17+ Loan Sanction Letter Format – Examples, Email Template, Tips

- Letter Format

- March 12, 2024

- Approval Letters , Bank Letters , Loan Letters

Loan Sanction Letter Format: A loan sanction letter is an official document issued by a financial institution, usually a bank or a credit union, that outlines the terms and conditions of a loan that has been approved. This letter serves as proof that the borrower has been granted a loan and specifies the amount, interest rate, repayment schedule, and other important details. In this article, we will discuss the Loan Sanction Letter Format and important components of a loan letter .

Also Check:

- Bajaj Finance Loan Approval Letter

- Bank Account Closing Letter Format

The loan sanction letter Format is an essential document that borrowers need to have to proceed with their loan application. This article will discuss the loan sanction letter format and what it typically includes the below format:

Tips for Loan Sanction Letter Format

Content in this article

- Header: The header of the loan sanction Approval letter should include the name and address of the financial institution issuing the letter. It should also include the date and the borrower’s name and address.

- Salutation: The salutation should address the borrower by name and indicate that the loan has been approved.

- Opening Paragraph : The opening paragraph of the loan sanction letter should state that the borrower’s loan application has been approved and the amount of the loan that has been sanctioned.

- Loan Terms: The next section of the Bank letter should provide details about the loan terms, including the interest rate, repayment period, and the repayment schedule. The letter should also state any additional fees or charges associated with the loan.

- Collateral and Security: If the loan is secured against collateral or security, this should be mentioned in the letter. The letter should also specify the type of collateral or security that has been provided and its value.

- Conditions and Covenants: The letter should outline any conditions or covenants that the borrower must meet to receive the loan. These could include maintaining a certain credit score, providing proof of income, or meeting other requirements.

- Closing Paragraph: The closing paragraph should reiterate the loan terms and express confidence that the borrower will meet the conditions and covenants outlined in the letter.

- Signature and Contact Information: The letter should be signed by an authorized representative of the financial institution and should include their contact information, including phone number and email address.

Loan Sanction Letter Format – Sample Format

Below is a Sample format of Loan Sanction Letter Format:

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

[Loan Officer’s Name] [Bank Name] [Bank Address] [City, State, ZIP Code]

Subject: Loan Sanction Letter

Dear [Loan Officer’s Name],

I hope this letter finds you well. I am writing to express my sincere gratitude for the approval of my loan application with [Bank Name]. It is with great pleasure that I acknowledge the sanction of the loan requested for [purpose of the loan].

The terms and conditions outlined in the offer are well understood, and I am committed to adhering to them throughout the loan tenure. I appreciate the competitive interest rate and the favorable repayment plan provided by [Bank Name].

I would like to request the disbursal of the sanctioned loan amount to the specified account at your earliest convenience. Please let me know if any further documentation or formalities are required from my end.

I am confident that this financial assistance will contribute significantly to my endeavors, and I assure you of my responsibility in repaying the loan as per the agreed terms.

Once again, thank you for your prompt and efficient handling of my loan application. I look forward to a successful and mutually beneficial relationship with [Bank Name].

Please feel free to contact me for any additional information or clarification.

Thank you for your cooperation.

[Your Name] [Your Signature]

Feel free to customize this loan sanction letter based on your specific situation and the terms of the loan offer.

Loan Sanction Letter Format – Example

Here’s an Example of Loan Sanction Letter Format:

[Name of Borrower] [Address] [City, State ZIP Code]

Dear [Name of Borrower],

We are pleased to inform you that your loan application has been approved by [Name of Lender] for the amount of [Loan Amount]. The loan will be disbursed in [Number of Disbursements] equal installments of [Installment Amount], with the first installment being disbursed on [Date of First Disbursement].

The interest rate on this loan is [Interest Rate], and the repayment period is [Repayment Period]. The loan also includes a processing fee of [Processing Fee Amount] and a late payment fee of [Late Payment Fee Amount]. You are required to make all payments on time to avoid incurring additional charges.

Please note that the loan sanction letter contains important information about the terms and conditions of the loan. It is essential that you read and understand this document carefully before accepting the loan. If you have any questions or concerns, please do not hesitate to contact us.

Thank you for choosing [Name of Lender] as your financial partner. We look forward to working with you.

[Name of Lender] [Contact Information]

Home Loan Approval Letter

This home loan approval letter expresses gratitude for the approval, acknowledges terms, and requests disbursal while affirming commitment to the repayment schedule.

Subject: Home Loan Approval Letter

I hope this letter finds you well. I am writing to express my sincere appreciation for the approval of my home loan application with [Bank Name]. I am thrilled to receive the news of the loan approval and am excited to embark on the journey of homeownership.

I would like to extend my gratitude to you and the entire team at [Bank Name] for the thorough and efficient processing of my home loan application. The terms and conditions outlined in the approval letter are well understood, and I am fully committed to complying with them throughout the loan tenure.

I request the necessary arrangements to be made for the disbursal of the sanctioned home loan amount to the specified account at your earliest convenience. Please inform me of any additional documentation or formalities required from my end to facilitate a smooth disbursal process.

I am confident that this home loan will play a crucial role in achieving my dream of owning a home, and I assure you of my diligence in adhering to the repayment schedule as agreed.

Once again, thank you for your assistance and support throughout this process. I look forward to a positive and enduring relationship with [Bank Name].

Please feel free to contact me for any further information or clarification.

Feel free to customize this home loan approval letter based on your specific situation and the terms of the loan approval.

Personal Loan Sanction Letter

This personal loan sanction letter expresses thanks for approval, acknowledges terms, and requests disbursal, ensuring commitment to responsible repayment.

Subject: Personal Loan Sanction Letter

I trust this letter finds you well. I am writing to express my sincere gratitude for the approval of my personal loan application with [Bank Name]. It is with great pleasure that I acknowledge the sanction of the loan requested for [purpose of the loan].

I appreciate the competitive interest rate and the favorable repayment plan provided by [Bank Name]. The terms and conditions outlined in the offer are well understood, and I am committed to adhering to them throughout the loan tenure.

I would like to request the disbursal of the sanctioned personal loan amount to the specified account at your earliest convenience. Please inform me of any further documentation or formalities required from my end.

I assure you of my responsibility in repaying the loan as per the agreed terms, and I look forward to a positive and mutually beneficial relationship with [Bank Name].

Once again, thank you for your prompt attention to my loan application. Please feel free to contact me for any additional information or clarification.

Feel free to customize this personal loan sanction letter based on your specific situation and the terms of the loan offer.

Loan Sanction Letter Format – Template

Here’s a Template of Loan Sanction Letter Format:

We are pleased to inform you that your loan application for [Loan Purpose] has been approved by [Name of Lender]. The loan amount is [Loan Amount], and the interest rate is [Interest Rate]. The loan will be disbursed in [Number of Disbursements] equal installments of [Installment Amount], with the first installment being disbursed on [Date of First Disbursement].

In addition to the loan amount and interest rate, the loan also includes a processing fee of [Processing Fee Amount] and a late payment fee of [Late Payment Fee Amount]. Please ensure that all payments are made on time to avoid incurring additional charges.

The loan sanction letter contains important information about the terms and conditions of the loan. Please read this document carefully and ensure that you understand all of the terms and conditions before accepting the loan.

If you have any questions or concerns, please do not hesitate to contact us. We are committed to providing you with excellent service and support throughout the loan process.

Loan Disbursal Request Letter

This loan disbursal request letter formally seeks the release of sanctioned funds, affirming completion of requirements and eagerness to utilize the loan for the intended purpose.

Subject: Request for Loan Disbursal

I trust this letter finds you well. I am writing to formally request the disbursal of the sanctioned loan amount as per the terms outlined in the loan approval letter dated [approval date].

I have completed all the necessary documentation and formalities from my end, and I am eager to proceed with the utilization of the funds for the intended purpose. I kindly request your assistance in expediting the disbursal process.

Please let me know if there are any additional steps or documentation required from my end to facilitate the prompt release of the funds. I am available at your convenience to provide any necessary information or clarification.

