- LEGAL GLOSSARY

More results...

- Browse By Topic – Start Here

- Self-Help Videos

- Documents & Publications

- Find A Form

- Download E-Books

- Community Organizations

- Continuing Legal Education (MCLE)

- SH@LL Self-Help

- Free Legal Consultation (Lawyers In The Library)

- Ask a Lawyer

- Onsite Research

- Interlibrary Loan

- Document Delivery

- Borrower’s Account

- Book Catalog Search

- Passport Services

- Contact & Hours

- Library News

- Our Board of Trustees

- My E-Commerce Account

SacLaw Library

Www.saclaw.org.

- Documentary Transfer Tax

- Identifying grantors and grantees

- Free Sources

- Community Resources

Deed of Trust and Promissory Note

Templates and forms.

A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan.

Deed of trust is not used for transferring property to a trust A trust deed is not used to transfer property to a living trust (use a Grant Deed for that). Other than the terminology, trust deeds and living trusts have nothing in common. A living trust is used to avoid probate, not to provide security for a loan. Visit our page on Estate Planning for more information on that topic.

A trust deed is always used together with a promissory note (also called “prom note”) that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

A trust deed gives the third-party “trustee” (usually a title company or real estate broker) legal ownership of the property. This means that the trustee has no control over the property as long as the borrower (aka property owner or “trustor”) makes the agreed-upon loan payments and keeps the other promises in the trust deed. If the borrower defaults, however, the trustee has the power to sell the property to pay off the loan without having to file an action in court. The lender (also known as “beneficiary”) is then repaid from the proceeds.

Step-by-Step Instructions

Determine the parties to the agreement.

There will be three parties to these agreements. Identifying these parties ahead of time will make it easier to complete the forms.

Beneficiary

The beneficiary, more commonly known as the lender, is the person or company that lends the borrower money, and who will be entitled to be repaid from the proceeds of a foreclosure. If the lender is a corporation, be sure to include language such as “Lender is a corporation organized and existing under the laws of California” in your documents.

Borrower(s)

If there are two or more borrowers, they will be borrowing the money “jointly and severally.” This means each debtor is responsible (liable) for the entire amount of the debt. A creditor may collect from whichever debtor has the “deep pocket” (lots of money); the debtor who pays may demand contributions from the other debtors. Joint borrowers will want to carefully consider whether or not they wish to be jointly responsible with their co-borrower.

When the property used as security for the loan is owned by more than one person, you may want to consider who you will name as borrowers and owners of the property on the deed of trust. The names of all owners of the property, and their spouses, must be included to give the entire property (all owners’ interests in the property) as security. A co-owner can only give as security his or her interest in the property. In other words, a lender wants to be sure that all owners and their spouses sign the deed of trust as a condition of lending the money (unless the lender is willing to take as security one co-owner’s interest in property).

When a bank or savings and loan finances the purchase of real estate, the trustee is almost always a title or trust company. Sometimes real estate brokers act as trustees. Attorneys commonly write in the name of a title company as trustee on a trust deed, without consulting the title company. Title companies even give out trust deed forms with their names already printed in the “trustee” space. They don’t mind being named as trustee because a trustee has nothing to do unless the borrower defaults. If that happens, most title or escrow companies turn the deed over to a professional foreclosure firm.

