EasyKnock’s programs are designed with the needs of our customers in mind.

Sell & Stay

Sell your house to us, stay in it as a renter, but keep the option to buy it back.

- MoveAbility

Convert your home equity to cash you can use to make a more competitive offer on your next house.

Everything you need to know about today’s real estate industry and financial climate, straight from the experts.

Tools for agents, brokerages, lenders, and more.

EASYKNOCK FOR

- Submit a Lead Become a Partner

- Customer Testimonials

Tools for agents, brokerages, lenders, and other partners.

- Become a Partner

- Submit a Lead

- Debt Management

- Home Equity Loan

- Sale-Leaseback

- Acquisition

- Aging in Place

- Assisted Living

- Bridge Loans

- Cash Out Refinance

- College Loans

- Consolidation

- Construction

- Contractors

- Coronavirus

- Credit Card

- Credit Score

- Customer Story

- Debt-to-Income

- Down Payment

- Financial Crisis

- Financial Goals

- Financial Planning

- financial program

- financial wellness

- First Time Home Buyer

- Forbearance

- Foreclosure

- Home Equity

- Home Equity Conversion Mortgage

- Home Equity Line of Credit

- Home Improvement

- House Flipping

- House Pricing

- Interest Rates

- Jarred Kessler

- Landscaping

- Late Payments

- Loan Officers

- Medical Bills

- Medical Expenses

- Natural Disaster

- newamericanfunding

- pressrelease

- Proof of Income

- Property Tax

- proptechbreakthrough

- Real Estate

- Real Estate Tax

- Refinancing

- Restrictions

- Reverse Mortgages

- Seasonality

- Second Home

- Second Mortgage

- Self-Employed

- Sell & Stay

- Small Business

- South Carolina

- Student Loans

- Testimonial

- Vacation Home

How to Create a Mortgage Loan Officer Business Plan

Are you a mortgage loan officer looking to create a business plan? We have the steps you need to take for success.

When people ask you how much loan officers make, do you have a hard time coming up with a succinct answer?

Don’t worry! It just means you know your business. There are probably as many total compensation numbers in mortgage lending as there are loan officers.

According to Payscale, the average mortgage loan officer earns about $47,500 per year in salary and $36,500 in bonuses and commissions. But the outlying data is what shows you just how varied compensation can be from person to person.

The same Payscale report shows that the base salary of a mortgage loan officer ranges from just above $29,100 to almost $84,000. And that’s not all – recent data shows that the top earners are bringing in more than $131,000 from commissions alone.

To get to that level, you have to know your industry. You have to understand what your customers want, of course, but first and foremost you need to know exactly how you’re going to build your business. And that means developing a solid business plan.

Creating a Mortgage Loan Officer Business Plan in Five Steps

Without a business plan, mortgage loan offices don’t know where they’re going or how they’re going to get there. In such a competitive industry, that’s like running a race with a blindfold on – no matter how fast you run, someone who can see is going to get to the finish line faster. Here’s how to give yourself that edge.

1. Analyze Your Market

You can’t know how to develop your mortgage loan officer business plan until you know what the market needs . Before you even start writing your business plan, take some time to research what’s going on in your market. For the area you serve, find out:

- The average value of homes

- Median household income

- Home purchase and sales trends

- Property valuation forecasts

- Homeownership rates

- Housing vacancies

This information will help you to understand who you’re serving and what they need. Your business plan will be different if your area has a median income of $50,000 than if your average buyer is earning six figures a year. Your sales goals may change if you learn that homeownership rates in your area are declining.

Once you have as much information as you can gather, you can start to develop actionable objectives.

2. State Your Business Objectives and Goals

The real estate market is notoriously uncertain. Pair that with an “it depends” business strategy and you’ll have a difficult time creating a mortgage loan officer business plan.

Look at the information you have and consider what’s realistic for your market. Where do you want your revenue levels to be in five years? In one year? Take a look at some examples of mortgage business plans to get an idea of the objectives that others in your field are pursuing .

Next, decide if you want to add any milestones or short-term goals. For example, if you plan to add a second office within five years, will you need to hit a certain revenue level by the three-year mark?

3. Develop a Marketing and Public Relations Strategy

Identify the tools that you’ll use to pursue your goals for your mortgage loan officer business plan. Make sure to diversify and take advantage of digital marketing strategies as well as good old-fashioned networking.

Schedule your blog posts, then go out to a Chamber of Commerce event. Buy ad space on a real estate website, but don’t forget to talk to your neighbors and find out who might be buying or selling.

It’s particularly important to keep your digital content up to date. Networking is networking in any age, but online trends change quickly. In 2019, for example :

- Infographics offer a 40 percent engagement rate

- Facebook Live videos have twice the engagement of non-live options

- The ROI of emailing relevant content is approximately $38 for every dollar spent

- Promoted social media ads are expected to generate $17 billion

Just make sure that you create time in your day to get those messages and posts out into the world!

4. Develop a Referral Network

Your networking strategy should involve fellow professionals as well as people in the community. Join professional organizations, like the National Association of Mortgage Brokers or the Mortgage Bankers Association .

A mortgage loan officer business plan should include making connections with people who aren’t directly involved in mortgage lending but who work with people who need loans. Reach out to local :

- Accountants

- Appraisers

- Real estate attorneys

- Listing agents

Make sure that your referral strategy includes organizations that you can send clients to as well as vice versa. For example, at some point, you will probably have a client that needs a second mortgage or home equity line of credit but doesn’t qualify. More than 20 percent of people seeking this kind of funding can’t get approved.

5. Keep Tracking Your Progress!

Your mortgage loan officer business plan objectives should be specific enough that you can track your progress as you go. The best way to do this is with key performance indicators , or KPIs, which are data-based metrics of a business’s momentum.

To help you evaluate the success of your business plans, your KPIs need to be:

- Based on numerical data

- Presented in the context of performance goals

- Relevant to current company processes

- Useable to drive change as necessary

KPIs that are particularly useful to loan officers include:

- Application conversion rate: the ratio of funded loans to applications in a certain time frame

- Average origination value per loan: revenue earned from each loan

- Cost per loan originated: how much you spend on average to secure each loan agreement

Key Takeaways

If you don’t know where you’re headed with your mortgage loan officer business plan, how will you know when you’re there? To know your destination as well as your path, you need a solid business plan with specific and actionable steps.

Talk to a financial advisor and start developing a plan today. You’ll thank yourself when you reach your first goal!

Ready to Make Your Equity Work For You?

Suggested Reading

How to Pay Off Debt Fast with Low Income: 12 Ways

What Is a Home Equity Sharing Agreement? Pros & Cons

Is Reverse Mortgage a Good Idea for Seniors?

What Can You Use a Home Equity Loan For?

Debt Resolution vs Debt Consolidation: Pros & Cons

Finding Flexibility for the Boxed-In Homeowner

Debt Forgiveness for Seniors: 10 Options

Where to Live Between Selling and Buying a House

What is a Real Estate Settlement?

Ribbon, now powered by EasyKnock, Expands RibbonCash to Florida, Making Homeownership More Achievable for Local Everyday Buyers

An Interview with Robert “Nev” Neville

How to Get Equity Out of Your Home Without Refinancing

An Interview with Jarred Kessler – Rehab Warriors Advisor

7 HELOC and Home Equity Loan Alternatives to Consider

An Interview with Shawn Tate

How to Qualify for a HELOC: A Step-by-Step Guide

Is HELOC Interest Tax Deductible? Find Out Now

Do You Need an Appraisal for a Home Equity Loan or HELOC?

