- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Market Analysis for a Business Plan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A lot of preparation goes into starting a business before you can open your doors to the public or launch your online store. One of your first steps should be to write a business plan . A business plan will serve as your roadmap when building your business.

Within your business plan, there’s an important section you should pay careful attention to: your market analysis. Your market analysis helps you understand your target market and how you can thrive within it.

Simply put, your market analysis shows that you’ve done your research. It also contributes to your marketing strategy by defining your target customer and researching their buying habits. Overall, a market analysis will yield invaluable data if you have limited knowledge about your market, the market has fierce competition, and if you require a business loan. In this guide, we'll explore how to conduct your own market analysis.

How to conduct a market analysis: A step-by-step guide

In your market analysis, you can expect to cover the following:

Industry outlook

Target market

Market value

Competition

Barriers to entry

Let’s dive into an in-depth look into each section:

Step 1: Define your objective

Before you begin your market analysis, it’s important to define your objective for writing a market analysis. Are you writing it for internal purposes or for external purposes?

If you were doing a market analysis for internal purposes, you might be brainstorming new products to launch or adjusting your marketing tactics. An example of an external purpose might be that you need a market analysis to get approved for a business loan .

The comprehensiveness of your market analysis will depend on your objective. If you’re preparing for a new product launch, you might focus more heavily on researching the competition. A market analysis for a loan approval would require heavy data and research into market size and growth, share potential, and pricing.

Step 2: Provide an industry outlook

An industry outlook is a general direction of where your industry is heading. Lenders want to know whether you’re targeting a growing industry or declining industry. For example, if you’re looking to sell VCRs in 2020, it’s unlikely that your business will succeed.

Starting your market analysis with an industry outlook offers a preliminary view of the market and what to expect in your market analysis. When writing this section, you'll want to include:

Market size

Are you chasing big markets or are you targeting very niche markets? If you’re targeting a niche market, are there enough customers to support your business and buy your product?

Product life cycle

If you develop a product, what will its life cycle look like? Lenders want an overview of how your product will come into fruition after it’s developed and launched. In this section, you can discuss your product’s:

Research and development

Projected growth

How do you see your company performing over time? Calculating your year-over-year growth will help you and lenders see how your business has grown thus far. Calculating your projected growth shows how your business will fare in future projected market conditions.

Step 3: Determine your target market

This section of your market analysis is dedicated to your potential customer. Who is your ideal target customer? How can you cater your product to serve them specifically?

Don’t make the mistake of wanting to sell your product to everybody. Your target customer should be specific. For example, if you’re selling mittens, you wouldn’t want to market to warmer climates like Hawaii. You should target customers who live in colder regions. The more nuanced your target market is, the more information you’ll have to inform your business and marketing strategy.

With that in mind, your target market section should include the following points:

Demographics

This is where you leave nothing to mystery about your ideal customer. You want to know every aspect of your customer so you can best serve them. Dedicate time to researching the following demographics:

Income level

Create a customer persona

Creating a customer persona can help you better understand your customer. It can be easier to market to a person than data on paper. You can give this persona a name, background, and job. Mold this persona into your target customer.

What are your customer’s pain points? How do these pain points influence how they buy products? What matters most to them? Why do they choose one brand over another?

Research and supporting material

Information without data are just claims. To add credibility to your market analysis, you need to include data. Some methods for collecting data include:

Target group surveys

Focus groups

Reading reviews

Feedback surveys

You can also consult resources online. For example, the U.S. Census Bureau can help you find demographics in calculating your market share. The U.S. Department of Commerce and the U.S. Small Business Administration also offer general data that can help you research your target industry.

Step 4: Calculate market value

You can use either top-down analysis or bottom-up analysis to calculate an estimate of your market value.

A top-down analysis tends to be the easier option of the two. It requires for you to calculate the entire market and then estimate how much of a share you expect your business to get. For example, let’s assume your target market consists of 100,000 people. If you’re optimistic and manage to get 1% of that market, you can expect to make 1,000 sales.

A bottom-up analysis is more data-driven and requires more research. You calculate the individual factors of your business and then estimate how high you can scale them to arrive at a projected market share. Some factors to consider when doing a bottom-up analysis include:

Where products are sold

Who your competition is

The price per unit

How many consumers you expect to reach

The average amount a customer would buy over time

While a bottom-up analysis requires more data than a top-down analysis, you can usually arrive at a more accurate calculation.

Step 5: Get to know your competition

Before you start a business, you need to research the level of competition within your market. Are there certain companies getting the lion’s share of the market? How can you position yourself to stand out from the competition?

There are two types of competitors that you should be aware of: direct competitors and indirect competitors.

Direct competitors are other businesses who sell the same product as you. If you and the company across town both sell apples, you are direct competitors.

An indirect competitor sells a different but similar product to yours. If that company across town sells oranges instead, they are an indirect competitor. Apples and oranges are different but they still target a similar market: people who eat fruits.

Also, here are some questions you want to answer when writing this section of your market analysis:

What are your competitor’s strengths?

What are your competitor’s weaknesses?

How can you cover your competitor’s weaknesses in your own business?

How can you solve the same problems better or differently than your competitors?

How can you leverage technology to better serve your customers?

How big of a threat are your competitors if you open your business?

Step 6: Identify your barriers

Writing a market analysis can help you identify some glaring barriers to starting your business. Researching these barriers will help you avoid any costly legal or business mistakes down the line. Some entry barriers to address in your marketing analysis include:

Technology: How rapid is technology advancing and can it render your product obsolete within the next five years?

Branding: You need to establish your brand identity to stand out in a saturated market.

Cost of entry: Startup costs, like renting a space and hiring employees, are expensive. Also, specialty equipment often comes with hefty price tags. (Consider researching equipment financing to help finance these purchases.)

Location: You need to secure a prime location if you’re opening a physical store.

Competition: A market with fierce competition can be a steep uphill battle (like attempting to go toe-to-toe with Apple or Amazon).

Step 7: Know the regulations

When starting a business, it’s your responsibility to research governmental and state business regulations within your market. Some regulations to keep in mind include (but aren’t limited to):

Employment and labor laws

Advertising

Environmental regulations

If you’re a newer entrepreneur and this is your first business, this part can be daunting so you might want to consult with a business attorney. A legal professional will help you identify the legal requirements specific to your business. You can also check online legal help sites like LegalZoom or Rocket Lawyer.

Tips when writing your market analysis

We wouldn’t be surprised if you feel overwhelmed by the sheer volume of information needed in a market analysis. Keep in mind, though, this research is key to launching a successful business. You don’t want to cut corners, but here are a few tips to help you out when writing your market analysis:

Use visual aids

Nobody likes 30 pages of nothing but text. Using visual aids can break up those text blocks, making your market analysis more visually appealing. When discussing statistics and metrics, charts and graphs will help you better communicate your data.

Include a summary

If you’ve ever read an article from an academic journal, you’ll notice that writers include an abstract that offers the reader a preview.

Use this same tactic when writing your market analysis. It will prime the reader of your market highlights before they dive into the hard data.

Get to the point

It’s better to keep your market analysis concise than to stuff it with fluff and repetition. You’ll want to present your data, analyze it, and then tie it back into how your business can thrive within your target market.

Revisit your market analysis regularly

Markets are always changing and it's important that your business changes with your target market. Revisiting your market analysis ensures that your business operations align with changing market conditions. The best businesses are the ones that can adapt.

Why should you write a market analysis?

Your market analysis helps you look at factors within your market to determine if it’s a good fit for your business model. A market analysis will help you:

1. Learn how to analyze the market need

Markets are always shifting and it’s a good idea to identify current and projected market conditions. These trends will help you understand the size of your market and whether there are paying customers waiting for you. Doing a market analysis helps you confirm that your target market is a lucrative market.

