24 Resume Summary Examples That Get Interviews

By Biron Clark

Published: November 8, 2023

Biron Clark

Writer & Career Coach

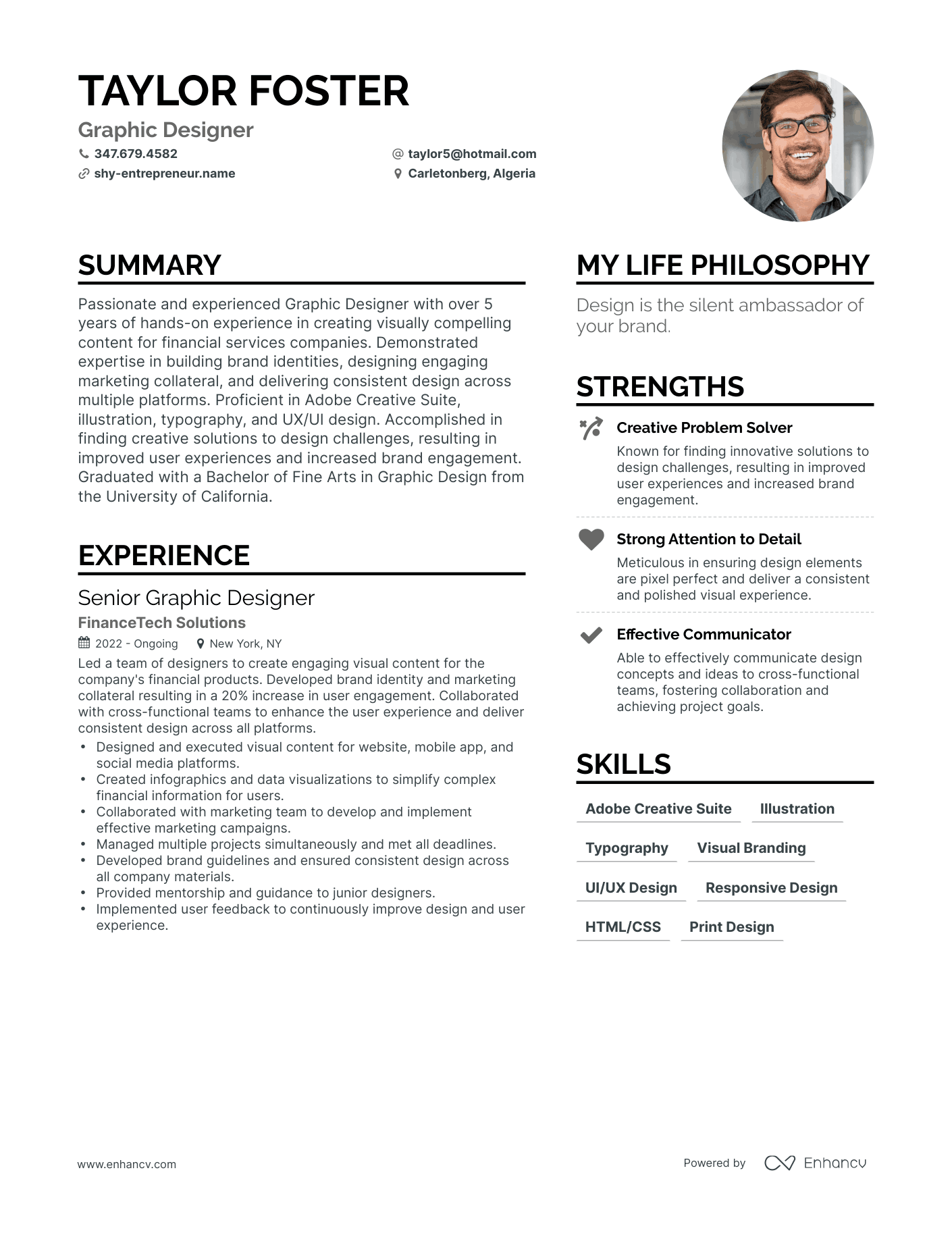

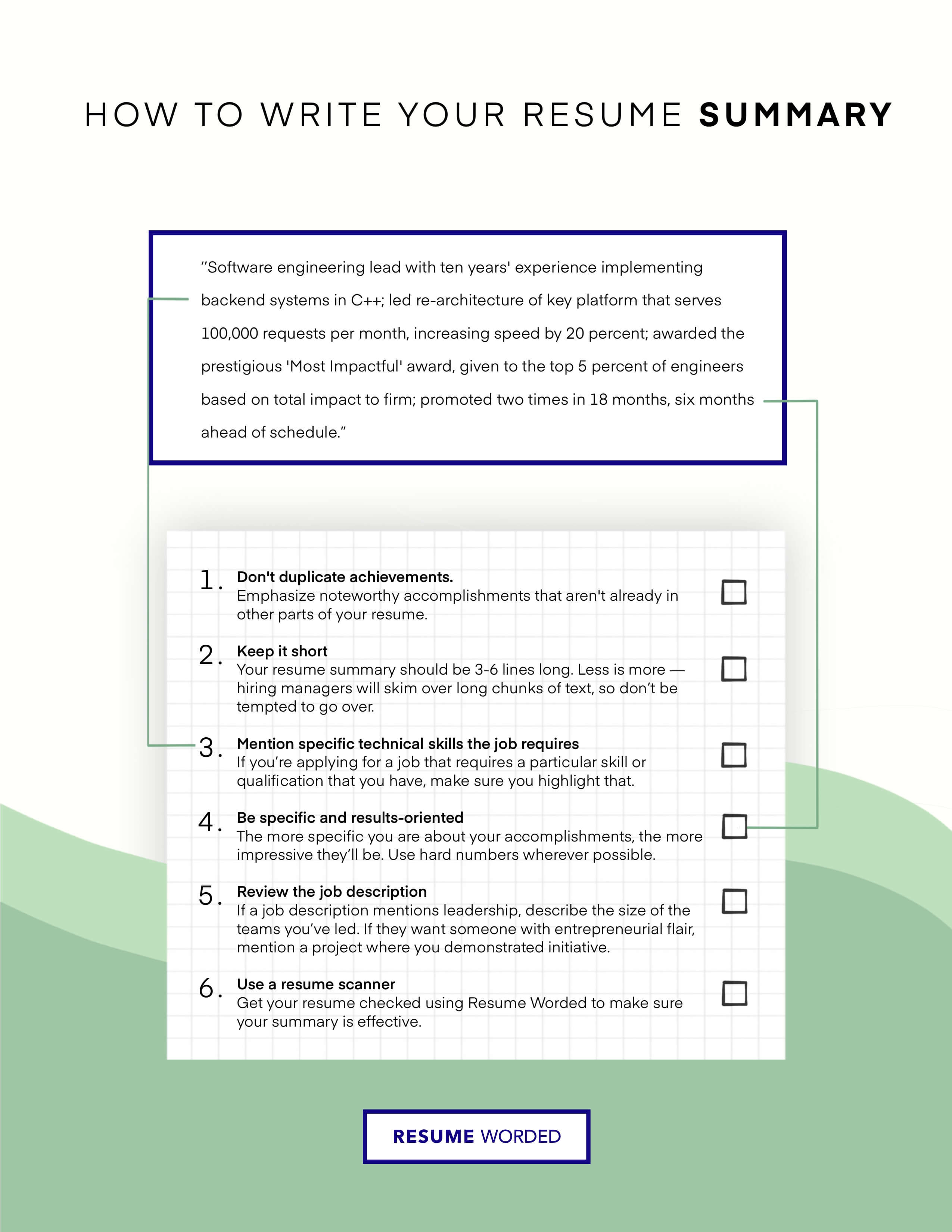

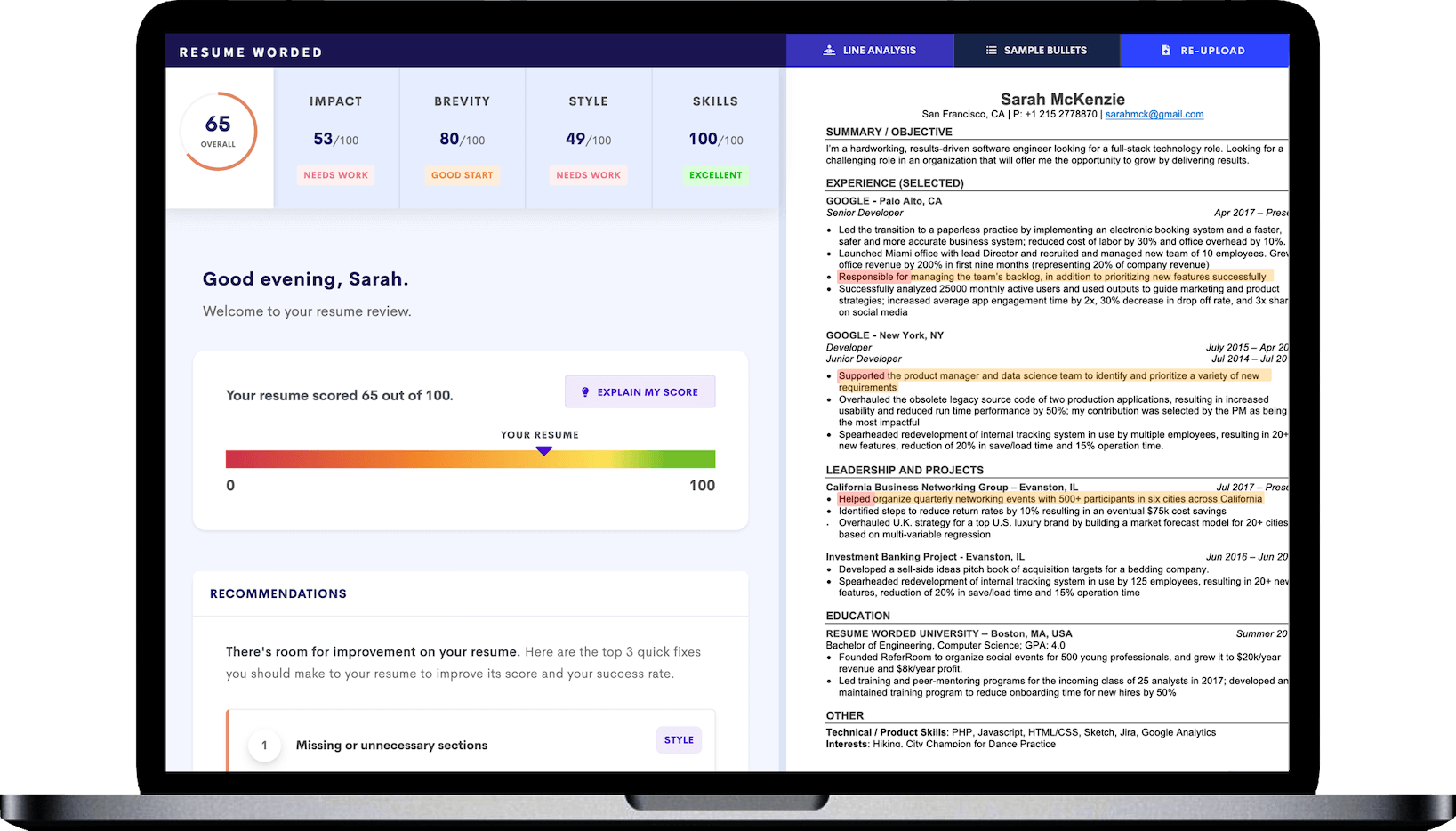

A resume summary statement usually comes right after a job seeker’s contact info and before other resume sections such as skills and work experience. It provides employers with a brief overview of a candidate’s career accomplishments and qualifications before they read further. Because of how early it appears on the document, your resume summary statement (or your CV “profile” in the UK) is one of the first places recruiters and employers look. And without the right information, they’ll doubt that you’re qualified and may move to another resume.

So I got in touch with a select group of professional resume writers, coaches and career experts to get their best resume summary examples you can use and adapt to write a resume summary that stands out and gets interviews.

As a former recruiter myself, I’ll also share my best tips to write your resume summary effectively.

Why the Resume/CV Summary is Important

You may have heard that recruiters only spend 8-10 seconds looking at your resume. The truth is: they spend that long deciding whether to read more. They do glance that quickly at first and may move on if your background doesn’t look like a fit. However, if you grab their attention, they’ll read far more. Recruiters aren’t deciding to interview you in 8-10 seconds, but they are ruling people out in 8-10 seconds. And this is why your resume summary is so crucial. It appears high up on your resume (usually right after your header/contact info) and is one of the first sections employers see. So it’s part of what they’ll see in the first 8-10 seconds.

Your resume summary statement is one of your first (and one of very few) chances to get the employer to stop skimming through their pile of resumes and focus on YOU.

Watch: Resume Summary Examples That Get Interviews

10 resume summary examples:.

These career summary examples will help you at any experience level – whether you’re writing a professional summary after a long executive career, or writing your first resume summary without any experience! After you finish this article you’re NEVER going to have to send out a limp, weak resume summary statement again (and you’ll get far more interviews because of it).

1. Healthcare Sales Executive Resume Summary Example:

Turnaround & Ground Up Leadership – Concept-to-execution strategies for untapped products, markets + solutions that yield 110% revenue growth – Negotiates partnerships with leading distributors + hospitals—Medline to Centara + Novant Health to Mayo Clinic – Revitalizes underperforming sales organizations via scalable, sustainable infrastructures emulated as best practice – C-Level networks of clinical + supply chain leadership acquired during tenures with XXX, XXX and XXX

Why this resume summary is good:

This resumes summary example’s strength lies in the detailed, unique information that has been included. By including revenue stats, names of past employers and partners, the reader right away sees that this person will bring to the role a strong networking ability with key players in his industry, and more importantly can build, grow and revitalize a sales organization, market or product.

By: Virginia Franco, Founder of Virginia Franco Resumes and Forbes contributor.

