Responsibilities and Liabilities of a Company or Business Owner

Are you a seasoned entrepreneur? Like, do you get the urge to be an entrepreneur occasionally? Or are you just starting out in business, permanently and for real?

Whoever you are, understanding your role as a company owner is important to your success. Because, as a business owner, you have a lot of control over your business and how it works. But you already know that with great power comes great responsibility, right? And it’s important to know your responsibilities and risks as a business owner. You have many responsibilities to run a successful and honest business, like ensuring your employees are safe and keeping your company’s assets safe.

Also, you need to know about your legal and financial responsibilities to keep yourself and your business safe from lawsuits and other legal problems. This blog post will discuss the most important responsibilities and liabilities of being a business owner and tips and best practices for doing these things well.

Who Is a Company or Business Owner?

A company’s owner runs the business, decides how it works, and makes money. A business is any place that sells things or provides services for money, like an online store or a freelance writer.

A business owner can work alone or with others, but they are responsible for making plans, teaching employees, and ensuring the business runs daily. A business owner oversees how the business runs and how well it does.

Bill Gates is a well-known business owner because he co-founded Microsoft, one of the world’s biggest software companies. As the business owner, he was a big part of deciding where it was going and making important decisions that helped it do well. Jeff Bezos, who started Amazon, and Elon Musk, who started Tesla and SpaceX, are also owners of businesses.

Roles and Responsibilities in a Business

There are different types of roles in a business, and every role has certain sets of responsibilities to maintain. Some of these roles and responsibilities are divided into three levels-

- Operations and production.

Let’s talk in detail about those three levels of roles and responsibilities. Please take a look below:

1. Executive Or Top-Level Business Roles

There are different executive-level positions in a business or company. Those are discussed below:

- Chief Executive Officer (CEO): A CEO makes top-level decisions, gets the company’s resources, and makes operational and structural changes that directly affect the organization’s growth. Either the president or the owner can carry out this task in smaller businesses.

- Chief Operating Officer (COO): A Chief Operating Officer oversees the company’s operations. In smaller businesses, the general manager can fill this role, which is similar to a COO. These top-level business jobs make sure that things run smoothly and often oversee different departments to ensure employees do their work right and on time.

- Chief Financial Officer (CFO): The CFO, also called the controller, oversees a business’s cash flow and how well it does financially. A CFO and a controller are usually two different jobs within a large company, but smaller companies may combine these two jobs into one job title. The CFO usually finds investors and other ways for the business to get money from outside sources, while the controller controls the company’s expenses and assets. When one person takes on both financial roles, they are in charge of both money coming in and money going out.

- Chief Marketing Officer (CMO): The chief marketing officer (CMO) oversees a company’s marketing campaigns, budgets, and the whole marketing department. This job may be in charge of multiple marketing teams, each with its own team leader or marketing manager. Also, the CMO usually makes the final decisions about how marketing projects are planned and carried out.

- Chief Technology Officer (CTO): The Chief Technology Officer (CTO) is in charge of the organization’s technology. They often use new technology trends and ensure that any new technology meets their company’s needs. The CTO oversees the most important tasks in companies with big IT departments.

- President: Some organizations don’t have a CEO but do have a president. Even though the president and the CEO have many of the same responsibilities, the president may also have other tasks that the CEO may not. They could do some of the things that a COO and a CFO do in bigger companies. As a company grows, the president may take on more specific responsibilities, such as making top-level decisions and leading the management teams, instead of a wide range of executive duties.

- Vice President: For the president, the vice president makes decisions and plans by telling mid-level managers and team leaders what to do. They can, among other things, be in charge of how a business runs and sets up its organizational structure.

- Executive Assistants: Most of the time, an executive assistant works directly for the CEO and does most of the CEO’s administrative work. A business often needs an executive assistant to keep the CEO’s schedule, agenda, and appointments in order.

2. Managerial Business Roles And Responsibilities

The responsibilities of managerial business roles are discussed below-

- Marketing Manager: Depending on the company’s size, the marketing manager oversees the whole marketing department. In a large company, the marketing department might have more than one team, and each team might have its own marketing manager. Every manager reports directly to the CMO. In smaller companies, the marketing manager may be the only person at the top level who is in charge of marketing.

- Product Manager: Product managers research product markets and streamline product development processes. A product manager may spend most of their time researching customer markets, evaluating popular products, analyzing how products are made, and working with marketing teams to develop product promotion strategies.

- Project Manager: Project managers are in charge of much of the planning and making of business projects. These people are responsible for planning, designing, monitoring, controlling, and finishing projects. Project managers may examine and minimize risks on various projects. They often work with other department managers, like marketing and product managers, to plan and develop all parts of a project, such as its budget, resources, and timeline.

- Finance Manager: Finance managers often look at costs and income and use this information to make financial reports. In smaller businesses, this job may be in charge of a number of financial tasks, such as figuring out how much money is coming in and how much it will cost the company. In larger businesses, the finance manager may be in charge of the accountants and bookkeepers on staff, and they depend on their work to make accurate financial reports and forecasts.

- Human Resources Manager: Human resources managers oversee the department of human resources. In larger organizations, they may be in charge of a lot of people, but in smaller ones, they may only be in charge of a few people. This business role is important for operations because they look for, interview, hire, and start working with new employees. HR managers often talk to top-level executives to develop strategic plans and act as a link between top-level management and the rest of the company’s staff.

3. Operational Roles And Responsibilities

- Marketing Specialist: The marketing specialist is an important part of the marketing team. Specialists do many different things, like gather customer information, research target demographics, and optimize content for SEO. In the marketing department of many companies, there is more than one marketing specialist, and this person usually reports directly to the marketing manager.

- Business Analyst: Many companies hire business analysts to evaluate how their businesses grow and change. This job analyzes market trends, predicts future revenue, and makes plans that help businesses track profitability, product viability, and the overall success of operations.

