Insurance Cover Letter: Sample & Guide [Entry Level + Senior Jobs]

Create a standout insurance cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Writing a cover letter for an insurance job can be intimidating. With this guide, you'll understand how to write a competitive and professional cover letter that will give you the best chance of landing the job. We'll walk you through crafting your cover letter, from understanding the basics of insurance cover letters to actionable tips for creating an impressive and unique document.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Community Health Nurse Cover Letter Sample

- Clinical Nurse Educator Cover Letter Sample

- Clinical Research Associate Cover Letter Sample

- Infusion Nurse Cover Letter Sample

- Hospital Pharmacist Cover Letter Sample

- Dental Lab Technician Cover Letter Sample

- General Practitioner Cover Letter Sample

- Athletic Trainer Cover Letter Sample

- Nursing Attendant Cover Letter Sample

- Assistant Director Of Nursing Cover Letter Sample

- Staff Pharmacist Cover Letter Sample

- ER Nurse Cover Letter Sample

- Orthodontist Cover Letter Sample

- Staff Nurse Cover Letter Sample

- Pediatric Nurse Cover Letter Sample

- Pharmacy Assistant Cover Letter Sample

- Care Manager Cover Letter Sample

- Experienced Psychiatrist Cover Letter Sample

- Director Of Nursing Cover Letter Sample

- Nursing Assistant Cover Letter Sample

Insurance Cover Letter Sample

Dear Hiring Manager,

I am submitting my application for the position of Insurance with your organization. With over 10 years of experience in the insurance industry, I have the knowledge and expertise to be an effective member of your team.

I am currently working as an Insurance Agent with ABC Insurance Company, where I am responsible for providing customers with a variety of insurance products and services. I specialize in life and health insurance, and have been successful in helping customers develop comprehensive insurance plans tailored to their needs. My experience also includes providing customers with quotes, explaining policy coverage options, and negotiating premium rates.

In addition to my technical knowledge of the insurance industry, I possess strong customer service skills. I have had success in building relationships with customers and helping them to understand their policy coverage. I am also skilled in resolving customer complaints and handling difficult conversations with professionalism and empathy.

I am confident that my experience and qualifications make me an ideal candidate for the position. I am excited at the prospect of joining your team and contributing to the growth of your organization.

Thank you for your time and consideration. I look forward to hearing from you.

Sincerely, John Doe

Why Do you Need a Insurance Cover Letter?

- A insurance cover letter is a great way to make sure that you are adequately covered for any eventuality.

- It can help to protect you from financial losses and provide peace of mind in the event of an accident or other unexpected event.

- Insurance cover letters provide an assurance that any losses you suffer will be covered by the insurance company.

- Having an insurance cover letter also helps to ensure that you are not left with a large financial burden if something unexpected happens.

- Having a insurance cover letter is also important if you have any assets such as a house or a car that you would like to be protected.

- In the event of an accident, the insurance cover letter will provide you with the financial assistance that you need in order to recover any losses.

- Having an insurance cover letter also helps to ensure that your medical costs are covered in the event of an illness or injury.

A Few Important Rules To Keep In Mind

- Start with a professional greeting. Address your letter to the hiring manager by name if you know it.

- Outline your most relevant qualifications and experience in your opening paragraph.

- Include specific details that relate to the position and demonstrate why you are the ideal candidate.

- Explain why you are interested in the position and why you are the best candidate for the job.

- Keep your letter brief and to the point. Avoid using flowery language and excessive detail.

- Provide examples that demonstrate your experience and qualifications.

- Close with a thank you and a call to action.

- Proofread your letter carefully to ensure that there are no spelling or grammar errors.

What's The Best Structure For Insurance Cover Letters?

After creating an impressive Insurance resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Insurance cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Insurance Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

A Insurance Cover Letter Body Should Typically Include:

- A brief introduction that states the position you are applying for and why you are a good fit for the role.

- A description of your relevant experience and skills, including any industry-specific knowledge.

- Examples of how you have demonstrated the required skills in past positions (if applicable).

- A statement of your enthusiasm for the job and the company.

- A closing paragraph that summarizes your qualifications and expresses your interest in the position.

When writing a cover letter for an insurance job, it is important to focus on the specific skills that you possess that make you a qualified candidate. It is important to demonstrate your knowledge of the insurance industry and your interest in the position. Your cover letter should also focus on the benefits that you can bring to the organization.

When highlighting my relevant experience, I focus on the skills and knowledge I have acquired through my past positions. For example, I have years of experience in the insurance industry, so I am well versed in the industry's regulations and procedures. I am also knowledgeable about the various types of insurance policies available and the various coverage levels. Additionally, I possess excellent customer service and communication skills, which I have utilized in my past roles.

In my previous positions, I have demonstrated my ability to handle customer inquiries and complaints in a timely and professional manner. I am also highly organized and have experience in processing and filing paperwork. My strong attention to detail ensures that all documents are accurate and up to date. I have the ability to work independently and as part of a team, and I am comfortable taking on additional tasks when needed.

I am excited about the opportunity to join your organization and am confident that I can make a positive contribution. I am eager to use my knowledge and experience to help your organization succeed. Please do not hesitate to contact me if you have any questions. I look forward to hearing from you.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Insurance Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Failing to customize the cover letter for the specific position and company.

- Including irrelevant personal information.

- Using a generic greeting such as "To whom it may concern" or "Dear Sir or Madam".

- Using too much technical jargon.

- Making spelling and grammar mistakes.

- Using overly flowery or fancy language.

- Including information that has already been included in the resume.

- Not mentioning any of the skills or qualifications the employer is looking for.

- Failing to provide contact information.

Key Takeaways For an Insurance Cover Letter

- Highlight relevant skills and qualifications that are relevant to the insurance industry.

- Express a clear understanding of the job role and how your skills will help the company.

- Explain the value you can bring to the company in terms of experience and qualifications.

- Outline the unique benefits of the insurance product and explain how it can help the customer.

- Communicate your enthusiasm and commitment to the insurance company and the customer.

- Provide examples of how you have successfully solved customer problems in the past.

- Convey a deep understanding of the customer’s needs and explain how the insurance product can meet them.

- Be professional and courteous in your correspondence.

- Ensure that all relevant information is included in the letter.

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Insurance Cover Letter Examples

Writing a cover letter for an insurance position can be challenging. Knowing how to present yourself in the best possible light to increase your chances of getting the job is key. To help you get started, we have compiled some examples of successful insurance cover letters, along with a guide on how to write an effective cover letter. With these helpful tips and examples, you can create an engaging, informative cover letter that will make a great impression.

