indexes don’t. That’s why indexes are settled in cash, whereas ETFs aren’t. I hope this helps.

There are many articles online that I read that are biased against options tradings and I am a bit surprised to read a really helpful article like this. I find this helpful in understanding options trading, what are the techniques and how to manage the risks. Before, I was hesitant to try this financial game but now, after reading this article, I am considering participating with live accounts and no longer with a demo account. A few months ago, I signed up with a company called IQ Options, but really never involved real money and practiced only with a demo account.

Thanks for your comment. I am glad to see that you liked the post. However, I don’t recommend sing IQ Option to trade since they are a very shady trading firm. You could check out my Review of IQ Option for all the details.

this is a great and amazing article. i sincerely your effort creating time to write on such an informative article which has taught me a lot more on what is options assignment and avoiding it. i just started trading but had no ideas on this as a beginner. i find this article very helpful because it has given me more understanding on options trading and knowing the techniques and how to manage the risks. thanks for sharing this amazing article

You are very welcome

Hello, the first thing that i noticed when i opened this page is the beauty of the website. i am sure you have put much effort into creating this article and the details are really clear here. after watching the video break down, i fully understood the entire process on how to avoid options assignment.

Thank you so much for the positive feedback!

I would love to create a website like yours as the design used is really nice, simple and brings about clarity of the write ups, but then you wrote a brilliant article on how to avoid options assignment. great video here. it was confusing at first. i will suggest another video be added to help some people like me.

Thanks for the feedback. I recommend checking out my options trading beginner course . In it, I cover all the basics that weren’t explained here.

Thanks for your very helpful article. I am contemplating selling a call that would cover half my shares on company X. How can ensure that the assignment process selects the shares that I bought at a higher price, so as to maximize capital losses?

Hi Luis, When you are assigned, you just automatically buy/sell shares of the underlying at the strike price. This means your overall portfolio is adjusted by these 100 shares. The exact shares and your entry price are irrelevant. If you have 50 shares of X and your short call is assigned, you will sell 100 shares of X at the strike price. After this, your position would be -50 shares of X which would be equivalent to being short 50 shares of X. I hope this helps.

Louis, I entered a CALL butterfly spread at $100 below where I intended, just 2 days before expiration date. I intended to speculate on a big earning announcement jump the next day. It was a debit of 1.25. Also, when I realized my mistake, I tried to close it for anything at all. The Mark fluctuated between 40 and 70, but I could not get it to close. So now I am assigned to sell 200 share at 70 dollars below the market price of the stock. I am having a heart attack. I do not have the 200 shares to deliver, so it seems I have to buy them at the market, and sell them for $70 less, for a loss of $14,000.

What other options are open to me? Can my trading firm force a close with a friendly market maker and make it as if it happened on Friday? I am willing to pay a friendly market maker several hundred dollars to make this trade. Is that an option? Other options the trading firm can do for me that would cost me less than $14,000?

Hi Paul, Thanks for your comment. From the limited information provided, it is hard to say what is actually going on. If you bought a call butterfly spread, your max loss should be limited to the premium you paid to open the position. An assignment shouldn’t have a huge impact on your overall P&L. I highly recommend contacting your broker and explaining your situation to them since they have all the information required to evaluate what’s actually going on. But if the loss is real, there is no way for you to make a deal with a market maker to limit or undo potential losses. I hope this helps.

What happens with ITM long call option that typically gets automatically exercised at expiration, if the owner of the call option doesn’t have the cash/margin to cover the stock purchase?

He would receive a margin call

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Receive Emails with Educational Content

Privacy Overview

Want to Become a Better Trader Today?

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

The Risks of Options Assignment

Any trader holding a short option position should understand the risks of early assignment. An early assignment occurs when a trader is forced to buy or sell stock when the short option is exercised by the long option holder. Understanding how assignment works can help a trader take steps to reduce their potential losses.

Understanding the basics of assignment

An option gives the owner the right but not the obligation to buy or sell stock at a set price. An assignment forces the short options seller to take action. Here are the main actions that can result from an assignment notice:

- Short call assignment: The option seller must sell shares of the underlying stock at the strike price.

- Short put assignment: The option seller must buy shares of the underlying stock at the strike price.

For traders with long options positions, it's possible to choose to exercise the option, buying or selling according to the contract before it expires. With a long call exercise, shares of the underlying stock are bought at the strike price while a long put exercise results in selling shares of the underlying stock at the strike price.

When a trader might get assigned

There are two components to the price of an option: intrinsic 1 and extrinsic 2 value. In the case of exercising an in-the-money 3 (ITM) long call, a trader would buy the stock at the strike price, which is lower than its prevailing price. In the case of a long put that isn't being used as a hedge for a long stock position, the trader shorts the stock for a price higher than its prevailing price. A trader only captures an ITM option's intrinsic value if they sell the stock (after exercising a long call) or buy the stock (after exercising a long put) immediately upon exercise.

Without taking these actions, a trader takes on the risks associated with holding a long or short stock position. The question of whether a short option might be assigned depends on if there's a perceived benefit to a trader exercising a long option that another trader has short. One way to attempt to gauge if an option could be potentially assigned is to consider the associated dividend. An options seller might be more likely to get assigned on a short call for an upcoming ex-dividend if its time value is less than the dividend. It's more likely to get assigned holding a short put if the time value has mostly decayed or if the put is deep ITM and close to expiration with a wide bid/ask spread on the stock.