- Human Resource Personnel: Human resources personnel are an important part of any business, and the HR manager oversees them. Most of the time, the people in these business roles are in charge of payroll, employee schedules, performance reviews, and evaluations. In big companies, the HR department might have a few HR managers and a lot of staff who work under them.

- Accountant: A business’s day-to-day operations, such as sales, paying bills, and filing taxes–an accountant oversees all of these. Accountants in smaller businesses may have to do things that finance managers or chief financial officers (CFOs) do in large businesses.

- Sales Representative: Sales representatives talk to customers to sell the products or services of their company. Successful sales teams use good communication and people skills to build customer relationships and maintain loyalty. This has a direct effect on how much money the business makes.

- Customer Service Representative: Customer service representatives deal with returns and refunds, help customers figure out how to fix problems, and listen to customer complaints. These operational roles are important to the company’s reputation and building long-term customer relationships.

- Administrative Assistant: Customers and clients first talk to the receptionist, office assistant, or administrative assistant when they enter a business place or company. They might be responsible for important tasks like running the phone lines, coordinating communication between clients and partners, and setting up staff schedules. They might even be given tasks like data entry to help keep business documents correct and up-to-date.

What Are the Responsibilities of a Business Owner?

The owners of businesses do everything they can to ensure their businesses do well. This could mean doing things they’d rather not do, like filling out paperwork, taking orders to the post office, or making plans for marketing.

What business owner does daily depends on what kind of business they run and how they spend their time. Most of the time, though, they boil down to the following roles and responsibilities-

Creating and Managing Plans: As a business owner, you must consider what you need to do to make your business successful. This means planning how they will run their business, promoting their goods or services, and finding ways to keep their business profitable. To be successful, you need to do research and make good plans. Business owners must also be good at time management to meet deadlines and balance their work and personal lives.

Managing Finance: Managing money is important. To start a business, a person needs money, so they may need to get a loan or find investors. They must also pay for new products, advertising, and staff. It’s important to keep track of your bank accounts, taxes, and how much money you make and spend.

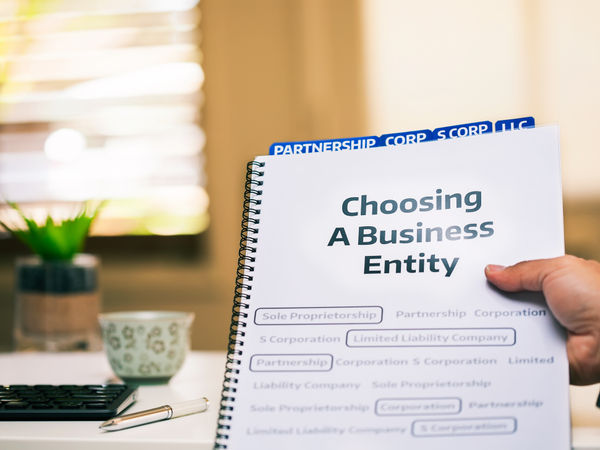

Compliance and Legal: A business owner must follow the laws and rules about how to run a business. This means getting the right licenses, registering their business as a legal entity, and knowing the rules about labor. A business owner should also have a lawyer on hand in case of problems with employees or customers.

Marketing and Sales: A business owner must ensure people know about their business and want to buy from it. This means making campaigns, approving ads, and promoting their business through social media and email. They also have to talk to people who might buy their products or services and make deals with them.

Regular Monitoring: The company owner needs to monitor how their employees are doing their jobs, how well the work is getting done, and how well their plans are working. They have to do this daily to quickly see where things are going wrong and fix them before they become big problems. This way, the owner can stay on top of any potential issues that may arise.

Supervising Customer Service: It is up to the business owner to ensure customers are happy with the service they get. This means making rules about how to treat customers and ensuring people think well of the business.

Hiring People According to the Company’s Rules: If you own a business, you must find and hire the right people to work with you. This means that the owner will decide what each person should do, give them feedback on how well they are doing, and decide how much they should be paid and what benefits they should get. The owner also helps them improve their jobs by providing training and support.

Liabilities of the Owner in a Business Plan

The liabilities of a business owner are the legal responsibilities and financial debts that the business owner is responsible for. Among these responsibilities are the following:

Business Debts: The owners of a business may have to pay for its debts themselves. If a business can’t pay its debts, the owner may have to use their own assets, like their home or savings, to pay them off.

To avoid this, business owners must separate their personal and business finances. They should keep their business transactions in a separate bank account and consider incorporating their business or making an LLC to limit liability.

Legal Claims: If a company owner’s business is sued for any reason, they could be held personally responsible for any damages given to the plaintiff. This can happen when someone hurts a worker, breaks a contract, or steals someone else’s idea.

To lower the chance of being sued, they should ensure their business follows all laws and rules and consider getting liability insurance to protect themselves in case they are sued.

Taxes: As business owners, they have to pay different taxes, such as income tax, payroll tax, and sales tax. If you don’t pay these taxes, you could face fines, penalties, or even be charged with a crime.

Maintaining accurate records of all business transactions, filing the owner’s tax returns on time, and considering hiring a qualified accountant or tax preparer can all help you avoid tax problems.

Employee Obligations: If a business owner has employees, they may have legal and financial responsibilities like paying their salaries, giving them benefits like health insurance and retirement plans, and following employment laws and rules.

To ensure you follow all employment laws and rules, you might want to talk to an employment lawyer and assemble a handbook for employees explaining the owner’s company’s policies and procedures.

Liabilities of the Owner in a Business Plan Example

A liability is any debt that your business has to pay. And in a business plan, the owner’s liabilities mean the financial obligations or debts they are responsible for paying. These liabilities can vary depending on the business structure and the owner’s role and responsibilities. Some of the most common business liabilities for which a business owner may have to pay personally are:

- Personal investment

- Loans, mortgages, and other forms of debt

- Taxes on income and other taxes due

- Employee wages and salaries

Importance of Owner in a Business

The business owner is in charge of the big picture and is not involved in the day-to-day tasks of running the service. Instead, they look at the whole picture. They set goals and plans. They know how to make strategic decisions and have the power to get rid of political and financial roadblocks. They talk to the people who matter most and work closely with the service owner, who creates a roadmap that fits the vision.

