How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

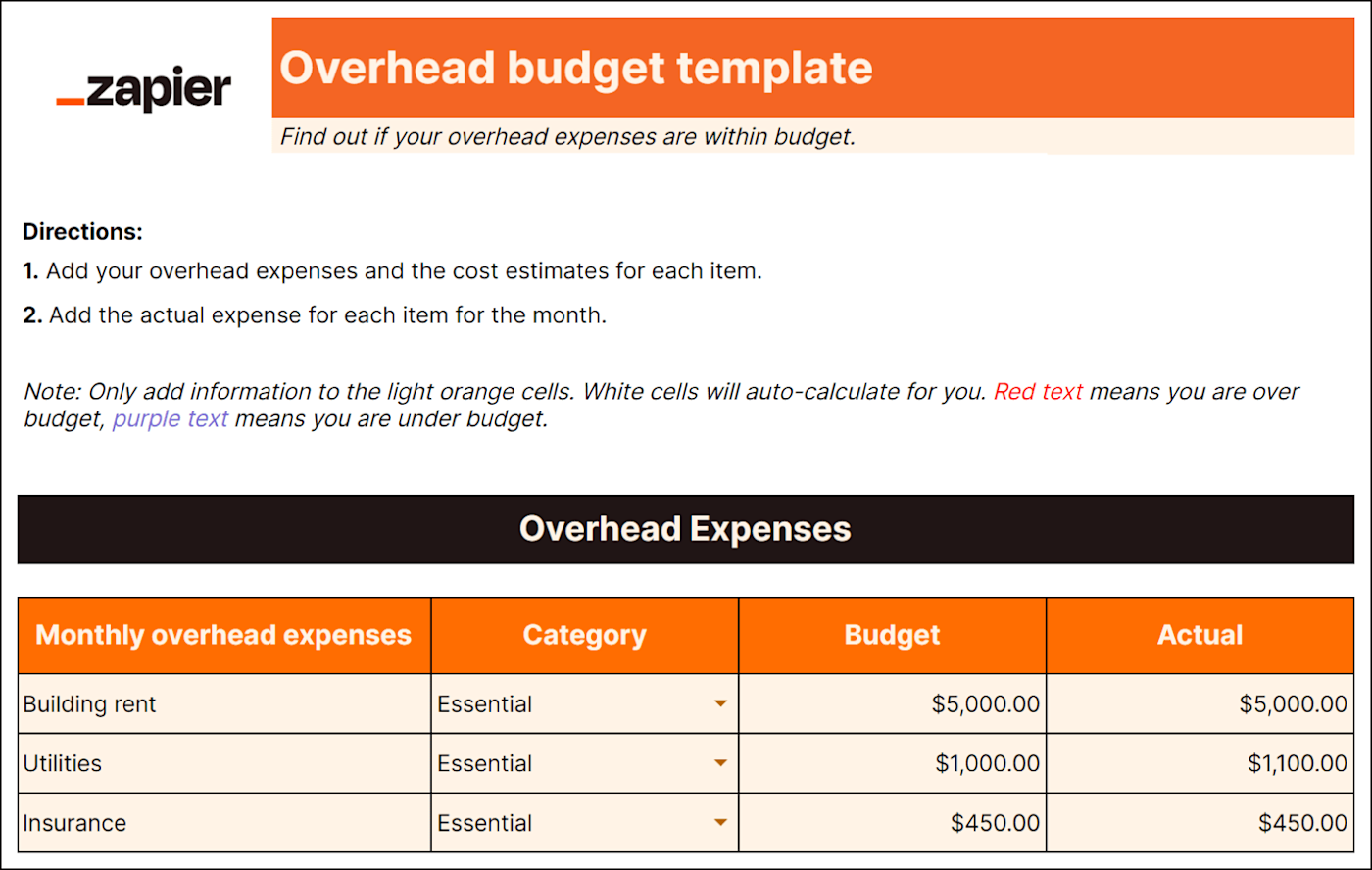

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

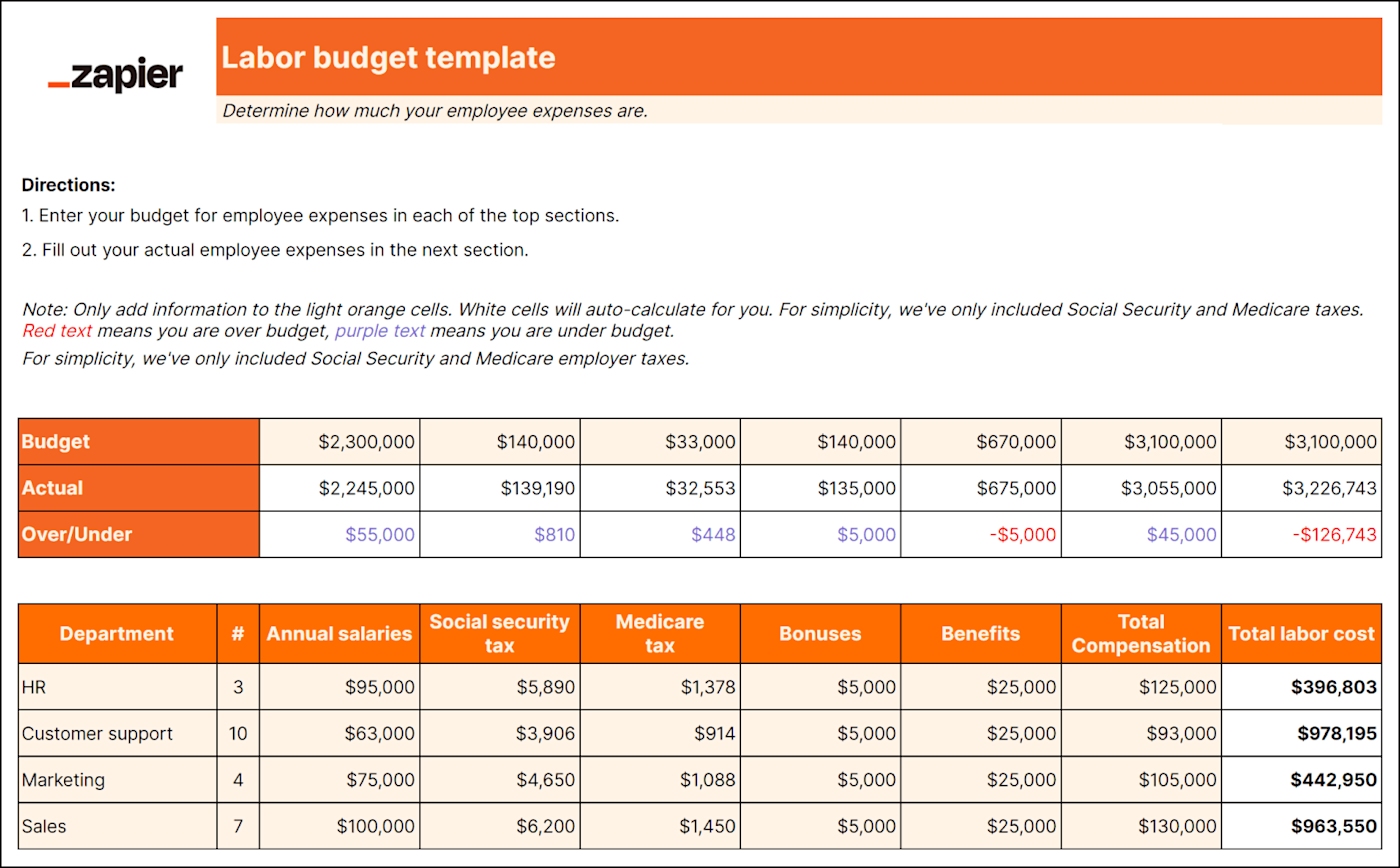

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

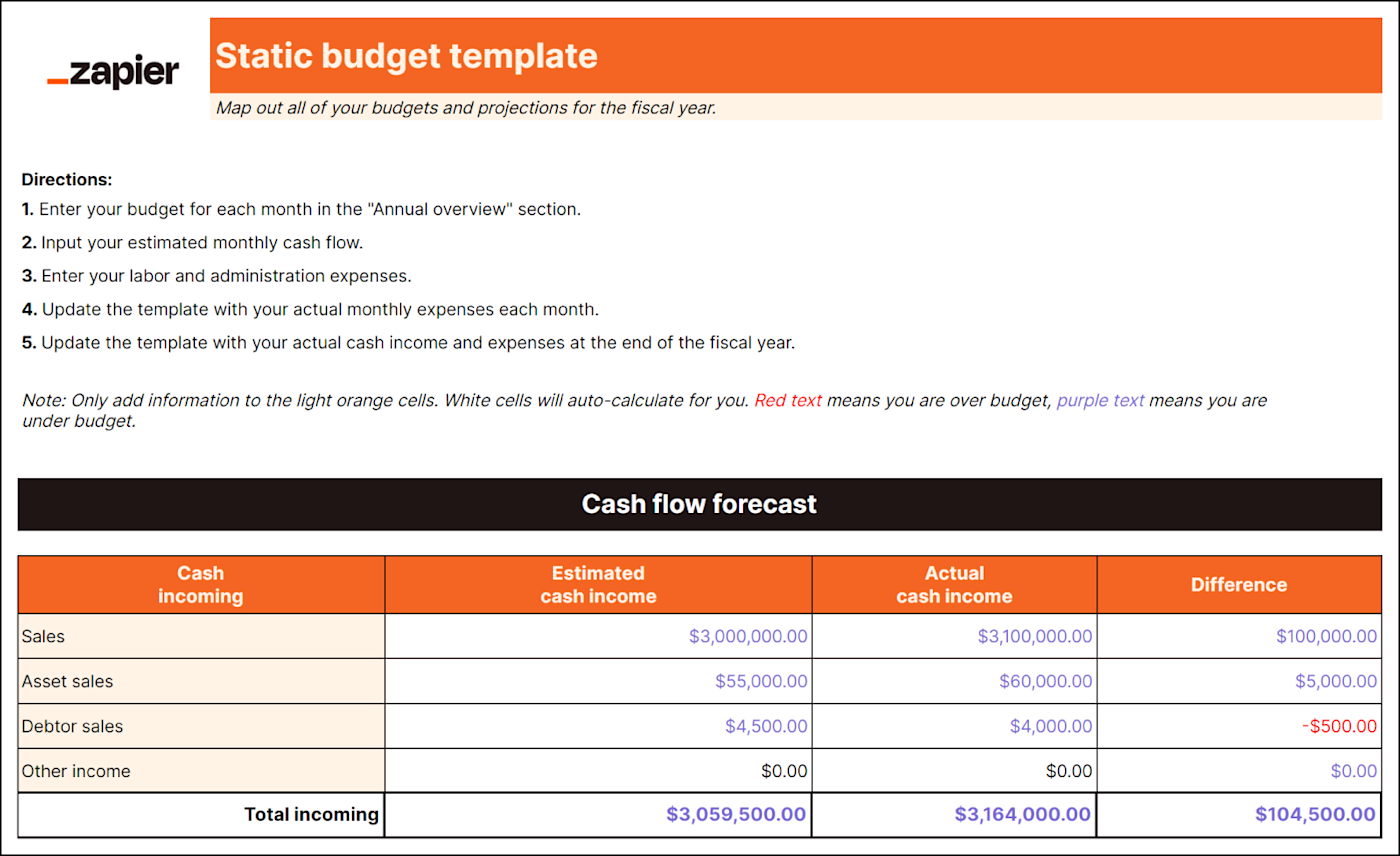

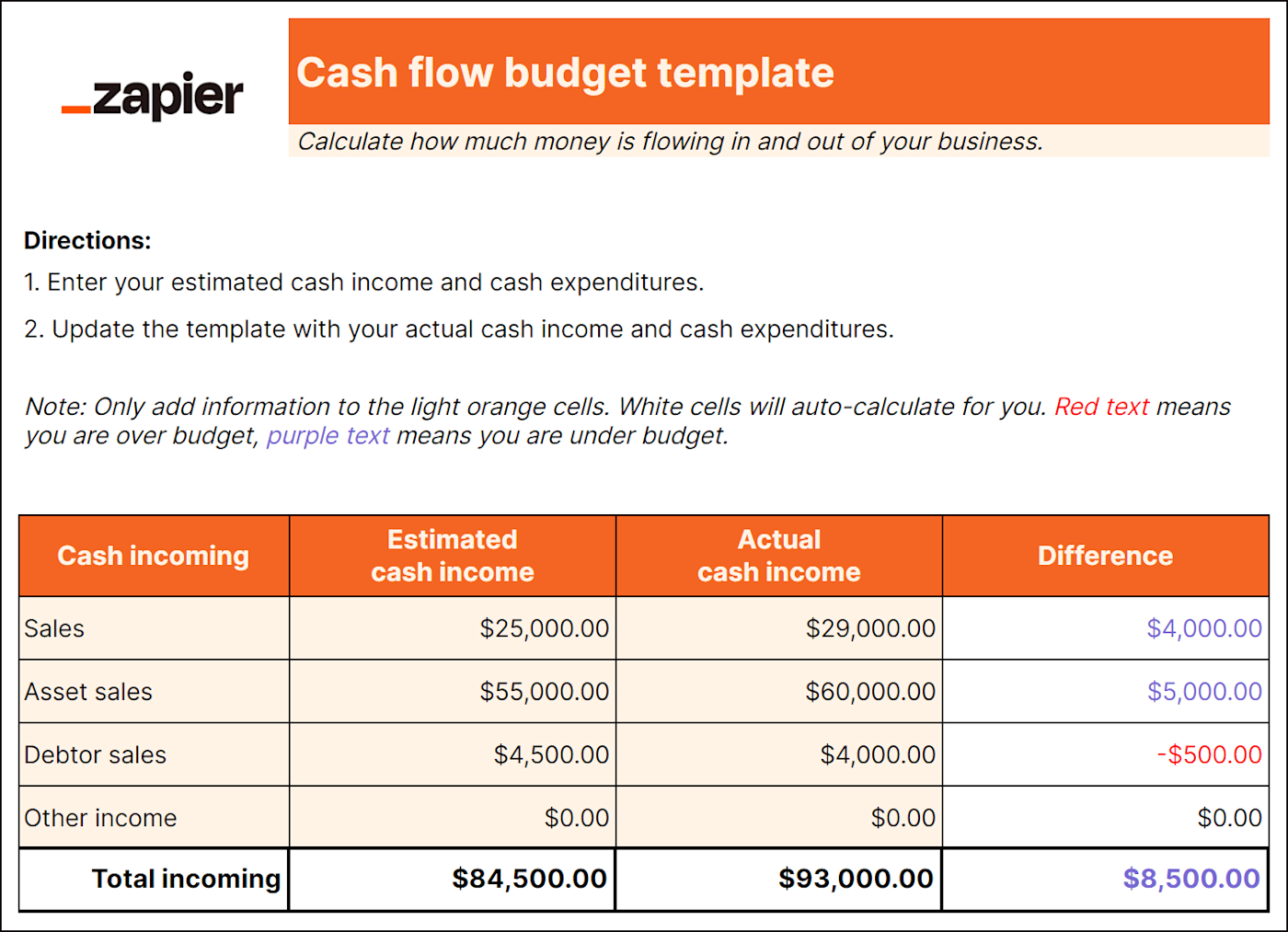

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

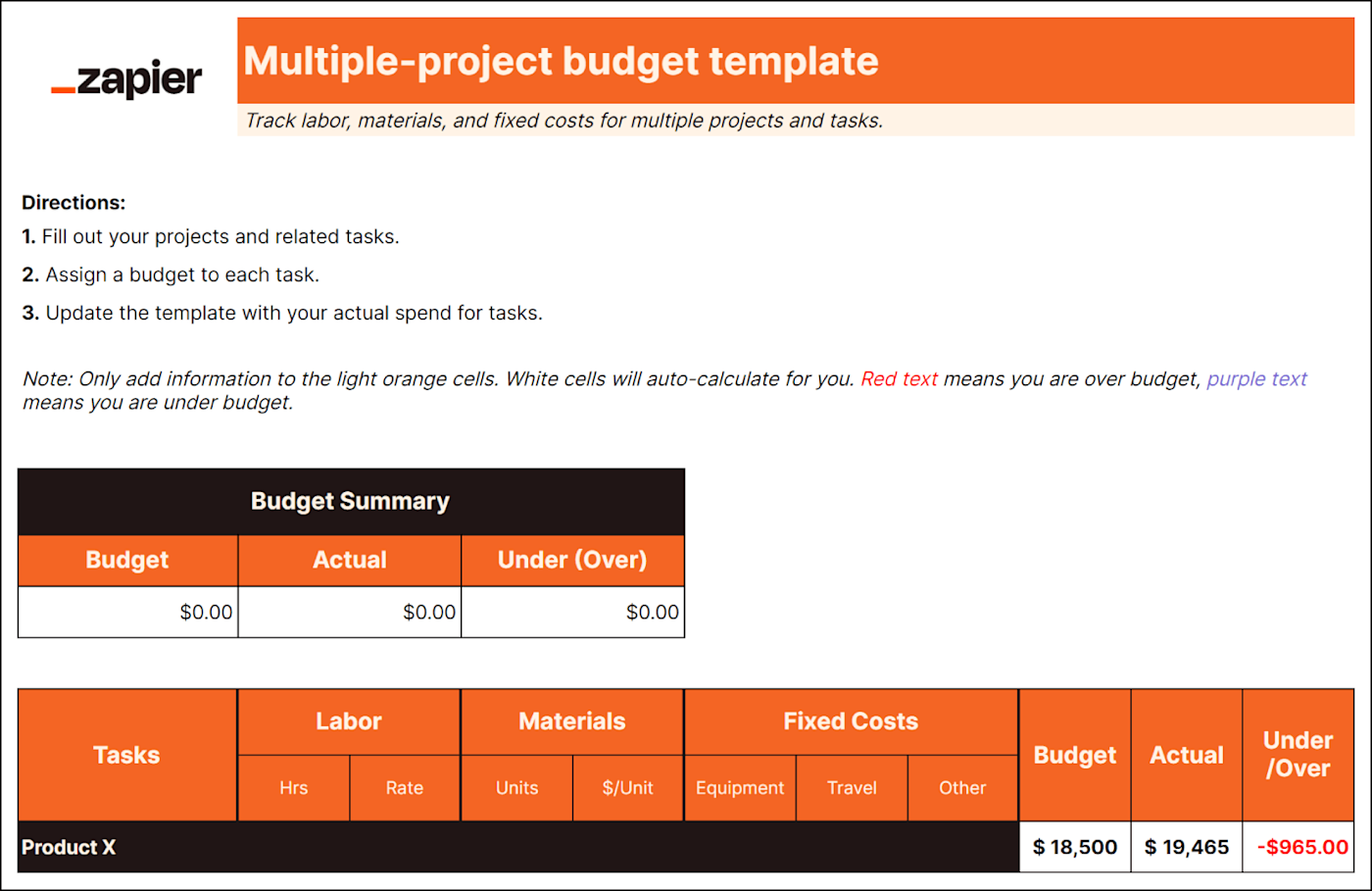

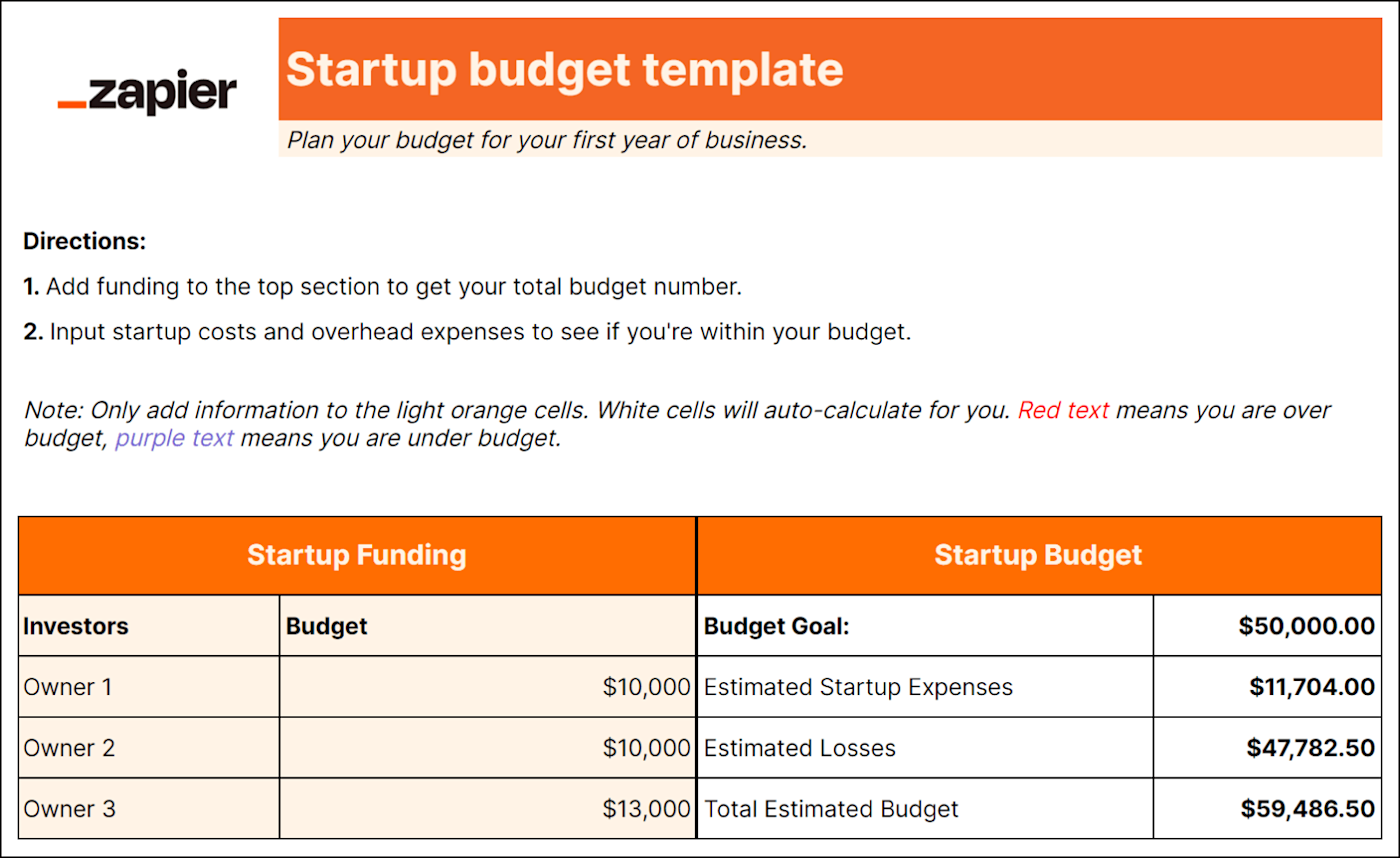

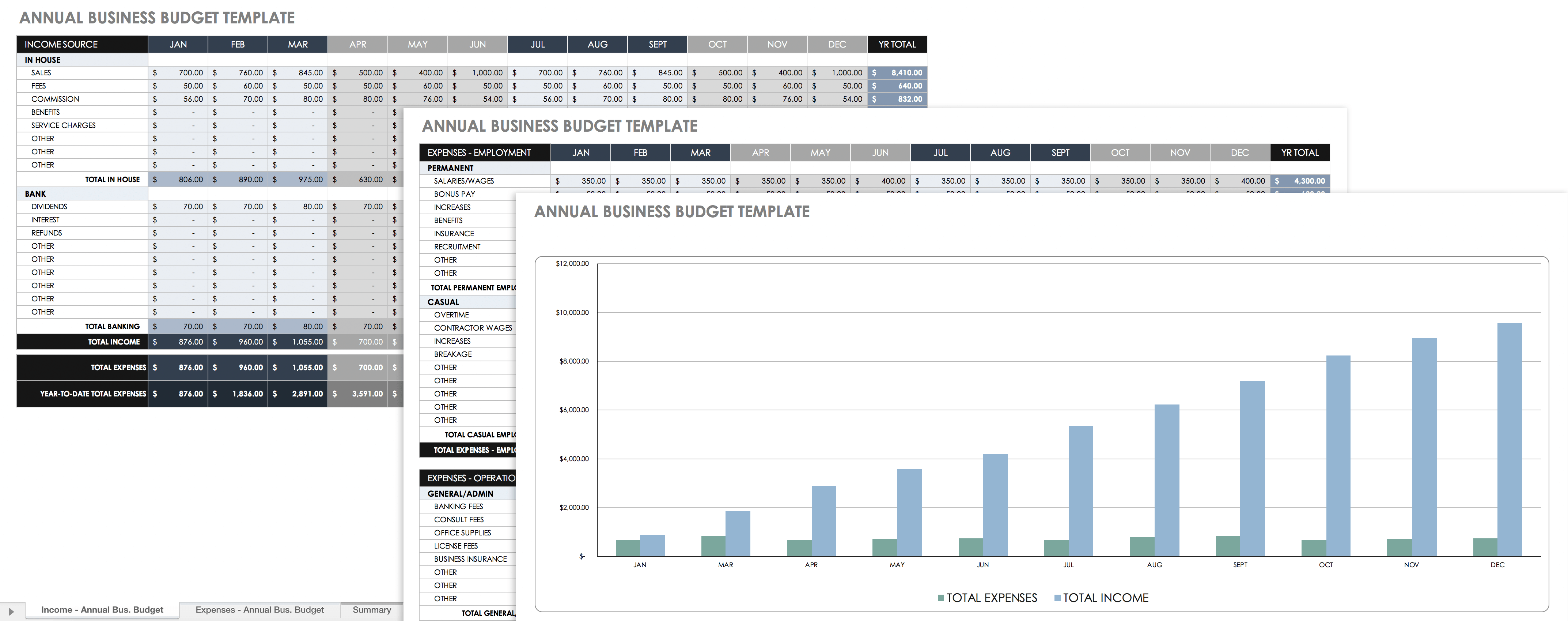

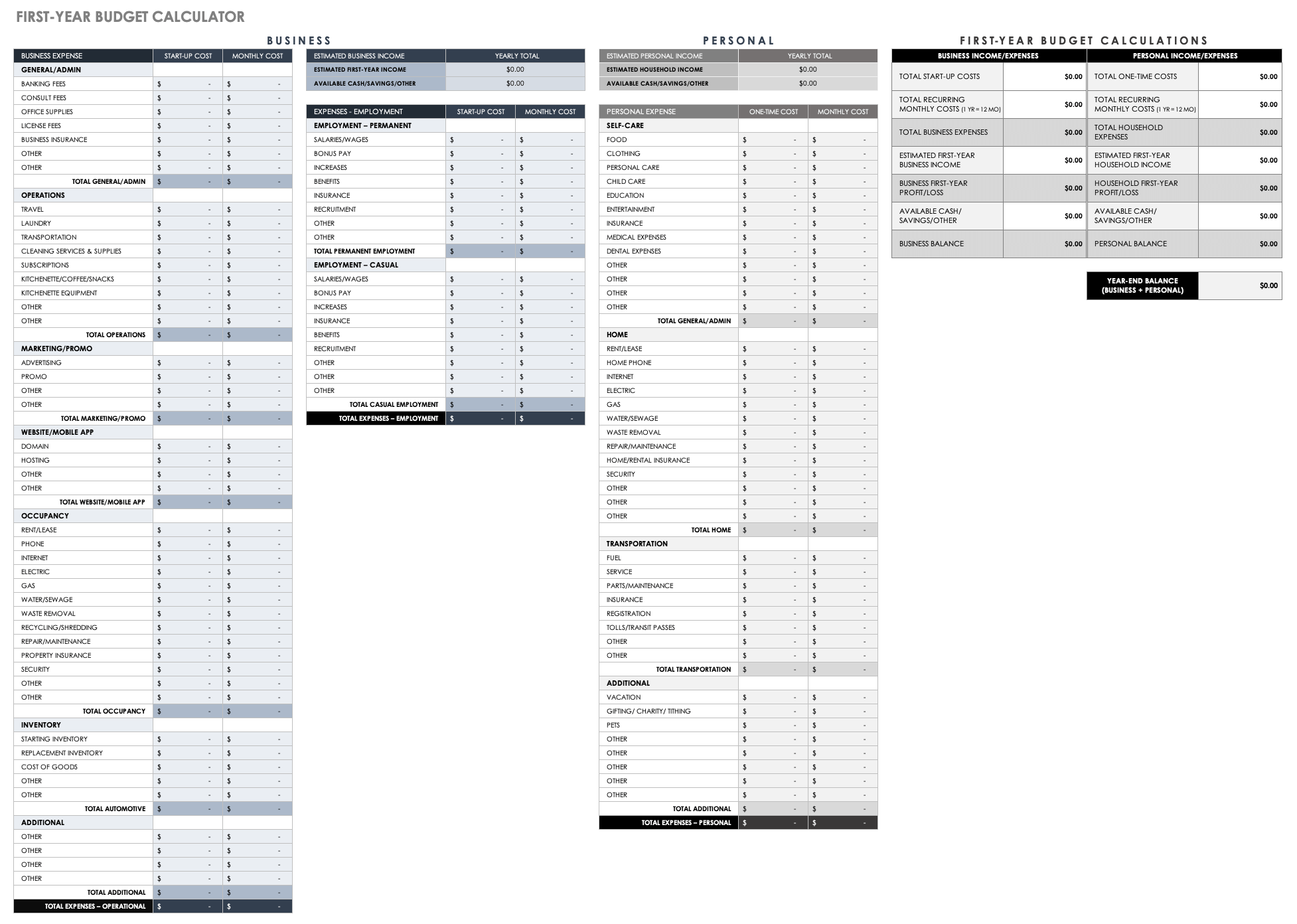

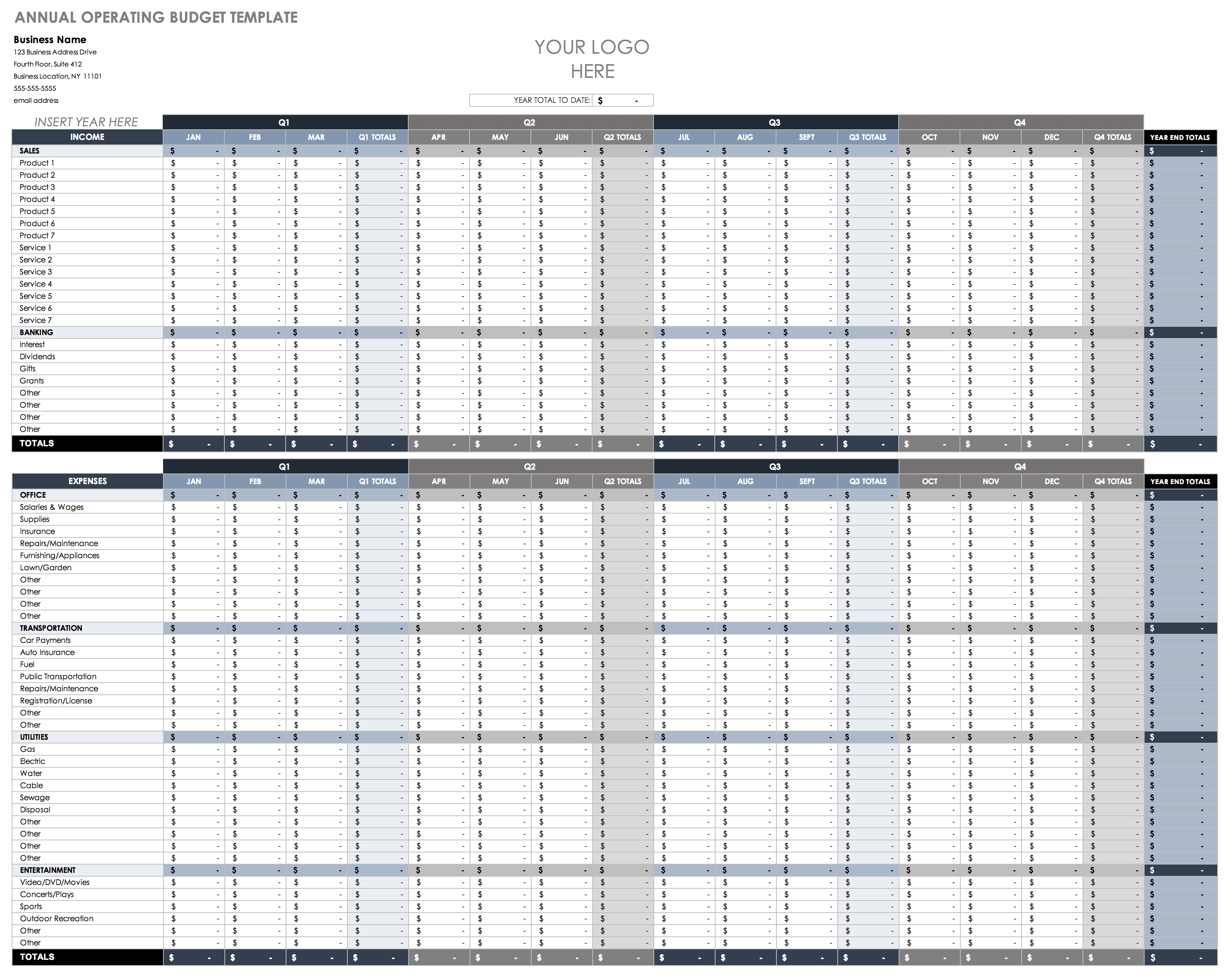

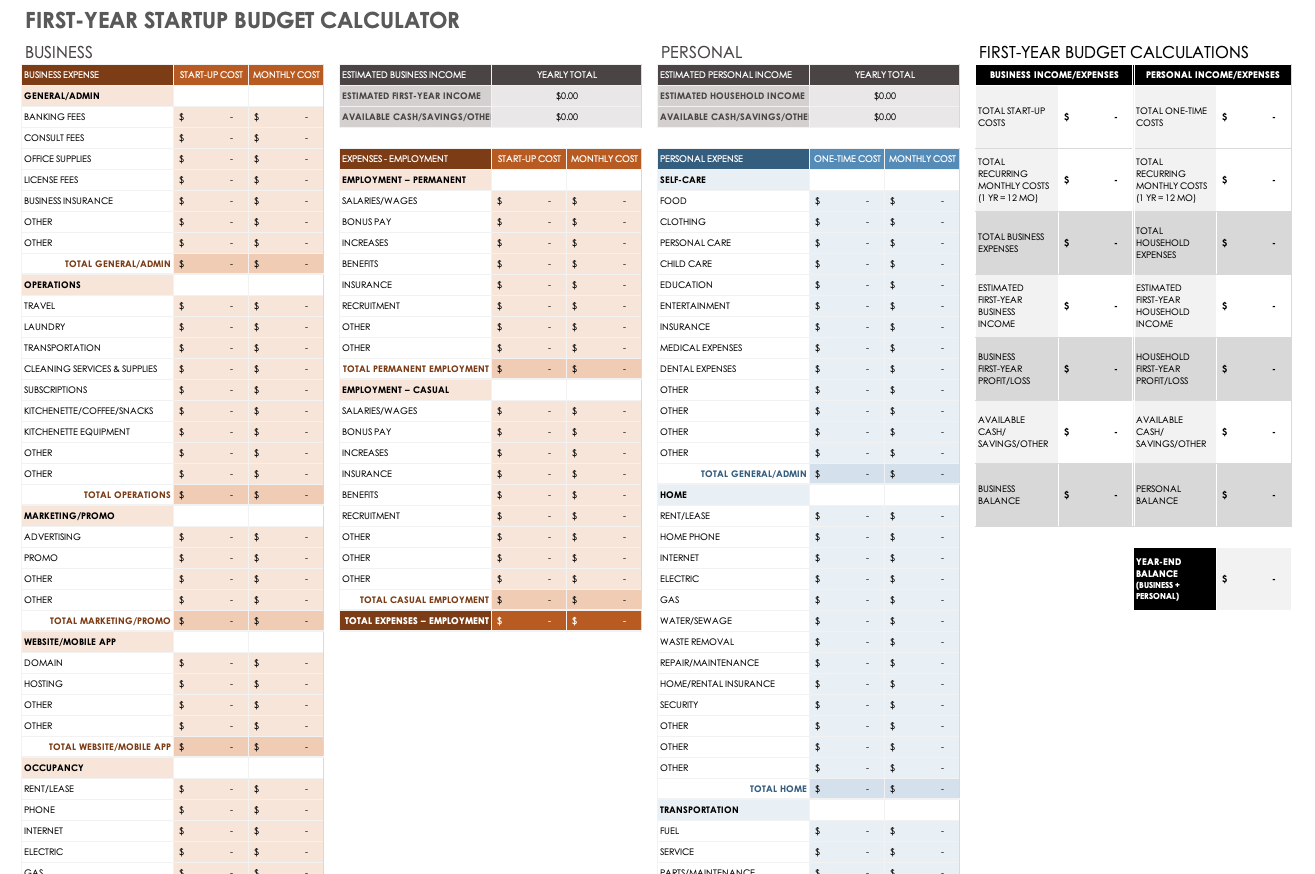

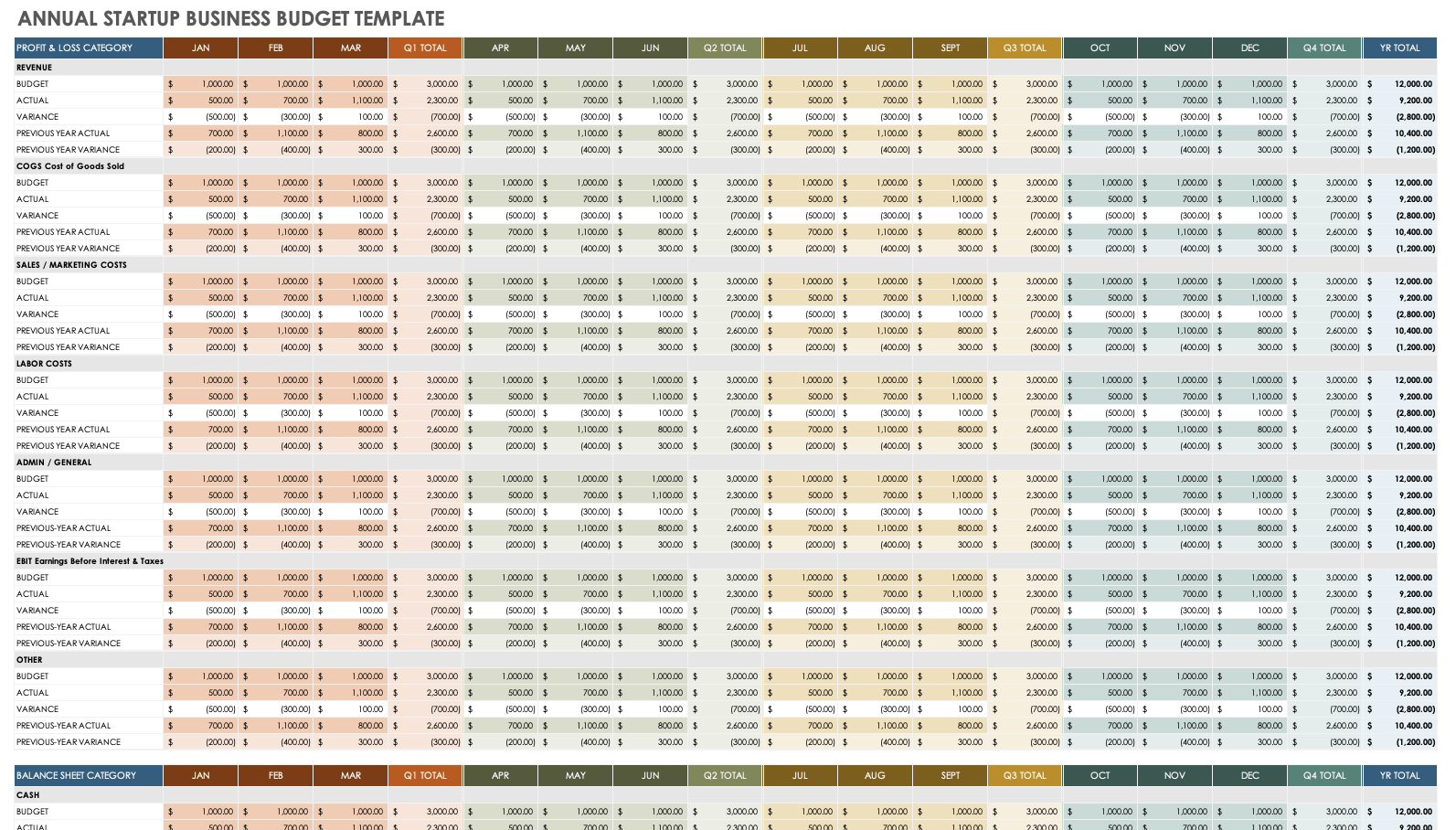

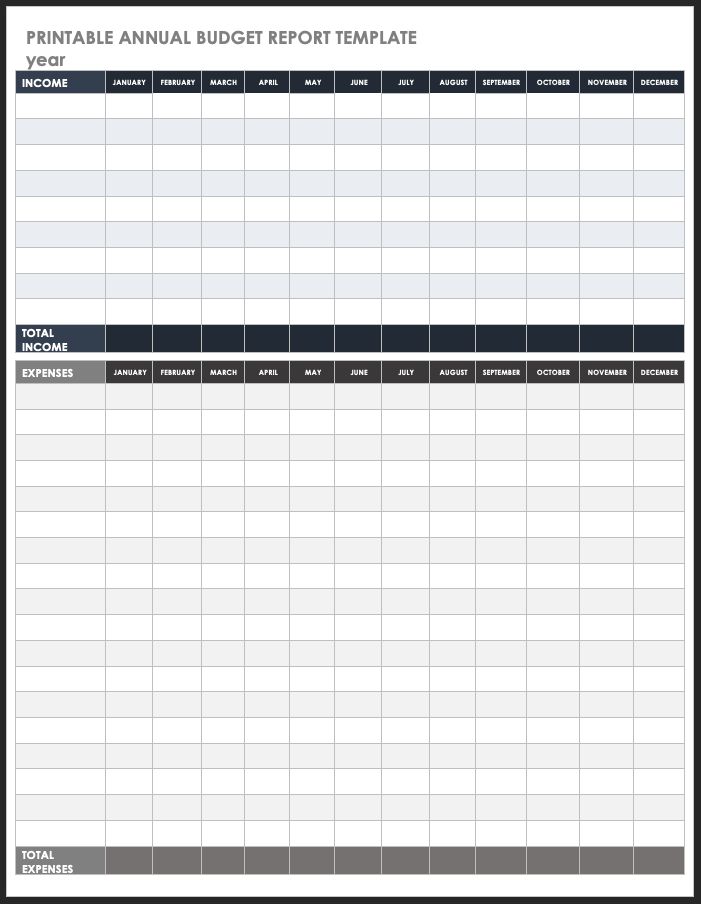

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

10 Min. Read

How to Write the Company Overview for a Business Plan

How to Write a Competitive Analysis for Your Business Plan

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to create a business budget

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Small business loans

- • Bad credit loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Portions of this article were drafted using an in-house natural language generation platform . The article was reviewed, fact-checked and edited by our editorial staff .

Key takeaways

- A business budget is a financial plan that helps estimate a company's revenue and expenses, making it an essential tool for small businesses

- The steps to creating a business budget include choosing budget and accounting software, listing expenses and forecasting revenue

- If a business finds itself in a budget deficit, strategies such as cutting costs, negotiating with suppliers and diversifying revenue streams can help

As a small business owner, keeping your finances organized through a business budget is crucial to running a successful company.