- Insurance Agent

- Insurance Broker

- Underwriter

- Claims Adjuster

- Claims Examiner

- Claims Investigator

- Risk Manager

- Insurance Sales Agent

- Customer Service Representative

- Insurance Appraiser

- Insurance Auto Damage Appraiser

- Insurance Fraud Investigator

- Insurance Account Manager

- Insurance Compliance Officer

- Insurance Analyst/Underwriting Analyst

- Insurance Product Manager

- Reinsurance Underwriter

- Insurance Medical Examiner

- Insurance Risk Surveyor

- Insurance Operations Manager

- Insurance Marketing Manager

- Insurance IT Analyst

- Insurance Actuarial Analyst

- Insurance Accountant

- Insurance Auditor

- Insurance Claims Manager

- Insurance Underwriting Manager

- Insurance Sales Manager

- Insurance Operations Analyst

- Insurance Compliance Analyst

- Insurance Data Analyst

- Insurance Marketing Coordinator

- Insurance Portfolio Manager

- Insurance Project Manager

- Insurance Business Analyst

- Insurance Credit Analyst

- Insurance Loss Control Specialist

- Insurance Benefits Administrator

- Insurance Policy Administrator

- Insurance Fraud Prevention Analyst

- Insurance Legal Counsel

- Insurance Human Resources Manager

- Insurance Training and Development Specialist

Why a Insurance profession needs a cover letter

When applying for an insurance policy, it is essential to include a cover letter. A cover letter provides additional information about the policy itself, as well as the applicant’s motivations for requesting the policy. It is a way for applicants to express their needs and goals in a concise and effective way.

A cover letter is also a way for applicants to demonstrate their qualifications and credentials. Insurance companies often request policy applications to be accompanied by a cover letter, as it allows them to get a better understanding of why the applicant needs the policy. This includes the applicants’ financial and lifestyle needs, their asset protection goals, and any other motivations they may have for applying for the policy. The cover letter also provides an opportunity for applicants to make a strong case for themselves and why they are deserving of the insurance policy.

In addition to providing additional information, a cover letter also helps to ensure that the insurance company is aware of all the necessary details for the policy. Cover letters should include relevant information such as the applicant’s name, contact information, and the type of insurance being applied for. The letter should also include any relevant documents, such as evidence of income and financial statements. This information is necessary for insurance companies to make an informed decision about the policy.

A well- crafted cover letter can make all the difference when applying for an insurance policy. It is a valuable tool that allows applicants to share their motivations and qualifications, as well as provide necessary information that insurance companies require. A cover letter is an essential part of the insurance application process and should not be overlooked.

Writing the Perfect Insurance Cover Letter

Crafting a great insurance cover letter requires more than just inserting a generic template into your word processor. Your cover letter is your chance to make a strong first impression and show hiring managers why you’re the right fit for the insurance job.

The first step to writing an effective cover letter is to understand the job requirements. Research the company’s website and social media channels to get a better understanding of the company’s culture, the insurance job market, and the specific job you’re applying for. This will help you tailor your cover letter to the job and explain how you’re a great fit.

When writing your cover letter, use a professional tone and make sure your grammar, punctuation, and spelling are all correct. Include relevant details about your qualifications and career successes, such as any awards you’ve won or certifications you’ve earned.

Talk about the skills and experiences that make you an ideal candidate for the job. Make sure your cover letter is personal and conveys your enthusiasm for the role. Show that you’ve put in the effort to research the company, and explain why you’d be a great addition to the team.

Finally, be sure to thank the hiring manager for their time, and provide contact information in case they have any questions. Proofread your letter and make sure it’s error- free before sending it off.

By following these tips, you’ll be sure to write an effective insurance cover letter that will help you stand out from the competition and land your dream job!

What should be included in a Insurance cover letter

A cover letter is an important part of any insurance application, as it provides a snapshot of your qualifications and experience to the insurance company. It is essential that you include the relevant information needed to give the insurance provider an impression of who you are and why you are the best candidate for their policy.

A successful insurance cover letter should include the following:

- A brief introduction outlining your background and the reason for your application.

- A detailed explanation of your qualifications and experience, such as any relevant certifications, licenses, or any other qualifications related to the insurance field you are applying for.

- A statement of why you are the best candidate for the position.

- A summary of your achievements and successes in the past.

- Information about the type of policy and coverage you are seeking and why you feel it is best suited to your needs.

- Any additional information you believe will help you stand out from the other applicants.

- Contact information, including your name, address, phone number, and email address.

Conclusion :

Your insurance cover letter should also include a conclusion, thanking the provider for their time and consideration and reiterating your interest in the policy. By including all of the above elements in your cover letter, you will give the insurance provider the best possible impression of yourself and your qualifications.

How to format a Insurance cover letter

A well- formatted insurance cover letter should:

- Introduce yourself: Begin your letter by introducing yourself and why you are writing. Explain why you are a good fit for the position.

- Describe your experience: Provide a brief summary of your experience in the insurance field and highlight any accomplishments.

- Demonstrate your knowledge: Explain your knowledge of the industry, the specific company, and the position you’re applying for.

- Show your enthusiasm: Demonstrate your enthusiasm for the position and explain why you’re the best fit for the job.

- Express thanks: Conclude your letter by thanking the reader for their time and expressing interest in discussing the position further.

- Provide contact information: Include your contact information so that the hiring manager can easily reach you.

- Keep it concise: Aim for a one- page letter that is concise and to the point. Avoid using overly- technical language and focus on the essential points.

Common mistakes to avoid when creating a Insurance cover letter

- Not researching the company – Before creating a cover letter for any potential insurance employer, it is important to research the company and the job for which you are applying. This will help you to tailor your letter to the specific employer and position.

- Using a generic template – Use a customized cover letter that speaks to the specific employer and position. A generic template may not stand out to the employer and could make you seem like you are not taking the job seriously.

- Not addressing the employer directly – Address the cover letter to a specific person who will be reviewing it. If you are unable to find the exact name of the person, use a job title and department. This shows the employer that you took the time to personalize the letter.

- Focusing too much on yourself – Use your cover letter to highlight any relevant experience and skills you have, but keep it focused on how you will benefit the employer. Make sure to also include what you know about the company and the value you can add to the organization.

- Making spelling and grammar mistakes – Review your cover letter multiple times before sending it to the employer. Poorly written letters with spelling and grammar mistakes can make you look unprofessional, so double- check all of the content.

- Not proofreading – Before submitting your letter, have a friend or colleague review it. They may be able to spot mistakes and typos that you have missed.

- Not tailoring it to the job – Your cover letter should be tailored to the specific job you are applying for. Include any relevant experience and skills that are specifically required for the job.