But That’s Not All

We’ve reached the end of our blog, but that’s not all.

Remember that running a successful business takes a lot more than a good idea and a strong work ethic. As a business owner, you must know your legal and financial obligations and meet them. This means keeping good financial records, paying taxes, following rules and laws, and ensuring their business is properly insured.

By keeping their personal finances separate from their business finances, business owners can stay out of trouble with the law and protect themselves from liability. A business owner must also know their responsibilities to their employees, customers, and the community. For example, they have to follow health and safety rules and ensure the workplace is safe.

Lawyers, accountants, and insurance agents can help business owners understand their legal and financial obligations and ensure they are met. These experts can also advise them on making it less likely that they will have legal or financial problems.

Shortly, if you own a business or company, you need to work hard, take responsibility, and be willing to ask for help when you need it. By following these steps and doing what they need to do, business owners can build a successful business that helps their customers reach their goals and gives them value while avoiding liability issues.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Line of Credit

- How It Works

- Small Business Resources

- Small Business Blog

- Business Stories

- Our Platform

- Lender and Partner Resources

- Our Company

- 12 Responsibilities of a Small Business Owner

- Learning Center

- Business Owners

R unning a business comes with exciting opportunity, flexibility, and independence, but it’s also a major role to take on. Depending on your unique business situation, you’re probably doing much more than overseeing operations. Even when you’re involved in all the different everyday tasks, it’s important to remember your core responsibilities.

Why is it important to know the responsibilities of a small business owner?

Being a small business owner means wearing many hats and juggling many responsibilities each day. Understanding your responsibilities helps you stay organized and on the track to growth. Here’s why it’s important to know your responsibilities:

- Increased efficiency. Knowing that your responsibilities include the hiring and training process and overseeing your current employees means you’ll never neglect one group at the other’s expense. As a result, everyone will have all the resources they need to complete their work. With full resource access, your employees will get their work done more quickly, and your company will be more efficient.

- Less time wasted. When you sit atop the chain of command, your actions (or inaction) often affect your work environment and output. For example, if your development team can’t offer new goods or services without you approving the budget, your company loses precious time if you neglect your financial responsibilities. This possibility is far less likely if you know all your responsibilities.

- More knowledge. If you’re aware that business owners oversee customer service, marketing, finances, and all kinds of other tasks, you build knowledge in all kinds of areas. This means you have a stronger foundation to pull from when drafting a business plan for any new initiatives. It also means knowing what will and won’t work when executing your social media marketing strategy . For small business owners, knowledge is power.

12 responsibilities of a small business owner

Among the (many) responsibilities of a small business owner are the following:

1. Creating a business plan and strategy

As the owner of the small business, you decide the direction you’re heading and how you’ll get there. Setting benchmarks based on your long-term vision can help you understand what you need to achieve your dreams, whether that be time, resources, strategies, or a helping hand. If you do have a team supporting you, they’ll be empowered in their work when you’re transparent about your plan of action.

It can take a brainstorming session or two, or five, to narrow down what your most meaningful goals are and how they translate into actionable steps. Don’t hesitate to set aside time for high-level planning sessions where you measure progress, gather insights, and readjust the game plan if necessary.

2. Keeping track of finances and accounting

Most small businesses ( 81%, to be exact ) apply for a business loan or an SBA loan at some point. Depending on your needs and financial history, you’ll probably have to weigh your options when it comes to outside financing. Unless you’ve hired an accountant or bookkeeper, you’re also responsible for establishing and maintaining business bank accounts, payment processing systems, taxes, and day-to-day costs.

Not sure how you can apply the funds from a small business loan? Read our in-depth guide on the SmartBiz Resource Center: Determining Use of Proceeds .

3. Handling legal and compliance responsibilities

Running the ship comes with a new level of freedom, but it also means complying with rules and regulations. From the very beginning when you’re forming a business structure to the daily routines like drafting contracts and agreements, you should have at least some knowledge of the laws specific to your industry, location, and business type. When you need professional advice, it might be worth working with an attorney.

4. Managing marketing and sales

Even with a standout product or service, you’ll need to establish solid marketing strategies to bring customers through the door and drive your sales up. With so many available options out there, it’s up to you to decide the approach that fits best with your business goals. Some opportunities include social media, print advertising, PR, and event marketing.

5. Ensuring outstanding customer service

Next, once you’ve built a customer base, consider keeping them engaged throughout the sales process. Forming a relationship with the individuals who use your product or service is key to keep them coming back and even referring more customers. Whether you have a sales team or you’re wearing all the hats, there are plenty of tools out there that can help you manage and automate your processes. Looking into Customer Relationship Management (CRM) platforms is a great place to start. For inspiring customer service stories, check out this post: 6 Best Examples of Customer Service .

6. Identifying hiring and HR needs

As your small business grows, you might find that it’s time to hire help. Before you take the plunge and start placing ads, consider how much you’re willing to offer for potential candidates. Just like any other venture, this decision is probably a major turning point for your business so don’t underestimate the impact that hiring can have. Some of your responsibilities as the owner include identifying your company’s needs, crafting job descriptions, interviewing candidates, and making key hiring decisions.

7. Overseeing the team

The work doesn’t stop there—once you’ve hired the employees you think are a good fit, it’s your job to train, manage, and lead by example. When questions or concerns arise, you should be there for your team. Be sure to comply with local hiring laws to avoid any missteps that can result in big consequences. Visit the U.S. Department of Labor to learn what it takes to hire employees in your area.

