- Law of torts – Complete Reading Material

- Weekly Competition – Week 4 – September 2019

- Weekly Competition – Week 1 October 2019

- Weekly Competition – Week 2 – October 2019

- Weekly Competition – Week 3 – October 2019

- Weekly Competition – Week 4 – October 2019

- Weekly Competition – Week 5 October 2019

- Weekly Competition – Week 1 – November 2019

- Weekly Competition – Week 2 – November 2019

- Weekly Competition – Week 3 – November 2019

- Weekly Competition – Week 4 – November 2019

- Weekly Competition – Week 1 – December 2019

- Sign in / Join

- Companies Act 2013

- Corporate Law

- The Companies (Share Capital and debenture) Rules

Shares and share capital of the company

This article is written by Aadrika Malhotra . It talks about the concept of share capital in a company with a detailed analysis of how share capital helps raise company profits. Share capital is typically divided into equity share capital and preference share capital, depending on factors such as voting rights and dividends. This article delves into each type, outlining their characteristics and the associated liabilities for shareholders.

Table of Contents

Introduction

The Companies Act, 2013 (‘the Act’) details all laws related to companies and their functioning in India, including shares and share capital. A company is a form of organisation whose capital is contributed largely by its shareholders, who are the real owners of the company. This capital is the amount that is invested in the company to carry out the company’s activities. Since a company is an artificial person, all operations of the company are dependent upon its AOAs and MOAs that are signed with it. It has a corporate legal entity distinct from its shareholders and members, which means that the liability of the shareholders for the company depends a lot on shares. All companies limited by shares must have a share capital, and this share capital cannot be generated by the company on its own and has to be collected by several people. Although the issuance of share capital is not necessary for a company to be incorporated, it is crucial for running the business based on capital.

An overview of shares

Shares in a company show the percentage of ownership of a person or member in that company, which is a single unit that is further divided into several units with their own price. All of these units are of a specific amount, and when someone purchases these units, they also purchase certain defined units of the share capital of the company, which makes that person a shareholder in the company. The term share has been defined under Section 2(84) of the Act, which means a share in the share capital of the company and includes stock. It signifies the interests of the shareholders in the company, measured for the purposes of liability and dividends. A share, debenture, or any interest held by a member of a company is deemed movable property and can be transferred as stipulated in the company’s articles of association. A member has the option to transfer any “other interest” in the company following the procedures outlined in the articles.

Certificate of shares

A share certificate is a document that is attested by the company and acts as legal proof of the ownership of shares. There is a difference between the share that makes up the share capital and the share certificate. This certificate can either be a part of the company’s share capital or be owned by the shareholder while still being part of the company. Section 44 of the Act mentions that shares are movable properties and are transferable. This differs from a share certificate which under Section 46 is stated as a certificate under the common seal that specifies the shares held by members of the company. It is issued under the company’s seal, signed by two directors, a managing director and a company secretary. It is the prima facie evidence that the title acts as estoppel to the title and an estoppel to the payment.

Estoppel to the title

A share certificate, after it is issued to the shareholders, binds the company in two ways: either as a declaration by the company to the entire world about whose name the certificate is made under or to whom the certificate is given. The company here is thereby estopped from denying the title of the shares under the share certificate to the shareholder.

Estoppel to the payment

If the certificate states the shareholder has paid in full for all shares under that particular share certificate, the company is estopped as against a bona fide purchaser of the shares, i.e., the shareholder, from alleging that the shareholder has not paid the shares in full. If the statement in the certificate is not true, there will be no estoppel against the company.

Section 56(4) states that every company, unless prohibited by law, must deliver all certificates within a period of two months from the date of incorporation for the subscribers to the memorandum of the company and within two months from the date of allotment if any shares are allotted by the company. The issuance of share certificates shall be done in pursuance of a resolution issued by the Board, and if the letter of allotment is lost, the company may register the transfer of those on terms of indemnity as the Board may deem fit. Such certificate shall be issued with the company seal and shall be affixed by either two directors duly authorised by the Board of Directors or the secretary as authorised by the Board.

The share certificate shall contain particulars such as the name of the person and the date of issue, which shall be recorded in the registrar of members. These share certificates and documents have to be maintained as per the following requirements:

- All blank forms that are used for the share certificates are to be printed by the board in a resolution. The form shall be machine-numbered, and the engravings on the forms will be kept under the custody of the secretary and the board.

- The committee of the board, the company secretary, or the director assigned by the board shall be responsible for the maintenance and safe custody of the documents related to the issuance of share certificates and blank documents.

- All of these documents shall be preserved with care for at least thirty years, and they should be preserved forever if any of these cases are disputed before the Board. All share certificates that were surrendered by the shareholders are supposed to be destroyed within three years, as passed by the resolution by the Board.

Issuance of duplicate certificates

Section 46 of the Act, read with Rules 6 of the Companies (Share Capital and Debentures) Rules, 2014, states that duplicate share certificates can be issued to the shareholders if the original share certificate is lost or misappropriated. If the share certificate has been lost or misplaced, the shareholder must inform the company of the loss through a letter sent at the email address of the company or by post. The letter must detail the name, address, folio number and share certificate number.

Once the company receives the letter, it should freeze the transfer of shares for at least thirty days to avoid fraud. After the company registration procedure is completed, the shareholder will be guided to issue a duplicate certificate once the identity of the shareholder is established. The following documents are required to issue a duplicate share certificate:

- Agreement to guarantee out-of-court stamp paper,

- Affidavit on non-judicial stamp paper,

- FIR with the complete data about the lost share certificate, including the name of the shareholder, folio number, share certificate number, and the number of shares.

- Advertisement about the lost certificate.

Penal provision

Section 447 of the Act provides the penalty for the issuance of false shares by the company with an intention to defraud the public. The fine for such fraud shall be imprisonment for a term not less than six months extending to ten years with a fine of not less than the amount involved in the fraud.

Share capital in Company Law : an overview

Share capital refers to the capital raised by the company by issuing common or preferred stock, as the case may be. It is not important for a company to have a share capital; the case might be that it is a company limited by guarantee. The amount contributed by the shareholders is dependent on them, and they can buy shares divided into equal amounts. Simply put, share capital is the total value of funds raised by a company through the issuance of shares to its shareholders.

Authorised capital

The Memorandum of Association of a company states the amount and division of share capital in the company. This amount is called the authorised or nominal capital of the company as per Section 2(8) of the Act.

Issued capital

Section 4(1)(e)(i) of the Act mentions that this share capital is present in the capital clause of the memorandum, which can be issued depending upon the requirements. The portion of this share capital that is issued to the public is known as the ‘issued capital,’ which is distributed from time to time through subscriptions.

Subscribed capital

The part of the issued capital that is subscribed by the public is called the ‘subscribed capital’, which, as per Section 2(86) of the Act, is the part of the share capital that is subscribed by the members for the time being. The minimum subscription requirement presently is ninety percent of the issued capital, and the company has flexibility in calling the subscribed capital.

Paid-up capital

The actual amount that the company receives from the subscribed capital is called the ‘paid-up capital’ as per Section 2(64) of the Act, and the capital that forms the ‘uncalled share capital’ can be set aside as ‘reserve share capital.’