2. Learn about your customers

The best way to serve your customer is to understand them. A market analysis will examine your customer’s buying habits, pain points, and desires. This information will aid you in developing a business that addresses those points.

3. Get approved for a business loan

Starting a business, especially if it’s your first one, requires startup funding. A good first step is to apply for a business loan with your bank or other financial institution.

A thorough market analysis shows that you’re professional, prepared, and worth the investment from lenders. This preparation inspires confidence within the lender that you can build a business and repay the loan.

4. Beat the competition

Your research will offer valuable insight and certain advantages that the competition might not have. For example, thoroughly understanding your customer’s pain points and desires will help you develop a superior product or service than your competitors. If your business is already up and running, an updated market analysis can upgrade your marketing strategy or help you launch a new product.

Final thoughts

There is a saying that the first step to cutting down a tree is to sharpen an axe. In other words, preparation is the key to success. In business, preparation increases the chances that your business will succeed, even in a competitive market.

The market analysis section of your business plan separates the entrepreneurs who have done their homework from those who haven’t. Now that you’ve learned how to write a market analysis, it’s time for you to sharpen your axe and grow a successful business. And keep in mind, if you need help crafting your business plan, you can always turn to business plan software or a free template to help you stay organized.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

How to Write the Market Analysis Section of a Business Plan

Written by Dave Lavinsky

What is the Market Analysis in a Business Plan?

The market analysis section of your business plan is where you discuss the size of the market in which you’re competing and market trends that might affect your future potential such as economic, political, social and/or technological shifts.

This helps you and readers understand if your market is big enough to support your business’ growth, and whether future conditions will help or hurt your business. For example, stating that your market size is $56 billion, has been growing by 10% for the last 10 years, and that trends are expected to further increase the market size bodes well for your company’s success.

Download our Ultimate Business Plan Template here

What Should a Market Analysis Include?

You’ll want to address these issues in your market analysis:

- Size of Industry – How big is the overall industry?

- Projected Growth Rate of Industry – Is the industry growing or shrinking? How fast?

- Target Market – Who are you targeting with this product or service?

- Competition – How many businesses are currently in the same industry?

Learn how to write the full market analysis below.

How to Write a Market Analysis

Here’s how to write the market analysis section of a business plan.

- Describe each industry that you are competing in or will be targeting.

- Identify direct competition, but don’t forget about indirect competition – this may include companies selling different products to the same potential customer segments.

- Highlight strengths and weaknesses for both direct and indirect competitors, along with how your company stacks up against them based on what makes your company uniquely positioned to succeed.

- Include specific data, statistics, graphs, or charts if possible to make the market analysis more convincing to investors or lenders.

Finish Your Business Plan Today!

Industry overview.

In your industry overview, you will define the market in which you are competing (e.g., restaurant, medical devices, etc.).

You will then detail the sub-segment or niche of that market if applicable (e.g., within restaurants there are fast food restaurants, fine dining, etc.).

Next, you will describe the key characteristics of your industry. For example, discuss how big the market is in terms of units and revenues. Let the reader know if the market is growing or declining (and at what rate), and what key industry trends are facing your market.

Use third-party market research as much as possible to validate the discussion of your industry.

Here is a list of additional items you may analyze for a complete industry overview:

- An overview of the current state of the industry . How big is it, how much does it produce or sell? What are its key differentiators from competitors? What is its target customer base like – demographic information and psychographics? How has the industry performed over time (global, domestic)?

- Analyze the macro-economic factors impacting your industry . This includes items such as economic growth opportunities, inflation, exchange rates, interest rates, labor market trends, and technological improvements. You want to make sure that all of these are trending in a positive direction for you while also being realistic about them. For example, if the economy is in shambles you might want to wait before entering the particular market.

- Analyze the political factors impacting your industry . This is an often-overlooked section of any business plan, but it can be important depending on what type of company you are starting. If you’re in a highly regulated industry (such as medical devices), this is something that you’ll want to include.

- Analyze the social factors impacting your industry . This includes analyzing society’s interest in your product or service, historical trends in buying patterns in your industry, and any effects on the industry due to changes in culture. For example, if there is a growing counter-culture trend against big oil companies you might want to position yourself differently than a company in this industry.

- Analyze the technological factors impacting your industry . This includes analyzing new technologies being developed in software, hardware, or applications that can be used to improve your product or service. It also includes emerging consumer trends and will be highly dependent on your business type. In a technology-related venture, you would analyze how these changes are impacting consumers. For an educational-related venture, you would analyze how these changes are impacting students, teachers, and/or administrators.

For each of these items, you want to provide some detail about them including their current state as well as what external factors have played a role in the recent past. You can also include many other important factors if they apply to your business including demographic trends, legal issues, environmental concerns, and sustainability issues.

When you are done analyzing all of these factors, wrap it up by summing them up in a statement that includes your view on the future of the industry. This should be positive to attract investors, potential customers, and partners.

If you’re having trouble thinking about all of these factors then it might be helpful to first develop a SWOT analysis for your business.

Once you have an understanding of the market, you’ll need to think about how you will position yourself within that potential market.

Picking Your Niche

You want to think about how large your market is for this venture. You also want to consider whether you’d like to pick a niche within the overall industry or launch yourself into the mainstream.

If you have an innovative product it can be easier to enter the mainstream market – but at the same time, you might face some additional competition if there are similar products available.

You can choose to specialize in a niche market where you’ll face less competition – but might be able to sell your services at a higher price point (this could make it easier for you to get potential customers).

Of course, if your product or service is unique then there should be no competition. But, what happens if it isn’t unique? Will you be able to differentiate yourself enough to create a competitive advantage or edge?

If you are planning on entering the mainstream market, think about whether there are different sub-niches within your specific market. For example, within the technology industry, you can choose to specialize in laptops or smartphones or tablets, or other categories. While it will be more difficult to be unique in a mainstream market, you will still be able to focus on one type or category of products.

How Will You Stand Out?

Many companies are able to stand out – whether by offering a product that is unique or by marketing their products in a way that consumers notice. For example, Steve Jobs was able to take a business idea like the iPhone and make it into something that people talked about (while competitors struggled to play catch up).

You want your venture to stand out – whether with an innovative product or service or through marketing strategies. This might include a unique brand, name, or logo. It might also include packaging that stands out from competitors.

Write down how you will achieve this goal of standing out in the marketplace. If it’s a product, then what features do you have that other products don’t? If it’s a service, then what is it about this service that will make people want to use your company rather than your competition?

You also need to think about marketing. How are you going to promote yourself or sell your product or service? You’ll need a marketing plan for this – which might include writing copy, creating an advertisement, setting up a website, and several other activities. This should include a description of each of these strategies.

If you’re struggling with the details of any of these sections, it might be helpful to research what other companies in your market are doing and how they’ve been successful. You can use this business information to inform your own strategies and plans.

Relevant Market Size & Competition

In the second stage of your analysis, you must determine the size and competition in your specific market.

Target Market Section

Your company’s relevant market size is the amount of money it could make each year if it owned a complete market share.

It’s simple.

To begin, estimate how many consumers you expect to be interested in purchasing your products or services each year.

To generate a more precise estimate, enter the monetary amount these potential customers may be ready to spend on your goods or services each year.

The size of your market is the product of these two figures. Calculate this market value here so that your readers can see how big your market opportunity is (particularly if you are seeking debt or equity funding).

You’ll also want to include an analysis of your market conditions. Is this a growing or declining market? How fast is it growing (or declining)? What are the general trends in the market? How has your market shifted over time?

Include all of this information in your own business plan to give your readers a clear understanding of the market landscape you’re competing in.

