Equipment Leasing Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Service Industry » Equipment Rental & Leasing Business

If you are looking for a business that doesn’t require much stress or perhaps extensive period of training, then you should consider starting an equipment leasing business.

The truth is that this is one of the businesses that you can comfortably combine with another business and still have time to effectively manage both. There are loads of technicians and artisans who don’t have the required capital to acquire all the equipment needed to run their business but can afford to rent such equipment if they can find a place to rent from.

Much more than technicians and artisans, some organizations also rent equipment to carry out a project or job because it is cost effective for them to rent as against purchasing such equipment.

Ideally, people prefer to rent equipment to do a one – off job . So your responsibility is to look for such equipment and ensure that you have them in your store. So if you have decided to start an equipment leasing business, then you should ensure that you carry out feasibility studies and also market survey.

Business plan is yet another very important business document that you should not take for granted in the bid to launching your own business. Below is a sample equipment leasing business plan template that can help you to successfully write your own with little or no difficulty.

A Sample Equipment Leasing Business Plan Template

1. industry overview.

Equipment leasing business is part of the Industrial Equipment Rental & Leasing industry and this industry is made up of businesses that engage in general industrial equipment rental, light construction equipment rental, medical equipment rental, audiovisual equipment rental, industrial energy equipment and pumps rental, theatrical and motion picture rental amongst others.

In general, the Industrial Equipment Rental and Leasing industry offers a range of products, including industrial machinery, some construction equipment, entertainment products and medical devices, for fixed-term use. The variety of products rented or leased mitigates the impact of increasing demand.

Going forward, the industry will continue benefiting from contractors resuming their prominence as the industry’s largest consumer group. This will be supported by steady growth in the number of construction projects in both residential and nonresidential markets.

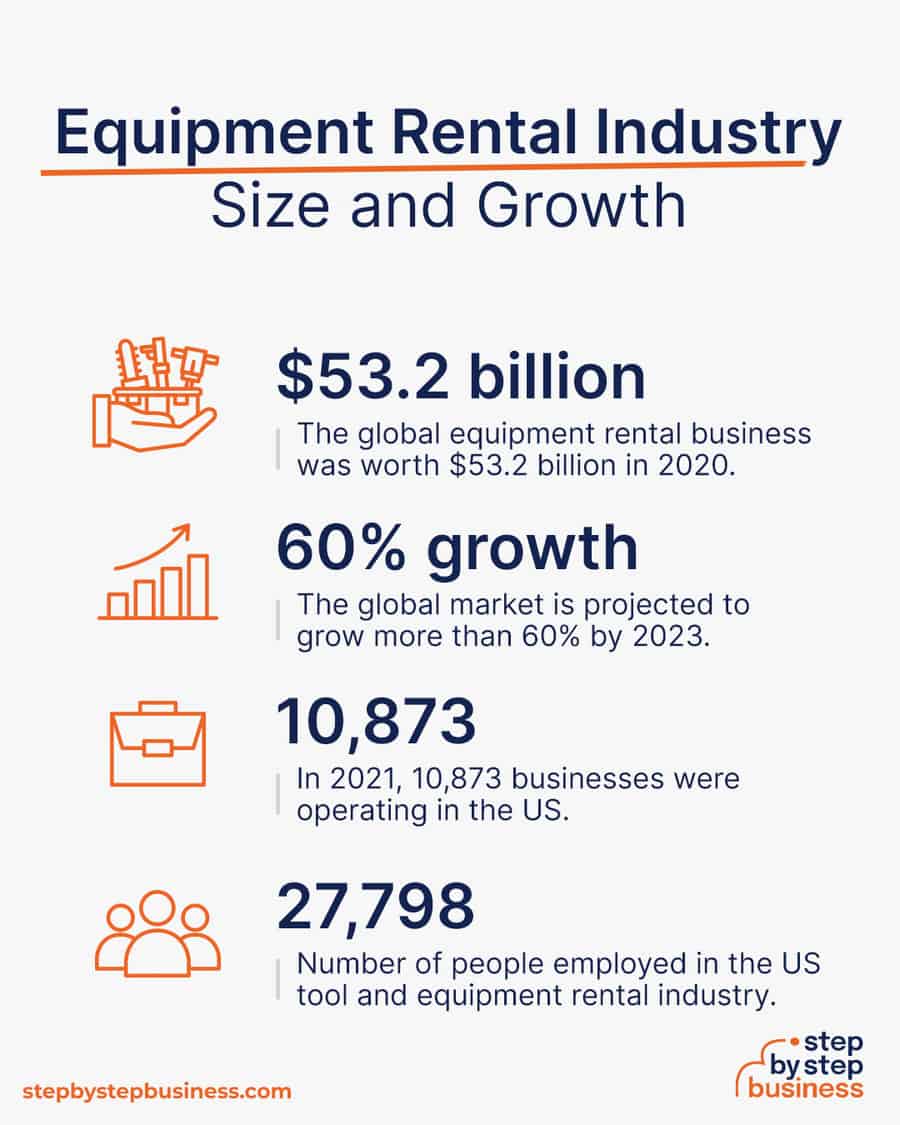

The Industrial Equipment Rental and Leasing Industry is indeed a large and vibrant industry not only in the united states of America and but also in most countries of the world. Statistics has it that the Industrial Equipment Rental and Leasing industry in the United States of America is worth about $37 billion, with an estimated growth rate of 7.2 percent between 2012 and 2017.

There are about 9,271 registered and licensed industrial equipment rental and leasing businesses in the United States and they are responsible for employing about 109,710 people. In the United States, it is only United Rentals Inc. that can boast of having the lion market share in the industry, so the industry is still very much open to investors who would want to launch their own equipment leasing business.

A recent report published by IBISWorld shows that over the past five years, the Industrial Equipment Rental & Leasing in the US industry has grown by 7.2 percent to reach revenue of $37bn in 2017. In the same timeframe, the number of businesses has grown by 3.0 percent and the number of employees has grown by 4.6 percent.

The Industrial Equipment Rental and Leasing industry is in the mature phase of its life cycle as indicated by its growth rate over the 10 years to 2022 and the widespread but growing acceptance of its services in downstream markets. This trend is not true globally, however, as the maturity of the Tool and Equipment Rental industry varies considerably depending on the country’s equipment sales performance.

Industry value added (IVA) is forecast to grow at an annualized rate of 2.4 percent over the 10 years to 2022, relatively in line with the projected growth of US GDP, which is set to rise at an annualized rate of 2.0 percent during the same period. IVA is a function of wages, depreciation and profit margins.

Lastly, it is a fact that the industrial equipment leasing and rental industry is indeed a profitable industry to venture into and the entry bar for starting the business is not too difficult to scale through.

The truth is that if an equipment leasing business is stocked with a wide array of equipment and also well positioned in an environment with the right demography, they will sure attract regular clients and their equipment will be hired on a regular basis.

2. Executive Summary

Drucker Philemon® Equipment Leasing Company, LLC is a licensed industrial equipment leasing and rental company that will be based in Hartford – Connecticut. We have been able to secure a corner piece property in a centralized and busy industrial location in the heart of the city; a location with robust industrial activities and the right demography for the kind of business we want to run.

We are a standard industrial equipment leasing and rental company that will be involved in leasing and renting equipment such as, mower, hand drillers, heavy duty drillers, welding machines, forklifts, light construction equipment, medical equipment, audiovisual equipment, industrial energy equipment and pumps and theatrical and motion picture equipment, power saw, filling machine, scaffoldings and virtually any equipment that is needed to get any task done.

