How to Write a Business Plan for Raising Venture Capital

Written by Dave Lavinsky

Are you looking for VC funding or funding from other potential investors?

You need a good business idea – and an excellent business plan.

Business planning and raising capital go hand-in-hand. A venture capital business plan is required for attracting a venture capital firm. And the desire to raise capital (whether from an individual “angel” investor or a venture capitalist) is often the key motivator in the business planning process.

Download the Ultimate VC Business Plan Template here

Writing an Investor-Ready Business Plan

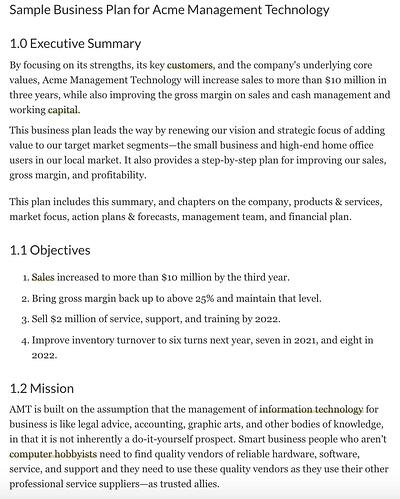

Executive summary.

Goal of the executive summary: Stimulate and motivate the investor to learn more.

- Hook them on the first page. Most investors are inundated with business plans. Your first page must make them want to keep reading.

- Keep it simple. After reading the first page, investors often do not understand the business. If your business is truly complex, you can dive into the details later on.

- Be brief. The executive summary should be 2 to 4 pages in length.

Company Analysis

Goal of the company analysis section: Educate the investor about your company’s history and explain why your team is perfect to execute on the business opportunity.

- Give some history. Provide the background on the company, including date of formation, office location, legal structure, and stage of development.

- Show off your track record. Detail prior accomplishments, including funding rounds, product launches, milestones reached, and partnerships secured, among others.

- Why you? Demonstrate your team’s unique unfair competitive advantage, whether it is technology, stellar management team, or key partnerships.

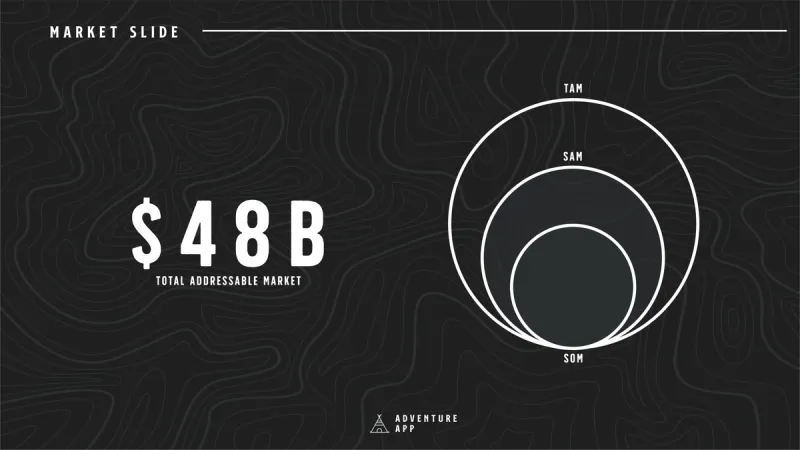

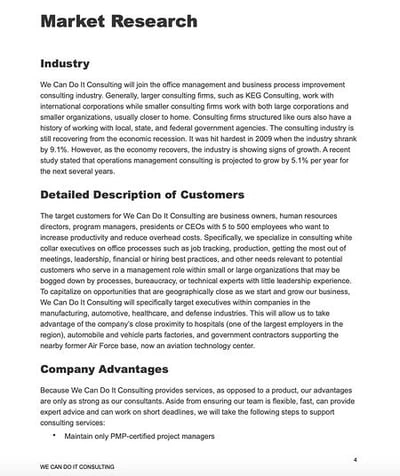

Industry Analysis

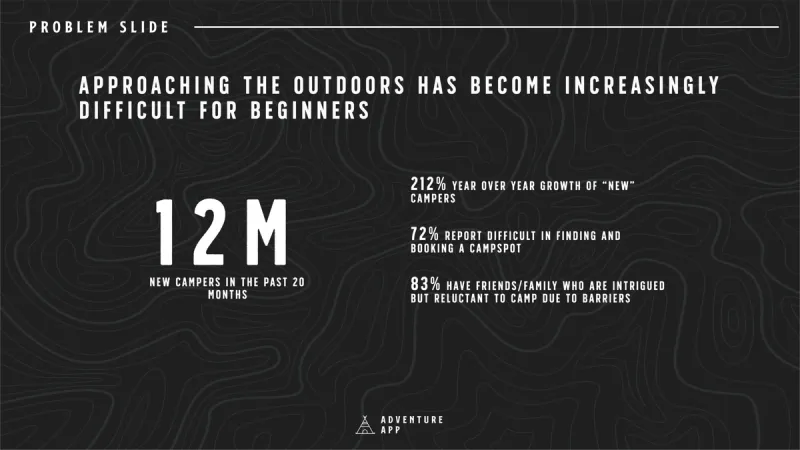

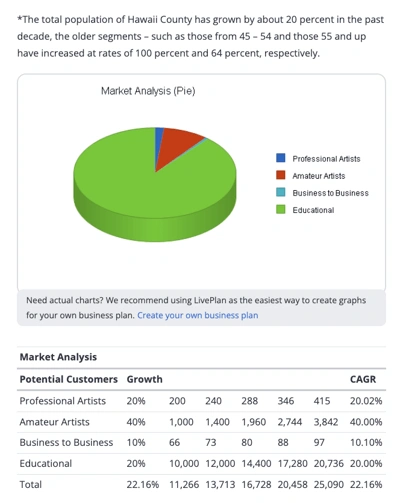

Goal of the industry analysis section: Prove that there is a real market for your product or service.

- Demonstrate the need – rather than the desire – for your product. Ideally, people are willing to pay money to satisfy this need.

- Cite credible sources when describing the size and growth of your market.

- Use independent research. If possible, source research through an independent research firm to enhance your credibility. For general market sizes and trends, we suggest citing at least two independent research firms.

- Focus on the “relevant” market size. For example, if you sell a portable biofeedback stress relief device, your relevant market is not the entire health care market. In determining the relevant market size, focus on the products or services that you will directly compete against.

- It’s not just a research report – each fact, figure, and projection should support your company’s prospects for success.

- Don’t ignore negative trends. Be sure to explain how your company would overcome potential negative trends. Such analysis will relieve investor concerns and enhance the venture capital business plan’s credibility.

- Be prepared for due diligence. It’s critical that the data you present is verifiable since any serious investor will conduct extensive due diligence.

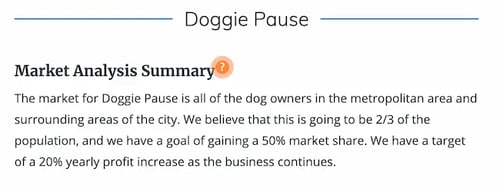

Customer Analysis

Goal of customer analysis section: Convey the needs of your potential customers and show how your company’s products and services satisfy those needs.

- Define your customers precisely. For example, it’s not adequate to say your company is targeting small businesses since there are several million of these.

- Detail their demographics. How many customers fit the definition? Where are these customers located? What is their average income?

- Identify the needs of these customers. Use data to demonstrate past actions (X% have purchased a similar product), future projections (X% said they would purchase the product), and/or implications (X% use a product/service which your product enhances).

- Explain what drives their decisions. For example, is price more important than quality?

- Detail the decision-making process. For example, will the customer seek multiple bids? Will the customer consult others in their organization before making a decision?

