14 Reasons Why You Need a Business Plan

10 min. read

Updated April 10, 2024

There’s no question that starting and running a business is hard work. But it’s also incredibly rewarding. And, one of the most important things you can do to increase your chances of success is to have a business plan.

A business plan is a foundational document that is essential for any company, no matter the size or age. From attracting potential investors to keeping your business on track—a business plan helps you achieve important milestones and grow in the right direction.

A business plan isn’t just a document you put together once when starting your business. It’s a living, breathing guide for existing businesses – one that business owners should revisit and update regularly.

Unfortunately, writing a business plan is often a daunting task for potential entrepreneurs. So, do you really need a business plan? Is it really worth the investment of time and resources? Can’t you just wing it and skip the whole planning process?

Good questions. Here’s every reason why you need a business plan.

- 1. Business planning is proven to help you grow 30 percent faster

Writing a business plan isn’t about producing a document that accurately predicts the future of your company. The process of writing your plan is what’s important. Writing your plan and reviewing it regularly gives you a better window into what you need to do to achieve your goals and succeed.

You don’t have to just take our word for it. Studies have proven that companies that plan and review their results regularly grow 30 percent faster. Beyond faster growth, research also shows that companies that plan actually perform better. They’re less likely to become one of those woeful failure statistics, or experience cash flow crises that threaten to close them down.

- 2. Planning is a necessary part of the fundraising process

One of the top reasons to have a business plan is to make it easier to raise money for your business. Without a business plan, it’s difficult to know how much money you need to raise, how you will spend the money once you raise it, and what your budget should be.

Investors want to know that you have a solid plan in place – that your business is headed in the right direction and that there is long-term potential in your venture.

A business plan shows that your business is serious and that there are clearly defined steps on how it aims to become successful. It also demonstrates that you have the necessary competence to make that vision a reality.

Investors, partners, and creditors will want to see detailed financial forecasts for your business that shows how you plan to grow and how you plan on spending their money.

- 3. Having a business plan minimizes your risk

When you’re just starting out, there’s so much you don’t know—about your customers, your competition, and even about operations.

As a business owner, you signed up for some of that uncertainty when you started your business, but there’s a lot you can do to reduce your risk . Creating and reviewing your business plan regularly is a great way to uncover your weak spots—the flaws, gaps, and assumptions you’ve made—and develop contingency plans.

Your business plan will also help you define budgets and revenue goals. And, if you’re not meeting your goals, you can quickly adjust spending plans and create more realistic budgets to keep your business healthy.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 4. Crafts a roadmap to achieve important milestones

A business plan is like a roadmap for your business. It helps you set, track and reach business milestones.

For your plan to function in this way, your business plan should first outline your company’s short- and long-term goals. You can then fill in the specific steps necessary to reach those goals. This ensures that you measure your progress (or lack thereof) and make necessary adjustments along the way to stay on track while avoiding costly detours.

In fact, one of the top reasons why new businesses fail is due to bad business planning. Combine this with inflexibility and you have a recipe for disaster.

And planning is not just for startups. Established businesses benefit greatly from revisiting their business plan. It keeps them on track, even when the global market rapidly shifts as we’ve seen in recent years.

- 5. A plan helps you figure out if your idea can become a business

To turn your idea into reality, you need to accurately assess the feasibility of your business idea.

You need to verify:

- If there is a market for your product or service

- Who your target audience is

- How you will gain an edge over the current competition

- If your business can run profitably

A business plan forces you to take a step back and look at your business objectively, which makes it far easier to make tough decisions down the road. Additionally, a business plan helps you to identify risks and opportunities early on, providing you with the necessary time to come up with strategies to address them properly.

Finally, a business plan helps you work through the nuts and bolts of how your business will work financially and if it can become sustainable over time.

6. You’ll make big spending decisions with confidence

As your business grows, you’ll have to figure out when to hire new employees, when to expand to a new location, or whether you can afford a major purchase.

These are always major spending decisions, and if you’re regularly reviewing the forecasts you mapped out in your business plan, you’re going to have better information to use to make your decisions.

7. You’re more likely to catch critical cash flow challenges early

The other side of those major spending decisions is understanding and monitoring your business’s cash flow. Your cash flow statement is one of the three key financial statements you’ll put together for your business plan. (The other two are your balance sheet and your income statement (P&L).

Reviewing your cash flow statement regularly as part of your regular business plan review will help you see potential cash flow challenges earlier so you can take action to avoid a cash crisis where you can’t pay your bills.

- 8. Position your brand against the competition

Competitors are one of the factors that you need to take into account when starting a business. Luckily, competitive research is an integral part of writing a business plan. It encourages you to ask questions like:

- What is your competition doing well? What are they doing poorly?

- What can you do to set yourself apart?

- What can you learn from them?

- How can you make your business stand out?

- What key business areas can you outcompete?

- How can you identify your target market?

Finding answers to these questions helps you solidify a strategic market position and identify ways to differentiate yourself. It also proves to potential investors that you’ve done your homework and understand how to compete.

- 9. Determines financial needs and revenue models

A vital part of starting a business is understanding what your expenses will be and how you will generate revenue to cover those expenses. Creating a business plan helps you do just that while also defining ongoing financial needs to keep in mind.

Without a business model, it’s difficult to know whether your business idea will generate revenue. By detailing how you plan to make money, you can effectively assess the viability and scalability of your business.

Understanding this early on can help you avoid unnecessary risks and start with the confidence that your business is set up to succeed.

- 10. Helps you think through your marketing strategy

A business plan is a great way to document your marketing plan. This will ensure that all of your marketing activities are aligned with your overall goals. After all, a business can’t grow without customers and you’ll need a strategy for acquiring those customers.

Your business plan should include information about your target market, your marketing strategy, and your marketing budget. Detail things like how you plan to attract and retain customers, acquire new leads, how the digital marketing funnel will work, etc.

Having a documented marketing plan will help you to automate business operations, stay on track and ensure that you’re making the most of your marketing dollars.

- 11. Clarifies your vision and ensures everyone is on the same page

In order to create a successful business, you need a clear vision and a plan for how you’re going to achieve it. This is all detailed with your mission statement, which defines the purpose of your business, and your personnel plan, which outlines the roles and responsibilities of current and future employees. Together, they establish the long-term vision you have in mind and who will need to be involved to get there.

Additionally, your business plan is a great tool for getting your team in sync. Through consistent plan reviews, you can easily get everyone in your company on the same page and direct your workforce toward tasks that truly move the needle.

- 12. Future-proof your business

A business plan helps you to evaluate your current situation and make realistic projections for the future.

This is an essential step in growing your business, and it’s one that’s often overlooked. When you have a business plan in place, it’s easier to identify opportunities and make informed decisions based on data.

Therefore, it requires you to outline goals, strategies, and tactics to help the organization stay focused on what’s important.

