METHODS article

Time series analysis for psychological research: examining and forecasting change.

- 1 Department of Psychological Sciences, Purdue University, West Lafayette, IN, USA

- 2 Department of Psychology, University of Central Florida, Orlando, FL, USA

- 3 Department of Statistics, Purdue University, West Lafayette, IN, USA

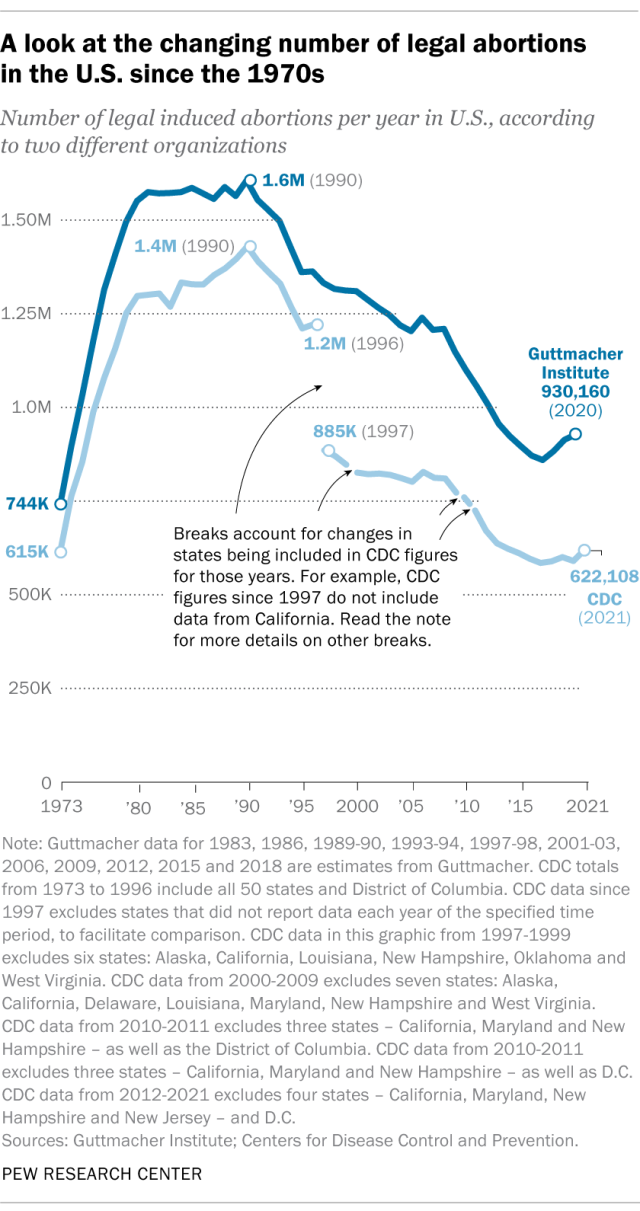

Psychological research has increasingly recognized the importance of integrating temporal dynamics into its theories, and innovations in longitudinal designs and analyses have allowed such theories to be formalized and tested. However, psychological researchers may be relatively unequipped to analyze such data, given its many characteristics and the general complexities involved in longitudinal modeling. The current paper introduces time series analysis to psychological research, an analytic domain that has been essential for understanding and predicting the behavior of variables across many diverse fields. First, the characteristics of time series data are discussed. Second, different time series modeling techniques are surveyed that can address various topics of interest to psychological researchers, including describing the pattern of change in a variable, modeling seasonal effects, assessing the immediate and long-term impact of a salient event, and forecasting future values. To illustrate these methods, an illustrative example based on online job search behavior is used throughout the paper, and a software tutorial in R for these analyses is provided in the Supplementary Materials.

Although time series analysis has been frequently used many disciplines, it has not been well-integrated within psychological research. In part, constraints in data collection have often limited longitudinal research to only a few time points. However, these practical limitations do not eliminate the theoretical need for understanding patterns of change over long periods of time or over many occasions. Psychological processes are inherently time-bound, and it can be argued that no theory is truly time-independent ( Zaheer et al., 1999 ). Further, its prolific use in economics, engineering, and the natural sciences may perhaps be an indicator of its potential in our field, and recent technological growth has already initiated shifts in data collection that proliferate time series designs. For instance, online behaviors can now be quantified and tracked in real-time, leading to an accessible and rich source of time series data (see Stanton and Rogelberg, 2001 ). As a leading example, Ginsberg et al. (2009) developed methods of influenza tracking based on Google queries whose efficiency surpassed conventional systems, such as those provided by the Center for Disease Control and Prevention. Importantly, this work was based in prior research showing how search engine queries correlated with virological and mortality data over multiple years ( Polgreen et al., 2008 ).

Furthermore, although experience sampling methods have been used for decades ( Larson and Csikszentmihalyi, 1983 ), nascent technologies such as smartphones allow this technique to be increasingly feasible and less intrusive to respondents, resulting in a proliferation of time series data. As an example, Killingsworth and Gibert (2010) presented an iPhone (Apple Incorporated, Cupertino, California) application which tracks various behaviors, cognitions, and affect over time. At the time their study was published, their database contained almost a quarter of a million psychological measurements from individuals in 83 countries. Finally, due to the growing synthesis between psychology and neuroscience (e.g., affective neuroscience, social-cognitive neuroscience) the ability to analyze neuroimaging data, which is strongly linked to time series methods (e.g., Friston et al., 1995 , 2000 ), is a powerful methodological asset. Due to these overarching trends, we expect that time series data will become increasingly prevalent and spur the development of more time-sensitive psychological theory. Mindful of the growing need to contribute to the methodological toolkit of psychological researchers, the present article introduces the use of time series analysis in order to describe and understand the dynamics of psychological change over time.

In contrast to these current trends, we conducted a survey of the existing psychological literature in order to quantify the extent to which time series methods have already been used in psychological science. Using the PsycINFO database, we searched the publication histories of 15 prominent journals in psychology 1 for the term “time series” in the abstract, keywords, and subject terms. This search yielded a small sample of 36 empirical papers that utilized time series modeling. Further investigation revealed the presence of two general analytic goals: relating a time series to other substantive variables (17 papers) and examining the effects of a critical event or intervention (9 papers; the remaining papers consisted of other goals). Thus, this review not only demonstrates the relative scarcity of time series methods in psychological research, but also that scholars have primarily used descriptive or causal explanatory models for time series data analysis ( Shmueli, 2010 ).