Drucker Philemon® Equipment Leasing Company, LLC is a client-focused and result driven industrial equipment leasing and rental outfit that provides reliable industrial equipment and tools at an affordable fee that won’t in any way put a hole in the pocket of our clients. We will ensure that we will surpass our clients’ expectations whenever they rent tools and equipment from us.

Drucker Philemon® Equipment Leasing Company, LLC will at all times demonstrate her commitment to sustainability, both individually and as a firm, by actively participating in our communities and integrating sustainable business practices wherever possible.

We will ensure that we hold ourselves accountable to the highest standards by meeting our client’s needs precisely and completely.

Our plan is to position Drucker Philemon® Equipment Leasing Company, LLC to become the leading brand in the industrial equipment leasing and rental industry in the whole of Connecticut, and also to be amongst the top 10 industrial equipment leasing and rental outfits in the United States of America within the first 10 years of operation.

This might look too tall a dream but we are optimistic that this will surely come to pass because we have done our research and feasibility studies and we are confident that Hartford – Connecticut is the right place to launch our industrial equipment leasing and rental business.

Drucker Philemon® Equipment Leasing Company, LLC is family business that is owned by Mr. Drucker Philemon and her immediate family members.

The organization will be managed by Mr. Drucker Philemon who has over 17 years’ hands on experience working at various capacities within the equipment leasing and rental industry in the United States. Drucker Philemon has a Diploma in Mechanical Engineering from the University of Connecticut.

3. Our Products and Services

Drucker Philemon® Equipment Leasing Company, LLC is going to offer varieties of services within the scope of the industrial equipment leasing and rental industry in the United States of America.

Our intention of starting our industrial equipment leasing and rental company is to make profits from the industry and we will do all that is permitted by the law in the US to achieve our aim and ambition. Our business offerings are listed below;

- General industrial equipment rental

- Light construction equipment rental

- Medical equipment rental

- Audiovisual equipment rental

- Industrial energy equipment and pumps rental

- Theatrical and motion picture rental

- Retail sales, product delivery and repair

- Rental of other products

- Rental of contractors’ and builders’ tools and equipment

4. Our Mission and Vision Statement

- Our vision is to build an industrial equipment leasing and rental business that will become the number one choice for both individual and corporate clients in the whole of Hartford – Connecticut. We want to be known as the go to company when it comes to industrial equipment leasing and rental.

- Our mission as an industrial equipment leasing and rental company is to service a wide range of clientele. We are going to position the business to become the leading brand in the industry in the whole of Hartford – Connecticut, and also to be amongst the top 10 equipment leasing and rental companies in the United States of America within the first 10 years of fully launching the business.

Our Business Structure

Drucker Philemon® Equipment Leasing Company, LLC is an industrial equipment leasing and rental company that intends to start small in Hartford – Connecticut, but looks to grow big in order to compete favorably with leading industrial equipment leasing and rental companies.

We are aware of the importance of building a solid business structure that can support the picture of the kind of world class equipment leasing and rental business we want to own. This is why we are committed to only hiring the best hands within our area of operations.

At Drucker Philemon® Equipment Leasing Company, LLC, we will ensure that we hire people that are qualified, hardworking, creative, customer centric and are ready to work to help us build a prosperous business that will benefit all the stakeholders.

As a matter of fact, profit-sharing arrangement will be made available to all our senior management staff and it will be based on their performance for a period of five years or more as agreed by the board of trustees of the company. In view of the above, we have decided to hire qualified and competent hands to occupy the following positions in our organization;

- Chief Executive Officer (Owner)

Equipment Rental Manager

Admin and HR Manager

Marketing and Sales Executive

- Customer Services Executive

Truck Driver

5. Job Roles and Responsibilities

Chief Executive Office:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results

- Responsible for fixing prices and signing business deals

- Responsible for providing direction for the business

- Creates, communicates, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

- Manages the rental of equipment in our organisation

- Achieves maximum profitability and over-all success by controlling costs and quality of equipment and service.

- Schedules staff as necessary to ensure adequate and consistent levels of service

- Responsible for industrial equipment leasing and rental control policies and completion of necessary forms.

- Follows proper purchasing and requisitioning procedures.

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Defines job positions for recruitment and managing interviewing process

- Carries out staff induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

- Identifies, prioritizes, and reaches out to new partners, and business opportunities et al

- Identifies development opportunities; follows up on development leads and contacts

- Writes winning proposal documents, negotiate fees and rates in line with company policy

- Responsible for handling business research, marker surveys and feasibility studies

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps to increase sales and growth for the company

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Provides managements with financial analyses, development budgets, and accounting reports

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting for one or more properties.

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the company

- Serves as internal auditor for the company

Client Service Executive

- Welcomes guests and clients by greeting them in person or on the telephone; answering or directing inquiries.

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s products and services

- Manages administrative duties assigned by the manager in an effective and timely manner

- Consistently stays abreast of any new information on the company’s products, promotional campaigns etc. to ensure accurate and helpful information is supplied to clients when they make enquiries

- Responsible for transporting heavy duty equipment to project sites of clients as agreed by the company

- Runs errand for the organization

- Handles any other duty as assigned by the equipment rental manager.

6. SWOT Analysis

Because of our drive for excellence, we were able to engage some of the finest business consultants in Hartford – Connecticut to look through our business concept and together we were able to examine the prospect of the business and to access ourselves to be sure we have what it takes to run the business.

In view of that, we were able to take stock of our strengths, our weakness, our opportunities and also the threats that we are likely going to be exposed to in Hartford – Connecticut. Here is a of what we got from the SWOT Analysis that was conducted for Drucker Philemon® Equipment Leasing Company, LLC;

Notwithstanding the fact that all our industrial equipment and tools are of world – class standard and our business is well positioned and equipped, we have a team that are trained and equipped to pay attention to details as regard assembling, servicing and maintaining industrial equipment. We are well positioned and we know we will attract loads of clients from the first day we open our doors for business.

As a new industrial equipment leasing and rental company, it might take some time for our organization to break into the market and gain acceptance in the already saturated industrial equipment leasing and rental industry especially from corporate clients; that is perhaps our major weakness.

Opportunities:

The opportunities in the industrial equipment leasing and rental industry is massive considering the number of individuals and businesses that for obvious reasons would prefer renting or leasing equipment as against purchasing. As a standard equipment leasing and rental company, we are ready to take advantage of any opportunity that comes our way.

Some of the threats that we may likely face as an industrial equipment leasing and rental company operating in the United States are unfavorable government policies , the arrival of a competitor within our location of operation and of course a sharp drop in the prices of the industrial equipment that we put out for leasing.

7. MARKET ANALYSIS

- Market Trends

The trends in the industrial equipment leasing and rental industry shows that interest rates are an important demand determinant, as loans, mortgages and bonds finance most developments and renovations. Low interest rates encourage new construction and economic activity because the cost of financing expansion drops, which ultimately raises demand for rented equipment.

Although some companies may buy more and rent less if rates are low, given the inexpensive credit, a low rate’s positive effect on demand in the economy is substantial and helps the industry. The yield on the 10-year Treasury note is expected to rise in 2017, presenting a potential threat to the industry.

As a matter of fact, investment in the private construction of educational, commercial and other facilities directly influences demand for commercial and industrial equipment rental. When the number of facilities being constructed or renovated is on the rise, general contractors need more equipment for fixed-time use.