The Competition

Next, you’ll need to create a comprehensive list of the competitors in your market. This competitive analysis includes:

- Direct Competitors – Companies that offer a similar product or service

- Indirect Competitors – Companies that sell products or services that are complementary to yours but not directly related

To show how large each competitor is, you can use metrics such as revenue, employees, number of locations, etc. If you have limited information about the company on hand then you may want to do some additional research or contact them directly for more information. You should also include their website so readers can learn more if they desire (along with social media profiles).

Once you complete this list, take a step back and try to determine how much market share each competitor has. You can use different methods to do this such as market research, surveys, or conduct focus groups or interviews with target customers.

You should also take into account the barriers to entry that exist in your market. What would it take for a new company to enter the market and start competing with you? This could be anything from capital requirements to licensing and permits.

When you have all of this information, you’ll want to create a table like the one below:

Once you have this data, you can start developing strategies to compete with the other companies which will be used again later to help you develop your marketing strategy and plan.

Writing a Market Analysis Tips

- Include an explanation of how you determined the size of the market and how much share competitors have.

- Include tables like the one above that show competitor size, barriers to entry, etc.

- Decide where you’re going to place this section in your business plan – before or after your SWOT analysis. You can use other sections as well such as your company summary or product/service description. Make sure you consider which information should come first for the reader to make the most sense.

- Brainstorm how you’re going to stand out in this competitive market.

Formatting the Market Analysis Section of Your Business Plan

Now that you understand the different components of the market analysis, let’s take a look at how you should structure this section in your business plan.

Your market analysis should be divided into two sections: the industry overview and market size & competition.

Each section should include detailed information about the topic and supporting evidence to back up your claims.

You’ll also want to make sure that all of your data is up-to-date. Be sure to include the date of the analysis in your business plan so readers know when it was conducted and if there have been any major changes since then.

In addition, you should also provide a short summary of what this section covers at the beginning of each paragraph or page. You can do this by using a title such as “Industry Overview” or another descriptive phrase that is easy to follow.

As with all sections in a business plan, make sure your market analysis is concise and includes only the most relevant information to keep your audience engaged until they reach your conclusion.

A strong market analysis can give your company a competitive edge over other businesses in its industry, which is why it’s essential to include this section in your business plan. By providing detailed information about the market you’re competing in, you can show your readers that you understand the industry and know how to capitalize on current and future trends.

Business Plan Market Analysis Examples

The following are examples of how to write the market analysis section of a business plan:

Business Plan Market Analysis Example #1 – Hosmer Sunglasses, a sunglasses manufacturer based in California

According to the Sunglass Association of America, the retail sales volume of Plano (non-prescription) sunglasses, clip-on sunglasses, and children’s sunglasses (hereinafter collectively referred to as “Sunwear”) totaled $2.9 billion last year. Premium-priced sunglasses are driving the Plano Sunwear market. Plano sunglasses priced at $100 or more accounted for more than 49% of all Sunwear sales among independent retail locations last year.

The Sunglass Association of America has projected that the dollar volume for retail sales of Plano Sunwear will grow 1.7% next year. Plano sunglass vendors are also bullish about sales in this year and beyond as a result of the growth of technology, particularly the growth of laser surgery and e-commerce.

Business Plan Market Analysis Example #2 – Nailed It!, a family-owned restaurant in Omaha, NE

According to the Nebraska Restaurant Association, last year total restaurant sales in Nebraska grew by 4.3%, reaching a record high of $2.8 billion. Sales at full-service restaurants were particularly strong, growing 7% over 2012 figures. This steady increase is being driven by population growth throughout the state. The Average Annual Growth Rate (AGR) since 2009 is 2.89%.

This fast growth has also encouraged the opening of new restaurants, with 3,035 operating statewide as of this year. The restaurant industry employs more than 41,000 workers in Nebraska and contributes nearly $3 billion to the state economy every year.

Nebraska’s population continues to increase – reaching 1.9 million in 2012, a 1.5% growth rate. In addition to population, the state has experienced record low unemployment every year since 2009 – with an average of 4.7% in 2013 and 2014.

Business Plan Market Analysis Example #3 – American Insurance Company (AIC), a chain of insurance agencies in Maine

American Insurance Company (AIC) offers high-quality insurance at low prices through its chain of retail outlets in the state of Maine. Since its inception, AIC has created an extensive network of agents and brokers across the country with expanding online, call center and retail business operations.

AIC is entering a market that will more than double in size over the next 50 years according to some industry forecasts. The insurance industry is enjoying low inflation rates, steady income growth, and improving standards of living for most Americans during what has been a difficult period for much of American business. This makes this a good time to enter the insurance industry as it enjoys higher margins because customers are purchasing more coverage due to increased costs from medical care and higher liability claims.

American Insurance Company provides affordable homeowners, auto, and business insurance through high-quality fulfillment centers across America that have earned a reputation for top-notch customer service.

AIC will face significant competition from both direct and indirect competitors. The indirect competition will come from a variety of businesses, including banks, other insurance companies, and online retailers. The direct competition will come from other well-funded start-ups as well as incumbents in the industry. AIC’s competitive advantages include its low prices, high quality, and excellent customer service.

AIC plans to grow at a rate that is above average for the industry as a whole. The company has identified a market that is expected to grow by more than 100% in the next decade. This growth is due to several factors: the increase in the number of two-income households, the aging population, and the impending retirement of many baby boomers will lead to an increase in the number of people who are purchasing insurance.

AIC projects revenues of $20M in year one, which is equivalent to 100% growth over the previous year. AIC forecasts revenue growth of 40%-60% each year on average for 10 years. After that, revenue growth is expected to slow down significantly due to market saturation.

The following table illustrates these projections:

Competitive Landscape

Direct Competition: P&C Insurance Market Leaders

Indirect Competition: Banks, Other Insurance Companies, Retailers

Market Analysis Conclusion

When writing the market analysis section, it is important to provide specific data and forecasts about the industry that your company operates in. This information can help make your business plan more convincing to potential investors.

If it’s helpful, you should also discuss how your company stacks up against its competitors based on what makes it unique. In addition, you can identify any strengths or weaknesses that your company has compared to its competitors.

Based on this data, provide projections for how much revenue your company expects to generate over the next few years. Providing this information early on in the business plan will help convince investors that you know what you are talking about and your company is well-positioned to succeed.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Resources for Writing Your Business Plan

How to Write a Great Business Plan Executive Summary How to Expertly Write the Company Description in Your Business Plan The Customer Analysis Section of Your Business Plan Completing the Competitive Analysis Section of Your Business Plan The Management Team Section of Your Business Plan Financial Assumptions and Your Business Plan How to Create Financial Projections for Your Business Plan Everything You Need to Know about the Business Plan Appendix Best Business Plan Software Business Plan Conclusion: Summary & Recap

Other Helpful Business Planning Articles & Templates

What Is Market Share & How Do You Calculate It?

Published: December 07, 2022

In the marketing industry, you've likely heard the term "market share" from time to time, but what does it mean? Why is it necessary, and how is it calculated?

As marketers, it's important to understand market share so you know how your company ranks against competitors and can develop new marketing strategies to reach more potential customers. In this post, we’ll outline what market share is, how to calculate it, give real-life examples, and explain how you can increase yours.

What is market share?

Market share formula.

Relative Market Share

Relative Market Share Formula

Market share examples.

How to Expand Your Market Share

Understand Your Market Share to Increase Business Success

![determination of the market share business plan example → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Market share is the percentage of an industry's sales that a particular company owns. Essentially, it is the share of your business's total industry revenue from selling your products and services. Businesses with larger market shares are industry leaders and competition for smaller companies.