This article is published for educational and informational purposes only. This article is not offered as advice and should not be relied on as such. This content is based on research and/or other relevant articles and contains trusted sources, but does not express the concerns of EasyKnock. Our goal at EasyKnock is to provide readers with up-to-date and objective resources on real estate and mortgage-related topics. Our content is written by experienced contributors in the finance and real-estate space and all articles undergo an in-depth review process. EasyKnock is not a debt collector, a collection agency, nor a credit counseling service company.

Mortgage Broker Business Plan Template

Written by Dave Lavinsky

Mortgage Broker Business Plan

You’ve come to the right place to create your Mortgage Broker business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Mortgage Broker companies.

Below is a template to help you create each section of your Mortgage Broker business plan.

Executive Summary

Business overview.

Davidson Mortgage, located in Tucson, Arizona, is a new mortgage brokerage specializing in residential mortgages. The company will operate in a professional setting, conveniently located next to several banks in the center of the shopping district. We offer a wide range of services to help our clients get a mortgage, including finding loan options, applying for the loans on the clients’ behalf, and completing all the paperwork. We strive to serve our clients with the utmost empathy to ensure they get the best mortgage for their situation.

Davidson Mortgage is headed by Harold Davidson. He is an MBA graduate from Arizona State University with 20 years of experience working in the finance industry. His passion is to help his clients qualify for their dream homes and provide them with a smooth process from start to finish.

Davidson Mortgage will focus on providing superior service to all of its clients to ensure they get the best mortgage possible. Our services include finding loan options, applying for loans on behalf of customers, and completing closing paperwork. Since customer service is our top priority, we will keep in touch with our clients after they have closed on the mortgage. Furthermore, Harold will create webinars, online courses, and other content to educate his clients and the local community on the mortgage lending process.

Customer Focus

Davidson Mortgage will primarily serve homebuyers interested in properties located in the Tucson, Arizona area. Tucson is a growing city with thousands of residents eager to purchase a new home. We expect our clientele to be equal parts first-time home buyers and existing homeowners.

Management Team

Davidson Mortgage is run by Harold Davidson. Harold has been a licensed mortgage broker for the past 20 years, working for several large firms. However, throughout his career, he desired to have a closer connection with his clients as well as have more flexibility to help them get their dream homes. He started this company in order to achieve those goals. In addition to his valuable experience, Harold also holds an MBA from Arizona State University.

Harold is joined by Bethany Peterson. She will serve as the company’s full-time assistant, who, among other things, will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

Success Factors

Davidson Mortgage is uniquely qualified to succeed due to the following reasons:

- Davidson Mortgage will fill a specific market niche in the growing community we are entering. In addition, we have surveyed local realtors and homebuyers and received extremely positive feedback saying that they would consider making use of our services when launched.

- Our location is in an economically vibrant area where new home sales are on the rise, and turnover in homes and rentals occurs often due to the upward mobility of residents.

- The management team has a track record of success in the mortgage brokerage business.

- The local area is currently underserved and has few independent mortgage brokers offering high customer service to homebuyers.

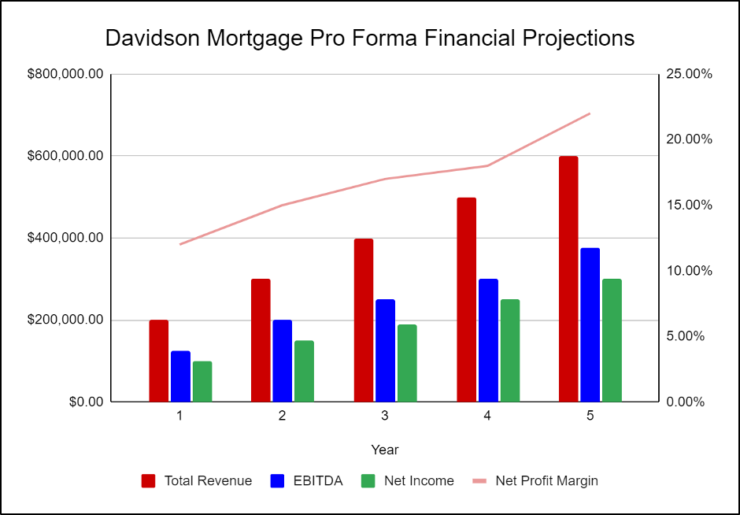

Financial Highlights

Davidson Mortgage is seeking a total funding of $250,000 of debt capital to open its office. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

- Office design/build: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $100,00

- Marketing expenses: $50,000

- Working capital: $50,000

Company Overview

Who is davidson mortgage, davidson mortgage history.

After surveying the local customer base and finding a potential office, Harold Davidson incorporated Davidson Mortgage as an S-Corporation on 1/1/2023.

The business is currently being run out of Harold’s home office, but once the lease on Davidson Mortgage’s office location is finalized, all operations will be run from there.

Since incorporation, Davidson Mortgage has achieved the following milestones:

- Found office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

Davidson Mortgage Services

Industry analysis.

Despite the pandemic hurting several industries, the mortgage brokers industry still performed strong and is projected to continue to do so. Last year, U.S. mortgage brokerages brought in revenues of $11.7 billion and employed 47,000 people. There were just over 12,000 businesses in this market.

However, the mortgage broker industry is highly fragmented, with the top two companies accounting for just over 11% of industry revenue. Furthermore, mortgage interest rates are on the rise, as well as housing prices, preventing many people from buying houses and applying for mortgages. These two factors significantly stunt the industry at present.

Despite these challenges, the industry is still projected to increase moderately throughout the rest of the decade. Though larger firms may dominate revenue and clientele, studies and surveys show that clients don’t necessarily favor working with large firms. Providing excellent service and personal touches throughout the process can help small firms succeed in the industry.

Customer Analysis

Demographic profile of target market.

Davidson Mortgage will primarily serve the residents of Tucson, Arizona. The area we serve has a significant population of people who are searching for their first home, as well as families and individuals who need a new home.

The precise demographics for Tucson, Arizona are:

Customer Segmentation

Davidson Mortgage will primarily target the following customer segments:

- Existing homeowners

- First-time home buyers

Competitive Analysis

Direct and indirect competitors.

Davidson Mortgage will face competition from other companies with similar business profiles. A description of each competitor company is below.

The Loan Store

Established in 2010, The Loan Store originates, finances, and sells mortgage and non-mortgage lending products throughout the United States. It offers a range of consumer credit products, such as home loan products, home equity loans, and unsecured personal loans, as well as home and personal loan servicing. The company claims to be one of the largest private, independent retail mortgage lenders in the U.S. Its current business channels include direct lending, affinity, branch retail, and servicing.

However, agents working with The Loan Store experience high turnover, resulting in little concern for maintaining ongoing relationships with clients. Also, the agents themselves are mixed in quality, ranging from part-time brokers with little experience or sales records to full-time brokers with long-term experience. There is no systematic company method for passing on knowledge from experienced to inexperienced brokers as all are competing with each other, to a certain extent, for commissions.

Direct Loan Connection

Founded in 2006, Direct Loan Connection (DLC) employs licensed mortgage professionals who have access to multiple lending institutions, including banks, credit unions, and trust companies. This access enables the company to offer a vast array of available mortgage products – ranging from first-time homebuyer programs to financing for the self-employed to financing for those with credit blemishes. In addition, to help homebuyers and homeowners, DLC offers commercial mortgages.

Though they are a local leader in the premium end of the market, they refuse to negotiate their broker’s fees and sometimes lose potential clients because of this. Davidson Mortgage’s fees will be far more reasonable.

Supreme Mortgage

Supreme Mortgage specializes in mortgage brokering and is committed to helping homebuyers, and homeowners get the best mortgage with the lowest interest rate. The brokerage works with more than 40 lenders who compete to provide mortgages and who pay Supreme Mortgage’s fee so that clients receive the service free of charge.