This boosts industry revenue derived from renting equipment for carpentry, carpet cleaning, scaffolding, floor waxing and sanding to general contractors. The value of private nonresidential construction is expected to increase in 2017, presenting a potential opportunity for the industry.

The fact remains that the industrial equipment leasing and rental industry is in a continuous state of evolution and as such, ground breaking strategies and ideas that are once highly successful are no longer as productive as they were in time past.

Close observation of the trend in the industry reveals that the past few years have seen the rise and proliferation of new tech tools. The trends also extend to increased attention paid to engagement and new market segments, adopting eco-friendly measures and sustainability when making use of equipment and tool, and of course increase in demands from contractors.

Lastly, aside from excellent customer services, equipment leasing and rental companies ensure that they have some of the best and latest equipment and tools they can get even if it means importing them or customizing them.

8. Our Target Market

Even though Drucker Philemon® Equipment Leasing Company, LLC will initially serve small to medium sized business, but that does not in any way stop us from growing to be able to compete with leading industrial equipment leasing and rental companies in the United States.

As an all – round industrial equipment leasing and rental company, Drucker Philemon® Equipment Leasing Company, LLC offers a wide range of services hence we are equipped to service a wide range of clientele base. Our target market cuts across players in different industries.

Below are some of our target customers;

- Building and construction contractors

- Film producers/makers

- Industrial cleaning companies

- Engineering companies

- Servicing and maintenance companies

Our competitive advantage

We know that to be highly competitive in the industrial equipment leasing and rental industry means that your equipment must be of high standard and your business must be well – positioned and you should be able to deliver consistent quality service.

Drucker Philemon® Equipment Leasing Company, LLC might be a new entrant into the industry in the United States of America, but the management staff of the business are highly qualified to run such business.

Other competitive advantages that we are bringing to the market are our ability to quickly adopt new technology, economies of scale and the fact that all our tools and equipment are of world – class standard and the business is well positioned to meet the 21st century demand. These are part of what will count as a competitive advantage for us.

Lastly, our employees will be well taken care of, and their welfare package will be amongst the best within our category in the industry meaning that they will be more than willing to build the business with us and help deliver our set goals.

9. SALES AND MARKETING STRATEGY

We are mindful of the fact that there is stiff competition amongst industrial equipment leasing and rental companies in the United States of America; hence we have been able to hire some of the best business developers to handle our sales and marketing concerns.

Our sales and marketing team will be recruited based on their vast experience in the industrial equipment leasing and rental industry and they will be trained on a regular basis so as to be well equipped to meet their targets and the overall goal of the organization.

We will also ensure that our excellent job deliveries speak for us in the market place; we want to build a standard business that will leverage on word of mouth advertisement from satisfied clients.

Our goal is to grow our industrial equipment leasing and rental company to become one of the top 10 rental companies in the United States of America which is why we have mapped out strategies that will help us take advantage of the available market and grow to become a major force to reckon with in Hartford – Connecticut.

Drucker Philemon® Equipment Leasing Company, LLC is set to make use of the following marketing and sales strategies to attract clients;

- Introduce our business by sending introductory letters alongside our brochure to contractors, engineers, film makers, industries, plumbers, households and key stake holders in Hartford and other cities in Connecticut

- Advertise our business in relevant related magazines, newspapers, TV and radio stations.

- List our business on yellow pages’ ads (local directories)

- Attend relevant international and local expos, seminars, and business fairs et al

- Create different packages for different category of clients in order to work with their budgets and still deliver quality equipment and services to them

- Leverage on the internet to promote our business

- Engage direct marketing approach

- Encourage word of mouth marketing from loyal and satisfied clients

- Join local chambers of commerce and industry with the aim of marketing our business

- Make use of attractive hand bills to create awareness and also to give direction to our facility

- Adopt direct mailing coupon marketing approach

- Position our signage / flexi banners at strategic places in and around Hartford – Connecticut

- Create a loyalty plan that will enable us reward our consistent clients especially those that refer clients to us.

- Engage in roadshows within our neighborhood to create awareness for our industrial equipment leasing and rental business.

Sources of Income

Drucker Philemon® Equipment Leasing Company, LLC is established with the aim of maximizing profits in the industrial equipment leasing and rental industry and we are going to go all the way to ensure that we do all it takes to attract clients on a regular basis.

Drucker Philemon® Equipment Leasing Company, LLC will generate income by offering the following equipment and tools rental services for individual clients and for corporate organizations;

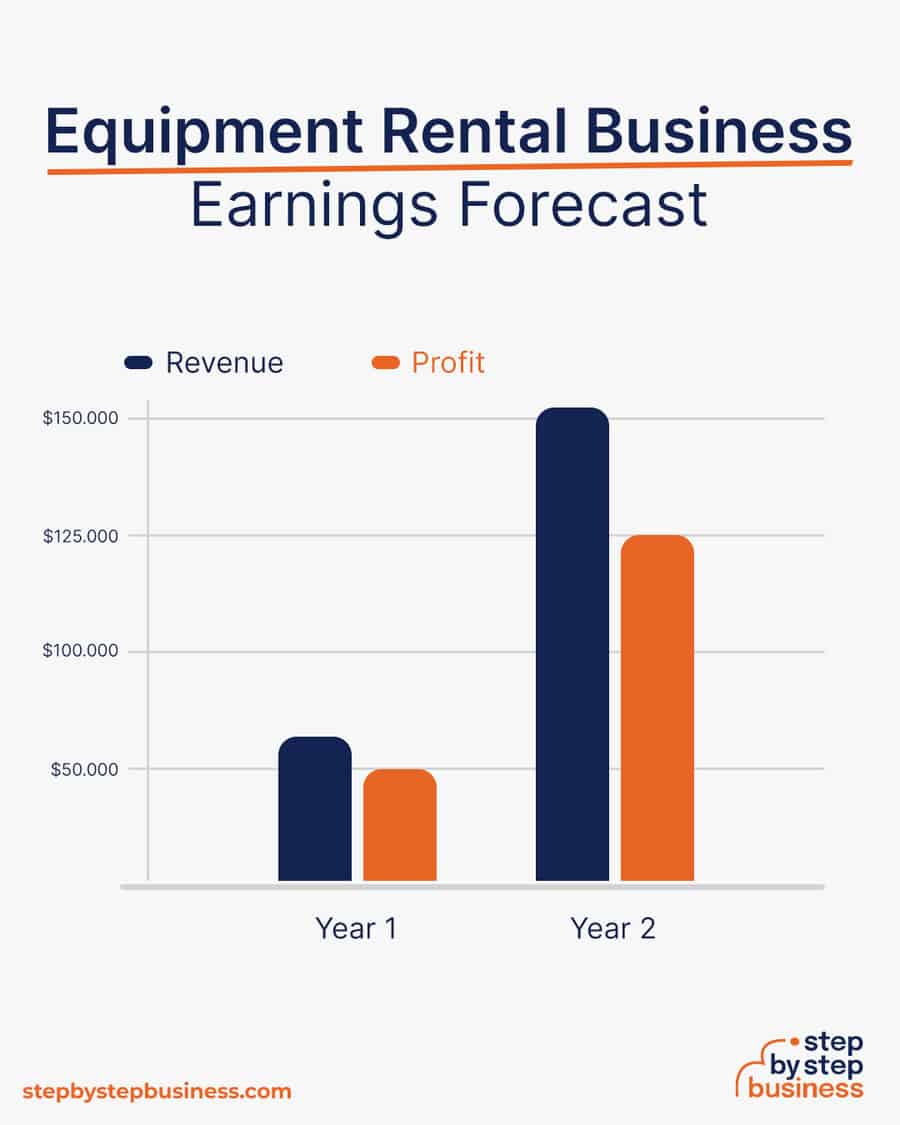

10. Sales Forecast

One thing is certain, there would always be need to carry out some jobs that require the rental of industrial equipment and power tools in the United States of America and as such the services of industrial equipment leasing and rental companies will always be needed. This, we have at the back of our minds always.