I appreciate your prompt attention to this matter and look forward to your positive response.

Feel free to customize this loan disbursal request letter based on your specific situation and the terms of the loan approval.

Loan Sanction Confirmation Letter

This letter formally acknowledges and confirms the loan sanction, expressing gratitude and readiness for the disbursal process.

Subject: Loan Sanction Confirmation

I am writing to acknowledge and confirm the sanction of the loan as per the terms outlined in the loan approval letter dated [approval date]. I appreciate the efforts of you and your team at [Bank Name] in processing my loan application efficiently.

I have carefully reviewed the terms and conditions mentioned in the loan approval letter, and I assure you of my commitment to fulfilling all the requirements and obligations stipulated therein.

I would like to request the disbursal of the sanctioned loan amount to the specified account at your earliest convenience. Please inform me of any further documentation or formalities required from my end.

I look forward to a positive and enduring relationship with [Bank Name] and appreciate your assistance throughout this process.

Feel free to customize this loan sanction confirmation letter based on your specific situation and the terms of the loan offer.

Business Loan Approval Letter

This letter celebrates the approval of a business loan, expresses gratitude to the bank, and requests disbursal while affirming commitment to the agreed terms.

[Your Company Name] [Your Company Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

Subject: Business Loan Approval Letter

I am delighted to inform you that our application for a business loan with [Bank Name] has been approved. I extend my sincere gratitude to you and your team for the efficient processing of our loan application.

The terms and conditions outlined in the approval letter dated [approval date] are well understood, and we are committed to complying with them throughout the loan tenure. The competitive interest rate and favorable repayment plan provided by [Bank Name] are greatly appreciated.

I kindly request the necessary arrangements to be made for the disbursal of the sanctioned business loan amount to our company’s specified account at your earliest convenience. Please inform us of any additional documentation or formalities required from our end to facilitate a smooth disbursal process.

We look forward to utilizing this financial assistance to support and enhance our business operations. Your support is instrumental in our growth, and we are eager to establish a positive and enduring relationship with [Bank Name].

Thank you once again for your assistance and cooperation.

[Your Name] [Your Position] [Your Company’s Employee ID] [Your Signature]

Feel free to customize this business loan approval letter based on your specific situation and the terms of the loan offer.

Email format about Loan Sanction Letter Format

Here’s an Email format of Loan Sanction Letter Format:

Subject: Loan Sanction Letter for [Borrower’s Name]

Dear [Borrower’s Name],

I am writing to inform you that your loan application with [Lender’s Name] has been approved. Attached to this email, you will find the loan sanction letter containing all the necessary details regarding the loan.

The loan amount is [Loan Amount], and the interest rate is [Interest Rate]. The loan will be disbursed in [Number of Disbursements] equal installments of [Installment Amount], with the first installment being disbursed on [Date of First Disbursement]. The loan also includes a processing fee of [Processing Fee Amount] and a late payment fee of [Late Payment Fee Amount].

It is essential that you read and understand the loan sanction letter carefully before accepting the loan. If you have any questions or concerns, please do not hesitate to contact us. We are committed to providing you with excellent service and support throughout the loan process.

Please note that you must provide us with all the necessary documentation and fulfill any other requirements before the loan amount can be disbursed. We encourage you to complete these formalities at the earliest convenience to avoid any delays in the disbursement process.

Thank you for choosing [Lender’s Name] as your financial partner. We look forward to working with you.

[Your Name] [Your Title] [Your Contact Information]

Email Format about Loan Sanction Letter Format

Professional Loan Sanction Letter Format

This professional Loan Sanction Letter Format expresses gratitude, acknowledges terms, and requests disbursal while affirming a commitment to a responsible and enduring financial relationship with the bank.

Subject: Professional Loan Sanction Letter

I trust this letter finds you well. I am writing to express my gratitude for the approval of my loan application with [Bank Name]. The professional and efficient manner in which my application was processed is commendable.

I have carefully reviewed the terms and conditions outlined in the loan approval letter dated [approval date], and I am fully committed to fulfilling all the requirements and obligations stipulated therein. The competitive interest rate and flexible repayment options provided by [Bank Name] align perfectly with my financial goals.

I would like to formally request the disbursal of the sanctioned loan amount to the specified account at your earliest convenience. Please advise me of any additional documentation or formalities required from my end.

I assure you of my diligence in adhering to the repayment schedule and look forward to a positive and enduring relationship with [Bank Name].

Thank you for your

cooperation and professionalism throughout this process. Please feel free to contact me for any further information or clarification.

Feel free to customize this professional Loan Sanction Letter Format based on your specific situation and the terms of the loan offer.

Loan Sanction Letter Format to Bank

This Loan Sanction Letter Format to the bank acknowledges approval, expresses gratitude, and requests disbursal, showcasing commitment to the agreed terms.

[Bank Name] [Bank Address] [City, State, ZIP Code]

Dear [Bank Name],

I am writing to acknowledge and express my gratitude for the approval of my loan application with your esteemed institution. I am pleased to receive the loan sanction letter dated [approval date].

I have thoroughly reviewed the terms and conditions specified in the sanction letter, and I am committed to fulfilling all the requirements and responsibilities outlined therein. The competitive interest rate and flexible repayment options provided by [Bank Name] align well with my financial needs.

I kindly request the disbursal of the sanctioned loan amount to the specified account at your earliest convenience. If there are any additional documents or formalities required, please inform me promptly.

I appreciate the professional and efficient manner in which my loan application was processed, and I look forward to a positive and enduring relationship with [Bank Name].

Feel free to adapt this Loan Sanction Letter Format to the bank based on your specific situation and the terms of the loan offer.

FAQS for Loan Sanction Letter Format – Examples, Email Template, Tips

What should be included in a loan sanction letter format.

A Loan Sanction Letter Format should include details about the borrower, loan amount, interest rate, repayment terms, and any specific conditions or requirements.

Can you provide an example of a Loan Sanction Letter Format?

Certainly! A Loan Sanction Letter Format typically includes information about the borrower, loan details, and terms of the loan. You can find sample formats online or request one from your lending institution.

How to format a professional Loan Sanction Letter Format Email?

A professional Loan Sanction Letter Format Email should be concise, clear, and formal in tone. It should include a subject line indicating the purpose, a greeting, the body containing all necessary details about the loan sanction, and a closing with your contact information.

What are the essential tips for writing a Loan Sanction Letter Format?

This Loan Sanction Letter Format include some Essential tips such as: 1. Ensure clarity and accuracy in conveying loan terms. 2. Use formal language and maintain a professional tone. 3. Include all relevant details such as loan amount, interest rate, repayment schedule, and any conditions. 4. Express gratitude for the loan sanction and readiness for disbursal. 5. Proofread carefully for errors before sending.

Are there different templates for various types of loans, like personal or business loans?

Yes, there are different templates tailored for personal, business, home, or auto loans. Each Loan Sanction Letter Format template may include specific details relevant to the type of loan, such as collateral requirements for business loans or property details for home loans. You can find templates online or request them from your lending institution.

A loan sanction letter Format is a vital document that outlines the terms and conditions of a loan that has been approved . The Loan Sanction Letter Format should be clear and concise, and it should include all of the important details of the loan. The Loan Sanction Letter Format should be carefully reviewed by the borrower to ensure that they fully understand the terms and conditions of the loan before signing .

Related Posts

11+ Authorized Signatory Letter Format – Templates, Writing Tips

15+ Vigilance Complaint Letter Format, Key Tips, Templates

22+ Specimen Signature Letter Format – Elements & Samples

20+ Single Account to Joint Account Letter Format & Examples

30+ Signature Verification Letter Format – Writing Tips & Examples

17+ SBI Appointment Letter Format PDF- How to Write, Examples

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

All Formats

Table of Contents

7 steps on how to write a loan sanction letter, 3+ loan sanction letter templates, 1. free loan sanction letter, 2. education loan sanction letter template, 3. loan sanction letter example, 4. free request for loan sanction letter in pdf, 3+ loan sanction letter templates in google docs | word | pages | pdf.

