- Design for Business

- Most Recent

- Presentations

- Infographics

- Data Visualizations

- Forms and Surveys

- Video & Animation

- Case Studies

- Digital Marketing

- Design Inspiration

- Visual Thinking

- Product Updates

- Visme Webinars

- Artificial Intelligence

How to Develop a Business Exit Strategy [+ Templates]

![investor exit strategy business plan How to Develop a Business Exit Strategy [+ Templates]](https://visme.co/blog/wp-content/uploads/2023/12/How-to-Develop-a-Business-Exit-Strategy-Header.jpg)

Written by: Idorenyin Uko

![investor exit strategy business plan How to Develop a Business Exit Strategy for Your Business [Including Templates]](https://visme.co/blog/wp-content/uploads/2023/12/How-to-Develop-a-Business-Exit-Strategy-Header.jpg)

No matter how successful your business is, you should plan for the day you move on from the start. At some point, you’re going to either sell or retire and pass it on to a successor.

However, most owners need to be more knowledgeable when it comes to exiting their business. William Buck’s 2019 Exit Smart Survey Report shows that about 53% of entrepreneurs don’t actually have an exit strategy in place.

An exit strategy defines how you will exit your business, providing guidance on how to sell your company or handle financial losses if it fails. In addition, it gives you a clear direction on what steps to take to ensure a successful transition.

This article will take a deep dive into how to develop a business exit strategy for your company. We’ll also share customizable templates you can use along the way.

Table of Contents

What is a business exit strategy, benefits of an exit strategy, 8 templates to support your business exit strategy, types of exit strategies, how to develop a business exit strategy, when to use an exit strategy, business exit strategy faqs.

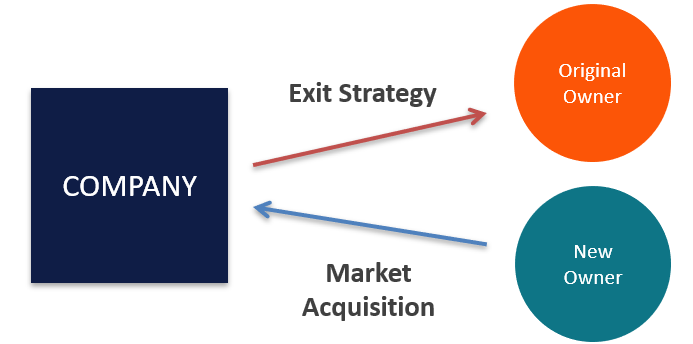

- An exit strategy for a business is a plan created by an investor or business owner to transfer ownership of the company or shares to another investor or company.

- Having an exit strategy helps you make better decisions, amplifies your ROI, makes your business attractive to investors and ensures smooth transitions.

- The main types of exit strategies are mergers & acquisitions (M&A), selling your stake to a partner or investor, family succession, acquihires, management and employee buyouts, leveraged buyouts, initial public offering (IPO), liquidation and bankruptcy.

- Follow these steps to develop a business exit strategy: determine when you want to leave, define what you want to achieve, identify potential buyers or successors, evaluate and increase the current value of your business and assemble the right team.

- Write an exit plan, create a communication plan, develop a contingency plan and build a data room.

- Visme provides templates for creating a robust business exit strategy , checklist, investor pitch, succession plan, press release, communication plan and more.

A business exit strategy is a strategic plan for a business owner, trader, investor or venture capitalist to sell their company or shares to another company or investor. Having a deliberate exit strategy helps owners generate maximum value from liquidating their assets.

In cases where the business is unsuccessful, an exit plan helps the owner reduce losses or transfer them to another party. A venture capitalist may also utilize an exit strategy to prepare for a cash-out of their investment.

Common exit strategies include initial public offering, mergers and acquisitions, liquidation, management or employee buyout and transfer to a successor.

Exit Strategy Options: Closing vs Selling

When weighing your exit options, you're going to have to choose between selling to a new owner or closing the business.

Selling to a new owner is a win-win. You'll make money while the buyer can start operations without a huge upfront investment. If there's a financing agreement, the buyer can spread the payment over a period of time. However, the downside of selling is that employees may be affected.

The second option is closing shop and selling assets as quickly as possible. While this method is simple and quicker, the proceeds only come from the sale of assets. These may include real estate, inventory and equipment. Also, if you have any creditors, the funds you generate must be paid to them before you can pay yourself.

Planning a complete exit strategy well before its execution does more than prepare for unexpected circumstances; it builds purposeful business practices and focuses on goals.

Even though a plan may not be used for years or decades, developing one benefits business owners in the following ways:

- Making Strategic Business Plans and Decisions: With an exit in mind, you will be more likely to set goals and make strategic decisions toward your expected business outcomes.

- Maximizing Your Return on Investment: When it comes to exiting, timing is key. Having a business plan exit strategy enables you to sell when market conditions are favorable, amplifying your ROI.

- Making Your Business More Attractive to Investors: Potential buyers value businesses with planned exit strategies because they demonstrate a commitment to long-term sustainability.

- Working Towards Business and Professional Goals: Executing an exit strategy that increases your business’s value and potential can prevent negative consequences of exiting, like bankruptcy.

- Revealing the Best Selling Situation: Planning your exit strategy requires an in-depth analysis of finances, market dynamics, competition and positioning. This helps you value your business and understand the best-selling situation.

- Ensuring a Smooth Transition: Exit strategies outline all roles and how they contribute to operations. With every employee and stakeholder informed about their responsibilities and actions, transitions are smooth and predictable. You can minimize disruption and maintain continuity during times of change.

- Implementing an Effective Succession Plan: For business owners, an exit strategy can be a part of company succession planning . This ensures a smooth transition of ownership or management. Be it to family members, existing partners, or external parties.

Executing a business exit strategy involves many moving parts. By using templates, you can effectively articulate your plan and ensure nothing slips through the cracks.

Keep in mind that you can tailor these to suit different industries, business sizes and exit goals.

Company Exit Strategy Presentation

When approaching investors or stakeholders to share your exit intent, you need a pitch deck. And we’re not just talking about “run-of-the-mill” decks. Use this orange-themed, captivating exit strategy template to wow investors and stir their excitement about the deal.

This presentation helps you explain what your business is about, how much you’ve grown, what you’ve achieved and the team behind the dream. It also paints a positive picture of the future. This business exit plan template utilizes charts, widgets and data visualizations to capture the timeline, traction and financing in an engaging way.

Do you have more evidence to support your presentation? You can link to your valuation, financial, legal and operations documents using Visme’s interactive features .

If you're racing against the clock and need to create your presentation quickly, use Visme's AI presentation maker . Input a detailed prompt, choose your preferred design and watch the tool produce your presentation in seconds. You also have the freedom to customize text and design with the extensive array of features and tools in Visme's editor.

Business Exits Checklist

Business exits (or even mergers and acquisitions) are complex. Without a checklist, you could miss out on some key steps. This business exit strategy checklist is a must-have if you want to increase your likelihood of success. It covers various aspects, from financial readiness and legal compliance to communication strategies and post-exit planning.

Think of it as a roadmap with essential steps and considerations to help you achieve a smooth and successful exit. Feel free to use it as is or customize it with the help of Visme’s intuitive editor. When working on this business exit plan template, you can change fonts, text and background colors to fit your branding.

