- What is customer research?

Last updated

Reviewed by

Designing products that both delight customers and solve their problems is essential in a competitive landscape!

But how do you identify what your customers want and need, let alone who your customers really are?

Customer research enables you to learn more about your customers, understand their motivations, and get to grips with their behavior on a deeper level. You can use all this knowledge to create truly user-centric products.

Customer research is how you understand your customers—their needs, pain points, and demographics.

It also allows you to dive into key aspects of customers’ motivations and behaviors. It’s about learning how customers act and what will encourage them to take certain actions.

This is important when developing products. Deeply understanding your customers helps you deliver products that are easy to use, satisfying, and better at solving problems.

You’ll keep designing products that fall short if you don’t know your customers well and can’t see things from their point of view.

- What’s the difference between customer research, market research, and user research

You may have heard the terms customer research, market research, and user research. They might sound similar and have some related functions, but they are distinct types of research.

Market research is generally conducted in the early stages of product creation. Its role is to generate an understanding of the whole market, including what people need and want from products. This type of research typically identifies market readiness, size, competition, and demographics.

While market research is broad, customer research is more specific. It’s a process by which data and information collected during market research are analyzed, grouped, and evaluated. You can think of it as an extension of market research, though some organizations may perform these functions simultaneously.

The focus of user research is generally on understanding what is and isn’t working with current products and where helpful innovation can occur.

- Types of customer research

Primary and secondary research are some of the main types of customer research.

Quantitative and qualitative data are two types of data.

It’s helpful to know the difference between these groups to ensure you collect the right data and information for your project.

Primary vs. secondary research

Primary research is data collected directly by the organization from customers. It is obtained through research methods like surveys, focus groups, or analytics.

The advantage of primary research is having the power to obtain the data that’s most relevant for you. Knowing exactly what data has been collected and how to collate that information into meaningful insights is also more simple.

Secondary research is data collected by external sources, such as research groups, governments, and other companies. You can use it to discover more about customers.

Using data collected by other sources gives you less control, but it can save you money.

Ideally, a combination of both primary and secondary research will help you build a true picture of who your customers are.

Qualitative vs. quantitative data

You also need to understand which type of data will be most helpful for the relevant project.

Qualitative data is obtained directly from users, usually through methods such as in-depth interviews, focus groups, usability testing, and field studies.

This type of data can help designers understand why users do things and gain insights into how to solve their issues.

Quantitative data consists of numeral value measurements gained indirectly from users.

This type of data usually involves measurements like how much, how many, and how many times. Surveys, metrics, and user tests are some of the methods through which it can be collated.

- The best customer research methods

The best customer research method will be the one that’s most relevant and useful for your project. So, what works for one product may not be the best match for another.

Before deciding on a customer research method, asking the following questions can be helpful:

What do we most need to know about our customers?

What do we not know about our customers?

Are we satisfied that our product has a market?

Do we truly understand our competitors?

Do we deeply understand our target market?

Is our product solving a real-world issue for people? Do we have data to back that up?

Is this product the best possible solution for our customers?

These questions can act as a starting point to discover knowledge gaps. They can also help your team choose the research methods that can plug any of these holes.

Customer surveys

Surveys involve asking customers a series of targeted questions. They’re a popular research method because they can be conducted in several ways, such as with an online questionnaire, phone call, or email.

Surveys can help organizations quickly discover large amounts of useful information. They are also relatively inexpensive, as many free templates are available online.

Keep in mind that a survey is only as good as its questions. Ensure that you’re asking questions that will help you discover the most relevant and helpful data about your customers.

Surveys that follow best practices include the following:

Open-ended questions to get the most information from customers

Consistent ranking scales to avoid ambiguity

Questions that are relevant to the team’s end goal

A short series of questions to avoid overwhelming participants

Customer interviews

Interviewing customers is one of the most straightforward and helpful ways to discover their views, wants, and needs.

Customer interviews include a team member or neutral party having a discussion with a customer. They offer the chance to discover new insights that might not otherwise have been uncovered.

This technique won’t enable you to gather quantitative data, but you will gain new insights into how your customers think and perceive products.

Here are some best practices to follow when conducting customer interviews:

Clarify answers. If there’s any ambiguity in what a customer said, make sure you follow up with further questions to aid true understanding.

Challenge your assumptions. Don’t bring any assumptions to the table. Instead, ask customers how they really think and feel. Having a neutral moderator can help remove any bias the team may bring.

Keep things open. Asking open-ended questions and offering a safe space to share answers are essential steps. Doing so will help you gain real thoughts, not hear what participants think they should say.

The benefit of real data should never be overlooked when it comes to customers. People might say they act in certain ways, but their behavior can show otherwise.

Analytics (in a product dashboard or other data collection method, for example) will reveal a great deal of information about customer behavior. It can help streamline your business, remove areas of friction, and improve the overall customer experience .

Metrics like heat maps, time spent, click tracking, and number of sessions can help you build a picture of your customer’s behavior.

Are customers failing to complete their payment information? Are people landing on your page and immediately clicking away? Is a particular aspect of your experience retaining your customers’ attention? These are just a few useful questions you can ask as you go through your analytics.

Focus groups

Focus groups are a well-known and popular research method. They help teams discover a large amount of information in a short time period.

In a focus group, a small number of people—usually eight or fewer—gather together to discuss products, pain points, preferences, and how they might engage with products.

Focus groups are run by a moderator or a person from the organization who can act neutrally. The moderator will set out a series of questions or topics for the group to discuss.

The benefits of focus groups include the following:

Gaining insights into how users perceive your product

Spontaneous responses you may not have discovered otherwise

Information about key problems and pain points

An understanding of what your users want from a solution

However, focus groups also present some challenges. Louder voices in a group may sway others to agree with the consensus rather than share their real opinions. To combat this, offer all members of the group a safe space to share their thoughts. Encourage varying responses.

Competitor analysis

Competitor analysis helps you dive into what the market is currently offering. It shows what competitors are doing well and what could be done better. This helps you create new products that solve your customers’ problems more effectively.

The following are best practices for conducting competitor analysis

Be clear on who your competitors are

Identify your competitors’ strengths and weaknesses

Clarify who holds the largest market share and why

Analyze online presence, reviews, and product information

Speak to competitors’ customers

Competitor analysis isn’t just about discovering information about your competitors; another goal is to turn information into action. You’ll ideally want to improve on what a competitor currently offers and provide a product that’s more satisfying for customers.

- How to conduct customer research

The following key steps will enable you to conduct useful customer research.

Set clear objectives

There’s a broad range of data and information that can be collected with customer research. However, not all of it will be relevant to your specific project.

That’s why setting clear objectives from the outset is critical. All methods and data should lead back to these objectives.

Use multiple methods

One research method is unlikely to gather enough information for your project. And no one method is perfect.

Conducting multiple forms of research ensures you discover more about your customers and that your team gathers enough helpful data.

Find the right people

Your research won’t be effective if you’re talking to the wrong customer group. But how do you find the right people?

If you already have a product, it would be enormously beneficial to speak to your current customers . They have proven that they’re in your target audience.

Forums, advertising, local groups, and organizations are good ways to identify potential customers to participate.

Let’s say you’re designing a dog-sitting app. In this case, you’ll need to speak to dog owners who would like more flexibility to travel. You could find these people in online groups, through a local meeting, or even at a park that’s popular for dog walking.

Consider incentives

It’s also worth considering incentives. These can encourage the right people to get on board. For example, you might offer participants the chance to win a voucher or give them a small amount of cash to participate.

Ensure any incentives are meaningful for your target audience.

Develop meaningful insights

Collecting a range of data and information from multiple methods is helpful. However, it’s ultimately meaningless if that data isn’t collated into useful insights .

Ensure that data is accurately grouped and represented clearly and concisely so that the entire business can benefit from the learnings. You might need to hire a data analyst.

- Surprise and delight your customers

Keeping customers at the center of what you do is the only way to create products that are helpful for people.

All products should help customers, whether that’s by solving a problem, making their life a little bit easier, or entertaining them in some way. Customers should want to use your product and enjoy the process.

By researching your customers, you can truly understand how they feel , where their pain points are, how they behave in real-life situations, and what solutions would please them. Ultimately, all this helps you better serve your customers.

Should you be using a customer insights hub?

Do you want to discover previous customer research faster?

Do you share your customer research findings with others?

Do you analyze customer research data?

Start for free today, add your research, and get to key insights faster

Editor’s picks

Last updated: 20 March 2024

Last updated: 16 March 2024

Last updated: 21 March 2024

Last updated: 29 February 2024

Last updated: 13 May 2024

Last updated: 4 July 2024

Last updated: 23 March 2024

Last updated: 2 March 2024

Last updated: 18 April 2024

Latest articles

Related topics, .css-je19u9{-webkit-align-items:flex-end;-webkit-box-align:flex-end;-ms-flex-align:flex-end;align-items:flex-end;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-flex-direction:row;-ms-flex-direction:row;flex-direction:row;-webkit-box-flex-wrap:wrap;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;row-gap:0;text-align:center;max-width:671px;}@media (max-width: 1079px){.css-je19u9{max-width:400px;}.css-je19u9>span{white-space:pre;}}@media (max-width: 799px){.css-je19u9{max-width:400px;}.css-je19u9>span{white-space:pre;}} decide what to .css-1kiodld{max-height:56px;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;}@media (max-width: 1079px){.css-1kiodld{display:none;}} build next, decide what to build next, log in or sign up.

Get started for free

What is Customer Research? Definition, Types, Examples and Best Practices

By Nick Jain

Published on: June 26, 2023

Table of Contents

What is Customer Research?

Types of customer research, how to conduct customer research: 10 key steps, examples of customer research questions, top 10 best practices for customer research.

Customer research is defined as the systematic process of gathering and analyzing information about customers, their behaviors, needs, preferences, and experiences. It involves qualitative and quantitative studies to understand the target audience in order to make informed business decisions and develop effective strategies to meet expectations on customer experience and product/ service demands.