It's possible to view this information on the Trade page of the thinkorswim ® trading platform. Review past dividends, the price of the short call, and the price of the put at the call's strike price. While past performance cannot be relied upon to continue, this information can help a trader determine whether assignment is more or less likely.

Reducing the risk associated with assignment

If a trader has a covered call that's ITM and it's assigned, the trader will deliver the long stock out of their account to cover the assignment.

A trader with a call vertical spread 4 where both options are ITM and the ex-dividend date is approaching may want to exercise the long option component before the ex-dividend date to have long stock to deliver against the potential assignment of the short call. The trader could also close the ITM call vertical spread before the ex-dividend date. It might be cheaper to pay the fees to close the trade.

Another scenario is a call vertical spread where the ITM option is short and the out-of-the-money (OTM) option is long. In this case, the trader may consider closing the position or rolling it to a further expiration before the ex-dividend date. This move can possibly help the trader avoid having short stock on the ex-dividend date and being liable for the dividend.

Depending on the situation, a trader long an ITM call might decide it's better to close the trade ahead of the ex-dividend date. On the ex-dividend date, the price of the stock drops by the amount of the dividend. The drop in the stock price offsets what a trader would've earned on the dividend and there would still be fees on top of the price of the put.

Assess the risk

When an option is converted to stock through exercise or assignment, the position's risk profile changes. This change could increase the margin requirements, or subject a trader to a margin call, 5 or both. This can happen at or before expiration during early assignment. The exercise of a long option position can be more likely to trigger a margin call since naked short option trades typically carry substantial margin requirements.

Even with early exercise, a trader can still be assigned on a short option any time prior to the option's expiration.

1 The intrinsic value of an options contract is determined based on whether it's in the money if it were to be exercised immediately. It is a measure of the strike price as compared to the underlying security's market price. For a call option, the strike price should be lower than the underlying's market price to have intrinsic value. For a put option the strike price should be higher than underlying's market price to have intrinsic value.

2 The extrinsic value of an options contract is determined by factors other than the price of the underlying security, such as the dividend rate of the underlying, time remaining on the contract, and the volatility of the underlying. Sometimes it's referred to as the time value or premium value.

3 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

4 The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month.

5 A margin call is issued when the account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when buying power is exceeded. Margin calls may be met by depositing funds, selling stock, or depositing securities. A broker may forcibly liquidate all or part of the account without prior notice, regardless of intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Today's Options Market Update

Weekly Trader's Outlook

Options Expiration: Definitions, a Checklist, & More

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled Characteristics and Risks of Standardized Options before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested.

Spread trading must be done in a margin account.

Multiple leg options strategies will involve multiple commissions.

Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

- Options Income Mastery

- Accelerator Program

Option Assignment Process

Options trading 101 - the ultimate beginners guide to options.

Download The 12,000 Word Guide

One of the biggest fears that new options traders have is that they may get assigned. The option assignment process means that the option writer is obligated to deliver on the terms specified in a contract.

For example, if a put option is assigned, the options writer would need to buy the underlying security at the strike price dictated in the contract.

Likewise for a call option, the options write would need to sell the underlying security at the strike price dictated in the contract.

As an options trader you’re usually seeking to make a profit from directional bets or to hedge your portfolio.

You’re rarely, if ever, looking to actually buy or sell the underlying security so being assigned can sound like a scary prospect.

This article will explore the option assignment process so you can understand how it works and how you can prevent yourself getting stuck with buying or selling an underlying security.

When Assignment Occurs

Assignment occurs when an option holder exercises an option. Exercising an option simply means that the option holder executes the terms in the options contract.

So for example if you are holding a call option, you have the right, but not the obligation to buy the underlying security at the agreed strike price.

When you exercise the option, the option holder will need to sell the underlying security at the agreed strike price and for the agreed quantity.

If you’re dealing with European style options, you will know when expiration is possible because they can only be exercised on the expiration date itself.

For American style options, which is what most people trade, options can be exercised at any time before the expiration date.

This means that if you are an options writer of American style options, you could theoretically be asked at any time to comply with the terms of the contract.

Unfortunately, there is no knowing when an assignment will take place.

However, generally options are not exercised prior to expiration as it is usually much more profitable to sell the option instead.

It’s worth noting that this will only happen to you if you’re an options seller. Option buyers can never be assigned.

There are two key steps to assignment and to make it fair, the process of selecting who is assigned is random.

In the first step, the Options Clearing Corporation (OCC) will issue an exercise notice to a randomly selected Clearing Member who maintains an account with the OCC.

In the second step, the Clearing Member then assigns the exercise notice to an individual account.

When You Are Most At Risk

There are several situations that can dramatically increase the risk that you will be assigned:

Situation 1: Your option is In The Money (ITM)

When an option is ITM, an option holder would stand to profit if they exercised the option.

The deeper the option is ITM, the greater the profit for the option holder and therefore the higher risk they may exercise the option and you will be assigned.

Situation 2: The option has an upcoming dividend

An ITM call buyer can profit from exercising an option before its ex-dividend date if the extrinsic value of the call is less than the amount of the dividend.