Business Exit Strategy

Use this strategic plan template as a framework to guide you throughout the business exit journey. It captures all the key components of an exit strategy, helping you decide what’s best for your business.

Use it as a guide to navigate various aspects such as financial planning, market analysis and stakeholder communication.

Since multiple stakeholders are involved in the exit planning process, this exit strategy for business can serve as a collaborative tool. With Visme’s collaboration feature , team members can contribute to and review it individually or in real time. (Check out the video below to see how it works.)

The best part is that you can even deploy the Workflow tool for better task management among stakeholders. You can assign different sections, set deadlines, track progress and make corrections—all in one place.

Merger Press Release Templates

Announce your company's recent merger in a polished and professional manner using this blue-themed template. It features dynamic content blocks where you can easily place your text and visual elements.

The blue mixed with a yellow sprinkle makes your news visually appealing and engaging. Leave a lasting impression on your audience with visuals of your product or team members.

The best part of using Visme? You can generate content ideas or drafts for your press release using Visme’s AI Writer . The tool also comes in handy for proofreading your press release.

You can replicate or customize this merger press release for different channels using the Dynamic Fields feature .

Ownership Succession Plan

An ownership succession plan is critical for the success and stability of any business. Craft a well-structured plan for transferring ownership with this ownership succession plan template.

This customizable template addresses every aspect of the transfer process, like ownership structure, transition timeline and financial implications. It also captures an ownership checklist, a succession plan for retirement, a consideration sheet and a successor development plan.

Use this document to facilitate effective communication among stakeholders, including the owner, management, board of directors and employees.

Edit this template to align with your brand identity and maintain a smooth operational flow during the transition. Feel free to beautify the document with icons , stock photos and videos from Visme’s library. You also have the option of generating unique visuals with Visme’s AI image generator .

General Due Diligence Report

Give your business a huge advantage on the negotiation table with this general due diligence report template. Presenting a stunning report makes your business more attractive to potential buyers. It also eliminates surprises during negotiations and expedites the overall deal execution process.

This report presents a clear picture of the company's assets, liabilities, financial performance and growth prospects. It also captures information about your company’s legal and regulatory compliance, operations and team.

After publishing your report, you can monitor traffic and engagement with the Visme analytics tool . It provides insights into your report’s views, unique visits, average time, average completion and more. Monitoring how readers consume the report will help you steer your conversations in the right direction.

Financial Due Diligence Report

Instill confidence in potential buyers, investors and other stakeholders with this financial due diligence report. It paints a clear picture of your company’s financial health, controls and systems. This template covers key sections like the company overview, financial analysis, income statement, taxation analysis and recommendations.

The beautiful thing about creating this report in Visme is that you don't have to type in your financial figures manually. You can easily connect to third-party sources and import financial information into your report. As you make changes to your data, your table or chart will also be updated in real-time.

Download this template to share with your recipient in different formats, including PDF, HTML, video and image. Or simply generate a shareable link for online sharing. This means you can cater to different reading preferences–whether print or digital.

Legal Due Diligence Report

Establish compliance with all relevant laws and regulations associated with the transaction with this report template. It offers both the buyer and seller an extensive understanding of the exit process. This report captures key sections, such as:

- Legal and regulatory compliance

- Privacy and data sharing

- Terms of Service and Licensing

- Data retention

With this report, you can identify potential legal risks and liabilities. Not only does it ensure a smoother exit process, but it also helps you make better decisions.

Keep your report on brand with Visme’s brand wizard . Just input your URL; the tool will pull in your brand assets and recommend branded templates. You don't have to manually import them into the Visme editor.

Whether you're mapping out a business strategy or creating a plan for a business exit, we’ve created this ultimate list of strategic planning examples and templates to help you.

There are eight major examples of exit strategies for entrepreneurs, startups and established businesses.

Made with Visme Infographic Maker

Ultimately, the strategy you select will depend on your own financial, personal and business goals. We’ll also touch on some of the pros and cons of each.

Merger and Acquisition (M&A)

This business exit strategy example involves merging with or selling your company (or a portion) to another company. The acquiring company may be a competitor, a supplier, a customer or a private equity firm. If you’ve built a strong brand, technology, or customer base, a Merger and acquisition exit strategy can provide an attractive exit option for your company.

- Creates economies of scale and increases efficiency by combining resources and capabilities.

- Enhances competitiveness and market position through expanded offerings and increased market share.

- Provides access to new markets, technologies and talent.

- Generates synergies and cost savings through combined operations.

Disadvantages

- Integration challenges and cultural differences can lead to significant difficulties in realizing expected benefits.

- High transaction costs and significant investment are required.

- Risk of overpaying for the acquired company or assets.

- Potential loss of focus on core business activities during integration.

Streamline your M&A exit strategy with the help of this customizable template. It captures every aspect of the transition process, including assessment, preparation, valuation and negotiation.

Exit Strategies for a Partner or Investor

Selling your stake to a partner or investor can be a strategic exit plan, particularly if you are not the sole business owner. In this shareholder exit strategy, you have the opportunity to sell your stake to a familiar entity, often referred to as a 'friendly buyer,' such as a trusted partner or a venture capital investor.

- Allows the business to continue operating smoothly with minimal disruption to daily activities, ensuring a consistent flow of revenue.

- A 'friendly buyer' already has a vested interest in the business and a commitment to its long-term success. This can contribute to the ongoing stability and growth of the company.

- Identifying a suitable buyer or investor for your share of the company can be a challenging task.

- When selling to someone with a close relationship, personal ties may influence negotiations. Hence, the process may not be as objective as with an external party.

- The close relationship with the buyer may make you lower the asking price.

Family Succession Exit Strategy

This exit strategy for a small business involves passing ownership and leadership of a business from one generation to the next within a family.

- Maintains the business's legacy and continuity with a sense of tradition.

- Successors often deeply understand the business because of their long-term affiliation.

- The successor’s familiarity with existing relationships, suppliers and customers can contribute to the business’s stability during the transition.

- Family dynamics can lead to conflicts of interest and an inability to make impartial business decisions.

- Successors may lack the necessary skills or experience to steer the business.

- Non-family employees may perceive favoritism or a lack of equal opportunities, causing dissatisfaction within the workforce.

- Narrow-mindedness within the family may hinder the introduction of new ideas and innovations.

Acquihires Exit Strategy

For this exit strategy in business, a larger company acquires a smaller company primarily for its talent and intellectual property. This allows acquiring companies to easily tap into the experience and expertise of skilled employees and innovative minds.

- Acquiring a team with a proven track record mitigates some of the risks associated with starting a new project or entering a new market.

- Provides a quick way for companies to onboard skilled and talented hires.

- The acquired team brings fresh perspectives, ideas and innovations to the acquiring company.

- Integrating a team already familiar with the industry can accelerate product development or market entry.

- Merging different cultures may lead to conflicts and clashes that affect team morale.

- Getting the acquired team acquainted with existing workflows and processes may present difficulties that impact productivity.

- Acquihires can be expensive and there's no guarantee you'll successfully integrate the new team.

Management and Employee Buyouts (MBO)

An MBO occurs when the company's management team purchases a majority stake from existing shareholders. This exit strategy in entrepreneurship allows managers to take control of the business and make decisions without external interference. MBOs can motivate employees, align interests and facilitate succession planning.