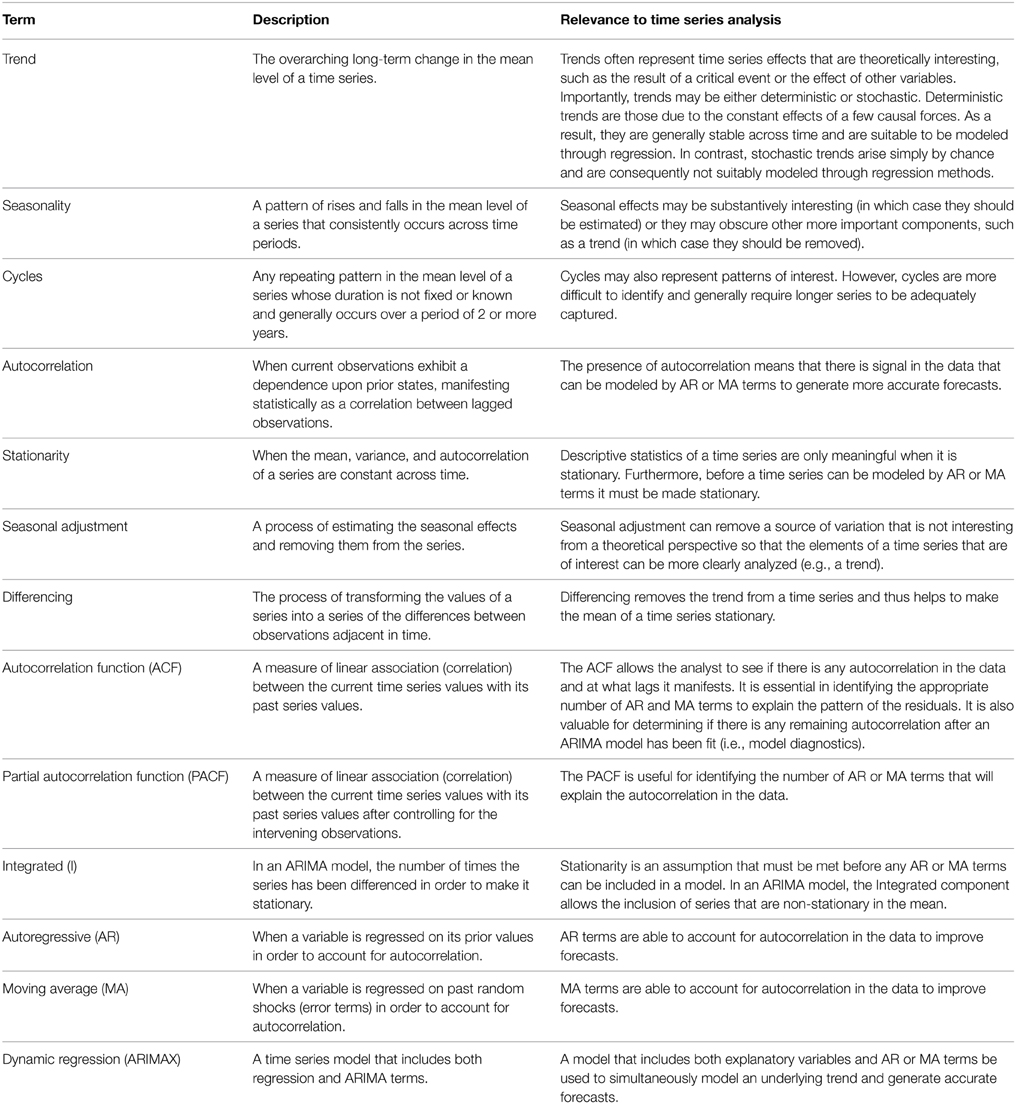

The prevalence of these types of models is typical of social science, but in fields where time series analysis is most commonly found (e.g., econometrics, finance, the atmospheric sciences), forecasting is often the primary goal because it bears on important practical decisions. As a result, the statistical time series literature is dominated by models that are aimed toward prediction , not explanation ( Shmueli, 2010 ), and almost every book on applied time series analysis is exclusively devoted to forecasting methods ( McCleary et al., 1980 , p. 205). Although there are many well-written texts on time series modeling for economic and financial applications (e.g., Rothman, 1999 ; Mills and Markellos, 2008 ), there is a lack of formal introductions geared toward psychological issues (see West and Hepworth, 1991 for an exception). Thus, a psychologist looking to use these methodologies may find themselves with resources that focus on entirely different goals. The current paper attempts to amend this by providing an introduction to time series methodologies that is oriented toward issues within psychological research. This is accomplished by first introducing the basic characteristics of time series data: the four components of variation (trend, seasonality, cycles, and irregular variation), autocorrelation, and stationarity. Then, various time series regression models are explicated that can be used to achieve a wide range of goals, such as describing the process of change through time, estimating seasonal effects, and examining the effect of an intervention or critical event. Not to overlook the potential importance of forecasting for psychological research, the second half of the paper discusses methods for modeling autocorrelation and generating accurate predictions—viz., autoregressive integrative moving average (ARIMA) modeling. The final section briefly describes how regression techniques and ARIMA models can be combined in a dynamic regression model that can simultaneously explain and forecast a time series variable. Thus, the current paper seeks to provide an integrative resource for psychological researchers interested in analyzing time series data which, given the trends described above, are poised to become increasingly prevalent.

The Current Illustrative Application

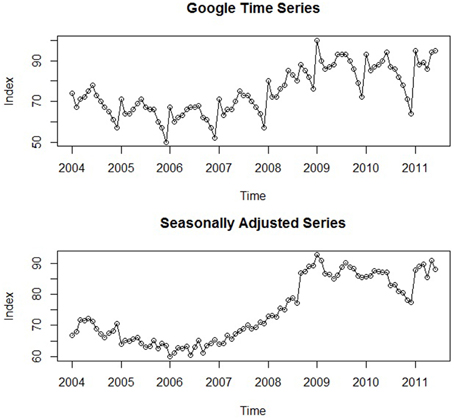

In order to better demonstrate how time series analysis can accomplish the goals of psychological research, a running practical example is presented throughout the current paper. For this particular illustration, we focused on online job search behaviors using data from Google Trends, which compiles the frequency of online searches on Google over time. We were particularly interested in the frequency of online job searches in the United States 2 and the impact of the 2008 economic crisis on these rates. Our primary research hypothesis was that this critical event resulted in a sharp increase in the series that persisted over time. The monthly frequencies of these searches from January 2004 to June 2011 were recorded, constituting a data set of 90 total observations. Figure 1 displays a plot of this original time series that will be referenced throughout the current paper. Importantly, the values of the series do not represent the raw number of Google searches, but have been normalized (0–100) in order to yield a more tractable data set; each monthly value represents its percentage relative to the maximum observed value 3 .

Figure 1. A plot of the original Google job search time series and the series after seasonal adjustment .

A Note on Software Implementation

Conceptual expositions of new analytical methods can often be undermined by the practical issue of software implementation ( Sharpe, 2013 ). To preempt this obstacle, for each analysis we provide accompanying R code in the Supplementary Material, along with an intuitive explanation of the meanings and rationale behind the various commands and arguments. On account of its versatility, the open-source statistical package R ( R Development Core Team, 2011 ) remains the software platform of choice for performing time series analyses, and a number of introductory texts are oriented solely toward this program, such as Introductory Time Series with R ( Cowpertwait and Metcalfe, 2009 ), Time Series Analysis with Applications in R ( Cryer and Chan, 2008 ), and Time Series Analysis and Its Applications with R Examples ( Shumway and Stoffer, 2006 ). In recent years, R has become increasingly recognized within the psychological sciences as well ( Muenchen, 2013 ). We believe that psychological researchers with even a minimal amount of experience with R will find this tutorial both informative and accessible.

An Introduction to Time Series Data

Before introducing how time series analyses can be used in psychological research, it is necessary to first explicate the features that characterize time series data. At its simplest, a time series is a set of time-ordered observations of a process where the intervals between observations remain constant (e.g., weeks, months, years, and minor deviations in the intervals are acceptable; McCleary et al., 1980 , p. 21; Cowpertwait and Metcalfe, 2009 ). Time series data is often distinguished from other types of longitudinal data by the number and source of the observations; a univariate time series contains many observations originating from a single source (e.g., an individual, a price index), while other forms of longitudinal data often consist of several observations from many sources (e.g., a group of individuals). The length of time series can vary, but are generally at least 20 observations long, and many models require at least 50 observations for accurate estimation ( McCleary et al., 1980 , p. 20). More data is always preferable, but at the very least, a time series should be long enough to capture the phenomena of interest.

Due to its unique structure, a time series exhibits characteristics that are either absent or less prominent in the kinds of cross-sectional and longitudinal data typically collected in psychological research. In the next sections, we review these features that include autocorrelation and stationarity . However, we begin by delineating the types of patterns that may be present within a time series. That is, the variation or movement in a series can be partitioned into four parts: the trend, seasonal, cyclical , and irregular components ( Persons, 1919 ).

The Four Components of Time Series

Trend refers to any systematic change in the level of a series—i.e., its long-term direction ( McCleary et al., 1980 , p. 31; Hyndman and Athanasopoulos, 2014 ). Both the direction and slope (rate of change) of a trend may remain constant or change throughout the course of the series. Globally, the illustrative time series shown in Figure 1 exhibits a positive trend: The level of the series at the end is systematically higher than at its beginning. However, there are sections in this particular series that do not exhibit the same rate of increase. The beginning of the series displays a slight negative trend, and starting approximately at 2006, the series significantly rises until 2009, after which a small downward trend may even be present.

Because a trend in the data represents a significant source of variability, it must be accounted for when performing any time series analysis. That is, it must be either (a) modeled explicitly or (b) removed through mathematical transformations (i.e., detrending ; McCleary et al., 1980 , p. 32). The former approach is taken when the trend is theoretically interesting—either on its own or in relation to other variables. Conversely, removing the trend (through methods discussed later) is performed when this component is not pertinent to the goals of the analysis (e.g., strict forecasting). The decision of whether to model or remove systematic components like a trend represents an important aspect of time series analysis. The various characteristics of time series data are either of theoretical interest—in which case they should be modeled—or not, in which case they should be removed so that the aspects that are of interest can be more easily analyzed. Thus, it is incumbent upon the analyst to establish the goals of the analysis and determine which components of a time series are of interest and treat them accordingly. This topic will be revisited throughout the forthcoming sections.

Seasonality

Unlike the trend component, the seasonal component of a series is a repeating pattern of increase and decrease in the series that occurs consistently throughout its duration. More specifically, it can be defined as a cyclical or repeating pattern of movement within a period of 1 year or less that is attributed to “seasonal” factors—i.e., those related to an aspect of the calendar (e.g., the months or quarters of a year or the days of a week; Cowpertwait and Metcalfe, 2009 , p. 6; Hyndman and Athanasopoulos, 2014 ). For instance, restaurant attendance may exhibit a weekly seasonal pattern such that the weekends routinely display the highest levels within the series across weeks (i.e., the time period), and the first several weekdays are consistently the lowest. Retail sales often display a monthly seasonal pattern, where each month across yearly periods consistently exhibits the same relative position to the others: viz., a spike in the series during the holiday months and a marked decrease in the following months. Importantly, the pattern represented by a seasonal effect remains constant and occurs over the same duration on each occasion ( Hyndman and Athanasopoulos, 2014 ).

Although its underlying pattern remains fixed, the magnitude of a seasonal effect may vary across periods. Seasonal effects can also be embedded within overarching trends. Along with a marked trend, the series in Figure 1 exhibits noticeable seasonal fluctuations as well; at the beginning of each year (i.e., after the holiday months), online job searches spike and then fall significantly in February. After February, they continue to rise until about July or August, after which the series significantly drops for the remainder of the year, representing the effects of seasonal employment. Notice the consistency of both the form (i.e., pattern of increase and decrease) and magnitude of this seasonal effect. The fact that online job search behavior exhibits seasonal patterns supports the idea that this behavior (and this example in particular) is representative of job search behavior in general. In the United States, thousands of individuals engage in seasonal work which results in higher unemployment rates in the beginning of each year and in the later summer months (e.g., July and August; The United States Department of Labor, Bureau of Labor Statistics, 2014 ), manifesting in a similar seasonal pattern of job search behavior.

One may be interested in the presence of seasonal effects, but once identified, this source of variation is often removed from the time series through a procedure known as seasonal adjustment ( Cowpertwait and Metcalfe, 2009 , p. 21). This is in keeping with the aforementioned theme: Once a systematic component has been identified, it must either be modeled or removed. The popularity of seasonal adjustment is due to the characteristics of seasonal effects delineated above: Unlike other more dynamic components of a time series, seasonal patterns remain consistent across periods and are generally similar in magnitude ( Hyndman and Athanasopoulos, 2014 ). Their effects may also obscure other important features of time series—e.g., a previously unnoticed trend or cycles described in the following section. Put simply, “seasonal adjustment is done to simplify data so that they may be more easily interpreted…without a significant loss of information” ( Bell and Hillmer, 1984 , p. 301). Unemployment rates are often seasonally adjusted to remove the fluctuations due to the effects of weather, harvests, and school schedules that remain more or less constant across years. In our data, the seasonal effects of job search behavior are not of direct theoretical interest relative to other features of the data, such as the underlying trend and the impact of the 2008 economic crisis. Thus, we may prefer to work with the simpler seasonally adjusted series. The lower panel of Figure 1 displays the original Google time series after seasonal adjustment, and the Supplementary Material contains a description of how to implement this procedure in R. It can be seen that the trend is made notably clearer after removing the seasonal effects. Despite the spike at the very end, the suspected downward trend in the later part of the series is much more evident. This insight will prove to be important when selecting an appropriate time series model in the upcoming sections.