Business budgeting involves creating a financial plan that estimates future revenue and expenses to make informed financial decisions, which can ultimately move the needle on your business’s financial goals and help it grow in profitability.

What is a business budget?

A business budget is a financial plan that outlines the company’s current revenue and expenses. The budget also forecasts expected revenue that can be used for future business activities, such as purchasing equipment. It sets targets for your business’s revenue, expenses and profit and helps you determine if you’ll have more money coming in than you pay out.

A business budget is an essential tool that helps you make wise business decisions. Without it, it’s difficult to gauge your business’s financial health.

What is the difference between a cash flow statement and a business budget?

A cash flow statement (CFS) is a financial document that summarizes the movement of cash coming in and going out of a company. The CFS gauges how effectively a company manages its finances, including how it manages debt responsibilities and funds day-to-day operations.

It’s similar to a business budget in that you can see expenses and revenue. But while a budget gives a moment-in-time snapshot of your business’s financial performance compared to forecasts, the cash flow statement focuses on the actual inflows and outflows of money through your business.

Follow these steps to ensure a well-developed budget, from understanding your expenses to generating revenue and adjusting expenses to balance the budget.

1. Choose a budget and accounting software

First, you’ll want to store your expense and revenue information with accounting software to help you track your numbers and generate reports. Some software may also help you assign categories to the transactions, identify tax deductions and file taxes. Quickbooks is an example of accounting software.

