How to Start a Property Business in South Africa

In this article we detail how to start a property business in South Africa. Real estate is an attractive industry and one that is profitable for many. There are some requirements to get into real estate and we will explain what the all are.

But first, we have explain the different property businesses that you can get into.

Related: 12 High Paying Referral Programs in South Africa

Table of Contents

Different Types of Property Businesses

There are several different types of property business, including:

Residential rental property: Residential rental property business is one of the most traditional types of property business. This type of business involves buying properties such as single-family homes, apartments, and townhouses with the intention of renting them out to tenants. The goal is to generate a steady stream of rental income and to potentially see an appreciation in property value over time. Residential rental properties can be managed by the owner or by a property management company.

Commercial rental property

Commercial rental property business involves buying properties such as office buildings, retail spaces, and warehouses to rent out to businesses. The goal is to generate a steady stream of rental income, and to potentially see an appreciation in property value over time. Commercial rental properties can be more complex to manage compared to residential properties, and may require more specialized knowledge and experience.

Vacation rental property

Vacation rental property business involves buying properties such as beach houses, cabins, and apartments with the intention of renting them out to vacationers. The goal is to generate a steady stream of rental income during peak tourist seasons and to potentially see an appreciation in property value over time. Vacation rental properties can be managed by the owner or by a vacation rental management company.

Flipping properties

Flipping properties business involves buying properties with the intention of renovating and reselling them for a profit. The goal is to purchase properties at a lower price, make improvements, and then sell them at a higher price. This type of business can be risky, and requires a significant amount of knowledge, expertise and resources to be successful.

Property management

Property management business involves managing properties for landlords or property owners. This includes tasks such as finding tenants, collecting rent, and handling maintenance and repairs. The goal is to generate a steady stream of management income and to provide landlords with a professional management service.Real estate investment trusts (REITs): Real estate investment trusts (REITs) business involves buying shares of publicly traded companies that own and manage real estate properties. This type of business allows investors to invest in a diversified portfolio of properties without the need to directly buy and manage properties.

Real estate development

Real estate development business involves buying land and developing it into residential or commercial properties such as building houses or apartment buildings. The goal is to make a profit by developing and selling the properties. This type of business requires significant capital, expertise, and resources.

Real estate brokerage

Real estate brokerage business involves buying and selling of property by connecting buyers and sellers. Real estate agents and brokers act as intermediaries between buyers and sellers, and typically charge a commission for their services. The goal is to generate income through commissions on the sale of properties.

Each type of property business has its own unique set of challenges and opportunities, and it’s important to research and consider which type may be the best fit for your goals and resources. It’s also important to stay informed about the local laws and regulations related to each type of property business, to ensure compliance with the legal framework.

Starting a property business in South Africa can be a complex and challenging process, but with proper planning and execution, it can also be a rewarding and profitable venture.

How to start a Property Business in South Africa

Researching the market.

Research is crucial in determining the viability of your property business. You need to understand the local property market including demand for different types of properties, rental rates, and areas that are popular for investment. You should also study the trends in the market to know when to buy, sell or hold properties.

One of the best ways to learn about business is from people who have already done what you are trying to do. So seek out other property business owners and ask them questions about what it takes and what their experiences have been. The internet is also a treasure trove of information so you can find content from people in real estate that can give you insight into the business and some ideas as well.

Obtaining a Property Agent’s License

In South Africa, it is legally required to have a property agent’s license to operate as a real estate agent. The requirements for obtaining a property agent’s license vary depending on the province, but in general, you will need to complete a training course and pass an exam.

Developing a Business Plan

A business plan is a roadmap for your property business. It should include your business goals, target market, marketing strategies, and financial projections. Your plan should also include information about your management team, the properties you plan to acquire, and your funding sources.

Securing Funding

Starting a property business can be capital-intensive, and you will need to secure funding to purchase properties. This can be done through various means such as finding investors, taking out a loan, or using your own savings.

Building a Network

Building a network of contacts is essential for any property business. You should establish relationships with other property professionals, such as attorneys, accountants, and contractors, who can assist you with your business. They can help you with legal, financial and technical aspects of your business.

Finding and Managing Properties

Finding properties to buy or manage is one of the most important aspects of your property business. You will need to market your properties to potential tenants or buyers and manage the properties once they are occupied.

Staying Compliant

It is essential to stay compliant with all relevant laws and regulations, including those related to property management, taxes, and labor laws. You should consult with an attorney who specializes in property law to ensure that your business is operating within the legal framework.

Overall, starting a property business in South Africa requires a lot of hard work, dedication, and a solid plan. It’s important to be aware of the laws and regulations, as well as the local market conditions, to increase your chances of success.

Benefits of Starting Property Business in South Africa

- Potential for long-term investment: One of the main benefits of starting a property business is the potential for long-term investment. Real estate is a tangible asset that can appreciate in value over time. Investing in properties that are located in areas with high demand, such as a growing population, or areas where there is a shortage of housing, can potentially provide a solid return on investment. Additionally, owning rental properties can provide a steady stream of rental income.

- Potential for steady income: Renting out properties can provide a steady stream of rental income, which can be used to cover the expenses associated with owning the property, such as mortgage payments, property taxes, and maintenance costs. The income from rental properties can also be used to purchase additional properties, increasing the overall value of the property business.

- Tax benefits: Owning and operating a property business can provide significant tax benefits. Many expenses related to owning and operating a property business, such as mortgage interest, property taxes, and depreciation, are tax-deductible. This can help to lower the overall cost of owning and operating a property business.

- Diversification: Investing in real estate can diversify an investment portfolio, reducing risk and potentially increasing returns. Real estate investments can provide a hedge against inflation and can perform differently from stocks and bonds, which can help to reduce overall portfolio risk.

- Flexibility: Property business owners have the flexibility to choose the type of properties they want to invest in and the level of involvement they want to have in managing the properties. Some property business owners choose to be hands-on and manage the properties themselves, while others hire property managers to handle the day-to-day operations.

- Ability to leverage: Property business owners can leverage their investment by borrowing money to purchase properties, potentially increasing their returns. This can be done through a mortgage or a line of credit. However, it’s important to be aware of the risks associated with leverage and to have a solid plan for managing the properties and paying off the debt.

- Job creation: Real estate development creates jobs for construction workers, architects, engineers, and other professionals. This can help to stimulate the local economy and create opportunities for employment.