What do you do when you need financial aid? You apply for a loan. However, you cannot just get a loan as soon as you ask for it. The loan needs to be sanctioned, by the appropriate bank or the loan agency. Only after the loan is sanctioned you can get the loan amount that you applied. To authorize this and validate the loan, a loan sanction letter is drafted. Loan Sanction Letter Templates are used to make these letters .

Step 1: Ask for the Reasons

Step 2: mention the eligibility standards, step 3: define the monthly installments, step 4: ask for approval, step 5: ask for the documents, step 6: provide the required clauses, step 7: mention the limitations.

- Google Docs

More in Letters

Loan modification calculator, loan guarantee letter, balloon loan calculator, legal template loan agreement, check register for loan repayments template, monthly loan amortization schedule template, loan interest rate amortization schedule template, finance loan template, simple interest loan calculator template, loan calculator template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Apply for Instant Loan

Download Our App

- Eligibility

- Interest Rates

- Document Required

EMI Calculator

- Personal Loan App

- Instant Cash Loan

- Mobile Loan

- Short Term Loan

- Salary Advance Loan

- Education Loan

- Medical Loan

- Travel Loan

- Debt Consolidation Loan

- Home Renovation Loan

- Marriage Loan

- Consumer Durable Loan

- Personal Loan For Women

- Personal Loan For Doctors

- Personal Loan For Businessman

- Personal Loan For Self-Employed

- Personal Loan For Corporate Employees

- Personal Loan For Government Employee

- Personal Loan For Salaried Employees

- Personal Loan For Chartered Accountant

- Personal Loan For Defence Personnel

- Unsecured Business Loans

- Bill Discounting Or Invoice Discounting

- Medical Equipment Loan

- Working Capital Loan

- MSME/SME Loan

- Car Insurance

- Bike Insurance

- Instant Loan

- Emergency Loan

- Personal Loan For Teachers

- Dealer Locator

- Customer Care

- Pay Online --> Pay Online

- Pay from anywhere

- Customer service app NEW

- Covid Safety Measures NEW

- Bill Discounting Portal

- RBI IRCAP - Customer Education DISCLOSURE

- Fraud Awareness

- Customer Education discclosure

- Personal Loan

Personal Loan Sanction Letter: Know About Its Meaning and Importance

- 13 January 2023

- Hero FinCorp Team

- 123619 Views

- 2023-01-13 12:19:26

Table of Contents

What is a loan sanction letter?

- Processing fees

- Loan application number

- Loan category

- Type of interest rate charged

To Avail Personal Loan

What factors do lenders consider before providing a personal loan sanction letter, credit history, debt-to-income ratio, employment status, additional income, what are the documents required for getting a personal loan sanction letter, what is the importance of a personal loan sanction letter.

- The loan sanction letter serves as an acceptance letter. If you accept the terms and conditions and other information on the document, the lender will proceed with the remaining steps required for loan disbursement.

- A sanction letter will assist you in determining whether or not to proceed with your lender. If you applied with two lenders at the same time, this letter will help you compare the offers on the table.

- In the event of multiple applications, you can use this letter to negotiate a lower personal loan interest rate with other lenders.

What is the validity period of the personal loan sanction letter?

Why does the lender not directly dispatch the loan agreement letter, to conclude.

How to Track Personal Loan Application Status Online?

Personal Loans are the best funding options for people who nee . . .

How To Get Instant Personal Loan for Low CIBIL Score?

Personal Loan with Low CIBIL score . . .

Instant Personal Loan without Salary Pay Slip or Bank Statement

An Instant personal loan is a quick and convenient method to cate . . .

Our Top 10 Picks for the Best High Mileage Electric Bikes and Scooters in India

The electric bike segment has drastically boomed in India in r . . .

.webp)

How to Calculate Your Personal Loan EMI Using Excel?

Equated monthly installments (EMIs) are the installments that you . . .

नहीं चुका पा रहे ऋण की किश्त बरतें ये सावधानियां

Everyone in India and abroad was surprised by the government’s announcement to replace ...

छोटे व्यवसायों में ऋण भुगतान के उचित उपाय

What is Personal Loan Overdraft Facility - Overview and How It Works?

Hero FinCorp

Disbursement

The act of paying out money for any kind of transaction is known as disbursement. From a lending perspective this usual implies the transfer of the loan amount to the borrower. It may cover paying to operate a business, dividend payments, cash outflow etc. So if disbursements are more than revenues, then cash flow of an entity is negative, and may indicate possible insolvency.

Subscribe to our newsletter and get exclusive deals you wont find anywhere else straight to your inbox!

Public Notice

Notice No. 1 of 2

Public Notice: Moratorium Message

Dated: march 31, 2020.

Dear Customers,

Today, the entire world is facing a crisis in the form of Covid-19, and it is during these times that we all need to come together to support each other and to act responsibly.

In light of the recent nationwide lockdown, we at Hero FinCorp are providing a three months moratorium to our loan customers as per eligibility and guidelines issued by RBI. This moratorium facility is only applicable for EMIs due between March 01, 2020 and August 31, 2020. EMIs / over dues prior to March 01, 2020 are not eligible for moratorium.

Please note, if you opt for the moratorium, interest will continue to accrue for the duration of the moratorium period at the currently running interest rate on your loan. This additional interest will be collected from you by extending the original tenor of your loan. We will also share an updated loan repayment schedule which would include all relevant details.

We urge customers to use this option only if absolutely necessary. This facility has been especially designed for those customers whose cash flows have been severely affected and they do not have sufficient savings or other income sources which they could use for paying their EMIs. The downsides of opting for the moratorium include:

- 1. Higher interest costs

- 2. Longer loan tenor

- 3. You pay more overall

If you can, then you must continue to pay EMIs as per your existing Repayment Schedule. This would be a far superior option in the long run as it offers several benefits, it is easier, simpler, and cheaper to do, so choose wisely!

To apply for moratorium, please send us a request from your Registered Email Address, along with your Loan Account Number and Registered Mobile Number. Post which we shall initiate the moratorium for unpaid EMI of March 2020 (if any), and for EMI of April and May 2020.

For moratorium request or any other information, please write to us at:

Retail Finance Customers:

Corporate Finance Customers:

Best Wishes, Team Hero FinCorp

Notice No. 2 of 2

Public Notice: Update on Hero FinCorp’s operations during COVID-19

Dated: march 26, 2020.

At Hero FinCorp, health and safety of all our employees, customers, and stakeholders is a top priority. In the wake of the Corona virus (COVID-19) outbreak, we are strictly adhering to guidelines from the government and other concerned authorities, in order to contain the spread of the virus and minimize impact on business.

During this challenging time, we have taken several measures to ensure safety of our employees, this includes providing work from home option for all our workforce and keeping a regular check on their and their family’s well-being. We have shut–down our offices and introduced alternate ways of working through Digital modes to ensure safety and business continuity. We are also working with our vendors and partners to ensure compliant and robust BCP plans are operationalized at their end as well.

Given the 21 day nation-wide lockdown announced by the honorable Prime Minister of India on March 24, 2020, we have put in place various initiatives to ensure that there is zero disruption in critical operational processes. Accordingly we are ensuring regular and relevant communication goes out to all our stakeholders and investors on the status of our operations.

While we remain committed to providing high levels of service to our customers, given the circumstances, we urge our customers to co-operate with us by ensuring the following:

- 1. Choose E-mail channel for any loan servicing related request - This is a channel that has been strengthened to ensure quick resolutions to issues raised. While our call center remains operational, customers might encounter longer wait times, as they are operating at a reduced capacity to accommodate work-from-home policy.

- 2. Ensure timely payments of EMIs through digital channels – We urge our customers to remain disciplined towards their EMI re-payments. We have made available numerous digital modes of payments on our official website (www.HeroFinCorp.com), and encourage our Retail customers to pay their dues by leveraging the same.

This is an unprecedented situation, and we at Hero FinCorp remain fully focused on overcoming the common crisis that we face. We are confident that with a little faith and discipline we shall soon see this situation through and normal business operations shall resume.

