A Consumers Approaches Towards Online Shopping in India: Challenges and Perspectives

- Conference paper

- First Online: 19 November 2023

- Cite this conference paper

- Savita Pramod Vaidya 9

Included in the following conference series:

- Techno-Societal 2016, International Conference on Advanced Technologies for Societal Applications

163 Accesses

Online shopping is a type of shopping where people can easily buy things and services online. We can get a sense of how much everything costs when purchased online through online shopping. Customers can buy a variety of goods and services through it, and sellers can keep track of their business and transactions online. It saves time and is convenient for shopping. It could be said that traditional shopping methods have evolved to make shopping simpler, more enjoyable, and more adaptable. The best way to shop for a wide range of items at once and from any location is online. As a result, we can consider online shopping to be one of the most enjoyable and convenient ways to shop. It saves money and time by reducing the crowd at the market. At the time, online shopping turned out to be a necessity. Because in today’s highly competitive world, people are too busy working in their offices to shop. Their lives will be made easier and faster by this technology. The primary objective of this research is to investigate consumer attitudes toward Indian online shopping as well as the obstacles and perspectives of this expanding industry.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Similar content being viewed by others

Beyond Kirana Stores: A Study on Consumer Purchase Intention for Buying Grocery Online

Behavioural differences and purchasing experiences through online commerce or offline within mall-based retail structures

Online Consumer Behaviour

Aahamad, M. L., & Zafar, S. M. (2017). Consumer perception towards online shopping. Asian Research Journal of Business Management , 4 (3), 1–14. https://doi.org/10.24214/arjbm/4/3/113129

Almugari, F., Khaled, A. S., Alsyani, M. K., Al-Homaidi, E. A., & Qaid, M. M. (2022). Factors influencing consumer satisfaction toward online shopping: A special reference to India context. International Journal of Procurement Management, 15 (2), 236–256.

Article Google Scholar

Bhandari, N., & Kaushal, P. (2013). Online consumer behavior: An exploratory study. Global Journal of Commerce & Management Perspective, 2 (4), 98–107.

Google Scholar

Chakravarthy, B. S. (2017). An empirical analysis on customer perception towards digital marketing. International Journal of Commerce, Business and Management (IJCBM), 5 (4), 118–123.

Choubey, V., & Solanki, S. S. (2014). Influence of age and income on online shopping adoption. Shodh: Pioneer Journal of IT & Management , 10 (1), 149–153.

Khare, A., & Rakesh, S. (2011). Antecedents of online shopping behavior in India: An examination. Journal of Internet Commerce, 10 (4), 227–244.

Nagra, G., & Gopal, R. (2013). A study of factors affecting on online shopping behavior of consumers. International Journal of Scientific and Research Publications, 3 (6), 1–4.

Prasad, C. J., & Raghu, Y. (2018). Determinant attributes of online grocery shopping in India—An empirical analysis. IOSR Journal of Business and Management, 20 (2), 18–31. https://doi.org/10.9790/487X-2002051831

Richa, D. (2012). Impact of demographic factors of consumers on online shopping behavior: A study of consumers in India. International Journal of Engineering and Management Sciences, 3 (1), 43–52.

Rohm, A. J., & Swaminathan, V. (2004). A typology of online shoppers based on shopping motivations. Journal of Business Research, 57 (7), 748–757. https://doi.org/10.1016/S0148-2963(02)00351-X

Sharma, S., Gupta, B., & Sharma, V. (2014). A study on gender differences in online shopping behaviour. Pioneer Journal of IT & Management, 10 (1), 352–355.

Shrivastava, A., & Lanjewar, D. U. (2011). Behavioural business intelligence framework based on online buying behaviour in Indian context: A knowledge management approach. International Journal of Computer Technology and Applications, 02 (06), 3066–3078.

Tandon, U. (2021). Predictors of online shopping in India: An empirical investigation. Journal of Marketing Analytics, 9 (1), 65–79.

Article MathSciNet Google Scholar

Undalea, S., & Patilb, H. (2022). Moderating effect of online shopping experience on adoption of e-Governance in rural India. Asia Pacific Journal of Information Systems, 32 (1), 32–50.

Download references

Author information

Authors and affiliations.

K.P. Mangalvedhekar Institute of Management, Sholapur, India

Savita Pramod Vaidya

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Savita Pramod Vaidya .

Editor information

Editors and affiliations.

SVERI’s College of Engineering, Pandharpur, Pandharpur, Maharashtra, India

Prashant M. Pawar

Babruvahan P. Ronge

Ranjitsinha R. Gidde

Meenakshi M. Pawar

SVERI's College of Engineering (Polytechnic), Pandharpur, Pandharpur, Maharashtra, India

Nitin D. Misal

SVERI’s College of Engineering, Pandharpur, Gopalpur, Maharashtra, India

Anupama S. Budhewar

SVERI’s College of Pharmacy, Pandharpur, Pandharpur, Maharashtra, India

Vrunal V. More

Amity University, Dubai, United Arab Emirates

P. Venkata Reddy

Rights and permissions

Reprints and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper.

Vaidya, S.P. (2024). A Consumers Approaches Towards Online Shopping in India: Challenges and Perspectives. In: Pawar, P.M., et al. Techno-Societal 2022. ICATSA 2022. Springer, Cham. https://doi.org/10.1007/978-3-031-34648-4_1

Download citation

DOI : https://doi.org/10.1007/978-3-031-34648-4_1

Published : 19 November 2023

Publisher Name : Springer, Cham

Print ISBN : 978-3-031-34647-7

Online ISBN : 978-3-031-34648-4

eBook Packages : Engineering Engineering (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Academy of Marketing Studies Journal (Print ISSN: 1095-6298; Online ISSN: 1528-2678)

Research Article: 2021 Vol: 25 Issue: 3S

A Study on Consumers attitude towards Online Grocery Shopping In Covid19 Pandemic

Ramkishen Yelamanchili, K J Somaiya Institute of Management, Somaiya Vidyavihar University

Bharati Wukadada, Associate Professor, K J Somaiya Institute of Management, Somaiya Vidyavihar University

Aparna Jain, S K Somaiya College, Somaiya Vidyavihar University

Poorvi Pathak, Student, K J Somaiya Institute of Management, Somaiya Vidyavihar University

Citation Information: Yelamanchili, R., Wukadada, B., Jain, A., & Pathak, P. (2021). A study on consumers attitude towards online grocery shopping in covid19 pandemic. Academy of Marketing Studies Journal, 25 (S3), 1-10.

Online Grocery Shopping (OGS), t Customer Awareness, E-commerce, Consumer Behavior and COVID19.

Introduction

E-commerce has radically altered the business perspective worldwide. In a developing country like India, its impact has been more evident due to the rise in internet users (Chatterjee, 2016). With 225 million online shoppers presently, it is predicted that by 2025, there will be 530 million people shopping online (Chandra, 2021). This underscores the idea that the E-commerce industry would strengthen its hold in the Indian economy. Factors contributing to this phenomenon are increasing consumer spending, rising urbanization and more disposable incomes of the working population of India (Choudhury, 2017).

Online grocery shopping (OGS) is the form of shopping where consumers can order their groceries online, while being at home (Adamides et al., 2006). The idea of online shopping gathered traction from various disciplines in the last few years (Pan et al., 2017). It is gaining momentum due to the convenience it provides to customers (Martin et al., 2019). It started with the western and southern parts of India and has now spread across the country. Online grocery stores have low set-up costs since no physical stores are required and vendors reduce their inventory costs by providing fast-moving goods (Sinha et al., 2015). To be successful in this industry, e-retailers must have efficient transport, distribution and inventory management (Turban et al., 2015). The major Indian e-grocery retailers are Big Basket, Amazon Fresh, Grofers, and JioMart.