Customer research aims to provide insights into various aspects of the customer journey, including their motivations, purchase behaviors, satisfaction levels, and pain points. It helps organizations gain a deep understanding of their customers, enabling them to tailor their products, services, and marketing efforts to better meet customer expectations.

The key components of customer research typically include the following:

- Research Objectives: Clearly defining the objectives and goals of the research is crucial. This involves determining what specific information or insights the organization aims to gather from customer research. Research objectives help guide the research process and ensure that the collected data is relevant and aligned with the organization’s needs.

- Target Audience Definition: Identifying the target audience or customer segment is essential. This involves determining the specific group of customers or potential customers that the research will focus on. The target audience should be representative of the organization’s customer base or the intended market.

- Research Methodology: Choosing the appropriate research methods and techniques is important to gather relevant data. The methodology may include a combination of quantitative and qualitative observation approaches such as surveys, interviews, focus groups , or data analytics. The chosen methods should align with the research objectives and provide the desired depth and breadth of insights.

- Data Collection: Conducting data collection activities is a core component of customer research. This involves implementing the selected research methods to collect data from the target audience. It may include distributing surveys, conducting interviews or focus groups , observing customer behaviors, or analyzing existing data sources. Proper data collection techniques ensure the accuracy and reliability of the gathered information.

- Data Analysis: Once the data is collected, it needs to be analyzed to extract meaningful insights. Data analysis involves organizing, categorizing, and interpreting the collected data. This may include quantitative research using statistical techniques, such as descriptive statistics or regression analysis, and qualitative research involving the identification of patterns, themes, and trends in the data. The goal is to derive actionable insights that can inform decision-making.

- Findings and Insights: Communicating the research findings and insights is a critical component. This involves summarizing and presenting the results in a clear and understandable manner. The findings should address the research objectives and provide valuable insights into customer behaviors, preferences, needs, or pain points. Visualizations, reports, presentations, or dashboards may be used to effectively convey the information.

- Recommendations: Based on the research findings, recommendations are made to guide business decisions and actions. Recommendations should be practical, actionable, and aligned with the organization’s goals. They may involve suggestions for product improvements, marketing strategies, customer experience enhancements, market segmentation approaches, or any other relevant areas.

- Iteration and Continuous Improvement: Customer research is an iterative process. Organizations should continuously gather customer feedback and update their understanding of customer needs and preferences. The insights gained from research should be regularly incorporated into business strategies and practices. This iterative approach ensures that the organization remains responsive to customer expectations and market changes.

There are various types of customer research that organizations can conduct to gather insights into customer experiences , behavior, and preferences. Some of the common types of customer research include:

- Customer Satisfaction Research

Customer satisfaction research focuses on measuring customer satisfaction levels with a product, service, or overall experience. It often involves surveys or feedback forms to gather customer opinions and perceptions. Customer satisfaction research helps organizations identify areas for improvement, gauge customer loyalty, and track changes in customer satisfaction over time.

- Customer Needs and Preferences Research

This type of research aims to uncover the needs, preferences, and expectations of customers. It helps organizations understand what customers value, what drives their purchasing decisions, and what features or attributes they desire in a product or service. Customer needs and preferences research can involve surveys, interviews, focus groups , or ethnographic research methods.

- Customer Experience (CX) Research

CX research focuses on understanding how users interact with a product, website, or service. It involves observing and analyzing user behaviors, attitudes, and perceptions to identify usability issues, pain points, and opportunities for improvement. The insights gained from CX research help organizations enhance the customer experience and increase satisfaction.

- Brand Perception Research

Brand perception research aims to understand how customers perceive a brand and its reputation in the market. It involves gathering customer feedback on brand awareness, brand image, brand associations, and brand loyalty. Brand perception research helps organizations assess the effectiveness of their branding strategies, identify brand strengths and weaknesses, and make informed decisions to enhance brand positioning.

- Customer Segmentation Research

Customer segmentation research involves grouping customers into distinct segments based on common characteristics, behaviors, or needs. It helps organizations understand their customer base and tailor their marketing strategies and offerings to specific customer segments. Customer segmentation research can involve data analysis, surveys, or clustering techniques to identify meaningful customer segments.

- Competitive Research

Competitive research focuses on analyzing competitors’ strategies, products, and customer experiences . It aims to gain insights into the competitive landscape and identify opportunities for differentiation. Competitive research involves analyzing competitors’ websites, conducting mystery shopping, monitoring social media, and gathering intelligence through industry reports or secondary research.

- Customer Journey Mapping

Customer journey mapping involves visualizing and understanding the end-to-end customer experience across various touchpoints and interactions with a company. It helps organizations identify pain points, gaps, and opportunities for improvement at each stage of the customer journey. Customer journey mapping can be done through a combination of data analysis, customer feedback , and qualitative research methods .

These are just a few examples of the types of customer research organizations can conduct. The choice of research type depends on the specific research objectives, the nature of the industry or market, and the information needed to make informed business decisions.

Learn more: What is Customer Feedback?

Conducting customer research involves a systematic approach to gathering insights about customers and their preferences. Here are the key steps to conduct customer research effectively:

1. Define Research Objectives: Clearly define the specific objectives of your customer research. Determine what information or insights you seek to gather and how you plan to use the research findings. This will guide the entire research process and ensure that it remains focused and aligned with your goals.

2. Identify Target Audience: Identify the specific target audience or customer segment you want to study. Consider factors such as demographics, location, behavior, or any other relevant criteria. The target audience should be representative of your customer base or the market you wish to understand.

3. Choose Research Methods: Select the appropriate research methods (such as quantitative , qualitative research ) and techniques that will help you gather the desired information from your target audience. This may include surveys, interviews, focus groups , observational research (such as quantitative , and qualitative observation ), data analytics, or a combination of these methods. Consider the advantages, limitations, and resource requirements of each method.

4. Develop Research Instruments: Design the research instruments, such as survey questionnaires, interview guides, or discussion protocols, based on your research objectives. Ensure that the instruments are clear, concise, and structured to gather the necessary data. Use validated scales or questions when available and pilot test the instruments to identify any issues or areas for improvement.

5. Recruit Participants: Recruit participants who fit your target audience criteria and are willing to participate in the research. Depending on the research methods chosen, recruitment can be done through various channels such as online panels, customer databases, social media, or targeted advertising. Clearly communicate the purpose and benefits of the research to encourage participation.

6. Conduct Data Collection: Implement the chosen research methods to collect data from your participants. Administer surveys, conduct interviews or focus groups , observe customer behaviors, or analyze existing data sources. Ensure that the data collection process follows ethical guidelines, respects privacy, and maintains data confidentiality.

7. Analyze Data: Once the data is collected, analyze it to derive meaningful insights. Use appropriate data analysis techniques based on the nature of your data and research objectives. This may involve quantitative research and analysis using statistical methods, qualitative research and analysis using thematic coding or content analysis, or a combination of both. Ensure that the data analysis is rigorous, systematic, and aligned with your research objectives.

8. Interpret Findings: Interpret the research findings to gain insights into customer behaviors, preferences, needs, or perceptions. Analyze patterns, trends, and relationships in the data and relate them back to your research objectives. Look for key themes, outliers, or significant findings that can inform your decision-making.

9. Communicate Results: Present the research findings in a clear and concise manner. Prepare reports, presentations, or visualizations that effectively communicate the insights to stakeholders. Tailor the communication format to the needs and preferences of your target audience, ensuring that the findings are easily understandable and actionable.

10. Apply Insights: Apply the insights gained from customer research to inform your business decisions and strategies. Use the findings to enhance product development, refine marketing strategies, improve customer experiences , or address specific pain points. Regularly revisit the research findings and incorporate them into your ongoing business practices.

Remember that customer research is an iterative process. As you implement the insights gained, monitor the outcomes and consider conducting follow-up research to assess the impact and gather further insights. Continuous customer research helps organizations stay informed about evolving customer needs and preferences, enabling them to stay competitive and customer-centric.

Learn more: What is Quantitative Market Research?

Here are some examples of customer research questions that businesses might ask:

- What factors influenced your decision to purchase our product/service?

- How did you first hear about our company?

- What specific features or aspects of our product/service do you find most valuable?

- What improvements or enhancements would you like to see in our product/service?

- How likely are you to recommend our product/service to others? Why?

- What obstacles or challenges did you encounter when using our product/service?

- How does our product/service compare to competitors in the market?

- How satisfied are you with the level of customer support you received?

- What are your expectations for pricing and value in relation to our product/service?

- How frequently do you use our product/service, and for what purposes?

These questions can help businesses gain insights into customer preferences, satisfaction levels, purchasing behavior, and areas for improvement. It’s important to tailor the questions to the specific industry, product, or service being researched to gather the most relevant information.

When conducting customer research, it’s essential to follow best practices to ensure accurate and valuable insights. Here are some best practices for customer research:

1. Clearly define research objectives

Start by identifying the specific goals and objectives of your customer research. What do you want to learn or achieve through the research? This will guide your research approach and help you focus on the most relevant questions and areas of investigation.

2. Use a mix of qualitative and quantitative methods

Combining qualitative and quantitative research methods can provide a comprehensive understanding of your customers. Qualitative methods , such as interviews or focus groups, offer in-depth insights and allow you to explore customer motivations and experiences. Quantitative methods , like surveys or data analysis, provide statistical data and help you identify patterns and trends.

3. Identify your target audience

Clearly define the characteristics and demographics of your target audience. This will help you select the right participants for your research and ensure that customer feedback represents your customer base accurately.

4. Create unbiased and neutral questions

Formulate questions that are clear, unbiased, and neutral to avoid leading or influencing participants’ responses. Use open-ended questions to encourage participants to provide detailed and honest feedback.

5. Use a variety of data collection methods

Explore various data collection methods to gather customer insights. These can include surveys, interviews, focus groups , social media listening, website analytics, customer feedback forms, or online reviews. Employing multiple methods (such as quantitative research methods , qualitative research methods , etc.) can provide a more comprehensive view of customer opinions and behaviors.