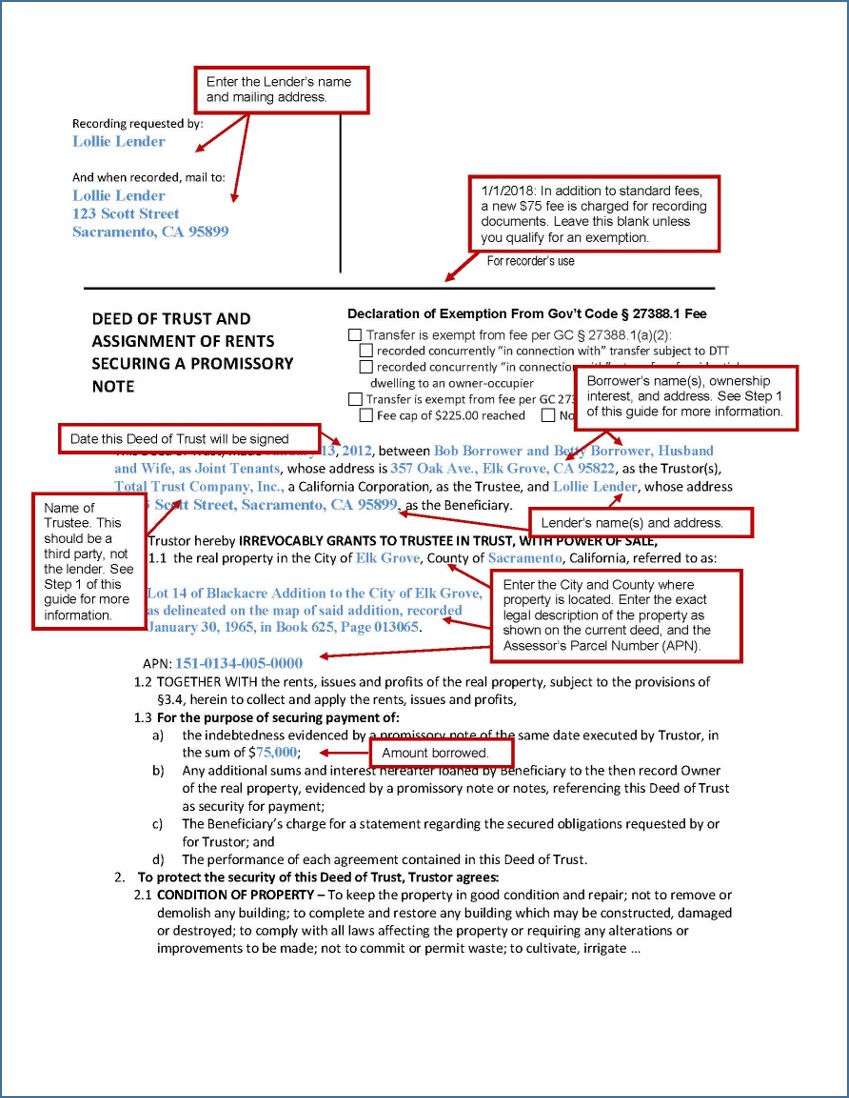

Prepare the Deed of Trust and Promissory Note

The Deed of Trust and Promissory Note must be in a format that the Sacramento County Clerk/Recorder’s Office will accept. Customizable templates may be downloaded from these links:

- Promissory Note

- Deed of Trust

Sample filled-in forms with instructions are available at the end of this Guide.

Get the Signatures Notarized

Notarization is required before recording these documents with the County Recorder. The notary’s acknowledgment of the trustor’s signature is formal proof that the signature is genuine. You can find a notary at your bank, a mailing service, or in the Yellow Pages. with instructions are available at the end of this Guide.

Record the Signed Documents at the County Recorder’s Office

Take the original signed and notarized Deed of Trust and Promissory Note to the County Recorder’s Office for the county where the property is located. In Sacramento, this is at 3636 American River Drive, Ste. 110, Sacramento CA 95864. You will need to pay a fee (you can check the current recording fees in Sacramento ). The clerk in the recorder’s office will take your original documents and stamp them with the date, time, a filing number, and book and page numbers. The original documents will be mailed back to you. Note: trust deeds are exempt from the documentary transfer tax. California Revenue and Taxation Code § 11921 .

What Happens Next?

If the borrower pays off the loan without defaulting (as happens in most cases), the beneficiary (lender) will request the trustee execute and record a deed reconveying the property to the borrower. You can find a Deed of Full Reconveyance on the Find A Form page of our website.

For more Information

At the law library:.

Deeds for California Real Estate KFC 170 .R36 (Self Help)

The Deed of Trust must be in a format the Sacramento County Recorder’s Office will accept. See the sample templates of the Deed of Trust and the Promissory Note below.

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.

- Contact Us: (916) 442-4204 Tap Here To Call Us

Assignment of California Deed of Trust Must Be Recorded Before Foreclosure- MERS Process Does Not Trump California Real Estate Law

A recent California bankruptcy court decision ( In re: Eleazar Salazar ) found a foreclosure invalid because of failure to record an assignment of the Deed of Trust. In the original Deed of trust (DOT) Accredited was the lender, Chicago Title was the trustee, and MERS was the nominal beneficiary. The DOT stated that MERS only held legal title to the interests granted by the borrower.

After the borrower defaulted, MERS signed a substitution of trustee and had no apparent role in the trustee’s sale. The sale was apparently run by Litton Loan Servicing and Quality Loan Service Corp. The Trustee’s Deed Upon Sale identified US bank as the “foreclosing beneficiary”, not MERS. The recital in the trustee’s deed is presumed to be true. While MERS was the beneficiary at the inception of the loan, it was not at time of foreclosure. In addition, no assignment of Accredited’s interest to US Bank was recorded. Facts like these make experienced real estate attorneys sit up and take notice.

The court noted that under California Civil Code section 2932.5 , the assignment to US Bank had to be recorded prior to sale. First, US Bank had to be entitled to payment of the secured debt to foreclose, and secondly, the public record must show US Bank’s status as foreclosing beneficiary before the sale occurs.

Though US bank claimed to be the holder of the note, satisfying the first condition, it did not record an assignment of its interest in the Deed of Trust, failing the second condition.

US Bank also argued that MERS status as ‘nominal beneficiary’ made recording of the assignment unnecessary. However, MERS was not beneficiary at the time of the foreclosure, and the deed of trust did not grant MERS more then nominal powers. US Bank was described in the trustee’s deed (which is presumed to be true) as the foreclosing beneficiary. So, MERS had no role in the foreclosure.

Lastly, US Bank argued that the assignment from Accredited to US bank could be tracked in the publicly accessible MERS system. The court refused to recognize MERS as an extra-judicial foreclosure alternative which can circumvent the public recordation system .

Bankruptcy courts in California have more readily addressed the arrogance of the MERS cabal of lenders efforts to circumvent state law. California state courts have been more reluctant, at least in published decisions. On the one hand, this is unfortunate, as it forces more borrowers into Bankruptcy. On the other hand, bankruptcy law provides more tools to reconfigure the parties relationships once a foreclosure sale is set aside.

- Get Started

Securing a Loan With Deed of Trust

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage. For the most part, people refer to a home loan as a “mortgage.” Technically, however, a mortgage is not actually a loan but rather a document given to a lender that creates a voluntary lien on real property. Certain states use mortgages, while other states use deeds of trust. California uses a deed of trust instrument to secure loans on real property.