Situation 3: There is no extrinsic value left

If there is no extrinsic value left, an option buyer could be tempted to exercise the option.

If there is extrinsic value, an option buyer would typically make a bigger profit by selling the option and buying/selling shares of the underlying asset.

How You Can Avoid The Risk Of Being Assigned

There are several steps you can take to avoid, or at the very least minimise, your risk of being assigned.

The first step to consider is avoiding selling any options that have an upcoming dividend.

Before selling any option, first check that the underlying security doesn’t have an upcoming dividend and if it does, consider waiting until after the dividend has occurred (i.e. the stock has gone ex-dividend).

If you do end up selling an option with an upcoming dividend, then the second step to protecting yourself is to close your position early as your risk begins to increase.

For example, if you are short an option with an extrinsic value less than the dividend amount and the ex-dividend of the underlying security is not too far away, close your position.

Otherwise you risk being assigned and being forced to pay the dividend as well!

To completely avoid early assignment risk, you could always sell only European style options which are cash settled at expiration. You can read more that here and here .

The final way to manage your risk is to close positions well before expiration date approaches.

As the time left to expiration decreases, so too does the extrinsic value. For option buyers, it means they could stand to benefit and so there is a risk they may exercise the option.

While this article deals with the process and risks behind being assigned, there will be times when this isn’t an issue for you.

Provided you have enough capital to meet the assignment, you may be fine with being assigned.

If this is the case, you would simply have a new stock position added which you could hold onto or immediately liquidate.

In the event that you don’t have enough capital, your broker will issue you with a margin call and the position should be automatically closed.

As the process of assignment can differ between brokers, its best you contact your broker to check the specific process they use when issuing assignments to individual accounts.

In general, provided you take a few key steps to mitigate your risks, particularly around dividend issuing securities, the chances of assignment are very low.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice . The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Like it? Share it!

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Closed my Oct BB (a few moments ago) for 34% profit…that is the best of the 3 BBs I traded since Gav taught us the strategy…so, the next coffee or beer on me, Gav 🙂

FEATURED ARTICLES

Small Account Option Strategies

The Ultimate Guide To Implied Volatility

What Is A Calendar Spread?

3,500 word guide.

Everything You Need To Know About Butterfly Spreads

Iron Condors: The Complete Guide With Examples and Strategies

Assignment in Options Trading

Introduction articles, what is an options assignment.

In options trading , an assignment occurs when an option is exercised.

As we know, a buyer of an option has the right but not the obligation to buy or sell an underlying asset depending on what option they have purchased. When the buyer exercises this right, the seller will be assigned and will have to deliver or take delivery of what they are contractually obliged to. For stock options, it is typically 1 , 000 shares per contract for the UK ; and 100 shares per contract in the US.

As you can see, a buyer will never be assigned, only the seller is at risk of assignment. The buyer, however, may be auto exercised if the option expires in-the-money .

The Mechanics of Assignment

Assignment of options isn’t a random process. It’s a methodical procedure that follows specific steps, typically beginning with the option holder’s decision to exercise their option. The decision then gets routed through various intermediaries like brokers and clearing +houses before the seller is notified.

- Exercise by Holder: The holder (buyer) of the option exercises their right to buy (for Call ) or sell (for Put ).

- Random Assignment by a Clearing House: A clearing house assigns the obligation randomly among all sellers of the option.

- Fulfilment by the Writer: The writer (seller) now must fulfill the obligation to sell (for Call) or buy (for Put) the underlying asset.

Option Assignments: Calls and Puts

Call option assignments.

When a call option holder chooses to exercise their right, the seller of the call option gets assigned. In such a situation, the seller is obligated to sell the underlying asset at the strike price to the call option holder.

Put Option Assignments

Similarly, if a put option holder decides to exercise their right, the put option seller gets assigned. The seller is then obligated to buy the underlying asset at the strike price from the put option holder.

The Implications of Assignments for Options Traders

Understanding assignment in options trading is crucial as it comes with potential risks and rewards for both parties involved.

For Option Sellers

Option sellers, or ‘writers,’ face the risk of unexpected assignments. The risk of being assigned early is especially present for options that are in the money or near their expiration date. We explain the difference between American and European assignments below.

For Option Holders

For option holders, deciding when to exercise an option (potentially leading to assignment) is a strategic decision. This decision must consider factors such as the intrinsic value of the option, the time value, and the dividend payment of the underlying asset.

Can Options be assigned before expiration?

In short, Yes, but it depends on the style of options you are trading.

American Style – Yes, this type of option can be assigned on or before expiry.

European Style – No, this type of option can only be assigned on the expiry date as defined in the contract specifications.

Options Assignment Example

For example, an investor buys XYZ PLC 400 call when the stock is trading at 385. The stock in the coming weeks rises to 425 after some good news, the buyer then decides to exercise their right early to buy the XYZ PLC stock at 400.

In this scenario, the call seller (writer) has been assigned and will have to deliver stock at 400 to the buyer (sell their stock at 400 when the prevailing market is 425).

An option typically would only be assigned if it is in the money, considering factors like dividends which do play an important role in exercise/assignments.

Can an Options Assignment be Prevented?

Assignment can sometimes come as a bit of a surprise but normally you should see it coming. You can only work to prevent assignment by closing the option before expiry or before any possible risk of assignment.