The organized retail trade includes supermarkets, retail chains and other licensed retailers (Sinha, 2017). Coula & Lapoule, 2012 reported how OGS avoids physically going to the stores, waiting in checkout lanes and carrying heavy shopping bags. Therefore, reducing physical effort by a huge margin. Research suggests that online orders include larger portions of fresh products than offline orders (Munson et al., 2017). Factors influencing the growth of online sale of groceries are

1. No geographical boundaries

2. Time efficiency

3. Free delivery and discounts

4. Current Pandemic

However, the coronavirus has disrupted the global economy as we know it. Its impact can be seen in almost every industry, including the manufacturing and FMCG sectors. When the lockdown was announced in India, it led to the closing of all the offline retail stores. In such a scenario, retailers with omnichannel presence could cope with the situation, albeit facing different challenges. They found themselves temporarily overwhelmed. As the restrictions were lifted, the e-grocers slowly started picking up. Overall, the e-grocers expanded manifold because consumers started to order groceries, packaged food and other essential items online. Likewise, Amazon and Flipkart saw an increment in groceries and daily-need items.

The paper aims to study the main elements affecting the acceptance and the intention to continue purchasing online ,which characteristic of the product or payment method can determine a higher frequency of OGS .Finally other studies examined the influence of the factors in the process of OGS .Existing literature is concentrated on impact on consumer behaviour in developing countries but very little is known about the acceptance ,the purchasing decisions and diffusion in developing countries.

Literature Review

The retail industry has been through a massive transformation over the past few years. Goswami & Mathur, 2011 explained how this tremendous change took place in India's retail industry. With so many choices available to the consumers and their changing lifestyles, there has been a diversification in the consumer demographics. People who prefer speed and convenience usually opt for online shopping (Yu & Wu, 2007). The younger population is at the centre of online shopping and hence, remains the focal point of studying consumer behaviour. One key aspect is how long they have been internet users, as more technically sound people would be more ardent e-shoppers (VA Sumathi et al., 2016). IAMAI, 2019 reported that more than 50% of internet users belong to 20-40 years. This group belongs to the working class, which an essential factor for an e-grocery shopper. Even though the younger population is more likely to go for online shopping, in the current scenario, people from all age groups are indulging in it because of changing customer mindsets (Mitra, 2018). A young and educated female who works long hours and earns a stable income living in a small household would purchase food online (Dominici et al., 2021).

Brand preference of OGS

Different e-retailers are competing in this industry, although Big Basket, Grofers and Amazon Fresh are the most prominent players. The strength of Big Basket lies in offering flexible delivery timings to the customers, but quality and prices should be maintained for its long-term growth (Upadhyay, 2019). It was reported that the number of Big Basket orders grew by three times since March 2020, as opposed to pre-Covid times, while customer retention has increased by 60% (Economic Times, 2021). This proves how this segment is growing exponentially and, in the future, will expand even more. People also prefer Amazon for online shopping due to its quick deliveries and highly convenient application, ultimately leading to a seamless shopping experience (Muralitharan et al., 2018).

Problems faced by Customers During OGS

Despite its advantages, OGS is not an optimal choice for the customers yet. Kaur & Shukla, 2017 outlined how they choose to purchase their groceries via online applications once or twice, but they do not prefer this medium when compared with their local stores and thus, their decision of OGS remains situation based. Goswami & Mathur, 2011 highlighted five main problems that customers face while shopping for groceries online: safety, product quality, no bargaining, and the need to touch and feel the item and delivery time. (Ramus & Nielsen, 2005)

Problems faced by Retailers in the OGS industry

The online grocery segment remains niche as it has many operational difficulties. Overall, the margins earned in the food and grocery segment have been low as retailers provide lower prices via discounts (Jhaveri & Anantharaman, 2016). It has slow sales growth compared to other sectors like electronics, consumer deliverables, cosmetics, etc. Meshram, 2020 analysed the impact of covid-19 on the online grocery retailers as they faced the out-of-stock situation with no labour and transport during the lockdown. This effectively derailed their supply chain management.

Objective and Hypothesis of the study

This study focuses on the consumers in Mumbai region and studies their acceptance and inhibitions towards OGS. Consequently, the broad objective is to study the consumer behaviors during COVID19 towards online grocery shopping. However, the specific objectives are as follows:

1. To understand the demographics of people going for online grocery shopping in the COVID19 situation

2. To examine the association between different demographic factors and preference of grocery shopping through online

3. To investigate the factors that can influence consumer’s intention to purchase grocery online

4. To find the problems faced by the customer during online grocery shopping

5. The study has following research hypothesis based on the above objective.

1Hypothesis : The preference for OGS has been increased after COVID19.

2Hypothesis : There is an association between age group and preference for OGS..

3Hypothesis : Ease of navigation is important aspect for the customer for OGS.

The present study is based on primary data collected through google form in Mumbai. Convenience sampling was used for data collection. The questionnaire contained questions on demographic information of individuals, information on preference of grocery shopping, different aspects for online grocery shopping, different brand preference for online grocery shopping and problems faced by customer during online shopping. Apart from these, questionnaire has questions on why people don’t go for online grocery shopping.

The total response for questionnaire were 380.

Statistical Analysis

Univariate analysis has been done to show percentage distribution of different demographic factor, preference of online shopping before lockdown, preference of online shopping after lockdown, frequency of buying, monthly expenditure on buying online grocery. Paired t- test has been done to show the significant change in preference of online grocery from before lockdown to after lockdown. Crosstabulation with chi-square is done to check association between demographic factors and preference of online grocery shopping. One sample t- test is used to check whether different aspects affect online grocery shopping. Different kinds of graphs are also used to get visual representation of results. The significance level is taken 5% for this study. All kind of analysis done with help of SPSS 25 and excel.

Sample Characteristics

Table 1 shows the sample characteristics according to demographics. Around 36% of respondents are less than age 25. The male respondents are more than female respondents. The proportion of married respondents are higher than single. 79% of respondents are working people. Only around 37% respondents have monthly income more than 50k. From Tables 2-4 , one can say that the number of people preferencing online grocery shopping has been significantly increased after COVID19.

| Sample Characteristics According to Demographics | |||

| Age | < 25 | 36.6 | 139 |

| 25-50 | 63.4 | 241 | |

| Gender | Male | 56.3 | 214 |

| Female | 43.7 | 166 | |

| Marital Status | Single | 29.7 | 113 |

| Married | 70.3 | 267 | |

| Occupation | Student | 8.2 | 31 |

| Job | 78.9 | 300 | |

| Other | 12.9 | 49 | |

| Monthly Income | < 50k | 63.2 | 240 |

| 51k and above | 36.8 | 140 | |

| Preference of People Buying Grocery Before Lockdown | ||

| Online | 20.3 | 77 |

| Offline | 79.7 | 303 |

| Preference of People Buying Grocery After Lockdown | ||

| Online | 67.1 | 255 |

| Offline | 32.9 | 125 |

| Paired T Test to Showing Changes in Preference Before and After Lockdown | ||||

| OGS before lockdown-after lockdown | -0.468 | 0.5 | 0.026 | <0.001 |

Background Characteristics and Preference of Online Grocery Shopping

Tables 5-7 represents association with background characteristics with online grocery shopping preference. Around 85% of people of age group “25 plus year” prefer online grocery shopping Females are more likely to prefer for grocery shopping through online. Unmarried are less likely to go for online shopping than married. 32.3% of students prefer online shopping.

| Association of Different Background Characteristics with Preference of Online Grocery Shopping | ||||

| Age | 25 and less yr | 36 | 139 | <0.001 |

| 25 plus yr | 85.1 | 241 | ||

| Gender | Male | 58.4 | 214 | <0.001 |

| Female | 78.3 | 166 | ||

| Marital Status | Single | 44.2 | 113 | <0.001 |

| Married | 76.8 | 267 | ||

| Occupation | Student | 32.3 | 31 | <0.001 |

| Job | 73.3 | 300 | ||

| Other | 51 | 49 | ||

| Monthly Income | < 50k | 64.6 | 240 | 0.171 |

| 51k and above | 71.4 | 140 | ||

| Percentage of Frequency of Buying Grocery Online | ||

| Daily | 3.5 | 9 |

| Thrice a week | 8.2 | 21 |

| Twice a week | 27.5 | 70 |

| Weekly | 60.8 | 155 |

| Percentage Distribution of Monthly Expenditure on Buying Grocery Through Online | ||

| <500 | 3.1 | 8 |

| 500-1000 | 27.1 | 69 |

| 1001-1500 | 20.8 | 53 |

| 1501-2000 | 18.4 | 47 |

| 2000 and above | 30.6 | 78 |

Factors affecting Online Grocery Shopping

Table 8 shows descriptive of factors affecting online grocery shopping. Around 44% people believe that prices are most important factors, while 7% believe that it doesn’t matter. 48% people say that Ease of navigation is important factor affecting online shopping and only 6.3% believe it doesn’t matter. 52.2% people found social distancing most important factor affecting online shopping, whereas only 1.6 % feel that it doesn’t matter. From Table 9 , all factors are significantly affecting online shopping.