- Increased chance of success since the management team is already familiar with the company's operations, culture and challenges.

- MBOs can provide continuity in leadership, ensuring a smooth transition without significant disruptions to daily operations.

- Enable more agile decision-making processes for a smaller group of decision-makers.

- Funding an MBO can be expensive. The management team may face difficulties raising the necessary capital to acquire the company.

- MBOs may lack the financial resources and expertise that external investors or buyers could bring to the company.

- Insiders may have a biased view of the company's value and potential, leading to overvaluation and unrealistic expectations.

Here's a template you can use to manage the transition process for your MBO exit strategy. The presentation template covers key aspects such as employee roles and ownership, the board’s role, the process, transition planning and management.

Leveraged Buyout (LBO)

An LBO is similar to an MBO but involves borrowing funds, equity and cash to finance the purchase. The assets of the purchased and acquiring companies are used as collateral for the loans. Private equity firms often use this method to acquire companies with the potential for high returns through financial leverage.

- If the acquired company performs well, the return on the equity investment can be substantial.

- LBOs allow investors to control a larger enterprise with less initial investment.

- Private equity firms involved in LBOs often bring operational expertise and efficiency.

- Private equity ownership supports strategic decision-making since the ownership structure is often less bureaucratic.

- If the acquired company's performance declines or interest rates rise, the debt burden increases.

- Capital structure of LBOs may limit the company's ability to generate cash for other purposes.

- LBOs are influenced by market conditions and economic downturns can impact profitable investment exits.

Create a robust strategy plan for your leveraged buyout exit strategy using this template.

Initial Public Offering (IPO)

An IPO exit strategy is when a privately held company goes public by issuing stocks to raise capital. This provides an opportunity for early investors and shareholders to cash out their shares and realize a return on their investment. However, going public also means increased scrutiny, regulation and pressure to perform well.

- Provides liquidity for existing shareholders, including founders and early investors.

- Enhances the company's public profile and can attract new investors.

- Preparing and executing an IPO can be an expensive and time-consuming process.

- The company becomes subject to rigorous regulatory requirements and market fluctuations.

Considering how challenging executing an IPO is, this template is your trusted ally. The green fashion-themed design makes it visually appealing. The pictures bring more context to the company’s products or offerings. This strategy plan accounts for every single aspect of a successful exit via IPO, including objectives, the preparation phase, timing, IPO execution and post IPO.

Liquidation

Liquidation exit strategy involves winding down operations, selling off assets and distributing proceeds to shareholders. This option is usually considered when a company is no longer viable or has reached the end of its life cycle.

- Compared to other exit strategies, liquidation is a simpler process.

- Proceeds from liquidation can be used to settle outstanding debts, liabilities and other financial obligations.

- Allows you to sell and realize value from individual assets rather than the entire business.

- Often results in lower returns for shareholders compared to selling the business as a going concern.

- The liquidation process, especially if it involves bankruptcy, can damage the reputation of the business and its stakeholders.

- Assets can be sold below fair market value due to urgency.

Bankruptcy is a legal process where a company unable to pay its debts seeks protection from creditors. Depending on the circumstances, it can result in restructuring, refinancing or liquidation. While not always ideal, bankruptcy can provide relief and allow for a fresh start.

- Provides a legal process for discharging or restructuring debts.

- Triggers an automatic stay and offers legal protection from creditors.

- Facilitates the orderly liquidation of assets. This ensures creditors get fair treatment and maximizes the value of assets for distribution.

- Has a severe impact on the credit ratings of both the company and its owners.

- The court takes control of the company's assets and may appoint a trustee to oversee the process.

- Proceedings involve legal and administrative costs that can further erode the company's assets.

- Often results in job losses and career disruptions for employees.

1. Determine When You Want to Leave

The first thing you should do when doing business exit planning is figure out how long you want to stay involved.

If it’s a voluntary exit, you can approach it in two ways. You can list goals that should be achieved before you exit or pick a date in the future and work towards it.

For example, you can decide to sell after hitting a certain milestone in revenue, profitability, growth, or liquidity. You can also determine whether you’ll proceed with the sale even if you don’t hit those targets.

The target date for this transition can change. But without a deadline, you won’t treat the plan with priority or commit resources to achieving it. Once you have a date, you can work toward making your business more valuable and attractive to potential buyers.

2. Define What You Want to Achieve

Ask yourself what you want to achieve from your exit strategy. These could be financial goals, legacy preservation or pursuing new opportunities.

Do you want to retire or will you pursue other opportunities? Do you still want to maintain control over the business? Are you hoping to preserve your legacy?

If you’re exiting a long-term business, succession planning or management buyouts may be your best bet. But if you’re looking to cash out or explore synergies, you can sell, merge or even launch an IPO.

3. Identify Potential Buyers or Successors

The potential buyer for your business will depend on your industry, financial performance, strategic fit, market position and other factors.

Create a profile of the type of investor that may be interested in acquiring your business.

For example, your buyer may be a bigger competitor or venture capital fund that can maximize value from your business model. It could also be a rival company that finds your new product line perfect for cross-sells. You may also be approached by rivals who want your intellectual property, staff or customer base.

The next step is to list businesses that fall into this category. If you're looking to sell your business, consider potential buyers who have expressed interest in your industry or have a track record of acquiring similar companies.

However, if you plan to pass your business down to family members, identify suitable candidates within your family who have the necessary skills and experience to run the business successfully.

4. Evaluate the Current Value of Your Business

The next step is to determine what your business is actually worth. This may involve a business valuation, considering factors like revenue, profits, assets, market position and growth potential.

We recommend hiring external auditing companies or professionals to value your business and conduct due diligence. Not only will you get a due diligence report , but you'll also get a transparent and impartial valuation of your finances.

Understanding your business's worth will help you set expectations for buyers and negotiate a fair deal.

In addition to valuing your business, do your due diligence. Organize all of your company and legal documents, including:

- Permits/licenses

- Employee data and payroll information

- Vendor and customer contracts

- Asset lists

- Insurance information

- Liabilities

- IP documentation

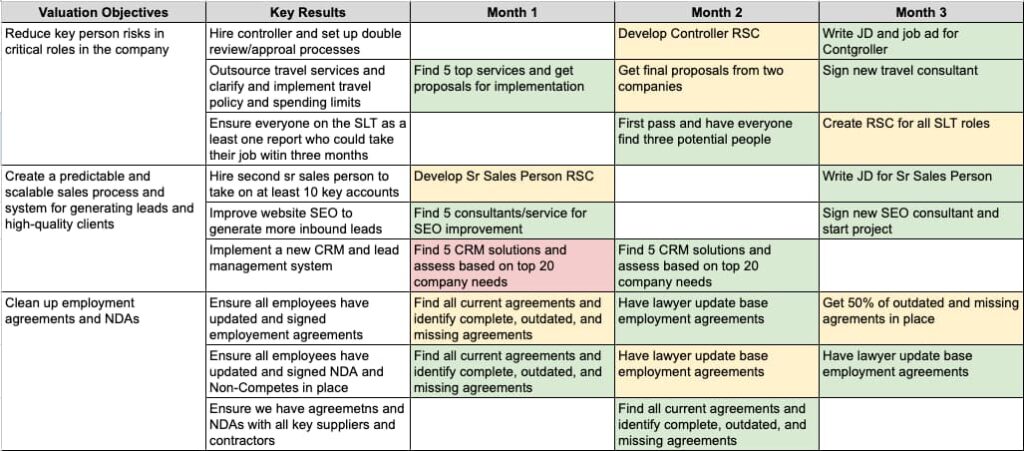

5. Increase Business Value and Improve Performance

Now that you know the value of your business, what's next?