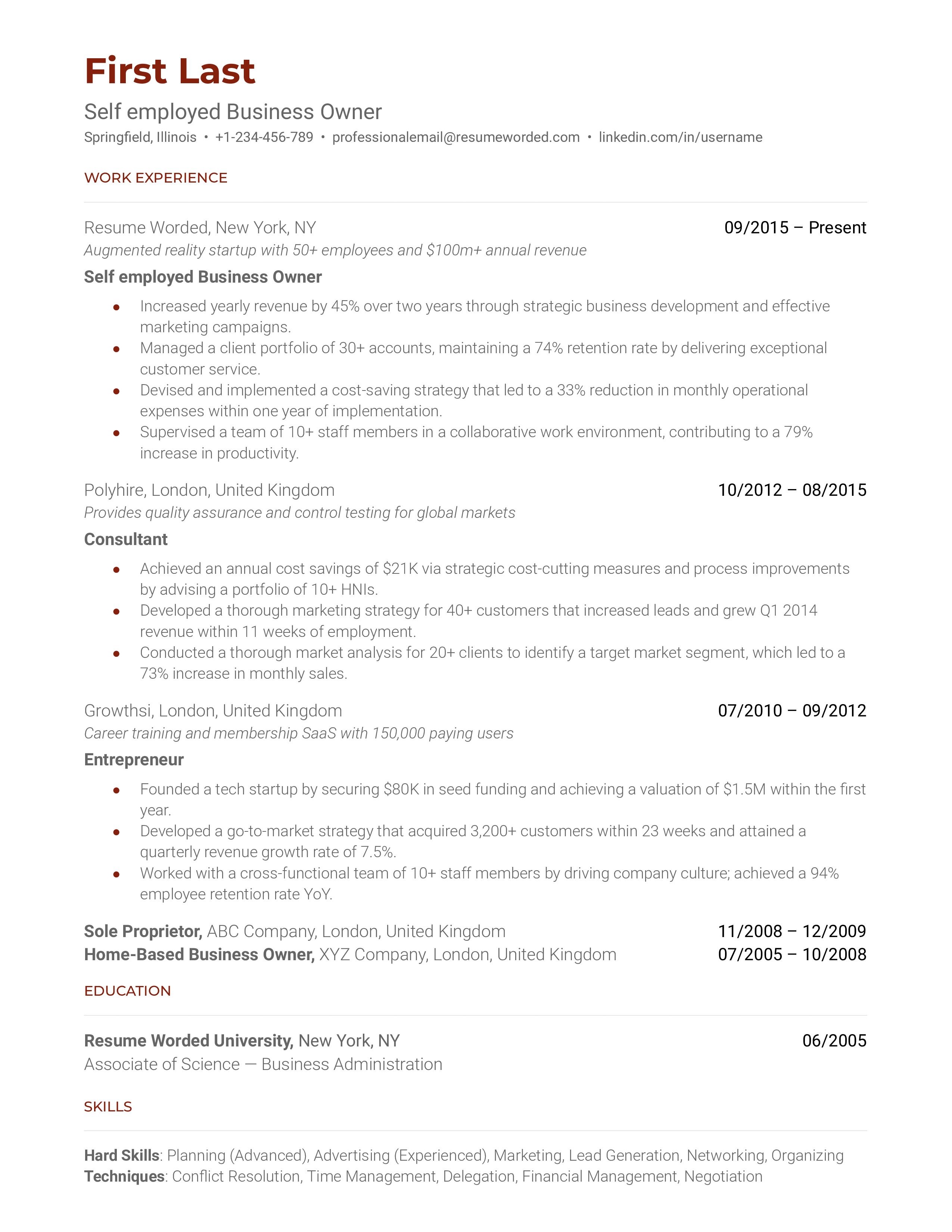

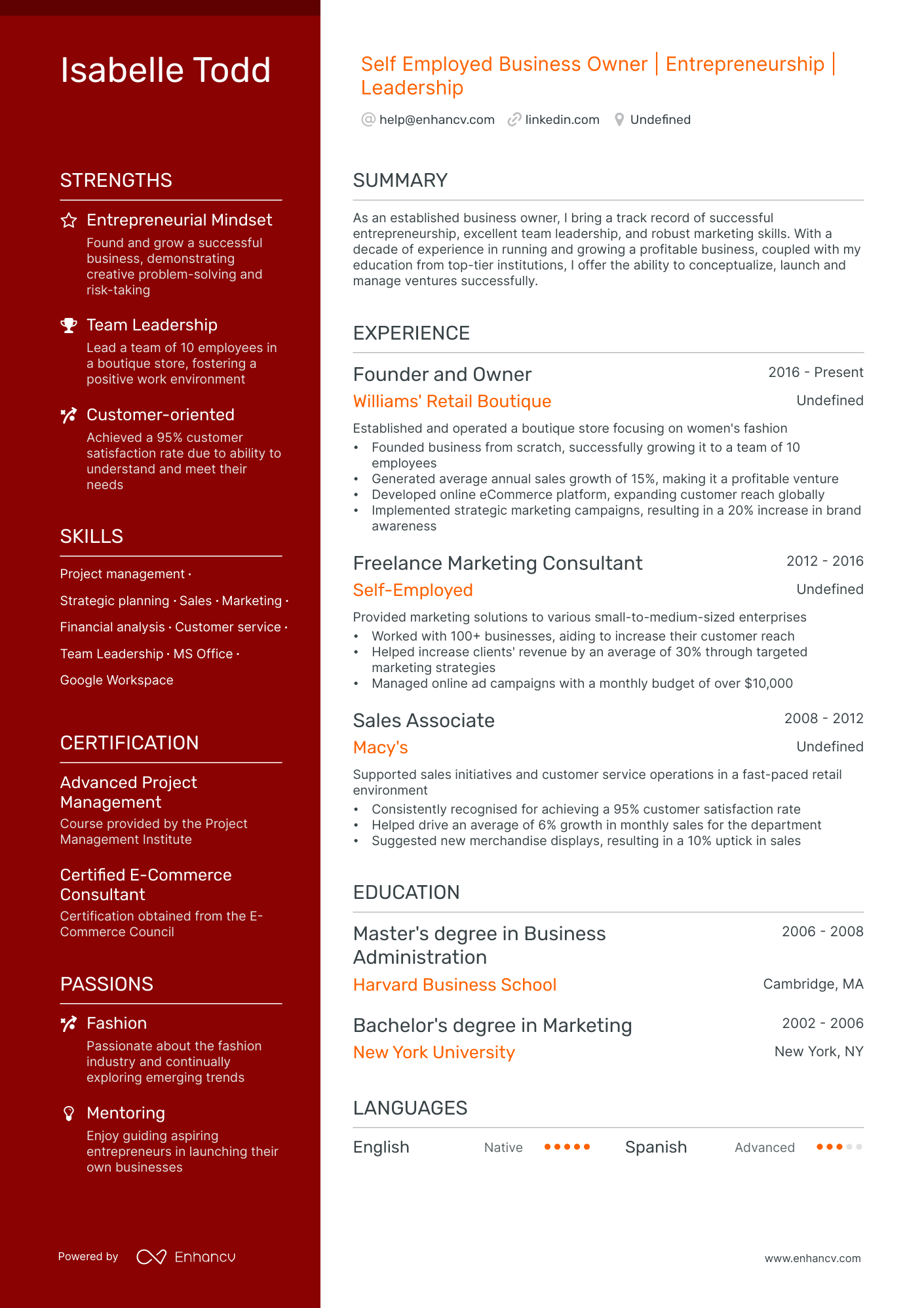

2. 15+ Year Business Owner Resume Summary Statement:

Dynamic and motivated marketing professional with a proven record of generating and building relationships, managing projects from concept to completion, designing educational strategies, and coaching individuals to success. Skilled in building cross-functional teams, demonstrating exceptional communication skills, and making critical decisions during challenges. Adaptable and transformational leader with an ability to work independently, creating effective presentations, and developing opportunities that further establish organizational goals.

Why this is a good summary section:

This is a resume summary statement that was for a candidate returning to work after having her own business for 15+ years. Because of this, we needed to emphasize her soft skills and what she can bring to this potential position. In addition, we highlighted the skills she has honed as a business owner so that she can utilize these qualifications as a sales professional, account manager , and someone knowledgeable about nutrition, medicine, and the overall sales process.

By: Dr. Heather Rothbauer-Wanish. MBA, Ph.D., CPRW, and Founder of Feather Communications

3. Human Resources Generalist Resume Summary Example:

Human Resources Generalist with progressive experience managing employee benefits & compliance, employee hiring & onboarding, performance management processes, licensure tracking and HR records. Dependable and organized team player with the ability to communicate effectively and efficiently. Skilled at building relationships with employees across all levels of an organization. Proficient with HRIS, applicant tracking and benefits management.

Why this is a good resume summary:

The applicant highlights their experience across a wide range of HR functions from the very first sentence, and continues this pattern throughout the rest of the summary. They then use easily digestible langue to showcase their hard skills (in the first & fourth sentences) and soft skills (in the second & third sentences). They also integrate a variety of keywords to get past automated job application systems , without sounding spammy or without overdoing it.

By: Kyle Elliott, MPA/CHES, Career Coach and Consultant

4. Social Media Marketing CV Profile Example (UK):

Social media expert with successes in the creation and management of social media strategies and campaigns for global retail organisations. Extensive experience in the commercial utilisation of multiple social media channels including Facebook, Twitter and YouTube; I build successful social strategies that increase brand awareness, promote customer engagement and ultimately drive web traffic and conversions.

Why this summary is good:

This summary is well-written, short, sharp, and gives recruiters a high-level explanation of the candidate’s core offerings in a persuasive and punchy style. A quick scan of this profile tells you the exact type of social media platforms the candidate is an expert in, as well as the campaigns they have experience running and types of organizations they have worked for. Most importantly, the summary is rounded off by showing the results that this person achieves for their employers, such as increased web traffic and conversions.

Editor’s note: This CV profile summary was written for the UK market… this is a great one to use/copy, but make sure you put it through a spell-checker if you’re applying for jobs in the US (utilisation vs. utilization, etc.)

By: Andrew Fennell, Director at StandOut CV , contributor for The Guardian and Business Insider

5. Marketing Manager Professional Summary Example:

Marketing Manager with over eight years of experience. Proven success in running email marketing campaigns and implementing marketing strategies that have pulled in a 20% increase in qualified leads. Proficient in content, social media and inbound marketing strategies. Skilled, creative and innovative.

This resume summary stands out because it gets straight to the point. By immediately introducing the number of years of experience the candidate has, the HR manager doesn’t need to spend time adding up years. The candidate also jumps right into his or her strongest skill, provides a statistic , then gives additional skills.

By: Sarah Landrum, career expert and contributor at Entrepreneur.com and Forbes

6. Warehouse Supervisor Resume Summary Example:

Warehouse Supervisor with Management, Customer Service, & Forklift Experience – Dependable manager with 15+ years of experience in warehouse management and employee supervision. – Skilled at managing inventory control, shipping & receiving, customer relations and safety & compliance. – Certified Power Equipment Trainer, Forklift Operator and Reach Operator skilled at coaching other staff. – Promoted to positions of increased responsibility given strong people and project management skills.

The applicant was applying for a warehouse supervisor position that required them to have demonstrated management, customer service and forklift experience. As such, the applicant showcased their experience in these areas with a few keywords in the title, followed by additional details in the accompanying bullet points. Their final bullet shows a record of promotions, while reinforcing the applicant’s customer service and project management skills.

7. IT Project Manager Resume Summary Example:

Experienced Project Manager with vast IT experience. Skills include computer networking, analytical thinking and creative problem solving. Able to apply customer service concepts to IT to improve user experience for clients, employees and administration.

Because this candidate is switching career paths, it’s important he or she take skills used for previous positions and apply those skills to the new job listing. This is a great example because the candidate makes it clear that his or her experience is not in the new field, but that they are still able to bring relevant experience to the table. When writing your resume summary, keep these tips in mind: Use writing that is straight to the point, clear and concise, you’ll have a higher chance of getting noticed by the hiring manager.

8. Career-Changer Resume Summary Example:

Earn trust, uncover key business drivers and find common ground as chief negotiator and identifier of revenue opportunities in sales, leadership and account management roles spanning e-Commerce, air travel and high-tech retail. Navigate cultural challenges while jumping time zones, lead international airline crews and manage corporate accounts to deliver an exceptional customer experience. A self-taught techie sought after as a go-to for complex billing systems and SaaS platforms alike—bridging the divide between technology and plain-speak. – Tenacious Quest for Success + Learning . Earned MBA and BS in just 3 years while working full-time – gaining hands-on experience in research- and data-driven product roadmap development, pricing and positioning. – Results-Driven Leadership. Whether leading Baby Boomers, Gen X or Millennials—figures out what makes teams tick, trains and transforms individuals into top-performers. – Challenger of Conventional Wisdom. Always ask the WHY. Improve the user experience through smart, strategic thinking that anticipates outcomes. Present cases that influence, and lead change that drives efficiency and profitability.

This client was eager for a career change and had moved from role to role and industry to industry. After completing her Master’s degree, she was eager to tie her skills together to land a role – which she did – as a Senior Technology Account Strategist for a global travel company. Although a bit longer than a traditional summary, its strength lies in the details. Without ever getting to the experience section, the reader gets a clear idea of the scope of responsibility, and hard and soft skills the candidate brings to the table.

By: Virginia Franco, Founder of Virginia Franco Resumes and Forbes contributor.

9. Project Management Executive Professional Summary Example:

15+ years of initiating and delivering sustained results and effective change for Fortune 500 firms across a wide range of industries including enterprise software, digital marketing, advertising technology, e-commerce and government. Major experience lies in strategizing and leading cross-functional teams to bring about fundamental change and improvement in strategy, process, and profitability – both as a leader and expert consultant.

Why this resume summary is good:

“Project Manager” is one of those job titles that’s REALLY broad. You can find project managers earning $50K, and others earning $250K. The client I wrote this for was at the Director level, and had worked for some of the biggest and best tech companies in her city. So this resume profile section shows her level and experience, and the wide array of areas she has responsibility for in her current work. You can borrow or use some of the phrasing here to show that you’ve been responsible for many important areas in your past work.

By: Biron Clark, Founder of CareerSidekick.com.

10. Startup And Finance Management Consultant Career Summary Example:

Experienced strategist, entrepreneur and startup enthusiast with a passion for building businesses and challenging the status quo. 8+ year track record of defining new business strategies, launching new ventures, and delivering operational impact, both as a co-founder and management consultant.

Why this resume summary example is good:

This summary was for a highly-talented management consultant looking to break out of finance, and into trendier tech companies like Uber . His track record and educational background were great, so the goal of this summary section was to stand out and show he’s more than just the typical consultant with a finance background. So we emphasized his passion for startups, and his ability to think outside the box and challenge the status quo. That’s something that companies like Uber and other “disruptive” tech companies look for.

14 Resume Summary Examples for Various Industries

Compassionate and effective 5th-grade teacher with experience overseeing the classroom and preparing lessons. Extensive experience encouraging students through positive reinforcement and motivational techniques. Collaborate well with school administration and other members of the teaching team. Ensure all students meet learning requirements, including literacy, social, and arithmetic skills.

2. Teacher’s Assistant

Goal-oriented teacher’s assistant with ten years of experience working with elementary school children. Aid teachers with lesson planning, classroom settings, and group instruction. Model positive behavior and maintain order in the classroom. Willingness to take on additional responsibilities to meet learning objectives.

Tech Industry

3. computer programmer.

Innovative computer programmer with a proven track record of writing high-quality code and supporting team needs with subject matter expertise. Adept in multiple programming languages, including Python, JavaScript, and C++. Ability to troubleshoot complex programming issues with inventive solutions.

4. Cybersecurity Analyst

Dedicated cybersecurity analyst with ten years of experience in online security research, execution, planning, and maintenance. Proven track record of identifying business risks and proactively resolving them. Experience designing and instituting layered network security for large-scale organizations. Train users and other staff members on IT safety procedures and preventive techniques.

