Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Secondary Research

Try Qualtrics for free

Secondary research: definition, methods, & examples.

19 min read This ultimate guide to secondary research helps you understand changes in market trends, customers buying patterns and your competition using existing data sources.

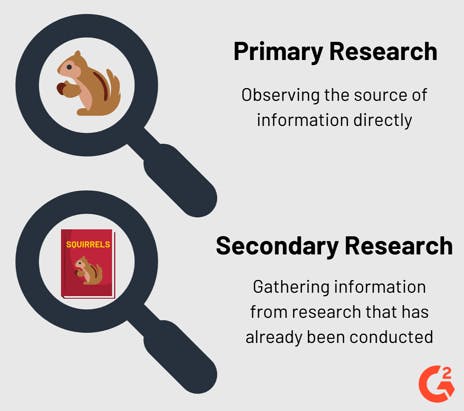

In situations where you’re not involved in the data gathering process ( primary research ), you have to rely on existing information and data to arrive at specific research conclusions or outcomes. This approach is known as secondary research.

In this article, we’re going to explain what secondary research is, how it works, and share some examples of it in practice.

Free eBook: The ultimate guide to conducting market research

What is secondary research?

Secondary research, also known as desk research, is a research method that involves compiling existing data sourced from a variety of channels . This includes internal sources (e.g.in-house research) or, more commonly, external sources (such as government statistics, organizational bodies, and the internet).

Secondary research comes in several formats, such as published datasets, reports, and survey responses , and can also be sourced from websites, libraries, and museums.

The information is usually free — or available at a limited access cost — and gathered using surveys , telephone interviews, observation, face-to-face interviews, and more.

When using secondary research, researchers collect, verify, analyze and incorporate it to help them confirm research goals for the research period.

As well as the above, it can be used to review previous research into an area of interest. Researchers can look for patterns across data spanning several years and identify trends — or use it to verify early hypothesis statements and establish whether it’s worth continuing research into a prospective area.

How to conduct secondary research

There are five key steps to conducting secondary research effectively and efficiently:

1. Identify and define the research topic

First, understand what you will be researching and define the topic by thinking about the research questions you want to be answered.

Ask yourself: What is the point of conducting this research? Then, ask: What do we want to achieve?

This may indicate an exploratory reason (why something happened) or confirm a hypothesis. The answers may indicate ideas that need primary or secondary research (or a combination) to investigate them.

2. Find research and existing data sources

If secondary research is needed, think about where you might find the information. This helps you narrow down your secondary sources to those that help you answer your questions. What keywords do you need to use?

Which organizations are closely working on this topic already? Are there any competitors that you need to be aware of?

Create a list of the data sources, information, and people that could help you with your work.

3. Begin searching and collecting the existing data

Now that you have the list of data sources, start accessing the data and collect the information into an organized system. This may mean you start setting up research journal accounts or making telephone calls to book meetings with third-party research teams to verify the details around data results.

As you search and access information, remember to check the data’s date, the credibility of the source, the relevance of the material to your research topic, and the methodology used by the third-party researchers. Start small and as you gain results, investigate further in the areas that help your research’s aims.

4. Combine the data and compare the results

When you have your data in one place, you need to understand, filter, order, and combine it intelligently. Data may come in different formats where some data could be unusable, while other information may need to be deleted.

After this, you can start to look at different data sets to see what they tell you. You may find that you need to compare the same datasets over different periods for changes over time or compare different datasets to notice overlaps or trends. Ask yourself: What does this data mean to my research? Does it help or hinder my research?

5. Analyze your data and explore further

In this last stage of the process, look at the information you have and ask yourself if this answers your original questions for your research. Are there any gaps? Do you understand the information you’ve found? If you feel there is more to cover, repeat the steps and delve deeper into the topic so that you can get all the information you need.

If secondary research can’t provide these answers, consider supplementing your results with data gained from primary research. As you explore further, add to your knowledge and update your findings. This will help you present clear, credible information.

