Best graduate school loan rates in April 2024

- • Personal finance

Kim Porter is a former contributor to Bankrate, a personal finance expert who loves talking budgets, credit cards and student loans. Porter writes for publications such as U.S. News & World Report, Credit Karma and Reviewed.com. When she’s not writing or reading, you can usually find her planning a trip or training for her next race.

- • Personal loans

- • Student loans

Hannah has been editing for Bankrate since late 2022. They aim to provide the most up-to-date information to help people navigate the complexities of loans and make the best financial decisions.

Mark Kantrowitz is an expert on student financial aid, the FAFSA, scholarships, 529 plans, education tax benefits and student loans.

Bankrate's ranking for the best student loan lender for graduate school considers lender terms, interest rates and additional features to help you find a loan that is right for you.

A graduate school loan is a type of student loan specifically designed for graduate studies, including a traditional master’s degree, a Ph.D, law degree, an MBA or a medical degree. Graduate school loans are used to pay for tuition and fees, although most lenders let you use the funds for books, supplies, housing and other expenses.

Graduate school loans are a great option for people who don't have the money to pay for college out of pocket and who have exhausted scholarships, grants and other aid opportunities. If you're searching for a loan, it's generally best to start with federal loans, as they offer flexible repayment options and you may qualify for forgiveness. However, private student loans can also be a good option. Many lenders don’t charge application or origination fees and borrowers with good credit could secure lower rates than those offered by federal loans.

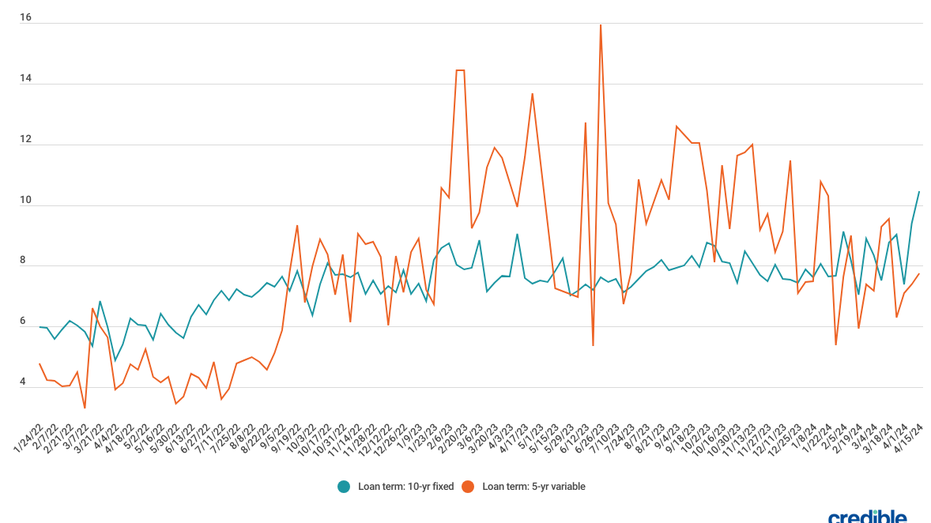

Federal student loans for graduate school in the 2023-2024 school year have an interest rate of 7.05 percent for direct unsubsidized loans and 8.05 percent for PLUS loans. Private student loans typically have rates ranging from 3 percent to 15 percent.

How to apply for a student loan

Fill out the fafsa., get prequalified with private lenders., submit an application., sign loan documents., how to choose a student loan, look at federal student loan options., compare offers from a few private lenders., consider interest rates and terms., look into unique features., on this page, the bankrate promise.

The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products. Bankrate does not endorse or recommend any companies.

- Student loan refinancing Refinance

- Private student loan Private

Secure a great loan in 3 easy steps

Answer a few questions, compare your offers, lock in your rate, the bankrate guide to choosing the best graduate student loans.

When shopping for a graduate student loan, compare APRs across multiple lenders to make sure you’re getting a competitive interest rate. Also look for lenders that keep fees to a minimum and offer repayment terms that fit your needs. Check the lenders’ websites for the most up-to-date information. The graduate student loan lenders listed here are selected based on factors such as APR, loan amounts, fees and repayment options. The methodology section at the bottom of the page has more details.

The best graduate student loan rates in April 2024

*The rates in this table are the rate ranges given for graduate student loans. The information on lenders below reflect the overall student loan rate range offered by each lender.

**The minimum amount is $2,001 except for the state of Massachusetts. Minimum loan amount for borrowers with a Massachusetts permanent address is $6,001.

Best overall

Federal Direct Unsubsidized and Subsidized Loans

on Bankrate

Pros & Cons

- Several repayment plan options.

- Forgiveness opportunities.

- One interest rate for all borrowers.

- Annual loan amount cap of $20,500.

- Loan fees for all loan disbursements.

- Not available to international or DACA students.

Eligibility & More

Best if you don’t have a co-signer.

.png?optimize=medium&width=150&format=pjpg&auto=webp)

Check rate with Credible

Why Ascent is best if you don't have a co-signer: Ascent claims that it considers factors like your school, program and GPA in addition to your credit score, so you may have a better chance of getting a lower rate without a co-signer than you would with other lenders.

- Forbearance for up to 24 months over the life of the loan.

- Extended in-school periods of up to 48 months for some loans.

- Considers factors outside of creditworthiness, such as school, program and GPA.

- High APR caps.

- Not available to students attending less than half time.

- Borrowers must have at least two years of credit history.

Best for multiyear approval

- Get approved for multiple years of funding.

- Low starting APRs.

- Loyalty discount for existing Citizens Bank customers.

- Aggregate loan limit of $150,000 to $350,000, depending on degree.

- Long co-signer release period of 36 months.

- Maximum repayment term of 15 years.

Bankrate 2024 Awards Winner: Best student loan for graduate students

College Ave

- Three-minute initial application.

- Available to borrowers enrolled less than half time.

- Several repayment options and terms.

- Forbearance limited to 12 months over the life of the loan.

- Maximum loan amount of $150,000 for some degrees.

- Limited eligibility information.

Best low APR

- Discounts for existing SoFi members.

- Member rewards.

- Vague income eligibility requirement.

- Relatively short grace period of six months.

- Maximum term length of 15 years.

What is a graduate student loan?

A graduate school loan is a type of student loan that can help pay for graduate school tuition, fees, books, housing and more. These loans often have higher borrowing limits than undergraduate student loans, since graduate school costs more. They may also have perks specific to your degree — for instance, extended deferment during a clerkship or fellowship opportunities.

Types of graduate student loans

When you need to borrow money to pay for graduate school, you have three main options: federal Direct Unsubsidized student loans, federal grad PLUS student loans and private student loans.

Federal graduate student loans

Federal student loans are backed by the U.S. Department of Education and are loaded with borrower protections and flexibility. Within this program, graduate students can choose between a Direct Unsubsidized student loan and a grad PLUS loan.

You can borrow up to $20,500 each school year with a Direct Unsubsidized student loan, with a $138,500 aggregate limit for most degrees. A grad PLUS loan allows you to borrow more — up to 100 percent of the cost of attendance. In general, it's best to maximize your unsubsidized loan options first, as interest rates are lower than those of grad PLUS loans. Additionally, you must go through a credit check for grad PLUS loans, which is not the case for Direct Unsubsidized Loans.