Finish Your Investor Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

And know it’s in the exact format that venture capitalists want?

With Growthink’s Ultimate Business Plan Template , you can finish your plan in just 8 hours or less!

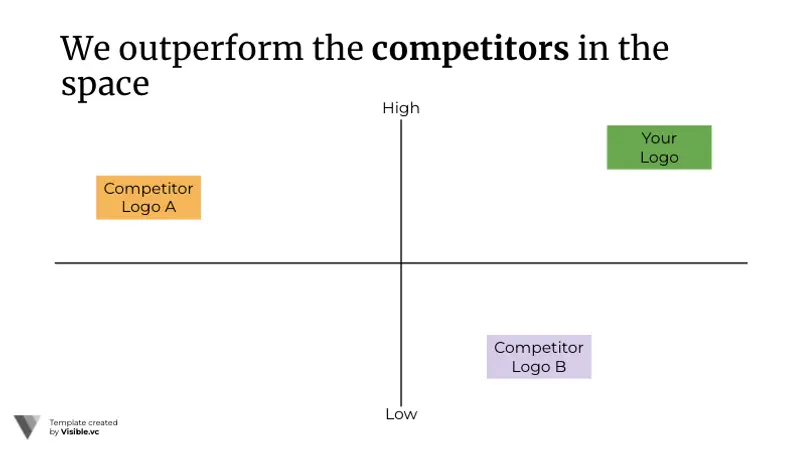

Competitive Analysis

Goal of the competitive analysis section: Define the competition and demonstrate your competitive advantage.

- List competitors. Many companies make the mistake of conveying that they have few or no real competitors. From an investor’s standpoint, a competitor is something that fulfills the same need as your product. If you claim you have no competitors, you are seriously undermining the credibility of your business plans.

- Include direct and indirect competitors. Direct competitors serve the same target market with similar products. Indirect competitors serve the same target market with different products or different target markets with similar products.

- List public companies (when relevant, of course). A public company implies that the market size is big. This gives the assurance that if management executes well, the company has substantial profit and liquidity potential.

- Don’t just list competitors. Carefully describe their strengths and weaknesses, as well as the key drivers of competitive differentiation in the marketplace. And when describing competitors’ weaknesses, be sure to use objective information (e.g. market research).

- Demonstrate barriers to entry. In describing the competitive landscape, show how your business model creates competitive advantages, and – more importantly – defensible barriers to entry.

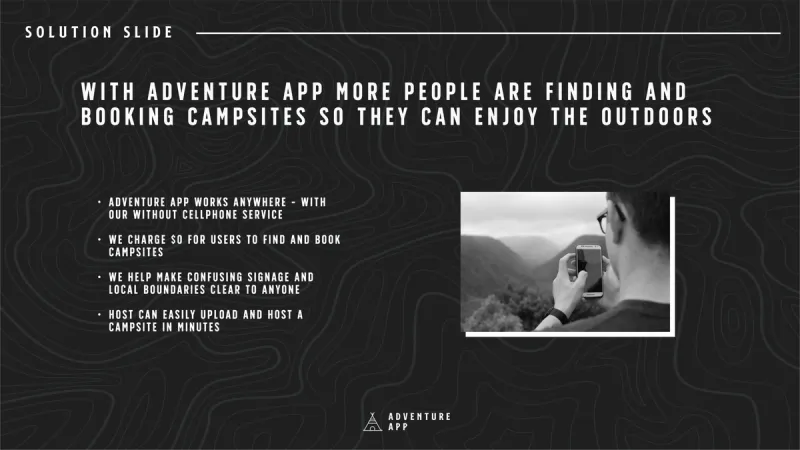

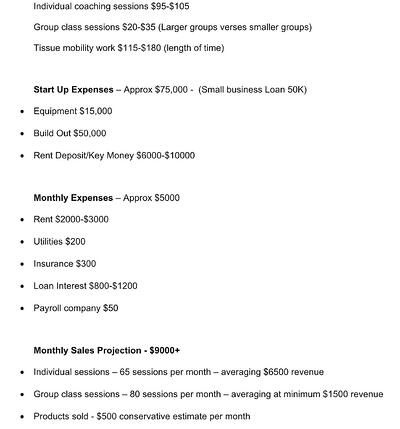

Marketing Plan

Goal of the marketing plan: Describe how your company will penetrate the market, deliver products/services, and retain customers.

- Products. Detail all current and future products and services – but focus primarily on the short-to-intermediate time horizon.

- Promotions. Explain exactly which marketing/advertising strategies will be used and why.

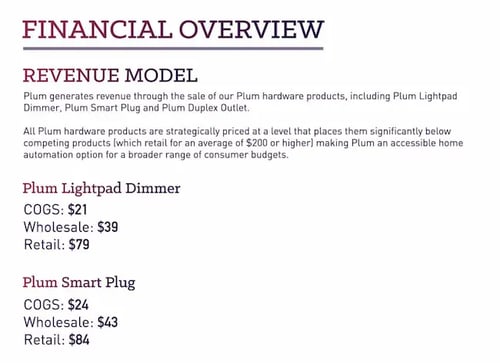

- Price. Be sure to provide a clear rationale for your pricing strategy.

- Place. Explain exactly how your products and services will be delivered to your customers.

- Detail your customer retention plan. Explain how you will retain your customers, whether through customer relationship management (CRM) applications, building network externalities, introducing ongoing value-added services, or other means.

- Define your partnerships. From an investor’s perspective, what partnership you have with whom is not nearly as important as the specific terms of the partnership. Be sure to document the specifics of the partnerships (e.g. how it will work, the financial terms, the types of customer leads expected from each partner, etc.).

Operations Plan

Goal of the operations plan: Present the action plan for executing your company’s vision.

- Concept vs. reality. The operations plan transforms business plans from concept into reality. Investors do not invest in concepts; they invest in reality. And the operations plan proves that the management team can execute your concept better than anybody else.

- Everyday processes. Detail the short-term processes and systems that provide your customers with your products and services.

- Business milestones. Lay out the significant long-term business milestones for the company, and prove that the team will execute on the long-term vision. A great way to present the milestones is to organize them into a chart with key milestones on the left side and target dates on the right side.

- Be consistent. Make sure that the milestone projections are consistent with the rest of the venture capital business plan – particularly the financial plan.

- Be aggressive but credible. Presenting a plan in which the company grows too quickly will show the naiveté of the team while presenting too conservative a growth plan will often fail to excite an early stage investor (who typically looks for a 10X return on her investment).

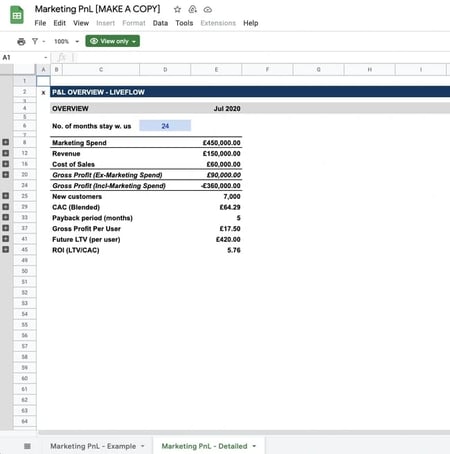

Financial Plan

Goal of the financial plan: Explain how your business will generate returns for your investors.

- Detail all revenue streams. Be sure to include all revenue streams. Depending on the type of business, these may include sales of products/services, referral revenues, advertising sales, licensing/royalty fees, and/or data sales.