We are well positioned to take on the available market in Hartford – Connecticut and we are quite optimistic that we will meet our set target from the first six months of operation.

We have been able to examine the industrial equipment leasing and rental market, we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. The sales projections are based on information gathered on the field and some assumptions that are peculiar to startups in Hartford – Connecticut.

Below are the sales projection for Drucker Philemon® Equipment Leasing Company, LLC, it is based on the location of our business and the wide range of tools, plants and industrial equipment that we will be offering;

- First Fiscal Year : $250,000

- Second Fiscal Year : $650,000

- Third Fiscal Year : $970,000

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and natural disasters within the period stated above. There won’t be any major competitor offering same additional services as we do within same location.

11. Publicity and Advertising Strategy

We have been able to work with our brand and publicity consultants to help us map out publicity and advertising strategies that will help us walk our way into the heart of our target market. We are set to take the industrial equipment leasing and rental industry by storm which is why we have made provisions for effective publicity and advertisement of our industrial equipment leasing and rental company.

Below are the platforms we intend to leverage on to promote and advertise Drucker Philemon® Equipment Leasing Company, LLC;

- Place adverts on both print (community based newspapers and magazines) and electronic media platforms

- Sponsor relevant community based events / programs

- Leverage on the internet and social media platforms like; Instagram, Facebook, twitter, YouTube, Google + et al to promote our brand

- Install our billboards in strategic locations all around Hartford – Connecticut

- Engage in roadshows from time to time in target neighborhoods to create awareness of our business

- Distribute our fliers and handbills in target areas

- Ensure that all our workers wear our branded shirts and all our vehicles and trucks are branded with our company’s logo et al.

12. Our Pricing Strategy

Just like in rental and consulting business, hourly billing for rental services is also a long – time tradition in the industry. However, for some types of rental services, flat fees make more sense because they allow clients to better predict the overall service charges.

As a result of this, Drucker Philemon® Equipment Leasing Company, LLC will charge our clients both flat fee and hourly billing as long as it favors both parties. At Drucker Philemon® Equipment Leasing Company, LLC we will keep our fees below the average market rate for all of our clients by keeping our overhead low and by collecting payment in advance.

We are aware that there are some clients especially contractors that would need to rent tools and equipment on a regular basis, we will offer flat rate for such services that will be tailored to take care of such clients’ needs.

- Payment Options

The payment policy adopted by Drucker Philemon® Equipment Leasing Company, LLC is all inclusive because we are quite aware that different customers prefer different payment options as it suits them but at the same time, we will ensure that we abide by the financial rules and regulation of the United States of America.

Here are the payment options that Drucker Philemon® Equipment Leasing Company, LLC will make available to her clients;

- Payment via bank transfer

- Payment with cash

- Payment via credit cards

- Payment via online bank transfer

- Payment via check

In view of the above, we have chosen banking platforms that will enable our client make payment for rentals or our equipment and tools without any stress on their part. Our bank account numbers will be made available on our website and promotional materials

13. Startup Expenditure (Budget)

From our market survey and feasibility studies, we have been able to come up with a detailed budget on achieving our aim of establishing a standard and one stop industrial equipment leasing and rental company in Hartford – Connecticut and here are the key areas where we will spend our start – up capital;

- The total fee for incorporating the Business in the United States of America- $750.

- The budget for basic insurance policy covers , permits and business license – $2,500

- The amount needed to acquire a suitable facility that will accommodate our heavy duty plants, tools and equipment, trucks and small office facility (Re – Construction of the facility inclusive) – $150,000.

- The cost for equipping the office (computers, software applications, printers, fax machines, furniture, telephones, filing cabins, safety gadgets and electronics et al) – $ 5,000

- The cost of launching an official website – $600

- The cost for the purchase of standard industrial equipment and tools – $100,000

- The cost for the purchase of a truck – $10,000

- Budget for paying at least 4 employees for 2 months plus utility bills – $70,000

- Additional Expenditure (Business cards, Signage, Adverts and Promotions et al) – $2,500

- Miscellaneous: $5,000

Going by the report from the market research and feasibility studies conducted, we will need about four hundred and fifty thousand (450,000) U.S. dollars to successfully set up a medium scale but standard industrial equipment leasing and rental business firm in the United States of America.

Generating Startup Capital for Drucker Philemon® Equipment Leasing Company

Drucker Philemon® Equipment Leasing Company, LLC is a family business that will be owned by Mr. Drucker Philemon and his immediate family members. They are the only financier of the business, which is why they decided to restrict the sourcing of the startup capital for the business to just three major sources.

- Generate part of the startup capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from the bank

N.B : We have been able to generate about $150,000 (Personal savings $100,000 and soft loan from family members $50,000) and we are at the final stages of obtaining a loan facility of $300,000 from our bank. All the papers and documents have been duly signed and submitted, the loan has been approved and any moment from now our account will be credited.

14. Sustainability and Expansion Strategy

The future of a business lies in the number of loyal customers that they have, the capacity and competence of their employees, their investment strategy and the business structure. If all of these factors are missing from a business, then it won’t be too long before the business close shop.

One of our major goals of starting Drucker Philemon® Equipment Leasing Company, LLC is to build a business that will survive off its own cash flow without the need for injecting finance from external sources once the business is officially running.

We know that one of the ways of gaining approval and winning customers over is to rental out our power tools and industrial equipment a little bit lower than what is obtainable in the market and we are prepared to survive on lower profit margin for a while.

Drucker Philemon® Equipment Leasing Company, LLC will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner.

We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check : Completed

- Business Incorporation: Completed

- Opening of Corporate Bank Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Securing a standard warehouse facility and reconstruction inclusive: In Progress

- Conducting Feasibility Studies: Completed

- Generating part of the startup capital from the founder: Completed

- Applications for Loan from our Bankers: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: Completed

- Recruitment of employees: In Progress

- Purchase of the needed furniture, office equipment, electronic appliances and facility facelift: In progress

- Purchase of various sizes of standard power tools and industrial equipment: Completed

- Purchase of trucks and vans: Completed

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business (Business PR): In Progress

- Health and Safety and Fire Safety Arrangement: In Progress

- Establishing business relationship with vendors and key players in the industry: In Progress

Related Posts:

- Construction Equipment Rental Business Plan [Sample Template]

- Plant and Tool Hire Business Plan [Sample Template]

- How to Start a Trade Show Booth and Equipment Business

- How to Start a Tool Rental Company – Sample Business Plan Template

- Sand Dredging Business Plan [Sample Template]

JavaScript is not available

We are unable to load JavaScript in your browser. Please enable JavaScript or switch to a supported browser to continue using EquipmentRadar.com.

© 2024 Equipment Radar, LLC

Guide To Starting A Profitable Equipment Rental Company In 2021

Sept. 18, 2021

The equipment rental industry has outgrown the overall construction industry over the past few decades. Learn how you can start your own equipment rental company.

Equipment Rental Industry Overview

Owning and operating an equipment rental business can be very rewarding and profitable. Many equipment rental business owners started out with one used machine, and gradually built up their businesses through hard work, great customer service and maintaining a fresh and healthy equipment fleet.