By regularly revisiting your business plan, especially when the global market changes, you’ll be better equipped to handle whatever challenges come your way, and pivot faster.

You’ll also be in a better position to seize opportunities as they arise.

- 13. Tracks your progress and measures success

An often overlooked purpose of a business plan is as a tool to define success metrics. A key part of writing your plan involves pulling together a viable financial plan. This includes financial statements such as your profit and loss, cash flow, balance sheet, and sales forecast.

By housing these financial metrics within your business plan, you suddenly have an easy way to relate your strategy to actual performance. You can track progress, measure results, and follow up on how the company is progressing. Without a plan, it’s almost impossible to gauge whether you’re on track or not.

Additionally, by evaluating your successes and failures, you learn what works and what doesn’t and you can make necessary changes to your plan. In short, having a business plan gives you a framework for measuring your success. It also helps with building up a “lessons learned” knowledge database to avoid costly mistakes in the future.

- 14. Your business plan is an asset if you ever want to sell

Down the road, you might decide that you want to sell your business or position yourself for acquisition. Having a solid business plan is going to help you make the case for a higher valuation. Your business is likely to be worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Free business plan template

Join over 1-million businesses and make planning easy with our simple, modern, investor-approved business plan template.

Download Template

- Writing your business plan

By taking the time to create a business plan, you ensure that your business is heading in the right direction and that you have a roadmap to get there. We hope that this post has shown you just how important and valuable a business plan can be. While it may still seem daunting, the benefits far outweigh the time investment and learning curve for writing one.

Luckily, you can write a plan in as little as 30 minutes. And there are plenty of excellent planning tools and business plan templates out there if you’re looking for more step-by-step guidance. Whatever it takes, write your plan and you’ll quickly see how useful it can be.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- 6. You’ll make big spending decisions with confidence

- 7. You’re more likely to catch critical cash flow challenges early

Related Articles

10 Min. Read

Use This Simple Business Plan Outline to Organize Your Plan

When Should You Write a Business Plan?

5 Min. Read

Business Plan Vs Strategic Plan Vs Operational Plan—Differences Explained

6 Min. Read

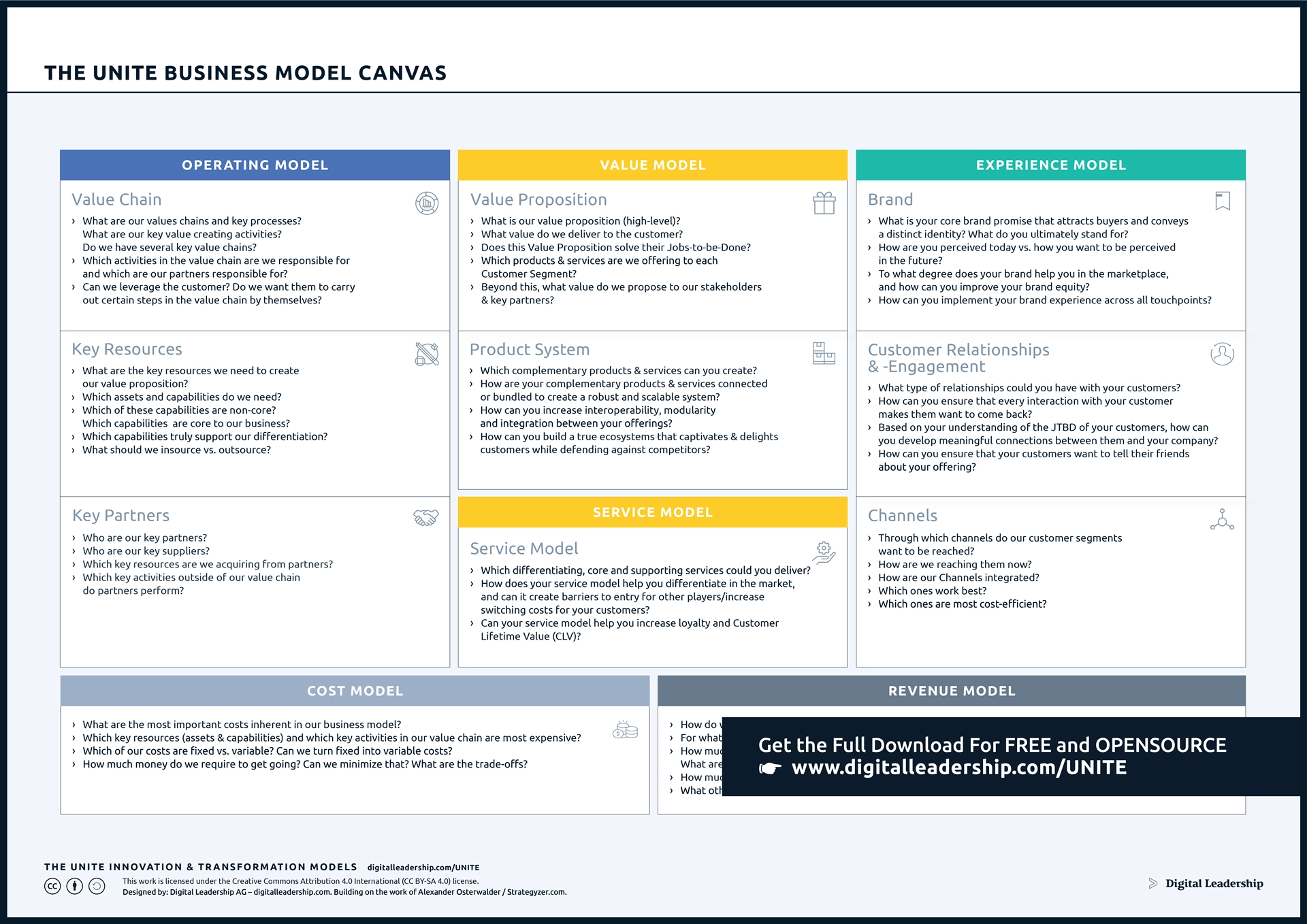

Business Plan vs Business Model Canvas Explained

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

6 Reasons You Really Need to Write A Business Plan

Published: October 14, 2020

Starting a busine ss can be a daunting task, especially if you’re starting from square one.

It’s easy to feel stuck in the whirlwind of things you’ll need to do, like registering your company, building a team, advertising, the list goes on. Not to mention, a business idea with no foundation can make the process seem incredibly intimidating.

Thankfully, business plans are an antidote for the new business woes that many entrepreneurs feel. Some may shy away from the idea, as they are lengthy documents that require a significant amount of attention and care.

However, there’s a reason why those who take the time to write out a business plan are 16% more likely to be successful than those who don’t. In other words, business plans work.

What is a business plan, and why does it matter?

In brief, a business plan is a roadmap to success. It's a blueprint for entrepreneurs to follow that helps them outline, understand, and cohesively achieve their goals.