8. Managing day-to-day operations

As a small business owner, you need to identify and manage all processes that keep your customers happy and support healthy growth, from manufacturing products to signing off on invoices. Although you don’t necessarily need to be hands-on in every process, you do need to make sure your team completes every step in a timely, thorough manner. Without this management, your products or services might not reach your standards.

9. Planning new initiatives

If your day-to-day operations aren’t getting you where you want to be, maybe it’s time to branch out. The responsibility for planning this expansion falls on you, though you can seek help from your employees or business partners. Market research will come in handy here, as will identifying other companies with which you can partner. So too will drafting a business plan for your new initiatives. Learn more via the SmartBiz Loans blog Ultimate Guide on How to Start A Business Plan .

10. Training your team

Employee training doesn’t stop after the initial onboarding process. Continued training is highly recommended, as it can minimize employee mistakes and prepare your team for any new paths your company might take. However, even if you task certain employees with executing your training program, it remains your responsibility to ensure everyone is receiving adequate instructions. After all, it’s your business – you wouldn’t want anyone working for you without being fully prepared.

11. Addressing technology issues

Small business owners like yourself should know the ins and outs of all the technology their company uses. This way, both new and longtime employees can go to you for quick, thorough answers. The result is a more efficient team that doesn’t fall behind when technological obstacles arise.

12. Staffing and management

As the owner of your company, you’re the final step for all human resources, customer service, and employee management concerns. Depending on the type of company you own, you may have sole discretion over these concerns. Alternatively, if you’re small enough that you’ve outsourced your HR to a third party, this entity may handle it. However, if you’re unhappy with how things are handled, you still get the final say.

Small business resources

As you see continued business success, you’ll probably identify key areas where you can grow. A boost in cash flow means that you can expand your programs and build your operations. Interested in receiving personalized recommendations and tips that can help you take your business to the next level?

Get started with SmartBiz Advisor today. Our free, AI-powered tool will be your Intelligent CFO, providing you with the insights and resources you need to strengthen your lending profile and qualify for the funding you deserve.

Have 5 minutes? Apply online

- Follow SmartBiz

Access to the right loan for right now

- Business Credit

- Business Finances

- Business Marketing

- Business Technologies

- Emergency Resources

- Employee Management

- Small Business Loans

- SmartBiz University

- More SBA Articles

Related Posts

Smartbiz helps facilitate access to financing for underrepresented entrepreneurs, women-owned business certification: learn about how to get yours, bank term loans 101: understanding the basics for small business, smart growth is smart business.

See if you pre-qualify, without impacting your credit score. 1

*We conduct a soft credit pull that will not affect your credit score. However, in processing your loan application, the lenders with whom we work will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and happens after your application is in the funding process and matched with a lender who is likely to fund your loan.

The SmartBiz® Small Business Blog and other related communications from SmartBiz Loans® are intended to provide general information on relevant topics for managing small businesses. Be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed. Please consult legal and financial processionals for further information.

- You are here:

- Home »

- Blog »

- Business Growth »

Key Roles And Responsibilities Of A Small Business Owner

- Business Growth

Read this if you want to know what the key tasks, duties and responsibilities are of a small business owner.

The key roles and responsibilities of a small business owner is to maximize revenue, profit, cash flow, income and long-term net worth, by consistently producing greater results and performance from the same time, the same effort, the same activities, the same people, and the same money invested in your business. Secondly to continually reduce cost, and neutralize or eliminate weaknesses, risk and threats and develop a strategic competitive advantage to combat increasing competition.

Focus on the 6 key business drivers .

The business owners' day to day responsibility and success will come from your ability to identify, analyze, plan, implement and manage the performance of these simple but very important 6 business drivers or top-key-success-factors.

- Management - Manage yourself every day

- Money - Financial Management

- Marketing and Sales - Management sales, marketing and customers service

- People - Management of productivity, training and development of employees, suppliers and partners

- Product and Service - Your Operations. Manage quality and quantity, price, packaging, display, stock, distribution ...

- Process and Systems - Management daily operations, Admin, bookkeeping

Every one of these 6 business drivers have their own numbers. It is your job and responsibility to identify them and measure them to be able to manage them.

"Great success and mastery in any field always go to those who are brilliant on the basics"

- Brian Tracy -

Strengthen the company on the inside

The key role of a business owner is to contribute, looking for ways to become an ever more valuable person in every area of your business. Including to employees, partners, suppliers and your customers. Part of business owner job description and responsibility is to strengthen the business on the inside while expanding the business on the outside.

Clearly define the mission, goals and vision of the company.

Find the best people for the job and train them into a great team.

Keep control over finances and focused on the fundamentals of business - making money and generating cash.

Improve bottom line and maximizing long term profitability

Keeping focused on the fundamentals of business - making money and generating cash.

Building a unique business model that supports customer loyalty, trust, with a continuous stream of innovative products, added value and improved quality and quantity of service

Expand the company on the outside

Defending and maximizing market and wallet share

Focusing financial strategies on identifying sources of funds

Making investments to build company assets and long-term net worth

Exploit existing resources and develop or acquire needed resources

Spot trends and opportunities and neutralize or eliminate threats and weaknesses

Developing competitive strategic advantage on established market niche to combat the increasing competition.

Key roles and responsibilities of a business owner

The 3 most important things

Some of them have a greater responsibility and a bigger impact on your business depending on where the business is in the growth cycle. For instance for a new start up business Money, Marketing/Sales and Product is very important, As the business is growing and becoming bigger the other factors like developing the Owner, Team and Systems also becomes very important. Although every one of them is just as important as the other one, the most important ones in general will always be:

- Mone y - Financial Management

- Marketing/Sales and

- Your Operations - Your Product/Service.

Marketing/Sales and Money is the small business biggest task and responsibility. But the one key success factor and responsible for most success and failure, and the main responsibility of a business owner is Money - Financial Management. You can read the article " How To Eliminate Biggest Money Mistakes in Small Businesses" for full details.