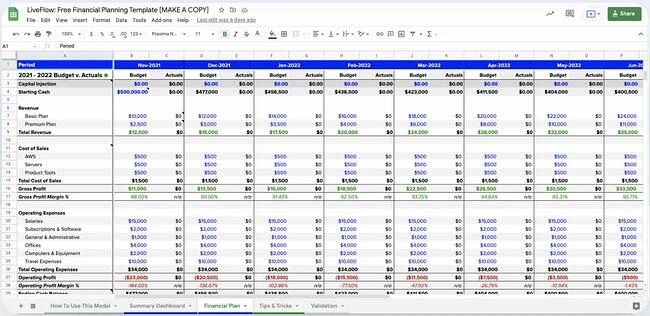

- Be consistent with your Pro-forma statements. Pro-forma statements are projected financial statements. It is critical that these projections reflect the other sections of your newly formed business plan.

- Validate your assumptions and projections. The financial plan must detail your key assumptions, and it is critical that these assumptions are feasible. Be sure to use competitive research to validate your projections and assumptions versus the reality in your marketplace. Assessing and basing financial projections on those of similar firms will greatly validate the realism and maturity of the financial projections.

- Detail the uses of funds. Understandably, investors want to know what, specifically, you plan to do with their money. Uses of funds could include expenses involved with marketing, staffing, technology development, office space, among other uses.

- Provide a clear exit strategy. All investors are motivated by a clear picture of your exit strategy, or the timing and method through which they can “cash in” on their investment. Be sure to provide comparable examples of firms that have successfully exited. The most common exits are IPOs or acquisitions. And while the exact method is not always crucial, the investor wants to see this planning in order to better understand the management team’s motivation and commitment to building long-term value.

Above all, the business plan is a marketing document that helps to sell the investor on the business opportunity, the team, the strategy, and the potential for significant return on investment.

How to raise venture capital is a difficult and time-intensive challenge. There is no easy shortcut or silver bullet. However, you can greatly improve your chances of raising venture capital by writing a business plan that speaks directly to the investor’s perspective. A VC business plan template will significantly help in cutting down the time it takes to complete your plan.

Finish Your VC Business Plan in 1 Day!

Raising venture capital faqs, what is the purpose of a business plan for raising venture capital.

The purpose of writing a business plan for raising venture capital is to convince investors that the proposed new or existing company has a good chance of being successful and can earn them a favorable return on investment (ROI).

A VC Business Plan Template will help you in creating an investor ready plan quickly and easily.

What Does VC Funding Entail?

VC funding is a type of financial transaction in which the venture capital firm invests in startup companies or early-stage companies. The firm invests its own capital (which it receives from other entities that invest in the VC firm) in these nascent companies with the goal of rapidly expanding them. Generally, early-stage companies use bootstrapping, self-funding, bank loans, and/or angel investment before raising their first round of venture capital. Companies might receive several rounds of VC funding.

What is a Typical Amount of Capital to Raise?

Typically, the first round (Series A) of venture capital amounts to $2-10 million. To raise that amount from VCs at the very start of your company is often very difficult. Rather, you should consider approaching angel investors and banks to provide initial financing to get you to the point at which venture capitalists are interested in providing funding. Gaining customer traction is generally the point in which VCs are ready to provide Series A financing. VCs will provide Series B funding, Series C funding, etc. to help continue to fund a company’s growth if the company seems poised for success. These funding rounds are usually much larger than Series A rounds.

How Long Does It Take For Investors To Decide If My Business Is Worth Investing In?

It varies from investor to investor, but prepare yourself to wait up to three months before receiving a check from a VC. The process typically includes sending the VC a teaser email to get their interest, following up with a business plan, giving a pitch presentation, and negotiating the terms of the funding round.

How Do I Find Venture Capitalists?

There are many venture capital firms and virtually all of them have websites and are thus fairly easy to find. There are also directories of them available on the internet. You may also be able to find VCs through personal introductions or by attending industry events.

Look for VCs that have funded companies in your industry/sector, at your stage of development and in your geographical area.

What Capital Raising Options are Available For a Business?

There are four broad options for raising money or venture capital when you run a business. These include venture capital firms, angel investors, loans and venture debt, or bootstrapping.

Venture Capitalists

A Venture Capitalist is an investor that provides equity financing for companies that have already achieved some traction but lack the financial resources to scale up their operations. Their investment objective is typically to grow the company so it can be sold or go public at a later date so the VC can exit or cash in on their success.

Angel Investors

Angel investors are wealthy individuals who invest their own money into startup companies because they believe they will get an above-average return on their investment. They also invest if/when they like the entrepreneurs and/or management team, they are passionate about the concept, or if they’d like to get involved in an exciting new venture.

Loans and Venture Debt

Business loans or venture debt is money given to a company in return for interest and principal payments over time, but without the investor taking an ownership stake in the company. Such funding is typically issued by local banks. Debt funding is typically less expensive than equity financing, but it is much harder for early-stage companies to raise significant amounts of debt capital.

Bootstrapping

Bootstrapping is the process of a startup company funding its own growth from internal sources such as the founder's savings, loans from friends and family, or credit card debt.

Firms that are bootstrapped can grow at a more controlled rate while they achieve product-market fit before an angel investor or venture capital firm injects their money to scale up the company.

Bootstrapping is best for companies with low capital needs because there’s only so much you can raise in this manner. If you need millions of dollars, bootstrapping just won’t work and you’ll need to tap venture capital.

How exactly will your small business persuade these potential investors to sign a check? Once you know what type of capital you are trying to raise, you can develop business plans to suit their exact requirements.

Need help with your business plan?

Speak with one of our professional business plan consultants or contact our private placement memorandum experts.

Or, if you’re developing your own PPM, consider using Growthink’s new private placement memorandum template .

Other Helpful Funding & Business Plan Articles

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Venture Capital Business Plan: A Guide for Entrepreneurs

AUG.01, 2023

Are you looking for VC funding or funding from other potential investors? You need a good business idea – and an excellent business plan. Business planning and raising capital go hand-in-hand. An investor business plan is required to attract a venture capital firm. And the desire to raise capital (whether from an individual “angel” investor or a venture capitalist) is often the key motivator in business planning.

What is a venture capitalist?

A venture capitalist, often referred to as a VC, strategically allocates financial capital to early-stage, high-potential startup companies to foster exponential growth and catalyze groundbreaking innovation. By leveraging their investments, venture capitalists secure partial ownership and wield a profound influence over critical strategic decisions and operational facets. Furthermore, they impart invaluable guidance and mentorship and harness their extensive network of influential contacts and abundant resources.

Venture capitalists aim to attain considerable returns on their investments through the strategic divestment of their ownership stake in the company at a subsequent stage, commonly facilitated through an IPO or a trade sale, encompassing mergers or acquisitions. Given the inherent risks associated with their investment endeavors, venture capitalists adopt an exceptionally discerning approach, meticulously selecting a mere fraction of the myriad companies that seek their sought-after financial backing.

Their active pursuit centers around identifying enterprises that epitomize disruptive technologies or trailblazing business models, thrive within expansive and rapidly evolving markets, exhibit a significant competitive edge, and are steered by an adept and fervent management team. These are the essential elements of a compelling Business Plan for Investors that can attract the attention and support of venture capitalists.

What is a Venture Capital Firm?

Venture capital firms (VCs) are money companies that put money in and help new and scalable startups. VCs get funds from different investors and then give them to startups they think can change or make new markets. VCs use a team of experts who check the chance of new companies. These experts have different backgrounds and skills in different businesses, and they use their ideas to help VCs pick companies that are likely to do well.

Besides giving money, VCs also give their companies other benefits, such as advice and access to their network of people, which can be very important to early-stage companies.

Types of Venture Capital Investments

Venture capital investments can be classified into different types based on the company’s development stage. The main types are:

1. Seed Capital

Seed capital is the earliest funding given to an innovator or group with a vision for a novel product or service but has yet to transform it into a feasible business. Seed capital is typically used for market exploration, product creation, prototype evaluation, customer verification, etc. Seed capital is very precarious because there is no assurance that the vision will work or that there will be a market appetite for it. However, seed capital can also generate very high rewards if the vision becomes successful and attracts more funding.