Writing a business plan involves defining critical aspects of your business, like brand messaging, conducting market research, and creating pricing strategies — all before starting the company.

A business plan can also increase your confidence. You’ll get a holistic view of your idea and understand whether it's worth pursuing.

So, why not take the time to create a blueprint that will make your job easier? Let’s take a look at six reasons why you should write a business plan before doing anything else.

Six Reasons You Really Need To Write a Business Plan

- Legitimize your business idea.

- Give your business a foundation for success.

- Obtain funding and investments.

- Hire the right people.

- Communicate your needs.

- It makes it easier to sell your business.

1. Legitimize your business idea.

Pursuing business ideas that stem from passions you’ve had for years can be exciting, but that doesn’t necessarily mean it’s a sound venture.

One of the first things a business plan requires you to do is research your target market. You’ll gain a nuanced understanding of industry trends and what your competitors have done, or not, to succeed. You may find that the idea you have when you start is not likely to be successful.

That may feel disheartening, but you can always modify your original idea to better fit market needs. The more you understand about the industry, your future competitors, and your prospective customers, the greater the likelihood of success. If you identify issues early on, you can develop strategies to deal with them rather than troubleshooting as they happen.

It’s better to know sooner rather than later if your business will be successful before investing time and money.

2. Give your business a foundation for success.

Let's say you’re looking to start a clean beauty company. There are thousands of directions you can go in, so just saying, “I’m starting a clean beauty company!” isn’t enough.

You need to know what specific products you want to make, and why you’re deciding to create them. The Pricing and Product Line style="color: #33475b;"> section of a business plan requires you to identify these elements, making it easier to plan for other components of your business strategy.

You’ll also use your initial market research to outline financial projections, goals, objectives, and operational needs. Identifying these factors ahead of time creates a strong foundation, as you’ll be making critical business decisions early on.

You can refer back to the goals you’ve set within your business plan to track your progress over time and prioritize areas that need extra attention.

All in all, every section of your business plan requires you to go in-depth into your future business strategy before even acting on any of those plans. Having a plan at the ready gives your business a solid foundation for growth.

When you start your company, and your product reaches the market, you’ll spend less time troubleshooting and more time focusing on your target audiences and generating revenue.

3. Obtain funding and investments.

Every new business needs capital to get off the ground. Although it would be nice, banks won’t finance loans just because you request one. They want to know what the money is for, where it’s going, and if you’ll eventually be able to pay it back.

If you want investors to be part of your financing plan, they’ll have questions about your business’ pricing strategies and revenue models. Investors can also back out if they feel like their money isn’t put to fair use. They’ll want something to refer back to track your progress over time and understand if you’re meeting the goals you told them you’d meet. They want to know if their investment was worthwhile.

The Financial Considerations section of a business plan will prompt you to estimate costs ahead of time and establish revenue objectives before applying for loans or speaking to investors.

You’ll secure and finalize your strategy in advance to avoid showing up unprepared for meetings with potential investors.

4. Hire the right people.

After you’ve completed your business plan and you have a clear view of your strategies, goals, and financial needs, there may be milestones you need to meet that require skills you don’t yet have. You may need to hire new people to fill in the gaps.

Having a strategic plan to share with prospective partners and employees can prove that they aren’t signing on to a sinking ship.

If your plans are summarized and feasible, they’ll understand why you want them on your team, and why they should agree to work with you.

5. Communicate your needs.

If you don’t understand how your business will run, it’ll be hard to communicate your business’s legitimacy to all involved parties.

Your plan will give you a well-rounded view of how your business will work, and make it easier for you to communicate this to others.

You may have already secured financing from banks and made deals with investors, but a business’ needs are always changing. While your business grows, you’ll likely need more financial support, more partners, or just expand your services and product offers. Using your business plan as a measure of how you’ve met your goals can make it easier to bring people onto your team at all stages of the process.

6. It makes it easier to sell your business.

A buyer won’t want to purchase a business that will run into the ground after signing the papers. They want a successful, established company.

A business plan that details milestones you can prove you’ve already met can be used to show prospective buyers how you’ve generated success within your market. You can use your accomplishments to negotiate higher price points aligned with your business’ value.

A Business Plan Is Essential

Ultimately, having a business plan can increase your confidence in your new venture. You’ll understand what your business needs to succeed, and outline the tactics you’ll use to achieve those goals.

Some people have a lifetime goal of turning their passions into successful business ventures, and a well-crafted business plan can make those dreams come true.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![what are the two primary reasons for writing a business plan How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

What is a Business Plan? Definition, Tips, and Templates

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![what are the two primary reasons for writing a business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![what are the two primary reasons for writing a business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Why You Should Write a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

To Test the Feasibility of Your Business Idea

To give your new business the best chance of success, to secure funding, to make business planning manageable and effective, to attract investors, frequently asked questions (faqs).

The Balance / Getty Images

A business plan is the blueprint for your business. Starting a business without a business plan is like building a house without a blueprint. Yet, unlike a house, a business isn't static. We often make the mistake of thinking of a business plan as a single document that you put together once when you're starting out and never touch again. But as the business develops, so should its business plan. In fact, any particular business may have multiple business plans as its objectives change.

Writing a business plan is time-consuming, but it's essential if you want to have a successful business that's going to survive the startup phase.

Key Takeaways

- Writing a business plan reveals how tenable your idea is.

- Updating and amending a business plan as the business develops and its goals change is vital to your success.

- A good business plan helps you define your target market, competitive advantage, optimum pricing strategies, and better prepares the business for upcoming challenges.

- A business plan helps you secure funding and attract new investors.

Writing a business plan is the best way—other than going out and doing it—to test whether an idea for starting a business is feasible. In this sense, the business plan is your safety net. If working through a business plan reveals that your business idea is untenable, it will save you a great deal of time and money.

Often, an idea for starting a business is discarded at the marketing analysis or competitive analysis stage , freeing you to move on to a new (and better) idea.

Unfortunately, many prospective business owners are so convinced that their idea for a product or service is a can't-miss proposition, that they don't take the time to do the necessary research and work through a proper business plan. The more you know about your industry, your prospective customers, and the competition, the greater the likelihood that your business will succeed.

Writing a business plan will ensure that you pay attention to the broad operational and financial objectives of your new business and the small details, such as budgeting and market planning. The process will ultimately make for a smoother startup period and fewer unforeseen problems as your business gets up and running.

The exercise of budgeting and market planning will help you define your target market , your unique selling proposition, optimum pricing strategies, and outline how you intend to sell and deliver your products to customers. In addition, developing a budget for implementation will assist with determining your startup and operating capital requirements.

According to the Small Business Administration, one of the most-cited reasons why businesses fail is inadequate planning. By starting too soon and without a sufficient plan, your business is setting itself up for failure.

Most new businesses need startup and operating capital to get off the ground. Without a well-developed business plan, there is no chance of getting debt financing from established financial institutions such as banks or equity financing from angel investors.