| Descriptive of Factors Affecting Online Grocery Shopping | ||||

| Better Prices | 112(43.9%) | 107(42%) | 18(7.1%) | 18(7.1%) |

| Ease of Navigation | 94(36.9%) | 122(47.8%) | 23(9%) | 16(6.3%) |

| Product Variety | 92(36.1%) | 138(54.1%) | 8(3.1%) | 17(6.7%) |

| Peer Recommendation | 26(10.2%) | 82(32.2%) | 69(27.1%) | 78(30.6%) |

| Same Day Delivery | 92(36.1%) | 110(43.1%) | 33(12.9%) | 20(7.8%) |

| Social Distancing | 133(52.2%) | 105(41.2%) | 13(5.1%) | 4(1.6%) |

| Delivery Fee | 69(27.1%) | 107(42%) | 51(20%) | 28(11%) |

| Result of T-Test to Show Factors Affecting Significantly to Online Grocery Shopping | |||

| Better Prices | 39.3 | 254 | <0.001 |

| Ease of Navigation | 37.5 | 254 | <0.001 |

| Product Variety | 48.3 | 254 | <0.001 |

| Peer Recommendation | 13.7 | 254 | <0.001 |

| Same Day Delivery | 31.1 | 254 | <0.001 |

| Social Distancing | 59.6 | 254 | <0.001 |

| Delivery Fee | 23.8 | 254 | <0.001 |

Brand Preference

Table 10 shows brands preference of customer for online grocery shopping. The Big Basket is most preferred brand for online shopping with 78.43%. Amazon fresh is second most preferred brand having choice of 75.29% of people. Nature’s Basket is least preferred brand for grocery shopping with only 12.55%.

| Brand Preferences of Customer for Online Grocery Shopping | ||

| Big Basket | 78.43 | 200 |

| Grofers | 62.75 | 160 |

| Dmart Ready | 40.78 | 104 |

| JioMart | 40.78 | 104 |

| Amazon fresh | 75.29 | 192 |

| Nature's Basket | 12.55 | 32 |

| Flipkart Supermarket | 15.69 | 40 |

Problems during Online Shopping

Table 11 revels percentage of customer having different problems during online shopping. The most reported problem during online shopping is not availability of product. Delivery time is second most problem reported by customer with 43.9%. 3.1% customer faced problem during payment stage. 17.3% customers are not happy with customer services. Only 1.6% customer are not comfort with delivery charges.

| Problem’s Customer Face During Online Grocery Shopping | ||

| Product not available | 48.6 | 124 |

| Product quality not as expected | 40.8 | 104 |

| Delivery time issues | 43.9 | 112 |

| Unable to return/exchange items once delivered | 34.5 | 88 |

| Payment issues | 3.1 | 8 |

| Poor customer service | 17.3 | 44 |

| App not working | 6.3 | 16 |

| Services not available at our location | 3.1 | 8 |

| High delivery charges | 1.6 | 4 |

Findings, Discussions, and Implications

Our study suggests that the number of people purchasing their groceries online has increased since the pandemic and social distancing is a significant reason for their online buying decision, as evident in (Kashyap, 2020) and (Jain & Sayyed, 2020). This answers our first hypothesis that preference for online grocery shopping has been significantly increased after COVID19. All the demographic factor of this study is significantly affecting preference of grocery shopping through online except income of person. This answer’s our all hypothesis regarding demographic factors.

In regards with hypothesis of influencing factors, the study found that discounted prices, Ease of navigation, product variety, peer recommendation, delivery fee, social distancing and same-day delivery attract the customers. This result is in line with research conducted by (Sathiyaraj et al., 2015), (Sreeram et al., 2017), and (Kian et al., 2018). Regarding customer apprehensions towards online grocery shopping (OGS) we deduced that product quality and high delivery cost are the common reasons. This supports the work of (Ramus & Nielsen, 2005), (Hanus, 2016) an (Mkansi et al., 2018).

The findings of this research have implications for the Indian retail industry, which includes e-commerce, government, researchers, and other stakeholders for increasing the adoption of OGS in the pandemic times regarding the Indian context. This study will offer insights to the grocery retail service providers in their day-to-day business and improve customer intention behavior using OGS.

Future Scope and Limitations of the Study

This study is conducted to acquire deeper insights into various antecedents of customers behavioral intention to adopt OGS.. There are limitations to this study that needs scholars to investigate the constructs in different geographical and consumer contexts which helps in generalizing the results.

The authors try to conceive a conceptual framework to understand the comprehensive insights on behavioral intentions of OGS users. Further, in this study, the moderating effect of demographic variables such as gender, age, income levels, and education were not tested which could be considered in the future studies concerning OGS adoption.

This study can be extended to other technical services such as mobile wallets, social media usage and more variety of products offered as services for developing markets like India. Future studies can also incorporate variables like social influence, status symbol, service quality and other facilitating conditions to get a broader perspective.

- Adamides, G., Marianthi, G., & Savvides, S. (2006). Traditional Vs Online Attitudes Towards Grocery Shopping In Cyprus. In Computers in Agriculture and Natural Resources, 23-25 July 2006, Orlando Florida (p. 60). American Society of Agricultural and Biological Engineers.

- Akram, U., Hui, P., Khan, M.K., Yan, C., & Akram, Z. (2018). Factors affecting online impulse buying: evidence from Chinese social commerce environment. Sustainability, 10(2), 352.

- Boaler, M. (2020). New Retail a Game Changer for Sustainable Development.

- Chandra S., 2021. Invest India – Retail & E-commerce https://www.investindia.gov.in/sector/retail-e-commerce

- Chatterjee, S. (2016). E-commerce in India: A review on culture and challenges. International Conference on Soft Computing Techniques and Implementations (ICSCTI), art.no.7489547.

- Choudhury, R (2017). Challenges and future of grocery business in India; Advance Research Journal of Multidisciplinary Discoveries. 14.0, C-3 (2017):09-19 ISSN-2456-1045

- Colla, E., & Lapoule, P. (2012). E‐commerce: exploring the critical success factors. International Journal of Retail & Distribution Management.

- Dominici, A., Boncinelli, F., Gerini, F., & Marone, E. (2021). Determinants of online food purchasing: The impact of socio-demographic and situational factors. Journal of Retailing and Consumer Services, 60, 102473.

- Gopal, R., & Jindoliya, D. (2016). Consumer buying behaviour towards online shopping: A literature review. International journal of information research and review, 3, 3385-3387.

- Ha, S., & Stoel, L. (2009). Consumer e-shopping acceptance: Antecedents in a technology acceptance model. Journal of business research, 62( 5), 565-571.

- Hanus, G. (2016, September). Consumer behaviour during online grocery shopping. In CBU International Conference Proceedings (Vol. 4, pp. 010-013).

- Internet and Mobile Association of India (IAMAI) Report, November 2019

- Jain, S. & Sayyed, A. (2020). Online Grocery Industry: Retail Transformation in India as an Impact of COVID-19, International Journal of All Research Education and Scientific Methods.

- Jhaveri, A., & Anantharaman, A. (2016). Royal India food retail: struggling to stay fresh. Emerald Emerging Markets Case Studies.

- Joseph, M. (2008). Impact of organized retailing on the unorganized sector (No. 222). Working Paper.

- Kapuria, P., & Nalawade, H. S. (2021). Digitising Indian Retail: Analysing Challenges and Exploring Growth Models.

- Kashyap, N., (2020). Online Grocery Shopping in India: Anticipating Trends Post-Pandemic. European Journal of Molecular & Clinical Medicine, 10(07).

- Kaur, H. & Shukla, R. (2017). Consumer’s attitude for acceptance of online grocery shopping in India, International Journal of Current Research, 9 (05), 50776-50784.

- Kian, T.P., Loong, A.C.W., & Fong, S.W.L. (2018). Customer purchase intention on online grocery shopping. International Journal of Academic Research in Business and Social Sciences, 8 (12).