Managing Risks in Options Trading

While options trading can offer high returns, it is not devoid of risks. Therefore, understanding and managing these risks is key.

Buyers Risk: The premium paid for an option is at risk. If the option is not profitable at expiration, the premium is lost.

Writers Risk: The writer takes on a much larger risk. If a call option is assigned, they must sell the underlying asset at the strike price, even if its market price is higher.

Options Assignment Summary

The concept of ‘assignment’ in options trading, although complex, is a cornerstone of understanding options trading. It not only clarifies the responsibilities of an options seller but also helps the traders to gauge and manage their risks more effectively. Successful trading involves not just knowing your options but also understanding your obligations.

Options Assignment FAQs

What is options assignment.

Options assignment refers to the process by which the seller (writer) of an options contract is obligated to fulfill their contractual obligation to buy or sell the underlying asset, as specified by the terms of the options contract.

When does options assignment occur?

Options assignment can occur when the buyer of the options contract exercises their right to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset before or at expiration .

How does options assignment work?

When a buyer exercises their options contract, a clearing house randomly assigns a seller who is short (has written) the same options contract to fulfill the obligations of the exercise.

What happens to the seller upon options assignment?

If assigned, the seller (writer) of the options contract is obligated to fulfill their contractual obligation by buying or selling the underlying asset at the specified price (strike price) per the terms of the options contract.

Can options be assigned before expiration?

Yes, options can be assigned at any time (depending on contract type) before expiration if the buyer chooses to exercise their right. However, it is more common for options to be assigned closer to expiration as the time value diminishes.

What factors determine options assignment?

Options assignment is determined by the buyer’s decision to exercise their options contract. They may choose to exercise if the options contract is in-the- money and it is financially advantageous for them to do so.

How can I avoid options assignment?

As a seller (writer) of options contracts, you can avoid assignment by closing your position before expiration through a closing trade (buying back the options contract) or rolling it over to a future expiration date.

What happens if I am assigned on a short call option?

If assigned on a short call option, you are obligated to sell the underlying asset at the specified price (strike price). This means you would need to deliver the shares . To fulfill this obligation, you may need to buy the shares in the open market if you do not hold them .

What happens if I am assigned on a short put option?

If assigned on a short put option, you are obligated to buy the underlying asset at the specified price (strike price). This means you would need to purchase the shares .

How does options assignment affect my account?

Options assignment can impact your account by requiring you to fulfill the obligations of the assigned options contract, which may involve buying or selling the underlying asset. It is important to have sufficient funds or margin available to cover these obligations.

OptionsDesk Tips & Considerations

You should always have enough funds in your account to cover any assignment risk. If you have a short call position and it is in-the-money at the time of an ex-dividend be aware of extra assignment risk here as buyer/holder of the option may look to exercise to qualify for the dividend. Assignments can happen at any time!

Check out our other articles

Important information : Derivative products are considerably higher risk and more complex than more conventional investments, come with a high risk of losing money rapidly due to leverage and are not, therefore, suitable for everyone. Our website offers information about trading in derivative products, but not personal advice. If you’re not sure whether trading in derivative products is right for you, you should contact an independent financial adviser. For more information, please read our Important Derivative Product Trading Notes .

Mike Martin

Option exercise and assignment explained w/ visuals.

- Categories: Options Trading

Last updated on February 11th, 2022 , 06:38 am

Buyers of options have the right to exercise their option at or before the option’s expiration. When an option is exercised, the option holder will buy (for exercised calls) or sell (for exercised puts) 100 shares of stock per contract at the option’s strike price.

Conversely, when an option is exercised, a trader who is short the option will be assigned 100 long (for short puts) or short (for short calls) shares per contract.

- Long American style options can exercise their contract at any time.

- Long calls transfer to +100 shares of stock

- Long puts transfer to -100 shares of stock

- Short calls are assigned -100 shares of stock.

- Short puts are assigned +100 shares of stock.

- Options are typically only exercised and thus assigned when extrinsic value is very low.

- Approximately only 7% of options are exercised.

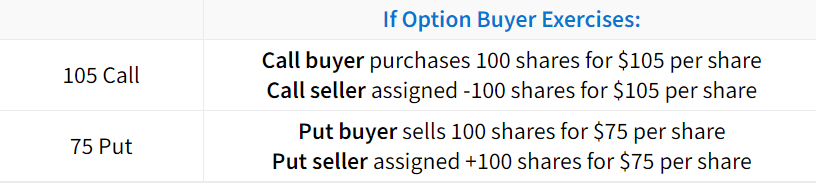

The following sequences summarize exercise and assignment for calls and puts (assuming one option contract ):

Call Buyer Exercises Option ➜ Purchases 100 shares at the call’s strike price.

Call Seller Assigned ➜ Sells/shorts 100 shares at the call’s strike price.

Put Buyer Exercises Option ➜ Sells/shorts 100 shares at the put’s strike price.

Put Seller Assigned ➜ Purchases 100 shares at the put’s strike price.

Let’s look at some specific examples to drill down on this concept.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Exercise and Assignment Examples

In the following table, we’ll examine how various options convert to stock positions for the option buyer and seller:

As you can see, exercise and assignment is pretty straightforward: when an option buyer exercises their option, they purchase (calls) or sell (puts) 100 shares of stock at the strike price . A trader who is short the assigned option is obligated to fulfill the opposite position as the option exerciser.