In Brian Tracy's book - The 100 absolutely unbreakable laws of business success, the "Law of Three" says that there are only three things that you do each day that account for 90% of the value of everything that you do. There are only three things that account for 90% of your sales, profit, income and your success in the future. This Law of Three is applicable to every job, responsibility and area in your business.

In Sales, we now know that the three activities that account for 90% of your value are: Prospecting, Presenting, and Closing.

In business Profits, we know that the three most important things are: Sales, Cost and Profit margin %(or markup %)

In business Revenue, we know that the three most important things are: Lead generation, The %, of Leads Converted into sales and the Average Amount customers spend every time they buy from you.

The three most important things In Marketing are: The right target, The right message, and The right Medium.

These are just a few basics and as a business owner it's your responsibility to identify and focus on the big three important things in your business. Your other activities are also important, but not as important as the big three.

Financial responsibilities of a business owner

In Financial Management, the three areas are: Financial Record keeping, Financial Controls, and Financial analysis , forecasting and planning

1. Financial Record Keeping

Bookkeeping – This includes maintaining your business financial records like invoices, delivery notes, customers details, accounts receivable & accounts payable, and keeping the accounting system up to date. It also includes keeping records of bank statements, legal documents and tax related documents.

2. Financial Controls

Financial controls are the rules, policies and procedures that are implemented to insure control over the in, and out flow of money in the business. The purpose is to eliminate theft, corruption, and misuse or unauthorized spending of money. It's also to control client credit approval, credit limits and collections from clients.

3. Financial Analysis, Forcasting and Planning

Business Financial analysis refers to a valuation of the current and future viability, stability, and profitability of a business. It includes the evaluation of the business financial performance to determine the overall health and business using information taken from its operational activities, accounting and historical financial statements.

Business financial performance is the overall financial measure of how well a business can achieve its financial objectives, using its assets to generate revenue and profit over a given period. Signs Of Poor Financial Performance in a business may indicate that the business may be under pressure, at risk, or in financial trouble and may be going out of business in the near future. Signs of financial distress in business are merely symptoms of different causes that are responsible for a business in financial trouble.

Action steps

Take a close look at your business and divide it up in different areas of responsibilities and success factors.

Search for the three things that account for 90% of your success in the future in all the different areas like: growth, sales, profit, income, cash flow, employee satisfaction, customer service, quality .....

Identify the 3 big areas that will account for 90% of your success and make that your primary focus. Don't neglect the rest, they are all important, but most of your time should be focused o the BIG 3.

Related Articles:

- Visit our Free Tools section for more tools to help you

- Lead and Lag Indicators For Small Business: With Examples

About the Author Hans

Hans had 40 of his own businesses over the last 30 years and is famous for creating fast-growing businesses” He is an author, speaker, coach, and consultant and a specialist in business optimization and turnaround, helping smaller business owners eliminate business limitations, threats, and growth challenges in achieving their sales, profit, cash flow, and income goals with sniper precision.

Popular posts

20 big money mistakes business’s make in 2021, 6 ways to save & turnaround a failing business, 7 proven business turnaround strategy steps, ten keys to a successful business turnaround.

How to write the structure and ownership section of your business plan?

Business planning is vital to the success of any entrepreneur because it helps them secure funding and find competent business partners. The document itself contains a variety of key sections, including the presentation of the legal structure and ownership of the business.

This section details the legal structure of your business and helps interested parties such as lenders and investors understand who they will be doing business with if they decide to go ahead and finance your company.

In this guide, we’ll look at the objective of the structure and ownership section, deepdive into the information you should include, and cover the ideal length. We’ll also assess the tools that can help you write your business plan.

Ready? Let’s get started!

In this guide:

What is the objective of the structure and ownership section of your business plan?

What information should i include when presenting the legal structure and ownership of my company in my business plan.

- How long should the structure and ownership section of your business plan be?

- Example of structure and ownership in a business plan

What tools should I use to write my business plan?

The objective of this section is to provide potential investors, lenders, and strategic partners with a clear and transparent view of your business's legal form, ownership distribution, and registration details.

It aims to build credibility and trust by showcasing your commitment to openness and compliance with regulations. Let's take a look at some of the key objectives:

Communicate the legal form and registration details

- You should explicitly state your business's legal form. For example, your business might be corporation, sole proprietorship, or limited liability company (LLC).

- Clearly explaining your chosen legal form helps stakeholders understand your entity's liability, taxation, and management implications.

- It is also essential to disclose where your company is registered. This information is vital as it provides clarity on the jurisdiction under which your business operates.

- It also helps investors and lenders assess any legal and regulatory implications specific to the location of registration.

Identify shareholders

- Potential investors and lenders need to know who owns the company and the percentage of ownership each party holds.

- By providing this information, you instill confidence in your business and help identify what needs to be verified as part of Know Your Customer (KYC) and Anti-Money Laundering (ALM) checks down the line.

Transparency is the cornerstone of credibility for businesses. By openly presenting the legal structure and ownership, you signal to potential investors that your business operates with integrity and adherence to regulations.

Notably, anti-money laundering regulations require investors to verify the identity of all shareholders before committing funds. By providing a clear picture of the parties involved, you can facilitate this process and build trust with investors.

Venture capitalists (VC) firms and angel investors in particular, may have specific criteria such as location and ownership mandates governing the companies they can finance. Being transparent about your company's structure and ownership enables potential investors to assess whether your business aligns with their investment preferences and requirements.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The structure and ownership subsection arrives quite early in your business plan as it is the first part of the company section which is the second section of the document (after the executive summary) if you are following a standard business plan outline .

At this stage, the reader is still in the process of getting familiar with your business, and this section serves as a crucial foundation for potential investors and partners and helps them understand the core aspects of your business’s structure.

Here's what you should include:

Company registration details and registered office address

Provide information about when and where your company was registered and its registration number. This enables readers to understand the jurisdiction under which your business is operating and helps verify its legal existence.