Ask yourself: Does it align with the exit strategy goals? Can I achieve my exit strategy goals with this current valuation? What can I do to increase the value of the business or make it more appealing to investors?

Keep finding areas for improvement across your business. This could involve expanding your product or service offerings, entering new markets or implementing new technologies.

Focus more on areas that will make other businesses want to acquire or merge with you. If you haven’t found those value drivers yet, it’s about time you did. Similarly, figure out the biggest drawbacks and fix them.

For example, if you have a strong financial track record, consistent profitability and positive growth trends, you’re likely to attract potential buyers. Your proprietary technology, patents, intellectual property, customer base, supplier relationship and geographic presence may just be the reasons other companies find your business valuable.

Another great practice to increase value is to do a competitor analysis. Analyze the competitors in your market. Where are they doing better than you? How can you beat them in their game? Acting on this intel can increase your chances of finding a suitable buyer and negotiating a favorable deal.

6. Assemble a Solid Team to Manage the Process

Buyers will come to the negotiation table with a solid team. You should assemble a great team as well.

You should also do this if you’re creating an exit strategy for startups.

When it comes to selling your business or liquidating shares, you’ll need professional guidance to navigate the complexities and emerge with confidence. The key is to surround yourself with trustworthy individuals who understand the intricacies of selling.

These professionals should have a proven track record and a wealth of knowledge to handle various situations associated with exits. Some professionals you should consider adding to your team include:

- Accountants

- Business brokers

- Corporate lawyers

- Merger and acquisition advisors

- Financial experts

- Marketing experts

- Information and communication experts

7. Write an Exit Plan

Establish a succession plan that outlines how you’ll ensure business continuity. This should outline how leadership will be transferred, including a clear chain of command, roles and responsibilities and a timeline for the transition.

Once you’ve decided to exit your business, gradually remove yourself. If operations, revenues and survival are 100% tied to the owner, that becomes a red flag for buyers.

Choose new leadership and start transferring some of your responsibilities to them while you finalize your plans. Establish a set of standard operating procedures (SOPs), ideally in written form, that would enable any buyer to keep the business in gear by following a set of instructions.

If you already have a documented operation strategy, transitioning new responsibilities to others will become seamless.

Ultimately, your business exit plan should capture these elements:

- Valuation of the business

- Timeline for your exit

- Financial preparedness

- The most suitable exit strategy

- General due diligence report

- Post exit involvement (consultancy roles, advisory positions, or other forms of ongoing involvement)

We've shared dozens of business exit plan templates. Alternatively, you can create one in minutes using our AI document generator .

8. Create a Communication Plan

Plan how and when you will communicate the exit to customers, employees and other stakeholders.

Create a communication plan to manage this process. It can minimize disruptions and maintain the confidence of key stakeholders.

Once you have established a solid succession plan, communicate this information to your employees. Be prepared to address any concerns or questions they may have. Notably, approach this communication with empathy and transparency so your employees feel heard and valued throughout the process.

Finally, inform your clients and customers. If your company will continue with a new owner, make the transition smooth by introducing them to your clients. However, if you are shutting down your business, point your customers to alternative options.

Here’s a communication plan you can use for this step.

9. Develop a Contingency Plan

During the exit process, things could go south. For example, unexpected events—like market condition changes, delays or disputes with stakeholders—could impact the exit process.

That’s why you need a contingency plan to address these risks. Evaluate the potential impact and likelihood of each risk you’ve identified. Then, you can develop strategies to mitigate their effect.

Let’s say there’s a sudden change in market conditions. Your contingency plan could be to diversify your revenue streams or implement cost-cutting measures. Ensure the strategies are feasible, practical and aligned with the overall business goals.

10. Create a Data Room

The data room consolidates comprehensive information on financial results, key business drivers, legal affairs, organizational structure, contracts, information systems, insurance coverage, environmental matters and human resources issues such as employment agreements, benefits and pension plans.

As soon as the Confidential Information Memorandum (CIM) is drafted, start compiling information for the data room, as it supports much of the document.

It is important to balance the amount of information and the level of detail provided in the data room. The information should be sufficient to enable buyers to determine the asset's value and complete their due diligence.

However, it is equally important to limit the amount of sensitive or competitive information disclosed to anyone other than the ultimate purchaser. Achieving the right balance often requires discussions between sellers and their advisers.

There are different instances where you may need to use an exit strategy. Let’s look at a few of them.

- Retirement: If a business owner is approaching retirement age, an exit strategy can help them plan for the transfer of ownership or sale of the business.

- Profit Objective : An angel investor can sell their stakes and exit, achieving a specific profit objective.

- Mergers and Acquisitions: If a business owner receives an offer to purchase their business, an exit strategy can help them negotiate the terms of the sale and ensure a smooth transition.

- Financial Losses: An exit strategy is a great way to liquidate losses from a business with financial challenges or heavy debt burdens.

Other situations that can necessitate developing an exit strategy for startups and corporations include

- Change in personal circumstances such as a divorce, illness, or death in the family.

- Shift in business direction or industry changes.

- Lack of growth opportunities.

- Legal or regulatory issues.

- Planning for succession or transition to new leadership.

- Aligning with the investment horizon or expectations of investors or stakeholders.

Q. What Is the Best and Cleanest Way to Exit the Business?

The best exit strategy depends on your personal goals, financial needs and the specific circumstances of your business.

However, a clean exit can provide peace of mind and financial security. This type of exit involves a smooth transfer of ownership where you receive your payout and know your business will be left in capable hands.

With a clean exit, there’s little or no disruption to business operations. The owners maximize the value of their business and realize their financial goals.

Q. What is the Master Exit Strategy?

There isn't a single "master exit strategy" that universally applies to all businesses. Different businesses may benefit from different exit strategies. In addition, a small business exit strategy may not work for a larger company.

When exiting your business, deploy a strategy that helps you maximize your company's value and benefits all stakeholders.

Q. What Are the Two Essential Components of an Exit Strategy?

The two essential components of an exit strategy are:

A clear definition of the business owner's objectives: This includes identifying what the owner wants to achieve through the exit, such as maximum financial return, continued legacy, or minimal disruption to employees and customers.

A thorough assessment of the business's current situation: This includes evaluating the company's financial health, operational performance, market position and competitive landscape.

How Visme Can Equip Your Company & Team

There you go. This article has covered the basics of how to prepare an exit strategy.

Exiting a business you’ve built or invested in can be emotional and overwhelming. But doing it the right way pays off.

Planning a proper exit strategy in entrepreneurship requires diligence in terms of time and care. That’s why you need a tool like Visme that helps you manage the entire process—from planning to documentation to execution.

Visme provides templates for creating a robust business exit strategy , checklist, investor pitch, succession plan, press release and communication plan.

That’s just the tip of the iceberg regarding what you can create in Visme. With a rich library and cutting-edge features, teams can collaborate and create stunning business documents.

