- Harvard Business School →

- Interviewing

- Negotiating

- Getting Started

- Develop Your Career Vision

Resumes & Cover Letters

- Diversity, Inclusion & Belonging Questions for Hiring Organizations

Leverage LinkedIn

- Generative AI

- Finding Job Opportunities

- Salary & Career Trends

- U.S. Business Immigration Overview

- Global Opportunity Fellowship GO: AFRICA

- Virtual Job Search Teams

- Resumes & Cover Letters →

Resumes: What You Need to Know

The resume is an opportunity to market yourself to a prospective employer. It should be succinct, target an employer's needs, and distinguish you from your competitors. Before you get started, think about your strengths, weaknesses, personal preferences, and motivations. You should also consider the company's needs, who your competition might be, and your unique skill set. The best way to convince employers that you will add value is to show them that you've done it before.

Alumni Resume Book

Our Alumni Resume Book connects you with organizations looking for talent. Visit 12twenty (our recruiting platform) and upload your resume to get started. You should complete your Profile in 12twenty by updating your Background tab which contains information about your career experience, skills, preferences and more. Ensuring your Background tab is complete and accurate will greatly improve your chance of being contacted by an organization. Looking to connect with fellow HBS alumni? Upload your resume to the Alumni Networking Resume Book to kick start those connections.

Resume Makeover Using VMock and Aspire

Gain instant feedback on your resume and LinkedIn Profile

VMock is a smart career platform that provides instant personalized feedback on your resume and LinkedIn Profile to help improve aspects like presentation, language, and skills.

VMock Smart Editor tool will enable you to:

- Receive an objective score on your resume based on recruiter criteria

- Review line-for-line targeted feedback on your resume

- Re-upload your resume up to 10 times to track improvement

Sign up using your HBS email address. Account requests are granted within 24 business hours. During holidays and winter break (December 24th – January 1st) turnaround time will be delayed until the CPD office reopens. Please note, we recommend you review your resume before considering it final.

Resumes: Sections, Templates & Examples

- Contact details - Let others know who you are and how to get in touch with you. In addition to your name, you should list your mailing address, phone number, and email address. It is expected to be found at the top of the page. No need to include it on additional pages.

- Professional history - Start with your most recent role and list in descending chronology. For each role, provide a sentence or two that describes the scope of your responsibility. Then in bullet format, provide accomplishment statements. To write an accomplishment statement, state the problem you encountered, the action you took and the result or impact of your actions. For example, "Led team in implementing a new general ledger package by providing expertise and encouragement, which contributed to a successful, on-time project completion."

- Education - Spell out your degree so it will stand out better. It is not necessary to include your GPA or GMAT score. Do not list courses. Do list any leadership roles or study abroad experiences.

- Summary/Profile - A great opportunity to tell the reader exactly what you want them to know. It should be 3-4 sentences in paragraph form following your contact information. Be careful not to load up on overused resume jargon and avoid listing previous jobs/education as it is redundant. Instead, focus on your branding statement, unique themes in your career path, and skills.

- Key skills - Listing your skills is a great way for the reader to quickly evaluate your skill set. List skills that are relevant to your next position. For each skill, you will need a proof statement in the form of an accomplishment stated in the professional experience section. A good way to set up this section is in 2 or 3 columns with 3-4 skills in each column. The heading could be "Key Areas of Expertise" or "Core Competencies".

- Personal/Interests - Only include if it helps tell your story.

- Additional roles - If you participate in organizations outside of your professional employment, you may list these in a separate section. Headings are typically "Volunteer Leadership Roles" or "Community Service".

- Licenses and Professional Certifications - If you possess a license or certification, these should be called out in a separate section.

- Objective - No longer in style. Do not include in your resume.

- References available upon request - No longer in style. Do not include in your resume.

- Zip file of all resume templates (login required)

Chronological - This is the most commonly used layout. Recommended for a mostly consistent record of employment showing progression/growth from position to position. Not recommended for gaps in employment dates, those out of job market for some time, or changing careers.

- Template 1 (login required)

- Template 2 (login required)

- Template 3 (login required)

- Template 4 (login required)

- Sample 1: C-Level Resume (login required)

- Sample 2: Consulting to Operating Company Resume (login required)

- Sample 3: VP with Long Tenure Resume (login required)

- Sample 4: C-Level Biotech resume (login required)

- Sample 5: Exec. Ed. with Long Tenure Resume (login required)

- Sample 6: Financial Services Resume (login required)

Streamlined Chronological - This layout also shows progression from one job to the next, but does not include extra sections such as Summary/Profile or Areas of Expertise. Recommended for recent alumni.

- Template: Streamlined Chronological (login required)

Chronological/Functional Hybrid Resume - In this layout, you can highlight your employment history in a straight chronological manner, but also make it immediately clear you have filled a variety of roles that use different but related skill sets. This is useful to provide a few accomplishments in the beginning to show a theme. Each role would also have specific accomplishment statements.

- Template: Chronological/Functional Hybrid (login required)

- Sample: Accomplishment Focus Resume (login required)

Cover Letter Writing

It is essential to send a cover letter with your resume to provide a recruiter with insight into your qualifications, experience, and motivation for seeking a position. The letter also conveys your personal communication style, tone, and professionalism. An effective employment letter should:

- Be targeted and personalized

- State why you are interested in the company

- Explain how you can fill a need

- Convey your enthusiasm about the opportunity

- Suggest next steps for communication and action

Guidelines & Examples

Investigate your target company. What is the company's "breaking news?" What drives their business? What are their greatest challenges and opportunities? How can you contribute? eBaker can help with your research.

Outline your objectives using relevant information that attracts the attention of the reader.

- Salutation Address the letter to a specific person. Capture the reader's attention and briefly introduce yourself. Mention the referral/company contact, if applicable. State the purpose of your letter.

- Body Describe relevant information you discovered about the company. Discuss the position offered or the position you are looking for. Detail how your skills will benefit the company.

- Closing Convey your enthusiasm. Anticipate response.

Pay close attention to sentence structure, spelling, and punctuation. Always print your letter to check for typographical errors. Have a friend, colleague, or family member review your letter whenever possible.