A cyclical component in a time series is conceptually similar to a seasonal component: It is a pattern of fluctuation (i.e., increase or decrease) that reoccurs across periods of time. However, unlike seasonal effects whose duration is fixed across occurrences and are associated with some aspect of the calendar (e.g., days, months), the patterns represented by cyclical effects are not of fixed duration (i.e., their length often varies from cycle to cycle) and are not attributable to any naturally-occurring time periods ( Hyndman and Athanasopoulos, 2014 ). Put simply, cycles are any non-seasonal component that varies in a recognizable pattern (e.g., business cycles; Hyndman and Athanasopoulos, 2014 ). In contrast to seasonal effects, cycles generally occur over a period lasting longer than 2 years (although they may be shorter), and the magnitude of cyclical effects is generally more variable than that of seasonal effects ( Hyndman and Athanasopoulos, 2014 ). Furthermore, just as the previous two components—trend and seasonality—can be present with or without the other, a cyclical component may be present with any combination of the other two. For instance, a trend with an intrinsic seasonal effect can be embedded within a greater cyclical pattern that occurs over a period of several years. Alternatively, a cyclical effect may be present without either of these two systematic components.

In the 7 years that constitute the time series of Figure 1 , there do not appear to be any cyclical effects. This is expected, as there are no strong theoretical reasons to believe that online or job search behavior is significantly influenced by factors that consistently manifest across a period of over one year. We have significant a priori reasons to believe that causal factors related to seasonality exist (e.g., searching for work after seasonal employment), but the same does not hold true for long-term cycles, and the time series is sufficiently long enough to capture any potential cyclical behavior.

Irregular Variation (Randomness)

While the previous three components represented three systematic types of time series variability (i.e., signal ; Hyndman and Athanasopoulos, 2014 ), the irregular component represents statistical noise and is analogous to the error terms included in various types of statistical models (e.g., the random component in generalized linear modeling). It constitutes any remaining variation in a time series after these three systematic components have been partitioned out. In time series parlance, when this component is completely random (i.e., not autocorrelated), it is referred to as white noise , which plays an important role in both the theory and practice of time series modeling. Time series are assumed to be in part driven by a white noise process (explicated in a future section), and white noise is vital for judging the adequacy of a time series model. After a model has been fit to the data, the residuals form a time series of their own, called the residual error series . If the statistical model has been successful in accounting for all the patterns in the data (e.g., systematic components such as trend and seasonality), the residual error series should be nothing more than unrelated white noise error terms with a mean of zero and some constant variance. In other words, the model should be successful in extracting all the signal present in the data with only randomness left over ( Cowpertwait and Metcalfe, 2009 , p. 68). This is analogous to evaluating the residuals of linear regression, which should be normally distributed around a mean of zero.

Time Series Decomposition

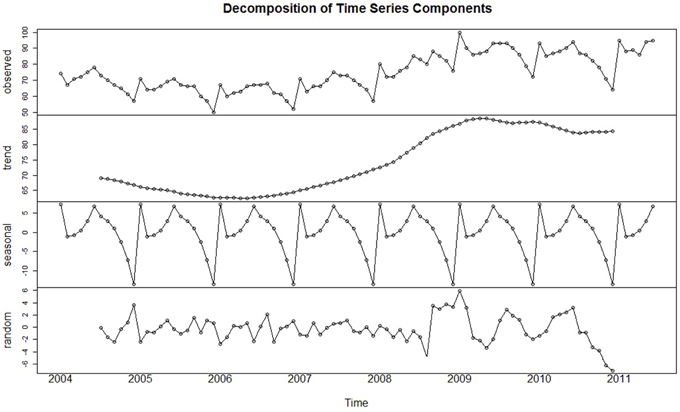

To visually examine a series in an exploratory fashion, time series are often formally partitioned into each of these components through a procedure referred to as time series decomposition . Figure 2 displays the original Google time series (top panel) decomposed into its constituent parts. This figure depicts what is referred to as classical decomposition , when a time series is conceived of comprising three components: a trend-cycle, seasonal, and random component. (Here, the trend and cycle are combined because the duration of each cycle is unknown; Hyndman and Athanasopoulos, 2014 ). The classic additive decomposition model ( Cowpertwait and Metcalfe, 2009 , p. 19) describes each value of the time series as the sum of these three components:

Figure 2. The original time series decomposed into its trend, seasonal, and irregular (i.e., random) components . Cyclical effects are not present within this series.

The additive decomposition model is most appropriate when the magnitude of the trend-cycle and seasonal components remain constant over the course of the series. However, when the magnitude of these components varies but still appears proportional over time (i.e., it changes by a multiplicative factor), the series may be better represented by the multiplicative decomposition model, where each observation is the product of the trend-cycle, seasonal, and random components:

In either decomposition model, each component is sequentially estimated and then removed until only the stochastic error component remains (the bottom panel of Figure 2 ). The primary purpose of time series decomposition is to provide the analyst with a better understanding of the underlying behavior and patterns of the time series which can be valuable in determining the goals of the analysis. Decomposition models can be used to generate forecasts by adding or multiplying future estimates of the seasonal and trend-cycle components ( Hyndman and Athanasopoulos, 2014 ). However, such models are beyond the scope of this present paper, and the ARIMA forecasting models discussed later are generally superior 4 .

Autocorrelation

In psychological research, the current state of a variable may partially depend on prior states. That is, many psychological variables exhibit autocorrelation : when a variable is correlated with itself across different time points (also referred to as serial dependence ). Time series designs capture the effect of previous states and incorporate this potentially significant source of variance within their corresponding statistical models. Although the main features of many time series are its systematic components such as trend and seasonality, a large portion of time series methodology is aimed at explaining the autocorrelation in the data ( Dettling, 2013 , p. 2).

The importance of accounting for autocorrelation should not be overlooked; it is ubiquitous in social science phenomena ( Kerlinger, 1973 ; Jones et al., 1977 ; Hartmann et al., 1980 ; Hays, 1981 ). In a review of 44 behavioral research studies with a total of 248 independent sets of repeated measures data, Busk and Marascuilo (1988) found that 80% of the calculated autocorrelations ranged from 0.1 to 0.49, and 40% exceeded 0.25. More specific to the psychological sciences, it has been proposed that state-related constructs at the individual-level, such as emotions and arousal, are often contingent on prior states ( Wood and Brown, 1994 ). Using autocorrelation analysis, Fairbairn and Sayette (2013) found that alcohol use reduces emotional inertia, the extent to which prior affective states determine current emotions. Through this, they were able to marshal support for the theory of alcohol myopia , the intuitive but largely untested idea that alcohol allows a greater enjoyment of the present, and thus formally uncovered an affective motivation for alcohol use (and misuse). Further, using time series methods, Fuller et al. (2003) found that job stress in the present day was negatively related to the degree of stress in the preceding day. Accounting for autocorrelation can therefore reveal new information on the phenomenon of interest, as the Fuller et al. (2003) analysis led to the counterintuitive finding that lower stress was observed after prior levels had been high.

Statistically, autocorrelation simply represents the Pearson correlation for a variable with itself at a previous time period, referred to as the lag of the autocorrelation. For instance, the lag-1 autocorrelation of a time series is the correlation of each value with the immediately preceding observation; a lag-2 autocorrelation is the correlation with the value that occurred two observations before. The autocorrelation with respect to any lag can be computed (e.g., a lag-20 autocorrelation), and intuitively, the strength of the autocorrelation generally diminishes as the length of the lag increases (i.e., as the values become further removed in time).

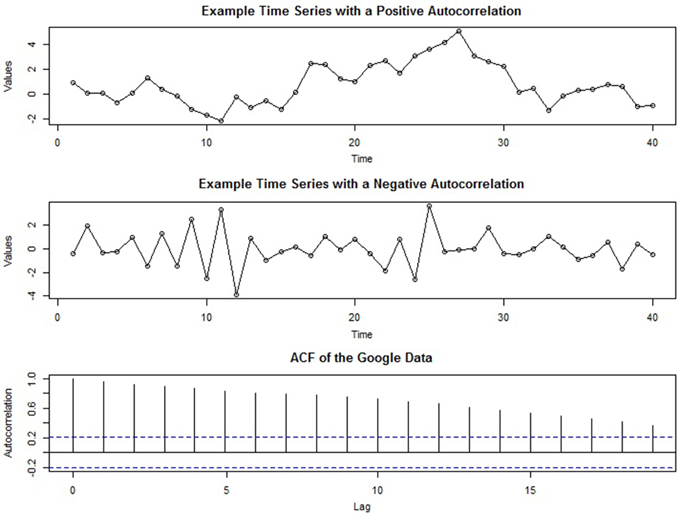

Strong positive autocorrelation in a time series manifests graphically by “runs” of values that are either above or below the average value of the time series. Such time series are sometimes called “persistent” because when the series is above (or below) the mean value it tends to remain that way for several periods. Conversely, negative autocorrelation is characterized by the absence of runs—i.e., when positive values tend to follow negative values (and vice versa). Figure 3 contains two plots of time series intended to give the reader an intuitive understanding of the presence of autocorrelation: The series in the top panel exhibits positive autocorrelation, while the center panel illustrates negative autocorrelation. It is important to note that the autocorrelation in these series is not obscured by other components and that in real time series, visual analysis alone may not be sufficient to detect autocorrelation.

Figure 3. Two example time series displaying exaggerated positive (top panel) and negative (center panel) autocorrelation . The bottom panel depicts the ACF of the Google job search time series after seasonal adjustment.

In time series analysis, the autocorrelation coefficient across many lags is called the autocorrelation function (ACF) and plays a significant role in model selection and evaluation (as discussed later). A plot of the ACF of the Google job search time series after seasonal adjustment is presented in the bottom panel of Figure 3 . In an ACF plot, the y-axis displays the strength of the autocorrelation (ranging from positive to negative 1), and the x-axis represents the length of the lags: from lag-0 (which will always be 1) to much higher lags (here, lag-19). The dotted horizontal line indicates the p < 0.05 criterion for statistical significance.

Stationarity

Definition and purpose.