Suppose consumers buy 100 T-shirts, and 70 are from Company A, 25 from Company B, and 5 from Company C. In that case, Company A owns a market share of 70% and is the leading industry competitor .

Market share is typically calculated for a specific period, like yearly or quarterly sales, and is sometimes separated by region.

How to Calculate Market Share

Find your business’s total sales revenue for your preferred period and divide that number by your industry’s total revenue during the same period. Once you have this result, multiply the number by 100 to generate your market share percentage.

Calculating your market share will give you an overall understanding of your position in the industry, but it’s also helpful to understand how you measure up to your direct competitors. By understanding the basics of the stock market , you can easily understand how each company and their share make up the entire industry.

Relative Market Share

Relative market share compares your performance to industry leaders.

Rather than using total industry revenue, you’re dividing your market share by your top competitor's market share, multiplying the result by 100. The result will show you the portion of the market you own in relation to your most significant competitor. The image below shows the relative market share formula.

It may be easier to understand market share with real-life examples, so we’ll go over some below for businesses you may already be familiar with.

Nike Market Share

Nike is part of the athletic footwear and apparel industry, selling various sports equipment, casual shoes, and accessories.

Nike’s global market share in sportswear is estimated to be 43.7% . The brand is an industry competitor for Adidas and Under Armour.

Tesla Market Share

Tesla is part of the automotive industry and produces electric vehicles (EVs). Within the U.S. EV industry, Tesla holds an over 70% market share.

It's essential to recognize that the market for EVs worldwide is significantly smaller than standard vehicles. EV’s market share in the automobile industry is 2.8%, and Tesla’s is .8% . These differences are significant, so it is vital to analyze relative market share to compare your business to your direct competitors rather than just the market as a whole.

Spotify is a music-streaming platform and has the highest music-streaming market share with 31% of the market.

The second-highest market share belongs to Apple Music (15%), followed by Amazon Music (13), Tencent (13%), and YouTube (8%).

E-commerce company Amazon has a U.S. e-commerce market share of 37.8% and is the leading online retailer in the country. Second place belongs to Walmart with 6.3%, and third place goes to Apple with 3.9%.

Most recent statistics show Target is the largest department store retailer in the U.S. with a 38% market share. Walmart and Macy's both rank second with 13%.

Chew is an online pet product and food retailer with a market share of 40% in the U.S. The company plans to expand into the global market in 2024 and is expected to gain a 20% market share outside of the U.S. by 2030.

Google Market Share

Google has a market share of 92.37% , making it the most popular search engine in the world. It dominates the competition, as the second-largest industry leader is Bing with a market share of just 3.57%.

Once you’ve calculated your market share and understand how you relate to your industry competitors, you can begin strategizing how to increase your overall revenue.

How To Expand Your Market Share

Below are a few strategies your company can use to expand your market share .

1. Lower prices.

A great way to compete in your industry is to offer low prices. This is the low-hanging fruit of expanding your market share because consumers typically look for lower-cost products.

However, it's also important to note that the cheap option isn't right for every brand. You want to ensure that you’re pricing products appropriately to provide value to customers but not lose out on revenue opportunities to beat the competition.

2. Innovate new products and features.

Companies innovating and bringing new technology to the table often see their market share increase.

New products and features attract new customers, also known as acquisition , which is a driving factor for generating revenue. New customers make new purchases and, in turn, contribute to higher profit margins and larger contributions to overall industry revenue. More significant contributions directly translate to increased market share.

3. Delight your customers.

One of the best ways to grow your market share is to work on existing customer relationships.

You can inspire customer loyalty by delighting current customers by providing exceptional experiences and customer loyalty. Loyal customers are more likely to make repeat purchases, which increases your business revenue and contribution to total industry revenue. As mentioned above, higher revenue contributions equal a higher market share percentage.

4. Increase brand awareness.

Branding awareness and national marketing play a significant role in capturing market share. Getting your name out there is important, so customers know who you are. Becoming a household name and the preferred brand in an industry will help increase your market share.

Generally, larger companies have the highest market share because they can provide products and services more efficiently and effectively.

But why is this so important? Below, let's figure out what impact market share can have on your company.

Why is market share important?

Calculating market share lets companies know how competitive they are in their industry. Additionally, the more market share a company has, the more innovative, appealing, and marketable they are.

Market share is more important in industries that are based on discretionary income. Market share doesn't always have a significant impact in constantly growing industries. However, it's important to remember that a company can have too much market share — also known as a monopoly.

For example, with growing industries with a growing market share, companies can still increase their sales even if they lose market share.

On the other hand, with discretionary income industries, such as travel or non-essential goods like entertainment and leisure, the economy can significantly impact market share. Sales and margins can vary depending on the time of year, meaning that competition is always at an all-time high.

Higher competition often leads to risky strategies. For instance, companies might be willing to lose money temporarily to force competitors out of the industry and gain more market share. Once they have more market share, they can raise prices.

Lower market shares can let you know that you need to focus on customer acquisition, marketing to raise brand awareness, and overall strategies to increase revenue. Higher percentages indicate that your current plan is adequate and that you should focus on customer retention and product innovation.

Whether your company is well-established or just starting, it’s important to understand your industry standing as it will help you meet business objectives and achieve desired success.

Don't forget to share this post!

Related articles.

25 Tools & Resources for Conducting Market Research

What is a Competitive Analysis — and How Do You Conduct One?

Market Research: A How-To Guide and Template

![determination of the market share business plan example SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![determination of the market share business plan example How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![determination of the market share business plan example 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

![determination of the market share business plan example 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

What is Market Share: Definition, Formulas, and Examples

Market Share represents the success of a business in cold hard numbers.

Knowing what it is and how to measure it can help a business benchmark performance, track success, and make plans to grow.

What is market share?

Market share is a company’s percentage of the overall sales in a given industry or market.

Why is market share important?

Market share is the ultimate measure of a company’s success within its market. It’s calculated using sales revenue, not profit. Knowing how you stack up against rivals is a solid indicator that can be used for competitive benchmarking , identifying industry leaders , strategic planning, and much more.

Why do you need to grow your market share?

Market share is usually assessed over a fiscal year or quarter. Monitoring it helps evaluate your company’s growth by examining how you progress relative to the overall market growth. A thriving company will see its market share increase faster than that of the competition.

Any tiny shift in the market distribution in stable markets can disrupt well-balanced market forces. In growth markets, changes are expected and, therefore, less significant. With new products or technology, a vendor could bite off a competitor’s share or attract a new target audience that wasn’t previously part of the equation.

However dynamic your market, increasing your industry share is vital for growth. Capturing a larger percentage of the market means you are increasing sales and revenue.

How do you calculate market share?

There are many ways to establish market share, and finding the right method for your business is important. It can be gained or taken quickly, so companies must use Digital Intelligence tools like Similarweb to keep track of key market share metrics in real time. Simply using revenue figures alone is no longer enough to keep up with the speed of change that most markets are experiencing .

Market share formula by revenue

Take your total annual revenue figure, divide it by the total overall revenue for your market, and then multiply it by 100 to get the percentage. For example, if your annual revenue is $1M, and the total revenue for your market is $100M, then you have a 1% share of the market.

Relative market share formula

You may want to compare your business to a specific competitor or industry leader. In this case, you can calculate the relative market share. Divide your market share by that of the relevant rival.

Read more in our full guide to market share formulas – Expand Your Reach: 4 Market Share Formulas to Get You There

Analyzing your market share

The company with the largest market share is usually considered the industry leader. But market share is no key indicator of a company’s financial health, profitability, or growth. It measures your competitiveness and gives you a general idea of how you match up in your target arena.