Cover letters are the place to briefly and directly address the gap in your career. For example, "I am returning to the workforce after a period of raising children." Then address your strengths, qualifications and goals. Emphasize your excitement and preparedness to re-enter the workforce now.

Response to Identified Advertisement (pdf)

Branding You

Resume writing tips , creating visual impact.

A concise, visually appealing resume will make a stronger impression than a dense, text-laden document. Respect page margins and properly space the text. Learn to appreciate the value of "white space." Limit a resume to one or two pages but not one and ¼. Ensure content is balanced on both pages. A CV is typically longer because it includes additional sections such as publications and research.

Use Parallel Construction

Select a consistent order of information, format, and spacing. If one experience starts with a brief overview followed by bullet points, subsequent experiences should follow a similar form. Parallel construction—including the use of action verbs (pdf) (login required) to start all phrases—greatly enhances a resume's readability.

Always Proofread

Pay close attention to margin alignment, spelling, punctuation, and dates. Read your resume backward to check for typographical errors. (You will focus on individual words, rather than the meaning of the text.) Better yet, have a friend, colleague, or family member review your resume.

Use Action Verbs

Action Verbs List (login required)

Improve Your Writing

Common questions, past program resources .

How to Build a Resume that Stands Above the Competition

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Cover letters

- Managing yourself

- Job interviews

The Best Cover Letter I Ever Received

- David Silverman

- June 15, 2009

How to Find a New Job: An HBR Guide

- January 12, 2022

How to Write a Cover Letter

- February 04, 2014

How to Write a Cover Letter That Sounds Like YOU (and Gets Noticed)

- Elainy Mata

- May 10, 2022

HBR Guide to Your Job Search

- Harvard Business Review

- February 06, 2024

HBR Guide to Your Job Search Toolkit

- April 16, 2024

The Key to Landing Your Next Job? Storytelling.

- Janine Kurnoff

- Lee Lazarus

- May 13, 2021

Looking For a Job: Our Favorite Reads

- Kelsey Alpaio

- August 11, 2022

How to Write a Cover Letter That Sounds Like You (and Gets Noticed)

Popular topics, partner center.

How to Write a Great Resume and Cover Letter

Linda Spencer offers helpful tips and resources to help you write your resumé and cover letter.

What makes a great résumé and cover letter? Linda Spencer, associate director and coordinator of career advising at Harvard Extension School, shares examples of a few strong résumés and explains what makes them stand out.

Perfect Your Marketing Documents

Spencer stresses it’s important to know that your résumé and cover letter are marketing documents. Also keep in mind that the average employer takes about seven seconds to review these documents. They’re not reading: they’re skimming. So you need to make it clear right off the bat how you can add value.

Strong résumés don’t have to be lengthy. One to two pages that feature your most top accomplishments works well.

Use Action Words and Customize Your Pitch

When highlighting your professional experience, use accomplishment statements rather than descriptions of your role. Start with an action verb. Then detail the impact that action had: Did you increase, decrease, modify, or change anything in your work? Finally, be sure to quantify the accomplishments. Data helps.

Your cover letter should be one page, highly customized to each position you’re applying for. It answers two questions: why are you the right fit for the position? And how will you add value to the organization?

While it’s important to have a strong résumé and cover letter, it’s also important to remember that the number one job search strategy is networking. You don’t want to simply be reactive, applying blindly to job postings. You want to conduct a series of informational meetings so that you build a network of people you can reach out to when it comes time to start your job search.

Any Extension student can attend first-come, first-served 15-minute call-ins (via phone or Skype) with Linda. See Career Services for more information.

Ready to take your next step? Browse graduate and undergraduate options

Choose from individual courses, certificates, or degree programs

Tips on Public Speaking: Eliminating the Dreaded “Um”

Learn how to remove filler words from formal speeches to present with confidence.

Harvard Division of Continuing Education

The Division of Continuing Education (DCE) at Harvard University is dedicated to bringing rigorous academics and innovative teaching capabilities to those seeking to improve their lives through education. We make Harvard education accessible to lifelong learners from high school to retirement.

Employee Timesheet Login AspiringMinds Connect with us on LinkedIn Like us on Facebook Follow us on YouTube

- Who We Place

- Temporary & Contract

- Direct Hire

- Talent We Recruit

- Search Jobs

- Community Service & Affiliations

- Candidate Resource Center

- Hiring Manager Resource Center

- Salary Guide

News & Information

The dynamic cover letters formula for job-search success.

Posted September 22nd, 2022

If you need help building a great team at your company, connect with the group at Harvard Resource Solutions. We provide the talented candidates your organization needs. Schedule a meeting with us at your earliest convenience.

Contact Harvard Resource Solutions, now hiring for Detroit jobs today .

- Candidates in the Spotlight

- Hiring Advice

- Uncategorized

Featured Video

- Contributors

ACGA Open Letter: Strategic Shareholdings in Corporate Japan

Amar Gill is a Secretary General at Asian Corporate Governance Association and Kei Okamura is a Portfolio Manager at Neuberger Berman and ACGA Japan Working Group Chair. This post is based on an open letter by the Asian Corporate Governance Association (ACGA), prepared by Mr. Gill and Mr. Okamura, with support from Jane Moir.

The Asian Corporate Governance Association (ACGA) recently formed a working group of members and other interested investors to discuss the issue of Japanese companies’ so-called “strategic shareholdings” that include allegiant and cross-shareholdings. We are writing to share our thoughts and suggestions on this topic.

In recent years, Japanese companies have embarked on a number of landmark reforms to improve corporate value over the medium to long term, which global investors attribute as one of the key catalysts driving the Japanese stock market’s strong performance of late. Sound resource allocation by corporates is key to the revival of the Japanese economy and is expected to benefit all stakeholders including employees, customers and shareholders. ACGA and its undersigned members thus look forward to constructive discussions around this topic.

One of the most entrenched areas, however, is the so-called “strategic shareholdings” also known as “allegiant shareholdings”. [1] These often exist to form business relationships between group companies and their suppliers as well as customers and has often been criticized as an inefficient use of capital, an inhibitor of corporate reforms and at times a source of anti-competitive behaviour by businesses. [2] While there has been some divestments of strategic holdings by companies and more recently the reported guidance by Japan’s Financial Services Agency (FSA) to general insurance companies to provide plans to divest these shares, the progress on unwinding these investments has been slow, particularly outside of the financial sector.