- Martín, Juan Carlos & Pagliara, Francesca & Román, Concepción. (2019). The Research Topics on E-Grocery: Trends and Existing Gaps. Sustainability. 11. 321. 10.3390/su11020321

- Mathur, M., & Goswami, S. (2011). Retail Goes Online-An Indian Perspective. IJMT, 19 (2).Mehra, S., & Shakeel, M. (2014). Comparative study of unorganised and organised retail:the case of Indian grocery market at NCR. International Journal of Research in Commerce, Economics and Management, 4 (10), 78-84.

- Meshram, J. (2020). How COVID-19 affected the online grocery buying experiences-A study of select cities of Mumbai and Pune. International Journal of Latest Technology in Engineering, Management & Applied Science (IJLTEMAS) Volume IX, Issue XI.

- Mitra, D. (2018). Analysis of the factors responsible for shifting from Traditional marketing to Online marketing: a study on consumers working in Organised sector in Kolkata. Jamshedpur Research Review. 7 (31). 74-80. ISSN 2320-2750

- Mkansi, M., Eresia-Eke, C., & Emmanuel-Ebikake, O. (2018). E-grocery challenges and remedies: Global market leaders perspective. Cogent Business & Management, 5 (1), 1459338.

- Noor, A. M., Zaini, Z. M., Jamaluddin, M. R., & Zahari, M. S. M. (2011). Exploratory studies on online grocery shopping. In 3rd International Conference on Informa-tion and Financial Engineering IPEDR . 12, 423-427.

- Parmar, G., & Chauhan, J. (2018). Factors affecting online impulse buying behaviour. International Journal of Education and Management Studies, 8 (2), 328-331.

- Prasad, D. C., & Raghu, Y. (2018). Determinant Attributes of Online Grocery Shopping In India-An Empirical Analysis. IOSR Journal of Business and Management, 20 (2), 18-31.

- Sreeram, A., Kesharwani, A., & Desai, S. (2017). Factors affecting satisfaction and loyalty in online grocery shopping: an integrated model. Journal of Indian Business Research.

- Verma, V., Sharma, D., & Sheth, J. (2016). Does relationship marketing matter in online retailing? A meta-analytic approach. Journal of the Academy of Marketing Science, 44 (2), 206-217.

- Yu, T. K., & Wu, G. S. (2007). Determinants of internet shopping behavior: An application of reasoned behaviour theory. International Journal of Management, 24 (4), 744.

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Elsevier - PMC COVID-19 Collection

The impact of COVID-19 on the evolution of online retail: The pandemic as a window of opportunity

Levente szász.

a Faculty of Economics and Business Administration, Babeș-Bolyai University, 400591, Cluj-Napoca, Teodor Mihali str, 58-60, Romania

Csaba Bálint

b National Bank of Romania, 030031, Bucharest, Lipscani str. 25, sector 3, Romania

Ottó Csíki

Bálint zsolt nagy, béla-gergely rácz, dénes csala.

c Department of Engineering, Lancaster University, Engineering Building, Lancaster University, Lancaster, LA1 4YW, United Kingdom

d Economics Observatory, School of Economics, University of Bristol, Beacon House, Queens Road, Bristol, BS8 1QU, United Kingdom

Lloyd C. Harris

e Alliance Manchester Business School, University of Manchester, Booth St W, Manchester, M15 6PB, United Kingdom

Associated Data

Data will be made available on request.

Pandemic-related shocks have induced an unexpected volatility into the evolution of online sales, making it difficult for retailers to cope with frequently occurring, drastic changes in demand. Relying on a socio-technical approach, the purpose of this paper is to (a) offer a deeper insight into the driving forces of online sales during the pandemic, and (b) investigate whether pandemic-related shocks accelerate the long-term growth of online retail. Novel, high-frequency data on GPS-based population mobility and government stringency is used to demonstrate how time spent in residential areas and governmental restrictions drive the monthly evolution of online sales in 23 countries. We deconstruct these effects into three main phases: lure-in, lock-in, and phase-out. Lastly, using time series analysis, we show that the pandemic has induced a level shift into the long-term growth trend of the online retail sector in the majority of countries investigated.

1. Introduction

The outbreak of the pandemic caused by the spread of a novel type of coronavirus, SARS-CoV-2, has induced an unprecedented shock to the global economy in terms of its speed and encompassing nature, having a significant impact on virtually all countries and economic sectors. During the pandemic, businesses and consumers have been forced continuously to adapt to the immediate and drastic changes brought about by this crisis. Furthermore, there is a general consensus that there will be long lasting global effects and the world economy will return to a “ new normal ” ( Roggeveen and Sethuraman, 2020 ; Sneader and Singhal, 2021 ).

As with similar health-related and economic crises in the past, it is widely accepted that online retail represents a sector that plays a crucial role ( Li et al., 2020 ; Guthrie et al., 2021 ), providing vital access for customers to essential products ( Kirk and Rifkin, 2020 ; Martin-Neuninger and Ruby, 2020 ). Given its significant role, the present paper focuses on the evolution of online retail during the COVID-19 pandemic and analyses the short-term and potential long-lasting effects of this crisis.

Most of the existing papers studying the interaction between the early-stage of the pandemic and the online retail sector report that in several countries the outbreak of COVID-19 led to an unprecedented surge in online retail demand (e.g., Gao et al., 2020 ; Hobbs, 2020 ; Hwang et al., 2020 ). These observations are supported by commentators suggesting that in 2020 the “share of e-commerce in retail sales grew at two to five times the rate before COVID-19” ( Lund et al., 2021 ). However, only a few studies acknowledge that, beyond the general upswing, the pandemic has increased the volatility of online sales evolution. Furthermore, literature offers little guidance on which factors can explain these changes in online sales during a crisis when traditional market mechanisms do not function as usual. In response, therefore, this paper aims to use large-scale, longitudinal data covering 23 different countries and multiple waves of the pandemic to investigate the drivers of short-term online retail evolution during COVID-19 .

While some researchers have tentatively begun to explore these short-term effects (e.g., Chang and Meyerhoefer, 2021 ; Eger et al., 2021 ), the longer-lasting implications of the pandemic on the online retail sector have yet to be studied empirically. Most scholars emphasize the need to investigate whether the pandemic has truly altered the evolution trajectory of online retail or if the current crisis is merely a single shock after which the sector will return to its traditional evolutionary path as consumers and retail businesses return to their “old habits” in the post-pandemic period ( Sheth, 2020 ; Eger et al., 2021 ; Reardon et al., 2021 ; Schleper et al., 2021 ). Consequently, given the uncertainty of what the “ new normal ” might bring for the online retail market, this paper also intends to use the most recent time series to investigate whether the pandemic has altered the long-term evolution of the sector .

In pursuing the two objectives (investigation of short-term drivers and long-term trend implications), this paper adopts Geels’ (2002) multi-level perspective (MLP) as a theoretical lens to investigate technological transitions in a complex socio-technical context. We interpret the pandemic as a force capable of opening a “window of opportunity” ( Dannenberg et al., 2020 ). Such windows constitute powerful tensions created at the level of the socio-technical landscape that bring a unique possibility for a technological novelty to break through and become more dominant in mass markets ( Geels, 2004 ). Hence, we explore the interplay between the window of opportunity opened by COVID-19 and the growth of the online retail sector. More specifically, we aim to investigate (a) the short-term driving forces behind the exponential evolution of the online retail sector during the pandemic, and (b) whether the pandemic has truly created a window of opportunity for a positive shift in the long-term evolution of online retail. Along with pursuing these objectives we also aim to provide a theoretical contribution to the literature on windows of opportunity, a central concept that has received only limited attention in previous MLP studies ( Geels, 2011 ; Dannenberg et al., 2020 ). In this regard, our paper aims to offer a more detailed insight into how a technological transition path might behave during such a period and to provide a means to evaluate the potential long-term effect of windows of opportunity.

2. Literature review

2.1. the impact of covid-19 on online retail.