In case of any query regarding your loan, re-payment or loan servicing requests, please do reach out to us on the below mentioned E-Mail IDs:

For Retail Loans Help

- Two-Wheeler

- Personl Loan

- Simply Cash

For Corporate Loans Help

- Machinery Loans

- Loan Against Property

- Corporate loans and Structured Finance

- Doctor Loans

- Supply Chain Finance/ Bill Discounting

- Medical Equipment Finance

- Construction/ Healthcare/ Education Finance

Team Hero FinCorp

Personal Loan Sanction Letter: Meaning & Importance

A personal loan gives you a handy credit line to fund various expenses - from medical to travel. While several online guides help you determine the application process, most leave out the part about 'how to know if your request has been approved?'

It's pretty simple. You get a personal loan approval letter from your lender. This letter states that the lender has cleared your loan application under specific terms and conditions. Also known as the loan sanction letter, it is one of the essential documents in the loan approval process.

What is a Personal Loan Approval Letter?

A personal loan approval letter is a lender-issued document that qualifies as proof of approval. This signals that the lender has green-lighted your loan request. The components of a personal loan approval letter clearly outline the terms and conditions for its approval.

While personal loan sanction letter formats can vary from one lender to the next, most contain the following particulars:

- Loan application number

- Sanctioned loan amount

- Type of interest rate applicable (fixed, floating, or mixed)

- Rate of interest applicable

- Loan tenure

- Processing fees and other charges

- Validity of the letter

Note: Most personal loan sanction letters are valid for up to 6 months. If this validity window expires, you will have to start the application process from scratch. Moreover, this letter is not equivalent to a disbursal letter the lender sends once the loan agreement is signed.

Is a Personal Loan Approval Letter Really That Important?

Yes. While not your disbursement letter, your personal loan approval letter is just as important. Here's a list of reasons why you should assess, sign, and preserve this letter:

- It is equivalent to a letter of acceptance by your lender. Once you get this letter, you know that the vetting process has ended, and your loan stands approved - should you choose to sign the letter.

- The terms of your loan application are clearly outlined in this letter. This includes essential particulars like your loan tenure, ROI, sanctioned amount, and the processing fees and prepayment charges associated with the loan.

- Reviewing this comprehensive loan document helps you avoid the hassle of juggling paperwork. More importantly, assessing these terms and conditions lets you decide whether to proceed with the loan.

- If you had anticipated better lending terms, you could leverage this letter to get better interest rate quotes from other lenders. Moreover, if you've applied to two lenders, you can compare the two approval letters and pick the better offer.

- Personal loan approval letters ensure transparency between you and the lender. If any loan terms are unclear, you can bring them up with the lender before signing the loan agreement.

- Your personal loan sanction letter can substantiate the loan terms discussed between you and the lender. Simply put, it can serve as a communication document between the two parties. You can use it to settle any disputes arising in the future between you and the lender.

- Your personal loan approval letter mentions your EMIs and repayment duration. Reviewing these EMI numbers helps you assess your ability to manage the loan, given your expenses.

Can I Improve My Personal Loan Approval Chances?

To improve your chances of getting an approval letter, you can lower your debt-to-income ratio and clear outstanding debts to improve your CIBIL score. Having a stable source of income and the right documents in place expedites the verification process, improving your approval chances.

However, waiting for your personal loan approval can take a while. If you need immediate funds and have a good CIBIL score, you can rely on Fi Money's pre-approved instant loans borrowing a maximum of Rs. 5 Lakhs at pocket-friendly rates.

Frequently Asked Questions

What is a personal loan sanction letter .

A personal loan sanction letter qualifies as an official loan approval document issued by the lender after verifying the loan request. It outlines all the terms and conditions of the loan, including loan amount, ROI, EMI amount, tenure, fees, etc.

How do you sanction a personal loan?

To get a personal loan sanctioned, you must meet the lender's eligibility criteria and submit the necessary supporting documents. The lender will then review the application, check your credit history, and assess the documents to sanction the loan if the application meets its requirements.

Can I reject the loan after getting the sanction letter?

Yes. If you're unhappy with the loan terms, you can reject the loan even after receiving the sanction letter.

Where can I get a loan sanction letter?

You can only receive a loan sanction letter from your lender. If you've applied for a personal loan, you can expect one from the lender once the verification is completed.

Home Loan Archive | Home Loan Sanction Letter : How to Apply, Meaning and Process

Business Loan Archive

CIBIL Score Archive

Financial News

Home Loan Archive

LAP Archive

Media Coverage

Mutual Funds Archive

Personal Loan Archive

- Eligblity Calculator AI Based

Home Loan Sanction Letter : How to Apply, Meaning and Process

April 26, 2023

Sanction letter is an important document that provides clarity and transparency in the loan process. It outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, processing fee, prepayment charges, security or collateral, and other relevant details. This letter helps the borrower to understand the loan process and make informed decisions. It diminishes the risk of any misunderstandings or disputes in the future.

This blog will discuss the importance of a home loan sanction letter and what it includes.

Table of Contents

Significance of a Home Loan Sanction Letter

The home loan sanction letter is an important document that provides several benefits to the borrower. Firstly, it confirms that the loan application has been approved, which is a significant relief for the borrower.

Secondly, it outlines the terms and conditions of the loan, which helps borrowers to understand the repayment schedule and interest rates. This enables borrowers to plan their finances and make timely repayments.

Thirdly, the home loan sanction letter indicates the loan amount the borrower is eligible for. This helps the borrower assess the house’s affordability and make informed decisions. Finally, the home loan sanction letter is a legal document that provides clarity and transparency in the loan process. It ensures that both the borrower and the lender are on the same page and reduces the risk of any misunderstandings or disputes in the future.

Sanction Letter Sample Format

Best Bank for Home Loan In 2023

Components of a home loan sanction letter.

A home loan sanction letter is a comprehensive document including several vital details. These details provide transparency and help make the loan process easier and quicker. This document also allows the borrower to understand all loan-related conditions. Some of the key information included in a home loan sanction letter is:

Loan Amount

The home loan sanction letter specifies the loan amount for which the borrower is eligible. This amount is based on the borrower’s income, credit score, and other relevant factors.

Interest Rate

The home loan sanction letter specifies the interest rate that will be charged for the loan. This rate may be fixed or floating and can significantly impact the overall cost of the loan.

Repayment Schedule

The home loan sanction letter outlines the repayment schedule. This includes the tenure of the loan, the frequency of the repayments (monthly, quarterly, etc.), and the amount of each repayment.

Processing Fee

The home loan sanction letter may include a processing fee the borrower must pay the lender. This fee is typically a percentage of the loan amount and covers the cost of processing the loan application.

Prepayment Charges

The home loan sanction letter may specify the prepayment charges that the borrower needs to pay if they decide to repay the loan before the end of the tenure. These charges may be a percentage of the outstanding loan amount or a fixed fee.

Security or Collateral

The home loan sanction letter may specify the security or collateral that the borrower needs to provide to the lender. This may include the purchased house or any other assets the borrower owns. Other Terms and Conditions: The home loan sanction letter may include additional terms and conditions that the borrower needs to comply with. These may consist of maintaining a specific credit score, not defaulting on the loan, and providing regular updates on their financial status.

How to Apply for a Home Loan Sanction Letter?

To apply for a sanction letter, you must complete an application and provide the necessary documentation to your lending institution. This includes financial information such as bank statements, tax returns, and other proof of income. You must also provide proof of identity, such as a driver’s license or passport. Your lender will evaluate your application and provide a loan sanction letter if approved.

Home Loan Sanction Letter – Documents Required

The applicant must produce the following documents for a home loan sanction letter.

- Identification Proof: Aadhaar Card, PAN Card, and Passport.

- Residential Proof

- Passport – Size Photograph

- Bank Statements for the last six months.