2. Startup Capital

Startup capital is the funding given to a company that has created its product or service and has introduced it in the market but has yet to generate substantial revenue or profit. Startup capital is typically used for promotion, sales, distribution, customer acquisition, etc. Startup capital is less precarious than seed capital because there is some indication of product-market fit and traction. However, startup capital can also be challenging to obtain because there is still uncertainty about the scalability and sustainability of the business model.

3. Early Stage Capital

Early-stage capital is the funding granted to a company that has validated its product or service in the market and has begun generating revenue and profit but has yet to attain its full potential. Early-stage capital is typically used to diversify the product or service portfolio, penetrate new segments, recruit more talent, optimize operations, etc. Early-stage capital is less precarious than startup capital because there is more evidence and traction of the business. However, early-stage capital can also be challenging and demanding because there are more expectations and pressure from the investors.

4. Expansion Capital

Expansion capital is the funding given to a company that has attained a significant market presence, revenue, and profit growth and is ready to scale up its business to the next level. Expansion capital is usually used to acquire other entities, develop new products or services, open new outlets, increase production capability, etc. Expansion capital is less perilous than early-stage capital because the business has more stability and predictability. However, expansion capital can also be costly and dilutive because more investors are engaged, and more equity is surrendered.

5. Late Stage Capital

Late-stage capital is the funding bestowed to a company that has reached a mature stage of development and growth and is preparing for an exit event such as an IPO or a trade sale. Late-stage capital is usually used to enhance the company’s valuation, reputation, and visibility, improve financial performance, strengthen governance, etc. Late-stage capital is less perilous than expansion capital because there is more certainty and credibility in the business. However, late-stage capital can also be complex and restrictive because more regulations and obligations are involved. However, a SBA Business Plan can help late-stage companies comply with the requirements and expectations of investors.

6. Bridge Financing

Bridge financing is the interim funding granted to a company that requires short-term capital to fill an urgent need or gap until it obtains a lasting or stable source of financing. Bridge financing is typically utilized for satisfying payroll, settling bills, accomplishing a project, etc. Bridge financing is perilous because there is no assurance that the firm can secure lasting or stable financing. However, bridge financing can also be beneficial and adaptable because it can offer swift and effortless access to cash.

The following table compares the different types of venture capital investments based on their stage, amount, risk, return, and purpose:

Venture Capital and VC Funding Methods

Venture capital is a source of funding for entrepreneurs who need money to grow their businesses. VC funding methods are the terms and conditions venture capitalists agree on when investing in the companies they support. Different methods of making a venture capital deal exist based on the people involved, worth, chance, and choices. The main methods are:

1. Common stock

This is the most straightforward form of VC funding method. It involves issuing shares of common stock to investors in exchange for capital. A common stock gives the investors voting rights and dividends (if any) in proportion to their ownership stake. Common stock is usually preferred by early-stage companies with low valuation and high risk.

2. Preferred stock

This is a more complex and sophisticated form of VC funding method. It involves issuing shares of preferred stock to investors in exchange for capital. Preferred stock gives the investors preference over common stockholders regarding dividends, liquidation, and conversion rights. Preferred stock is usually preferred by later-stage companies that have higher valuations and lower risk.

3. Convertible debt

This is a mixed form of VC funding method. It means giving the investors a debt instrument that can be converted into shares later or when some conditions are satisfied. Convertible debt pays the investors interest and money back until it gets converted. Early companies with unclear worth and a high chance of failure often choose convertible debt.

4. SAFE (Simple Agreement for Future Equity)

This is a newer and simpler form of VC funding method. It means making a deal with the investors that lets them get shares in the future at a fixed worth or lower price. SAFE only involves issuing shares or debt instruments to the investors once a future financing event occurs. SAFE is usually preferred by seed-stage companies that have uncertain valuations and high risk.

Main Sections of a Venture Capital Business Plan

A venture business plan is a document describing your business idea, market opportunity, competitive advantage, financial projections, and funding needs. It is a tool that helps you communicate your vision and strategy to potential investors and partners. A venture business plan sample should include the following sections:

1. Executive Summary

The executive summary is pivotal in your venture business plan, serving as the primary section that demands attention. It aims to present a concise yet comprehensive overview of your business idea, target market, unique value proposition, traction and milestones, financial summary, and funding request. It is vital to draft the executive summary clearly and compellingly that captivates readers and incites their curiosity to explore your venture further.

2. Company Analysis

The company analysis section delves deeper into your company’s narrative, providing a detailed account of its history, mission, vision, values, goals, objectives, team, culture, and legal structure. This section highlights your company’s noteworthy achievements and inherent strengths while addressing the potential challenges and risks it faces. Moreover, it presents a compelling case for the qualifications and capabilities of your team, demonstrating their aptitude in executing the business plan.

3. Industry Analysis

The industry analysis section demonstrates your understanding of the market you operate in or plan to enter. It should provide relevant information about your industry’s size, growth, trends, drivers, challenges, opportunities, and outlook. It should also identify and analyze your industry’s key segments and sub-segments.

4. Customer Analysis

The customer analysis section is important as it outlines and describes your target market and various customer segments. It should encompass a detailed profile of your ideal customers, covering their demographics, psychographics, behaviors, needs, pains, desires, preferences, and purchasing patterns. Furthermore, this section should include an estimation of your product or service’s total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM).

5. Competitive Analysis

The competitive analysis section is crucial in identifying and evaluating direct and indirect competitors. It thoroughly assesses their strengths, weaknesses, strategies, products, services, prices, features, benefits, market share, customer satisfaction, and distinctive factors. Additionally, this section explains your market positioning strategy, emphasizing your competitive advantages and unique selling points.

6. Marketing Plan

The marketing plan section outlines your marketing strategy and tactics for reaching and attracting your target customers and generating sales and revenue. It should cover the following elements:

- Product and service

- Distribution

- Marketing process

- Marketing Physical Evidence

7. Operations Plan

The operations plan section describes how you will run and manage your business daily. It should cover the following aspects:

- Human Resources

- Legal issues and requirements

8. Financial Plan

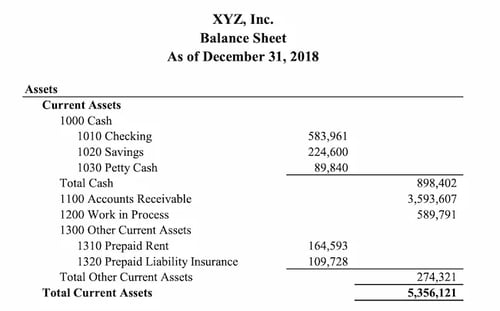

The financial plan section provides a detailed projection of your financial performance and position for three to five years. It should include the following components:

- Income Statement

- Cash Flow Statement

- Balance Sheet

- Break-Even Analysis

- Funding Request

- Funding Sources

- Exit Strategy

OGSCapital for Your Venture Capital Business Plan

Are you looking for an answer to: How to write a venture capital business plan? Our business plan experts at OGSCapital can help. We have a team of professional business plan writers with over 15 years of experience offering business plan writing services. We have helped over 5,000 clients attract more than $2.7 billion in financing. Here are some of the reasons why you should choose OGSCapital for your venture capital business plan:

OGSCapital can provide you with the following benefits:

- A customized and high-quality business plan

- Comprehensive and in-depth market research and analysis

- A realistic and accurate financial model and projections

- A persuasive and compelling executive summary

- A professional and attractive design and layout of your business plan

- Fast and reliable delivery within 10 to 15 days

- A revision after receiving the first draft of your business plan

If you’re also confused about how to write a business plan for venture capital that stands out from the crowd and increases your chances of getting funded, contact our experts at OGSCapital today.

