Excel: Financial Modelling for a Real Estate Investment

Note: if you are looking for a freelancer to build a custom financial model for your business, I'm available. Learn more here .

In our previous tutorial, we learned the concept of problem-solving modelling . Today, we're stepping into a more advanced realm, financial modelling in Excel, with a real-life example.

Before we start, you can download the Excel model by clicking this link . It contains 3 tabs: Inputs , Calculations , and Outputs , that we will cover below.

The Problem

You're interested in investing in real estate: buying an apartment and renting it out. Is it a profitable investment? How much do you need to invest? Real estate investment is exciting, but it can be tricky to navigate the financial aspects.

To make an informed decision, you want to forecast your cash flows and understand your potential returns. The financial model we're introducing here will help you do just that. Let's see how it works!

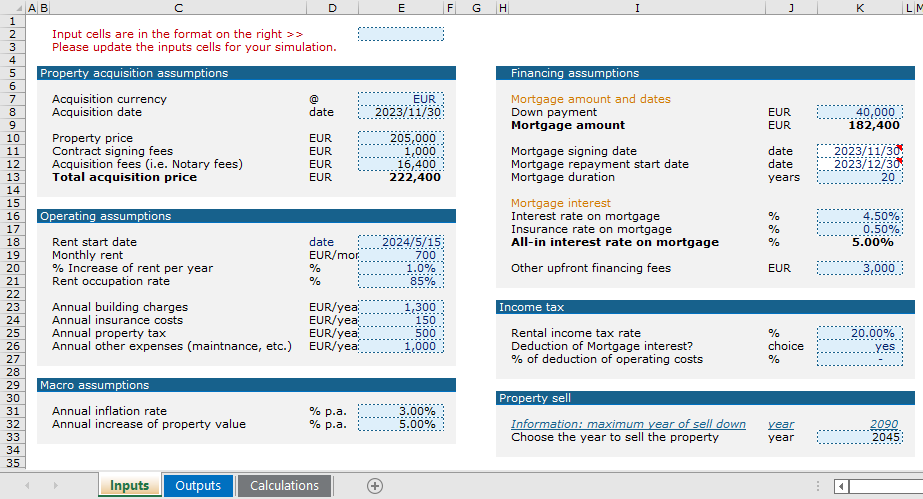

We start by defining our investment assumptions in the Inputs tab. Here is the data you either have at hand or can make educated guesses about.

For our scenario, the main inputs you need to set are:

- Property Purchase Date and Price.

- Down Payment: the upfront payment made when buying the property.

- Mortgage Rate: the interest rate on the loan.

- Mortgage Duration: the duration of the loan in years.

- Monthly Rent: the amount you plan to charge tenants each month.

- Occupation Rate: the percentage of time your property is rented out over a year.

- Expenses: regular costs that you need to pay like maintenance, property taxes, insurance, etc.

- Rental Income Tax Rate: the percentage of gross rental income that is paid to the government as income tax.

- Tax Deductible Expenses: costs that can be subtracted from the rental income, thus reducing the overall tax.

- Property Sell Date: the date when you sell your property.

- Appreciation Rate: the yearly rate at which the property’s value increases.

- Inflation Rate: the percentage increase of prices for goods and services in our economy over a year.

Fill in the inputs based on your specific situation or projections. The better your estimates, the more reliable the results.

So, how do we turn these inputs into meaningful information?

Intermediary Calculations

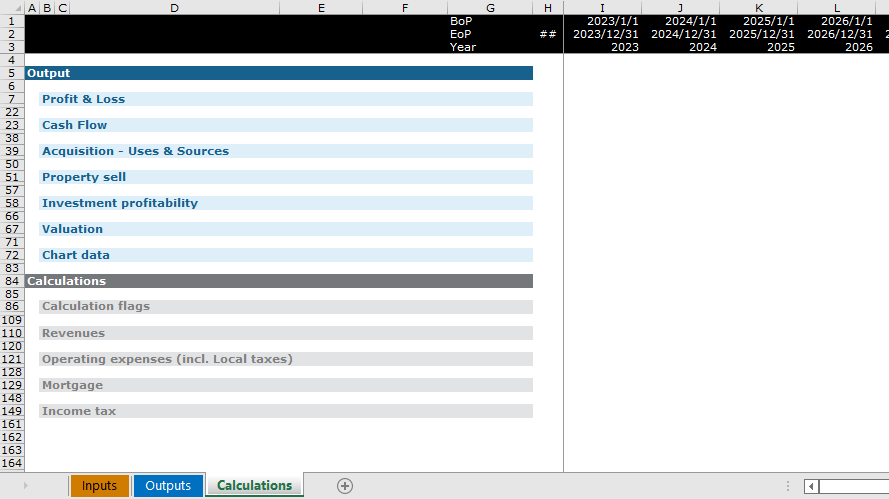

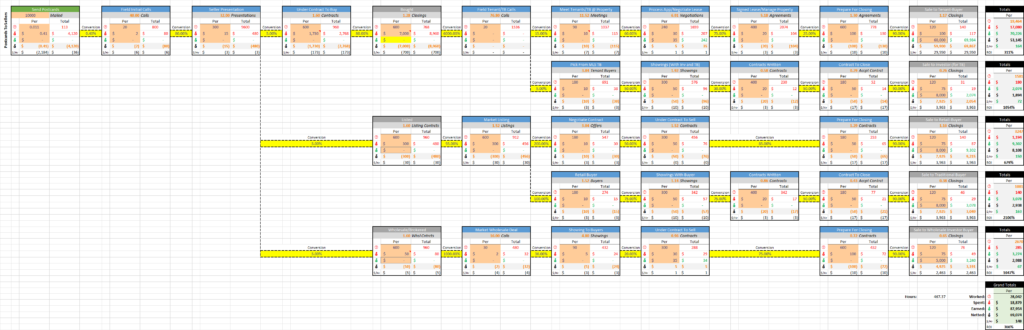

Now, let's move onto the Calculations tab, which is essentially the powerhouse of our model.

The entire tab is automatically calculated and updated based on the assumptions you provided. The goal of this tab is to break down complex computations into intermediary steps.

There are different computation modules, each dedicated to calculating a specific aspect of the real estate investment, such as revenues, operating expenses, mortgage, tax, and more. You can find the the intermediary results at the top of the tab.

If you are curious about the magic that makes these calculations work, we're crafting a series of tutorials that will open up each module for you.

The Outputs

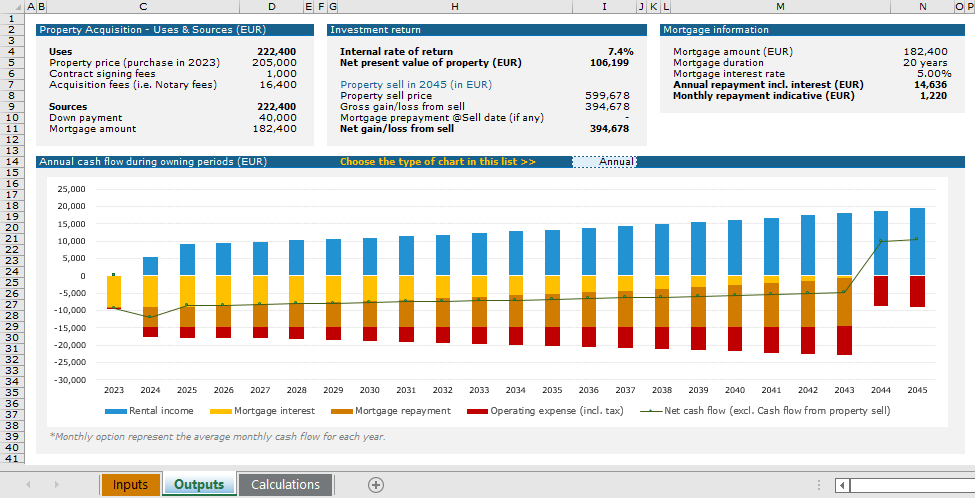

The Outputs tab is possibly the most sought-after section of our financial model. It contains a dashboard revealing the details of your real estate investment performance.

Here you can explore four key aspects of your investment:

- Uses and Sources for Property Purchase: this section breaks down the costs of acquiring the property and your funding strategy.

- Investment Return Indicators: this presents critical indicators to measure your investment's profitability.

- Mortgage Info: if you've opted for a bank loan to finance your purchase, this area holds all relevant details.

- Cash Flow Chart: this dynamic chart visualizes the year-on-year cash flow scenario of your property. You can choose to display either annual cash flow or monthly average cash flow per year.

This dashboard is customizable, look out for our upcoming tutorials with tips on how to personalize it.

Exploring Different Scenarios

By adjusting the inputs, you can simulate different scenarios and see how they affect your potential returns. This is a powerful way to plan and prepare for a variety of outcomes.

Once you've entered the inputs, the calculations and outputs update automatically, allowing you to easily adjust and test different scenarios.

Model Limitations

Before we conclude, it's important to be aware of the limitations of this model:

- One investment per simulation: this model assumes you're buying a single property. If you have a portfolio of investments, you might need to duplicate the model or adapt it to suit your needs.

- Annual calculation: this model calculates returns on an annual basis. This is a simplification that can lead to less precise results, but it still gives you a good high-level overview.

- High-level simulation: this model includes only essential assumptions and some calculations are simplified, like income tax. If your investment scenario includes unique factors not covered in this model, you may need to modify it.

By breaking down the problem into inputs, intermediary calculations, and outputs, real estate investment analysis becomes far more manageable. With the help of this model, you can confidently navigate your real estate investment journey.

Don't forget to download the model for yourself and start exploring. Stay tuned, keep learning, and happy investing!

Other articles you might like on ExcelFrog.com

- How and when to use the four COUNT functions

- Understand IF, nested IF, and IFS functions

- Three features to handle a spreadsheet full of data

See all the tutorials on the homepage

A Framework For Assessing the Impact of Inflation on Real Estate

June 28, 2022.

Featured in PREA Quarterly Spring 2022 issue:

“when full employment is reached, any attempt to increase investment still further will set up a tendency in money-prices to rise without limit…i.e. we shall have reached a state of true inflation.” — john maynard keynes[1].

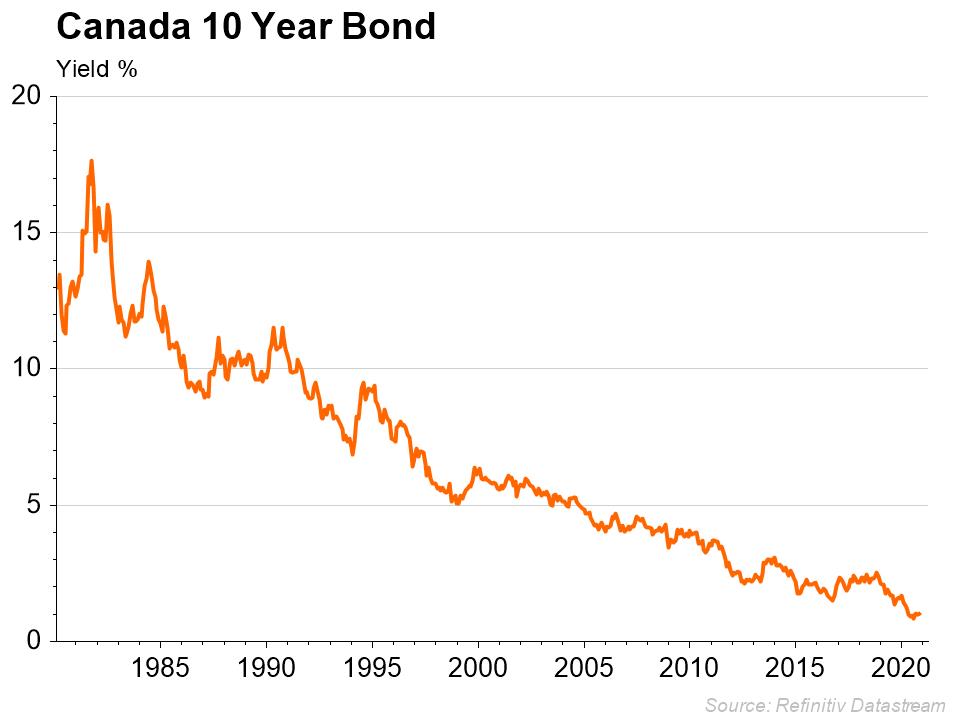

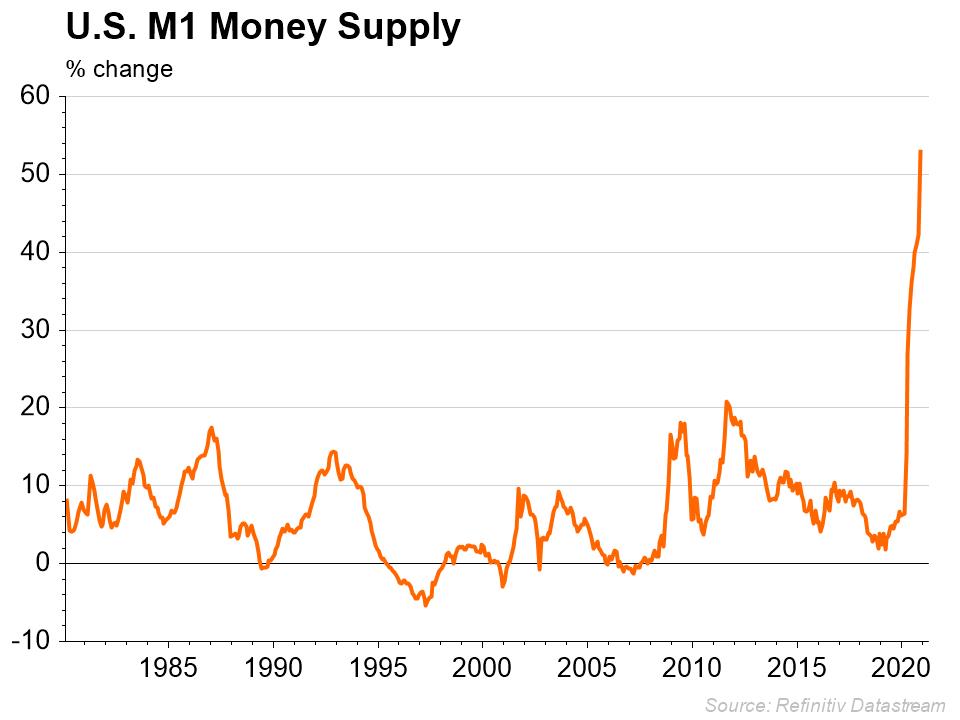

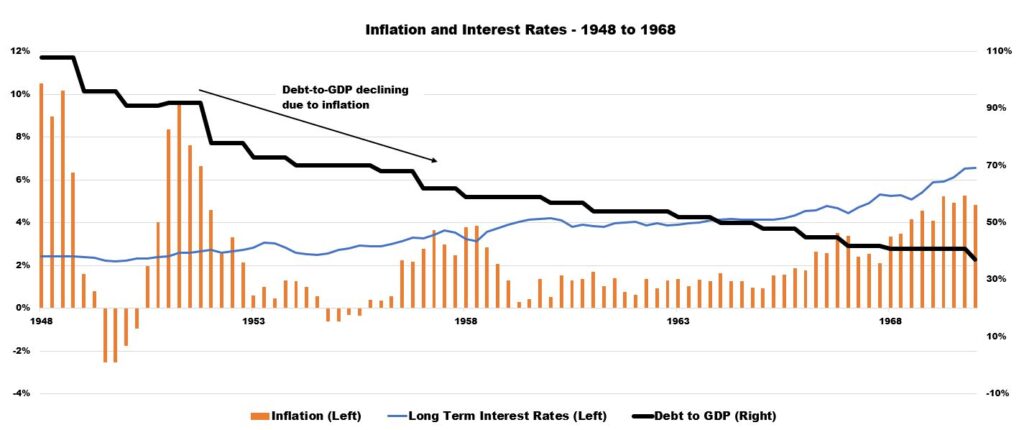

With an unemployment rate of 3.6%, year-over-year job openings growing at 7.1%, and average monthly nonfarm payroll gains exceeding 500,000 in the past year, the US economy arguably has reached a state of Keynesian full employment and true inflation. Signs of inflation are pervasive in year-over-year statistics: the headline Consumer Price Index (CPI) rose by 8.3% in April, the GDP deflator increased 8.0% in 1Q22, and West Texas Intermediate crude oil prices breached $100 per barrel earlier this year for the first time since 2014. Real estate costs have not been invulnerable to these macroeconomic shifts. According to one prominent index, construction costs increased by 7.1% year-over-year as of 1Q22.[2] Additionally, the Bureau of Labor Statistics reported that total compensation for individuals in the real estate, rental, and leasing sector increased by 5.2% in 1Q22 relative to 1Q21.