- Not including contact information – To make it easier for employers to reach you, make sure to include your contact information such as your phone number, email address, and LinkedIn profile.

Benefits of submitting a Insurance cover letter

A cover letter is an important document when applying for insurance. It provides a unique opportunity for the potential policyholder to personalize their application and make it stand out. Here are some of the key benefits of submitting an insurance cover letter:

- Demonstrate a Professional Image: A well- crafted cover letter shows that the applicant is knowledgeable about the insurance industry and has taken the time to carefully craft an impressive document. It projects an image of professionalism and attention to detail that can help the applicant stand out from the competition.

- Explain Insurance Needs: A cover letter provides the policyholder with an opportunity to explain their insurance needs and how the policy they are applying for will meet those needs. This can help the insurance provider better understand the applicant’s needs and tailor their coverage to better suit them.

- Highlight Unique Qualifications: A cover letter can also be used to highlight any unique qualifications or experiences the applicant may possess that would make them an ideal policyholder. This could include anything from previous insurance experience to special certifications or training.

- Showcase Personality: An insurance cover letter is also a chance to showcase the applicant’s personality and demonstrate that they are a good fit for the policy. This can help to create mutual trust and understanding between the policyholder and the insurance provider.

- Strengthen Negotiations: A strong cover letter can also strengthen the applicant’s negotiations with the insurance provider. By clearly outlining their needs, qualifications, and personality, the applicant is better equipped to negotiate for a policy that is tailored to fit their unique needs.

When writing your insurance cover letter, it is important to keep in mind the purpose of the letter and tailor it to the specific job and company you are applying for. This guide has shown you how to write an effective cover letter for an insurance job and provided you with examples of cover letter templates to help you get started. By following the tips and advice provided here, you will be well on your way to writing a professional cover letter that will make you stand out from the competition. Best of luck in your job search!

1 Insurance Agent Cover Letter Example

Insurance Agents excel at assessing risk, tailoring policies to individual needs, and providing peace of mind in uncertain situations. Similarly, your cover letter is your opportunity to assess and present your own professional 'risks' and 'policies' - your skills, experiences, and unique value - in a way that provides recruiters with confidence in your potential. In this guide, we'll navigate through top-notch Insurance Agent cover letter examples, ensuring your application stands out in the competitive insurance industry.

Cover Letter Examples

Cover letter guidelines, insurance agent cover letter example, how to format a insurance agent cover letter, cover letter header, what to focus on with your cover letter header:, cover letter header examples for insurance agent, cover letter greeting, get your cover letter greeting right:, cover letter greeting examples for insurance agent, cover letter introduction, what to focus on with your cover letter intro:, cover letter intro examples for insurance agent, cover letter body, what to focus on with your cover letter body:, cover letter body examples for insurance agent, cover letter closing, what to focus on with your cover letter closing:, cover letter closing paragraph examples for insurance agent, pair your cover letter with a foundational resume, cover letter writing tips for insurance agents, highlight your expertise in the insurance industry, showcase your sales skills, demonstrate your customer service abilities, emphasize your attention to detail, express your adaptability, cover letter mistakes to avoid as a insurance agent, failing to highlight relevant skills, using generic language, not proofreading, being too lengthy, not showing enthusiasm, cover letter faqs for insurance agents.

The best way to start an Insurance Agent cover letter is by addressing the hiring manager directly, if their name is known. Then, introduce yourself and state the position you're applying for. Make sure to include a compelling hook in your opening paragraph that highlights your relevant experience, skills, or achievements. For instance, you could mention how your expertise in risk management strategies led to a significant decrease in claims at your previous company. This not only grabs the reader's attention but also shows that you understand the role and its requirements.

Insurance Agents should end a cover letter by summarizing their key skills and experiences that make them a suitable candidate for the role. They should express enthusiasm for the opportunity and show interest in the company's mission or values. It's also crucial to include a call to action, such as a request for an interview or a meeting. For example: "I am excited about the opportunity to bring my unique blend of skills and experience to your team and am confident that I can contribute to your company's success. I look forward to the possibility of discussing my application with you further. Thank you for considering my application." Remember to end the letter professionally with a closing like "Sincerely" or "Best regards," followed by your full name and contact information.

An Insurance Agent's cover letter should ideally be about one page long. This length is sufficient to introduce yourself, explain why you're interested in the insurance field, highlight your relevant skills and experiences, and express your interest in the specific agency you're applying to. It's important to keep it concise and to the point, as hiring managers often have many applications to review and may not spend a lot of time on each one. A well-written, one-page cover letter can effectively convey your qualifications and enthusiasm for the job without overwhelming the reader with too much information.

Writing a cover letter with no experience as an Insurance Agent can seem challenging, but it's all about showcasing your transferable skills, eagerness to learn, and passion for the industry. Here's a step-by-step guide on how to do it: 1. Start with a Professional Greeting: Address the hiring manager by name if possible. If you can't find the name, use a professional greeting such as "Dear Hiring Manager". 2. Opening Paragraph: Begin by stating the position you're applying for. Express your enthusiasm for the role and the company. If someone referred you, mention their name and connection to the company here. 3. Highlight Transferable Skills: Even if you don't have direct experience as an Insurance Agent, you likely have skills that can be applied to the role. These could include customer service, sales, problem-solving, or analytical skills. Use specific examples from your past work, education, or volunteer experience to demonstrate these skills. For example, if you've worked in retail, you might discuss how you upsold products or handled customer complaints. 4. Show Industry Knowledge: Show that you understand the insurance industry and the role of an Insurance Agent. You could mention relevant coursework, certifications, or self-study. Discuss why you're interested in insurance and how you plan to contribute to the company. 5. Show Enthusiasm and Willingness to Learn: Employers value candidates who are eager to learn and grow. Express your willingness to undergo training and learn the ins and outs of the industry. 6. Closing Paragraph: Reiterate your interest in the role and the company. Thank the hiring manager for considering your application and express your hope for further discussion. 7. Professional Sign-off: Close the letter with a professional sign-off such as "Sincerely" or "Best regards", followed by your full name. Remember to keep your cover letter concise and to the point, and always proofread before sending it. Tailor each cover letter to the specific job and company, showing that you've done your research and are genuinely interested in the role.

Related Cover Letters for Insurance Agents

Insurance agent cover letter, call center cover letter.

Customer Service Manager Cover Letter

Customer Success Manager Cover Letter

Flight Attendant Cover Letter

Personal Trainer Cover Letter

Related Resumes for Insurance Agents

Insurance agent resume example.

