Lien Assignment Process and Procedure

The lien assignment process almost always begins with the owner’s mortgage lender (i.e. bank) commencing a foreclosure on its first deed of trust. Prior to the bank proceeding to foreclosure sale, it must submit a bid to the Public Trustee’s office. At that time, investors review the bank’s bid and determine if they would be interested in paying off the bank in exchange for acquiring the property. This is usually about the same time that investors obtain title work on the property and contact the association, its management company or our office to inquire about the potential purchase of the association’s lien. Most investors realize that even if no recorded lien exists, the association still may have an assignable lien by operation of Colorado Common Interest Ownership Act.

Assuming the investor gets in touch with our office (whether directly or following a referral from the manager or association), our firm will contact the board or management company for an updated ledger on the property. We then review the ledger and add in any time that may have been written off because of a bankruptcy and additional attorney fees that are not yet reflected on the ledger. We use this information to formulate a lien sale price. In some instances we will attempt to sell the lien for more than the total amount owed, but we always assign the lien for at least payment in full through the current month. Following an agreement with an investor to purchase the lien, our office processes the lien sale through the execution of a lien assignment document. This document sets forth the legal rights and obligations between the investor and the association and allows the investor to acquire property through a redemption process.

If the lien is sold, the association receives payment in full (or occasionally, more than payment in full) and the investor receives all rights associated with the association’s lien. The investor takes the completed lien assignment to the Public Trustee and files what is known as an Intent to Redeem. This document tells the Public Trustee that the investor has purchased the association’s lien and corresponding right to redeem at the Public Trustee’s sale. The investor then tenders payment to the Public Trustee for all amounts owed to the foreclosing lender. This process is known as redemption.

Following a successful redemption, the investor will take title to the property and will be issued a Public Trustee’s Deed. This Deed confirms that the investor now owns the property. It is important to remember that the Public Trustee’s Deed is sometimes issued several weeks after the investor actually takes legal title to a property. Technically, legal title transfers once all applicable redemption periods expire. Associations should contact our office if there are any questions about the actual date that a title transferred to an investor.

Usually, investors that acquire association liens through the lien assignment process are interested in rehabilitating the property and reselling it relatively quickly. However, during the time the investor owns the property, he or she is subject to all the same covenants as any other owner, including the obligation to pay assessments.

Keep In Touch

Sign up for our Newsletter and Blog today.

I'm Ready to Gain Some Altitude

Schedule a Consultation

If you’re looking for legal consultation, schedule one today .

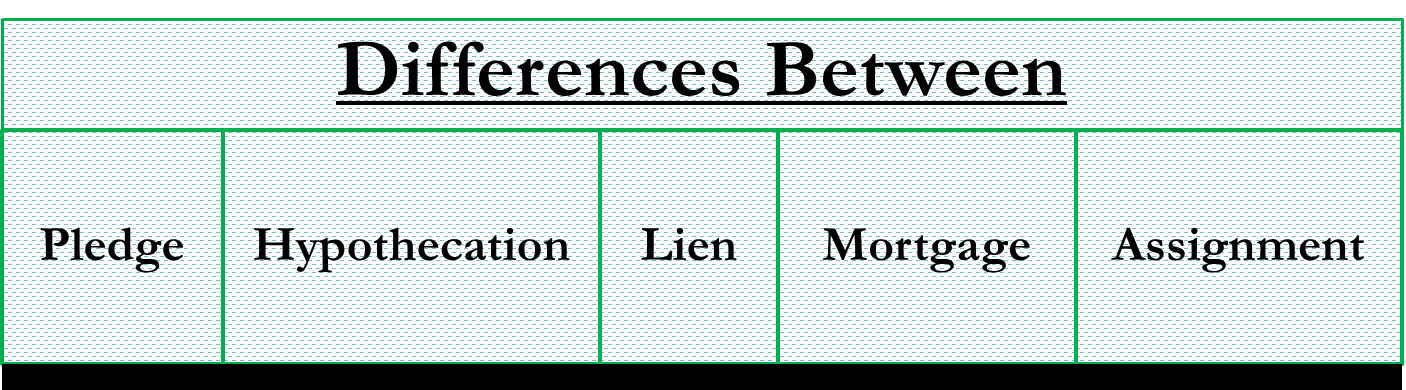

Pledge vs Hypothecation vs Lien vs Mortgage vs Assignment

The difference between pledge, hypothecation, lien, mortgage, and assignment lies in the security charge that can be created on any asset held by a lender against the money lent (usually called the collateral). The type of asset charge defines whether the agreement can be classified as a pledge, lien, or mortgage. Let us see in detail the difference between pledge vs hypothecation vs lien vs mortgage vs assignment.

There are several types of security interests that can be adopted by banks or lenders depending upon the collateral involved and the circumstances. Different forms of creating charges on assets are as follows:

Hypothecation

Short summary table.

Pledge is commonly used for goods or securities such as gold, stocks, certificates, etc. The lender (pledgee) holds the actual possession of such securities until the borrower (pledger) has the borrowed amount with him. Once the borrowed amount has been returned, the securities are returned as well. If the pledger defaults on the loan amount, the pledgee can sell off the goods pledged to him as security in order to recover the principal and the interest amount. In this case risk of lending comparatively reduces because possession of assets is with the lender.

Hypothecation is usually when the charge is on movable assets rather than having a charge on fixed assets. However, hypothecation is different from pledges in the sense that the possession of such movable security stays with the borrower. Hence, in the event of default, the lender is first required to take possession / seize such property or asset in order to recover the principal and interest. An example of hypothecation is vehicle financing, where the lender has the asset that has been hypothecated against the loan with a bank. If the borrower defaults, the bank then takes possession of the vehicle after sufficient notice to recover the money.

Also Read: Hypothecation

Under a lien, the lender gets the right to hold up a property or machinery used as collateral against funds borrowed. However, unless the contract states otherwise, the lender doesn’t have the right to sell the property or the asset if the borrower defaults on the loan. Examples of lien include rent receivable, unpaid fees, etc. It is a right given to the creditor to retain/possess the security until the loan amount g. Since possession is with the creditor, it is the strongest form of security. Lien can be on both movable and immovable property. But generally, lending companies choose to have mortgages on immovable property and lien on movable security like shares, gold, deposits, etc.

Under a mortgage , the legal ownership of the asset can be transferred to the lender if the borrower defaults on the loan amount. However, the borrower continues to remain in possession of the property. A mortgage is usually used for immovable assets (example: house, land, building, or any property which is permanently fixed to the earth or attached to the land). Home loans classify as mortgages.

An assignment is another type of charge on current assets or fixed assets. Under assignment, the charge is created on the assets held in the books. It is another mode of providing security against borrowing. Examples of assignments include life insurance policies, books of debts, receivables, etc., which the bank can finance. For example – A bank can finance against the book debts. The borrower assigns the book debts to the bank in such a case.

To get an idea about the difference between pledge vs hypothecation vs lien vs mortgage vs assignment, refer to the table below.

| Basis | Pledge | Hypothecation | Lien | Mortgage | Assignment |

|---|---|---|---|---|---|

| Collateral | Goods or securities such as gold, stocks, certificates, etc | Movable assets | Property or machinery | Immovable assets | Current assets or fixed assets |

| Examples | Gold, stocks, certificates, etc. | Vehicle financing | Rent receivable, unpaid fees, etc | House, land, building, | Life insurance policies, books of debts, receivables, etc. |

Quiz on Pledge vs Hypothecation vs Lien vs Mortgage vs Assignment

Let’s take a quick test on the topic you have read here.