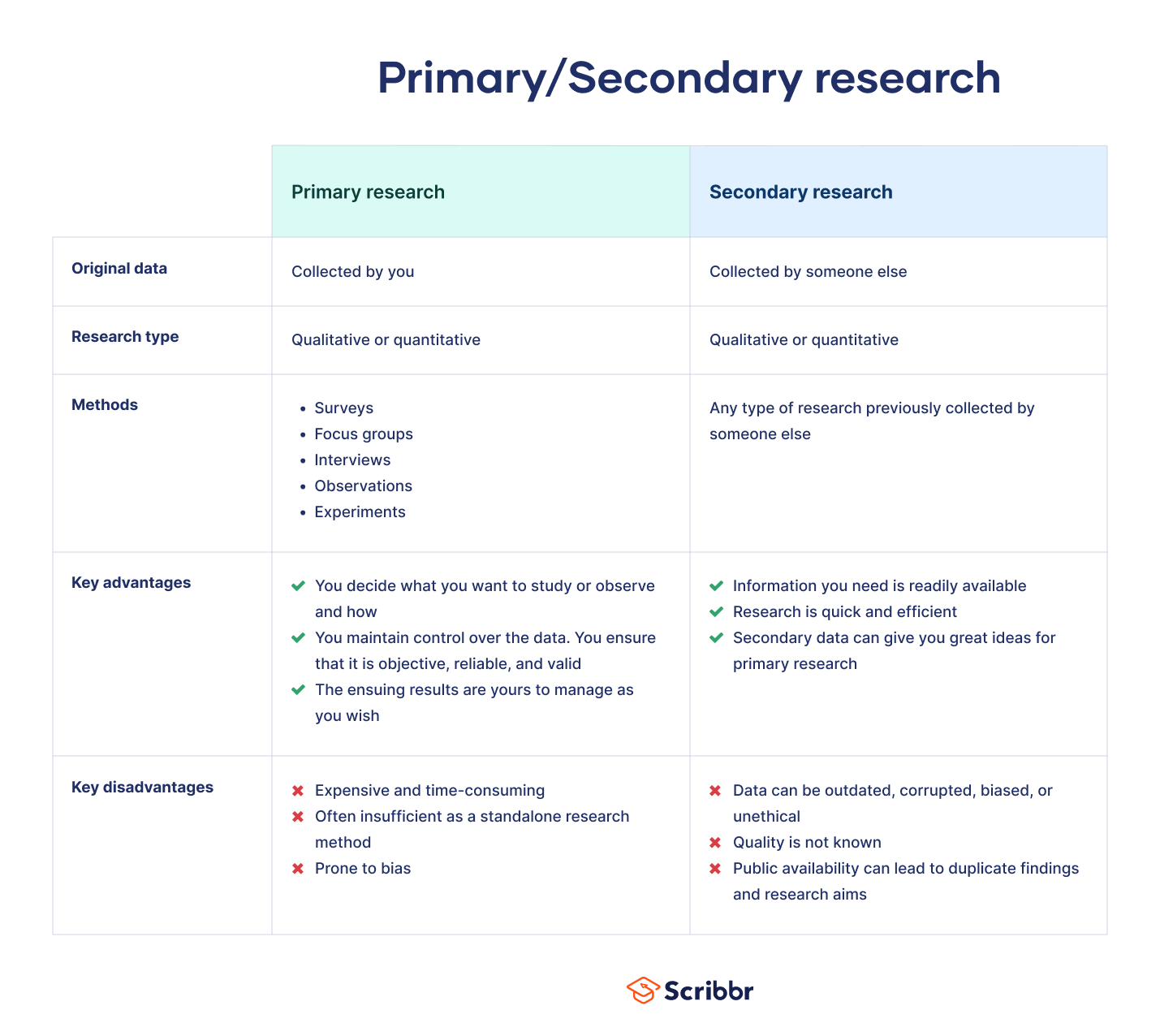

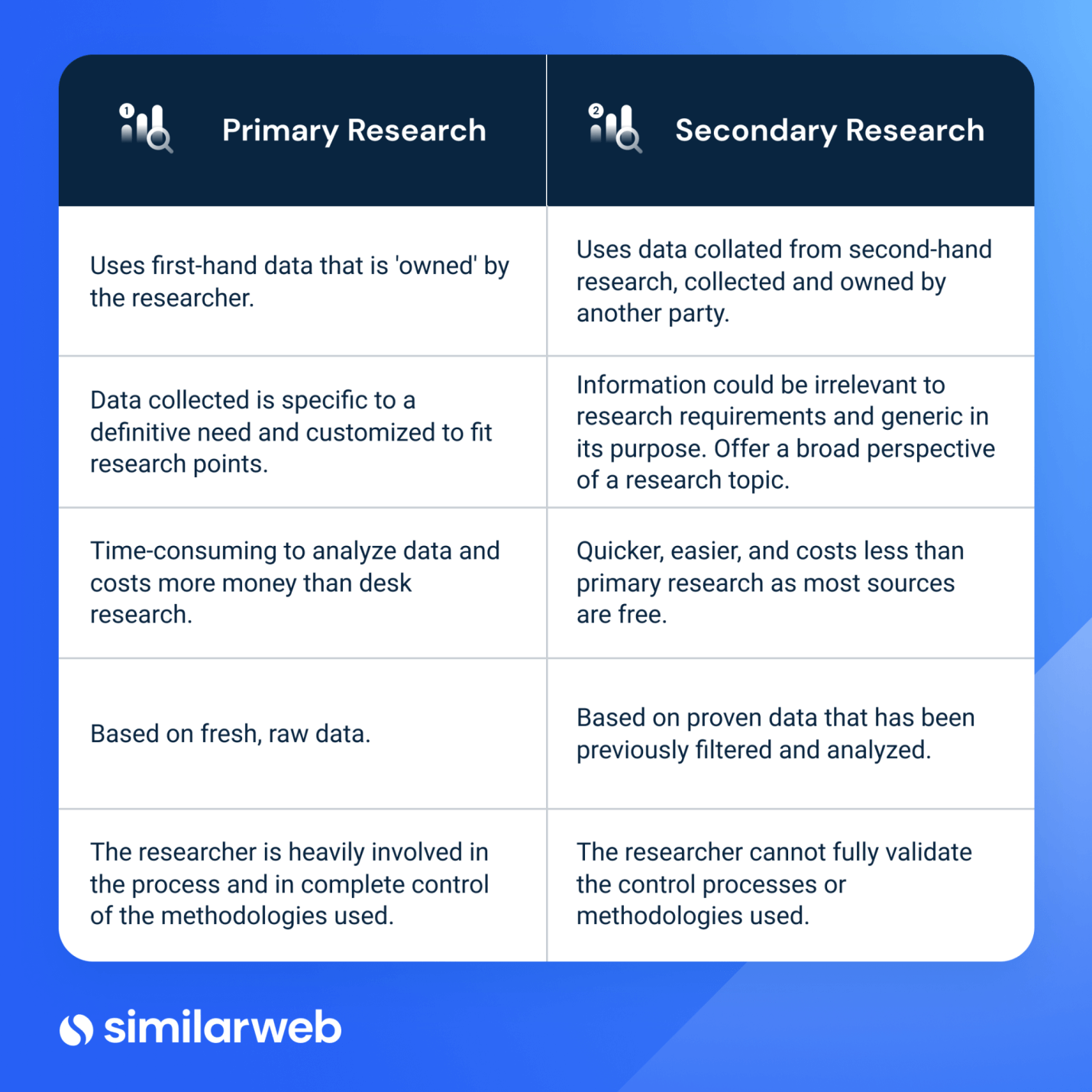

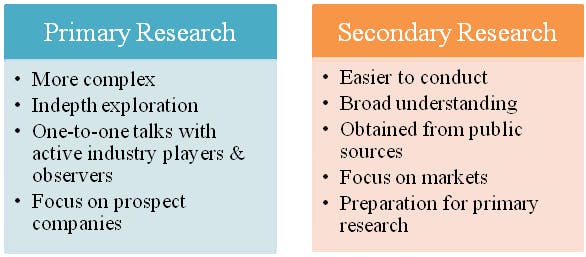

Primary vs secondary research

Unlike secondary research, primary research involves creating data first-hand by directly working with interviewees, target users, or a target market. Primary research focuses on the method for carrying out research, asking questions, and collecting data using approaches such as:

- Interviews (panel, face-to-face or over the phone)

- Questionnaires or surveys

- Focus groups

Using these methods, researchers can get in-depth, targeted responses to questions, making results more accurate and specific to their research goals. However, it does take time to do and administer.

Unlike primary research, secondary research uses existing data, which also includes published results from primary research. Researchers summarize the existing research and use the results to support their research goals.

Both primary and secondary research have their places. Primary research can support the findings found through secondary research (and fill knowledge gaps), while secondary research can be a starting point for further primary research. Because of this, these research methods are often combined for optimal research results that are accurate at both the micro and macro level.

| First-hand research to collect data. May require a lot of time | The research collects existing, published data. May require a little time |

| Creates raw data that the researcher owns | The researcher has no control over data method or ownership |

| Relevant to the goals of the research | May not be relevant to the goals of the research |

| The researcher conducts research. May be subject to researcher bias | The researcher collects results. No information on what researcher bias existsSources of secondary research |