To apply for either of these loans, you'll have to complete the FAFSA, which opens on Oct. 1 each year. If you're applying for a grad PLUS loan, you'll also have to fill out a separate application once the FAFSA is complete. If this is your first time receiving a Direct Loan, you'll be required to complete entrance counseling.

- Flexible repayment options, including income-driven repayment plans.

- The same fixed rates for all borrowers, regardless of credit score.

- Borrower protections, including deferment and forbearance options and potential loan forgiveness.

- Relatively low loan limits for Direct Unsubsidized Loans.

- Origination fees.

- Potential for garnishment of wages or tax refunds if you default.

- Potentially higher interest rates than private lenders offer if you have excellent credit.

Private graduate student loans

Private student loans are originated by private financial institutions, such as banks, credit unions and online lenders. You have dozens of options to choose from, but each lender sets its own rates, terms and eligibility requirements. Rates are commonly anywhere from about 4 percent to 17 percent and can be fixed or variable. The exact rate you're quoted depends on your credit score and financial profile. As such, you'll have to go through a hard credit check in order to be approved for a loan.

Unlike with federal student loans, you'll generally have a range of repayment terms to choose from with private lenders, usually between five and 20 years. Private student loan lenders also often offer degree-specific loans that are tailored to the needs of law school , medical school , business school and more.

- Zero fees with many lenders.

- Lower interest rates if you have an excellent credit score.

- Choice between fixed and variable interest rates.

- High loan limits.

- No defined hardship plans.

- No income-driven repayment or forgiveness plans.

- Harder to qualify with poor credit.

FAQ about graduate student loans

Do graduate students qualify for subsidized loans.

As of July 1, 2012, graduate students are not eligible for subsidized Stafford loans. However, if you took out a subsidized loan before this time, that loan will still count toward your aggregate loan limits.

What is the average interest rate for graduate student loans?

How much can i borrow in graduate student loans.

Many private student loan lenders will let you borrow up to the full cost of attendance, minus any financial aid received. However, you may be subject to aggregate limits based on your degree program. If you're taking out a federal loan, you may borrow up to $20,500 per year in Direct Unsubsidized Loans or up to the full cost of attendance with grad PLUS loans.

Is taking out loans for graduate school worth it?

You should never take on a large amount of debt without careful consideration; student loans in particular tend to stick around for a decade or more, which can delay wealth-building and eat into your monthly budget. However, for many students, taking out loans is the only way to achieve an advanced degree and potentially open up higher-paying careers.

Ultimately, it's up to you to decide whether it's worth it to take out loans for graduate school. You can start by weighing how much you need to borrow (and what your monthly payment will be) against projected future incomes for your career path. Remember to borrow the minimum amount you need; this limits how much interest builds up and how large your monthly payments will be after graduation.

Methodology

To find the best graduate school student loans, we first compiled lenders that are reputable and have a wide reach, offering loans to students across the United States. We also considered lenders' starting interest rates to ensure that they fell below national averages.

From there, we narrowed down our list by comparing interest rate ranges, available loan amounts, required fees, repayment options, discounts and degree types covered to ensure that our picks catered to a variety of graduate students. To determine our final rankings, we selected lenders with unique features, such as a quick application process or multiyear approval.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Compare Personal Loans

The best graduate student loans for financing an advanced degree, these lenders can help grad student loan borrowers of all types..

Deciding whether or not to go to graduate school is an expensive decision to make. Graduate degree programs typically cost more than undergraduate programs, plus some students enter their grad school era already carrying student loan debt from their undergrad years.

At the same time, however, grad school can pay off. Many people pursue an advanced degree to become more specialized in their field and, ideally, earn more money in the future.

To lessen the burden that an advanced degree can have on your finances, give good consideration to how you'll pay for it. The most favorable borrowing option for graduate students is generally federal direct unsubsidized loans through the government. But because there's an annual $20,500 limit, you'll likely need to turn to grad PLUS loans or private student loans to finance the rest.

CNBC Select set out to find the best graduate school student loans from private lenders. In choosing the top ones, we focused on lenders' loan amounts, loan specializations offered, credit requirements and eligibility, as well as repayment terms, interest rates and fees. (See our methodology for more information on how we made this list.)

Best graduate student loans

- Best for instant credit decision : College Ave

- Best for multi-year financing : Citizens Bank

- Best for applying with a co-signer : Sallie Mae

- Best for applying without a co-signer : Ascent

- Best for fair credit : Earnest

- Best for a grad-level certificate : SoFi

Best for instant credit decision

College ave, eligible borrowers.

Undergraduate and graduate students, parents

Loan amounts

$1,000 minimum; maximum up to cost of attendance

Range from 5 to 20 years

Variable and fixed

Borrower protections

Deferment, forbearance and grace period options available

Co-signer required?

Only for international students

Offer student loan refinancing?

Yes - click here for details

Terms apply.

- High loan amount

- Flexible repayment terms

- Variable and fixed rates, so you can choose

- Borrowers have hardship protections

- No co-signer required for U.S. students

- Offers co-signer release

- No origination, application or prepayment fees

- 0.25% interest rate discount for autopay

- Offers student loan refinancing

- Accepts in-school payments

- Non-cosigned loans tend to charge higher interest rates

- Co-signer release can't be made until half of repayment term has passed

With College Ave , borrowers can apply within minutes and get an instant decision on their student loan so they can quickly know their next move.

[ Jump to more details ]

Best for multi-year financing

$150,000 maximum, or cost of attendance, whichever is lower

Range from 5 to 15 years

Forbearance options available

- No co-signer required

- Up to 0.50% interest rate discount for autopay

- Loan amount is limited to $150,000 maximum, or cost of attendance, whichever is lower

Instead of having to re-apply each year for grad school funding, Citizens Bank lets borrowers apply for all years in one go. This relieves the stress of worrying about how you'll pay for that next semester. (Borrowers may need to verify their continued eligibility.)

Best for applying with a co-signer

Sallie mae student loan.

Undergraduate and graduate students, borrowers seeking career training

Range from 10 to 15 years

Deferment and forbearance options available

- Doesn't offer student loan refinancing

Sallie Mae offers a co-signer release option with a relatively easy-to-meet threshold: Borrowers can apply to let go of their co-signer after they graduate, make 12 on-time principal and interest payments and meet certain credit requirements. This could be an incentive for a co-signer to sign on, knowing they don't have to be on the hook the whole loan term.

Best for applying without a co-signer

Ascent® funding.

Qualifying undergraduate juniors and seniors, graduate students

Up to $200,000 for undergraduate and $400,000 for graduate loans

- Considers borrowers with no credit

- Up to 1% interest rate discount for autopay

- 1% cash back rewards

Ascent can be a good lender to consider if you don't have access to a co-signer. Borrowers without a co-signer must meet the following requirements to get a grad school loan: either a U.S. citizen, U.S. permanent resident or someone with DACA status, an annual income of at least $24,000 and at least two years of credit history. There are minimum credit score requirements as well, but these vary. To help with your grad school funding, Ascent also offers its own graduate school scholarships .