Skilled healthcare professional with ten years of experience in patient care, diagnosis, and providing appropriate treatments and medical services. Manage medical staff and resolve complex medical cases with maximum efficiency. Communicate the patient’s condition and treatment plan in easily understood terminology. Remain current with the latest advancements in medicine and research to ensure patients receive proper care.

6. Registered Nurse

Seasoned registered nurse offering comprehensive patient care in emergency room settings. Experience handling diverse patient populations and caring for various conditions. Proven leadership managing nursing teams and other staff. Focus on enhancing patient care and satisfaction through empathetic communication and excellent customer service.

7. Digital Marketing Manager

Forward-thinking digital marketing manager experienced in all facets of digital marketing, including social media management, PPC advertising, SEO, and email marketing. Proven experience creating comprehensive marketing plans that improve lead prospecting and enhance brand awareness. Up to date with the newest tools available for digital marketing campaigns.

8. Marketing Analyst

Industrious marketing analyst well-versed in analyzing marketing campaign analytics and making recommendations to improve performance. Collaborate with account managers and use KPI metrics to explain the results of marketing initiatives. Meticulous with a strong work ethic and robust communication skills.

Food and Service Industry

Experienced wait staff member capable of managing orders, processing payments, and upselling menu items. Ensure restaurant guests feel welcome with attentive service catered to their needs. Remain current on updates to the menu and assist guests with selecting orders to meet their dietary requirements. Maintain a positive attitude and focus during busy restaurant periods.

10. Hotel Receptionist

Friendly hotel receptionist with extensive experience handling guest check-ins, check-out, and payments. Facilitate a positive guest experience with polished customer service skills and a readiness to address common inquiries and complaints. Collaborate well with other hotel team members, including executive administration and on-site restaurant staff.

Business/Office Jobs

11. financial analyst.

Highly motivated financial analyst with a proven track record of recommending appropriate financial plans based on financial monitoring, data collection, and business strategizing. Experienced in qualitative and quantitative analysis, forecasting, and financial modeling. Excellent communication skills for building and fostering long-term business relationships across the organization.

12. Tax Accountant

Experienced tax accountant with ten years of experience preparing federal and state tax returns for corporations and partnerships. Monitor changes in laws to ensure the organization properly complies with reporting requirements. Assist with tax audits, ensuring the team receives proper supporting evidence for tax positions. Analyze and resolve complex tax issues. Look for available tax savings opportunities for corporations with an aggregate savings of $500K last year. Excellent analytical skills and attention to detail.

Sales and Customer Service

13. sales representative.

Enthusiastic sales representative with expertise in identifying prospects and converting qualified leads to paying customers. Provide quality customer service and contribute to team sales success. Offer exceptional communication skills and seek to understand client needs before making the appropriate product recommendations. Continually meet and exceed sales goals. Leverage extensive knowledge of available products to provide appropriate client solutions and enhance customer loyalty and retention.

14. Customer Service Associate

Knowledgeable customer service professional with extensive experience in the insurance industry. Known as a team player with a friendly demeanor and proven ability to develop positive rapport with clients. Maintain ongoing customer satisfaction that contributes to overall company success. Highly articulate, with a results-oriented approach that addresses client inquiries and issues while maintaining strong partnerships. Collaborate well with the customer service team while also engaging independent decision-making skills.

Now you have 24 professional resume summary statements and some explanations of why they’re effective. Next, I’ll share tips for how to write your own in case you’re still unsure how to begin based on these examples above.

How to Write a Resume Summary: Steps and Hints

We’ve looked at 10 great resume summary examples above. As you begin writing a resume summary for yourself, here are some helpful tips to keep in mind:

- Read the employer’s job description. Your career summary shouldn’t be a long list of everything you’ve done; it should be a refined list of skills and experiences that demonstrate you’re a fit for their job.

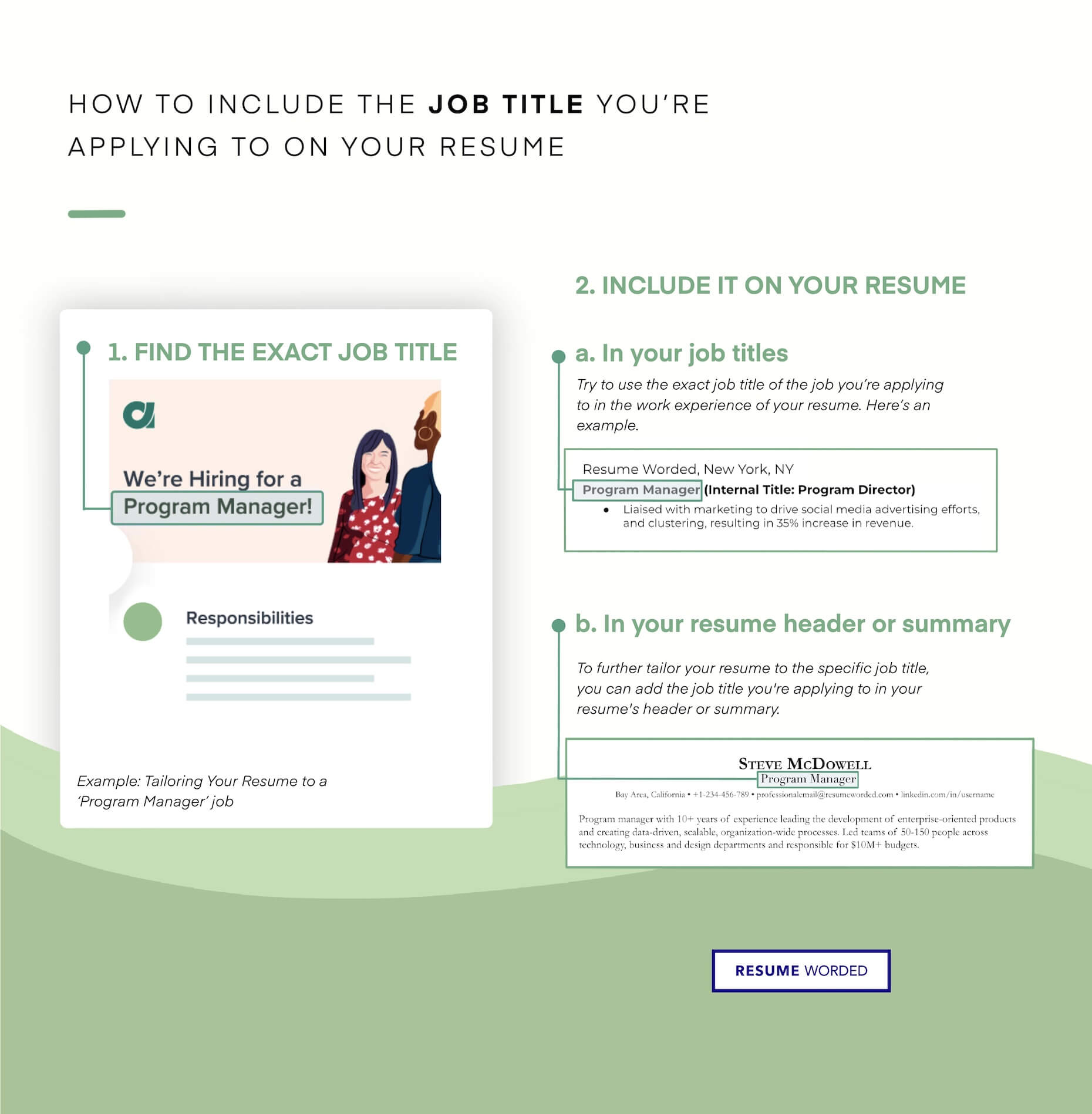

- Mention your current job title if relevant. One common way to begin your resume summary is to state your current job title.

- Explain how you can help employers achieve their goals or solve their problems.

- Consider using bold text to emphasize one or two key phrases.

- Include any relevant metrics and data like dollar amounts, years of experience, size of teams led, etc. This helps your resume stand out.

- Focus on making the employer want to read more. The goal of your resume summary isn’t to show everything you can do, but to grab their attention and show enough that they continue reading.

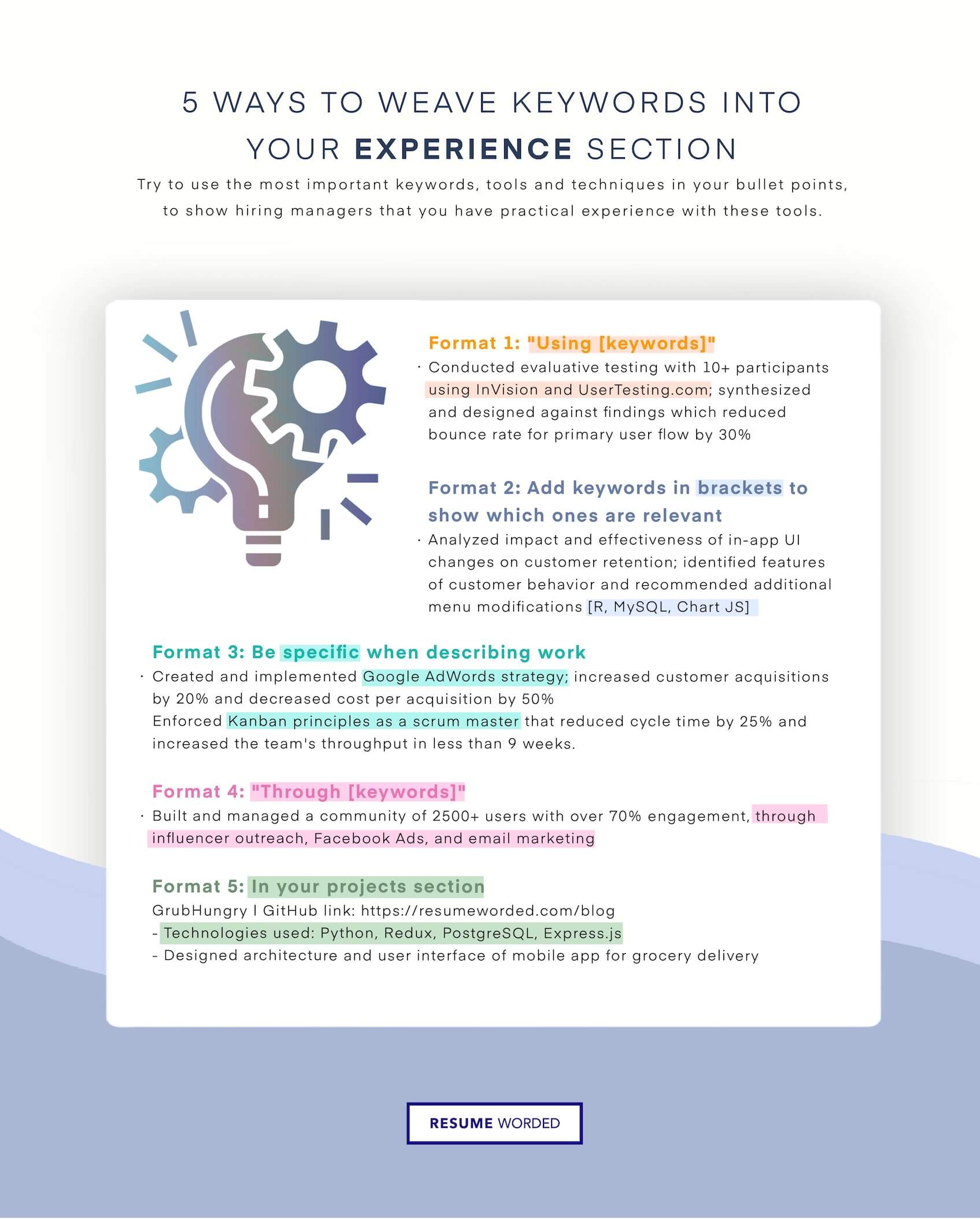

Creating a Customized Resume Summary

While general summaries are appropriate when applying for jobs requiring similar skills and experience, a customized resume summary can enhance your chances of moving on to the next step in the hiring process.

That’s because most companies use automated tracking systems (ATS) to review submitted resumes for content directly related to the job posting. If you use keywords and natural language phrases in your summary that interlink to the job description, you’ll have a much higher chance of passing the ATS review.

Let’s look at an example of a resume summary that is customized for the specific job description below:

“Highly motivated social media specialist with strong project management skills. Creative marketer skilled in crafting innovative social media campaigns that resonate with a target audience. Regularly develop compelling copy and social media content to enhance lead generation and brand awareness. Detail-oriented with extensive project management skills that ensure proper prioritization of tasks and projects. Work with various social media management and analytics tools to examine results and make adjustments as necessary.”

This summary directly addresses the key points in the job description but rewrites them so the customization is natural and flows well. It’s personalized for the open role and uses similar terms with a few strategically placed keywords, such as “social media content” and “project management.”

How Long Should a Resume Summary Be?

As you read the resume summaries above, you probably noticed there are some short single-paragraph resume summary examples and much longer career summaries that are two to three paragraphs plus bullet points. So how long should YOUR professional summary be? If you have relevant work experience, keep your summary to one or two paragraphs. The piece you really want the hiring manager to read is your most recent work experience (and you should make sure you tailored that info to fit the job description). The resume summary is just a “bridge” to get the hiring manager into your experience.

If I were writing my own career summary right now, I’d likely use one single paragraph packed with skills, accomplishments, and exactly why I’m ready to step into the job I’ve applied for and be successful!

Even for a manager resume summary, I recommend a very short length. However, if you’re changing careers, or you’re looking for jobs without any work experience , the summary section needs to stand on its own, and should be longer. That’s why some examples above are a bit longer.

Formatting Your Resume/CV Career Summary

You may have noticed a variety of different formats in the career summary examples above. There isn’t one “right” way to format this section on your resume or CV. However, I recommend either using one or two brief paragraphs, or combining a short sentence or paragraph with bullets. Avoid writing three or four long paragraphs with no special formatting like bullet points. That’s simply too much text for your summary section and will cause recruiters and hiring managers to skip over it in some cases.

Should You Include a Resume Objective?

You do not need to include an objective on your resume, and doing so can make your resume appear outdated. Use a resume summary instead of an objective. Follow the resume summary examples above and focus on discussing your skills, qualifications, and achievements, rather than stating your objective. Employers know that your objective is to obtain the position you’ve applied for, and the resume objective has no place on a modern resume/CV in today’s job market.

Examples of Bad Resume Summaries

Now that we’ve seen a few exemplary resume summaries, let’s look at some that you should avoid at all cost.

1. Typos and Grammatical Errors

“Experienced cashier who knows how to run the register cash. Responsible with the money and can talk with the customer. Knows when to stoc up the invenory and checks it all the time. Can count change and run credit card tranactions. Get the customer happy by good service. I am always cheerful and organized.”