Your answer:

Correct answer:

SHARE YOUR RESULTS

Your Answers

RELATED POSTS

- Mortgage Vs. Hypothecation – Similarities and Differences

- Secured Loans

- Secured Personal Loans – Meaning, Features, Benefits and Drawbacks

- Recourse vs Non-Recourse Loan/Debt

- Floating Lien – Meaning, Importance and More

- Restrictive Debt Covenants on Term Loan Agreement

Sanjay Bulaki Borad

MBA-Finance, CMA, CS, Insolvency Professional, B'Com

Sanjay Borad, Founder of eFinanceManagement, is a Management Consultant with 7 years of MNC experience and 11 years in Consultancy. He caters to clients with turnovers from 200 Million to 12,000 Million, including listed entities, and has vast industry experience in over 20 sectors. Additionally, he serves as a visiting faculty for Finance and Costing in MBA Colleges and CA, CMA Coaching Classes.

5 thoughts on “Pledge vs Hypothecation vs Lien vs Mortgage vs Assignment”

Really simple and so easy to refer .Especially good for nonfinance people who aims to move to general top management .

Thanks for sharing. I really like your explanations.

Tysm sir it helps me easily to understand n differentiate between all type of securities

Really great way illustration. It helped me a lot.

I love the concept; so very easy to understand.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Sign me up for the newsletter!

N.Y. Lien Law Section 14 Assignment of lien

Source: Section 14 — Assignment of lien , https://www.nysenate.gov/legislation/laws/LIE/14 (updated Sep. 22, 2014; accessed Jun. 8, 2024).

Accessed: Jun. 8, 2024

Last modified: Sep. 22, 2014

§ 14’s source at nysenate.gov

Blank Outline Levels

The legislature occasionally skips outline levels. For example:

In this example, (3) , (4) , and (4)(a) are all outline levels, but (4) was omitted by its authors. It's only implied. This presents an interesting challenge when laying out the text. We've decided to display a blank section with this note, in order to aide readability.

Do you have an opinion about this solution? Drop us a line.

Practice Area

- Administration

- Administrative & Public Law

- Aviation & Transportation

- Banking & Financial Services

- Caribbean & Offshore

- Charities & Non-Profits

- Commercial Leasing

- Commercial Litigation

- Construction

- Corporate & Commercial

- Design-Build

- Employment & Labour

- Energy & Utilities

- Environmental

- Expropriation

- Health Care

- Human Rights

- Indigenous Peoples

- Infrastructure/P3

- Insolvency & Restructuring

- International/Cross Border

- Litigation & Dispute Resolution

- Media & Defamation

- Mergers & Acquisitions

- Planning & Land Development

- Privacy & Access to Information

- Private Equity

- Procurement

- Public Companies

- Real Property

- Subrogation & Recovery

- Technology & Intellectual Property

- Universities & Colleges

- Wills, Trusts & Estates

- Zoning & Official Plans

- Publications

- In the Media

- Commercial Litigation Insights

- July 27, 2021

- Printable PDF

Lien Rights: To Assign or Not to Assign (Should you ask the question?)

- By Michael Swartz,

Assignment of lien is a powerful but underused section of Ontario’s Construction Act . Assignment allows a party with lien rights to transfer their rights (and rights to any related court lawsuit or arbitration) to a third party. Unlike many other sections of the Construction Act that contain detailed and specific rules, the Construction Act does not provide much in the way of guidance to parties considering making or taking assignment of a construction lien, except that the assignment must be made in writing. This provides parties with broad latitude to create assignment arrangements that fit their individual needs.

What is assignment of construction lien rights?

Lien rights are a remedy available to those who supply services and/or materials to construction projects in Ontario. A party who has construction lien rights has a unique form of security for claims of non-payment in the form of a charge on the project property and on any holdbacks that are retained from payments on the project, or a charge on any security posted into court to remove the lien from title to the property.

Lien rights arise on the supply of services and/or materials to an improvement to a property and are for the price of the service and/or materials supplied. Construction lien rights are governed by the rules and procedures contained in the Construction Act . Subject to certain exceptions, a claim for lien is typically registered on title to the property to which the party with lien rights supplied the services and/or materials.

An assignment is the process by which Party A, who has a claim, account receivable, or some other legal right or benefit (including construction lien rights), transfers that legal right or benefit to Party B. Often, Party B will provide some sort of benefit to Party A in return for the assignment of legal rights, such as a payment of money and/or as part of a settlement. As discussed above, the Construction Act specifically allows for lien rights to be assigned to a third party.

Why assign construction lien rights?

Assignment has several benefits for the party with the lien rights. If you have lien rights, the assignment of those rights may be part of a settlement arrangement allowing you to be paid more quickly. Assignment also allows you avoid the time, expense, and risk of litigation. It allows you to move on from the claim, except for any assistance you may agree to provide the party who is taking assignment of the lien rights.

Assignment can also be beneficial for the party taking assignment of the lien rights. In complex disputes with multiple parties and claims, it can simplify and consolidate the dispute by allowing one party to take control of the claims. For example, in construction projects with multiple owners, assignment may allow one owner to clear title to their property while advancing the claim against the other owners. A contractor could also take assignment of claims from its subcontractors and advance the claims together up to the owner.

Assignment can also be helpful as a means for an insurer or surety to take control of a claim and recover amounts paid out to an insured.

What do you need to do for an assignment?

The only direct rule in the Construction Act with respect to assignment is that the assignment must be in writing. Courts have held that this is a requirement for a valid assignment. While this one rule may seem simple, an assignment agreement written on the back of a napkin likely will not be sufficient. There are many considerations that need to carefully be taken into account, including:

- the lien rights are valid and capable of being assigned under the Construction Act ;

- proper protections are in place for both the party assigning the lien rights and the party taking assignment of the lien rights;

- the assigning party’s assistance with any litigation relating to the lien claim is properly addressed;

- the proper steps are taken to ensure the party taking the assignment can advance a lawsuit or arbitration relating to the lien claim, if necessary; and

- where the assignment is part of a settlement, that the terms of the settlement are agreed and properly documented.

For assistance regarding the assignment of lien rights, or with construction liens, disputes, and contracts more generally, please contact Michael Swartz and Paul Conrod .

The information and comments herein are for the general information of the reader and are not intended as advice or opinion to be relied upon in relation to any particular circumstances. For particular application of the law to specific situations, the reader should seek professional advice.

- Media Contact

NEW RELEASE: NCS Credit Lien Index Q1 2024

- How We Serve Overview

- Collections

- Notice & Lien

- Additional Resources

- Who We Serve Overview

- Manufacturing

- Construction

- Food Distributors

- Learning Center

- About Overview

- Case Studies

Understanding the Assignment of Mechanic's Lien & Bond Claim Rights

Mechanic’s lien and bond claims may be assigned from one party another. However, whether assignment rights are available will vary by state and circumstance.

In this infographic, you’ll learn what it means to assign lien rights, who’s involved in the assignment of rights, and whether rights are always assignable.