Best for fair credit

Undergraduate and graduate students, parents, half-time students, international and DACA students

$1,000 minimum (or up to state); maximum up to cost of attendance

9-month grace period

- Applicants with fair credit can qualify

- No origination or prepayment fees

- Allows qualified borrowers to skip one payment every 12 months and make it up later

- No co-signer release option available

- Variable rates not available everywhere

Actual rate and available repayment terms will vary based on your income. Fixed rates range from 5.19% APR to 9.74% APR (excludes 0.25% Auto Pay discount). Variable rates range from 5.99% APR to 9.74% APR (excludes 0.25% Auto Pay discount). Earnest variable interest rate student loan refinance loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once per month. The maximum rate for your loan is 9.99% if your loan term is 10 years or less. For loan terms of more than 10 years to 15 years, the interest rate will never exceed 9.95%. For loan terms over 15 years, the interest rate will never exceed 11.95%. Please note, we are not able to offer variable rate loans in AK, IL, MN, NH, OH, TN, and TX. Our lowest rates are only available for our most credit qualified borrowers and contain our .25% auto pay discount from a checking or savings account.

Those with fair credit should look to private lender Earnest to help finance their graduate degree. Earnest allows borrowers — or their co-signers — with a minimum FICO® Score of 650 to apply. Earnest also stands out for offering a Rate Match Guarantee where the lender will match a competing lender's rate, plus give a $100 Amazon gift card upon rate match confirmation.

Best for a grad-level certificate

Undergraduate and graduate students, parents, health professionals

$5,000 minimum (or up to state); maximum up to cost of attendance

Range from 5 to 15 years; up to 20 years for refinancing loans

Offer parent loan?

- 0.125% interest rate discount on any additional SoFi lending product

- Loan size minimum of $5,000

It can be harder to find financing for those seeking just a graduate certificate instead of a full-on graduate degree since not all graduate certificate programs qualify for federal aid. However, SoFi provides lending to eligible borrowers in graduate-level certificate programs, as well as to half-time graduate students (which not many private lenders accommodate).

More on our top graduate school student loans

College Ave offers competitive interest rates, plus no application, origination or prepayment fees. Borrowers can choose a fixed or variable rate and there's a 0.25% rate discount when signing up for autopay. College Ave also offers hardship protections like deferment, forbearance and grace period options. Borrowers with College Ave student loans can start repaying while still in school.

In addition to a generic graduate student loan, College Ave offers financing for those pursuing degrees in the following programs: dental, law, medical, MBA and health professions.

Eligible loans

Undergraduate and graduate loans, parent loans

5, 8, 10, 15 years; graduate loans up to 20 years

[ Return to account summary ]

Citizens Bank

Citizens Bank is a big bank that offers competitive student loan rates, plus no application, origination or prepayment fees. Citizens Bank also offers hardship protections like forbearance, and student loan borrowers can start repaying while still in school.

Citizens Bank provides loans for master's degrees, MBAs, law school, medical school and dental school.

5, 10, 15 years

Sallie Mae has interest rates that are competitive with other private lenders, and they can be variable or fixed. Borrowers can score a 0.25% autopay rate discount and take advantage of no origination, application or prepayment fees. Borrower protections include deferment and forbearance. Sallie Mae lets its borrowers start repaying their loans while still in school.

Sallie Mae offers general graduate school loans (for master's or doctoral degrees), MBA loans, medical school and medical residency loans, health professions loans, dental school and dental residency loans, law school and bar study loans.

Undergraduate and graduate loans

10, 15 years

Ascent borrowers can choose between a fixed or a variable rate, and there's an up to 1% interest rate discount for autopay. There are no fees for paying off your loan early, as well as no origination or application fee. Ascent also offers rewards like 1% cash back on principal loan amounts at graduation. There are also deferment and forbearance options available to borrowers. Ascent student loan borrowers can start making their payments while in school.

Ascent offers the following graduate school loan options: MBA loans, medical school loans, dental school loans, law school loans, doctorate and master's loans, plus health professional loans.

$2,001 minimum; maximum up to $200,000 for undergraduate loans and up to $400,000 for graduate loans

5, 7, 10, 12, 15, 20 years

With Earnest , there are competitive interest rates and the option to choose between variable or fixed. Borrowers will also get a 0.25% autopay rate discount. There are no origination fees or prepayment penalties. Borrower protections include a 9-month grace period and borrowers can make payments while in school.

Earnest offers general graduate student loans, MBA loans, medical school loans and law school loans.

Undergraduate and graduate loans, parent loans, international and DACA student loans

5, 7, 10, 12, 15 years

SoFi offers solid interest rates, both fixed and variable, as well as a 0.25% autopay rate discount. There are no application or origination fees and no prepayment penalties. Borrowers can get unemployment protection and other forbearance options, plus make student loan payments while still in school.

SoFi offers general graduate school loans, law school loans, MBA loans and health professions loans. As a SoFi student loan borrower, you'll get exclusive member benefits like premium travel offers, personalized career advice, financial planning from real-life advisors and more.

5, 7, 10, 15 years; refinancing loans up to 20 years

Compare offers to find the best personal loan

Types of graduate school loans.

Graduate student loans consist of both federal and private loans. Under the federal student loan umbrella, there are federal direct unsubsidized loans and grad PLUS loans. (Unlike undergraduate borrowers, graduate borrowers can't access federal direct subsidized loans.)

Federal direct unsubsidized loans are low-interest, fixed loans that don't have any credit requirements and come with federal benefits like income-driven repayment (IDR) plans and loan forgiveness programs. Borrowers can only borrow up to $20,500 per year, however.

To finance the rest of grad school after reaching this limit, borrowers can either turn to the other federal loan option, grad PLUS loans or private student loans.

Grad PLUS loans and private student loans both require a credit check but should be weighed against one another. PLUS loans come with federal borrower protections but charge a loan origination fee. Meanwhile, many private lenders offer zero origination fees and lower interest rates for those with good credit. Plus, private lenders tend to have loans for specialized programs such as law school, medical school, dental school, residencies, MBAs or certain health professions, as well as general graduate loans for those pursuing a master's or doctoral degree.

What kind of loan is best for graduate school?

The loan that's best for graduate school is a federal student loan from the government, also known as federal direct unsubsidized loans. Note that grad students can't get access to subsidized loans like undergraduate students can. Federal direct unsubsidized loans have low, fixed interest rates and come with all the typical federal benefits like income-driven repayment (IDR) plans and loan forgiveness programs. Borrowers aren't required to meet any credit requirements like they have to with private student loans.

What is a good interest rate for grad school loans?

A good interest rate for grad school loans is in line with the current rate on federal direct unsubsidized loans for graduate students, which, at the time of this writing, is 7.05% .

How can I get the best student loans for graduate school?

To get the best student loans for graduate school, start by filling out and submitting the FAFSA ® form (Free Application for Federal Student Aid) to see what federal aid you qualify for. This type of aid can include federal student loans, scholarships, grants and work-study. After you exhaust all federal aid — and any college savings you have — then move on to a private lender on this list to fill in any financial gaps.

What is the maximum federal loan for graduate school?