A complication with time series data is that its mean, variance, or autocorrelation structure can vary over time. A time series is said to be stationary when these properties remain constant ( Cryer and Chan, 2008 , p. 16). Thus, there are many ways in which a series can be non-stationary (e.g., an increasing variance over time), but it can only be stationary in one-way (viz., when all of these features do not change).

Stationarity is a pivotal concept in time series analysis because descriptive statistics of a series (e.g., its mean and variance) are only accurate population estimates if they remain constant throughout the series ( Cowpertwait and Metcalfe, 2009 , pp. 31–32). With a stationary series, it will not matter when the variable is observed: “The properties of one section of the data are much like those of any other” ( Chatfield, 2004 , p. 13). As a result, a stationary series is easy to predict: Its future values will be similar to those in the past ( Nua, 2014 ). As a result, stationarity is the most important assumption when making predictions based on past observations ( Cryer and Chan, 2008 , p. 16), and many times series models assume the series already is or can be transformed to stationarity (e.g., the broad class of ARIMA models discussed later).

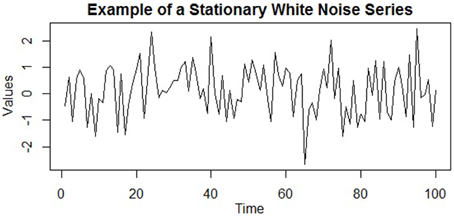

In general, a stationary time series will have no predictable patterns in the long-term; plots will show the series to be roughly horizontal with some constant variance ( Hyndman and Athanasopoulos, 2014 ). A stationary time series is illustrated in Figure 4 , which is a stationary white noise series (i.e., a series of uncorrelated terms). The series hovers around the same general region (i.e., its mean) with a consistent variance around this value. Despite the observations having a constant mean, variance, and autocorrelation, notice how such a process can generate outliers (e.g., the low extreme value after t = 60), as well as runs of values that are both above or below the mean. Thus, stationarity does not preclude these temporary and fluctuating behaviors of the series, although any systematic patterns would.

Figure 4. An example of a stationary time series (specifically, a series of uncorrelated white noise terms) . The mean, variance, and autocorrelation are all constant over time, and the series displays no systematic patterns, such as trends or cycles.

However, many time series in real life are dominated by trends and seasonal effects that preclude stationarity. A series with a trend cannot be stationary because, by definition, a trend is when the mean level of the series changes over time. Seasonal effects also preclude stationarity, as they are reoccurring patterns of change in the mean of the series within a fixed time period (e.g., a year). Thus, trend and seasonality are the two time series components that must be addressed in order to achieve stationarity.

Transforming a Series to Stationarity

When a time series is not stationary, it can be made so after accounting for these systematic components within the model or through mathematical transformations. The procedure of seasonal adjustment described above is a method that removes the systematic seasonal effects on the mean level of the series.

The most important method of stationarizing the mean of a series is through a process called differencing , which can be used to remove any trend in the series which is not of interest. In the simplest case of a linear trend, the slope (i.e., the change from one period to the next) remains relatively constant over time. In such a case, the difference between each time period and its preceding one (referred to as the first differences ) are approximately equal. Thus, one can effectively “detrend” the series by transforming the original series into a series of first differences ( Meko, 2013 ; Hyndman and Athanasopoulos, 2014 ). The underlying logic is that forecasting the change in a series from one period to the next is just as useful in practice as predicting the original series values.

However, when the time series exhibits a trend that itself changes (i.e., a non-constant slope), then even transforming a series into a series of its first differences may not render it completely stationary. This is because when the slope itself is changing (e.g., an exponential trend), the difference between periods will be unequal. In such cases, taking the first differences of the already differenced series (referred to as the second differences ) will often stationarize the series. This is because each successive differencing has the effect of reducing the overall variance of the series ( Anderson, 1976 ), as deviations from the mean level are increasingly reduced through this subtractive process. The second differences (i.e., the first differences of the already differenced series) will therefore further stabilize the mean. There are general guidelines on how many orders of differencing are necessary to stationarize a series. For instance, the first or second differences will nearly always stationarize the mean, and in practice it is almost never necessary to go beyond second differencing ( Cryer and Chan, 2008 ; Hyndman and Athanasopoulos, 2014 ). However, for series that exhibit higher-degree polynomial trends, the order of differencing required to stationarize the series is typically equal to that degree (e.g., two orders of differencing for an approximately quadratic trend, three orders for a cubic trend; Cowpertwait and Metcalfe, 2009 , p. 93).

A common mistake in time series modeling to “overdifference” the series, when more orders of differencing than are required to achieve stationarity are performed. This can complicate the process of building an adequate and parsimonious model (see McCleary et al., 1980 , p. 97). Fortunately, overdifferencing is relatively easy to identify; differencing a series with a trend will have the effect of reducing the variance of the series, but an unnecessary degree of differencing will increase its variance ( Anderson, 1976 ). Thus, the optimal order of differencing is that which results in the lowest variance of the series.

If the variance of a times series is not constant over time, a common method of making the variance stationary is through a logarithmic transformation of the series ( Cowpertwait and Metcalfe, 2009 , pp. 109–112; Hyndman and Athanasopoulos, 2014 ). Taking the logarithm has the practical effect of reducing each value at an exponential rate. That is, the larger the value, the more its value is reduced. Thus, this transformation stabilizes the differences across values (i.e., its variance) which is also why it is frequently used to mitigate the effect of outliers (e.g., Aguinis et al., 2013 ). It is important to remember that if one applies a transformation, any forecasts generated by the selected model will be in these transformed units. However, once the model is fitted and the parameters estimated, one can reverse these transformations to obtain forecasts in its original metric.

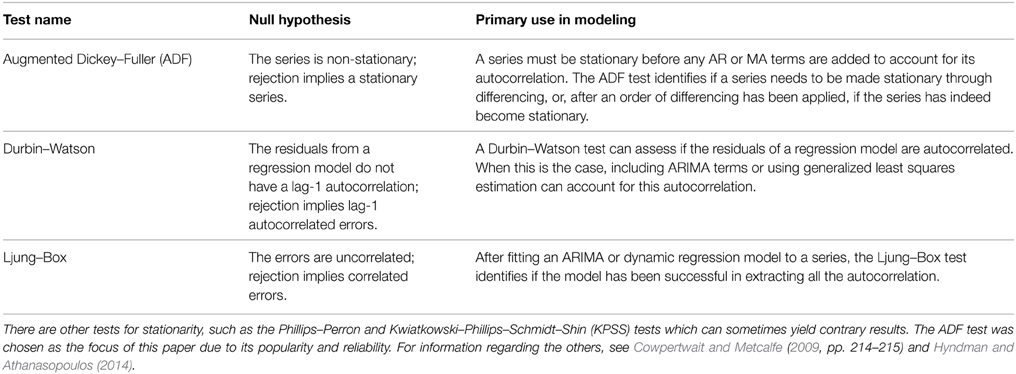

Finally, there are also formal statistical tests for stationarity, termed unit root tests. A very popular procedure is the augmented Dickey–Fuller test (ADF; Said and Dickey, 1984 ) which tests the null hypothesis that the series is non-stationary. Thus, rejection of the null provides evidence for a stationary series. Table 1 below contains information regarding the ADF test, as well as descriptions of other various statistical tests frequently used in time series analysis that will be discussed in the remainder of the paper. By using the ADF test in conjunction with the transformations described above (or the modeling procedures delineated below), an analyst can ensure that a series conforms to stationarity.

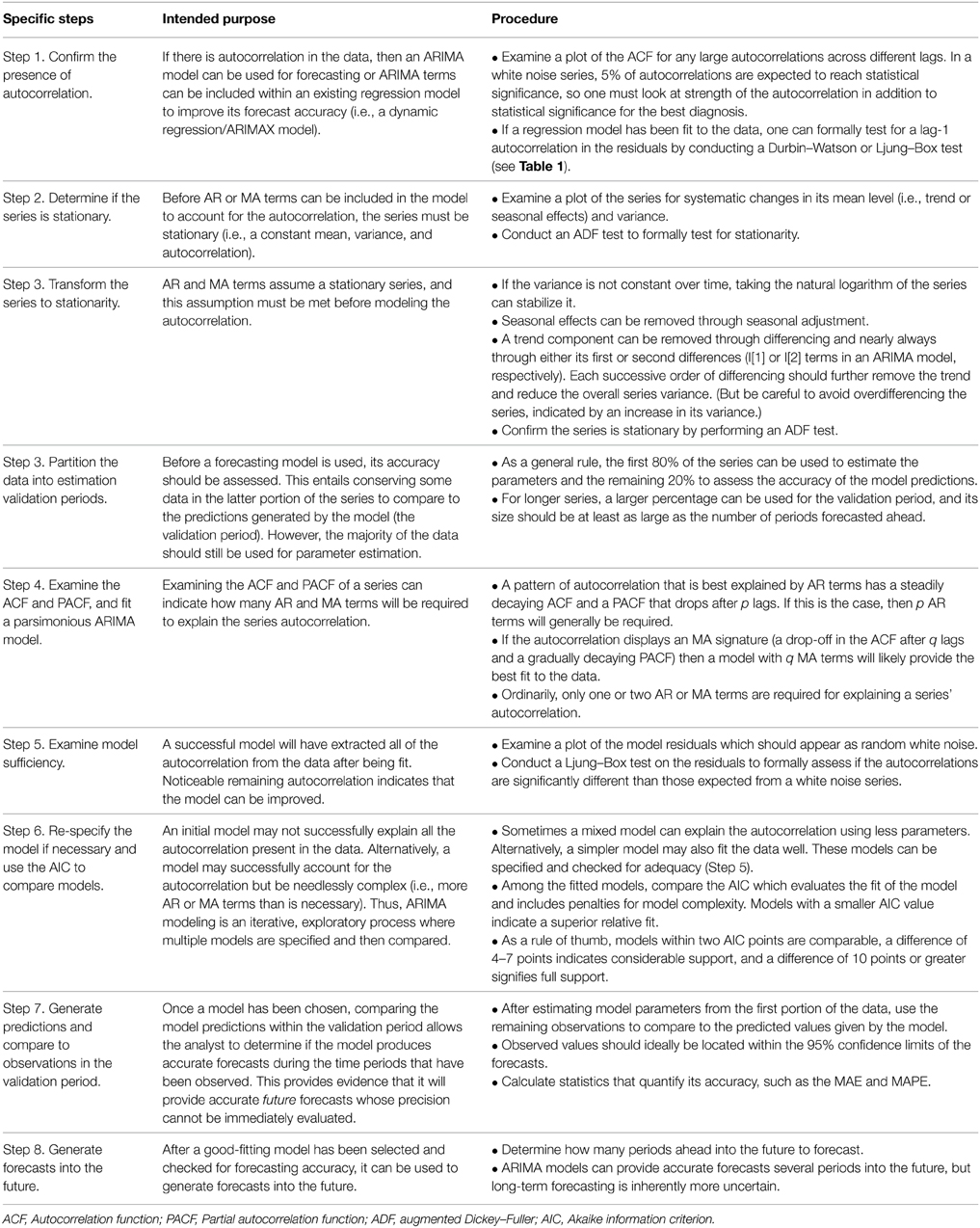

Table 1. Common tests in time series analysis .