| Can be expensive to carry out | More affordable due to access to free data |

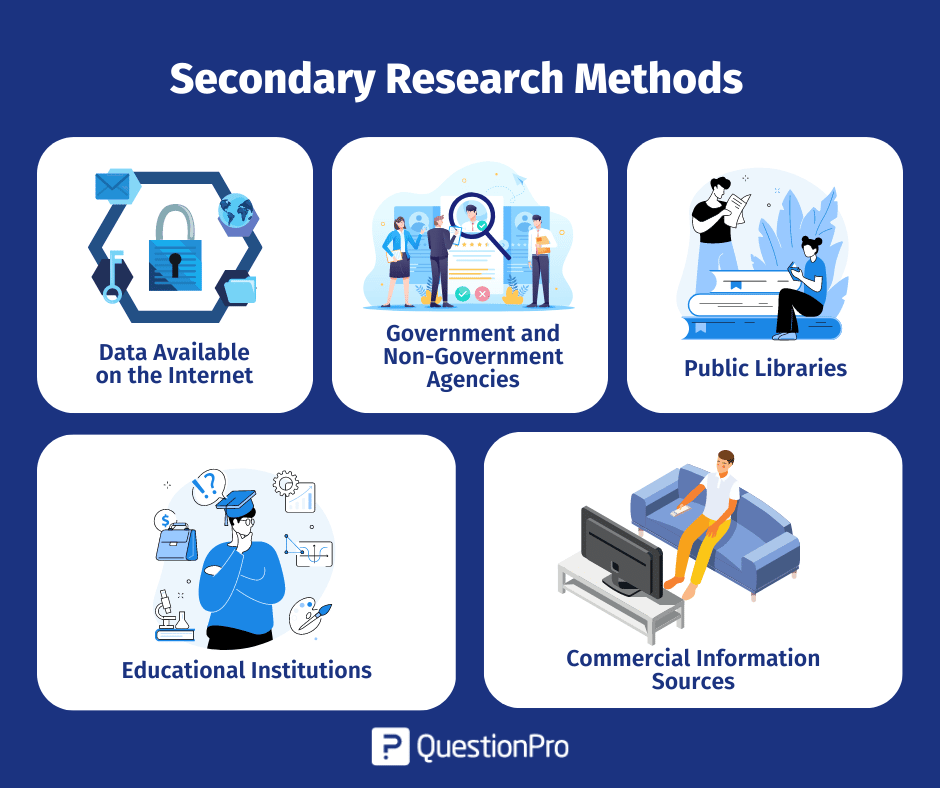

Sources of Secondary Research

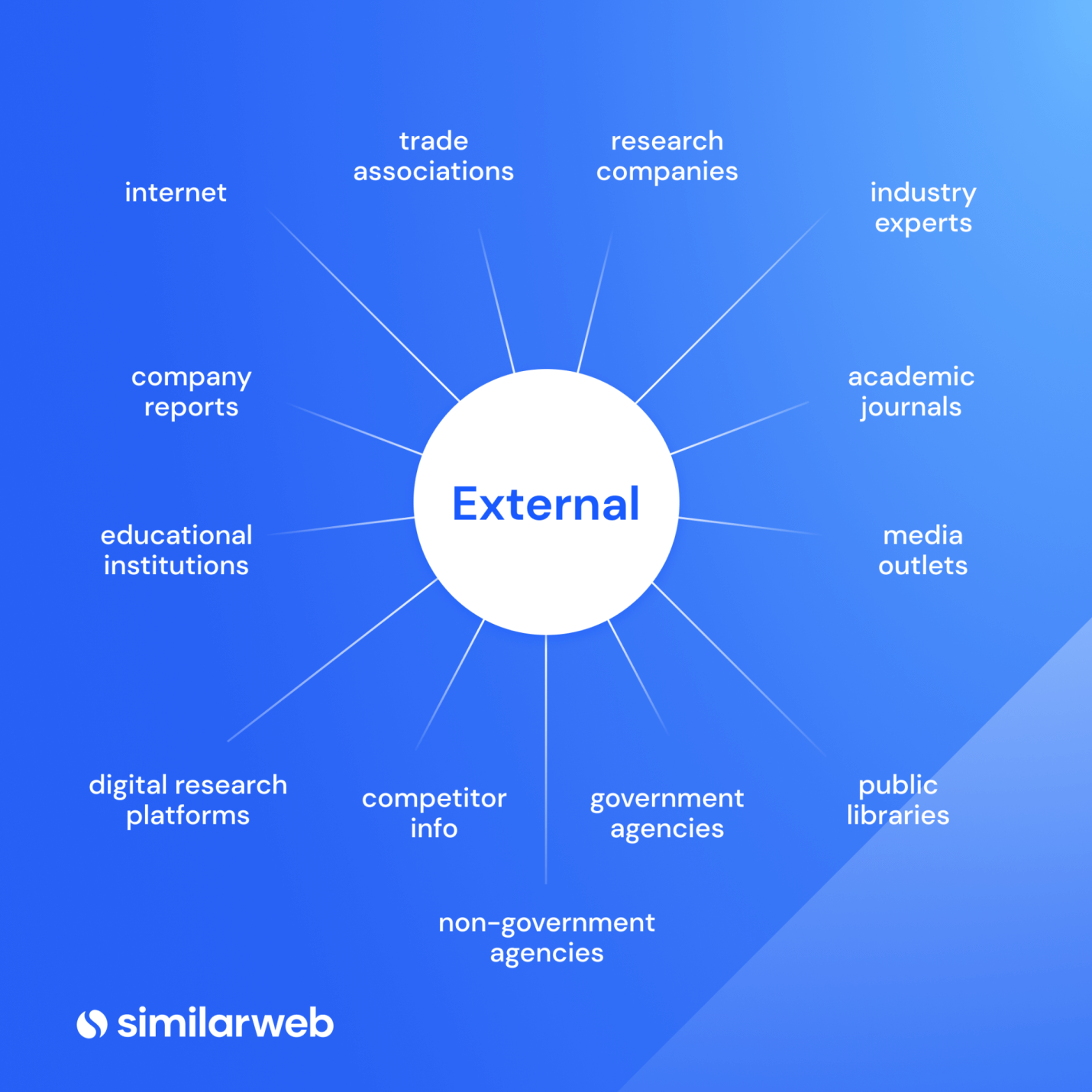

There are two types of secondary research sources: internal and external. Internal data refers to in-house data that can be gathered from the researcher’s organization. External data refers to data published outside of and not owned by the researcher’s organization.

Internal data

Internal data is a good first port of call for insights and knowledge, as you may already have relevant information stored in your systems. Because you own this information — and it won’t be available to other researchers — it can give you a competitive edge . Examples of internal data include:

- Database information on sales history and business goal conversions

- Information from website applications and mobile site data

- Customer-generated data on product and service efficiency and use

- Previous research results or supplemental research areas

- Previous campaign results

External data

External data is useful when you: 1) need information on a new topic, 2) want to fill in gaps in your knowledge, or 3) want data that breaks down a population or market for trend and pattern analysis. Examples of external data include:

- Government, non-government agencies, and trade body statistics

- Company reports and research

- Competitor research

- Public library collections

- Textbooks and research journals

- Media stories in newspapers

- Online journals and research sites

Three examples of secondary research methods in action

How and why might you conduct secondary research? Let’s look at a few examples:

1. Collecting factual information from the internet on a specific topic or market

There are plenty of sites that hold data for people to view and use in their research. For example, Google Scholar, ResearchGate, or Wiley Online Library all provide previous research on a particular topic. Researchers can create free accounts and use the search facilities to look into a topic by keyword, before following the instructions to download or export results for further analysis.

This can be useful for exploring a new market that your organization wants to consider entering. For instance, by viewing the U.S Census Bureau demographic data for that area, you can see what the demographics of your target audience are , and create compelling marketing campaigns accordingly.

2. Finding out the views of your target audience on a particular topic

If you’re interested in seeing the historical views on a particular topic, for example, attitudes to women’s rights in the US, you can turn to secondary sources.

Textbooks, news articles, reviews, and journal entries can all provide qualitative reports and interviews covering how people discussed women’s rights. There may be multimedia elements like video or documented posters of propaganda showing biased language usage.

By gathering this information, synthesizing it, and evaluating the language, who created it and when it was shared, you can create a timeline of how a topic was discussed over time.

3. When you want to know the latest thinking on a topic

Educational institutions, such as schools and colleges, create a lot of research-based reports on younger audiences or their academic specialisms. Dissertations from students also can be submitted to research journals, making these places useful places to see the latest insights from a new generation of academics.

Information can be requested — and sometimes academic institutions may want to collaborate and conduct research on your behalf. This can provide key primary data in areas that you want to research, as well as secondary data sources for your research.

Advantages of secondary research

There are several benefits of using secondary research, which we’ve outlined below:

- Easily and readily available data – There is an abundance of readily accessible data sources that have been pre-collected for use, in person at local libraries and online using the internet. This data is usually sorted by filters or can be exported into spreadsheet format, meaning that little technical expertise is needed to access and use the data.

- Faster research speeds – Since the data is already published and in the public arena, you don’t need to collect this information through primary research. This can make the research easier to do and faster, as you can get started with the data quickly.

- Low financial and time costs – Most secondary data sources can be accessed for free or at a small cost to the researcher, so the overall research costs are kept low. In addition, by saving on preliminary research, the time costs for the researcher are kept down as well.

- Secondary data can drive additional research actions – The insights gained can support future research activities (like conducting a follow-up survey or specifying future detailed research topics) or help add value to these activities.

- Secondary data can be useful pre-research insights – Secondary source data can provide pre-research insights and information on effects that can help resolve whether research should be conducted. It can also help highlight knowledge gaps, so subsequent research can consider this.

- Ability to scale up results – Secondary sources can include large datasets (like Census data results across several states) so research results can be scaled up quickly using large secondary data sources.

Disadvantages of secondary research

The disadvantages of secondary research are worth considering in advance of conducting research :

- Secondary research data can be out of date – Secondary sources can be updated regularly, but if you’re exploring the data between two updates, the data can be out of date. Researchers will need to consider whether the data available provides the right research coverage dates, so that insights are accurate and timely, or if the data needs to be updated. Also, fast-moving markets may find secondary data expires very quickly.

- Secondary research needs to be verified and interpreted – Where there’s a lot of data from one source, a researcher needs to review and analyze it. The data may need to be verified against other data sets or your hypotheses for accuracy and to ensure you’re using the right data for your research.

- The researcher has had no control over the secondary research – As the researcher has not been involved in the secondary research, invalid data can affect the results. It’s therefore vital that the methodology and controls are closely reviewed so that the data is collected in a systematic and error-free way.

- Secondary research data is not exclusive – As data sets are commonly available, there is no exclusivity and many researchers can use the same data. This can be problematic where researchers want to have exclusive rights over the research results and risk duplication of research in the future.

When do we conduct secondary research?

Now that you know the basics of secondary research, when do researchers normally conduct secondary research?

It’s often used at the beginning of research, when the researcher is trying to understand the current landscape . In addition, if the research area is new to the researcher, it can form crucial background context to help them understand what information exists already. This can plug knowledge gaps, supplement the researcher’s own learning or add to the research.

Secondary research can also be used in conjunction with primary research. Secondary research can become the formative research that helps pinpoint where further primary research is needed to find out specific information. It can also support or verify the findings from primary research.

You can use secondary research where high levels of control aren’t needed by the researcher, but a lot of knowledge on a topic is required from different angles.

Secondary research should not be used in place of primary research as both are very different and are used for various circumstances.

Questions to ask before conducting secondary research

Before you start your secondary research, ask yourself these questions:

- Is there similar internal data that we have created for a similar area in the past?

If your organization has past research, it’s best to review this work before starting a new project. The older work may provide you with the answers, and give you a starting dataset and context of how your organization approached the research before. However, be mindful that the work is probably out of date and view it with that note in mind. Read through and look for where this helps your research goals or where more work is needed.

- What am I trying to achieve with this research?

When you have clear goals, and understand what you need to achieve, you can look for the perfect type of secondary or primary research to support the aims. Different secondary research data will provide you with different information – for example, looking at news stories to tell you a breakdown of your market’s buying patterns won’t be as useful as internal or external data e-commerce and sales data sources.