Some business bank accounts also have accounting software built in, helping you stay organized by keeping your accounting and banking in one place.

2. List your business expenses

The next step in creating a small business budget is to list all your business expenses. Here are the types of expenses you want to include in your budget:

- Fixed expenses: Fixed expenses cost a fixed amount monthly or within the assessed period. Those costs include rent, insurance, salaries and loan payments.

- Variable expenses: Variable expenses can change monthly or over time, making them trickier to budget. This might include materials, direct labor, utility bills or marketing expenses.

- Annual or one-time costs: Some costs only occur a few times per year, while others you’ll only pay for as needed, such as buying new equipment. You still want to budget for these expenses by allocating a portion of your weekly or monthly budget toward one-time expenses.

- Contingency funds: Unexpected business costs can throw a wrench in your budget if not planned for. Such costs could include emergency repairs, necessary equipment purchases, sudden tax increases or unforeseen legal fees. To plan for these costs, you can create a contingency or emergency fund that’s separate from your operational budget.

- Maintenance costs: To allocate funds for maintenance costs, begin by including regular inspections and maintenance in your budget. Then, make sure to leave room for changes and unexpected maintenance costs.

3. Forecast your revenue

To estimate your future revenue, start by deciding on a timeline for your forecast. A good place to start is the previous 12 months. Your accounting software may also include revenue forecasting as one of its features, which can automate this step for you.