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

2021 New York Laws LIE - Lien Article 2 - Mechanics' Liens 14 - Assignment of Lien.

§ 14. Assignment of lien. A lien, filed as prescribed in this article, may be assigned by a written instrument signed and acknowledged by the lienor, at any time before the discharge thereof. Such assignment shall contain the names and places of residence of the assignor and assignee, the amount of the lien and the date of filing the notice of lien, and be filed in the office where the notice of the lien assigned is filed. The facts relating to such an assignment and the names of the assignee shall be entered by the proper officer in the book where the notice of lien is entered and opposite the entry thereof. Unless such assignment is filed, the assignee need not be made a defendant in an action to foreclose a mortgage, lien or other incumbrance. A payment made by the owner of the real property subject to the lien assigned or by his agent or contractor, or by the contractor of a public corporation, to the original lienor, on account of such lien, without notice of such assignment and before the same is filed, shall be valid and of full force and effect. Except as prescribed herein, the validity of an assignment of a lien shall not be affected by a failure to file the same.

Get free summaries of new opinions delivered to your inbox!

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Mortgage Liens: Assignment & Assumption In Sales Transaction

Shawn has a masters of public administration, JD, and a BA in political science.

Table of Contents

Mortgage assignments, mortgage assumptions, lesson summary.

Real estate financing involves a promissory note, which is the actual promise to repay the loan, and a mortgage, which is an interest in the real estate given to a lender to secure repayment of the loan. If the borrower doesn't pay, the lender can commence a foreclosure lawsuit and sell the property at auction to satisfy the debt. Thus, the mortgage is very important to lenders because it helps reduce the chance they'll get stuck with a non-performing loan.

It may surprise you to learn that many lenders who provide real estate loans don't actually keep them very long. Instead, the lender will often sell its loans to other banks or investors at a discount so they (the lender) can turn around and make more loans. Importantly, the mortgage will follow the note, which means that whoever holds the promissory note should also hold the mortgage securing it. This makes sense because there's really no reason to hold a mortgage if you don't own the debt underlying it (since the whole purpose of the mortgage is to secure payment of the debt).

Transferring a promissory note is pretty easy. If a promissory note is negotiable (i.e., transferable) all you have to do to negotiate (i.e., transfer) it is to endorse and deliver it, similar to endorsing the back of a check. The mortgage, on the other hand, is transferred by an assignment. Most mortgages have a provision that permits the mortgagor (the person who holds the mortgage) to assign it to another.

An assignment is the legal term used to indicate that someone is transferring a legal right or interest they have to someone else. In our case, the lender is transferring the mortgage. The party transferring the interest or right is called the assignor and the party receiving it is called the assignee . The assignee will record the assignment in the land records office to provide notice to the public that it now holds the mortgage.

What does this mean for the buyer? From a practical standpoint, not much except that the borrower now makes payments to someone other than the previous creditor. Of course, the borrower must be provided notice of the assignment.

Assume for a moment that an owner is facing foreclosure but there hasn't been a proper negotiation of the promissory note or assignment of the mortgage. In this instance, the creditor bringing the action may not be entitled to do so because it doesn't actually hold the note or the mortgage upon which the foreclosure action is based. In reality, this may only delay the inevitable as the creditor will correct the defect in negotiation or assignment.

To unlock this lesson you must be a Study.com Member. Create your account

A mortgage assumption is an entirely different creature. A mortgage assumption involves a buyer and seller of real estate and occurs when the buyer agrees to assume or 'take over' the seller's loan and mortgage obligations. An assumption may be attractive if the present interest rates for new loans are higher than the interest rate on the current loan.

Lenders don't particularly like assumable mortgages without their consent because they want to know that the buyer taking the assumption is a good credit risk. Consequently, lenders will often require a due on sale clause on their loans, which will accelerate all payments on the loan upon the sale of the property to another. A due on sale clause will cut off the possibility of a mortgage assumption, at least without the consent of the mortgagor (i.e., the person holding the mortgage). This is because the clause gives the lender the right to demand that the entire balance left on the loan be paid in full upon the sale or transfer of the mortgaged property to someone else.

Most conventional loans (i.e., traditional bank loans) are not assumable for the reasons we discussed. However, certain federal government backed loans are assumable. FHA loans, which are loans insured by the Federal Housing Administration, are assumable. Likewise, VA loans, which are guaranteed by the Department of Veterans Administration, are assumable as well.

Let's review what we've learned. A mortgage assignment occurs when the holder of a mortgage transfers the mortgage to another person or entity. Assignments are generally freely permitted in most modern mortgage agreements. Once the borrower has received proper notice of the assignment, payments will be made to the new creditor.

A mortgage assumption occurs when a buyer agrees to take on the seller's current loan and mortgage obligations. Most conventional mortgages are not assumable without the consent of the mortgagor because of a due on sale clause . However, FHA and VA loans are assumable.

Register to view this lesson

Unlock your education, see for yourself why 30 million people use study.com, become a study.com member and start learning now..

Already a member? Log In

Resources created by teachers for teachers

I would definitely recommend Study.com to my colleagues. It’s like a teacher waved a magic wand and did the work for me. I feel like it’s a lifeline.

Mortgage Liens: Assignment & Assumption In Sales Transaction Related Study Materials

- Related Topics

Browse by Courses

- Human Resource Management Textbook

- Organizational Behavior Textbook

- Business Law Textbook

- UExcel Human Resource Management: Study Guide & Test Prep

- Business Ethics Syllabus Resource & Lesson Plans

- Organizational Behavior Syllabus Resource & Lesson Plans

- Business Math Curriculum Resource & Lesson Plans

- Macroeconomics Syllabus Resource & Lesson Plans

- Introduction to Business Textbook

- Principles of Management Textbook

- Intro to Business Syllabus Resource & Lesson Plans

- Business Law Syllabus Resource & Lesson Plans

- Developing Interpersonal Communication Skills for Work

- Understanding Customer Relationship Management Basics

- Mastering Effective Team Communication in the Workplace

Browse by Lessons

- Medical Lien | Definition, Requirements & Benefits

- Hospital Lien | Definition, Act & Facts

- Mortgage Liens: Definition & Overview

- Lien | Definition, Types & Examples

- Mortgage Brokerage Fees & Broker Liens in Connecticut

- Equity Method of Accounting

- Cost Method of Accounting | Pros, Cons & Examples

- Fixed-Income Investment Definition, Benefits & Examples

- Functional Currency | Overview, Importance & Examples

- Mental Accounting Definition, Consumer Choice & Examples

- Soft Dollar Arrangements, Risks & Importance

- Hard Dollar Compensation

- Special Dividend Purpose, Impact & Examples

- Stock Market Speculation | Definition & Examples

- Closed-End Fund (CEF) vs. Open-End Fund

Create an account to start this course today Used by over 30 million students worldwide Create an account

Explore our library of over 88,000 lessons

- Foreign Language

- Social Science

- See All College Courses

- Common Core

- High School

- See All High School Courses

- College & Career Guidance Courses

- College Placement Exams

- Entrance Exams

- General Test Prep

- K-8 Courses

- Skills Courses

- Teacher Certification Exams

- See All Other Courses

- Create a Goal

- Create custom courses

- Get your questions answered

- More Blog Popular

- Who's Who Legal

- Instruct Counsel

- My newsfeed

- Save & file

- View original

- Follow Please login to follow content.

add to folder:

- My saved (default)

Register now for your free, tailored, daily legal newsfeed service.

Find out more about Lexology or get in touch by visiting our About page.

Lien Rights: To Assign or Not to Assign (Should you ask the question?)

Assignment of lien is a powerful but underused section of Ontario’s Construction Act . Assignment allows a party with lien rights to transfer their rights (and rights to any related court lawsuit or arbitration) to a third party. Unlike many other sections of the Construction Act that contain detailed and specific rules, the Construction Act does not provide much in the way of guidance to parties considering making or taking assignment of a construction lien, except that the assignment must be made in writing. This provides parties with broad latitude to create assignment arrangements that fit their individual needs.