Given the crucial role of online retail channels during a pandemic, researchers have examined a variety of ways in which COVID-19 has influenced online shopping. As COVID-19 was first identified in China, initial studies investigated how the outbreak of the crisis has reshaped the retail landscape in China with emphasis on the increasing importance of online channels ( Gao et al., 2020 ; Guo et al., 2020 ; Hao et al., 2020 ; Li et al., 2020 ; Jiang and Stylos, 2021 ). These studies focused on how the outbreak of the pandemic influenced online shopping ( Gao et al., 2020 ; Guo et al., 2020 ), and how online channels helped the population to cope with the emerging health-crisis ( Li et al., 2020 ; Hao et al., 2020 ).

Given the narrow focus of initial studies, authors called for further research in other countries better to understand the global impact of the pandemic on online retail ( Gao et al., 2020 ; Li et al., 2020 ; Jiang and Stylos, 2021 ). Subsequent studies taking this research avenue offered a good cross-section globally by covering multiple different countries but investigated almost exclusively the short-term impacts of COVID-19 on online retail, using data from the first wave of the pandemic ( Table 1 ). Moreover, observers typically argued that the major driving forces behind the exponential proliferation of online channel use in the context of COVID-19, can be grouped in two distinct, but intertwined categories: (a) governmental regulations and restrictions, and (b) pandemic-induced changes in customer behavior. In line with this observation, Shankar et al. (2021) also contend that “many shoppers move a large portion of their business online during the COVID-19 outbreak either by choice or due to regulation …” . Therefore, the next two subsections review the studies that attribute the changes in online sales to one of these two factors.

Summary of the literature on the impact of COVID-19 on the evolution of online retail.

| Author(s) | Country (retail branch) | Period | COVID-19 implications | |

|---|---|---|---|---|

| Short-term drivers | Long-term implications | |||

| China (various sectors) | First wave (Feb 2020) | (number of COVID-19 cases/day/city) | – | |

| China (food retail) | First wave (Feb 2020) | (reduce health risks, gain access to food products) | – | |

| China (food retail) | First wave (Feb 2020) | (food stockpile behavior associated with online channels; community-based ordering) | – | |

| China (food retail) | First wave | (securing food supply for the urban population) | – | |

| China (various sectors) | First wave (Feb–Mar 2020) | (digital engagement during lockdowns) | ||

| Vietnam (various sectors) | First wave (Jan–Mar 2020) | (Fear of pandemic) | Depending on COVID-19 lifespan, consumer behavior might change in the long run. | |

| New Zealand (various sectors) | First wave (Feb–Mar 2020) | (travel restrictions and lockdown policies) | – | |

| New Zealand (grocery) | First wave (Feb–Apr, 2020) | (lockdown policies) | Negative online experience can have a long-term impact | |

| Czech Republic (various sectors) | First wave (Apr, 2020) | spread of COVID-19) (government restriction) | – | |

| India (food retail) | First wave (Apr, 2020) | (Fear for health) | – | |

| US (craft and art supplies) | First wave (until Apr, 2020) | (government-issued interventions) | – | |

| Taiwan (food retail) | First wave (Jan–Apr, 2020) | (number of new infections) (media consumption) | Customers trying the online channel for the first time might continue using this channel | |

| Belgium (various sectors) | First wave (Apr–Jun 2020) | (travel restrictions, social distancing rules) | The ad-hoc setup of local online retail channels threatens their post-covid sustainability | |

| France (para-pharmaceutical, healthcare, well-being and beauty) | First wave (until Jul 2020) | (panic buying, coping with and adapting to the pandemic context) | – | |

| Canada (food retail) | First wave | (panic buying) (stay-at-home and distancing orders) | Online food retail will receive a sustained upward shift in adoption | |

| US (various sectors) | First wave | (social distancing rules) | – | |

| n.a. (various sectors) | First wave | (lower accessibility of stores) (health concerns) | Further store closures or bankruptcy of major brick and mortar retailers | |

| Asia and Latin America (food retail) | First wave | (lockdown policies) | – | |

| n.a. | First wave | (impact of a disaster and crisis on shopping behavior) | – | |

| Czech Republic (various sectors) | Second wave (Sep 2020) | (fear for health) | Customers might change their shopping habits in the long run | |

| India (mobile shopping) | Second wave (Sep–Dec 2020) | (fear of Covid-19) | – | |

2.1.1. Studies highlighting the impact of changing customer behavior

Adopting a behavioral perspective, Chang and Meyerhoefer (2021) illustrated how the first wave in Taiwan (where no strict stay-at-home orders or business closures were imposed) has shifted consumers’ attention towards online channels. In the early weeks of the pandemic the surge in the number of confirmed cases increased both sales and the number of customers of online food commerce. The change in customer behavior was also induced by the media, as COVID-19 related press articles and Google searches also positively correlated with online food sales.

In a similar manner, Sheth (2020) argued that the pandemic had several powerful and immediate effects on consumer behavior: while facing constraints, consumers improvised and replaced old habits with new ones, such as switching to online retail channels, enabling thereby the “store to come home”. In line with this, Jiang and Stylos (2021) proposed that individual pressures during lockdowns force consumers to create a “new retail purchasing normality” involving higher digital engagement and increased online purchases. Consultancy papers also supported this view. A multi-country survey conducted by McKinsey & Company demonstrated that the pandemic induced a major shift in consumer behavior, at least two thirds of customers having tried new, mostly online forms of shopping ( Sneader and Singhal, 2021 ).

In terms of shifting consumer behavior, Tran (2021) proposed that fear of the pandemic can also drive online purchasing intentions aiming to improve the health safety of the consumer and the surrounding community. Researchers focusing on the second wave of the pandemic ( Chopdar et al., 2022 ; Eger et al., 2021 ) also connected the fear of the virus to increased online shopping. One exception is identified by Mehrolia et al. (2021) , concluding that a considerable majority of Indian customers decided not to order food through online channels during the first wave of the pandemic due to the fear connected to food delivery.

Hao et al. (2020) focused on a different aspect of customer behavior. Their study points out that panic buying (i.e., ordering more than the short-term necessity of the household due to fear), which is a common consumer response during disasters, is more associated with online food retail channels than with traditional channels. Following this idea, Guthrie et al. (2021) use the react-cope-adapt model ( Kirk and Rifkin, 2020 ) to illustrate that during the first month of the pandemic in France consumers reacted by panic buying, dramatically increasing the online purchasing of essential products. This period was followed by coping with the crisis which led to an increase of online orders related to non-essential products. The adapt phase was supposed to show a sustained modification of online purchasing behavior. However, due to limited data available, the authors concluded that long-term behavior changes require further investigation.

2.1.2. Studies highlighting the impact of government regulations

During the pandemic, several governmental restrictions had an immediate impact on online retail. For example, Martin-Neuninger and Ruby (2020) and Hall et al. (2021) identify government-related factors, namely the lockdown period and travel restrictions, as primary reasons behind the surge in online shopping in New Zealand. Hobbs (2020) also argued that initial stay-at-home and distancing orders issued in Canada led to an uptake of the online food retail: while online grocery deliveries were already used by early adopters in the pre-pandemic era, during the outbreak many late-adopter customers tried this channel for the first time. Jílková and Králová (2021) reported similar phenomena in the Czech Republic for all generational cohorts. In summary, unexpected regulations imposed by governments determined an immediate increase in demand for online shopping: existing customers started to use online channels more frequently, while new customers, including older and less tech-savvy generations, turned to online channels for the first time ( Hwang et al., 2020 ; Pantano et al., 2020 ).

From the retailer’s perspective, Reardon et al. (2021) provided several case examples of Asian and Latin American food industry firms strengthening their e-commerce business models or reconfiguring their entire food supply chains as a response to early-stage lockdown policies. Based on a survey among small Belgian retailers, Beckers et al. (2021) found that restrictions have doubled online orders during the first wave of the pandemic. To match the increase in demand, half of the retailers not using online channels before the pandemic opened one during the first months of COVID-19. Based on a literature review, Kirk and Rifkin (2020) also predicted that in order to conform to social distancing regulations, online retail coupled with contactless distribution methods would substantially gain ground during the pandemic. However, results related to the long-lasting effects of the pandemic on online retail are still “speculative in nature” ( Hobbs, 2020 ). Many of the customers who made the shift due to the restrictions might continue to utilize online channels in the long run. Other customers might return to traditional channels as soon as possible ( Beckers et al., 2021 ; Mehrolia et al., 2021 ). Thus, whether online retail can capitalize on the pandemic in the long run is still a subject of debate.