The timeline and your recent past growth can help you understand how much revenue you’ll generate in the future. Consider external factors that could drive revenue growth, such as planned business activities like expansion, marketing campaigns or new product launches.

You’ll also want to think about anything that might slow your growth. Many businesses experience seasonal fluctuations, which can impact your budget if you don’t plan for it. To account for these changes, list the minimum expenses required to keep your business running. Use your financial statements to understand these costs, and consider averaging out irregular expenses over the year to avoid surprises.

Ideally, your business should build a cash reserve during profitable periods to cover expenses during slower seasons. If necessary, consider various financing options, such as a business credit card or line of credit, that you can draw from to manage cash flow during peak or off times.

4. Calculate your profits

The next step in creating a business budget is to calculate your business profits. You can look at your total profits by calculating revenue minus expenses. That way, you see how much money you have to work with, called your working capital .

You should also understand your profit margins for each of your products and services, which can help you set prices or decide whether to offer a new product or service.

How to calculate your profit margins

To find out your gross profit margin, you’ll first need to calculate the gross profit. To calculate your business’s gross profit, subtract the cost of goods sold (COGS) from your total revenue. COGS includes all the expenses related to producing your products and services.

Once you have the gross profit, use the gross profit margin formula: (Revenue – COGS) / Revenue x 100. This will give you a percentage that shows how much profit you gain from that particular product after accounting for the product’s costs.

5. Make a strategy for your working capital