- How credible will my research be?

If you are looking for credibility, you want to consider how accurate the research results will need to be, and if you can sacrifice credibility for speed by using secondary sources to get you started. Bear in mind which sources you choose — low-credibility data sites, like political party websites that are highly biased to favor their own party, would skew your results.

- What is the date of the secondary research?

When you’re looking to conduct research, you want the results to be as useful as possible , so using data that is 10 years old won’t be as accurate as using data that was created a year ago. Since a lot can change in a few years, note the date of your research and look for earlier data sets that can tell you a more recent picture of results. One caveat to this is using data collected over a long-term period for comparisons with earlier periods, which can tell you about the rate and direction of change.

- Can the data sources be verified? Does the information you have check out?

If you can’t verify the data by looking at the research methodology, speaking to the original team or cross-checking the facts with other research, it could be hard to be sure that the data is accurate. Think about whether you can use another source, or if it’s worth doing some supplementary primary research to replicate and verify results to help with this issue.

We created a front-to-back guide on conducting market research, The ultimate guide to conducting market research , so you can understand the research journey with confidence.

In it, you’ll learn more about:

- What effective market research looks like

- The use cases for market research

- The most important steps to conducting market research

- And how to take action on your research findings

Download the free guide for a clearer view on secondary research and other key research types for your business.

Related resources

Market intelligence 10 min read, marketing insights 11 min read, ethnographic research 11 min read, qualitative vs quantitative research 13 min read, qualitative research questions 11 min read, qualitative research design 12 min read, primary vs secondary research 14 min read, request demo.

Ready to learn more about Qualtrics?

What is Secondary Research? Types, Methods, Examples

Appinio Research · 20.09.2023 · 13min read

Have you ever wondered how researchers gather valuable insights without conducting new experiments or surveys? That's where secondary research steps in—a powerful approach that allows us to explore existing data and information others collect.

Whether you're a student, a professional, or someone seeking to make informed decisions, understanding the art of secondary research opens doors to a wealth of knowledge.

What is Secondary Research?

Secondary Research refers to the process of gathering and analyzing existing data, information, and knowledge that has been previously collected and compiled by others. This approach allows researchers to leverage available sources, such as articles, reports, and databases, to gain insights, validate hypotheses, and make informed decisions without collecting new data.

Benefits of Secondary Research

Secondary research offers a range of advantages that can significantly enhance your research process and the quality of your findings.

- Time and Cost Efficiency: Secondary research saves time and resources by utilizing existing data sources, eliminating the need for data collection from scratch.

- Wide Range of Data: Secondary research provides access to vast information from various sources, allowing for comprehensive analysis.

- Historical Perspective: Examining past research helps identify trends, changes, and long-term patterns that might not be immediately apparent.

- Reduced Bias: As data is collected by others, there's often less inherent bias than in conducting primary research, where biases might affect data collection.

- Support for Primary Research: Secondary research can lay the foundation for primary research by providing context and insights into gaps in existing knowledge.

- Comparative Analysis : By integrating data from multiple sources, you can conduct robust comparative analyses for more accurate conclusions.

- Benchmarking and Validation: Secondary research aids in benchmarking performance against industry standards and validating hypotheses.

Primary Research vs. Secondary Research

When it comes to research methodologies, primary and secondary research each have their distinct characteristics and advantages. Here's a brief comparison to help you understand the differences.

Primary Research

- Data Source: Involves collecting new data directly from original sources.

- Data Collection: Researchers design and conduct surveys, interviews, experiments, or observations.

- Time and Resources: Typically requires more time, effort, and resources due to data collection.

- Fresh Insights: Provides firsthand, up-to-date information tailored to specific research questions.

- Control: Researchers control the data collection process and can shape methodologies.

Secondary Research

- Data Source: Involves utilizing existing data and information collected by others.

- Data Collection: Researchers search, select, and analyze data from published sources, reports, and databases.

- Time and Resources: Generally more time-efficient and cost-effective as data is already available.

- Existing Knowledge: Utilizes data that has been previously compiled, often providing broader context.

- Less Control: Researchers have limited control over how data was collected originally, if any.

Choosing between primary and secondary research depends on your research objectives, available resources, and the depth of insights you require.

Types of Secondary Research

Secondary research encompasses various types of existing data sources that can provide valuable insights for your research endeavors. Understanding these types can help you choose the most relevant sources for your objectives.

Here are the primary types of secondary research:

Internal Sources

Internal sources consist of data generated within your organization or entity. These sources provide valuable insights into your own operations and performance.

- Company Records and Data: Internal reports, documents, and databases that house information about sales, operations, and customer interactions.

- Sales Reports and Customer Data: Analysis of past sales trends, customer demographics, and purchasing behavior.

- Financial Statements and Annual Reports: Financial data, such as balance sheets and income statements, offer insights into the organization's financial health.

External Sources

External sources encompass data collected and published by entities outside your organization.

These sources offer a broader perspective on various subjects.

- Published Literature and Journals: Scholarly articles, research papers, and academic studies available in journals or online databases.

- Market Research Reports: Reports from market research firms that provide insights into industry trends, consumer behavior, and market forecasts.

- Government and NGO Databases: Data collected and maintained by government agencies and non-governmental organizations, offering demographic, economic, and social information.

- Online Media and News Articles: News outlets and online publications that cover current events, trends, and societal developments.

Each type of secondary research source holds its value and relevance, depending on the nature of your research objectives. Combining these sources lets you understand the subject matter and make informed decisions.

How to Conduct Secondary Research?

Effective secondary research involves a thoughtful and systematic approach that enables you to extract valuable insights from existing data sources. Here's a step-by-step guide on how to navigate the process:

1. Define Your Research Objectives

Before delving into secondary research, clearly define what you aim to achieve. Identify the specific questions you want to answer, the insights you're seeking, and the scope of your research.

2. Identify Relevant Sources

Begin by identifying the most appropriate sources for your research. Consider the nature of your research objectives and the data type you require. Seek out sources such as academic journals, market research reports, official government databases, and reputable news outlets.

3. Evaluate Source Credibility

Ensuring the credibility of your sources is crucial. Evaluate the reliability of each source by assessing factors such as the author's expertise, the publication's reputation, and the objectivity of the information provided. Choose sources that align with your research goals and are free from bias.

4. Extract and Analyze Information

Once you've gathered your sources, carefully extract the relevant information. Take thorough notes, capturing key data points, insights, and any supporting evidence. As you accumulate information, start identifying patterns, trends, and connections across different sources.

5. Synthesize Findings

As you analyze the data, synthesize your findings to draw meaningful conclusions. Compare and contrast information from various sources to identify common themes and discrepancies. This synthesis process allows you to construct a coherent narrative that addresses your research objectives.

6. Address Limitations and Gaps

Acknowledge the limitations and potential gaps in your secondary research. Recognize that secondary data might have inherent biases or be outdated. Where necessary, address these limitations by cross-referencing information or finding additional sources to fill in gaps.

7. Contextualize Your Findings

Contextualization is crucial in deriving actionable insights from your secondary research. Consider the broader context within which the data was collected. How does the information relate to current trends, societal changes, or industry shifts? This contextual understanding enhances the relevance and applicability of your findings.

8. Cite Your Sources

Maintain academic integrity by properly citing the sources you've used for your secondary research. Accurate citations not only give credit to the original authors but also provide a clear trail for readers to access the information themselves.

9. Integrate Secondary and Primary Research (If Applicable)

In some cases, combining secondary and primary research can yield more robust insights. If you've also conducted primary research, consider integrating your secondary findings with your primary data to provide a well-rounded perspective on your research topic.

You can use a market research platform like Appinio to conduct primary research with real-time insights in minutes!

10. Communicate Your Findings

Finally, communicate your findings effectively. Whether it's in an academic paper, a business report, or any other format, present your insights clearly and concisely. Provide context for your conclusions and use visual aids like charts and graphs to enhance understanding.

Remember that conducting secondary research is not just about gathering information—it's about critically analyzing, interpreting, and deriving valuable insights from existing data. By following these steps, you'll navigate the process successfully and contribute to the body of knowledge in your field.

Secondary Research Examples

To better understand how secondary research is applied in various contexts, let's explore a few real-world examples that showcase its versatility and value.

Market Analysis and Trend Forecasting

Imagine you're a marketing strategist tasked with launching a new product in the smartphone industry. By conducting secondary research, you can:

- Access Market Reports: Utilize market research reports to understand consumer preferences, competitive landscape, and growth projections.

- Analyze Trends: Examine past sales data and industry reports to identify trends in smartphone features, design, and user preferences.