Called-up capital

The part of the subscribed capital that the company calls up for payment is called the ‘called-up capital’ as per Section 2(15) of the Act.

The simple formula for this paid-up capital can be:

Paid-Up Capital = Number of Equity Shares Issued * The Face Value Called Up

For example, let’s say that ABC has an authorised share capital of Rs 10 lakh, which is divided into equity shares worth Rs 1 lakh with a face value of Rs 10 per share. Here, let’s assume that the shareholders fully pay for 50,000 equity shares at the decided face value. To calculate the paid-up capital, we would have to follow the formula as follows:

Paid-up capital = 50,000 shares * 10 rupees per share

Paid-up capital= Rs 5 lakh

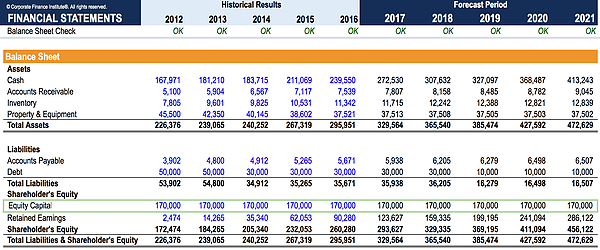

This capital is reported in the balance sheet of companies in the shareholders’ equity section in separate line items depending upon the sources, like common stock, preferred stock, and additional paid-in capital. Common stock and preferred stock shares are reported in accounts at their par value at the time of sale, and the amount received in excess of this par value is called the additional paid-up capital. The share capital amount reported by a company includes only those payments made directly by the company and later sales and purchases or the rise or fall of these shares have no effect.

Kinds of share capital in Company Law

Section 43 of the Act mentions the two types of share capital that a company can have:

- Equity share capital

- With voting rights

- With differential rights as in dividends, voting, or any other in accordance with the rules prescribed.

- Preference share capital ,unless otherwise specified by the company’s Articles of Association (AOA) or Memorandum of Association (MOA).

Equity shares

Equity share capital means all share capital that is not preference share capital, which represents ownership in a company. All equity shareholders are eligible to voting rights in the company and are eligible for a share of the company’s profits, thus bearing a high risk with the possibility of higher returns as well. The dividend that the shareholders get is not fixed in equity shares, and the company might not give any profits to its equity shareholders even if it has them. Though, as per Section 43(a) and Section 50(2) , all equity shareholders get a right to vote on every resolution that is passed in the company, and their voting can be determined by the pool of paid-up capital until otherwise provided by the AOA and MOA.

Equity share capital is divided on the basis of differential (dividend) and voting rights, with the former providing the shareholders with much fewer voting rights. Long term, small investors can reduce their voting power to make up for the difference and seek higher dividends. Rule 4 of the Companies (Share Capital and Debentures) Rules, 2014 lays down the conditions for the issuance of equity shares:

- The AOA of the company is responsible for the issuance of equity shares with differential rights, such as dividends.

- The shares are issued by the passing of a resolution at a general meeting of the shareholders, where if the equity shares are listed on a stock exchange, the issuance of shares will be decided upon by the shareholders through a postal ballot.

- The equity shares that provide differential rights should not exceed more than 26 percent of the total post-issued paid-up capital shares.

- The company giving out the equity shares must have a consistent track record of distributable profits for at least three years and should not have defaulted in filing facial statements or returns for those three years and the three years preceding the year the shares are issued.

- The company should not have defaulted on the payment of its dividends, repayment, or redemption of preference shares to its shareholders.

- The company should not have defaulted on the payment of dividends, preference shares, and the repayment of loans taken from a public or private institution or a bank that requires statutory payments.

- The company should not have been penalised by any court or tribunal for at least the last three years under the Companies Act passed by the Central Government or SEBI that pose sectoral restrictions.

Companies that have their equity shares listed on a stock exchange can have their shares issued by postal ballot with the shareholders’ approval. Section 102 talks about the statement to be annexed to a general meeting talking about the issuance of these shares. Though the company cannot cover its existing differential rights for its shares with voting rights or the other way around.

Preference shares

Preference shares are the shares where the shareholders get preferential rights related to the capital they hold and a dividend over equity shares. Preference shares are shares with a fixed rate of dividend and preferential rights over ordinary equity shares. People who buy preferential share capital get priority in dividend declarations, and at the time of winding up, they are the first ones to receive money. They have the right to vote only when the matter directly or indirectly affects them. This dividend may be a fixed amount that is payable to the shareholders to give them preference over the equity shareholders and to give them a higher claim over the assets of the company without the privilege of voting rights.

Preference shareholders can only vote on resolutions that directly concern them or affect their rights as preference shareholders or the winding up of the company. If the preference dividend is not paid for two years or more, the preference shareholders will get the right to vote on every resolution.

In summary, preference share capital with reference to any company limited by shares means that part of the issued share capital of the company that carries or would carry a preferential right with respect to:

- Payment of dividend, either as a fixed amount or an amount calculated at a fixed rate, which may either be free of or subject to income-tax; and

- Repayment, in the case of a winding up or repayment of capital, of the amount of the share capital paid-up or deemed to have been paid-up, whether or not there is a preferential right to the payment of any fixed premium or premium on any fixed scale, specified in the memorandum or articles of the company.

Kinds of preference shares

Preference shares can be categorised into:

- On the basis of rights to dividends : Cumulative and Non-cumulative preference shares

- On the basis of convertibility: Convertible and Non-Convertible preference shares

- On the basis of maturity period : Redeemable and Irredeemable preference shares

- On the basis of participations in surplus profits: Participating and Non-Participating preference shares

Cumulative and non-cumulative preference shares

In circumstances where the company cannot generate profits or fails to give dividends. In this case, the cumulative preference shareholders can get paid from their profits made in the subsequent years for the current year’s dividends in arrears, which until fully paid will lead to the fixed dividend keep on accumulating.

Non-cumulative preference shares give the shareholder the right to obtain a fixed amount of dividends from the profits each year. If there are no profits or dividends available, the preference shareholders will not get anything and neither can they claim unpaid dividends as well in the next few years.

Convertible and non-convertible preference shares

Convertible preference shares are the shares of the company that are issued on the terms liable to be converted to certain ordinary shares or cash at a certain time. These shares may be converted on the sale of initial public offering of the company or at a set conversion price. The number of ordinary shares given to the shareholders will depend on the conversion method used. Non-convertible preference shares are shares that cannot be converted into equity shares. Shareholders with non-convertible preference shares get preferential benefits during the distribution of dividends and the dissolution of the company.

Redeemable and irredeemable preference shares

As per Section 55 of the Act, Preference shares can be either redeemable or irredeemable as mentioned earlier. Redeemable preference shareholders are repaid after an estimated period of time which is known as redemption of preference shares. This amount will be repaid to them after the completion of the stipulation period, which on the contrary the ones that cannot be paid are known as irredeemable preference shares.