What does market share mean for your position in the competitive environment? It shows how the pie is sliced and how big a piece you have relative to everyone else. When you segment your target market , you receive a more granulated view. Picture each segment as a whole pie and compare how the distribution of portions varies.

Digital companies often use traffic share to gauge their control of the online “pie.” This is particularly valuable if you are running a non-ecommerce site and can’t measure your percentage based on revenue. Measure your traffic share and segment it as you would the market. Take a look at the example in the following section to see how it’s done.

Understanding your market share

Market share is also relative to your business. A global market share of 1% is nothing to brag about for a company that sells to the worldwide market. But if you only target Texas, it’s an impressive number, and you might even be leading the local market.

As a local vendor, you should consider benchmarking against comparable businesses in other regions. Choose similar size companies with equivalent audience demographics . This lets you evaluate if your market share is average for your type of company or exceptionally high or low.

To gauge market share correctly, look at your target audience segment. Your company may focus primarily on women, millennials , or high-income customers, which means your goal is leadership in a particular market segment. You’ll conquer the rest later with a new strategy.

The bottom line; when you try to gain insights from market share, make sure to view it in the proper context.

Market share example

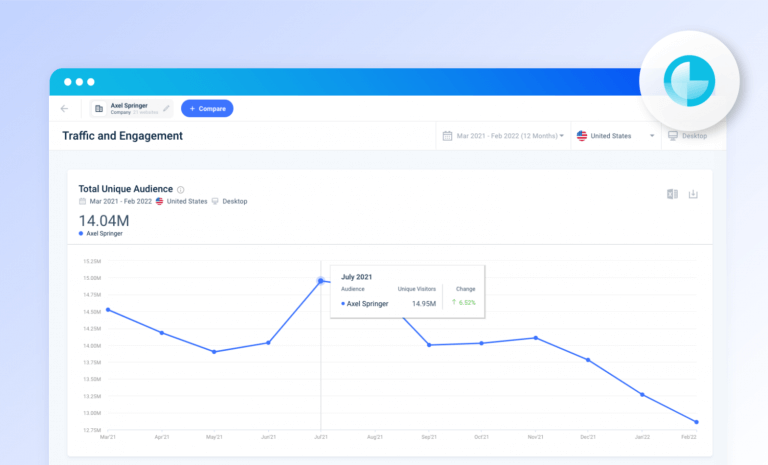

Another way to calculate market share is to use website traffic as your key performance indicator . This way, you get a benchmark you can track in real-time, and while it’s not revenue-based, it shows how much interest and activity takes place in a market and allows you to track known industry leaders and your own site efficiently and easily.

Here’s a faster, more modern approach to measuring your share of the market. In this example, I’m using the accommodation and hotel market to demonstrate how to quickly analyze market share.

In 30 seconds, I can see who the industry leaders are and by what percent their business has grown or declined in a given period. I also see rising players; this is interesting, as these companies show notable growth in my market . So, while they have a relatively low share right now, they are emerging names with the ability to disrupt a market fast. At the bottom of the market leaders page, I can see a list of market leaders, sorted by share of traffic, with other useful traffic and engagement metrics to track, along with a yearly change %. This covers the top 10k domains in a sector, so it’s extensive and comprehensive.

You’ll have noticed a market quadrant analysis too. A quick click downloads a nice visual representation of the market leaders; which you can filter and sort according to the market share metrics that matter to you most. In this example, I chose unique visitors and traffic share.

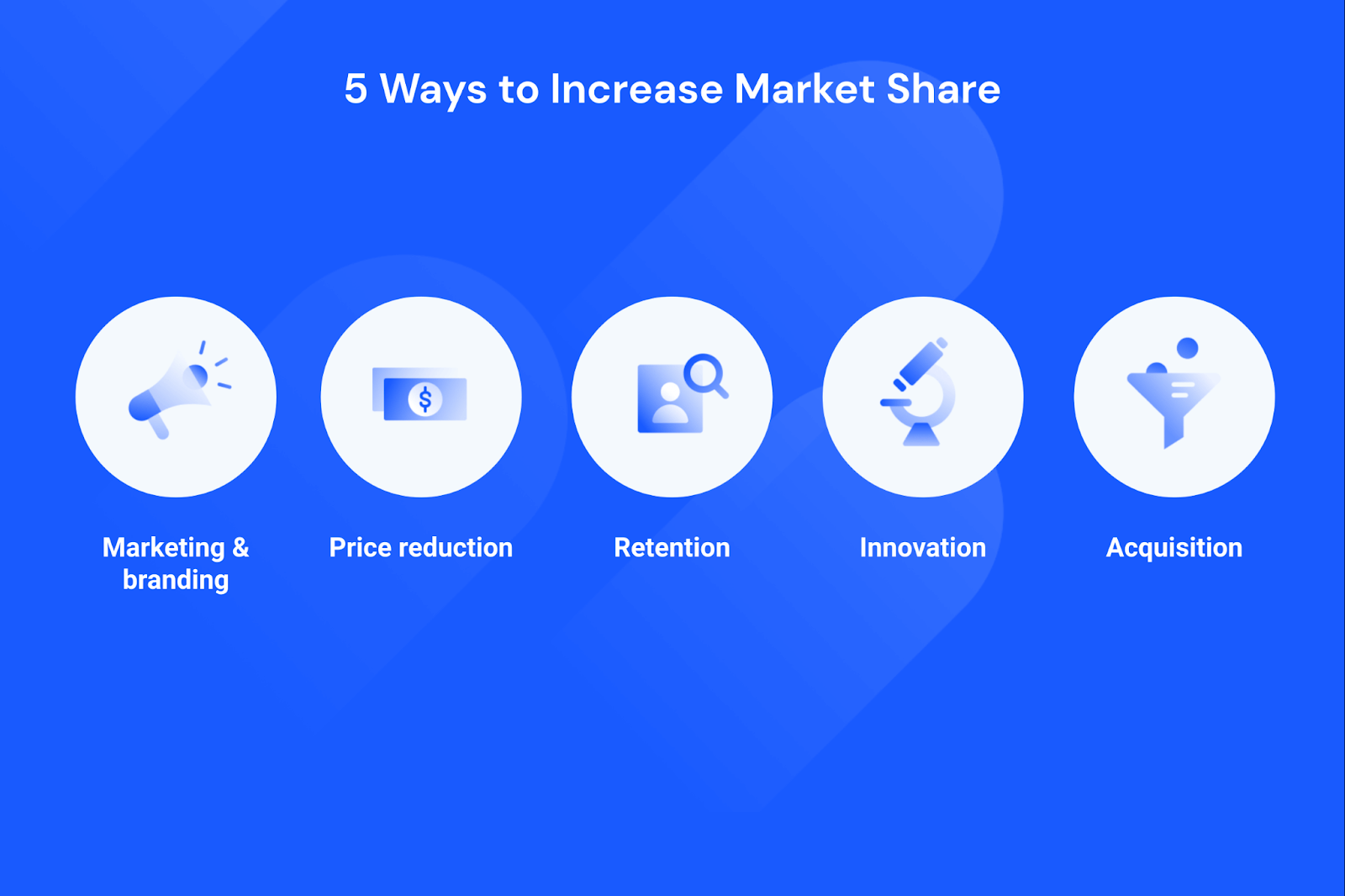

5 ways to increase market share

- Marketing and branding With more aggressive advertising, you can expand your reach, gain more users, and increase customer loyalty. For long-term effectiveness, a strong branding strategy is essential.

- Price reduction You can tackle the issue from another angle by lowering your pricing just enough to beat the competition. This is the idea behind periodic discount campaigns, in which companies manage to steal competitors’ customers before raising prices again.

- Retention Nurturing your existing customer base is an underutilized and highly effective method. You keep your customers close when you maintain a positive relationship and send an occasional special offer.