Starting an equipment rental company is not as expensive or encumbering as you would think. With some careful planning, initial capital, and passion for the industry, you can start your own equipment rental company in a few weeks.

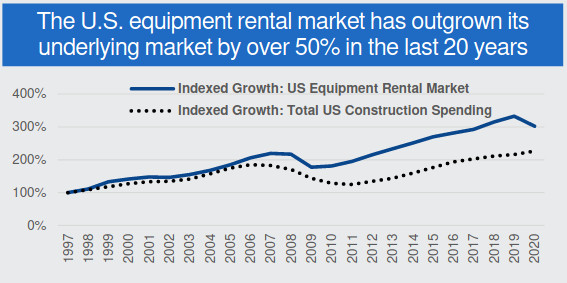

The equipment rental industry has grown at about 5% per year over the past few decades. The outlook for the industry is very positive, with many industry experts forecasting 4-5% annual growth over the coming years. The long-term shift by contractors to rent more equipment is causing the equipment rental industry to outgrow the overall construction industry.

Equipment Rental Industry Market Share

The equipment rental industry is very fragmented - this means that the vast majority of industry sales are generated by small and medium-sized rental companies. According to the American Rental Association (ARA), the top 10 equipment rental companies have about 35% market share, and the top 3 companies have about 25% market share.

The largest North American equipment rental companies include United Rentals , Sunbelt Rentals , Herc Rentals , Home Depot Rentals , and Ahern Rentals . The total annual industry sales are over $50 billion, and the long-term growth rate is about 5% per year.

Source: United Rentals and Equipment Radar Takeaway: The top three industry players have a 25% combined market share. This means the industry is very fragmented and comprised mostly of small and medium-size companies.

Source: United Rentals , American Rental Association (ARA) , Rental Equipment Register (RER) , and US Census Bureau Takeaway: The US Equipment Rental industry size is over $50 billion, with a growth rate of about 5% each year.

Source: United Rentals, ARA, RER, and US Census Bureau Takeaway: The US Equipment Rental industry has outgrown overall construction spending since 1997.

Equipment Rental Covers More Than Just Construction Machinery

Many equipment rental companies augment their equipment fleets to include general tools, HVAC, power generation, and event (party, wedding, concerts, etc) equipment.

The ARA segments the rental industry into three primary categories:

- Construction and Industrial Equipment: This category primarily serves construction firms and contractors. Equipment typically includes earthmoving equipment such as excavators, loaders, backhoes and compaction machinery, light towers, aerial work platforms. This segment can also include road infrastructure, energy projects, commercial buildings, malls, demolition and more.

- DIY General Tool Equipment: This category includes equipment typically rented by professional contractors and do-it-yourself (DIY) homeowners. Equipment includes small and light construction equipment such as power tools, air compressors, aerators, lawn tractors, compact tractors, skid-steer loaders and small excavators, etc.

- Party/Wedding/Event Equipment: This category includes equipment rented by consumers, homeowners and businesses for parties and events. Items can include tents, tables, chairs, lights, dance floors, decorations, linens, plates and glassware, portable restrooms, concession equipment, inflatables (moonwalks), and other furniture. Projects can range from large corporate events to small family gatherings.

When you start your rental company, you can choose to serve one or more categories. Many established rental companies offer an all-in-one stop rental offering. You should research your local market demand for each category to understand which suits your local market best.

Aerial lifts and earthmoving equipment tend to be popular categories for equipment rental companies. When you choose your categories, you should study the local rental rates, seasonality (demand fluctuates through the year based on weather and construction patterns) and competition.

Herc Rentals Equipment Fleet Mix

Source: Herc Rentals Takeaway: Large rental companies such as Herc Rentals have diverse fleets. Both United Rentals and Herc Rentals have placed increased focus on expanding into the specialty rentals category over the past few years.

Equipment Rental Customers

The equipment and event rental industry offers customers the opportunity to gain the benefit of using goods (from excavators and aerial lifts to party tents) for a defined time. Customers are attracted to rentals instead of purchasing equipment for multiple reasons, including:

- Control expenses and inventory

- Wide selection of equipment

- Professional customer care / service

- No need for maintenance or downtime

- Save on storage / warehousing

- Reliability

- Equipment tracking

- Conserve capital

- Manage risk

Customers can range from professional contractors who need aerial lifts for several months to an average homeowner who needs a stump grinder for a weekend project.

Steps to Starting Your Equipment Rental Business

1. business plan.

Every great business out there today started with a simple idea. To transform that idea from something imaginary into something real, you should make a business plan that outlines your strategy and thoughts. Writing a business plan is one of the best ways to force yourself to think about your business from many angles. It also is a helpful document to share with potential investors and lenders.

When you create your business plan, it is important to keep your expectations realistic. Setting goals and metrics too high at the beginning can lead to wasted time and money down the road. Remember that there are always unforeseen costs and challenges with any new venture, so it is prudent to bake in padding and leeway.

A typical business plan includes the following sections:

- Summary: Wait to write this at the end. This is the 30,000-foot view of your entire business plan summarized in a few paragraphs. This helps others understand the business plan without reading the entire document.

- Company Description: Write about what your company will do, who it will involve (you and any others), where it will be located, what kind of equipment you will buy for your fleet, what hours you plan on working, etc.

- Market Analysis: Understand the rental industry in your area. Get to know the rental rates in your area. Talk with people in the industry to understand who your main customers would include.

- Competitive Analysis: List out the competition, what they do, how big they are, and how you plan to offer a better value proposition.

- Product/Service Offering: Determine which types of equipment you will offer for rent. Also, make a road map of where you plan on expanding as your business grows. Will you offer parts and service too?

- Marketing Plan: Figure out how you will tell the world about your new company. Create social media pages and advertise in local publications. Make sure you add your business to online directories such as Google Maps and the Equipment Radar Directory so people can find it.

- Financial Plan: Spend a lot of time thinking about the capital resources you have to deploy and how you plan on deploying them. Most equipment rental companies borrow money from banks to make new and used machinery purchases. Figure out which lenders you can work with to buy your machinery.

2. Form Your Company

You should create a legal entity such as a corporation or LLC to separate your business interests from your personal interests. You must register your business with your state, pay a registration fee, and also register with the IRS . Once you have formed your company, you should open a bank account and deposit initial capital into it.

3. Purchase New or Used Equipment For Fleet

Many newly-formed rental companies start with just one used machine, and later they upgrade and expand their fleets over time. You can shop online for new and used equipment to buy your first equipment.

4. Create Safety & Risk Management Plans

Buy proper insurance to cover your business from accidents and injuries. Talk with your business insurer, so you understand what is covered and what is not covered.

Create safety guidelines for your shop, and teach employees how to handle the equipment safely. Make sure any dangerous areas in your storage or warehouse are safeguarded.

5. Organize Business Operations

Choose a store location. You will need enough space to store your equipment, an office area for you and other workers to work, a service area, a check-in/out counter to handle customers, and a showroom for equipment, accessories and more.

A nice-looking showroom can be a strong selling point for your business. It gives your customers an opportunity to look around and see what you have to offer. You should think of your showroom as your marketing platform.

6. Make Maintenance & Fleet Refresh Plan

You should pay close attention to the condition of your fleet. Inspect it after every rental, and perform both scheduled and unscheduled maintenance as needed. The top-performing rental companies typically have a systematized process to inspect, clean and renew equipment after it is returned from a job site.