Why this resume summary is bad:

If you read the summary carefully, you’ll notice several spelling errors. The words “stock,” “inventory,” and “transactions” are all spelled wrong. Grammatical errors make the summary choppy and difficult to follow (“Get the customer happy by good service”). A summary like this probably won’t fly with a company looking for a detail-oriented cashier responsible for managing in-person sales.

2. Lacks Relevant Keywords

“Talented worker with experience managing a team of staff. Creative and responsible with knowledge of organizational processes. Can keep up with the busiest of environments. Stays focused when at work, ensuring prompt task completion. Dependable and willing to collaborate with a team to get things done.”

In this example, the chef doesn’t use keywords relevant to cooking, restaurants, or kitchens. The summary is very generic and can apply to nearly any job. A manager who receives the application isn’t likely to understand what value the candidate can bring to the restaurant. To fix the summary, the applicant must rewrite it to include relevant keywords and phrases.

3. No Numbers to Quantify Achievements

“An experienced and hardworking manager ready to align procedures for maximum revenue and profits. Proven track record of streamlining and strengthening processes, resulting in higher sales and better customer satisfaction. Collaborate well with sales team members, ensuring they have the resources and knowledge to support customer purchases and inquiries. Develop strong rapport with clients and maintain ongoing relationships.”

This isn’t a terrible summary for a sales manager, but it has room for improvement. For one, the first two sentences essentially duplicate each other, mentioning an aptitude for improving processes with the objective of higher sales. The other issue is a lack of quantifying achievements.

The applicant mentions they have a proven record of increasing sales, but they could strengthen the summary by quantifying their results. For example, they might say, “Proven track record of streamlining and strengthening processes, resulting in a 25% increase in sales over the past year.” The quantifier provides additional credibility.

4. Not Targeting the Specific Job

“Looking for work in a role that requires great customer service, project management, and communication skills. Able to collaborate with people from diverse and varying backgrounds. Highly organized and reliable worker with a strong work ethic. Responsible and reliable worker you can count on.”

While the candidate lists various skills they have, including customer service and project management, there’s no indication of prior roles held or what position they’re applying for. The summary could apply to numerous positions in a variety of industries. To improve the resume summary, the applicant must specify the job they’re applying for and indicate their prior experience in a similar role, if they have any.

After You Start Getting Interviews, Make Sure to Take Advantage…

If you follow the advice above, you’ll have a great professional resume summary to make your qualifications stand out to employers. But landing the interview is only half the battle… So make sure you go into every interview ready to convince employers that they should hire you, too! If you write a great resume summary example that gets employers excited to interview you, they’re going to ask you questions like, “tell me about yourself” early in the interview to learn more about your background. So make sure you’re prepared with an answer.

I also recommend you review the top 20 interview questions and answers here.

Your resume caught their interest, so naturally, they’re going to follow up with a variety of questions to learn more about your professional background.

The bottom line is: A strong professional resume summary, followed up by other well-written resume sections will get you the interview, but your interview performance is what determines whether you get the job offer!

About the Author

Read more articles by Biron Clark

More Resume Tips & Guides

Crafting the perfect resume for teens (template & expert advice), how to beat applicant tracking systems with your resume, what do recruiters look for in a resume, what happens when you lie on your resume 10 risks, don’t say you’re a quick learner on your resume, guide to resume sections, titles, and headings, 12 resume formatting tips from a professional, how artificial intelligence (ai) is changing resume writing, 22 resume bullet point examples that get interviews, are resume writers worth it, 41 thoughts on “24 resume summary examples that get interviews”.

I would recommend to customise the skills section of your resume, and ensure that it matches the job posting. The higher the number of phrases within the resume matching the job requirements the more are the chances that the recruiter will pick you for the job.

I just wanted to say, “thank you!”. This was very helpful. Instead of jumping from one website to the next there’s so much useful, relevant information right here.

Hi, I have been having trouble creating a resume as My old one is so long, I’ve worked for a government agency for the past 14 years and held multiple positions doing many different duties for each and now I have to relocate to another area where they do not have an agency like mine in my new area within a 3 hour drive, how can I squeeze all my experience and duties on one page and where do I even start, I’m so nervous, it’s been so long since I’ve attempted the job hunt. So I’m wondering, I do not want to cut anything out that may hurt my chances and I can’t afford to have my resume rewritten by a professional. Can you guide me as to where you think would be a good place to start, I’ve been staring at this laptop for weeks trying to decide on a resume template, there are so many. I thank you for your time and any input will help.

Hi, I am a new graduate and do not have any experience in my field which is Nursing. I want to apply for the jobs but I have no idea about what to mention in my resume.

Hi, this article should help with the resume summary, at least: https://careersidekick.com/summary-for-resume-no-experience/

Other than that, you need to put your academic experience. And internships/part-time jobs if you’ve had any.

Dear Biron,, Thanks for sharing the 10 examples of professional summaries in your article, and especially the reasons why they were considered to be good. However, as a HR professional, I would most likely skip over most of them and would not read much past the first or second sentence. The summaries were mostly too wordy and boring, and did not demonstrate ‘oomph’ at first cursory reading. Simply indicating certain skills or behaviors does not give an idea of the level of expertise, and could simply be wishful thinking on the part of the resume writer.

Just goes to show that there are many ways to see what makes a good summary.

I am a chemical engineer and project management professional with 15+years experience. My experience is between process engineering and project management . How can I marry the two in my profile summary?

It’s not about showing everything you’ve done. It’s about showing employers evidence you’ll succeed in their job. You can show a bit of both but focus heavily on what’s most relevant for the jobs you’re applying for right now. 80/20.

This was absolutely helpful and amazing! Thank you very much!

Hello, I am an active job seeker. I hold a law degree from a foreign country and currently in college for an associate degree. My question is, how do I blend both my foreign job experience with that of the United States in my resume. Thank you.

I’d put your work history in chronological order, starting with the most recent up top. That’s what I’d recommend for 95% of people actually. Then it doesn’t matter where you held each job.

And then in your Education section, I’d include your foreign degree and the current degree you’re pursuing in the US, too (for the US degree, you can say “in progress” or “graduating May 2019” for example).

I am 40 years old & B.A degree holder I have experience in many fields.I would like to join any one fields

I am a fresh graduate, who has five years teaching experience and some months customer service representative experience. Pls kindly assist me to put the resume summary together

I’m an active duty service member and finding in a little difficult creating a good transitional summary from 20 year profession in tactical communications to a drug and alcohol counselor. Do you have any recommendations how I should approach this? Any assistance would be helpful. Thanks

Great piece

How to write the CAREER ABSTRACT in resume for ware super visor retail business?

Just wanted to say thank you.Your advise and information was clear and easy to understand , sometimes there is nothing pertaining to what im looking fot in particular, buy you have sermed to cover everything I n a short quick easy to understand method.It will help tremendously.

Thanks! Glad to hear it helped :)

Very informational

What if you have work experience, but the job your going for(teachingeducation) has nothing to do with warehouse work? How should I build my resume?

In the summary, describe yourself and then say, “…looking to transition into ___” (the type of work you want to be doing now).

This is a bit like a resume “Objective”. I normally don’t recommend an Objective section (and I recommend a Summary section instead), however the one time an Objective does make sense is when you’re trying to change industries or make a big change in the type of role you have.

So that’s why my advice here might seem like I’m telling you to combine an Objective with your resume Summary.

Then “tailor” your previous work to be as relevant as possible. Even if you worked in a different industry you can still show things like leadership, accountability, progress/improvement, hard work, achieving goals, strong teamwork skills, etc. You can do all of that in your resume bullets and work history.

Don’t u have Resume Summary of legal secretary/legal assistant?

No, sorry about that. There are hundreds of different professions/job titles, and we aren’t able to include an example for every scenario out there. These resume summary examples are designed to give you a general idea of how to write yours.

The summaries listed are excellent example and have helped me develop a stand out summary for a new position.

Hello, I been trying to land the job of my dreams. I need help with my resume if i want the recruiters in airlines to notice me. I’ve applied before but haven’t had complete success to making it to a face-to Face Interview. It is a career change – yet i feel i am a great candidate bc i have had many customer service and I even attended an academy for that specific position. Can you please tell me what I am doing wrong on my resume ?

what if i never had a job experience?

Great question. If you don’t have any work experience, take one of the formats/examples above and put your accomplishments and qualifications from your academic studies.

Your headline could say: “Motivated Bio-Sciences Graduate With Expertise in ____”.

And then you might talk about accomplishments in school, group projects you worked on or led, etc.

Basically, when you have no work experience, your school/studies BECOMES your recent work. You should talk about that like it’s a job, because that’s the experience you do have.

really amazing article and too useful , thanks

Hi Mr. Clark, I have been out of the work force for about 18+years and I have been a small business owner for the same number of years. However, I want to go back to the work force. But my problem is that, I don’t know how to prepare my resume or resume summary statement. I had a degree in Communication,Arts and Sciences and a postgraduate degree in Public Administration. I’m a bit confused as to how to incorporate all these experiences into my resume. Please can you help?

Hi Dorothy, I can recommend a professional resume writer if you want. But they’re typically not cheap, so it’s something you’d have to be willing to invest in. If not, there’s a lot of free info online about how to “tailor” your resume for specific jobs. I can’t help one-on-one unfortunately, but I’d recommend thinking about which type of jobs you want, and think of what experience you have that is most relevant. that’s what to put on your resume. Your resume isn’t only about you, it’s about them – what do they want/need? (if you want to get a ton of interviews, that’s how to do it :) ).

Can I have a professional resume writer?

I use a similar format when writing my opening statement for my coverletter. How do you recommend differentiating the two? Or is it ok to use largely the same language?

I think it’s okay to use something similar. I might be more brief in the cover letter… it needs to be about them just as much as it’s about you. Whereas the resume is all about you, at least in the summary section. (The later sections should still be tailored to THEIR needs..)

Struggling to write a Summary Statement for a Secretary/Administrative Assistant position. I have 15 years government experience but have been away from the government since 9/1993 and have spent 15 years as a Substitute Teacher after taking off for 10 years to raise my children.

Hiya! I am a mother of three attempting to return to the workforce. I have been a stay at mom for about 13 years, so I have a (large) gap in my employment history; which doesn’t look great. I have a college education and have obtained a few certifications whilst not employed, plus many volunteer hours. I know that I should probably use a functional resume format. Would love some advice on what I should include in my summary statement.

Hi Juniper,

I rarely like functional resumes, but it might be worth trying. I’d “split-test” it (a marketing term). Create two resume styles, send out 50% one way, 50% the other way, and track results for a week.

I’d treat the resume summary statement just like any other resume. Highlight your skills and past wins/accomplishments.

how do i explain long term gaps in employment? leave them out?

Hi Paulette,

Don’t mention them on a resume summary. But do mention the gaps on a cover letter or lower down on the resume. Here’s an article on how to explain gaps in employment:

https://careersidekick.com/explaining-gaps-in-employment/

I am student in civil engineering field. Have 1.5 yrs of work ex. How should i structure my resume. Thanks.

Hello My name is Shataka and I’m a current job seeker trying to land my dream job as a Counselor. I have Master degree in Counseling Psychology and a Bachelor’s degree in Social Work. My experience lies in many different fields. I’m currently a Substance Abuse Counselor, with a teaching background and over 5 years of social service experience. I guess my question is how would I sum up all my experience to help me find a job as a Counselor.

Comments are closed.