- Innovation The best example of this strategy is Apple. The company constantly and regularly offers new product lines and innovative features for its existing products. Customers keep coming back for more.

- Acquisition If you can’t beat them, buy them. One way that helps Facebook to expand is by acquiring smaller companies and taking over their market share. Instead of winning over new customers, they take over the company.

Drawing conclusions from market analysis

Let’s look at an example of a non-ecommerce digital competitive set and the insights we gain from looking at market share.

Take the news site cnn.com. To define the target market , we look at the overall traffic to publishers and media sites . Specifically in the U.S., CNN’s traffic share is roughly 12%, putting them in second place right after Yahoo, also the global leader.

On the other hand, the news channel ranks number 85 globally. Does this mean CNN isn’t a significant news channel? Not necessarily. We can learn two things: Americans are the largest segment of news consumers, and CNN successfully targets American readers. We can also analyze traffic segments, such as specific marketing channels or devices, to learn more.

The next step

Similarweb Digital Research Intelligence is THE go-to platform for accurate traffic trend data. Compared to other market analysis tools , it provides the freshest insights, packaged in an intuitive platform that highlights the important changes and market share metrics you need to track.

Why Similarweb

- Data you can depend on

- Dynamically updates to give daily insights

- Easy-to-use platform, filled with useful market intelligence

- Highly accurate market trends data

- Try it for free and find out where your market stands.

How can I measure market share growth?

Calculate market growth by subtracting the market size for year one from the market size for year two. Divide the result by the market size for year one and multiply by 100 to convert it to a percentage.

What is the market share formula?

Divide your business revenue (traffic) by the total industry revenue (traffic). The result is your market share.

What is the quickest way to calculate market share?

Use a digital intelligence platform to capture real-time market share data. Outdated methods that rely on revenue alone fail to give you a current view of industry leaders.

How can you increase your market share?

Increase market share by using marketing and branding, price reduction, retention, innovation, and acquisition.

Related Posts

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Most Popular Messaging Apps Worldwide 2023

Market Sizing: Measuring Your TAM, SAM, and SOM

How to Research a Company: The Ultimate Guide

How To Create Better Competitive Analysis Reports

Fresh Updates: Analyze Entire Companies With Company Analysis

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

How to Write a Market Analysis for a Business Plan?

Free Market Analysis Kit

- April 11, 2024

13 Min Read

Market analysis is the foundation upon which the success of your business relies.

Whether you are a seasoned entrepreneur planning to enter a new geographical market or an emerging startup struggling to place together your business plan—a thorough understanding of the market, customers, and competitors is essential for a business to thrive successfully.

Now, writing a market analysis for your business plan is quite a challenge. But with this step-by-step guide, we have made the entire process quite simple and easy to follow.

Also, get tips to write this section and our curated market analysis example for a business plan.

Ready to dive in? Let’s get started.

What is Market Analysis?

Market analysis is a detailed analysis of your business’s target market and the competitive landscape within a specific industry. It is an important section of your business plan offering a thorough insight into the state of the industry, the potential target market, and your business’s competition.

A well-targeted market analysis forms the base upon which the foundation of your business relies. It assures the readers that you have a thorough understanding of the market you are about to enter.

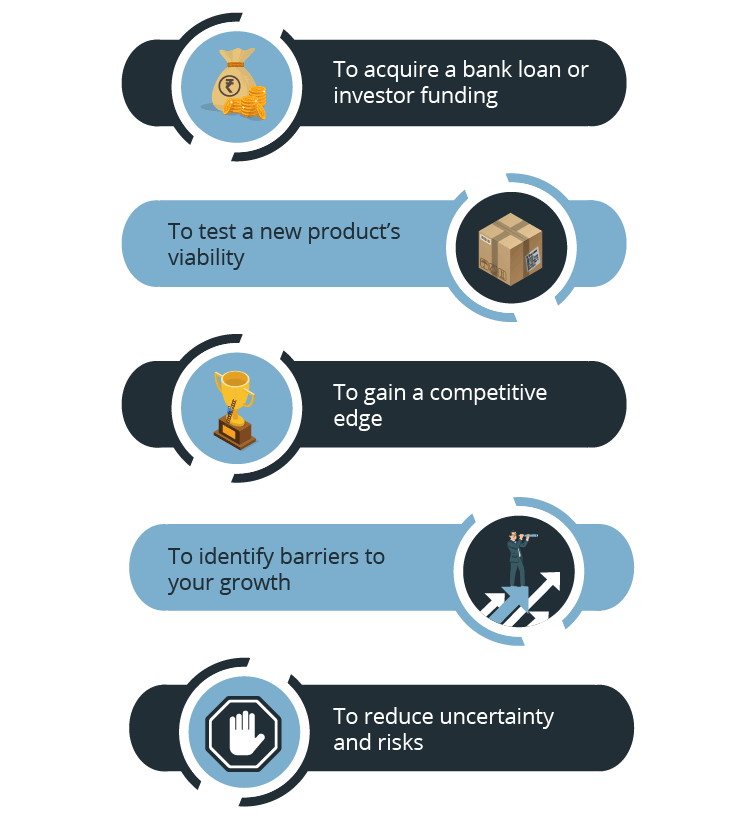

Why should you Conduct Market Analysis?

Wondering how market analysis will contribute to the success of your business? Well, check these benefits of conducting a comprehensive market analysis for your business:

1. Reduces the risk

Instead of operating on instincts and gut feelings, market research enables you to make decisions based on data and analysis. When you know with surety what works and what doesn’t, you will make decisions that are more likely to succeed than fail.

To summarize, having an in-depth market analysis will reduce the risks associated with starting a business in a thriving marketplace.

2. Identifies emerging trends

A market analysis identifies emerging market trends and patterns and thereby helps you stay at the top of the competition. Not only the trends, but you can also identify challenges that may potentially arise in your business and design a pivot plan.

3. Assist in product development

A detailed analysis of the target market, industry, and competitors helps you create the product that the customer will be willing to buy. The analysis will not only assist in product development, but also with pricing, marketing, and sales strategies to ensure thriving business conditions.

4. Optimize your target market

Your business is not for everyone and the sooner you realize this the better. A target market analysis helps in understanding who your potential customers are and accordingly strategize your marketing efforts to attract them.

5. Establishes evaluation benchmarks

Market analysis benefits your business by offering evaluation metrics and KPIs. Such metrics help in measuring a company’s performance and its edge over the competitors.

Lastly, a thorough market analysis is quintessential if you are planning to secure funds. As a matter of fact, it is non-negotiable.

Now that you know how important having a market analysis section is, let’s learn a detailed way of conducting such analysis.

How to Simplify Your Market Analysis?

Market analysis is a broad concept covering a wide range of details. There’s no denying that it is a tiring task requiring extremely dedicated efforts.

From understanding the purpose of research to undertaking surveys, gathering data, and converting it into worthy analysis—the research itself is a lot for an individual to cover.

Upmetrics market analysis tool kit includes a variety of guidebooks and templates that will help you with target customer analysis , surveys, and competitor surveys.

The documents will guide you in a strategic direction to conduct qualitative research and analysis. They are well-crafted and quite simple to follow even for someone with no prior experience at market analysis.

Got it? No more side talking, let’s get straight to what you are here for.