Established businesses often need money, too, to buy new equipment or property, or because of market downturns. Having an up-to-date business plan gives you a much better chance of getting the money you need to keep operating or expand.

Even an angel investor will want to ensure their money is going to a business that knows what it's doing. The easiest way to prove this is via a well-developed business plan.

Investors and financiers are always looking at the risk of default, and word of mouth is no substitute for written facts and figures in a properly prepared business plan.

A business plan is essential if you're thinking of starting a business, but it's also an important tool for established businesses. Viable businesses are dynamic; they change and grow. Your company's original business plan needs to be revised as you set new goals .

Reviewing the business plan can also help you see what goals have been accomplished, what changes need to be made, or what new directions your company's growth should take.

Whether you want to shop your business to venture capitalists or attract angel investors , you need to have a solid business plan. A presentation may pique their interest, but they'll need a well-written document they can study before they'll be prepared to make any investment commitment.

Be prepared to have your business plan scrutinized. Both venture capitalists and angel investors will want to conduct extensive background checks and competitive analyses to be certain that what's written in your business plan is indeed the case.

What are the sections of a business plan?

A comprehensive business plan should include the following sections:

- Executive summary

- Company description

- Competitor analysis

- Industry analysis

- Product and services description

- Financial data

What is the purpose of a business plan?

A business plan has four main purposes:

- Tests the feasibility and model of your business idea

- Attracts investors

- Sets a plan for growth

- Identifies capital needs

Small Business Administration. " Selecting a Business That Fits ."

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Nine reasons why you need a business plan

Building a great business plan helps you plan, strategize and succeed. Presented by Chase for Business .

Making the decision to create a new business is an exciting yet stressful experience. Starting a business involves many tasks and obstacles, so it’s important to focus before you take action. A solid business plan can provide direction, help you attract investors and ensure you maintain momentum.

No matter what industry you plan on going into, a business plan is the first step for any successful enterprise. Building your business plan helps you figure out where you want your business to go and identify the necessary steps to get you there. This is a key document for your company to both guide your actions and track your progress.

What is the purpose of a business plan?

Think of a business plan like a roadmap. It enables you to solve problems and make key business decisions, such as marketing and competitive analysis, customer and market analysis and logistics and operations plans.

It can also help you organize your thoughts and goals, as well as give you a better idea of how your company will work. Good planning is often the difference between success and failure.

Here are nine reasons your company needs a business plan.

1. Prove your idea is viable

Through the process of writing a business plan, you can assess whether your company will be successful. Understanding market dynamics, as well as competitors, will help determine if your idea is viable.

This is also the time to develop financial projections for your business plan, like estimated startup costs, a profit and loss forecast, a break-even analysis and a cash flow statement . By taking time to investigate the viability of your idea, you can build goals and strategies to support your path to success.

A proper business plan proves to all interested parties—including potential investors, customers, employees, partners and most importantly yourself — that you are serious about your business.

2. Set important goals

As a business owner, the bulk of your time will mostly likely be spent managing day-to-day tasks. As a result, it might be hard to find time after you launch your business to set goals and milestones. Writing a business plan allows you to lay out significant goals for yourself ahead of time for three or even five years down the road. Create both short- and long-term business goals.

3. Reduce potential risks

Prevent your business from falling victim to unexpected dangers by researching before you break ground. A business plan opens your eyes to potential risks that your business could face. Don’t be afraid to ask yourself the hard questions that may need research and analysis to answer. This is also good practice in how your business would actually manage issues when they arise. Incorporate a contingency plan that identifies risks and how you would respond to them effectively.

The most common reasons businesses fail include:

- Lack of capital

- Lack of market impact or need

- Unresearched pricing (too high or low)

- Explosive growth that drains all your capital

- Stiff competition

Lack of capital is the most prevalent reason why businesses fail. To best alleviate this problem, take time to determine how your business will generate revenue. Build a comprehensive model to help mitigate future risks and long-term pain points. This can be turned into a tool to manage growth and expansion.

4. Secure investments

Whether you’re planning to apply for an SBA loan , build a relationship with angel investors or seek venture capital funding, you need more than just an elevator pitch to get funding. All credible investors will want to review your business plan. Although investors will focus on the financial aspects of the plan, they will also want to see if you’ve spent time researching your industry, developed a viable product or service and created a strong marketing strategy.

While building your business plan, think about how much raised capital you need to get your idea off the ground. Determine exactly how much funding you’ll need and what you will use it for. This is essential for raising and employing capital.

5. Allot resources and plan purchases

You will have many investments to make at the launch of your business, such as product and services development, new technology, hiring, operations, sales and marketing. Resource planning is an important part of your business plan. It gives you an idea of how much you’ll need to spend on resources and it ensures your business will manage those resources effectively.

A business plan provides clarity about necessary assets and investment for each item. A good business plan can also determine when it is feasible to expand to a larger store or workspace.

In your plan, include research on new products and services, where you can buy reliable equipment and what technologies you may need. Allocate capital and plan how you’ll fund major purchases, such as with a Chase small business checking account or business credit card .

6. Build your team

From seasoned executives to skilled labor, a compelling business plan can help you attract top-tier talent, ideally inspiring management and employees long after hiring. Business plans include an overview of your executive team as well as the different roles you need filled immediately and further down the line.

Small businesses often employ specialized consultants, contractors and freelancers for individual tasks such as marketing, accounting and legal assistance. Sharing a business plan helps the larger team work collectively in the same direction.

This will also come into play when you begin working with any new partners. As a new business, a potential partner may ask to see your business plan. Building partnerships takes time and money, and with a solid business plan you have the opportunity to attract and work with the type of partners your new business needs.

7. Share your vision

When you start a business, it's easy to assume you'll be available to guide your team. A business plan helps your team and investors understand your vision for the company. Your plan will outline your goals and can help your team make decisions or take action on your behalf. Share your business plan with employees to align your full staff toward a collective goal or objective for the company. Consider employee and stakeholder ownership as a compelling and motivating force.

8. Develop a marketing strategy

A marketing strategy details how you will reach your customers and build brand awareness. The clearer your brand positioning is to investors, customers, partners and employees, the more successful your business will be.

Important questions to consider as you build your marketing strategy include:

- What industry segments are we pursuing?

- What is the value proposition of the products or services we plan to offer?

- Who are our customers?

- How will we retain our customers and keep them engaged with our products or services and marketing?

- What is our advertising budget?

- What price will we charge?

- What is the overall look and feel of our brand? What are our brand guidelines?

- Will we need to hire marketing experts to help us create our brand?

- Who are our competitors? What marketing strategies have worked (or not worked) for them?

With a thoughtful marketing strategy integrated into your business plan, your company goals are significantly more in reach.

9. Focus your energy

Your business plan determines which areas of your business to focus on while also avoiding possible distractions. It provides a roadmap for critical tradeoffs and resource allocation.