Conditions not seen since the early 1980s now confront real estate investors, who want to know how higher inflation impacts cash flows, valuations, and returns. The preponderance of empirical studies Heitman has reviewed on private real estate and inflation shows that real estate has been at least a partial inflation hedge. However, incorporating that conclusion into a broader risk, return, and asset allocation framework adds another layer of complexity. Uncertainty abounds in the current environment with respect to the direction of the economy, inflation, and real estate returns, and investors need a method that incorporates both their informed views and the dispersion surrounding their assumptions. Heitman has developed a framework to address these issues.

Heitman views the contour of macroeconomic consensus forecast distributions as a useful starting point for thinking about market expectations. Further, real estate market participants can use these distributions—with proprietary adjustments—in a forward-looking simulation analysis to understand more thoroughly inflation risks and their impact on real estate.

Real Estate as a Partial Inflation Hedge

When inflation was raging in the late 1970s, Eugene Fama and William Schwert set out to determine the extent to which stocks, bonds, and real estate were inflation hedges.[3] In the pre-NCREIF era, the authors relied on the housing component of the CPI to conduct tests for residential real estate and found that it was a “complete” inflation hedge (i.e., it served as a hedge against both expected and unexpected inflation). New data and econometric techniques have flourished over the past 45 years since the article was written, but its methods are still applicable.

In that 1977 paper, Fama and Schwert disaggregated inflation into expected and unexpected components, drawing inspiration from Irving Fisher’s famous equation: nominal interest rate = expected real return + expected inflation rate. Empirically, the proxy for expected inflation was the Treasury bill yield, and the stand-in for unexpected inflation was the inflation rate minus the Treasury bill yield. If the regression coefficient for expected inflation and that for unexpected inflation were indistinguishable from 1.0, then Fama and Schwert deemed the asset to be a “complete hedge against inflation.”

Taking inspiration from these assertions, Heitman reproduced a fragment of the study using NCREIF data and slightly different methods. [4] Exhibit 1 stacks NCREIF Property Index (NPI) return sensitivities to expected and unexpected inflation on a rolling, trailing five-year basis over the past few decades. The exhibit highlights that real estate is a partial inflation hedge, on average, and that its inflation hedging abilities are time varying. It may be that the results from this chart (and many modern academic studies) reach a more modest conclusion relative to that of Fama and Schwert (real estate as a partial instead of a complete inflation hedge) in part because of the underlying indices used. [5] But it is important to note that real estate also seems to be a good hedge against inflation when inflation levels are high, although data is limited. Given estimation error and other limitations, investors should also consider commonsense or theoretical models to supplement these types of calculations. For example, the presence of explicit CPI provisions, percentage rent, and other features of leases and real estate itself should create at least some inflation protection. In addition, real estate investors may wish to incorporate these kinds of foundational assumptions into a broader risk, return, and asset allocation framework. The remainder of this article progresses toward a simplified illustration of one such synthesis.

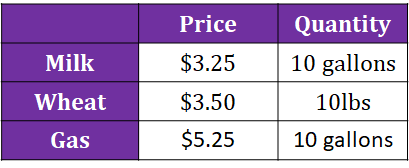

A Non-Normal Environment for Inflation

Many economic and financial variables exhibit non-normal return distributions, and inflation is no exception. Since 1948, US CPI inflation on a year-over-year basis has hovered in the 0% to 5% range in just under 75% of months. That means more than 25% of the time, inflation might plausibly be characterized as uncomfortably high or low (outside the 0% to 5% range), as demonstrated in Exhibit 2. The chart shows heavy tails and a conspicuous long right tail of the distribution, which explains why mean inflation since 1948 is 3.5% while the median is only 2.8%. For comparison purposes, a simulated normal distribution with a mean of 2.8% is also included in the graph.

For purposes of forward-looking decision-making, perhaps just as interesting is the fact that macroeconomic consensus forecast distributions may exhibit unexpected shapes. Often, the configuration of consensus forecasts for GDP, inflation, unemployment, the federal funds rate, the ten-year note, and other variables are surprising. For example, given the long right tail in historical CPI percentage changes shown in the exhibit and the uncertainty about the path of future inflation, a nontrivial number of forecasts might be expected to differ significantly from the middle of the pack. But for 4Q22, inflation forecasts in the tails are not dramatically different from that implied by a normal distribution. In part, this phenomenon occurs because consensus forecast distributions represent measures of central tendency without variance around the forecasts. Even so, the amount of certainty rooted in consensus forecasts might be surprising to some market participants.

Why does the contour of consensus forecast distributions matter? Because the underlying assumptions represent the views of some of the largest financial institutions with extensive sway in markets. Rather than starting from scratch, real estate investors can use the distributions to begin a conversation about initial capital market expectations. For example, if a real estate investor believes that the consensus distribution for CPI does not sufficiently capture inflation risk, then the analyst might create macroeconomic suppositions with an inflation distribution that is positively skewed (long right tail) relative to that of consensus. Subsequently, the investor could take additional steps toward a broader framework.

Steps Toward a Quantitative Procedure

An approachable quantitative procedure could advance along these five steps:

- Gather macroeconomic consensus forecast distributions for the applicable variables and other relevant data.

- Fit the individual distributions along with any adjustments for a “house view.”[6]

- Specify how the variables are related to one another.

- Simulate all variables forward over the given horizon.

- Analyze risk, return, and portfolio construction.

Even though these steps entail some complexity, the procedure is approachable in the important sense that the analysis can be performed in a spreadsheet without the need for more advanced econometric software.[7]

Example: Inflation Risk and Real Estate Price Changes in a Dynamic Framework

Returning to the Keynes quote at the beginning of the article can help frame a model for purposes of illustration.[8] Namely, the much-discussed time-varying, short-term trade-off between the inflation rate and the unemployment rate is used as the basis for a rudimentary macroeconomic framework. Inflation and unemployment may be combined with changes in real estate prices to observe how the three variables evolve over time and influence one another. Specifically, the headline CPI, the unemployment rate, and commercial property prices are used and information over the historical period December 2000 to February 2022 is gathered.[9] Moreover, the macroeconomic consensus forecast distributions for the period 4Q21 to 4Q22 are analyzed because the analysis of a one-year period is straightforward. On their own, the mean and median for inflation and unemployment forecasts are fairly close to each other, suggesting somewhat symmetrical distributions.[10] In this example, the shape of the distribution for real estate is based on the historical contour of price changes, but PREA’s Consensus Forecast Survey can be used in future research.

A real estate investor either may adopt the general shape and central position of the forecast distribution or may adjust it. If a market participant has no special insight into inflation or unemployment forecasts, then the general form of the consensus distribution can be assumed. This option may be appropriate for many real estate observers who do not generate proprietary forecasts of macroeconomic variables. Because the forecast distributions represent individual estimates of the central outcome, they may understate the true dispersion in the forecast. Therefore, even if the shape of the forecast distribution is adopted, there is room to increase the weight in the tails to account for more risk.[11]

Some institutions have their own forecasts or prefer to weight specific forecasts more heavily (perhaps in a way that changes the configuration of the distribution). In such a case, the institution should use its own house view instead of embracing the more passive approach described. But investors should be mindful of overconfidence bias when doing so. For purposes of this example, the general shape of consensus forecast distributions is considered as a starting point, but based on the shape of the CPI historically and a hypothesis, just for illustration, that inflation surprises will be on the upside, subjective distributions are created by variable and by month that assign upside risk to inflation and the unemployment rate. The historical distribution for real estate prices is negatively skewed (long left tail), and this general shape is applied for the forecast.

Correlation analysis is one useful method for understanding the relationship among variables. But static correlation matrices should be used with caution for a variety of reasons.[12] For purposes of this example, a couple of basic adjustments are included to increase the likelihood that the correlation estimates are useful, but more sophisticated adjustments should be contemplated. Specifically, all three variables are normalized before calculating correlations, and correlations from different time periods are applied (50% probability of the correlation matrix from April 2020 to the present, 30% from 2011 to March 2020, and 20% from 2001 to 2010; only one correlation matrix is used for each simulation run over the one-year forecast horizon). Finally, each variable is related to its past values through a regression model.[13] In summary, real estate prices, inflation, and unemployment are related to their own past values as a baseline forecast; forecast distributions around this baseline are applied by variable and by month, as described in the “Gather” section; and the normalized variables are related to one another through correlation matrices (more recent correlations are given a higher weight).

Changes in real estate prices and inflation and differences in the unemployment rate are all simulated forward over a one-year period.[14] Importantly, correlated variables are simulated forward; the model does not use indices independent of one another. In other words, uncertainty is integrated into the framework but in such a way that allows for dynamic relationships among the variables.

The results convey that the average real estate price appreciation over the forecast horizon is 3.3%, CPI inflation is 7.5%, and the increase in the unemployment rate is 260 basis points (bps). Inflation and unemployment risk are on the upside, but the average and median for real estate are quite close (a more symmetrical distribution). If these results are to be believed, portfolios could be tilted to favor assets with shorter lease terms, downside protection, and related attributes. However, pricing is key in the portfolio construction process because savvy investors with a similar view may have already caused market pricing to reflect these valued attributes.

The most likely outcome is that the average of the simulated forecasts in Exhibit 4 will be wrong. But even though these forecasts are quite likely to be wrong, the method outlined can be used to appreciate inflation and real estate risk more thoroughly and identify other areas in which underappreciated risks should be acknowledged. Wrestling with the assumptions and mechanics of the model can be just as important or more important than observation of the forecasts themselves.

A discrete probability table is another way to display the results. One advantage of this approach is its concreteness and intuitiveness that may reinforce insights from the continuous probability distributions. The views of an investor and the set of possible outcomes are captured holistically in the continuous distributions, but discrete scenarios may be useful for purposes of communication. Exhibit 5 shows one way of presenting the information, but the number of scenarios and other features can be adjusted based on personal preferences. In the table, for Scenario #2, a 50% probability is assigned to the median values derived from the continuous distributions, and the remaining values are implied based on the probabilities given and the relationships described previously. Scenario #1 shows lower inflation but at the cost of higher unemployment and no real estate price appreciation. Conversely, Scenario #3 depicts higher inflation, continued low unemployment, and higher real estate price appreciation.

The contour of macroeconomic consensus forecast distributions can be combined with insights from historical data along with proprietary assumptions and integrated into a dynamic framework. This framework may be used to assess the impact of inflation on real estate more thoroughly and to consider how portfolio construction might need to adapt to the current environment. It is well established that real estate offers at least a partial inflation hedge. The five-step procedure recommended in this article starts with that well-established foundation and translates it into a broader set of forecast distributions. At a time when the US economy may be in a state of Keynesian “true inflation,” investors need tools to address an uncertain future with few domestic historical parallels. The methods outlined here may represent one component of a more comprehensive approach to appreciating how inflation impacts real estate.

1. John Maynard Keynes, 1936, The General Theory of Employment, Interest and Money, reprint, Cambridge University Press, 2014. 2. Turner Building Cost Index. 3. Eugene F. Fama and G. William Schwert, “Asset Returns and Inflation,” Journal of Financial Economics, Vol. 5, No. 2, 1977, pp. 115–146. 4. NCREIF Property Index (NPI) data is used instead of the housing component of the CPI. A regression is also run with NPI returns as the dependent variable and four quarterly lags of NPI returns, the three-month Treasury bill yield, and the CPI minus the three-month Treasury bill yield as independent variables (instead of using lags of the CPI minus the Treasury bill yield, as Fama and Schwert proposed in the original article). 5. The housing component of the CPI should be highly correlated with the headline CPI. 6. The initial consensus forecast distributions along with adjustments may be thought of as the “prior” in Bayesian analysis. 7. Roger B. Myerson’s SIMTOOLS Excel Add-In is used for the calculations, but other simulation software can produce similar results. 8. The example in this section is not Heitman’s official house view; it is intended solely as an illustration. 9. The time period selected is based on data available from Real Capital Analytics; inflation (monthly log percentage changes; source: St. Louis Fed); unemployment rate (first difference of unemployment rate; winsorized at the 5th and 95th percentiles; source: St. Louis Fed); commercial property prices (Real Capital Analytics CPPI National All-Property Commercial Property Price Index). 10. Bloomberg is the source of the macroeconomic forecast distributions. 11. A slightly more complex version of this first approach could include combining a heavy-tailed variation of consensus forecast distributions with the shape of the distribution based on historical data. 12. For example, nonlinear relationships, non-normal distributions, and time-varying correlations can render static correlation matrices less meaningful. 13. An autoregressive model with two lags is used for simplicity—AR(2). 14. 10,000 simulations are created for each variable at the end of the horizon (4Q22).

Recent News & Insights

Heitman Expands Portfolio with Acquisition of Three Residential Apartment Buildings in Japan

Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the acquisition of a portfolio of three residential apartment buildings located in the heart of Osaka, Japan. This strategic acquisition marks Heitman’s entry into Osaka’s thriving residential real …

May 9, 2024

Heitman further expands investment in norwegian student housing.

Global real estate investment management firm, Heitman LLC (“Heitman”), today announces further growth in its student housing platform with the acquisition of two assets, Studinen and SG 28, in Gjøvik, Norway. Gjøvik is one of the largest student markets in …

November 2, 2023

Heitman expands norwegian student housing footprint with latest acquisition.

Global real estate investment management firm, Heitman LLC (“Heitman”), today announces it has grown its Norwegian student housing platform with another acquisition. The purchase of Steinan Studentby in Trondheim adds 218 beds in 102 apartments across two buildings to Heitman’s …

October 9, 2023

New report from heitman & uli – climate-risk disclosures and the future of real estate investment decision-making.

