Assignment Of Partnership Interest

Jump to Section

What is an assignment of partnership interest.

- Information about the partnership like the name of the business

- The type of interest being transferred

- The names and information of both the assignor and the assignee

- Information about the remaining partners

Common Sections in Assignments Of Partnership Interest

Below is a list of common sections included in Assignments Of Partnership Interest. These sections are linked to the below sample agreement for you to explore.

Assignment Of Partnership Interest Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.37 15 dex1037.htm FORM OF AGREEMENT AND ASSIGNMENT OF PARTNERSHIP INTEREST , Viewed October 25, 2021, View Source on SEC .

Who Helps With Assignments Of Partnership Interest?

Lawyers with backgrounds working on assignments of partnership interest work with clients to help. Do you need help with an assignment of partnership interest?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignments of partnership interest. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

Need help with an Assignment Of Partnership Interest?

Meet some of our assignment of partnership interest lawyers.

Jason has been providing legal insight and business expertise since 2001. He is admitted to both the Virginia Bar and the Texas State Bar, and also proud of his membership to the Fellowship of Ministers and Churches. Having served many people, companies and organizations with legal and business needs, his peers and clients know him to be a high-performing and skilled attorney who genuinely cares about his clients. In addition to being a trusted legal advisor, he is a keen business advisor for executive leadership and senior leadership teams on corporate legal and regulatory matters. His personal mission is to take a genuine interest in his clients, and serve as a primary resource to them.

Christopher R.

Trusted business and intellectual property attorney for small to midsize businesses.

Terry Brennan is an experienced corporate, intellectual property and emerging company transactions attorney who has been a partner at two national Wall Street law firms and a trusted corporate counsel. He focuses on providing practical, cost-efficient and creative legal advice to entrepreneurs, established enterprises and investors for business, corporate finance, intellectual property and technology transactions. As a partner at prominent law firms, Terry's work centered around financing, mergers and acquisitions, joint ventures, securities transactions, outsourcing and structuring of business entities to protect, license, finance and commercialize technology, manufacturing, digital media, intellectual property, entertainment and financial assets. As the General Counsel of IBAX Healthcare Systems, Terry was responsible for all legal and related business matters including health information systems licensing agreements, merger and acquisitions, product development and regulatory issues, contract administration, and litigation. Terry is a graduate of the Georgetown University Law Center, where he was an Editor of the law review. He is active in a number of economic development, entrepreneurial accelerators, veterans and civic organizations in Florida and New York.

Scott Bowen, Esq brings legal experience in family law, special education law, and healthcare law matters. Scott also has over 20 years of expertise in healthcare compliance, medical coding, and healthcare consulting to the firm.

Damian is a founding partner of Holon Law Partners. He began his career as an officer in the Marine Corps, managing legal affairs for his command in Okinawa, Japan. In this role, he conducted investigations, assembled juries for courts martial, and advised his commander on criminal justice matters. Damian was twice selected to serve as his unit’s liaison to the Japanese government and self-defense forces. Damian later worked as a transactional attorney in New York, where he handled commercial real estate, finance, and restructuring matters. He has also participated in insider trading investigations at the SEC, worked on compliance at a private equity firm, and managed legal operations and special projects at a vertically integrated cannabis company in New Mexico. Damian draws on these diverse experiences to provide his clients with creative solutions to thorny legal issues – from negotiating commercial leases to managing complex securities offerings. In addition to practicing law, Damian volunteers as a research assistant at the University of New Mexico Medical School’s McCormick Lab – studying the microbiology of longevity and aging. When not working, he enjoys spending time with his two pit bulls and pursuing his passions for foreign languages, art, philosophy, and fitness. Damian resides in Albuquerque, New Mexico.

Jonathan F.

Trial and transactional attorney with over 30 years experience with complex business transactions and disputes.

My passion is protecting the passions of others. I have 5+ years of contract review, and all aspects of entertainment law including negotiation, mediation, intellectual property, copyright, and music licensing. I also have experience working with nonprofits, and small businesses helping with formation, dissolution, partnerships, etc. I am licensed in both Texas and California.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Business lawyers by top cities

- Austin Business Lawyers

- Boston Business Lawyers

- Chicago Business Lawyers

- Dallas Business Lawyers

- Denver Business Lawyers

- Houston Business Lawyers

- Los Angeles Business Lawyers

- New York Business Lawyers

- Phoenix Business Lawyers

- San Diego Business Lawyers

- Tampa Business Lawyers

Assignment Of Partnership Interest lawyers by city

- Austin Assignment Of Partnership Interest Lawyers

- Boston Assignment Of Partnership Interest Lawyers

- Chicago Assignment Of Partnership Interest Lawyers

- Dallas Assignment Of Partnership Interest Lawyers

- Denver Assignment Of Partnership Interest Lawyers

- Houston Assignment Of Partnership Interest Lawyers

- Los Angeles Assignment Of Partnership Interest Lawyers

- New York Assignment Of Partnership Interest Lawyers

- Phoenix Assignment Of Partnership Interest Lawyers

- San Diego Assignment Of Partnership Interest Lawyers

- Tampa Assignment Of Partnership Interest Lawyers

ContractsCounsel User

Business Contract

Location: florida, turnaround: less than a week, service: drafting, doc type: assignment of partnership interest, number of bids: 2, bid range: $1,000 - $1,250, business partnership agreement, number of bids: 6, bid range: $300 - $1,500, want to speak to someone.

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Assignment Agreement Partnership Interest

Assignment of Partnership Interest Form

Use our free Assignment of Partnership Interest to sell a stake in a partnership to a new partner.

Updated February 5, 2024 Reviewed by Brooke Davis

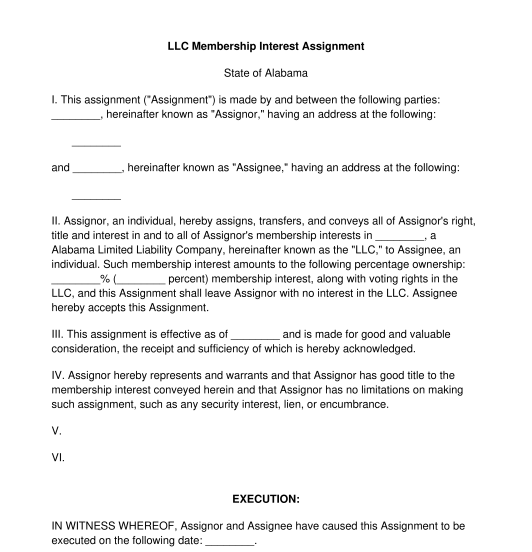

A partner uses an Assignment of Partnership Interest form to sell their interest in the partnership to a new partner. Through the Assignment of Partnership Interest, the potential new partner (known as “the assignee”) agrees to pay the current partner (known as “the assignor”) in exchange for all the financial interests and obligations included in the partnership rights.

Keep in mind that in some cases, full partnership rights cannot be sold to the new partner unless all current partners also agree. Economic partnership rights, however, can still be sold without the agreement of all partners.

What is an Assignment of Partnership Interest?