6. Engage with customers at different touchpoints

Interact with customers throughout their journey with your product or service. This can include pre-purchase, purchase, and post-purchase stages. Collect feedback at different touchpoints to understand the entire customer experience and identify areas for improvement.

7. Maintain confidentiality and anonymity

Assure participants that their responses will be kept confidential and anonymous. This encourages honest and unbiased feedback. Respect privacy regulations and data protection guidelines when collecting and storing customer data.

8. Analyze and interpret data systematically

Once you have collected the data, analyze it systematically. Look for patterns, trends, and common themes. Identify key insights and use them to inform your decision-making process. Consider using data visualization techniques to present findings in a clear and concise manner.

9. Continuously iterate and improve

Customer research should be an ongoing process. Regularly revisit your research objectives and update your research methods to reflect changing customer needs and preferences. Continuously gather customer feedback and make improvements based on customer insights.

10. Communicate findings and take action

Share the results of your customer research with relevant stakeholders within your organization. Communicate the key findings, insights, and recommendations. Use the research findings to inform strategic decisions, product development, marketing strategies, and customer support initiatives.

By following these best practices, you can conduct effective customer research that provides valuable insights and helps you better understand and serve your customers.

Learn more: What is Qualitative Research?

Enhance Your Research

Collect feedback and conduct research with IdeaScale’s award-winning software

Elevate Research And Feedback With Your IdeaScale Community!

IdeaScale is an innovation management solution that inspires people to take action on their ideas. Your community’s ideas can change lives, your business and the world. Connect to the ideas that matter and start co-creating the future.

Copyright © 2024 IdeaScale

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Customer Research

Business Services · Washington, United States · 77 Employees

View Company Info for Free

Headquarters

Phone number, recent news & media, dominion dms announces integration with customer research in..., who is customer research.

Customer Research, Inc. provides customer satisfaction measurement, customer loyalty, market research, and contact center solutions in the marketin g industry. It also provides call center solutions and multiple channels of communication. The company was established in 1967 and is based in Seahurst, Washington. Read more

Customer Research Org Chart

President & Owner

Explore Complete Organization Structure

Is Customer Research your ideal customer?

Let us give you the heads up on whether it's a good time to reach out

Product Launch: Get notified with Customer Research new products launch

Funding: Get notified immidiatlly once Customer Research has new funding data

Earning: See what the market has to say on Customer Research recently announced quarterly report

Website visits: Recent activity has been detected on your website

Congratulate Masked Content for being promoted to Masked Content at Customer Research

Competitive Alert! Recent activity has been detected by your competitor Masked Content

Check if Customer Research has recently received funding, and reach out quickly before it becomes old news!

Click to see if Customer Research had a recent Job posting/layoffs

Customer Research , which may be a good buyer, showed buying intent in Masked Content Topic

Check out if Customer Research is spiking on competitors!

Recommended Actions

Similar Companies to Customer Research

View Email Formats for Customer Research

Customer Research Employee Growth Rate

View Customer Research’s full employee growth data

Percentage of growth

1st year Mask

2nd year Mask

Customer Research Tech Stack

A closer look at the technologies used by Customer Research

Top Companies in United States

Top 10 companies in united states by revenue.

Top 10 companies in United States by number of employees

Top 10 companies in united states by total funding amount.

Most Recent Scoops

Customer research news & media, dominion dms announces integration with customer research inc., frequently asked questions regarding customer research.

Customer Research, Inc. provides customer satisfaction measurement, customer loyalty, market research, and contact center solutions in the marketing industry. It also provides call center solutions and multiple channels of communication. The company was established in 1967 and is based in Seahurst, Washington.... Read More

Get Started with ZoomInfo

Sign up for free, supercharge your prospecting, grow your business, test drive zoominfo's directories.

- Product management

- Collections: Customer research

A complete guide to customer research — with templates

What makes your product great? What problems does it solve? People will look to you — the product manager — as the expert on these questions. But you know that the answers are not based solely on your own opinions and experience. The most important input often comes from somewhere else: customers.

Understanding customers is integral to developing a lovable product . As a product manager, you will want to explore everything from your users' demographics to their inner motivations and struggles. This process of sussing out their needs and challenges is called customer research.

Conducting customer research is complex and dynamic work, where your curiosity is a tremendous asset. To plan, gather, and analyze feedback, product managers use a wide variety of methods — qualitative, quantitative, and a mix of both. You can take a highly sophisticated approach to this, but many times effective customer research entails talking to customers and using simple tools or templates to analyze their feedback.

In this guide, you will learn the fundamentals of conducting primary research so you can better understand the folks you are trying to help. You can try seven customer research templates to help you experiment with different methods and save time in the research process.

Engage a community and analyze feedback in Aha! Ideas. Start a free trial .

With Aha! Ideas , you can host live empathy sessions with your customers to learn more about their need and preferences.

Why should you do customer research?

Customer research is an essential component of product strategy — alongside competitor analysis , market research, and overall business needs. The insights you glean from meeting and surveying customers help to shape your strategic initiatives , ensuring that your team is poised to deliver what people really want from your product.

A key reason to perform customer research is to gain new perspectives on your product. Your customers may tell you things you never realized — hidden problems, unique ways of completing tasks, and even alternate use cases. What you believe matters most about your product may not even be on your customers' radar.

Let's say your product has a reporting feature with low usage . Your team decides to give the reporting interface a major upgrade. You spend the time and resources to build these updates — only to scratch your head when there is no uptick in usage. What went wrong?

If you breezed past talking to your customers, it is possible that the interface was not the factor keeping them from engaging. Maybe they prefer to use a separate reporting tool — in which case, an integration capability would have been a much more valuable feature to build.

Customer research helps you avoid spending time solving proble ms that do not exist — and highlights the ones that are real and deserving of your attention. This way, you know where to focus your efforts for the best chance of making your customers happy and meeting business goals.

How much customer feedback is the right amount?

The short answer? It depends. Your specific goals, the scope of your research, and the stage of your product's development all play a role. Here are some things to keep in mind when determining the right amount of customer feedback to collect:

Understand your goals Are you looking to validate a new product idea or improve an existing product? Do you need to better understand customer pain points or gather usability insights? These answers will shape your product development goals and dictate the depth and breadth of feedback required.

Define your sample size Consider the size of your target audience and customer base. In some cases, a smaller sample size can provide valuable insights, especially if you are conducting in-depth qualitative research . For quantitative research, a larger sample size might be necessary to ensure statistical relevancy.

Ensure diversity of perspective Aim for variety in your feedback pool. Different demographic groups, usage patterns, and customer segments can provide a more comprehensive understanding of customer needs and preferences.

Include a mix of feedback channels Analyzing feedback from different channels can provide unique perspectives and insights. Experiment with a variety of feedback methods and channels — such as releasing surveys, conducting interviews , and reviewing your social media and customer support interactions.

Consider resource constraints Think about the time, budget, and staff you have available for collecting and analyzing feedback. Balance the scope of your research with what you can realistically manage.

Remember, customer feedback is often collected in iterations. Start with a small group of users for early insights, then expand your feedback pool as you make improvements. Each iteration helps you refine your product and strategy.

And while quantity matters, the quality of feedback is crucial. Sometimes a few detailed, insightful responses can be more valuable than a large number of superficial ones.

Primary vs. secondary customer research

Product managers will use both primary and secondary customer research to gather information. Briefly, the difference is:

Primary customer research refers to gathering your own data and feedback firsthand via interviews, focus groups, surveys, and other methods.

Secondary customer research refers to findings gleaned from external sources like analyst reports and third-party surveys.

Both types can be valuable, but when it comes to your goals as a product manager, primary research is superior. While secondary research will help you understand demographics and broader trends, primary research allows you to drill down into the details of your specific product and target audience.

Your customers' own experiences are invaluable and one of the surest signals to creating a lovable product. For this guide, we will focus on the fundamentals of conducting primary research.

How do product managers gather customer feedback?

How do product managers come up with new ideas for a product?

How to conduct customer research

On a basic level, customer research entails reaching out to current or potential customers and gathering feedback from them via direct conversations or more indirect methods (like online surveys). Advanced tools such as product analytics and idea management software can certainly augment your approach — but are not necessary to get started.

Follow these steps to conduct your own primary customer research:

1. Define your objective Outline your research goals and determine what it is you really want to learn. For example, your objective could be to learn broadly about your customers' business goals or gain a deeper understanding of their experience with a specific feature set.

2. Decide which customers to contact Your objectives will help you decide who to speak with — especially if your product caters to a diverse group of customers. Think about current and potential customers and form a list of people to reach out to.

3. Prepare If you are leading an interview or focus group, meet with your product teammates to prepare your questions. Keep in mind you may need to coordinate with other team members who want to sit in on discussions. If you are conducting a survey, build it — then decide how and when to distribute it.

4. Start your research Conduct your interviews or hit "send" on your survey When talking directly with customers, remember to listen more than you speak. Ask meaningful follow-up questions to encourage deeper thinking and discussion.

5. Analyze, summarize, and share your findings Look for trends in the feedback you received. What did customers agree on? What were the most popular ideas or recurring pain points? Find common threads and share the findings with your team. Together, you can discuss and prioritize the customer ideas that support your overall goals — and promote those ideas to your product roadmap .

6. Repeat Customer research is an ongoing part of product management. You will need to collect feedback from many customers to make informed product decisions. And with every new product launch or major release, you may need to start fresh with a new objective and customer set.

Because it is ongoing, it helps to keep all of your customer research organized. You want to be clear on how your findings will inform the features you develop. For example, the Research tab in Aha! helps you collect whiteboards, interview notes, and ideas right on feature cards.

Editor's note: Although the video below still shows core functionality within Aha! software, some of the interface might be out of date. View our knowledge base for the most updated insights into Aha! software.

Related: 35+ customer questions for product innovation

Get started with customer research templates

Customer research templates offer a simple way to start discovering who your audience really is and what matters to them. Using templates helps you add much-needed structure to your customer research process. Below, you will find an assortment of templates to try — from planning to interviews, surveys, and summarizing your findings.