New Report from ULI and Heitman Equips Real Estate Investors with Insights on Climate Risk Disclosure Data Download the Full Report The Urban Land Institute (ULI) and Heitman released a report highlighting how investors may leverage the data resulting from …

September 18, 2023

Why european alternative sectors provide a haven for investors in inflationary times.

Featured in IPE Real Estate’s Sept/Oct 2022 issue: Real estate investors today face the greatest economic uncertainty in over a decade. The ongoing economic crisis is anything but conventional, defined by supply chain turmoil, geopolitical upheaval, spiraling consumer prices, and …

October 3, 2022

Heitman expands uk student housing portfolio, invests in bath purpose-built student accommodation.

London, Sept. 27, 2022 – Heitman LLC (“Heitman”), a global real estate investment management firm, today announced that it has invested in the Hollis Building, Bath, a 120-bed student housing development in an off-market transaction with Alumno Group, a leading …

September 27, 2022

Heitman acquires dallas-fort worth baylor micro-hospital medical office portfolio.

Chicago, Sept. 14, 2022 – Heitman LLC (Heitman), a global real estate investment management firm, today announced the acquisition of a six building portfolio of Baylor-anchored micro-hospital locations totaling approximately 190,000 square feet. Heitman acquired the Baylor Scott & White …

September 14, 2022

Heitman acquires arizona’s tallest multifamily tower in downtown phoenix.

Chicago, Aug. 18 2022 – Heitman LLC (“Heitman”), a global real estate investment management firm, today announced the acquisition of 44 Monroe, a 34-story high-rise multifamily community comprised of 184 residential units and four retail spaces in the heart of …

August 18, 2022

Heitman acquires two freehold residential blocks in london’s west end in partnership with addington capital.

London, Aug. 3, 2022 – Heitman LLC (“Heitman”), a global real estate investment management firm, and its operating partner Addington Capital, the specialist UK investment and property asset management business, announced today the acquisition of two contiguous, freehold residential blocks …

August 3, 2022

Heitman invests in largest irish self-storage platform.

London, July 25, 2022 – Heitman LLC (“Heitman”), a global real estate investment management firm, today announced an investment in U Store It, an Irish and Northern Irish self-storage business with six existing locations across four cities: Dublin, Belfast, Cork, …

July 25, 2022

Heitman appoints new chief diversity officer to lead global dei for the firm.

Chicago, July 18, 2022 – Heitman LLC (“Heitman”), a global real estate investment management firm, is pleased to announce that Rachna Velamati has rejoined the firm and will serve as Chief Diversity Officer. In her new role, Velamati will be …

July 19, 2022

Heitman continues expansion of space station self-storage platform, more acquisitions planned.

London, June 13, 2022 – Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the closings of three new sites across the UK that will be developed or converted into self-storage facilities as part of the Space …

June 13, 2022

Riding the demographic wave.

Featured in IPE Real Estate’s May/June 2022 issue: Senior housing. Demand for this property type is driven by predictable, long-term demographic trends. The sector also has other appealing fundamentals, including an attractive income return and greater opportunities for value creation …

May 26, 2022

Heitman acquires hong kong industrial asset for cold storage logistics.

Hong Kong, May 3, 2022 – Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the acquisition of an approximately 100,000 square foot Hong Kong logistics asset located in the strategic industrial precinct of Fanling at No.6 …

May 3, 2022

Heitman sells newly-built dresden, germany residential asset.

London, March 24, 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, today announced that it sold the Behringold rented-residential property in Dresden to institutional investor Swiss Life Asset Managers Germany on behalf of an affiliate of …

March 24, 2022

Heitman invests in three uk student housing assets for nearly £70 million.

London, March 9, 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, recently agreed to acquire three UK student housing assets – one fully-occupied asset and two forward-funded developments for approximately £70 million in an off market …

March 9, 2022

Alternative options – the growing appeal of nontraditional asset classes.

Featured in Institutional Real Estate Asia-Pacific’s February 2022 issue: If the pandemic has taught us anything, it has highlighted the need for investors to future proof their portfolios. To this end, many institutions are reassessing their portfolio allocations. For real …

February 14, 2022

New report from heitman & uli – climate migration and real estate investment decision-making.

New Research from ULI and Heitman Finds Need for Deeper Understanding of the Risks Posed by Climate Migration Climate change is prompting movement of people and jobs, with more expected in the years ahead as a result of the warming …

January 27, 2022

Heitman forms joint venture with sylvan road to aggregate $640m portfolio of single-family rental homes.

Chicago, Jan. 5, 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the formation of a joint venture with Sylvan Road Capital to acquire and aggregate a portfolio of single-family rental assets diversified across US …

January 5, 2022

Heitman acquires diversified us self-storage portfolio.

Chicago, Dec. 9, 2021 – Heitman LLC (Heitman), a global real estate investment management firm, has announced the formation of a joint venture with Life Storage, Inc (NYSE:LSI) to acquire thirteen newly-constructed self-storage properties diversified across seven MSAs. Heitman acquired …

December 9, 2021

Heitman acquires german all seasons self-storage platform.

Plans to Expand Self-Storage Portfolio via Aggregation Strategy London, Dec. 1, 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the acquisition of All Seasons, a German self-storage platform based in Northwestern Germany with portfolio …

December 1, 2021

Heitman acquires prime tokyo multifamily portfolio.

Hong Kong, Nov. 8, 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the acquisition of a portfolio of eight multifamily assets, located across Tokyo’s prime residential submarkets. Heitman acquired the portfolio in connection with …

November 8, 2021

Heitman achieves 5-star fund ranking in 2021 global real estate sustainability benchmark (gresb).

Heitman North American Core Fund Reaches 5 Stars for Second Consecutive Year Chicago, Oct. 20, 2021 – Heitman LLC (Heitman), a global real estate investment management firm, today announced that its North American Core Fund (Fund) has achieved a 5-star …

October 20, 2021

Climate migration and real estate.

Summary of Preliminary Findings Climate migration is already happening. People are moving within regions in search of higher ground. They are moving between regions—fleeing the cold or trying to escape unbearable heat, seeking access to water or running from to …

October 14, 2021

A mountain to climb.

Featured in IPE Real Estate’s September/October 2021 issue: The European Green Deal and Alternative Real Estate Investment In the summer of 2021, Europe experienced a series of extreme-weather emergencies bringing the reality of climate risk to the continent’s doorstep. Previously, …

October 6, 2021

Heitman expands space station self-storage platform.

London, Oct. 5, 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the acquisition of Squab Daventry, a self-storage asset located in the Midlands. The investment marks the second acquisition expanding Space Station, a UK …

October 5, 2021

Heitman acquires office building in prime london submarket.

London, Sept. 21, 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the acquisition of 15 Suffolk Street (“Suffolk”), a well-located office asset in the centre of one of London’s premier areas, the West End …

September 21, 2021

Heitman celebrates pride month.

At Heitman, we are committed to cultivating a workplace where differences are celebrated and each individual is empowered to bring their whole self to work. Heitman launched EPiC in 2019 to support its LGBTQ colleagues and foster both allies and …

June 30, 2021

Europe’s big bang moment.

Featured in IPE Real Estate’s May/June 2021 issue: How COVID-19 could reshape real estate portfolios After great disruption often comes great reform. Multilateralism was pursued after World War II to safeguard international security, while the Global Financial Crisis gave rise …

May 27, 2021

Heitman expands uk’s oldest private self-storage platform.

Acquires 58,000 sqft, high-quality, purpose-built Shrewsbury asset London, May 18, 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the acquisition of Rent-A-Space Shrewsbury, a high-quality UK self-storage asset by an affiliate of Heitman. The …

May 18, 2021

Heitman, signature senior lifestyle joint venture expands to highgate, london.

London, Jan. 25 2021 – Heitman LLC (Heitman), a global real estate investment management firm, today announced that its joint venture with Signature Senior Lifestyle (Signature) and Revera Inc. (Revera) to develop, own, and operate senior living communities across Greater …

January 25, 2021

Heitman sells fully-let, high-quality amsterdam residential complex.

London, Jan. 14 2021 – Heitman LLC (“Heitman”), a global real estate investment management firm, today announced the sale of a two-building, 196 residential unit portfolio located in Amsterdam. Heitman managed and sold the asset, on behalf of an affiliate …

January 14, 2021

Heitman achieves 5-star fund ranking in 2020 global real estate sustainability benchmark (gresb) real estate assessment.

Chicago, Dec. 2, 2020 – Heitman LLC (Heitman), a global real estate investment management firm, today announced that the Heitman North American Core Open-end Fund (Fund) has achieved a 5-star ranking in the 2020 Global Real Estate Sustainability Benchmark (GRESB) …

December 2, 2020

Heitman commits to global net zero carbon operations by 2030.

Chicago, Oct. 14, 2020 – Heitman LLC (Heitman), a global real estate investment management firm, today announced that the firm will reduce its private equity portfolio’s operational carbon emissions under its control to net zero by the year 2030. This …

October 14, 2020

Heitman acquires london-based self-storage platform.

London, Oct. 12, 2020 – Heitman LLC (“Heitman”), a global real estate investment management firm, today announced the acquisition of Space Station, a 10-facility UK self-storage business with locations across London and Birmingham, on behalf of Sunsuper, one of Australia’s …

October 12, 2020

Heitman acquires paris residential property.

London, Oct. 8, 2020 – Heitman LLC (“Heitman”), a global real estate investment management firm, today announced the acquisition of a 34-unit residential asset in Paris. Heitman acquired the asset on behalf of an affiliate of the firm. The 34-unit …

October 8, 2020

Climate risk and real estate: emerging practices for market assessment – new report from uli and heitman.

Real estate investors reveal increasing need for improved screening of market-level risk and resilience, says second climate risk report from ULI and Heitman A report by the Urban Land Institute (ULI), a global multidisciplinary real estate organization, and Heitman LLC …

October 5, 2020

Resilience and opportunity in european specialty.

Featured in IPE Real Estate’s September/October 2020 issue: The longest economic expansion in modern history came to an abrupt end due to the COVID-19 pandemic, causing severe disruption to real estate markets. In commercial property, the pandemic has accelerated structural …

October 1, 2020

Heitman acquires two class-a greater seoul distribution centers.

Hong Kong, July 13, 2020 – Heitman LLC (“Heitman”), a global real estate investment management firm, today announced the acquisition of the Yeoju Distribution Center A & B, two newly-developed, fully-leased, class-A warehouse facilities located in Yeoju city of the …

July 13, 2020

Living across europe.

Featured in IPE Real Estate’s September/October 2019 issue: Why Build a Pan-European, Pan-Living Sectors Portfolio? Four years ago in these pages, we identified the Living sectors in Europe as a target for real estate investors seeking attractive risk-adjusted returns (“Introducing …

October 2, 2019

A demographic future: how ongoing structural shifts fuel value-added opportunities across the asia pacific region.

Featured in Institutional Real Estate Asia-Pacific’s October 2019 issue: For investors seeking value-added exposure in their real estate portfolios, the Asia Pacific region offers an attractive array of investible structural trends The region — for this article, Asia Pacific typically …

Storing Value: European Self-Storage Can Deliver Resilient Cash-Rich Returns

Featured in Institutional Real Estate Europe’s October 2019 issue: The European self-storage sector is at an earlier stage of development compared to its US counterpart Institutional investment in the sector has yet to take off in a meaningful way, despite …

Climate Risk and Real Estate Investment Decision-Making: New Report from ULI and Heitman

Heitman and the Urban Land Institute (ULI) developed a new research report focused on the risks that climate change poses to real estate and the measures that leading firms are taking today to mitigate those risks. Climate Risk and Real …

February 5, 2019

Packaged for delivery: e-commerce is fueling the asia-pacific region’s rapidly-developing logistics landscape.

Featured in Institutional Real Estate Asia-Pacific’s February 2019 issue: The logistics sector has become a global darling. Few real estate property types currently enjoy such rosy demand drivers. With e-commerce forecasts rising, big tech targeting a smartphone in every hand, …

February 1, 2019

- The Investment Banker Micro-degree

- The Project Financier Micro-degree

- The Private Equity Associate Micro-degree

- The Research Analyst Micro-degree

- The Portfolio Manager Micro-degree

- The Restructurer Micro-degree

- Fundamental Series

- Asset Management

- Markets and Products

- Corporate Finance

- Mergers & Acquisitions

- Financial Statement Analysis

- Private Equity

- Financial Modeling

- Try for free

- Pricing Full access for individuals and teams

- View all plans

- Public Courses

- Investment Banking

- Investment Research

- Equity Research

- Professional Development for Finance

- Commercial Banking

- Data Analysis

- Team Training

- Felix Continued education, eLearning, and financial data analysis all in one subscription

- Learn more about felix

- Publications

- Online Courses

- Classroom Courses

- My Store Account

- Learning with Financial Edge

- Certification

- Masters in Investment Banking MSc

- Find out more

- Diversity and Inclusion

- The Investment banker

- The Private Equity

- The Portfolio manager

- The real estate analyst

- The credit analyst

- Felix: Learn online

- Masters Degree

- Public courses

How to Create a Real Estate Investment Model in Excel

By Chris Cordone |

Reviewed By Rebecca Baldridge |

March 28, 2023

What is a Real Estate Investment Model?

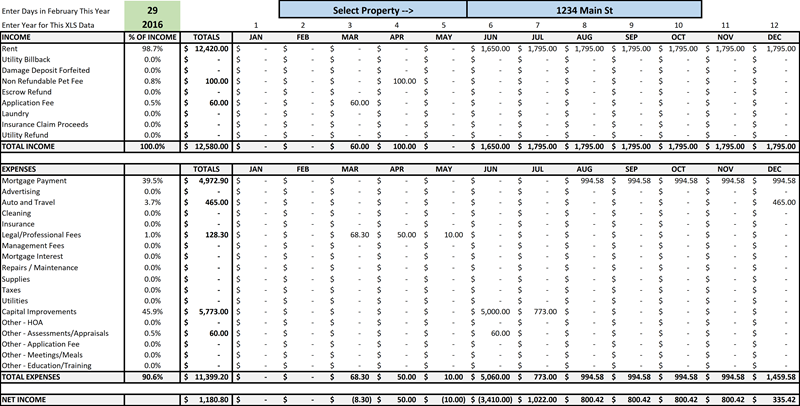

A real estate investment model is used to analyze the cash flows and returns to stakeholders from a real estate asset or collection of real estate assets. Unlike corporations, which use three statement modeling (income statement, balance sheet, and cash flow statement), a real estate model is primarily a cash flow statement with several ancillary pages on the revenues, costs, financing, metrics, and returns. Several assets can be grouped into one model; however, in most cases the analysis is done on a property-by-property basis.

Key Learning Points

- Real estate models have several purposes, but are principally intended to bring efficiency to the buying, managing, and selling of real estate assets.

- Models are mainly cash flow-based with very little, if any, accrual-based accounting

- The key drivers of a real estate model are rental revenues, operating expenses, and capital expenditures. Net operating income, as well as levered and unlevered cash flows, are the key measurement figures.