When is a partnership assignment needed, the consequences of not having a partnership assignment, common uses for an assignment of partnership interest, what should be included in a partnership assignment, assignment of partnership interests sample.

An Assignment of Partnership Interest is a legal document that transfers the rights to receive benefits from an original business partner (“Assignor”) to a new business partner (“Assignee”).

It’s essential to learn about the types of partnerships and potential advantages and disadvantages of a partnership before entering into this business relationship.

This document will identify the following essential elements:

- Partnership Details : legal name of the business, its purpose, and date established

- Assignee : name and address of the new partner receiving the business interest

- Assignor : name and address of the old partner giving the business interest

- Partners : name and address of the remaining partners of the business

- Consideration : the amount of money exchanged for the business transfer

- Closing Date : when the assignment will end

- Signatures : all members of the original partnership and the assignee must sign

This document is needed to formally document a business transaction between the old and new partners.

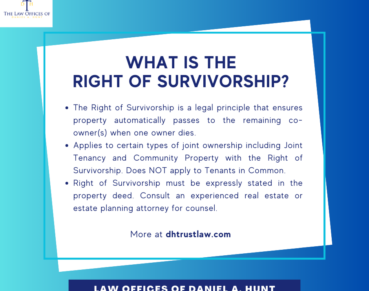

Some partnership agreements contain a right of first refusal so that the original partners have a right to purchase the interest before an outside party. [1]

What happens if I do not have one?

Without this document, neither the old nor new partners are legally obligated to follow through with their promises to buy or sell the business’s shares. The Assignment may also clarify whether the new partner has the right to participate in the business’s operation, finances, or management.

For example, a full-fledged partner usually has the right to inspect the books, take possession of partnership property, and make decisions with other partners.

Otherwise, the new partner only has the right to receive a share of the profits and any distributions if the partnership ends.

Most partnership agreements only allow the transfer of the partner’s interest in the business so that the new partner can only receive the old partner’s share of the money but not have a say in the business operations or finances.

An Assignment of Partnership Interest is usually just one of several legal documents needed during the sale process. A Confidentiality Agreement plus a Purchase Order are also used to complete the transaction.

Here are just a few of the situations when this document is commonly used:

- Cash flow needs of the business change [2]

- Business assets are allocated differently

- The strategy of the partnership changes

- The regulatory environment presents new challenges

An Assignment of Partnership Interest should generally address the following:

- Who will be giving and receiving the business interest

- What rights does the assignee have in terms of operation or management

- Where is the business partnership located

- When was the partnership first established

- How much will the old partner receive in return for giving a part of their interests

Here’s what an assignment of partnership interests typically looks like:

Use can download the free template in PDF & Word format or use our document builder to help guide you through the writing process.

Legal Templates uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial guidelines to learn more about how we keep our content accurate, reliable and trustworthy.

- Assignment of Partnership Interests. http://delcode.delaware.gov/title6/c017/sc07/index.shtml

- ADAM HAYES. Cash Flow. https://www.investopedia.com/terms/c/cashflow.asp

Related Documents

- Purchase Agreement : Outlines the terms and conditions of an item sale.

- Business Purchase Agreement : A legally enforceable contract that documents the sale of a business.

- Stock Purchase Agreement : Record the purchase of stock and protect the buying and selling parties.

- Shareholder Agreement : Use this document to explain the structure and nature of shareholders' relationships to the corporation and to one another.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

Join us at one of our events. Register Today

- Newsletters

- Client Portal

- Make Payment

- (855) Marcum1

Services Search

Tax issues to consider when a partnership interest is transferred.

By Colleen McHugh - Co‑Partner‑in‑Charge, Alternative Investments

There can be several tax consequences as a result of a transfer of a partnership interest during the year. This article discusses some of those tax issues applicable to the partnership.

Adjustments to the Basis of Partnership Property Upon a transfer of a partnership interest, the partnership may elect to, or be required to, increase/decrease the basis of its assets. The basis adjustments will be for the benefit/detriment of the transferee partner only.

- If the partnership has a special election in place, known as an IRS Section 754 election, or will make one in the year of the transfer, the partnership will adjust the basis of its assets as a result of the transfer. IRS Section 754 allows a partnership to make an election to “step-up” the basis of the assets within a partnership when one of two events occurs: distribution of partnership property or transfer of an interest by a partner.

- The partnership will be required to adjust the basis of its assets when an interest in the partnership is transferred if the total adjusted basis of the partnership’s assets is greater than the total fair market value of the partnership’s assets by more than $250,000 at the time of the transfer.

Ordinary Income Recognized by the Transferor on the Sale of a Partnership Interest Typically, when a partnership interest is sold, the transferor (seller) will recognize capital gain/loss. However, a portion of the gain/loss could be treated as ordinary income to the extent the transferor partner exchanges all or a part of his interest in the partnership attributable to unrealized receivables or inventory items. (This is known as “Section 751(a) Property” or “hot” assets).

- Unrealized receivables – includes, to the extent not previously included in income, any rights (contractual or otherwise) to payment for (i) goods delivered, or to be delivered, to the extent the proceeds would be treated as amounts received from the sale or exchange of property other than a capital asset, or (ii) services rendered, or to be rendered.

- Property held primarily for sale to customers in the ordinary course of a trade or business.

- Any other property of the partnership which would be considered property other than a capital asset and other than property used in a trade or business.

- Any other property held by the partnership which, if held by the selling partner, would be considered of the type described above.

Example – Partner A sells his partnership interest to D and recognizes gain of $500,000 on the sale. The partnership holds some inventory property. If the partnership sold this inventory, Partner A would be allocated $100,000 of that gain. As a result, Partner A will recognize $100,000 of ordinary income and $400,000 of capital gain.

The partnership needs to provide the transferor with sufficient information in order to determine the amount of ordinary income/loss on the sale, if any.

Termination/Technical Termination of the Partnership A transfer of a partnership interest could result in an actual or technical termination of the partnership.

- The partnership will terminate on the date of transfer if there is one tax owner left after the transfer.

- The partnership will have a technical termination for tax purposes if within a 12-month period there is a sale or exchange of 50% or more of the total interest in the partnership’s capital and profits.

Example – D transfers its 55% interest to E. The transfer will result in the partnership having a technical termination because 50% or more of the total interest in the partnership was transferred. The partnership will terminate on the date of transfer and a “new” partnership will begin on the day after the transfer.

Allocation of Partnership Income to Transferor/Transferee Partners When a partnership interest is transferred during the year, there are two methods available to allocate the partnership income to the transferor/transferee partners: the interim closing method and the proration method.

- Interim closing method – Under this method, the partnership closes its books with respect to the transferor partner. Generally, the partnership calculates the taxable income from the beginning of the year to the date of transfer and determines the transferor’s share of that income. Similarly, the partnership calculates the taxable income from the date after the transfer to the end of the taxable year and determines the transferee’s share of that income. (Note that certain items must be prorated.)

Example – Partner A transfers his 10% interest to H on June 30. The partnership’s taxable income for the year is $150,000. Under the interim closing method, the partnership calculates the taxable income from 1/1 – 6/30 to be $100,000 and from 7/1-12/31 to be $50,000. Partner A will be allocated $10,000 [$100,000*10%] and Partner H will be allocated $5,000 [$50,000*10%].