2.1.3. Summary and research questions

A summary of the key studies is provided in Table 1 in chronological order, highlighting the short-term drivers (i.e., government regulations and/or customer behavior, beside the papers narrowly focusing on the effect of the pandemic itself) and potential long-term implications related to the growth of the online retail sector.

Based on the literature, we derive two main conclusions that serve as basis for our research questions. First, as demonstrated in Table 1 , there is a plethora of mostly anecdotal, non-empirically-based evidence that during the pandemic (and beside the pandemic itself) two major factors, i.e., government restrictions and consumer behavior changes, drove a significant initial surge in online shopping. Second, extant studies failed to offer insights into how these factors drive online sales during the entire period of the current pandemic ( Schleper et al., 2021 ). Therefore, we cover the full period of COVID-19 to date and provide more conclusive empirical evidence on how these two factors influence the evolution of online retail.

RQ1. How do changes in customer behavior and government regulations drive the evolution of online retail during the pandemic?

Moreover, the long-term implications of this change in online retail use have remained, so far, a subject of anecdotal speculation ( Table 1 ). However, changes to the retail sector might become a constant in the “ new normal ”, and further research is needed “to understand the short-term and long-term impact of the pandemic on consumer behavior and provide guidance on how retailers should cope with those changes” ( Roggeveen and Sethuraman, 2020 ). Hobbs (2020) suggested that COVID-19 prompted sceptics and late-adopters to use online retail channels, and these new customers are likely to continue to shop online even after the pandemic. More cautious voices, however, asked the question whether the pandemic has “swung the pendulum too far and too fast towards online shopping” ( Gauri et al., 2021 ), which may potentially result in an unsustainable boost to online retail. Thus, the extent to which this shift will lead to a fundamental leap in the long-term role of online retailing is unknown.

RQ2. What trend-shifting impact does the pandemic have on the long-term evolution of online retail?

In answering RQ1 and RQ2 we also aim to extend the scope of existing research ( Table 1 ) in four different aspects. Given that COVID-19 is a global phenomenon, we aim to cover a larger geographical region compared to the majority of previous studies focusing on a single country. Second, in contrast with existing research mostly investigating a single branch of the online retail sector, we propose to analyze the online retail sector as a whole, covering the sales of all types of products. Third, we integrate novel measures into the analysis that have emerged during this pandemic (mobility indicators, government stringency index) to be able better to explain the evolution of the online retail sector during this crisis. Fourth, we investigate a longer period before and during the pandemic than previous studies to infer long-term implications.

2.2. A socio-technical approach to study the evolution of online retail during COVID-19

The multi-level perspective (MLP) has been established as insightful in studying COVID-19 related developments in the online retail sector ( Dannenberg et al., 2020 ). Consequently, we use the MLP as a theoretical lens to study the short and long-term evolution of online retail. Geels (2002) argues that the central tenet of MLP is that technological transitions are not only dependent on the development of the technology itself, but also pivot on the broader socio-technical context. In line with this view, technological transition represents a change from one socio-technical configuration (regime) to other: beyond the substitution of an older technology with a newer one, such transitions include changes in other socio-technical dimensions such as infrastructures, policies, user practices, and markets ( Geels, 2002 , 2004 ).

According to the MLP, technological transitions are shaped by the interaction between developments unfolding on three analytical levels ( Geels, 2002 , 2004 , 2011 ):

- • Technological niches represent the micro-level of the MLP. Niches are quasi-protected spaces where radical innovations are developed (e.g., R&D laboratories, subsidized development projects, or specific user categories supporting emerging innovations). They are unstable socio-technical configurations where innovations are carried out by a limited number of actors. Processes in the niche are gradually linked together and stabilize in time into a dominant design that allows for the radical innovation to break through to the next level.

- • Socio-technical regimes represent the meso-level of the MLP. Regimes refer to “the semi-coherent set of rules that orient and coordinate the activities of social groups” ( Geels, 2011 ) creating thereby a “deep structure” that ensures the stability of the current socio-technical system. Nevertheless, the semi-coherence of these rules allows for a dynamic stability which enables further incremental innovation, with small adjustments accumulating into stable technological transition paths. A socio-technical regime is formed by the co-evolution of different sub-regimes, each with its own set of rules and dynamics: user and market, technological, science, policy, and socio-cultural sub-regimes. According to Geels (2004) , the socio-technical regime can be understood as the meta-coordination of the different sub-regimes that determines technology adoption and use.

- • The socio-technical landscape represents the macro-level of the MLP. The landscape provides a wider, technology-external context for the interactions of actors within the niche and the socio-technical regime. Actors cannot influence elements of the landscape on the short-run, and changes at the landscape level take place usually slowly, representing longer-term, deep structural tendencies (e.g., macroeconomic processes, cultural patterns, political trends).

An important implication of the MLP is that the future evolution of a (new) technology does not only depend on the processes within the niche, but also on the interactions between different levels; including the regime and landscape levels. Geels and Schot (2007) contend that the general pattern of technology transition involves all three levels: (1) niche innovations align and gain internal momentum, (2) landscape developments put pressure on existing regimes, and (3) regimes destabilize creating an opportunity for niche innovations to break through to mass markets.

In terms of the interplay between COVID-19 and online retailing, another important concept linked to the MLP is the “window of opportunity”. Geels (2002) argues that windows of opportunity are created when tensions appear in the current socio-technical regime or when landscape developments put a pressure on the current regime for internal restructuring. These tensions loosen the rules of the socio-technical regime and create opportunities for technologies to escape the niche-level and become more deeply embedded in the regime. Competition with the existing technology becomes more intensive, triggering wider changes in the regime, where the new technology may replace the old one in the long run ( Geels, 2004 ).

Dannenberg et al. (2020) conclude that COVID-19 represents a critical landscape development that puts pressure on the socio-technical configuration of the retail sector. In line with our literature review, they suggest that two sub-regimes were particularly affected: policy regime (government regulations) and, user and market regime (sudden change in customer behavior). The authors further argue that these two major changes have opened a window of opportunity for online grocery retail to gain substantial market share. In this regard, RQ1 aims to investigate how the developments within these two dimensions influence the evolution of the online retail sector during the opening up of a window of opportunity ( Fig. 1 ). Given that, to date, the MLP offers little insight into the evolution of a technology during a window of opportunity ( Dannenberg et al., 2020 ), answering RQ1 should enrich this theoretical framework by explicating the forces that drive technology transitions during tensions in the landscape and the socio-technical regime (i.e., during a window of opportunity).

COVID-19 and the trajectory of online retail evolution (adapted from: Geels, 2002 ; Dannenberg et al., 2020 ).

Concerning the long-term impact of this window of opportunity, we investigate whether it enables the online retail sector to gain a significantly higher share of the whole retail sector on the long run (technology trajectory in Fig. 1 ) to the detriment of offline channels ( Helm et al., 2020 ). However, in the long run, MLP is not necessarily about mapping “winning” technologies that entirely replace/reconfigure existing regimes: it is just as possible that the breakthrough of a new technology will lead to a symbiosis with incumbent socio-technical regimes ( Geels, 2002 ; Genus and Coles, 2008 ). Thus, in our case, the question is more about the relative share of online retail and physical retail within the retail sector (cf. omnichannel retailing, Gauri et al., 2021 ). Beside speculation, current literature offers little guidance in this regard. Dannenberg et al. (2020) suggest that even if the pandemic has led to an upswing of online shopping, there is no indication for a fundamental long-term shift from physical to online retail. The authors, however, base their assumptions on a limited set of data, both from a temporal (March–May 2020) and from a geographical/sectoral perspective (German grocery retail). On the other hand, many other authors advocate a breakthrough of online retail as a result of taking advantage of the window of opportunity created by the pandemic (e.g., Chang and Meyerhoefer, 2021 ; Hobbs, 2020 ; Tran, 2021 ). Answering RQ2 is designed to explicate and illuminate further this debate.

3. Data and variables

3.1. data used in short-term analysis (rq1).