Some reviews of Supreme Mortgage point out the low-quality service offered by brokers, who have little training in customer service. Furthermore, Supreme Mortgage does not attempt to maintain long-term relationships with customers who will eventually purchase another home.

Competitive Advantage

Davidson Mortgage enjoys several advantages over its competitors. These advantages include:

- Location: Davidson Mortgage’s location is near the center of town, in the shopping district of the city. It is visible from the street, where many residents shop for both day-to-day and luxury items.

- Client-oriented service: Davidson Mortgage will have a full-time assistant to keep in contact with clients and answer their everyday questions. Harold Davidson realizes the importance of accessibility to his clients and will further keep in touch with his clients through monthly seminars on topics of interest.

- Management: Harold Davidson has been extremely successful working in the mortgage brokerage sector and will be able to use his previous experience to grant his clients detailed insight into the world of home loans. His unique qualifications will serve customers in a much more sophisticated manner than many of Davidson Mortgage’s competitors.

- Relationships: Having lived in the community for 25 years, Harold Davidson knows many of the local leaders, newspapers, and other influencers.

Marketing Plan

Davidson Mortgage will use several strategies to promote its name and develop its brand. By using an integrated marketing strategy, Davidson Mortgage will win clients and develop consistent revenue streams.

Brand & Value Proposition

The Davidson Mortgage brand will focus on the company’s unique value proposition:

- Client-focused residential mortgage brokerage services, where the company’s interests are aligned with the customer

- Service built on long-term relationships and personal attention

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Davidson Mortgage is as follows:

Website/SEO

Davidson Mortgage will invest heavily in developing a professional website that displays all of the features and benefits of working with the mortgage broker. It will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

Davidson Mortgage will invest heavily in a social media advertising campaign. Harold and Bethany will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Davidson Mortgage understands that the best promotion comes from satisfied customers. The company will work to partner with local realtors by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

By offering webinars and courses on topics of interest in the office or other locations, Harold Davidson will encourage residents in the community to become comfortable with the expertise and character of Davidson Mortgage. These webinars will generally be offered free of charge as general promotion and for direct networking.

Davidson Mortgage’s pricing will rely on the standard industry rates in order to be perceived as neither a luxury nor a discount broker. The standard rate for brokering a mortgage is 1-2% of the loan amount. By seeking quality clients and maintaining long-term relationships with them, Davidson Mortgage will fend off pressure to discount their rates, even in down markets.

Operations Plan

The following will be the operations plan for Davidson Mortgage.

Operation Functions:

- Harold Davidson is the founder and will operate as the President of the company. He will be in charge of all the general operations and executive functions within the company. Furthermore, until he hires additional staff, he will personally help all clients who agree to utilize the company’s services.

- Harold is assisted by his long-term assistant Bethany Peterson. She will serve as the company’s full-time assistant and will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

- As the business grows and Harold takes on more clients, he will hire other mortgage brokers to assist him.

Milestones:

The following are a series of steps that will lead to the company’s long-term success. Davidson Mortgage expects to achieve the following milestones in the next six months:

3/202X Finalize lease agreement

4/202X Design and build out Davidson Mortgage office

5/202X Hire and train initial staff

6/202X Kickoff of promotional campaign

7/202X Reach break-even

8/202X Reach 25 ongoing clients

Financial Plan

Key revenue & costs.

Davidson Mortgage’s revenues will come primarily from the commissions earned from residential mortgage sales.

The major cost drivers for the company will include employee salaries, lease payments, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Annual lease: $30,000

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Mortgage Broker Business Plan FAQs

What is a mortgage broker business plan.

A mortgage broker business plan is a plan to start and/or grow your mortgage broker business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Mortgage Broker business plan using our Mortgage Broker Business Plan Template here .

What are the Main Types of Mortgage Broker Businesses?

There are a number of different kinds of mortgage broker businesses , some examples include: Retail Mortgage Broker, Business/Corporate Mortgage Broker, or Private Mortgage Brokers.

How Do You Get Funding for Your Mortgage Broker Business Plan?

Mortgage Broker businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Mortgage Broker Business?

Starting a mortgage broker business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Mortgage Broker Business Plan - The first step in starting a business is to create a detailed mortgage broker business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your mortgage broker business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your mortgage broker business is in compliance with local laws.

3. Register Your Mortgage Broker Business - Once you have chosen a legal structure, the next step is to register your mortgage broker business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your mortgage broker business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Mortgage Broker Equipment & Supplies - In order to start your mortgage broker business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your mortgage broker business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful mortgage broker business:

- How to Start a Mortgage Broker Business

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Templates

Loan Officer Business Plan Guide

Published Jul.05, 2023

Updated Apr.23, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

Table of Content

1. What are loan officers’ services?

Loan officers serve both home buyers and businesses. When evaluating clients’ eligibility for loans, they carefully assess their credit history and financial status. Additionally, they offer expert guidance in selecting mortgage products that cater to the unique needs of each client. Loan officers collaborate with lenders, streamlining the application process, negotiating terms, and facilitating closing.

2. Executive Summary

Why do you need a business plan for a loan officer business.

A business plan holds immense importance for the success of a Loan Officer business. A comprehensive guide on crafting a loan officer business plan acts as a roadmap leading to operational and financial success for the Loan Officer business. It should identify not only milestones but also the processes and strategies needed to achieve those goals.

The business plan should outline the company’s overall mission and objectives, its financials (including a budget and a pro forma income statement), market analysis, organizational structure, and customer acquisition strategies.

How to write an executive summary for a Loan officer business plan?

The executive summary of a loan officer business plan worksheet provides a comprehensive overview of the entire plan. The provided sentence lists various components of a summary, including the mission, goals, products and services, financial projections, and competitive analysis. It also mentions that the qualifications and experience of the loan officer are highlighted.

The executive summary should prioritize the loan officer’s objectives and strategies for acquiring and fulfilling client requests. It should outline how the loan officer plans to reach these goals effectively while explaining the specific techniques they will utilize.

The executive summary of the commercial loan officer business plan template should provide a concise overview of the products and services offered by the loan officer. Additionally, it should include anticipated financial projections and competitive analysis. This section aims to present an outline of available loans, associated fees, charges, and estimated total revenue for the loan officer’s business.

The executive summary should provide a concise overview of the loan officer’s qualifications and experience. This section briefly highlights the loan officer’s education, professional certifications, and pertinent industry expertise within lending.

3. Company Overview

History of loan officer company.

Loan Officer Company was founded in 2021 to become a top-tier mortgage loan provider. The company offers specialized mortgage loan services to its customers. These services are provided through a team of experienced and knowledgeable loan officers.

Moreover, our organization takes great pride in being a member of esteemed professional associations such as the National Association of Mortgage Professionals , the Mortgage Bankers Association of America, and the National Reverse Mortgage Lenders Association.

Our range of loan products encompasses conventional loans, government-backed loans, jumbo loans, and refinancing. Loan officers undergo ongoing training and must pass a stringent certification process to guarantee exceptional customer service quality.

The company’s main objective is to provide personalized creditworthy loans to every customer. Transparency and fairness are our core principles, ensuring that each customer receives the loan that suits their unique circumstances. Additionally, we prioritize clarity and understanding by guiding customers through the entire loan process from start to finish.

4. Services and pricing

- Conventional Loans: Fixed or adjustable rate mortgages as low as 3.875%, Low or no down payments, Flexible qualification criteria

- Government-Backed Loans: VA, FHA, and USDA loans with competitive rates and flexible qualifications

- Jumbo Loans: Loan limits up to $3.5 million with competitive rates and flexible qualifications

- Refinancing: Lower rates, cash-out options, and the ability to consolidate debt

- Mortgage Consultations: Comprehensive assessment of your financial situation and personalized advice

- Loan Packaging: Comprehensive loan packaging and presentation services to ensure competitive offers

- Loan Servicing: Professional loan servicing that includes payment processing, collections, and customer service

5. Customer Analysis

Customer segmentation.