Sign up to discover how Visme can help you execute your business exit strategy.

Discover the Business Value of Brand-Aligned, Collaborative & Interactive Content

Trusted by leading brands

Recommended content for you:

Create Stunning Content!

Design visual brand experiences for your business whether you are a seasoned designer or a total novice.

About the Author

Join us for funding and investment opportunities.

Exit Strategies

How to Craft an Exit Strategy for Investors

Staying informed about industry trends, learning from both successful and challenging exit stories, and continuously refining the presentation of exit strategies will empower founders to make informed decisions and navigate the path to success.

As founders aim to build successful and scalable companies, it's essential to consider exit strategies – a crucial aspect that plays into the risk-return dynamic VC firms evaluate.

I. Understanding Exit Strategies

A. Defining the Exit

An exit strategy is a planned approach by which startup founders and investors intend to realize their investment returns. It's a crucial component of the business plan that outlines how investors will eventually liquidate their stake in the company, allowing them to capture the anticipated profits.

B. Common Exit Avenues

Acquisition : The startup is acquired by a larger company, providing investors with a return on their investment.

Initial Public Offering (IPO) : The startup goes public, and shares are traded on a stock exchange, allowing investors to sell their shares.

Merger : The startup merges with another company, creating a larger, more competitive entity.

Management Buyout (MBO) : The existing management team, possibly in collaboration with external investors, buys out the investors' stake.

Liquidation : In certain cases, the startup may choose to wind down its operations, and assets are sold off to repay investors.

II. Timing the Exit

A. Considerations for Timing

Market Maturity : Assess the maturity of the market and industry trends. Some markets may be more conducive to acquisitions or IPOs at specific times.

Company Growth Stage : The exit strategy often aligns with the company's growth stage. Early-stage startups might opt for acquisition, while more mature startups may consider an IPO.

Investor Expectations : Understand the expectations of investors regarding the timeline for an exit. Some investors prefer shorter-term exits, while others are more patient.

III. Aligning Exit Strategies with Business Goals

A. Strategic Alignment

Business Mission : Ensure that the chosen exit strategy aligns with the overall mission and goals of the startup. For instance, an acquisition may align better with certain strategic objectives than an IPO.

Impact on Innovation : Consider how the chosen exit strategy may impact the startup's ability to innovate. Some founders prioritize remaining independent to maintain a focus on innovation, while others see acquisition as an opportunity for greater resources.

IV. Factors Influencing Exit Strategy Selection

A. Financial Considerations

Investor Returns : Different exit strategies yield different returns for investors. Understand the financial implications for both founders and investors.

Valuation : Consider the current and potential future valuation of the startup. High valuation may make an IPO more attractive, while a strategic acquisition may be more feasible at a different valuation.

B. Market Dynamics

Competitive Landscape : Assess the competitive landscape and potential interest from larger players in the market. High demand for innovative solutions can make acquisition more likely.

Regulatory Environment : Understand the regulatory environment, especially if considering an IPO. Regulatory requirements can influence the feasibility and timing of going public.

V. Crafting a Presentation for Venture Capital Investors

A. Transparency and Communication

Open Dialogue : Establish open communication with investors about exit strategy considerations. Transparent discussions foster trust and alignment of expectations.

Regular Updates : Provide regular updates on the progress of the startup and any relevant industry developments that may impact the chosen exit strategy.

B. Tailoring the Presentation

Investor Preferences : Understand the preferences of your specific investors. Some VC firms may have a preference for certain exit strategies based on their investment thesis.

Scalability Narrative : Weave the chosen exit strategy into the broader narrative of the startup's scalability and potential market impact. Show how the exit strategy aligns with long-term growth.

C. Scenario Planning

Contingency Plans : Acknowledge the uncertainties in the startup landscape. Presenting various exit scenarios and associated plans demonstrates preparedness and strategic thinking.

Market Timing : Discuss how market conditions and timing may influence the chosen exit strategy. Highlight the flexibility to adapt to changing circumstances.

VI. Case Studies: Learning from Exit Strategies

A. Successful Exits

Instagram (Acquisition by Facebook) : Instagram's acquisition by Facebook for $1 billion in 2012 is a classic example of a successful exit. The strategic fit with Facebook's vision led to a substantial return for both founders and investors.

Alibaba (IPO) : Alibaba's IPO in 2014 is one of the largest in history. Going public allowed the company to access massive capital markets and facilitated continued growth.

B. Lessons from Challenges

Snap (IPO) : Snap's IPO faced challenges as the company struggled with monetization and faced intense competition from Facebook. The stock price volatility post-IPO highlighted the importance of a solid business model.

Theranos (Liquidation) : Theranos, once a highly valued startup, faced regulatory and legal challenges that led to its downfall. The liquidation of assets became the only viable exit option.

Crafting and presenting exit strategies to venture capital investors is a strategic process that requires careful consideration, transparency, and adaptability. Startup founders should view exit strategies not as an endpoint but as a critical part of the entrepreneurial journey. By aligning the chosen exit strategy with the company's mission, demonstrating financial acumen, and maintaining open communication with investors, founders can navigate the complexities of the funding landscape and position their startups for long-term success.

As the startup landscape evolves, so too will the expectations and preferences of venture capital investors. Staying informed about industry trends, learning from both successful and challenging exit stories, and continuously refining the presentation of exit strategies will empower founders to make informed decisions and navigate the path to success.

More resources

Stay connected!

If you have a serious, bonafide inquiry into the VentureCapital.com or PrivateEquity.com domain names, please contact us here

Business Exit Strategy

A plan for the transition of business ownership either to another company or investors

What is a Business Exit Strategy?

A business exit strategy is a plan for the transition of business ownership either to another company or investors. Even if an entrepreneur is enjoying good proceeds from his firm, there may come a time when he wants to leave and venture into something different.

When such time comes, the business can be sold, left in the hands of new management, or acquired by a larger company. Even if it will be decades before the entrepreneur can sell his business, what he does in the present moment can set it up for a smooth exit or make the process more challenging.

What Should Be Considered In An Exit Strategy?

While different businesses will require different tactics in an exit strategy, there are key elements that can be helpful across the board. These elements factor into play the company’s financial circumstances, market conditions , objectives, and timeline.

1. Objectives

One aspect that should never be missed in a business exit strategy is the owner’s individual goals. Upon exiting the business, is the owner interested in getting profits or does he also want to leave a legacy? Establishing the purpose of exiting the company helps to identify the specific objectives and activities to be prioritized.

2. Timeline

Another factor that should be considered is the time frame of the business. When does the owner intend to sell the business? When establishing this time frame, a business owner should allow for flexibility. In such a way, he will have more negotiating power.

However, if the time frame is tight, the business sale might not go through smoothly since everything will be done in a rush. Similarly, the stakeholders might not have enough time to make the business reach its full potential.

3. Intentions for the Business

Does the firm owner want to see his business continue its operations or does he prefer that it gets dissolved? Answering this question will help to establish whether the company will end up being liquidated, merged with another, or sold and set up for transition via succession planning.

4. Market Conditions

Both the current supply and demand for the company’s products or services, and the marketplace demand for businesses are also factors to consider. Are there a lot of potential buyers or only a few?

Why a Business Exit Strategy is Important

1. business owners become weary.