- Salary Slips for the last three months

- Documentation of Property

- Income Tax Return Form

Home Loan Sanction Letter vs Home Loan Approval

A home loan sanction letter is a document issued by a bank or other financial institution formally confirming that your loan application is accepted and the loan amount is sanctioned. It has all the details regarding the loan amount, interest rate, repayment tenure, etc.

On the other hand, a home loan approval is a decision made by a lender to approve a borrower’s request to purchase a home. This approval is based on the borrower’s creditworthiness and other factors such as income, debt-to-income ratio, and down payment. A borrower must have a pre-approval letter before making an offer on a home.

Digital Sanction Letter

The digital revolution has tremendously influenced the banking industry, as nowadays, one can also opt for a digital sanction letter from various banks and lending institutions. One can apply for a Digital sanction letter directly from the bank or from their home through the institution’s official website. Top financial institutions such as HDFC and SBI have established a hassle-free process for Digital Sanction letters.

This feature also allows users to review their online home loan application status. A digital sanction letter is like any other sanction letter, with the difference that it features a digital format.

Factors to Keep in Mind While Applying for Sanction Letter

Applicants must consider the following factors when filing the home loan sanction letter.

- Be fluent with the application procedure the bank has established to ensure a hassle-free loan disbursement.

- The applicant must also factor in any inconsistency in the loan amount instead of the amount applied, as the loan amount sanctioned concerns their credit history.

- The applicants must review all the details provided in the document, including the interest rates for the sanction letter.

- They are also required to produce any additional documents before the validity of the sanction letter ends.

- Applicants must ensure the authenticity of the property they plan to acquire. It is crucial as their loan application can be rejected in failure to do so.

FAQs For Sanction Letter

How long is a home loan sanction letter valid.

The home loan sanction letter's validity concerns the lending institution. Generally, it varies between one to three months.

Can a home loan sanction letter be revoked?

If the applicant does not meet the requirements established by the bank, their application can be revoked from the home loan sanction letter.

Is a home loan sanction letter the same as a pre-approved home loan?

A home loan sanction letter is a formal document issued by a lender to a borrower confirming that the lender has approved the loan amount and the terms and conditions of the loan. A pre-approved home loan is an offer made by a lender to a borrower before a loan application is made based on the borrower's credit score and other factors.

Is a home loan sanction letter mandatory to buy a home?

No, a home loan sanction letter is not mandatory to buy a home. It is only necessary if you are taking out a loan to finance your purchase.

Is a home loan sanction letter a guarantee of a home loan?

No, a home loan sanction letter does not guarantee a home loan. It indicates that a lender has reviewed the borrower's application and is willing to lend the borrower an amount of money, subject to certain conditions being met.

Looking for something more?

Personal Loan

Business Loan

Loan Against Property

You may like these posts

February 09, 2024

October 05, 2023

September 11, 2023

September 05, 2023

September 01, 2023

August 31, 2023

Check Credit Score

Eligibilty calculator.

EMI Calculator

Balance Transfer

Pre Payments Calculator

- Credit Score

Most Popular

Top 10 Best Private Banks in India List 2024

January 03, 2024

Top10 List of Petrol Pump Companies in India

May 16, 2023

Top 10 Best Bank for Home Loan In India…

Types of Mutual Funds : Based…

September 14, 2022

Plot Loan for Land Purchase

January 12, 2023

How Balance Transfer Affects Your Credit…

June 25, 2022

Social Platform

Home Loan Interest Rates

Personal Loan Interest Rates

Personal Loan By Banks

- BOB Personal Loan

- SBI Personal Loan

- HDFC Personal Loan

- ICICI Personal Loan

- IDFC Personal Loan

- Federal Personal Loan

Personal Loan By Cities

- Personal Loan in Delhi

- Personal Loan in Gurgaon

- Personal Loan in Bangalore

- Personal Loan in Chennai

- Personal Loan in Hyderabad

- Personal Loan in Pune

Personal Loan By Professions

- Personal Loan for Women

- Personal Loan for Self Employed

- Personal Loan for Senior Citizens

- Personal Loan for Students

- Personal Loan for Doctors

- Personal Loan for Salaried Employee

Personal Loan By Amount

- 1 Lakh Personal Loan

- 2 Lakh Personal Loan

- 3 Lakh Personal Loan

- 5 Lakh Personal Loan

- 8 Lakh Personal Loan

- 10 Lakh Personal Loan

Personal Loan By CIBIL Score

- Personal Loan with 550 CIBIL Score

- Personal Loan with 600 CIBIL Score

- Personal Loan with 650 CIBIL Score

- Personal Loan with 700 CIBIL Score

- Personal Loan with 750 CIBIL Score

- Personal Loan with 800 CIBIL Score

Personal Loan By Schemes

- Personal Loan for Medical Emergency

- Personal Loan for Travel

- Debt Consolidation Personal Loan

- Personal Loan for Wedding

Personal Loan Without

- Personal Loan without Income Proof

- Personal Loan Low CIBIL Score

- Personal Loan without Salary Slip

- Personal Loan without Documents

Other Personal Loan

- Overdraft Personal Loan

- Flexi Personal Loan

- Small Personal Loan

- Personal Loan Balance Transfer

- Short Term Personal Loan

Personal Loan Calculators

- Personal Loan EMI Calculator

- Personal Loan Eligibility Calculator

- Personal Loan Prepayment Calculator

- Personal Loan Balance Transfer Calculator

Home Loan By Banks

- HDFC Ltd Home Loan

- SBI Home Loan

- LIC Housing Finance Home Loan

- Bank of Baroda Home Loan

- Axis Bank Home Loan

- HDFC Home Loan

Home Loan By Cities

- Home Loan in Gurgaon

- Home Loan in Delhi

- Home Loan in Bangalore

- Home Loans in Hyderabad

- Home Loans in Chennai

- Home Loans in Dehradun

Home Loan By Professions

- Home Loan for Women

- Home Loan for Government Employees

- Home Loan for Self Employed

- Home Loan for Senior Citizens

- Home Loan for Salaried Person

- Home Loan for Bank Employees

Home Loan By Amount

- 20 Lakh Home Loan EMI

- 25 Lakh Home Loan EMI

- 30 Lakh Home Loan EMI

- 40 Lakh Home Loan EMI

- 50 Lakh Home Loan EMI

- 1 crore Home Loan EMI

Home Loan By Property

- Home Loan for Plot

- Home Loan for Renovation

- Home Loan for Construction

- Commercial Property Loan

Home Loan By CIBIL Score

- Home Loan with 550 Credit Score

- Home Loan with 600 Credit Score

- Home Loan with 650 Credit Score

- Home Loan with 700 Credit Score

- Home Loan with 750 Credit Score

- Home Loan with 800 Credit Score

Home Loan By Salary

- Home Loan for 20000 Salary

- Home Loan for 30000 Salary

- Home Loan for 40000 Salary

- Home Loan for 50000 Salary

- Home Loan for 60000 Salary

- Home Loan for 70000 Salary

Home Loan By Other

- NRI Home Loan

- Home Loan without Income Proof / ITR

- Home Loan for Low CIBIL Score

- Home Loan without Documents

- Home Loan without Salary Slip

Home Loan Calculators

- Home Loan EMI Calculator

- Home Loan Eligibility Calculator

- Home Loan Prepayment Calculator

- Home Loan Balance Transfer Calculator

Business Loan By Banks

- Axis Bank Business Loan

- Kotak Bank Business Loan

- Bajaj Finserv Business Loan

- Yes Bank Business Loan

- Hero Fincorp Business Loan

Business Loan Calculators

- Business Loan EMI Calculator

- Business Loan Prepayment Calculator

- Business Loan Balance Transfer Calculator

Loan Against Property By Banks

- HDFC Bank Loan Against Property

- Axis Bank Loan Against Property

- Kotak Bank Loan Against Property

- Bajaj Finserv Loan Against Property

- IDFC First Bank Loan Against Property

Home Loan Interest Rate of All Banks

- SBI Home Loan Interest Rates

- HDFC Ltd Home Loan Interest Rates

- ICICI Bank Home Loan Interest Rates

- Bank of Baroda Home Loan Interest Rates

- LIC Housing Finance Home Loan Interest Rates

- Axis Bank Home Loan Interest Rates

- PNB Home Loan Interest Rates

- Canara Bank Home Loan Interest Rates

- HDFC Bank Home Loan Interest Rates

- Bank of India Home Loan Interest Rates

- Kotak Mahindra Home Loan Interest Rates

- IDBI Bank Home Loan Interest Rates

- Indian Bank Home Loan Interest Rates

- Bank of Maharashtra Home Loan Interest Rates

- Union Bank of India Home Loan Interest Rates

Personal Loan Interest Rate of All Banks

- SBI Personal Loan Interest Rates

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Axis Personal Loan Interest Rates