Try our AI-Powered Resume Builder

5 Professional Insurance Agent Cover Letter Examples for 2024

Your insurance agent cover letter must immediately highlight your expertise in the industry. Demonstrate your proficiency with various insurance products and markets in the first few lines. Tailor your second paragraph to reflect your exceptional customer service skills. An insurance agent's success is deeply rooted in client trust and satisfaction.

All cover letter examples in this guide

Insurance Account Manager

Insurance Agent

Insurance Product Manager

Insurance Sales

Cover letter guide.

Insurance Agent Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Insurance Agent Cover Letter

Key Takeaways

Crafting an insurance agent cover letter can feel like a daunting task as you step into the world of job applications, eager to stand out from the crowd. You've polished your resume to perfection, yet the cover letter remains a hurdle, struggling not to echo what's already listed. Remember, the key is to present a compelling narrative about that shining professional moment without falling into clichés. We'll guide you to keep it succinct, personal, and confined to a single page, ensuring your cover story captivates.

- Writing the essential insurance agent cover letter sections: balancing your professionalism and personality;

- Mixing storytelling, your unique skill set, and your greatest achievement;

- Providing relevant (and interesting) information with your insurance agent cover letter, despite your lack of professional experience;

- Finding the perfect format for your[ insurance agent cover letter, using templates from industry experts.

Leverage the power of Enhancv's AI: upload your resume and our platform will map out how your insurance agent cover letter should look, in mere moments.

If the insurance agent isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Insurance Agent resume guide and example

- Pawn Broker cover letter example

- Account Manager cover letter example

- Customer Account Manager cover letter example

- Grocery Stocker cover letter example

- SaaS Account Executive cover letter example

- Regional Account Manager cover letter example

- Senior Sales Executive cover letter example

- Leasing Manager cover letter example

- Product Specialist cover letter example

- Sales Lead cover letter example

Insurance Agent cover letter example

AMELIA MILLER

San Jose, California

+1-(234)-555-1234

- Emphasizing relevant past achievements, like improving a customer service process, can demonstrate direct experience and potential for impact in the new role.

- Quantifying success, such as reducing call wait times by 30% and achieving a 95% customer satisfaction rating, provides concrete evidence of one's effectiveness and competency.

- Expressing alignment with the company's values reinforces the candidate's fit for both the role and the organizational culture.

- Showing enthusiasm to bring specific expertise, like customer service management and problem-solving, to the new team can make the applicant stand out as a proactive and committed candidate.

Standard formatting for your insurance agent cover letter

Structure your insurance agent cover letter, following industry-leading advice, to include:

- Header - with your name, the role you're applying for, the date, and contact details;

- Greeting - make sure it's personalized to the organization;

- Introduction paragraph - no more than two sentences;

- Body paragraph - answering why you're the best candidate for the role;

- Closing paragraph - ending with a promise or a call to action;

- Signature - now that's optional.

Set up your insurance agent cover letter for success with our templates that are all single-spaced and have a one-inch margin all around.

Use the same font for your insurance agent cover as the one in your resume (remember to select a modern, Applicant Tracker System or ATS favorites, like Raleway, Volkhov, or Chivo instead of the worn-out Times New Roman).

Speaking of the ATS, did you know that it doesn't scan or assess your cover letter? This document is solely for the recruiters.

Our builder allows you to export your insurance agent cover letter in the best format out there: that is, PDF (this format keeps your information intact).

The top sections on a insurance agent cover letter

Header : This should include the applicant's contact information, the date, and the insurance agency's details; it is essential for establishing professionalism and making it easy for the recruiter to reach out for an interview.

Greeting : A personalized greeting to the hiring manager shows attention to detail and a personal touch, which is valuable in a client-focused industry like insurance.

Introduction : This section should grab attention by succinctly stating the applicant’s interest in the role and highlighting relevant experience in sales, customer service, or previous insurance positions to indicate immediate value to the agency.

Body : In one or two paragraphs, the body should detail the candidate’s qualifications, including sales achievements, knowledge of insurance policies, and customer relationship management skills, directly correlating those with the needs of the insurance agency.

Closing : The closing should reiterate the applicant's enthusiasm for the position, include a call to action such as asking for an interview, and express gratitude to the recruiter for considering the application, reflecting the interpersonal skills important for an insurance agent role.

Key qualities recruiters search for in a candidate’s cover letter

- Deep understanding of insurance products: Knowledge of various insurance policies, terms, and concepts is essential to effectively explain coverage options and advise clients.

- Strong sales skills: Ability to persuade and influence decisions is vital for selling insurance policies and meeting sales targets.

- Excellent customer service abilities: An insurance agent must be able to handle client inquiries, claims, and issues with empathy and professionalism.

- Proven track record of meeting and exceeding sales goals: Demonstrates the agent's ability to thrive in a competitive environment and generate business for the agency.

- Effective communication and interpersonal skills: Crucial for building and maintaining relationships with clients, underwriters, and other stakeholders.

- Attention to detail: Accuracy is important when preparing and reviewing policies, applications, and related paperwork to ensure compliance and avoid errors.

Kick off your insurance agent cover letter: the salutation or greeting

When writing your insurance agent cover letter, remember that you're not writing for some complex AI or robot, but for actual human beings.

And recruiters, while on the lookout to understand your experience, would enjoy seeing a cover letter that is tailored to the role and addresses them . Personally.

So, if you haven't done so, invest some time in finding out who's the hiring manager for the role you're applying to. A good place to start would be LinkedIn and the corporate website.

Alternatively, you could also get in touch with the company to find out more information about the role and the name of the recruiter.

If you haven't met the hiring manager, yet, your insurance agent cover letter salutation should be on a last-name basis (e.g. "Dear Mr. Donaldson" or "Dear Ms. Estephan").

A good old, "Dear HR Professional" (or something along those lines) could work as your last resort if you're struggling to find out the recruiter's name.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Department Name] Hiring Committee,

- Dear Mr./Ms. [Last Name],

- Dear [First Name] [Last Name],

- Dear Dr. [Last Name],

Your insurance agent cover letter introduction and the value you bring

Moving on from the "Dear Recruiter" to your professional introduction .

Use those first two sentences of your insurance agent cover letter to present the biggest asset you'd bring to the organization.

Don't go into too much detail about your achievement or the skill set, but instead - go straight for the win.

That is - what is your value as a professional?

Would you be able to build stronger, professional relationships in any type of communication? Or, potentially, integrate seamlessly into the team?

What to write in the middle or body of your insurance agent cover letter

Here's where it gets tricky.

Your insurance agent cover letter body should present you in the best light possible and, at the same time, differ from your resume.