As your equipment begins to age, you should consider selling your older equipment and buying newer equipment to keep your overall rental fleet relatively new. Large rental companies typically target an average fleet age of about 50 months (4 years old), which means that they sell equipment when it gets to be about 7-8 years old. Customers often prefer newer equipment that looks good.

Financial Planning

Rental rates.

Rental rates are often determined by local supply and demand for rental equipment in your area. Rates go up and down based on time of year, type of equipment and equipment condition.

Rental rate changes are very important to monitor. Each $1 change in rental rate is a $1 increase or decrease to the bottom line. When your rental rate changes, your other costs do not change much.

Typically most companies will provide daily, weekly and monthly rental rates. As the rental term extends, the average daily rate tends to go lower. Weekly and monthly rentals can often be more profitable for equipment rental companies even if their average daily rental rates are lower because there are not as many inefficiencies associated with them (transportation to and from the location, downtime for inspection and servicing, etc).

Utilization

Utilization is an important metric that you should watch carefully. Higher utilization typically means higher profitability. The equipment rental business is largely a fixed-cost business - your equipment, building lease, employee costs all stay about the same whether you have your equipment out on rent or not.

Utilization is a two-edged sword. If your utilization is too high and you do not have any equipment available for rent, then customers may be forced to go with a competitor. It's best to increase your fleet size if utilization goes too high, and reduce your fleet size if your utilization goes too low.

Seasonality

Construction tends to be very seasonal, depending on your geographic location. You should research the swings in seasonality to understand business trends during the busy summertime and slower wintertime.

Cyclicality

Equipment rental is susceptible to economic cycles. When the broader economy slows and construction pulls back, the demand for rental equipment also slows. Typically rental rates will soften or fall during a downturn.

Rental Industry Terms & Metrics

The industry uses several common terms to measure equipment fleets and financial performance. Below is a list created by the ARA to help you get acquainted with industry standards:

Original Equipment Cost (OEC)

Time (physical) utilization (tu), financial utilization ($u), fleet age (age), change in rental rate %rr.

Keeping a fresh fleet that is well-maintained and serviced is very important to managing customer relations and expectations. Typically rental companies will target an average age for the entire fleet. By regularly buying newer equipment and selling older equipment, the rental company can maintain a constant fleet age.

Below is a sample overview of United Rental's fleet statistics from its 2020 annual report :

Starting your own equipment rental company is within the realm of possibilities. Spend time researching your local market and creating a business plan, and soon enough, you will be ready to launch your new venture.

Find Similar Articles By Topic

#construction #material handling #United Rentals #Herc Rentals #Sunbelt Rentals #checklists

Your trusted equipment navigator

© 2024 Equipment Radar LLC

- Search Listings

(786) 713-4996 --> --> sales@equipmentradar.com

Our site uses cookies. By using our site you agree to our Cookie Policy

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Leasing equipment can be cheaper in the short term than buying, but there are a few things you should know before you rent your equipment.

Table of Contents

Buying and maintaining equipment is expensive, and new equipment is coming out all of the time. Leasing equipment offers advantages that owning does not, including monthly rental payments and the ability to upgrade to the latest equipment as it comes out.

If your business needs new equipment or technology but you can’t afford to buy it outright, leasing may be an option to consider. However, leasing could be more expensive in the long run, making it a tough decision for many businesses. This guide explains how equipment leasing works and what to consider when deciding whether to buy or lease equipment for your business.

What is equipment leasing?

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles and computers. The equipment is leased for a specific period; once the contract is up, you may return the equipment, renew the lease or buy the equipment.

Editor’s note: Looking for information on equipment leasing? Use the questionnaire below, and our vendor partners will contact you to provide you with the information you need:

Equipment leasing is different from equipment financing – taking out a business loan to purchase the equipment and paying it off over a fixed term with the equipment as collateral . In that case, you own the equipment once you pay off the loan.

With an equipment lease , the equipment isn’t yours to keep once the leasing term is over. As with a business loan, you pay interest and fees when leasing equipment, and they’re usually added into the monthly payment. There may be extra fees for insurance, maintenance and repairs.

Equipment leasing can be much more expensive in the long term than purchasing equipment outright, but for cash-strapped small business owners, it’s a means to access necessary equipment quickly.

How does an equipment lease work?

If you decide to lease equipment for your business rather than purchase it upfront, you enter into a lease agreement with the equipment owner or vendor. Similar to how a rental lease agreement works, the equipment owner drafts an agreement, laying out how long you’ll lease the equipment and how much you’ll pay each month.

During the lease term, you use the equipment until the deal expires. There are cases in which you can break the lease – and these instances should be spelled out in the contract – but many leases cannot be canceled. Once the lease is up, you can often purchase the equipment at the current market rate or lower, depending on the vendor.

The rates you pay to lease the equipment vary by leasing company. Your business credit score also plays a role in the rates you’re quoted. The riskier you are in which to lend, the more expensive it will be for you to lease equipment. An equipment lease can be approved online in a few minutes. Leasing companies tend to specialize in specific industries, so it’s important to do your homework to find the right financing option for your business.

Equipment leasing terms are typically for three, seven or 10 years, depending on the type of equipment.

Equipment leasing is not a loan, which means it won’t show up on your credit report or hurt your ability to borrow. In many cases, the IRS lets you deduct your equipment lease payments if you’re using the equipment for your company.

Benefits of equipment leasing

Leasing equipment offers many benefits to cash-strapped small businesses. While not all equipment leases are the same, and there are many ways to finance a lease, here are some advantages to leasing your equipment:

- It’s cost-effective to get started. Many lessors don’t require a significant down payment.

- You can update your equipment. If you often need to update equipment, leasing is a good option because you aren’t stuck with obsolete machinery.

- It’s easier to scale. If you need to upgrade to more advanced equipment to handle a higher work volume, you can do so without selling your existing machinery and shopping for replacements.

- It may offer tax credits. Equipment leases are often eligible for tax credits. Depending on the lease, you may be able to deduct your payments as a business expense by taking advantage of Section 179 qualified financing deductions .

How to get started with equipment leasing

Before you start the equipment leasing process, answer the following questions. It may seem like a lot of effort upfront, but without answering these questions as they relate to your business, you can’t make an informed decision on leasing or buying equipment.

What is your monthly budget?

Leasing offers substantially lower monthly payments than purchasing, but you still need to factor the costs into your monthly cash flow. Start with what you can afford and work from there; don’t work the other way around by getting price quotes and trying to squeeze them into your budget.

How long will you use the equipment?

For short-term equipment use, leasing is almost always the most cost-effective route. If you’ll use the equipment for three years or more, a loan or standard line of credit may be more beneficial. Factor in your business’s growth too: If your company is rapidly growing and evolving, a lease may be a better option than buying.

How quickly will the equipment become obsolete?

Technology becomes outdated more quickly in some industries than others. Consider obsolescence before deciding whether buying or leasing makes sense for you.

Can the equipment be leased?

Equipment that qualifies for a lease is practically limitless. But there are a couple of conditions.

- Purchase price: Equipment leases enable your business to obtain equipment and machinery with a high dollar value. This includes costly single items – like heart monitors and extraction machinery – and smaller items needed in bulk, like kiosks, software licenses and telephones. For this reason, it’s uncommon to find a lease agreement for purchases under $3,000, and many large lenders require a minimum purchase of $25,000 to $50,000.

- Hard assets: The equipment you lease must be considered a hard asset – anything that could be listed as personal property and not permanently attached to real estate. Soft assets, such as employee training programs and warranties, do not qualify for lease programs.