Hence, ACGA and its undersigned members are issuing this letter to underscore the need to accelerate the further reduction of these shareholdings, which we believe in principle should be zero for most companies . In this letter, we provide key recommendations on divestment of strategic shareholdings in a manner that would advance governance practices and help companies achieve sustainable long-term growth. Please see pages 6-8 for our recommendations.

Background and historical context

Strategic shareholdings among Japanese companies proliferated amid the post-World War II redevelopment when firms faced two key events. First, during the 1945 to 1952 Allied occupation, the industrial conglomerates, also known as Zaibatsu , were dismantled. Stocks held by group families and companies were expropriated and redistributed to the general public, thus dramatically increasing individual shareholders participation in Japan’s equity market. [3] This, however, caused alarm among company management that viewed the new shareholder base could interfere with the running of their businesses. Second, the economic recession that ensued following the 1953 Korean War created difficult business conditions for many firms; management thus sought financial support to help shoreup weak balance sheets.

The combination of management concern over control and the need for capital allowed Japanese banks to expand their domestic lending business by acquiring shares of key clients and deepening capital ties in exchange for banking relationships. [4] Today’s strategic shareholdings can be seen as resulting from these circumstances. These capital tie-ups continued to expand especially among the so-called Keiretsu industrial and commerce groups that spearheaded Japan’s rapid economic growth into the late 1980s. [5]

Following the bursting of the economic bubble in the early 1990s and over the so-called “Lost Decades” of deflation that followed, the material weaknesses of the interlocking capital alliances became apparent. Plummeting stock prices caused significant impairment losses especially in the financial sector. [6] Thus began the gradual unwinding process in the mid-1990s as businesses and banks started to sell-down their strategic holdings. [7] The action of various financial groups and certain other companies to initiate reducing their strategic investments is commendable, reducing the drag of these investments on governance and Return on Equity (ROE).

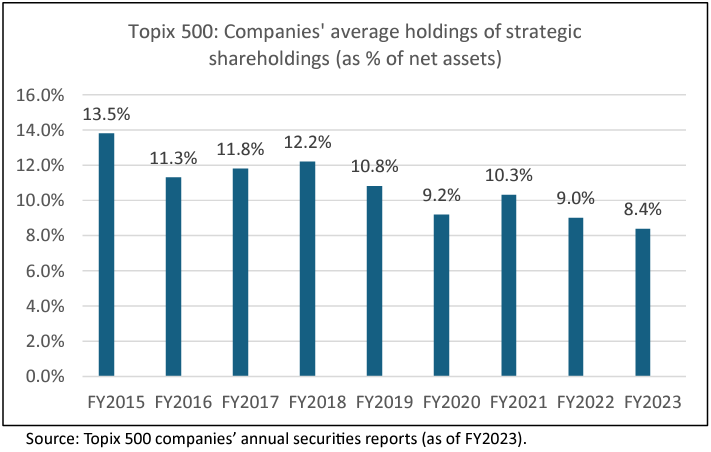

Although this trend has continued over the past 20 years, the pace of decline has been gradual. By the data from Topix 500 companies’ annual securities reports ( Yukashoken Hokokusho , below “Yuho”), between fiscal year-end March 2015 to 2023, of the 500 biggest companies listed on the Topix index, the simple average of strategic shareholdings has declined from 13.5% to 8.4% of net asset value. However, as at the end of March 2023, 320 companies, or 64% of the Topix 500 constituents, had strategic shareholdings up to 10% of their net asset value while 140 companies, or 28% of constituents, had over 10% of their net asset value in strategic shareholdings.

Economic implications

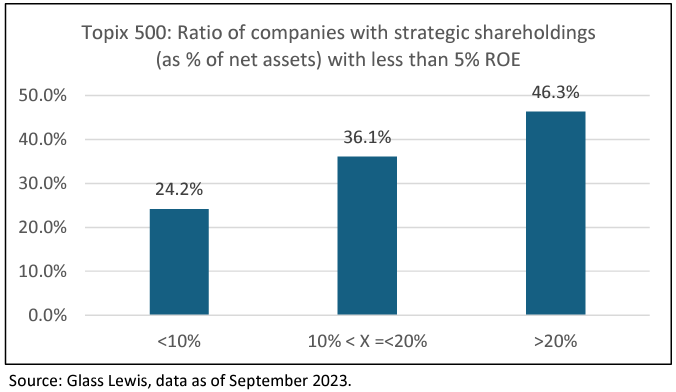

In our view, strategic shareholdings can have a detrimental impact on companies’ capital efficiency. According to Glass Lewis’ research, the proxy advisor firm found that the average 5-year ROE of Topix 500 listed companies fell as the ratio of strategic investments to net assets grew, which we believe is a result of the capital tied-up in strategic shareholdings weighing on the equity component of ROE and thus ultimately reducing the firms’ overall capital efficiency. It is worth noting that analysis conducted by the Tokyo Stock Exchange (TSE) found that the same group of Topix 500 companies had a disproportionately higher ratio of companies with ROE below 8% compared to global peers such as the US S&P500 and Europe’s STOXX600 members, indicating that this unique Japanese capital alliance structure may have contributed to inferior capital returns vis-à-vis global firms that do not generally have these structures. [8]

Governance concerns

Poor financial performance can persist for extended periods at companies that have a high level of strategic shareholders. These friendly shareholders may well have a tacit understanding that they will be aligned with management and vice-versa if there is a cross holding of shares. The result is that there can be a significant block of shareholding, represented by these strategic interests, that will generally not vote against management despite the poor performance. Moreover, when companies continue to see lackluster financial results, investors expect independent directors to play a mitigating role to help management address these issues to ultimately raise corporate value. However, if independent directors hail from the strategic investor, including individuals who have recently retired from the investor firm, this may lead to a conflict of interest between the strategic investor and other minority shareholders where the independent director may prioritize the commercial interest of the strategic investor over other minority shareholders