- Leases analysis is the most detailed component of real estate modeling.

- Like most transactions in finance, models can be built quickly for back of the envelope analysis or in great detail for transaction support.

Importance of Real Estate Modeling

In real estate, a successful deal is defined by paying the right price, choosing the correct capital structure, managing the asset at the highest level of efficiency, and selling at the right time and price. In order to compile and present that data for analysis, a model is needed.

The primary stakeholders in a real estate investment are the debt and equity holders. The analysis is geared toward satisfying their risk/return profiles. Let’s look at the debt investors first. They are making a loan based on the value of property. This is called loan sizing. However, once the loan is made, there must be cash flows to service the loan — the interest and principal payments. A cash flow analysis of the property is necessary to determine if the rent receipts, net of any building expenses, are sufficient to service the debt. The cash flow that debt holders look at to determine debt service coverage is called the unlevered cash flow, as it has not yet been affected by the financial structure.

The example below shows a model from NOI to levered and unlevered cash flow.

From the equity perspective, the model needs to do more than that since equity investors have a greater cost of capital, or required return, than do debt holders. The real estate model will look at historical cash flows to assess the asset is in terms of generating current cash flow. Assumptions must then be made about the future cash flows. It’s necessary to forecast rental revenues and building operating expenses, as well as capital, or longer term, expenditures. Since the equity holders’ returns come after the debt holders, we need to look at the cash flows after debt service. This is called the levered cash flow. It is the residual cash flow that goes to equity investors. Equity holders measure their returns using metrics such as IRR (Internal rate of return), MoIC (multiple of invested capital), and cash on cash yield (which measures the regular dividend payments)

The following is an example of the kind of analysis performed for equity investors. Access the free download to see

Step-by-Step Process to Real Estate Financial Modeling

1) Net Rental Revenues

Rental revenues are the key drivers and they are heavily dependent on the leases that are in place. A very detailed real estate model will have lease assumptions for each tenant. Assumptions are also made for rent increases, as well as potential vacancies, and for credit losses (tenants not paying their rent). This analysis can be extremely complicated from a modeling perspective so it is typically only done once a buyer is serious about investing or by the asset manager who is responsible for keeping the property’s returns high. A modeler will also have to consider any ancillary revenues that are part of the property such as parking, concessions, vending, storage, etc.

Below is an example of detailed lease analysis modeling

2) Operating expenses

The cost of running the building day to day are the operating expenses. The main building expenses include insurance, property taxes, and common area maintenance fees (CAM). In addition, there are the costs of utilities for the rented spaces. Depending on the type of leases, these expenses are either fully paid by the lessee (renter), shared by the lessor and lessee, or are paid entirely by the lessor. This will have an impact on the model. In many buildings, the leases are consistent, so if one tenant is responsible for their share of the expenses, the other leases most likely work the same way. Expenses are shared by the pro rata share of the property’s rentable space.

The net of the rental revenues and the operating expenses is called the Net Operating Income, or NOI, and it is a very basic measure of the asset’s profitability.

3) Capital expenditures

There are expenses that are not considered part of the daily upkeep but instead, benefit the owners for the longer term. These are the significant upgrades to the property such as landscaping, new elevators, painting/refinishing, and structural elements such as roofs, parking decks, etc. These are slightly more discretionary than operating expenses so they are not included in the NOI.

In addition, there are a few other expenses that fall into the capital expenditure category that are related to how the owner manages the property and they are not considered day-to-day. When vacancies are rented or leases are renewed, a broker is paid a commission on the contract. That is considered long term since it benefits the life of the contract. Furthermore, to attract new tenants there are several concessions that are made that involve improving the space for the new tenant. These can be upgrades to the infrastructure or funds to be applied to the buildout of the space.

The net of the NOI and the capex will deliver the unlevered cash flow, which we can use to begin our analysis to the stakeholders. Due to the unique tax structure of real estate assets, corporate tax is not paid but rather personal taxes are applied to the pass- through earnings.

4) Debt Schedule

The terms of the loan or loans must now be modeled so that we can determine if there is enough cash flow or cushion to support the loan. We would also need to determine the principal and interest payments to determine the levered cash flows, or cash flows post-debt service. An example of a debt schedule is shown in the graphic below.

5) Equity returns

The levered cash flows will enable us to look at what cash is left over for quarterly or annual distribution to investors. With the levered cash flows modeled out over the life of the investment, we can also determine what the overall return is to the equity investor using an IRR analysis. An example of an equity returns analysis is shown in the graphic that appears earlier in the blog post.

Types of Real Estate Models

Depending on the timing and the information available, a real estate model can be very basic or extremely detailed. With all forecasting, there is an element of guesswork and assumption. With real estate, however, we have the ability to forecast according to the leases in the building. That means a very detailed model will often show monthly cash flows since that is how rent and operating expenses are handled. Debt holders will often require monthly service as well. Investors might not need to see monthly returns as their distributions are either quarterly or annually. But once we have a monthly model, it is easy to add quarterly or annual tallies.

For a transaction in the due diligence stage or an asset manager overseeing the efficiency of the property, a detailed lease-by-lease or tenant-by-tenant model is necessary. For any other purpose, a model can be built making broad assumptions about the revenues and costs according to both historical figures and market projections.

Real estate models are critical to the analysis necessary to buy, manage, and sell a property. These models are typically done on a monthly basis but can be quarterly or yearly. They can be extremely complex and model cash flows on a per-tenant or per-lease basis, or they can be higher level and forecast according to historical and general market trends. Either way, stakeholders in the deal will be able to see their potential returns and the risks that are inherent in the investment to determine if it is a good fit or if improvements can be made to enhance the returns. The Real Estate Analyst Course will teach you how to build a real estate investment model.

Additional Resources

Cap Rates in Real Estate

Investing in Real Estate

Real Estate Valuation

Real Estate Financial Modeling

Share this article

Equity return modeling excel template.

Sign up to access your free download and get new article notifications, exclusive offers and more.

Recommended Course

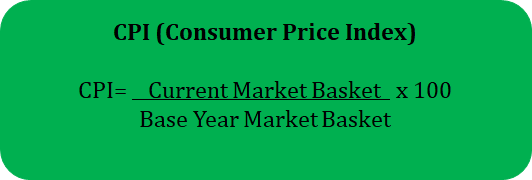

The Impact of Inflation on The Real Estate Industry

Inflation is a critical economic factor that has far-reaching effects on various sectors. The real estate, title, and financial services industries are three of the most impacted. Understanding the correlation between inflation rates, the economy, and real estate values is essential for investors, homeowners, and policymakers. It is also critical knowledge for professionals and business owners in the real estate and title industries. This article provides a comprehensive overview of the impact of inflation on real estate prices today and future implications.

READ THIS EBOOK: RIDING THE WAVES: How Interest Rates and Inflation Impact Real Estate

The Correlation Between Inflation Rates and Real Estate Values

Historically, there has been a strong link between the impact of inflation rates and real estate values. The most important factor is buyer or market expectations. In markets where future price expectations are higher, the market incorporates this expectation into today’s prices. This makes intuitive sense and drives interest rate expectations of investments. If buyers expect inflation rates to stay high, then future real estate values will be higher too. Investors seek to earn a “real” rate of return – over and above the rate of inflation.

This correlation can be further explained through several mechanisms:

1. Asset Appreciation – Inflation often leads to the devaluation of currency over time. Real estate, as a tangible asset, tends to appreciate in value during inflationary periods. This is because the cost of construction materials, labor, and land typically rises with inflation, leading to higher property prices.

2. Interest Rates – Central banks often respond to inflation by increasing interest rates. Higher interest rates can deter potential homebuyers from entering the market due to the increased cost of borrowing. However, this can lead to a decrease in demand, which may eventually put downward pressure on real estate prices.

3. Hedging Against Inflation – Real estate is often considered a hedge against inflation. Investors often turn to real estate to preserve their wealth during times of rising prices, as it offers a relatively stable and tangible asset that can retain its value.

4. Rental Income – Rental properties can provide a steady stream of income for investors. During inflationary periods, the impact of inflation can cause rental income to increase to keep pace with rising living costs.

5. Reduced Construction Activity – in higher inflationary environments, the cost of capital is higher too. This means it will cost more to build housing, which will (eventually) reduce the amount of new inventory coming online. This shortage will result in higher future real estate prices.

What to Expect in the Future?

Forecasting future interest rates is crucial for predicting the direction of real estate prices. The challenge, however, is that predicting interest rates is very difficult. There are many different variables to consider. World events can also have an impact at any time, adding further complexity to any interest rate forecast. Regardless, it is wise to stay current with various influential industry leader’s forecasts. Much can be learned by reading the reports. More importantly, what is critical to understand are market expectations. In the end, these have just as much of an impact on real estate market values and industry volume.

Here are three different reliable sources worthy of tracking to stay informed on the current impact of inflation. Each of these institutions publishes interest rate and inflation forecasts. These can then be used to have a better idea of what future real estate transactions will occur. Expectations then can directly impact the volume of real estate and title industry volume.

1. Federal Reserve Economic Projections – The Federal Reserve regularly publishes its economic projections, including the expected path of the federal funds rate. These projections provide insights into the central bank’s monetary policy decisions and can be accessed on the Federal Reserve’s official website .

2. Financial Institutions – Major financial institutions, such as JPMorgan Chase and Goldman Sachs, often release interest rate forecasts. These forecasts are based on in-depth economic analysis and can be found on the respective institutions’ websites.

3. Economic Research Firms – Firms like Moody’s Analytics and Oxford Economics specialize in economic forecasting. They offer detailed reports on various economic indicators, including interest rates, which can be valuable for predicting real estate market trends.

The Relationship Between Real Estate Values and Title Policy Issuance

The volume of title policy issuance is closely tied to the health of the real estate market. Title insurance is a crucial component of property transactions, as it provides protection against any unforeseen legal issues related to the property’s title. Therefore, the volume of title policy issuance can serve as a reliable indicator of business volumes in the real estate and title insurance sectors.

During periods of robust real estate activity, such as a seller’s market with high demand, the volume of title policy issuance tends to increase. Conversely, during economic downturns or periods of reduced real estate activity, the volume of title policies issued may decline.

To illustrate this relationship, you can refer to data from the American Land Title Association (ALTA). ALTA regularly publishes reports and statistics related to the title insurance industry, including data on policy issuance volumes.

Anticipating Future Business Volumes for Title Companies

The correlation between changing real estate values and the volume of title policy issuance can be utilized as a forecast tool for title companies. By monitoring trends in real estate prices and market activity, title companies can anticipate their business volumes in the coming years.

For example, if real estate prices are expected to rise due to inflation and there is a surge in homebuyer demand, title companies can prepare for increased policy issuance. Conversely, in a scenario where economic uncertainties lead to a slowdown in the real estate market, title companies may need to adjust their operations accordingly.

Furthermore, title companies can also adapt their marketing and pricing strategies based on the anticipated demand for title insurance policies. This proactive approach can help title companies remain competitive and financially resilient in changing market conditions.

Forecasting in Today’s Economic Environment

Today, there is a big problem with everything we shared above under a “business as usual” economy. Change used to be more predictable, and markets had more of an expected set of operating conditions. Then, along came COVID, and everything changed. Markets were significantly disrupted and are expected to stay in a status of recovery for many years to come. Significant structural changes occurred that have permanently shifted how goods and services are purchased, where people live, and how they work. Together, these changes have made it nearly impossible to predict interest rates or inflation with any great accuracy.

There is a term that summarizes today’s challenging market conditions quite well – VUCA. This acronym stands for Volatility, Uncertainty, Complexity, and Ambiguity. VUCA plays havoc on interest and inflation rate forecasting. Learn more about this market condition, Overcome VUCA With an IT Systems and Automation Strategy . Despite these challenges, companies can overcome VUCA by adopting modern systems and automation strategies. Organizations need to invest in new systems, processes, and automation strategies such that change can be executed quickly and accurately.

Artificial Intelligence will also play a greater role in helping with how to incorporate the myriad of factors potentially impacting future interest and inflation rates. This information, combined with an agile system and workflow strategy, offers the potential for real estate and title companies to rise to the challenge and deliver superior financial performance.

Inflation has a profound impact on real estate prices. Understanding this relationship is essential for making informed investment decisions and predicting future market trends. By examining historical data, monitoring forecasts of interest rates, and recognizing the connection between real estate values and title policy issuance, stakeholders in the real estate and title insurance industries can better prepare for the challenges and opportunities that lie ahead.

As with any economic analysis, it’s important to acknowledge that future outcomes are subject to various factors and uncertainties. Therefore, it’s advisable to stay informed, continuously monitor market conditions, and adapt strategies accordingly.

Share this post:

Recent posts, subscribe to our blog newsletter, more to read.

For Teachers and Students

- For Teachers & Students

- Econ Lowdown Teacher Portal

- Find Teacher Resources

- Scope and Sequence

- Permitted Use

A Dollar's Worth: Inflation Is Real

Understanding the reality of inflation can help consumers make decisions in personal finance. Learn more about inflation, how it’s measured, and how the inflation rate is calculated in the December 2021 issue of Page One Economics: Focus on Finance.

- High School / College Student Edition (pdf)

- High School / College Student Edition (html)

- Middle School Student Edition (pdf)

- Preview the High School/College Reading Q&A

- Preview the Middle School Reading Q&A

See the Page One Economics archive for more topics »

Keep your students in the know on timely economic issues with Page One Economics . Page One Economics provides a simple, short overview of a current economic event that offers students an opportunity to use close reading strategies. The Teacher’s Guide includes student questions and a teacher answer key, plus additional resources and lesson ideas for classroom, extra credit, or make-up assignments. You can subscribe via RSS feed or email .

If you have difficulty accessing this content due to a disability, please contact us at 314-444-8624 or [email protected] .

Find More Economics and Personal Finance Resources

Brought to you by:

Is Real Estate Real?

By: Lynne B. Sagalyn, Andrew Ang, Rona Smith

In this case a consultant to pension funds ponders the unique opportunities and risks she faces as she considers adding real estate to the fund's portfolio for the first time. While the fund already…

- Length: 17 page(s)

- Publication Date: Jul 8, 2011

- Discipline: Finance

- Product #: CU156-PDF-ENG

What's included:

- Educator Copy

- Supplements

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

In this case a consultant to pension funds ponders the unique opportunities and risks she faces as she considers adding real estate to the fund's portfolio for the first time. While the fund already owns REITs, its trustees believe that direct real estate investment could offer protection against the threat of inflation. But the category of real estate includes a wide range of distinct subclasses, including office, retail, industrial, hotel, and rental apartments. In analyzing the situation, students must determine which of these sectors provides the best hedge against inflation, and the risks and returns of the asset class as a whole.

Learning Objectives

To illustrate the value and risks for pension funds of direct investment in real estate versus investing in REITs. Considers various sectors of real estate market.