- Benchmark Competitors: Compare market share, customer satisfaction , and pricing strategies of key competitors to develop a strategic advantage.

- Forecast Demand: Use historical sales data and market growth predictions to estimate demand for your new product.

Academic Research and Literature Reviews

Suppose you're a student researching climate change's effects on marine ecosystems. Secondary research aids your academic endeavors by:

- Reviewing Existing Studies: Analyze peer-reviewed articles and scientific papers to understand the current state of knowledge on the topic.

- Identifying Knowledge Gaps: Identify areas where further research is needed based on what existing studies still need to cover.

- Comparing Methodologies: Compare research methodologies used by different studies to assess the strengths and limitations of their approaches.

- Synthesizing Insights: Synthesize findings from various studies to form a comprehensive overview of the topic's implications on marine life.

Competitive Landscape Assessment for Business Strategy

Consider you're a business owner looking to expand your restaurant chain to a new location. Secondary research aids your strategic decision-making by:

- Analyzing Demographics: Utilize demographic data from government databases to understand the local population's age, income, and preferences.

- Studying Local Trends: Examine restaurant industry reports to identify the types of cuisines and dining experiences currently popular in the area.

- Understanding Consumer Behavior: Analyze online reviews and social media discussions to gauge customer sentiment towards existing restaurants in the vicinity.

- Assessing Economic Conditions: Access economic reports to evaluate the local economy's stability and potential purchasing power.

These examples illustrate the practical applications of secondary research across various fields to provide a foundation for informed decision-making, deeper understanding, and innovation.

Secondary Research Limitations

While secondary research offers many benefits, it's essential to be aware of its limitations to ensure the validity and reliability of your findings.

- Data Quality and Validity: The accuracy and reliability of secondary data can vary, affecting the credibility of your research.

- Limited Contextual Information: Secondary sources might lack detailed contextual information, making it important to interpret findings within the appropriate context.

- Data Suitability: Existing data might not align perfectly with your research objectives, leading to compromises or incomplete insights.

- Outdated Information: Some sources might provide obsolete information that doesn't accurately reflect current trends or situations.

- Potential Bias: While secondary data is often less biased, biases might still exist in the original data sources, influencing your findings.

- Incompatibility of Data: Combining data from different sources might pose challenges due to variations in definitions, methodologies, or units of measurement.

- Lack of Control: Unlike primary research, you have no control over how data was collected or its quality, potentially affecting your analysis. Understanding these limitations will help you navigate secondary research effectively and make informed decisions based on a well-rounded understanding of its strengths and weaknesses.

Secondary research is a valuable tool that businesses can use to their advantage. By tapping into existing data and insights, companies can save time, resources, and effort that would otherwise be spent on primary research. This approach equips decision-makers with a broader understanding of market trends, consumer behaviors, and competitive landscapes. Additionally, benchmarking against industry standards and validating hypotheses empowers businesses to make informed choices that lead to growth and success.

As you navigate the world of secondary research, remember that it's not just about data retrieval—it's about strategic utilization. With a clear grasp of how to access, analyze, and interpret existing information, businesses can stay ahead of the curve, adapt to changing landscapes, and make decisions that are grounded in reliable knowledge.

How to Conduct Secondary Research in Minutes?

In the world of decision-making, having access to real-time consumer insights is no longer a luxury—it's a necessity. That's where Appinio comes in, revolutionizing how businesses gather valuable data for better decision-making. As a real-time market research platform, Appinio empowers companies to tap into the pulse of consumer opinions swiftly and seamlessly.

- Fast Insights: Say goodbye to lengthy research processes. With Appinio, you can transform questions into actionable insights in minutes.

- Data-Driven Decisions: Harness the power of real-time consumer insights to drive your business strategies, allowing you to make informed choices on the fly.

- Seamless Integration: Appinio handles the research and technical complexities, freeing you to focus on what truly matters: making rapid data-driven decisions that propel your business forward.

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

03.09.2024 | 3min read

Get your brand Holiday Ready: 4 Essential Steps to Smash your Q4

03.09.2024 | 8min read

Beyond Demographics: Psychographic Power in target group identification

29.08.2024 | 32min read

What is Convenience Sampling? Definition, Method, Examples

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- What is Secondary Research? | Definition, Types, & Examples

What is Secondary Research? | Definition, Types, & Examples

Published on January 20, 2023 by Tegan George . Revised on January 12, 2024.

Secondary research is a research method that uses data that was collected by someone else. In other words, whenever you conduct research using data that already exists, you are conducting secondary research. On the other hand, any type of research that you undertake yourself is called primary research .

Secondary research can be qualitative or quantitative in nature. It often uses data gathered from published peer-reviewed papers, meta-analyses, or government or private sector databases and datasets.

Table of contents

When to use secondary research, types of secondary research, examples of secondary research, advantages and disadvantages of secondary research, other interesting articles, frequently asked questions.

Secondary research is a very common research method, used in lieu of collecting your own primary data. It is often used in research designs or as a way to start your research process if you plan to conduct primary research later on.

Since it is often inexpensive or free to access, secondary research is a low-stakes way to determine if further primary research is needed, as gaps in secondary research are a strong indication that primary research is necessary. For this reason, while secondary research can theoretically be exploratory or explanatory in nature, it is usually explanatory: aiming to explain the causes and consequences of a well-defined problem.

Here's why students love Scribbr's proofreading services

Discover proofreading & editing

Secondary research can take many forms, but the most common types are:

Statistical analysis

Literature reviews, case studies, content analysis.

There is ample data available online from a variety of sources, often in the form of datasets. These datasets are often open-source or downloadable at a low cost, and are ideal for conducting statistical analyses such as hypothesis testing or regression analysis .

Credible sources for existing data include:

- The government

- Government agencies

- Non-governmental organizations

- Educational institutions

- Businesses or consultancies

- Libraries or archives

- Newspapers, academic journals, or magazines

A literature review is a survey of preexisting scholarly sources on your topic. It provides an overview of current knowledge, allowing you to identify relevant themes, debates, and gaps in the research you analyze. You can later apply these to your own work, or use them as a jumping-off point to conduct primary research of your own.

Structured much like a regular academic paper (with a clear introduction, body, and conclusion), a literature review is a great way to evaluate the current state of research and demonstrate your knowledge of the scholarly debates around your topic.

A case study is a detailed study of a specific subject. It is usually qualitative in nature and can focus on a person, group, place, event, organization, or phenomenon. A case study is a great way to utilize existing research to gain concrete, contextual, and in-depth knowledge about your real-world subject.

You can choose to focus on just one complex case, exploring a single subject in great detail, or examine multiple cases if you’d prefer to compare different aspects of your topic. Preexisting interviews , observational studies , or other sources of primary data make for great case studies.

Content analysis is a research method that studies patterns in recorded communication by utilizing existing texts. It can be either quantitative or qualitative in nature, depending on whether you choose to analyze countable or measurable patterns, or more interpretive ones. Content analysis is popular in communication studies, but it is also widely used in historical analysis, anthropology, and psychology to make more semantic qualitative inferences.

Secondary research is a broad research approach that can be pursued any way you’d like. Here are a few examples of different ways you can use secondary research to explore your research topic .

Secondary research is a very common research approach, but has distinct advantages and disadvantages.

Advantages of secondary research

Advantages include:

- Secondary data is very easy to source and readily available .

- It is also often free or accessible through your educational institution’s library or network, making it much cheaper to conduct than primary research .

- As you are relying on research that already exists, conducting secondary research is much less time consuming than primary research. Since your timeline is so much shorter, your research can be ready to publish sooner.

- Using data from others allows you to show reproducibility and replicability , bolstering prior research and situating your own work within your field.

Disadvantages of secondary research

Disadvantages include:

- Ease of access does not signify credibility . It’s important to be aware that secondary research is not always reliable , and can often be out of date. It’s critical to analyze any data you’re thinking of using prior to getting started, using a method like the CRAAP test .

- Secondary research often relies on primary research already conducted. If this original research is biased in any way, those research biases could creep into the secondary results.

Many researchers using the same secondary research to form similar conclusions can also take away from the uniqueness and reliability of your research. Many datasets become “kitchen-sink” models, where too many variables are added in an attempt to draw increasingly niche conclusions from overused data . Data cleansing may be necessary to test the quality of the research.