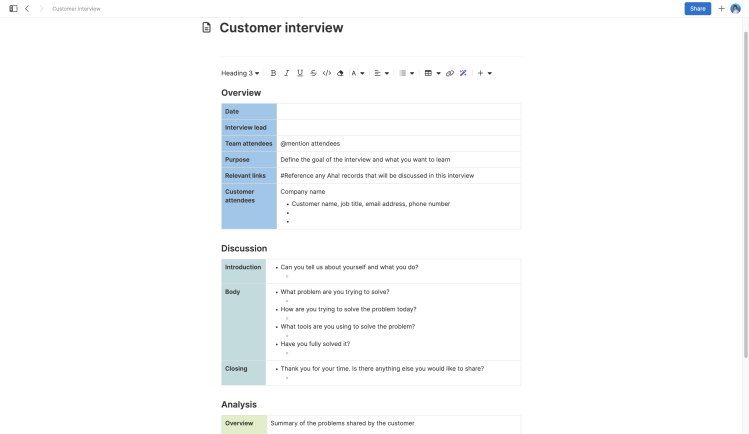

Aha! software customer interview template

Customer research planning template, customer interview notes template.

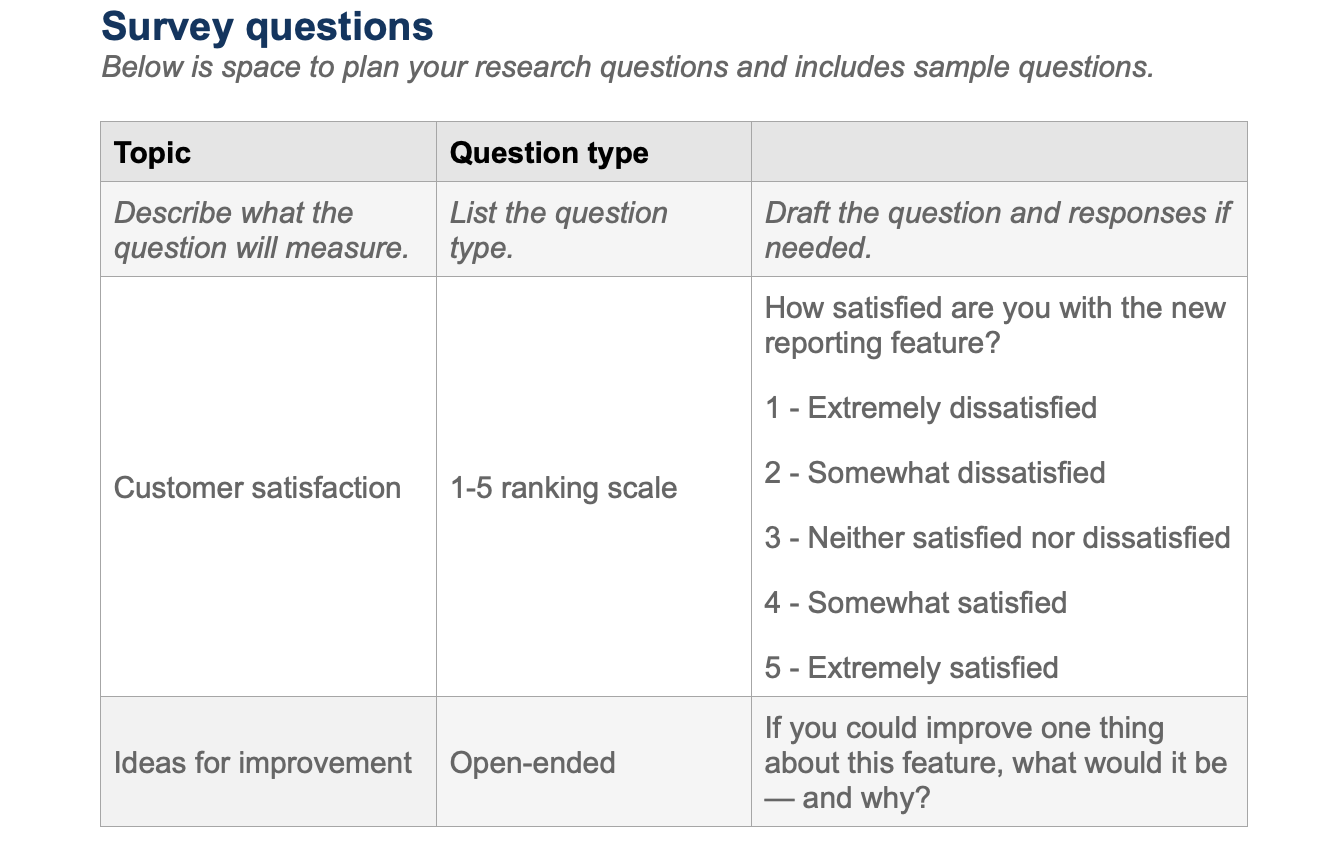

Customer survey template

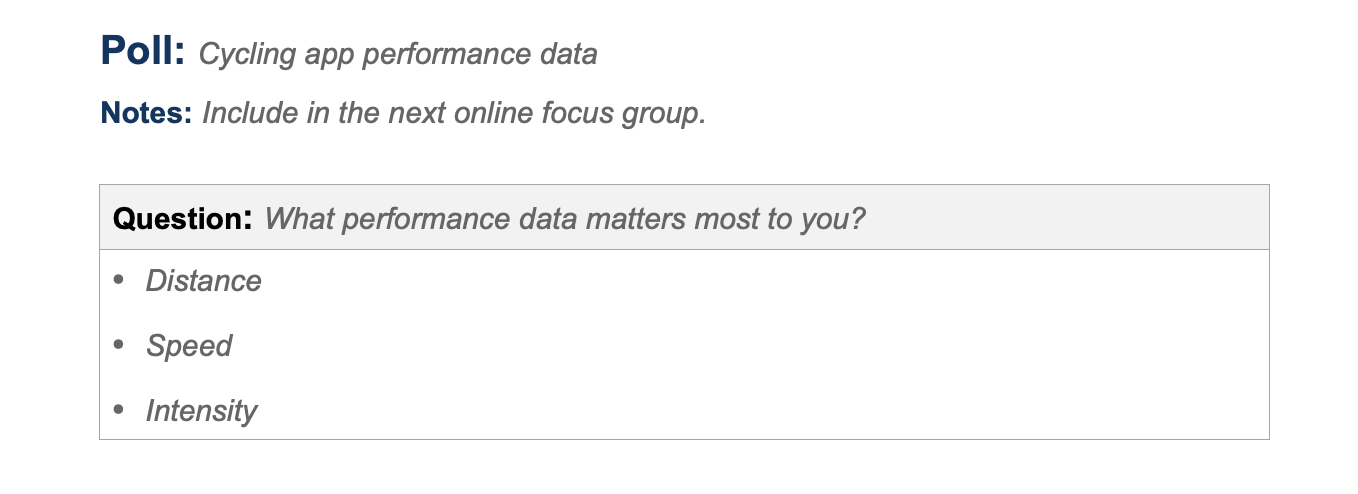

Customer feedback poll template

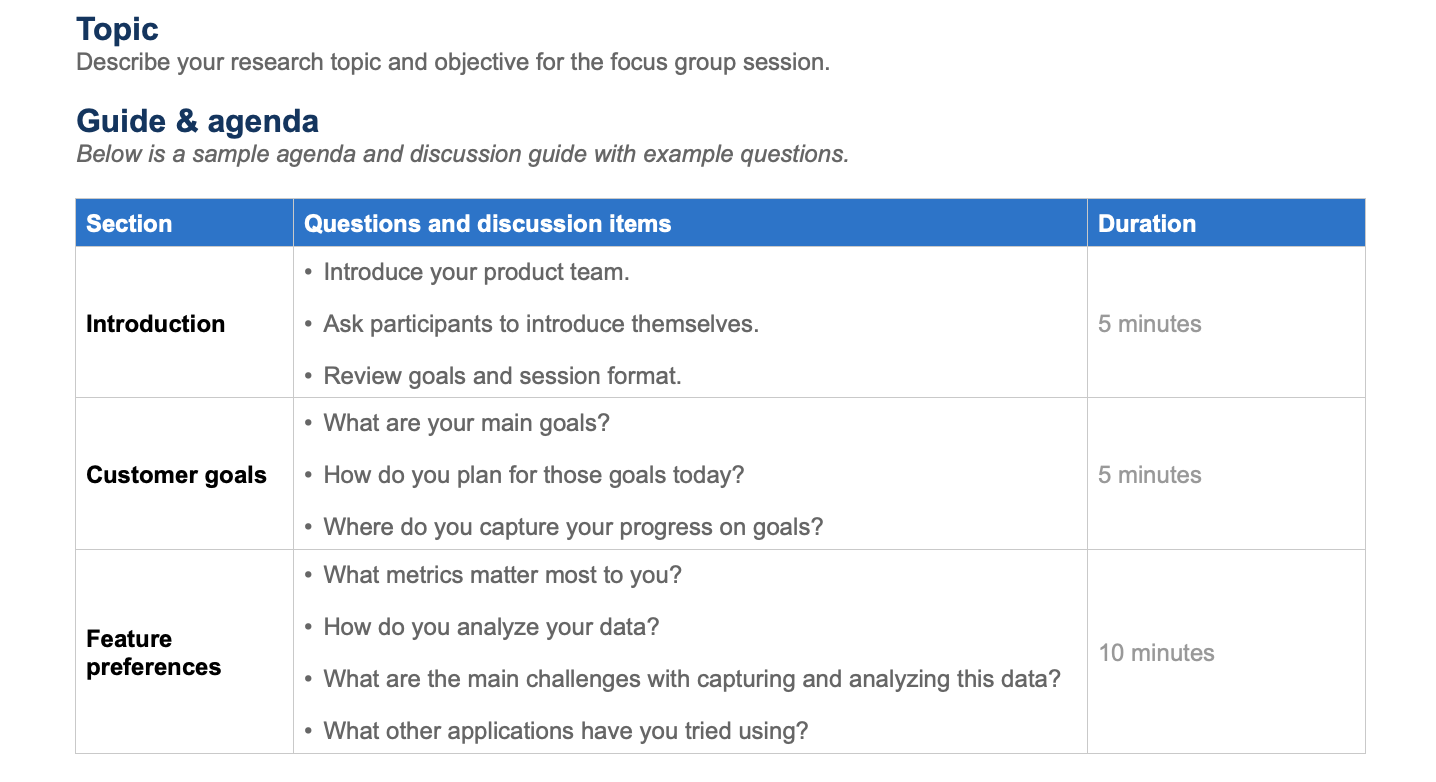

Customer focus group discussion template, customer research presentation template.