What is assignment of construction lien rights?

Lien rights are a remedy available to those who supply services and/or materials to construction projects in Ontario. A party who has construction lien rights has a unique form of security for claims of non-payment in the form of a charge on the project property and on any holdbacks that are retained from payments on the project, or a charge on any security posted into court to remove the lien from title to the property.

Lien rights arise on the supply of services and/or materials to an improvement to a property and are for the price of the service and/or materials supplied. Construction lien rights are governed by the rules and procedures contained in the Construction Act . Subject to certain exceptions, a claim for lien is typically registered on title to the property to which the party with lien rights supplied the services and/or materials.

An assignment is the process by which Party A, who has a claim, account receivable, or some other legal right or benefit (including construction lien rights), transfers that legal right or benefit to Party B. Often, Party B will provide some sort of benefit to Party A in return for the assignment of legal rights, such as a payment of money and/or as part of a settlement. As discussed above, the Construction Act specifically allows for lien rights to be assigned to a third party.

Why assign construction lien rights?

Assignment has several benefits for the party with the lien rights. If you have lien rights, the assignment of those rights may be part of a settlement arrangement allowing you to be paid more quickly. Assignment also allows you avoid the time, expense, and risk of litigation. It allows you to move on from the claim, except for any assistance you may agree to provide the party who is taking assignment of the lien rights.

Assignment can also be beneficial for the party taking assignment of the lien rights. In complex disputes with multiple parties and claims, it can simplify and consolidate the dispute by allowing one party to take control of the claims. For example, in construction projects with multiple owners, assignment may allow one owner to clear title to their property while advancing the claim against the other owners. A contractor could also take assignment of claims from its subcontractors and advance the claims together up to the owner.

Assignment can also be helpful as a means for an insurer or surety to take control of a claim and recover amounts paid out to an insured.

What do you need to do for an assignment?

The only direct rule in the Construction Act with respect to assignment is that the assignment must be in writing. Courts have held that this is a requirement for a valid assignment. While this one rule may seem simple, an assignment agreement written on the back of a napkin likely will not be sufficient. There are many considerations that need to carefully be taken into account, including:

- the lien rights are valid and capable of being assigned under the Construction Act ;

- proper protections are in place for both the party assigning the lien rights and the party taking assignment of the lien rights;

- the assigning party’s assistance with any litigation relating to the lien claim is properly addressed;

- the proper steps are taken to ensure the party taking the assignment can advance a lawsuit or arbitration relating to the lien claim, if necessary; and

- where the assignment is part of a settlement, that the terms of the settlement are agreed and properly documented.

Filed under

- Construction

- WeirFoulds LLP

Popular articles from this firm

Ontario’s bill 194 proposes new requirements regarding cybersecurity and the use of artificial intelligence *, should you gift the cottage or other appreciating personal use property before the increase to the capital gains inclusions rate *, the first home savings account - a key to savings for first-time home buyers *, primer on permanent, mandatory and interlocutory injunctions *, commercial litigation insights: settlement privilege and the limits of ‘with prejudice’ communications in ontario *.

If you would like to learn how Lexology can drive your content marketing strategy forward, please email [email protected] .

Related practical resources PRO

- How-to guide How-to guide: How to identify and manage antitrust and unfair trade practice risk (USA)

- Checklist Checklist: Data subject access rights under the GDPR (UK)

- How-to guide How-to guide: How to investigate internal complaints (USA)

Related research hubs

Assignments vs. Liens In the Personal Injury Context

- Share story on Facebook

- Share story on Twitter

- Share story on LinkedIn

- Share story via email

A large number of people, attorneys included, don’t know the difference between “assignments” and “liens.”

Why does it matter, you ask? For a number of reasons that will be more obvious when the difference is understood.

An assignment is the easier of the two to understand since, as the name implies, it is an transfer of all or some rights or property to a third-party. Although an assignor cannot ever assign more rights or property than it holds, it can assign less than all of the rights or property subject to the assignment.

An assignment is bears the hallmarks of ownership . That is, an assignee steps into the assignor’s shoes and has the ability to control the rights or property subject to the assignment. This means that the assignee can further assign the rights or property, can sell them, donate them, pledge them as collateral or simply enjoy the rights or property as though they were his or her own; subject, of course, to restrictions in the assignment agreement.

Here is where it will get tricky: an assignment can, in effect, extinguish an obligation to one party by transferring the obligation to another party.

Take, for example, a debt. Assume you owe a friend $10,000 for a car that you bought from him, and you agree to pay it of at a rate of $1,000 a year for 10 years. After two years, however, your friend decides that he really needs money and so he assigns the remaining $8,000 debt to me for $5,000 immediate cash. The debt to your friend is now, in effect, extinguished and transferred to me – that is, you owe me the $8,000.

You may not realize it, but a personal injury claim is a bundle of property rights, and to make matters a little more confusing, some states prohibit assignment of personal injury claims. Now, understand, this is a seemingly narrow restriction and assignment of other rights (such as debts) and property (such as cars) are fully assignable in every state.

What this anti-assignment law in the personal injury context means is that you cannot assign to someone a claim for bodily injury to a third-party. Remember, you can still assign the part of the case that corresponds to property damage, such as damage to your vehicle or personal belongings, and you can still assign any non-bodily injury claims, such as breach of contract or bad-faith.

Now keep that all in mind. What is a lien?

A lien is “[a] charge or encumbrance upon property to secure the payment or performance of a debt, duty or other obligation,” and it “ is distinct from the obligation which it secures .” Matlow v. Matlow , 89 Ariz. 293, 297-98, 361 P.2d 648, 651 (1961) (citing 53 C.J.S. Liens § 1, at 826). In Arizona, a lien can be created by statute, but an equitable lien may also arise from an express contract if the parties indicate an attempt to charge particular property as security for an obligation. Kalmanoff v. Weitz , 8 Ariz.App. 171, 172, 444 P.2d 728 (1968).

Unlike assignments, there is no prohibition on liens against personal injury cases, but this subject matter creates a great deal of confusion. Admittedly, what has contributed to the confusion is that the law has undergone centuries of perversion and that it is sometimes hard to tell the difference between an assignment versus a lien on a personal injury claim.

The courts examining this issue have often overlooked the distinction and, typically, have incorrectly deemed simple liens to be prohibited assignments without examining the real character of the transaction. To be sure, there are decisions that uphold standard (non-statutory) medical liens between a doctor and patient for services, and opinions which preclude insurance companies from recouping payment made to those same doctors as being impermissible assignments. These decisions are irreconcilable and fail to appreciate the difference between an assignment versus a lien on a personal injury claim.

Simply put, such arrangements – e.g. , where someone is due money for services rendered – are permissible liens on a personal injury claims. That is, where an injured person owes money to a third-party and agrees to secure the debt with an encumbrance upon proceeds in a personal injury claim, the third-party does not own or control the personal injury claim (as they would had there been an assignment) and the personal injury claim remains “distinct from the obligation which it secures.” The third-party has no say in how the claim is handled, does not need to assent to the settlement of the claim and will not be a party to signing a release of such a claim, which would be hallmarks of an assignment. To the contrary, if the injured party loses the personal injury suit, the “distinct . . . obligation” remains and must still be satisfied (absent an agreement making the debt or obligation contingent upon an event, such as prevailing in a personal injury action). In contrast, assignment of a losing claim would always result in an assignee receiving nothing (with the obligation having been extinguished upon the assignment).