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Normal distribution

- Degrees of freedom

- Null hypothesis

- Discourse analysis

- Control groups

- Mixed methods research

- Non-probability sampling

- Quantitative research

- Inclusion and exclusion criteria

Research bias

- Rosenthal effect

- Implicit bias

- Cognitive bias

- Selection bias

- Negativity bias

- Status quo bias

A systematic review is secondary research because it uses existing research. You don’t collect new data yourself.

The research methods you use depend on the type of data you need to answer your research question .

- If you want to measure something or test a hypothesis , use quantitative methods . If you want to explore ideas, thoughts and meanings, use qualitative methods .

- If you want to analyze a large amount of readily-available data, use secondary data. If you want data specific to your purposes with control over how it is generated, collect primary data.

- If you want to establish cause-and-effect relationships between variables , use experimental methods. If you want to understand the characteristics of a research subject, use descriptive methods.

Quantitative research deals with numbers and statistics, while qualitative research deals with words and meanings.

Quantitative methods allow you to systematically measure variables and test hypotheses . Qualitative methods allow you to explore concepts and experiences in more detail.

Sources in this article

We strongly encourage students to use sources in their work. You can cite our article (APA Style) or take a deep dive into the articles below.

George, T. (2024, January 12). What is Secondary Research? | Definition, Types, & Examples. Scribbr. Retrieved September 3, 2024, from https://www.scribbr.com/methodology/secondary-research/

Largan, C., & Morris, T. M. (2019). Qualitative Secondary Research: A Step-By-Step Guide (1st ed.). SAGE Publications Ltd.

Peloquin, D., DiMaio, M., Bierer, B., & Barnes, M. (2020). Disruptive and avoidable: GDPR challenges to secondary research uses of data. European Journal of Human Genetics , 28 (6), 697–705. https://doi.org/10.1038/s41431-020-0596-x

Is this article helpful?

Tegan George

Other students also liked, primary research | definition, types, & examples, how to write a literature review | guide, examples, & templates, what is a case study | definition, examples & methods, "i thought ai proofreading was useless but..".

I've been using Scribbr for years now and I know it's a service that won't disappoint. It does a good job spotting mistakes”

Secondary Market Research: Key Methods and Sources

- by Alice Ananian

- August 27, 2024

In today’s data-driven world, businesses that thrive harness the power of market research. While primary research involves collecting data firsthand, secondary market research leverages existing data to provide valuable insights without the hefty costs. Entrepreneurs, small business owners, and business students alike must understand the intricacies of market research. Let’s explore how secondary market research can be your key to success.

What Is Secondary Market Research?

Secondary market research is the process of collecting and analyzing data that has already been gathered by others. This information can come from a variety of sources, including government agencies, industry associations, market research firms, and academic institutions. Unlike primary research, which involves collecting data firsthand, secondary research leverages existing information to gain insights into a specific market.

Key benefits of secondary market research include:

- Cost-effective: Often less expensive than primary research as it avoids the costs associated with data collection.

- Time-saving: Existing data is readily available, reducing the time required to gather information.

- Access to large datasets: Provides access to extensive data that might be difficult or impossible to collect independently.

- Industry benchmarks: Offers comparisons to industry standards and trends.

By utilizing secondary market research, businesses can make informed decisions, identify market opportunities, understand customer behavior, and develop effective marketing strategies.

Secondary Market Research Sources

Secondary market research offers a wealth of information, but knowing where to look can be overwhelming. Here’s a breakdown of key sources:

Government Data

Government agencies collect and publish a vast amount of data on demographics, economic indicators, industry trends, and consumer behavior. This data is often free and highly reliable. The following examples are applicable for the US.

- Census Bureau : Provides comprehensive data on population, housing, business, and economy.

- Bureau of Labor Statistics (BLS) : Offers data on employment, wages, prices, and productivity.

- Federal Trade Commission (FTC) : Provides information on consumer protection and antitrust issues.

Industry Associations and Trade Organizations

Industry-specific associations often publish market research , statistics, and trends relevant to their members.

- National Retail Federation (NRF) : Offers data and insights on the retail industry.

- Marketing Association (AMA) : Provides resources and research on marketing topics.

Market Research Firms

These companies specialize in collecting and analyzing market data. Their reports often provide in-depth insights into specific industries or consumer segments.

- Statista : Offers a vast collection of market data, studies, and infographics.

- Mintel : Provides market research on consumer goods and services.

- Nielsen : Offers data and analytics on consumer behavior and media consumption.

Academic Research

Universities and research institutions publish studies and papers on various topics, including market research.

- Google Scholar : A search engine for academic literature.

- JSTOR : A digital library of academic journals, books, and primary sources.

Business Databases

Many databases offer access to company information, industry reports, and news articles.

- Bloomberg Terminal : Provides financial data, news, and analytics.

- Factiva : Offers news and business information from thousands of sources.

Other Online Resources

The internet provides a wealth of free and paid secondary research data.

Social Media: Platforms like Facebook, Twitter, and Instagram offer insights into consumer sentiment and behavior.

Industry Websites and Blogs: Many companies and industry experts publish valuable information online.

Considerations When Using Secondary Data

When conducting research, it is crucial to ensure relevance by verifying that the data aligns with your research question. Equally important is reliability , which involves confirming the credibility and accuracy of your sources. Additionally, consider the timeliness of the data, taking into account its age and current applicability. Lastly, ensure consistency by comparing data from multiple sources to verify uniformity.

By carefully selecting and utilizing these sources, you can gather valuable insights to inform your market research and decision-making processes.

Secondary Market Research Methods

Conducting secondary market research involves several methods, each tailored to the type of data being analyzed. Here are some common methods along with examples to provide greater context:

Data Mining

This involves uncovering patterns within substantial datasets. By employing statistical algorithms and machine learning, researchers can extract valuable insights. This method is instrumental in identifying customer segments, forecasting sales trends, detecting anomalies, and optimizing marketing strategies.

Example: Imagine a retail company that uses data mining to analyze its sales data over the past five years. By examining patterns in purchase history, customer demographics, and seasonal trends, they identify a growing segment of eco-conscious millennials who prefer sustainable products. This insight leads to the development of a new product line targeting this specific customer segment.

Content Analysis

Content analysis systematically examines communication to understand its meaning. Applicable to textual, visual, or audio data, content analysis helps analyze media coverage, gauge brand perception, identify consumer sentiment, and track industry trends.

Example: A social media marketing firm conducts content analysis on Twitter mentions of a client’s brand. By analyzing the language, sentiment, and context of these tweets, they discover that customers frequently praise the product’s durability but express frustration with its packaging. This information guides the company to improve its packaging design while maintaining product quality.

Trend Analysis

This type of analysis identifies patterns and shifts in data over time. It aids in predicting future trends and making informed decisions. By analyzing historical data, businesses can forecast market growth, recognize emerging trends, assess the competitive landscape, and develop long-term strategies.

Example: An electric vehicle manufacturer performs trend analysis on global sales data of electric cars over the past decade. They notice a consistent year-over-year increase in sales, with a significant spike in regions that have implemented green energy incentives. This information helps them prioritize market expansion in areas with favorable policies and growing demand.

Competitive Analysis

Competitive analysis evaluates the strengths, weaknesses, opportunities, and threats of competitors. Understanding the competitive landscape is crucial for developing effective strategies. Through benchmarking performance, identifying market gaps, and differentiating products, businesses can gain a competitive edge.

Example: A streaming service conducts a competitive analysis of other platforms in the market. They discover that while a major competitor has a larger content library, users complain about its confusing interface. The streaming service decides to focus on improving its user experience and curating a smaller but high-quality content selection to differentiate itself.

Benchmarking

Benchmarking compares a company’s performance to industry standards or best practices. It helps identify areas for improvement and set performance goals. By assessing operational efficiency, measuring customer satisfaction, and evaluating product quality, companies can enhance their processes.

Example: A mid-sized hospital benchmarks its patient satisfaction scores against top-performing hospitals in the country. They find that their scores lag in the areas of wait times and staff communication. Using this information, the hospital implements new scheduling software and staff training programs to improve in these areas.

SWOT Analysis

This well-known acronym is a strategic planning technique that identifies a company’s strengths, weaknesses, opportunities, and threats. It assesses the internal and external environment. By developing business strategies, identifying competitive advantages, mitigating risks, and allocating resources effectively, companies can improve their overall performance.

Example: A local coffee shop chain conducts a SWOT analysis before expanding to a new city. They identify their strength in sourcing high-quality, ethically produced beans, and their weakness in brand recognition outside their home market. Opportunities include a growing demand for specialty coffee in the target city, while threats include established national chains. This analysis helps them develop a market entry strategy that emphasizes their unique selling points.