- Proration method – this method is allowed if agreed to by the partners (typically discussed in the partnership agreement). Under this method, the partnership allocates to the transferor his prorata share of the amount of partnership items that would be included in his taxable income had he been a partner for the entire year. The proration may be based on the portion of the taxable year that has elapsed prior to the transfer or may be determined under any other reasonable method.

Example – Partner A transfers his 10% interest to H on June 30. The partnership’s taxable income for the year is $150,000. Under the proration method, the income is treated as earned $74,384 from 1/1 – 6/30 [181 days/365 days*$150,000] and $75,616 from 7/1-12/31 [184 days/365 days*$150,000]. Partner A will be allocated $7,438 [$74,384*10%] and Partner H will be allocated $7,562 [$75,616*10%]. Note that this is one way to allocate the income. The partnership may use any reasonable method.

Change in Tax Year of the Partnership The transfer could result in a mandatory change in the partnership’s tax year. A partnership’s tax year is determined by reference to its partners. A partnership may not have a taxable year other than:

- The majority interest taxable year – this is the taxable year which, on each testing day, constituted the taxable year of one or more partners having an aggregate interest in partnership profits and capital of more than 50%.

Example – Partner A, an individual, transfers his 55% partnership interest to Corporation D, a C corporation with a year-end of June 30. Prior to the transfer, the partnership had a calendar year-end. As a result of the transfer, the partnership will be required to change its tax year to June 30 because Corporation D now owns the majority interest.

- If there is no majority interest taxable year or principal partners, (a partner having a 5% or more in the partnership profits or capital) then the partnership adopts the year which results in the least aggregate deferral.

Change in Partnership’s Accounting Method A transfer of a partnership interest may require the partnership to change its method of accounting. Generally, a partnership may not use the cash method of accounting if it has a C corporation as a partner. Therefore, a transfer of a partnership interest to a C corporation could result in the partnership being required to change from the cash method to the accrual method.

As described in this article, a transfer of a partnership interest involves an analysis of several tax consequences. An analysis should always be done to ensure that any tax issues are dealt with timely.

If you or your business are involved in a transfer described above, please contact your Marcum Tax Professional for guidance on tax treatment.

Related Insights & News

Tennessee Legislature Repeals the Alternative Property Tax Measure of Franchise Tax; Tax Refunds Authorized by Legislation; Deadlines and Procedures Announced

After extended debate, the Tennessee Legislature has repealed the alternative property measure of the franchise tax.

Real Estate Tax Tactics: Combining 1031 Exchanges and Cost Segregation for Ultimate Efficiency

Significant sales tax rate reduction on commercial rentals in florida starting june 2024, marcum llp-hofstra university ceo survey pinpoints political uncertainty as key challenge for business planning, federal judge rules corporate transparency act unconstitutional, enforcement halted, upcoming events.

Navigating Carbon Emission for Tomorrow’s Middle Market

Next Generation Networking

Marlton, NJ

From Groundwork to Growth: Governance as a Catalyst for Sustainable Development in Construction

Managed IT Services Mastery: Choosing the Right MSP & Unlocking Business Benefits

Marcum Manufacturing Forum

Cromwell, CT

The Pivot in Workforce Management Practices for 2024 and Beyond

Marcum’s Governmental Accounting & Reporting Training Course

Warwick, RI

Cocktails & Conversations

Portland, ME

Providence, RI

The Future of Finance: Moving from On-Premises to Cloud-Based ERP Systems

Hartford, CT

Political and Market Update featuring Michael Townsend

Bedford, NH

Essentials of an Operating Reserve Policy for Nonprofits

Marcum Women’s Forum: Courage

Greenwich, CT

Nashville, TN

The Marcum & GNHCC 2024 Regional Real Estate Forum

Branford, CT

Cleveland, OH

Mission Possible: Nonprofits in the Age of Digital Finance

Washington, DC

Integrating FP&A Software into Your Financial Operations

Top 5 Nonprofit Investment Insights

New Haven, CT

Streamlining the Financial Close Process: How Close Management Software Transforms Efficiency

Marcum Women’s Initiative: Coffee and Conversations

Robotic Process Automation and AI: The Next Frontier in Finance Transformation

Marcum New England Construction Summit

Marcum Mid-South Construction Summit

Marcum Ohio Construction Summit

Warrensville Heights, OH

Related Service

Tax & Business

Have a Question? Ask Marcum

- Legal GPS for Business

- All Contracts

- Member-Managed Operating Agreement

- Manager-Managed Operating Agreement

- S Corp LLC Operating Agreement

- Multi-Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (S Corp)

Assignment of Membership Interest: The Ultimate Guide for Your LLC

LegalGPS : May 9, 2024 at 12:00 PM

As a business owner, there may come a time when you need to transfer ownership of your company or acquire additional members. In these situations, an assignment of membership interest is a critical step in the process. This blog post aims to provide you with a comprehensive guide on everything you need to know about the assignment of membership interest and how to navigate the procedure efficiently. So, let's dive into the world of LLC membership interest transfers and learn how to secure your business!

Table of Contents

Necessary approvals and consent, impact on ownership, voting, and profit rights, complete assignment, partial assignment.

- Key elements to include

Step 1: Gather Relevant Information

Step 2: review the llc's operating agreement, step 3: obtain necessary approvals and consents, step 4: outline the membership interest being transferred, step 5: determine the effective date of the assignment, step 6: specify conditions and representations, step 7: address tax and liability issues, step 8: draft the entire agreement and governing law clauses, step 9: review and sign the assignment agreement.

- Advantages of using a professionally-created template

- How our contract templates stand out from the rest

Frequently Asked Questions (FAQs) about Assignment of Membership Interest

Do you need a lawyer for this.

What is an Assignment of Membership Interest?

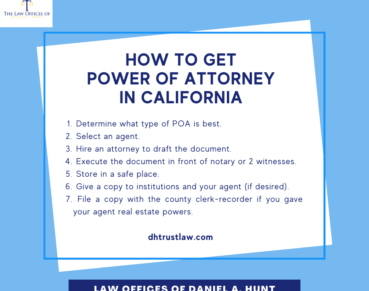

An assignment of membership interest is a document that allows a member of an LLC to transfer their ownership share in the company to another person or entity. This can be done in the form of a sale or gift, which are two different scenarios that generally require different types of paperwork. An assignment is typically signed by the parties involved and delivered to the Secretary of State's office for filing. However, this process can vary depending on where you live and whether your LLC has members other than yourself as well as additional documents required by state law.

Before initiating the assignment process, it's essential to review the operating agreement of your LLC, as it may contain specific guidelines on how to assign membership interests.

Often, these agreements require the express consent of the other LLC members before any assignment can take place. To avoid any potential disputes down the line, always seek the required approvals before moving forward with the assignment process.

It's essential to understand that assigning membership interests can affect various aspects of the LLC, including ownership, voting rights, and profit distribution. A complete assignment transfers all ownership rights and obligations to the new member, effectively removing the original member from the LLC. For example, if a member assigns his or her interest, the new member inherits all ownership rights and obligations associated with that interest. This includes any contractual obligations that may be attached to the membership interest (e.g., a mortgage). If there is no assignment of interests clause in your operating agreement, then you will need to get approval from all other members for an assignment to take place.