Forming a company from the ground up and transforming it into a successful and profitable one is challenging. It calls for a significant investment of time and money. Most of the time, entrepreneurs need to wear many hats before they can earn enough profits to invest in recruitment and training.

Considering the amount of effort that business owners put into these ventures, they are often unwilling to delegate tasks. These individuals invest all their time in running the business operations. They work round-the-clock looking for new clients, marketing their products, and recording the business finances. Since such company owners rarely take some time off to recharge, they can get to the point of fatigue or burnout.

Burnout can occur at any time and for several reasons. When it does happen, the firm owner will not want to spend another three months getting his business ready for sale. Prospective buyers prefer that the company owners have performance metrics, revenue history, and any other paperwork ready. A business exit strategy ensures that company managers have systems in place for recording essential information on a regular basis.

2. Get a better understanding of revenue streams

An exit plan requires that one keeps consistent and up-to-date data regarding the business’ performance. This means that company owners will always have a good understanding of their revenue streams and cash inflows and outflows. They are able to determine the activities that are bringing in the most revenue and how this revenue is being spent.

Having accurate financial data makes for better decision-making. It also helps firm owners to make realistic predictions. They will be able to manage cash flows more efficiently, plan for seasonal fluctuations, and focus their marketing efforts on the projects that matter.

Coming up with an exit strategy helps firm owners decide whether they should go after short, medium, or long-term income projects. If an individual intends to exit the business within the next few months, he can focus his efforts on activities that bring in cash quickly. These would include items such as monthly subscriptions, automatic renewals, and membership models that remain active up to when customers cancel them. Such income-generating projects require minimal effort, yet they keep money flowing into your business.

However, firm owners who want to remain in business for the next couple of years should focus their efforts on long-term growth activities. Developing life-long client relationships, building a reliable pool of employees, and being innovative will go a long way in helping the company grow.

3. Developing effective leadership

Whether a company owner intends to sell his business or pass it onto his next generation, effective leadership can make or break this deal. To ensure that the transition is a success, the firm owners should outline the chain of command that is to be followed upon exiting. This plan should also lay out the basics of company decision-making.

When a longtime manager or leader leaves, some firms end up in chaos with numerous stakeholders fighting for power. The players that are left waste so much time deciding who will take over that they forget the primary goals of the firm. By outlining a clear succession plan, firm owners help to minimize such risks and ensure that the business continues to thrive long after they leave.

4. Smooth operations

An exit plan highlights all the information that the company’s successor would need to run it. This way, the new investors or managers won’t waste their resources collecting basic information regarding employees’ salaries, finances, and partners. If the business exit strategy contains all the necessary information, its successors can hit the ground running as soon as the company leader leaves.

Key Takeaways

Entrepreneurs think of themselves as innovators. Their primary goal is to take ideas and turn them into successful ventures. This is beneficial; it’s what helps most firms survive and thrive. However, placing too much focus on the start of a business takes away focus from its end, which can be detrimental. A good number of entrepreneurs don’t have solid strategies in place for how they will exit the industry or company.

Exit plans are crucial in ensuring that firms transition smoothly to the new management. Having an exit strategy also makes it easy to keep tabs on the company’s finances. If an individual intends to sell his business later, he will have to present the firm’s revenue history and performance metrics to prospective buyers.

Also, a business exit strategy is important as it outlines the chain of command to be followed once a leader exits the company. This way, the new owners won’t spend too much time determining who will take over the managerial positions.

Additional Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

- Corporate Structure

- Leadership Traits

- Management Theories

- Succession Planning

- See all valuation resources

- See all equities resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Exit Strategies - All You Need to Know about Business Exit Planning

Kison Patel is the Founder and CEO of DealRoom, a Chicago-based diligence management software that uses Agile principles to innovate and modernize the finance industry. As a former M&A advisor with over a decade of experience, Kison developed DealRoom after seeing first hand a number of deep-seated, industry-wide structural issues and inefficiencies.

The question, “What is your exit plan?” tends to draw blank expressions when asked to business owners.

A survey of business owners conducted by the Exit Planning Institute shows that a startling 2 out of 10 businesses that are listed for sale eventually close a transaction, and of these, around a half end up closing only after significant concessions have been made by the seller.

Business owners need to think about exit planning before searching for potential buyers. The tools provided by DealRoom can be a valuable asset to any business owner looking to develop an exit strategy.

By working with a team of professional advisors, accountants, lawyers, and brokers, you can ensure the right documents are in place for a business exit whenever the time comes.

In this article, we talk about creating a business exit plan and how to make one for your business.

What is a Business Exit Strategy?

A business exit strategy outlines the steps that a business owner needs to take to generate maximum value from selling their company. A well-designed business exit strategy should be flexible enough to allow for unforeseen contingencies and account for the fact that business owners don’t always decide on their own terms when to exit. By creating a strategy in advance, owners can ensure that they can at least maximize value in the event of an unplanned exit from the business.

Investor exit strategy

An investor exit strategy is similar to that of a business exit strategy. However, investors look for a financial return on their exit from a company, so bequeathing is never one of the options considered. An investor will often have a list of potential acquirers in mind, as well as a timeframe, as soon as their investment is made. In this type of scenario, there is often an exit multiple in mind (i.e. a multiple of EBITDA or a multiple of the original investment made in the business).

Venture capital exit strategy

Another business exit strategy option is a venture capital exit strategy. As our article on venture capital outlines, if a company is venture funded then consider that your investor will have a pre-planned exit. As an early stage company, this is a natural part of taking investments. Usually, with a VC investment, the aim is for an exit after five years, either through an industry sale or an IPO, where they can liquidate their original equity investment.

Motives for Developing Exit Strategies

Technically, it is important for equity owners to have a broad outline of what an exit would look like. For example, the image below represents various motives ranging from financial gain to mitigating environmental risk.

Some of the common motives for business exit include the following:

Retirement - Arguably the most common reason of all motives is retirement. Business owners will inevitably retire at some stage, and it’s best that they have an exit strategy in place before doing so.

Investment return - A business exit strategy as part of a wider investment strategy - for example, the VC company planning to go to IPO after five years - makes the exit valuation part a component of the initial investment in the business.

Loss limit -A business exit is ultimately a kind of real option for a business. If the business is hemorrhaging money, the best option may be to exit immediately - ‘cutting your losses’ on the business, a sit was.

Force majeure - Like the examples of Covid-19 and Russia’s invasion of Ukraine, sometimes an investor or owner doesn’t really have a choice: The circumstances dictate that they have to exit.

Types of Exit Strategies

Sale to a strategic buyer

Strategic buyers are usually in the same industry as the company whose owner is looking to exit. And in other cases, the buyer can be in an adjacent market looking to compliment their products in an existing market, or expansion of their products into a market.

Sale to a financial buyer

Financial buyers are solely looking for a financial return from their investment in a business and the exit is the primary means of achieving this return. Examples include venture capital and private equity investors.

Initial Public Offering (IPO)

This form of exit, far more common with startups than mature companies, enables company owners to exit by selling their equity to investors in public equity markets.

Management buyout (MBO)

An exit through MBO would occur when the owner sells the company to its current management team, whose familiarity with the business technically should make them the best candidates to achieve value from an acquisition.