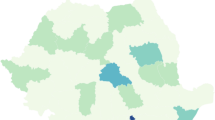

To investigate RQ1, we use as dependent variable the monthly evolution of online retail sales during the pandemic (Feb 2020–Jan 2022) in European countries. We rely on Beckers et al. (2021) who define online retail channel use as the selling of goods via mail, phone, website, or social media. Therefore, we adopt NACE-level retail trade data published by Eurostat using the index of deflated turnover (i.e., turnover in real terms, 2015 = 100) for the “Retail sale via mail order houses or via Internet” sector. Seasonally and calendar adjusted time series data is used to assess the monthly changes during the pandemic in this sector, shortly denoted from now on “online retail” ( ΔOnline_retail ). In terms of countries, the Eurostat database was deemed the most suitable to study our research questions as it provides online retail data for 23 European countries (20 countries of the European Union, plus Norway, UK, and Turkey, covering thereby all major economies from Europe). This sample offers a rich variety of pandemic-related contexts: each of these countries was hit by the pandemic to a different extent and the reaction of authorities was also fairly diverse ( Hale et al., 2021 ). Fig. 2 illustrates the evolution of the ΔOnline_retail variable in these countries.

Monthly changes in online retail turnover during the pandemic in the countries investigated.

To investigate this volatile evolution, two novel measures are used as explanatory variables that have been introduced recently as a response to the need to track social phenomena more frequently and more precisely during the pandemic.

The first variable is a proxy of changes in general customer behavior: population mobility . Shankar et al. (2021) argue that during a period characterized by dramatic and frequent changes in shopping behaviors, high-frequency, mobile GPS data can offer better information for retailers. Therefore, we integrate into our analysis the mobility data provided by Google® through their Community Mobility Reports ( Google, 2021 ), comprising several types of mobilities grouped by the destination/location of the mobility. Based on Beckers et al. (2021) who argue that COVID-19 has temporarily put an end to hypermobility cutting short consumers’ physical range around their homes, we select the residential component ( ΔResidential ) from the different forms of mobility, arguing that the changes in residential mobility (i.e., amount of time spent at home) could be the strongest component to explain changes in online shopping. Given that there might be some time needed for online shopping behavior to adjust to changes in mobility, the one-month lagged version of the variable is also used in our model ( ΔResidential(-1) ).

The second explanatory variable incorporated in our analysis is related to government restrictions . We use data from the Oxford COVID-19 Government Response Tracker, more precisely the values of the COVID-19 Stringency Index which aggregates the stringency of lockdown-type governmental measures, such as school closures, travel restrictions, bans on public gatherings, workplace closures, etc. ( Hale et al., 2021 ). This represents the most suitable proxy to measure the type of regulations connected by previous literature to online channel use during the pandemic ( Table 1 ). The index provides a multi-country panel of daily frequency, measured as a percentage value; 100% representing the highest level of stringency. To match the frequency of the dependent variable, the monthly change of the index is computed as explanatory variable ( ΔGovernment_stringency ). The one-month lagged variant is also introduced in the analysis ( ΔGovernment_stringency(-1) ).

Beside the two novel explanatory variables generated during the pandemic, we integrate several control variables in our analysis. These variables assess the income and purchasing power of the population (GDP/capita and unemployment level in each country), the level of urbanization (density of the population in each country), the level of education (percentage of the population attending tertiary education), the pervasiveness of online channels (Internet penetration), and the actual pervasiveness of online shopping (Online retail share in the retail sector) ( Hortaçsu and Syverson, 2015 ). Data for all countries analyzed are retrieved from the Eurostat database. The unemployment variable has a monthly frequency ( Δ Unemployment ), while the other variables ( GDP/capita, Internet penetration, Tertiary education, Population density, Online retail share ) change on a yearly basis. Descriptive statistics for the monthly variables are provided in Table 2 . The correlation matrix is included in Appendix A.

Descriptive statistics of the main variables included in the short-term analysis.

| Variables | ||||||

|---|---|---|---|---|---|---|

| Statistics | Δ Online retail | Δ Unemployment | Δ Residential | Δ Residential (−1) | Δ Government stringency | Δ Government stringency (−1) |

| 0.0206 | −0.0132 | 0.0039 | 0.0035 | 2.1595 | 2.1232 | |

| 0.0087 | −0.1000 | 0.0027 | 0.0021 | 0.0000 | 0.0000 | |

| 0.5520 | 1.5000 | 0.2071 | 0.2071 | 58.0242 | 58.0242 | |

| −0.2554 | −2.0000 | −0.1321 | −0.1321 | −31.4557 | −31.4557 | |

| 0.0904 | 0.4170 | 0.0419 | 0.0426 | 13.5469 | 13.7702 | |

| 1.1902 | 0.1672 | 0.7464 | 0.7609 | 1.37032 | 1.36048 | |

| 7.1846 | 6.1327 | 5.3353 | 5.2217 | 5.8321 | 5.70269 | |

| 507 | 509 | 552 | 529 | 552 | 529 | |

3.2. Data used in long-term analysis (RQ2)

To evaluate the trend-shifting potential of the pandemic in the online retail sector, the same retail trade data is used as for the short-term analysis, covering however a longer period of time between Jan 2000 and Jan 2022 ( Online_Retail ). To offer an overview of the long-term evolution of our focal variable, we present a boxplot containing data for all countries aggregated to annual averages, normalized on a 0–100 scale ( Fig. 3 , left). Primary visual inspection suggests that two periods can be distinguished in terms of the dynamism of the sector (2000–2010 characterized by slower growth pace versus 2011–2021 showing stronger momentum), while the relatively higher values of the last two boxplots indicate that it is beneficial to investigate whether the pandemic has induced a level shift into the evolution of online retail.

Long-term evolution of online retail turnover (left) and online retail market share (right) in the countries investigated (normalized: min = 0, max = 100).

Furthermore, to assess whether the online retail sector could exploit the window of opportunity opened by the pandemic, we compute another variable as a proxy measuring the share of online retail in total retail sales. For this purpose, we calculate the ratio between the indices of deflated turnover of online retail and the “Retail trade, except of motor vehicles and motorcycles” sector, this latter being a proxy for total retail sales ( Online_Retail_Ratio ≈ Online_Retail/Total_Retail ) ( Fig. 3 , right). The ratio approach is also consistent with theory (symbiotic technologies: Geels, 2002 ) and previous research ( Hortaçsu and Syverson, 2015 ).

4. Analysis and results

4.1. short-term analysis (rq1), 4.1.1. panel regression analysis.

To illuminate the impact of mobility and government restrictions on the monthly evolution of online sales, we have elected to implement a panel regression model. We have performed three random-effects and three cross-section fixed-effects panel regressions. We opted for the panel specification because it enables us to harness the rich structure of our data and to account for the unobserved heterogeneity present in the data. We perform 2 × 3 = 6 regressions because of the different methodology (fixed vs. random effects), and the 3 combinations resulting from including only the government stringency variables, only the residential mobility variables, and both. Five control variables were nearly collinear in the fixed effects case; therefore Table 3 presents only the estimates for these variables in the random effects case. Our main specification is the following:

where C i j t and β ( C ) j are the independent variables and their coefficients, i is the index of countries, t of time, and j of the equation variables.

Regression models.

| Dependent variable: Δ Online retail | ||||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| Fixed effects (FE) | Random effects (RE) | |||||

| – | – | – | −0.000000 (−0.64) | −0.000000 (−0.39) | −0.000000 (−0.61) | |

| – | – | – | −0.000656 (−0.47) | −0.000546 (−0.39) | −0.000554 (−0.40) | |

| – | – | – | −0.000405 (−1.30) | −0.000485 (−1.55) | 0.000428 (−1.38) | |

| – | – | – | 0.028760 (1.04) | 0.031739 (1.15) | 0.028319 (1.03) | |

| – | – | – | −0.000011 (−0.01) | 0.000033 (0.04) | −0.000011 (−0.01) | |

| 0.010779 (1.65) | 0.001487 (0.15) | 0.008275 (0.84) | 0.007104 (0.61) | −0.007929 (−0.67) | −0.001937 (−0.16) | |

| 0.283552 (1.72) | 0.228287 (1.10) | |||||

| 0.000801 (1.52) | 0.000615 (1.01) | |||||

| 0.001006 (1.94) | ||||||

| 0.204 | 0.202 | 0.217 | 0.220 | 0.219 | 0.237 | |

| 0.160 | 0.158 | 0.169 | 0.203 | 0.202 | 0.216 | |

| 4.60 | 4.55 | 4.57 | 12.91 | 12.78 | 11.28 | |

| 456 | 456 | 456 | 374 | 374 | 374 | |

Notes: t-values in parentheses; *significant at 0.05; **significant at 0.01.