Knowing what to do with extra revenue, which is your working capital, is crucial for managing your business finances and growth. Here’s how to get started with a financial strategy that propels your business goals forward:

- Set spending limits for different categories in your budget. When listing your expenses, you should have set a dollar amount for each category. You can estimate this by a monthly average or a general forecasted amount.

- Set realistic short- and long-term goals. These goals will motivate you to stick to your budget and guide your spending decisions.

- Compare your actual spending with your net income and priorities. Look at the areas you’re spending and consider whether you need to reallocate money to different categories. Consider separating expenses into business needs and extras.

- Adjust your budget and actual spending. Adjust your spending to ensure you do not overspend and can allocate money towards your goals. If you need to cut spending, consider the categories that are extras, such as types of marketing that you don’t know will generate a return on investment.

6. Review your budget and forecasts regularly

Finally, review your budget regularly. By frequently checking in on your budget, you can identify any discrepancies between your planned and actual expenses and adjust accordingly. This allows you to proactively handle any financial issues that may arise rather than reacting to them after they’ve become a problem.

Regular reviews also allow you to refine your budgeting process and improve its accuracy over time. Keep in mind that your budget is not set in stone but rather a tool to guide your financial decisions and help you achieve your business goals.

What to do if you have a deficit in your business budget

Finding a deficit in your small business budget can be alarming, but there are several strategies you can employ to handle this situation.