Section 55 of the Act states that a company cannot issue irredeemable preference shares and can issue shares that are supposed to be redeemed in a period not exceeding twenty years. There are certain conditions for this redemption that have been stated in the Act:

- Profits that would be available for dividend

- Proceeds of the issue of shares

- Shares that are not fully paid cannot be redeemed.

In case a company redeems the shares out of the profits of the company, a sum equal to the nominal amount of the shares as to be set aside as reserve amount that is to be redeemed with the Capital Redemption Reserve Account. If the Capital Redemption Reserve Account was the paid-up share capital of the company, the provision relating to the reduction of share capital of the company of this Act, i.e Section 66 will apply. The capital reserved can be utilised by the company to pay up unissued shares to be paid up as bonus shares.

The preference shares can be redeemed if the class of companies comply or if its accounting statements are up to the standards as prescribed by Section 133 of the Act.

If there is any premium payable on redemption, it will be provided for out of profit from the company before the shares are redeemed.

Rule 10 of the Act states that a company that deals with infrastructure projects may issue preference shares for a period exceeding twenty years but not thirty years which would be subject to a redemption of a minimum of ten percent from the preference shares per year after the twenty years have expired.

Participating and non-participating shares

Participating preference shares are entitled to a fixed preferential dividend and they have a right to participate in the surplus profits of the company along with the equity shareholders once the certain dividend amount has been paid to them. If there is still some surplus left after paying both the equity and preference shareholders during winding up of the company, then the participating shareholders will get the share of the additional surplus of the company. These shareholders only get the fixed preferential dividend and the return of capital during winding up after meeting all external liabilities. The rights to these shareholders should be set down in the AOA and MOA of the company or in the terms of issue.

Other types of share capital in Company Law

There are shares which are used to raise the capital of the company. Those shares are:

Sweat Equity Shares

- Employee Stock Option Scheme

Bonus Issue

Rights issue.

According to Section 2(88) of the Act, sweat equity shares are issued by a company to its directors or employees at a discount with some other consideration that does not include cash, like the know-how for getting rights to intellectual property or some other value additions from them. It is a mode of payment of shares to the employees of a company that allows it to retain the employees as well as reward them for their services by giving them incentives for their contribution to aid the development of the company.

As per Section 102 of the Act, the special resolution passed for the sweat equity share should contain:

- The date of the board meeting at which consideration for the shares was brought on;

- The rationale behind the issuance of the shares;

- The class under which these shares would be issued;

- The total number of shares to be issued;

- The class of employees or the directors to whom these shares would be issued;

- The terms and conditions, along with the valuation for the insurance of these shares;

- The time period of employment or association of the concerned shareholders;

- The names of the employees or directors to whom these shares will be issued;

- The price at which these shares will be issued;

- The consideration at which these shares will be issued;

- The ceiling on the remuneration received at a managerial level, and if disputed, the procedure for how it would be dealt with;

- The statement of effect by the company acknowledging the accounting standards;

- The value of the diluted earnings per share for the securities calculated according to the accounting standards.

After the sweat equity shares are issued, this resolution will cease to exist after twelve months from the authorisation. The company cannot issue sweat equity shares for more than 15% of the total paid-up capital of the company. The total amount of these shares should also not exceed more than 5 crores, or 25% of the total paid-up capital of the company. The directors of the company also get issued sweat equity shares, and those shares will be non-transferable to anyone for 3 years, during which they would be in a lock-in period.

Sweat equity shares are valued at a fair price by a valuer who will give a fair determination of the price and the valuation of any intellectual property rights. The valuation also includes the know-how of the employees or the directors. The price of the sweat equity shares shall be fixed by the valuer after the submission of a proper report to the board of directors with the proper justification, which would be sent to the shareholders after holding a general meeting. Any non-cash consideration in a depreciable asset will be carried into the balance sheet of a company in accordance with the applicable accounting standards. If those considerations do not meet accounting standards, they will be expensed for other financial activities.

It is issued for the purpose of:

- Contribution to the financial activities of the company.

- Contribution to the intellect of the company.

- Value addition to the employees.

According to Section 54 of the Act, whatever limitations on profits and dividends are applicable to equity shares are applicable to sweat equity shares as well. Section 53 of the Act voids any other shares provided at a discount except for sweat equity shares and lays down the punishment for the company as a fine, which shall not be less than 1 lakh rupees and might extend to 5 lakhs and imprisonment for six months for each individual responsible for that penalty. The preliminary requirements for the issue of sweat equity shares are as follows:

- It should be authorised by a special resolution passed by the company.

- The resolution must specify the number of shares, the class of directors, and the current market price valuation.

- If the equity shares of a company are listed on a recognised stock exchange board, the issue of sweat equity shares shall be looked over by the SEBI ( Securities and Exchange Board of India) and its rules.

- For the issuance of sweat equity shares, an employee must be a permanent employee of the company who might be working for the Indian office or a foreign one and/or a director of the company.

Employee’s Stock Option Scheme

According to Section 2(37) of the Act, an employees stock option is a scheme or option given to the employees, directors, or officers of a company along with the holding or subsidiary companies that gives these people a benefit or the right to purchase or subscribe to the shares of the company at a future date at a predetermined price. SEBI, in its guidelines, clarifies that it is a right and not an obligation that is granted to all permanent employees of the company.

The objective behind the issuance of this scheme is to provide incentives and reward the employees of the company to make the company more profitable. Rule 12 of the Companies (Share Capital and Debentures) Rules, 2014, lays down certain requirements of this scheme:

- The issuance of the scheme would need the approval of the shareholders through a special resolution.

- This option is not transferable to any other person who was not previously entitled to it.

- There should be a minimum period of one year between the grant of the scheme and its vesting, and after this period, the exercising limit of this scheme will be decided by the company.

- Any amount payable by the employee during the grant of the scheme will be returned or refunded.

- Any company that does not comply with the SEBI rules, apart from a listed company, cannot issue the scheme.

- The company that is granting the scheme has to maintain a separate register that contains all the details about these shares.

- An employee who is a promoter of the company is not eligible for this scheme, nor is any director who already owns 10% of the company’s equity shares.

Bonus shares are issued to existing members according to Section 63 of the Act, where the company can issue paid-up bonus shares to its members in the following manners:

- Free reserves: These reserves must be built out of only genuine profits or shares premium collected in cash.

- Securities premium account: It is a reserve account made from a company’s profits made by issuing shares of a certain face value for a higher price.

- Capital redemption reserve account: It is an account made when the company redeems its redeemable preference shares out of profits kept for paying dividends.

Capitalising reserves that were created by the revaluation of assets will not be the parameters for the issue of bonus shares, nor can they be issued in lieu of dividends.

Conditions

- The AOA of a company should mention that bonus shares can be alloted to the shareholders. If such is not mentioned in the AOA, it is altered by a special majority resolution.

- A special resolution is passed by the Board of Directors, managers, and top level management, where they see if there is profit made by the company. If there is a lot of accumulated profit, in that case, the resolution is passed and a bonus is issued to all shareholders.

- There should be no previous defaults in the payments of interest to the debenture holder or of dividends.

- There should be no pending salaries or provident funds for any employee, etc.