As a business owner, you will feel the urge to solve all of your internal and customers’ problems, but it is important to maintain focus. Keep your priorities at the top of your mind as you set off to build your company.

As a small business owner, writing a business plan should be one of your first priorities. Read our checklist for starting a business, and learn how to take your business from a plan to reality. When you’re ready to get started, talk with a Chase business banker to open a Chase business checking or savings account today.

For Informational/Educational Purposes Only: The views expressed in this article may differ from other employees and departments of JPMorgan Chase & Co. Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s). Outlooks and past performance are not guarantees of future results.

JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Lender, ©2023 JPMorgan Chase & Co

What to read next

Manage your business how to help protect your business from check fraud.

Think writing checks is a safe way to pay vendors? Think again. Learn about five common scams and how to help prevent them.

START YOUR BUSINESS 10 tips before starting your new businesses

Thinking about starting a business? Check these 10 items off your list.

MANAGE YOUR BUSINESS Inventory management can help maintain cash flow

Inventory can eat up a lot of cash. Here are a few ways to manage inventory with cash flow in mind.

MANAGE YOUR BUSINESS Banking tips for cash businesses

Learn how to keep your cash business safe, secure and compliant.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

5 Reasons to Write a Business Plan There are any number of reasons why you need to create a business plan, including starting a business, seeking funding and more.

By The Staff of Entrepreneur Media, Inc. • Dec 2, 2014

In their book Write Your Business Plan , the staff of Entrepreneur Media offer an in-depth understanding of what's essential to any business plan, what's appropriate for your venture, and what it takes to ensure success. In this edited excerpt, the authors offer five reasons why someone would want to write a business plan and what they'll use it for.

Anybody beginning or extending a venture that will consume significant resources of money, energy or time and that's expected to return a profit should take the time to draft some kind of business plan.

But there are many reasons to write a business plan, including the following five:

1. You want to start a business.

The classic business plan writer is an entrepreneur seeking funds to help start a new venture. Many great companies had their starts in the form of a plan that was used to convince investors to put up the capital necessary to get them under way.

2. You own an established firm and are seeking help.

Many business plans are written by and for companies that are long past the startup stage but also well short of large-corporation status. These middle-stage enterprises may draft plans to help them find funding for growth. They may feel the need for a written plan to help manage an already rapidly growing business and to convey the mission and prospects of the business to customers, suppliers or other interested parties. A business plan can address the next stage in the life process of a business.

3. You need to determine your objectives.

There are so many options when it comes to starting a business, including the size, location, and, of course, the reason for existence. You'll be able to determine all of these and so many more aspects of business with the help of your business plan. It forces you to think through all of the areas that form the main concept to the smallest details. This way, you don't find yourself remembering at the last minute that your website still isn't developed or that you still have most of your inventory in a warehouse and no way to ship it.

4. You're trying to predict the future.

It may seem dishonest to say that a business plan can't predict the future. What are all those projections and forecasts for if they're not attempts to predict the future? The fact is, however, no projection or forecast is really a hard-and-fast prediction of the future. The best you can do is have a plan in which you logically and systematically attempt to show what will happen if a particular scenario occurs. You'll use your research, sales forecasts, market trends and competitive analysis to make well thought-out predictions of how you see your business developing if you're able to follow a specified course. To some extent, you can create your future rather than simply trying to predict it by the decisions you make. For example, you may not have a multimillion-dollar business in ten years if you're trying to start and run a small family business. Your decision on growth would therefore factor into your predictions and the outcome.

5. You want to use it to raise all the money you'll need.

A business plan can't guarantee that you'll raise all the money you need at any given time, especially during the startup phase. Even if you're successful in finding an investor, odds are good you won't get quite what you asked for. There may be a big difference in what you have to give up, such as majority ownership or control, to get the funds. Or you may be able to make minor adjustments if you cannot snare as large a chunk of cash as you want.

In a sense, a business plan used for seeking funding is part of a negotiation taking place between you and your prospective financial backers. The part of the plan where you describe your financial needs can be considered your opening bid in this negotiation. In a way, a business plan is an excellent opening bid -- it's definite, comprehensive and clear.

But you know what happens to bids in negotiations: They get whittled away, the terms get changed, and, sometimes, the whole negotiation breaks down under the force of an ultimatum from one of the parties involved. Does this mean you should ask for a good deal more money than you actually need in your plan? Actually, that may not be the best strategy either. Investors who see a lot of plans are going to notice if you're asking for way too much money. Such a move stands a good chance of alienating those who might otherwise be enthusiastic backers of your plan. It's probably a better idea to ask for a little more than you think you can live with, plus slightly better terms than you really expect.

Entrepreneur Staff

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- This 103-Year-Old Doctor Opened Her Medical Practice Before Women Could Have Bank Accounts — Here Are Her 6 Secrets to a Healthy, Successful Life

- Lock 5 Ways You Might Be Cheating on Your Taxes — And Why You Will Get Caught

- I've Had a Secret Side Hustle for Decades. It Keeps Tens of Thousands of Dollars in My Pocket — and Gets Me Into Places I Wouldn't Go Otherwise .

- Lock Here's How Steve Jobs Dealt With Negative Press and Avoided Brand Disasters

- One Factor Is Helping This Entrepreneur Tackle Business Ownership Later in Life. Now, She's Jumping Into a $20 Billion Industry .

- Lock Narcissism Can Help You Be Successful — Here's How to Harness It Without Going Too Far, According to an Ivy League-Trained Psychotherapist

Most Popular Red Arrow

This dad started a side hustle to save for his daughter's college fund — then it earned $1 million and caught apple's attention.

In 2015, Greg Kerr, now owner of Alchemy Merch, was working as musician when he noticed a lucrative opportunity.

I Designed My Dream Home For Free With an AI Architect — Here's How It Works

The AI architect, Vitruvius, created three designs in minutes, complete with floor plans and pictures of the inside and outside of the house.

7 Link-Building Tactics You Need to Know to Skyrocket Your Website's Rankings

An essential component of SEO, link building is not just a 'Set them and forget them' proposition, but a dance of skills and strategies.

This Fan-Favorite Masters 2024 Item Is Still $1.50 as Tournament Menu Appears Unscathed by Inflation

The pimento cheese sandwich is a tradition almost as big as the tournament itself.

Here's One Thing Americans Would Take a Pay Cut For — Besides Remote Work

An Empower survey found a high percentage of respondents would take a pay cut for better retirement benefits and remote work options.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

Successfully copied link

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

How to Write a Business Plan in 9 Steps (+ Template and Examples)

Every successful business has one thing in common, a good and well-executed business plan. A business plan is more than a document, it is a complete guide that outlines the goals your business wants to achieve, including its financial goals . It helps you analyze results, make strategic decisions, show your business operations and growth.