- Do a cash flow analysis. Begin by doing a cash flow analysis to review what your business is earning and spending money on. Identify potential problems and adjust the budget as needed to prevent overspending.

- Cut nonessential business costs. Cutting spending may involve eliminating nonessential costs and transferring funds from other categories to overspent categories. Your goal is a balanced or profitable budget.

- Negotiate with suppliers. Be transparent in your communications with suppliers and explain your quality standards and why you’re seeking cost reduction. Explore options for cost reduction that do not compromise quality, such as process improvements or ordering in larger quantities.

- Create a lean business model. By removing anything that doesn’t benefit your customer, your business can potentially save time and resources. Lean business models focus on continually improving processes and customer experience without adding additional resources, time or funds.

- Add revenue and diversify revenue streams. Raising revenue requires a realistic plan with measurable goals to increase sales and overall business income. You can also consider other products and services you could offer that would make your business profitable.

- Use financing to cover temporary gaps. Applying for a small business loan can help pay bills during an unplanned shortfall. Since this will add an expense to your budget, make sure you can handle the loan repayments and your regular expenses.

- Plan for a deficit. In some cases, a planned budget deficit might be a strategic decision, such as investing in new opportunities that promise long-term benefits.

Bottom line

Having a well-developed business budget is crucial for making informed decisions. You can effectively manage your small business’s finances by tracking and analyzing your business’s inflows and outflows, forecasting your expected revenue and adjusting your budget to stay balanced.

Even in the face of a budget deficit, there are various strategies you can use to keep your business profitable, including negotiating costs with your suppliers, assessing your business operations and offering new products and services.

With a solid business budget in place, you can confidently navigate financial challenges and drive long-term success for your small business.

Frequently asked questions

What are the benefits of a business budget, what are the components of a business budget, how do you calculate fixed and variable costs in a business budget, related articles.

How to finance a small business for the holidays

Average cost of starting a small business

How to bootstrap your small business

How to start a small business

Running a business without a budget opens oneself up to a host of financial problems, including failure. But what is a business budget and what does budgeting mean?

At its core, a business budget lets companies know how much money they have, how much they’ve spent, and how much they need for future initiatives. With budgeting, business owners can stay out of debt, reduce costs, earn profits, and make decisions aimed at growing their business. This is true for both large and small businesses.

This article takes a deep dive into business budgets, types of budgets, the meaning of budgeting and why it is essential business practice.

What is a business budget?

A budget is a detailed, formal spending plan for a business for a specified time period (a month, quarter, or year). It is a forward-looking document estimating a company’s expenses and revenue within that period. A budget provides the necessary information for a business to fund and fulfil its commitments and make a profit while making sure it has money left over for unexpected expenses and future ventures.

Components of a budget

Understanding a business budget requires a clear understanding of its components:

This is the projected income from sales, investments, or other sources. This estimate is usually based on past financial records or, in the case of a new business, from the revenue of rival companies. While estimating revenue, it is important to take note of lean periods when business and revenue are down and factor in a financial cushion to tide over them.

2. Expenses

This component is split into:

- Fixed costs , or expenses that remain constant, such as rent, lease, utilities, salaries, insurance, legal and accounting fees.

- Variable costs , or production-dependent fluctuating expenses, such as raw material prices, labour costs, packaging charges, shipping and transportation fees.

- One-time expenses , such as money spent on a new building, furniture, equipment, software, or product patent.

This is what is left after subtracting estimated costs from revenue. Profit is key to making investment decisions.

4. Cash flow

This is money that flows in (income) and out (expenses) of a business and helps companies predict future earnings. It is important to know not only how much money is coming in or going out but also when (peak and lean seasons) to make the right projections.

Some people might confuse a business budget with a cash flow statement because both track how money travels in and out of a company. The difference is that a cash flow statement is a summary of the movement of money while a budget serves a greater purpose as a tool for decision-making.

Types of budgets

There are different types of budgets in use, depending on the size, resources, and market position of businesses. A company typically has a Master Budget , which presents a broad overview of its finances. Within the Master Budget are multiple lower-level budgets.

Budgets might be specific to a department, subsidiary, or project. Depending on the time frame, they can also be long-term or short-term. Annual budgets are the norm but many companies also have monthly and quarterly budgets. Similarly, a business can use a long-term budget to plan financial goals three, five, or even 10 years down the line.

Then there are static and flexible budgets. With fixed revenue and expense estimates, a static budget isn’t affected by ups and downs in sales. It is mostly used by organisations with fixed funds, such as government agencies and non-profits. A flexible budget, on the other hand, adjusts to changes in production and sales volumes or external economic factors. It is ideal for businesses that are new or seasonal or have varying income.

What does budgeting mean?

A search online will result in various budgeting meanings. But to put it simply, budgeting is the process of preparing and using a budget. It is also called budget management or spend management . Budgeting means analysing data specific to the business as well as historical and current market trends to make informed business decisions. These decisions can range from the marketing strategies to be deployed for a venture to plans to expand the business into overseas markets. For small businesses, intelligent budgeting helps them use their modest financial resources to make the most of a business opportunity.

Five stages of budget management

1. financial analysis.

Budget planners must have keen analytical skills to ensure projections are accurate and goals realistic. By researching company records and market conditions, they must accurately determine the company’s financial health and use that knowledge to make good business decisions.

2. Financial forecasting

Financial forecasting helps companies predict their performance in a pre-determined future by providing valuable insights into, say, areas where they might incur extra expenses or where investments should be added or removed altogether.

3. Budget preparation

At this stage, a company determines its revenue, expenses, and profit, breaking these down by month, quarter, and year. It also sets goals and takes important decisions (such as identifying high-priority goals and projects that require maximum funding). It is good practice to set aside an emergency fund to account for unexpected challenges.

4. Budget implementation

Many businesses fail to do this as they find their budgets restrictive. However, they must remember that a budget improves financial control. If a company struggles to implement its budget despite having the will to do so, it might be because the spend management plan has shortcomings that need to be examined.

5. Budget evaluation

Companies mustn’t forget to go back to their budgets periodically to check if the actual numbers match the projections. This will lead to necessary revisions and keep the budget relevant. Regular reviews also ensure budgets change with the way a business evolves.

Components of a growing company’s budget

At the top is the Master Budget, which has two components, the Operating Budget and the Financial Budget. These, in turn, are broken down into sub-budgets:

1. Operating Budget

It presents an overview of a company’s projected income for a period, usually up to a year. Its objective is to set financial goals and check the results. An operating budget can be created every month or quarter and relies on the following sub-budgets:

Sales Budget

It lists the expected product units, per unit price, and total revenue expected from their sale. To arrive at these estimates, budget planners depend primarily on feedback from salespeople and to a lesser extent on other information sources such as the state of the economy and pricing policies. The Sales Budget – also called a Sales Forecast or Revenue Budget – is the first step in preparing the Master Budget.

Production Budget

The next step is to determine the number of product units to be produced, taking into account the number of units already in stock and the final number that is needed. This is the only budget to be stated in unit terms instead of dollar terms. Companies use the Production Budget to adjust production levels.

Direct Materials Purchases Budget

Next comes the materials purchase budget, which states how much additional raw material is required to produce the projected number of items and how much this will cost.

Direct Labour Budget

Production requires manpower and the labour budget specifies the number of work hours and workers required and their cost.

Overhead Budget

Excluding direct materials and direct labour expenses, the Overhead Budget accounts for all other production-related costs – for use of machinery, equipment and factory premises; for indirect materials such as machine parts and safety devices for workers; for indirect labour such as supervisors and security wages; and compliance charges related to government regulations on safety, emissions, and hazardous material.

Administrative Expenses Budget

It details the administrative expenses related to the production and sale of goods, such as employee salaries and benefits, taxes, expenses associated with buying office supplies and hiring professional advisors and consultants, and so on.

Ending Finished Goods Inventory Budget

It helps set the per unit product price based on material, labour, and overhead costs.

Cost of Goods Sold Budget

This budget details direct expenses incurred on producing a company’s goods. It includes direct costs for raw materials and labour and excludes indirect expenses such as those associated with distributing the goods or hiring sales personnel to sell them.

Budgeted Income Statement

Combining information provided in the eight sub-budgets, this is a statement of a company’s net income – the earnings left after deducting the cost of goods sold, other expenses, taxes, and interests – for the budget period.

2. Financial Budget

The second component of the Master Budget, the Financial Budget serves as a strategic plan for managing a company’s assets, liabilities, income, expenses, cash flow, and investments. It helps companies arrive at their net profit (earnings minus operating costs, taxes, and interest) at the end of the budgeting process. The Financial Budget is mostly used by larger firms to carry out long-term plans, but it can be invaluable to small and growing businesses as it presents a clear view of their financial resources, which can greatly help in decision-making. Like the Operating Budget, the Financial Budget is split into sub-budgets:

Capital Expenditures Budget

It is a list of expenses incurred on the purchase and maintenance of fixed assets such as machinery, equipment, and plants. Most small and growing businesses don’t own their own factories and, therefore, have conservative capital expenditures. A typical Capital Expenditures Budget for a growing business might include money spent on buying software or leasing equipment.

Cash Budget

This is of special interest to small and medium businesses, which typically operate on cash. Usually prepared on a monthly basis, a Cash Budget tells companies how much money they have (net working capital) at the month-end. They also pinpoint areas where the company might be overspending or underspending.

Budgeted Balance Sheet

A statement of expected assets and liabilities at the end of the budget period. It is drawn from information provided in the Capital Expenditures, Cash, and Operating Budgets.