The maximum federal loan for graduate school is up to $20,500 per year (unsubsidized only).

Bottom line

The best graduate school student loans are federal direct unsubsidized loans from the government. But because they have a funding limit of up to $20,500 per year, to fill in the remaining gap consider the private student loan lenders on this list.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every student loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of student loan products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best graduate school student loans.

Our methodology

To determine the best graduate school student loans, CNBC Select analyzed and compared private student loan funding from national banks, credit unions and online lenders. We narrowed down our ranking by only considering those that offer competitive student loan rates and prequalification tools that don't hurt borrowers' credit.

While the companies we chose in this article consistently rank as having some of the market's lower interest rates, we also compared each company on the following features:

- Broad availability: All of the companies on our list offer undergraduate and graduate private student loans, and they all offer variable and fixed interest rates to choose from

- Flexible loan terms: Each company provides a variety of financing options that borrowers can customize based on their monthly budget and how long they need to pay back their student loan. Each company also allows borrowers to start repaying their student loans while still in school, ultimately saving them money

- No origination or signup fee: None of the companies on our list charge borrowers an upfront "origination fee" for taking out their loan

- No early payoff penalties: The companies on our list do not charge borrowers prepayment penalties for paying off loans early

- Streamlined application process: We made sure companies offered a fast online application process

- Autopay discounts: All of the companies listed offer an autopay interest rate discount

- Private student loan protections: Each company on our list offers some type of financial hardship protection for borrowers

- Loan sizes: The above companies offer private student loans in an array of sizes, all the way up to the cost of college attendance. Each company advertises its respective loan sizes, and completing a preapproval process can give borrowers an idea of what their interest rate and monthly payment would be

- Credit requirements/eligibility: We took into consideration the minimum credit scores and income levels required if this information was available

- Customer support: Every company on our list provides customer service available via telephone, email or secure online messaging. We also opted for lenders with an online resource hub or advice center to help borrowers educate themselves about student loans in general

After reviewing the above features, we sorted our recommendations by best for instant credit decision, best for multi-year financing, best for applying with a co-signer, best for applying without a co-signer, best for fair credit and best for a grad-level certificate.

Note that the rates and fee structures for private student loans are not guaranteed forever; they are subject to change without notice and they often fluctuate in accordance with the Fed rate. Choosing a fixed-rate APR will guarantee that one's interest rate and monthly payment will remain consistent throughout the entire term of the loan.

A borrower's interest rate depends on their credit score, income, debt-to-income (DTI) ratio, savings, payment history and overall financial health. To take out private student loans, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

- AIG Travel Guard insurance review: What you need to know Ana Staples

Shop for Car Insurance

Other Insurance Products

Types of mortgages

Calculators

Find & Compare Credit Cards

Cards with Rewards

Cards for a Purpose

Cards for Building Credit

Credit Card Reviews

Understanding Credit & Score

Student Loans

Paying for College

Personal Finance for College Students

Life Events

Best Student Loans for Graduate School in January 2024

MoneyGeek’s study found that the best student loan for graduate school is from Ascent, thanks to its flexible terms and zero fees. Discover more graduate student loan options and explore their pros and cons.

Updated: January 3, 2024

Advertising & Editorial Disclosure

- Grad School Loan Tips

- Graduate Student Loan FAQs

Methodology

A postgraduate degree can help you further your career — but for many students, it can be an investment that requires the help of graduate student loans.

Thanks to their range of benefits, federal student loans are the primary option, but they may not cover the total cost of graduate school. After federal options are exhausted, a private student loan for graduate school can help make up the difference. You can use a private loan to help pay for graduate studies, whether a master’s degree or a Ph.D.

MoneyGeek analyzed the best student loans for graduate school by looking at more than 35 data points in six categories: affordability, accessibility, user-friendliness, customer service, flexibility and transparency.

Ascent Review

Sofi review, discover review, sallie mae review, how to find the right graduate student loan, frequently asked questions about graduate student loans.

Best for students who want flexible repayment terms and quick co-signer release terms.

- 4.36%–14.08% Fixed APR Range

- 1.47%–11.31% Variable APR Range

- $2,001–$200,000 Loan Amount Range

- Non-U.S. citizens and temporary residents Co-signer

WHY WE GEEK OUT

Ascent aims to support student learning through its range of private student loans for undergraduate and graduate students — with or without co-signers. Thanks to its wide range of benefits, MoneyGeek ranks Ascent as the best student loan for graduate school. Students can get flexible repayment options and terms, with payments that you can postpone up to nine months after graduation. Additionally, co-signers can get released after 12 months of consecutive on-time payments.

However, while Ascent has its benefits, it also has some drawbacks. For instance, students who opt for non-co-signed loans may be subject to a minimum income requirement. Ascent may also not cover your school, as there is a list of schools that the provider works with.

PROS & CONS

- Grace period of up to nine months after graduation

- Flexible repayment options and terms

- Co-signer release after 12 months of consecutive on-time payments

- Specific loans based on what you’re pursuing (MBA, medical, etc.)

- No application, origination, disbursement or prepayment penalty fees

- Minimum income requirement for non-co-signed loans

- Not all colleges and institutions may work with Ascent

- Maximum fixed APR is at a whopping 16.24%

Best for students who need to fund the total cost of their education through private loans.

- 3.22%–11.16% Fixed APR Range

- 1.10%–11.68% Variable APR Range

- $5,000 minimum, no maximum Loan Amount Range

- Optional Co-signer

As a leader in providing affordable and accessible financing options to students since 2011, SoFi offers flexible terms and an easy application process to graduate students who need to finance their education. This is proven through the company’s no-fee loans and discount opportunities not often available from other lenders. Ascent also offers an Unemployment Protection program, which puts your loan in forbearance if you are eligible.

While Ascent is a good choice thanks to its flexibility and money-saving opportunities, graduate students may find that some of the discounts are difficult to qualify for. Additionally, Ascent may take up to four to six weeks to disburse your funds.

- No fees of any kind

- Multiple discount opportunities

- Unemployment protection

- Flexible repayment and terms

- Offers career services

- Not all schools are eligible

- Funds may take four to six weeks to be disbursed

- Discounts may be hard to qualify for

Best for those who want to maximize loan discounts.

- 3.99%–11.59% Fixed APR Range

- 1.79%–11.09% Variable APR Range

- $1,000 up to 100% of college expenses Loan Amount Range

Discover Student Loans, provided by Discover Bank, offers loans to students at colleges and graduate schools across the country, covering up to 100% of school-certified costs. Graduate students can take advantage of the company’s various benefits, such as cash rewards for good grades, interest rate reduction for automatic payments or interest-only loans, zero fees and 24/7 support.

However, Discover may not be for everyone. The lender requires that students be enrolled at least half-time and demonstrate satisfactory academic progress (SAP) to qualify. Discover’s variable APR for graduate student loans also caps at a whopping 16.72%. This is higher than other lenders and is not ideal for students with no co-signer or credit history.

- No application, origination, prepayment or late payment fees

- 0.25% reduction in interest rate for automatic payments

- Get rewards for good grades

- Offers in-school or deferred repayment options

- 0.35% interest rate discount

- Students must be enrolled half-time to qualify

- Satisfactory academic progress (SAP) is required for eligibility

- High variable APR maximum of 16.72%

Best for students enrolled less than half time.