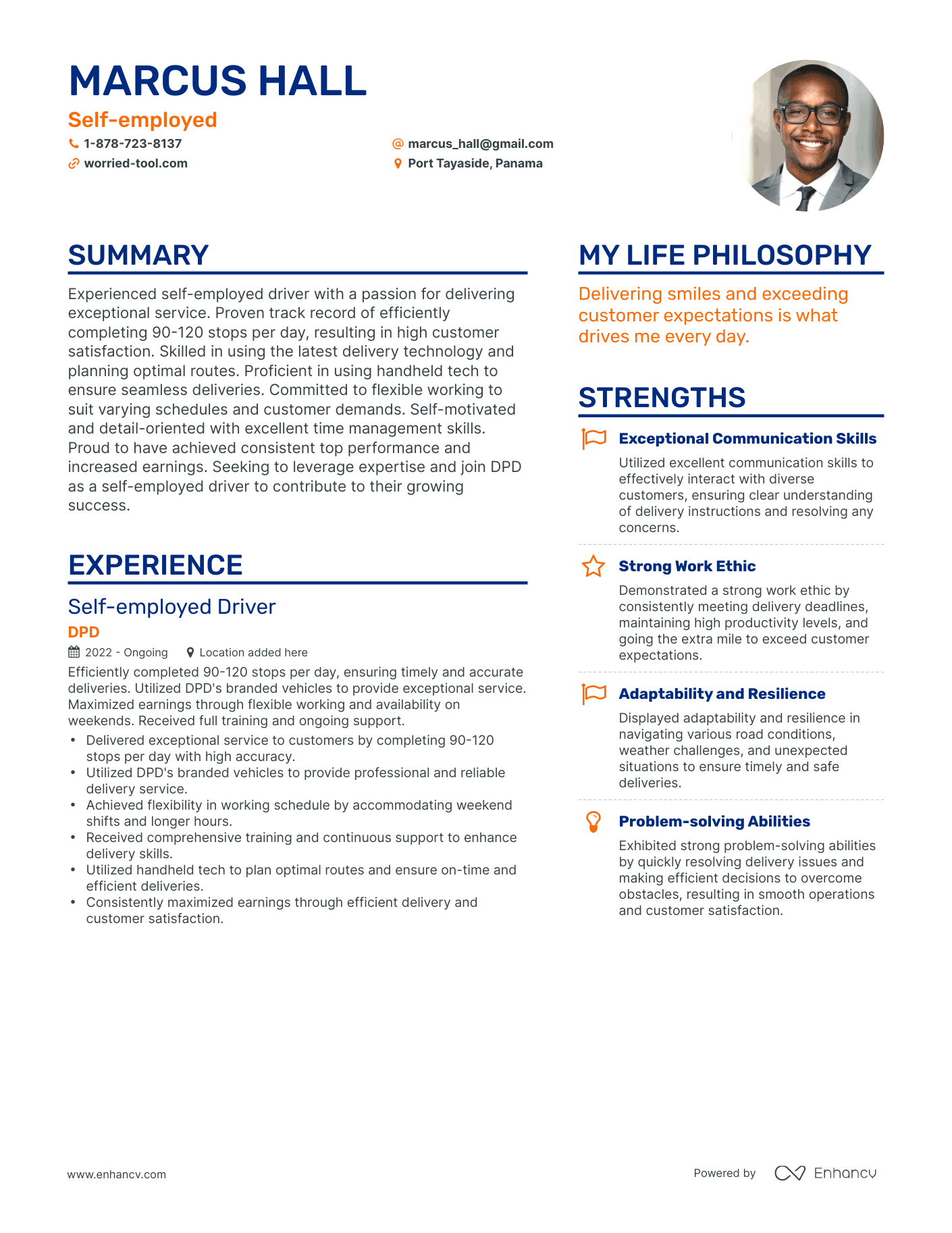

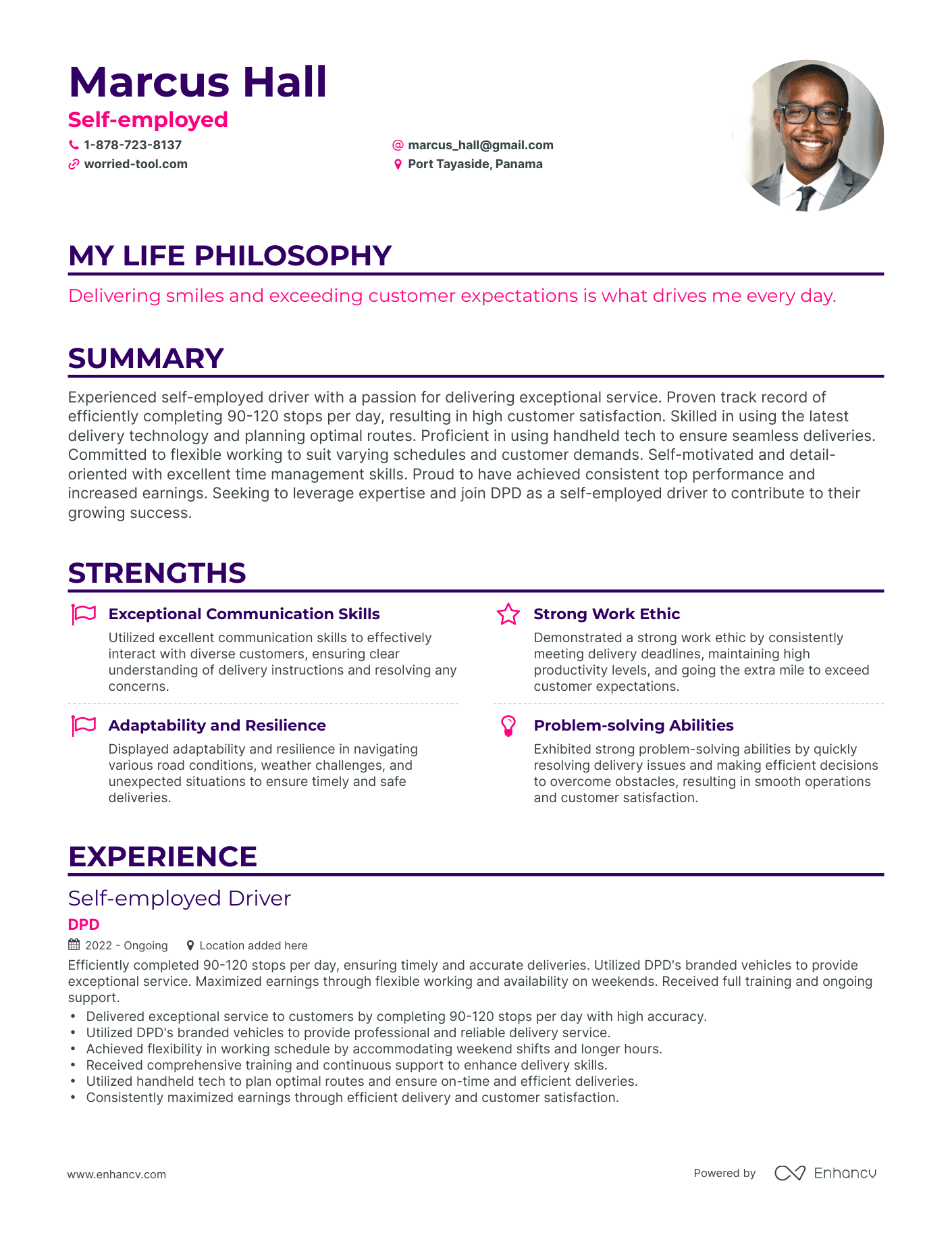

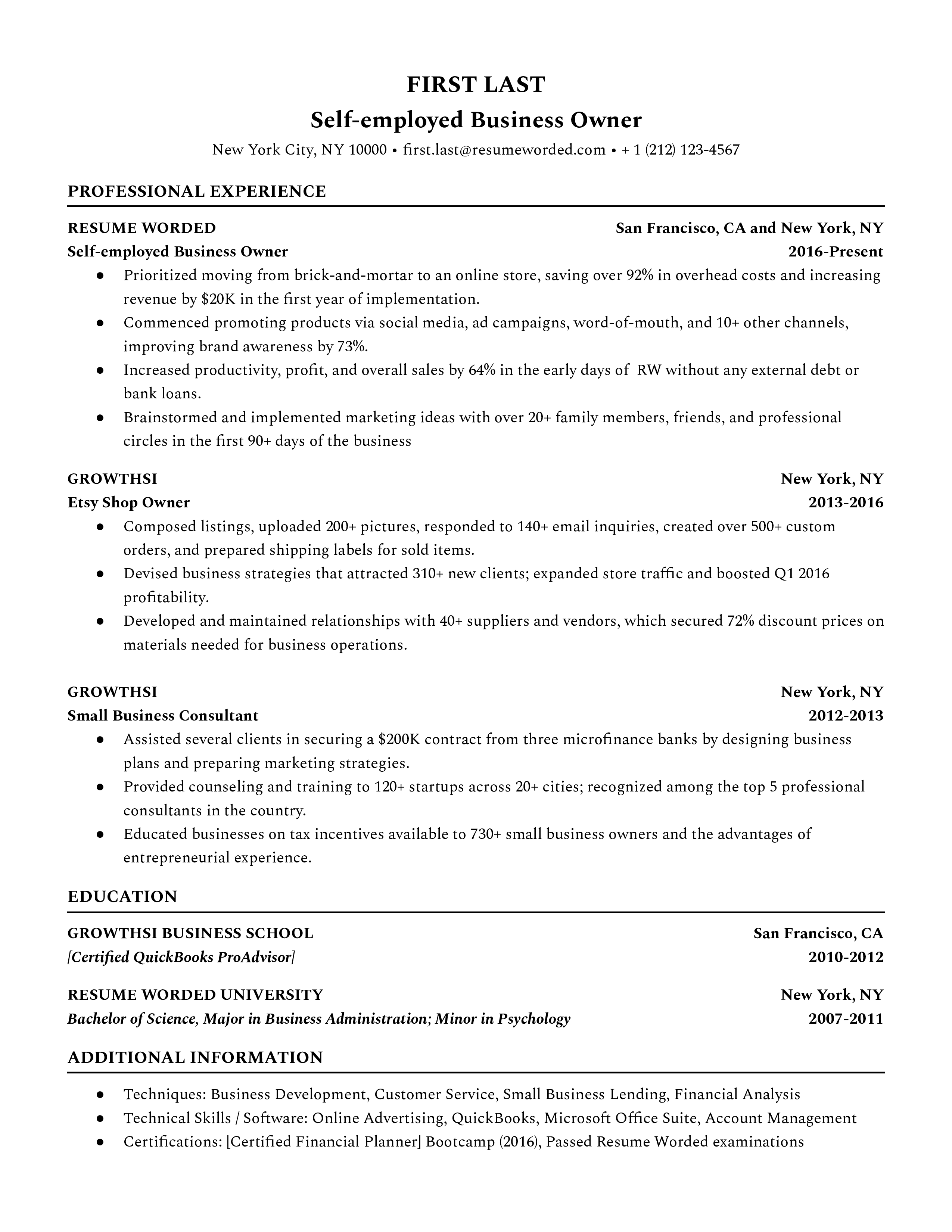

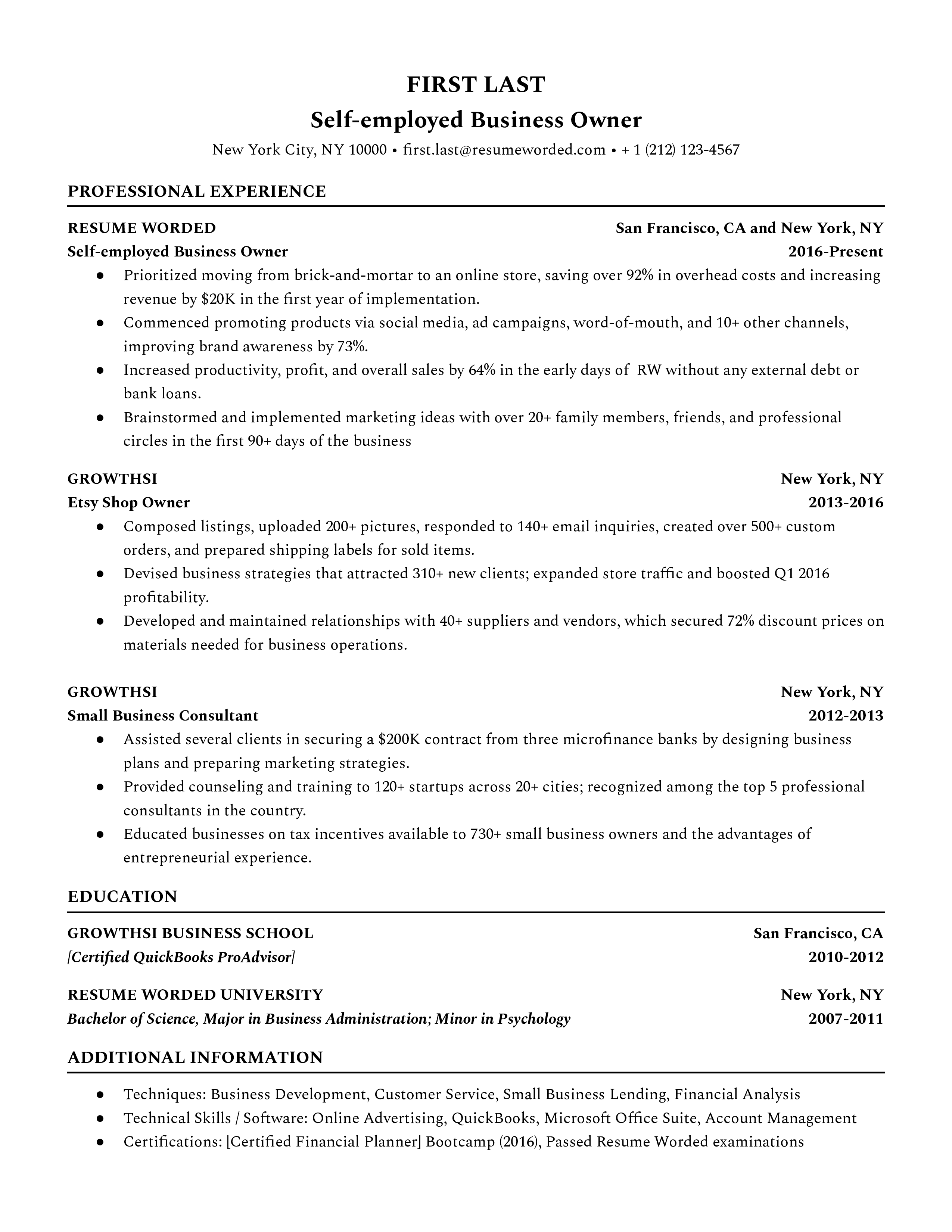

Self Employed Resume Samples [+ 3 Examples]

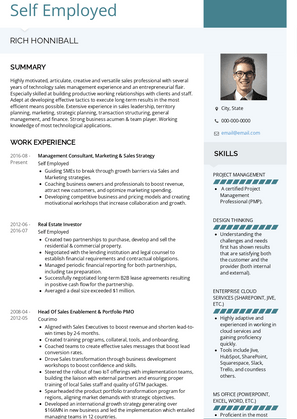

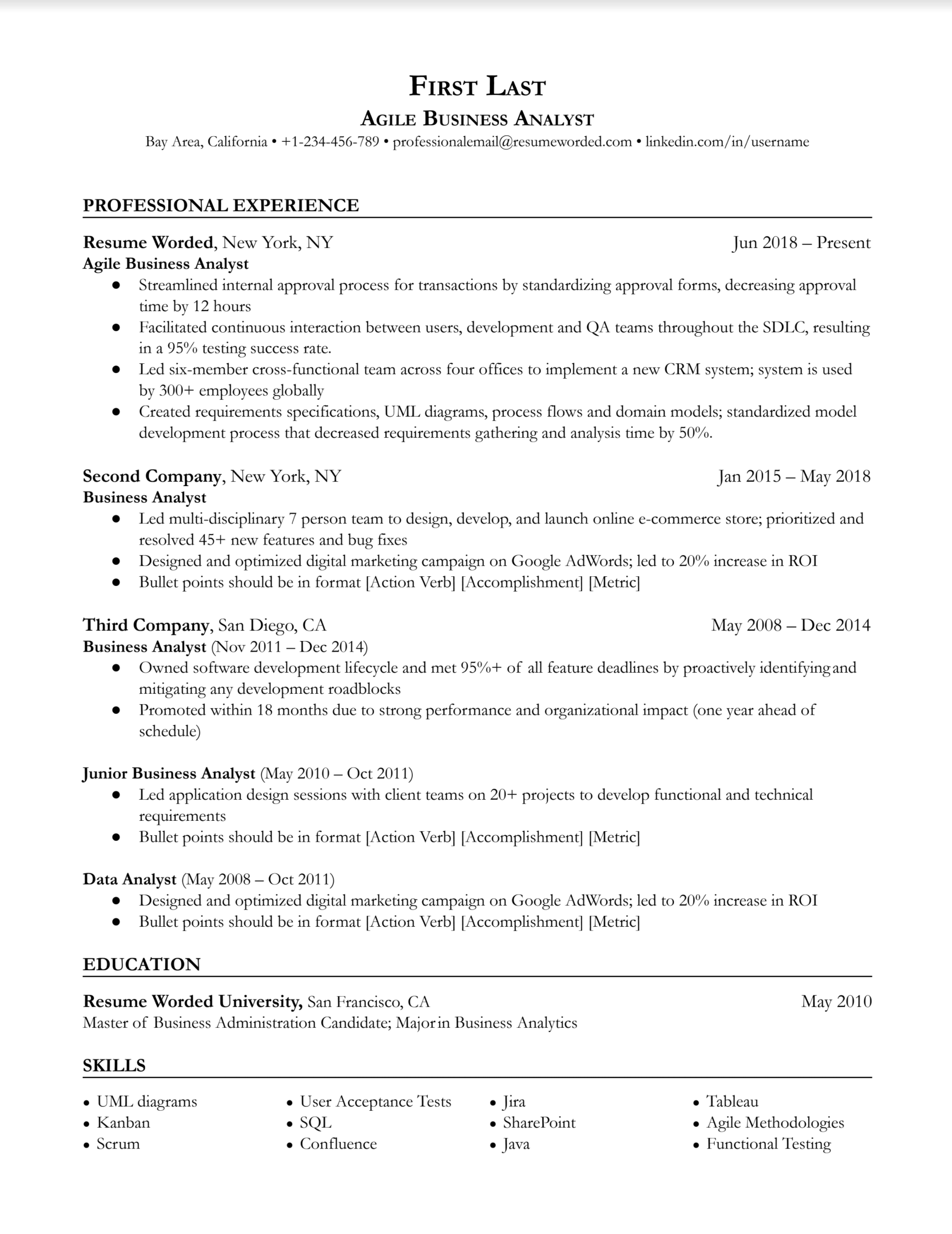

This page provides you with Self Employed resume samples to use to create your own resume with our easy-to-use resume builder . Below you'll find our how-to section that will guide you through each section of a Self Employed resume.