One of the key differences between a mortgage and a deed of trust involves the procedure for enforcing the lien through a foreclosure process. States that have mortgages as the security instrument usually go through a judicial foreclosure process. This means that in order for the lender to foreclose on the property, they must file a court proceeding through the state court system. On the other hand, a nonjudicial foreclosure process is typically used in states that use deeds of trust. If the deed of trust has a power of sale clause, the lender can foreclose on the real property without having to go to court . Read on to learn more about securing a loan with a deed of trust.

What is a Deed of Trust?

A deed of trust pledges real property to secure repayment of a loan. A deed of trust involves three parties:

- The trustor (borrower)

- The beneficiary (the lender)

- The trustee (an independent third-party the holds “bare” or “legal” title to the property.

Get help with your Note and Deed of Trust today!

With a deed of trust, the borrower promises the lender to repay the loan. The loan is secured on real property which the borrower has pledged as security (collateral) for the loan. The true “title” to the property is held by a neutral third-party, the trustee, until the loan is paid off. The trustee is an entity (example – title company) that holds the “Power of Sale” in the event of default. Securing a loan with a deed of trust allows the trustee to sell the property and pay off the lender. A foreclosure by power of sale is neither supervised nor confirmed by the court. The property title is reconveyed to the borrower once the loan is repaid.

The deed of trust identifies the following:

- Original loan amount

- The legal description of the property being used as security for the mortgage

- The parties

- Date loan was made

- The date loan is due (maturity date)

- Legal description of the property being used to secure the loan

- Provisions and requirements for the deed of trust

- Legal procedures

- Acceleration and alienation clause

- Special notice requirements

- Assignment of rent provisions

Once executed, the deed of trust is recorded with the county recorder to show that a loan is secured on the real property. Contact A People’s Choice for more information about drafting a deed of trust to secure a real property loan.

What is a Promissory Note?

A promissory note is required to be signed by the borrower in addition to the deed of trust to secure a loan on real property. As mentioned above, the deed of trust is the security instrument. Accordingly, it binds the property to the lender in case the borrower defaults on the loan. In contrast, the promissory note is the contract between the borrower and the lender. In essence, it reflects the borrower’s consent to payback the lender the full value of the security note.

The promissory note identifies the terms of the loan such as the interest rate and payment obligations. The borrower is provided with a copy of the promissory note. The lender keeps the original document. Once the borrower pays the loan, the promissory note is marked “Paid in Full.” The note is returned to the borrower along with a recorded reconveyance deed.

Generic deed of trust forms found online may not be suited for your particular needs. Although you don’t need to hire an attorney to prepare a promissory note and deed of trust, professional help is recommended. Using the services of A People’s Choice is a great option for low-cost, professional help to make sure your documentation is properly prepared. You don’t want to find out later that your documents are flawed and your loan security compromised! Contact A People’s Choice for more information about preparing the necessary documents to secure a loan with a deed of trust. A deed of trust should be properly planned, drafted and executed. Contact us today for more information about our real estate title services.

Get help with your Legal documents today!

A people’s choice can save you hundreds of dollars by preparing your legal documents instead of an expensive attorney.

We would love to know your thoughts on this article. Connect with us over on Google+ or Twitter and join the conversation

Related Posts

How to Write a Will Without a Lawyer: Complete DIY Guide

Understanding Federal Estate and Gift Tax Rates in California

Do I Need a Probate Lawyer in California?

- basics foreclosure deed trust california

The Basics of Foreclosure on a Deed of Trust in California

While many Californians have executed Deeds of Trusts on their homes or real estate investments when buying property, few fully understand precisely what they are. There is a vague feeling that they are akin to mortgages and secure loans to purchase property. There is a vague feeling that if one does not pay, somehow the Deed of Trust allows the lender to seize the property. But when pressed, most people do not fully understand a document that is probably the single most powerful document in terms of enforcing rights against them that the law allows.

This article shall briefly review the basics of a Deed of Trust and foreclosure procedure in California. Other states have different laws on their books. The reader is advised to first read the two articles, Real Estate Transactions and Debt Collection before reading further.

What is a Deed of Trust?

When one borrows money, the lender can ask for security for repayment of the loan. That security can comprise assignment of a car’s pink slip; a pledge of various assets owned by the debtor which are secured by filing what is called a UCC-1; or a pledge of real property. If real property is utilized to secure a loan, it is usually achieved by executing a mortgage or, in California, a Deed of Trust.

A mortgage is a document that allows the creditor, who is unpaid, to proceed to court to force the sale of the property to pay off the debt.

A Deed of Trust allows a similar relief, but without requiring the court process.

A Deed of Trust (D.O.T.) is similar to a mortgage, however varies in a few crucial points.

1) A D.O.T. is much easier to foreclose upon then a mortgage because the process to foreclose on a D.O.T. bypasses the judicial process. Assuming the Trustee gives the right notices (Notice of Default and Notice of Sale) the process will go to sale without court involvement at all.

2) The parties involved consist of three persons (Beneficiary(Lender); and Trustee; and Borrower (Trustor).for the D.O.T. and two for a mortgage.