Scenario Planning

Scenario planning creates hypothetical future scenarios to assess potential outcomes and develop contingency plans. It helps businesses develop strategic options, manage risks, identify opportunities, and make informed decisions in uncertain environments.

Example: An international airline uses scenario planning to prepare for various post-pandemic travel scenarios. They develop plans for rapid recovery, slow recovery, and potential new travel restrictions. This exercise helps them adjust their fleet management, route planning, and staffing strategies to remain flexible in an uncertain market.

These methods often complement each other to maximize the value extracted from secondary data. By applying these techniques, businesses can gain valuable insights, make data-driven decisions, and achieve a competitive advantage.

Advantages of Secondary Market Research

Secondary market research offers several benefits for businesses and researchers:

- Cost-effective: It is generally less expensive than primary research as data is already collected and available.

- Time-efficient: Since data is readily accessible, researchers can gather information quickly, accelerating the research process.

- Access to large datasets: Secondary research often provides access to extensive datasets that would be challenging or impossible to collect independently.

- Industry benchmarks: This research allows for comparisons to industry standards and trends, providing valuable context.

- Reduced errors: Data collected by professionals can be more reliable and accurate than data gathered independently.

- Identification of research gaps: By exploring existing research, researchers can identify areas where further investigation is needed.

- Understanding the broader context: Secondary research helps place specific findings within a larger industry or market context.

- Supports primary research: It can provide a foundation for designing effective primary research studies.

By leveraging secondary market research, businesses can make informed decisions, identify opportunities, understand customer behavior, and develop effective marketing strategies.

Limitations of Secondary Research

While secondary market research offers numerous advantages, it also has its drawbacks:

- Lack of specificity: The data may not align precisely with the specific research question or business needs.

- Outdated information: Data can become outdated quickly, especially in rapidly changing markets.

- Data quality and reliability: The accuracy and consistency of data can vary across sources.

- Limited depth: Secondary research often provides a broad overview but may lack in-depth insights.

- Potential bias: The original data collection methods or the interpretation of the data may be biased.

- Access limitations: Some high-quality data sources may require subscriptions or fees.

- Competitive advantage: Information available to one company is often available to competitors as well.

It’s essential to carefully evaluate the limitations of secondary research and consider combining it with primary research to obtain a more comprehensive understanding of the target market.

Examples of Secondary Market Research

To illustrate the practical applications of secondary market research, let’s consider a few examples:

Business Examples

Coca-Cola’s Market Penetration: Coca-Cola extensively uses demographic data from census bureaus to understand consumer preferences and consumption patterns across different regions. This information helps them tailor their marketing campaigns and product offerings.

Netflix’s Content Strategy: Netflix relies heavily on viewing data and audience preferences to determine which shows and movies to produce or acquire. By analyzing user behavior, they can identify popular genres and create content that resonates with their audience.

Amazon’s Product Recommendations: Amazon utilizes customer purchase history and browsing behavior to suggest products to customers. This data-driven approach significantly influences consumer purchasing decisions.

Academic Examples

Climate Change Research: Scientists use government reports, academic papers, and satellite data to study climate patterns, predict future trends, and inform policy decisions.

Economic Forecasting: Economists rely on GDP data, employment statistics, and consumer spending patterns to forecast economic growth or recession.

Public Health Studies: Researchers use health records, epidemiological data, and government statistics to identify disease outbreaks, track health trends, and evaluate public health interventions.

Other Examples

Government Policy Making: Governments use census data, economic indicators, and social surveys to inform policy decisions on education, healthcare, and infrastructure.

Market Research Firms: Companies like Nielsen and Kantar collect and analyze consumer data to provide insights to businesses for market segmentation, product development, and advertising.

These examples highlight how secondary market research is used across various sectors to make informed decisions, develop strategies, and understand market trends.

Tips for Effective Secondary Market Research

Conducting effective secondary market research requires a systematic approach. Here are some tips:

Define Your Research Objectives Clearly

To conduct effective research, it’s crucial to clearly outline your objectives. Specificity in what you aim to achieve will guide your efforts, while ensuring that your research questions align with your business goals will maintain relevance throughout the process.

Identify Reliable Sources

Reliability is key in research, so prioritize sources with a strong reputation for accuracy. It’s also important to use a diverse range of sources to cross-verify information and ensure that the data you gather is current and relevant to your research.

Critically Evaluate Information

As you gather information, be mindful of potential biases that may affect the data. Consistency is vital, so compare information from different sources to identify any discrepancies. Additionally, consider the depth of the information provided to ensure a comprehensive understanding.

Organize and Analyze Data

Creating a structured system to organize your collected data is essential for effective analysis. Synthesize information from various sources to identify patterns and trends, and employ visualization techniques such as graphs and charts to represent your data clearly.

Leverage Technology

Take advantage of online databases to access a wide range of information. Utilize data analysis tools to efficiently analyze large datasets, and keep an eye on social media for insights into consumer sentiment.

Triangulation

To strengthen your findings, use data from multiple sources. Cross-verify the information you gather to ensure accuracy and reliability. By following these tips, you can maximize the value of secondary market research and make informed decisions.

Secondary market research is a powerful tool that can provide valuable insights for businesses, entrepreneurs, and professionals. By leveraging existing data, you can save time and resources while gaining a comprehensive understanding of the market landscape.

Whether you are looking to enter a new market, analyze competitors, or understand customer preferences, secondary market research offers a wealth of information to guide your decisions. Remember to use reliable sources, define clear objectives, and critically analyze the data to make the most of your research efforts.

Ready to take your market research to the next level? Start exploring the wealth of secondary data available and unlock new opportunities for your business.

For those seeking personalized guidance, consider booking a consultation with one of our market research experts. Together, we can help you harness the power of secondary market research to achieve your business goals.

Alice Ananian

Alice has over 8 years experience as a strong communicator and creative thinker. She enjoys helping companies refine their branding, deepen their values, and reach their intended audiences through language.

Related Articles

B2B Market Research: Benefits, Methods, and Examples

- June 28, 2024

How to Use Google Trends for Market Research in 2024

- July 17, 2024

Secondary Research Guide: Definition, Methods, Examples

Apr 3, 2024

8 min. read

The internet has vastly expanded our access to information, allowing us to learn almost anything about everything. But not all market research is created equal , and this secondary research guide explains why.

There are two key ways to do research. One is to test your own ideas, make your own observations, and collect your own data to derive conclusions. The other is to use secondary research — where someone else has done most of the heavy lifting for you.

Here’s an overview of secondary research and the value it brings to data-driven businesses.

Secondary Research Definition: What Is Secondary Research?

Primary vs Secondary Market Research

What Are Secondary Research Methods?

Advantages of secondary research, disadvantages of secondary research, best practices for secondary research, how to conduct secondary research with meltwater.

Secondary research definition: The process of collecting information from existing sources and data that have already been analyzed by others.

Secondary research (aka desk research or complementary research ) provides a foundation to help you understand a topic, with the goal of building on existing knowledge. They often cover the same information as primary sources, but they add a layer of analysis and explanation to them.

Users can choose from several secondary research types and sources, including:

- Journal articles

- Research papers

With secondary sources, users can draw insights, detect trends , and validate findings to jumpstart their research efforts.

Primary vs. Secondary Market Research

We’ve touched a little on primary research , but it’s essential to understand exactly how primary and secondary research are unique.

Think of primary research as the “thing” itself, and secondary research as the analysis of the “thing,” like these primary and secondary research examples:

- An expert gives an interview (primary research) and a marketer uses that interview to write an article (secondary research).

- A company conducts a consumer satisfaction survey (primary research) and a business analyst uses the survey data to write a market trend report (secondary research).

- A marketing team launches a new advertising campaign across various platforms (primary research) and a marketing research firm, like Meltwater for market research , compiles the campaign performance data to benchmark against industry standards (secondary research).

In other words, primary sources make original contributions to a topic or issue, while secondary sources analyze, synthesize, or interpret primary sources.

Both are necessary when optimizing a business, gaining a competitive edge , improving marketing, or understanding consumer trends that may impact your business.

Secondary research methods focus on analyzing existing data rather than collecting primary data . Common examples of secondary research methods include:

- Literature review . Researchers analyze and synthesize existing literature (e.g., white papers, research papers, articles) to find knowledge gaps and build on current findings.

- Content analysis . Researchers review media sources and published content to find meaningful patterns and trends.

- AI-powered secondary research . Platforms like Meltwater for market research analyze vast amounts of complex data and use AI technologies like natural language processing and machine learning to turn data into contextual insights.