“You are self-employed! I don’t get why you would need to work on a resume!”

How many times have you heard your peers asking you this question? How often do you get frustrated at them because they just don’t understand?

Well, you have done the right thing, looking for the best self-employed resume sample on the web. Even professionals like you need a resume (actually, a standout resume!). It’s quite likely you just want to know your worth in today’s market or perhaps you want to send out a few resume to see if you could get a once-in-a-lifetime call that might change your mind regarding your future.

We have helped thousands of entrepreneurs like you probe the market and see if it’s worth staying in their position as a self-employed or if they actually want to take the leap. Let us inspire you, as well, with the most effective self-employed resume sample you could think of: we are ready to start building your future!

Also, check out our collection of 500+ resume samples .

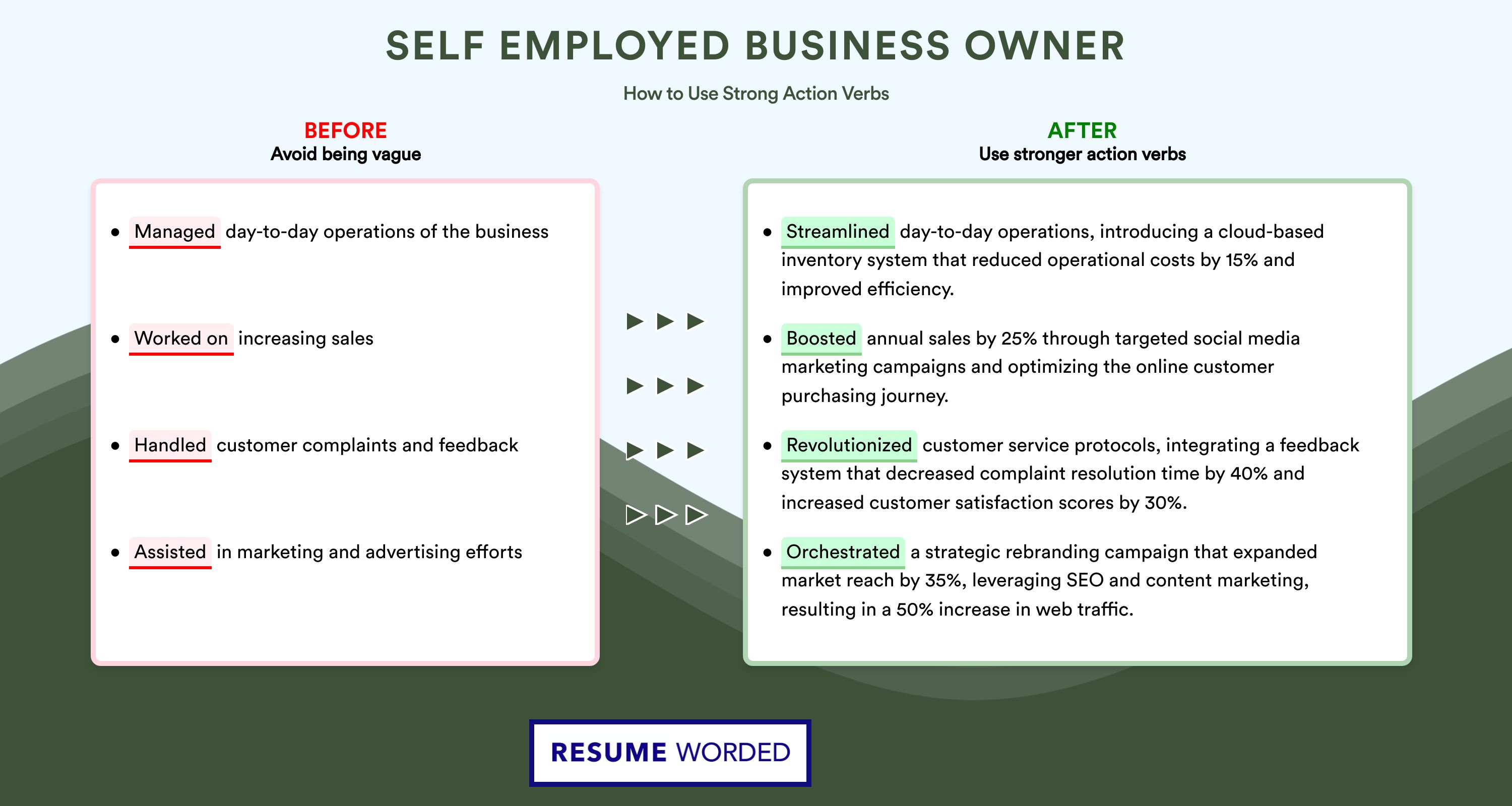

You are or have been the mastermind behind the creation of your business: you do not know what fear feels like! You have an outstanding amount of talents, from conceptualizing organizational operations, budgets and branding to implementing them through careful feedback and research. You have had stellar ideas and you most likely have outstanding leadership and motivational skills...and don’t forget about your exceptional problem-solving skills!

As a business innovator, you have so many different and desirable strengths and your biggest challenge in creating a strong resume is to remain concise.

One of the first steps you should take is to format the resume so that your strengths are highlighted, along with your best achievements.

Ensure clear layouts are used to make sure the recruiters keep on scrolling down: white space and legible fonts make for easy reading and give the recruiters’ eyes a rest

Last but not least, make sure you save your resume as a .pdf.

We won’t have anything against you, Microsoft, but the Word formatting can sometimes be an issue whereas a .pdf is set in carbonite.

How to Write a Self Employed Resume?

To write a professional Self Employed resume, follow these steps:

- Select the right Self Employed resume template.

- Write a professional summary at the top explaining your Self Employed’s experience and achievements.

- Follow the STAR method while writing your Self Employed resume’s work experience. Show what you were responsible for and what you achieved as a Self Employed professional.

- List your top Self Employed skills in a separate skills section.

How to Write Your Self Employed Resume Header?

Write the perfect Self Employed resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Self Employed to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Self Employed resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

- Bad Self Employed Resume Example - Header Section

Deon 696 Rock Maple St. South Lyon, MI 48178 Marital Status: Married, email: [email protected]

- Good Self Employed Resume Example - Header Section

Deon Nguyen, Lyon, MI, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- [email protected] - [email protected]

- [email protected] - [email protected]

- [email protected] - [email protected]

- [email protected] - [email protected]

- [email protected] - [email protected]

- [email protected] - [email protected]

For a Self Employed email, we recommend you either go with a custom domain name ( [email protected] ) or select a very reputed email provider (Gmail or Outlook).

The Self Employed Resume Summary Section

Summaries don’t sound the most appealing or even necessary elements of a resume and yet they are needed. Most times recruiters don’t have the time to read every single detail of your resume and all they want is summaries. Make sure you captivate them with your most impressive business achievements and your excellent and unrivaled networking ability.

There are one or two tips from us to help you today:

DO (Summarize your employment)

- Keep the list of your skills short.

- Ensure you highlight one or two important skills above the others.

- Use numbers, percentages and figures to demonstrate measurable success

DON’T (Summarize your life)

- Try to be too funny, this is a professional resume

- Use a smart or pompous tone in the summary.

- Talk as if you are better than the recruiter.

Self Employed Resume Examples - Summary

- Owner - Self Employed Resume Sample - Summary

Highly motivated, articulate, creative and versatile sales professional with several years of technology sales management experience and an entrepreneurial flair. Especially skilled at building productive working relationships with clients and staff. Adept at developing effective tactics to execute long-term results in the most efficient means possible.

- Self Employed Resume Example - Summary

A highly resourceful general management and marketing communications professional with years of experience in strategic planning, improving operational efficiency, building and managing teams across multiple departments, financial management, and project management.

Work Experience

This section might get tricky - you have had a couple (or more!) of experiences working on your own business. The biggest mistake you could do is to say something like: “That business didn’t do that well, I should not include it”.

That is so wrong - as a self-employed, you have worn so many hats that it does not really matter if you have failed, because you will never really fail as long as you have learnt from something. We suggest you list any experience you have had, as an entrepreneur and even any previous one as an employee. Show your future employer your level of experience and be as detailed as possible!

Self Employed Resume Examples - Work Experience

- Owner, Self Employed Resume - Work Experience

- Guiding SMEs to break through growth barriers via Sales and Marketing strategies.

- Coaching business owners and professionals to boost revenue, attract new customers, and optimize marketing spending.

- Developing competitive business and pricing models. Create motivational workshops that increase collaboration and growth.

- Self Employed Resume - Work Experience

Self Employed

- Preparing individual and sole proprietorship tax returns.

- Prepare offer in compromise on behalf of the client to resolve tax debt.

- Building new and maintaining existing client relationships.

- Conduct research and analyze state and federal tax issues.

Here are tips to help with this part:

Do (Summarize your work history)

- Showcase why you are the perfect candidate for the job.

- Be concise and detailed

- Experience should be added where applicable.

DON’Ts (Summarize your relationship history)

- Bring your ego to the table.

- Have more than 3 references at the bottom of the work history.

- Fake references or work history is a no!

For more tips on writing the best work experience section for a self-employed like you, check out our detailed resume guide .

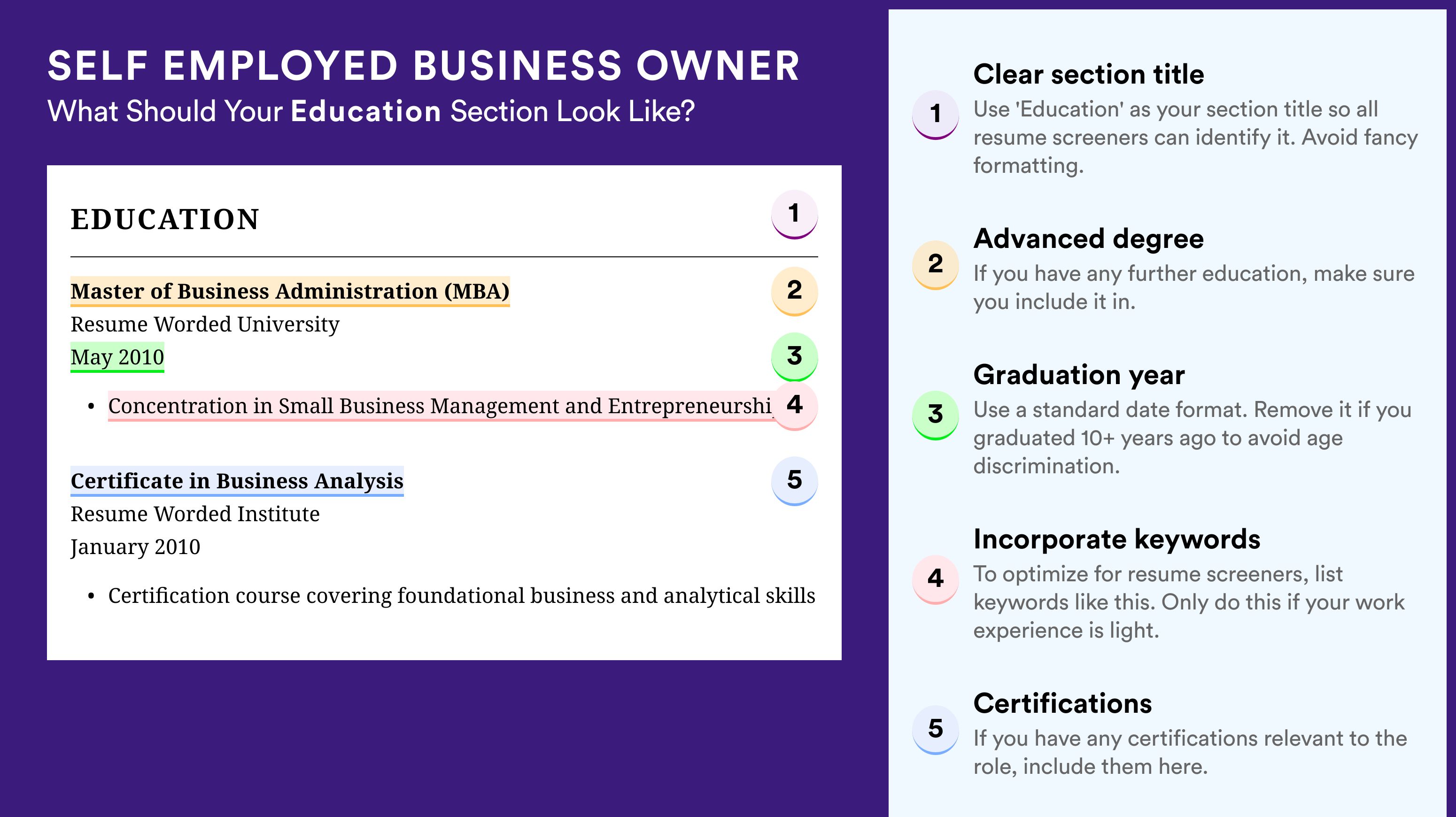

We get it, lots of successful self-employed professionals are dropout miracles. That does not have to apply to everyone though. Your education is very valuable and recruiters want to know what made you the professional you currently are. It’s very important to have even a brief section covering your education, where these points should be covered:

- Which learning institutes you attended and what you studied.

- The number of years you studied.

- The outcome of the education – i.e. qualifications.

It doesn’t matter if you’re only able to provide the most basic elements of your educational background, it still counts. Employers are often suspicious of people who leave their education out of a resume as it gets them wondering what they’re hiding. Even if it’s limited, it’s good to list and in truth, not everyone will have university degrees or education to list. If that’s the case, don’t worry, list what education you can.

Top Self-Employed Resume Skills

Recruiters aren’t going to spend hours and hours going through hundreds of resumes; they are going to use simple but effective methods to narrow their search down.

One of the simplest methods they will use is to opt for a keyword search, which is why the skills you list must be relevant to the job at hand. Remember, if you aren’t using relevant keywords you won’t get far!

We believe it’s fundamental that you add both hard and soft skills. These will make the difference and potentially get your name to the top of the list. Of course, if you start listing skills which aren’t really relevant to your job, we doubt you’ll get a callback, so think carefully before you list any skill!