Time Series Modeling: Regression Methods

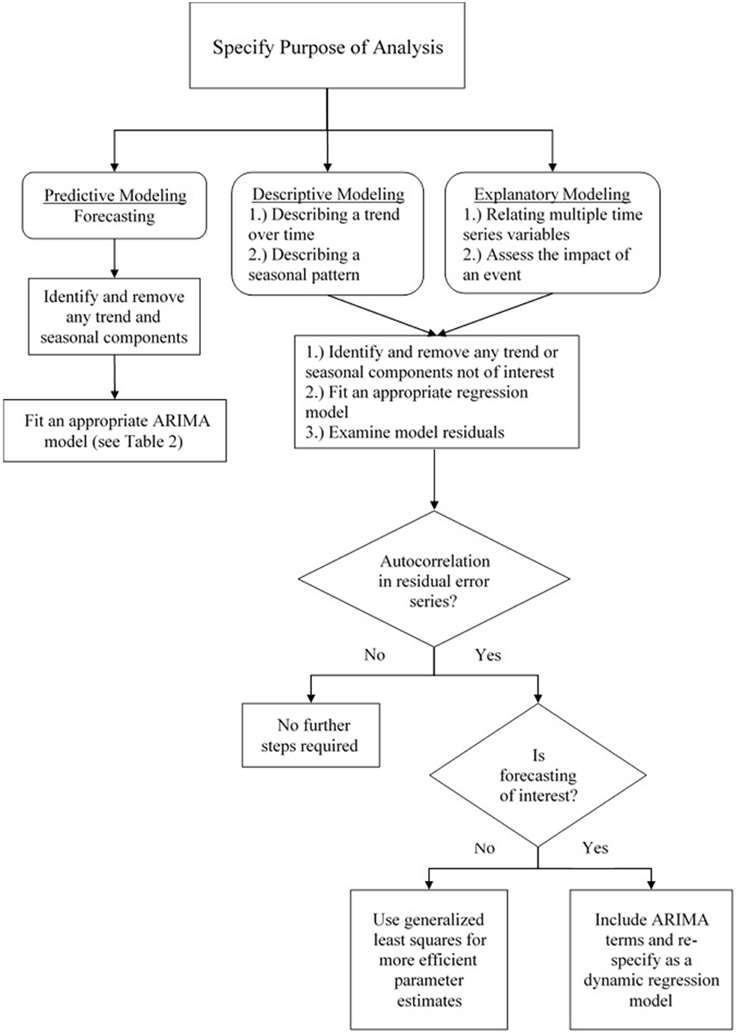

The statistical time series literature is dominated by methodologies aimed at forecasting the behavior of a time series ( Shmueli, 2010 ). Yet, as the survey in the introduction illustrated, psychological researchers are primarily interested in other applications, such as describing and accounting for an underlying trend, linking explanatory variables to the criterion of interest, and assessing the impact of critical events. Thus, psychological researchers will primarily use descriptive or explanatory models, as opposed to predictive models aimed solely at generating accurate forecasts. In time series analysis, each of the aforementioned goals can be accomplished through the use of regression methods in a manner very similar to the analysis of cross-sectional data. After having explicated the basic properties of time series data, we now discuss these specific modeling approaches that are able fulfill these purposes. The next four sections begin by first providing an overview of each type of regression model, how psychological research stands to gain from the use of these methods, and their corresponding statistical models. We include mathematical treatments, but also provide conceptual explanations so that they may be understood in an accessible and intuitive manner. Additionally, Figure 5 presents a flowchart depicting different time series models and which approaches are best for addressing the various goals of psychological research. As the current paper continues, the reader will come to understand the meaning and structure of these models and their relation to substantive research questions.

Figure 5. A flowchart depicting various time series modeling approaches and how they are suited to address various goals in psychological research .

It is important to keep in mind that time series often exhibit strong autocorrelation which often manifests in correlated residuals after a regression model has been fit. This violates the standard assumption of independent (i.e., uncorrelated) errors. In the section that follows these regression approaches, we describe how the remaining autocorrelation can be included in the model by building a dynamic regression model that includes ARIMA terms 5 . That is, a regression model can be first fit to the data for explanatory or descriptive modeling, and ARIMA terms can be fit to the residuals in order to account for any remaining autocorrelation and improve forecasts ( Hyndman and Athanasopoulos, 2014 ). However, we begin by introducing regression methods separate from ARIMA modeling, temporarily setting aside the issue of autocorrelation. This is done in order to better focus on the implementation of these models, but also because violating this assumption has minimal effects on the substance of the analysis: The parameter estimates remain unbiased and can still be used for prediction. Its forecasts will not be “wrong,” but inefficient —i.e., ignoring the information represented by the autocorrelation that could be used to obtain better predictions ( Hyndman and Athanasopoulos, 2014 ). Additionally, generalized least squares estimation (as opposed to ordinary least squares) takes into account the effects of autocorrelation which otherwise lead to underestimated standard errors ( Cowpertwait and Metcalfe, 2009 , p. 98). This estimation procedure was used for each of the regression models below. For further information on regression methods for time series, the reader is directed to Hyndman and Athanasopoulos (2014 , chaps. 4, 5) and McCleary et al. (1980) , which are very accessible introductions to the topic, as well as Cowpertwait and Metcalfe (2009 , chap. 5) and Cryer and Chan (2008 , chaps. 3, 11) for more mathematically-oriented treatments.

Modeling Trends through Regression

Modeling an observed trend in a time series through regression is appropriate when the trend is deterministic —i.e., the trend is due to the constant, deterministic effects of a few causal forces ( McCleary et al., 1980 , p. 34). As a result, a deterministic trend is generally stable across time. Expecting any trend to continue indefinitely is often unrealistic, but for a deterministic trend, linear extrapolation can provide accurate forecasts for several periods ahead, as forecasting generally assumes that trends will continue and change relatively slowly ( Cowpertwait and Metcalfe, 2009 , p. 6). Thus, when the trend is deterministic, it is desirable to use a regression model that includes the hypothesized causal factors as predictors ( Cowpertwait and Metcalfe, 2009 , p. 91; McCleary et al., 1980 , p. 34).

Deterministic trends stand in contrast to stochastic trends, those that arise simply from the random movement of the variable over time (long runs of similar values due to autocorrelation; Cowpertwait and Metcalfe, 2009 , p. 91). As a result, stochastic trends often exhibit frequent and inexplicable changes in both slope and direction. When the trend is deemed to be stochastic, it is often removed through differencing. There are also methods for forecasting using stochastic trends (e.g., random walk and exponential smoothing models) discussed in Cowpertwait and Metcalfe (2009 , chaps. 3, 4) and Hyndman and Athanasopoulos (2014 , chap. 7). However, the reader should be aware that these are predictive models only, as there is nothing about a stochastic trend that can be explained through external, theoretically interesting factors (i.e., it is a trend attributable to randomness). Therefore, attempting to model it deterministically as a function of time or other substantive variables via regression can lead to spurious relationships ( Kuljanin et al., 2011) and inaccurate forecasts, as the trend is unlikely to remain stable over time.

Returning to the example Google time series of Figure 1 , the evident trend in the seasonally adjusted series might appear to be stochastic: It is not constant but changes at several points within the series. However, we have strong theoretical reasons for modeling it deterministically, as the 2008 economic crisis is one causal factor that likely had a profound impact on the series. Thus, this theoretical rationale implies that the otherwise inexplicable changes in its trend are due to systematic forces that can be appropriately modeled within an explanatory approach (i.e., as a deterministic function of predictors).

The Linear Regression Model

As noted in the literature review, psychological researchers are often directly interested in describing an underlying trend. For example, ( Fuller et al. (2003) examined the strain of university employees using a time series design. They found that each self-report item displayed the same deterministic trend: Globally, strain increased over time even though the perceived severity of the stressful events did not increase. Levels of strain also decreased at spring break and after finals week, during which mood and job satisfaction also exhibited rising levels. This finding cohered with prior theory on the accumulating nature of stress and the importance of regular strain relief (e.g., Bolger et al., 1989 ; Carayon, 1995) . Furthermore, Wagner et al. (1988) examined the trend in employee productivity after the implementation of an incentive-based wage system. In addition to discovering an immediate increase in productivity, it was found that productivity increased over time as well (i.e., a continuing deterministic trend). This trend gradually diminished over time, but was still present at the end of the study period—nearly 6 years after the intervention first occurred.

By visually examining a time series, an analyst can describe how a trend changes as function of time. However, one can formally assess the behavior of a trend by regressing the series on a variable that represents time (e.g., 1–50 for 50 equally-spaced observations). In the simplest case, the trend can be modeled as a linear function of time, which is conceptually identical to a regression model for cross-sectional data using a single predictor:

where the coefficient b 1 estimates the amount of change in the time series associated with a one-unit increase in time, t is the time variable, and ε t is random error. The constant, b 0 , estimates the level of the series when t = 0.