- 3.50%–13.83% Fixed APR Range

- 1.37%–11.76% Variable APR Range

- $1,000 minimum, no maximum Loan Amount Range

- Allowed but not required Co-signer

Since its inception in 1972 as a public banking corporation, Sallie Mae has become a prominent source of private student loans. It’s a great option for students enrolled less than half-time, as most lenders require at least half-time enrollment to qualify.

Apart from its unique eligibility requirements, you can defer Sallie Mae’s graduate student loans for up to 48 months during an internship or fellowship, or six months after graduation. There are no prepayment penalties or origination fees and you have the option to release any co-signers after 12 months straight of on-time payments. However, interest rates can be high depending on your creditworthiness, as Sallie Mae’s maximum variable APR can reach 15.47%.

- Get up to 48 months of deferment during internship or fellowship

- No origination or prepayment penalties fees

- Loans available to less than half-time students

- Co-signer release after 12 months of on-time consecutive payments

- Discounts for interest repayment option

- Lowest interest rate is only offered to interest repayment plans and creditworthy applicants

- No prequalification

- Charges late fees

Since graduate school is a significant investment, finding the right graduate student loan provider is essential. Exploring your options and comparing lenders will help you find the most favorable loan terms.

- Determine the amount you need: Calculate the amount of money you need to cover the costs of your program. Understanding how much you need to cover graduate school, particularly after you exhaust federal student loans , can help you evaluate lenders’ limits.

- See eligibility requirements: Before pre-qualifying with providers or looking at other details, it’s important to narrow down your choices based on eligibility requirements. See if you or your co-signer meets your desired providers’ qualifications.

- Compare providers: Once you’ve identified the providers you qualify for, compare them by prequalifying to see their interest rates and terms. Note that these offers are not official and terms may change once you apply, but they can give a good idea of what you might get.

- Choose a provider and send in your application: After choosing a provider, find out its application process . You can often find this on its website or you can call the lender to talk to an agent.

- Receive funds and start making payments: If your graduate student loan gets approved, wait to receive your funds. The money is usually sent directly to your school, with any leftovers sent to you after all tuition and fees are paid. Make a plan for payment depending on your repayment terms.

Getting a private student loan for graduate school can help fill any gaps that a federal loan can’t meet — but understanding the ins and outs is essential before you apply. Discover more about graduate student loans through MoneyGeek’s frequently asked questions.

Are subsidized loans available to graduate students?

Direct Subsidized Loans are only available to undergraduate students.

How much graduate student loans should I borrow?

It depends on how much you need. You should first exhaust any federal options you have, then use private graduate student loans to fill in any gaps. For instance, if you don’t get enough federal student loans to pay for your books or other miscellaneous program fees, a private student loan may help.

How are graduate PLUS loans different from other federal student loans?

Graduate PLUS loans allow you to borrow up to the total cost of attendance, while other options such as the Direct Unsubsidized Loan only allow you to borrow up to a limit of $20,500 per year.

Are graduate loans included in loan forgiveness?

Private graduate student loans cannot be forgiven, but if you get a federal graduate loan, you may be eligible for forgiveness if you meet certain conditions.

What can graduate student loans be used for?

Student loans for graduate school can be used for any education-related purpose. This not only includes your tuition and other fees, but it can also include the cost of transportation to school, books, housing and more.

How are interest rates on a graduate student loan determined?

Most loans — student loans included — are based on creditworthiness. If you have a co-signer, their credit will impact your interest rate and terms, but your credit will be considered if you don't. However, if you use outcomes-based loans, your interest may depend on the lender’s criteria.

How do I pay off my graduate student loans?

The best repayment plan for you will depend on your circumstances. Most lenders will allow you to defer all payments until after graduation, but you can also choose to pay interest during enrollment or start making payments immediately after getting the loan.

How long does it take to pay off graduate student loans?

It depends on the terms you’ve set with your lender. Repayment can last anywhere from five years up to 20 years, depending on the lender and your financial circumstances.

Is graduate school worth the debt?

Whether graduate school is worth it for you depends on your personal goals and financial circumstances. If your financial situation isn’t ideal, like if you carry a lot of debt or you’re struggling with bills at home, then getting into more debt for graduate school may not be the best idea.

Should I take out a graduate student loan from a private lender?

Getting a federal student loan to pay for graduate school should be your first priority. Once you’ve exhausted federal options, you may want to consider applying for a private student loan.

We reviewed more than 30 private student loan lenders using 35+ individual data points across six key categories: loan affordability, accessibility, consumer friendliness, customer service, flexibility and lender transparency.

Within each ranking criteria category, we considered several individual data points that we feel carry the most weight when choosing a private student loan lender. These factors include APR ranges, available loan amount, minimum credit score, minimum income amount, application fees and disbursement time.

With the consumer in mind, we also factor in each lender’s customer support, business ratings and additional features that could make your experience easier and more accessible — like pre-qualification, payment options and mobile apps.

- Ascent . " Graduate Student Loans ." Accessed February 14, 2023 .

- SoFi . " Graduate Loans ." Accessed February 14, 2023 .

- Discover . " Graduate Student Loans ." Accessed February 14, 2023 .

- Sallie Mae . " Sallie Mae® Graduate School Loan ." Accessed February 14, 2023 .

- Federal Student Aid . " Direct PLUS Loans are federal loans that graduate or professional students can use to help pay for college or career school. ." Accessed February 14, 2023 .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Financial Aid for Graduate School: Who Qualifies and How to Apply

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Key takeaways

Financial aid for graduate school includes grants, scholarships, fellowships, assistantships and loans.

Exhaust all opportunities for free aid before considering student loans.

If you take out student loans, borrow federal direct loans first. For additional funding, compare offers between federal PLUS loans and private loans to see where you’ll get the best deal.

If you’re considering graduate school, make sure you have a funding plan in place ahead of time. Costs for graduate school can vary greatly depending on the type and length of the program, but there are opportunities to help cut down out-of-pocket costs.

Graduate students can get financial aid through:

FAFSA: The Free Application for Federal Student Aid provides access to federal, state and some school-based grants.

Organization grants: Industry-specific organizations may provide grants to those studying in relevant fields.

Scholarships: State governments, schools and private organizations may provide scholarships for academic excellence or other factors, like studying in high-needs fields or increasing diversity.

Fellowships: Schools, private organizations and government entities offer fellowships based on field of study and academic performance in exchange for research activities.

Assistantships: Schools may award living stipends and tuition waivers to full-time students in exchange for work.

Employer tuition assistance: Employers may offer to reimburse their employees’ tuition expenses as an employment benefit.

Here’s who qualifies and how to apply for each type of aid.