Frequently Asked Questions

1. What do venture capitalists look for in a business plan?

A business plan to raise venture capital should demonstrate a great business idea, a talented and experienced team, a unique and valuable product or service, a market validation, a huge and expanding market, and a good deal and exit strategy. Plus, it should be clear, concise, well-researched and realistic.

2. What is the golden rule for venture capitalists?

For venture capitalists, people matter more than ideas. They look for entrepreneurs and managers with passion, dedication, flexibility, and willingness to learn from feedback. Venture capitalists believe these are the essential qualities that make or break a venture.

Download Venture Capital Business Plan Sample in PDF

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

Venture Capital Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business Plans » Financial Services

Are you about starting a venture capital firm ? If YES, here’s a complete sample venture capital business plan template & feasibility report you can use for FREE to raise money .

If you are interested in the capital market and you have some form of financial expertise and certifications, one of the businesses that you can conveniently start is a venture capital firm. As a venture capital firm, your responsibility is to pool capital from investors and then invest it in startups businesses.

Aside from the money invested, venture capitalists also ensure that they provide the capacity and support which startups companies need to grow and become profitable. The first step you need to take if you want to start your own venture capital firm is to conduct an extensive research on venture capital firm.

A Sample Venture Capital Firm Business Plan Template

1. industry overview.

The Venture Capital and Principal Trading industry is an industry that comprises of firms and investment consultants basically acting as principals in the buying or selling of financial contracts. Essentially, principals in this context are investors who trade (buy or sell) for their own account, rather than on behalf of their clients.

This industry consist of venture capital firms, investment clubs and venture settlement companies and does not include investment bankers, securities dealers and commodity contracts dealers trading as principals.

It is a fact that, the Venture Capital and Principal Trading industry is growing faster than most industries in the financial services sector not only in the united states but across the global market. Industry value added (IVA), a measure of the industry’s contribution to the overall economy, is projected to increase at a 6.9 percent annualized rate over the next 10 years.

Indeed, the Venture Capital and Principal Trading industry is a very large and thriving industry not only in the developed nations, but also in developing and under developing countries of the world. Statistics has it that the Venture Capital and Principal Trading industry in the United States of America, is worth $106 billion, with an estimated growth rate of 4.2 percent.

There are about 29,069 registered and licensed venture capital firms in the United States and they are responsible for employing about 74,814 people. It is important to state that there is no company with a dominant market share in this industry; the industry is open for fair competitions for the available market.

Over and above, the main reasons for starting a venture capital firm is obviously to provide funding for startup companies with great potential of making profits and growing big in the future.

So your responsibility is not just to raise capital but also to look for startup companies where the capital can be invested and it will generate good returns for over a period of time. The truth is that it takes a core professional to be able to identify a startup company that has the potential to grow and become profitable if funds and pumped into it.

2. Executive Summary

St. Martins& Associates, LLP is a registered, licensed and accredited venture capitalist firm that will be based in New York City – New York.

The company will handle all aspect of venture capitalists services such as investing in financial contracts on own account, participating in investment clubs (group of people who pool their money to make investments), mineral royalties or leases dealing (as principal in dealing to investors), oil royalty dealing (as principal in dealing to investors), vertical settlement (purchasing life insurance policy at a discount to later collect the death benefit), venture capital (investing in startups and small businesses with long-term growth potential), trade in financial products and other relevant investment advisory and consulting services.

We are aware that to run a standard venture capital firm can be demanding which is why we are well trained, certified and equipped to perform excellently well. St. Martins & Associates, LLP is a client – focused and result driven venture capitalist firm that provides broad- based services.

We will offer trusted and profitable venture capitalists services to all our individual clients, and corporate clients at local, state, national, and international level. We will ensure that we work hard to meet and surpass our clients’ expectations whenever they invest their funds with us.

At St. Martins & Associates, LLP, our client’s best interest would always come first, and everything we do is guided by our values and professional ethics. We will ensure that we hire professionals who are well experienced in venture capitalist line of business and other investment portfolios with good track record of return on investments.

St. Martins & Associates, LLP will at all times demonstrate her commitment to sustainability, both individually and as a firm, by actively participating in our communities and integrating sustainable business practices wherever possible.

We will ensure that we hold ourselves accountable to the highest standards by meeting our client’s needs precisely and completely. We will cultivate a working environment that provides a human, sustainable approach to earning a living, and living in our world, for our partners, employees and for our clients.

Our plan is to position the business to become one of the leading brands in the venture capitalists line of business in the whole of New York City, and also to be amongst the top 20 venture capitalists firms in the United States of America within the first 10 years of operations.

This might look too tall a dream but we are optimistic that this will surely be realized because we have done our research and feasibility studies and we are enthusiastic and confident that New York is the right place to launch our venture capitalists business before expanding our investment portfolio sourcing for start – ups from other cities in The United States of America.

St. Martins & Associates, LLP is founded by Martin Yorkshire and his business partners for many years Carlos Dominguez. The organization will be managed by both of them since they have adequate working experience to manage such business.

Martin Yorkshire has well over 15 years of experience working at various capacity as a venture capitalist for leading investment banks and related firms in the United States of America. Martin Yorkshire graduated from both University of California – Berkley with a Degree in Accounting, and University of Harvard (MSc.) and he is an accredited and certified venture capitalist.

3. Our Products and Services

St. Martins & Associates, LLP is going to offer varieties of services within the scope of the financial investment services industry in the United States of America. Our intention of starting our St. Martins & Associates, LLP firm is to work with promising start – ups and other business ventures.

We are well prepared to make profits from the Venture Capital and Principal Trading industry and we will do all that is permitted by the law in the United States to achieve our business goals, aim and ambition. Our business offering are listed below;

- Investing in financial contracts on own account

- Participating in investment clubs (group of people who pool their money to make investments)

- Mineral royalties or leases dealing (as principal in dealing to investors)

- Oil royalty dealing (as principal in dealing to investors)

- Vertical settlement (purchasing life insurance policy at a discount to later collect the death benefit)

- Venture capital (investing in startups and small businesses with long-term growth potential)

- Trade in financial products

- Related investment consulting and advisory services

4. Our Mission and Vision Statement

- Our vision is to build a venture capitalists brand that will become one of the top choices for investors in the whole of New York City – New York.

- Our vision reflects our values: integrity, service, excellence and teamwork.

- Our mission is to position the business to become one of the leading brands in the Venture Capital and Principal Trading industry in the whole of New York City, and also to be amongst the top 20 venture capitalist firms in the United States of America within the first 10 years of operations.

Our Business Structure

Ordinarily we would have settled for two or three staff members, but as part of our plan to build a standard venture capitalist firm in New York City – New York, we have perfected plans to get it right from the beginning which is why we are going the extra mile to ensure that we have qualified, competent, honest and hardworking employees to occupy all the available positions in our firm.

The picture of the kind of the venture capitalist firm we intend building and the business goals we want to achieve is what informed the amount we are ready to pay for the best hands available in and around New York and environs as long as they are willing and ready to work with us to achieve our business goals and objectives. Below is the business structure that we will build St. Martins & Associates, LLP;

- Chief Executive Officer

- Venture Capitalists Consultants

Admin and HR Manager

Risk Manager

- Marketing and Sales Executive

Chief Financial Officer (CFO) / Chief Accounting Officer (CAO).

- Customer Care Executive / Front Desk Officer

5. Job Roles and Responsibilities

Chief Executive Office:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results; developing incentives; developing a climate for offering information and opinions; providing educational opportunities.