Leveraged buyout (LBO)

A leveraged buyout occurs when a buyer takes a loan or debt to purchase another company. The buyer also uses a combination of their assets and the acquired company's assets as collateral. Financial models can be used for multiple scenarios and simulations of when an LBO is an effective choice.

Liquidation

Liquidation can be used by a business owner to exit if they feel like the liquidation would yield cash faster or that the individual assets (i.e. property, plant, and equipment) of the business were more liquid than the business as a going entity.

Exit Strategy for Startups

Startups looking for VC investment can include an exit strategy as part of their initial pitch. It is not mandatory. Sometimes this can work when well, for example, when a startup founder is well versed in the industry and has a credible 5-year forecast.

Startup exit strategies depend on a few different factors:

Market timing

How have IPOs for startups performed in the past 12-18 months? If public markets are showing enthusiasm for companies like the one being pitched, it makes it easier to show how an exit can occur.

Comparable transactions

Similar to IPOs, companies can use comparable transactions (industry or private equity sales) to show investors their route to an exit. The comparable firms should be operating in the same or close to the same competitive space.

How to Put Together a Business Exit Plan

Remember that the purpose of the plan is to make the new business owner transition as straightforward as possible.

Although the steps which follow are general, nobody knows a business better than its owner, so take whatever steps are necessary to make your business as marketable to potential buyers as possible.

These steps also assume that you, the owner of a business, have weighed up the options elsewhere. Personal finances, family situations, and other career options are beyond the scope of this article.

Rather, the intention of the points below is to ensure that a business will be ready to sell in the fastest possible time at a fair price.

Business exit plan

- Know the business

- Ensure that finances are in order

- Pay off creditors

- Remove yourself from the business

- Create a set of standard operating procedures

- Establish (and train) the management team

- Draw up a list of potential buyers

1. Know the business

This sounds obvious but a business can lose focus quickly in the aim of diversification, to the extent that it becomes ‘everything to every man.’

This may be useful in the short-term for revenue streams, but just be sure that your business has focus. It will help you find the right buyers when the time comes and to be able to communicate which part of the market your business occupies.

2. Ensure that finances are in order

This should be a priority regardless of any future business plans.

But if you intend to sell your business at short notice, it's best to have a clean, well-maintained set of financial statements going back at least three years.

3. Pay off creditors

The less debt that a business holds on its balance sheet, the more attractive it will be to potential buyers.

A common theme among small business owners in the US is thousands of dollars of credit card debt. This can be a red flag to many buyers and should be paid off as soon as possible.

4. Remove yourself from the business

How important are you to the day-to-day operations? If your business would lose more than 10% of its revenue were you to leave, the answer is “too important.”

If revenues are tied to the owner, buyers are not going to want to buy the business if the owner is going to leave right after.

Although it can be a challenge, seek to minimize your direct impact on the business, in turn making it more marketable.

5. Create a set of standard operating procedures

Closely related to the above point, ensure that your business has a set of standard operating procedures (SOPs), ideally in written form, that would allow any owner to maintain the business in working order merely by following a set of instructions.

6. Establish (and train) the management team

Are the existing managers capable of taking over the business and running it as is? If you leave the business for a vacation and one of your managers calls you several times, the answer to this question may be ‘no’.

They may need more training, or you may need a different set of managers. In either case, having a capable team in place will be valuable whether you decide to exit your business or not.

7. Draw up a list of potential buyers

A list of buyers should be made and refreshed on a reasonably regular basis. Ideally, you would know their criteria for buying a business, but this is not always practical.

Keeping a long list of buyers means that you can reach out to them at short notice if it is required at some point in the future.

This list is likely to include at least some of your managers or suppliers.

Importance of Exit Strategy

Many owners make the mistake of thinking that a business exit plan means the same thing as a ‘retirement plan’, believing that they can start thinking about putting one together as soon as they hit 55 years of age.

This is an error. Not because your departure is impending, but because it doesn’t give you the flexibility.

Instead of looking at a business exit plan as a retirement plan, rethink it as a divestment option.

An alternative way of thinking about this is, what happens to the business owner that doesn’t have an exit strategy? Think of the value destruction that occurs to the business if something unexpected happens and the owner has to make an unplanned sale, at a discount, in unattractive market circumstances, or even at a time of personal loss.

Instead of thinking about the business exit as something that will happen in the future, rethink it as something that could happen at any moment.

Exercising critical thinking to write a business exit strategy can be exciting as well as enlightening. Thinking of an exit as an end state is not the best approach since this limits businesses to a strict definition. Rather, consider how the process can be supportive of a business' growth strategy. Take these top three considerations:

- Financial considerations: If the exit strategy has a target revenue number in 5 years then how will the business get there? What financial dashboards are needed to properly run the company? How will expenses be managed so a business does not outspend against earnings?

- Supply chain considerations: What products will need to be in your catalog to maximize margins? What inventory turns ratio are you aiming for on a monthly basis?

- People considerations: Who do I hire to grow the company exponentially? What benefits do I offer to attract the best talent but don't cause complications at the exit? How do I write the force majeure so I protect the company and employees?

A business's primary goal is long-term value generation to its customers, itself, and its stakeholders. Having a thoughtful exit strategy shows the maturity of a business's Leadership towards longevity and value creation. There are many facets of the journey from owner motivation to financial strategies.

At DealRoom we help the owners of businesses of all sizes prepare for this eventuality. Our Professional Services team is ready to help businesses think through these details. It is important that an exit strategy be a journey throughout the growth stages.

Talk to us about how our tools can be an asset for you in your exit plan.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

- Business exit strategies

What is an exit strategy in business?

Types of exit strategies, acquisition, liquidations, how to plan a successful exit, organize your financial statements, due diligence preparation, communicate with investors and stakeholders, communicate with employees and customers, secondary transactions before an exit.

The founder journey doesn’t stop after you’ve launched your startup and raised multiple rounds of venture capital. Whether your sights are set on exiting through an acquisition, merger, initial public offering (IPO), or another path, having an exit strategy in place early on can help guide your startup to success well before you ring the opening bell at NYSE or sign the final paperwork for a big merger.

An exit strategy is a business plan that outlines how and when a founder, CEO, investor, or other stakeholder will liquidate a company. There are several types of liquidity events you may plan for, including:

Public offerings

Acquisitions

Below is a basic overview of the most common exit strategies available for private companies. We recommend consulting with your startup lawyer or other advisor to help comb through the different options—and to help you weigh potential buyers.

Going public via an IPO is the ultimate dream for most entrepreneurs and business owners. But a traditional IPO isn’t for everyone—and in fact, most private companies don't exit through an IPO. A company can also list its shares publicly through a direct public offering or a SPAC (special purpose acquisition company) .

Depending on your goals, such as price-per-share, avoiding lock up periods, or keeping a set business valuation, one type of public offering will be more beneficial.

→ To learn more about the differences between traditional IPOs, direct listings, and SPA, read our IPO Readiness Guide .

Want to download a free IPO readiness checklist to maximize your chances of a successful public offering?

Download your free IPO Readiness Checklist here:

A merger is when two or more companies combine to become one (they might adopt a new name in the process). In a reverse triangular merger (the most common merger structure), the buyer forms a new subsidiary that merges with the target company, resulting in the target becoming a subsidiary of the buyer.