- Community development: Real estate development can also lead to community development, improving infrastructure and increasing property values in the surrounding area. This can lead to an overall improvement in the quality of life for residents, and can also attract new businesses and residents to the area.

Risks of a Property Business

There are several risks associated with starting a property business in South Africa, including:

- Economic downturn: The property market can be affected by economic downturns, which can lead to decreased demand for rental properties, and a decrease in property values.

- Political instability: Political instability can also have an impact on the property market, and can lead to uncertainty and decreased demand for properties.

- Property market fluctuations: Property prices can fluctuate, which can make it difficult to predict the value of properties and can lead to potential financial losses.

- Difficulty in finding tenants: Finding tenants for rental properties can be difficult, especially in areas with high vacancy rates.

- Property maintenance and repair costs: Maintaining and repairing properties can be costly and can eat into profits.

- Tenant management: Managing tenants can be challenging, and there is a risk of non-payment of rent or property damage.

- Compliance with regulations: Property business owners are required to comply with a wide range of regulations, such as health and safety standards, building codes, and zoning laws, which can be complex and costly to comply with.

- Legal disputes: Property business owners may face legal disputes with tenants, landlords, or other parties, which can be time-consuming and costly to resolve.

- Property crime: South Africa has a high rate of property crime, which can increase the cost of insurance and security.

- Limited access to finance: Access to finance can be limited, especially for small and medium enterprises and in low-income areas, which can make it difficult to secure funding for property purchases.

It’s important to be aware of these risks and to have a solid plan in place to mitigate them. It’s also essential to stay informed about the local laws and regulations related to property business, to ensure compliance with the legal framework. It’s recommended to consult with a property law attorney to understand the specific risks and regulations in South Africa.

How much do you need to start a real estate business in South Africa?

How much money you need to start a real estate business in South Africa depends on a multitude of factors. You can get into the real estate business for a little as R100,000. You can do this by buying a property in a low income area and renting it out. The more sophisticated you want to make your business, the more money it will require and there is no limit to how much you can invest in a real estate business.

How can I find properties to invest in for my property business?

Properties can be found through a variety of means such as online property listing websites, local newspapers, real estate agents, and through networking with other property professionals. It’s important to research the local property market and to have a clear understanding of the types of properties that are in demand.

What are the laws and regulations related to property business in South Africa?

Laws and regulations related to property business in South Africa can vary depending on the province and type of property business. Some of the key laws and regulations include the Estate Agency Affairs Act , the Rental Housing Act, and the National Building Regulations and Building Standards Act. It’s important to stay informed about these laws and regulations to ensure compliance with the legal framework.

Related Article: How to start a Construction Company

Leave a Comment Cancel reply

Business Plan Pro®

021 834 9799

Property Business Plan

Need a Property Business Plan for your Property Business ? We write Professional Property Business Plans.

Our Property Business Plan is for Start-Ups looking to apply for basic Funding , Tenders and Industry Regulators .

Our Property Business Plan is focused on the Property and Real Estate Industry in South Africa. Included in this option is a Professional Business Plan layout and a 5-Year Financial Projection.

Business Plan Pro® Accreditations

Business Plan Pro® is a Subsidiary Brand of My SME™, and an IMCSA Accredited Business Coaching institute (My SME™ Accreditation Number: 073PIMC ).

We focus on Business Plan and Feasibility Study services to assist Businesses to grow through Funding . Business Plan Pro® is the first South African Business to create Custom Business Plan Software for South Africans.

Our Property Business Plan is focused on the Real Estate and Property Industry in South Africa. Included in this option is a Professional Business Plan layout and a 5-Year Financial Projection.

(7 Working Days)

Our Property Business Plan is focused on the Real Estate and Property Industry in South Africa. Included in this option is a Professional Business Plan layout and a 5-Year Financial Projection.

Service Includes:

- 40 – 60 Pages.

- Professional Business Plan Layout.

- 5-Year Financial Projection.

- Basic Real Estate and Property Market Research.

- Basic Real Estate and Property Industry Research.

NOTE that with the Property Business Plan the market and industry research is very basic . If you need in-depth market & industry research from the Business Plan Pro® team, please select either the Comprehensive Business Plan or Specialised Business Plan .

Start-Up Business Package

(21 Working Days)

Our Start-Up Business Package is for Start-Up’s looking to start their Business on the right foot with a Property Business Plan and a Professional Brand .

Package Includes:

- Property Business Plan (Valued at R4,490).

- Entry Level Brand Package (Valued at R3,490).

- Entry Level 1-Pager Website (Valued at R3,990).

NOTE that with this package you complete a brand questionnaire that tells us all we need to know about your business to create a professional logo. The logo concepts presented are standard options that you are required to choose from. No custom amendments are allowed, but one basic amendment is allowed.

Some Client Reviews

What an awesome company and experience. Prompt, on time, flexible, yet sooooo professional….. Even my wife does not know how my mind works. Yet Business Plan Pro® could put my vision into paper in an amazing way….. Looking good. Thanks Kayleen and Nicole. Looking forward to the rest of our journey together.

Louis Lubbe Managing Director of Lubbe Projects & Company (Pty) Ltd.

Business Plan Pro® will give you the best Business Plan, with that said I can stand on the edge of a cliff on a windy day for you to prove me wrong, I had a very close deadline when I gave them my information, in fact with my little knowledge on business planning I thought they would fumble so I panicked and gave them every single bit of information I had and I couldn’t sleep worrying about whether I won’t find them the next day 😂😭🤣, well they are legit & you can sleep peacefully, they truly exceeded my expectations. BEST BUSINESS PLAN IN SA so far. Braaaaaah The level of research I saw in that business plan I realized I didn’t know my business 😩🤣

Success Ngcobo

From day one of contacting Business Plan Pro® I received five star service. I was even happier with their delivery. There’s no doubt I will be using Business Plan Pro® again in future. Anyone who needs their service should not hesitate. Business Plan Pro® is simply the best. Thank you once again!

Boitumelo Ralenala

Thanks Business Plan Pro® for Quality, Prompt and Professional service and uber presentation of the Business Plan. Keep it up!

Ashraf Patel Managing Director of Baobab Green Tech (Pty) Ltd.

Get Started

Learn more about our service.

Please let us know if you have a question, want to leave a comment, or would like further information.

Our Track Record

Our services will empower you to apply for funding, a lease agreement or at an industry regulator, see how business plan pro® assisted coco vogue (pty) ltd. to get funding and secure a lease agreement..