- Creating, communicating, and implementing the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for fixing prices and signing business deals

- Responsible for providing direction for the business

- Creates, communicates, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

Venture Capitalist Consultants

- Provides market research and implementing new investment product and strategies

- Creates research and review platforms for new, existing and potential investment products

- Exceeds client expectations with returns on investments

- Works closely with analysts and traders to ensure trading strategy is carried out correctly

- Construct and review performance reports to show to investors

- Works directly with marketer to relay investment strategy and risk measures for website and other forms of marketing for your hedge fund

- Performs due diligence visits and assessing investment management firms and quantitatively analyzing investment pools

- Has extensive knowledge of industry policies and regulations set in place by the SEC

- Focuses on capital introductions and networking to sign up new investors to your fund

- Plans, designs and implements an overall risk management process for the organization;

- Risk assessment, which involves analyzing risks as well as identifying, describing and estimating the risks affecting the business;

- Risk evaluation, which involves comparing estimated risks with criteria established by the organization such as costs, legal requirements and environmental factors, and evaluating the organization’s previous handling of risks;

- Establishes and quantifies the organization’s ‘risk appetite’, i.e. the level of risk they are prepared to accept;

- Risk reporting in an appropriate way for different audiences, for example, to the board of directors so they understand the most significant risks, to business heads to ensure they are aware of risks relevant to their parts of the business and to individuals to understand their accountability for individual risks;

- Corporate governance involving external risk reporting to stakeholders;

- Carries out processes such as purchasing insurance, implementing health and safety measures and making business continuity plans to limit risks and prepare for if things go wrong;

- Conducts audits of policy and compliance to standards, including liaison with internal and external auditors;

- Provides support, education and training to staff to build risk awareness within the organization.

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Design job descriptions with KPI to drive performance management for clients

- Regularly hold meetings with key stakeholders to review the effectiveness of HR Policies, Procedures and Processes

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defines job positions for recruitment and managing interviewing process

- Carries out staff induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Updates job knowledge by participating in educational opportunities; reading professional publications; maintaining personal networks; participating in professional organizations.

- Oversees the smooth running of the daily office activities.

Marketing / Investor Relations Officer

- Identifies, prioritizes, and reach out to new partners, and business opportunities et al

- Identifies development opportunities; follows up on development leads and contacts; participates in the structuring and financing of projects; assures the completion of relevant projects.

- Writes winning proposal documents, negotiate fees and rates in line with company policy

- Responsible for handling business research, marker surveys and feasibility studies for clients

- Responsible for supervising implementation, advocate for the customer’s needs, and communicate with clients

- Develops, executes and evaluates new plans for expanding increase sales

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps increase sales and growth for the company

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- create reports from the information concerning the financial transactions recorded by the bookkeeper

- Prepares the income statement and balance sheet using the trial balance and ledgers prepared by the bookkeeper.

- Provides managements with financial analyses, development budgets, and accounting reports; analyzes financial feasibility for the most complex proposed projects; conducts market research to forecast trends and business conditions.

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting for one or more properties.

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the company

- Serves as internal auditor for the company

Client Service Executive / Front Desk Officer

- Welcomes guests and clients by greeting them in person or on the telephone; answering or directing inquiries.

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s products and services

- Manages administrative duties assigned by the manager in an effective and timely manner

- Consistently stays abreast of any new information on the company’s products, promotional campaigns etc. to ensure accurate and helpful information is supplied to clients

- Receives parcels / documents for the company

- Distributes mails in the organization

- Handles any other duties as assigned my the line manager

6. SWOT Analysis

St. Martins & Associates, LLP engaged the services of a core professional in the area of business structuring to assist our organization in building a well – structured venture capitalist firm that can favorably compete in the highly competitive Venture Capital and Principal Trading industry.

Part of what the team of business consultant did was to work with the management of our organization in conducting a SWOT analysis for St. Martins & Associates, LLP. Here is a summary from the result of the SWOT analysis that was conducted on behalf of St. Martins & Associates, LLP;

Our core strength lies in the power of our team; our workforce. We have a team that can go all the way to give our clients value for their money ( good returns on their investment ) and also to increase our annual returns; a team that are trained and equipped to pay attention to details and to deliver excellent jobs. We are well positioned and we know we will attract loads of clients from the first day we open our doors for business.

As a new venture capitalist firm, it might take some time for our organization to break into the market and gain acceptance especially from corporate clients in the already saturated Venture Capital and Principal Trading industry that is perhaps our major weakness. So also we may not have the required cash to give our business the kind of publicity we would have loved to.

- Opportunities:

The opportunities in the Venture Capital and Principal Trading industry is massive considering the number of small businesses who would need financial supports and strategies from venture capitalists to grow their business and increase their profits.

As a standard and accredited venture capitalist firm, we are ready to take advantage of any opportunity that comes our way.

Venture capitalist firms services involves large amount of cash and it is known to be a very high risk venture, Hence, whoever chooses to manage it must not just have solid investment background, but must also know how to handle risks and discover potential thriving businesses and opportunities.

The truth is that if you are not grounded in risks management as a venture capitalist, you may likely throw away peoples’ monies and investment. Just as in any other business and investment vehicles, economic downturn, unstable financial market and unfavorable government economic policies can hamper the growth and profitability of venture capitalist firms.

7. MARKET ANALYSIS

- Market Trends

A close watch on the Venture Capital and Principal Trading industry shows that in the dawn of recessionary declines, the industry is expected to continue on a path to growth, but not without a few more ups and downs. This group of firms and individuals has benefited from rising security prices and increasing merger and acquisition activity over the last five years.

As a result of this trend, Venture Capital and Principal Trading industry revenue is expected to grow over the five-year period at an annualized rate of 9.1 percent to $42.9 billion in 2016.

The revenue growth for the industry was restrained in the early part of the period as the industry was reluctant to bounce back from the financial crisis and subsequent recession of the prior period that caused stock markets and business activity to dramatically contract in the United States and of course in the global market.

On the average, it is trendy to find venture capital firms employ strategies that can help them reduce market risk specifically by shorting equities or through the use of derivatives.

8. Our Target Market

The main reasons for starting a venture capital firm is obviously to provide funding for startup companies with great potential of making profits and growing big in the future. So your responsibility is not just to raise capital but also to look for startup companies where the capital can be invested and it will generate good returns for over a period of time.

The truth is that it takes a core professional to be able to identify a startup company that has the potential to grow and become profitable if funds and pumped into it.

As a standard, accredited and licensed venture capitalist firm, St. Martins & Associates, LLP offers a wide range of investment portfolio management services hence we are well trained and equipped to services a wide range of clientele base and start – ups.

Our target market cuts across businesses and investors that have the required capital to invest in start – ups and other investment portfolios. We are coming into the industry with a business concept and investment strategies that will enable us produce good returns on investment for ourselves and our clients.

Below is a list of the individual and organizations that we have specifically design our products and services for;

- Small and medium scales businesses

- Accredited Investors

- Start – ups

- Investment Clubs

- Top corporate executives

- Corporate Organizations / Blue Chip Companies

Our Competitive Advantage

Despite the fact that venture capitalist investment strategies give huge returns on investment, it is indeed risky venture. If you drive through the street of New York City, you will come across several venture capitalists firms and related business ventures; that goes to show you that there is competition in the industry.

For you to survive as a venture capitalist firm, you should be able to come up with workable investment strategies; strategies that will help you attract the required cash / capital and above all you should be a good risks manager and one that can spot a potential thriving business from afar.

We are quite aware that to be highly competitive in the Venture Capital and Principal Trading industry means that we should be able to give good returns on investments to our clients, turn around the fortune of a dying company for good , spot potential successful business ideas and invest in them, deliver consistent quality service, our clients should be satisfied with our investment strategies and we should be able to meet the expectations of clients.