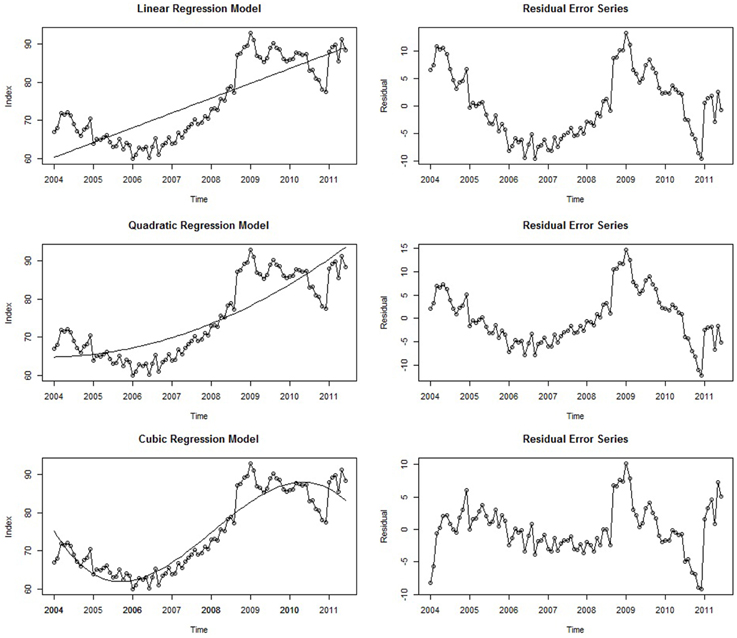

If a deterministic trend is fully accounted for by a linear regression model, the residual error series (i.e., the collection of residuals which themselves form a time series) will not contain any remaining trend component; that is, this non-stationary behavior of the series will have been accounted for Cowpertwait and Metcalfe (2009) , (p. 121). Returning to our empirical example, the linear regression model displayed in Equation (3) was fit to the seasonally adjusted Google job search data. This is displayed in the top left panel of Figure 6 . The regression line of best-fit is superimposed, and the residual error series is shown in the panel directly to the right. Here, time is a significant predictor ( b 1 = 0.32, p < 0.001), and the model accounts for 67% of the seasonally-adjusted series variance ( R 2 = 0.67, p < 0.001). However, the residual error series displays a notable amount of remaining trend that has been left unaccounted for; the first half of the error series has a striking downward trend that begins to rise at around 2007. This is because the regression line is constrained to linearity and therefore systematically underestimates and overestimates the values of the series when the trend exhibits runs of high and low values, respectively. Importantly, the forecasts from the simple linear model will most likely be very poor as well. Although there is a spike at the end of the series, the linear model predicts that values further ahead in time will be even higher. By contrast, we actually expect these values to decrease, similar to how there was a decreasing trend in 2008 right after the first spike. Thus, despite accounting for a considerable amount of variance and serving as a general approximation of the series trend, the linear model is insufficient in several systematic ways, manifesting in inaccurate forecasts and a significant remaining trend in the residual error series. A method for improving this model is to add in a higher-order polynomial term; modeling the trend as quadratic, cubic, or an even higher-order function may lead to a better-fitting model, but the analyst must be vigilant of overfitting the series—i.e., including so many parameters that the statistical noise becomes modeled. Thus, striking a balance between parsimony and explanatory capability should always be a consideration when modeling time series (and statistical modeling in general). Although a simple linear regression on time is often adequate to approximate a trend ( Cowpertwait and Metcalfe, 2009 , p. 5), in this particular instance a higher-order term may provide a better fit to the complex deterministic trend seen within this series.

Figure 6. Three different regression models with time as the regressor and their associated residual error series .

Polynomial Regression Models

When describing the trend in the Google data earlier, it was noted that the series began to display a rising trend approximately a third of the way into the series, implying that a quadratic regression model (i.e., a single bend) may yield a good fit to the data. Furthermore, our initial hypothesis was that job search behavior proceeded at a generally constant rate and then spiked once the economic crisis began—also implying a quadratic trend. In some time series, the trend over time will be non-linear, and the predictor terms can be specified to reflect such higher-order terms (quadratic, cubic, etc.). Just like when modeling cross-sectional data, non-linear terms can be incorporated into the statistical model by squaring the predictor (here, time) 6 :

The center panels in Figure 6 show the quadratic model and its residual error series. In line with the initial hypothesis, both the quadratic term ( b 2 = 0.003, p < 0.001) and linear term ( b 1 = 0.32, p < 0.001) were statistically significant. Thus, modeling the trend as a quadratic function of time explained an additional 4% of the series variance relative to the more parsimonious linear model ( R 2 = 0.71, p < 0.001). However, examination of this series and its residuals shows that it is not as different from the linear model than was expected; although the first half of the residual error series has a more stable mean level, there are still noticeable trends in the first half of the residual error series, and the forecasts implied by this model are even higher than those of the linear model. Therefore, a cubic trend may provide an even better fit, as there are two apparent bends in the series:

After fitting this model to the Google data, 87% of the series variance is accounted for ( R 2 = 0.87 p < 0.001), and all three coefficients are statistically significant: b 1 = 0.69, p < 0.001, b 2 = 0.003, p = 0.05, and b 3 = −0.0003, p < 0.001. Furthermore, the forecasts implied by the model are much more realistic. Ultimately, it is unlikely that this model will provide accurate forecasts many periods into the future (as is often the case for regression models; Cowpertwait and Metcalfe, 2009 , p. 6; Hyndman and Athanasopoulos, 2014 ). It is more likely that either (a) a negative trend will return the series back to more moderate levels or (b) the series will simply continue at a generally high level. Furthermore, relative to the linear model, the residual error series of this model appears much closer to stationarity (e.g., Figure 4 ), as the initial downward trend of the time series is captured. Therefore, modeling the series as a cubic function of time is the most successful in terms of accounting for the trend, and adding an even higher-order polynomial term has little remaining variance to explain (<15%) and would likely lead to an overfitted model. Thus, relative to the two previous models, the cubic model strikes a balance between relative parsimony and descriptive capability. However, any forecasts from this model could be improved upon by removing the remaining trend and including other terms that account for any autocorrelation in the data, topics discussed in an upcoming section on ARIMA modeling.

Interrupted Time Series Analysis

Although we are interested in describing the underlying trend within the Google time series as a function of time, we are also interested in the effect of a critical event, represented by the following question: “Did the 2008 economic crisis result in elevated rates job search behaviors?” In psychological science, many research questions center on the impact of an event, whether it be a relationship change, job transition, or major stressor or uplift ( Kanner et al., 1981 ; Dalal et al., 2014 ). In the survey of how time series analysis had been previously used in psychological research, examining the impact of an event was one of its most common uses. In time series methodology, questions regarding the impact of events can be analyzed through interrupted time series analysis (or intervention analysis ; Glass et al., 1975 ), in which the time series observations are “interrupted” by an intervention, treatment, or incident occurring at a known point in time ( Cook and Campbell, 1979 ).

In both academic and applied settings, psychological researchers are often constrained to correlational, cross-sectional data. As a result, researchers rarely have the ability to implement control groups within their study designs and are less capable of drawing conclusions regarding causality. In the majority of cases, it is the theory itself that provides the rationale for drawing causal inferences ( Shmueli, 2010 , p. 290). In contrast, an interrupted time series is the strongest quasi-experimental design to evaluate the longitudinal impact of an event ( Wagner et al., 2002 , p. 299). In a review of previous research on the efficacy of interventions, Beer and Walton (1987) stated, “much of the research overlooks time and is not sufficiently longitudinal. By assessing the events and their impact at only one nearly contemporaneous moment, the research cannot discuss how permanent the changes are” (p. 343). Interrupted time series analysis ameliorates this problem by taking multiple measurements both before and after the event, thereby allowing the analyst to examine the pre- and post-event trend.

Collecting data at multiple time points also offers advantages relative to cross-sectional comparisons based on pre- and post-event means. A longitudinal interrupted time series design allows the analyst to control for the trend prior to the event, which may turn out to be the cause of any alleged intervention effect. For instance, in the field of industrial/organizational psychology, Pearce et al. (1985) found a positive trend in four measures of organizational performance over the course of the 4 years under study. However, after incorporating the effects of the pre-event trend in the analysis, neither the implementation of the policy nor the first year of merit-based rewards yielded any additional effects. That is, the post-event trends were almost totally attributable to the pre-event behavior of the series. Thus, a time series design and analysis yielded an entirely different and more parsimonious conclusion that might have otherwise been drawn. In contrast, Wagner et al. (1988) was able to show that that for non-managerial employees, an incentive-based wage system substantially increased employee productivity in both its baseline level and post-intervention slope (the baseline level jumped over 100%). Thus, interrupted time series analysis is an ideal method for examining the impacts of such events and can be generalized to other criteria of interest.

Modeling an Interrupted Time Series

Statistical modeling of an interrupted time series can be accomplished through segmented regression analysis ( Wagner et al., 2002 , p. 300). Here, the time series is partitioned into two parts: the pre- and post-event segments whose levels (intercepts) and trends (slopes) are both estimated. A change in these parameters represents an effect of the event: A significant change in the level of the series indicates an immediate change, and a change in trend reflects a more gradual change in the outcome (and of course, both are possible; Wagner et al., 2002 , p. 300). The formal model reflects these four parameters of interest:

Here, b 0 represents the pre-event baseline level, t is the predictor time (in our example, coded 1–90), and its coefficient, b 1, estimates the trend prior to the event ( Wagner et al., 2002 , p. 31). The dummy variable event t codes for whether or not each time point occurred before or after the event (0 for all points prior to the event; 1 for all points after). Its coefficient, b 2 , assesses the post-event baseline level (intercept). The variable t after event represents how many units after the event the observation took place (0 for all points prior to the event; 1, 2, 3 … for subsequent time points), and its coefficient, b 3 , estimates the change in trend over the two segments. Therefore, the sum of the pre-event trend ( b 1 ) and its estimated change ( b 3 ) yields the post-event slope ( Wagner et al., 2002 , p. 301).