If the board passes a resolution declaring the bonus shares will be issued, it cannot withdraw the resolution.

Restriction on Issuing Bonus Share

As mentioned in the sweat equity share, there is a class of shares. A company can’t issue bonus shares if they have outstanding fully or partly convertible debt instruments at the time of issuing bonus shares. Unless there is a reservation made of equity shares of the same class in favour of such holders of convertible debt instruments on the same terms and proportion to the convertible part.

The equity shares reserved for the holder of the fully or partly convertible debt instrument shall be issued at the time of conversion of such convertible debt instrument on the same terms or proportions as the bonus shares were issued.

In the case of Standard Chartered Bank and Anr. Etc. v. Custodian and Anr. Etc. (2000) , the court held that bonus shares are a distribution of capitalised undivided profits of the company. Bonus shares lead to an increase in the company’s capital because they transfer the amount from the company’s reserve towards its capital, which results in the issuance of extra shares to its shareholders.

Section 62 of the Act talks about rights issues, which is an easy way of procuring finance for a company. The previous shareholders of the company have the right to subscribe for the new shares of the company. There is no prospectus or offer for sale of shares issued in rights issue, and equity shareholders of the company are given the offer through an application form, which entitles them to take up shares at a price way below the listed price. Shareholders who do not want to keep their rights to the shares can sell them to other third parties at a specified price. Shareholders can also renounce their rights to the company and sell the shares to the public in a manner prescribed by the board of directors.

Compliance with rights issue

- It has to be mentioned in the articles of association of the company.

- A notice to the shareholders regarding the same has to be sent.

- This offer should be available for 15-30 days.

- The existing shareholders may renounce or accept this offer.

- The number of shares and the price of such shares have to be mentioned.

Voting rights

Section 47 of the Act states that every equity shareholder has a voting right in the company, which is proportionate to the number of shares they hold in the paid-up equity share capital of the company. Preference shareholders of a company have the right to vote on the following:

- Resolutions passed before the company which directly affect the rights attached to their preference shares.

- Resolutions passed for the winding up of the company.

- Repayment for the reduction of the share capital.

These voting rights are in proportion to the shares held by the shareholders in the paid-up preference share capital of the company. The proportion of the voting rights of the preference shareholders and equity shareholders will depend upon the proportion of the paid-up share capital of each. Preference shareholders have the right to vote on every resolution passed by the company if the dividends held in those preference shares are in arrears for 2 years or more.

Issue of shares at premium

When a company issues shares at a premium, a sum equal to the amount of premium received on those shares will be transferred into a securities premium account. According to Section 52 of the Act, the provisions for the reduction of shares of a company apply on this premium account as well as if it is a part of the paid up share capital of the company. These shares can be applied by the company:

- Towards the issuance of unissued shares of the company in the form of fully paid bonus shares.

- Towards writing off the preliminary expenses of the company.

- Towards writing of the expenses or discounts allowed on the issuance of any shares or debentures of the company.

- Towards providing the premium payable for the redeemable preference shares of the company.

- Towards the purchase of more shares and other securities.

The companies classifying under Section 133 of the Act can also utilise this premium account in the following manner:

- Paying up unissued equity shares to the members of the company in the form of bonus shares.

- Writing off the expenses incurred on the insurance of equity shares.

- Purchase of its own shares or other securities.

Allotment of shares

Allotment of shares is the procedure followed by a company to give its shares to the investor in an exchange for a purchase offer to signify the act of allotting. The investors make the offer through application forms or prospectus supplied by the company for these shares, and the acceptance of this application by the company amounts to the allotment of the shares.

The court in the case of Sri Gopal Jalan & Co. v. Calcutta Stock Exchange Association Ltd, (1964 ) defined the allotment of shares as the appropriation of the unappropriated capital of the company by giving a certain number of shares to certain people.

Procedure for allotment of shares

- Before allotting the shares to new shareholders, the company must take into account the shares allotted to the existing shareholders and analyse how much more shares it should give out;

- The board of directors will hold a meeting to pass a resolution for the allotment of shares;

- The company has to sign the Form MGT-14 and the special resolution passed with the register of the companies;

- The secretary then makes the necessary arrangements with company’s bank for collecting the money to issue the letters of allotment to the investors, mentioning the shares allotted to them;

- If necessary, the company has to file a return of allotment form within 30 days of the allotment along with the name and address of the allottees, value of shares, amount paid, and amount payable;

- The company needs to prepare the register of members in accordance with Section 88 of the Act;

- The person either gets issued a share certificate or they can see the allotment of their shares in their Demat account.

Calls and forfeiture of shares

If a member of the company fails to provide a valid call within the stipulated period of time, the company can sue that member for the recovery of the amount of the call after waiting for a reasonable period of time. The articles of association of a company generally provide for the forfeiture of shares for non-payment of any calls. Power for forfeiture of shares is enacted bona fide and in the interest of the company and should not be collusive or fraudulent. All shareholders cease to be members when this forfeiture takes place, as per the liabilities provided under clause 1 of Schedule 32 of the Act. These forfeited shares become the property of the company, which also involves a reduction in the share capital until these shares are reissued. The company can also reissue these shares at any point in time at a discounted price, provided that the total amount paid by the previous owners of the shares and the reissued amount are not lesser than the par value. If the shareholders do not pay the amount for the shares in the stipulated time, the directors of the company can pass a resolution for the forfeiture of those shares with proper notice.

Calls on shares

The company collects the unpaid balance of the allotted shares after the application and allotment amounts in accordance with the terms and conditions of the shares by making calls:

- First call: The unpaid balance is supposed to be collected with the first call itself, which would also be treated as the final one.

- Second call: If the call amount is collected in instalments, the other call is known as a second call.

- Last call : The last instalment is collected in the final call, known as the last call.

This amount is part of the issue price of the share or debenture issued by the company to its shareholders or members that has not yet been paid. The board of directors has the party make these calls in accordance with resolutions passed in the general meetings, which can be made anytime during the timeline of the company and its winding up as well. Non payment of these calls will render the shareholders or members an interest payment of 10% per annum.

Calls in advance

Articles of association corresponding to the shares of the company authorise it to accept the money remaining on the shares, irrespective of the calls not made by the company. Companies can accept a part or the whole payment made by the shareholders even if the calls are not made, and they can pay an interest agreed upon by the board and the members for the sum of the shares set at a maximum rate of 12% per annum. The amount received for calls in advance is not refundable, and it has to be paid along with the interest.

Calls in arrears

Shareholders may not pay the called amount on the due date, which is known as calls in arrears or unpaid calls. These represent the debit balance of all the calls in arrears and appear as notes to account for in the balance sheet. The directors, through the articles of association of the company, can charge interest on these calls in arrears, which shall not exceed more than 5% per annum and shall be paid on all unpaid amounts on these shares. When the call amount is received, the amount of interest received will be credited into the interest account, and the call money will be credited into the call’s arrears account.

Reduction of share capital and dematerialization

Reduction of share capital refers to the reduction of the issued, paid-up, and subscribed share capital of the company as laid down under Section 66 of the Act. The buyback and redemption of preference shares are also considered as the reduction of capital and do not require approval from the Tribunal. The reduction of the share capital for the company is subject to confirmation by the National Company Law Tribunal (NCLT).