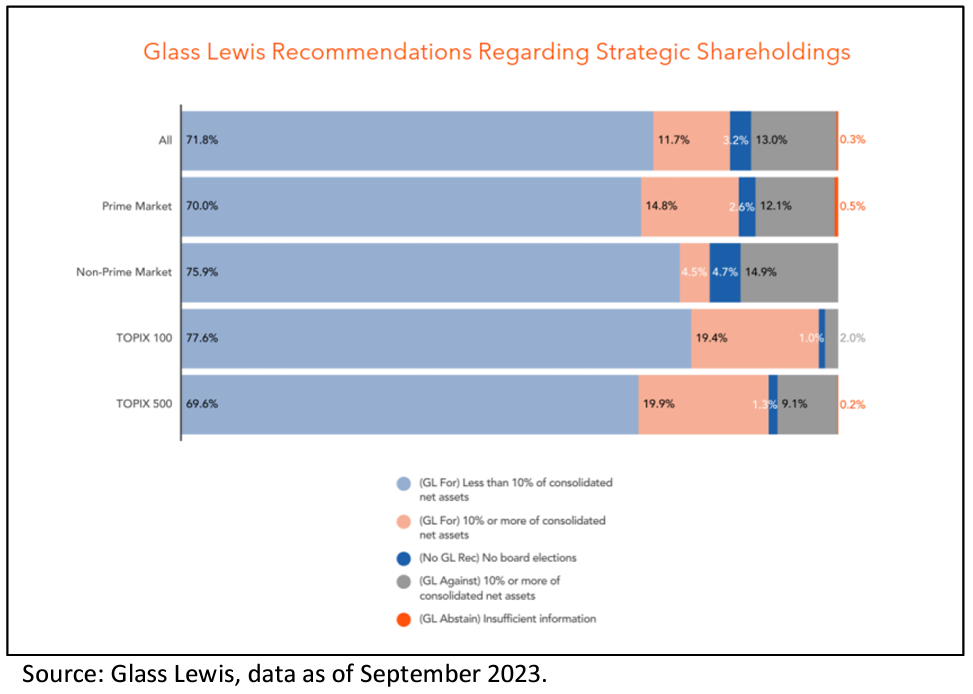

The questionable corporate governance of companies with strategic shareholdings not surprisingly leads to recommendations by proxy advisors to vote against election of directors, with investors voting similarly by their own policies. Last year, across the wider market of the Topix Prime Market of over 1,600 companies, Glass Lewis recommended voting action against the Chairman of the Board of 12.1% of companies and almost 15% of other companies in the non-Prime segments where they held strategic investments equivalent to 10% or more of consolidated net assets. Meanwhile Institutional Shareholder Services (ISS) set a higher threshold of strategic assets at 20% or more of net assets to trigger a recommendation to vote against top executives, usually the President or alternatively the Chairman of the company or a representative director.

Anti-competitive concerns of strategic shareholdings

Another concerning aspect of strategic shareholdings is the impact on competitive behaviour. Companies with strategic equity interests in their customers, and vice versa customers that have strategic equity holdings in their suppliers, are likely to favour these companies in their day-to-day business arrangements. Competitors are thus kept out of these contracts even if they may provide better terms. [9] This anti-competitive behaviour may be negative on shareholder value in not pursuing the best terms from the most efficient suppliers; it is also pernicious on progress of reforms in the relevant sectors and for the economy overall.

In the insurance sector, for instance, the FSA alleged price fixing between general insurance companies citing that the strategic shareholdings contributed to anti-competitive behaviour and ordered the companies to accelerate the unwinding of the holdings. To note, these four insurers are reported to hold 5,900 such investments equivalent to ¥6.5 trillion (US$43 billion, as of February 2024) [10] . Since then, the involved companies have published business improvement plans including targets to reduce the strategic investments to zero over the next several years.

These anti-competitive implications underscore that good corporate governance, including transparent shareholding structures, are essential to foster healthy competition in the relevant sectors and sustained economic growth for the country. Hence it is incumbent on regulators to continue to pursue the unwinding of these strategic shareholdings across the various sectors in the interest of economic efficiency.

Positive regulatory developments

Over the past decade Japanese regulators have addressed this issue through various initiatives such as the Corporate Governance Code that seeks companies to disclose policies on reducing these holdings and an assessment on the benefits and risks of maintaining these investments from a capital efficiency standpoint. [11]

New rules were introduced through a Cabinet Office Ordinance that became effective on 31 January 2019. [12] Strategic shareholding disclosures were enhanced in the Yuho for financial years ending on or after March 2019. These changes form the basis for the disclosure we see today, which increased the number of strategic shareholdings required to be disclosed from the largest 30 to the top 60. The Yuho complements the more qualitative disclosure required in the separate Corporate Governance Reports of companies as mandated by the Corporate Governance Code.

We believe such efforts, including the voting action by investors, have been instrumental in reducing these holdings. The latest “Shareownership Survey” from the Japan Exchange Group (JPX) for fiscal year to March 2023 shows the ownership share of financial institutions in other listed companies falling from a high of around 40% of market capitalisation in the mid-1980s to just 7% by the end of March 2023. [13]

ACGA and investor member recommendations

Given the concerns above, ACGA and the undersigned investors would like through this letter to make some recommendations for advancing the governance of companies with strategic investments. We believe these recommendations will help to improve governance and financial returns of the relevant companies and will be positive for the overall economy. Our recommendations are highlighted below.

1. Policy and implementation

ACGA recommends a general policy of no (zero percent) strategic share holdings . To achieve that end, companies that have strategic shareholdings should adhere to the Corporate Governance Code Principle 1.4 [14] and set clear reduction targets appropriate for each company respectively. Reduction of strategic investments should not be through reclassifying these investments as “pure investments”. Indeed, unless a company is an investment holding company, we recommend as a policy that it should not have any company’s securities held as “pure investments”. Instead, the reduction of such investments should be done in the context of maximizing shareholder value and as part of a comprehensive effort to improve corporate governance and capital returns. In cases where the unwinding of strategic shareholdings could potentially impact the supply and demand dynamics of shares trading in the market, we urge companies to take appropriate measures to minimize the negative fallout to existing shareholders.