Don't be stuck in making up new things or copy-pasting from your resume. Instead, select just one achievement from your experience.

Use it to succinctly tell a story of the job-crucial skills and knowledge this taught you.

Your insurance agent cover letter is the magic card you need to further show how any organization or team would benefit from working with you.

Final words: writing your insurance agent cover letter closing paragraph

The final paragraph of your insurance agent cover letter allows you that one final chance to make a great first impression .

Instead of going straight to the "sincerely yours" ending, you can back up your skills with a promise of:

- how you see yourself growing into the role;

- the unique skills you'd bring to the organization.

Whatever you choose, always be specific (and remember to uphold your promise, once you land the role).

If this option doesn't seem that appealing to you, close off your insurance agent cover letter with a follow-up request.

You could even provide your availability for interviews so that the recruiters would be able to easily arrange your first meeting.

No experience insurance agent cover letter: making the most out of your profile

Candidates who happen to have no professional experience use their insurance agent cover letter to stand out.

Instead of focusing on a professional achievement, aim to quantify all the relevant, transferrable skills from your life experience.

Once again, the best practice to do so would be to select an accomplishment - from your whole career history.

Another option would be to plan out your career goals and objectives: how do you see yourself growing, as a professional, in the next five years, thanks to this opportunity?

Be precise and concise about your dreams, and align them with the company vision.

Key takeaways

Winning recruiters over shouldn't be difficult if you use your insurance agent cover letter to tell a story that:

- Is personalized by greeting your readers and focusing on key job skills greets;

- Isn't spread all over the place, but instead focuses on one key achievement and selling your value as a professional;

- Introduces your enthusiasm for the role, passion for the job, or creativity in communication;

- Is also visually appealing - meeting the best HR practices;

- Ends with a nod to the future and how you envision your growth, as part of the company.

Insurance Agent cover letter examples

Explore additional insurance agent cover letter samples and guides and see what works for your level of experience or role.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

Curating GitHub Links on Your Resume: Projects, Seniority, and How to Guide

3 tips to craft the perfect linkedin summary (with examples), santa claus - the man who’s never changed his job, good resume characteristics: what to put on yours, how to write an informational interview email that lands you the interview, alice's resume for a masters scholarship.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

15 Insurance Agent Cover Letters That Will Get Hired (NOW)

Are you are looking to write a cover letter for Insurance Agent jobs that will impress recruiters and get you noticed by hiring managers? You need one to apply for a job, but you don’t know what to say.

Cover letters can be a great way to introduce yourself before an in-person interview. They are not only a chance to highlight your strengths, but also to show off your personality and work ethic.

Here are 15 amazing Insurance Agent cover letters that are professionally written and will help you stand out and get that job!

Insurance Agent Cover Letters

Each cover letter is written with a different focus. Review all of them and pick the ones that apply to your situation. Take inspiration from multiple samples and combine them to craft your unique cover letter.

Insurance Agent Sample 1

Dear Employer,

I am a recent graduate from DeVry University with a degree in Business Administration and I believe my skill set will be advantageous to your organization. As an Insurance Agent, I am able to analyze and solve complex problems independently. My ability to think critically and work interactively is invaluable as well as my commitment to take ownership of any task assigned to me. I also have excellent interpersonal skills which help foster strong relationships with clients.

I would like the opportunity to interview for the Insurance Agent position you advertised on August 24th for your organization. Thank you for your time and consideration of this application.

Insurance Agent Sample 2

Dear Sir/Madame,

I hope this letter finds you well. My name is _______ and I am writing to inquire about the Insurance Agent position you advertised. I have a degree in business administration and am currently working as a sales representative for ______________. I would be excited to talk with you about this opportunity and my qualifications in more detail, so please don’t hesitate to contact me at your earliest convenience. I am looking forward to hearing from you soon.

Sincerely yours,

Insurance Agent Sample 3

Dear Company Representative,

I am writing to you to inquire about the Insurance Agent position. I would make a great addition to your team because of my strong work ethic and attention to detail. I will reply to this email with my resume in the next 24 hours. Thank you in advance for your time and consideration and I look forward to hearing from you soon.

Insurance Agent Sample 4

I am writing to express my interest in the Insurance Agent position with your company. I am a recent college graduate who is devoted to providing exceptional customer service and sales. I have extensive knowledge of life insurance, retirement planning, and risk management. What originally drew me to this position was your company’s dedication to delivering exemplary service and respect for their customers.

I hope you will consider me for this role and I look forward to hearing from you soon.

Insurance Agent Sample 5

I am a recent college graduate with an interest in insurance. I have always been interested in the way that people interact with one another when it comes to financial needs, and this position would be perfect for me. I have already had experience in customer service-driven roles at the bank, so the skills that I possess are ideal for this position.

A cover letter is mandatory when applying for jobs. It should not exceed 5 sentences and should include information about your qualifications, why you are specifically qualified to work for this company, any personal connections to the company or person you are writing to (if applicable), and what kind of work you are seeking.

Insurance Agent Sample 6

To whom it may concern, Hi! My name is ____ and I am interested in applying for the Insurance Agent position. I have a Bachelors degree in Business Administration with a concentration in Marketing from _____University. My marketing degree gave me excellent skills that would be beneficial to you as an insurance agent. I have experience managing social media accounts, coordinating events, creating flyers and posters for new products, creating press releases about our new products. These are all skills that would be very applicable to the Insurance Agent position which was what convinced me to apply for this position. I believe my skills are perfect for your company because I am not only creative but also organized–creativity is important because it’s how you find new customers

Insurance Agent Sample 7

I am writing to express interest in your Insurance Agent position. I have over 5 years of experience working in the insurance industry and would make a great addition to your team. Please consider me for this opportunity.

Sincerely, ____

Insurance Agent Sample 8

Dear ________, I am writing to express my interest in the Insurance Agent position at your company. I have experience as an agent, and am passionate about providing great customer service. My skills are diverse and include marketing, customer relations, problem-solving, negotiation skills and more. I would be grateful for the opportunity to interview with you personally. Thank you for your consideration of my application! Given the opportunity to represent your company as an insurance agent, I will work hard to meet all of the expectations that you have for this job position.

Insurance Agent Sample 9

Dear Hiring Manager, I am a Licensed Insurance Agent with 5 years of experience in selling life insurance. I have an excellent track record of success and have created relationships with my clients over the years. Please consider me for the position in your organization. Thank you for your time.