Automatic Exercise at Expiration

Another important thing to know about exercise and assignment is that standard in-the-money equity options are automatically exercised at expiration. So, traders may end up with stock positions by letting their options expire in-the-money.

An in-the-money option is defined as any option with at least $0.01 of intrinsic value at expiration . For example, a standard equity call option with a strike price of 100 would be automatically exercised into 100 shares of stock if the stock price is at $100.01 or higher at expiration.

What if You Don't Have Enough Available Capital?

Even if you don’t have enough capital in your account, you can still be assigned or automatically exercised into a stock position. For example, if you only have $10,000 in your account but you let one 500 call expire in-the-money, you’ll be long 100 shares of a $500 stock, which is a $50,000 position. Clearly, the $10,000 in your account isn’t enough to buy $50,000 worth of stock, even on 4:1 margin.

If you find yourself in a situation like this, your brokerage firm will come knocking almost instantaneously. In fact, your brokerage firm will close the position for you if you don’t close the position quickly enough.

Why Options are Rarely Exercised

At this point, you understand the basics of exercise and assignment. Now, let’s dive a little deeper and discuss what an option buyer forfeits when they exercise their option.

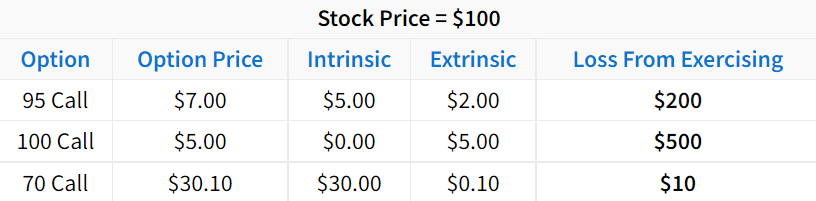

When an option is exercised, the option is converted into long or short shares of stock. However, it’s important to note that the option buyer will lose the extrinsic value of the option when they exercise the option. Because of this, options with lots of extrinsic value remaining are unlikely to be exercised. Conversely, options consisting of all intrinsic value and very little extrinsic value are more likely to be exercised.

The following table demonstrates the losses from exercising an option with various amounts of extrinsic value:

As we can see here, exercising options with lots of extrinsic value is not favorable.

Why? Consider the 95 call trading for $7. Exercising the call would result in an effective purchase price of $102 because shares are bought at $95, but $7 was paid for the right to buy shares at $95.

With an effective purchase price of $102 and the stock trading for $100, exercising the option results in a loss of $2 per share, or $200 on 100 shares.

Even if the 95 call was previously purchased for less than $7, exercising an option with $2 of extrinsic value will always result in a P/L that’s $200 lower (per contract) than the current P/L. F

or example, if the trader initially purchased the 95 call for $2, their P/L with the option at $7 would be $500 per contract. However, if the trader decided to exercise the 95 call with $2 of extrinsic value, their P/L would drop to +$300 because they just gave up $200 by exercising.

7% Of Options Are Exercised

Because of the fact that traders give up money by exercising an option with extrinsic value, most options are not exercised. In fact, according to the Options Clearing Corporation, only 7% of options were exercised in 2017 . Of course, this may not factor in all brokerage firms and customer accounts, but it still demonstrates a low exercise rate from a large sample size of trading accounts.

So, in almost all cases, it’s more beneficial to sell the long option and buy or sell shares instead of exercising. We like to call this approach a “synthetic exercise.”

Congrats! You’ve learned the basics of exercise and assignment. If you’d like to know how the exercise and assignment process actually works, continue to the next section!

Who Gets Assigned When an Option is Exercised?

With thousands of traders long and short options in the market, who actually gets assigned when one of the traders exercises their option?

In this section, we’ll run through the exercise and assignment process for options so you know how the assignment decision occurs.

If a trader is short a single option, how do they get assigned if one of a thousand other traders exercises that option?

The short answer is that the process is random. For example, if there are 5,000 traders who are long a call option and 5,000 traders who are short that call option, an account with the short option will be randomly assigned the exercise notice. The random process ensures that the option assignment system is fair

Visualizing Assignment and Exercise

The following visual describes the general process of exercise and assignment:

If you’d like, you can read the OCC’s detailed assignment procedure here (warning: it’s intense!).

Now you know how the assignment procedure works. In the final section, we’ll discuss how to quickly gauge the likelihood of early assignment on short options.

Assessing Early Option Assignment Risk

The final piece of understanding exercise and assignment is gauging the risk of early assignment on a short option.

As mentioned early, only 7% of options were exercised in 2017 (according to the OCC). So, being assigned on short options is rare, but it does happen. While a specific probability of getting assigned early can’t be determined, there are scenarios in which assignment is more or less likely.

The following scenarios summarize broad generalizations of early assignment probabilities in various scenarios:

In regards to the dividend scenario, early assignment on in-the-money short calls with less extrinsic value than the dividend is more likely because the dividend payment covers the loss from the extrinsic value when exercising the option.