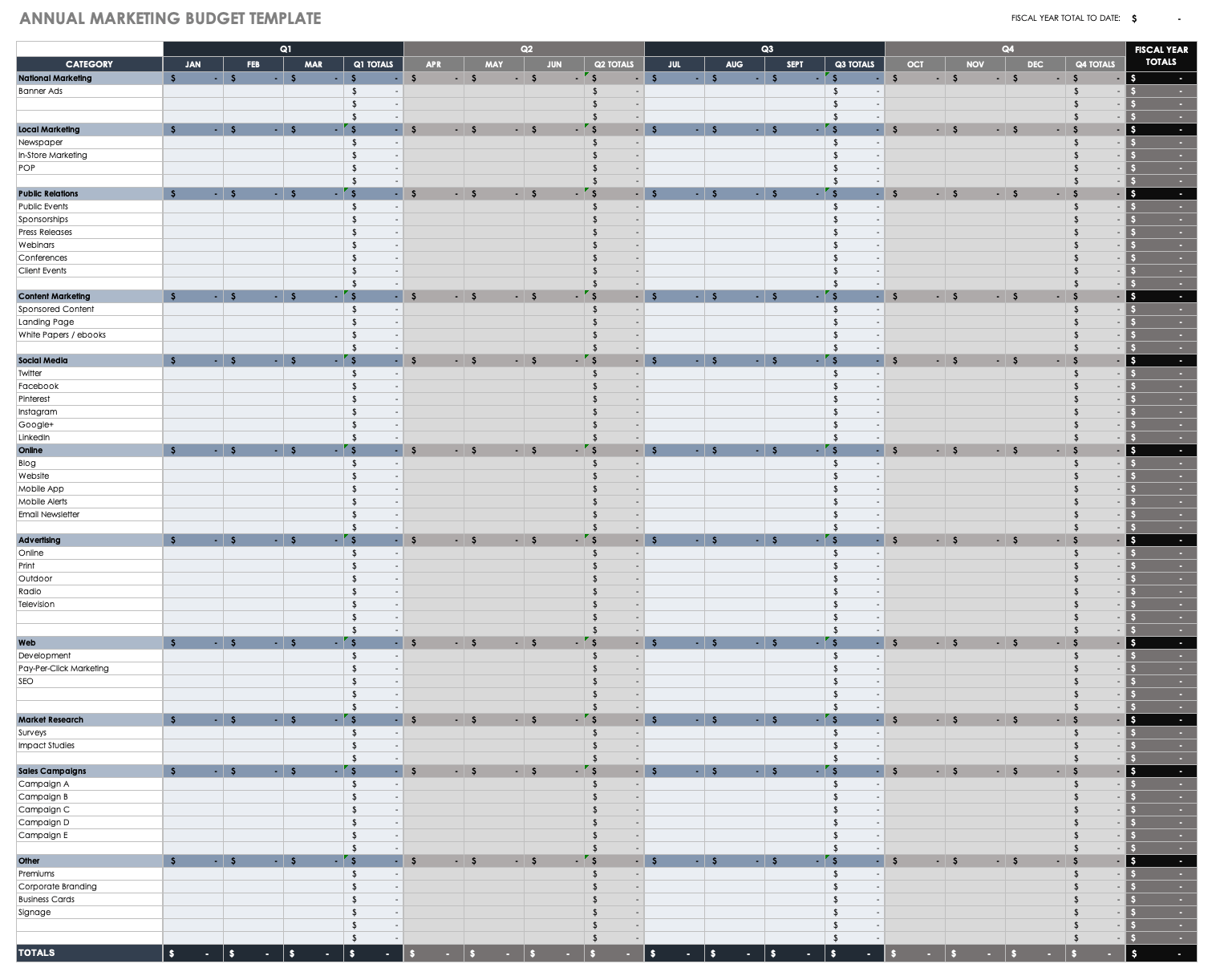

Additionally, many growing businesses have department-specific budgets such as an IT budget (hardware, software, personnel, outsourcing costs), HR budget (recruitment, training, learning and development, salaries and benefits), and a marketing budget (advertising, social media, and website development).

Develop your business budget with our monthly budget Excel template

Now that we’ve covered the components of a business budget, learn to make one for your small business. This monthly budget Excel template is the perfect place to start. Input your own data into the budget template to turn it into a customised spend plan for your future endeavours, whether it is increasing sales or launching a new product. Need a marketing budget template on the double? This easy-to-use Excel template can be your guide to creating the perfect business budget.

5 budgeting benefits for small businesses

1. meeting financial goals.

All companies have financial goals – from cutting costs to increasing investments. Attaining its financial goals means a company has succeeded. But without a budget, it might not know if these goals were fulfilled at all. Another way budgeting helps businesses set and achieve goals is by replacing guesswork with accurate information and insights, maybe about opportunities waiting to be explored that they didn’t know about.

2. Ready for emergencies

In business as in life, one must plan for the unexpected. Budgeting does just that. Take the Covid-19 pandemic, which saw scores of businesses shut shop. Those that survived probably had a little fund cushion to fall back on. As previously mentioned, setting aside a contingency fund is crucial in budget management. It can help companies tide over emergencies like economic recessions and even the general unpredictability of running a small business.

3. Planning ahead

Running a business without a budget is like flying blind. Not knowing where its money is coming from or going can make companies incapable of making long-term commitments to customers/suppliers or taking advantage of opportunities. It can also deal a death blow to expansion dreams. Surely, no small business wants to stay small forever.

4. Being debt-free

With few financial resources, small companies rely on external funding to keep the business running. Failure to pay their debts can lead to loss of reputation and shut down funding avenues. To avoid this fate, businesses must meet monthly or quarterly repayment obligations and set these in their budget management plans.

5. Better decision-making

To make any business decision, an organisation needs to know how much money it can allocate for that purpose. For instance, can it afford to offer employees a raise or hire advisors to improve productivity? With the clarity a budget provides, such decisions aren’t that difficult to make. From wise allocation of resources to knowing the right time to scale up operations, small businesses have much to gain from the improved decision-making budgeting brings.

5 risks of not having a budget

1. spending money you don’t have.

Budgets help businesses forecast spending, keep up with payments, manage cash flow smoothly, and inject efficiency into expense management (employee-initiated expenses). Without a budget, a company might be spending money it doesn’t have, resulting in debt and worse.

2. Denial of funding

Banks and other financial institutions won’t lend to a company unless it has a budget detailing where the funds will be invested and how revenue will be raised to repay the debt. For the same reason, investors won’t put their money in a business unless they see a spend management document. For small businesses, a lack of funding doesn’t just put the lid on expansion plans. It could very well put the survival of the business on the line.

3. Poor product pricing

Companies price their products on the basis of what they need to spend to produce them. Without the accurate cost estimates budgeting provides, they might not be setting optimal prices for profitable products. Or, they might be wasting their resources on products with insignificant profit margins.

4. Failed commitments and unhappy clients

Without proper spend management, small businesses may run out of funds and fail to deliver on their commitments, leading to unhappy clients who won’t think twice before moving to more competent rivals. Such a loss of reputation can be permanently damaging for small companies and start-ups.

5. Helpless in changing conditions

Doing business is fraught with challenges and changes. It isn’t possible to predict every change but a budget gives businesses the flexibility to adjust quickly – perhaps, by cutting costs in the face of a sudden dip in sales. On the other hand, the absence of a budget makes businesses less agile and incapable of adapting to change.

How budgeting works – the methods

Are you a start-up, a small business, or a large corporation? The size of a business is one of many factors determining what budgeting methodology works best for you. Others include spend patterns, sales performances, and scale of resources.

- Incremental budgeting: This involves adjusting your previous budget by an increment or percentage to arrive at your current budget. It suits established businesses with historical data and companies whose funding patterns aren’t subject to sudden changes. Incremental budgeting is easy, uncomplicated, and common practice. But it can promote unnecessary spending and doesn’t account for external factors (changing market conditions).

- Zero-based budgeting: Here, a business creates a fresh budget from scratch, assuming it begins at zero. Each dollar requested must therefore be justified. Zero-based budgeting is ideal for companies of all sizes, but particularly for those that want to focus on specific goals. It ensures resources are allocated efficiently and unnecessary expenses curbed. However, the process can be time-consuming.

- Value proposition budgeting: This method lies midway between incremental and zero-based budgeting. It determines whether the value created from a product for the company and its stakeholders, including customers, justifies the cost of producing it. By helping companies prioritise products with high customer value, it helps reduce unnecessary expenses. As such, it is considered a good fit for small businesses.

- Activity-based budgeting: It analyses activities – any activity that incurs a cost – to predict expenses. With activity-based budgeting, companies can pinpoint where each dollar goes, making it easier to cut costs where feasible and predict how much profit can be earned. On the flip side, this type of budgeting is time-consuming, expensive, and requires expert analysts. It is commonly used by large companies with considerable revenue.

- Cash flow budgeting: As the name suggests, this method estimates how much cash flows in and out of a business over a specific period. This insight helps businesses use allocated funds wisely, ensuring there is enough to maintain day-to-day operations and also a little left over at the end of the budget period. Cash flow budgeting is suitable for all businesses, but it might be difficult for companies with thin profit margins.

- Surplus budgeting: This comes into play when the estimated revenue exceeds total expenditure, resulting in a surplus. Surplus budgeting helps companies make prudent use of this surplus – for example, should it be used to grow the business or put aside for use during an emergency?

Budgeting methods can also vary according to the type of accounting used:

- Cash accounting: This method records income only after it has been received in the company bank account and expenses after the money has left the account.

- Accrual accounting: Here, revenue is recorded when it is earned, not when it enters the bank account. Similarly, expenses are recorded when they are billed, not when money leaves the account.

Principles of successful budgeting

To come up with a well-thought-out budget, business owners must stand by these principles:

Be realistic

Set goals that can be reasonably achieved. Similarly, make sure the company doesn’t overestimate its projected income. Inaccurate projections not only cause operational problems but also harm a company’s credibility.

Be flexible

Running a business can be unpredictable and budgets should be built to adapt to changing conditions. Whether it is an unexpected spike in raw material prices or a sudden shortage of shipping containers (which much of the world witnessed in 2021), make sure your budget has the elbow room to account for the unexpected. Again, earmarking savings for an emergency fund should be a golden rule of budgeting, if it isn’t already.