Dematerialisation is a process by which the physical share certificate of an investor is taken back by the company in exchange for an equivalent amount of securities in electronic form. The investor opens an account with the depository participant, who then requests the dematerialisation of the share certificate so that the dematerialised holdings can be credited into the investor’s account. This process is optional, and the investor can still hold his shares in physical form. Though the investor will still have to demat the shares if he wishes to sell them through the same stock exchange. If an investor purchases shares, he will get the delivery of those shares in the form of a demat.

Investors have to trade in a dematerialised form to trade in the shares of a listed company, and the company enlists its shares with the depositories. The Depositories Act, 1996 , set up two depositories in India:

- National Securities Depository Limited (NSDL)

- Central Depository Services (India) Limited (CDSL)

There are several advantages to a depository system:

- Paper forms of shares that are held can be lost, damaged, or stolen easily, which can be avoided through the depository system.

- Shares under this system are held in electronic form, similar to bank accounts, which makes trading for these shares easier.

- Trading in the shares of a company has also been mandated by SEBI under the compulsory Demat segment.

- Banks prefer dematerialised securities to provide credit facilities because demat securities attract lower margins and rates of interest compared to physical securities.

Transfer and transmission of shares

A transfer of shares is done when a shareholder transfers shares to another person in the form of a gift or sale. This transfer, when done by law, particularly by inheritance, is known as the transmission of shares, which is caused by either death or insolvency of the shareholder. Section 56 of the Act lays down the procedure for the transfer of shares and states that a deceased shareholder’s shares can be transmitted through a legal representative even if he is not a member.

The basic difference between the transfer and transmission of shares is that the former is a voluntary act and the latter is an operation of the law. Transfer of shares requires the existence of a stamp duty, unlike the transmission of shares, which even a private listed company cannot refuse. The transferee does not have the same amount of liabilities that the transferor will have in the process of transferring shares, though in the transmission of shares, the original liabilities apply. While the transfer of shares is not permitted during a lock-in period, the transmission of shares takes place even during lock-in because it is an operation of the law. Transmission of shares does not require any operation or interference of the court of law, though the transfer of shares cannot be possible without an official liquidator.

Buy-back of shares

Buy-back is a tool for the financial reengineering of the company to purchase or buy back its shares from its existing shareholders when the company has sufficient cash balance with it, and the market price of the securities is much lesser than their face value. Section 68 of the Act permits the buy-back of shares by a company, either public or private, as listed. Section 68(1) lays down the sources for such buy-back:

- Free reserves: These are the reserves the company has as per the last audited balance sheet available for distribution and share premium but not available for the share application amounts.

- Securities Premium Account : It is a reserve account that is made from the profits earned by the issuance of shares at a premium.

- Proceeds of any shares or other securities, though the buy-back of the shares will not be made out of the proceeds of an earlier issue of shares of the same kind of shares or securities.

- The maximum buy-back limit of the aggregate paid-up capital or reserves of the company is 25%, which requires a specific balance amount with the company to accommodate the total value of the buy-back of shares.

No company shall purchase its own shares unless:

- The buy-back is authorised by its articles of association, which can be altered to authorise the buy-back.

- A special resolution needs to be passed at a general meeting or the buy-back of shares, depending on the quantum of the buy-back. In a listed company, the approval of the directors can only be obtained by a postal ballot. The board of directors can approve the buy-back of shares up to 10% of the total paid-up capital and free reserves of the company. Shareholders can approve a buy-back of 25% through a special resolution of the total equity capital, reserved, or paid-up capital.

- The ratio of the aggregate secured and unsecured debts that the company owes after the buy-back should not be more than twice the paid-up capital and the free reserves of the company (2:1). The central government can notify a higher ratio for certain classes of companies so that the shares are fully paid-up.

- The buy-back of the shares and securities listed on a recognised stock exchange will adhere to the rules specified by the SEBI, and the buy-back in respect of the shares of other specified securities other than the other listed securities is in accordance with the rules specified in Chapter IV of the Act.

- No offer of buy-back stands that is made within a period of 1 year from the date of the closure of the preceding buyback.

- The company, after the completion of the buyback, shall file it with the register of the SAPI in a matter of 30 days. If the company buybacks securities, it shall extinguish its securities within 7 days of the completion of the buyback.

- If a company purchases its own shares out of the free reserves during the buyback, the amount equal to the nominal value of the shares will be transferred to the share redemption reserve, and the details of this transfer shall be included in the balance sheet with no other issues until after 6 months of the buy-back.

The notice of the meeting at which the special resolution for the buyback is passed will be accompanied by an explanatory statement consisting of:

- Full and complete disclosure of material facts;

- necessity for buy-back;

- the class of the shares and securities to be purchased;

- amount to be invested;

- time limit for the completion of the said buy-back.

Section 70(1) of the Act prohibits the buy-back of shares in certain circumstances:

- Any subsidiary company that has its own subsidiary companies;

- any investment company or group of investment companies;

- a default made by the company in the repayment of the deposits made by it either before or after the initiation of the Act on any interest payment, debenture, redemption of preference shares; or the payment of dividends, loans, or other interests still owed to pay to any financial institution. Though if the company remedies this default within three years, it can still issue buy-backs.

Advantages and disadvantages of buy-back

There are several advantages and disadvantages of buy-back for a company depending upon the shares and securities withheld:

- The company can use its unutilised surplus cash if there are no other proper investment opportunities.

- Buy-back of shares and securities can improve the return on capital, net profitability, and earning per share of the company.

- Buy-back can also be used to enable settlement amongst the dissatisfied members of the company.

- The company can buy the shares of the retiring employees, and the existing management can also keep control over the company because there would be less shares to sell.

- The remaining shareholders of the company can also be satisfied because of the increased amount of dividend and the increased market value of shares.

- Buy-back brings liquidity to the investors, and it rationalises the capital structure of the company.

The disadvantages of buy-back are as follows:

- Buy-back can also be misused by the companies by endangering the investors through insider trading.

- The promoters before the buy-back of shares may understate the earrings by manipulating the valuations and accounting policies of the company which would lead to a fall in the price of shares and the promoters would buy them at the lowest prices.

- The insiders would be able to make more money when the company buy-backs these shares at a higher price.

- Buy-back of shares can lead to the artificial manipulation of stock prices and also weaken the position of the minority shareholders because buy-back enables the management to increase their control over the company.

Rights of shareholders

Shareholders and members of companies enjoy the following rights:

- Section 47 of the Act gives all the equity members the right to vote pertaining to their shares in the company on every resolution passed by the board. That voting right will be in proportion to the amount of shares they hold in the paid-up share capital of the company. The preference share capital holders will only get the voting rights on the resolutions that directly affect the amount of shares they hold in the company. If the dividend on a specific class of preference shares is not paid-up for 2 years or more, those preference shareholders will get to vote on every resolution passed by the company.

- If a company accepts the unpaid share capital which is not yet called up, the shareholders will not be entitled to any voting rights of that share capital paid by them.