Insurance Agent Sample 10

To Whom It May Concern,

I am writing to you all in regards to the Insurance Agent position that has been posted. I would like to apply for the position and my skills and experience make me a perfect candidate. I graduated from _______ with a degree in Business Administration with an emphasis on Risk Management and Insurance. This is my fifth year as an insurance agent but my first as an independent agent at _____, where we work with Aetna, Blue Cross Blue Shield, United Healthcare and several other local carriers for both health care and auto insurance needs. Working as one of the top agents at this company has given me many opportunities to be successful in various areas of the industry such as client service skills, risk management skills

Insurance Agent Sample 11

I am writing with interest in the Insurance Agent position at _____. I am looking for an opportunity that will allow me to utilize my experience and skills, while also providing an opportunity for growth.

My background includes 10 years of customer service experience which includes working with both brokerage and retail clients with most recent position as a Client Service Representative at ABC Insurance Agency where I worked with brokers on new business opportunities, renewed policies, and created quotes for prospective customers.

Insurance Agent Sample 12

I am writing in response to your advertisement for a Insurance Agent position. I’m confident that my qualifications are a good fit for this opportunity. I am very communicative and enjoy meeting new people. As an insurance agent, I will be able to assist customers with their needs, while also working the on behalf of the company with clients and policy holders.

Insurance Agent Sample 13

Dear HR Dept, I am a graduate from University of Memphis pursuing a career in insurance. I have been in the industry for three years and understand the importance of customer service and providing quality products. My experience in this field has taught me how to build rapport with customers and make their experience seamless. I believe my skills make me an ideal candidate for this position and hope to hear from you soon.

Insurance Agent Sample 14

Dear Mr. Smith,

I am writing to express my interest in the Insurance Agent position that is currently available at your company. I have a degree from a top rated university and have extensive experience selling insurance to the general public. I would truly love an opportunity to work with you and can provide references upon request. Thank you for your time and consideration of my application, please contact me with any questions or for more information.

Insurance Agent Sample 15

April 1, 2017 I am writing to apply for the Insurance Agent position with ABC Company. I have a degree in Business Administration and 5 years’ experience working in the insurance industry. My education has qualified me to work closely with clients, understand their needs, and ultimately better serve them. I believe my experience will make me an excellent addition to your team. I am excited about speaking with you further about this opportunity and hope you will consider me for the position. Sincerely,

Recruiters and hiring managers receive hundreds of applications for each job opening.

Use the above professionally written Insurance Agent cover letter samples to learn how to write a cover letter that will catch their attention and customize it for your specific situation.

Related Careers:

- 15 Background Investigator Cover Letters That Will Get Hired (NOW)

- 15 School Secretary Cover Letters That Will Get Hired (NOW)

- 15 Retail Pharmacist Cover Letters That Will Get Hired (NOW)

- 15 Software Engineer Cover Letters That Will Get Hired (NOW)

- 15 Nanny Cover Letters That Will Get Hired (NOW)

- 15 Fashion Stylist Cover Letters That Will Get Hired (NOW)

- 15 Portfolio Manager Cover Letters That Will Get Hired (NOW)

- 15 Research Scientist Cover Letters That Will Get Hired (NOW)

- 15 Program Manager Cover Letters That Will Get Hired (NOW)

- 15 Postal Worker Cover Letters That Will Get Hired (NOW)

Leave a Comment Cancel reply

You must be logged in to post a comment.

How to Write a Good Life Insurance Cover Letter

Updated: September 5, 2023, at 4:11 PM

I’m sure underwriters ask you for cover letters…and cover letters…and more cover letters.

I was once at an underwriting conference with 20 or so carriers, and the individual carrier underwriters kept talking about cover letters. But all that talk doesn’t necessarily tell you how to write a life insurance cover letter.

When I was a home office underwriter, I learned that well-written cover letters are essential. How else could I understand the context of the application? Where else was I going to get necessary information that didn’t fit on the forms? At the same time, I didn’t appreciate cover letters that were poorly written or full of extraneous information.

Now that I’m in a position to write cover letters myself, here are the three main underwriting factors I think about to make sure I give the underwriter what he or she needs.

1. Is it Needed?

As important as cover letters are, not all cases need them. Say a young individual making $50,000 a year at an office job, with no medical history, comes in for a $100,000 term for the purpose of income replacement. In that scenario, no extra information is necessary.

Underwriters already read a lot so they don’t appreciate being given unnecessary material. Look at the information you’re sending. If it tells a complete story by itself, you don’t need a cover letter. If it doesn’t, or if there’s some facet of the applicant’s situation you want to stress, then it’s best to write a letter.

2. Purpose of Coverage

Your life insurance cover letter should focus on explaining the need and justifying the face amount, especially in cases where the need may be outside normal underwriting guidelines.

For example, say the case involves business key person insurance at 15 to 20 times the applicant’s compensation. Since key person insurance is generally only five to ten times compensation, you have to make a strong case of why your client’s employer would suffer a loss of the applied-for amount.

If your client has a difficult medical situation, you could have a hard time securing the rate you want. You’ll have to use your cover letter to address all potential roadblocks and pull out every favorable factor about the client’s medical history to lobby for the best rates.

That’s a lot easier if you have the complete medical records in front of you. If you don’t, do the best you can based on the application itself. And use the information obtained during your fact-finding.

3. Writing the Cover Letter

Now that you know whether to write a cover letter and what to put in it, be sure to write it well; meaning keep it short, clear, and to the point—with no unnecessary information.

No cover letter should ever be over one page in length, and most should be shorter. Also, be realistic. If your client had three heart attacks before the age of 40, don’t recommend him or her for Super Preferred. You’re not going to get it, and pretending you are is a good way to quickly lose credibility with an underwriter.

Again: write a clear, succinct, and realistic letter that makes both the need and amount clear to the underwriter and highlights the favorable factors of your client’s medical history. That letter is your best bet to secure the best possible rates for your client.

Keep Reading: How Life Insurance Loans Work

You May Also Like

Maximizing your conference experience: a guide for financial..., closing the divide: insight from 3 female leaders..., 7 tips to help you master the art..., lead generation strategies for financial advisors: 9 appointment-setting..., 2024 new year’s resolutions for financial planners [7..., a gratuitous recipe: tips for financial decision-making and..., ai and cybersecurity: what financial professionals need to..., mastering the monster hunt for top talent: stay..., do you need a business coach or business..., 5 facts & 5 thoughts on market volatility....