The customer base for the loan officer business plan example can be segmented as follows:

- Homeowners: This segment comprises existing homeowners looking to obtain or refinance a mortgage loan. They are likely between the ages of 35-55 and have a higher net worth than the average consumer.

- First-time Home Buyers: This segment consists mostly of younger people who are first becoming homeowners. They may have lower credit scores or more limited finances and require more assistance in obtaining a mortgage loan.

- Real Estate Investors: This segment typically consists of experienced investors or business-minded individuals looking to purchase property as an income-generating tool.

- Small Business Owners: Small business owners may be interested in obtaining a commercial loan to purchase a building or expand their business operations.

- Homeowners with Equity: This segment comprises existing homeowners looking to access the built-up equity in their homes to finance a large purchase or investment.

6. SWOT Analysis

- The knowledgeable and experienced loan officer

- Access to data and analytics to better determine loanworthiness

- Established relationships with lenders

- Long-term relationships with customers

Weaknesses:

- Lack of resources, such as access to capital or the ability to hire new loan officers

- Lack of technology to efficiently process and monitor loan applications

Opportunities:

- Expansion into new geographic areas

- Leveraging new technology to increase efficiency and effectiveness in the loan process

- Establishing relationships with new lenders and financial service providers

- Increasing competition in the loan officer business

- Strained lending regulations that may limit loan products or terms

- Changing economic environment and interest rate markets that may inhibit borrower demand

7. Marketing Analysis

The Mortage Broker Business Plan industry is highly competitive, dominated by traditional banks and large financial institutions.

Competitors

Business plan for investors.

The primary competitors of our Payday Loan officer services are other loan officers, mortgage brokers, banks, credit unions, mortgage lenders, and real estate agents. They offer services similar to our company, such as home loans, refinancing options, loan terms and conditions, etc.

Market trends

Recent market trends in the loan officer industry have seen an increase in demand and competition as the US housing market has continued to boom.

Competitive Advantage (USPs)

Our commitment lies in providing a comprehensive loan service, giving us a competitive edge. We dedicate ourselves to understanding the unique needs and financial goals of each client, allowing us to offer personalized loan advice and tailored solutions. Rather than settling for standard options, we go the extra mile to ensure our clients receive the absolute best choices available.

8. Marketing Plan

Create a commercial loan officer business plan marketing plan that includes a mix of promotional strategies and goals, an organizational structure for tracking and measuring effectiveness, and a budget.

Promotions Strategy

The promotional strategy for a loan officer business plan involves several activities, including direct mail advertising, personal contacts and referrals, print media, and social media.

- Direct Mail Advertising: Direct mailers are a great way to reach potential clients and remind existing clients of your services. When preparing a direct mailer, it is important to tailor the message and design to the target market.

- Print Media: Print media provides an effective way to showcase the qualifications of a loan officer and the services provided.

- Social Media: Social media presents a powerful opportunity for businesses to connect with potential clients.

9. Management Team

Organizational structure.

An organizational structure for a loan officer 1-year business plan includes the following components:

- Accounting and Financial Support Team

- Loan Processing Team

- Customer Service Team

- Loan Administration Team

- Compliance and Regulatory Team

- Sales and Marketing Team

10. Financial Plan

Startup costs.

Developing a loan officer Finance Business Plan requires an initial investment of capital. These costs may be broken down into the following categories:

- Technology and Equipment: $2,500

- Legal and Regulatory Fees: $2,500

- Insurance: $2,500

- Licensing: $1,000

- Office Expenses: $2,000

- Marketing and Advertising: $1,000

Total Startup Costs: $11,000

Financial Projections

Assuming a loan officer is loaned out at an average of $250 per hour yearly, the following financial projections may be made:

- Year 1: $60,000

- Year 2: $75,000

- Year 3: $90,000

- Year 1: $25,000

- Year 2: $30,000

- Year 3: $35,000

- Year 1: $35,000

- Year 2: $45,000

- Year 3: $55,000

Funding Ask

Initial funding for the loan officer business plan can be obtained through a variety of sources, including personal savings, friends and family, business loans, or venture capital. Depending on the sources, the owner may need to provide collateral or a personal guarantee.

11. Accelerate Your Loan Officer Business Goals with OGS Capital

Are you a Loan Officer looking to get ahead?

OGS Capital has the expertise to accelerate your business growth. Our team comprises experienced financial and marketing professionals with extensive knowledge in the mortgage and banking sector. They are dedicated to supporting Loan Officers, like yourself, in achieving their business goals.

Note”

The OGS Capital team of advisors possesses extensive experience and expertise in the realms of business strategy and management. They have collaborated with a diverse array of companies, ranging from fledgling startups to reputable Fortune 500 corporations.

Our strategy plans are customized to align with the unique goals and objectives of your loan office business. They provide valuable insights and guidance for effectively targeting niche markets and reaching your desired audience. By employing data-driven methods, our plans prioritize actionable insights for your marketing campaigns, optimize spending, and drive sales and revenue growth in a cost-efficient manner.

Whether you’re looking for an effective growth strategy or a comprehensive roadmap to success, the experienced consultants at OGS Capital are on hand to provide the knowledge and expertise to turn your vision into reality.

Are you looking for expert guidance on business growth? Reach out to OGS Capital today to obtain your personalized roadmap towards achieving your goals.

Q. What is the easiest way to finalize a loan officer business plan?

The easiest way to finalize a loan officer business plan is to utilize online resources or templates to customize it to meet your needs. Templates are typically available online for free or at nominal costs and often include sections like a mission statement, financial goals, target audience, risk assessment, and more. Additionally, consider seeking professional help from a financial advisor who can provide additional guidance and advice.

Q. Where can I download the loan officer business plan in PDF format?

You can download a Loan Officer Business Plan Template in PDF format from websites such as SCORE, HubSpot, OGS Capital, and BizPlanBuilder.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Real Estate

Export/Import

Manitoba MPNP Visa Business Plan (Canada)

Nova Scotia NSNP Visa Business Plan (Canada)

British Columbia BC PNP Visa Business Concept (Canada)

Self-Employed Visa Business Plan (Canada)

Start-Up Business Visa (Canada)

E1 Visa Business Plan (USA)

Lamp Business Plan for Bank Loan

Pitch Deck Marketing Agency

L1 Visa Business Plan (USA)

E2 Visa Business Plan (USA)

Franchise Business Plan

Maeme’s Franchise Business Plan

Subway Franchise Business Plan

Pitch Deck Sport Wear

Cannabis Business Plan PDF

Ecommerce Business Plan PDF

EB2 NIW visa Business Plan

EB-1 Business Plan

Cananabis Pitch Deck Sample

StartUp Visa Business Plan (UK)

Start Up Visa Business Plan (Canada)

Real Estate Business Plan Sample

Innovator Visa Business Plan Sample (UK)

Cannabis Business Plan Sample

Intra-Company Transfer (ICT) Work Permit Business Plan

OINP Program Business Plan

LMIA Business Plan Canada

Business Plan for Mentoring Program

Business Continuity Plan for Manufacturing

Business Plan for Potato Chips

Sourcing and Fulfillment Business Plan

Business Plan for Sheep Farming

Business Plan for Sole Proprietor

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Financial modeling spreadsheets and templates in Excel & Google Sheets

- Your cart is empty.

Ultimate Guide To Creating A Mortgage Loan Officer Business Plan

Have you ever considered that nearly 50% of new mortgage loan officers fail within their first year? This daunting statistic underscores the critical importance of a robust business plan. Crafting a thorough and strategic plan can be your difference between joining that statistic or setting up a prosperous career.