This customer interview template is a great one to start with. It is a guided template with helpful prompts and instructions in each section. This makes it simple to plan your conversations with customers so you can get the most out of each interview. It is available in Aha! software — which gives you a central place to document and organize your findings.

Start using this template now

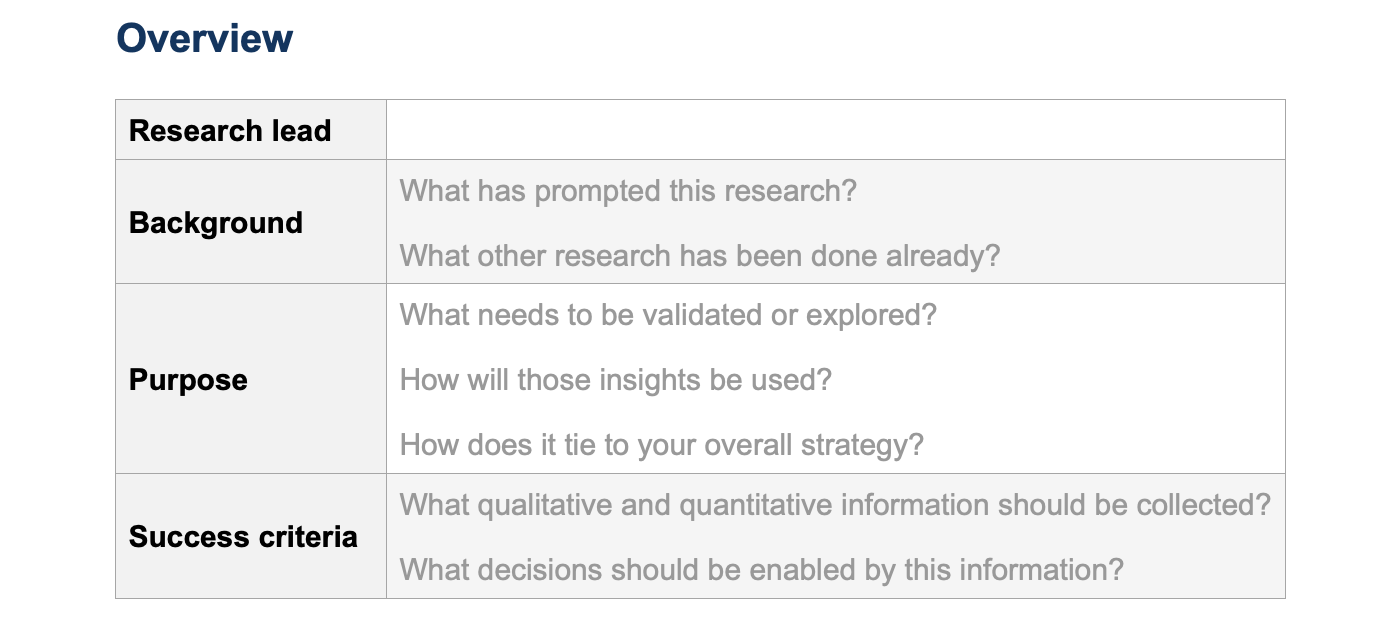

This planning template helps you define your objectives, identify which customers to talk to, and prepare for your research session. It includes sections for customer profiles (personas, segments, and companies) to add context to your research group.

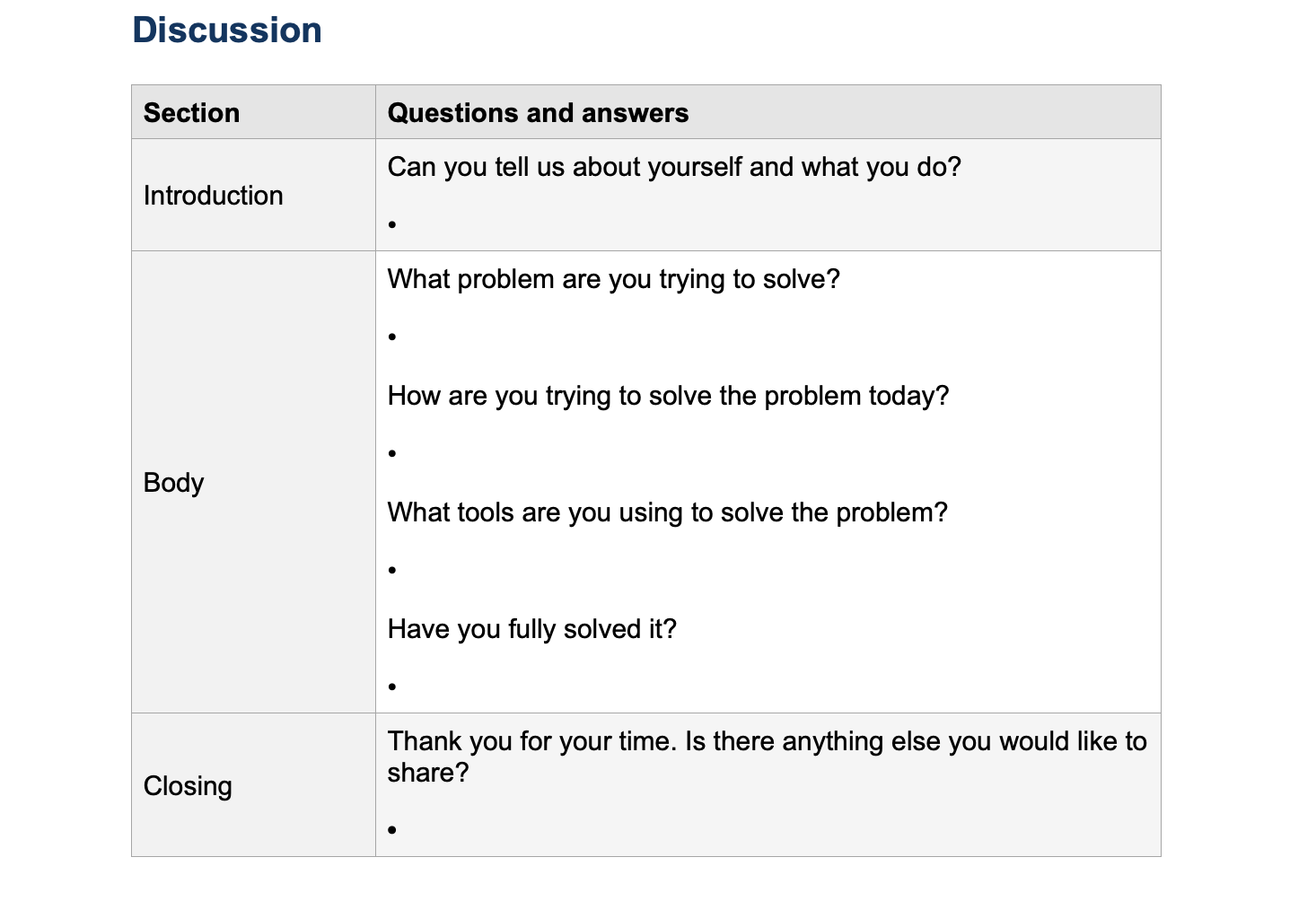

An interview template will keep your notes organized during conversations with customers. It will also help you guide the flow of the interview and note any takeaways or action items to proceed with after the session ends. Feel free to customize the discussion questions to match your objective.

Customer research survey template

Customer surveys allow you to gather insights from more people in less time — with the added benefit of built-in reporting via online survey tools. This template will help you learn how to design an effective customer research survey and plan the demographic, use case, and customer satisfaction questions that you want to ask. It includes a blend of question types for both fixed and open-ended responses.

Polls offer a simple way to incorporate a quantitative component into your qualitative research. For example, you can quickly gauge the group's opinion on an idea by inserting a poll in an online focus group or empathy session . This template will help you jot down ideas for future polls.

Similar to the customer interview template, this focus group template will help you structure your session. It emphasizes a well-planned agenda over note-taking — encouraging you to be present in the discussion when you are facilitating a focus group. You can always record the focus group session to revisit later and take detailed notes.

After you have conducted your research, showcase your findings. Sharing results with your team makes customer research even more impactful — customer opinions matter at every level of the business and every stage of the product development process . This template will help you convey your top takeaways in a presentation.

Customer research has long been a core tenet of product management — and will continue to be. Templates like these will help you streamline your research process so you can focus on interacting with your audience and distilling insights from what they share.

When you are ready for a more comprehensive solution beyond simple templates, give idea management software like Aha! Ideas a try. With Aha! Ideas, you can crowdsource feedback via ideas portals, engage your community with empathy sessions, and analyze trends at the individual, organization, and segment levels. This helps you prioritize customer feedback with ease and promote the ideas that support your business goals directly to your product roadmap. (Note that you can use Aha! Ideas as a standalone tool, but many of its features are also available on Aha! Roadmaps . This makes it a great choice for teams seeking an all-encompassing product development solution.)

Discover exactly what your customers want. Start a free Aha! Ideas trial today.

- The Aha! Framework for product development

- The activities in The Aha! Framework

- What is a business model?

- What is customer experience?

- What is the Complete Product Experience (CPE)?

- What is a customer journey map?

- What is product-led growth?

- What are the types of business transformation?

- What is enterprise transformation?

- What is digital transformation?

- What is the role of product management in enterprise transformation?

- What is a Minimum Viable Product (MVP)?

- What is a Minimum Lovable Product (MLP)?

- What is product vision?

- How to set product strategy

- What is product-market fit?

- What is product differentiation?