Researchers today have access to more secondary research companies and market research tools and technology than ever before, allowing them to streamline their efforts and improve their findings.

Want to see how Meltwater can complement your secondary market research efforts? Simply fill out the form at the bottom of this post, and we'll be in touch.

Conducting secondary research offers benefits in every job function and use case, from marketing to the C-suite. Here are a few advantages you can expect.

Cost and time efficiency

Using existing research saves you time and money compared to conducting primary research. Secondary data is readily available and easily accessible via libraries, free publications, or the Internet. This is particularly advantageous when you face time constraints or when a project requires a large amount of data and research.

Access to large datasets

Secondary data gives you access to larger data sets and sample sizes compared to what primary methods may produce. Larger sample sizes can improve the statistical power of the study and add more credibility to your findings.

Ability to analyze trends and patterns

Using larger sample sizes, researchers have more opportunities to find and analyze trends and patterns. The more data that supports a trend or pattern, the more trustworthy the trend becomes and the more useful for making decisions.

Historical context

Using a combination of older and recent data allows researchers to gain historical context about patterns and trends. Learning what’s happened before can help decision-makers gain a better current understanding and improve how they approach a problem or project.

Basis for further research

Ideally, you’ll use secondary research to further other efforts . Secondary sources help to identify knowledge gaps, highlight areas for improvement, or conduct deeper investigations.

Tip: Learn how to use Meltwater as a research tool and how Meltwater uses AI.

Secondary research comes with a few drawbacks, though these aren’t necessarily deal breakers when deciding to use secondary sources.

Reliability concerns

Researchers don’t always know where the data comes from or how it’s collected, which can lead to reliability concerns. They don’t control the initial process, nor do they always know the original purpose for collecting the data, both of which can lead to skewed results.

Potential bias

The original data collectors may have a specific agenda when doing their primary research, which may lead to biased findings. Evaluating the credibility and integrity of secondary data sources can prove difficult.

Outdated information

Secondary sources may contain outdated information, especially when dealing with rapidly evolving trends or fields. Using outdated information can lead to inaccurate conclusions and widen knowledge gaps.

Limitations in customization

Relying on secondary data means being at the mercy of what’s already published. It doesn’t consider your specific use cases, which limits you as to how you can customize and use the data.

A lack of relevance

Secondary research rarely holds all the answers you need, at least from a single source. You typically need multiple secondary sources to piece together a narrative, and even then you might not find the specific information you need.

| Advantages of Secondary Research | Disadvantages of Secondary Research |

|---|---|

| Cost and time efficiency | Reliability concerns |

| Access to large data sets | Potential bias |

| Ability to analyze trends and patterns | Outdated information |

| Historical context | Limitations in customization |

| Basis for further research | A lack of relevance |

To make secondary market research your new best friend, you’ll need to think critically about its strengths and find ways to overcome its weaknesses. Let’s review some best practices to use secondary research to its fullest potential.

Identify credible sources for secondary research

To overcome the challenges of bias, accuracy, and reliability, choose secondary sources that have a demonstrated history of excellence . For example, an article published in a medical journal naturally has more credibility than a blog post on a little-known website.

Assess credibility based on peer reviews, author expertise, sampling techniques, publication reputation, and data collection methodologies. Cross-reference the data with other sources to gain a general consensus of truth.

The more credibility “factors” a source has, the more confidently you can rely on it.

Evaluate the quality and relevance of secondary data

You can gauge the quality of the data by asking simple questions:

- How complete is the data?

- How old is the data?

- Is this data relevant to my needs?

- Does the data come from a known, trustworthy source?

It’s best to focus on data that aligns with your research objectives. Knowing the questions you want to answer and the outcomes you want to achieve ahead of time helps you focus only on data that offers meaningful insights.

Document your sources

If you’re sharing secondary data with others, it’s essential to document your sources to gain others’ trust. They don’t have the benefit of being “in the trenches” with you during your research, and sharing your sources can add credibility to your findings and gain instant buy-in.

Secondary market research offers an efficient, cost-effective way to learn more about a topic or trend, providing a comprehensive understanding of the customer journey . Compared to primary research, users can gain broader insights, analyze trends and patterns, and gain a solid foundation for further exploration by using secondary sources.

Meltwater for market research speeds up the time to value in using secondary research with AI-powered insights, enhancing your understanding of the customer journey. Using natural language processing, machine learning, and trusted data science processes, Meltwater helps you find relevant data and automatically surfaces insights to help you understand its significance. Our solution identifies hidden connections between data points you might not know to look for and spells out what the data means, allowing you to make better decisions based on accurate conclusions. Learn more about Meltwater's power as a secondary research solution when you request a demo by filling out the form below:

Continue Reading

How To Do Market Research: Definition, Types, Methods

What Are Consumer Insights? Meaning, Examples, Strategy

Market Intelligence 101: What It Is & How To Use It

The 13 Best Market Research Tools in 2024

Consumer Intelligence: Definition & Examples

9 Top Consumer Insights Tools & Companies

What Is Desk Research? Meaning, Methodology, Examples

Top Secondary Market Research Companies | Desk Research Companies

Secondary Market Research: What It Is and How to Do It Fast

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

Secondary market research is cost-effective. There’s no professional training needed. And it’s a great place to find inspiration and ideas for growth, or explore a topic deeper before making strategic decisions. When you think about it, it’s how most types of research start out.

Whether you’re digging around on a rival’s website, reading industry news, or snooping on social media, it all counts.

So, sit back and take ten to discover everything you need to know about the what, why, and how to do secondary market research right.

For good measure, I’ve included examples of secondary market research and a detailed review of secondary research methods.

What is secondary market research?

By definition, secondary market research uses pre-existing data collected or published by a third party. It’s mainly used to establish key facts about a market, product, or service. It’s also known as desk-based research , and all you need is an internet connection to get started. There are plenty of places to obtain secondary data for free. These include internal and external sources, such as company sales and analytics data, industry or government reports, and published market research surveys .

To save time:

Choose the right secondary market research methods from the onset. And use a methodical approach to help you analyze a topic, spot trends, and decide whether further primary market research is worth it, or not.

Why is secondary market research important?

Finding cost and time-efficient ways to do market research is key. By leveraging prior efforts, you can build on existing research, uncover insights, and make informed decisions faster.

This type of market research presents a huge window of opportunity! As long as you’re willing to invest the time needed to gather and analyze the data. Particularly when you consider how much data is out there, and is never reviewed.

https://x.com/forrester/status/902218053768933377

Examples of secondary market research

All secondary market research types can be split into two subsets; internal and external.

- Internal sources come from data held within your organization.

These examples of secondary market research are for your eyes only. And because it’s data your rivals won’t be able to benefit from, it’s one of the most valuable activities you can do.

2. External sources come from outside your business.

External secondary research examples can be accessed by almost anyone, being openly available by nature.

By choosing the right secondary market research methods, you can significantly cut your research time and increase your speed to insight.

In June this year, over 500 business leaders and analysts shared their go-to sources of secondary market research with me via a survey on the HARO platform . The key ranking factors were speed, value, and ROI.

With these findings, I’ve collated a list of the best types of secondary market research.

Internal examples of secondary market research

1. Website and mobile app analytics

Think Google Analytics or your mobile app intelligence software . Both show data about people who interact with your business online. They can also help you understand the device split between desktop and mobile .

2. Customer data

Here, you get exclusive insights into your audience demographics. This is first-hand information about how people use your product or service, their likes, dislikes, and more.

3. Previously conducted research

Perhaps your business used analysts or carried out research in the past. So, even if it seems unrelated, it may be relevant to your research,

4. Historical marketing or campaign information

Things like conversions, website traffic , sales, and marketing data. It’s all going to help you build a picture that’ll impact your research.

External examples of secondary market research

Government and non-government agencies.

Whether you want to view global or country-specific data, there’s lots of free information here. See below for a quick guide to some of the best secondary data sources in the US.

- Congressional Research Service – Information is authoritative, objective, and timely. Topics include economy, finance, commerce, technology, and policy. Sources include infographics, reports, and posts.

- US Census Bureau – Produces more stats than any other agency in the US. Tables, articles, studies, and reports show current and historical data.

- US Small Business Administration – If you’re a small business, the SBA website is a goldmine. Use it to access reports and other data that are ideal for secondary market research purposes.

Read More: Get Growing with Small Business Market Research

- The Bureau of Labor Statistics – As an independent national statistical agency, it produces timely, unbiased reports that are highly relevant to modern-day economic and social issues. Its data retrieval tool is a game-changer for fast access to relevant data.