» MORE: How to pay for grad school: 5 strategies for students

Student loans from our partners

on Sallie Mae

4.5% - 15.49%

Mid-600's

on College Ave

College Ave

4.07% - 15.48%

4.09% - 15.66%

Low-Mid 600s

12.9% - 14.89%

13.74% - 15.01%

5.24% - 9.99%

5.49% - 12.18%

on Splash Financial

Splash Financial

6.64% - 8.95%

4.07% - 14.49%

5.09% - 14.76%

4.11% - 14.3%

6.5% - 14.83%

Complete the Free Application for Federal Student Aid, or FAFSA , as your first step to funding your graduate education. Citizens and eligible non-citizen graduate students, including permanent residents and U.S. nationals, are eligible to file.

You must file the FAFSA to qualify for federal and state-based grant awards. Many school-based grants also require the FAFSA.

Federal grants for graduate students include the Teacher Education Assistance for College and Higher Education, or TEACH, grant. The TEACH grant provides up to $4,000 a year to education students who will teach in a low-income school or high-needs field after graduation.

Contact the department of education for your state and your school’s state to learn more about state-based grant opportunities.

Contact your school’s financial aid office to learn more about school-based grants and ask your department head about industry-specific grants.

» MORE: Guide to grants for college

Scholarships

Scholarships are available at the state, local and school levels. These awards are based on various eligibility criteria, which can include field of study and academic achievement. Some scholarships are also need-based or allocated only for certain demographics.

Apply for as many scholarships as you qualify for to increase your chances of getting the most money.

Check the Department of Labor’s Scholarship Finder or National Association of Student Financial Aid Administrators’ state-based scholarship search tool to find programs.

Contact your school’s financial aid office and department head about specific scholarship programs you may be eligible for.

» MORE: How to get a scholarship

Fellowships and assistantships

Eligibility requirements and service commitments for fellowship and assistantship programs vary. While fellowships are offered by schools, private organizations or government agencies, assistantships typically only come from the school.

With a fellowship, you may perform research activities outside of your school and payment may not be directly tied to tuition. As assistantships are generally school-based, they are more likely to directly provide full or partial tuition waivers. Some assistantships also come with living stipends .

Contact your financial aid office about school-based fellowships and assistantships, including teaching and resident assistantships. Search the zintellect database, which has ties to the Department of Education and a consortium of Ph.D.-granting institutions, for government and private-sector fellowships.

» MORE: Is a masters degree worth it?

Employer tuition assistance

According to a 2020 survey by the Society for Human Resource Management, or SHRM, about 47% of employers offer tuition assistance as part of their benefits package. This benefit can be in the form of tuition reimbursement, where the employer gives a lump sum to employees after they prove their tuition expenses. Other companies may pay tuition costs directly to the school, so the employee doesn't have to front the bill.

The amount of reimbursement varies by employer. The most common benefit ranges from $5,000-$5,999, according to a 2019 report by the International Foundation of Employee Benefit Plans.

Contact your human resources team to ask about your company’s tuition assistance benefit. Make sure to verify that graduate school tuition qualifies. You also want to get an understanding of any service commitments that come with accepting the benefit. Some employers require you to stay with the company for a certain period after the reimbursement funds are disbursed.

If you exhaust all of your opportunities for aid that doesn’t have to be repaid, look to student loans to fill the remaining funding gaps for graduate school. Schools may include student loans as part of your aid package, but you have to repay them.

Filing the FAFSA typically qualifies you for direct unsubsidized federal student loans. As a graduate student, you can borrow up to $20,500 each year. These loans will accrue interest while you are in school, but typically come with lower interest rates than their private loan counterparts. They also offer repayment options that private student loans don’t, like income-driven repayment .

» MORE: Government student loans: What are the benefits?

If you still need more funding, compare offers between the Grad PLUS loan from the federal government and options available with private student loan companies .

Unlike other federal student loans, PLUS loans require a hard credit check and may come with a higher rate than you can get with a private lender. But if you think you’ll need the protections of federal student loans, they’re still a better option.

On a similar note...

Student Loans

Student loans are commonly used financing options that are available to both residential and part-time online applicants, and require a minimum enrollment of 6 credits per term in a degree-granting program. Please note these pages provide information about both federal and supplemental (private) student loans, credit, and debt counseling. Some links will take you to sites outside of the HGSE Financial Aid Office. The HGSE Financial Aid Office is not responsible for the content of any external sites.

The Harvard Graduate School of Education, like all of Harvard University, participates in the Federal Direct Loan Program offered through the U.S. Department of Education. The only lender we list is Direct Lending, however you are free to research and borrow from any lender.

When considering a supplemental loan, we remind students there are many options in addition to those listed in these materials. We encourage students to consider all of their borrowing options to ensure the best possible choice for their individual needs. Remember, only Federal Direct Unsubsidized and Graduate PLUS Loans are administered by the HGSE Financial Aid Office; supplemental loans are available from numerous lenders and you are welcome to explore those that interest you. Both Federal and supplemental loans are split and disbursed evenly across semesters for full-year students. Harvard University and the Harvard Graduate School of Education have no financial interest in which supplemental loan you choose to borrow.

Federal Direct Loans

- Federal Direct Loan Program and Related Information

- Federal Student Aid (FSA) Loan Repayment Simulator - learn about your repayment options using this FSA resource.

- Federal Student Aid Loan Information

Federal Direct Graduate PLUS & Supplemental Loans

Supplemental loans, like the Direct Graduate PLUS Loan, can be borrowed in addition to your Federal Loans to help meet the cost of education. Please note: students pursuing a supplemental loan should apply for the amount they wish to borrow for the entire academic year, and all supplemental loans are split and disbursed evenly across semesters for full-year students.

- Supplemental Education Loan Programs

Loan and Financial Management Information

- Federal Student Aid - You can find information on all Federal Aid programs and loan repayment resources here.

- MyMoney.gov - The U.S. Government's site dedicated to teaching financial literacy

- Consumer Financial Protection Bureau - This site presents information and assistance on a range of consumer financial products, including student loans.

- Student Loan Borrower Assistance - This is a comprehensive and very useful website that covers almost all the basics regarding past, present, or future student loans of all varieties.

Understanding Your Credit

Applicants must demonstrate credit worthiness in order to be eligible for supplemental education loans such as the Federal Direct Grad PLUS Loan or loans from private lenders. Supplemental education loan lenders carefully review an applicant's credit history to determine their eligibility for a loan.

Individuals establish a credit history in many ways, like borrowing money or charging retail purchases. Financial institutions and major retail stores report their customer's credit information to national credit bureaus, which, in turn, compile the information in the form of a credit report. A credit report is a record of every credit card, retail account, student and personal loan, and other credit accounts made or established in your name.

In reviewing your credit report, the lender is trying to determine your ability and willingness to pay based on your payment history. A good credit record indicates that you are likely to repay the loan for which you are applying. If you are unsure about the status of your credit, you should request a copy of your credit report from a credit bureau. You may contact a local credit bureau in your area or one of the three national credit bureaus listed below:

Equifax : 800-685-1111

Experian : 800-682-7654

TransUnion : 877-322-8228

You may also receive a free copy of your credit report from all 3 major credit bureaus listed above by visiting www.annualcreditreport.com , and we recommend reviewing your credit reports on an annual basis.