On the other hand, a partial assignment permits the original member to retain some ownership rights while transferring a portion of their interest to another party. To avoid unintended consequences, it's crucial to clearly define the rights and responsibilities of each party during the assignment process.

Types of Membership Interest Transfers

Membership interest transfers can be either complete or partial, depending on the desired outcome. Understanding the differences between these two types of transfers is crucial in making informed decisions about your LLC.

A complete assignment occurs when a member transfers their entire interest in the LLC to another party, effectively relinquishing all ownership rights and obligations. This type of transfer is often used when a member exits the business or when a new individual or entity acquires the LLC.

For example, a member may sell their interest to another party that is interested in purchasing their share of the business. Complete assignment is also used when an individual or entity wants to purchase all of the interests in an LLC. In this case, the seller must receive unanimous approval from the other members before they can transfer their entire interest.

Unlike a complete assignment, a partial assignment involves transferring only a portion of a member's interest to another party. This type of assignment enables the member to retain some ownership in the business, sharing rights, and responsibilities proportionately with the new assignee. Partial assignments are often used when adding new members to an LLC or when existing members need to redistribute their interests.

A common real-world example is when a member receives an offer from another company to purchase their interest in the LLC. They might want to keep some ownership so that they can continue to receive profits from the business, but they also may want out of some of the responsibilities. By transferring only a partial interest in their membership share, both parties can benefit: The seller receives a lump sum payment for their share of the LLC and is no longer liable for certain financial obligations or other tasks.

How to Draft an Assignment of Membership Interest Agreement

A well-drafted assignment of membership interest agreement can help ensure a smooth and legally compliant transfer process. Here is a breakdown of the key elements to include in your agreement, followed by a step-by-step guide on drafting the document.

Key elements to include:

The names of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name of your LLC and the state where it was formed

A description of the membership interest being transferred (percentage, rights, and obligations)

Any required approvals or consents from other LLC members

Effective date of the assignment

Signatures of all parties involved, including any relevant witnesses or notary public

Before you begin drafting the agreement, gather all pertinent data about the parties involved and the membership interest being transferred. You'll need information such as:

The names and contact information of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name and formation details of your LLC, including the state where it was registered

The percentage and value of the membership interest being transferred

Any specific rights and obligations associated with the membership interest

Examine your LLC's operating agreement to ensure you adhere to any predetermined guidelines on assigning membership interests. The operating agreement may outline specific procedures, required approvals, or additional documentation necessary to complete the assignment process.

If your LLC doesn't have an operating agreement or if it's silent on this matter, follow your state's default LLC rules and regulations.

Before drafting the assignment agreement, obtain any necessary approvals or consents from other LLC members as required by the operating agreement or state law. You may need to hold a members' meeting to discuss the proposed assignment and document members' consent in the form of a written resolution.

Detail the membership interest being transferred in the Assignment of Membership Interest Agreement. Specify whether the transfer is complete or partial, and include:

The percentage of ownership interest being assigned

Allocated profits and losses, if applicable

Voting rights associated with the transferred interest

The assignor's rights and obligations that are being transferred and retained

Any capital contribution requirements

Set an effective date for the assignment, which is when the rights and obligations associated with the membership interest will transfer from the assignor to the assignee.

This date is crucial for legal and tax purposes and helps both parties plan for the transition. If you don’t specify an effective date in the assignment agreement, your state's law may determine when the transfer takes effect.

In the agreement, outline any conditions that must be met before the assignment becomes effective. These could include obtaining certain regulatory approvals, fulfilling specific obligations, or making required capital contributions.

Additionally, you may include representations from the assignor attesting that they have the legal authority to execute the assignment. Doing this is important because it can prevent a third party from challenging the assignment on grounds of lack of authority. If the assignor is an LLC or corporation, be sure to specify that it must be in good standing with all necessary state and federal regulatory agencies.

Clearly state that the assignee will assume responsibility for any taxes, liabilities, and obligations attributable to the membership interest being transferred from the effective date of the assignment. You may also include indemnification provisions that protect each party from any potential claims arising from the other party's actions.

For example, you can include a provision that provides the assignor with protection against any claims arising from the transfer of membership interests. This is especially important if your LLC has been sued by a member, visitor, or third party while it was operating under its current management structure.

In the closing sections of the assignment agreement, include clauses stating that the agreement represents the entire understanding between the parties concerning the assignment and supersedes any previous agreements or negotiations. Specify that any modifications to the agreement must be made in writing and signed by both parties. Finally, identify the governing law that will apply to the agreement, which is generally the state law where your LLC is registered.

This would look like this:

Once you've drafted the Assignment of Membership Interest Agreement, ensure that all parties carefully review the document to verify its accuracy and completeness. Request a legal review by an attorney, if necessary. Gather the assignor, assignee, and any necessary witnesses or notary public to sign the agreement, making it legally binding.

Sometimes the assignor and assignee will sign the document at different times. If this is the case, then you should specify when each party must sign in your Assignment Agreement.

Importance of a Professionally-drafted Contract Template

To ensure a smooth and error-free assignment process, it's highly recommended to use a professionally-drafted contract template. While DIY options might seem tempting, utilizing an expertly-crafted template provides several distinct advantages.

Advantages of using a professionally-created template:

Accuracy and Compliance: Professionally-drafted templates are designed with state-specific regulations in mind, ensuring that your agreement complies with all necessary legal requirements.

Time and Cost Savings: With a pre-written template, you save valuable time and resources that can be better spent growing your business.

Reduced Legal Risk: Legal templates created by experienced professionals significantly reduce the likelihood of errors and omissions that could lead to disputes or litigations down the road.

How our contract templates stand out from the rest:

We understand the unique needs of entrepreneurs and business owners. Our contract templates are designed to provide a straightforward, user-friendly experience that empowers you with the knowledge and tools you need to navigate complex legal processes with ease. By choosing our Assignment of Membership Interest Agreement template, you can rest assured that your business is in safe hands. Click here to get started!

As you embark on the journey of assigning membership interest in your LLC, here are some frequently asked questions to help address any concerns you may have:

Is an assignment of membership interest the same as a sale of an LLC? No. While both processes involve transferring interests or assets, a sale of an LLC typically entails the sale of the entire business, whereas an assignment of membership interest relates to the transfer of some or all membership interests between parties.

Do I need an attorney to help draft my assignment of membership interest agreement? While not mandatory, seeking legal advice ensures that your agreement complies with all relevant regulations, minimizing potential legal risks. If you prefer a more cost-effective solution, consider using a professionally-drafted contract template like the ones we offer at [Your Company Name].

Can I assign my membership interest without the approval of other LLC members? This depends on your LLC's operating agreement and state laws. It's essential to review these regulations and obtain any necessary approvals or consents before proceeding with the assignment process.

The biggest question now is, "Do you need to hire a lawyer for help?" Sometimes, yes ( especially if you have multiple owners ). But often for single-owner businesses, you don't need a lawyer to start your business .