The biggest prep work needed for an acquisition is determining the deal structure. There are two common structures for acquisitions:

Stock sale: This happens when the target company’s stockholders sell their stock to the buyer, such that the target company becomes a wholly owned subsidiary of the buyer. In some cases, a stock sale could involve the buyer absorbing the target so the target ceases to become a distinct entity.

Asset sale: This happens when the target company sells all or most of its assets to the buyer, then dissolves and pays the proceeds of the sale to the stockholders in the company's wind-down process.

→ Learn more about asset sales and stock sales

Private equity acquisition

Private equity buyers acquire business across the financing landscape— bootstrapped , venture capital backed, private equity backed, carveouts (public and private), among others.

Leveraged buyouts (LBO) are the most common private equity investment strategy. In an LBO, the private equity firm acquires a majority stake in the company, using equity and debt . This capital typically buys out existing stakeholders, and goes on the company’s balance sheet to fund growth. The portfolio company is then responsible for paying back that debt and interest through cash resulting from the operational improvements made during the private equity firm’s ownership tenure.

Not all private equity firms use debt. Growth equity or growth buyout firms may fund transactions with minimal to no leverage, allowing the company to continue investing in growth.

Liquidation is a conversion of assets to cash or cash equivalents by selling to a consumer. This is typically an option if your business is insolvent and isn't able to pay its creditors. The liquidation process also can help with negotiating the debt down with those creditors as well as help to avoid filing for bankruptcy. When your business is liquidated, any remaining assets are paid to creditors and shareholders. Although not as common, liquidation can also be a voluntary option.

Liquidation is also an alternative to (and in most instances, is easier than) attempting to sell your business. The sale of a business requires the buyer to purchase all assets, which can become a more difficult and complex sale.

Liquidation vs. dissolution

Liquidation is part of the process of ending a business. However, if your business entity is an LLC or corporation , it will continue to exist after a liquidation and will still be subject to obligations such as annual filings and taxation requirements .

Dissolution is the process of terminating a legal business entity. When the business is dissolved, it will no longer have compliance obligations within the state in which it was incorporated or registered.

Once you’ve determined which exit option is right for you, here are some general steps you can take to prepare. Carta can help support you during this process when it comes to deal modeling, due diligence, IPO preparation, liquidity solutions, and tax planning.

Ahead of term sheet negotiations, it’s important to understand your company’s anticipated returns based on deal size and other factors so you can in turn understand your breakeven valuation. Settle any debts and address any other outstanding obligations.

You can prepare your company for an M&A deal by familiarizing yourself with what sorts of documents will be requested by the buyer and what happens during their due diligence. The due diligence process may involve sharing disclosures with potential buyers, additional financial audits and reporting, and negotiation conversations between management teams. Some due diligence processes take a couple of weeks, while others take months.

→ See an example of a M&A due diligence request list, provided by one of Carta’s partner law firms, and a leader in the M&A space, Goodwin.

Investor communications are always important, but especially leading up to an exit event. Your investors , board members , and other key stakeholders want to know how they’ll be paid out and what their expected ROI is. If you have employee owners, you may want to inform them at this time, ahead of customers.

Depending on the size and scope of your company, you may also want to share your exit plans with employees and customers ahead of time to ensure a smooth transition. This should only be done after due diligence, board approval, and other key steps are completed.

Companies can run structured secondary transactions to allow for liquidity in their shares for their stockholders at any time, but there are strategic opportunities to do so—for example, within 90 days of a primary funding round or when a cohort of early employees fully vest in their initial stock grants. If an exit is still far away, you may choose to use secondary transactions— like tender offers — as a tool to clean up your cap table by consolidating your stockholder base.

In addition, private secondary transactions can offer shareholders an opportunity to liquidate some or all of their shares while the company is still private. Liquidity can allow early investors to secure a return on their investment and can give employees the chance to cash in their equity compensation .

Related Content

How to Plan Your Exit Strategy

Candice Landau

8 min. read

Updated April 17, 2024

Many people start businesses with the goal of seeking acquisition. But others decide later that it’s time to move on—they’d like to pull their time and money out of a particular venture. It’s never too early (or too late) to start planning your exit strategy.

- What is the purpose of an exit strategy?

An exit strategy is how entrepreneurs (founders) and investors that have invested large sums of money in startup companies transfer ownership of their business to a third party. It’s how investors get a return on the money they invested in the business.

Common exit strategies include being acquired by another company, the sale of equity, or a management or employee buyout.

- Who needs an exit strategy?

For anyone seeking venture capital funding or angel investment , having a clear exit strategy is essential.

Even if you’re a small business, it’s a good idea to plan ahead and think about how you will transfer ownership of the business down the line, whether you choose to sell the business, or try to scale it and seek to be acquired. It’s never too early to plan.

- Should I include my exit strategy in my business plan?

Including your exit strategy in your business plan and in your pitch is especially important for startups that are asking for funding from angel investors or venture capitalists for funds to grow and scale.

Most of the time, small businesses don’t need to worry as much about it because they probably won’t seek investment (not all good businesses are good investments for angels and VCs). The small business founder’s goal might be to own the business themselves for the foreseeable future.

- What type of exit strategy is right for my business?

This list should give you an idea of common types of exit strategies. The type of strategy you adopt will depend on what type of company you are and your financial and strategic goals.

Here are some of the most common:

Acquisition, initial public offering (ipo), management buyout, family succession, liquidation.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

The acquisition is often known as a “merger and acquisition.” This is because, when a company decides to sell itself to another company, the buyer will often incorporate or merge the services of that company into their own product or service offerings.

This happened when Google bought YouTube, seamlessly integrating the video platform into their own search product. Now, when you google a topic, you will often notice that videos appear on your search result page.

On a smaller scale, it might happen when a coffee chain decides to buy a bakery business so that they can add a line of pastries and tarts to their menu. An acquisition or merger can be an appropriate approach for businesses of all sizes, including startups.

The best thing about an acquisition is that if you get “strategic alignment” right, you stand to sell the company for more than it may actually be worth. And, if there are multiple companies interested in your product, you may be able to raise the price further or begin a bidding war!

Reasons an outside company might seek to acquire or merge with another company range from allowing them to break into a new market, to giving them a competitive edge, or a strong built-in customer base. Or they might be interested in eliminating you as a competitor from the current market.

If you know that being acquired is your exit strategy right from the start, this gives you room to make yourself appear attractive to the companies who may be interested in purchasing you. That said, remember that those particular companies may decide not to purchase you or may never have been interested in doing so. If you do go down the road of creating a very niche product only one specific company will be interested in, you also stand to lose big time if they don’t take the bait.

This exit strategy is right for a small number of startups and larger corporations, but is not suited to most small businesses, primarily because it means convincing both investors and Wall Street analysts that stock in your business will be worth something to the general public.

For smaller companies that have already begun expanding—like restaurants that have franchised —an IPO may be a good way for the owner to recoup money spent, though it is worth noting that he or she may not be allowed to sell stock until the lock-up period has passed.

A couple of well-known examples of restaurants on the stock exchange include Buffalo Wild Wings and BJ’s .

If you think this is the right strategy for you, or you want to at least have the option of going public later, the easiest way to get listed is to seek investors that have done it before with other companies. They will know the ins and outs and be able to better prepare you for the process.