3) Foreclosed real estate may be easier for the tenant who has been foreclosed upon to regain their property[1]

In a D.O.T. there will are three parties involved, a Beneficiary (the Grantor or Lender, e.g. one who gives the loan), the Trustor (Grantee or Borrower), and the Trustee (ensures that the loan is paid back, often a title company.). If someone should default on their loan then the Trustee will organize a sale of the property in order to recover as much of the loan as possible, paying off the Lender(s) and, if any sums are left over, giving them to the Borrower.

For the first ninety days after a Notice of Default is recorded, the Trustor may normally cure the default by paying off back due payments and some minor costs. Once a Notice of Sale is recorded, at least ninety days from Notice of Default, this right to cure is extinguished.

During the process in which the Trustee is selling the property the Trustor may still renegotiate a deal with the Beneficiary or pay back the loan completely and the entire process may be stopped but after ninety days, the right to force the sale to stop is limited. If the property is sold then, because of the lack of judicial mandate, the Trustor may challenge the sale if all procedures are not strictly followed.

The reason no court involvement is required is that the Trustee “owns” the property legally until the property no longer secures the loan and thus the Trustee may utilize its legal title, in conformity with legal requirements, to pay off the loan by sale of the property in a public auction. The borrower retains equitable title and if sums are left over from the sale after payment of all creditors with liens and the costs of the sale, the proceeds go to the borrower.

If the borrower (the Trustor) fails to make a timely payment, often after some informal demands from the Lender, the Trustee will usually record a Notice of Default in the county in which the property is located.. After the Notice of Default is recorded the Trustor has 90 days to cure the default as a matter of right, by paying the past due balance and some costs.

During that 90 days the Trustee will normally determine the priority of loans and liens to be paid off at the sale by ordering a Trustee’s Sale Guarantee which will provide a list of the various liens placed upon the property and the taxes, then the private liens that were filed first will receive payment first[2].

After 90 days the Trustee will normally record and file a Notice of Trustee’s Sale, or N.O.S. This document requires that the public be made aware of the sale through either newspapers or other public notification processes. This notice must continue for 21 days at minimum. At the sale, the property is sold by the Trustee and the creditor(s) may bid all or part of their own loans to buy the property.

If all the costs and loans are paid off, any remaining balance is paid to the borrower. If insufficient sums are received from the sale, the creditors are paid off in order of their claims and the borrower receives nothing.

If the property is a home, the owner normally cannot face further liability on the Note, predicated on the anti deficiency statute . This means that upon foreclosure, the debt is extinguished in full for the home owner. Non residential property may result in further action against the borrower if the sale does not completely pay off the creditors.

Practicalities

Thirty four out of fifty states allow a D.O.T. to be used in place of a mortgage and in some of those states, a Deed of Trust is the only option presented to handle the repayment of a loan that uses home equity[3].

The sad fact is that after ninety days from Notice of Default, it may be impossible to cure the default though many lenders are not anxious to foreclose and will still renegotiate the loan. It is always worthwhile to discuss restructuring the debt with the Lender. One usually has nothing to lose and much to gain. Be sure to avoid waiving the protections of the anti deficiency statue without good legal advice. Indeed, good legal and accounting advice is critical to make these discussions worthwhile in most instances.

While the anti deficiency statue may eliminate further pressure from the note holder after the sale, one still faces the possibility of other debts and one’s credit is normally sullied for at least five to seven years.

After the sale the previous owner must vacate the premises though quite often the owners leave long before the sale.

It is important to recall that Deeds of Trusts are not limited to residential property. Further numerous Deeds of Trust may pertain to a single property, normally to be paid off in order of their recording. Most Deeds of Trust provide that if another Deed of Trust is foreclosed upon the property, that this becomes a violation of the terms of the Note for each Deed of Trust, so all the Deeds of Trust become due and owing.

Thus, fast action should be taken by the borrower the moment one receives the first Notice of Default. Waiting can only result in extinguishment of rights and a snow balling of claims against the Borrower.

[1] Deed of Trust vs. Mortgage Accessed August 6, 2008 http://www.diffen.com/difference/Deed_Of_Trust_vs_Mortgage

[2] California Civil Code 2897

[3] Mortgage Question: What is a Mortgage? Accessed August 6, 2008 Entered July 27, 2007 http://news.mortgagecalculator.org/mortgage-question-what-is-a-deed-of-trust/

Founded in 1939, our law firm combines the ability to represent clients in domestic or international matters with the personal interaction with clients that is traditional to a long established law firm.

Read more about our firm

© 2024, Stimmel, Stimmel & Roeser, All rights reserved | Terms of Use | Site by Bay Design

Collateral Assignment

Jump to Section

A collateral assignment involves granting a security interest in the asset or property to a lender. It is a lawful arrangement where the borrower promises an asset or property to the lender to guarantee the debt repayment or meet a financial obligation. Moreover, in a collateral assignment, the borrower maintains asset ownership, the lender holds the security interest, and the lender has the right to seize and sell the asset in event of default. This blog post will discuss a collateral assignment, its purpose, essential considerations, and more.

Key Purposes of a Collateral Assignment

Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan. If the borrower defaults on loan settlement, the lender can seize and market the collateral to recover the unpaid debt. Below are the key purposes of a collateral assignment.