If you want to start a business or already have one and need to pitch it to investors for funding, writing a good business plan improves your chances of attracting financiers. As a startup, if you want to secure loans from financial institutions, part of the requirements involve submitting your business plan.

Writing a business plan does not have to be a complicated or time-consuming process. In this article, you will learn the step-by-step process for writing a successful business plan.

You will also learn what you need a business plan for, tips and strategies for writing a convincing business plan, business plan examples and templates that will save you tons of time, and the alternatives to the traditional business plan.

Let’s get started.

What Do You Need A Business Plan For?

Businesses create business plans for different purposes such as to secure funds, monitor business growth, measure your marketing strategies, and measure your business success.

1. Secure Funds

One of the primary reasons for writing a business plan is to secure funds, either from financial institutions/agencies or investors.

For you to effectively acquire funds, your business plan must contain the key elements of your business plan . For example, your business plan should include your growth plans, goals you want to achieve, and milestones you have recorded.

A business plan can also attract new business partners that are willing to contribute financially and intellectually. If you are writing a business plan to a bank, your project must show your traction , that is, the proof that you can pay back any loan borrowed.

Also, if you are writing to an investor, your plan must contain evidence that you can effectively utilize the funds you want them to invest in your business. Here, you are using your business plan to persuade a group or an individual that your business is a source of a good investment.

2. Monitor Business Growth

A business plan can help you track cash flows in your business. It steers your business to greater heights. A business plan capable of tracking business growth should contain:

- The business goals

- Methods to achieve the goals

- Time-frame for attaining those goals

A good business plan should guide you through every step in achieving your goals. It can also track the allocation of assets to every aspect of the business. You can tell when you are spending more than you should on a project.

You can compare a business plan to a written GPS. It helps you manage your business and hints at the right time to expand your business.

3. Measure Business Success

A business plan can help you measure your business success rate. Some small-scale businesses are thriving better than more prominent companies because of their track record of success.

Right from the onset of your business operation, set goals and work towards them. Write a plan to guide you through your procedures. Use your plan to measure how much you have achieved and how much is left to attain.

You can also weigh your success by monitoring the position of your brand relative to competitors. On the other hand, a business plan can also show you why you have not achieved a goal. It can tell if you have elapsed the time frame you set to attain a goal.

4. Document Your Marketing Strategies

You can use a business plan to document your marketing plans. Every business should have an effective marketing plan.

Competition mandates every business owner to go the extraordinary mile to remain relevant in the market. Your business plan should contain your marketing strategies that work. You can measure the success rate of your marketing plans.

In your business plan, your marketing strategy must answer the questions:

- How do you want to reach your target audience?

- How do you plan to retain your customers?

- What is/are your pricing plans?

- What is your budget for marketing?

How to Write a Business Plan Step-by-Step

1. create your executive summary.

The executive summary is a snapshot of your business or a high-level overview of your business purposes and plans . Although the executive summary is the first section in your business plan, most people write it last. The length of the executive summary is not more than two pages.

Generally, there are nine sections in a business plan, the executive summary should condense essential ideas from the other eight sections.

A good executive summary should do the following:

- A Snapshot of Growth Potential. Briefly inform the reader about your company and why it will be successful)

- Contain your Mission Statement which explains what the main objective or focus of your business is.

- Product Description and Differentiation. Brief description of your products or services and why it is different from other solutions in the market.

- The Team. Basic information about your company’s leadership team and employees

- Business Concept. A solid description of what your business does.

- Target Market. The customers you plan to sell to.

- Marketing Strategy. Your plans on reaching and selling to your customers

- Current Financial State. Brief information about what revenue your business currently generates.

- Projected Financial State. Brief information about what you foresee your business revenue to be in the future.

The executive summary is the make-or-break section of your business plan. If your summary cannot in less than two pages cannot clearly describe how your business will solve a particular problem of your target audience and make a profit, your business plan is set on a faulty foundation.

Avoid using the executive summary to hype your business, instead, focus on helping the reader understand the what and how of your plan.

View the executive summary as an opportunity to introduce your vision for your company. You know your executive summary is powerful when it can answer these key questions:

- Who is your target audience?

- What sector or industry are you in?

- What are your products and services?

- What is the future of your industry?

- Is your company scaleable?

- Who are the owners and leaders of your company? What are their backgrounds and experience levels?

- What is the motivation for starting your company?

- What are the next steps?

Writing the executive summary last although it is the most important section of your business plan is an excellent idea. The reason why is because it is a high-level overview of your business plan. It is the section that determines whether potential investors and lenders will read further or not.

The executive summary can be a stand-alone document that covers everything in your business plan. It is not uncommon for investors to request only the executive summary when evaluating your business. If the information in the executive summary impresses them, they will ask for the complete business plan.

If you are writing your business plan for your planning purposes, you do not need to write the executive summary.

2. Add Your Company Overview

The company overview or description is the next section in your business plan after the executive summary. It describes what your business does.

Adding your company overview can be tricky especially when your business is still in the planning stages. Existing businesses can easily summarize their current operations but may encounter difficulties trying to explain what they plan to become.

Your company overview should contain the following:

- What products and services you will provide

- Geographical markets and locations your company have a presence

- What you need to run your business

- Who your target audience or customers are

- Who will service your customers

- Your company’s purpose, mission, and vision

- Information about your company’s founders

- Who the founders are

- Notable achievements of your company so far

When creating a company overview, you have to focus on three basics: identifying your industry, identifying your customer, and explaining the problem you solve.

If you are stuck when creating your company overview, try to answer some of these questions that pertain to you.

- Who are you targeting? (The answer is not everyone)

- What pain point does your product or service solve for your customers that they will be willing to spend money on resolving?

- How does your product or service overcome that pain point?

- Where is the location of your business?

- What products, equipment, and services do you need to run your business?

- How is your company’s product or service different from your competition in the eyes of your customers?

- How many employees do you need and what skills do you require them to have?

After answering some or all of these questions, you will get more than enough information you need to write your company overview or description section. When writing this section, describe what your company does for your customers.

The company description or overview section contains three elements: mission statement, history, and objectives.

- Mission Statement

The mission statement refers to the reason why your business or company is existing. It goes beyond what you do or sell, it is about the ‘why’. A good mission statement should be emotional and inspirational.

Your mission statement should follow the KISS rule (Keep It Simple, Stupid). For example, Shopify’s mission statement is “Make commerce better for everyone.”

When describing your company’s history, make it simple and avoid the temptation of tying it to a defensive narrative. Write it in the manner you would a profile. Your company’s history should include the following information:

- Founding Date

- Major Milestones

- Location(s)

- Flagship Products or Services

- Number of Employees

- Executive Leadership Roles

When you fill in this information, you use it to write one or two paragraphs about your company’s history.

Business Objectives

Your business objective must be SMART (specific, measurable, achievable, realistic, and time-bound.) Failure to clearly identify your business objectives does not inspire confidence and makes it hard for your team members to work towards a common purpose.