Results of the fixed effects specifications of our panel regression model (equations 1 to 3) indicate that our first variable of interest, residential mobility, and its one-period lag, have a significant impact on the monthly change in online retail sales, both variables having the expected positive sign. The same can be pointed out for the government stringency and lag variables. However, when we include both residential mobility and government stringency, only the first remains significant, due to high collinearity between the two explanatory variables. The results are similar in the random effects case (equations 4 to 6). The goodness-of-fit statistics (adjusted R-squared, F-statistic) are quite high for panel regressions, indicating that the explanatory variables introduced in the panel explain a large proportion of the variation of the monthly change in online retail sales.

Thus, results altogether indicate that both residential mobility and government stringency are significant predictors of online retail channel use: as residential mobility increases (i.e., people spend more time at home) and, alternatively, as government stringency increases (i.e., anti-COVID-19 measures become stricter) the use of online retail channels increases. Furthermore, the impact of all control variables is insignificant, meaning that mobility and government stringency indicators provide a better explanation for the variation of online retail sales during the pandemic than traditional variables that have been used to explain the evolution of the online retail sector in pre-pandemic periods.

4.1.2. Detailed analysis of short-term effects

While panel regression results show that both residential mobility and government stringency are good predictors of the evolution of online sales, relationships between variables are rarely perfectly linear. Therefore, we provide a more detailed analysis on the interplay between these variables. Fig. 4 illustrates the monthly evolution of online sales (vertical axis) together with the monthly percentage change in residential mobility (horizontal axis) for the entire period of the pandemic, each dot representing one country in one month.

Monthly evolution of online sales and residential mobility during the pandemic in the countries investigated.

Beside the general positive relationship between the two variables, the scatter plot also indicates that three different forces can be identified that shape the evolution of online retail sales during the pandemic. First, there are periods in which mobility is restricted more and more to residential areas, and consumers adapt by significantly increasing their monthly spending on online retail channels (as high as +30–50% during the first wave of the pandemic). This process is exactly what was expected during the pandemic: as the mobility range of people is restricted primarily to their homes, they turn to online retail channels more frequently. This process is termed the “lure-in” phase. Typical months during which the lure-in phase was dominant were Mar 2020, Apr 2020, Oct–Nov 2020, Nov 2021, and Jan 2022 ( Fig. 5 ).

Monthly evolution of online sales and residential mobility during different phases of the pandemic in the countries investigated.

However, it is also observable that when consumers are not confined to residential areas and start increasing their mobility outside their homes (i.e., residential mobility decreases), a decrease in online spending does not follow automatically, as people tend to continue to use, or even increase the usage of, online retail channels. Additionally, in many cases a large drop in residential mobility is paired with no significant change in online retail sales. These cases are labelled as the “lock-in” phase, which means that temporarily consumers remain users of online channels even if their mobility would allow them to use offline channels more intensively. Thus, mobility restrictions have an immediate (lure-in), but also a lagged (lock-in) impact on online retail channel use, in line with the significance of lagged variables in our panel regression model ( Table 3 ). The most typical months in which several European countries went through this lock-in phase were May 2020, Jun 2020, Feb 2021, Mar 2021 ( Fig. 5 ). This phase is not as consistent on a monthly basis as the lure-in phase, several countries experiencing a negative change in online channel use, concurrently with the decrease of residential mobility.

Lastly, there is also a “phase-out” period denoting cases where online retail use decreases, while time spent at home generally decreases. During these months a part of the former online shopping volume of customers is most probably replaced by (or allocated back to) offline channels. Furthermore, in some rare instances residential mobility has a slight increase, while consumers still decrease their online spending. Predominantly phase-out months include Jul 2020, May–Jul 2021, Dec 2021 ( Fig. 5 ).

The same three phases can be observed if the residential mobility indicator on the vertical axis is replaced by the government stringency index ( Fig. 6 , Fig. 7 ). In summary, there is a clear lure-in phase which was noticeable especially during the beginning of the first and second wave of the pandemic (Mar–Apr, 2020; Oct–Nov 2020): sudden drops in mobility and severe governmental restrictions clearly prompt customers to shop online. This effect has some “stickiness” (lock-in phase) because as governmental restrictions are eased, certain customers continue to use (or even increase the use of) online retail channels. Nevertheless, after a relatively short period the lock-in effect fades and customers drop their online shopping volume significantly (phase-out), countervailing to some extent the argument of the pandemic-induced upward boost of the online retail sector. Thus, while illuminating in other respects, this analysis, in itself, is unhelpful regarding the longer-term implications of the pandemic for the online retail sector. The next section aims to address this deficiency.

Monthly evolution of online sales and government stringency during the pandemic in the countries investigated.

Monthly evolution of online sales and government stringency during different phases of the pandemic in the countries investigated.

4.2. Long-term analysis (RQ2)

To investigate the potential trend-shifting impact of the pandemic in the online retail sector, a two-step approach is applied. First, to establish a basis for comparison, we analyze the 20-years trend of the sector without considering the specific effect of the pandemic. Second, based on the long-term trend established, we focus on the period of the pandemic, and use outlier detection methods to estimate whether the pandemic has induced a level shift in the long-term trend of the sector.

4.2.1. Long-term trend analysis

Online retail sales and online retail market shares show an increasing tendency during the last 20+ years ( Fig. 3 ). While the retail sector as a whole had a slight increasing tendency during this period, the average annual growth rate of the online retail sector was clearly higher. This difference is most visible during the last ten years when the online retail sector has been constantly on an increasing trajectory, thereby raising its market share within the total retail sector. Thus, the online retail sector has been benefitting from continuous market share gains with a relatively lower growth pace in the early period (2001–2010), and with rapid increases in the last period (2011–2021). These differences are illustrated in Fig. 8 .

Average annual growth rates in the retail sector in European countries (%).

Next, we use unit root tests to statistically demonstrate that there is an underlying long-term growth trend in the data ( Chatfield and Xing, 2019 ), both in terms of monthly online retail turnover ( Online_Retail ) and in terms of online retail market share ( Online_Retail_Ratio ). Applying the most widely used Augmented Dickey-Fuller (ADF) test, we aim to show that there is a systematic, persistent stochastic trend in the time series (i.e., an upward tendency in our case). Unit root test results confirm that in most of the countries investigated the null hypothesis of one unit root cannot be rejected: the p-values are above 0.05 in 23 cases out of 24 in case of the Online_Retail variable and in 21 cases out of 24 for Online_Retail_Ratio . Thus, for the vast majority of countries neither Online_Retail , nor Online_Retail_Ratio is stationary, indicating that there is an (upward) long-term stochastic trend in the time series. Furthermore, unit root test results also imply that any positive or negative shock (such as the pandemic) during the period investigated has a persistent effect on the trend. Nevertheless, further investigation is needed to determine whether this shock applies for the pandemic period as well.

4.2.2. Outlier detection during the pandemic

Outlier detection is used to determine whether the pandemic has caused a level shift in the Online_Retail , and especially in the Online_Retail_Ratio time series. For this purpose, we use ARIMA 1 models with specific dummy regressors on both time series, implemented in JDemetra+ which is a proprietary software developed by the National Bank of Belgium in cooperation with the Deutsche Bundesbank and Eurostat. The software has been officially recommended since 2015 to the members of the European Statistical System and the European System of Central Banks as a tool for seasonal adjustment and other connected time series issues, such as outlier detection. In general, outliers are represented by abrupt changes in a time series caused by unexpected natural or socioeconomic effects, such as the pandemic. Three main types of outliers can be identified ( Fig. 9 ): (a) additive outlier (AO), which changes the time series for one period only, returning to the original trend afterwards, (b) level shift (LS) that causes a permanent (upward or downward) change in the level of a time series, and (c) transitory change (TC) whose effect of changing the time series is faded out over a limited number of periods ( IMF, 2018 ). Here, we specifically look for LS type outliers: a positive LS would suggest that online retail turnover and its market share registered a sudden increase during the pandemic, and that therefore the pandemic has accelerated the underlying growth trend of online retail.

Level shift versus other outlier types (source: IMF, 2018 ).