St. Martins& Associates, LLP might be a new entrant into the Venture Capital and Principal Trading industry in the United States of America, but the management staffs and owners of the business are considered gurus. They are people who are core professionals and licensed and highly qualified portfolio management experts in the United States. These are part of what will count as a competitive advantage for us.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category (start – ups venture capitalist businesses) in the industry meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives.

9. SALES AND MARKETING STRATEGY

- Sources of Income

St. Martins& Associates, LLP is established with the aim of maximizing profits in the Venture Capital and Principal Trading industry and we are going to go all the way to ensure that we do all it takes to attract clients on a regular basis. St. Martins& Associates, LLP will generate income by offering the following investment related services;

10. Sales Forecast

One thing is certain, there would always be accredited investors, small scale and medium scale businesses and wealthy individuals who would need the services of tested and trusted venture capitalist firms.

We are well positioned to take on the available market in New York City and other key cities in the United States of America and we are quite optimistic that we will meet our set target of generating enough income / profits from the first six month of operations and grow the business and our clientele base beyond New York City to other cities in the United States of America.

We have been able to critically examine the Venture Capital and Principal Trading industry and we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. The sales projection is based on information gathered on the field and some assumptions that are peculiar to similar startups in New York City.

Below is the sales projection for St. Martins& Associates, LLP, it is based on the location of our business and the wide range of investment management services that we will be offering;

- First Fiscal Year-: $750,000

- Second Year-: $1.5 Million

- Third Year-: $3 Million

N.B : This projection is done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and there won’t be any major competitor offering same additional services as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

We are mindful of the fact that there are stiffer competition amongst venture capitalists firms and other related financial investment cum consulting service providers in the United States of America; hence we have been able to hire some of the best business developer to handle our sales and marketing.

Our sales and marketing team will be recruited based on their vast experience in the industry and they will be trained on a regular basis, so as to be well equipped to meet their targets and the overall goal of the organization.

We will also ensure that our return on investment and excellent job deliveries speaks for us in the market place; we want to build a standard venture capitalist business that will leverage on word of mouth advertisement from satisfied clients (both individuals and corporate organizations).

Our goal is to grow our venture capitalists firm to become one of the top 20 venture capitalist firms in the United States of America which is why we have mapped out strategy that will help us take advantage of the available market and grow to become a major force to reckon with not only in the New York City but also in other cities in the United States of America.

St. Martins& Associates, LLP is set to make use of the following marketing and sales strategies to attract clients;

- Introduce our business by sending introductory letters alongside our brochure to corporate organizations, start – ups, accredited investors, entrepreneurs and key stake holders in New York City and other cities in The United States

- Advertise our business in relevant financial and business related magazines, newspapers, TV stations, and radio station.

- List our business on yellow pages ads (local directories)

- Attend relevant international and local finance and business expos, seminars, and business fairs et al

- Create different packages for different category of clients (start – ups and established corporate organizations) in order to work with their budgets and still deliver good returns on investment

- Leverage on the internet to promote our business

- Engage direct marketing approach

- Encourage word of mouth marketing from loyal and satisfied clients

11. Publicity and Advertising Strategy

The uniqueness of the Venture Capital and Principal Trading industry is such that it is the result they produce that helps boost their brand awareness.

Venture capitalists firms do not go out there to source any businesses or investors that they can come across but they are strategic when it comes to inviting investors to invest in a project or when it comes to acquiring a struggling company.

It will be out of place to boost your venture capitalist firm brand if you have not proven your worth in the industry. If you have successfully proven that you have what it takes to operate a successful venture capitalist firm, then you next port of call is to strategically engage the media to help you promote your brand and also to create a positive corporate identity.

We have been able to work with our brand and publicity consultants to help us map out publicity and advertising strategies that will help us walk our way into the heart of our target market.

We are set to take the Venture Capital and Principal Trading industry by storm which is why we have made provisions for effective publicity and advertisement of our venture capitalist firm. Below are the platforms we intend to leverage on to promote and advertise St. Martins & Associates, LLP;

- Place adverts on both print ( community based newspapers and magazines ) and electronic media platforms

- Sponsor relevant community based events / programs

- Leverage on the internet and social media platforms like; Instagram, Facebook , twitter, YouTube, Google + et al to promote our brand

- Install our Bill Boards on strategic locations all around New York City.

- Engage in road show from time to time

- Distribute our fliers and handbills in target areas

- Ensure that all our workers wear our branded shirts and all our vehicles are well branded with our company’s logo et al.

12. Our Pricing Strategy

Venture capitalists are known to generate income from various investment portfolios hence there are no pricing models for this type of business.

But on the other hand, they tend to negotiate with their financial partners on percentage whenever they invest their hard earned money in an investment vehicle handled by a venture capitalist firm. At St. Martins& Associates, LLP we will ensure that we give good returns on investment (ROI) and always maximize profits.

- Payment Options

At St. Martins & Associates, LLP our payment policy will be all inclusive because we are quite aware that different people prefer different payment options as it suits them. Here are the payment options that we will make available to our clients;

- Payment by via bank transfer

- Payment via online bank transfer

- Payment via check

- Payment via bank draft

- Payment with cash

In view of the above, we have chosen banking platforms that will help us achieve our plans with little or no itches.

13. Startup Expenditure (Budget)

The cost of starting a venture capitalists firm is in the two fold; the cost of setting up the office structure and of course the capital meant for investment. The amount required to invest in this line of business could range from 1 Million US Dollars to even multiple Millions of Dollars. So you must employ aggressive strategies to pool such cash together.

As regard the cost of setting up the office structure, your concern should be to secure a good office facility in a busy business district; it can be expensive though, but that is one of the factors that will help you position your hedge fund firm to attract the kind of investors you would need. This is the financial projection and costing for starting St. Martins & Associates, LLP;

- The Total Fee for incorporating the Business – $750.

- The budget for basic insurance policy covers, permits and business license – $2,500

- The Amount needed to acquire a suitable Office facility in a business district 6 months (Re – Construction of the facility inclusive) – $40,000.

- The Cost for equipping the office (computers, software applications, printers, fax machines, furniture, telephones, filing cabins, safety gadgets and electronics et al) – $5,000

- The cost for purchase of the required software applications (CRM software, Accounting and Bookkeeping software and Payroll software et al) – $10,500

- The Cost of Launching your official Website – $600

- Budget for paying at least three employees for 3 months plus utility bills – $10,000

- Additional Expenditure (Business cards, Signage, Adverts and Promotions et al) – $2,500

- Investment fund – 1 Million Dollars

- Miscellaneous: $1,000

Going by the report from the market research and feasibility studies conducted, we will need $150,000 excluding $1M investment capital to successfully set – up a medium scale but standard venture capitalist firm in the United States of America.

Generating Funding / Startup Capital for St. Martins & Associates, LLP

St. Martins & Associates, LLP is a business that will be owned and managed by Martin Yorkshire and his business partners for many years Carlos Dominguez. They are the sole financial of the firm, but may likely welcome other partners later which is why they decided to restrict the sourcing of the start – up capital for the business to just three major sources.

These are the areas we intend generating our start – up capital;

- Generate part of the start – up capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from my Bank

N.B: We have been able to generate about $50,000 ( Personal savings $40,000 and soft loan from family members $10,000 ) and we are at the final stages of obtaining a loan facility of $100,000 from our bank. All the papers and document has been duly signed and submitted, the loan has been approved and any moment from now our account will be credited.

14. Sustainability and Expansion Strategy

The future of a business lies in the numbers of loyal customers that they have the capacity and competence of the employees, their investment strategy and the business structure. If all of these factors are missing from a business (company), then it won’t be too long before the business close shop.