Establishing a solid business plan for a mortgage loan officer dates back to proven financial principles and modern market strategies. Key elements include market analysis, client acquisition strategies, and financial projections . These components, tailored to your unique business model, ensure both growth and stability in a competitive landscape.

The Importance of a Mortgage Loan Officer Business Plan

Creating a business plan is essential for mortgage loan officers because it lays the foundation for their success. Without a plan, navigating the complexities of the mortgage industry becomes much harder. A well-crafted plan acts as a roadmap to guide your career.

A solid business plan helps in setting clear goals and actionable steps. It identifies key areas where you need to focus your efforts. Knowing where you are headed makes it easier to stay on track.

Moreover, having a business plan improves your credibility and professionalism. Clients and partners feel more confident working with someone who has a strategic approach. This leads to better business relationships and opportunities.

Lastly, a business plan allows you to track your progress and make necessary adjustments. It serves as a benchmark for your achievements. Keeping it updated ensures you remain competitive and relevant in the market.

Elements of a Successful Business Plan

A successful business plan consists of several critical elements that guide your operations and strategies. These elements ensure a comprehensive approach to setting and achieving goals. Let’s delve into the key aspects of an effective business plan.

Executive Summary

The executive summary is the first section of your business plan. It provides an overview of your business propositions. Think of it as a snapshot of what your business is all about.

This section should be compelling and concise, capturing the essence of your business in just a few paragraphs. This helps investors and stakeholders quickly grasp your business objectives. A good executive summary can make or break your business plan.

Include key points such as your mission statement, product offerings, and target market. Summarize your financial projections as well. This gives a quick yet thorough look at your business landscape.

Market Analysis

A thorough market analysis is essential for understanding the environment in which your business operates. This involves researching your industry, market size, and target audience. Analyzing competitors helps you identify opportunities and threats.

Market analysis also includes understanding the trends and demands of your potential clients. This helps you align your services to meet market needs. Accurate market analysis guides your marketing and operational strategies.

- Industry Trends

- Customer Demographics

- Competitive Analysis

Financial Projections

Financial projections are one of the most critical elements in a business plan. They provide a forecast of your business’s financial performance. This section includes income statements, cash flow statements, and balance sheets.

Having well-structured financial projections helps attract investors. It shows that you have a clear understanding of your financial future. Regularly updating these projections is crucial for adapting to market changes.

Make sure to base your projections on realistic assumptions. Consider various scenarios and their financial impacts. Accuracy here builds trust and demonstrates your business’s potential for profitability.

Market Analysis and Planning

Conducting a market analysis is a vital step in planning your business strategy. A thorough analysis helps you understand your industry dynamics. Knowing your market enables you to identify potential opportunities and challenges.

Start with researching your target audience. Understand their needs, preferences, and buying behavior. Creating customer profiles can give you more clarity.

Next, analyze your competitors to see what they are doing right and where they fall short. This knowledge allows you to position your services effectively. Stay aware of industry trends and shifts to stay competitive.

Finally, gather this data into a strategic plan. Use it to set achievable goals and outline actionable steps. A well-informed plan keeps you on track for success.

Strategies for Client Acquisition

Acquiring clients is crucial for the growth of any mortgage loan officer’s business. Effective strategies ensure a steady inflow of new clients. Let’s explore some key methods for attracting clients.

Networking is a fundamental strategy for client acquisition. Building relationships with real estate agents and financial advisors can bring in referrals. Attend industry events to expand your network.

Online marketing is another powerful tool. Utilize social media platforms to reach a broader audience. Share valuable content to engage potential clients.

Email marketing also plays a significant role. Send newsletters with tips and updates on mortgage rates. Personalized emails make clients feel valued.

Offering exceptional customer service helps retain clients. Satisfied clients often refer friends and family. Building trust is key to long-term success.

Setting Up Financial Projections

Financial projections are crucial for any business, including mortgage loan officers. These projections help you plan for future expenses and income. Accurate projections guide your financial decisions .

Start by outlining your expected revenue. Consider the different sources of income, such as loan processing fees and commissions. Make informed estimates based on past performance.

| Revenue Source | Monthly Amount |

|---|---|

| Loan Processing Fees | $2,000 |

| Commissions | $3,500 |

Next, list your projected expenses. This includes office rent, marketing costs, and salaries. Keeping track of these expenses keeps your budget in check.

- Office Rent: $1,200

- Marketing Costs: $800

- Salaries: $2,500

Finally, balance your revenues and expenses to get a clear picture of your financial health. Regularly update these projections to adjust for changes. Staying on top of your finances ensures long-term stability.

Planning for Growth and Stability

Planning for both growth and stability is crucial for a mortgage loan officer’s success. Balancing these two aspects ensures long-term viability. Effective planning encompasses strategic initiatives and risk management .

Focus on setting realistic growth goals. Identify areas where you can expand your services and clientele. Strategic growth leads to sustainable development.

- Expand your client base

- Invest in new technologies

- Offer new service lines

Financial stability is just as important. Maintain a healthy cash flow and reserve funds for emergencies. This prepares you for market fluctuations and unexpected expenses.

| Stability Measures | Details |

|---|---|

| Emergency Fund | 3-6 months of operating costs |

| Diversified Income | Multiple revenue streams |

Regularly review your growth plans and stability measures. Adjust as needed based on performance and market trends. This keeps your business agile and competitive.

Revision and Continual Improvement

Consistent revision is key to staying relevant in the mortgage industry. A static business plan can quickly become obsolete. Regular updates keep your strategy aligned with market changes.

Analyze your performance periodically. Look for areas where you’re excelling and where improvements are needed. This helps you refine your strategies effectively.

- Quarterly reviews

- Annual assessments

- Client feedback

Incorporate feedback from clients and stakeholders to identify weaknesses. Act on this information to improve services and operations. Customer insights are invaluable for continual growth.

| Improvement Areas | Action Steps |

|---|---|

| Customer Service | Add training programs |

| Marketing Strategies | Diversify outreach channels |

A culture of continual improvement fosters innovation and adaptability. Stay open to new ideas and technologies that enhance your services. This approach ensures long-term success in a competitive market.

Frequently Asked Questions

Explore some of the most common questions related to creating a mortgage loan officer business plan. These answers aim to help you understand and implement essential aspects effectively.

1. What are the key components of a mortgage loan officer business plan?

The key components include an executive summary, market analysis, client acquisition strategies, financial projections, and detailed action plans. Each component requires careful planning and research to ensure they align with your business goals.

An executive summary outlines your mission and objectives. Market analysis helps understand competitors and target customers. Both parts are crucial for mapping out viable strategies.

2. How can market analysis benefit my business plan?

A thorough market analysis provides insights into your competition, helping you identify opportunities and threats. By understanding the landscape, you can better position your services to meet customer needs.

This analysis also helps in tailoring marketing efforts effectively. It ensures your strategies are data-driven rather than based on assumptions, leading to more successful outcomes.

3. Why are financial projections important in a business plan?

Financial projections offer a forecast of future revenue and expenses, guiding critical decisions. They help in identifying potential financial challenges early on.

Well-prepared projections attract investors by demonstrating fiscal responsibility and growth potential. Accurate financial models build trust with stakeholders and provide a roadmap for sustainable growth.

4. What should be included in client acquisition strategies?

Effective client acquisition strategies include networking, online marketing, email campaigns, and excellent customer service practices. These methods work together to enhance visibility and build strong client relationships.

Networking involves building connections within the industry through events or partnerships with real estate agents. Email campaigns , on the other hand, keep clients engaged by providing ongoing value through useful information.