Due to the anti-assignment case law, which is inconsistently applied, this causes confusion in personal injury cases. Although we are not going to ever resolve the issue here, it helps to remember the reason for anti-assignment law in the personal injury context is to prevent “trafficking in personal injury claims.” That is, the courts long ago decided that it was not acceptable for people to market in buying and selling personal injury actions, ostensibly because of the unsavory possibilities of having injured people victimized by those wishing to purchase such rights. In reality, it has more to do with the image of justice and the likelihood that it would encourage fraudulent personal injury claims.

Ironically, the quiet exception to the rule prohibiting assignment of personal injury claims is that attorneys are permitted to take contingency fees on personal injury claims, which (if you believe what you read about other so-called impermissible assignment arrangements) is nothing more than an assignment of a personal injury claim. It used to be that such arrangements were considered impermissible, but after many years the courts relented an allowed contingency fee arrangements in all but criminal and divorce proceedings. In those cases, courts still felt that there was too must risk to allowing contingency fees — that contingency fees would encourage unethical or unsavory conduct in criminal and divorce cases.

The reason contingency fees are allowed to attorneys, however, is to open the door to parties who would not otherwise be able to afford paying for attorneys on an hourly basis. And, most often, the same reason underlies lien arrangements for injured persons, whether it be health insurance liens, contractual doctors liens, liens for pharmaceutical expenses, liens for rental cars or liens for cash advanced to pay bills. Accordingly, although courts have long misunderstood and confused the difference between impermissible assignments and permissible liens, the simple fact is that such liens are a necessary element in modern personal injury practice to provide immediate care and compensation to impecunious injured parties who cannot afford to battle for years with an insurer for a tortfeasor. Such arrangements to not give rise to the concerns underlying the old anti-assignment laws and, in fact, do not reveal ownership characteristics of assignments.

The Legal Examiner

The Legal Examiner and our Affiliate Network strive to be the place you look to for news, context, and more, wherever your life intersects with the law.

Comments for this article are closed.

From Our Newsroom

Bravo TV Star Experiences Stevens-Johnson Syndrome Misdiagnosis

What To Do If You Are Having Trouble with a Camp Lejeune Claim

New Study Links Talc Powder to Ovarian Cancer

FDA Misses Deadline to Ban Dangerous Chemical in Hair Relaxers

Recent articles.

Fatal Orange Blossom Rd Crash near Wamble Rd Kills Ceres Man, 23, in Oakdale

Vanguard High School Dean, Gregory Ramputi, Arrested for Sexual Offenses Against Students

How Technology Can Make Delivery Vans Safer

Fatal Single-Vehicle Crash with Guardrail on Highway 33 near Sutter Ave in Fresno County

Popular on our affiliate network.

What Common Surgeries Carry the Highest Risks of Harm?

Two Pedestrians Hospitalized after Locust St, Cole Ave Hit-and-Run near Walnut Creek Farmer’s Market

Dangers of Unnecessary Back Surgeries

Pedestrian Woman Injured by Teens in Allegedly Stolen Vehicle in North Highlands

- Search Search Please fill out this field.

What Is a Lien?

How liens work, types of liens, what is a lien on my house, what does a lien mean, how do i get rid of a lien.

- Corporate Finance

- Corporate Debt

Lien: Three Main Types of Claim Against and Asset

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt. A creditor or a legal judgment could establish a lien. A lien serves to guarantee an underlying obligation, such as the repayment of a loan. If the underlying obligation is not satisfied, the creditor may be able to seize the asset that is the subject of the lien. There are many types of liens that are used to secure assets.

Key Takeaways

- A lien is a claim or legal right against assets that are usually used as collateral to satisfy a debt.

- The creditor may be able to seize the asset that is the subject of the lien.

- Bank, real estate, and tax are three types of liens.

- If a contract on a property is not paid, the lender has a legal right to seize and sell the property.

- Various types of liens can be established including by a creditor, legal judgment, or tax authority.

Investopedia / Dennis Madamba

A lien provides a creditor with the legal right to seize and sell the collateral property or asset of a borrower who fails to meet the obligations of a loan or contract. The owner cannot sell the property that is the subject of a lien without the consent of the lien holder. A floating lien refers to a lien on inventory or other unfixed property.

Liens can be voluntary or consensual, such as a lien on a property for a loan. However, involuntary or statutory liens exist whereby a creditor seeks legal action for nonpayment. As a result, a lien is placed on assets, including property and bank accounts.

Some liens are filed with the government to let the public know that the lienholder has an interest on the asset or property. A lien's public record tells anyone interested in purchasing the asset or collateral that the lien must be released before the asset can be sold.

There are many types of liens and lien holders. Liens can be put in place by financial institutions, governments, and small businesses. Below are some of the most common liens.

A lien is often granted when an individual takes out a loan from a bank to purchase an asset. For example, if an individual purchases a vehicle, the seller would be paid using the borrowed funds from the bank. In turn, the bank would be granted a lien on the vehicle. If the borrower does not repay the loan, the bank may execute the lien , seize the vehicle, and sell it to repay the loan.

If the borrower does repay the loan in full, the lien holder (the bank) then releases the lien, and the individual owns the car free and clear of any liens.

Judgment Lien

A judgment lien is a lien placed on assets by the courts, which is usually a result of a lawsuit. A judgment lien could help a defendant get paid back in a nonpayment case by liquidating the accused's assets.

Mechanic's Lien

A mechanic's lien can be attached to real property if the owner fails to pay a contractor for services rendered. If the debtor never pays, the contractor could go to court and get a judgment against the non-paying party whereby property or assets can be auctioned off to pay the lien holder. Many service providers have the option to place a lien to secure payment, including construction companies and dry cleaners.

Real Estate Lien

A real estate lien is a legal right to seize and sell real estate property if a contract is not fulfilled. Some real estate liens are automatically put in place, such as in the case of a mortgage lien. When a party borrows money from a bank to purchase their home, the bank places a lien on the house until the mortgage is paid off.

However, some real estate liens are due to non-payment to a creditor or financial institution and as a result, are involuntary and nonconsensual liens.

There are also several statutory liens, meaning liens created by law instead of those created by a contract. These liens are very common in the field of taxation, where laws often allow tax authorities to put liens on the property of delinquent taxpayers. For example, municipalities can use liens to recover unpaid property taxes .

In the United States, if a taxpayer becomes delinquent and does not demonstrate any indication of paying owed taxes, the Internal Revenue Service (IRS) may place a legal claim against a taxpayer's property, including the taxpayer's home, vehicle, and bank accounts. A notice of federal tax lien notifies creditors of the government's claim and can lead to a sheriff's sale . A sheriff's sale is a public auction whereby assets are repossessed, sold, and the generated funds are used to repay a debt to a creditor, bank, or the IRS.

A tax lien also affects the taxpayer's ability to sell existing assets and obtain credit. The only way to release a federal tax lien is to fully pay the tax owed or reach a settlement with the IRS. The IRS has the authority to seize a taxpayer's assets who ignore a tax lien. Typically, the IRS uses liens for delinquent taxes as a last resort, following all other options being exhausted, such as collection, installment repayment plans, and settlement.

When you buy a house using a mortgage, the lender has a legal right to seize your property, if you don't pay the mortgage. Your house basically is the collateral for the mortgage loan and when you borrow money to buy it, a mortgage lien is put on your house, until you pay off your mortgage.