Leasing vs. purchasing

While many companies benefit from equipment leasing, an outright purchase is more cost-effective in some instances. When comparing purchasing and leasing options, consider these factors:

- Purchase price

- Amount to be financed

- Annual depreciation

- Tax rates and inflation

- Monthly lease costs

- Equipment usage

- Ownership and maintenance costs

Pros and cons of equipment leasing

A lease is ideal for equipment that routinely needs upgrading – for instance, computers and other electronic devices. Leasing gives you the freedom to obtain the latest machinery with a low upfront cost, plus with a fixed rate, you’ll have monthly payments you can budget.

At the same time, leasing provides a wider range of equipment options for businesses. Leasing makes it financially possible for you to afford equipment that would otherwise be too costly to purchase.

There are some drawbacks, though. Leasing requires that you pay interest, which adds to the overall cost of the machine over time. Sometimes, leasing can be more expensive than purchasing the equipment outright – especially if you purchase the equipment when the lease term has expired.

Additionally, some lenders enforce a certain term length and mandatory service packages. This can add to the overall cost if the lease term extends beyond how long you need the equipment. In this scenario, you could get stuck with a monthly payment and storage costs associated with unused equipment.

Pros and cons of buying equipment

When you own a piece of equipment, you can modify it to suit your exact needs. This isn’t always the case with a lease. Similarly, buyers aren’t bound by the limitations an equipment lessor imposes.

Purchases also enable you to resolve any issues more promptly because you don’t have to obtain approval from the leasing company to schedule a repair or order a replacement part. In addition to the depreciation tax benefits available through Section 179, you can recoup some money by reselling the equipment when you no longer need it.

Like leasing, purchasing has its drawbacks. The biggest is obsolescence; with a purchase, you’re stuck with outdated machinery until you buy new equipment. Also, market competitiveness and the availability of tax incentives with leasing are often enough to dissuade many business owners from purchasing equipment outright. The costs to maintain and repair machinery, plus a steep purchase price, may put too much of a financial strain on your company.

By some estimates, businesses budget 1 to 3 percent of sales for maintenance costs. This is a rough estimate, though. The equipment, service hours, ages, quality and warranty determine the actual maintenance costs.

Equipment leasing vs. other financing options

A purchase isn’t the only alternative to leasing. In fact, it’s not even the most common. Some of the best business loans can cater to your small business’s equipment needs. Lines of credit and factoring services are also popular ways to finance equipment acquisitions.

Business loans

Like a purchase, business loans provide more ownership of the equipment. With a lease, the lessor holds the title to any equipment and offers you the option to buy it when the lease concludes. A loan enables you to retain the title to any of the items you purchase, securing the purchase against existing assets.

Unfortunately, terms can be a loan’s major drawback. Unlike a lease, which provides fixed-rate financing, a loan or line of credit’s interest rate may fluctuate throughout the loan term. This can make budgeting problematic, depending on the size of the loan. Furthermore, banks and other lenders often require a much larger down payment – 20 percent of the total cost of equipment by some estimates.

Invoice factoring

Factoring is another way to purchase costly equipment and is often faster than applying for a loan. By leveraging your accounts receivable , you can quickly turn outstanding payments into cash by selling these invoices to a factor. Factoring is an ideal alternative to leasing and loans for startups and small businesses, often paying up to 90 percent of the total value of your accounts receivable – depending on the creditworthiness of your customers.

Funding is usually available in a matter of days. This makes factoring a popular resource for smaller manufacturing operations, the transportation industry and businesses that routinely handle contracts with a fast turnaround.

The leasing process: What to expect

When applying for a lease, you can expect the process to include these steps:

- You complete an equipment lease application. Be sure you have financial data available for your company and its principals, as this may be required upfront or after initially completing the application.

- The lessor processes your application and notifies you of the result. This usually happens within 24 to 48 hours of submitting the application. Some lessors may not require financials or a business plan for applications on dollar amounts ranging from $10,000 to $100,000. For financing over $100,000, expect to provide complete financials and a business plan .

- Once you receive approval, you must review and finalize the lease structure – including monthly payments and the fixed APR. You’ll then sign the documents and resubmit them to the lessor, typically along with the first payment.

- When the lessor has received and accepted the signed documents and first payment, you are notified that the lease is in effect and that you are free to accept delivery of the equipment and commence any necessary training.

Equipment lease types: Operating and finance

There are two primary types of equipment leases: operating leases and financial leases. Here’s a breakdown of both.

What is an operating lease?

An operating lease allows a company to use an asset for a specific period of time without ownership. The lease period is usually shorter than the economic life of the equipment. At the end of the lease, the lessor can recoup additional costs through resale.

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It’s accounted for as a rental expense. This provides two specific financial advantages:

- Equipment is not recorded as an asset or liability.

- Equipment still qualifies for tax incentives.

Dealers’ rates may vary widely, but in general, the average APR for an operating lease is 5 percent or lower. Average contracts last 12 to 36 months.

With the prevalence of leasing, accounting regulations set in 2016 by the Financial Accounting Standards Board require companies to reveal their lease obligations to avoid the false impression of financial strength.

In fact, all but the shortest-term equipment leases must now be included on balance sheets . While leased equipment does not have to be reported as an asset under an operating lease, it’s far from free of accountability.

What is a finance lease?

Sometimes known as a capital lease, a finance lease structure is similar to an operating lease in that the lessor owns the equipment purchased. It differs in that the lease itself is reported as an asset, increasing your company’s holdings and its liability.

Commonly used by large companies – such as major retailers and airlines – this setup provides a unique advantage, as it allows the business to claim both the depreciation tax credit on the equipment and the interest expense associated with the lease itself. In addition, the company may choose to purchase the equipment at the end of a finance lease.

Given the financial edge this provides, the APR for a finance lease is higher. Standard interest rates are currently between 6 and 9 percent, while contracts range from 24 to 72 months.

Lessee responsibilities

Additional responsibilities can result in expenses above and beyond your monthly lease payment. These typically include the following items:

- Liability insurance: Average estimates for liability insurance range from $200 to $2,200 annually, with many businesses reporting costs of $1,000 or less.

- Extraneous costs: Depending on your lease structure, you may be held liable for some maintenance and repairs. Extraneous costs can include any legal fees, fines and certification expenses.

- Shipping charges: This includes transportation and shipping costs to return the equipment.

- Added fees: Read your contract carefully. Fees can be added for a one-time documentation fee (which is sometimes as much as $250) or late payments (which run from $25 to 15 percent of the amount overdue).

Comparing equipment finance providers

Given the costs and considerations we’ve addressed, comparing several lease providers is essential to ensure you get the best rate. Before beginning your search, you familiarize yourself with these three types of equipment finance providers and the benefits each provides:

Lease broker

A lease broker serves as an intermediary between you and any prospective lessors. The broker will present you with the offers and submit your requests for financing, handling much of the paperwork for you.

Brokers represent only a small segment of the leasing market, and their services do not come cheap. Brokers reportedly charge 2 to 4 percent of the equipment cost to negotiate a deal.

The benefit of using a broker is realized in their extensive relationships. Often industry-specific, they specialize in obtaining a wider range of equipment, sometimes at better prices than would be available through standard channels.

Leasing company

A leasing company is often the subsidiary leasing arm of a manufacturer or dealer. Also known as a captive lessor, a leasing company’s sole aim is to facilitate leases with its parent company or dealer network. For this reason, you will usually deal with a leasing company only when working directly with a manufacturer.