2. Governance

In keeping with Japan’s Corporate Governance Code Principle 1.4 on Cross Shareholdings, ACGA recommends the board of directors and audit board members play a stronger role in the oversight of strategic shareholdings so as to implement the Principles of the Code more effectively. In cases where a company holds significant strategic shareholdings (for example more than 5% of net assets), [15] we would encourage companies to establish a committee of independent directors and audit board members ( Kansayaku ) tasked with reviewing such shareholdings, the plans to divest and how reduction targets will be achieved, as well as the use of proceeds within a specific timeframe.

We also recommend that the internal audit department of an issuer be responsible for vetting all contracts and business relationships with investee companies to determine any explicit or implicit agreements between the parties that could give rise to an inference that these shares are being held for strategic purposes by the other party or could give rise to a conflict of interest by virtue of strategic shareholdings. Internal audit should report directly to the committee of independent directors and audit board members ( Kansayaku ) on this matter, and this committee should scrutinize whether these contracts have been conducted on an arms’ length basis and have followed the issuer’s tender process.

3.1 Disclosure on policy

ACGA recommends improved disclosure on the state of strategic shareholdings . In accordance with the Cabinet Office Ordinance on Disclosure of Corporate Affairs, we reiterate the need for listed companies to provide shareholders with specific and more detailed disclosure in the Yuho of the rationale for strategic shareholdings. Additional to the current requirements, we recommend issuers disclose the existence of any current and historical agreements, either explicit or implicit, with the investee company , to exercise its voting rights, confer a benefit or provide any other support to the investee company and its officers in exchange for investee company’s holding issuer’s shares. The exact nature of any such arrangement should be set out in full, including any vendor/purchaser relationship, services contract, or any other relationship (financial or otherwise), and should indicate its length of existence and how it benefits the company and its shareholders. There should be a declaration by the issuer that any holdings of an entity with which it has such a relationship do not give rise to any conflicts of interest, or potential conflicts of interest, or any inference of undue influence being exerted on the investee company and its officers. If there is no such agreement, or has not been any explicit or implicit, the issuer should be required to make a declaration to that effect in the Yuho in respect of each investment holding.

There should be a declaration by issuers to their shareholders who they know, or reasonably believe, to be holding their stock on a strategic basis, that any divestment by the counterpart would not be met by a loss of benefit or detriment to the shareholder . This would include the loss of any contract, business relationship or any explicit or implicit understanding between the parties. We recommend that this declaration by investee companies be required by the TSE to be provided in the Corporate Governance Report so that it can be made available to all shareholders by the next reporting period.

3.2 Disclosure on governance

ACGA recommends company boards should provide disclosure on how they oversee the strategic shareholding investments , how they raise awareness within business units of appropriate policies in relation to investee companies, and to frame board discussions of strategic investments in context of ROE, return on invested capital (ROIC) and weighted average cost of capital (WACC), and how these factors are represented in key performance indicators (KPIs) of senior management of investor companies and their compensation. This disclosure should be made in relation to the TSE’s March 2023 announced “ Action on Cost of Capital-Conscious Management and Other Requests ”.

In accordance with the Corporate Governance Code Principle 1.4, companies should have a voting policy and disclose how they vote their strategic shareholdings , including disclosure at the individual investee company and resolution level with the rationale for the vote. This is similar to the required disclosure for institutional shareholders and is good practice for transparency on how the fiduciary responsibility as a shareholder is being exercised. We encourage companies, while they have strategic share holdings, to adopt the relevant provisions of the Stewardship Code and to state this in their Corporate Governance Report. We recommend that the TSE consider to incorporate this into the Corporate Governance Code.

Companies that have sound reasons to maintain strategic shareholdings which they do not plan to reduce should be encouraged to sign the Stewardship Code, just as institutional shareholders do. The Stewardship Code should apply to all relevant shareholders who have a fiduciary responsibility: the vote of the strategic investors is as relevant, if not more so, than voting of institutional shareholders most of whom have much smaller investments in the companies. The engagement efforts and voting action of investors may be less effective if the larger strategic investors in the companies vote aligned to management, do not exercise their fiduciary responsibility and are not required to make similar disclosures as institutional investors. Regulators may thus consider extending the Stewardship Code to companies that have strategic investments as well.

We reiterate that full and transparent disclosures on strategic shareholders is crucial for all shareholders to determine if the board has exercised its oversight role appropriately and thus should be disclosed prior to the AGM to guide shareholders in their decisions on key proposals including the election of board members.

3.3 Disclosure on capital management

ACGA recommends companies undertaking divestment of their strategic investments should articulate their plans for the proceeds from these divestments . We would encourage companies to make this disclosure as part of its Action Plan in response to the TSE’s cost of capital guidelines. Unless a divesting company has good use for the proceeds for specific investments that generate ROE and ROIC higher than WACC, companies should generally return proceeds of divestments to shareholders in the form of special dividends and/or share repurchases when appropriate. Indeed, having these investments with low returns on the balance sheet shift to holding cash from their divestments would not lead to material improvement in ROE. Companies should thus avoid substantial increases in cash and/or financial securities resulting from these divestments.

We trust this letter and our recommendations will prove constructive in helping to enhance governance practices and shareholder value in corporate Japan. ACGA and the undersigned members look forward to discussing these issues further with you.