A lien is simply the legal right of a lender to sell your property (a house or a car, for example) if don't meet your contractual obligations on the loan you took out to purchase it.

You can get rid of a lien on your property, car, or other asset by paying off your loan in full.

Internal Revenue Service. " Understanding a Federal Tax Lien ."

:max_bytes(150000):strip_icc():format(webp)/148985994-5bfc2b8c46e0fb0083c07ba8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Understanding a Federal Tax Lien

More in file.

- Business Tax Account

- Employer ID Numbers

- Business Taxes

- Reporting Information Returns

- Self-Employed

- Starting a Business

- Operating a Business

- Closing a Business

- Industries/Professions

- Small Business Events

- Online Learning

- Large Business

- Corporations

- Partnerships

- Governmental Liaisons

- Federal State Local Governments

A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. The lien protects the government’s interest in all your property, including real estate, personal property and financial assets. A federal tax lien exists after:

- Puts your balance due on the books (assesses your liability);

- Sends you a bill that explains how much you owe (Notice and Demand for Payment); and

- Neglect or refuse to fully pay the debt in time.

The IRS files a public document, the Notice of Federal Tax Lien , to alert creditors that the government has a legal right to your property. For more information, refer to Publication 594, The IRS Collection Process PDF .

How to Get Rid of a Lien

How a lien affects you, avoid a lien, lien vs. levy, help resources.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt.

When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

Discharge of property

A "discharge" removes the lien from specific property. There are several Internal Revenue Code (IRC) provisions that determine eligibility. For more information, refer to Publication 783, Instructions on How to Apply for Certificate of Discharge From Federal Tax Lien PDF and the video Selling or Refinancing when there is an IRS Lien .

Subordination

"Subordination" does not remove the lien, but allows other creditors to move ahead of the IRS, which may make it easier to get a loan or mortgage. To determine eligibility, refer to Publication 784, Instructions on How to Apply for a Certificate of Subordination of Federal Tax Lien PDF and the video Selling or Refinancing when there is an IRS Lien .

A "withdrawal" removes the public Notice of Federal Tax Lien and assures that the IRS is not competing with other creditors for your property; however, you are still liable for the amount due. For eligibility, refer to Form 12277, Application for the Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien (Internal Revenue Code Section 6323(j)) PDF and the video Lien Notice Withdrawal .

Two additional Withdrawal options resulted from the Commissioner’s 2011 Fresh Start initiative.

One option may allow withdrawal of your Notice of Federal Tax Lien after the lien’s release. General eligibility includes:

Your tax liability has been satisfied and your lien has been released; and also:

- You are in compliance for the past three years in filing - all individual returns, business returns, and information returns;

- You are current on your estimated tax payments and federal tax deposits, as applicable.

The other option may allow withdrawal of your Notice of Federal Tax Lien if you have entered in or converted your regular installment agreement to a Direct Debit installment agreement. General eligibility includes:

- You are a qualifying taxpayer (i.e. individuals, businesses with income tax liability only, and out of business entities with any type of tax debt)

- You owe $25,000 or less (If you owe more than $25,000, you may pay down the balance to $25,000 prior to requesting withdrawal of the Notice of Federal Tax Lien)

- Your Direct Debit Installment Agreement must full pay the amount you owe within 60 months or before the Collection Statute expires, whichever is earlier

- You are in full compliance with other filing and payment requirements

- You have made three consecutive direct debit payments

- You can’t have defaulted on your current, or any previous, Direct Debit Installment agreement.

- Assets — A lien attaches to all of your assets (such as property, securities, vehicles) and to future assets acquired during the duration of the lien.

- Credit — Once the IRS files a Notice of Federal Tax Lien, it may limit your ability to get credit.

- Business — The lien attaches to all business property and to all rights to business property, including accounts receivable.

- Bankruptcy — If you file for bankruptcy, your tax debt, lien, and Notice of Federal Tax Lien may continue after the bankruptcy.

You can avoid a federal tax lien by simply filing and paying all your taxes in full and on time. If you can’t file or pay on time, don’t ignore the letters or correspondence you get from the IRS. If you can’t pay the full amount you owe, payment options are available to help you settle your tax debt over time.

A lien is not a levy. A lien secures the government’s interest in your property when you don’t pay your tax debt. A levy actually takes the property to pay the tax debt. If you don’t pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

Collection Advisory Group — For all complex lien issues, including discharge, subordination, subrogation or withdrawal; find contact information for your local advisory office in Publication 4235, Collection Advisory Group Addresses PDF .

Office of Appeals — Under certain circumstances you may be able to appeal the filing of a Notice of Federal Tax Lien. For more information, see Publication 1660, Collection Appeal Rights PDF .

Taxpayer Advocate Service — For assistance and guidance from an independent organization within IRS, call 877-777-4778 .

Centralized Insolvency Operation — If you are questioning whether your bankruptcy has changed your tax debt, call 800-973-0424 .

Contact the IRS —

- Individuals (Self-Employed) 800-829-8374

- Individuals (Other) 800-829-0922

- Businesses 800-829-0922

Related Topics

Publications.

(888) 578-9673

- What is an assignment of rents?

by Brian D. Moreno, Esq., CCAL | General Real Estate Law , Homeowners Association

With the collection of assessments, community associations are always looking for creative ways to increase the chance of recovery. One underutilized remedy that may provide associations good results is an assignment of rents. If an owner-landlord fails to pay HOA assessments but continues to collect rent payments from his or her tenant, the association should consider rent assignment. There are prejudgment and post-judgment rent assignment remedies that can be pursued with regard to the delinquency. A post-judgment rent assignment can be pursued by way of a request to the court after a Judgment is entered against the owner-landlord.

A prejudgment rent assignment can be pursued even before filing a lawsuit if executed properly. In California, Civil Code Section 2938 regulates the formation and enforcement of the assignment of rents and profits generated by a lease agreement relating to real property. It provides that “[a] written assignment of an interest in leases, rents, issues, or profits of real property made in connection with an obligation secured by real property. . .shall, upon execution and delivery by the assignor, be effective to create a present security interest in existing and future leases, rents, issues, or profits of that real property. . . .” Once a written assignment of rents is properly authorized and formed, the law creates a security interest (i.e., lien) against the rents and profits paid by a tenant.

The question then is whether the association’s CC&Rs, by itself, creates an assignment of the right to a tenant’s rent payment in favor of the association. Indeed, section 2938(b) provides that the assignment of an interest in leases or rent of real property may be recorded in the same manner as any other conveyance of an interest in real property, whether the assignment is in a separate document or part of a mortgage or deed of trust. Since a homeowners association’s CC&Rs is a recorded document and contains covenants, equitable servitudes, easements, and other property interests against the development, it follows that the assignment of rents relief provided in Section 2938(b) can be extended to community associations provided the CC&Rs contains an appropriate assignment of rents provision.

Section 2938, however, does not clarify whether the CC&Rs document on its own creates a lien and enforceable assignment right. Moreover, a deed of trust is much different than a set of CC&Rs, in that the deed of trust creates a lien against the trustor’s property upon recordation, while a homeowners association would not have a lien until an owner becomes delinquent with his or her assessments and the association records an assessment lien against the property. Therefore, depending on the scope of the assignment of rents provision in the CC&Rs, a homeowners association would likely need to record an assessment lien first before pursuing rents from a tenant. Moreover, even after a lien is recorded, homeowners associations should consider adding a provision in the assessment lien giving notice to the delinquent owner that an assignment right is in effect upon recordation of the assessment lien. Nevertheless, association Boards should consult with legal counsel to ensure proper compliance with the law.