5. How often should I revise my business plan?

You should review your business plan at least annually or whenever significant changes occur in the market or within your business operations. Frequent revisions ensure that your strategy remains relevant and effective.

This practice allows you to adapt quickly to new challenges or opportunities. It encourages continual improvement by integrating feedback from performance reviews and market trends.

Creating a comprehensive mortgage loan officer business plan is essential for achieving success in a competitive market. By focusing on market analysis, client acquisition strategies, and financial projections, you can set a solid foundation. Regular revisions ensure your approach remains relevant and effective.

Strategic planning for growth and stability ensures long-term viability and business success. Using these guidelines, you can navigate the demands of the mortgage industry confidently. Your plan isn’t just a document; it’s your roadmap to sustained achievement.

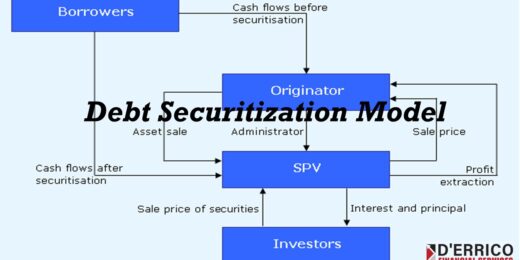

Debt Securitization Model

The Debt Securitization is the process of packaging debt into a Securitization Vehicle sold to a Fiduciary where it is converted into bonds sold to in... read more

- Free PDF Preview – $0.00

- Full Excel Model – $65.00

Discounted Big Bundle Real Estate Valuation and Financial Models

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels, Commercial Office Buildings, Retail Shopping Cent... read more

- Full Open Excel – $119.00

Lending Model Startup Forecast: 10-Year Scaling – 3 Loan Types

This is a full 10-year startup lending business financial model, including a 3-statement model. Accurately scale the origination of 3 loan categories.... read more

- Excel Model – $75.00 Version 5

Real Estate Development Bundle

This Real Estate Development Bundle is a collection of real estate calculators or tools in MS Excel that will help with real estate development proje... read more

- Template Bundle – $139.00 Version 1

The Realtors Quintessential ALL-IN-ONE Toolkit

Professional Realtors need a professional Toolkit which allows them to operate at a higher level. The ALL-IN-ONE Quintessential Real Estate Toolkit in... read more

- PDF Explainer – $0.00

- Full Excel Model – $77.00

Real Estate Development Model

The Real Estate Development model projects monthly future cash flows from a development property from the purchase of the land through the sale of uni... read more

- Free PDF Preview – $0.00 Version 2

- Full Excel Model – $75.00 Version 2

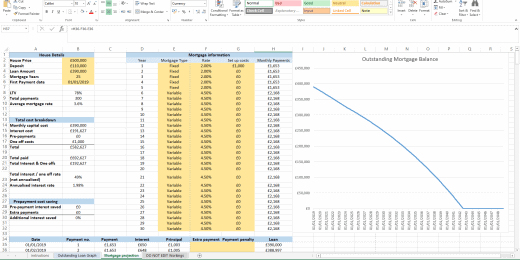

Mortgage Calculator in Excel

The mortgage calculator helps you understand your mortgage costs, different mortgage rates and how early repayments will reduce our overall loan profi... read more

- Full Excel Model – $5.95

- Free PDF example – $0.00

Commercial Bank Financial Model – Dynamic 10 Year Forecast

Financial Model analyzing operations and performing valuation for a Commercial Bank.

- Excel Financial Model – $179.00

- PDF Free Demo – $0.00

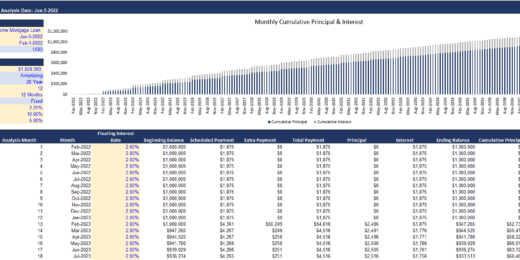

Amortization Schedules Template (Loans, Mortgages, LC, Bonds, Leases)

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance Leases, Bonds and a Line of Credit Calculator.

- Excel Financial Model – $89.00 Version 1

- PDF Free Demo – $0.00 Version 1

Product Dealer Startup – The Customer Centric Financial Model

With this financial model, you can create a financial plan for the startup of your product dealership. Its main advantage is the focus on customer beh... read more

- Full Excel Version – $79.00

- Free Demo PDF – $0.00

Dynamic Single-Family Home Investment Analysis Model

This is a highly dynamic single-family home investment analysis model. The model allows for up to a 30-year investment horizon and allows inputs for i... read more

- Full Model – $30.00

- Free Demo – $0.00

Triple Net Lease (NNN) Real Estate Investment with Returns & Waterfall

This Pro Forma Model is used to analyze the financial return from a triple net lease (NNN) real estate investment, such as a quick service restaurant... read more

- Excel Model – $50.00

- PDF Demo – $0.00

Real Estate Rental Property Investment (01 & Multiple Properties)

This is a comprehensive yet very friendly financial model for Rental Property Investment. You will have the option to tailor the model to fit with any... read more

- 01 Property – $19.99

- 03 Property (or less) – $59.99

AirBnB, Boutique Hotel, and Bed and Breakfast Investment Model

This investment model can be used to analyze a potential investment property to be used for AirBnB or bed and breakfast purposes.

- Full Model – $50.00

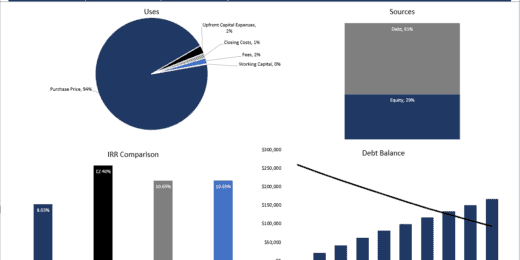

Commercial Real Estate Valuation Calculator

This Commercial Property Valuation Template makes use of NPV, IRR and MIRR as the primary Valuation Results. There are only 9 x Inputs fields and the ... read more

- Full Excel Open – $37.00 Version 1

- PDF Explainer – $0.00 Version 1

Debt Schedule – Up to 30 Year Model with Prepay, Fixed/Floating, and Interest Only

This debt schedule model is dynamic, easy to use, and can handle complicated debt situations such as fixed/interest only, fixed with an interest only ... read more

- Full Excel Model – $10.00

- PDF Demo Version – $0.00

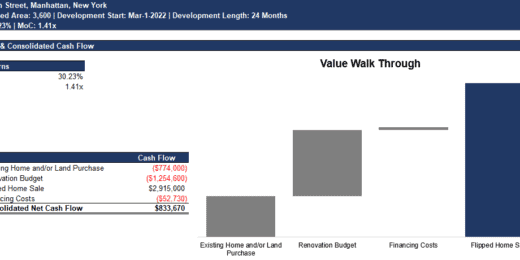

Home Flipping Model

This model can be used to budget and analyze the feasibility and investment return of flipping a home. This model is a necessary tool if you are plann... read more

- Full Model – $30.00 Version 2

- Free Demo – $0.00 Version 1

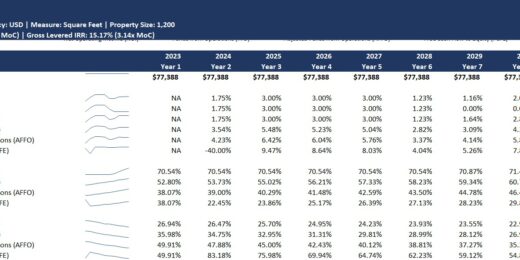

Apartment Building / Self-Storage / Multi-Family Acquisition Model: 15 Year

This real estate model works great for acquisitions of apartment buildings, multi-family properties, or self-storage facilities. Monthly and annual vi... read more

- Multi_Model Template – $125.00 Version 1

Merchant Builder Model

This model can be used to budget and analyze the feasibility and investment return of building as a real estate merchant builder. This model is a nece... read more

- Full Model – $30.00 Version 1

Multi (20) AIRBNB Acquisition and/or Portfolio Model

This AIRBNB 20 model will assist you in evaluating up to 20 x propositions simultaneously and comparing them with one another.