- Every equity shareholder has the right to obtain dividends and interim dividends declared by the directors of the company yearly as stated in Section 143 of the Act. Every preference shareholder has the right to obtain the preferred dividend as per the terms of the issue of their preference shares. Participating preference shareholders will have the right to obtain extra dividends from surplus profit of the company which may be in proportion to the amount of the paid-up capital on its shares if its articles authorise it to do so.

- Every shareholder of the company has the right to uniform calls on shares when the calls are made by the company for a class of shares for the unpaid capital.

- Every shareholder of the company has the right to be paid during the winding up of the company for their shares. Preference shareholders of the company have the right to be paid for their preference shares or repayment of the capital and participating preference shareholders have the right to participate in surplus capital as well. Equity shareholders have the right of payment from the capital that is left after repaying the creditors and the preference shareholders.

- Section 48 of the Act, restricts the variation in the shareholders’ rights Except with the consent of the shareholders of not less than three fourths of the total issued shares whose rights are being modified. Such modification can be made through a special resolution through a shareholders meeting if such modification can be kept according to the memorandum of association and the articles of the company. If the variations in one class of shares affect the other class of shares as well, the three-fourth consent of that other class has to be obtained as well. Descending shareholders holding not less than 10% Of the issued shares of the class which Is under variation shall apply with the restriction of the variation.

- Every shareholder of the company has the right to participate in the Annual General Meeting along with a notice, financial statements, auditors report, and directors report of the meeting.

- Every shareholder of the company will have the right to transfer the shares and securities or other interest of the company to other members and shareholders. As per Section 44 of the Act, shareholders of a public company can easily transfer their shares without any restrictions. Shareholders in private companies need the approval of the board for transfer of their shares. Securities holders have the right to nominate people to whom the securities would be vested after their death. If the nominee of the securities is a minor, the holder has to appoint a person who will be responsible for those securities during the minority period of the nominee.

- Every equity shareholder of the company has a pre-emptive right to be offered shares when the company further issues capital under Section 62 of the Act.

Liabilities of shareholders

The liabilities and duties of shareholders of a company are subjected to terms and conditions stated in the articles of the company. The members are obligated to take part in the meetings of the company and vote on resolutions that they have the power to vote on. Shareholders of the company have to take an active interest in decision-making and the appointment of directors, auditors, alteration of memorandums and articles of the company. The shareholders also have to pay the full amount of their shareholding and if required, pledge or mortgage their shares since they are movable property. Share certificates in physical forms can be pledged to raise loans and securities can be pledged to retain the loan amount. If some rights or shares are transferred to the creditor, it amounts to the mortgage of shares and where shares are in dematerialised form with the depositories, the pledge and mortgage have to be registered with the depository.

Shares are the cornerstone of any major financial activity taking place in a company, and a company’s share capital is the total number of shares that it has. Every business organisation needs funds for its business activities that it has to raise through several means. The company can raise this cash either internally, through external sources, or by issuing shares and raising capital. Share capital not only helps in getting investment from investors but also helps the company in re-investing in itself. Shares are divided into equity shares and preference shares, which are further divided into other subcategories based on dividends and voting rights. Every shareholder of a company has certain rights and liabilities towards the company that they have to adhere to. A company that wants to increase its share capital and increase its equity can do so by obtaining authorisation from the company’s board of directors for issuing and selling additional shares. Understanding share capital comprehensively is crucial for both companies and their investors to make smart business choices. Companies, on the other hand, can manage their capital structure better and improve their finances in the long run.

Frequently asked questions (FAQs)

Are share capital and equity the same.

Share capital is a part of the company’s equity that is raised from issuing equity or preference shares which makes it different from other types of equity accounts. Capital is a subcategory of equity that includes assets and property, and both the company and investors find it highly profitable.

What is the time limit for share allotment?

According to the SEBI regulations, companies have a time frame of thirty days to allot shares before closing the subscription of public issues.

Can the share capital be withdrawn?

The share capital issued cannot be withdrawn because it provides stability and sustainability for the creditors. Though, buy-back allows the company to withdraw these shares for capital reduction and re-allotment.

Can a company issue more shares than its authorised share capital?

A company cannot issue more shares than its authorised share capital if it wishes to do so, it first has to increase its authorised capital through a special resolution passed by the board of directors.

What is the difference between share and stock?

Shares in the consolidated form bear distinct numbers, whereas stocks are the consolidated value of the share capital. A share comes into existence before the stock and forms a part of the share capital of the company.

What is the difference between reserve capital and capital reserve?

Reserve capital is the part of the uncalled capital of a company which the company decides not to call for the winding up of the company. Capital reserve is created out of capital profit and can be written off for capital losses of the company.

References

- https://epgp.inflibnet.ac.in/epgpdata/uploads/epgp_content/law/04._corporate_law/05._share_capital,_its_nature,_kinds,_rights_and_liabilities_of_shareholders/et/8137_et_et.pdf

- https://www.smallcase.com/learn/what-is-share-capital/

- https://lawcorner.in/types-of-shares-and-share-capital-under-companies-act-2013/#Introduction

- https://ncert.nic.in/ncerts/l/leac201.pdf

- https://www.taxmann.com/post/blog/a-comprehensive-guide-on-capital-of-the-company/

- https://www.thkjaincollege.ac.in/onlineStudy/commerce/2ndSem/CompanyLaw-2ndSem-AnuOjha.pdf

- https://wbsche.wb.gov.in/assets/pdf/commerce/GCC&BA_SUPR_Share-capital-1_Sushita-Chakraborty_UG(R1).pdf

- https://umeschandracollege.ac.in/pdf/study-material/company-law/Share%20Capital%20&%20Debenture.pdf

- https://www.icsi.edu/media/portals/0/SHARE%20CAPITAL%20AND%20DEBENTURES.pdf

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

https://t.me/lawyerscommunity

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content.

RELATED ARTICLES MORE FROM AUTHOR

Allotment of shares under company law, evolution and effectiveness of independent directors in indian corporate governance, roles and responsibilities of independent directors , leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

How to Become an Insolvency Professional: Enter the Glamorous World of Corporate Restructuring, Management and Deal-Making

Register now

Thank you for registering with us, you made the right choice.

Congratulations! You have successfully registered for the webinar. See you there.

Share Capital

The cash invested by shareholders and investors

What is Share Capital?

Share capital (shareholders’ capital, equity capital, contributed capital, or paid-in capital) is the amount invested by a company’s shareholders for use in the business. When a company is first created, if its only asset is the cash invested by the shareholders, the balance sheet is balanced with cash on the left and share capital on the right side.

Share capital is a major line item but is sometimes broken out by firms into the different types of equity issued. There can be common stock and preferred stock, which are reported at their par value or face value. Note that some states allow common shares to be issued without a par value.

Share capital is separate from other types of equity accounts. As the name “additional paid-in capital” indicates, this equity account refers only to the amount “paid-in” by investors and shareholders, and is the difference between the par value of a stock and the price that investors actually paid for it.