Also, mention the registration date to showcase the company's longevity or recent establishment.

Include the registered office address of your company. This is the official address where the company can be contacted, and legal notices can be served. Providing this address demonstrates your commitment to compliance and transparency.

The information above needs to repeated for each subsidiary or joint venture owned by your business in order to provide a clear map of the coporate structure.

Overview of ownership

Offer a concise overview of the ownership structure of the company. Identify the shareholders, and specify their ownership percentages or shares.

If there are numerous shareholders, list individuals or entities owning 5% or more, and highlight those with a controlling interest in the company or on the board.

If the business is controlled by another business, such as a holding company for example, it is also useful to explain who controls that business as well.

Roles and responsibilities of shareholders

In case of multiple shareholders, explain their respective roles and responsibilities within the organization.

Differentiate between passive investors, board members, and executive or non-executive directors.

Shareholders' agreement (if applicable)

If the business plan is presented for investment purposes, it is useful to clarify if a shareholders' agreement is in place between the existing investors.

This agreement outlines the rights and obligations of shareholders and adds an extra layer of legal protection for investors and shareholders.

Expertise of co-shareholders

Highlight any shareholders who contribute more than just financial capital to the company.

If, for instance, a shareholder is an industry expert and brings valuable advice, contacts, and credibility, emphasize this aspect.

Doing so demonstrates the added value these shareholders bring to the business.

Group or franchise structure

If your company operates as part of a group or franchise, provide this information for each individual company receiving funds.

Clarify the relationship between the main company and the individual entities within the group and their respective legal structures.

Addressing geographical restrictions

If some investors have geographical restrictions on their investments, clearly indicate whether your company meets their eligibility criteria.

This helps investors quickly assess whether your business aligns with their investment mandates or not.

How long should the structure and ownership section of your business plan be?

The length of your business plan's structure and ownership section requires a delicate balance.

While a general rule of thumb suggests that it should be about 2 to 3 paragraphs, the actual length depends on several factors, including the complexity of your corporate structure and the number of shareholders involved.

The complexity of your corporate structure

- A concise presentation may be sufficient if your company's legal structure is relatively straightforward, with a single owner or a small number of co-founders.

- In such cases, aim to provide the necessary information without overwhelming the reader with unnecessary details. A paragraph or two may convey the key points effectively, ensuring clarity and brevity.

- However, if you have a complex business structure, aim to provide details about members who play a key role in business continuity and profitability.

The number of shareholders involved

- If your business involves multiple shareholders, each with significant ownership percentages or unique roles, you may need to dedicate more space to this section.

- Do this by providing a comprehensive breakdown of ownership distribution and outlining each shareholder's contributions.

- This may take up more space as you need to add additional information. However, if you have a pretty straightforward ownership structure, a paragraph or two will be sufficient enough.

Regardless of the complexity, striking the right balance between providing sufficient detail and avoiding excessive technical jargon is crucial. The structure and ownership section should be reader-friendly, allowing potential investors and stakeholders to understand the core aspects of your company without feeling overwhelmed by intricate legalities.

Repetition can dilute the impact of your message and unnecessarily lengthen the section. Ensure that you don't reiterate information that has already been covered in other parts of the business plan. Instead, focus on providing unique insights and details that enhance the reader's understanding of your corporate structure and ownership.

When crafting this section, prioritize the most critical points that investors or partners need to know about your company's structure and ownership.

Focus on aspects that directly impact decision-making, such as the majority shareholder's influence, board composition, different classes of shares in issue, or any unique arrangements that set your business apart.

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

Example of structure and ownership section in a business plan

Below is an example of what the structure and ownership section of your business plan might look like. As you can see, it is part of the overall company section and precedes the location and management team subsections.

The structure and ownership section of a business plan provides a detailed overview of how your company is organized and who holds ownership stakes in the business.

This example was taken from one of our business plan templates .

In this section, we will review three solutions for creating a business plan for your business: using Word and Excel, hiring a consultant to write the business plan, and utilizing an online business plan software.

Create your business plan using Word and Excel

This is the old-fashioned way of creating a business plan (1990s style) and using Word and Excel has both pros and cons.

On the one hand, using either of these two programs is cheap and they are widely available.

However, creating an error-free financial forecast with Excel is only possible if you have expertise in accounting and financial modeling.

Because of that investors and lenders might not trust the accuracy of your forecast unless you have a degree in finance or accounting.

Also, writing a business plan using Word means starting from scratch and formatting the document yourself once written - a process that can be quite tedious - especially when the numbers change and you need to manually update all the tables and text.

Ultimately, it's up to the business owner to decide which program is right for them and whether they have the expertise or resources needed to make Excel work.

Hire a consultant to write your business plan

Outsourcing your business plan to a consultant can be a viable option, but it also presents certain drawbacks.

On the plus side, consultants are experienced in writing business plans and adept at creating financial forecasts without errors. Furthermore, hiring a consultant can save you time and allow you to focus on the day-to-day operations of your business.

However, hiring consultants is expensive: budget at least £1.5k ($2.0k) for a complete business plan, more if you need to make changes after the initial version (which happens frequently after the first meetings with lenders).

For these reasons, outsourcing the plan to a consultant or accountant should be considered carefully, weighing both the advantages and disadvantages of hiring outside help.

Ultimately, it may be the right decision for some businesses, while others may find it beneficial to write their own business plan using an online software.

Use an online business plan software for your business plan

Another alternative is to use online business plan software .

There are several advantages to using specialized software:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you without errors

- You get a professional document, formatted and ready to be sent to your bank

- The software will enable you to easily track your actual financial performance against your forecast and update your forecast as time goes by

If you're interested in using this type of solution, you can try our software for free by signing up here .

To sum it up, a well-written structure and ownership subsection is key to ensuring that the reader is clear on who controls the business, and whether or not it fits their investment criterias.

Also on The Business Plan Shop

- How to do a market analysis for a business plan

- How to present your management team in your business plan?