Many business owners instead use tools like Legal GPS for Business , which includes a step-by-step, interactive platform and 100+ contract templates to help you start and grow your company.

We hope this guide provides valuable insight into the process of assigning membership interest in your LLC. By understanding the legal requirements, implications, and steps involved, you can navigate this essential task with confidence. Ready to secure your business with a professionally-drafted contract template? Visit our website to purchase the reliable and user-friendly Assignment of Membership Interest Agreement template that enables your business success.

Why Your Company Absolutely Needs a Membership Interest Pledge Agreement

When it comes to running a business, it's essential to cover all your bases to ensure the smooth operation of your company and the protection of your...

Understanding the Membership Interest Purchase Agreement for Single Owners

Welcome to another of our informative blog posts aimed at demystifying complex legal topics. Today, we're addressing something that many solo...

Why Every Company Needs a Media Consent and Release Form: Top Reasons Explained

Picture this: you’re a business owner, and you’ve just wrapped up a fantastic marketing campaign featuring your clients’ success stories. You're...

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Withholding and information reporting on the transfer of private partnership interests

November 2020

Treasury and the IRS released on October 7 Final Regulations (the Final Regulations ) under Sections 1446(f) and 864(c)(8). Section 1446(f), added to the Code by the 2017 tax reform legislation, provides rules for withholding on the transfer or disposition of a partnership interest. Proposed Regulations were issued in May 2019, which laid the framework for guidance on withholding and reporting obligations under Section 1446(f) (the Proposed Regulations). The Proposed Regulations also addressed information reporting under Section 864(c)(8); these rules were finalized in September 2020. The Final Regulations retain the basic structure and guidance of the Proposed Regulations, but with various modifications.

The Final Regulations apply to both publicly traded partnerships (PTPs) and private partnerships. This insight summarizes some of the changes applicable to PTPs but primarily focuses on private partnerships. A separate detailed Insight will be circulated with respect to PTPs.

The Final Regulations generally are applicable to transfers occurring on or after the date that is 60 days after their publication in the Federal Register. However, the backstop withholding rules only apply to transfers that occur on or after January 1, 2022.

PTPs . Significantly, beginning January 1, 2022, the Final Regulations will require withholding under Section 1446(f) on both dispositions of and distributions by PTPs. This is a significant evolution of these rules, which to date have not been extended to PTPs due to the informational and operational challenges associated with imposing withholding taxes in respect of publicly traded securities. As will be discussed in more detail in the separate alert, these challenges result from the expansion of withholding obligations to new parties (e.g., executing brokers) that traditionally may not have been withholding agents and a substantial expansion of the qualified intermediary (QI) obligations.

Other partnerships . The Final Regulations retain the presumption that withholding is required unless an applicable certification is provided. However, they now provide a limitation on the transferee’s liability to the extent the transferee can establish the transferor had no tax liability under Section 864(c)(8). The Final Regulations also include new or expanded exceptions to the withholding requirements. These include the ability to rely on a valid Form W-9 to prove US status as well as a new exception from withholding for partnerships that are not engaged in a US trade or business.

Download the full publication Withholding and information reporting on the transfer of private partnership interests

The takeaway.

The Final Regulation package retains the basic approach and structure of the Proposed Regulations, with some modifications. Taxpayers (particularly minority partners and taxpayers in tiered structures) who are intending to either eliminate or reduce the withholding tax should be mindful of the time restrictions in order to be compliant with a reduction or elimination of withholding and the potential difficulty in obtaining information from a partnership and should plan accordingly.

- Final Regulations modify treatment of gain or loss on sale of partnership interest by foreign partner (October 21, 2020)

- PwC Client Comments re Section 1446(f) Proposed Regulations (July 12, 2019)

- Proposed regulations address tax withholding, information reporting on partnerships with US trade or business (May 31, 2019)

Our insights. Your choices.

Subscribe to receive our tax insights.

Related content

Tax services.

Delivering tax services, insights and guidance on US tax policy, tax reform, legislation, registration and tax law.

Sightline is a tax platform that makes the entire tax process more collaborative and insightful. Built by tax professionals for tax professionals.

2024 Tax Policy Outlook: Defining the choices ahead

The stakes rarely have been higher as business leaders seek to manage operations and plan investments in an environment of uncertain tax policy and tax changes....

Policy on Demand

Policy on Demand is a news platform that provides in-depth insights and analysis on tax policy, legislative and regulatory developments that impact your...

Ken Kuykendall

US Tax Leader and Tax Consulting Leader, PwC US

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Withholding on foreign partner or firm.

Fixed or determinable annual or periodical (FDAP) income.

Withholding under the Foreign Investment in Real Property Tax Act (FIRPTA).

Withholding on foreign partner’s effectively connected taxable income (ECTI).

Withholding on foreign partner’s sale of a partnership interest.

Withholding under the Foreign Account Tax Compliance Act (FATCA).

Comments and suggestions.

Getting answers to your tax questions.

Getting tax forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

- Useful Items - You may want to see:

Organizations formed after 1996.

Limited liability company (LLC).

Organizations formed before 1997.

Community property.

Gift of capital interest.

Purchase considered gift.

Applicable partnership interest (API).

Applicable trade or business.

Specified assets.

Business Owned and Operated by Spouses

Qualified joint venture election, partnership agreement.

Date of termination.

Short period return.

Conversion of partnership into LLC.

Electronic Filing

Investing partnership.

Operating agreement partnership.

Electing the exclusion.

Partnership Return (Form 1065)

Effect on partner's basis.

Effect on partnership.

Certain distributions treated as a sale or exchange.

Substantially appreciated inventory items.

Qualified opportunity investment.

Marketable securities treated as money.

Loss on distribution.

Distribution of partner's debt.

Net precontribution gain.

Effect on basis.

Exceptions.

Complete liquidation of partner's interest.

Partner's holding period.

Basis divided among properties.

Allocating a basis increase.

Allocating a basis decrease.

Distributions before August 6, 1997.

Partner's interest more than partnership basis.

Special adjustment to basis.

Mandatory adjustment.

Required statement.

Marketable securities.

Payments by accrual basis partnership to cash basis partner.

Minimum payment.

Self-employed health insurance premiums.

Including payments in partner's income.

Payments resulting in loss.

More than 50% ownership.

More information.

Disguised sales.

Form 8275 required.

Contribution to partnership treated as investment company.

Contribution to foreign partnership.

Basis of contributed property.

Allocations to account for built-in gain or loss.

Distribution of contributed property to another partner.

Disposition of certain contributed property.

Capital interest.

Profits interest.

Interest acquired by gift, etc.

Partner's liabilities assumed by partnership.

Book value of partner's interest.

When determined.

Alternative rule for figuring adjusted basis.

Partner's basis increased.

Partner's basis decreased.

Assumption of liability.

Related person.

Property subject to a liability.

Partner's share of recourse liabilities.

Constructive liquidation.

Limited partner.

Partner's share of nonrecourse liabilities.

Abandoned or worthless partnership interest.

Partnership election to adjust basis of partnership property.

Installment reporting for sale of partnership interest.