- FULL Open Excel – $67.00 Version 1

- Free PDF Demo – $0.00 Version 1

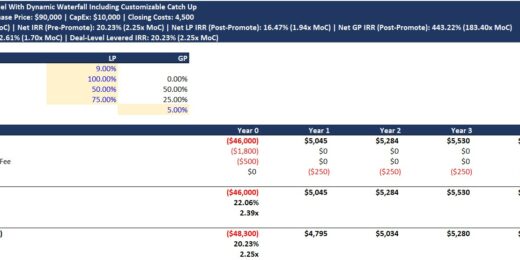

Real Estate Investment Model Template with Waterfall & Catch Up

The waterfall model includes a dynamic catch up. This model allows users to quickly underwrite and value a real estate investment at the property, ove... read more

- Full Model – $40.00

Rental Property Financial Model

The Rental Property financial model template, forecasts a rental property's expected financials 30 years into the future. The model gives clear analys... read more

- Excel Model – $60.00 Version 2

- Free PDF Preview – $0.00 Version 1

Commercial Real Estate Development Model Template

This Commercial Real Estate Development Model is for both types of Development. Developing to hold and lease model comes with an automated and annuali... read more

- Full Open Excel – $50.00 Version 1

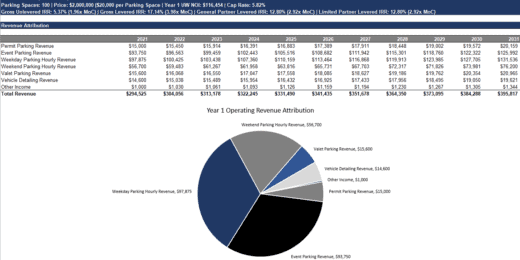

Parking Lot Investment Financial Model Template

This model can be used to analyze the financial/investment return of parking lot investment.

- Full Model – $45.00 Version 2

- Free Demo – $0.00 Version 2

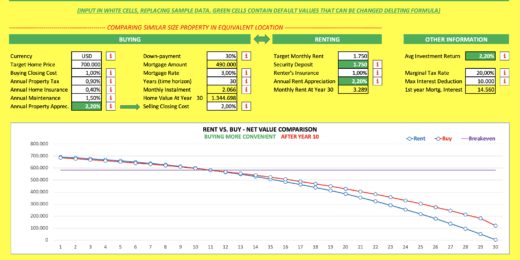

RENT VS. BUY CALCULATOR

RENT OR BUY YOUR NEXT HOME? THIS CALCULATOR CAN HELP DECIDE WHAT’S RIGHT FOR YOU! The model compares the net value generated by buying a home vs. re... read more

- Fully Editable Version – $5.00 Version 2

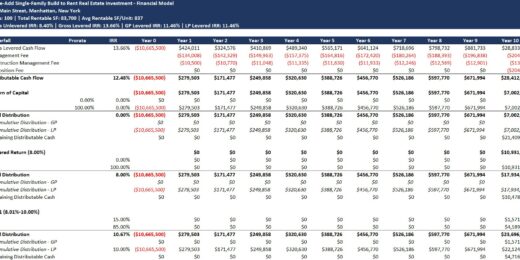

Value-Add Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

A financial model to help calculate and analyze the pro forma indicative return from a Value-Add Single-Family (SFR) Build to Rent (B2R) Real Estate I... read more

- Full Excel Model – $50.00 Version 1

Loan Tape Analysis / KPI Dashboard

A framework that makes it easy to drop in your loan data and automatically generate analytical insights such as loans settled by risk rating and weigh... read more

- Full Version – $75.00 Version 1

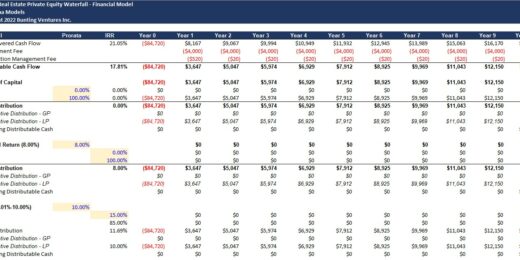

10 Year Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity professionals to evaluate the return of a 10 year hold investment with a waterfall promote stru... read more

- Full Model – $10.00

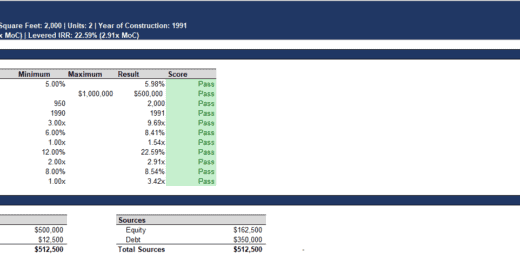

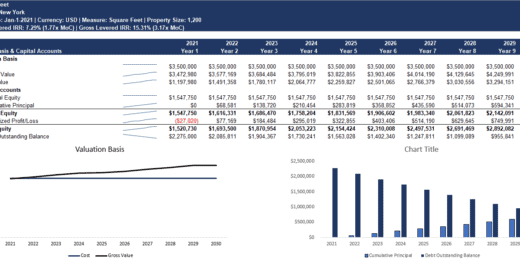

Residential Investment Property Acquisition Model Template

Residential Investment Property Acquisition Model provides detailed monthly Cash Flow Statements, Annualised Income Statements, and Balance Sheets for... read more

Property Flipping Financial Model

The Property Flipping Financial Model forecasts the financial viability of up to 10 real estate property flipping operations in the same Excel, foreca... read more

- Excel Model – $65.00 Version 1

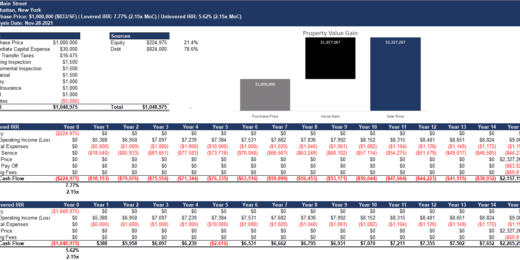

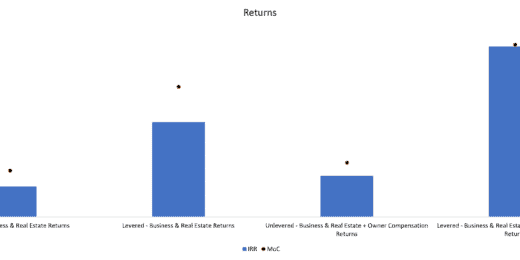

Real Estate Investment Screening Model – Levered IRR, Unlevered IRR, Cap Rate, DSCR, and More

This model can be used to quickly (5 minutes if you have the required information available) analyze a real estate investment against 11 customizable ... read more

- Full Excel Model – $40.00

Single Tenant Property Investment Valuation & Return Model

This model can be used to analyze the financial return from a single tenant property investment, such as a quick service restaurant (QSR), triple net ... read more

- Full Model – $45.00

Grocery Store plus Deli/Bakery 10 year Financial and Business Model

This Grocery Store 10-year Financial and Business Model also contains a Stencil Business Plan which auto imports Financial Information from your Forec... read more