- Bank of India Personal Loan Interest Rates

- Canara Bank Personal Loan Interest Rates

- PNB Personal Loan Interest Rates

- BOB Personal Loan Interest Rates

- Indian Bank Personal Loan Interest Rates

- Yes Bank Personal Loan Interest Rates

- Indusind Bank Personal Loan Interest Rates

- IDBI Bank Personal Loan Interest Rates

- IDFC First Bank Personal Loan Interest Rates

- Kotak Bank Personal Loan Interest Rates

ICICI Bank Credit Card

YES Bank Credit Card

Standard Chartered Credit Card

Axis Bank Credit Card

IDFC Bank Credit Card

Mutual Funds

FD Interest Rates

Recurring Deposit

Employees Provident Fund

Public Provident Fund

Voluntary Provident Fund

National Pension Scheme

National Savings Certificate

Senior Citizen Savings Scheme

- SBI Mutual Fund

- ICICI Prudential Mutual Fund

- HDFC Mutual Fund

- Nippon India Mutual Fund

- Kotak Mahindra Mutual Fund

- Aditya Birla Sun Life Mutual Fund

Fund Categories

Equity fund.

- Tax Saver Mutual Fund

- Hybrid Mutual Fund

Commodity Fund

- Others Funds

- SBI Equity Fund

- ICICI Equity Fund

- HDFC Equity Fund

- Nippon India Equity Fund

- Kotak Mahindra Equity Fund

- Aditya Birla Sun Life Equity Fund

Tax Saving Fund

- SBI Tax Saving Fund

- ICICI Tax Saving Fund

- HDFC Tax Saving Fund

- Nippon India Tax Saving Fund

- Kotak Mahindra Tax Saving Fund

- Aditya Birla Sun Life Tax Saving Fund

- SBI Debt Fund

- ICICI Debt Fund

- HDFC Debt Fund

- Nippon India Debt Fund

- Kotak Mahindra Debt Fund

- Aditya Birla Sun Life Debt Fund

Hybrid Fund

- SBI Hybrid Fund

- ICICI Hybrid Fund

- HDFC Hybrid Fund

- Nippon India Hybrid Fund

- Kotak Mahindra Hybrid Fund

- Aditya Birla Sun Life Hybrid Fund

- Kotak Mahindra Commodity Fund

- SBI Commodity Fund

- ICICI Commodity Fund

- HDFC Commodity Fund

- Nippon India Commodity Fund

- Aditya Birla Sun Life Commodity Fund

Other Mutual Funds

- Large Cap Mutual Fund

- Midcap Mutual Fund

- Small Cap Mutual Fund

- Multi Cap Mutual Fund

- Short Term Deposit Mutual Fund

Popular Mutual Funds

- Axis Bluechip Fund

- Mirae Asset Large Cap Fund

- Parag Parikh Flexi Cap Fund

- UTI Flexi Cap Fund

- Axis Midcap Fund

- Kotak Emerging Equity Fund

- Bank of Baroda

- Canara Bank

- Union Bank of India

nationalized-banks

- Indian Bank

- Bank of India

- State Bank of India

- Punjab National Bank

- Bank of Maharashtra

- Punjab and Sind Bank

Private Banks

- Kotak Mahindra Bank

- Indusind Bank

- IDFC First Bank

- Federal Bank

- Bajaj Finserv

- AU Small Finance Bank

- Hero Fincorp

- L&T Finance

- Ujjivan Small Finance Bank

- Capital First Ltd

- Cholamandalam Finance

- Fullerton India

- IIFL Finance

Banking Guide

- Axis Bank Mini Statement

- Axis Bank Timings

- Axis Bank Net Banking

Calculators

- Axis Bank Home Loan Calculator

- Axis Bank Personal Loan Calculator

- Axis Bank Business Loan Calculator

- Axis Bank Loan Against Property Calculator

- Axis Bank FD Calculator

- Axis Bank RD Calculator

- Axis Bank PPF Calculator

- Bank of Baroda Balance Check

- Bank of Baroda Mini Statement

- Bank of Baroda Timings

- Bank of Baroda Net Banking

- Bank of Baroda Home Loan Calculator

- Bank of Baroda Personal Loan Calculator

- Bank of Baroda Business Loan Calculator

- Bank of Baroda Loan Against Property Calculator

- Bank of Baroda FD Calculator

- Bank of Baroda RD Calculator

- Bank of Baroda PPF Calculator

- Canara Bank Net Banking

- Canara Bank Timings

- Canara Bank Mini Statement

- Canara Bank Balance Check

- Canara Bank Home Loan Calculator

- Canara Bank Personal Loan Calculator

- Canara Bank Business Loan Calculator

- Canara Bank FD Calculator

- Canara Bank RD Calculator

- Canara Bank PPF Calculator

- SBI SMS Banking

- SBI Mini Statement

- SBI Password Reset

- SBI Customer Care Number

- SBI ATM Pin Generation

- SBI CIF Number

- SBI mPassBook

- SBI Account Number

- SBI Home Loan Calculator

- SBI Personal Loan Calculator

- SBI Business Loan Calculator

- SBI Loan Against Property Calculator

- SBI FD Calculator

- SBI RD Calculator

- SBI PPF Calculator

- HDFC NetBanking

- HDFC Bank Customer ID

- HDFC ATM PIN Generation

- HDFC Bank Timings

- HDFC Bank Mini Statement

- HDFC Bank Account Closure

- HDFC Home Loan Calculator

- HDFC Personal Loan Calculator

- HDFC Business Loan Calculator

- HDFC Loan Against Property Calculator

- HDFC FD Calculator

- HDFC RD Calculator

- HDFC PPF Calculator

- Union Bank of India Net Banking

- Union Bank Timings

- Union Bank Balance Check

- Union Bank Mini Statement

- Union Bank of India Home Loan Calculator

- Union Bank of India Business Loan Calculator

- Union Bank of India FD Calculator

- Union Bank of India RD Calculator

- Union Bank of India PPF Calculator

- Union Bank of India Personal Loan Calculator

- Union Bank of India Loan Against Property Calculator

SIP Calculator

Income Tax Calculator

FD Calculator

PPF Calculator

Mutual Fund Calculator

RD Calculator

GST Calculator

Lumpsum Calculator

Salary Calculator

HRA Calculator

TDS Calculator

Sukanya Samridhi Yojana Calculator

Currency Converter

Today Gold Rate

Today Silver Rate

Adhaar Card

Indian Holidays

© 2024 www.urbanmoney.com. All rights reserved.

- Terms and Conditions

- Policy of Use

Need Loan Assistance?

Query submitted

Thank you for showing your interest. Our agent will get in touch with you soon.

Loan Sanction Letter: Meaning, Sample, Format, Validity, Process

Blessy George

Updated on: April 2, 2024

A loan sanction letter is an official document issued by a lender (bank or financial institution) to a borrower, confirming approval of the borrower’s loan application. It includes details such as the approved loan amount, interest rate, repayment schedule, terms, and conditions. It serves as a formal agreement between the lender and borrower, outlining the terms of the loan agreement.