Importantly, this analysis requires that the time of event occurrence be specified a priori, otherwise a researcher may search the series in an “exploratory” fashion and discover a time point that yields a notable effect, resulting in potentially spurious results ( McCleary et al., 1980 , p. 143). In our example, the event of interest was the economic crisis of 2008. However, as is often the case when analyzing large-scale social phenomena, it was not a discrete, singular incident, but rather unfolded over time. Thus, no exact point in time can perfectly represent its moment of occurrence. In other topics of psychological research, the event of interest is a unique post-event time may be identified. Although interrupted time series analysis requires that events be discrete, this conceptual problem can be easily managed in practice; selecting a point of demarcation that generally reflects when the event occurred will still allow the statistical model to assess the impact of the event on the level and trend of the series. Therefore, due to prior theory and for simplicity, we specified the pre- and post-crisis segments to be separated at January 2008, representing the beginning of the economic crisis and acknowledging that this demarcation was imperfect, but one that would still allow the substantive research question of interest to be answered.

Although not utilized in our analysis, when analyzing an interrupted time series using segmented regression one has the option of actually specifying the post-event segment after the actual event occurred. The rationale behind this is to accommodate the time it takes for the causal effect of the event itself manifest in the time series—the equilibration period (see Mitchell and James, 2001 , p. 539; Wagner et al., 2002 , p. 300). Although an equilibration period is likely a component of all causal phenomena (i.e., causal effects probably never fully manifest at once), two prior reviews have illustrated that researchers account for it only infrequently, both theoretically and empirically ( Kelly and McGrath, 1988 ; Mitchell and James, 2001 ). Statistically, this is accomplished through the segmented regression model above, but simply coding the event as occurring later in the series. Comparing models with different post-event start times can also allow competitive tests of the equilibration period.

Empirical Example

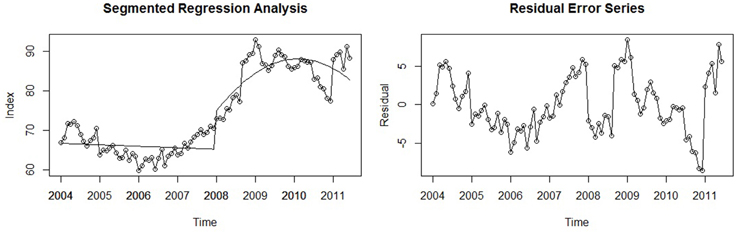

For our working example, a segmented regression model was fit to the seasonally adjusted Google time series: A linear trend estimated the first segment and a quadratic trend was fit to the second due to the noted curvilinear form of the second half of the series. Thus, a new variable and coefficient were added to the formal model to account for this non-linearity: t after event 2 and b 4 , respectively. The results of the analysis indicated that there was a practically significant effect of the crisis: The parameter representing an immediate change in the post-event level was b 2 = 8.66, p < 0.001. Although the level (i.e., intercept) differed across segments, the post-crisis trend appears to be the most notable change in the series. That is, the real effect of the crisis unfolded over time rather than having an immediately abrupt impact. This is reflected in the other coefficients of the model: The pre-crisis trend was estimated to be near zero ( b 1 = −0.03, p = 0.44), and the post-crisis trend terms were b 3 = 0.70, p < 0.001 for the linear component, and b 4 = −0.02, p < 0.001 for the quadratic term, indicating that there was a marked change in trend, but also that it was concave (i.e., on the whole, slowly decreasing over time). Graphically the model seems to capture the underlying trend of both segments exceptionally well ( R 2 = 0.87, p < 0.001), as the residual error series has almost reached stationarity ( ADF = −3.38, p = 0.06). Both are shown in Figure 7 below.

Figure 7. A segmented regression model used to assess the effect of the 2008 economic crisis on the time series and its associated residual error series .

Estimating Seasonal Effects

Up until now, we have chosen to remove any seasonal effects by working with the seasonally adjusted time series in order to more fully investigate a trend of substantive interest. This was consistent with the following adage of time series modeling: When a systematic trend or seasonal pattern is present, it must either be modeled or removed. However, psychological researchers may also be interested in the presence and nature of a seasonal effect, and seasonal adjustment would only serve to remove this component of interest. Seasonality was defined earlier as any regular pattern of fluctuation (i.e., movement up or down in the level of the series) associated with some aspect of the calendar. For instance, although online job searchers exhibited an underlying trend in our data across years, they also display the same pattern of movement within each year (i.e., across months; see Figure 1 ). Following the need for more time-based theory and empirical research, seasonal effects are also increasingly recognized as significant for psychological science. In a recent conceptual review Dalal et al. (2014) noted that, “mood cycles… are likely to occur simultaneously over the course of a day (relatively short term) and over the course of a year (long term)” (p. 1401). Relatedly, Larsen and Kasimatis (1990) used time series methods to examine the stability of mood fluctuations across individuals. They uncovered a regular weekly fluctuation that was stronger for introverted individuals than for extraverts (due to the latter's sensation-seeking behavior that resulted in greater mood variability).

Furthermore, many systems of interest exhibit rhythmicity. This can be readily observed across a broad spectrum of phenomena that are of interest to psychological researchers. At the individual level, there is a long history in biopsychology exploring the cyclical pattern of human behavior as a function of biological processes. Prior research has consistently shown that humans possess many common physiological and behavioral cycles that range from 90-min to 365-days ( Aschoff, 1984 ; Almagor and Ehrlich, 1990 ) and may affect important psychological outcomes. For instance, circadian rhythms are particularly well-known and are associated with physical, mental, and behavioral changes within a 24-h period ( McGrath and Rotchford, 1983 ). It has been suggested that peak motivation levels may occur at specific points in the day ( George and Jones, 2000 ), and longer cyclical fluctuations of emotion, sensitivity, intelligence, and physical characteristics over days and weeks have been identified (for a review, see Conroy and Mills, 1970 ; Luce, 1970 ; Almagor and Ehrlich, 1990 ). Such cycles have been found to affect intelligence test performance and other physical and cognitive tasks (e.g., Latman, 1977 ; Kumari and Corr, 1996 ).

Regression with Seasonal Indicators

As previously stated, when seasonal effects are theoretically important, seasonal adjustment is undesirable because it removes the time series component pertinent to the research question at large. An alternative is to qualitatively describe the seasonal pattern or formally specify a regression model that includes a variable which estimates the effect of each season. If a simple linear approximation is used for the trend, the formal model can be expressed as:

where b 0 is now the estimate of the linear relationship between the dependent variable and time, and the coefficients b 1:S are estimates of the S seasonal effects (e.g., S = 12 for yearly data; Cowpertwait and Metcalfe, 2009 , p. 100). Put more intuitively, this model can still be conceived of as a linear model but with a different estimated intercept for each season that represents its effect (Notice that the b 1:S parameters are not coefficients but constants).

As an example, the model above was fit to the original, non-seasonally adjusted Google data. Although modeling the series as a linear function of time was found to produce inaccurate forecasts, it can be used when estimating seasonal effects because this component of the model does not affect the estimates of the seasonal effects. For our data, the estimates of each monthly effect were: b 1 = 67.51, b 2 = 59.43, b 3 = 60.11, b 4 = 60.66, b 5 = 63.59, b 6 = 66.77, b 7 = 63.70, b 8 = 62.38, b 9 = 60.49, b 10 = 56.88, b 11 = 52.13, b 12 = 45.66 (Each effect was statistically significant at p < 0.001). The pattern of these intercepts mirrors the pattern of movement qualitatively described in the discussion on the seasonal component: Online job search behaviors begin at its highest levels in January ( b 1 = 67.51), likely due to the end of holiday employment, and then dropped significantly in February ( b 2 = 59.43). Subsequently, its level continued to rise during the next 4 months until June ( b 6 = 66.77), after which the series decreased each successive month until reaching its lowest point in December ( b 12 = 45.66).

Harmonic Seasonal Models

Another approach to modeling seasonal effects is to fit a harmonic seasonal model that uses sine and cosine functions to describe the pattern of fluctuations seen across periods. Seasonal effects often vary in a smooth, continuous fashion, and instead of estimating a discrete intercept for each season, this approach can provide a more realistic model of seasonal change (see Cowpertwait and Metcalfe, 2009 , pp. 101–108). Formally, the model is:

where m t is the estimate of the trend at t (approximated as a linear or polynomial function of time), s i and c i are the unknown parameters of interest, S is the number of seasons within the time period (e.g., 12 months for a yearly period), i is an index that ranges from 1 to S/2 , and t is a variable that is coded to represent time (e.g., 1:90 for 90 equally-spaced observations). Although this model is complex, it can be conceived as including a predictor for each season that contains a sine and/or cosine term. For yearly data, this means that six s and six c coefficients estimate the seasonal pattern ( S/2 coefficients for each parameter type). Importantly, after this initial model is estimated, the coefficients that are not statistically significant can be dropped, which often results in fewer parameters relative to the seasonal indicator model introduced first ( Cowpertwait and Metcalfe, 2009 , p. 104). For our data, the above model was fit using a linear approximation for the trend, and five of the original twelve seasonal coefficients were statistically significant and thus retained: c 1 = −5.08, p < 0.001, s 2 = 2.85, p = 0.005, s 3 = 2.68, p = 0.009, c 3 = −2.25, p = 0.03, c 5 = −2.97, p = 0.004. This model also explained a substantial amount of the series variance ( R 2 = 0.75, p < 0.001). Pre-made and annotated R code for this analysis can be found in the Supplementary Material.

Time Series Forecasting: ARIMA ( p, d, q ) Modeling

In the preceding section, a number of descriptive and explanatory regression models were introduced that addressed various topics relevant to psychological research. First, we sought to determine how the trend in the series could be best described as a function of time. Three models were fit to the data, and modeling the trend as a cubic function provided the best fit: It was the most parsimonious model that explained a very large amount of variation in the series, it did not systematically over or underestimate many successive observations, and any potential forecasts were clearly superior relative to those of the simpler linear and quadratic models. In the subsequent section, a segmented regression analysis was conducted in order to examine the impact of the 2008 economic crisis on job search behavior. It was found that there was both a significant immediate increase in the baseline level of the series (intercept) and a concomitant increase in its trend (i.e., slope) that gradually decreased over time. Finally, the seasonal effects of online search behavior were estimated and mirrored the pattern of job employment rates described in a prior section.