Jul 8, 2011

Discipline:

Geographies:

United States

Industries:

Financial service sector, Investment management services

Columbia Business School

CU156-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

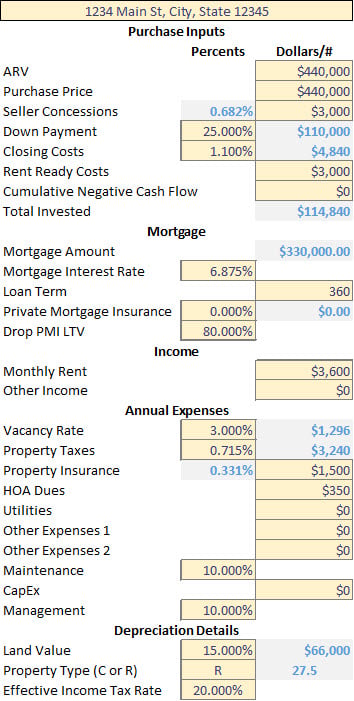

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ Version 2024.02

Watch the Video Overview…

All Other Deal Analysis Spreadsheets Are Wrong…

If you’re not accounting for:

- Reserves (including the return you earn on your reserves)

- All 4 areas of returns (appreciation, debt paydown, depreciation and cash flow)

- Return on equity (actually your True Net Equity™ after expenses)

- The cost of accessing equity, and

- Negative cash flow (if applicable)…

…when analyzing deals, then you’re analyzing deals all wrong .

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ is the only spreadsheet that analyzes deals correctly… all other spreadsheets come up short and do not correctly account for everything above.

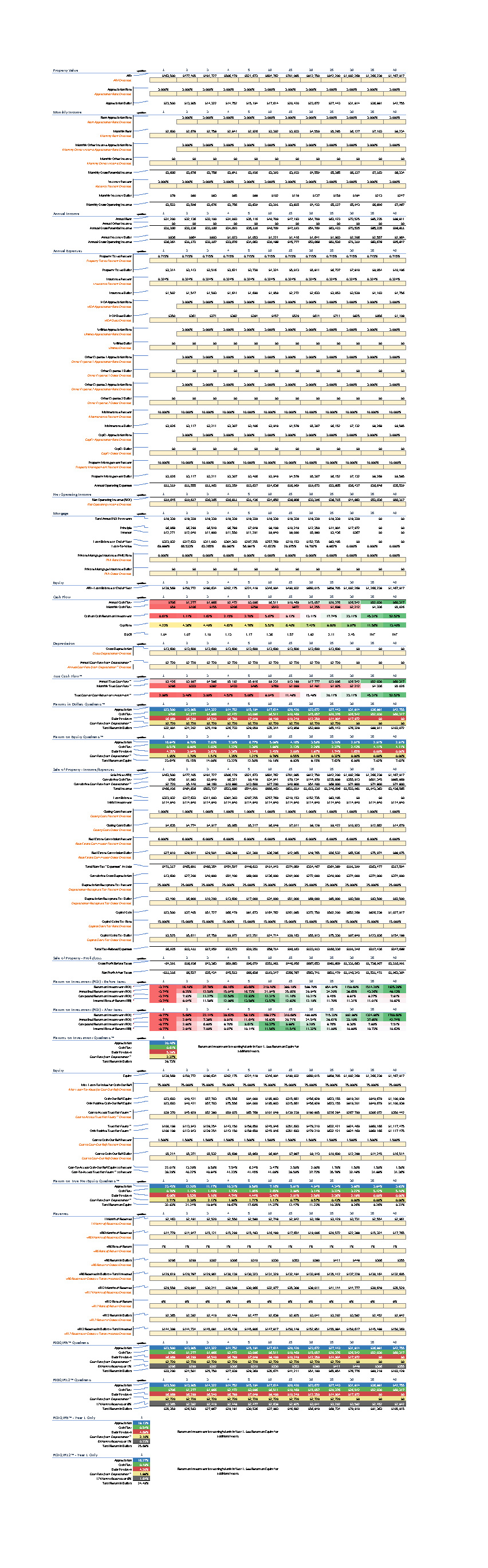

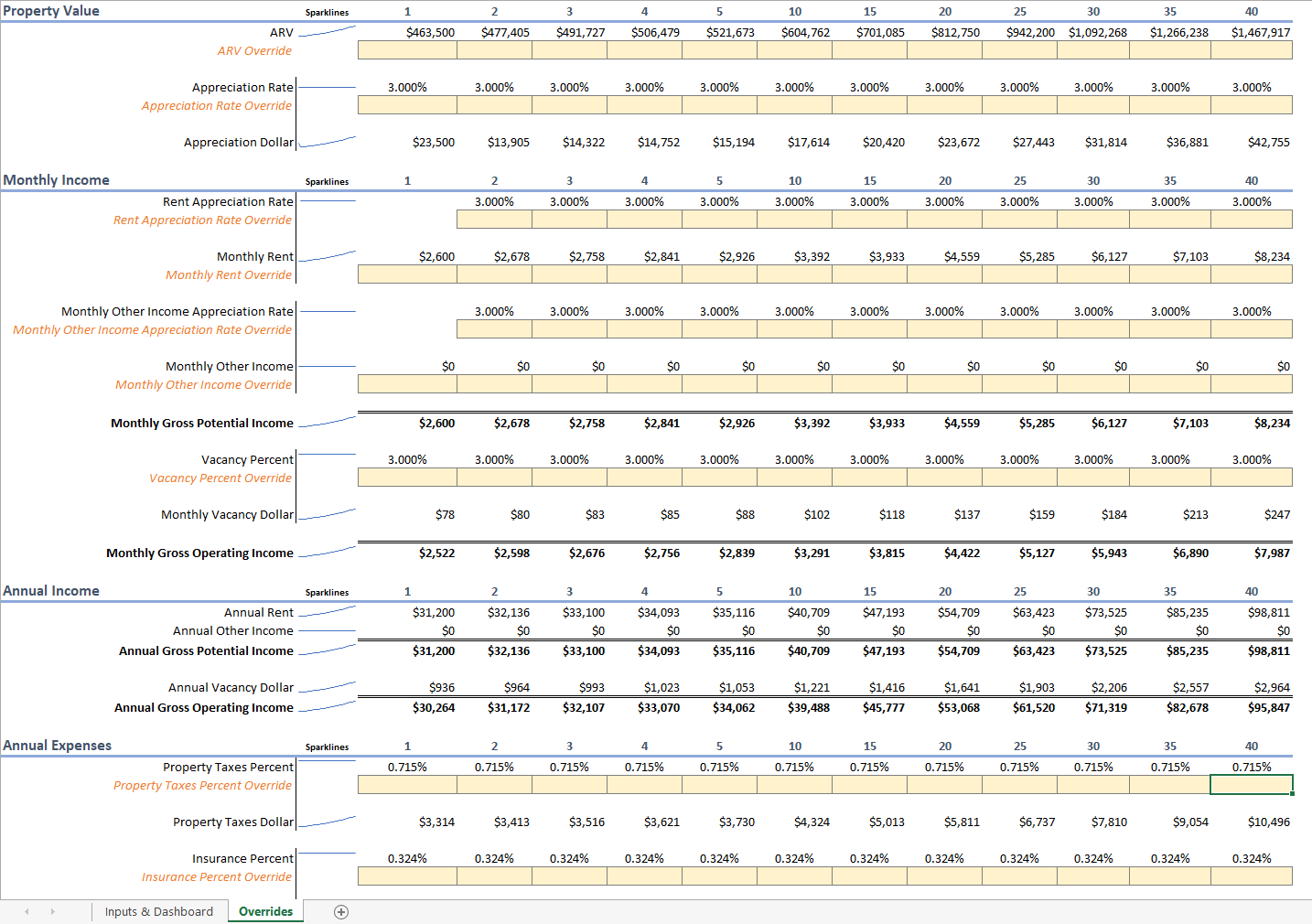

Track Your Investment Property Return Over Time

Plus, The World’s Greatest Real Estate Deal Analysis Spreadsheet™ allows you to track your investment and returns over time.

Enter in how much your property appreciated each year that you own it and see the spreadsheet update all your returns.

Do the same with debt paydown, cash flow and depreciation. Easily track how your rental property is performing by updating the spreadsheet with numbers for each year in the Overrides tab.

Simpler to Use

The new rental property analysis spreadsheet is simpler to use.

We’ve moved all the information we rarely look at when analyzing a deal from the main Inputs & Dashboard tab to the Overrides tab.

We took the 9 most important decision-making metrics, made them easy-to-read charts that take up 80% of the main tab.

More Powerful Than Ever

First, we simplified the input for making a decision if the property is a deal or not.

But, we also empowered you to do what you’ve never been able to do before in a deal analysis spreadsheet… override EVERYTHING .

The new rental property analysis spreadsheet is more powerful than ever because you can edit just about any input, for any year. This allows you to model incredibly complexed and nuanced situations like changing tax situations, changing costs to sell or refinance depending on the year, plus much, much more.

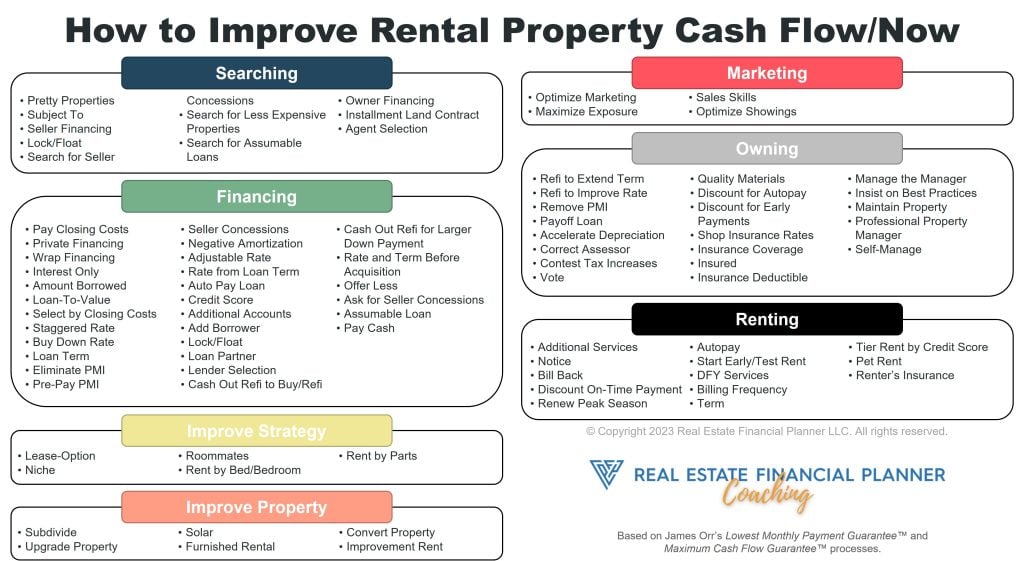

Improve Cash Flow

Use the spreadsheet and our comprehensive list of 88 strategies to improve cash flow on your rental properties to ensure that you’re only doing the best, most profitable deals.

Everything on One Screen

Use “Full Screen Mode” in Excel with 100% zoom to see the entire Inputs & Dashboard on one, reasonably-sized screen (1920×1080).

Easily Print to One “Landscape” Page

Want to print your deal analysis to share it with others? Easily print the entire Inputs & Dashboard on one “landscape” page.

Legal-sized paper is better, but letter-sized paper works.

Simplified Inputs

Everything you need, but nothing you don’t.

Color coded:

- Manilla Boxes: Inputs

- Gray Background with Blue Text: Calculated

Advanced Input Overrides

Feel empowered: override just about ANY variable using the Overrides tab.

Sparklines help understand what is happening at a glance.

Drill down more if needed and see Return Quadrants™ and more calculated.

Different Tools

- The World’s Greatest Real Estate Deal Analysis Spreadsheet™ = analyzing a deal/property.

- Real Estate Financial Planner™ = analyze/compare entire investment strategy/strategies, goals and risks.

There are plenty of different real estate investing strategies … some better than others depending on your specific goals. Find out which works for you with the Real Estate Financial Planner™ software.

The Real Estate Financial Planner™ software gives you unprecedented insight into how your entire strategy of stocks, bonds, commodities and, of course, rental properties performs in a variety of market conditions.

It answers questions about how quickly you can achieve financial independence and how much risk you have with each strategy you’re considering with questions like:

- Should I pay off my rentals? Sell some to pay off others?

- Should I refinance? Cash out refi? Buy more properties when I refi? Invest in something else?

- Should sell properties? Buy more properties when I sell? Invest in something else?

- What if I stop working on this date?

- What if I take social security on a specific date and/or buy an annuity?

- Plus, much much more…

Export to Real Estate Financial Planner™

One-click export will allow you to go straight from deal analysis to full portfolio and strategy analysis.

Easily Export Charts for Presentations

Raising money?

Sharing your deal with a partner, spouse, lender, or banker?

Teaching classes?

Easily export charts from The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to Microsoft Power Point or Microsoft Word.

Export as an image like this:

Or, export as a dynamic chart that updates when you make changes to the original spreadsheet like this:

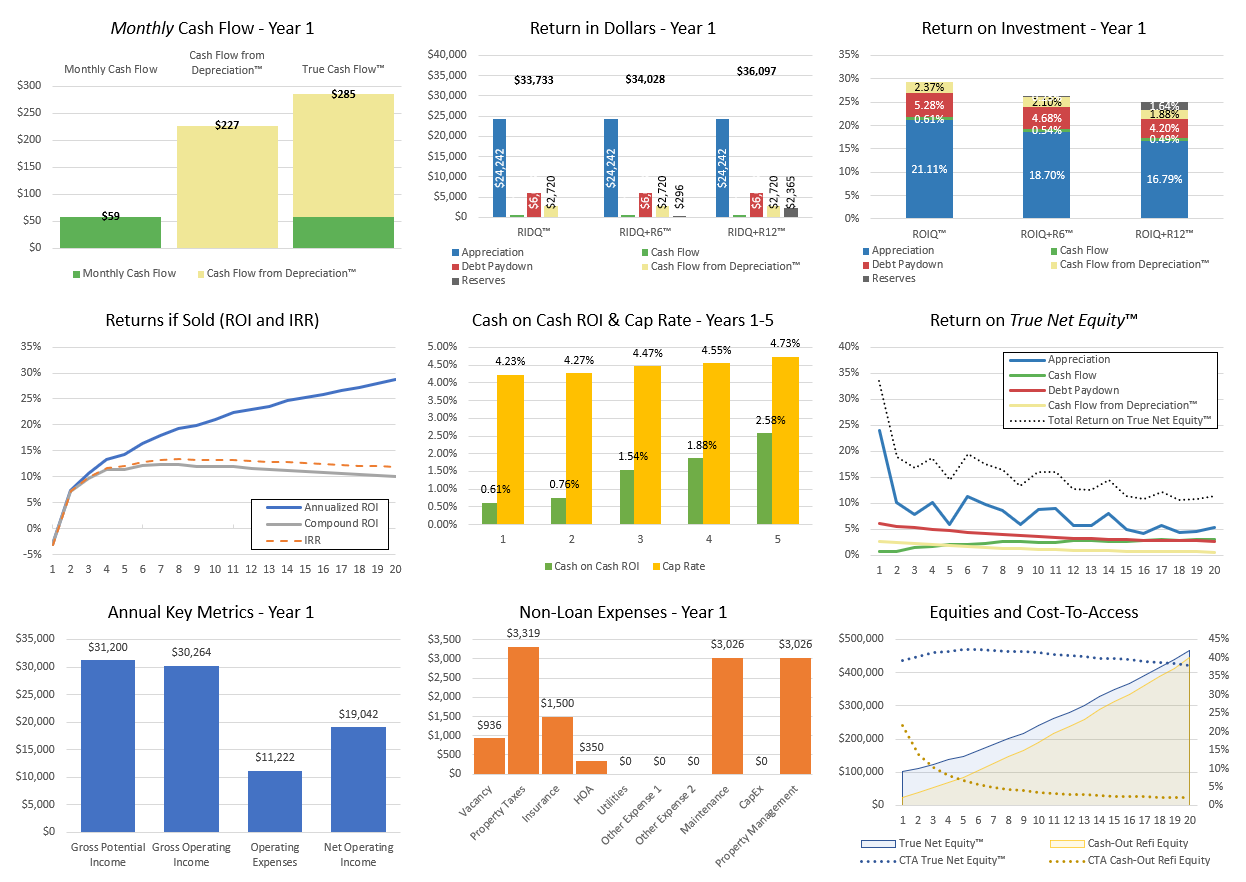

9 Primary Charts

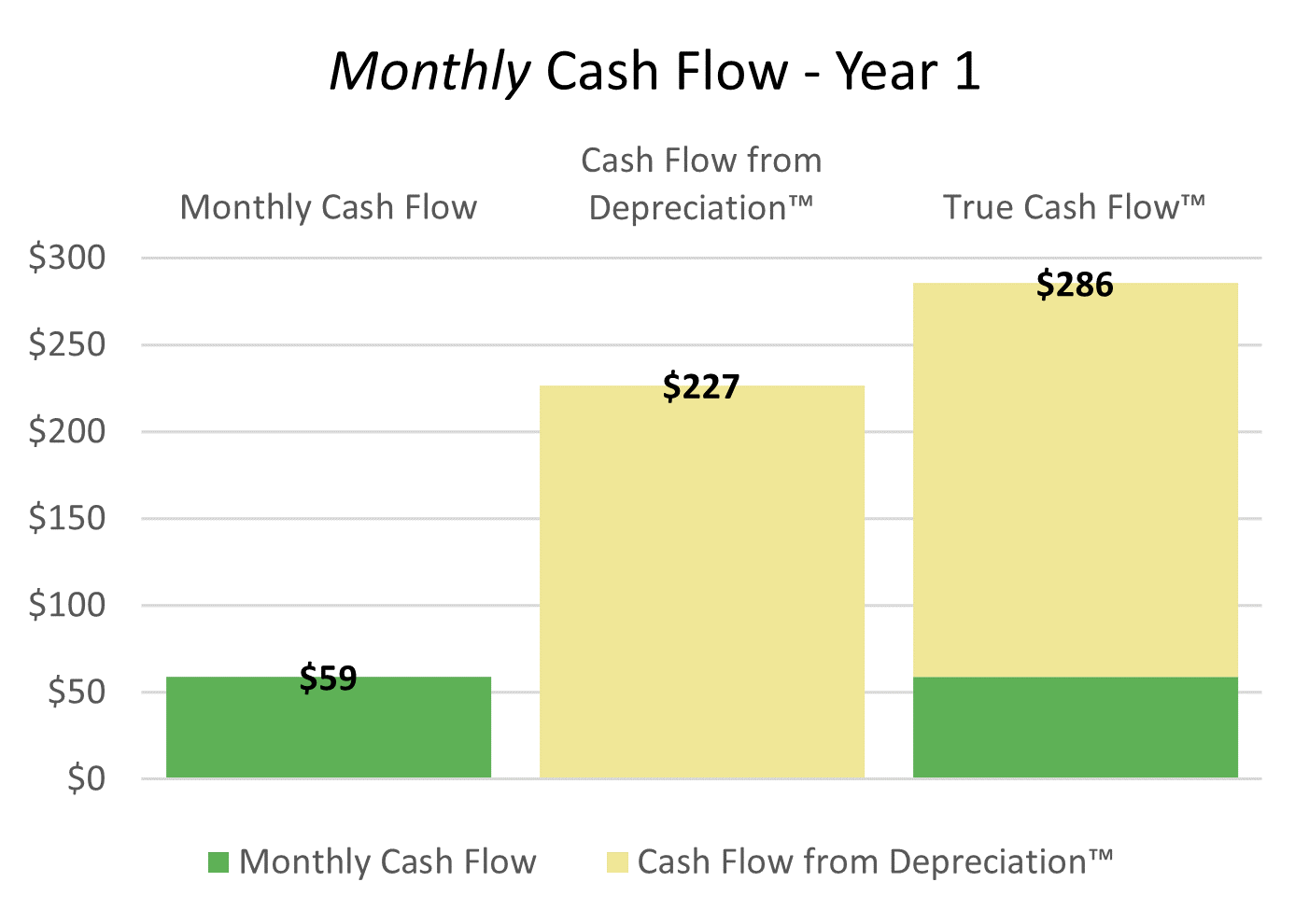

Monthly Cash Flow – Year 1

Return in dollars – year 1, return on investment – year 1, returns if sold (roi and irr) – years 1-20, cash on cash roi & cap rate – years 1-5, return on true net equity™ – years 1-20, key metrics – annual – year 1, non-loan expenses – year 1, equities and cost-to-access – years 1-20.

Shows the monthly value of:

- Cash Flow (after all expenses)

- Cash Flow from Depreciation™ – Just the cash flow from your depreciation benefit (after taxes).

- True Cash Flow™ – Which is the sum of cash flow and Cash Flow from Depreciation™ .

Cash Flow tends to be the primary metric folks look at when analyzing a rental property.

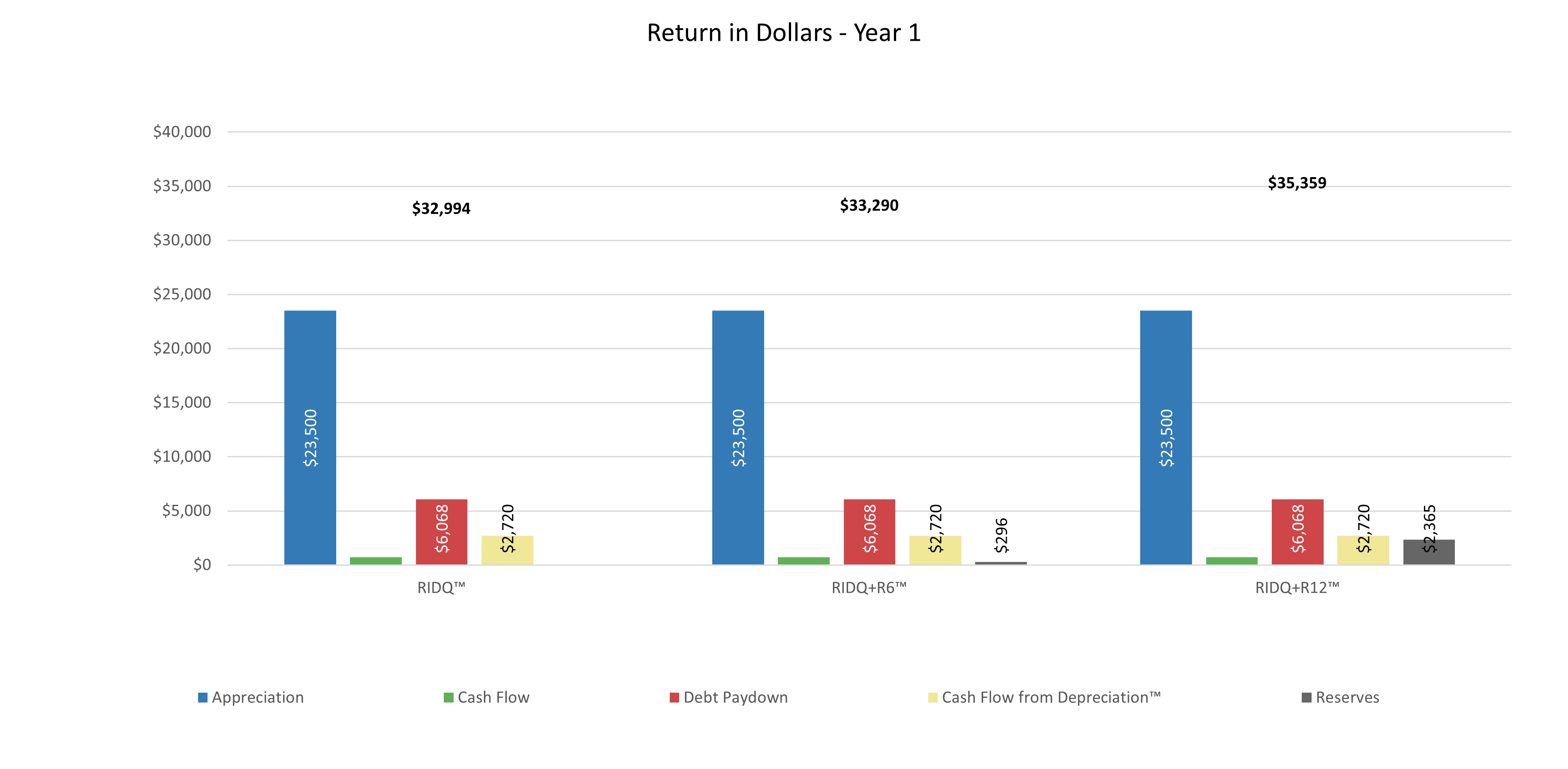

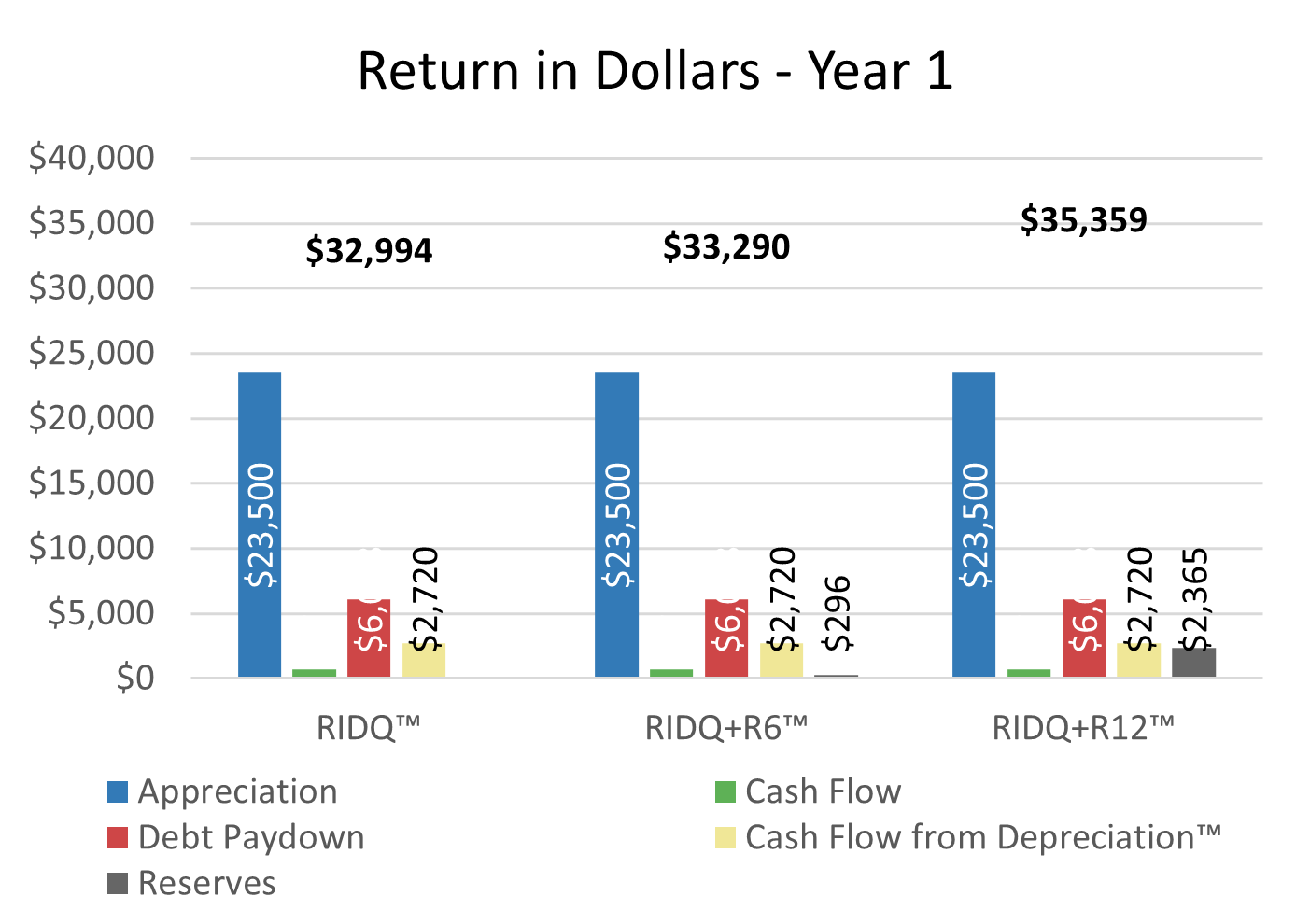

This shows you the Return in Dollars Quadrant™ values (in chart form) for year 1.

That’s the dollar amount of each of the following in the first year:

- Appreciation

- Debt Paydown , and

- Cash Flow from Depreciation™

There is more to buying rental properties than cash flow. This chart shows you this succintly.

It answers the questions of:

- How much did the property appreciate in year 1?

- How much cash flow did you generate in year 1?

- How much did you pay down in debt in year 1?

- How much cash flow did your tax benefits of depreciation generate?

- What was the TOTAL benefit (in dollars) you gained by owning this property in year 1? The number at the top in bold.

Then, it does the same numbers but also includes the amount you earned from reserves.

We have 2 “flavors” of reserves depending on how people choose to handle their reserves: 6 months of reserves in an account that earns 1% per year (RIDQ+R6™) or 12 months of reserves in an account that earns 8% per year (RIDQ+R12™). For more information on this concept, check out Everything You Learned About Deal Analysis is Wrong – ROIQ+R™ .