1 In this open letter, we will refer to “strategic investments” in reference to allegiant and cross-shareholdings among companies. (go back)

2 “Opinion Summaries Received from Investors in Response to Listed Company Corporate Governance Questionnaire for Investor”, Tokyo Stock Exchange, August 26th, 2008, <https://www.jpx.co.jp/english/equities/improvements/general/tvdivq0000004iib-att/opinions_summary.pdf>. (go back)

3 Mark Scher, “Bank-firm Cross-shareholding in Japan: What is it, why does it matter, is it winding down?”, DESA Discussion Paper, February 2001, <https://www.un.org/esa/desa/papers/2001/esa01dp15.pdf> (go back)

4 Chisato Haganuma, “Reduction of strategic investments in focus” (translated title), Mitsubishi UFJ Trust Bank, March 2021, <https://www.tr.mufg.jp/houjin/jutaku/pdf/u202103_1.pdf> (go back)

5 Mark Scher, “Bank-firm Cross-shareholding in Japan: What is it, why does it matter, is it winding down?”, DESA Discussion Paper, February 2001, <https://www.un.org/esa/desa/papers/2001/esa01dp15.pdf> (go back)

6 Federal Reserve Bank of San Francisco, “Japan’s cross-shareholding legacy: the financial impact on banks”, Country Analysis Unit, Asia Focus, August 2009, <https://www.frbsf.org/banking/wp-content/uploads/sites/5/August-2009-JapansCross-Shareholding-Legacy-the-Financial-Impact-on-Banks-august-09-FINAL.pdf> (go back)

7 Ibid. (go back)

8 ”TSE’s Recent Initiatives on Corporate Governance”, Tokyo Stock Exchange, April 2023, <https://www.fsa.go.jp/en/refer/councils/follow-up/material/20230419-03.pdf>. (go back)

9 Mark Scher, “Bank-firm Cross-shareholding in Japan: What is it, why does it matter, is it winding down?”, DESA Discussion Paper, February 2001, <https://www.un.org/esa/desa/papers/2001/esa01dp15.pdf> (go back)

10 Sora Kitajima and Takanobu Aimatsu, “Japan tells casualty insurers to unwind cross-holdings amid scandal”, Nikkei Asia Review, February 10th, 2024, <https://asia.nikkei.com/Business/Insurance/Japan-tells-casualty-insurers-to-unwind-crossholdings-amid-scandal> (go back)

11 Japan’s Corporate Governance Code Principle 1.4: Cross Shareholdings. “When companies hold shares of other listed companies as cross-shareholdings, they should disclose their policy with respect to doing so, including their policies regarding the reduction of cross-shareholdings. In addition, the board should annually assess whether or not to hold each individual cross-shareholding, specifically examining whether the purpose is appropriate and whether the benefits and risks from each holding cover the company’s cost of capital. The results of this assessment should be disclosed. Companies should establish and disclose specific standards with respect to the voting rights as to their cross-shareholdings, and vote in accordance with the standards.” (Japan’s Corporate Governance Code, Tokyo Stock Exchange, June 11th, 2021 (revised)) (go back)

12 “Corporate Governance Overview 2019”, KPMG, November 2019, <https://assets.kpmg.com/content/dam/kpmg/jp/pdf/2020/jp-en-corporate-governance-overview-2019.pdf> (go back)

13 “2022 Shareownership Survey”, Tokyo Stock Exchange, <https://www.jpx.co.jp/english/markets/statisticsequities/examination/p6b22i00000024gs-att/e-bunpu2022.pdf> (go back)

14 Japan’s Corporate Governance Code, Tokyo Stock Exchange, June 11th, 2021 (revised), < https://www.jpx.co.jp/english/news/1020/b5b4pj0000046kxj-att/b5b4pj0000046l0c.pdf> (go back)

15 We have derived strategic investments at 5% of net assets as an appropriate threshold as the Topix 500 constituents’ median ratio of strategic investments to net assets is 5.4% (as of end-March 2023) (go back)

Post a Comment

Your email is never published nor shared. Required fields are marked *

You may use these HTML tags and attributes: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>

Supported By:

Subscribe or Follow

Program on corporate governance advisory board.

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Holger Spamann

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

2L Announcements / 3L Announcements

DC Superior Court Judge Seeking Clerkship Applicants

Judge Neal E. Kravitz, of the Superior Court of the District of Columbia, is seeking clerkship applications for the term beginning in the late summer of 2025. Applicants should submit a cover letter, a resume, a law school transcript, and up to three letters of recommendation to [email protected] and [email protected] . The position is open until filled.

Modal Gallery

Gallery block modal gallery.

- Share full article

Advertisement

Supported by

Help! Our Cruise Operator Went Bankrupt and We Are Out $17,905.

A couple purchased an Arabian Sea voyage, but Vantage, the cruise company, went under. Their travel insurance was supposed to cover financial default, but the claim was repeatedly denied.

By Seth Kugel

Dear Tripped Up,

In September 2022, I booked a 17-day Arabian Sea cruise through Vantage Travel Services to celebrate my 80th birthday with my wife. The cruise was to set sail in October 2023. I used my credit card to leave a $2,000 deposit and paid the remaining $17,905 shortly afterward by bank transfer. I also bought the Worldwide Trip Protector plan from Travel Insured International (for $1,954), in part because it covered financial default and bankruptcy of cruise lines. Vantage then canceled the cruise and offered me an alternative date I could not make; I also declined their offer of credit and asked for a refund, which they agreed to. But no refund ever came, and they stopped answering the phone. My credit card returned the $2,000, and I filed an insurance claim for $17,905. It was denied, as was my first appeal. Then Vantage filed for bankruptcy, and my second appeal was denied too. The reasons given by the insurer were outrageous. They cited a vague parenthetical phrase in the policy’s bankruptcy clause, claiming I wasn’t covered because I purchased the cruise directly from the cruise line (rather than, say, through a travel adviser). Then they said my policy lapsed when I canceled the trip. But I did not cancel; Vantage did. I also filed a complaint with the New York State Department of Financial Services, which was rejected. Can you help? Michael, Smithtown, N.Y.

Dear Michael,

When Boston-based Vantage filed for bankruptcy last year, it owed thousands of customers a total of $108 million for cruises and other travel products they had paid for but never received. The company’s former owner is facing lawsuits in New York and Pennsylvania. But you had purchased an insurance policy to cover just such a risk, a smart move. Or so you thought until the insurance company, Travel Insured International, denied your claim and then used exasperating logic to fend off your two appeals, first interpreting the policy’s financial default and bankruptcy clause in a maddening way and then twisting the meaning of the word “cancel.”

You made a few mistakes as well — most notably, by making a claim based on a financial default that had not yet happened. But after speaking with law professors, insurance experts and competing insurance companies, I believe Travel Insured International was wrong, at least by the time of your second appeal, and should pay up.