- Enhanced Lender Protection: The primary purpose of the collateral assignment is to provide lenders with an added layer of security and assurance. Also, by maintaining a claim on the borrower's properties, lenders lower their risk and improve the probability of loan settlement. In case of default, the lender can sell the collateral to recover the unpaid balance. This security authorizes lenders to offer loans with lower interest rates, as the threat associated with the loan is reduced.

- Favorable Loan Terms: Collateral assignment allows borrowers to access financing on more favorable terms than unsecured loans . However, the terms of the loan will vary depending on the borrower’s creditworthiness and the value of the collateral. Generally, lenders are more willing to extend larger loan amounts and lower interest rates when they have collateral to fall back on. The presence of collateral reassures lenders that they have a viable means of recouping their investment, even in case of default. This increased confidence often leads to more competitive loan offers for borrowers.

- Unlocking Asset Value: Collateral assignment enables borrowers to leverage the value of their assets, even if those assets are not readily convertible into cash. For instance, a business owner with valuable machinery can assign it as collateral to secure a business loan. This arrangement allows the borrower to continue utilizing the asset for operational purposes while accessing the necessary funds for expansion or working capital. Collateral assignment, thus, enables the efficient allocation of resources. However, the collateral will still be considered in determining the loan amount and terms.

- Access to Higher Loan Amounts: When borrowers promise collateral against a loan, lenders can present greater loan amounts than for other unsecured loans. The worth of the collateral serves as a reassurance to lenders that they can recover their investment even if the borrower fails to settle the loan. Therefore, borrowers can obtain higher loans to finance important endeavors such as purchasing property, starting a business, or funding major projects.

- Diversification of Collateral: Collateral assignment offers flexibility for borrowers by allowing them to diversify their collateral base. While real estate is commonly used as collateral, borrowers can utilize other valuable assets such as investment portfolios, life insurance policies, or valuable personal belongings. This diversification allows borrowers to access financing without limiting themselves to a single asset, thereby preserving their financial flexibility.

Steps to Execute a Collateral Assignment

A collateral assignment is a financial procedure that involves utilizing an asset as security for a loan or other responsibilities. Below are the essential steps involved in the collateral assignment process.

- Assess the Need for Collateral Assignment. The initial step in collateral assignment is determining whether collateral is necessary. Lenders or creditors may require collateral to mitigate the risk of default or ensure repayment. Evaluating the value and marketability of the proposed collateral is crucial to ascertain if it meets the lender's requirements.

- Select Appropriate Collateral. The next step involves choosing a suitable asset for collateral assignment. Common classifications of collateral comprise stocks, real estate, bonds, cash deposits, and other valuable assets. The collateral's value should be sufficient to cover the loan amount or the obligation being secured.

- Understand Lawful and Regulatory Requirements. Before proceeding with collateral assignment, it is essential to comprehend the lawful and regulatory provisions specific to the jurisdiction where the transaction happens. Collateral assignment laws can vary, so seeking advice from legal professionals experienced in this area is advisable to ensure compliance.

- Negotiate Provisions. Once the collateral is recognized, the collateral assignment provisions must be negotiated among the concerned parties. It includes specifying the loan amount, interest rates, repayment terms, and any further duties or limitations associated with the collateral assignment.

- Prepare the Collateral Assignment Agreement. The collateral assignment agreement is a lawful document that typically includes details about the collateral, the loan or obligation being secured, and the rights and responsibilities of both parties. It is highly advised to engage the services of a legal specialist to prepare or review the contract.

- Enforce the Collateral Assignment Agreement. After completing the collateral assignment agreement, it must be executed by all involved parties. This step ensures that all necessary signatures are obtained and copies of the agreement are distributed to each individual for record-keeping objectives.

- Notify Relevant Parties. To ensure proper recognition and recording of the collateral assignment, it is important to notify all relevant parties. It may involve informing the lender or creditor, the custodian or holder of the collateral, and any other pertinent stakeholders. Sufficient documentation and communication will help prevent potential disputes or misunderstandings.

- Record the Collateral Assignment. Depending on the nature of the collateral, it may be necessary to record the collateral assignment with the appropriate government authority or registry. This step provides public notice of the assignment and establishes priority rights in case of multiple claims on the same collateral. Seeking guidance from legal professionals or relevant authorities can determine if recording the collateral assignment is required.

- Monitor and Maintain the Collateral. Throughout the collateral assignment term, it is crucial to monitor and maintain the value and condition of the collateral. This includes ensuring insurance coverage, property maintenance, and compliance with any ongoing obligations associated with the collateral. Regular communication between all parties involved is essential to address concerns or issues promptly.

- Terminate the Collateral Assignment. Once the loan or obligation secured by the collateral is fully satisfied, the collateral assignment can be terminated. This involves releasing the collateral from the assignment, updating relevant records, and notifying all parties involved. It is important to follow proper procedures to ensure the appropriate handling of the legal and financial aspects of the termination.

Nicholas M.

Key terms for collateral assignments.

- Security Interest: It is the legal right granted to a lender over the assigned collateral to protect their interests in case of borrower default.

- Collateral Valuation: The process of determining the worth or market value of the assigned collateral to assess its adequacy in securing the loan.

- Release of Collateral: The action taken by a lender to relinquish its claim over the assigned collateral after the borrower has fulfilled the loan obligations.

- Subordination Agreement : A legal document that establishes the priority of multiple creditors' claims over the same collateral, typically in the case of refinancing or additional loans.