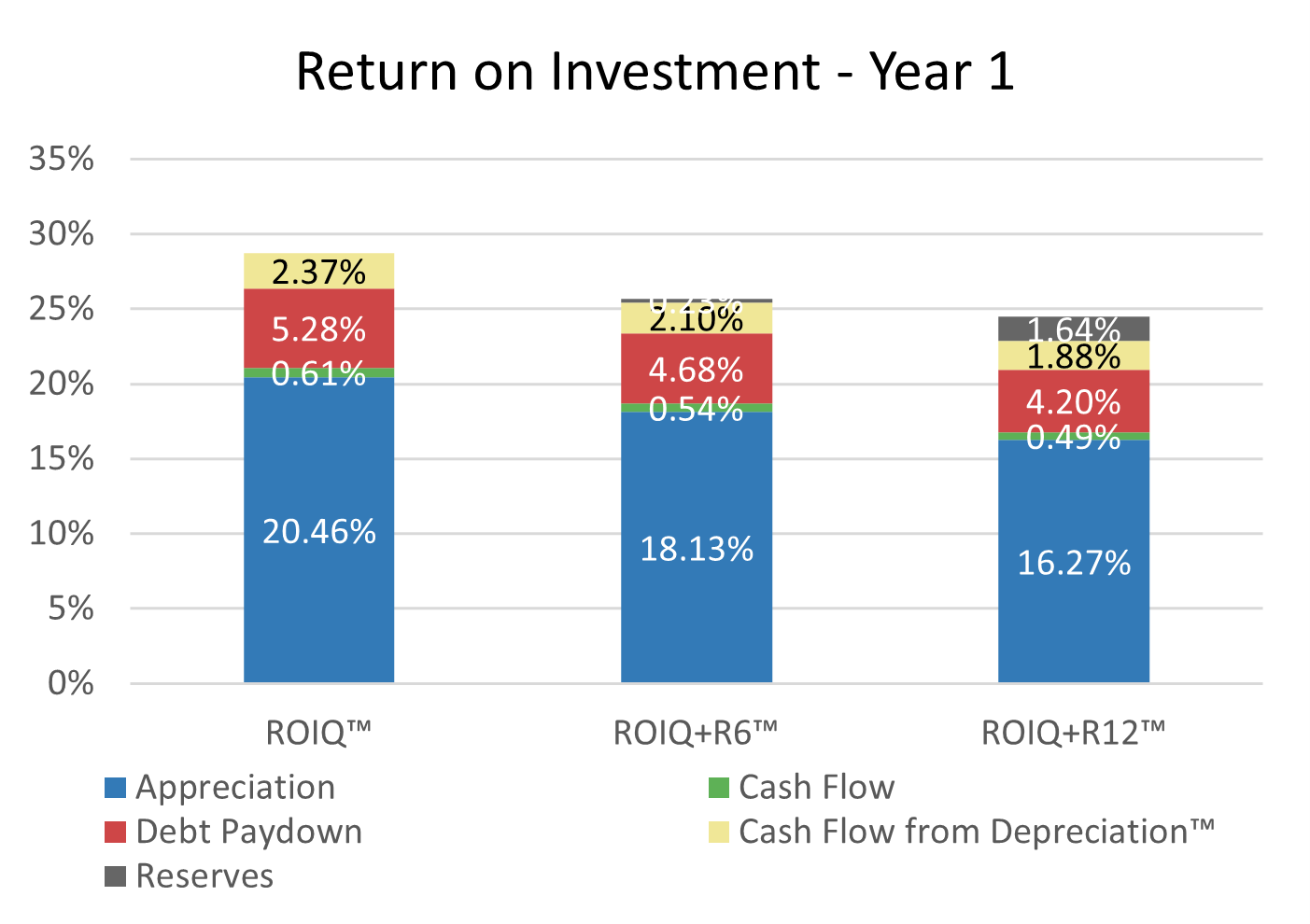

In the last chart, we showed the DOLLAR AMOUNT from appreciation, cash flow, debt paydown and Cash Flow from Depreciation™ … but this chart we show you that dollar amount divided by the Total Invested .

In the case of Return on Investment Quadrant + 6 Months Reserves ( ROIQ+R6™ ) and Return on Investment Quadrant + 12 Months Reserves ( ROIQ+R12™ ) it is the dollar amount divided by the Total Invested PLUS… either 6 months of reserves or 12 months reserves.

Astute investors will recognize that the “cash flow” ROI here is the same calculation as Cash on Cash Return on Investment .

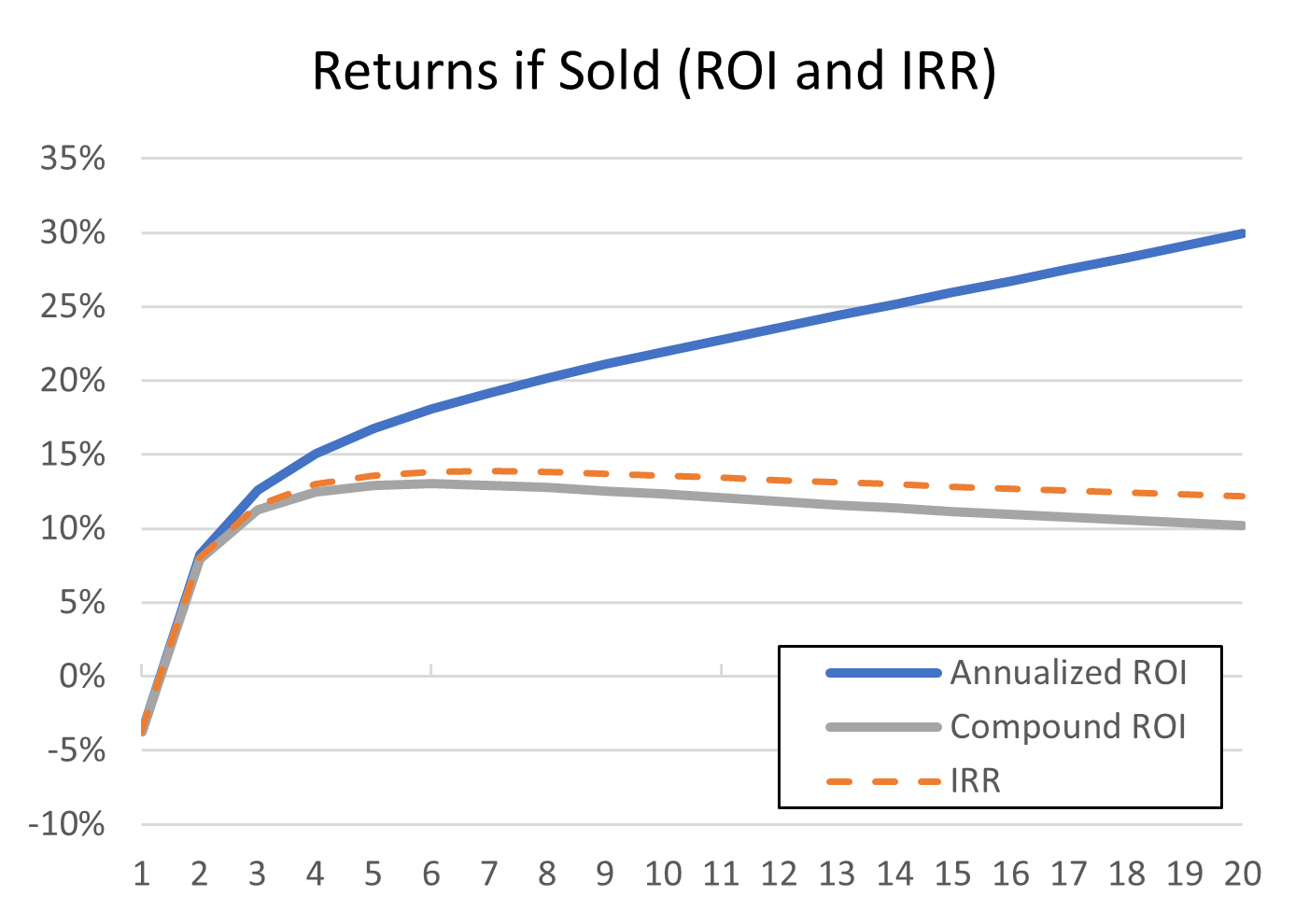

This chart shows you the returns you’d earn if you sold the property calculated 3 different ways.

First, the total returns you earned for the entire holding period (after all sales costs) divided by the Total Invested and the number of years you held the property. This is the Annualized Return on Investment (aka Annualized ROI ).

Second, the same calculation except the compounding rate of return version. This is the Compound Return on Investment (aka Compound ROI ).

And finally, the Internal Rate of Return ( IRR ) calculation that better accounts for WHEN you put money in and take money out of the property to calculate the return you’re earning on the investment. One could argue that this is the best return to use.

Many investors who plan on selling their property after holding it for a period of time will find this chart invaluable.

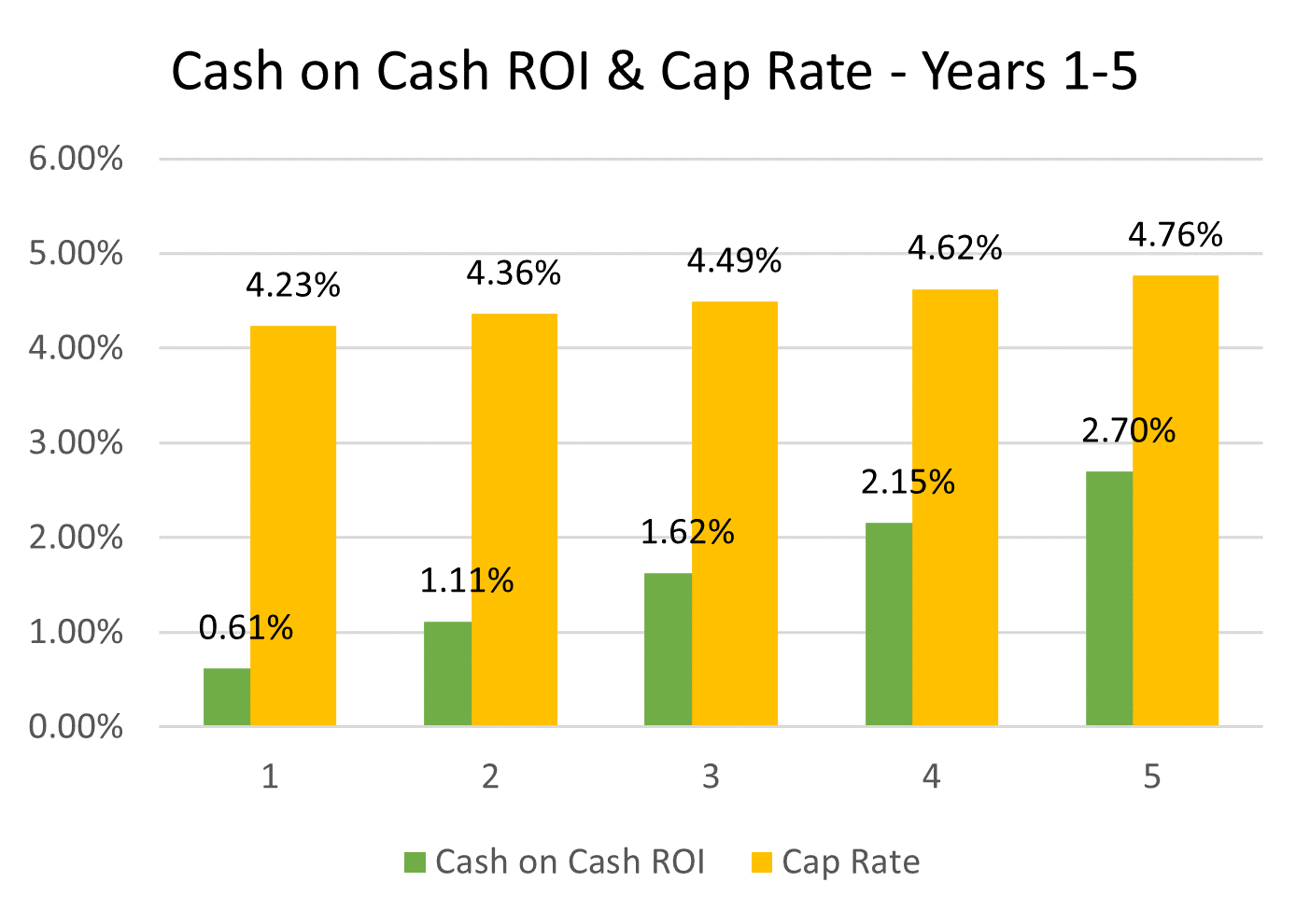

In the Return on Investment chart above, we showed Cash on Cash Return on Investment as one of the returns.

It is so important to some investors that we list it again here and compare it to Capitalization Rate (aka Cap Rate ).

Most investors prefer to use Cash on Cash Return on Investment , but a good number of investors prefer to use Cap Rate in their decision-making process.

So, here’s both.

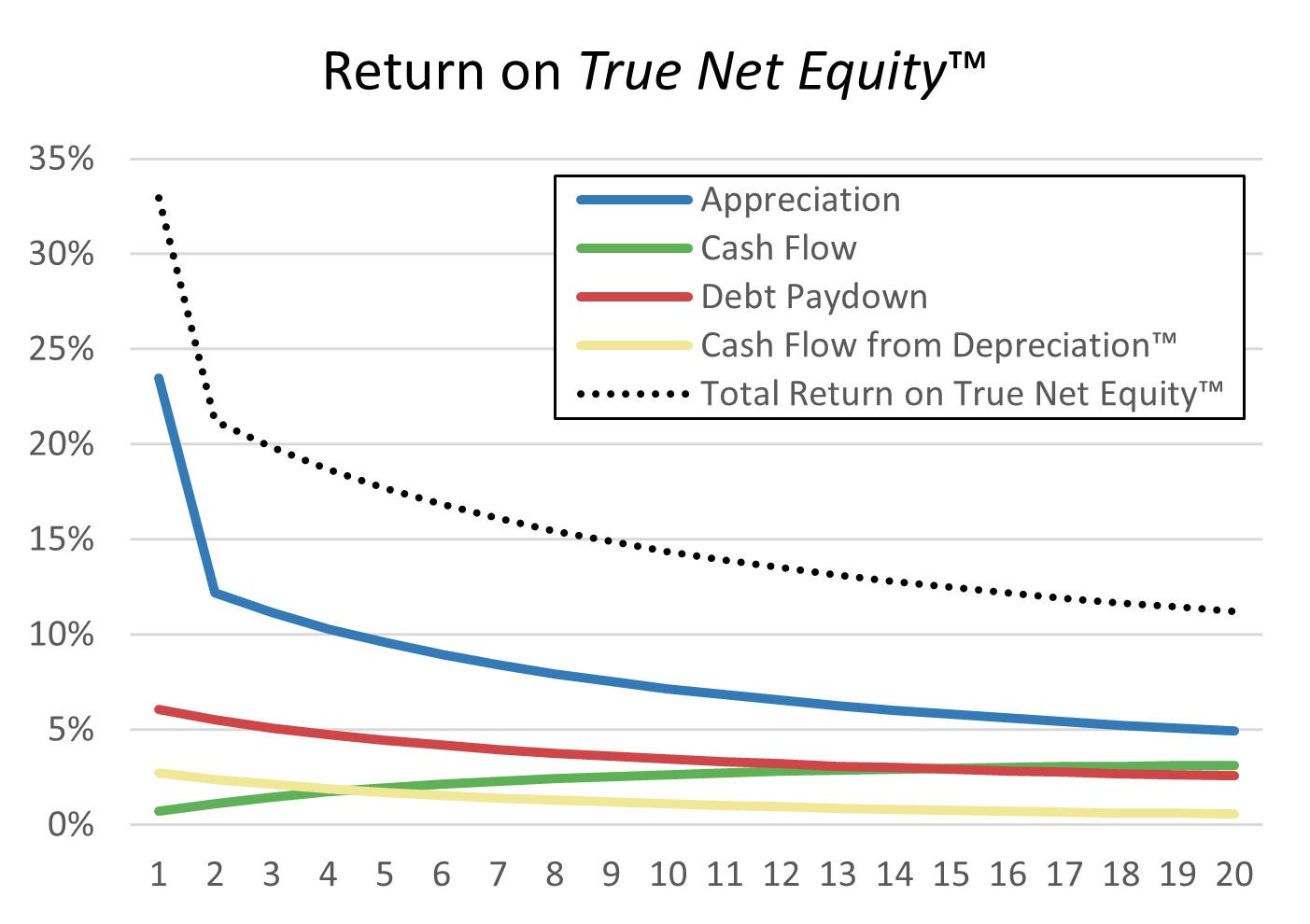

After year 1, taking the dollar amount of return earned in that year and dividing it by the initial Total Invested when you bought the property becomes a less important measure.