Independent lessor

An independent lessor encompasses all third-party lease providers. Independent lessors include banks , lease specialists and diversified financial companies that provide equipment leases directly to your business. They differ from leasing companies in that they typically specialize in equipment remarketing, a skill that enables them to group products from multiple manufacturers and offer more competitive APRs.

Tips on choosing a lessor

The best advice for choosing a quality lessor is to examine the company with the same level of scrutiny with which you and your company are being scrutinized. Give preference to those willing to partner with your firm. This may be represented in the level of background and experience they have in relation to your line of business or their willingness to work with you on certain terms.

Some fees specified under the lessee’s responsibilities – particularly application fees and late fees (at least on the first late payment) – may be covered or waived altogether depending on the lessor.

Also, take time to research some key items about the lessor.

- Business information: Look into the lessor’s payment history, credit history, business summary, corporate relationships, financial statements and any public filings.

- Pending litigation: Search public records for any notices of pending litigation.

- Payment system: Is it simple, or does it require mountains of paperwork?

Questions to ask a dealer

Before choosing a dealer, get price quotes from at least three companies, and ask all the dealers on your list these questions. Asking the right questions is half the battle for getting a fair deal for your company’s services and goods.

- How much money is required upfront? Lease financing often provides 100 percent of the dues required for an equipment purchase. Loans do not, often requiring up to 20 percent of the total as a down payment. If a down payment is required, consider reassigning capital to cover any upfront costs.

- Who takes advantage of the tax incentives? Under a loan structure, your company can claim depreciation. However, you will have to provide a down payment, and the interest rate is higher. Under a lease, the lessor claims depreciation. In exchange, it offers a lower APR – often half that of a loan. If the depreciation credit is important to you and you still want to lease, ask about the availability of finance or capital leases.

- Are the financing terms flexible? Leasing is often viewed as the most flexible financing option, especially compared to loans. Depending on the lease structure, you can start with low payments and increase them as time goes by (known as a “step-up lease”), defer payment to give yourself an extra window before the first payment is due, and even add more equipment onto an existing lease under a “master lease” structure.

Lease-to-own agreements

If you’re interested in keeping the equipment you lease for your business but don’t have the cash to purchase it or the credit to qualify for a traditional loan, consider a lease-to-own option. Lease-to-own agreements require businesses to make scheduled payments for a specified time frame before gaining ownership of the equipment.

A lease-to-own agreement has four primary components:

- The lessee enters an equipment leasing agreement with the option to purchase at the end of the contract.

- The lessor applies a percentage of each payment to the equipment’s purchase price.

- At the end of the contract, the lessor pays the remaining balance to gain ownership of the equipment.

- If the lessee decides not to purchase the equipment, payments made and equipment are forfeited to the lessor.

It’s important to note that if you enter a lease-to-own agreement, your business will likely pay a price above fair market value for the equipment. On the other hand, once payments are made, your business has complete ownership of the equipment.

Typically, lease-to-own contracts last the same amount of time as other equipment leasing agreements. The main difference with an equipment leasing option is that a percentage of your payments is applied to the equipment’s purchase price. If a business can’t purchase the equipment at the end of the contract, the lessee may, in most instances, request an extension, ask for a renewal or opt to return the equipment.

While a lease-to-own situation may be convenient for many small business owners, it’s not without risks. If your company isn’t capable of purchasing the equipment at the end of the agreement, you forfeit the equipment and all payments, which can be a major financial loss for a small business. The most important factor in this type of agreement is to consistently communicate with your lessor and ask to renegotiate time frames if necessary.

Lease-to-own agreements are best for heavy machinery, production equipment or any other type of equipment your business would typically need a traditional loan to purchase.

To lease or buy equipment is a key consideration

Depending on your budget and circumstances, leasing your equipment may offer your business important advantages. However, there are drawbacks, such as higher costs over time, interest payments and lack of control over the equipment. It can help you reduce maintenance costs and stay up to date with the latest equipment, though, since you won’t be sinking a lot of money into a piece of equipment you can’t easily replace. Consider all of these factors before leasing or buying new equipment to set your business up for success.

Tejas Vemparala and Dachondra Cason contributed to this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Equipment Leasing Business Plan

Published Jul.05, 2023

Updated Apr.22, 2024

By: Jakub Babkins

Average rating 3 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

Table of Content

1. What Is Equipment Leasing?

Equipment leasing provides businesses with a financing option to obtain the necessary equipment for their operations without the commitment of purchasing it. This arrangement allows businesses to utilize the equipment for a specific duration, ranging from a few months up to five years or even longer in some cases.

The lease agreement typically involves the business paying a fixed monthly amount over the lease term that covers the equipment cost and interest. The business then can either return the equipment to the leasing company at the end of the lease term or purchase it for a predetermined price.

2. Executive Summary

Why do you need a business plan for the equipment leasing business.

When embarking on the journey of establishing a thriving equipment leasing business, crafting an impeccable business plan assumes paramount importance. Moreover, it encompasses a thorough competitive evaluation alongside a meticulously devised marketing strategy. Moreover, essential information regarding key personnel is also provided within this crucial blueprint.

The small equipment leasing business plan template serves as a vital organizing document with multiple functions.

How to write an executive summary for an Equipment leasing business plan?

The Executive Summary is the most important element of your equipment leasing business plan sample, like the Car Rental Business . It should detail your objectives, key target markets, competitive advantages, and how your leasing business will provide value to your customers.

Specifically, the Executive Summary should include the following:

- Company Information: State the company’s name, its legal structure and ownership, contact information, and the location of the leasing business.

- Objectives: Describe the company’s goals and ambitions.

- Description of the Business: Explain why your leasing business is needed and distinct from its competitors, and provide an overview of the services you offer.

- Target Markets: Identify and profile the key customer segments.

- Competitive Advantages: Describe how your equipment leasing business will differentiate itself from its competitors.

- Financials: Summarize the financial projections for the business and describe the amount of funds needed to get the business off the ground.

3. Company Overview

History of the equipment leasing company.

Equipment leasing is one of the world’s oldest and most well-developed financing types. The company that this business plan is for is a long-standing financing provider with over 25 years of industry experience. Over time, the company has solidified its position as a leading provider of both short-term and long-term equipment leasing plans. Additionally, it has successfully executed numerous sale-leaseback transactions.

The company, similar to the Tent Rental Business , primarily focuses on offering financing solutions to small and medium-sized businesses. It provides a range of financing options to its clients, including dollar and percentage leases, capital leases, sale-leaseback transactions, master-variable rate agreements, and lease line agreements. In addition to this, the company also offers consulting services that help clients compare different equipment types, suppliers, and costs. This helps them make informed decisions before entering into any financial contracts.

The improved version of the sentence is as follows: The company takes pride in its deep understanding of complex financial instruments associated with equipment leasing, its commitment to exceptional customer service, and its capacity to develop and offer tailor-made solutions for every client. [related_business_plan id=”515″ layout=”horizontal”]

The mission is straightforward: to offer customers the best financing solutions. Their aim is to excel in the industry by providing customized and user-friendly options for restaurant equipment leasing and other needs.

4. Products and pricing

- Cash Flow Financing: term lengths ranging from 24 months to up to 30 years, depending on the asset type, value, and specifics of the transaction. Upfront payments are similar to other equipment leasing options.

- Operating Leases: short-term leases with terms ranging from 1-5 years. No upfront payments are required.

- Percentage or Fair Market Value Leases: term lengths ranging from 1-5 years with fair market value buyouts at the end of the term. There is no upfront payment required.