- Lien : A legal claim or encumbrance on a property or asset, typically created through a collateral assignment, that allows a lender to seize and sell the collateral to recover the loan amount.

Final Thoughts on Collateral Assignments

A collateral assignment is a valuable instrument for borrowers and lenders in securing loans or obligations. It offers borrowers access to profitable terms and more extensive loan amounts while reducing the risk for lenders. Nevertheless, it is essential for borrowers to thoughtfully assess the terms and threats associated with collateral assignment before proceeding. Seeking professional guidance and understanding the contract can help ensure a successful and beneficial financial arrangement for all parties involved.

If you want free pricing proposals from vetted lawyers that are 60% less than typical law firms, click here to get started. By comparing multiple proposals for free, you can save the time and stress of finding a quality lawyer for your business needs.

Meet some of our Collateral Assignment Lawyers

Kerbis' practice includes business and real estate transactions, estate planning, and limited scope litigation consulting. Mathew has negotiated deals involving multinational corporate franchises and has collectively helped hundreds of clients with their transactional, civil litigation, and appellate legal needs. Throughout his tenure as an American Bar Association leader, Mathew has advocated for legal education reform, interviewed ABA Presidents and State Appellate and Supreme Court Justices, and lobbied Congress on behalf of the legal profession. As a law student, Mathew served as an extern for the Honorable Justice Robert E. Gordon of the Illinois Appellate Court, First District.

Craig E. Yaris is a Managing Partner at Holon Law Partners, with the experience and drive to handle all your Franchise, General Business Practice, and Mediation needs. As a former small business owner and Chief Operating Officer of a franchisor himself, Mr. Yaris is passionate about promoting business growth. He has experience handling daily operations, employee disputes, and negotiations of pertinent contracts for a franchise company with 100 locations in five states, where he organized and conducted semi- annual meetings to educate and inform franchisees of best practices for improved growth. In addition, Mr. Yaris was responsible for the preparation and filing of the UFOC (Uniform Franchise Offering Circular) in several states and is well-versed in business formation. Between his time as Franchisor and Conflict Resolution Specialist, Mr. Yaris was the Co-Founder and Chief Operating Officer of an online company whose goal was to help inform marketers and business owners of the fast-paced and ongoing changes within their specific verticals. This experience helped him hone his research and writing skills and prepared him for the cloud-based aspects of Holon Law Partners. Mr. Yaris also has extensive experience in public speaking, as he has planned and delivered several keynote addresses and educational seminars for many New York-based organizations, and as a Continuing Education Instructor for Hofstra University. Prior to joining Parlatore Law Group, Mr. Yaris worked as a Patient Advocate, and more recently, a Conflict Resolution Specialist, where he mediated and resolved disputes on behalf of patients with insurance companies. In this role, he negotiated for coverage of previously denied medications and medical procedures as well as successfully mediated disputes between individuals and business partners which would have otherwise resulted in protracted litigation. In addition, he has experience mediating employer and employee disputes as well as helping resolve family conflict. He has also studied and attended many Non-Violent Communication (NVC) workshops and strives to bring these tools and methods to all of his mediations. His variety of experiences speak to his ability to handle small business needs at all stages of business growth and development. Mr. Yaris also has experience with business growth and development, as he has worked with several small business on creating and implementing strategies for steady growth. In addition, to spending time with family, Mr. Yaris volunteers his time helping spread the message of the ACLU and he supports many local charities focused on families and children. He is admitted to practice in New York.

15 years for legal experience; expertise in contracts, healthcare, ERISA, physicians, financial services, commercial contracts, employment agreements, etc. I am adept at all contracts and can provide you with efficient and quality services. I have worked at a law firm, financial services company, consulting ,and non-profit.

In his firm, Talented Tenth Law, Antoine focuses on helping people maximize their protection and prosperity in the courtroom and the boardroom. His firm’s services include representing people in lawsuits involving breach of contract, many types of civil lawsuits and helping business owners win government contracts among other things.

Tom is a former chief legal officer of public and private companies. He has extensive experience in mergers & acquisitions, commercial transactions, joint ventures, finance, securities laws and general corporate law across a broad range of industries, including construction, consumer products, e-commerce, energy and healthcare. As an attorney who practiced at two different Top 50 international law firms, he can deliver "Big Law" service at a competitive price. Prior to becoming a lawyer, Tom served as an officer in the U.S. Army and attained the rank of Captain. He served a tour in Iraq where he led a reconnaissance platoon and was awarded the Bronze Star Medal.

Amy has served as outside general counsel and litigator to established businesses throughout western Washington since 2010. Her passion and focus is providing the best possible representation for clients in the construction, transportation and hospitality industries.

I am bar certified in the lovely state of Missouri. I received my J.D. from The University of Iowa College of Law (2019) and my B.A. in Political Science from BYU-Idaho (2015).