Once you have received your credit report check it for accuracy. If the information on your report is incorrect, you should contact the credit agency and request that the information be investigated. It is also advisable to contact the company that has reported you to that credit agency. If the information on your report is correct and you do have credit problems, it is imperative that you try to resolve these as soon as possible. Contact the company that has reported you to the credit agency and discuss the steps necessary to clear up your credit problem. If you do succeed in clearing up your credit, you should request this in writing from the reporting company and subsequently submit this information to the credit agency.

It may take several weeks to receive a credit report and several months to correct a credit problem, thus please plan accordingly. In the event that you may need to borrow through one of the alternative education loan programs, we encourage you to remedy any credit issues prior to coming to campus. Any questions or concerns that you may have regarding your credit worthiness should be addressed directly with the appropriate private education loan agency. Unfortunately, the HGSE Financial Aid Office is unable to assist you with personal credit problems or offer advice on the credit review process.

Debt Management Tools

Debt management is an important consideration when attending any college or university. You must properly prepare yourself financially in the near and long term. It is crucial that students have an understanding of the costs of education as well as how to plan and budget accordingly. We encourage students to begin this process as far in advance as possible when considering continuing their education to ensure the highest possible return on their academic investments.

- Federal Student Aid Loan Repayment Calculator

- Your Federal Student Loans: Learn the Basics and Manage Your Debt

- MyMoney.gov - the U.S. Government's site dedicated to teaching financial literacy

- Consumer Financial Protection Bureau

- Bankrate.com - interest rates for a variety of financial products and payment calculators

- Annual Credit Report - receive your free annual credit report from the 3 major credit bureaus

- IRS Tax Benefits for Education - find out what rules may benefit you when filing your U.S. taxes

- Student Loan Borrower Assistance - a comprehensive and very useful website that covers almost all the basics regarding past, present or future student loans of all varieties

- PhD Loans – 2023 Guide for Doctoral Students

- Funding a PhD

- A PhD Loan can fund a PhD in any field lasting between three to eight years .

- You can borrow up to £28,673 for courses that started on or after 1st August 2023.

- There are several eligibility restrictions, including that you must be a UK national resident and not receiving other funding (e.g. from Research Council or NHS).

- The repayments will be 6% of your annual income above £21,000 .

What Is a PhD Loan?

A PhD loan is a form of UK Government loan made available to doctoral students residing in England or Wales. It is designed to help students fund their doctoral programme or equivalent degree, covering basic costs such as the tuition course fees and living costs.

The most common degrees they cover are:

- PhD – Doctor of Philosophy

- EngD – Doctor of Engineering

- EdD – Doctor of Education

Note: PhD Loans are formally known as Postgraduate Doctoral Loans, however, many postgraduate students commonly refer to Doctoral Loans as PhD Loans due to their primary use to fund PhDs.

Am I Eligible for a PhD Loan?

There are several requirements you must meet to be an eligible student for a PhD loan, such as your residency status. The eligibility criteria are summarised below into two categories – those that make you eligible and those that make you ineligible for a PhD loan.

Requirements That Make You Eligible:

- Be a UK or Irish citizen or have settled or pre-settled status under the EU Settlement Scheme , and ordinarily a resident of England or Wales.

- Be under the age of 60.

- Undertake a PhD (or another doctoral degree) that is three to eight years long and provided by a university in the UK.

Note: A common misunderstanding amongst university students is that a Doctoral Loan can fund an MPhil degree. As an MPhil is a Master’s degree, it does not meet the ‘Doctoral or equivalent’ requirement for being eligible for a Doctoral Loan. Therefore, if you are considering undertaking an MPhil, you should instead be applying for a Postgraduate Master’s Loan. If more appropriate for your situation, you can find out more information about Postgraduate Loans here .

Requirements That Make You Ineligible:

You must not:

- Already hold a PhD or equivalent doctoral degree.

- Already be receiving funding. This includes grants from the Research Council (studentships, stipends & scholarships etc.), a social work bursary or NHS bursary (note that being eligible for an NHS Bursary even if you’re not receiving one will make you ineligible for a PhD loan).

- Already have had a Doctoral Loan before, unless you left your course due to illness, bereavement or another serious personal reason. You are still eligible if you have received an undergraduate loan in previous study.

- Obtain your PhD through publication (as this won’t have a period of study associated with it)

Aspects That Don’t Affect Your Eligibility:

There are several aspects of your PhD course that do not affect your eligibility to receiving Doctoral Loans. These are:

- Your doctoral course – your PhD can be in any subject or field. The underlying requirement is that it is provided by a university in the UK; i.e. a university in either England, Wales, Scotland or Northern Ireland.

- Full-time or part-time course – you need not pursue your PhD full-time to be eligible. The underlying requirement is that your PhD can be completed within eight years regardless of how you allocate your time.

- Taught, research-based or a combination of both – as long as your PhD has an aspect of studying associated with it, the method of obtainment of your PhD will not affect your eligibility.

How Much Funding Can I Get?

The amount of funding you can obtain isn’t means-tested. This means that it isn’t related to your financial background or household income and therefore you can qualify for the full amount regardless of your situation.

The maximum loan amount you can borrow falls into one of three categories:

- Up to £28,673 if your course starts on or after 1st August 2023 ,

- Up to £27,892 if your course started between 1st August 2022 and 31st July 2023 ,

- Up to £27,265 if your course started between 1st August 2021 and 31 July 2022 .

You may apply for a Postgraduate Doctoral Loan in any year of study, however you may not receive the maximum amount if you apply after the first year of your PhD. For annual costs, you may receive:

- Up to £12,167 per year if your course starts on or after 1st August 2023 ,

- Up to £11,836 per year if your course started between 1st August 2022 and 31st July 2023 ,

- Up to £11,570 per year if your course started between 1st August 2021 and 31 July 2022 .

When Will I Get Paid?

Your loan payments will be spread out across all academic years of your course.

Example: If you undertake a full-time PhD over 5 years and apply for a loan amount of £25,000, you will receive £5,000 in each academic year.

Further to this, the allocation for each academic year will be paid in three even instalments, with each instalment paid at the start of a new term.

Example: Continuing with the above example, the £5,000 per each academic year would be paid in three instalments of £1,667.

Your first instalment will typically be paid immediately after your course start date. This is because your university will first need to confirm to Student Finance England (SFE) or Student Finance Wales that you’ve officially enrolled with them before the student loan can be released to you.

How and When Do I Repay?

Repayment terms – You will need to start repaying your loan once you have completed your PhD and started earning an annual income over £21,000 .

Once both these conditions are met, you will start making your repayments at 6% of your income above £21,000 . This means that for the first £21,000 you earn, you won’t need to make any contributions towards your loan repayment, however, anything above £21,000 will be subject to a 6% deduction for repayment towards your student loan.

It’s worth noting that if you work for an employer after your PhD, your repayments will be automatically deducted from your salary and there isn’t anything you will directly need to do. However, if you decide to work for yourself as opposed for an employer, you will need to make the repayments yourself.

Like undergraduate loans taken for undergraduate degrees, a postgraduate Doctoral Loan is subject to interest, which will need to be paid on top of your original student loan value. The interest rate is the retail price index (RPI) plus 3%.

Example: The average UK RPI for 2019 was approximately 2.4%. This means that besides the mandatory 3% that is owed, the average interest rate on a Doctoral Loan in 2019 would have been 5.4%.