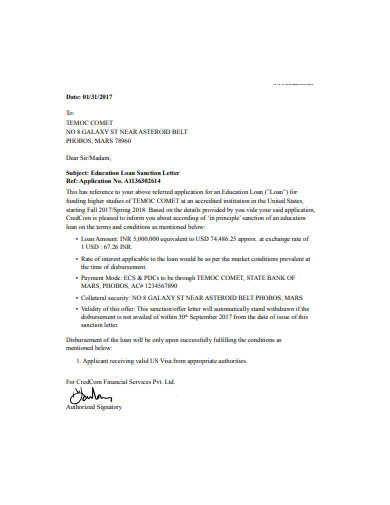

The bank or lending institution issues after checking that the borrower meets the eligibility criteria. The students can also submit the loan sanction letter to their university as evidence of financial support. Let’s understand in detail all about an education loan sanction letter.

What is an Education Loan Sanction Letter?

An education loan sanction letter is a letter that states the approval of a loan by the lender. All the major details of the education loan like interest rate, net eligible loan amount, repayment period, EMI amount, and details of course and university. However, the loan sanction letter is not the final loan agreement. The borrower still needs to provide the documents to the lender. Check more details below:

- After the sanction of the loan, you can check all the details and decide whether to proceed with the loan or not

- If you want to take the loan, you need to submit certain documents to the bank or lender like the admission letter, visa approval letter, details of travel and health insurance etc

- Post submission, the bank will verify the documents and initiate the process of loan disbursement

Steps to Issue the Letter by the Lender

When you submit an education loan application to a bank, the bank starts the verification process. All the details which you mention in the loan application form are verified properly and it shall be supported by a valid document. Check more details below:

- The credit history and credit score of the applicant

- Applicant’s ability to repay the loan. For this purpose, the applicant’s debt-to-income ratio, net monthly income, liabilities etc are considered

- The sources of income of the candidate are verified

- The documents submitted are verified and the lender checks if there is any outstanding debt that the borrower has.

Significance of a Loan Sanction Letter

A sanction letter is important for several reasons. Some of these reasons are listed below:

- It is a letter of acceptance that comes with a validity

- A sanction letter allows further processing of the loan application

- Applicant can read the sanction letter to decide whether to go ahead with the loan application

- It also gives an opportunity to the borrower to negotiate lower interest rates & easier terms with other lenders

Also Read: Loan Related Terms That Every Student Should Know!

What is Included in a Loan Sanction Letter?

The format of the sanction letter remains the same. However, the details included would differ on the basis of the loan.

- Loan application number

- Residential address of the applicant

- The loan category under which the loan is offered

- The amount of loan sanctioned

- Tenure of the loan and the Rate of interest

- EMI is applicable and the processing fee

- Type of interest and the base rate at which interest is calculated

- Aside from these details, the validity of the sanction letter, details of loan processing, and the situations in which the loan can be revoked will also be mentioned

Also Read; How To Get An Education Loan Against Property To Study Abroad? Here’s The Answer!

Validity of a Loan Sanction Letter

The validity of this letter is generally for a period of 6 months. During this time frame, the borrower has to avail the loan. If the letter has expired or the loan is revoked then the borrower is required to make a fresh application. Thus, the borrower has to meet the eligibility requirements set by the lender and make a fresh loan application.

Documents Required

Several documents have to be submitted to receive a sanction letter. These are as follows:

- Loan application form

- Identification documents/KYC documents

- Address proof of the applicant

- Last 6 months’ bank statements

- Form 16/income tax returns

- Salary slips for the last 3 months

- Proof of business/business financials (self-employed)

- Income tax returns of the last 2 years (self-employed)

How is a Sanction Letter Different From In-Principle Approval and Disbursement Letter?

A sanction letter, in-principle approval letter, and disbursement letters are different. The following are the main differences between an in-principle approval letter and a sanction letter.

After the bank verification of documents, the loan is disbursed. The disbursal of the loans takes place after the loan agreement is drafted, stamped, and signed. The bank will keep the documents as security till the loan is repaid. A loan disbursement letter is issued after the loan amount has been granted. It contains details of the loan paid by the lender.

What Happens After You Receive the Sanction Letter?

After receiving a personal sanction letter, the bank will send a certified offer letter mentioning important details of the loan. The loan applicant needs to sign the document and submit it to the lender. At this stage, the borrower must carefully read and understand the terms and conditions.

What is a Digital Sanction Letter?

The personal loan application process has been simplified and made digital. Several banks offer the facility to customers to digitally apply for a personal loan. Thus, the loan applicant can get a digital sanction letter. As the name implies, a digital sanction letter is a sanction letter sent digitally to the loan applicant.

Also Read: Can You Get A Study Abroad Education Loan With Low Cibil Score?

A loan sanction letter is a document sent by the lender to the applicant. The document states that the loan applicant is eligible for the personal loan.

The total amount of time taken to sanction a loan and the disbursement is 72 hours.

A sanction letter is not legally binding. It means the banks can reject your loan application if you do not meet the terms and conditions.

A sanction letter is an important part of the loan application process. However, it is not legally binding. A sanction letter does not legally approve the loan. Loan applicants have to undergo document verification, and background checks before the loan agreement is drafted. Applicants who get a the letter must go through the details of the loan and consult the lender for any discrepancies. It is important to bring to the notice of the lender such issues before the next stage of loan approval begins. For any student loan, bank account, or money-related queries, contact the Fly. Finance Team.

About Blessy George

Blessy George is a seasoned finance specialist who specialises in school financing. With over two years of experience, Blessy has polished her abilities in negotiating the complexities of the education loan procedure and has become an expert at problem-solving in this arena. Her extensive knowledge of financial systems and lending practices, together with her rigorous attention to detail, has earned her the trust of students and parents seeking educational financial help. Blessy's passion for empowering individuals through education drives her dedication to developing customised solutions and ensuring that aspiring students can attain their academic goals.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Latest Blogs

Education Loan

Axis Bank Education Loan Interest Rate: Calculation, Major Factors

Bank of India Education Loan Documents Required

Axis Bank Education Loan Processing Time

Bank of Maharashtra Education Loan Processing Time

Bank of Maharashtra Education Loan for Abroad

Student Bank Account

Best Student Bank Account to Open for Study Abroad

Kotak Mahindra Bank Education Loan Interest Rate: Calculation, Major Factors

ICICI Bank Education Loan to Study Abroad: Interest, Eligibility, Documentation

Bank of India Education Loan Processing Time and Steps Involved

DCB Bank Education Loan Interest Rate

Part Period Interest in Education Loan: Meaning, Calculation Method, Importance

SBI Zero Balance Account: Features, Interest, Documents, Eligibility

Baroda Yoddha Education Loan for Wards of Defence Personnel

A Comprehensive Guide to Karnataka Bank Education Loan to Study Abroad

HDFC Bank Education Loan to Study Abroad: Eligibility, Interest, How to Apply

Latest Web Stories

PH 1800-572-126

2nd & 3rd floor, Windsor Grand, Sector 126, Noida - 201313

© LEVERAGE ED-TECH PVT LTD

Send Money Abroad in

Request a callback, get an education loan at the lowest interest rate, thank you your call request has been submitted.