Learn more about our Business Plan Services!

- Advice Centre

- Agent Advice

6 ways to build up your property rental business

Building up a rental “book” is a great way to increase and steady the cash flow in a real estate business.

However, many owners and principals don’t really know how to win more rental management contracts from landlords.

Here are some expert suggestions:

Tap into your existing network first. Probably the easiest and most cost-effective way to start building up your book is through the people you currently already have relationships with or come into contact with on a daily basis. “You should never be afraid to ask for new business or referrals to their friends or colleagues who may be struggling with a rental management problem,” says Shaun Rademeyer, CEO of SA’s biggest mortgage originator BetterLife Home Loans , “as you will often find it resolves a problem for them at the same time as it boosts your revenue.”

Put someone on the task full-time. If you want to increase your rental management book and thrive, you need a person who is permanently looking for new customers and keeping in touch with existing ones. The ideal person for this task is someone with sales and customer relations skills who is 100% dedicated to acquiring and retaining the rental business .

Build and maintain a database with the contact details of all your landlords, tenants, tradespeople, prospective investors, prospective tenants, past landlords, past tenants, and past home sellers and buyers. Communicate with all these people regularly, perhaps via a monthly newsletter, and increase business by offering incentives for landlords to transfer other properties to your agency, incentives for referrals that lead to new business, and incentives for tenants who purchase a new home through your agency.

Use proven rental property management software. Rademeyer notes that there are several excellent systems available that will enable you to easily keep track of your mandates, deposits, rental payments, lease details and renewal dates, maintenance requirements, and the profitability of your rental book. Some will even enable you to run credit and tenant history checks on potential tenants and generate standard lease and other documents that are regularly updated and fully legally compliant.

Reward any of your own team members who bring in the new 0 , such as an agent who has just sold an investment property to a landlord and persuaded him to let your company manage it. You should also ensure that your sales staff always have your rental management marketing material on hand.

Advertise your rental listings everywhere - including local noticeboards and smaller newspapers as well as the classifieds in bigger papers and online through all the major property portals. And, says Rademeyer, you should not forget to work on your own website so that when tenants (and landlords) visit, it is attractive and easy for them to find the information they require, including your contact details. “These days, it is also increasingly important to ensure that your site is mobile-friendly because most people now access the internet via their smartphones.”

Related Topics

Subscribe to our newsletter.

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share on WhatsApp

Related Articles

Why you should consider responsive design for your agency website.

With more and more people accessing the internet via their cell phones and tablets, it’s clear that mobile is the future. On Private Property we've seen an increase of 140% for mobile users and 30% ...

Is your real estate agent too old school?

While certain marketing tactics will be completely lost on the younger generation, others will continue to resonate with buyers across the ages.

Collaboration in the time of Covid-19

How estate agents can work efficiently and effectively from home.

Get instant property alerts

Rental Properties Business Plan Template

Written by Dave Lavinsky

Rental Property Business Plan

Over the past 20+ years, we have helped over 10,000 entrepreneurs and business owners create business plans to start and grow their rental property business. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a rental property business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Rental Properties Business Plan?

A business plan provides a snapshot of your rental property business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Rental Properties Business

If you’re looking to purchase a rental property, multiple rental properties, or add to your existing rental properties business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your rental property business in order to improve your chances of success. Your rental property business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Rental Property Companies

With regards to funding, the main sources of funding for rental properties are personal savings, credit cards, mortgages, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a rental property is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan. Venture capitalists will not fund a rental property company. They might consider funding a rental property company with a national presence, but never an individual location. This is because most venture capitalists are looking for millions of dollars in return when they make an investment, and an individual location could never achieve such results.

Finish Your Business Plan Today!

How to write a business plan for a rental property company.

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of rental property you are operating and the status; for example, are you a startup, or do you have a portfolio of existing rental properties that you would like to add to?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the rental properties industry. Discuss the type of rental property you are offering. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of rental properties you are offering.

For example, you might offer the following options:

- Single family homes – This type of rental property is often owned by a single individual, rather than a company, who acts as both landlord and property manager.

- Multi-family properties – These types of properties can be subcategorized by the number of units per site. Buildings with 2 – 4 units are the most common (17.5%), while multistory apartment complexes with more than 50 units represent the next-largest, at 12.6% of the industry.

- Short-Term Rental properties – These are fully furnished properties that are rented for a short period of time – usually on a weekly basis for vacation purposes.

In addition to explaining the type of rental property you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include occupancy goals you’ve reached, number of property acquisitions, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the rental properties industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the rental property industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your rental property business plan:

- How big is the rental properties industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your rental property. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population or tourist arrivals.

Customer Analysis

The customer analysis section of your rental property business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: households, tourists, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of rental property you offer. Clearly, vacationers would want different amenities and services, and would respond to different marketing promotions than long-term tenants.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Rental Properties Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

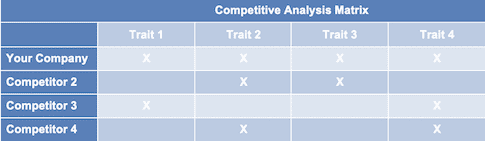

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other rental property companies.

Indirect competitors are other options customers may use that aren’t direct competitors. This includes the housing market, or hotels. You need to mention such competition to show you understand that not everyone who needs housing or accommodation will seek out a rental property.

With regards to direct competition, you want to detail the other rental properties with which you compete. Most likely, your direct competitors will be rental properties in the vicinity.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What lease lengths or amenities do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior properties?

- Will you provide services that your competitors don’t offer?

- Will you make it easier or faster for customers to book the property or submit a lease application?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a rental property business plan, your marketing plan should include the following:

Product : in the product section you should reiterate the type of rental property business that you documented in your Company Analysis. Then, detail the specific options you will be offering. For example, in addition to long-term tenancy, are you offering month-to-month, or short-term rental?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the properties and term options you offer and their prices.

Place : Place refers to the location of your rental property. Document your location and mention how the location will impact your success. For example, is your rental property located in a tourist destination, or in an urban area, etc. Discuss how your location might draw customer interest.

Promotions : the final part of your rental property marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your rental property business, such as customer service, maintenance, processing applications, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect 100% occupancy, or when you hope to reach $X in sales. It could also be when you expect to acquire a new property.

Management Team

To demonstrate your rental property business’ ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in rental property management. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in real estate, and/or successfully running small businesses.