3. Perform Market and Competitive Analyses to Proof a Big Enough Business Opportunity

The third step in writing a business plan is the market and competitive analysis section. Every business, no matter the size, needs to perform comprehensive market and competitive analyses before it enters into a market.

Performing market and competitive analyses are critical for the success of your business. It helps you avoid entering the right market with the wrong product, or vice versa. Anyone reading your business plans, especially financiers and financial institutions will want to see proof that there is a big enough business opportunity you are targeting.

This section is where you describe the market and industry you want to operate in and show the big opportunities in the market that your business can leverage to make a profit. If you noticed any unique trends when doing your research, show them in this section.

Market analysis alone is not enough, you have to add competitive analysis to strengthen this section. There are already businesses in the industry or market, how do you plan to take a share of the market from them?

You have to clearly illustrate the competitive landscape in your business plan. Are there areas your competitors are doing well? Are there areas where they are not doing so well? Show it.

Make it clear in this section why you are moving into the industry and what weaknesses are present there that you plan to explain. How are your competitors going to react to your market entry? How do you plan to get customers? Do you plan on taking your competitors' competitors, tap into other sources for customers, or both?

Illustrate the competitive landscape as well. What are your competitors doing well and not so well?

Answering these questions and thoughts will aid your market and competitive analysis of the opportunities in your space. Depending on how sophisticated your industry is, or the expectations of your financiers, you may need to carry out a more comprehensive market and competitive analysis to prove that big business opportunity.

Instead of looking at the market and competitive analyses as one entity, separating them will make the research even more comprehensive.

Market Analysis

Market analysis, boarding speaking, refers to research a business carried out on its industry, market, and competitors. It helps businesses gain a good understanding of their target market and the outlook of their industry. Before starting a company, it is vital to carry out market research to find out if the market is viable.

The market analysis section is a key part of the business plan. It is the section where you identify who your best clients or customers are. You cannot omit this section, without it your business plan is incomplete.

A good market analysis will tell your readers how you fit into the existing market and what makes you stand out. This section requires in-depth research, it will probably be the most time-consuming part of the business plan to write.

- Market Research

To create a compelling market analysis that will win over investors and financial institutions, you have to carry out thorough market research . Your market research should be targeted at your primary target market for your products or services. Here is what you want to find out about your target market.

- Your target market’s needs or pain points

- The existing solutions for their pain points

- Geographic Location

- Demographics

The purpose of carrying out a marketing analysis is to get all the information you need to show that you have a solid and thorough understanding of your target audience.

Only after you have fully understood the people you plan to sell your products or services to, can you evaluate correctly if your target market will be interested in your products or services.

You can easily convince interested parties to invest in your business if you can show them you thoroughly understand the market and show them that there is a market for your products or services.

How to Quantify Your Target Market

One of the goals of your marketing research is to understand who your ideal customers are and their purchasing power. To quantify your target market, you have to determine the following:

- Your Potential Customers: They are the people you plan to target. For example, if you sell accounting software for small businesses , then anyone who runs an enterprise or large business is unlikely to be your customers. Also, individuals who do not have a business will most likely not be interested in your product.

- Total Households: If you are selling household products such as heating and air conditioning systems, determining the number of total households is more important than finding out the total population in the area you want to sell to. The logic is simple, people buy the product but it is the household that uses it.

- Median Income: You need to know the median income of your target market. If you target a market that cannot afford to buy your products and services, your business will not last long.

- Income by Demographics: If your potential customers belong to a certain age group or gender, determining income levels by demographics is necessary. For example, if you sell men's clothes, your target audience is men.

What Does a Good Market Analysis Entail?

Your business does not exist on its own, it can only flourish within an industry and alongside competitors. Market analysis takes into consideration your industry, target market, and competitors. Understanding these three entities will drastically improve your company’s chances of success.

You can view your market analysis as an examination of the market you want to break into and an education on the emerging trends and themes in that market. Good market analyses include the following:

- Industry Description. You find out about the history of your industry, the current and future market size, and who the largest players/companies are in your industry.

- Overview of Target Market. You research your target market and its characteristics. Who are you targeting? Note, it cannot be everyone, it has to be a specific group. You also have to find out all information possible about your customers that can help you understand how and why they make buying decisions.

- Size of Target Market: You need to know the size of your target market, how frequently they buy, and the expected quantity they buy so you do not risk overproducing and having lots of bad inventory. Researching the size of your target market will help you determine if it is big enough for sustained business or not.

- Growth Potential: Before picking a target market, you want to be sure there are lots of potential for future growth. You want to avoid going for an industry that is declining slowly or rapidly with almost zero growth potential.

- Market Share Potential: Does your business stand a good chance of taking a good share of the market?

- Market Pricing and Promotional Strategies: Your market analysis should give you an idea of the price point you can expect to charge for your products and services. Researching your target market will also give you ideas of pricing strategies you can implement to break into the market or to enjoy maximum profits.

- Potential Barriers to Entry: One of the biggest benefits of conducting market analysis is that it shows you every potential barrier to entry your business will likely encounter. It is a good idea to discuss potential barriers to entry such as changing technology. It informs readers of your business plan that you understand the market.

- Research on Competitors: You need to know the strengths and weaknesses of your competitors and how you can exploit them for the benefit of your business. Find patterns and trends among your competitors that make them successful, discover what works and what doesn’t, and see what you can do better.

The market analysis section is not just for talking about your target market, industry, and competitors. You also have to explain how your company can fill the hole you have identified in the market.

Here are some questions you can answer that can help you position your product or service in a positive light to your readers.

- Is your product or service of superior quality?

- What additional features do you offer that your competitors do not offer?

- Are you targeting a ‘new’ market?

Basically, your market analysis should include an analysis of what already exists in the market and an explanation of how your company fits into the market.

Competitive Analysis

In the competitive analysis section, y ou have to understand who your direct and indirect competitions are, and how successful they are in the marketplace. It is the section where you assess the strengths and weaknesses of your competitors, the advantage(s) they possess in the market and show the unique features or qualities that make you different from your competitors.

Many businesses do market analysis and competitive analysis together. However, to fully understand what the competitive analysis entails, it is essential to separate it from the market analysis.

Competitive analysis for your business can also include analysis on how to overcome barriers to entry in your target market.

The primary goal of conducting a competitive analysis is to distinguish your business from your competitors. A strong competitive analysis is essential if you want to convince potential funding sources to invest in your business. You have to show potential investors and lenders that your business has what it takes to compete in the marketplace successfully.

Competitive analysis will s how you what the strengths of your competition are and what they are doing to maintain that advantage.

When doing your competitive research, you first have to identify your competitor and then get all the information you can about them. The idea of spending time to identify your competitor and learn everything about them may seem daunting but it is well worth it.

Find answers to the following questions after you have identified who your competitors are.