What does it have to say for itself? For nearly five months, Travel Insured International and its parent company, Crum & Forster, did not respond to my detailed inquiries. Days before publication, however, a spokeswoman, Amy Whilldin, sent the following statement:

“The claim was properly considered, and the correct determination was made based on the facts of this claim, which was to the satisfaction of both the New York Department of Financial Services and the New York State attorney general.”

Ms. Whilldin is correct about the state’s financial services department . An examiner with the department, which regulates the insurance industry, rejected your complaint. “After a review of the policy language," he wrote, “we do not find they are acting in an arbitrary or capricious manner,” referring to Travel Insured International. I disagree with that determination, as we are about to get into.

But the attorney general’s office was not satisfied. You had complained to its Department of Consumer Frauds and Protection, and they did not receive a response from the company. “Despite our repeated efforts,” an employee wrote, “they have failed to respond.” The letter goes on to recommend you consider suing the company.

I have a better idea. You should file a formal grievance with Travel Insured International, which under your policy allows you to submit new evidence, and if that fails even argue your case in person. (You told me you are not interested in a third option, to accept travel credits under the conditions offered by the Australian company that bought Vantage’s assets.)

In the meantime, your story provides great lessons on how travelers should choose the appropriate travel insurance policy, and what can go wrong even when they do.

In your initial claim to Travel Insured International, filed in late 2022, you cited Vantage’s “very poor record” in refunding its customers and your “assumption that the company is in default in making payments.”

This was an error: Your policy defines financial default as “the total cessation of operations,” and Vantage at the time was running at least some cruises. Travel Insured International’s response simply said that “your travel supplier canceling your trip is not a covered reason.” True.

When you first appealed in April, Vantage was two months short of declaring bankruptcy outright, and was not yet in financial default as defined by the policy. But it was teetering. (That one of its cruises left at all made headlines in The Boston Globe .) This time, Travel Insured International denied your claim, citing the bankruptcy clause, which protects policy holders in case of “Bankruptcy or default of an airline, cruise line, tour operator or other travel provider (other than the Travel Supplier, tour operator, travel agency, organization or firm from whom you purchased your travel arrangements).”

That parenthetical says you are not covered if the organization that sold you the cruise goes bankrupt. You purchased the cruise directly from Vantage, so you are not covered, according to the claims adjuster’s reasoning. (Why the company even cited this clause, if the cruise line was not yet in default, remains a mystery.)

Similar clauses appear in many travel policies, but that’s not what they’re supposed to mean, said Loretta Worters, vice president for media relations at the Insurance Information Institute , an industry group.

Such provisions, she explained, are intended to exclude coverage for an unscrupulous or financially flailing middleman that goes belly-up after collecting your money but before passing it along to the actual travel provider.

“Some of these are fly-by-night, travel-agencies-in-their-kitchen kinds of things,” Ms. Worters said. ( We encountered one such agency in a previous Tripped Up column .)

Guess who agreed with Ms. Worters: The agent who answered the phone when I called Travel Insured International’s customer care line as a potential customer. I asked about the clause and she agreed it was ambiguous, checking with a supervisor before saying: “If you are booking directly with the company and the company itself goes under default or bankruptcy, you would be able to file a claim for the nonrefundable portion of your trip.”

Ms. Whilldin, the spokeswoman for Travel Insured International, did not specifically answer my question about this apparent conflict. But it seems their claims adjuster made a mistake, aided by the ambiguous language of the underwriter who wrote the policy. (That’s United States Fire Insurance, another Crum & Forster company.)

Now, let’s discuss the second appeal. “Once you cancel your trip, the coverage under the plan ends,” Travel Insured International said. Your argument is that you did not cancel; Vantage did.

I think almost anyone who isn’t a lawyer would agree with you. But Oren Bar-Gill , a professor at Harvard Law School and the author of “Seduction by Contract: Law, Economics and Psychology in Consumer Markets,” explained to me the opposing argument. Vantage was contractually allowed to change the dates or offer credit, and you refused, the equivalent of canceling.

But, he added, when Vantage agreed to refund your cruise, it could be “considered a waiver of their contractual rights,” weakening the argument that you canceled your contract.

In a lawsuit New York State filed against the now-defunct Vantage and its former owner, Henry Lewis, the issue also comes up: The suit says Vantage “deceptively” mislabeled cancellations as “postponements.”

Even Travel Insured International admitted that Vantage had canceled, in its original letter rejecting your claim. “It is our understanding that your travel supplier, Vantage, canceled your cruise,” the claims adjuster wrote. Somehow, however, by the third response you had gone from cancelee to canceler.

You also missed a red flag when you chose your policy. Suzanne Morrow, the chief executive of InsureMyTrip , where you found your plan, told me you called the company within minutes of your purchase and asked an agent to point you to the bankruptcy clause. (You confirmed this to me.)

That means you’re not the typical insurance customer blindsided by small print you never read. If you were so concerned about the cruise line’s solvency, you could have canceled your plan during the insurer’s “free look” period and chosen one with more straightforward language — I found several on the InsureMyTrip website.

What lessons can we take away from your debacle?

To begin with, pay for everything with a credit card when your credit limit allows. Because of an odd quirk in a 1974 law , card issuers are required to reimburse you if the company you interacted with goes bankrupt.

Beyond that, the basic advice for travel insurance remains unchanged: Shop for a plan separately through a provider you trust or an aggregator like InsureMyTrip, rather than adding trip protection by checking a box just before you purchase a big-ticket item. Read the policy summaries fully and click through to the actual policy document to read fine print on issues that concern you most (say, bankruptcy protection or medical coverage for pre-existing conditions).

If you don’t understand anything, call the company. If it cannot answer satisfactorily and follow up in writing, choose another provider.

If you need advice about a best-laid travel plan that went awry, send an email to [email protected] .

Follow New York Times Travel on Instagram and sign up for our weekly Travel Dispatch newsletter to get expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places to Go in 2024 .

Seth Kugel is the columnist for “ Tripped Up ,” an advice column that helps readers navigate the often confusing world of travel. More about Seth Kugel

Come Sail Away

Love them or hate them, cruises can provide a unique perspective on travel..