Financial Plan

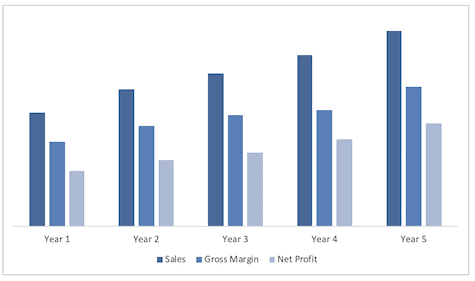

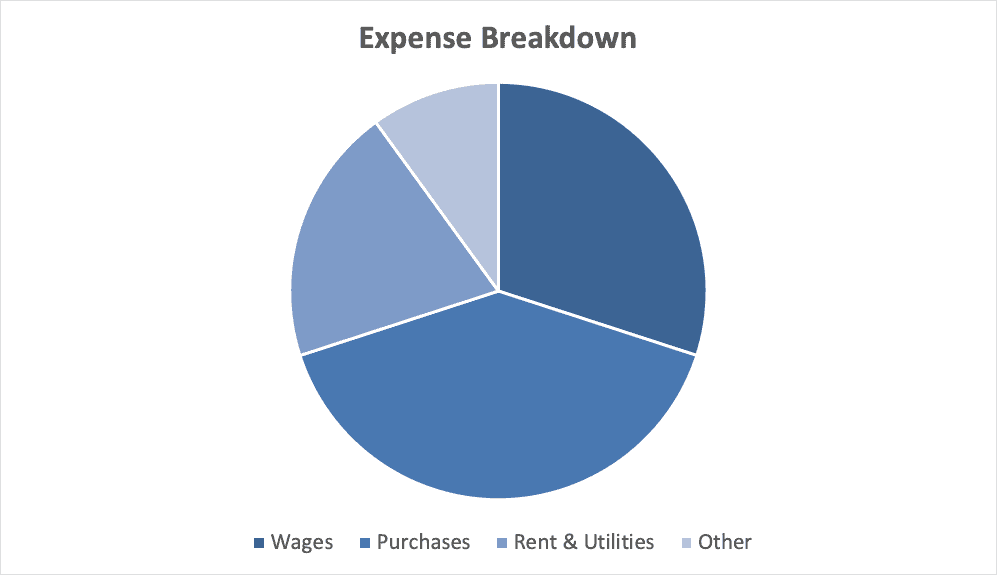

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you have 1 rental unit or 10? And will revenue grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $200,000 on purchasing and renovating your rental property, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $200,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a rental property business:

- Location build-out including design fees, construction, etc.

- Cost of equipment like computers, software, etc.

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your property blueprint or map.

Putting together a business plan for your rental properties company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the rental property industry, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful rental properties business.

Rental Properties Business Plan FAQs

What is the easiest way to complete my rental properties business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Rental Properties Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of rental property business you are operating and the status; for example, are you a startup, do you have a rental properties business that you would like to grow, or are you operating multiple rental property businesses.

Don’t you wish there was a faster, easier way to finish your Rental Properties business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- Sample Business Plans

- Real Estate & Rentals

Rental Property Business Plan

A rental property business is a great way of earning a passive income. It can help you have great finances if you go about it in the right way.

The rental property market stood at a size of 174.2 bn dollars in the US in 2021. And with the subsiding pandemic isn’t about to shrink any time soon.

Now, if you are planning to become a landlord, you might need just one thing before you start your business. A business plan.

A business plan would become a guide in your business journey. It would also make your journey a less difficult and more successful one. So, if you are ready to start your rental property business , read on to find out all about a rental property business plan.

How can a rental property business plan help you?

A rental property business plan can help you have a clear goal, a well-defined business model, and strategies that work. It can also help you navigate smoothly through roadblocks in your journey and steer clear of costly business mistakes.

Also, putting your idea on paper makes it look more real and clear. Moreover, a business plan also comes in handy while you explain your ideas to your collaborators and investors.

All in all a business plan will help you figure out your way around obstacles through rigorous analysis and strategic planning. This brings us to our next section, how to write a business plan.

Rental Property Business Plan Outline

This is the standard rental property business plan outline which will cover all important sections that you should include in your business plan.

- Business Objectives

- Mission Statement

- Guiding Principles

- Keys to Success

- Start-Up Summary

- Location and Facilities

- Products/Services Descriptions

- Competitive Comparison

- Market Size

- Industry Participants

- Main Competitors

- Market Segments

- Market Tests

- Market Needs

- Market Trends

- Market Growth

- Positioning

- SWOT Analysis

- Strategy Pyramid

- Unique Selling Proposition (USP)

- Competitive Edge

- Positioning Statement

- Pricing Strategy

- Promotion and Advertising Strategy

- Marketing Programs

- Sales Forecast

- Sales Programs

- Exit Strategy

- Organizational Structure

- Steve Rogers

- Linda Rogers

- Management Team Gaps

- Personnel Plan

- Important Assumptions

- Start-Up Costs

- Source and Use of Funds

- Projected Profit and Loss

- Projected Cash Flow

- Projected Balance Sheet

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

After getting started with Upmetrics , you can copy this rental property business plan example into your business plan and modify the required information and download your rental property business plan pdf and doc file. It’s the fastest and easiest way to start writing your business plan.

How to write a rental property business plan?

Before writing a business plan, it is always good to ask yourself a few questions. It would surely make the process shorter and easier.

You should think about the following questions:

- What do you wish to achieve with your business?

- Who is your target audience?

- How would your business model work?

- What are your sources of funding?

- What would be your marketing strategy and so on?

All these questions would help you understand what you are getting yourself into. After that, you can start writing a business plan that focuses on all the different aspects of your business.

You can easily write such a plan either by using a premade template on the internet or through an online business plan software that’ll help you write a flexible and ever-changing plan.

What to include in a rental property business plan?

This section would give you a brief overview of the segments you can include in your business plan to make it a well-rounded one. They are as follows:

1. Executive Summary

The executive summary section contains a precise summary of all that your business stands for. If written well, it can help your business in getting funded. As it is mostly the only page an investor would read.

Professionals frequently suggest that this section should be written at the very end while writing your business plan, even if it is the first page. This helps you in summing up your business ideas properly.

2. Company Description

This section would consist of all the information about your business including its location, the services you offer, and your team.