- How to position your product

- How to price your product

- What are product goals and initiatives?

- How to set product goals

- How to set product initiatives

- What is product value?

- What is value-based product development?

- Introduction to marketing strategy

- Introduction to marketing templates

- What is a marketing strategy?

- How to set marketing goals

- Marketing vs. advertising

- What is a creative brief?

- How to define buyer personas

- Understanding the buyer's journey

- What is competitive differentiation?

- 10Ps marketing matrix

- 2x2 prioritization matrix

- Business model

- Customer journey map

- Decision log

- Decision tree

- Fit gap analysis

- Gap analysis

- Lean canvas

- Marketing strategy

- MoSCoW model

- Opportunity canvas

- Porter's 5 forces

- Pricing and packaging research

- Pricing plan chart

- Pricing strategies (Kotler)

- Product positioning

- Product vision

- SAFe® framework

- Scrum framework

- Segment profile

- SMART goals

- Strategic roadmap

- Strategy mountain

- SWOT analysis

- The Aha! Framework

- Value proposition

- VMOST analysis

- Working backwards

- Collections: Business model

- Collections: SWOT

- Collections: Objectives and key results (OKR)

- Collections: Product positioning

- Collections: Market positioning

- Collections: Marketing strategy

- Collections: Marketing messaging

- What is product discovery?

- How to do market research

- How to define customer personas

- How to research competitors

- How to gather customer feedback

- Asking the right questions to drive innovation

- Approaches table

- Competitive analysis

- Customer empathy map

- Customer interview

- Customer research plan

- PESTLE analysis

- Problem framing

- Product comparison chart

- Pros and cons

- Target audience

- Collections: Competitor analysis

- Collections: Marketing competitor analysis

- How to brainstorm product ideas

- Brainstorming techniques for product builders

- Why product teams need an internal knowledge hub

- Why product teams need virtual whiteboarding software

- How to use an online whiteboard in product management

- What is idea management?

- 4 steps for product ideation

- How to estimate the value of new product ideas

- How to prioritize product ideas

- What is idea management software?

- Introduction to marketing idea management

- How to gather marketing feedback from teammates

- Brainstorming new marketing ideas

- How to estimate the value of new marketing ideas

- Brainstorming meeting

- Brainstorming session

- Concept map

- Data flow diagram

- Fishbone diagram

- Ideas portal guide

- Jobs to be done

- Process flow diagram

- Proof of concept

- Sticky note pack

- User story map

- Workflow diagram

- Roadmapping: Your starter guide

- Agile roadmap

- Business roadmap

- Features roadmap

- Innovation roadmap

- Marketing roadmap

- Product roadmap

- Product portfolio roadmap

- Project roadmap

- Strategy roadmap

- Technology roadmap

- How to choose a product roadmap tool

- How to build a brilliant roadmap

- What to include on your product roadmap

- How to visualize data on your product roadmap

- What milestones should be included on a roadmap?

- How often should roadmap planning happen?

- How to build a roadmap for a new product

- How to build an annual product roadmap

- How to customize the right roadmap for your audience

- Product roadmap examples

- How to report on progress against your roadmap

- How to communicate your product roadmap to customers

- What is a content marketing roadmap?

- What is a digital marketing roadmap?

- What is an integrated marketing roadmap?

- What is a go-to-market roadmap?

- What is a portfolio marketing roadmap?

- How to choose a marketing roadmap tool

- Epics roadmap

- Now, Next, Later roadmap

- Portfolio roadmap

- Release roadmap

- Collections: Product roadmap

- Collections: Product roadmap presentation

- Collections: Marketing roadmap

- What is product planning?

- How to diagram product use cases

- How product managers use Gantt charts

- How to use a digital whiteboard for product planning

- Introduction to release management

- How to plan product releases across teams

- What is a product backlog?

- Product backlog vs. release backlog vs. sprint backlog

- How to refine the product backlog

- Capacity planning for product managers

- What is requirements management?

- What is a market requirements document (MRD)?

- How to manage your product requirements document (PRD)

- What is a product feature?

- What is user story mapping?

- How to prioritize product features

- Common product prioritization frameworks

- JTBD prioritization framework

- Introduction to marketing plans

- What is a marketing plan?

- How to create a marketing plan

- What is a digital marketing plan?

- What is a content marketing plan?

- Why is content marketing important?

- What is a social media plan?

- How to create a marketing budget

- 2023 monthly calendar

- 2024 monthly calendar

- Feature requirement

- Kanban board

- Market requirements document

- Problem statement

- Product requirements document

- SAFe® Program board

- Stakeholder analysis

- Stakeholder map

- Timeline diagram

- Collections: Product development process

- Collections: MRD

- Collections: PRD

- Collections: Gantt chart

- Collections: User story

- Collections: User story mapping

- Collections: Feature definition checklist

- Collections: Feature prioritization templates

- Collections: Marketing plan templates

- Collections: Marketing calendar templates

- Product design basics

- What is user experience design?

- What is the role of a UX designer?

- What is the role of a UX manager?

- How to use a wireframe in product management

- Wireframe vs. mockup vs. prototype

- 18 expert tips for wireframing

- Analytics dashboard wireframe

- Product homepage wireframe

- Signup wireframe

- Collections: Creative brief

- Common product development methodologies

- Common agile development methodologies

- What is agile product management?

- What is agile software development?

- What is agile project management?

- What is the role of a software engineer?

- What is waterfall product management?

- What is agile transformation?

- Agile vs. lean

- Agile vs. waterfall

- What is an agile roadmap?

- What is an agile retrospective?

- Best practices of agile development teams

- What is a burndown chart?

- What is issue tracking?

- What is unit testing?

- Introduction to agile metrics

- Agile glossary

- What is kanban?

- How development teams implement kanban

- How is kanban used by product managers?

- How to set up a kanban board

- Kanban vs. scrum

- What is scrum?

- What are scrum roles?

- What is a scrum master?

- What is the role of a product manager in scrum?

- What is a sprint?

- What is a sprint planning meeting?

- What is a daily standup?

- What is a sprint review?

- Product release vs. sprint in scrum

- Themes, epics, stories, and tasks

- How to implement scrum

- How to choose a scrum certification

- What is the Scaled Agile Framework®?

- What is the role of a product manager in SAFe®?

- What is PI planning?

- How to run a PI planning event

- SAFe® PI planning

- SAFe® PI retrospective

- SAFe® Sprint planning

- Sprint planning

- Sprint retrospective

- Sprint retrospective meeting

- UML class diagram

- Collections: Sprint retrospective

- How to test your product before launch

- What is a go-to-market strategy?

- How to write excellent release notes

- How to plan a marketing launch

- Knowledge base article

- Product launch plan

- Product updates

- Release notes

- Collections: Product launch checklist

- Collections: Marketing launch checklist

- How to make data-driven product decisions

- How to measure product value

- What is product analytics?

- What are product metrics?

- What is a product?

- What is a product portfolio?

- What is product development?

- What is product management?

- What is the role of a product manager?

- What is portfolio product management?

- What is program management?

- What is product operations?

- What are the stages of product development?

- What is the product lifecycle?

- What is a product management maturity model?

- What is product development software?

- How to build a product wiki

- What to include in an internal product documentation hub

- Internal vs. external product documentation

- How to build a customer support knowledge base

- Use cases for knowledge base software

- Introduction to marketing methods

- What is agile marketing?

- What is digital marketing?

- What is product marketing?

- What is social media marketing?

- What is B2B marketing?

- Collections: Product management

- How to structure your product team meeting

- 15 tips for running effective product team meetings

- Daily standup meeting

- Meeting agenda

- Meeting notes

- Product backlog refinement meeting

- Product feature kickoff meeting

- Product operations meeting

- Product strategy meeting

- Sprint planning meeting

- What are the types of product managers?

- 10 skills to succeed as a product manager

- Common product management job titles

- What does a product manager do each day?

- What is the role of a product operations manager?

- What is the role of a program manager?

- Templates for program and portfolio management

- How to become a product manager

- How to prepare for a product manager interview

- Interview questions for product managers

- Typical salary for product managers

- Tips for new product managers

- How to choose a product management certification

- Introduction to marketing

- What are some marketing job titles?

- What is the role of a marketing manager?

- What is the role of a product marketing manager?

- How are marketing teams organized?

- Which tools do marketers use?

- Interview questions for marketing managers

- Typical salary for marketing managers

- How to make a career switch into marketing

- Job interview

- Negotiating an offer

- Product manager resume

- Collections: Product manager resume

- How to structure your product development team

- Best practices for managing a product development team

- Which tools do product managers use?

- How to streamline your product management tools

- Tips for effective collaboration between product managers and engineers

- How do product managers work with other teams?

- How product managers achieve stakeholder alignment

- How to complete a stakeholder mapping exercise

- Aha! record map

- Creative brief

- Marketing calendar

- Organizational chart

- Presentation slides

- Process improvement

- Collections: Product management meeting

- Collections: Diagrams, flowcharts for product teams

- Collections: Whiteboarding

- Collections: Templates to run product meetings

- Product development definitions

- Marketing definitions

- Privacy policy

- Terms of service

Learn More About:

- Customer Acquisition

- Optimization

- Customer Experience

- Data & Analytics

Customer Research: The Most Underappreciated Strategy In Your Toolkit

Customer research has far-reaching positive implications for businesses. This is a step-by-step guide for how to leverage the tool.

These ecommerce scenarios all have something in common:

- Glossier names its cult-hit cleanser “Milky Jelly”

- Harry’s launches a new deodorant and shifts from a shave brand to a personal care

- Katelyn Bourgoin positions Charboyz meat kits as a social solution for suburban dads

- A maternity brand figures out how to present its proprietary sizing, which improves conversions and decreases returns

The answer: good customer research.

Each of those bullets came about because the brand or founder listened closely to stories their customers and prospective customers told.

These brands know something too few ecommerce companies have taken to heart: customer research has far-reaching implications for businesses. With the right resources and process, it’s possible to collect meaningful insights that help you improve many areas of your business, from marketing to customer support to product development.