All in all, the risk of being assigned early on a short option is typically very low for the reasons discussed in this guide. However, it’s likely that you will be assigned on a short option at some point while trading options (unless you don’t sell options!), but at least now you’ll be prepared!

Next Lesson

Options Trading for Beginners

Intrinsic and Extrinsic Value in Options Trading Explained

Option Greeks Explained: Delta, Gamma, Theta & Vega

Projectfinance options tutorials.

➥ Bullish Strategies

➥ Bearish Strategies

➥ Neutral Strategies

➥ Vertical Spreads Guide

☆ Options Trading for Beginners ☆

➥ Basics of Calls and Puts

➥ What is a Strike Price?

➥ Option Expiration

➥ Intrinsic and Extrinsic Value

➥ Exercise and Assignment

➥ The Bid-Ask Spread

➥ Volume and Open Interest

➥ Option Chain Explained

➥ Option Greeks 101

➥ Delta Explained

➥ Gamma Explained

➥ Theta Explained

➥ Vega Explained

➥ Implied Volatility Basics

➥ What is the VIX Index?

➥ The Expected Move

➥ Trading VIX Options

➥ Trading VIX Futures

➥ The VIX Term Structure

➥ IV Rank vs. IV Percentile

➥ Option Order Types 101

➥ Stop-Loss Orders On Options Explained

➥ Stop Limit Order in Options: Examples W/ Visuals

➥ Limit Order in Option Trading Explained w/ Visuals

➥ Market Order in Options: Don’t Throw Away Money!

➥ TIF Orders Types Explained: DAY, GTC, GTD, EXT, GTC-EXT, MOC, LOC

Additional Resources

Exercise and Assignment – CME Group

Learn About Exercise and Assignment – CME Group

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.

Our Authors

Share this post

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Quick Links

Other links.

- Terms & Conditions

- Privacy Policy

© 2024 projectfinance, All Rights Reserved.

Disclaimer: Neither projectfinance or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered investment adviser, registered broker-dealer or FINRA|SIPC|NFA-member firm. projectfinance does not provide investment or financial advice or make investment recommendations. projectfinance is not in the business of transacting trades, nor does projectfinance agree to direct your brokerage accounts or give trading advice tailored to your particular situation. Nothing contained in our content constitutes a solicitation, recommendation, promotion, or endorsement of any particular security, other investment product, transaction or investment. Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past Performance is not necessarily indicative of future results.

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Project Finance(Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

How dividends can increase options assignment risk

Most experienced investors are familiar with the adage that "if an investment opportunity sound too good to be true, it probably is." While this sentiment may often be associated with overly optimistic assumptions, it also applies to investors who sell options contracts without first considering the ex-dividend date for a stock or ETF.

How dividends work

A quick review of how dividends work: A dividend represents a payment of a company's revenues to shareholders, most often in the form of cash. Cash dividends are paid out on a per-share basis. For example, if you own 100 shares of a stock that pays a $0.50 quarterly dividend, you will receive $50.

Not all companies pay dividends, but if you're investing in options contracts for companies that do pay them, you need to keep several important dates in mind:

- Declaration date: Date on which a company announces the per-share amount of its next dividend.

- Record date: The cut-off date established by the company to determine which shareholders of its stock are eligible to receive a distribution. This is usually, but not always, 1 day after the ex-dividend date.

- Ex-Dividend date: Date on which a stock's price adjusts downward to reflect its next dividend payment. For example, if a stock pays a $0.50 dividend, the stock price will drop by a half point prior to trading on the ex-dividend date. If you buy a stock on or after the ex-dividend date, you are not entitled to the next dividend.

- Dividend (payment) date: Date shareholders receive cash in their account from a dividend.