- What are your successful competitors doing?

- Why is what they are doing working?

- Can your business do it better?

- What are the weaknesses of your successful competitors?

- What are they not doing well?

- Can your business turn its weaknesses into strengths?

- How good is your competitors’ customer service?

- Where do your competitors invest in advertising?

- What sales and pricing strategies are they using?

- What marketing strategies are they using?

- What kind of press coverage do they get?

- What are their customers saying about your competitors (both the positive and negative)?

If your competitors have a website, it is a good idea to visit their websites for more competitors’ research. Check their “About Us” page for more information.

If you are presenting your business plan to investors, you need to clearly distinguish yourself from your competitors. Investors can easily tell when you have not properly researched your competitors.

Take time to think about what unique qualities or features set you apart from your competitors. If you do not have any direct competition offering your product to the market, it does not mean you leave out the competitor analysis section blank. Instead research on other companies that are providing a similar product, or whose product is solving the problem your product solves.

The next step is to create a table listing the top competitors you want to include in your business plan. Ensure you list your business as the last and on the right. What you just created is known as the competitor analysis table.

Direct vs Indirect Competition

You cannot know if your product or service will be a fit for your target market if you have not understood your business and the competitive landscape.

There is no market you want to target where you will not encounter competition, even if your product is innovative. Including competitive analysis in your business plan is essential.

If you are entering an established market, you need to explain how you plan to differentiate your products from the available options in the market. Also, include a list of few companies that you view as your direct competitors The competition you face in an established market is your direct competition.

In situations where you are entering a market with no direct competition, it does not mean there is no competition there. Consider your indirect competition that offers substitutes for the products or services you offer.

For example, if you sell an innovative SaaS product, let us say a project management software , a company offering time management software is your indirect competition.

There is an easy way to find out who your indirect competitors are in the absence of no direct competitors. You simply have to research how your potential customers are solving the problems that your product or service seeks to solve. That is your direct competition.

Factors that Differentiate Your Business from the Competition

There are three main factors that any business can use to differentiate itself from its competition. They are cost leadership, product differentiation, and market segmentation.

1. Cost Leadership

A strategy you can impose to maximize your profits and gain an edge over your competitors. It involves offering lower prices than what the majority of your competitors are offering.

A common practice among businesses looking to enter into a market where there are dominant players is to use free trials or pricing to attract as many customers as possible to their offer.

2. Product Differentiation

Your product or service should have a unique selling proposition (USP) that your competitors do not have or do not stress in their marketing.

Part of the marketing strategy should involve making your products unique and different from your competitors. It does not have to be different from your competitors, it can be the addition to a feature or benefit that your competitors do not currently have.

3. Market Segmentation

As a new business seeking to break into an industry, you will gain more success from focusing on a specific niche or target market, and not the whole industry.

If your competitors are focused on a general need or target market, you can differentiate yourself from them by having a small and hyper-targeted audience. For example, if your competitors are selling men’s clothes in their online stores , you can sell hoodies for men.

4. Define Your Business and Management Structure

The next step in your business plan is your business and management structure. It is the section where you describe the legal structure of your business and the team running it.

Your business is only as good as the management team that runs it, while the management team can only strive when there is a proper business and management structure in place.

If your company is a sole proprietor or a limited liability company (LLC), a general or limited partnership, or a C or an S corporation, state it clearly in this section.

Use an organizational chart to show the management structure in your business. Clearly show who is in charge of what area in your company. It is where you show how each key manager or team leader’s unique experience can contribute immensely to the success of your company. You can also opt to add the resumes and CVs of the key players in your company.

The business and management structure section should show who the owner is, and other owners of the businesses (if the business has other owners). For businesses or companies with multiple owners, include the percent ownership of the various owners and clearly show the extent of each others’ involvement in the company.

Investors want to know who is behind the company and the team running it to determine if it has the right management to achieve its set goals.

Management Team

The management team section is where you show that you have the right team in place to successfully execute the business operations and ideas. Take time to create the management structure for your business. Think about all the important roles and responsibilities that you need managers for to grow your business.

Include brief bios of each key team member and ensure you highlight only the relevant information that is needed. If your team members have background industry experience or have held top positions for other companies and achieved success while filling that role, highlight it in this section.

A common mistake that many startups make is assigning C-level titles such as (CMO and CEO) to everyone on their team. It is unrealistic for a small business to have those titles. While it may look good on paper for the ego of your team members, it can prevent investors from investing in your business.

Instead of building an unrealistic management structure that does not fit your business reality, it is best to allow business titles to grow as the business grows. Starting everyone at the top leaves no room for future change or growth, which is bad for productivity.

Your management team does not have to be complete before you start writing your business plan. You can have a complete business plan even when there are managerial positions that are empty and need filling.

If you have management gaps in your team, simply show the gaps and indicate you are searching for the right candidates for the role(s). Investors do not expect you to have a full management team when you are just starting your business.

Key Questions to Answer When Structuring Your Management Team

- Who are the key leaders?

- What experiences, skills, and educational backgrounds do you expect your key leaders to have?

- Do your key leaders have industry experience?

- What positions will they fill and what duties will they perform in those positions?

- What level of authority do the key leaders have and what are their responsibilities?

- What is the salary for the various management positions that will attract the ideal candidates?

Additional Tips for Writing the Management Structure Section

1. Avoid Adding ‘Ghost’ Names to Your Management Team

There is always that temptation to include a ‘ghost’ name to your management team to attract and influence investors to invest in your business. Although the presence of these celebrity management team members may attract the attention of investors, it can cause your business to lose any credibility if you get found out.

Seasoned investors will investigate further the members of your management team before committing fully to your business If they find out that the celebrity name used does not play any actual role in your business, they will not invest and may write you off as dishonest.

2. Focus on Credentials But Pay Extra Attention to the Roles

Investors want to know the experience that your key team members have to determine if they can successfully reach the company’s growth and financial goals.

While it is an excellent boost for your key management team to have the right credentials, you also want to pay extra attention to the roles they will play in your company.

Organizational Chart

Adding an organizational chart in this section of your business plan is not necessary, you can do it in your business plan’s appendix.

If you are exploring funding options, it is not uncommon to get asked for your organizational chart. The function of an organizational chart goes beyond raising money, you can also use it as a useful planning tool for your business.

An organizational chart can help you identify how best to structure your management team for maximum productivity and point you towards key roles you need to fill in the future.

You can use the organizational chart to show your company’s internal management structure such as the roles and responsibilities of your management team, and relationships that exist between them.

5. Describe Your Product and Service Offering

In your business plan, you have to describe what you sell or the service you plan to offer. It is the next step after defining your business and management structure. The products and services section is where you sell the benefits of your business.

Here you have to explain how your product or service will benefit your customers and describe your product lifecycle. It is also the section where you write down your plans for intellectual property like patent filings and copyrighting.