And although it may seem intimidating first, the time and financial investment customer research requires is manageable for most teams — especially in light of its ROI.

This article is a step-by-step guide to formulating a research plan, interviewing customers, and turning the qualitative data you collect into meaningful improvements for your brand.

The rest of this articles outlines how to:

- Think about the benefits of customer research

- Put together a research plan

- Run effective customer interviews

- Gather indirect customer research

- Put your research data to good use

What is customer research?

Customer research is a structured way to find out why customers do and don’t buy. It’s an effective way to step out of your head and into the buyer’s journey, so you can provide better products and experiences.

Why is it especially important for ecommerce?

For ecommerce leaders, the biggest benefits of customer research include:

- Getting outside the jar

- Knowing what to improve (instead of guessing)

- Providing better customer-centric experiences

Customer research gets you outside the jar

Imagine sitting inside a jar (an empty one) and trying to read the label. Even if you could make out a letter or two, or perhaps a fine print medical warning, it’d be impossible to piece together what the whole label looks like from the outside.

That’s a bit like trying to imagine a new customer’s experience from inside your brand. You know your site inside and out, and that’s a strength in many contexts. But it’s also a weakness because your proximity to the brand makes it impossible to know what it’s like for new customers to hit your homepage or try to purchase something.

You’re stuck inside the jar, and one of the best ways to get out is customer research.

But that’s not the only benefit.

Customer research helps you identify data-backed improvements

There’s a marketing approach Katelyn Bourgoin calls “ liquor and guessing .” It’s the old formula of gathering smart, creative people in the same room, giving them a cool product to work with, and letting them guess their way (occasionally with liquor) to more sales.

While that occasionally works, it’s a bit like throwing a dart with your eyes closed — you could hit the board, but it’s not likely. Customer research provides a more guaranteed path.

Some of the most common benefits folks cite is clarity around their messaging strategy — who to speak to, how to speak with them, and when to do so.

Just wrapped up my 1st customer interview. 🕺Walked away with an entirely new approach, at least 10 content ideas, and a plethora of vocabulary I hadn't used before. Future copy has written itself. @KateBour never stop pushing this narrative. This changed my marketing world. 🙏 — Kristen LaFrance (@kdlafrance) May 2, 2019

But depending on what you set out to discover, customer research can do way more than that.

Harry’s for example, crowdsourced some of their newest products from current shoppers. Jaime Crespo, GM at Harry’s, told Retail Brew the brand had 1,600 customers call in or send emails requesting deodorant. And 120,000 customers said in a survey they wanted to see deodorant or antiperspirant. Harry’s leaned into this.

Crespo says, “We have a very strong, close connection with the customers. So we start talking with the customers and asking them, okay, why do you want a new product in deodorant? What’s wrong with the products that you’re currently using? And that’s how we develop our proposition.”

This ties into the third major benefit for ecommerce brands.

Customer research shows you how to build better customer experiences

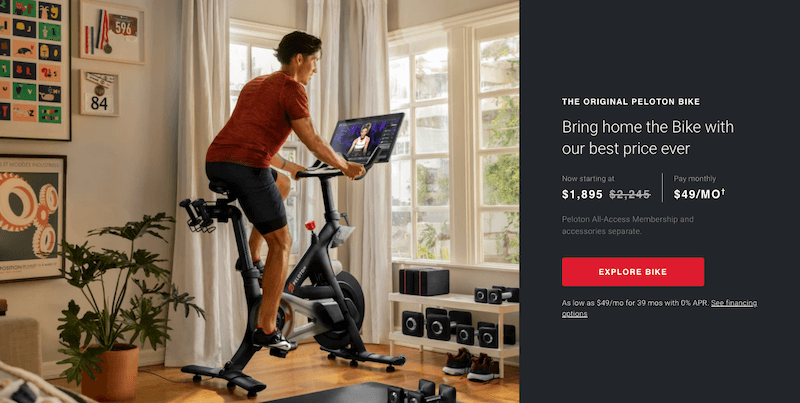

One of the biggest strengths of ecommerce, and especially DTC, is the unique opportunity brands have to influence or control every aspect of the customer experience .

And better experiences pay off:

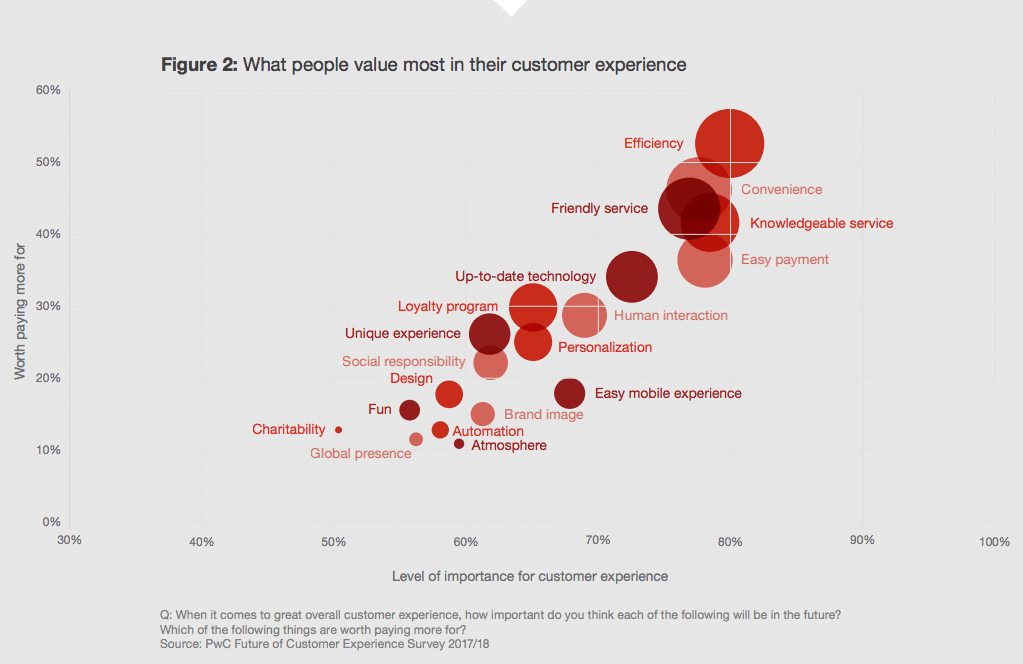

- PwC surveyed 15,000 consumers and found 65% of them said they were more strongly influenced by a positive experience than a great ad campaign

- Coschedule found marketers who do audience research at least once per year are 303% more likely to hit marketing goal

- McKinsey says brands that improve the customer journey see revenue increases as much as 10-15% — while lowering service costs by 15-20%

When you start dialing in the customer experience , metrics like conversion rate, lifetime value, average order value, return on ad spending, and others improve as well.

Customer research shows you, with astonishing clarity, how visitors are experiencing your brand. Meaning, it also shows you where to improve, where to double down, and where missed opportunities are, too.

Here’s how to get started.

How to build a foundation with a one-page research plan

If you’re doing DIY research for your brand (DIY as in not hiring outside) help, start with a plan. This doesn’t have to be complex, either.

To put together a one-page customer research plan, you’ll want to define:

- Your goals for researching

- Who will “own” the research

- Who you’ll talk with

- What success looks like

Below are each of those pieces in more detail.

What are your goals for customer research?

While it’s admirable to simply want to know your customers better, your research will be far more effective (read: impactful for a specific area of business) if you start with some goals.

I say “goals” because Hannah Shamji, Customer Researcher , emphasizes every customer research project should have two goals:

- A research goal

- A business goal

Your research goal is typically in the form of a question. Be careful of going too broad here though. Shamji says a question like “why are customers buying?’ is too vague to be useful. It’s not something you can actually measure and answer. Instead, try something like, “why are customers in the past 6 months buy or not buying?” This is more specific, measurable, and directive.

Once you have your research goal, your business goal outlines how you’ll use the research — what decision it’ll drive internally or what it will inform. Hannah explains this as, “stepping away and peeling back the future state of where this data is going to live and be used.” For example, if you want to know why customers have and haven’t bought in the last six months, perhaps you’re looking to improve new customer conversion rates.

Who is going to be doing the research?

Ideally, you want to appoint one person to lead the research efforts. This person “owns” the research project.

They can be an internal team member or an external expert, like Shamji or an agency. The point is, you identify one person who’s responsible for running the research and organizing the findings. This, among other things, ensures the research actually happens.

How will you find customers or prospects to talk to?

Once you have your goals and your project owner, you now need someone to research.

Figuring out who that “someone” is involves two steps:

- Identifying which type(s) of customer you need to talk with

- Outlining how you’ll engage them

1. Identifying who to talk with

You’re no doubt aware you have different types of customers. These different types include distinct personas with distinct needs. Your different customer types also include action-based segments — customers who just purchased, signed up for the email list, or canceled a subscription.

Each type of customer provides a different type of insight. For example:

- Prospective visitors can help you understand why folks come to your site, what they’re looking for, and where they get tripped up.

- Customers who just purchased can give insight into what triggers and contexts motivate other new customers to buy.

- Repeat customers can help you see what’s both delightful and frustrating about the experience you’re providing.

- Higher average order value customers can provide insight into what drives brand fanatics.

And that’s just to name a few.

Ultimately, who you focus on depends on your research question. Let’s say you’re a DTC drink subscription company, and you want to understand why subscribers canceled their recurring soda subscription last month. Your goal is to reduce churn. To do this research, you’ll want to speak with subscribers who canceled last month and dig into why they moved on.

The general rule is, speak with the customer segment or prospective customer segment that’s best equipped to answer your research questions.

2. Outlining how you’ll engage them

Once you know who you’d like to talk with, you can identify how you’ll reach out to them.

If you’re speaking with existing customers, this may be as simple as an email.

If you’re speaking with prospective customers, you’ll also want to consider where to find folks and how to qualify them as well.

Note: I’ll get into the logistics of both of those below. For now, simply write how you plan to reach out to folks.

What types of research make the most sense?