From these analyses, it can be seen that the main features of many times series are the trend and seasonal components that must either be modeled as deterministic functions of predictors or removed from the series. However, as previously described, another critical feature in time series data is its autocorrelation , and a large portion of time series methodology is aimed at explaining this component ( Dettling, 2013 , p. 2). Primarily, accounting for autocorrelation entails fitting an ARIMA model to the original series, or adding ARIMA terms to a previously fit regression model; ARIMA models are the most general class of models that seek to explain the autocorrelation frequently found in time series data ( Hyndman and Athanasopoulos, 2014 ). Without these terms, a regression model will ignore the pattern of autocorrelation among the residuals and produce less accurate forecasts ( Hyndman and Athanasopoulos, 2014 ). Therefore, ARIMA models are predictive forecasting models . Time series models that include both regression and ARIMA terms are referred to as dynamic models and may be a primary type of time series models used by psychological researchers.

Although not strongly emphasized within psychological science, forecasting is an important aspect of scientific verification ( Popper, 1968 ). Standard cross-sectional and longitudinal models are generally used in an explanatory fashion (e.g., estimating the relationships among constructs and testing null hypotheses), but they are quite capable of prediction as well. Because of the ostensible movement to more time-based empirical research and theory, predicting future values will likely become a more important aspect of statistical modeling, as it can validate psychological theory ( Weiss and Cropanzano, 1996 ) and computational models ( Tobias, 2009 ) that specify effects over time.

At the outset, it is helpful to note that the regression and ARIMA modeling approaches are not substantially different: They both formalize the variation in the time series variable as a function of predictors and some stochastic noise (i.e., the error term). The only practical difference is that while regression models are generally built from prior research or theory, ARIMA models are developed empirically from the data (as will be seen presently; McCleary et al., 1980 , p. 20). In describing ARIMA modeling, the following sections take the form of those discussing regression methods: Conceptual and mathematical treatments are provided in complement in order to provide the reader with a more holistic understanding of these methodologies.

Introduction

The first step in ARIMA modeling is to visually examine a plot of the series' ACF (autocorrelation function) to see if there is any autocorrelation present that can be used to improve the regression model—or else the analyst may end up adding unnecessary terms. The ACF for the Google data is shown in Figure 3 . Again, we will work with the seasonally adjusted series for simplicity. More formally, if a regression model has been fit, the Durbin–Watson test can be used to assess if there is autocorrelation among the residuals and if ARIMA terms can be included to improve its forecasts. The Durbin–Watson test tests the null hypothesis that there is no lag-1 autocorrelation present in the residuals. Thus, a rejection of the null means that ARIMA terms can be included (the Ljung–Box test described below can also be used; Hyndman and Athanasopoulos, 2014 ).

Although the modeling techniques described in the present and following sections can be applied to any one of these models, due to space constraints we continue the tutorial on time series modeling using the cubic model of the first section. A model with only one predictor (viz., time) will allow more focus on the additional model terms that will be added to account for the autocorrelation in the data.

I( d ): integrated

ARIMA is an acronym formed by the three constituent parts of these models. The AR( p ) and MA( q ) components are predictors that explain the autocorrelation. In contrast, the integrated (I[ d ]) portion of ARIMA models does not add predictors to the forecasting equation. Rather, it indicates the order of differencing that has been applied to the time series in order to remove any trend in the data and render it stationary. Before any AR or MA terms can be included, the series must be stationary . Thus, ARIMA models allow non-stationary series to be modeled due to this “integrated” component (an advantage over simpler ARMA models that do not include such terms; Cowpertwait and Metcalfe, 2009 , p. 137). A time series that has been made stationary by taking the d difference of the original series is notated as I( d ). For instance, an I(1) model indicates that the series that has been made stationary by taking its first differences, I(2), by the second differences (i.e., the first differences of the first differences), etc. Thus, the order of integrated terms in an ARIMA model merely specifies how many iterations of differencing were performed in order to make the series stationary so that AR and MA terms may be included.

Identifying the Order of Differencing

Identifying the appropriate order of differencing to stationarize the series is the first and perhaps most important step in selecting an ARIMA model ( Nua, 2014 ). It is also relatively straightforward. As stated previously, the order of differencing rarely needs to be greater than two in order to stationarize the series. Therefore, in practice the choice comes down to whether the series is transformed into either its first or second differences, the optimal choice being the order of differencing that results in the lowest series variance (and does not result in an increase in variance that characterizes overdifferencing).

AR( p ): Autoregressive Terms

The first part of an ARIMA model is the AR( p ) component, which stands for autoregressive . As correlation is to regression, autocorrelation is to autoregression. That is, in regression, variables that are correlated with the criterion can be used for prediction, and the model specifies the criterion as a function of the predictors. Similarly, with a variable that is autocorrelated (i.e., correlated with itself across time periods), past values can serve as predictors, and the values of the time series are modeled as a function of previous values (thus, autoregression ). In other words, an ARIMA ( p, d, q ) model with p AR terms is simply a linear regression of the time series values against the preceding p observations. Thus, an ARIMA(1, d, q ) model includes one predictor, the observation immediately preceding the current value, and an ARIMA(2, d, q ) model includes two predictors, the first and second preceding observations. The number of these autoregressive terms is called the order of the AR component of the ARIMA model. The following equation uses one AR term (an AR[1] model) in which the preceding value in the time series is used as a regressor:

where ϕ is the autoregressive coefficient (interpretable as a regression coefficient), and y t−1 is the immediately preceding observation. More generally, a model with AR( p ) terms is expressed as:

Selecting the Number of Autoregressive Terms

The number of autoregressive terms required depends on how many lagged observations explain a significant amount of unique autocorrelation in the time series. Again, an analogy can be made to multiple linear regression: Each predictor should account for a significant amount of variance after controlling for the others. However, a significant autocorrelation at higher lags may be attributable to an autocorrelation at a lower lag. For instance, if a strong autocorrelation exists at lag-1, then a significant lag-3 autocorrelation (i.e., a correlation of time t with t -3) may be a result of t being correlated with t -1, t -1 with t -2, and t -2 with t -3 (and so forth). That is, a strong autocorrelation at an early lag can “persist” throughout the time series, inducing significant autocorrelations at higher lags. Therefore, instead of inspecting the ACF which displays zero-order autocorrelations, a plot of the partial autocorrelation function (PACF) across different lags is the primary method in determining which prior observations explain a significant amount of unique autocorrelation, and accordingly, how many AR terms (i.e., lagged observations as predictors) should be included. Put simply, the PACF displays the autocorrelation of each lag after controlling for the autocorrelation due to all preceding lags ( McCleary et al., 1980 , p. 75). A conventional rule is that if there is a sharp drop in the PACF after p lags, then the previous p -values are responsible for the autocorrelation in the series, and the model should include p autoregressive terms (the partial autocorrelation coefficient typically being the value of the autoregressive coefficient, ϕ; Cowpertwait and Metcalfe, 2009 , p. 81). Additionally, the ACF of such a series will gradually decay (i.e., reduce) toward zero as the lag increases.

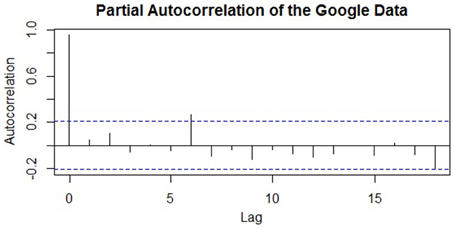

Applying this knowledge to the empirical example, Figure 3 depicted the ACF of the seasonally adjusted Google time series, and Figure 8 displays its PACF. Here, only one lagged partial autocorrelation is statistically significant (lag-6), despite over a dozen autocorrelations in the ACF reaching significance. Thus, it is probable that early lags—and the lag-6 in particular—are responsible for the chain of autocorrelation that persists throughout the series. Although the series is considerably non-stationary (i.e., there is a marked trend and seasonal component), if the series was already stationary, then a model with a single AR term (an AR[1] model) would likely provide the best fit, given a single significant partial autocorrelation at lag-6. The ACF in Figure 3 also displays the characteristics of an AR(1) series: It has many significant autocorrelations that gradually reduce toward zero. This coheres with the notion that one AR term is often sufficient for a residual time series ( Cowpertwait and Metcalfe, 2009 , p. 121). However, if the pattern of autocorrelation is more complex, then additional AR terms may be required. Importantly, if a particular number of AR terms have been successful in explaining the autocorrelation of a stationary series, the residual error series should appear as entirely random white noise (as in Figure 4 ).

Figure 8. A plot of the partial autocorrelation function (PACF) of the seasonally adjusted time series of Google job searches .

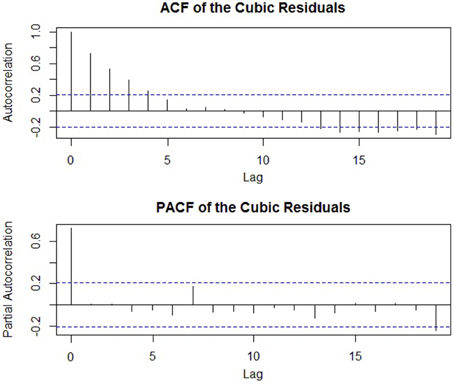

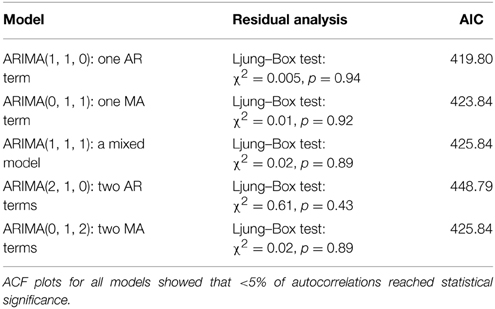

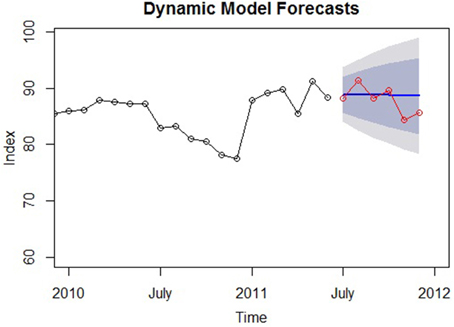

MA( q ): Moving Average Terms