Our team will connect with your shortly

Credit Cards

Axis bank credit card, axis bank kwik rupay credit card, axis bank my zone credit card, axis bank select credit card, indianoil axis bank credit card, axis bank magnus credit card, flipkart axis bank credit card, axis bank vistara credit card, axis bank rewards credit card, axis bank vistara infinite credit card, axis bank neo credit card, samsung axis bank signature credit card, axis bank aura credit card, axis bank vistara signature credit card, axis bank privilege credit card, samsung axis bank infinite credit card, axis bank reserve credit card, axis bank airtel credit card, axis bank insta easy credit card, axis bank freecharge credit card, axis bank forex card, axis bank rupay credit card, axis bank burgundy private credit card, axis bank credit card interest rates, axis bank credit card pin generation, axis bank credit card offers, axis bank credit card types, hdfc credit card, hdfc freedom credit card, hdfc indian oil credit card, hdfc moneyback credit card, hdfc infinia credit card, hdfc diners club black credit card, hdfc swiggy credit card, hdfc regalia credit card, hdfc millennia credit card, hdfc business moneyback credit card, hdfc regalia gold credit card, hdfc regalia first credit card, hdfc upi rupay credit card, paytm hdfc bank credit card, hdfc moneyback+ credit card, tata neu plus hdfc bank credit card, shoppers stop hdfc bank credit card, flipkart wholesale hdfc bank credit card, 6e rewards indigo credit card, hdfc times platinum credit card, hdfc bank corporate platinum credit card, hdfc rupay credit cards, hdfc forex cards, hdfc virtual credit card, best hdfc credit cards, sbi credit card, sbi prime credit card, sbi simply click credit card, sbi elite credit card, sbi irctc platinum credit card, sbi simply save credit card, sbi pulse credit card, sbi cashback credit card, idfc first bank credit card, idfc millennia credit card, idfc classic credit card, idfc wealth credit card, idfc wow credit card, idfc select credit card, au bank credit card, au bank zenith credit card, au bank vetta credit card, au bank altura plus credit card, au bank altura credit card, au bank lit credit card, au bank credit card eligibility, au bank credit card customer care number, au bank credit card net banking, au bank credit card bill payment, american express credit card, amex membership rewards credit card, amex platinum reserve credit card, american express platinum charge card, amex smartearn credit card, american express gold charge card, amex platinum travel credit card, amex payback credit card, hsbc credit card, hsbc smart value credit card, hsbc visa platinum credit card, hsbc premier credit card, hsbc cashback credit card, hsbc lifetime free credit card, hsbc bank credit card statement, hsbc credit card reward points, hsbc credit card application status, hsbc credit card bill payment, standard chartered credit card, standard chartered smart credit card, standard chartered manhattan platinum credit card, standard chartered platinum rewards credit card, standard chartered easemytrip credit card, standard chartered credit card login, standard chartered credit card customer care, standard chartered credit card bill payment, standard chartered bank credit card statement, yes bank credit card, yes prosperity rewards plus credit card, yes prosperity edge credit card, yes premia credit card, yes bank byoc credit card, yes first exclusive credit card, yes bank wellness credit card, yes bank rupay credit card, yes bank lifetime free credit card, close yes bank credit card, kotak credit card, urbane gold credit card, royale signature credit card, league platinum credit card, lic credit card, lic idfc credit cards, lic idfc classic credit card, lic idfc select credit card, axis bank lic credit card, lic axis platinum credit card, lic axis signature credit card, personal loan, hdfc personal loan, idfc first bank personal loan, moneyview personal loan, kreditbee loan, smartcoin loan, kotak personal loan, bajaj finserv personal loan, tata capital personal loan, yes bank personal loan, l&t finance consumer loan, instant loan apps, instant loan without cibil, lowest personal loan interest rates, business loan, kreditbee business loan, moneyview business loan, prefr credit business loan, lendingkart business loan, protium business loan, iifl business loan, sbi business loan, bank of baroda business loan, kotak business loan, icici bank business loan, neogrowth business loan, women business loans, unsecured business loans, working capital loan, cgtmse scheme, psb loans in 59 minutes, sbi e mudra loan, startup business loan, saksham yuva yojana, bank of baroda msme loan, home loan interest rates, best home loan interest rates, hdfc home loan, dda housing scheme 2024, pnb housing finance, kotak mahindra bank home loan, idfc first home loan, bajaj finserv home loan, 5 crore home loan emi, 2 crore home loan emi, 1 crore home loan emi, 70 lakh home loan emi, pradhan mantri awas yojana, home loan balance transfer, home loan balance transfer interest rates, hdfc home loan balance transfer, kotak home loan balance transfer, pnb home loan balance transfer, home first home loan balance transfer, canara bank home loan balance transfer, loan against property, loan against property interest rate, hdfc loan against property, federal bank loan against property, kotak loan against property, idfc first loan against property, sbi loan against property, home first loan against property, pnb housing loan against property, bajaj finance loan against property, loan against property without income proof, sbi loan against property interest rates, loan against property eligibility, bank of baroda loan against property, canara bank loan against property, lic loan against property, gold loan interest rates, rupeek gold loan, muthoot fincorp gold loan, dbs gold loan, indiagold loan, oro gold loan, iifl gold loan, sbi gold loan, icici gold loan, canara gold loan, financial tools, emi calculator, home loan emi calculator, sbi home loan emi calculator, icici home loan emi calculator, hdfc home loan emi calculator, pnb home loan emi calculator, navi home loan emi calculator, lic home loan emi calculator, can fin home loan emi calculator, personal loan emi calculator, sbi personal loan emi calculator, hdfc personal loan emi calculator, icici bank personal loan emi calculator, idfc personal loan emi calculator, navi personal loan emi calculator, business loan emi calculator, loan against property emi calculator, sbi loan against property emi calculator, hdfc loan against property emi calculator, icici loan against property emi calculator, pnb hosuing loan against property emi calculator, compound interest calculator, loan prepayment calculator, rd calculator, fd calculator, fixed deposit, fixed deposit interest rates, credit card against fd, banking full form, imps full form, upi full form, acf full form, noc full form, icici full form, hdfc full form, credit card customer care number, hdfc credit card customer care, axis bank credit card customer care number, sbi credit card customer care, american express credit card customer care, standard chartered credit card customer care number, yes bank credit card customer care, idfc credit card customer care number, hsbc credit card customer care, credit card ifsc code, hdfc credit card ifsc code, axis bank credit card ifsc code, yes bank credit card ifsc code, amex credit card ifsc code, credit card types, best fuel credit card, best shopping credit card, best student credit card, best lifetime free credit card, best cashback credit cards, best travel credit card, best reward credit card, airport lounge access credit cards, hdfc credit card airport lounge access, sbi credit card airport lounge access, axis bank credit card airport lounge access, hsbc credit card airport lounge access, flipkart axis bank credit card lounge access, yes bank credit card lounge access, axis bank my zone credit card lounge access, epf passbook, uan member portal, epf claim status, ppf interest rates, ppf withdrawal, uan activation, epf balance check, epf withdrawal rules, sbi ppf account, hdfc ppf account, icici ppf account, aadhaar card, aadhaar card status, aadhaar card download, aadhaar card update, pan aadhaar link, link aadhar to mobile number, personal loan customer care, bajaj finance personal loan customer care, sbi personal loan customer care, indiabulls personal loan customer care, kotak bank personal loan customer care, hdfc personal loan customer care, moneytap customer care, money view customer care, mpokket loan customer care, cashe customer care, hdb personal loan customer care, iifl personal loan customer care, home loan customer care, sbi home loan customer care, hdfc home loan customer care number, lic home loan customer care, pnb housing finance customer care, bank of baroda home loan customer care, dhfl home loan customer care, indiabulls home loan customer care, dsa registration, dsa full form, sbi dsa registration, hdfc dsa registration, icici bank dsa registration, axis bank dsa registration, dsa loan agent registration, credit card dsa registration, nbfc dsa registration online, health insurance, life insurance, what is a personal loan sanction letter and its importance.

When you apply for a personal loan, the first formal step that a bank or a non-banking financial corporation (NBFC) takes to greenlight your application is a loan sanction letter.

While not the official loan agreement, this letter can be viewed as a proof of the lender deeming the borrower credit-worthy. This letter of approval from your would-be lender is the first step in the loan disbursement process.

What does a personal loan sanction letter contain?

The loan sanction letter will spell out the details of the loan and the conditions under which the facility will be extended to you.

Apart from the details of the borrower (you), the letter will also mention the approved loan amount, interest rate offered, repayment tenure, EMI amount, as well as the loan processing fee (if any).

It will also contain:

- Your personal loan application number

- The loan category under which credit is being offered to you

- Whether the interest would be of fixed or floating type

- Base rate for calculating the interest on the loan

Getting the loan sanction letter is a crucial step

As the loan sanction letter is an intermediate step and not the final agreement, in case you are unhappy with any of the conditions specified in it, you can try and renegotiate the terms with your lender.

You should also flag off any errors that you notice in the letter.