- Full Excel – $57.00

Multifamily Real Estate Acquisition Financial Model with Waterfall

This Multifamily Real Estate Acquisition Financial Model will help bidders to take a correct decision in the real estate deal. Bidders will use this t... read more

Apartments Development Model – 20 year three statement analysis (Hold and Lease) or QS type for Sale Model

This Apartment Development Model will produce 20 years of three-statement analysis for the (develop-to-hold and lease) type. A separate model for the ... read more

- Full Excel – $50.00 Version 1

Coffee Shop Financial Model & Business Plan Template 10 years (Start-up or Expand)

This Coffee Shop 10-year Financial Model also has a Business Plan Template which will automatically pull in particular financial information to reduce... read more

- Full Open Excel – $37.00 Version 1

- PDF Preview – $0.00 Version 1

Dynamic Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity professionals to evaluate the return of up to a 10 year hold investment with a waterfall promot... read more

- Full Model – $20.00

Multifamily Acquisition-Rent-Sell Financial & Valuation Analysis Model

We are glad to present our new integrated, dynamic and ready-to-use Valuation & Analysis financial model for Multifamily Acquisition – Rent – Sell... read more

- Full Excel Model – $105.00 Version 1

Core Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and analyze the pro forma indicative return from a Core Single-Family (SFR) Build to Rent ... read more

- Excel Full Model – $50.00 Version 1

Shopping Center Valuation and Financial Model 20 years – Acquisition

This Shopping Center Valuation and Three Statement (20 years) Model is an excellent tool to measure the viability and price on offer.

- Full Open Excel – $47.00 Version 1

Core Multi-Family (Apartment) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and analyze the pro forma indicative return from a core multi-family real estate investment... read more

- Full Model – $50.00 Version 1

- PDF Demo – $0.00 Version 1

Principal Residence Real Estate Investment Model

This Pro Forma Model is designed to analyze Principal Residence Real Estate Investments with the ability to model income components for house hacking,... read more

- Excel Model – $40.00 Version 1

Scaling Multiple Rental Properties: Up to 100

Configure up to 100 rental property acquisitions and view the return on investment, IRR, and more over the course of 20 years. (Fund and single operat... read more

- Single Operator Version – $45.00 Version 1

- Fund Version – $75.00 Version 1

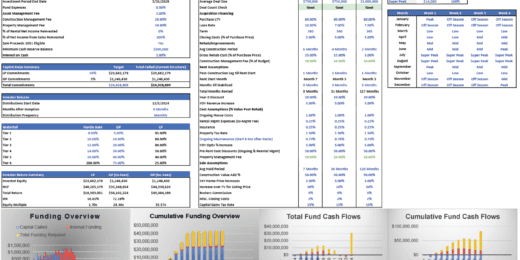

Real Estate Brokerage Business Plan with Return Calculation

Pro Forma Models created this model to analyze the financial return of acquiring an existing real estate brokerage company (M&A), operating an ex... read more

Student Accommodation / Village Development Model – 20 years

This Student Accommodation 20-year Development Model (hold and lease) will produce 20 years of Three Statement Analysis, Re-valuations and the consequ... read more

- Excel Full Open – $50.00 Version 7

- PDF Explainer – $0.00 Version 7

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall - a comprehensive tool that empowers users to analyze and underwrite mult... read more

- Full Excel Model – $100.00 Version 1

- PDF (Expanded Model) – $0.00 Version 1

- PDF (Condensed Model) – $0.00 Version 1

Own or Rent Home: Personal Finance Tool

Should you buy your home or rent? This template looks at the pure financial impact of both scenarios and allows for every possible assumption configur... read more

- Full Version – $45.00 Version 1

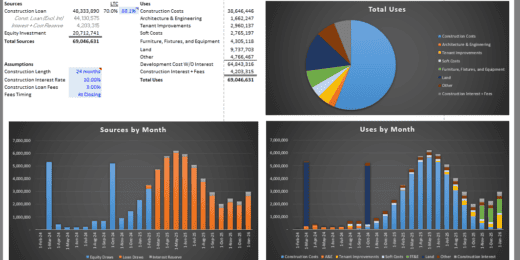

Construction Draw Schedule & Gantt (New Development Cost/Sources & Uses Model)

Elevate your construction project planning with our Construction Draw Schedule & Gantt model. Perfect for developers and investors in the evaluati... read more

- Excel Model – $100.00 Version 1

Rental Property Investment Fund Model (AirBnb/VRBO/STR/LTR)

The Rental Property Investment Fund Model is a tool designed for investors looking to create an investment fund for various property investment strate... read more

- Excel Model – $175.00 Version 1

Adjusted Cost Basis Calculator

A top-down calculator to figure out your property cost basis. Accounts for everything from accumulated depreciation to tax credits.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Business Plan for Loan Officers

Table of contents

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Top loan officers in the mortgage industry do not reach their level of success without a business plan in place. Whether you are a new loan officer or a seasoned professional lender struggling to find the success you desire, creating and implementing a business plan gives you a clear roadmap to follow to reach your long-term vision. The more you focus on your business goals, the more likely you are to achieve them. Setting time aside each year to adjust your business plan allows you to adjust your strategies and objectives to the rapidly changing mortgage industry.

Key Takeaways

- Successful loan officers need a business plan to guide them towards their goals and navigate the changing mortgage industry.

- A loan officer’s business plan should define their target audience and market, establish SMART goals, identify daily actions and marketing strategies, create a networking strategy, and measure their campaigns.

- A loan officer’s business plan should include an executive summary, company analysis, industry analysis, customer analysis, competitive analysis, marketing and operations plans, management team, financial plan, and an appendix.

- Developing a comprehensive business plan will not only help loan officers achieve their business goals, but also provide them with a better understanding of the mortgage industry and how to stand out from their competitors.

What is a business plan?

A business plan begins by focusing on where your business is today. Next, it turns the focus to where you hope to be at the end of the next year, in five years, or further down the road. Within your business plan, you define your goals and your business strategies for reaching those goals, including research that supports the strategies that you choose. By creating a business plan, you will gain an in-depth understanding of the mortgage industry, your audience and market, and how to stand out above your competition.

Why do loan officers need a business plan?

Whether you are just starting out as a new loan officer or looking to grow your existing business, a structured business plan helps create a roadmap to success. It offers you a clear picture of what is today, what you hope tomorrow will bring, and the strategies you need to implement and follow in order to achieve the business goals you have in place.

How to create a loan officer business plan?

Before you begin creating a loan officer business plan, you need to thoroughly research and understand some key areas of your business. Gaining this knowledge will help you better understand your industry and your clients while also helping to establish realistic and attainable business goals to include in your business plan. Here are some key areas to focus on while starting your business plan.

1. Define your audience and target market

The best place to begin when creating a business plan is your audience. You need to establish who your potential clients are and define your specific niche. For example, if you focus on first-time home loans, your target audience may be millennials and younger homebuyers whereas if your niche is home refinancing, your target market may be older adults. Defining and understanding your niche and target market is necessary to complete other segments of your business plan.

2. Understand your business objectives and goals

When creating a business plan, another major component to consider is your business objectives and goals. You can’t grow your business without first determining your goals. When establishing your business goals, it is important to consider the SMART method. SMART stands for specific, measurable, achievable, relevant, and time-bound. Establishing goals based on these components will help you move forward with your business plan.

3. Identify daily action and marketing strategies

Once you have your target audience and goals defined, it is time to start creating your marketing strategy and daily objectives. When developing your marketing strategy , it is important to consider your target audience and where they are. For example, if your target audience is seniors, social media marketing strategies may not be as effective as they would be for a millennial-driven target audience.

Daily objectives are small, daily changes you can make to work towards your bigger business goals for the year. Putting these daily objectives into your regular routine help provide a roadmap toward your final destination.

4. Create a networking strategy