- Where to write the conclusion of your business plan?

Know someone who needs help writing-up their business plan? Share this article with them and help them out!

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

The Roles of a Business Owner

by Steve Milano

Published on 1 Jan 2021

When you start a small business, you’re often forced to manage most of the functions of your company. As your business grows, you’ll benefit by hiring experts to run different areas of your company. Owners who refuse to delegate functions so that they can focus on the core business can dilute their overall effectiveness.

Product Development

A small business owner usually has the most product or service expertise of anyone at his company. If this is the case with your business, stay focused on maintaining and improving what you sell. This includes evaluating the competition, understanding your customers inside and out and maintaining or improving quality while controlling costs and adding new features or products to your line.

If you are not skilled at sales, it’s still important to work closely with your sales director. Someone motivated primarily by commissions might take shortcuts to selling and damage your brand. Keep control over how and where your sales team sells your product or service. Offering discounts to increase sales can make you look cheap, inferior or desperate. Selling on your website, through a big box or using fundraisers, rather that putting your product in boutiques or high-end retailers, might send the wrong message to your target customers.

Limit your involvement in the area of finance to preparing annual forecasts and budgets, reviewing monthly financial performance and conducting year-end audits. Let your accounting staff handle your day-to-day accounting, payroll, payables and receivables and check-writing. Always run your budgets and projections, especially those involving sales and income, by an objective third party who has access to at least one year’s financial records. Work with a qualified tax attorney to ensure you only take allowable deductions and pay all of your taxes when they are due.

If you’re not trained in marketing, including research, advertising, public relations and promotions, resist the temptation to get too involved. Many small business owners believe that marketing is primarily a creative endeavor and that a company’s advertising and promotions reflect personally on the owner. Don’t overrule a trained marketing professional on his recommendations if you simply have a gut feeling or opinion.

Human Resources

You will want to have the final say on hiring key employees, but once your staff is on board, don’t skip the chain of command and start managing employees who have supervisors. You will diminish the authority of your management team, increase turnover and frustrate employees. An owner’s role in HR should include creating an organization chart, discussing job descriptions and interviewing top-level candidates.

The Roles of a Business Owner

- Small Business

- Business Communications & Etiquette

- Role of Business Communication

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Wake Up the Sleep Function in a Microsoft Digital Keyboard

How to register a kindle without wi-fi, key positions to be filled in a start-up company.

- How to Put a Password on a Linksys Without the CD

- Role of Financial Management in Corporate Structure

Starting your own business means that you'll be taking on a project that requires you to wear many hats -- often at the same time. The smaller and newer your business is, the more roles you are likely to have to fill. As your business grows, you can gradually hire employees and contractors to assume some of these roles.

Business Planner

To get your business started, you must first take on the role of a business planner. The United States Small Business Administration suggests taking steps such as selecting a location, gaining financing, registering your business and getting all of the appropriate licenses and permits. The planning doesn't stop when you get your new business underway, however. You'll need to continue to adjust your business model to account for ever-changing factors such as trends and the economy.

Human Resouces Specialist

The people who work for you are your greatest resource, and you'll want to hire the best people you can. You'll also need to comply with federal laws regarding personnel management and have each employee fill out the appropriate paperwork. Many small businesses approach hiring and other human resource issues haphazardly. Read books on human resource management or take a course on the subject to familiarize yourself with this oft-neglected role.

Office Manager

In the beginning, chances are you'll serve as the office manager, taking phone calls, dealing with suppliers, keeping track of receipts and setting up a workable system to organize this hub of your company. You might find yourself making calls to collect late payments, troubleshooting computer and other technical problems, sending invoices, and handling customer complaints or requests. Consider hiring someone early on that you can train to assist you with these tasks, as they can quickly become overwhelming when trying to manage the other aspects of your business.

Marketing Expert

No matter how good your product or service is, if the public isn't aware of it, your business won't be a success. Every business owner must put time into developing effecting marketing and advertising campaigns. Often, these require a large investment of time in addition to money, as you'll want to research your target market to determine the most effective ways to reach them. You'll likely play the role of marketer for the duration of your business unless your company grows large enough to hire someone specifically for this position.

Bookkeeper and Accountant

To make the most of your business, keep meticulous track of your expenses and income. While performing the tasks of a bookkeeper, you also must play the role of a tax expert, learning the relevant tax laws so that your company doesn't inadvertently violate any of them -- a mistake that can result in hefty fines. In this role, watch for deductions that you can take, as this can save you a significant amount of money each year. Consider hiring an accountant to do your quarterly taxes if you believe your math skills are unequal to this role.

- U.S. Small Business Administration: Follow These Steps to Starting a Business

- "Small Business Management: Launching and Growing Entrepreneurial Ventures"; Justin Longenecker, et al.; 2009

Elise Wile has been a writer since 2003. Holding a master's degree in curriculum and Instruction, she has written training materials for three school districts. Her expertise includes mentoring, serving at-risk students and corporate training.

Related Articles

How to get in safe mode on the dell latitude, three problems of entrepreneurship, how to run a successful small business, how to turn on usb debugging in the htc g2, how to authorize a computer to put apps on an iphone, government resources for starting a clothing store, how to determine your pc domain controller, how to use itunes to sync google contacts, how to be a good entrepreneur, most popular.

- 1 How to Get in Safe Mode on the Dell Latitude

- 2 Three Problems of Entrepreneurship

- 3 How to Run a Successful Small Business

- 4 How to Turn on USB Debugging in the HTC G2

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-14343635291-33bf053f368c43f6a792e94775285bbd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

The 4 Roles of a Business Owner

Roles and responsibilities of a business owner.

The roles of a Business Owner can seem never-ending as you wear so many hats – mainly because all the responsibilities of the business ultimately rest with you.