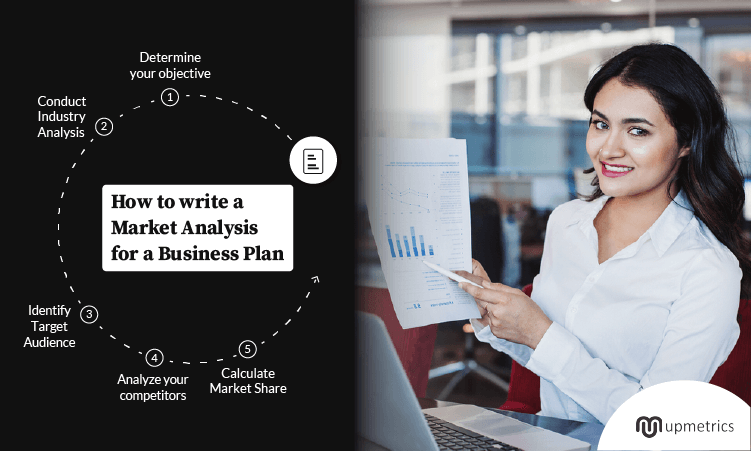

How to Conduct a Market Analysis?

Conducting thorough market research and analysis could be a hassle, but not with this easy-to-follow 7-step guide. Let’s get over it.

1. Determine your objective

When you write a business plan , market analysis is going to be one prominent component.

However, it is important to know the clear objective of conducting such analysis before you kickstart.

For instance, are you planning to acquire funding from investors or are you conducting this research to test the viability of your business idea? Are you looking to add a new product segment to your business or are you looking to expand in other states and countries?

That being said, the purpose of your market analysis will determine the extent and scope of research essential for your business.

Spend more time researching, less writing

Make business plans in minutes with AI

Plans starting from $7/month

2. Conduct an Industry Analysis

In this part of your analysis, you will highlight the state of the current industry and show where it seems to be moving. Investors would want to know if the industry is growing or declining, so present accordingly.

This section should include metrics for market size, projected growth, average market growth rate, product life cycle, and market trends.

Ensure that you gather data from highly authoritative sites like the US Bureau of Labor Statistics (BLS), Bureau of Economic Analysis, and industry publications to make your analysis.

To make this section enriching and meaningful, begin with a macro industry overview and then drill down to your specific market and business offering as thorough details as possible.

3. Identify your target audience

This section of your market analysis is dedicated to your potential target customers.

And, although your product might be suitable for everyone, there is a high possibility that not all of them will be your customers due to many reasons.

It is therefore better to target a specific category of customers to grow your business effectively and efficiently.

Now, you can begin by creating a buyer’s persona of your ideal customer describing their demographic and psychographic details. This includes talking about the age, gender, location, income, occupation, needs, pain points, problems, and spending capacity of your target customer.

You can conduct surveys, interviews, and focus groups, and gather data from high-end sources to get essential details for a customer profile.

However, make sure that you dig into details to make this section resourceful for business planning and strategizing.

4. Analyze your competitors

Competitive analysis is the most important aspect of your market analysis highlighting the state of the competitive landscape, potential business competitors, and your competitive edge in the market.

Now, a business may have direct as well as indirect competitors. And while indirect competition won’t affect your business directly, it definitely would have an impact on your market share.

To begin this section, identify your top competitors and list them down.

Conduct a SWOT analysis of your top competitors and evaluate their strengths and weaknesses against your business.

Identify their USPs, study their market strategies, understand how they pose a threat to your business, and ideate strategies to leverage their weaknesses.

Don’t undervalue or overestimate your competitors. Instead, focus on offering a realistic state of competition to the readers.

Additionally, readers also want to know your strengths and how you will leverage a competitive edge over your competitors. Ensure that this section highlights your edge in terms of pricing, product, market share, target customer, or anything else.

Want to create a SWOT analysis for your business?

Craft a powerful SWOT Analysis in just minutes using our user-friendly and free online SWOT Analysis Generator Tool!

5. Calculate your market share

The analysis section of your business plan must also include details of your market share.

If your estimated market share is not big enough, chances are your business idea might not be profitable enough to pursue further.

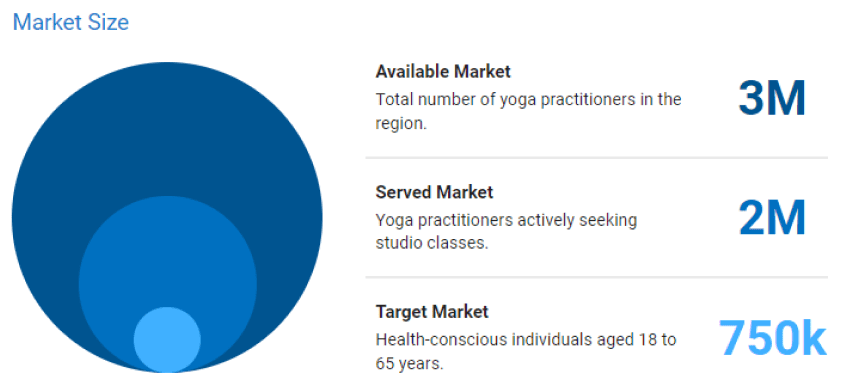

Now, you can use these proven metrics to forecast your market share:

TAM (Total available market)

It represents the total demand available in the market. In other words, it is the maximum amount of sales or revenue the market has to offer.

SAM (Serviceable available market)

It represents the segment of TAM that you can obtain with your solution within your limitations. These limitations can be geographical location, business model, type of product, etc.

SOM (Serviceable obtainable market)

It represents the segment of SAM that you can realistically capture after considering your competitors, customer preferences, production capabilities, etc.

SOM is your estimated market share. Once you have calculated it, you can actualize it via suitable pricing strategies.Apart from this method, you can also use other approaches like top-down, bottom-up, and triangulation to estimate your market share.

However, whatever method you use, ensure that the projections are realistic and attainable.

6. Know the regulations and restrictions

Before entering a new market or starting a new business , you need to know the regulations and restrictions in your industry.

Understanding these can help you stay out of legal pitfalls and inspire confidence in prospective investors.

Some of the regulations you need to know are:

- Government policies

- Tax regulations

- Trade policies

- Employment laws

- Environmental regulations

- Security and privacy

- Protection of intellectual properties

Include these details in your market analysis section to help readers understand the risk value and federal regulations associated with your business.

7. Organize and implement the data

After completing your research, it’s now time to make sense of all the data you’ve gathered.

There is no strict structure when it comes to organizing your market analysis. However, ensure that your analysis includes specific sections for objective, target market, and competition.

Focus on creating an easy-to-digest and visually appealing analysis section to help the readers gather essential essence.

Now, it’s a waste if you are not putting all this research to some use. Identify the business areas where you can implement your research be it product development, exploring the new market, or business operations, and develop strategies accordingly.

All in all lay the foundation of a successful business with a thorough and insightful market analysis. And, you can do it by having an organized market analysis section in your business plan.

Create visually appealing business plan with our

Tips to Write Your Market Analysis

After conducting thorough market research, it is important to present that information strategically in a business plan to help the readers get meaningful insights.

Well, here are a few tips to help you write the market analysis for a business plan.

1. Stay in context

Remember the objective of your market analysis and stick to it. Keeping the context in mind, identify what essential information to present and back them up with high-end sources.

Also, tie your data with essential analysis to show how your business would survive and thrive in the market.

2. Add visual graphics

No one prefers shifting through pages of pure text content. Graphics and visuals make your market analysis easy to absorb and understand. You are more likely to capture readers with visual attractiveness rather than risk their attention with pure textual content.

3. Offer an engaging summary

Offer readers a quick overview of your detailed market analysis by including a summarizing text. A summary will help readers gather a macro perspective before diving deep into hard facts and figures.

4. Avoid fluff and repetition

Ensure that everything you present in your market analysis section holds a meaning. Avoid adding inessential and fluff information.

To best identify whether or not the information is essential for the reader, ask this simple question: Will the reader learn something about my business’s market or its customers from this information?