Share Capital and the Balance Sheet

Through the fundamental equation where assets equal liabilities plus equity, we can see that assets must be funded through one of the two. One method for a company to fund its assets is to create liabilities (borrow money or issue debt) and, therefore, create obligations that must be paid back. The other option is to issue equity through common shares or preferred shares. In exchange for an ownership interest claim to the company, the company receives cash from investors and shareholders.

Contributed Surplus and Additional Paid-in Capital

Share capital may also include an account called contributed surplus or additional paid-in capital .

Contributed Surplus is an accounting item that’s created when a company issues shares above their par value or issues shares with no par value. If a company raised $1 million from shares that had a par value of $100,000 it would have a contributed surplus of $900,000. The par value of shares is essentially an arbitrary number, as shares cannot be redeemed for their par value.

Additional Paid-in Capital is the same as described above.

In summary, if a company issued $10 million of common shares with $100,000 par value, it’s equity capital would break down as follows:

- $100,000 Common Shares

- $900,000 Contributed Surplus (or Additional Paid-in Capital)

- $1,000,000 total share capital

More Resources

Thank you for reading CFI’s guide to Share Capital. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below:

- Balance Sheet Overview

- Debt Schedule

- Investment Methods

- Debt to Equity Ratio

- See all accounting resources

- See all capital markets resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- List of Commerce Articles

- Categories Of Share Capital

Categories of Share Capital

Meaning of share capital:.

Share capital is referred to as the capital that is raised by the company by issuing shares to investors. Share capital comprise of capital that is generated from funds generated by issuing of shares for cash or non-cash considerations.

Companies have a requirement of share capital for the purpose of financing their operations. The share capital of the company will increase with the issuance of new shares.

Share capital is of two types namely, equity share capital and preference share capital. Equity share capital is generated by raising of funds from the investors and preference share capital is obtained by the issuance of preference shares.

Types of Share Capital:

Also, Explore:

- TS Grewal Solutions for Accounting for Share Capital

- Accounting for Share Capital

Share capital can be classified as authorised, issued, subscribed, called up and paid-up share capital. From an accounting point of view the share capital of the enterprise can be categorised as follows :

- Authorised Capital: Authorised capital is the amount of the share capital in which a company is allowed to issue its Memorandum of Association. The company is not supposed to raise more than the amount of capital as mentioned in the Memorandum of Association. It is also known as Registered or Nominal capital. The authorised capital can be either decreased or increased as per the process furnished in the Companies Act. It should be understood that the company need not issue the complete authorised capital for public subscription at one time. Relying upon its necessity, it may circulate share capital but in any scenario, it should not cross more than the amount of authorised capital.

- Issued Capital: It is that portion of the authorised capital which is usually circulated to the public for subscription comprising the shares assigned to the merchants and the endorsers to the enterprise ’ s memorandum. The authorised capital which is not proffered for public consent is called as ‘unissued capital’.

- Subscribed Capital: The subscribed capital is referred to as that part of issued capital that is subscribed by the company investors. It is the actual amount of capital that the investors have taken.

- Called up Capital : The amount of share capital that the shareholders owe and are yet to be paid is known as called up capital. It is that part of the share capital that the company calls for payment.

The above mentioned is the concept that is explained in detail about Categories or Types of Share Capital for the Class 12 Commerce students. To know more , stay tuned to BYJU ’ S.

| COMMERCE Related Links | |

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

- Search Search Please fill out this field.

- Options and Derivatives

- Strategy & Education

Assignment: Definition in Finance, How It Works, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

What Is an Assignment?

Assignment most often refers to one of two definitions in the financial world:

- The transfer of an individual's rights or property to another person or business. This concept exists in a variety of business transactions and is often spelled out contractually.

- In trading, assignment occurs when an option contract is exercised. The owner of the contract exercises the contract and assigns the option writer to an obligation to complete the requirements of the contract.

Key Takeaways

- Assignment is a transfer of rights or property from one party to another.

- Options assignments occur when option buyers exercise their rights to a position in a security.

- Other examples of assignments can be found in wages, mortgages, and leases.

Uses For Assignments

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, or other asset of value. to another entity through a written agreement.

Assignment rights happen every day in many different situations. A payee, like a utility or a merchant, assigns the right to collect payment from a written check to a bank. A merchant can assign the funds from a line of credit to a manufacturing third party that makes a product that the merchant will eventually sell. A trademark owner can transfer, sell, or give another person interest in the trademark or logo. A homeowner who sells their house assigns the deed to the new buyer.

To be effective, an assignment must involve parties with legal capacity, consideration, consent, and legality of the object.

A wage assignment is a forced payment of an obligation by automatic withholding from an employee’s pay. Courts issue wage assignments for people late with child or spousal support, taxes, loans, or other obligations. Money is automatically subtracted from a worker's paycheck without consent if they have a history of nonpayment. For example, a person delinquent on $100 monthly loan payments has a wage assignment deducting the money from their paycheck and sent to the lender. Wage assignments are helpful in paying back long-term debts.

Another instance can be found in a mortgage assignment. This is where a mortgage deed gives a lender interest in a mortgaged property in return for payments received. Lenders often sell mortgages to third parties, such as other lenders. A mortgage assignment document clarifies the assignment of contract and instructs the borrower in making future mortgage payments, and potentially modifies the mortgage terms.

A final example involves a lease assignment. This benefits a relocating tenant wanting to end a lease early or a landlord looking for rent payments to pay creditors. Once the new tenant signs the lease, taking over responsibility for rent payments and other obligations, the previous tenant is released from those responsibilities. In a separate lease assignment, a landlord agrees to pay a creditor through an assignment of rent due under rental property leases. The agreement is used to pay a mortgage lender if the landlord defaults on the loan or files for bankruptcy . Any rental income would then be paid directly to the lender.

Options Assignment

Options can be assigned when a buyer decides to exercise their right to buy (or sell) stock at a particular strike price . The corresponding seller of the option is not determined when a buyer opens an option trade, but only at the time that an option holder decides to exercise their right to buy stock. So an option seller with open positions is matched with the exercising buyer via automated lottery. The randomly selected seller is then assigned to fulfill the buyer's rights. This is known as an option assignment.

Once assigned, the writer (seller) of the option will have the obligation to sell (if a call option ) or buy (if a put option ) the designated number of shares of stock at the agreed-upon price (the strike price). For instance, if the writer sold calls they would be obligated to sell the stock, and the process is often referred to as having the stock called away . For puts, the buyer of the option sells stock (puts stock shares) to the writer in the form of a short-sold position.

Suppose a trader owns 100 call options on company ABC's stock with a strike price of $10 per share. The stock is now trading at $30 and ABC is due to pay a dividend shortly. As a result, the trader exercises the options early and receives 10,000 shares of ABC paid at $10. At the same time, the other side of the long call (the short call) is assigned the contract and must deliver the shares to the long.