Once the assignment right becomes enforceable, the next issue is how the Association can and should proceed. Section 2938(c)(3) allows the association to serve a pre-lawsuit demand (a sample of which is included in the statute) on the tenant(s), demanding that the tenant(s) turn over all rent payments to the association. This can be a powerful tool for homeowners associations. Moreover, if the tenant complies, the association will receive substantial monthly payments that can be applied towards the assessment debt, and collecting the funds does not appear to preclude the association from pursuing judicial or non-judicial foreclosure proceedings at a later time.

While homeowner associations have the option of pursuing a lawsuit against the delinquent owner and seeking to collect the rent payments after a judgment has been obtained, there are obvious advantages to enforcing the assignment of rents provision prior to pursuing litigation. A pre-lawsuit assignment of rents demand may prove to be more effective and cheaper. Additionally, the tenant affected by the assignment of rents demand may place additional pressures on the delinquent owner/landlord having received such a demand. Given this, the options available pursuant to Section 2938, including the pre-lawsuit demand for rents, should at least be considered and analyzed before action is taken.

Truly, the initial pre-lawsuit demand for rents may persuade the landlord-owner to resolve the delinquency with the association in the face of the potential disturbance of the landlord-tenant relationship. Even if the tenant fails to comply with the demand and/or the owner fails to bring the account current, the association could nonetheless pursue foreclosure remedies and/or seek to have a receiver appointed to specifically enforce the assignment of rents provision.

In sum, if a delinquent homeowner is leasing the property to a tenant, the homeowners association should consider making a pre-lawsuit demand for rent payments. If the association’s CC&Rs does not contain an assignment of rents provision, the board of directors should consider amending the CC&Rs to include an appropriate provision. Without question, the pre-lawsuit demand for rents could provide an excellent opportunity for recovery of unpaid assessments during these difficult economic times.

Recent Posts

- HOA Recall Elections – Must They Be Held Within 90 Days?

- Judgment Enforcement: What can an association do to collect an old small claims judgment?

- Encroachment Disputes: New considerations based on recent laws

Blog Archives

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Suspended Counterparty Program

FHFA established the Suspended Counterparty Program to help address the risk to Fannie Mae, Freddie Mac, and the Federal Home Loan Banks (“the regulated entities”) presented by individuals and entities with a history of fraud or other financial misconduct. Under this program, FHFA may issue orders suspending an individual or entity from doing business with the regulated entities.

FHFA maintains a list at this page of each person that is currently suspended under the Suspended Counterparty Program.

| Suspension Order | |||||

|---|---|---|---|---|---|

| YiHou Han | San Francisco | California | 03/26/2024 | Indefinite | |

| Alex A. Dadourian | Granada Hills | California | 02/08/2024 | Indefinite | |

| Tamara Dadyan | Encino | California | 01/10/2024 | Indefinite | |

| Richard Ayvazyan | Encino | California | 01/10/2024 | Indefinite | |

| Michael C. Jackson | Star | Idaho | 01/10/2024 | Indefinite |

This page was last updated on 03/26/2024

- Received a document?

Assignment of Mechanics Liens (But Not The Right to Lien)

380 articles

Get free mechanics lien form

We're the mechanics lien experts. We offer forms made by attorneys and trusted by thousands.

This makes sense. In practical, straightforward terms, in order for a mechanic’s lien to be assigned, there must actually be a lien to be assigned. Generally speaking, a party may not assign their right to file a mechanic’s lien – only a lien they already have. Again, this makes sense when considered against the background of what a mechanic’s lien is. A mechanic’s lien is personal in the sense that it is a right that can be exercised only by the person in whose favor the right arises. If you didn’t do the work, you don’t have the right to lien, but you can be assigned a lien that has already been created.

This may seem simple enough, but it can be a little tricky semantically. By buying a mechanic’s lien you are buying the right to proceed against the property under the lien – but you cannot just buy the right to file the lien in the first place.

View Profile

About the author

Recommended for you

Can i file a lien if my workmanship is in dispute.

This probably isn't news to anyone reading this, but construction projects can sometimes be a complicated mess. There's just so...

Mayer Building Company for Subcontractors: Payment Guide & Resources

For subcontractors looking to work with Mayer Building Company (MBC), it’s helpful to research the company’s history, past projects, and...

I Just Received a Lien. What Does It Mean?

Receiving a mechanics lien can be stressful – but it doesn’t have to be confusing. Liens generally supply the recipients with...

How Long Does a Contractor Have To File a Mechanics Lien?

We answer hundreds of questions (and probably more than that!) about payments from folks in the construction industry each and...

Can California Mechanic Liens Be Enforced In Small Claims Court?

The answer: No. It doesn’t matter whether your mechanics lien claim is for just $300, the small claims courts in...

FAQ: If My Lien Expires, Can’t I Just File It Again?

Short Answer: No. In a minority of states (like New York), parties can file a mechanic’s lien extension. The majority...

No Lien Clauses: A 50-State Overview for the Construction Industry

Can You Waive Lien Rights Before Starting Work? Can you waive your right to file a mechanics lien or bond...

Can You File A Mechanics Lien For Installing Signage?

Anyone in the signage business knows that signs come in all shapes and sizes. Sometimes they are attached directly on...

for Education

- Google Classroom

- Google Workspace Admin

- Google Cloud

Elevate education with simple, flexible, and secure tools with Google Workspace for Education

Make collaboration easier, streamline instruction, and keep your learning environment secure with Google Workspace for Education. Use our tools available without cost, or add enhanced capabilities to suit the needs of your institution.

- Get started

- Explore advanced editions

Enhance class instruction

Utilize easy-to-use learning tools for better collaboration and connection.

Boost productivity

Save time by creating, organizing, sharing, and grading all in one place.

Elevate student work

Help students turn in their best work with simple tools to support learning.

Protect your school data

Keep everyone’s work, identity, and privacy safe with proactive security features and controls.

Choose the Google Workspace for Education edition that’s right for your institution

- Compare editions

Google Workspace for Education Fundamentals 1

Bring your school community together with a suite of tools that enables better communication and collaboration.

Includes essential education tools and features like:

Collaboration tools including Classroom, Docs, Sheets, Slides, Forms, and more

Communication tools including Google Meet, Gmail, and Chat

Data loss prevention for Gmail and Drive

Can be used in compliance with FERPA, COPPA and GDPR

- See all features

Google Workspace for Education Standard

Level up with advanced security, analytics, and controls to safeguard against evolving digital threats.

- Contact for pricing

Includes everything in Education Fundamentals, as well as:

Security center to proactively prevent, detect, and remediate threats

Advanced device and app management to perform audits and enforce security and app access rules

Gmail log and Classroom log export for insights and analysis in BigQuery

Teaching and Learning Upgrade

Enhance instructional impact with advanced video communication, enriched class experiences, and tools to drive academic integrity.

Meetings with up to 250 participants and live streams with up to 10,000 in-domain viewers using Meet

Premium engagement features in Meet including interactive Q&As, polls, breakout rooms, and more

Classroom add-ons to directly integrate your favorite tools and content

Unlimited Originality reports and the ability to check for peer matches across a private repository of past student work

Transform new and existing content into engaging and interactive assignments with practice sets

Google Workspace for Education Plus

(Formerly known as G Suite Enterprise for Education)

Transform your school with a comprehensive solution incorporating advanced security and analytics, enhanced teaching and learning tools, and more.