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Collateral Assignment lawyers by city

- Austin Collateral Assignment Lawyers

- Boston Collateral Assignment Lawyers

- Chicago Collateral Assignment Lawyers

- Dallas Collateral Assignment Lawyers

- Denver Collateral Assignment Lawyers

- Houston Collateral Assignment Lawyers

- Los Angeles Collateral Assignment Lawyers

- New York Collateral Assignment Lawyers

- Phoenix Collateral Assignment Lawyers

- San Diego Collateral Assignment Lawyers

- Tampa Collateral Assignment Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Scammers are Seeking to Steal Your Property Using Wild Deeds

What One Municipality is Doing About It

Could someone transfer your property ownership away from you without your knowledge? One scam takes advantage of the fact that California County Recorders do not vet the contents of deeds to ensure validity: an individual without any connection to the property creates confusion in the public property ownership records by recording fake deeds (“wild deeds”) purporting to grant ownership to themselves or someone else, counting on that confusion to further defraud or extort money and property from others. Such scams have been conducted recently in San Diego County, and policymakers are taking steps to protect homeowners and businesses.

Wild Deeds in the Wild

A series of recent San Diego County Superior Court cases allege that, without the participation of the true property owners, an individual claiming to be Joan E. Tapper allegedly recorded quitclaim deeds with the County of San Diego Recorder’s Office, purporting to transfer various parcels that she did not own to the hands of a fake company called Oh It Is Jesus, LLC.

As the real property owners learned the hard way, the County Recorder does not (and legally cannot) vet the contents of a deed or other recorded document. The Recorder only ensures that the general procedural requirements are followed when recording a document. For example, ensuring that the wording of the deed states that the parcel is located in San Diego County; that signatures are acknowledged by a notary with the proper notary acknowledgment language; that the text of the document is legible; and that the paper and margins are the right size (and so on).

Because the Recorder does not investigate either the substantive validity of the documents presented for recording or the authority of the persons requesting that they be recorded, a “wild” deed that confuses the chain of title potentially can be recorded even if it has been fraudulently executed by someone other than the legal owner of the real property.

Until recently, landowners who were unknowing victims of such wild deed real estate scams typically only found out about them by accident–for example, when a title search was ordered by a title company in connection with a sale or refinance or for some other purpose. For properties that change hands infrequently – for example because title to the property is held by a company or remains within a family trust for multiple generations – a wild deed might go undetected for a long period of time. When finally discovered, a wild deed can cause unintended delay or difficulty with the true owner’s ability to validly transfer ownership of the property, to obtain financing using the property as collateral, and other problems.

What a Property Owner Can Do

Fortunately, if you or your business is an owner of real property in San Diego County, you now have the option to be proactive by signing up for the County’s free real estate notice service called “Owner Alert,” which is designed to alert users when the Recorder records a deed or other instrument which references your property. Learn more on the County website .

Related Posts

- Clarity for California Medical Staffs Regarding Statutory and Common Law Fair Hearing Rights

- How Digital Health Companies are Impacted by the USPTO’s New Obviousness Guidance

- Climate Disclosure Obligations for U.S. Companies: A Work in Progress

Latest Posts

- Contract Terms Serve as Eligibility Criteria for Medical Staff Membership and Privileges

See more »

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Refine your interests »

Written by:

Published In:

Procopio, cory, hargreaves & savitch llp on:.

"My best business intelligence, in one easy email…"

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

This docket was last retrieved on April 29, 2024. A more recent docket listing may be available from PACER .

Use the links below to access additional information about this case on the US Court's PACER system. A subscription to PACER is required.

Access this case on the Virginia Eastern District Court's Electronic Court Filings (ECF) System

- Search for Party Aliases

- Associated Cases

- Case File Location

- Case Summary

- Docket Report

- History/Documents

- Related Transactions

- Check Status

Disclaimer: Justia Dockets & Filings provides public litigation records from the federal appellate and district courts. These filings and docket sheets should not be considered findings of fact or liability, nor do they necessarily reflect the view of Justia.

Why Is My Information Online?

Subscribe to Justia's Free Newsletters featuring summaries of federal and state court opinions .

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

IMAGES

VIDEO

COMMENTS

FOR VALUE RECEIVED, the undersigned hereby grants, assigns and transfers to. all beneficial interest under that certain Deed of Trust dated executed by. to and recorded as Instrument No. Recorder's office of. on. , as Trustor , Trustee , of Official Records in the County County, California. Describing land therein as (insert legal description):

A typical assignment of the Deed of Trust alone will purport to assign "all beneficial interest under that certain Deed of Trust dated xyz.." But the long-established law in California is clear: the beneficial interest under a Deed of Trust is held by the party who holds the Note (or is entitled to enforce it), without regard to the ...

California has a 150-year history of development and evolution in the way its courts have applied legal principles regarding the title to real property and the conveyance/transfer of the title. These legal principles also ... provided that the deed of trust or assignment of the deed of trust or collateral documents in favor of the lender

COLLATERAL ASSIGNMENT OF DEED OF TRUST With Request for Notice of Default and Notice of Delinquency Prepared by: Agent _____ Broker _____ Phone _____ Email ... California that the foregoing paragraph is true and correct. WITNESS my hand and official seal.

first deed of trust in the amount of $25,000.00. and is requesting a second deed of trust in the amount of $40,000.00 and no other liens will be placed against the Property, which is valued at $100,000.00, the loan-to-value ratio is 65% ($25,000.00 +$40,000.00 divided by $100,000.00 = 65%).

A trust deed is always used together with a promissory note (also called "prom note") that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party "trustee" (usually a title company or real estate broker) legal ownership of ...