:max_bytes(150000):strip_icc():format(webp)/options-lrg-4-5bfc2b2046e0fb0051199e91.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- (+632)8470-6126

- [email protected]

How to Transfer Shares of Stock in a Corporation

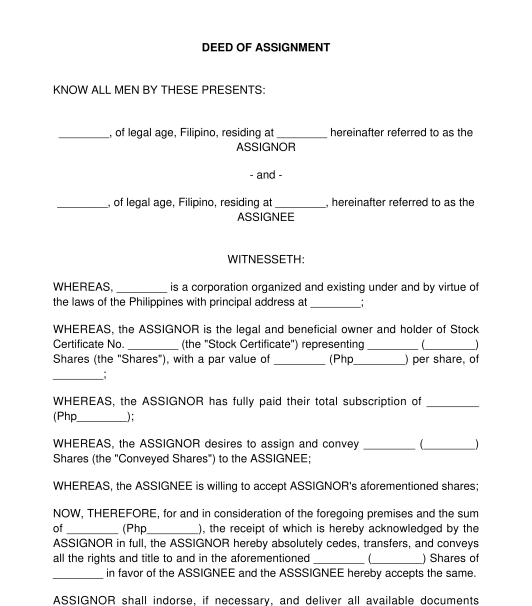

Philippine law treats shares of stock in a corporation as personal property . Similar to other personalty, the owner of the property can sell, assign, transfer or convey his property to another as he wishes. This is an attribute and principle of ownership which cannot be taken away. However, being in the nature of intangible personal property, the law regulates such kinds of properties, including the manner in which they can be conveyed or transferred.

Section 63 of the corporation code affirms that the owner of a share of stock in a corporation has the right to transfer his shares . It is the provision that outlines the fundamental requirements which must be complied with if a stockholder in a corporation wishes to transfer his shares to another. Section 63 reads:

“ Sec. 63. Certificate of stock and transfer of shares. – The capital stock of stock corporations shall be divided into shares for which certificates signed by the president or vice president, countersigned by the secretary or assistant secretary, and sealed with the seal of the corporation shall be issued in accordance with the by-laws. Shares of stock so issued are personal property and may be transferred by delivery of the certificate or certificates endorsed by the owner or his attorney-in-fact or other person legally authorized to make the transfer. No transfer, however, shall be valid, except as between the parties, until the transfer is recorded in the books of the corporation showing the names of the parties to the transaction, the date of the transfer, the number of the certificate or certificates and the number of shares transferred.

No shares of stock against which the corporation holds any unpaid claim shall be transferable in the books of the corporation. “

Being intangible personalty, the corporation code requires that , before a share of capital stock is validly sold, transferred, assigned or in any manner conveyed, it must be covered by a stock certificate . This requirement is borne out of practical considerations. It is a fundamental principle of contract law (be it of sale, assignment or any other conveyance) in the Philippines and probably in any jurisdiction, that the parties to any contract must be aware of the subject matter – what is being sold, transferred or otherwise conveyed. On the other hand, shares of stock in a corporation do not have physical form, unlike ordinary chattel such as goods or vehicles, where a person has a clear notion of what is being sold or conveyed.

The stock certificate is evidence of the personalty owned by the stockholder. It defines the nature and extent of his ownership over the share/s of stock. It also outlines the regulations and limitations of ownership, which must be considered and made known to the parties prior to any conveyance. Obviously, without the stock certificate, these matters would be unknown to a prospective buyer or transferee of shares of stock. Simply stated, the subject matter of the conveyance will not be clear. Therefore, only shares of stock covered by a stock certificate can be subject of a legally demandable and binding sale or disposition.

There may be instances where shares of stock are sold or transferred prior to the issuance of stock certificates. At best, these transactions are only binding between the parties, and will not bind the corporation. As a matter of fact, the corporation can legally refuse to recognize such transfers, especially if the shares which were sold have not yet been fully paid. The last paragraph of Section 63 states that no shares of stock against which the corporation holds any unpaid claim shall be transferable in the books of the corporation. This means that the corporation can altogether refuse to recognize the validity of a sale or transfer of a share of capital stock that has not been fully paid, or which the corporation has a lien. In this case, the purchaser’s only remedy lies with the stockholder.

In the case of De los Santos, et al. vs. MacGrath, et al., G.R. No. L-4818, 28 February 1955 , the Supreme Court interpreted the provisions of Section 63 of the corporation code . The Supreme Court held that any voluntary transfer of shares of stock in a corporation that is represented by a certificate of stock must strictly comply with the following conditions:

a. There must be delivery of the certificate;

b. The share must be indorsed by the owner or his agent; and

c. To be valid to the corporation and third parties, the transfer must be recorded in the books of the corporation.

One of the requirements to effect a valid transfer of shares of stock is that the certificate of stock must be endorsed by the owner or his agent . Mere delivery or handing over of the stock certificate is insufficient , and does not produce the effects of a transfer or conveyance to another. Endorsement of the stock certificate is one of the operative acts which validates the transfer . Without the act of endorsement by the stockholder, the sale or disposition will not be binding upon the corporation. Of course, there are remedies under the law to compel the owner to endorse the stock certificate which he or she has already conveyed to another. But before endorsement of the stock certificate, the corporation can refuse recognize the transferee stockholder.

Moreover, as between the corporation on one hand, and its shareholders and third persons on the other, the corporation looks only to its books for the purpose of determining who its shareholders are. Thus, as between the “real” owner of a stock certificate and the registered owner or the person actually registered in the Stock and Transfer Book of a corporation , it is the person registered in the Stock and Transfer Book who must sign or endorse the certificate of stock to allow its sale or transfer.

Further, the Supreme Court in the case of Padgett vs. Babcock & Templeton, Inc., G.R. No. 38684, 21 December 1933, held that shares of corporate stock are regarded as personal property and may be disposed by the owner as he sees fit, unless the corporation is dissolved, or unless the right to do so is properly restricted or the owner’s privilege is hampered by his actions. A corporation cannot impose undue restrictions upon the owner’s right to sell, transfer or otherwise convey his shares of stock.

According to the Supreme Court, a restriction imposed upon a stock certificate, which unduly prohibits the owner from conveying his property, is null and void on the ground that it constitutes and unreasonable limitation of the right of ownership and is in restraint of trade. It was also held that any restriction on a stockholder’s right to dispose of his shares must be construed strictly; and any attempt to restrain a transfer of shares is regarded as being in restraint of trade, in the absence of a valid lien upon its shares, and except to the extent that valid restrictive regulations and agreements exist and are applicable. Subject only to such restrictions, a stockholder cannot be controlled in or restrained from exercising his right to transfer by the corporation or its officers or by other stockholders, even though the sale is to a competitor of the company, or to an insolvent person, or even though a controlling interest is sold to one purchaser.

However, recognizing the right of the corporation to regulate the transfer of shares of stock in a corporation, the Supreme Court stated that there can be restrictive regulations or agreements which can be entered into between the corporation and the stockholder, to regulate ownership of the shares of stock. These regulations or agreements pertain to those indicated in the certificates of stock, and also those that may be found in the By-Laws of the corporation. The Supreme Court emphasized that these regulations are construed strictly against the corporation, and in favor of the ownership rights of the stockholder. An absolute prohibition from selling shares of stock was held as null and void on the ground that it constitutes and unreasonable limitation of the right of ownership and is in restraint of trade.