Top Self Employed Resume Skills for 2022

- Microsoft Office

- Communication

- Strategic Planning

- Hyperion Planning, HFM, Essbase, SAP

- Budget Preparation & Implementation

- Reporting, IFRS and USGAAP

- Applications

- General: Business Development

- People Management

How Long Should my Self Employed Resume be?

Your Self Employed resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Self Employed, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How to List Self Employed on a Resume?

In addition to the ones at top, these additional self-employed resume examples serve as an excellent examples of how to list self employed on a resume.

- How to List Self Employed on Resume Sample

- Cover Letter: yes or no?

If you want an advantage over other candidates, we strongly suggest you use a cover letter.

If you need help, we’ve got you covered !

Should I Add my Self-Employment to a Resume?

Yes, self-employment should be added to your resume. Apart from displaying your relevant work experience, adding self employment to your resume also ensures that there are no unexplained gaps in your work history.

How to List Self-Employment on Your Resume?

To list self employment on your resume, consider adding a job title for the period of self-employment and add relevant work experience under it. If you were a self-employed freelancer who worked for multiple clients - consider adding a line for each of your relevant client work under your work history.

What is your job title if you are self employed?

If you are self employed, your job title should be either "Self Employed" or "Freelance". You can also put a specific title e.g. "Editor" or "Freelance Editor".

How to write own business experience in resume?

If you ran your own business, list yourself as the Owner, CEO or Managing Director of the business under your work experience. List your relevant responsibilities in the form of a bullet list.

How to add your small business to your resume?

While adding your small business experience to resume, make sure you select on the most relevant roles and responsibilities. Most small business owners wear multiple hats, but listing specific responsibilities keeps your relevant to the job that you are applying for.

How to put independent contractor on resume?

To list yourself as an independent contractor on resume, create a separate entry under your work experience. Add “Independent Contractor” as title followed by the responsibilities in a bulleted list.

How to write entrepreneur experience on resume?

Create an entry in your work experience section with a title of Entrepreneur/CEO/Self Employed and list your duties below it. Make sure to display the impact of work done. Keep your responsibilities relevant to the job that you are applying for.

We really, really want you to get your dream job, and we’ve come up with some additional tips!

DO (make yourself look great)

- Include awards, they are always welcomed.

- Promotions or how you’ve climbed the ranks can show your quality.

- Create a brief list of hobbies, if they fit the job.

- Honesty goes a long way.

- Include a link to your LinkedIn page

DON’T (embarrass yourself)

- Avoid adding information which might be sensitive about other businesses or organizations.

- Avoid having a link to your Facebook, Twitter or Instagram accounts!

- Sell yourself short.

We have given you tips for the best self-employed resume sample: now, if you are also looking for the best self-employed resume templates, you should check this masterpiece we have been working on ; many professionals like you have successfully used it to take their career to the next level.

Copyright © 2024 Workstory Inc.

Select Your Language:

How to Create a Self-Employed Resume in 2024 [+Example]

People who are self-employed depend on successfully advertising their services for a living, and one of the best tools for that is an impactful self-employed resume. Independent professionals can gain a considerable edge in a competitive job market by creating a well-structured, experience-focused resume and sending it out to potential clients.

So, if you don’t have one or if you want to freshen up your current one to increase your chances of expanding your client base, then this article is tailor-made for you.

Our HR experts did a deep dive on the topic and gathered everything that should be on your self-employed resume and more, so make sure you read through to the very end.

Key Takeaways

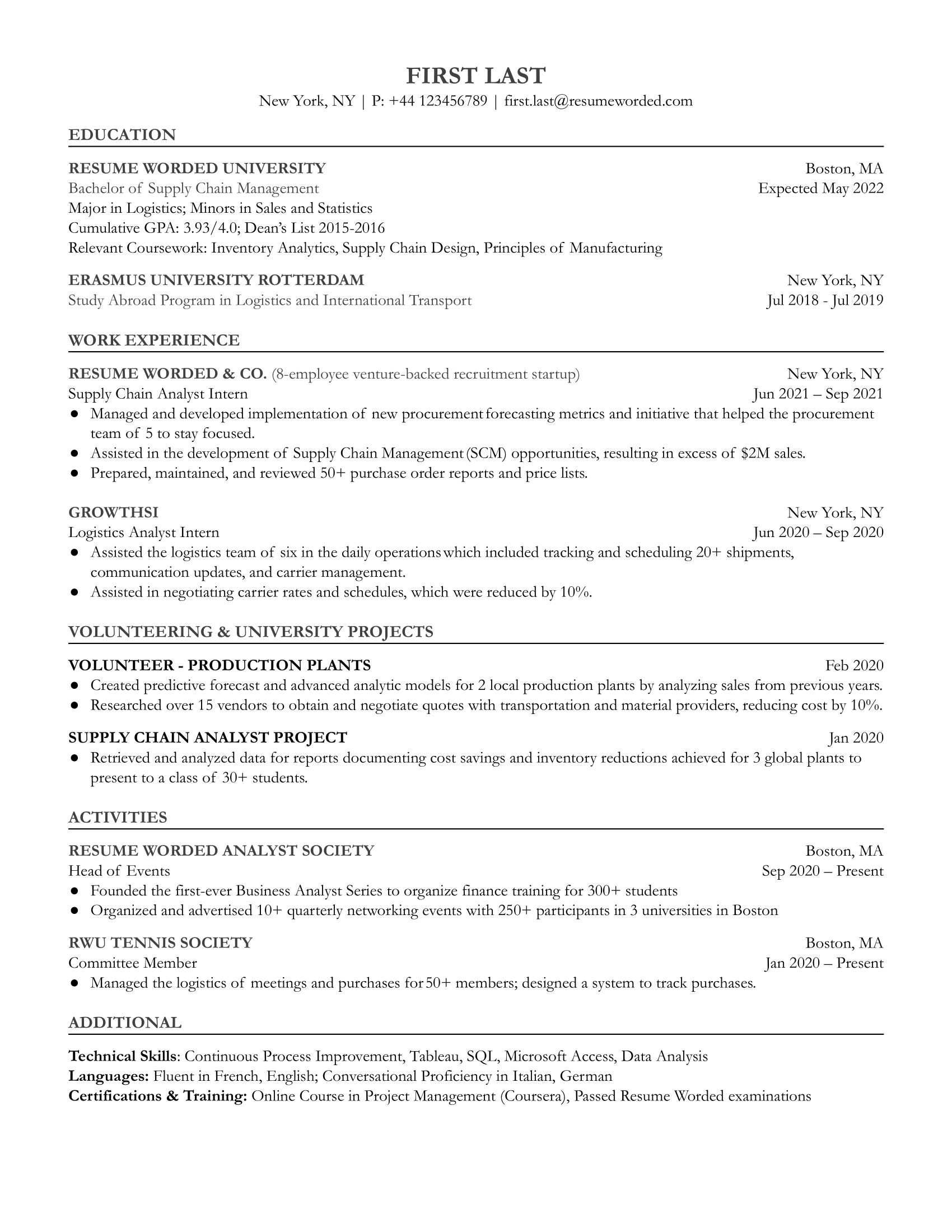

- Due to the increased freedom that comes with self-employment, candidates should highlight their initiative, project management expertise, and leadership potential on their resumes.

- Your resume should have a summary or objective statement, your contact information, your educational and work history, and a section detailing your soft and hard skills.

- When outlining your background as a self-employed person, it’s a good idea to include information like volunteer work, languages spoken, certifications obtained, and publications.

- At the end of this article, you can find a sample resume for a digital marketer that covers all the pillars of a good self-employed resume.

What is Self-Employed?

Instead of working for a corporation and receiving a salary, self-employed people choose to either work for themselves and supply certain services or contract with businesses directly.

Being your own boss gives you a lot of freedom to choose your own hours, work from wherever you like, and keep as much or as little of what you make as you like. To keep on top of things, though, a lot of discipline, time management skills, and organizational abilities are also necessary.

Several categories of self-employment exist, including but not limited to:

- Freelancer. It is common practice for freelancers to provide their services to clients on a contract or project basis.

- Independent contractor. When businesses need help with a specific project but don’t want to hire full-time employees, they often turn to independent contractors.

- Sole proprietor. A sole proprietorship is a business that has one owner and is operated under that person’s name. The business is run by the owner, who is also responsible for paying taxes based on the business’s profits.

Should You Include Self-Employment on Your Resume?

You should highlight your self-employment on your resume for the following reasons:

- It showcases your autonomy. Your ability to take charge and take responsibility for your work is highlighted when you include your self-employment experience on your resume. When you work independently, you are accountable for all of your work and professional decisions instead of hiding behind answering to another person or following the guidelines of an organization.

- It demonstrates project management experience. You can highlight your ability to see projects through successfully by listing self-employment on your resume. Whether you’re working solo or in a team, you may explain how you identify and implement the most effective methods for getting things done. This exemplifies your problem-solving and analytical abilities.

- It displays leadership skills. Including self-employment on a resume can show an employer that you are capable of handling several responsibilities. You need leadership abilities to motivate your team to complete assignments on time and to achieve your team’s or organization’s goals.

Self-Employment Resume Contact Information

Your contact information, which should be listed first on the resume, should include:

- Full legal name. Put your name at the top of the resume, where it will be clearly seen.

- Professional job title. Think about your title or the heading that best describes what you do for a living.

- Contact details. Add your phone number, email, and physical address (if applicable) as a last touch.

The following is an example of how a self-employed resume’s contact information may look:

Madison Miller Digital Marketer 418-555-7979 [email protected]

How to Write a Resume Summary/Objective for Self-Employment

There is a significant distinction between a resume summary and an objective, despite their superficial similarities.

The summary provides the prospective employer with a concise overview of your qualifications for the advertised position. The objective, on the other hand, concentrates on the kind of job that you are looking for and places an emphasis on your long-term professional objectives.

Self-Employment Resume Summary

I am a result-driven digital marketer who has two years of experience working in corporate environments and three years of experience running my own business. I have extensive knowledge when it comes to the areas of social media and SEO.

This self-employed resume summary provides a condensed review of the applicant’s talents, highlighting strengths such as the applicant’s ability to work in a variety of different capacities within the marketing industry.

Self-Employment Resume Objective

To provide digital marketing services while leveraging my understanding of search engine optimization (SEO) and social media marketing in order to assist my clients in expanding their brand awareness, boosting their revenue, and driving more traffic.

This resume objective displays the individual’s ambition as well as their desire to apply their abilities to the benefit of their clients and bring success to those clients.

Education Section of Self-Employment Resume

When you are putting together an education section of your self-employed resume, the first thing you should do is label the section “Educational Background.”

Then, you should provide a comprehensive summary of the academic accomplishments you have achieved. Be sure to put the most recent item at the top of the list.

Include information on the degree that was obtained, the name and location of the educational institution that was attended, and the number of years spent there. If you already possess a degree beyond that of a high school graduate, there is no need to mention your high school diploma.

The following is an example of a potential structure for the education section:

Educational Background

Master of Science in Marketing Science, Columbia University, New York City, NY September 2018–June 2020

Bachelor of Science in Marketing Analytics, New York University, New York City, NY September 2014–June 2018

How to Add Self-Employment Experience to Your Resume

Consider the following suggestions if you are not sure how to write your own business experience on your resume:

- Come up with a title. Choose a title that communicates something about the nature of your self-employment and the services you provide.

- Compose a summary. Summarize your history of self-directed work. Make sure to highlight these accomplishments using metrics like key performance indicators (KPIs) to back up your claims.

- Create a list. To demonstrate the extent of your business experience, provide a list of relevant clients and projects, as well as the kind of success your work has brought them.

In your self-employed resume, you can demonstrate your experience as a digital marketer in the following ways:

Owner of Madison Miller Marketing: 2020 to present day

- I worked with clients in the beauty industry and created online advertising and search engine marketing campaigns for them. As a result of my contribution, the clients saw a rise of 25% to 34% in their annual revenue.

- I developed strategies for marketing through social media for my clients in the health industry. My clients were able to get a minimum of 20,000 social media followers in less than a quarter, thanks to my services.

- I wrote SEO content for clients in the wellness industry. I assisted the clients in achieving a 700% increase in the amount of organic website traffic they received.

How to Add Skills to Self-Employment Resume

When it comes to adding self-employed resume skills, it is essential to keep in mind that both soft skills and hard skills should be included.

Soft skills, also known as transferable skills, are the kinds of skills that are applicable to a wide range of vocations and work environments. For instance, some of the best-known examples of soft skills include communication, teamwork, dispute resolution, critical thinking, and logical reasoning.

Hard skills, on the other hand, are workplace-specific abilities that may be learned through direct experience. Data entry, maintaining network security, developing original content, conducting market research, and other similar activities are all examples of hard skills.

When it comes to including these abilities on your self-employed resume, the most effective strategy for drawing attention to them is to create a section labeled “skills” and list them all in that section. For the sake of greater clarity, you may want to categorize soft skills and hard skills into different groups.

Also, make sure that you place a strong emphasis on the skills that are required for the position that you are applying for, which can help you differentiate yourself from the other candidates.

This section of your resume could contain information along these lines:

Soft Skills

- Active listening

- Conflict resolution

- Critical thinking

- Effective communication

Hard Skills

- Campaign management

- Digital advertising

- Market research

You can add a phrase or two to each skill that explains how you put them to use if you haven’t already demonstrated the practical application of these skills in the experience section of your self-employed resume.

How to Add Other Sections to Self-Employment Resume

You have the option of deviating from the standard self-employed resume format by incorporating certain additional sections, such as:

- Volunteer work. Think about including volunteer work that is related to your line of employment. Consider the following sentence as an illustration: As a social media specialist at an NGO, I am responsible for maintaining audience interaction and the consistent uploading of content to social media platforms.

- Languages. Make a list of all the languages you can communicate fluently in. You can present yourself as a person who is proficient in French, Spanish, and English, which enables you to engage effectively with customers located all over the world.

- Certifications. You can also include any applicable certifications that you have received. Consider stating: Certified Digital Marketing Professional (CDMP), obtained by completing an intensive online learning program that covers topics such as SEO, social media marketing, and metrics.

- Publications. Bring employers’ attention to any literary work that you have made or that you have contributed to. Take a look at the following as an illustration: Author of a book about running a business that offers guidance to ambitious folks who are looking to be self-employed.

Should You Write a Cover Letter With Your Self-Employment Resume?

It is recommended that you accompany your resume with a cover letter . A cover letter gives you the opportunity to introduce yourself and demonstrate why you would be a benefit to the company or client you want to work with.

The following is an example of a cover letter that accomplishes exactly that goal.

Dear HR Manager,

I am writing to express my enthusiasm about the possibility of working for Publicis Groupe in the capacity of a digital marketing specialist. As a professional with five years of experience in the industry, I am certain that my knowledge of SEO, search engine marketing, market research, and digital advertising will contribute to the success of your company.

You will find attached a copy of my resume, which provides an overview of my experience and skills, for your consideration. I would be grateful to discuss with you how my background aligns with the requirements you have at the moment.