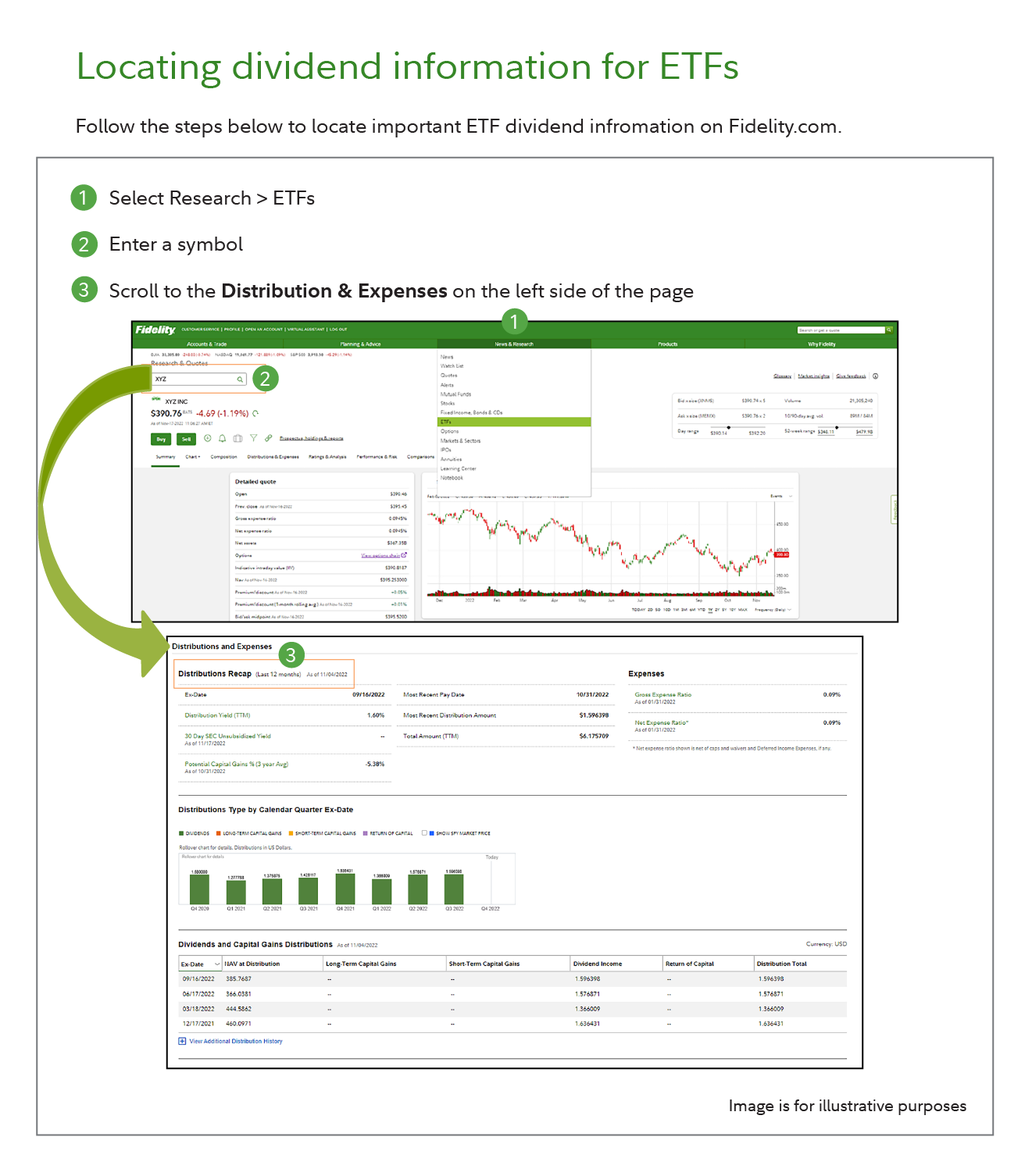

See Locating dividend information for stocks for additional details.

Dividends offer an effective way to earn income from your equity investments. However, call option holders are not entitled to regular quarterly dividends, regardless of when they purchase their options. And, unlike stock or ETF prices, options contract prices are not adjusted downward on ex-dividend dates.

This can cause a problem for anyone who has sold an options contract without first considering the impact of dividends. Why? Because the risk of being assigned on an option contract is higher when the underlying security of an in-the-money option starts trading ex-dividend. To understand the risks and how dividends impact options contracts, let's explore some potential scenarios.

Avoiding or managing early assignment on covered calls

As noted above, the ex-dividend date is particularly important to anyone who writes a covered or uncovered call option. If a covered call option you have sold is in the money and the dividend exceeds the remaining time value of the option, there is a good chance an owner of those calls will exercise his options early.

If you are assigned, you must deliver your shares of the underlying security, as well as the dividend income, to the owner of the call. Let's examine a hypothetical example to illustrate how this works.

- Bob owns 500 shares of ABC stock, which pays a quarterly $0.50 dividend.

- The stock is trading around $25 a share on August 1 when Bob decides to sell 5 October 30 calls.

- By early October, ABC stock has risen to $31 and, as a result, Bob's covered calls are in the money by $1. The calls will expire in 10 days and tomorrow the stock will start trading ex-dividend.

- Because the remaining time value of the call option is less than the value of the dividends, the call owner will likely exercise his options on the day before the ex-dividend date.

See Locating option values in Active Trader Pro ® .

If Bob does not take any action to close his covered call position, there is a good chance he will be assigned on the ex-dividend date. This means he will no longer own 500 shares of the stock and he will not receive the dividend income.

To avoid this scenario, Bob has a couple of choices:

- He could buy back the calls he sold to retain the stock and the dividend. However, he would have to do this prior to the ex-dividend date. If he waits until the ex-dividend date or later, he will not be entitled to the dividend income. Keep in mind that it's possible to get assigned prior to the day before the ex-dividend date, so this strategy is not foolproof.

- The other option is to close out his short position and write a new covered call with a later expiration date or a higher strike price. This strategy is known as "rolling" your options contract forward.

Sign up for Fidelity Viewpoints weekly email for our latest insights.

Avoiding or managing early assignment on calls not covered by shares

Now let's consider what could happen if Bob had sold uncovered calls on ABC stock:

- As in the example above, ABC stock pays a quarterly $0.50 dividend and is trading around $25 a share

- Bob has a negative view on the stock and decides to sell 5 uncovered October 30 calls

- By early October, ABC stock has risen to $31 and, as a result, his uncovered calls are in the money by $1

To make matters worse, Bob learns that tomorrow the stock will start trading ex-dividend. Because the remaining time value of the options is less than the value of the dividends, owners of these calls will likely exercise their options 1 day prior to the ex-dividend date.