Cruise Ship Surprises: Here are five unexpected features on ships , some of which you hopefully won’t discover on your own.

Icon of the Seas: Our reporter joined thousands of passengers on the inaugural sailing of Royal Caribbean’s Icon of the Seas . The most surprising thing she found? Some actual peace and quiet .

Th ree-Year Cruise, Unraveled: The Life at Sea cruise was supposed to be the ultimate bucket-list experience : 382 port calls over 1,095 days. Here’s why those who signed up are seeking fraud charges instead.

TikTok’s Favorite New ‘Reality Show’: People on social media have turned the unwitting passengers of a nine-month world cruise into “cast members” overnight.

Dipping Their Toes: Younger generations of travelers are venturing onto ships for the first time . Many are saving money.

Cult Cruisers: These devoted cruise fanatics, most of them retirees, have one main goal: to almost never touch dry land .

IMAGES

COMMENTS

Harvard College Resumes & Cover Letter Guide. A resume is a concise, informative summary of your abilities, education, and experience. It should highlight your strongest assets and skills, and differentiate you from other candidates seeking similar positions. View Resource.

How to Write a Cover Letter That Sounds Like You (and Gets Noticed) by. Elainy Mata. May 10, 2022. EM. Elainy Mata is a Multimedia Producer at Harvard Business Review. ElainyMata.

Always use your @college email account and check it frequently, even if you have enabled forwarding. Resume Sample. Firstname Lastname. If an employer asks for your SAT/ ACT scores or GPA, include in your Education section. 17 Main Street • Los Angeles, CA 92720 • [email protected] • (714) 558-9857.

17 Main Street • Los Angeles, CA 92720 • [email protected] • (714) 558-9857 . Education. HARVARD UNIVERSITY. Cambridge, MA A.B. Honors degree in History. GPA 3.73. May 2023 Relevant Coursework: International Political Economics and the European Community. Commit 25 hours per week to Harvard Varsity Field Hockey Program ...

No part of this publication may be reproduced in any way without the express written permission of the Harvard University Faculty of Arts & Sciences Office of Career Services. 8/21. Office of Career Services Harvard University Faculty of Arts & Sciences Cambridge, MA 02138 Phone: (617) 495-2595 www.ocs.fas.harvard.edu. Resumes and Cover Letters.

A comprehensive guide to the world of Resumes and Cover Letters, written and presented specifically for Master's students by the Harvard FAS Office of Career Services. Click here to access the handbook.

Harvard University • Harvard College and Graduate School of Arts and Sciences 54 Dunster Street • Cambridge, MA 02138 Telephone: (617) 495-2595 • www.ocs.fas.harvard.edu GSAS: CVs and Cover Letters CVs and Cover Letters GSAS: Graduate Student Information www.ocs.fas.harvard.edu

uConnect: The first ever all-in-one virtual career center platform

Cover Letter Writing. It is essential to send a cover letter with your resume to provide a recruiter with insight into your qualifications, experience, and motivation for seeking a position. The letter also conveys your personal communication style, tone, and professionalism. An effective employment letter should: Be targeted and personalized.

Simply enter the company name and some keywords into the search bar (e.g., "Google, hiring manager, sales") and a variety of related profiles will appear. 2. Clearly state the purpose of your ...

Published on September 7, 2022. The Only Resume Cheat Sheet You'll Ever Need was originally published on Idealist Careers. A lot goes into drafting a good resume. You'll want to make sure you're using the best format to showcase your skills and achievements, that you've carefully edited each section, and that the information you include ...

The Best Cover Letter I Ever Received. Hiring and recruitment Digital Article. David Silverman. In my last post I talked about how to make your résumé more likely to catch the attention of a ...

Network. While it's important to have a strong résumé and cover letter, it's also important to remember that the number one job search strategy is networking. You don't want to simply be reactive, applying blindly to job postings. You want to conduct a series of informational meetings so that you build a network of people you can reach ...

Step 2: Add your contact info. At the top of your cover letter, you should list out your basic info. You can even copy the same heading from your resume if you'd like. Some contact info you might include (and the order you might include it in) is: Your name. Your pronouns (optional)

RESUMES AND COVER LETTERS Your cover letter is a writing sample and a part of the screening process. By putting your best foot forward, you can increase your chances of being interviewed. A good way to create a response-producing cover letter is to highlight your skills or experiences that are most applicable to the job or industry and to ...

The cover letter is a tool to help introduce yourself in a memorable, personal way during a job application. A well-crafted cover letter goes over information on your resume and expands this information for the reader, taking them on a guided journey of some of your greatest career and life achievements.. Its purpose is to elaborate on the information contained in your resume while infusing ...

A comprehensive, widely-applicable guide to the world of CVs and Cover Letters, written and presented by the Harvard FAS Office of Career Services. Click here to access the handbook.

Harvard Law School provides unparalleled opportunities to study law with extraordinary colleagues in a rigorous, vibrant, and collaborative environment.

Posted September 22nd, 2022. ... There is a formula that can be followed as a guide to writing your cover letters. However, it is critical that each cover letter be unique and specific to you and to the employer—not one that any applicant could have written to any employer. ... Contact Harvard Resource Solutions, now hiring for Detroit jobs ...

Let's review four key pieces of information you can weave into your career change cover letter. 1. Clarify your career change context. Explaining why you're interested in changing careers and how the role you're applying to fits within your larger career aspirations can preemptively contextualize your story.

The Asian Corporate Governance Association (ACGA) recently formed a working group of members and other interested investors to discuss the issue of Japanese companies' so-called "strategic shareholdings" that include allegiant and cross-shareholdings. We are writing to share our thoughts and suggestions on this topic. In recent years, Japanese companies have embarked on a number of […]

Judge Neal E. Kravitz, of the Superior Court of the District of Columbia, is seeking clerkship applications for the term beginning in the late summer of 2025. Applicants should submit a cover letter, a resume, a law school transcript, and up to three letters of recommendation to [email protected] and [email protected]. The position is open until filled.

In September 2022, I booked a 17-day Arabian Sea cruise through Vantage Travel Services to celebrate my 80th birthday with my wife. The cruise was to set sail in October 2023.