Unrealized receivables.

Other items treated as unrealized receivables.

Determining gain or loss.

Inventory items.

Notification required of partner.

Information return required of partnership.

Statement required of partner.

Partner's disposition of distributed unrealized receivables or inventory items.

Exception for inventory items held more than 5 years.

Substituted basis property.

Foreign partner's transfer of an interest in a partnership engaged in the conduct of a U.S. trade or business.

Liquidating payments.

Unrealized receivables and goodwill.

Partners' valuation.

Gain or loss on distribution.

Other payments.

Calculation and reporting for the API 1-year distributive share amount and 3-year distributive share amount by a pass-through entity

Calculation and reporting of recharacterization amount by the owner taxpayer, the owner taxpayer reporting of the recharacterization amount on schedule d (form 1040) or schedule d (form 1041) and on form 8949.

Reporting example for Worksheets A and B.

Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA)

Role of partnership representative, electing out of the centralized partnership audit regime.

AARs filed under the centralized partnership audit regime.

Partner amended return filed as part of modification of the imputed underpayment during a BBA examination.

How To Sign Documents on Behalf of the Partnership

Preparing and filing your tax return.

Free options for tax preparation.

Using online tools to help prepare your return.

Need someone to prepare your tax return?

Advance child tax credit payments.

Coronavirus.

Employers can register to use Business Services Online.

IRS social media.

Watching IRS videos.

Online tax information in other languages.

Free Over-the-Phone Interpreter (OPI) Service.

Accessibility Helpline available for taxpayers with disabilities.

Getting tax forms and publications.

Getting tax publications and instructions in eBook format.

Access your online account (individual taxpayers only).

Tax Pro Account.

Using direct deposit.

Getting a transcript of your return.

Reporting and resolving your tax-related identity theft issues.

Ways to check on the status of your refund.

Making a tax payment.

What if I can’t pay now?

Filing an amended return.

Checking the status of your amended return.

Understanding an IRS notice or letter you’ve received.

Contacting your local IRS office.

What Is TAS?

How can you learn about your taxpayer rights, what can tas do for you, how can you reach tas, how else does tas help taxpayers, tas for tax professionals, low income taxpayer clinics (litcs), section 1061 worksheets and tables, publication 541 - additional material, publication 541 (03/2022), partnerships.

Revised: March 2022

Publication 541 - Introductory Material

Section 1061 reporting. Section 1061 recharacterizes certain long-term capital gains of a partner that holds one or more applicable partnership interests as short-term capital gains. An applicable partnership interest is an interest in a partnership that is transferred to or held by a taxpayer, directly or indirectly, in connection with the performance of substantial services by the taxpayer or any other related person, in an applicable trade or business. See Section 1061 Reporting Instructions for more information.

Schedules K-2 and K-3 (Form 1065). New Schedules K-2 and K-3 replace the reporting of certain international transactions on Schedules K and K-1. The new schedules are designed to provide greater clarity for partners on how to compute their U.S. income tax liability with respect to items of international tax relevance, including claiming deductions and credits. See the Instructions for Schedules K-2 and K-3 for more information.

Photographs of missing children. The Internal Revenue Service is a proud partner with the National Center for Missing & Exploited Children® (NCMEC) . Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. You can help bring these children home by looking at the photographs and calling 1-800-THE-LOST (1-800-843-5678) if you recognize a child.

Introduction

This publication provides supplemental federal income tax information for partnerships and partners. It supplements the information provided in the Instructions for Form 1065, U. S. Return of Partnership Income; the Partner's Instructions for Schedule K-1 (Form 1065); and Instructions for Schedule K-2 and Schedule K-3 (Form 1065). Generally, a partnership doesn't pay tax on its income but “passes through” any profits or losses to its partners. Partners must include partnership items on their tax returns.

For a discussion of business expenses a partnership can deduct, see Pub. 535, Business Expenses. Members of oil and gas partnerships should read about the deduction for depletion in chapter 9 of that publication.

For tax years beginning before 2018, certain partnerships must have a tax matters partner (TMP) who is also a general partner.

The TMP has been replaced with partnership representative for partnership tax years beginning after 2017. Each partnership must designate a partnership representative unless the partnership has made a valid election out of the centralized partnership audit regime. See Designated partnership representative in the Form 1065 instructions and Regulations section 301.6223-1.

A partnership that has foreign partners or engages in certain transactions with foreign persons may have one (or more) of the following obligations.

A partnership may have to withhold tax on distributions to a foreign partner or a foreign partner’s distributive share when it earns income not effectively connected with a U.S. trade or business. A partnership may also have to withhold on payments to a foreign person of FDAP income not effectively connected with a U.S. trade or business. See section 1441 or 1442 for more information.

If a partnership acquires a U.S. real property interest from a foreign person or firm, the partnership may have to withhold tax on the amount it pays for the property (including cash, the fair market value (FMV) of other property, and any assumed liability). See section 1445 for more information.

If a partnership has income effectively connected with a trade or business in the United States (including gain on the disposition of a U.S. real property interest), it must withhold on the ECTI allocable to its foreign partners. See section 1446(a) for more information.

A purchaser of a partnership interest, which may include the partnership itself, may have to withhold tax on the amount realized by a foreign partner on the sale for that partnership interest if the partnership is engaged in a trade or business in the United States. See section 1446(f) for more information.

A partnership may have to withhold tax on distributions to a foreign partner of a foreign partner’s distributive share when it earns withholdable payments. A partnership may also have to withhold on withholdable payments that it makes to a foreign entity. See sections 1471 through 1474 for more information. A partnership that has a duty to withhold but fails to withhold may be held liable for the tax, applicable penalties, and interest. See section 1461 for more information.

For more information on withholding on nonresident aliens and foreign entities, see Pub. 515.

We welcome your comments about this publication and suggestions for future editions.

You can send us comments through IRS.gov/FormComments . Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. Don’t send tax questions, tax returns, or payments to the above address.

If you have a tax question not answered by this publication or the How To Get Tax Help section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.gov/Help/ITA where you can find topics by using the search feature or viewing the categories listed.

Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

Useful Items

Publication

334 Tax Guide for Small Business

505 Tax Withholding and Estimated Tax

515 Withholding of Tax on Nonresident Aliens and Foreign Entities

535 Business Expenses

537 Installment Sales

538 Accounting Periods and Methods

544 Sales and Other Dispositions of Assets

551 Basis of Assets

925 Passive Activity and At-Risk Rules

946 How To Depreciate Property

See How To Get Tax Help at the end of this publication for information about getting publications and forms.

Publication 541 - Main Contents

Forming a partnership.

The following sections contain general information about partnerships.

Organizations Classified as Partnerships

An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade, business, financial operation, or venture and divide its profits. However, a joint undertaking merely to share expenses is not a partnership. For example, co-ownership of property maintained and rented or leased is not a partnership unless the co-owners provide services to the tenants.

The rules you must use to determine whether an organization is classified as a partnership changed for organizations formed after 1996.

An organization formed after 1996 is classified as a partnership for federal tax purposes if it has two or more members and it is none of the following.

An organization formed under a federal or state law that refers to it as incorporated or as a corporation, body corporate, or body politic.