It would also have information about your company’s history and its current position in the market. You can also include information about the projects you have worked on in the past.

3. Market Analysis

This is one of the chief sections of any business plan. It helps you understand what you are getting yourself into.

In this section, write down everything you can find out about the market. Include your target market, ways of reaching out to them, your market position, etc. Also, it is a good practice to include competitive analysis and take note of what your direct and indirect competitors are doing.

4. Marketing Strategy

While market analysis helps you in understanding the market, a marketing strategy helps you while getting into the market.

While formulating a marketing strategy, the most important thing is to have your target audience and market position in mind. Besides, keep in mind that your branding campaign should resonate with the client base you plan on serving.

5. Organization and management

This section includes information about the functioning aspects of your firm as well as about your team.

Include the roles and responsibilities of your team members as well as the progress they are making in their work.

If you write this section clearly and precisely, you’ll be able to identify the gaps you have in your team and your management system. This helps you in resolving those issues on time.

6. Financial Plan

This is one of the most crucial aspects of your business plan. More so in the rental property business. Planning your finances early on saves you from having financial troubles later on.

A financial plan section includes everything from your financial history, funding options, and requirements to projected cash flow and profits.

Download a sample rental property business plan

Need help writing your business plan from scratch? Here you go; download our free rental property business plan pdf to start.

It’s a modern business plan template specifically designed for your rental property business. Use the example business plan as a guide for writing your own.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Rental property business plan summary

In conclusion, a good business plan can help you have good finances, a proper marketing strategy, a well-managed company and team as well as clear business goals.

Especially, in the rental property business, planning the flow and structure of your business as well as your finances can take you a long way.

A rental property business depends highly upon well-managed finances and strategies. Planning your business is necessary to make it a good source of passive or primary income.

Moreover, it also makes the process of carrying out your business easier and smoother. So, if you are ready to start your rental property business, go ahead and start planning.

Related Posts

Party Rental Business Plan

Real Estate Investment Business Plan

400+ Business Plan Samples

How to Write Business Plan Step By Step

10 Main Components of a Business Plan

Important Location Strategy for a Business

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Real Estate

How to Start a Real Estate Business in South Africa?

- 27 June 2023

- views 1,888

Are you considering starting a real estate business in South Africa? With its growing economy and diverse property market, South Africa offers excellent opportunities for real estate entrepreneurs. However, venturing into this industry requires careful planning, market understanding, and knowledge of legal and regulatory aspects. In this comprehensive guide, we will walk you through the essential steps to kickstart your real estate business in South Africa.

Table of Contents

Introduction, 1.1 real estate trends, 1.2 market analysis, 2.1 business registration, 2.2 licenses and permits, 2.3 compliance and regulations, 3.1 networking opportunities, 3.2 collaborating with professionals, 4.1 investment options, 4.2 securing loans, 5.1 finding potential properties, 5.2 property evaluation, 6.1 developing a brand, 6.2 online marketing strategies, 7.1 hiring and managing employees, 7.2 expanding your portfolio, 8.1 economic factors, 8.2 competition, frequently asked questions.

Starting a real estate business is an exciting endeavor that can lead to financial success and personal fulfillment. However, it is essential to approach it with the right strategy and mindset. In this article, we will provide you with valuable insights and actionable steps to help you establish and grow your real estate business in South Africa.

1. Understanding the Market

Before diving into the real estate business, it’s crucial to familiarize yourself with the current market trends in South Africa. Stay updated on the demand for residential, commercial, and industrial properties, as well as emerging neighborhoods and investment hotspots.

Conduct a comprehensive market analysis to identify potential opportunities and assess competition. Analyze property prices, rental rates, vacancy rates, and other relevant data to make informed decisions about your investment strategy and target market.

2. Legal and Regulatory Considerations

To ensure a smooth and compliant operation, you need to understand the legal and regulatory framework for real estate businesses in South Africa.

Begin by registering your business with the Companies and Intellectual Property Commission (CIPC) in South Africa. Choose an appropriate business structure and consult with a legal professional to navigate the registration process smoothly.

Check the specific licenses and permits required to operate a real estate business in your target area. These may include estate agency licenses, fidelity fund certificates, and other regulatory requirements imposed by the Estate Agency Affairs Board (EAAB).

Familiarize yourself with the legal obligations and compliance regulations related to real estate transactions, property management, and financial reporting. This includes adhering to the Consumer Protection Act, the Financial Intelligence Centre Act, and other applicable laws.

3. Building a Strong Network

Success in the real estate industry heavily relies on building a robust network of professionals and potential clients.

Attend industry events, conferences, and seminars to meet fellow professionals, potential investors, and influential individuals in the real estate sector. Join local real estate associations and actively engage in networking activities to expand your connections.

Form strategic partnerships with professionals such as real estate agents, property developers, architects, and lawyers. Collaborating with experts in different areas of the industry can enhance your business’s credibility and open doors to valuable opportunities.

4. Financing Your Real Estate Business

Securing adequate funding is crucial for starting and growing your real estate business. Explore various financing options and determine the most suitable approach for your venture.

Consider different investment models, such as using your own capital, forming partnerships, seeking private investors, or applying for business loans. Each option has its pros and cons, so carefully evaluate the financial implications and align them with your business goals.

If you decide to seek financing through loans, approach banks and financial institutions specializing in real estate lending. Prepare a comprehensive business plan, including financial projections, to demonstrate the profitability and viability of your real estate business.

5. Property Sourcing and Evaluation

Finding and evaluating properties are vital aspects of running a successful real estate business.

Explore multiple channels to identify potential properties, such as online listings, auctions, real estate agents, and personal networks. Develop a keen eye for identifying properties with potential for growth and profitability.

Perform thorough due diligence on each property before making a purchase. Assess factors like location, market demand, potential return on investment, legal aspects, and property condition. Engage professionals, such as property inspectors and appraisers, to ensure accurate evaluations.

6. Marketing and Advertising

Effective marketing and advertising strategies play a pivotal role in attracting clients and growing your real estate business.

Create a compelling brand identity that resonates with your target audience. Develop a logo, website, and marketing materials that reflect your unique value proposition and professionalism. Consistently communicate your brand’s message across different marketing channels.

Leverage digital marketing techniques to reach a wider audience and generate leads. Establish a strong online presence through a well-designed website, search engine optimization (SEO), social media marketing, and targeted online advertising campaigns.