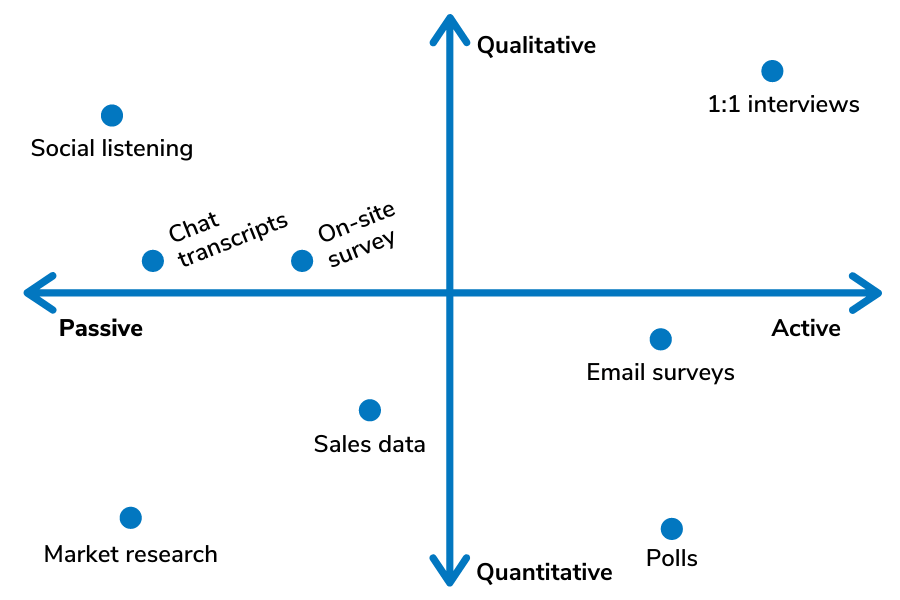

The next planning decision you’ll want to make is, “What type or types of research will give us the best data for our question?” There are quite a few types of research, and they all have strengths and weaknesses.

Here’s one helpful framework:

- Direct vs. indirect : Direct research involves actively reaching out to customers. Think interviews, online surveys, questionnaires, user testing, and similar primary research methods. Indirect research is more passive. These are methods like social listening (gleaning data from social media) or buying market research.

- Qualitative vs. quantitative: Qualitative research methods focus on substance and answering “why is this the case?” Quantitative research methods focus on numbers and answering “how often is this happening?” Most research methods excel in one area or the other. But some methods, such as surveys, can help you answer both.

You can plot most research methods (interviews, surveys, polls) along those two axes:

Keep in mind combining multiple types of research is often an effective way to gain clarity around your research question.

For example, if you want to know why website visitors aren’t converting on the homepage you rolled out last month, interviewing prospective visitors will help. But so will looking at heatmaps and path analytics in Google docs.

Non-interview research options

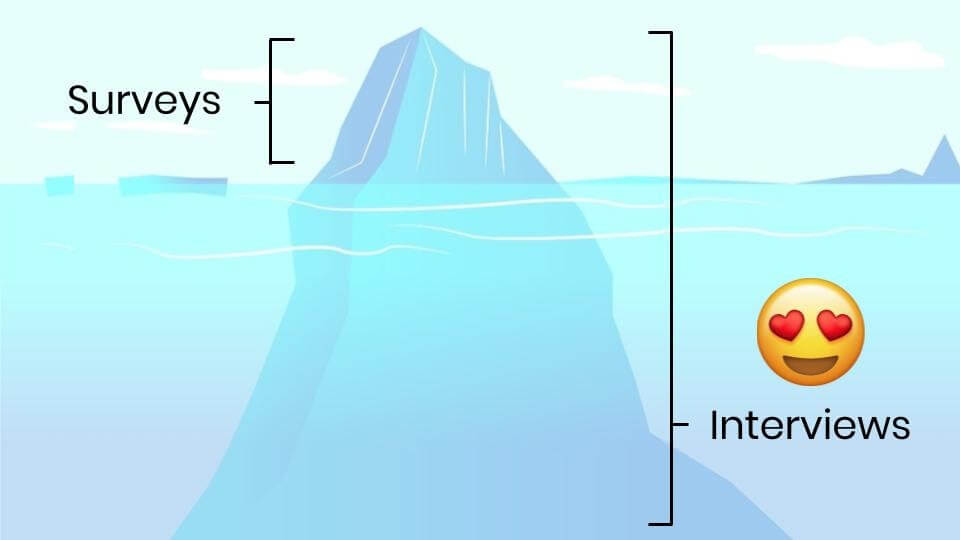

The rest of this article will focus on interviewing customers because this is one of the most impactful research methods , as Katelyn Bourgoin illustrated:

That being said, you may sometimes want to start with research options that aren’t interviews. For example, when you’re:

- Not sure what questions you need to ask or who could answer them

- Needing to gather a large volume of data points quickly around a specific question

In those scenarios, non-interview options include:

- Customer surveys: Via email or form add-ons

- Live chat transcripts : 29% of consumers use or plan to use chatbots to shop online. If you’re using chatbots, there’s a wealth of qualitative data sitting in those conversations.

- Customer support: The people answering emails, calls, and chats from potential customers or customers every day are a rich source of insight . Don’t neglect what they know.

- Forums/communities : Listen in wherever your potential customers hang out — Quora, Slack groups, Facebook communities, LinkedIn groups, local meetups, etc. This is a helpful way to find common pain points and desires.

- Social Media: Twitter, Instagram, Pinterest, TikTok, Clubhouse, Facebook…if your potential customers are chatting there, there’s something you can learn from lurking.

- Product reviews: Mining competitor reviews, similar products on amazon, or browsing aggregate review sites can indicate where customers are most fed up and what they may be looking for instead.

- Audience research tools. Several tools, such as SparkToro , UserInput , and Hotjar , are specially built for figuring out who your audience is and what they’re interested in.

Again, we don’t go deeper on each of those types of research here because that could be a book in itself. But keep in mind these can be a good starting point in certain scenarios, and they’re often useful to layer on top of interviews for additional context.

For example, Natalie Thomas, Director of Strategy at The Good, explains we always start with the journey: the path the visitor takes, where they’re coming from, and what their mindset is.

If we were working with a glasses company, we might ask, “what keywords are people searching for? Are they landing on your site because they’re looking for cute glasses? Are they looking for blue light glasses, or are they looking for acetate glasses, or are they not looking for glasses at all?” This kind of journey analysis diagnoses any problems, which helps us form specific research questions and business goals. With this method, we can ensure we’re asking the right question and focusing research on points of highest return.

How to Conduct Customer Research to Improve Customer Experience

How do you define “enough” and wrap up the project?

The last piece of your plan is defining “enough.” Or, what success looks like. This is identifying, “we know we’re done with this phase of research when…”

There are a few ways to benchmark this:

- After x amount of weeks

- After talking with y customers

- After identifying z trends

While customer research ideally becomes an ongoing effort at your brand, it’s useful to know when each piece of research wraps up. So, make sure and set a finish line.

How to conduct effective 1:1 customer interviews

Once you have a plan, you can start executing your research. This part is a lot of logistics — and a lot of fun. It involves:

- Reaching out to potential interviewees

- Formulating interview questions

- Running interviews

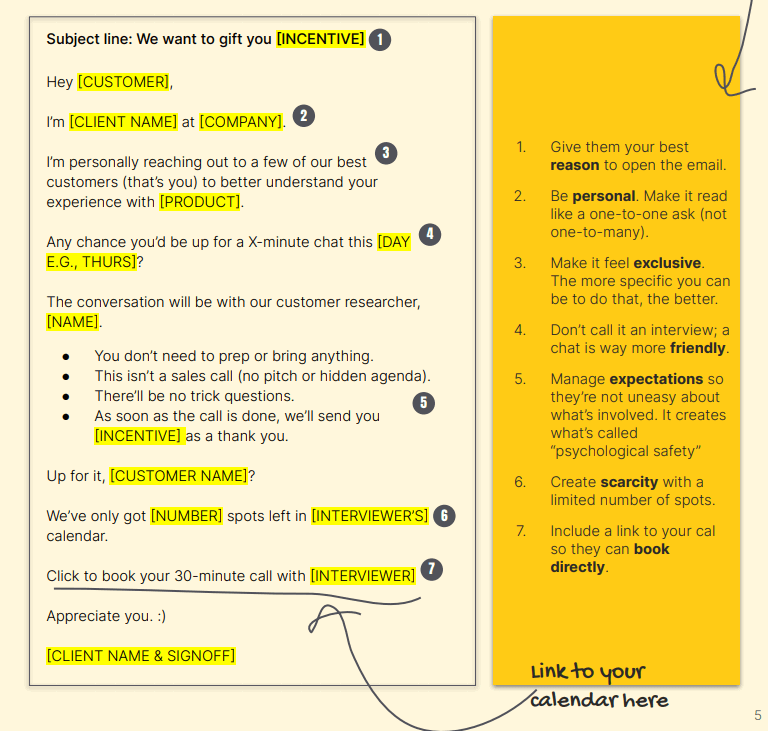

Those steps sound simple enough, but many folks get tripped up here. Do you pay people to participate? What do you say in the emails? And, for the love, what do you say in the interview??

Here are some answers based on our experience and the experts we talked with.

First, reach out to your target audience and get them to engage

The plan you built above identified which customer segment you’ll interview. Here’s where you start engaging that segment. Some questions you might run into here include:

- How many people do I contact?

- Do I pay or incentivize them to participate?

- How do I qualify them?

- What do I say when I email people?

- How do I not lose my mind scheduling it all?

They’re all good questions! Let’s take them one-by-one.

How many people do I reach out to?

It’s unlikely every customer will accept, so email 1.5 to 2x the number of customers you’d like to wind up talking to.

If you’re doing customer interviews, aim to speak with at least 5-10 people. Jess Nichols, User Research Leader and Experience Strategist, recommends , “For exploratory research, like interviews, I aim for eight to 10 participants per segment. This number ensures you can identify patterns, similarities, or differences in your participants’ responses and allow you to dive deeper into nuances you may discover during research.”