Includes everything in Education Standard and the Teaching and Learning Upgrade, as well as:

Meetings with up to 500 participants and live streams with up to 100,000 in-domain viewers using Google Meet

Sync rosters directly to Classroom from any Student Information System

Personalized Cloud Search for your domain to make information accessible and easy to find

Build custom apps with AppSheet – no coding required

Priority response from a team of education specialists

Make an informed decision for your institution

Education Plus Impact Calculator

Get an estimate on the impact google workspace for education plus could have on your institution..

- Calculate potential impact

Product demos

Explore each product in detail via step-by-step guides to get a feel for how they work..

- Go to demos

More than 170 million students and educators are using Google Workspace for Education.

Get up to speed with google workspace for education.

- Visit Help Center

Empower school communities with simple and flexible tools to better collaborate, manage classes, and support safer learning environments.

- Download overview

Privacy and Security

Get the details on privacy and security features built into Google Workspace for Education to keep students, educators, and administrators more secure.

Accessibility

Learn about Google Workspace for Education accessibility features to support students with diverse needs and learning styles.

Enhance your teaching and learning with a large suite of app extensions that work seamlessly with Google Workspace for Education.

- Explore apps

Guardians Guide to Google Workspace for Education

Help families gain a thorough understanding of Google Workspace for Education and how students are using them in school.

- Download guide

Find answers to commonly asked questions

What editions does google workspace for education offer.

Google Workspace for Education offers Education Fundamentals to all qualifying institutions at no cost. For those that want more premium features, Google also offers paid editions including Education Standard, the Teaching and Learning Upgrade, and Education Plus.

How much does each edition within Google Workspace for Education cost?

For pricing information and specific features included in each of the Google Workspace for Education editions, please visit our comparison chart .

Are there differences in storage across editions?

All editions provide schools with 100TB of storage shared across the institution. Additional storage is provided with the Teaching and Learning Upgrade and Education Plus editions based on the number of licenses purchased. Please review our comparison chart for more details or visit our Help Center .

Can I have more than one edition at the same time?

You must have an Education Fundamentals edition to upgrade to any of the other editions (Education Standard, the Teaching and Learning Upgrade, or Education Plus).

You cannot have Education Plus in combination with Education Standard or the Teaching and Learning Upgrade — only Education Fundamentals.

You can have a combination of Education Standard and the Teaching and Learning Upgrade at the same time. Although we believe the maximum value of those combined editions can be realized in Education Plus, we wanted to be as flexible as possible to school community needs.

Are discounts available and/or are there incentives for longer term commitments?

Yes, Google offers automatic discounts for customers that contractually commit to a multi-year purchase (two years or more) of Google Workspace for Education Plus. To learn more, please connect with your Google Workspace for Education partner reseller and/or Google for Education representative.

When upgrading to a paid edition of Google Workspace for Education (Plus, Teaching & Learning Upgrade, and/or Standard), will I need to sign a new Workspace for Education Terms of Service agreement?

No, there is no need for a new Workspace for Education contract nor an addendum.

Can I upgrade/downgrade between the editions?

Customers who purchase the Teaching and Learning Upgrade can add Education Standard at any time (and vice versa) as well as upgrade to Education Plus.

Customers can reevaluate continuing with their subscription or downgrade at the end of their subscription term.

What is the duration of a paid Google Workspace for Education subscription?

All paid Google Workspace for Education editions are available as annual subscriptions, and pricing is locked for the duration of the subscription term. However, institutions can also purchase the Teaching and Learning Upgrade on a monthly subscription, as an alternative to purchasing it as an annual subscription.

Will schools that previously purchased G Suite Enterprise for Education automatically get access to all new features that come with Google Workspace for Education Plus?

Yes, all customers who have purchased G Suite Enterprise for Education will receive new features and functionality that are released to the new Google Workspace for Education editions.

Is it possible to trial the paid Google Workspace for Education editions?

Yes, our authorized Google Workspace for Education partners can provision 60 day trials for Education Plus, Education Standard, and the Teaching and Learning Upgrade. 50 licenses are provided for the trial.

Where can I learn more?

Visit our Help Center for more details on Google Workspace for Education.

Start today with Google Workspace for Education

Connect and collaborate across your whole school community. Choose the edition that best suits you and your institution.

Google Workspace for Education and Chromebooks work better together

1 Google Workspace for Education Fundamentals is available at no cost for qualifying institutions. Learn more

You're now viewing content for a different region.

For content more relevant to your region, we suggest:

Sign up here for updates, insights, resources, and more.

IMAGES

VIDEO

COMMENTS

Examples of Assignment of Lien in a sentence. On May 5, 2009, an Assignment of Lien ("Assignment") was executed by an Agent of JPMC, as purchaser of loans and other assets of WaMu from the FDIC, and he recorded the Assignment in the real property records of Dallas County, Texas.. The municipality will execute, and return to the County, an Assignment of Lien naming "Cook County, Illinois ...

Lien Assignment Process and Procedure. The lien assignment process almost always begins with the owner's mortgage lender (i.e. bank) commencing a foreclosure on its first deed of trust. Prior to the bank proceeding to foreclosure sale, it must submit a bid to the Public Trustee's office. At that time, investors review the bank's bid and ...

The difference between pledge, hypothecation, lien, mortgage, and assignment lies in the security charge that can be created on any asset held by a lender against the money lent (usually called the collateral). The type of asset charge defines whether the agreement can be classified as a pledge, lien, or mortgage.

Lien rights are not always assignable, and it typically comes down to state law to determine if you're able to assign your mechanics lien rights. Since a lien claim is an asset, most states will allow it to be assigned. There are, however, a few states that do not authorize the assignment of a mechanics lien claim.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

What: Mechanic's liens cover all claims arising from contracts to improve real property. The amount of the lien claim is limited to the unpaid amount remaining due on the project contract. The form of a Claim of Lien on Property is statutorily prescribed in N.C.G.S. § 44A-12(c) and requires the following:

Lien Law Section 14. Assignment of lien. A lien, filed as prescribed in this article, may be assigned by a written instrument signed and acknowledged by the lienor, at any time before the discharge thereof. Such assignment shall contain the names and places of residence of the assignor and assignee, the amount of the lien and the date of filing ...

the lien rights are valid and capable of being assigned under the Construction Act; proper protections are in place for both the party assigning the lien rights and the party taking assignment of the lien rights; the assigning party's assistance with any litigation relating to the lien claim is properly addressed; the proper steps are taken ...

Mechanic's lien and bond claims may be assigned from one party another. However, whether assignment rights are available will vary by state and circumstance. In this infographic, you'll learn what it means to assign lien rights, who's involved in the assignment of rights, and whether rights are always assignable. Download now.

Assignment of lien. A lien, filed as prescribed in this article, may be assigned by a written instrument signed and acknowledged by the lienor, at any time before the discharge thereof. Such assignment shall contain the names and places of residence of the assignor and assignee, the amount of the lien and the date of filing the notice of lien ...

An assignment is the legal term used to indicate that someone is transferring a legal right or interest they have to someone else. In our case, the lender is transferring the mortgage. In our case ...

Assignment of lien is a powerful but underused section of Ontario's Construction Act. Assignment allows a party with lien rights to transfer their rights (and rights to any related court lawsuit ...