7. Managing and Growing Your Business

To ensure long-term success, focus on effective business management and continuous growth.

As your business expands, consider hiring a competent team to support various functions, such as property management, marketing, and administration. Implement efficient systems and processes to streamline operations and maintain high-quality service.

As you gain experience and build a solid foundation, aim to expand your real estate portfolio. Diversify your investments by exploring different property types, locations, and investment strategies. Continuously assess market conditions and adjust your portfolio accordingly.

8. Overcoming Challenges

The real estate industry is not without its challenges. Be prepared to overcome obstacles and adapt to changing market conditions.

Monitor economic trends and fluctuations that can impact the real estate market. Stay informed about interest rates, inflation rates, and government policies that may influence property prices and demand.

Competition in the real estate industry can be fierce. Differentiate your business by offering unique value propositions, exceptional customer service, and innovative solutions. Stay updated on industry trends and embrace technology to stay ahead of the competition.

Starting a real estate business in South Africa requires careful planning, market analysis, and compliance with legal regulations. By following the steps outlined in this guide, you can lay a solid foundation for success and navigate the challenges of the industry. Remember to continuously adapt, learn from experiences, and nurture relationships to thrive in the dynamic real estate market.

- Can I start a real estate business without prior experience? Starting a real estate business without prior experience is possible but challenging. It’s beneficial to have a basic understanding of the industry, market trends, and legal requirements. Consider gaining experience by working with a real estate agency or partnering with experienced professionals to learn the ropes before starting your own venture.

- How much capital do I need to start a real estate business in South Africa? The amount of capital required to start a real estate business in South Africa can vary depending on factors such as your business model, target market, and investment strategy. It’s important to create a detailed business plan that outlines your expenses, including licensing fees, marketing costs, office space, staff salaries, and initial property investments. It’s recommended to have a substantial amount of capital or access to financing to ensure a solid start.

- What are the main factors to consider when evaluating a property? When evaluating a property, consider factors such as location, market demand, potential return on investment, property condition, and legal aspects. Assess the proximity to amenities, transportation, schools, and employment hubs. Conduct thorough research on market trends, property prices, and rental rates in the area. Additionally, evaluate the property’s structural integrity, maintenance requirements, and any legal issues that may affect its value.

- Do I need a real estate license to operate in South Africa? Yes, you need a real estate license to operate legally in South Africa. The Estate Agency Affairs Board (EAAB) regulates the industry and requires real estate professionals to obtain valid estate agency licenses. To obtain a license, you must meet specific educational requirements, undergo training, and pass the required examinations. It’s essential to comply with these regulations to ensure a legitimate and reputable operation.

- What are some effective marketing strategies for real estate businesses? Effective marketing strategies for real estate businesses include developing a strong online presence through a well-designed website, utilizing search engine optimization (SEO) techniques, and leveraging social media platforms to showcase properties and engage with potential clients. Networking, attending industry events, and collaborating with professionals can also help expand your reach. Additionally, traditional marketing methods such as print advertisements, direct mail campaigns, and signage can still be effective in reaching local audiences.

- How do I find potential investors for my real estate business? Finding potential investors for your real estate business can be achieved through networking events, real estate forums, and industry conferences where you can connect with individuals interested in real estate investments. Join local business organizations, seek referrals from existing contacts, and consider utilizing online platforms specifically designed for connecting real estate entrepreneurs with investors. Develop a compelling business plan and pitch to showcase the potential returns and benefits of investing in your real estate business.

- Are there any specific tax obligations for real estate businesses in South Africa? Yes, real estate businesses in South Africa have specific tax obligations. It’s crucial to consult with a tax professional or an accountant who specializes in real estate to ensure compliance with the tax regulations. Some tax considerations may include property tax, capital gains tax, rental income tax, and value-added tax (VAT). Keeping accurate financial records and submitting tax returns on time is essential to avoid any penalties or legal issues.

- How long does it take to establish a profitable real estate business? The timeline to establish a profitable real estate business can vary based on several factors, such as the local market conditions, your business strategy, marketing efforts, and the economy. It typically takes time to build a client base, establish a solid reputation, and generate consistent revenue. It’s important to set realistic expectations and have a long-term perspective when starting a real estate business as success often comes with patience, perseverance, and continuous efforts.

- What are the common challenges faced by real estate entrepreneurs? Real estate entrepreneurs often face challenges such as fierce competition, economic fluctuations, changing market conditions, and regulatory compliance. Finding suitable investment opportunities, securing financing, and managing cash flow can also be challenging. Additionally, staying updated on industry trends, maintaining a strong network, and adapting to technological advancements are crucial for long-term success in the real estate industry.

- Can I invest in real estate with a limited budget? Yes, it is possible to invest in real estate with a limited budget. Consider options such as investing in smaller properties, starting with partnerships or joint ventures, or exploring crowdfunding platforms that allow fractional ownership. Additionally, you can explore creative financing options like seller financing or lease-to-own arrangements. Conduct thorough research, consult with professionals, and carefully assess the risks and potential returns associated with each investment opportunity.

Remember to seek professional advice and conduct thorough research before making any significant financial decisions related to starting a real estate business.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Post

What is real estate.

Real estate is a term that encompasses a vast and diverse industry associated with the ownership, management, development, and transaction of property. It refers to land and any physical structures or improvements attached to it, such as buildings, houses, apartments, offices, retail spaces, and more. Real estate is a crucial part of the economy and […]

Don’t have an account yet? Sign up for free

Forgot your password?

Already have an account? Log in

Password Recovery

- My Favorites

- Submit Listing

How to Start a Property Business in South Africa

By: Author Tony Martins Ajaero

The demand for businesses in the general real estate industry in South Africa is growing massively due to the hiking prices of properties in the country. Reports show that 60% of all construction is centered within the Gauteng region, and this number will continue to rise in the next few years.

Real estate is without doubt one of the most exciting and lucrative businesses to be involved in, and South Africa is a fertile ground to invest your money. A lot of investors buy properties and bank them, and then sell the properties off once they have either served their purpose or have gained value.

Property business is not a simple business and not for the faint of heart, but the adrenaline rush when a major deal comes together would truly be worth it. In this age, property buying or selling is huge, and those that are good value for money can really bring substantial profits.

A lot of property business owners and investors buy run down shopping centers, commercial buildings and warehouses for the sole purpose of fixing them up and selling them off at a profit. These are some of the most sought-after real estate investments. Statistics has also shown that residential property is also big business if you are looking to start your own property business.