This is often done when a Deed of Trust has been sold. This allows the new Lender the right to collect payments of the debt. A typical Deed of Trust contains a Power of Sale clause, allowing a non-judicial foreclosure. (The power of sale may be exercised by the assignee if the assignment is duly acknowledged and recorded.) (California Code 2932.5)

ASSIGNMENT OF DEED OF TRUST. FOR VALUABLE CONSIDERATION, the undersigned hereby grants, assign, and transfers to all beneficial interest under that certain Deed of Trust dated by to as Trustee, and recorded , in Book/Reel , at Page/Image , Series Number of Official Records of County, California, together with the Promissory Note secured by said ...

Section 2934 - Recordation of assignment of mortgage or beneficial interest under deed of trust. Any assignment of a mortgage and any assignment of the beneficial interest under a deed of trust may be recorded, and from the time the same is filed for record operates as constructive notice of the contents thereof to all persons; and any instrument by which any mortgage or deed of trust of, lien ...

County, California, describing land therein as: See Exhibit A attached hereto and made a part hereof. TOGETHER with the note or notes therein described or referred to, the money due and to become due thereon with interest, and all rights accrued or to accrue under said Deed of Trust. Dated: _____ STATE OF CALIFORNIA

A recent California bankruptcy court decision (In re: Eleazar Salazar) found a foreclosure invalid because of failure to record an assignment of the Deed of Trust.In the original Deed of trust (DOT) Accredited was the lender, Chicago Title was the trustee, and MERS was the nominal beneficiary. The DOT stated that MERS only held legal title to the interests granted by the borrower.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

Trustee shall deliver to such purchaser its deed conveying the property so sold, but without any covenant or warranty, express or implied. The recitals in such deed of any matters or facts shall be conclusive proof of the truthfulness thereof. Any person, including Trustor, Trustee, or Beneficiary as hereinafter defined, may purchase at such sale.

SHORT FORM DEED OF TRUST AND ASSIGNMENT OF RENTS. ORDER NO. The following is a copy of provisions (1) to (14), inclusive, of the fictitious deed of trust, recorded in each county in Cal ifornia, as stated in the foregoing Deed of Trust and incorporated by reference in said Deed of Trust as being a part thereof as if set forth at length therein.

With a deed of trust, the borrower promises the lender to repay the loan. The loan is secured on real property which the borrower has pledged as security (collateral) for the loan. The true "title" to the property is held by a neutral third-party, the trustee, until the loan is paid off. The trustee is an entity (example - title company ...

Updated July 17, 2023. A California deed of trust is a deed used in connection with a mortgage loan. It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. A short form deed of trust for use in typically smaller and non-institutional loans secured by any type of real property (commercial and residential) located in California.

A Deed of Trust allows a similar relief, but without requiring the court process. A Deed of Trust (D.O.T.) is similar to a mortgage, however varies in a few crucial points. 1) A D.O.T. is much easier to foreclose upon then a mortgage because the process to foreclose on a D.O.T. bypasses the judicial process. Assuming the Trustee gives the right ...

3. Payment of such further sums as the then record owner of said property may borrow from Beneficiary, when evidenced by another note (or notes) reciting it is so secured. To Protect the Security of This Deed of Trust, Trustor Agrees: (1) To keep said property in good condition and repair, not to remove or demolish any building thereon, to ...

Deed of Trust - Assignment of Rents / Due on Sale. (for use with Note containing Due on Sale provision) MS Word. PDF. Request for Copy of Notice of Default. MS Word. PDF. Request for Notice of Delinquency. MS Word.

A collateral assignment involves granting a security interest in the asset or property to a lender. It is a lawful arrangement where the borrower promises an asset or property to the lender to guarantee the debt repayment or meet a financial obligation. Moreover, in a collateral assignment, the borrower maintains asset ownership, the lender ...

The instrument will contain the name of the original Lender, Trustee, and Borrower, the book and page where this Deed is recorded, and the name and address of the successor Trustee. Without conveyance of the Property, the successor Trustee will succeed to all the title, powers, and duties of the Trustee. 24.

Again, while a mortgage involves two parties, a deed of trust involves three: the trustor (the borrower) the lender (sometimes called a "beneficiary"), and. the trustee. The trustee is an independent third party, like a title company, trustee company, or bank. The trustee holds "bare" or "legal" title to the property.

The assignment shall be enforced by one or more of the following: (1) The appointment of a receiver. (2) Obtaining possession of the rents, issues, or profits. (3) Delivery to any one or more of the tenants of a written demand for turnover of rents, issues, and profits in the form specified in subdivision (k), a copy of which demand shall also ...

For example, ensuring that the wording of the deed states that the parcel is located in San Diego County; that signatures are acknowledged by a notary with the proper notary acknowledgment ...

A deed of trust or a trust deed is a legal document used in financed real estate transactions as an alternative to mortgages in certain states. Unlike mortgages that only involve a borrower and lender, a deed of trust introduces a neutral third party — a trustee.

Date Filed Document Text; April 29, 2024: Filing 1 Complaint for a Judicial Sale ( Filing fee $ 405, receipt number AVAEDC-9498672.), filed by Trustee Services of Virginia, LLC, Truist Bank f/k/a Branch Banking and Trust Company. (Attachments: #1 Exhibit 2002 Deed, #2 Exhibit 2009 Deed of Trust, #3 Exhibit 2011 Assignment, #4 Exhibit 2012 Loan Modification, #5 Exhibit 2016 Judgment, #6 Exhibit ...