Sincerely, Madison Miller

Self-Employment Resume Example

After going over the many parts that make up a resume and looking at several different self-employed resume examples, let’s take a look at a comprehensive example of a resume for a self-employed digital marketer.

Summary I am a result-driven digital marketer who has two years of experience working in corporate environments and three years of experience running my own business. I have extensive knowledge when it comes to the areas of social media, marketing for search engines, and SEO.

Self-employment Experience

- I worked with clients in the beauty industry and provided them with online advertising and search engine marketing campaigns. As a result of my contribution, the clients saw a rise of 25% to 34% in their annual revenue.

- I wrote SEO content for clients in the wellness industry. I assisted the clients in achieving a 700% increase in the amount of organic website traffic they received. Skills

Certifications

HubSpot Academy’s Digital Marketing Certification Course OMCA™ Certification for Digital Marketers

Final Thoughts

And with that, we’ve reached the end of our resume guidance for self-employed individuals for 2024!

As a professional who is self-employed, it is essential to have a resume that showcases all of your previous work, qualifications, talents, and anything else that is relevant in order to differentiate yourself from the other professionals in your field.

If you were unsure before, after reading this article, you should know everything there is to know about creating a stellar self-employed resume. Good luck with your next career adventure!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

You’ll also like

How to Write a Resume Summary in 2024 + 11 Examples

What is a Mock Interview & How to Prepare for It [2024]

63 Meta (Facebook) Behavioral & Technical Interview Questions

Why are Cover Letters Necessary in 2024?

12 Networking Opportunities to Help You Grow Your Network

20+ Nursing Interview Questions & How to Answer Them

What Are Professional References & How to Provide Them

13 Teacher Interview Questions with Sample Answers

How to Ask Someone to Be Your Mentor—Dos and Don’ts

Subscribe to our newsletter.

Resume and cover letter tips, interview questions prep, and so much more!

- Resume Writing

- Resume Review

- How To Write an ATS Friendly Resume

- 13 Highest Paying IT Jobs

- Privacy Policy

Career Resources

- 48 Interview Questions and Answers

- 15 Top Paying Jobs Without a Degree

Here's the Ideal Way to Include Self-Employment on Your Next Resume

3 key takeaways

- What self-employment is

- Best practices for creating a self-employed job description

- How to put self-employed on a resume using the free Teal AI Resume Builder

If you’ve ever worked as a contractor, a freelancer, or a small business owner, you are someone who has been self-employed.

Thanks to this experience, you know that even when you’re working for yourself, this absolutely counts as real work experience. Beyond what you’d learn in a more traditional job, you’re also growing in areas like time management, taking initiative, and problem-solving.

The key is learning how to take this valuable work history and translate it onto self-employed resumes to increase your chances of landing a job.

Sound like a tall order? Here’s what you need to know about the best method of how to put self-employed work on your resume (with self-employed resume examples included).

Including self-employed on resumes: Why it matters

"Self-employed" is a fairly broad term. At its most basic level, it means that you worked independently, for yourself (rather than, for example, working with one specific company). But the life of a self-employed professional can vary widely, looking like:

- Freelancing: With freelance work, your schedule is highly flexible, working with multiple clients (whom you choose) on short-term projects.

- Sole proprietorship: Most freelancers are sole proprietors. In other cases, sole proprietors are considered business owners who can do things like hire employees.

- Contract work: An independent contractor generally has a working relationship with a single client on longer, fixed-term projects.

- Entrepreneurship: Entrepreneurs make money by starting and building a business.

- Partnership: A partnership is the next step up from a sole proprietorship. It’s a business owned by two or more people.

- Consulting: Consultants are often independent contractors—people who offer expert advice to private companies.

While these are all types of self-employed experiences, many of these terms carry some overlap. If you don’t know which one best describes your work and employment history, fall back on “self-employed.”

Should you put self-employment on your resume?

Absolutely!

Including career-focused experiences—such as freelance writing on the side, contract work between full-time jobs, or even opening a small business—can help prove your flexibility and resourcefulness. (But remember, listing every job title or experience you’ve ever had might not be relevant. Hiring managers probably don’t care about that lemonade stand you had in middle school.)

Outside of more general job skills (like interpersonal skills), people who are self-employed also commonly specialize in a certain type of work. You can showcase any technical competencies or hard skills in the " About Me" section of your self-employed resume and beyond.

Practical guide: Listing self-employment on your resume

In many ways, adding self-employed work to your resume will look the same as adding any other job or work experience on your resume . You’ll want to include:

- A job title (that clearly signals you were self-employed)

- A company name

- The dates you started and ended each position or gig (dividing up certain freelance projects, for example)

- Bullet points with compelling descriptions of what you did

- A well-written resume summary

- Additional skills, certifications , or successes

But figuring out what to put for the company name when self-employed can be tricky. One option is to include a header that says “Freelance” or “Contract” and list multiple independent contracting clients as subheaders under that:

- Freelance Writer

- XYZ Company

- ABC Company

Another is to name your job title and the client or company on the same line, with further description underneath:

- ABC Company — Freelance Graphic Designer

If you have your own business, you can include your business name. Just make sure to denote that you’re an entrepreneur rather than an employee.

Finally, if you don’t have much space to include your self-employed experience, it’s okay not to name any companies at all. Simply say “Consultant” or “Freelancer” with a couple of brief sentences about your self-employed work experience, mentioning specific personal projects where you achieved results:

- Freelance Developer: Helped five clients design and maintain websites, lowering bounce rate to 30% and increasing conversion rate to 3%. Worked with HTML, CSS, JavaScript, and PHP.

Write your self-employed resume with Teal

The Teal AI Resume Builder offers one tool to create, optimize, and manage your resume. You can build one from scratch or upload an existing resume (or your LinkedIn profile!) to get started. Then, use Resume Analysis and Matching Mode to bridge any gaps between your self-employed experience and each unique role you apply for.

Articulating your self-employed role: Creating a compelling job description

Once you’ve figured out a good header, the next step is writing a self-employed job description for a resume that explains exactly what you did as your own boss.

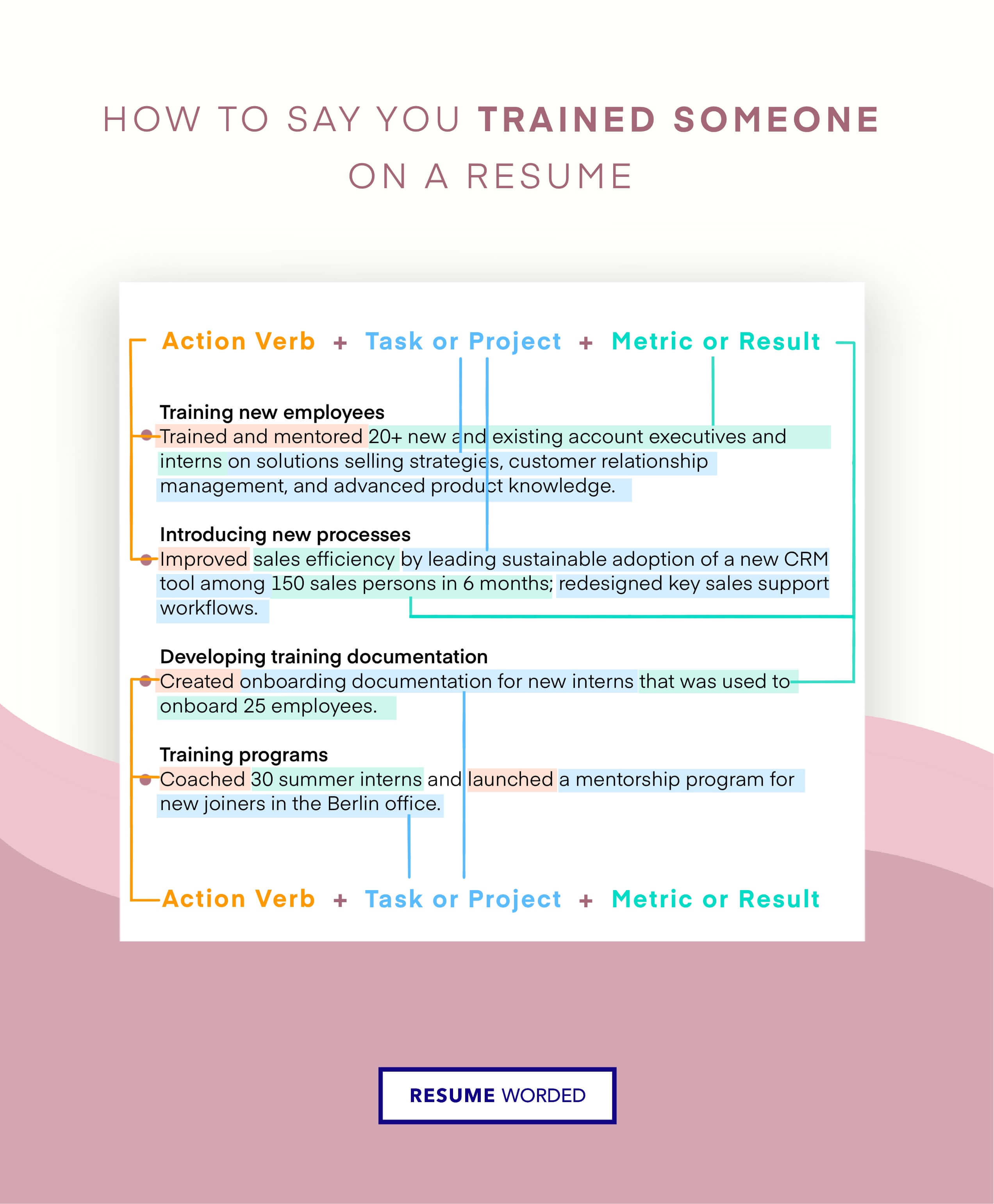

This means adding relevant achievements (with metrics, wherever possible); using strong action verbs (achieved, exceeded, generated); and staying honest about what you did or didn’t do

But as you list self-employment experiences on a resume, you’ll want to specifically highlight any self-employed skills you acquired or honed during those experiences that you might not have gotten during a traditional 9-5. For example, did you:

- Improve your time management and organizational skills by working on multiple new client projects at once?

- Market yourself and your personal brand on social media to gain more clients?

- Adapt your work to fit the different guidelines of each company you worked with?

These are all great details that you should weave into a self-employed resume summary.

Should you put your small business on your resume? Sure! If you’ve ever started your own small business, this is a great detail to include on your resume—this is something that not everyone has done. Describe yourself as business owner, CEO, or manager, whichever one feels most appropriate for you as a self-employed professional. If you have a company website, you can add it as a bullet point along with your contact details.

Self-employed resume examples

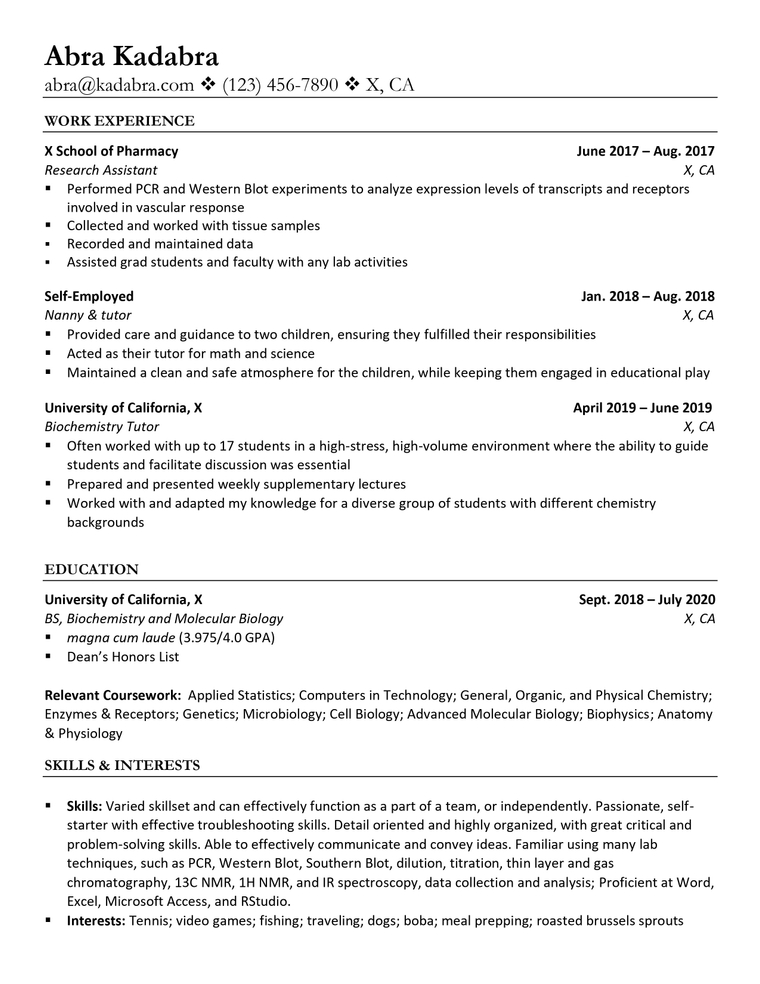

Full-time self-employed sample resume.

Looking for a sample self-employed resume to impress a hiring manager? Take a look at the work experience section of this self-employed photographer resume . As one of the best resume templates, this self-employed resume example breaks down the job seeker's self-employed projects into bullet points:

Self Employed Photographer

01/2023 – 04/2023

Captured Moments Photography

- Developed and implemented a comprehensive marketing plan, resulting in a 30% increase in client inquiries and a 20% increase in bookings within the first year.

- Collaborated with industry professionals to organize and host a successful photography exhibition, attracting over 500 attendees and generating significant media coverage.

- Established a streamlined system for organizing and storing client images, improving efficiency by 25% and ensuring quick and easy access to files for future projects.

Photography Business Manager

09/2022 – 12/2022

- Created a visually stunning and user-friendly website to showcase portfolio and services, resulting in a 40% increase in website traffic and a 15% increase in client conversions.

- Developed a pricing structure that maximized profitability while remaining competitive in the market, leading to a 10% increase in average project revenue.

- Implemented a client payment tracking system, reducing late payments by 20% and improving cash flow management.

Photography Assistant

07/2022 – 09/2022

- Researched and invested in high-quality photography equipment and software, resulting in enhanced image quality and increased client satisfaction.

- Stayed up-to-date on industry trends and techniques, incorporating new styles and editing methods into work, resulting in a 15% increase in client referrals.

- Developed an efficient system for editing and retouching images, reducing editing time by 30% and ensuring timely delivery of final products to clients.

Part-time Self-employed sample resume

If your self-employment experience is more of a side project, here’s what this freelance work on your resume might look like for a freelance artist , who has a full-time job while also doing freelance work:

Freelance Artist

ArtistFreelance Solutions

- Collaborated with a team of designers and developers to create a series of digital illustrations for a popular mobile game, resulting in a 25% increase in downloads and a 15% increase in revenue.