There are a handful of areas where you can buy houses in poor conditions but at excellent price, renovate them and then rent them out to tenants. This particular niche is lucrative, but can sometimes prove to be tricky if you are unfortunate to get poor tenants, but on the other hand, if the tenants are reliable and good payers, this can be a wonderful way to earn extra income.

When planning to start this business, you should first put an excellent business plan together. Buying properties at this point in time is a clever move if you have spare money to invest or if you want to get into the real estate business. A lot of property owners are willing sellers as the recession has taken its toll over the past couple of years.

With the real estate market climbing slowly back into recovery mode, it provides you a large opportunity to make more money. Read on as you are pointed towards the right direction on starting a successful property business.

17 Steps to Starting a Property Business in South Africa

1. understand the industry.

South Africa’s property market has since the year 2000 remained resilient, even with challenging macroeconomic conditions. Growing demand for affordable housing and a host of “new city” projects kicked off in the past year have kept the residential market steady, while A-grade commercial space which is on the verge of oversupply in some areas, is expected to experience strong growth.

Note that all segments of the real estate market have struggled with rising electricity prices, the country’s burgeoning e-commerce, transport and logistics segments.

Reports have it that the rising interest in real estate investment trusts (REITs), a robust retail segment, steady population growth and plans for billions in new infrastructure outlay have brought about a positive mid- to long-term forecast, although the sector will need to face near-term challenges, as slow headline growth, rising inflation, labour unrest, and an expected interest rate hike continue to affect consumer confidence and spending.

Reports have it that South Africa’s residential stock stood at 6.07m properties worth a total of R4.27trn ($368.93bn) in the Q4 of 2014 and in Q2 2015 Housing Review, 2.11m properties worth R2.25trn ($194.4bn) were bonded and 3.96m houses worth R2.02trn ($174.53bn) were non-condensing.

We also believe that the average nominal price of a middle segment home, offering between 80 and 400 sq. metres of space, and priced at less than R4.2m ($362,880), stood at roughly R1.32m ($112,320) during Q1 2015, and went up to 7.3% year-on-year, but then real price inflation in middle-segment housing stood at 3% in the same period, compared to a headline rate of 4.2%.

The report notes that its sample size for luxury properties is smaller than other segments, home prices in this category rose by a nominal 10.6% year-on-year (y-o-y) during Q1 2015 to average R5.77m ($498,528). Residential building activity was subdued in late 2014, however, and contracted further in early 2015, with approved building plans falling by 6.1% y-o-y to 8444 units in January and February 2015.

Reports have also shown that the residential segment is likely to face a number of serious challenges, more especially against rising inflation, falling consumer confidence, labour unrest, electricity shortages and a period of currency depreciation which saw the rand lose 7% of its value against the US dollar between January and July 2015.

2. Conduct Market Research and Feasibility Studies

- Demographics and Psychographics

In this business, your target market will cut across people of different classes and this is why we advise you develop a business concept that will allow you work with highly placed people and at the same lowly placed people who are only interested in putting a roof under their head at an affordable price. You’re target market will include;

- Foreign investors who are interested in owning properties in South Africa

- The government of South Africa (Government contracts)

- Managers of public facilities

- Families who are interested in acquiring a home

- Corporate organizations who are interested in acquiring their own property / properties

- Home Owners who are interested in selling off their home

- Properties Owners who are interested in selling off their properties

3. Decide Which Niche to Concentrate On

You need to understand that the property industry has different types of investment niches. Some of them might appeal to one type of person; some might appeal to another type of person. But you should know that each investment niche uses most of the same basic principles and fundamentals.

Here you simply buy or purchase property to rent it out to prospective clients with a view of generating rental income from the property.

- Renovate to Sell

Renovate as we know means to buy a decommissioned building or a dilapidated house in order to fix it (flip it), and then sell it off for a profit.

- Repossessed Property

If the owner of a property fails to make bond payments on the property, the issuer of the bond, usually a financial institution will then seize it. The sheriff of the High Court will then sell the property off at a sale price in order to recover losses from defaulting on the bond payment

- Letting Agency

This agency facilitates an agreement to rent out property to tenants on behalf of the property owner. The letting agency, in turn takes administration fee.

Level of Competition in the Business

The South African property sector is valued at R5.8 trillion. The report reveals the property sector’s size is at R5.3 trillion with a further R520 billion land officially zoned for commercial and residential development.

Commercial Property carries a value of around R1.3 trillion, up from some R780 billion, with almost R790 billion held by corporates, R300 billion held by REITs, R130 billion by unlisted funds, and R50 billion by life and pension funds. Note that the retail property has the highest value at R534 billion followed by office properties at R357 billion (R228 billion) and industrial properties at R281 billion (R187 billion).

Hotels and other property accounted for R94 billion in value (R25 billion). We also believe that that formal residential property still accounts for nearly three-quarters of property owned in South Africa, and grew from an estimated R3.0 trillion at the end of 2010 to R3.9 trillion.

Note that underdeveloped urban land zoned for development remained unchanged around R520 billion (1.1% of total land in SA). But then the public sector contributed a total of R237 billion, of which around R102 billion is estimated to be in the hands of the Department of Public Works, R66 billion held by SA’s 19 largest state-owned enterprises, and R69 billion owned by metros and selected local municipalities.

The research is part of a larger project by the council, which provides a point of departure against which various transformation charter imperatives can be assessed.

Experts estimate the property sector’s contribution to GDP at a significant R191.4 billion in 2012 in terms of annual income and expenditure flows generated by the sector and a R46.5 billion contribution. By the end of 2015, the naysayers and the sorry folks who have avoided listed property investing in the past said the sector would struggle in 2016.

Even though it didn’t exactly shine, it beat other equities and remained a tenacious sector. Statistics has it that from January to December 13, equities achieved a return of 3% and were completely battered by property which managed 8.4%. Cash only mustered 7% but bonds reigned supreme with a 14.8% total return. The property sector was hurt by political uncertainty and slow economic growth. The economy has barely grown this year.

Indeed the industrial sector continues to be resilient with landlords achieving above-inflation rental growth and tenant retention on warehouse and logistics properties while the office sector is the laggard with rising vacancies on properties and the oversupply of rental space.