One could easily argue that taking the dollar amount that you earn in that year and dividing by the equity you have in the property that year is a better measure of the return you’re earning on the amount you have in the deal.

Further, one could argue even better that it is not the return you’re earning on gross equity, but rather, the return you’re earning on the money you’d walk away with after sales costs (real estate commissions, closing costs, depreciation recapture tax and capital gains tax).

Really, what you want to know is the return you’re earning on the money you’d get if you exited the deal. If you sold the property, this is the return you’d need to earn on another, different investment to do better than this property.

This chart shows you the return you’re earning from the 4 component returns (appreciation, cash flow, debt paydown and Cash Flow from Depreciation™ ) divided by True Net Equity™ (equity after all those sales costs) for the first 20 years.

It also shows the total return for all 4 component returns divided by True Net Equity™ .

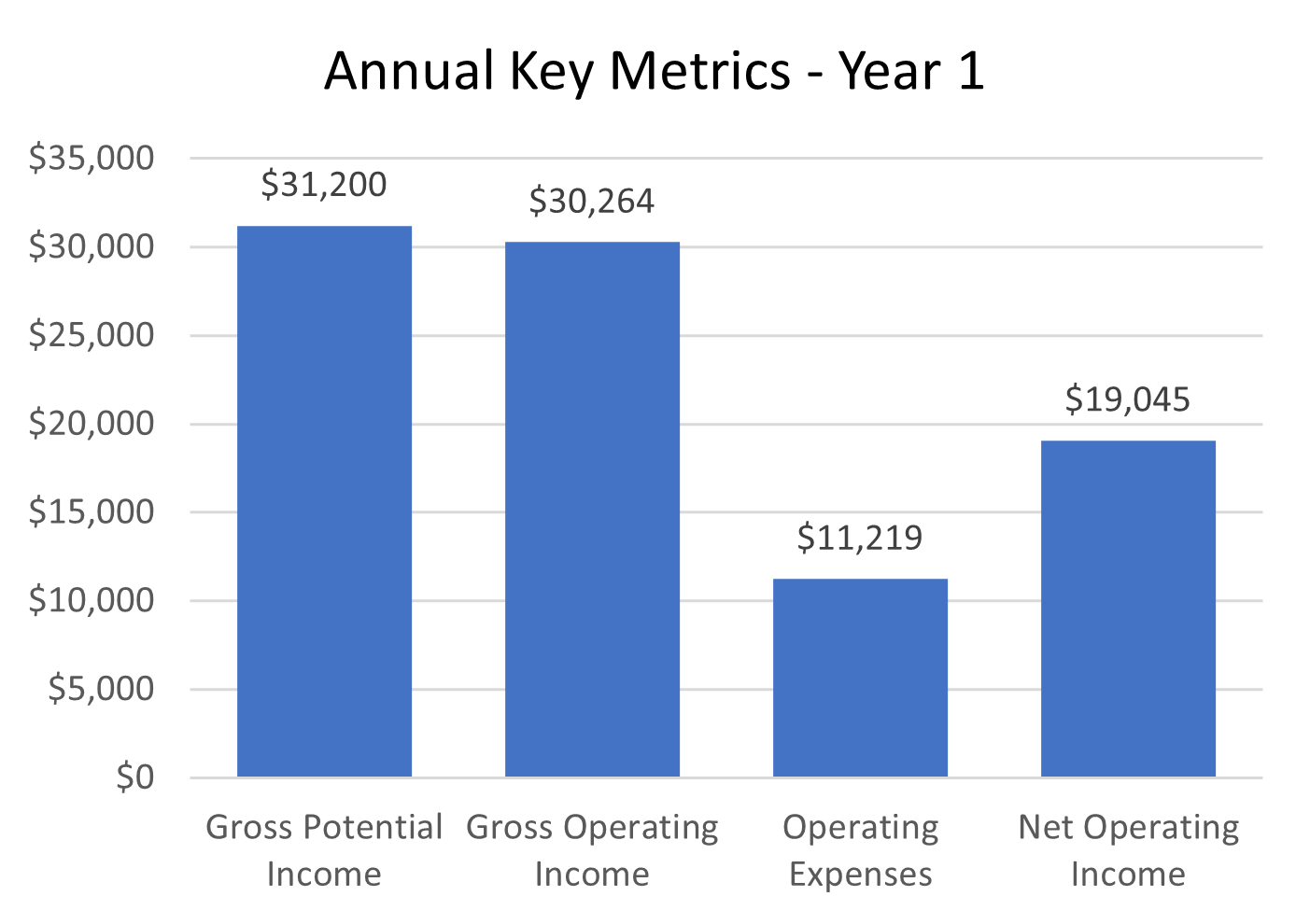

Some real estate investors would like to know Gross Potential Income ( GPI ), Gross Operating Income ( GOI ), Operating Expenses ( OpEx ), and Net Operating Income ( NOI ) for year 1.

So, that’s what this chart shows.

Often investors will want to get a feeling for the expenses on the property. This chart shows the non-loan expenses for the property in the first year.

It also includes the dollar amount for the vacancy allowance as well.

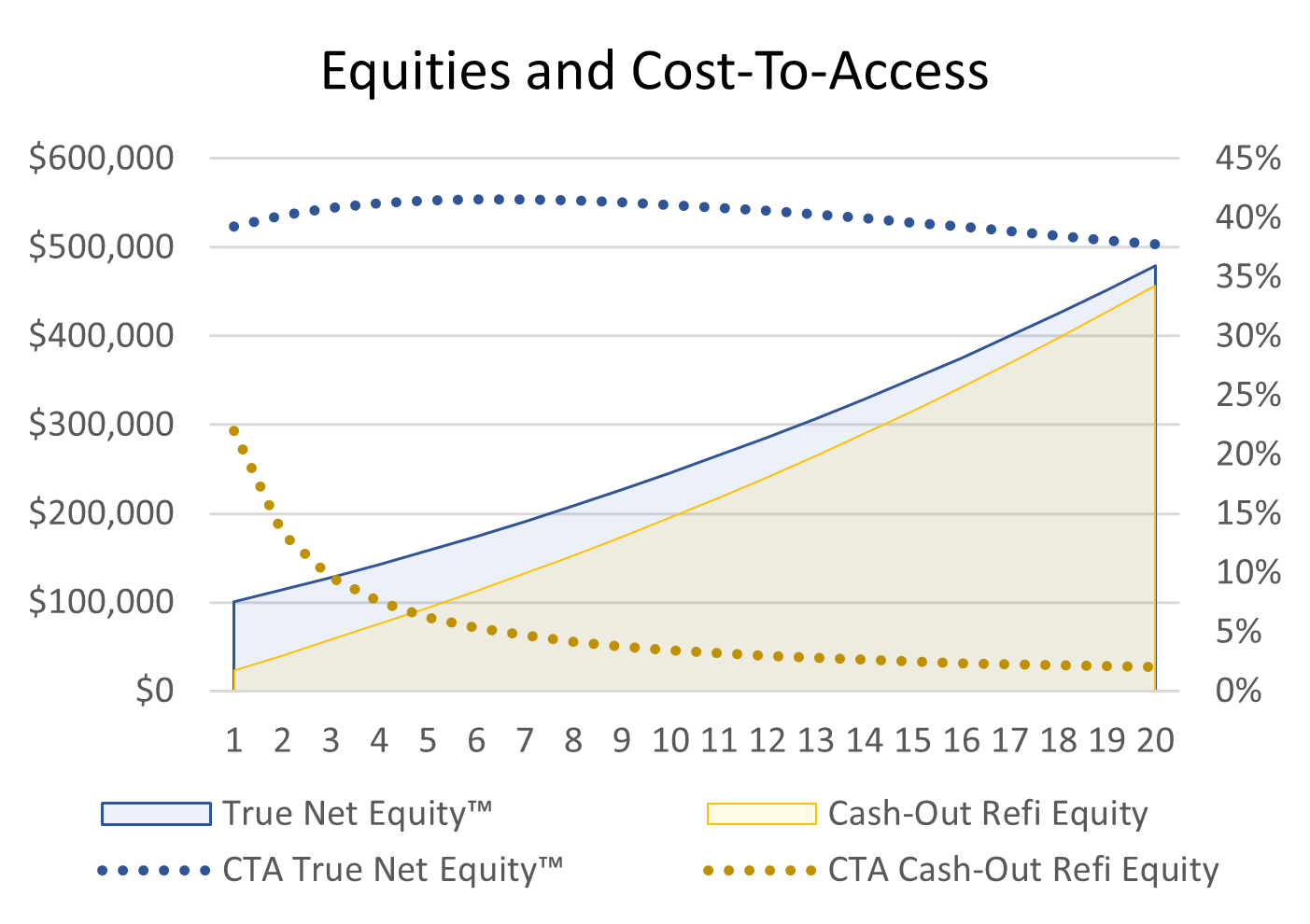

Some real estate investors will want to either sell the property or refinance the property to access the equity in the property at some point in the future.

This chart shows the amount of equity (after all sales costs… which we define as True Net Equity™ ) that they’d walk away with if they sold the property.

It also shows the amount of equity they could walk away with if they did a cash out refinance of the property.

Additionally, it shows the cost-to-access the equity in both cases as a percent of the money they’d walk away with.

Did we miss a key metric you use to make a buying decision when analyzing deals? Have suggestions? Found an error? Email [email protected]

You can still drill down into the Overrides tab.

Modeling Variable Returns

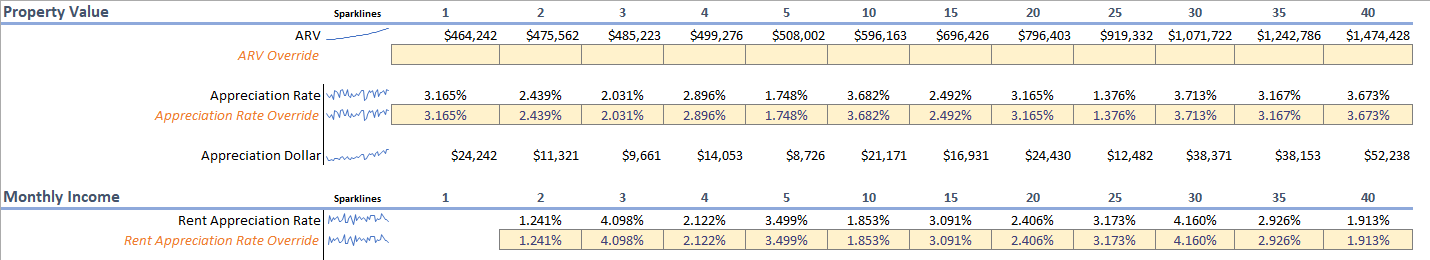

Appreciation isn’t always 3% per year (or whatever number you’re using). One year it may be 3%, then next 0%, the next 6.13% and so on.

With The World’s Greatest Real Estate Deal Analysis Spreadsheet™ you can use formulas for OVERRIDES to model variable returns for things like:

- Appreciation Rate

- Rent Appreciation Rate

- Maintenance Rate

And, you can see how your investment might perform with variable returns.

For example, you could use =NORMINV(RAND(),0.03,0.01) to override Appreciation Rate and Rent Appreciation Rate .

The overrides might look like this:

And, the new charts on the Inputs & Dashboard might look like this:

Professional Sponsorship Licensing

If you’re a professional that works with real estate investors (real estate agents/brokers, lenders, Accountants/CPAs, and financial planners) and want to license The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to have your contact information on it so you can give it to your clients, we offer the ability to license it and have your contact info on it.

Available in Two Editions: Silver and Gold

The Silver Edition includes everything above with the two tabs: Inputs & Dashboard and Overrides .

The Gold Edition has yet to be released but will have extra tabs and have additional dashboards/insights specifically for:

- Partnerships – Extra dashboard and insight for modeling buying your property with more than one partner with, possibly, unequal investments, cash flow and equity allocations between the partners.

- Return Quadrants™ – A summary tab showing a variety of Return Quadrants™ for your property.

- Lease-Options – Extra dashboard and insight if you’re considering selling the property to a tenant-buyer using a lease-option.

- Should I Sell My Property – Extra dashboard and insight if you’re considering selling your property.

- Should I Refi My Property – Extra dashboard and insight if you’re considering refinancing your property.

- Track Your Property’s Performance – Because we now allow you to OVERRIDE just about any variable for any year, you can use TWGREDAS™ to keep track of how your property has performed over time and calculate returns based on actual performance (not just pro-forma).

James plans to work on the Gold Edition sporadically, irregularly over the next year or two. He accepts bribes (of significant size) to move the thing you need toward the top of the list. Pay for and schedule a “support” call with James to discuss what you want moved toward the top of the list.

Or, if you need support with your specific situation or property, book a paid support call and we can go over the spreadsheet together.

Other Spreadsheets

The spreadsheet on this page is obviously for deal analysis, but we also offer other spreasheets.

Plus many more…

Real Estate Investing Classes and Videos

Check out our free real estate investing classes as well to learn more.

4 thoughts on “Real Estate Deal Analysis Spreadsheet”

Hey James, we’re both ostensibly pretty transactional people but you’ve got so many moving parts going in so many directions, I can’t keep up. I’d love to just buy some of your expertise if we could figure out how. First off, I’m not your targeted demographic. I’m not an RE investor, but an overly analytical home buyer (Nomad?) buying my own (non-conventional) residence — using investor methods. I have a bunch of spreadsheets — but would love to have yours if I can edit it — especially the macros — for my residential purposes. Would also love to buy downloadable files or documents on “creative deals” owner carry, wraps, subject to, etc. that I can share with a researcher. Thanks, Dru

Thanks for the comment Dru. Sorry you’re not able to keep up.

Yes, we definitely focus on providing resources for buy-and-hold real estate investors, Nomads™ and house hackers. That is our target audience.

You’re welcome to download Brian’s spreadsheet (aka The World’s Greatest Real Estate Deal Analysis Spreadsheet). He has it locked down so that anyone who is not an Excel expert can’t mess up the formulas and macros. If you’re an Excel expert you, of course, know how to unlock it so it is fully editable. If you need to ask Brian how to unlock it, you probably shouldn’t be messing with the formulas.