These roles and responsibilities also change and develop as your business grows and develops. Whilst every business is different, there are some fairly common and predictable phases that business owners go through – and if you know what they are, then you can anticipate them – which means you can plan and prepare for them, keeping you in control of events.

I think there are four main roles of a business owner – let’s look at them in turn.

Business Owner Role No 1: Owning your business

“Profits are better than wages.” Jim Rohn

When we first think of starting a business, we each have our own reasons and motives. Whilst this will be personal to you, there are some common themes,

- you want to create something that’s yours – to say “I did this!”

- it’s a practical response to your current situation – such as needing something flexible to fit around family life that’s not possible as an employee – or you like the possibility to choose your own working hours, or to work from home, or to be location independent, able to work from anywhere.

- you want control over our own destiny – the choice and freedom that comes with your own business. This might be because you’re naturally independently-minded. Or working for someone else led to so many compromises that starting your own business meant that you could carry on what you enjoy but without the overbearing boss and office politics!

- maybe it’s financially driven – you want to create long term wealth and see starting your own business as the most effective route to it. Or you just want to generate a reasonable income doing what you know and enjoy with the potential for growth in the future.

Whatever your motives, one thing is for certain, it starts with YOU!

You have complete freedom on how to build your business.

Including what to do, how to do it, where to operate, what customers to attract, whether you’re selling service or products – there are so many choices. You can build it how you want.

So you have an idea, create a brand name and voila – you’ve started a business!

In reality all you’ve created at this point is an empty container. An empty space in which to create your business. But the point is, it’s your container! You’re an Owner at last.

It’s this ownership that gives you autonomy.

The Owner is the first of the four roles of a business owner.

Business Owner Role No 2: Doing the work

“Far and away the best prize that life has to offer is the chance to work hard at work worth doing.” Theodore Roosevelt

Now you are an Owner, you now have your first choice to make – what to DO!

You start work, probably by yourself, getting things done as best you can.

The Do-er is the second role of the business owner.

This means actually doing the work for paying customers.

So if you’re an accountant, you start providing accounting services for people, if you’re a carpenter you start building tables and shelves for people, if you’re an electrician, you start installing cabling and sockets in buildings, if you’re a programmer you start writing code, if you’re a web designer you start building beautiful websites, and if you’re a beauty therapist you start providing various treatments for people.

You are the expert, the specialist in your field and you can now spend time doing what you’re good at without getting side-tracked by office politics, horrible bosses and all the rest of it.

However as the Do-er in chief, you rapidly discover that there are other things that you need to be doing as well, some marketing, bookkeeping, tax returns and accounts, making sales, customer service, finding suppliers, managing premises, keeping up to date with new regulations, choosing IT systems, chasing payments.

The list goes on.

O for Owner can quickly become O for Overwhelm.

And being independent can quickly become feeling alone.

You reach a crisis point and realise that you can no longer do it all by yourself.

Business Owner Role No 3: Managing others

“The secret to winning is constant, consistent management.” Tom Landry

So the doing needs to give way to something else. You need to get some help and so instead of doing everything yourself, you start managing other people who do some of the doing.

The Manager is the third role of the business owner.

Now this doesn’t mean just managing employees, it can include managing outsourced contractors – you’re not just buying a service, you’re managing a relationship – it can also mean managing systems that do some of the work for you – managing technology.

Either way you look at it, you are taking one step back from doing everything yourself and starting to manage people and systems.

So now you spend your time split between the two roles of Doing and Managing. Doing what you’re good at and specialise in, and managing others who are specialists in what they do.

So that works well and the business grows. It may be that over time you need to do more managing and as a result you do less doing, in fact you may become a pure manager.

You have gone from being a specialist, an expert in your field to being a generalist – a general manager with an overview of the many parts of your business.

Of course, you will still have specialist skills and knowledge in some areas. You will be still be required to turn your hand, when needed, to the more complicated issues that require the wealth of experience and expertise that only you have.

But fundamentally your main role is as a generalist, a general manager.

Business Owner Role No 4: Leading the business

“Management is about arranging and telling. Leadership is about nurturing and enhancing.” Tom Peters

So the business grows and you get to another crisis point. The business has got more complicated again. You can no longer manage all the areas yourself, they are too time-consuming or too specialist. So you recruit some managers or heads of department and they manage the Do-ers and you manage the Managers.

The Leader is the fourth role of the business owner.

You’re managing managers and leading teams. You’re in charge of creating an environment and culture in which others can Do and Manage effectively. Maybe you’re even an inspiring leader!

So at the level of Doing and Managing, it’s all about running the business – making sure the day-to-day-stuff happens.

At this level you are leading the business. You’re more focused on longer term strategic issues and thinking about the growth and development of the business.

In many ways you’re now back to where you started with autonomy. You’re focused on strategic decision-making and helping formulate a clear direction for everyone to follow.

The level of Doing and Managing is about working IN the business whilst at this Leadership level it’s more about working ON the business.

From this leadership vantage point you can see the big picture. It’s sometimes described as the helicopter view. You can look down and see it as a whole. You’re one step removed from the daily urgency. In fact, you should be able to go on holiday and leave the business to operate without you. (How’s that working out for you??)

So, we end up with this triangle of Doing, Managing and Leading. Now the triangle is a highly stable shape and these three roles can create a highly stable business.

You as a business owner are going from doing to managing to leading – a series of mini-crises which prompt transitions – which is why you need to grow and develop as your business grows and develops.

Business Owner Role No 5: Is there a fifth role?

“The self-owned and -operated business is the freest life in the world.” Paul Hawken

So where do you go next after leading?

Well the final step takes you back to where you started!

You go back to Owning as a major concern.

If you’ve transitioned through the different phases from Doing to Managing to Leading, you are now succession planning. You are looking for someone to take over as Leader and maybe as Owner.

In this phase, Owning is about considering the value of the business. Hopefully you’ve now got an asset to sell as your final step. You’ve worked hard building and growing your business, hopefully now you’ve added a few zeros to the value!