Industry remains the top-performing property sector in South Africa, with a total return of 13.6% delivered in 2016. At a sector level, industrial property was the top performing sector last year with a total return of 13.6%, outperforming retail at 12.6%. The office sector continues to struggle on the back of subdued capital growth and was particularly hard hit in 2016 with a total return of 7.6%.

At a property segment level, Inner City and decentralized offices counted among the worst performing segments for the year with total returns of 7.5% and 7.7% respectively. The top performing segments for the year were High Tech industrial property and Neighbourhood shopping centres which produced total returns of 18.1% and 20.3% respectively. Neighbourhood Centre returns should be seen in a longer term context, which suggests a return to trend growth in 2018 rather than continued outperformance.

4. Know Your Major Competitors in the Industry

Industry experts have speculated that 2016 was the worst performing year for residential property since at least 2012. It is believed that the socio-political landscape and economic climate have also done little to alleviate the pressure.

South Africans are looking for safe investments, and property remains one of the safest ways to grow money. Even though there has been a general slowdown in the property market over the last financial year, a lot of property businesses have managed to stay lucrative.

Property businesses no longer simply depend on traditional selling methods such as hanging ‘for sale’ boards outside houses or advertising in the newspaper. They have had to find more innovative ways to attract new clients. Below are seven property businesses that overcame the economic challenges and managed to not only sell the most property, but also made it artful.

- Pam Golding

- Just Property

- Chas Everitt

- Jawitz Properties

Economic Analysis

Experts strongly believe that population growth will ensure the residential sector is resilient. It is believed that South Africa’s population will rise to 72.9m by 2050, while 62% of its 53m residents will live in urban areas, with urbanization growing by 1.21% annually. This is why with urbanization and population growth rising, affordable housing and new city developments stand as the most high-potential growth drivers within the residential segment.

Reports have it that the price of affordable housing which includes homes of 40-79 sq. metres, priced up to R575,000 ($49,680) grew by 8.3% during Q1 2015 to hit R390,000 ($33,696), equivalent to real price inflation of 4%, compared to 1.9% during Q4 2014.

Note that new master-planned projects are sustaining their popularity among middle and upper income segments, providing self-sustaining, greenfield, mixed-use developments with heightened security and amenities. We believe that these developments have been a prominent feature of South Africa’s real estate market for years, and more projects are in the pipeline.

Although local banks have been increasingly involved in property lending, the size and scope of new cities entails much higher levels of financing. AIH’s finance agreement with Nedbank Corporate Property Group for the Waterfall Business Estate project was the largest of such deal ever concluded by the bank.

With billions in fresh investment and sustained construction efforts needed to deliver new projects, some stakeholders have questioned developers’ ability to maintain momentum and fully deliver all planned features and amenities.

Note that new cities will need significant investment in infrastructure before moving forward. Reports have it that one of the most significant risks to economic growth is the country’s ongoing energy challenges, which began in 2008 and became increasingly problematic over the subsequent 18 months. New city developers, meanwhile, have moved to build their own infrastructure, despite these adding significant costs to the projects’ total price tags.

5. Decide Whether to Buy a Franchise or Start from Scratch

It might seem like the ideal path to start small and grow bigger in the real estate industry, but this may not always be the best option for a property business. We believe that single unit properties and small single family homes are the most attractive to newbie investors, as they usually cost less to buy and renovate.

But the profit from these properties is often swallowed up by the renovation budget, and maintenance on the properties. The more reason buying a franchise is a better option in this business, and you can also partner with a wealthier individual or get more financing in order to purchase a more profitable property.

Note that we are not suggesting you over-extend yourself, but you should know that properties requiring small initial investments often offer small profit potential. It’s advisable that you research very extensively before you dive into a franchise.

6. Know the Possible Threats and Challenges You Will Face

The property business is an intense business where almost everyone works to do their own deals. All these and more makes the industry very interesting and competitive. There are many intelligent entrepreneurs out there who are very ready to do their own deals, however starting your own property business is incredibly challenging. Possible threats you should have at the back of your mind may include:

- Low barrier to entry

- Industrial unrest

- High fatalities due to lack of health and safety compliance

- Tender risks

- Non-payment risks

- Compliance with laws and regulations.

- In the industry Investors have unlimited investment choices

- Unlikely to experience a near-term capital event

- Hard to be patient even though that may be the best course of action

7. Choose the Most Suitable Legal Entity

The first thing you need to consider when starting your own property business is the type of ownership to go with. In South Africa, a good option is to open a close corporation (CC). This we believe will make things easier to manage. In a CC, the owners of the company are referred to as members, and you need a minimum of one member and there’s a limit of ten members.

A CC is a legal entity in South Africa, which means the CC is responsible for paying taxes and not one individual. You then need to register your CC by completing a CK1 form (Close Corporation Founding Statement). You can complete this online or download a form to complete.

We suggest you have an accountant sorted out. You’ll need to include the details of your accountant and an original signed letter from him or her agreeing to act for your CC. You’ll also have to provide the letter you receive confirming the registration of your company name. This process takes about five days to complete and costs R100. Once your property business is registered, don’t forget to register with SARS.

8. Choose a Catchy Business Name

- Universal housing

- Wealth contractors

- Target reality

- Sheraton Ltd

- Dream Home Real Estate Service

- Castle Realty

- Apartment Grey

- Four Leaf Clover

- Exquisite housing

- Bumpy Housing services

- Destiny Realty Solutions

- Future estates

- Affinity Investment Group

- Winter suits

- Housing giants

- Integra estates

- Numeric estate services

- Liberty world

- Tower Magnet

- Pitch mantra

9. Discuss with an Agent to Know the Best Insurance Policies for You

You need to understand that the importance of insurance in all phase of our lives cannot be ignored. Even Long-term property investors will want to have iron-clad insurance policies in place that include stipulations about what’s covered by the insurance and what is the responsibility of the renter. Have it in mind that you cannot lock yourself down into a long-term contract if you’re going to offload the property very soon. Note that every type of insurance has its own exclusions.

- General business liability insurance

- Investment property insurance

- Real estate finance insurance

- Loss of rental money insurance

- Equipment breakdown

- Umbrella insurance

10. Protect your Intellectual Property With Trademark, Copyrights, Patents

Indeed no time or moment is too early to begin thinking of intellectual property protection. Have it in mind that keeping a vigilant eye on these assets is an important part of the success of your business. New entrants into the business world tend to face the issue of intellectual property protection while some entrepreneurs will mistakenly believe that a company name is synonymous with a trademark.