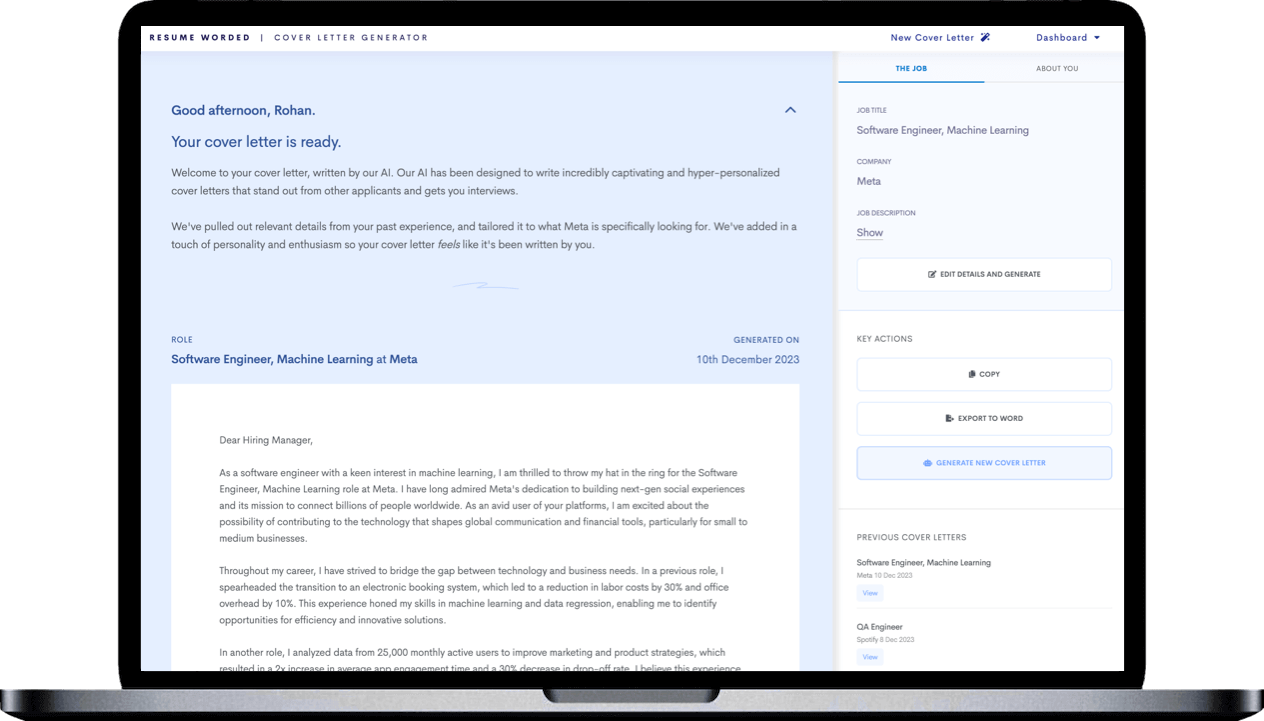

Resume Worded | Career Strategy

14 insurance underwriter cover letters.

Approved by real hiring managers, these Insurance Underwriter cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Insurance Underwriter

- Senior Insurance Underwriter

- Commercial Lines Underwriter

- Alternative introductions for your cover letter

- Insurance Underwriter resume examples

Insurance Underwriter Cover Letter Example

Why this cover letter works in 2024, highlighting relevant skills.

What I love about this cover letter is that it showcases the candidate's relevant skills without sounding boastful. You should focus on specific skills that align with the job requirements and demonstrate your expertise.

Quantifiable Achievements

It's important to include quantifiable achievements in your cover letter to establish credibility and show how you've made a difference in previous roles. Here, the candidate presents two accomplishments with clear numbers, making them more persuasive.

Showing Excitement for the Role

Expressing genuine excitement for the role and the company's mission can help your cover letter stand out from the rest. This sentence demonstrates that the candidate is not only qualified but also enthusiastic about the opportunity to contribute to the company.

Polite Closing

Ending your cover letter with a polite closing is a nice touch that leaves a positive impression on the reader. Here, the candidate thanks the hiring manager for considering their application and expresses hope for contributing to the company's success.

Showcase Tangible Achievements

When you mention specific, quantifiable accomplishments, it can make a big difference. You're not just saying you're good at your job, you're proving it with hard facts. By sharing that you handled a $5 million portfolio and reduced claim costs by 15%, you're painting a clear picture of what you can achieve.

Demonstrate Relevant Skills

Highlighting relevant skills that are directly linked to the job you're applying for can make you a more appealing candidate. By discussing your ability to accurately assess risk and make data-driven decisions, you're showing that you understand what's expected in the Insurance Underwriter role.

Align with Company Values

Showing that you're in sync with a company's values and mission can help establish a personal connection. By stating that you thrive in a dynamic environment and are passionate about creating value for customers, you're mirroring AIG's commitment to innovation and a customer-centric approach.

Making Your Accomplishments Plain

I love that you didn't beat around the bush about your accomplishments. You clearly stated what you achieved, and even included a quantifiable result. This directness is refreshing and gives me a solid understanding of how you've positively impacted your previous companies.

Aligning Skills with Company Goals

It's great to see you connecting the dots between your unique skills and what our company is trying to achieve. You're not just saying you have relevant skills, but you're demonstrating how those skills could be applied to our specific context. That's very compelling.

Expressing Genuine Enthusiasm

It's clear that you're not just looking for another run-of-the-mill job. You're excited about our company's mission, and you're eager to work on the challenges we're tackling. This kind of enthusiasm is infectious, and it definitely makes your application stand out.

Ending with a Forward-Looking Statement

Wrapping up your cover letter by looking towards the future is a fantastic move. It shows you're not just interested in getting a job, but you're ready to contribute to what we're doing here. It's a nice touch, really.

Show your passion for the insurance industry

When you talk about your fascination with how insurance helps people through unexpected challenges, it shows me your passion. It's good to see someone who cares about the impact of their work beyond just the day-to-day tasks.

Quantify your achievements

Telling me about the specific improvements you've made, like increasing efficiency by 15%, makes your success easy to understand. It gives a clear picture of what you might bring to our team.

Express excitement for teamwork

Your eagerness to work with a team of experts highlights your collaborative spirit. A good team player who is also excited about making a difference is exactly what we look for.

Close with a strong call to action

Ending your letter by inviting a discussion about how you can contribute to our success makes a strong closing. It shows you're proactive and serious about the opportunity.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Highlight your commitment to insurance underwriting

Starting your cover letter with enthusiasm for the role and the company sets a positive tone. It shows you're not just looking for any job, but you're specifically interested in what the company stands for.

Demonstrate the impact of your analytical skills

Describing how your skills have led to tangible outcomes, like policy growth and improved processes, proves your capabilities. It's effective to share examples that show your attention to detail and analytical prowess.

Emphasize your decision-making in risk assessment

Stating your ability to assess risks and make decisions underlines a core skill for an insurance underwriter. It reassures the employer of your competence in a critical area of the job.