If not, the information is most likely inessential. And, those were some quick tips to ensure effective market analysis for your business plan.

Market Analysis in a Business Plan Example

Before we conclude, check out this market analysis example from Upmetrics’ sample yoga studio business plan.

Business Name: Lotus Harmony

Location: Green Valley

Core Objective for Market Analysis

Our goal for the market analysis at Lotus Harmony is straightforward: to deeply understand what the Green Valley community seeks in yoga and wellness. We’ll closely look at local demand and the competitive scene, shaping our services to precisely meet community needs. This approach promises to make Lotus Harmony a distinct and beloved wellness destination in our neighborhood.

Industry Overview of the Green Valley Yoga Market

Market Size:

Green Valley is home to nearly 1M yoga enthusiasts, predominantly aged 25-45. This demographic suggests a robust market for yoga and wellness, ripe for a studio that offers diverse and inclusive programs.

Projected Growth:

The yoga community is expected to grow by 5% annually over the next five years. This growth is driven by an increasing interest in holistic health, presenting a fertile ground for a new yoga studio to thrive.

Market Trends:

A rising trend is the demand for comprehensive wellness services, including mindfulness and nutrition, alongside traditional yoga. Specialized classes like prenatal yoga are also gaining popularity, signaling opportunities for niche offerings.

By tapping into these insights, a new yoga studio in Green Valley can strategically position itself as a premier wellness destination, catering to the evolving needs of the community.

Target Market Analysis for Lotus Harmony

Lotus Harmony Yoga Studio’s ideal customers are mainly Urban Millennials and Gen Z (ages 18-35) who prioritize:

- Wellness and mindfulness as part of their lifestyle.

- Affordable, holistic health experiences blending physical and mental well-being.

- Convenience with flexible class schedules and online access.

- Community and sustainability, preferring spaces that offer personal growth and eco-consciousness.

- A welcoming atmosphere that supports inclusivity and connection.

Competitive Landscape for Lotus Harmony

Lotus Harmony’s success relies on understanding consumer preferences and income, securing prime locations, attracting patrons, and offering quality services. Competing with gyms, wellness centers, and home fitness, it positions itself as a holistic wellness choice, aiming to stand out in Green Valley’s wellness scene.

Market Share for Lotus Harmony

Regulatory Requirements for Lotus Harmony

Here are a few aspects of legal compliance essential for Lotus Harmony:

- Business Registration and Licensing

- Zoning and Land Use Permits

- Health and Safety Compliance

- Professional Liability Insurance

- Instructor Certifications

- Building Safety Certificates

- Accessibility Compliance

- Tax Registration

Final Thoughts

It takes an extremely dedicated effort to undertake market research and craft it into a compelling analysis. However, it’s a worthy business planning effort that will set a cornerstone of success for your business.

Don’t worry. You don’t need to spend days figuring out what and how to write your market analysis. Upmetrics, an AI-powered business planning app , will help you write your overall business plan in less than an hour.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

What are the 4 c's of marketing analysis.

The 4 C’s of marketing analysis are customer, cost, convenience, and communication which would together determine whether the company would succeed or fail in the long run.

Is SWOT analysis a market analysis?

SWOT analysis is a small but important tool for market research that would determine the success of a business or its edge over other businesses based on strengths, weaknesses, opportunities, and threats.

How long does a market analysis take?

Market analysis can take anywhere from 4 to 8 weeks, given that secondary sources of data are easily available. However, for complex large-scale projects, analysis can take up to months to complete.

What are the three core components of a market analysis?

The three most crucial components of a market analysis are the study of market size and market share, target market determination, and competitor analysis.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Related Articles

How to Write a Customer Analysis Section for Your Business Plan

5 Types Of Competitive Analysis Frameworks

Strategic Marketing Process: A Full Step-by-Step Guide

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Market Analysis Section of a Business Plan

Alyssa Gregory is an entrepreneur, writer, and marketer with 20 years of experience in the business world. She is the founder of the Small Business Bonfire, a community for entrepreneurs, and has authored more than 2,500 articles for The Balance and other popular small business websites.

:max_bytes(150000):strip_icc():format(webp)/alyssa-headshot-2018-5b73ee0046e0fb002531cb50.png)

The market analysis section of your business plan comes after the products or services section and should provide a detailed overview of the industry you intend to sell your product or service in, including statistics to support your claims.

In general, the market analysis section should include information about the industry, your target market, your competition, and how you intend to make a place for your own product and service. Extensive data for this section should be added to the end of the business plan as appendices, with only the most important statistics included in the market analysis section itself.

What Should a Market Analysis Include?

The market analysis section of your small business plan should include the following:

- Industry Description and Outlook : Describe your industry both qualitatively and quantitatively by laying out the factors that make your industry an attractive place to start and grow a business. Be sure to include detailed statistics that define the industry including size, growth rate , trends, and outlook.

- Target Market : Who is your ideal client/customer? This data should include demographics on the group you are targeting including age, gender, income level, and lifestyle preferences. This section should also include data on the size of the target market, the purchase potential and motivations of the audience, and how you intend to reach the market.

- Market Test Results : This is where you include the results of the market research you conducted as part of your initial investigation into the market. Details about your testing process and supporting statistics should be included in the appendix.

- Lead Time : Lead time is the amount of time it takes for an order to be fulfilled once a customer makes a purchase. This is where you provide information on the research you've completed on how long it will take to handle individual orders and large volume purchases, if applicable.

- Competitive Analysis : Who is your competition? What are the strengths and weaknesses of the competition? What are the potential roadblocks preventing you from entering the market?

7 Tips for Writing a Market Analysis

Here is a collection of tips to help you write an effective and well-rounded market analysis for your small business plan.

- Use the Internet : Since much of the market analysis section relies on raw data, the Internet is a great place to start. Demographic data can be gathered from the U.S. Census Bureau. A series of searches can uncover information on your competition, and you can conduct a portion of your market research online.

- Be the Customer : One of the most effective ways to gauge opportunity among your target market is to look at your products and services through the eyes of a purchaser. What is the problem that needs to be solved? How does the competition solve that problem? How will you solve the problem better or differently?

- Cut to the Chase : It can be helpful to your business plan audience if you include a summary of the market analysis section before diving into the details. This gives the reader an idea about what's to come and helps them zero in on the most important details quickly.

- Conduct Thorough Market Research : Put in the necessary time during the initial exploration phase to research the market and gather as much information as you can. Send out surveys, conduct focus groups, and ask for feedback when you have an opportunity. Then use the data gathered as supporting materials for your market analysis.

- Use Visual Aids : Information that is highly number-driven, such as statistics and metrics included in the market analysis, is typically easier to grasp when it's presented visually. Use charts and graphs to illustrate the most important numbers.

- Be Concise : In most cases, those reading your business plan already have some understanding of the market. Include the most important data and results in the market analysis section and move the support documentation and statistics to the appendix.

- Relate Back to Your Business : All of the statistics and data you incorporate in your market analysis should be related back to your company and your products and services. When you outline the target market's needs, put the focus on how you are uniquely positioned to fulfill those needs.

When & How to Calculate Market Share (With Formulas)

What is Market Share?

One of the first steps to building a business is understanding the market and understanding the viability of a successful business. Regardless if the goal is to be a multi-billion dollar company or a local joint that can sustain a few employees — understanding the market, and your share of the market is vital.

As Investopedia puts it , “Market share is the percent of total sales in an industry generated by a particular company. Market share is calculated by taking the company’s sales over the period and dividing it by the total sales of the industry over the same period. This metric is used to give a general idea of the size of a company in relation to its market and its competitors. The market leader in an industry is the company with the largest market share.”

Why is Market Share Important to Understand?