An organization formed under a state law that refers to it as a joint-stock company or joint-stock association.

An insurance company.

Certain banks.

An organization wholly owned by a state, local, or foreign government.

An organization specifically required to be taxed as a corporation by the Internal Revenue Code (for example, certain publicly traded partnerships).

Certain foreign organizations identified in Regulations section 301.7701-2(b)(8).

A tax-exempt organization.

A real estate investment trust (REIT).

An organization classified as a trust under Regulations section 301.7701-4 or otherwise subject to special treatment under the Internal Revenue Code.

Any other organization that elects to be classified as a corporation by filing Form 8832.

An LLC is an entity formed under state law by filing articles of organization as an LLC. Unlike a partnership, none of the members of an LLC are personally liable for its debts. However, if the LLC is an employer, an LLC member may be liable for employer-related penalties. See Pub. 15, Employer’s Tax Guide (Circular E), and Pub. 3402, Taxation of Limited Liability Companies. An LLC may be classified for federal income tax purposes as either a partnership, a corporation, or an entity disregarded as an entity separate from its owner by applying the rules in Regulations section 301.7701-3. See Form 8832 and Regulations section 301.7701-3 for more details.

An organization formed before 1997 and classified as a partnership under the old rules will generally continue to be classified as a partnership as long as the organization has at least two members and doesn't elect to be classified as a corporation by filing Form 8832.

Spouses who own a qualified entity (defined below) can choose to classify the entity as a partnership for federal tax purposes by filing the appropriate partnership tax returns. They can choose to classify the entity as a sole proprietorship by filing a Schedule C (Form 1040) listing one spouse as the sole proprietor. A change in reporting position will be treated for federal tax purposes as a conversion of the entity.

A qualified entity is a business entity that meets all the following requirements.

The business entity is wholly owned by spouses as community property under the laws of a state, a foreign country, or a possession of the United States.

No person other than one or both spouses would be considered an owner for federal tax purposes.

The business entity is not treated as a corporation.

For more information about community property, see Pub. 555, Community Property. Pub. 555 discusses the community property laws of Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Partnership Interests Created by Gift

If a family member (or any other person) receives a gift of a capital interest in a partnership in which capital is a material income-producing factor, the donee's distributive share of partnership income is subject to both of the following restrictions.

It must be figured by reducing the partnership income by reasonable compensation for services the donor renders to the partnership.

The donee's distributive share of partnership income attributable to donated capital must not be proportionately greater than the donor's distributive share attributable to the donor's capital.

For purposes of determining a partner's distributive share, an interest purchased by one family member from another family member is considered a gift from the seller. The FMV of the purchased interest is considered donated capital. For this purpose, members of a family include only spouses, ancestors, and lineal descendants (or a trust for the primary benefit of those persons).

Partnership Interests Held in Connection With Performance of Services

Section 1061 recharacterizes certain net long-term capital gains of a partner that holds one or more applicable partnership interests as short-term capital gains. The provision generally requires that a capital asset be held for more than 3 years for capital gain and loss allocated with respect to any applicable partnership interest (API) to be treated as long-term capital gain or loss. Proposed Regulations ( REG-107213-18 ) were published in the Federal Register on August 14, 2020. Final regulations (Treasury Decision (T.D.) 9945) were published in the Federal Register on January 19, 2021. T.D. 9945, 2021-5 I.R.B. 627, is available at IRS.gov/irb/2021-5_IRB#TD-9945 . Owner taxpayers and pass-through entities may rely on the proposed regulations for tax years beginning before January 19, 2021, (the date final regulations were published in the Federal Register) provided they follow the proposed regulations in their entirety and in a consistent manner. An owner taxpayer or pass-through entity may choose to apply the final regulations to a tax year beginning after December 31, 2017, provided that they consistently apply the final section 1061 regulations in their entirety to that year and all subsequent years. Owner taxpayers and pass-through entities must apply the final regulations to tax years beginning on or after January 19, 2021. See Section 1061 Reporting Instructions , later.

An API is any interest in a partnership that, directly or indirectly, is transferred to (or is held by) the taxpayer in connection with the performance of substantial services by the taxpayer, or any other related person, in any “applicable trade or business.” The special recharacterization rule applies to:

Capital gains recognized by a partner from the sale or exchange of an applicable partnership interest under sections 741(a) and 731(a); and

Capital gains recognized by a partnership, allocated to a partner with respect to an API.

An applicable trade or business means any activity conducted on a regular, continuous, and substantial basis (regardless of whether the activity is conducted through one or more entities) which consists in whole or in part of raising and returning capital, and either :

Investing in or disposing of “specific assets” (or identifying specified assets for investing or disposition), or

Developing specified assets.

Specified assets are:

Securities (as defined in section 475(c)(2), under rules for mark-to-market accounting for securities dealers);

Commodities (as defined under rules for mark-to-market accounting for commodities dealers in section 475(e)(2));

Real estate held for rental or investment;

Options or derivative contracts with respect to such securities;

Cash or cash equivalents; or

An interest in a partnership to the extent of the partnership’s proportionate interest in the foregoing.

A security for this purpose means any of the following.

Share of corporate stock.

Partnership interest or beneficial ownership interest in a widely held or publicly traded partnership or trust.

Note, bond, debenture, or other evidence of indebtedness.

Interest rate, currency, or equity notional principal contract.

Interest in, or derivative financial instrument in, any such security or any currency (regardless of whether section 1256 applies to the contract).

Position that is not such a security and is a hedge with respect to such a security and is clearly identified.

If spouses carry on a business together and share in the profits and losses, they may be partners whether or not they have a formal partnership agreement. If so, they should report income or loss from the business on Form 1065. They should not report the income on a Schedule C (Form 1040) in the name of one spouse as a sole proprietor. However, the spouses can elect not to treat the joint venture as a partnership by making a qualified joint venture election.

A "qualified joint venture," whose only members are spouses filing a joint return, can elect not to be treated as a partnership for federal tax purposes. A qualified joint venture conducts a trade or business where the only members of the joint venture are spouses filing jointly; both spouses elect not to be treated as a partnership; both spouses materially participate in the trade or business (see Passive Activity Limitations in the Instructions for Form 1065 for a definition of material participation); and the business is co-owned by both spouses and is not held in the name of a state law entity such as a partnership or an LLC.

Under this election, a qualified joint venture conducted by spouses who file a joint return is not treated as a partnership for federal tax purposes and therefore doesn't have a Form 1065 filing requirement. All items of income, gain, deduction, loss, and credit are divided between the spouses based on their respective interests in the venture. Each spouse takes into account their respective share of these items as a sole proprietor. Each spouse would account for their respective share on the appropriate form, such as Schedule C (Form 1040). For purposes of determining net earnings from self-employment, each spouse's share of income or loss from a qualified joint venture is taken into account just as it is for federal income tax purposes (that is, based on their respective interests in the venture).

If the spouses do not make the election to treat their respective interests in the joint venture as sole proprietorships, each spouse should carry their share of the partnership income or loss from Schedule K-1 (Form 1065) to their joint or separate Form(s) 1040. Each spouse should include their respective share of self-employment income on a separate Schedule SE (Form 1040), Self-Employment Tax.