Connect your passion with the company's goals

Expressing your interest in the company's use of technology indicates that you're not just a fit for the role but also aligned with the company's future direction. It's smart to show you share the company's vision.

Conclude with gratitude and an open door

Ending your cover letter by thanking the reader and looking forward to further discussion is courteous and professional. It leaves the conversation open for the next steps.

Show your enthusiasm for the insurance underwriter role

Starting your cover letter by expressing excitement for the position helps set a positive tone. It shows us you're not just looking for any job, but you're interested in this specific role at our company.

Highlight your experience in risk assessment

Mentioning your ability to assess risk and make decisions is crucial. Your real-world examples demonstrate your competence and how you've directly contributed to efficiency and profitability in past roles.

Emphasize your technical and problem-solving skills

By stating your confidence in your technical expertise, you're telling us you have the practical skills needed to succeed. This assurance is key in roles that require critical thinking and problem-solving.

Demonstrate your commitment to staying updated with industry trends

Your passion for continuous improvement and creativity is highly valued. It suggests that you will not only adapt to our company's culture but also drive innovation within our team.

Close with a clear call to action

Thanking us for considering your application and expressing eagerness to discuss your qualifications further shows professionalism and reinforces your interest in the position.

Senior Insurance Underwriter Cover Letter Example

Present proven results.

Presenting specific, measurable results, like managing a $10 million portfolio and decreasing claim costs by 20%, gives hiring managers a sense of your capabilities. It's one thing to talk about your skills, but showing that they've led to real-world results can be compelling.

Highlight Leadership Abilities

For senior roles, it's important to demonstrate your leadership abilities. By mentioning that you led a team of junior underwriters and improved their decision-making skills, you're showing that you can not only do the job, but also guide others and positively affect their performance.

Relating Experience to Company's Mission

You've done an excellent job of tying in your past accomplishments to our company's mission. That shows me you've really done your homework and understand how your skills and experience can contribute to our goals.

Demonstrating Alignment with Company Values

It's clear that you've taken the time to understand what we're about and how your experience aligns with our values. This shows me that you're not just interested in a job, but you're excited about contributing to our mission.

Appreciation for Company’s Innovative Approach

You've done your research, and I appreciate that. Recognising our innovative initiatives tells me you're thinking about how you can contribute to advancing our goals. It's a refreshing perspective that's truly appreciated.

Expressing an Active Interest in Company’s Vision

Your interest in contributing to the company's vision comes through loud and clear. It's fantastic to see an applicant who is not just after a job, but is genuinely interested in being a part of what we're aiming to achieve.

Demonstrate industry experience

Stating your eight years of experience sets a solid foundation for your expertise. It's great to see candidates who not only have experience but are also drawn to our values.

Highlight unique candidate qualities

Discussing your ability to balance risk with opportunity while prioritizing customer needs shows you have a deep understanding of the core aspects of being a senior insurance underwriter. This balance is crucial for success in the role.

Share your enthusiasm for the role

Your excitement about bringing your skills to a leading company in the industry indicates you're motivated. Motivation is key to driving innovation and achieving high performance.

End with gratitude and openness

Thanking the reader for considering your application and expressing eagerness to contribute to the company’s success is polite and shows you’re ready to be part of the team.

Show your senior insurance underwriter experience

When you talk about your long experience and passion for risk management, it helps me see you're not just looking for any job – you want this one because it fits what you love doing and what you're good at.

Highlight your mentorship and analytical skills

Pointing out your success in guiding others and managing complex decisions shows you're ready for the leadership part of the senior role. It's impressive when you not only do well yourself but also help others grow.

Applaud the company's culture

It's great to see you've done your homework about The Hartford. Mentioning your admiration for our continuous learning approach tells me you're someone who values growth and would fit in with our culture.

Express gratitude in your cover letter

A simple thank you notes your respect for the hiring process and the time taken to consider your application, making your application more memorable.

Share your eagerness to contribute

Your enthusiasm to add value and drive success at The Hartford shines through, making me excited about the potential impact you could have on our team.

State your confidence and experience upfront

Leading with your years of experience and confidence in your expertise grabs our attention. It helps us immediately understand your level and the value you could bring to our team.

Showcase your mentorship and leadership abilities

Highlighting your experience in guiding junior underwriters not only demonstrates your expertise but also your leadership qualities. These are invaluable in a senior role, where you're expected to lead by example.

Express admiration for the company's reputation

Your appreciation for our company's excellence and comprehensive solutions tells us you've done your homework. It also shows that your values align with ours, which is crucial for a successful partnership.

End with gratitude and eagerness for the next steps

Thanking us for reviewing your application and expressing excitement about contributing to our success leaves a lasting, positive impression. It also neatly ties your cover letter together, ending on an optimistic note.

Invite further discussion in an interview

Requesting an interview is a proactive move. It shows you're ready to take the next step and discuss how your skills and experiences can directly benefit our company in more detail.

Commercial Lines Underwriter Cover Letter Example

Show your enthusiasm for the commercial lines underwriter role.

Mentioning your excitement and why you're drawn to the company makes your cover letter more personal and shows you've done your homework about the company's reputation. It's good to connect your passion with the company's strengths.

Quantify your insurance underwriting success

By talking about a specific achievement, like increasing premium revenue by 20%, you make your past success concrete and measurable. This gives a clear picture of the value you can bring to the new role.

Express excitement about joining the team

When you share what excites you about working at the company, it demonstrates your interest in not just the job but also in contributing to the team and company culture. It shows you're a good fit beyond just your skills.

Extend a warm invitation for further discussion

Closing your cover letter by inviting the hiring manager to discuss your application further is polite and shows you're eager to move to the next step. It's a good way to end on a positive and proactive note.

Connect your passion with the commercial lines underwriter role

Starting off by matching your passion with the job's focus areas tells me you're not just qualified, but you're also highly motivated to help businesses through your underwriting work.

Showcase your client interaction skills

Emphasizing your attention to detail and relationship-building abilities highlights that you understand the importance of trust in commercial lines underwriting, making you a strong candidate for the role.

Express excitement about the company's innovation

When you talk about Nationwide's use of data and analytics, it shows you're up-to-date with industry trends and eager to contribute to our advancements, which is exactly what we're looking for.

Thank the recruiter in your cover letter

Your politeness in acknowledging the review of your application reinforces a positive, respectful attitude, which is crucial in any professional setting.

Convey your desire to impact the commercial lines market

Ending with your ambition to bring your risk management skills and passion to our team lets me see your potential to drive Nationwide's success further in the commercial lines space.

Show your commercial underwriting passion