One of our major goals of starting St. Martins & Associates, LLP is to build a business that will survive off its own cash flow without the need for injecting finance from external sources once the business is officially running. We know that one of the ways of gaining approval and winning customers over is to give investors good returns on their investment.

We will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare is well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and re – training of our workforce is at the top burner of our business strategy.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of three years or more as determined by the board of the organization. We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List / Milestone

- Business Name Availability Check:>Completed

- Business Incorporation: Completed

- Opening of Corporate Bank Accounts various banks in the United States: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of All form of Insurance for the Business: Completed

- Securing a standard office facility in New York City: Completed

- Conducting Feasibility Studies: Completed

- Generating part of the start – up capital from the founder: Completed

- Applications for Loan from our Bankers: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents: In Progress

- Design of The Company’s Logo: Completed

- Graphic Designs and Printing of Packaging Marketing / Promotional Materials: Completed

- Recruitment of employees: In Progress

- Purchase of the Needed software applications, furniture, office equipment, electronic appliances and facility facelift: In progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business (Business PR): In Progress

- Health and Safety and Fire Safety Arrangement: In Progress

- Establishing business relationship with vendors and key players in the industry: In Progress

Related Posts:

- Bookkeeping Business Plan [Sample Template]

- Tax Preparation Business Plan [Sample Template]

- Mortgage Brokerage Business Plan [Sample Template]

- Pawn Shop Business Plan [Sample Template]

- ATM Business Plan [Sample Template]

Venture Capital Business Plan

- Written By Dave Lavinsky

As a startup company, one of the most important things you can do is to create a business plan that will secure funding from venture capitalists. But what exactly is a business plan for a venture capitalist?

A business plan is a comprehensive document that outlines the business goals and strategies of a company seeking venture capital investment. It typically includes detailed information about the company’s product or service, market analysis, financial projections, and management team bios.

A business plan for potential investors must be well-written and well-presented to impress those looking to fund your business. It should clearly state why the company needs funding and how it will be used. The financial projections should be realistic and backed up by market research. The management team should be able to demonstrate their expertise in running a business.

If you are a startup company looking for venture capital investment, it is essential to create a well-crafted business plan that will impress potential investors.

Who are Venture Capitalists?

A venture capitalist (VC) is an individual or firm that invests its capital in startup companies in exchange for ownership equity. They are typically looking for high-growth businesses with solid business plans and a team of experienced entrepreneurs.

VCs can provide much-needed capital to young companies, but they also bring expertise and guidance. In return for their investment, VCs typically require a seat on the company’s board of directors and a share of the profits.

What are Venture Capital Firms?

A venture capital firm is an organization that invests money in startup companies in exchange for a percentage of ownership in the company. In return for their investment, venture capitalists typically require a seat on the company’s board of directors and a share of the profits.

There are many venture capital firms around the world, but not all of them are interested in investing in every type of company. It is important to do your research and find the right VC firm for your business.

Types of Venture Capital Investment

There are two main types of venture capital investment: equity financing and debt financing.

Equity financing is when VCs invest venture capital in exchange for a percentage of ownership in the company. This type of financing is typically used by early-stage companies that need a large amount of capital to get started. In return for their investment, VCs typically require a seat on the company’s board of directors and a share of the profits.

Debt financing is when VCs provide a loan of venture capital to the company in exchange for interest payments. This type of financing is typically used by more established companies that need a smaller amount of capital. In return for their investment, VCs typically require a personal guarantee from the company’s founders.

There are different stages of investment or funding for startup companies . They are:

Seed Funding

Seed funding is the earliest stage of venture capital investment. It typically goes to businesses just starting and has not yet launched their product or service. Seed funding can be used to cover the costs of research and development, marketing, and other early-stage expenses.

Series A Funding

Series A funding is the next stage of venture capital investment. It is typically used to finance the launch of a product or service, expand into new markets, or hire additional staff. Series A funding can also be used to cover the costs of marketing and advertising.

Series B Funding

Series B funding is a form of venture capital that is usually used to help a company grow at a faster pace. It can be used to finance the expansion of a business into new markets, hire additional staff, or develop new products or services.

Series C Funding

Series C funding is typically used by companies that are ready to go public or be acquired by another company. It can also be used to finance a major expansion, such as the opening of new offices or the launch of a new product line.

How to Raise Venture Capital and VC Funding

There are several ways to raise venture capital for your startup company. One option is to take out loans from family, friends, or banks. Another option is to sell equity in your company to a venture capitalist.

If you are selling equity in your company for venture capital, it is important to have a well-crafted business plan that will impress potential investors. Your business plan should include detailed information about your product or service, market analysis, financial projections, and management team bios.

You can also use crowdfunding platforms to raise capital from a large group of people. crowdfunding is a great way to get your business off the ground, but it is important to remember that you will be giving up a percentage of ownership in your company.

What Capital Raising Options are Available for a Business?

There are a few different types of capital-raising options available for businesses. The most common options are:

One option for raising capital is to take out loans from banks or other financial institutions. This type of financing is typically used by more established businesses that have a good credit history.

Venture Capital

Another option for raising capital is to take out investments from a venture capitalist. A venture capitalist is an individual or firm that invests money in startup companies in exchange for a percentage of ownership in the company.

Crowdfunding

Crowdfunding is a newer form of financing that allows businesses to raise money from a large group of people via the internet. There are several crowdfunding platforms available, such as Kickstarter and Indiegogo.

Initial Public Offering (IPO)

An IPO is when a company sells shares of stock to the public for the first time. This type of financing is typically used by more established companies that are looking to raise a large amount of capital.

Small Business Administration (SBA) Loans

The SBA is a government agency that provides loans to small businesses. These loans are typically used by businesses that may not qualify for traditional bank financing.

Which Capital Raising Option is Right for Your Business?

The type of capital-raising option that is right for your business will depend on many factors, such as the stage of your business, the amount of money you need to raise, and your credit history.

If you are just starting, you may want to consider crowdfunding or an SBA loan. If you have a good credit history, you may be able to get a bank loan. If you are looking to raise a large amount of money, you may want to consider an IPO.

No matter which option you choose, it is important to have a well-crafted business plan that will impress potential investors. Your business plan should include detailed information about your product or service, market analysis, financial projections, and management team bios.

Startup Companies Business Plan Template

If you are a startup company looking for venture capital investment, it is essential to create a well-crafted business plan that will impress potential investors. Use this business plan template to get started:

Executive Summary

The executive summary is a brief overview of your company’s history, mission, and objectives. It should be no more than two pages long.

Company Description

The company description should provide an overview of your business, including your products or services, market analysis, and target customers.

Management Team

The management team section should include bios of your executive team and any other key personnel.

When writing about the management team section of a business plan, you should include bios of your executive team and any other key personnel. This section should also include a description of each team member’s experience and qualifications. This is also a great section to include the management team’s motivation and why the business is raising money.

Financial Projections

The financial projections section should include your company’s historical financial information, as well as your projected income statement, balance sheet, and cash flow statement.

When writing about the financial projections section of a business plan, you should include your company’s historical financial information, as well as your projected income statement, balance sheet, and cash flow statement. This information will help potential investors understand how your company is performing financially and what the future outlook is for your business.

Investor Information

The investor information section should include your company’s equity structure and any terms or conditions that would be attached to an investment.

This business plan template will help you get started on creating a professional and impressive business plan that will attract venture capitalists. Remember to tailor the template to your specific business needs.

Raising Venture Capital FAQs

What is venture capital.

Venture capital is a type of investment that is typically used to finance the launch or expansion of a business. Venture capitalists are usually interested in high-growth companies with the potential to generate large returns.

How do I raise venture capital?