It’s worth noting that if you aren’t able to completely repay your postgraduate loan within 30 years from the date of your first payment, the remaining loan debt will be voided.

How Do I Apply?

You can apply in one of two ways – either online , by setting up an account on Student Finance England’s website, or by post , by filling in a printable form on GOV.UK ‘s website. Click the respective below to be taken directly to their websites where you can find out more. Note that you will only have to apply once for Postgraduate Doctoral Loans; Student Finance England will contact you every year to confirm the amount you will receive.

Online Application – Student Finance England

Postal Application – GOV.UK

Note: While English residents and EU students who will study in England need to apply to Student Finance England, Welsh residents and EU students who will study in Wales will need to apply to Student Finance Wales .

The application deadline is based on when your doctoral programme is due to start; you should apply within 9 months of this start date.

Finding a PhD has never been this easy – search for a PhD by keyword, location or academic area of interest.

Other PhD Funding Options

A PhD Loan is only one of several sources of funding to support your PhD studies and living expenses. The other postgraduate funding options available to you are:

- Research Council funding and studentships

- Scholarships and bursaries

- Employer sponsorship

- Charities and Trusts

Browse PhDs Now

Join thousands of students.

Join thousands of other students and stay up to date with the latest PhD programmes, funding opportunities and advice.

Doctoral Program Loans

Save Thousands of Dollars in Total Interest Paid

Pursuing a doctorate degree? You’re already one step closer to your dream career. Don’t let concerns about paying for your PhD derail your ambitions.

Earn your doctorate degree and become debt-free within a target number of years with Brazos’ affordable PhD loans.

Brazos Higher Education offers Texans more repayment flexibility than most lenders, allowing you to focus on your studies and plan your career. No matter what PhD program you are pursuing, Brazos’ student loan for doctorate degree makes it easy to achieve your educational and career goals while fulfilling your monthly obligations.

Even if you live outside of Texas and plan to attend a Texas college, we have loans that can save you money.

Brazos PhD Loan Rates 4

Fixed rates.

Starting at

Including 0.25% Auto-Pay Discount 3

Variable Rates

Why a brazos phd loan is right for you, competitive rates with no hidden fees, up to 100% of school-certified expenses covered.

Brazos student loan for doctorate degree makes it easier for you to focus on your career goals. You can borrow up to the full cost of attendance, less other financial aid received. Qualified expenses include tuition and fees, books and supplies, a computer, living expenses and other school-certified incidentals.

As a non-profit organization, Brazos doesn’t charge application fees, origination fees, or prepayment penalties ever. Use our loan calculator to see what your student loan PhD costs would be with various loan rates and repayment terms.

Repayment on Your Terms

Paying for your PhD is made even more achievable with Brazos’ multiple loan terms and repayment options. Take time to compare rates and evaluate what's best for your educational and career goals before making a decision.

Apply Online in Minutes 8

Check your Brazos PhD student loan eligibility and apply for a doctoral loan fast through our online portal. Unlike other lenders, Brazos offers a quick and easy doctoral student loan application process for your convenience.

Cosigning Made Easy

If you’ve got a limited credit history and are unsure how to pay for a doctorate degree, Brazos can help you. Add your parent, spouse or relative as a cosigner and increase your likelihood of securing the lowest possible student loan rate.

Texans Serving Texans

Brazos Higher Education is a Texas non-profit dedicated to making higher education more attainable for Texas residents. Even if you live outside Texas, if you plan to attend a Texas college, our loan can save you money.

Plus, GET $200 when you Refer-A-Friend .

Not a Texas Resident & Not attending a Texas school? - CLICK HERE

Earning a degree and paying for your PhD shouldn't take a toll on your finances. Use our doctoral student loan calculator to estimate your interest cost and evaluate your payoff options.

Comparing Student Loan Rates Can Save Significant Money!

Brazos nonprofit status and mission allow us to offer competitive rates to Texas borrowers. Our rates are designed to save you money over the life of your loans. Compare Brazos doctoral loan rates to rates offered by other lenders. Ranges cover multiple available repayment options and include available discounts.

Student Loan Doctoral Programs Fixed Interest Rates (APRs)

All displayed rates include a .25% Auto-Pay discount for auto-debt payments. Displayed rates taken from competitor websites as of 01 April 2024. For Earnest, displayed rates are taken from ELM Select (www.elmselect.com) as of 01 April 2024. The range of rates shown may have changed. Please visit the applicable website for each lender's most current rates and for terms and conditions to qualify for the auto-pay discount. Like at Brazos, the specific rate you receive from other lenders is dependent on numerous factors, including your creditworthiness, the term and repayment option you select, available borrower benefits and the length of any deferment period(s) assumed in calculating the rates.

Rates are not the only factor to consider when shopping for a private student loan. As with any loan, think carefully about your financial situation and understand the details about the loans you’re comparing when deciding which private student loan is right for you.

3 Ways to Repay Brazos Doctoral Loans

Choose one of three ways to repay your doctoral student loan:

Deferred Repayment

Make no payments of principal or interest while in school (up to 54 months) and for six months after you graduate or cease to be enrolled at least half-time at an eligible school.

Interest Only Repayment

Pay only the interest while studying and during a six-month grace period after you graduate or withdraw enrollment at least half-time at an eligible school.

Immediate Repayment

Begin repayment of principal and interest immediately after your student loan for doctorate degree is fully disbursed, even while you’re in school.

What If I Need to Refinance?

Need help paying for your PhD? Consolidate your student loans into one monthly payment to save money and make budgeting easier.

What People Say About Us

- kenn, brazos borrower.

"Our family has worked hard to build good credit. The team at Brazos made sure we were able to make that effort really pay off. We received a better rate on our two student’s education costs than we could find anywhere. Our advisor was always available and went the extra mile to make a complicated process work for us. Thank you... We will see you again next year!"

- Mitchell, Brazos Borrower

"Great people and service. Always there to help or answer my questions."

- Brad, Brazos Borrower

“I was surprised to find the Federal Parent PLUS Loan charges an origination fee of 4.2% with interest rates in the 7.6% range. Brazos offers lower rates and zero fees. They made it easy to apply and work through the process."

- Alison, Brazos Borrower

"Easy access to communicate with representatives. Prompt responses from all communication as well. Customer service is excellent and feels like a small town local bank. I’ve never felt like just another number."

- Kelley, Brazos Borrower

"Great experience. Super easy. Zero fees and decreases the overall amount I will owe on my student loans. So happy!"

Frequently Asked Questions

If your credit history does not meet our minimum credit criteria, you can still qualify by applying with a qualified cosigner. Additionally, even if you meet the minimum requirements, applying with a cosigner who has a stronger credit history may reduce the interest rate on your student loan PhD rate even further, thereby saving you more money over the lifespan of the loan.

Brazos PhD Loans cover school-certified educational expenses, including:

- Tuition and fees

- Living expenses, including room and board

- Textbooks, supplies and equipment

- Transportation

- Other costs necessary to complete your degree

Texas student loans may be requested up to the cost of attendance, less other financial aid, as certified by the school.

Texas Residents - The minimum student loan eligibility amount is $1,000.