To limit his exposure, Bob has several choices. He can buy back his uncovered calls at a loss, buy the stock to capture the dividend, or sit tight and hope to not be assigned. If his calls are assigned, however, he will have to pay the $250 in dividend income, in addition to covering the cost of delivering 500 shares of ABC stock. If Bob had initiated an option spread (buying and selling an equal number of options of the same class on the same underlying security but with different strike prices or expiration dates), he could also consider exercising his long option position to capture the dividend.

Other considerations and risks

If you are implementing a spread strategy that includes long contracts and short contracts, you need to remain particularly vigilant in regard to assignment risk. If both contracts are in the money and you are assigned on the short contracts, you will not be notified until the following business day. While you can exercise your long position on the ex-dividend date to eliminate the short stock position that was created, you will still owe the dividend because you were short the stock prior to the ex-dividend date.

Ways to avoid the risk of early assignment

If you are selling options (covered or uncovered), there is always the risk of being assigned if your trade moves against you. This risk is higher if the underlying security involved pays a dividend. However, there are ways to reduce the likelihood of being assigned early. These include:

- Do your homework: Know if the stock or ETF pays a dividend and when it will start trading ex-dividend

- Avoid selling options on dividend-paying stocks or ETFs when your trade includes ex-dividend

- Invest in European-style options: American-style options can be assigned at any time before the option expires, European-style options can only be exercised at expiration

See Locating dividend information for ETFs for details.

If you are a Fidelity customer and you have questions about your exposure to assignment risk, you can always contact a Fidelity representative for help.

Research options

Get new options ideas and up-to-the-minute data on options.

More to explore

Options strategy guide, 5 steps to develop an options trading plan, subscribe to fidelity viewpoints ®, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. analyzing stock fundamentals investing for beginners finding stock and sector ideas advanced trading strategies trading options stocks using technical analysis a covered call writer forgoes participation in any increase in the stock price above the call exercise price, and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. there are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. options trading entails significant risk and is not appropriate for all investors. certain complex options strategies carry additional risk. before trading options, please read characteristics and risks of standardized options . supporting documentation for any claims, if applicable, will be furnished upon request. 772967.5.0 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

What Is Assign?

Broadly speaking, to assign is to transfer the rights or property from one person or business to another. An assignment can be any transfer of any sort of rights. In the financial markets, the term "assign" generally relates to the party that is required to deliver on an options contract . In the wider business world, it may also refer to the transfer of trademarks, banknotes, or other property rights. Mortgage assignments involve transferring mortgage deeds, while lease assignments transfer lease contracts.

Key Takeaways

- To assign in the options market is to randomly match buyers and sellers for maturing or exercised options contracts.

- The assigned party is required to deliver the assets underlying the options to the contract holder at the date established by the contract.

- More generally, to assign is to transfer rights or property from one party to another.

Understanding Assign

To assign means one of two actions taken in transferring rights. It refers either to the transfer of property rights from one individual or entity to another individual or entity or when an options contract is exercised . When an options contract is exercised, the owner of the contract assigns an options writer to the obligation to fulfill the requirements of the contract.

In the options and futures contract markets, assign is the matching of counterparties. The process is random and carried out by clearinghouses and brokerages. Once the assignment is made, the underlying securities or commodities are delivered to the holders of maturing or exercised contracts.

For example, if one trader is looking to purchase a May futures corn contract and another trader is looking to sell a May futures corn contract, the clearinghouse would match the requests of both traders, assigning them the appropriate contracts. The traders themselves will not have to search for the corresponding contract but just execute their orders, which are then matched by the clearinghouse.

Not all options contracts will be exercised or tendered. The ones that are exercised or tendered must be settled with the delivery of the underlying security. These are randomly assigned to brokerages that, in turn, randomly select which of their clients will be assigned.

During an assignment of options or futures contracts, the clearinghouse assigns an option writer who will be the required buyer or seller of the underlying contract upon its exercise.

Assign and Options

Options offer the right but not the obligation to buy an underlying asset at a specific price. In the U.S. markets, options can be exercised anytime, while options in the European markets are exercised only on the option expiration date. If an option is exercised, the assignment will be made immediately.

When an option is exercised, the option writer, who is the call seller, in this case, must fulfill the obligations of the contract. The call writer could be obligated to sell a specific number of underlying securities for a specific price, for example.

Options buyers speculate on the future movements of stocks or other assets. Option buyers believe that the underlying asset will move one way, while option sellers, who are called writers, are betting that the asset moves in the opposite direction.

Brokerages and clearinghouses are needed to connect buyers and sellers of options contracts. The seller and writer of a call option will sell a set number of shares at a set price if the option is exercised. If the option is called, the brokerage assigns a client with a short position, again at random, to deliver the stock to another client with a long position in the same contract. The brokerage will randomly select the counterparty who must deliver the asset when the contract requires it to be delivered.

Assign and Property

In regards to property, assign refers to the transfer of rights. This can refer to any asset, whether tangible or intangible , property, or contract. The assignment is completed via an agreed-upon written document.

For example, a mortgage assignment is when the mortgage deed allows an individual interest in a property in return for payments received. Many banks that have mortgages sell their mortgages to other lenders in return for a lump payment in order to free up their balance sheet to make new mortgages. The bank would be assigning their mortgages to another lender.

Another form of property assignment includes wage assignments , where a court rules that a portion of a person's wages must be withheld in order to make specific payments, such as alimony .