This generally doesn't increase the total tax on the return, but it does give each spouse credit for social security earnings on which retirement benefits are based. However, this may not be true if either spouse exceeds the social security tax limitation.

For more information on qualified joint ventures, go to IRS.gov/QJV .

The partnership agreement includes the original agreement and any modifications. The modifications must be agreed to by all partners or adopted in any other manner provided by the partnership agreement. The agreement or modifications can be oral or written.

Partners can modify the partnership agreement for a particular tax year after the close of the year but not later than the date for filing the partnership return for that year. This filing date doesn't include any extension of time.

If the partnership agreement or any modification is silent on any matter, the provisions of local law are treated as part of the agreement.

Terminating a Partnership

A partnership terminates when all its operations are discontinued and no part of any business, financial operation, or venture is continued by any of its partners in a partnership.

See Regulations section 1.708-1(b)(1) for more information on the termination of a partnership. For special rules that apply to a merger, consolidation, or division of a partnership, see Regulations sections 1.708-1(c) and 1.708-1(d).

The partnership's tax year ends on the date of termination. The date of termination is the date the partnership completes the winding up of its affairs.

If a partnership is terminated before the end of what would otherwise be its tax year, Form 1065 must be filed for the short period, which is the period from the beginning of the tax year through the date of termination. The return is due the 15 th day of the 3 rd month following the date of termination. See Partnership Return (Form 1065) , later, for information about filing Form 1065.

The conversion of a partnership into an LLC classified as a partnership for federal tax purposes doesn't terminate the partnership. The conversion is not a sale, exchange, or liquidation of any partnership interest; the partnership's tax year doesn't close; and the LLC can continue to use the partnership's taxpayer identification number (TIN).

However, the conversion may change some of the partners' bases in their partnership interests if the partnership has recourse liabilities that become nonrecourse liabilities. Because the partners share recourse and nonrecourse liabilities differently, their bases must be adjusted to reflect the new sharing ratios. If a decrease in a partner's share of liabilities exceeds the partner's basis, they must recognize gain on the excess. For more information, see Effect of Partnership Liabilities under Basis of Partner's Interest , later.

The same rules apply if an LLC classified as a partnership is converted into a partnership.

Certain partnerships with more than 100 partners are required to file Form 1065; Schedule K-1; and related forms and schedules electronically. For tax years beginning after July 1, 2019, a religious or apostolic organization exempt from income tax under section 501(d) must file Form 1065 electronically. Other partnerships generally have the option to file electronically. For details about electronic filing, see the Instructions for Form 1065.

Exclusion From Partnership Rules

Certain partnerships that do not actively conduct a business can choose to be completely or partially excluded from being treated as partnerships for federal income tax purposes. All the partners must agree to make the choice, and the partners must be able to figure their own taxable income without figuring the partnership's income. However, the partners are not exempt from the rule that limits a partner's distributive share of partnership loss to the adjusted basis of the partner's partnership interest. Nor are they exempt from the requirement of a business purpose for adopting a tax year for the partnership that differs from its required tax year.

An investing partnership can be excluded if the participants in the joint purchase, retention, sale, or exchange of investment property meet all the following requirements.

They own the property as co-owners.

They reserve the right separately to take or dispose of their shares of any property acquired or retained.

They do not actively conduct business or irrevocably authorize some person acting in a representative capacity to purchase, sell, or exchange the investment property. Each separate participant can delegate authority to purchase, sell, or exchange their share of the investment property for the time being for their account, but not for a period of more than a year.

An operating agreement partnership group can be excluded if the participants in the joint production, extraction, or use of property meet all the following requirements.

They own the property as co-owners, either in fee or under lease or other form of contract granting exclusive operating rights.

They reserve the right separately to take in kind or dispose of their shares of any property produced, extracted, or used.

They don't jointly sell services or the property produced or extracted. Each separate participant can delegate authority to sell their share of the property produced or extracted for the time being for their account, but not for a period of time in excess of the minimum needs of the industry, and in no event for more than 1 year.

An eligible organization that wishes to be excluded from the partnership rules must make the election not later than the time for filing the partnership return for the first tax year for which exclusion is desired. This filing date includes any extension of time. See Regulations section 1.761-2(b) for the procedures to follow.

Every partnership that engages in a trade or business or has gross income must file an information return on Form 1065 showing its income, deductions, and other required information. The partnership return must show the names and addresses of each partner and each partner's distributive share of taxable income. The return must be signed by a partner. If an LLC is treated as a partnership, it must file Form 1065 and one of its members must sign the return.

A partnership is not considered to engage in a trade or business, and is not required to file a Form 1065, for any tax year in which it neither receives income nor pays or incurs any expenses treated as deductions or credits for federal income tax purposes.

See the Instructions for Form 1065 for more information about who must file Form 1065.

Partnership Distributions

Partnership distributions include the following.

A withdrawal by a partner in anticipation of the current year's earnings.

A distribution of the current year's or prior years' earnings not needed for working capital.

A complete or partial liquidation of a partner's interest.

A distribution to all partners in a complete liquidation of the partnership.

A partnership distribution is not taken into account in determining the partner's distributive share of partnership income or loss. If any gain or loss from the distribution is recognized by the partner, it must be reported on their return for the tax year in which the distribution is received. Money or property withdrawn by a partner in anticipation of the current year's earnings is treated as a distribution received on the last day of the partnership's tax year.

A partner's adjusted basis in their partnership interest is decreased (but not below zero) by the money and adjusted basis of property distributed to the partner. See Adjusted Basis under Basis of Partner's Interest , later.

A partnership generally doesn't recognize any gain or loss because of distributions it makes to partners. The partnership may be able to elect to adjust the basis of its undistributed property.

When a partnership distributes the following items, the distribution may be treated as a sale or exchange of property rather than a distribution.

Unrealized receivables or substantially appreciated inventory items distributed in exchange for any part of the partner's interest in other partnership property, including money.

Other property (including money) distributed in exchange for any part of a partner's interest in unrealized receivables or substantially appreciated inventory items.

See Payments for Unrealized Receivables and Inventory Items under Disposition of Partner's Interest , later.

This treatment doesn't apply to the following distributions.

A distribution of property to the partner who contributed the property to the partnership.

Payments made to a retiring partner or successor in interest of a deceased partner that are the partner's distributive share of partnership income or guaranteed payments.

Inventory items of the partnership are considered to have appreciated substantially in value if, at the time of the distribution, their total FMV is more than 120% of the partnership's adjusted basis for the property. However, if a principal purpose for acquiring inventory property is to avoid ordinary income treatment by reducing the appreciation to less than 120%, that property is excluded.

Partner's Gain or Loss

A partner generally recognizes gain on a partnership distribution only to the extent any money (and marketable securities treated as money) included in the distribution exceeds the adjusted basis of the partner's interest in the partnership. Any gain recognized is generally treated as capital gain from the sale of the partnership interest on the date of the distribution. If partnership property (other than marketable securities treated as money) is distributed to a partner, they generally don't recognize any gain until the sale or other disposition of the property.