Be accurate

A budget must be accurate when it comes to tracking expenses – especially purchases made in cash, which are often the biggest source of budget leaks. A budget that doesn’t account for every dollar will present a distorted expenditure estimate, which can endanger the entire budgeting process.

Be inclusive

When a company holds its employees responsible for results, it should also include them in budget preparation and seek their opinion at the goal-setting stage. By incorporating their work experience and knowledge in the budget, employers can significantly increase their chances of success and boost their commitment to work.

Hold regular reviews

Weekly, monthly, quarterly or yearly, a company’s financial goals and budgets must be revisited periodically to ensure the results match the projections. The review process should be standardised and a team set aside for it. Evaluations require manpower, time, and effort, but they are the only way to ensure the budget is fulfilling its function.

Be a budgeting pro with Aspire

Budgeting for business can be difficult, but Aspire can help you take effective control of your company spend. In tune with the industry best practices stated in this article, our budgeting solutions include:

- Spend limits and notifications to prevent overspending

- Real-time visibility into all company expenses

- Delegation of budget owners within teams for better accountability

- Automated receipt reminders, seamless uploading, and easily available transaction records

- Integrated accounting software for error-free transactions

- Interest-free credit for all those times you need ready cash.

Click here to get started or to speak with an expert.

Download this article as an e-book: The Complete Guide to Business Budgeting and Budget Management

Frequently Asked Questions

How to Create a Small Business Budget in 5 Simple Steps

Want to protect the financial health of your small business? You need a business budget. Here's how to create one.

When you build a business, there are a lot of things to stay on top of, from marketing and finding new clients to building a website and establishing your digital presence. But there’s one element that you want to stay on top of from the very beginning—and that’s your business budget.

Having a detailed and accurate budget is a must if you want to build a thriving, sustainable business. But how, exactly, do you create one? What are the steps for business budget planning?

As a small business owner, let’s take a look at how to create a business budget in five simple, straightforward steps.

What’s a Business Budget—and Why Is It Important?

Before we jump into creating a business budget, let’s quickly cover what a business budget is—and why it’s so important for small businesses.

A business budget is an overview of your business funds. It outlines key information on both the current state of your finances (including income and expenses) and your long-term financial goals. Because your budget will play a key role in making sound financial decisions for your business, it should be one of the first tasks you tackle to improve business success.

And, as a financially savvy owners, you’ll also want to have a budget in place to help you:

- Make sound financial decisions. In many ways, your business budgets are like a financial road map. It helps you evaluate where your business finances currently stand—and what you need to do to hit your financial goals in the future for business growth.

- Identify where to cut spending or grow revenue. Your business budgets can help you identify areas to decrease your spending or increase your revenue, which will increase your profitability in the process, outline unexpected costs, and help your sustain your business goals.

- Land funding to grow your business. If you’re planning to apply for a business loan or raise funding from investors, you’ll need to provide a detailed budget that outlines your income and expenses.

Now that you understand why budget creation is so important to your business decisions, let’s jump into how to do it.

Business Budget Step 1: Tally Your Income Sources

First things first. When building a small business budget, you need to figure out how much money your business is bringing in each month and where that money is coming from – this will hep create an operating budget based on your business income.

Your sales figures (which you can access using the Profit & Loss report function in FreshBooks) are a great place to start. From there, you can add any other sources of income for your business throughout the month.

Your total number of income sources will depend on your business model.

For example, if you run a freelance writing business, you might have multiple sources of income from:

- Freelance writing projects

- A writing course you sell on your website

- Consulting with other writers who are starting small businesses

Or, if you run a brick-and-mortar retail business, you may only have one source of income from your store sales.

However many income sources you have, make sure to account for any and all income that’s flowing into your business—then tally all those sources to get a clear picture of your total monthly income to build your master business budget template.

Business Budget Step 2: Determine Fixed Costs

Once you’ve got a handle on your income, it’s time to get a handle of your costs—starting with fixed costs.

Your fixed costs are any expenses that stay the same from month to month. This can include expenses like rent, certain utilities (like internet or phone plans), website hosting, and payroll costs.

Review your expenses (either via your bank statements or through your FreshBooks reports) and see which costs have stayed the same from month to month. These are the expenses you’re going to categorize as fixed costs.

Once these costs are determined, add them together to get your total fixed and variable costs expense for the month.

TIP: If you’re just starting your business and don’t have financial data to review, make sure to use projected costs. For example, if you’ve signed a lease for office space, use the monthly rent you will pay moving forward.

Business Budget Step 3: Include Variable Expenses

Related articles.

Variable costs don’t come with a fixed price tag—and will vary each month based on your business performance and activity. These can include things like usage-based utilities (like electricity or gas), shipping costs, sales commissions, or travel costs.

Variable expenses will, by definition, change from month to month. When your profits are higher than expected, you can spend more on the variables that will help your business scale faster. But when your profits are lower than expected, consider cutting these variable costs until you can get your profits up.

At the end of each month, tally these expenses. Over time, you’ll get a sense of how these expenses fluctuate with your business performance or during certain months, which can help you make more accurate financial projections and budget accordingly.

Business Budget Step 4: Predict One-Time Spends

Many of your business expenses will be regular expenses that you pay for each month, whether they’re fixed or variable costs. But there are also costs that will happen far less frequently. Just don’t forget to factor those expenses when you create a budget as well.

If you know you have one-time spends on the horizon (for example, an upcoming business course or a new laptop), adding them to your budget can help you set aside the financial resources necessary to cover those expenses—and protect your business from unexpected costs in the form of a sudden or large financial burden.

On top of adding planned one-time spends to your budget, you should also add a buffer to cover any unplanned purchases or expenses, like fixing a damaged cell phone or hiring an IT consultant to deal with a security breach. That way, when an unexpected expense pops up (and they always do), you’re prepared!

Business Budget Step 5: Pull It All Together

You’ve gathered all of your income sources and all of your revenue and expenses. What’s next? Pulling it all together to get a comprehensive view of your financial standing for the month.

On your businesses master budget, you’ll want to tally your total income and your total expenses (i.e., adding your total fixed costs, variable expenses, cost of goods, and one-time spends)—then compare cash flow in (income) to cash flow out (expenses) to determine your overall profitability.

Having a hard time visualizing what a business budget looks like in action? Here’s an operating budget example to give you an idea of what your new business budget might look like each month:

A Client Hourly Earnings: $5,000 B Client Hourly Earnings: $4,500 C Client Hourly Earnings: $6,000 Product Sales: $1,500 Loans: $1,000 Savings: $1,000 Investment Income: $500

Total Income: $19,500

Fixed Costs

Rent: $1,000 Internet: $50 Payroll costs: $5,000 Website hosting: $50 Insurance: $50 Government and bank fees: $25 Cell phone: $50 Accounting services : $100 Legal services: $100

Total Fixed Costs: $6,425

Variable Expenses

Sales commissions: $2,000 Contractor wages: $500 Electricity bill: $125 Gas bill: $75 Water bill: $125 Printing services: $300 Raw materials: $200 Digital advertising costs: $750 Travel and events: $0 Transportation: $50

Total Variable Expenses: $4,125

One-Time Spends

Office furniture: $450 Office supplies for new location: $300 December business retreat: $1,000 New time tracking software: $500 Client gifts : $100

One-Time Spends: $2,350

Expenses: $12,900

Total Income ($19,500) – Total Expenses ($12,900) = Total Net Income ($6,600)

Above all, once you have a clear sense of your profitability for the month, you can use it to make the right financial decisions for your small business moving forward.

For example, if you realize you’re in the red and spending more than you earn, you might cut your spending and focus on finding new clients . Alternatively, if your income is significantly higher than your expenses, you might consider investing your profits back into your business (like investing in new software or equipment).

Use Your Business Budget to Stay on Track

Putting in the work to create a budget for your small business may seem like a hassle. But while it takes a bit of time and energy, it’s worth the extra effort. Thorough business budgeting gives you the financial insights you need to make the right decisions for your business to grow, scale, and prosper in the future.

This post was updated in October 2023

Written by Deanna deBara , Freelance Contributor

Posted on June 20, 2017

Freshly picked for you

Thanks for subscribing to the FreshBooks Blog Newsletter.

Expect the first one to arrive in your inbox in the next two weeks. Happy reading!

Business Budget: What is it & Why is it important?

According to a survey conducted by Clutch , 61 percent of small businesses have not created a formal budget. Without a budget, you may not understand how your business is performing.

Creating a budget helps you understand how much money you have, how much you have spent, and how much money you will need in the future. A budget can drive important business decisions like cutting down on unwanted expenses, increasing staff, or purchasing new equipment. If you end up with insufficient money, the budget can guide you in altering your business plan or prioritizing your spending on activities.

With the right budgeting plan, you can keep your business out of debt or find ways to reduce the debt it is currently facing. A comprehensive budget can even be used for obtaining business loans from banks or other financial institutions.

In this guide, you will learn about the importance of a business budget, the components of a good budget, and the different types of budgets.

So, what exactly is a business budget?

A business budget is a spending plan for your business based on your income and expenses. It identifies your available capital, estimates your spending, and helps you predict revenue.

A budget can help you plan your business activities and can act as a yardstick for setting up financial goals. It can help you tackle both short-term obstacles and long-term planning.

Different types of budgets

Your final budget is usually a combination of inputs from several other budgets that are prepared at a departmental level. Let’s look at the different types of budget and how they contribute to drafting a business plan.

1. Master budget

A master budget is an aggregation of lower-level budgets created by the different functional areas in an organization. It uses inputs from financial statements, the cash forecast, and the financial plan. Management teams use master budgets to plan the activities they need to achieve their business goals. In larger organizations, the senior management is responsible for creating several iterations of the master budget before it is finalized. Once it has been reviewed for the final time, funds can be allocated for specific business activities.

Smaller businesses often use spreadsheets to create their master budgets, but replacing the spreadsheets with efficient budgeting software typically reduces errors.

2. Operating budget

An operating budget shows a business’s projected revenue and the expenses associated with it for a period of time. It’s very similar to a profit and loss report. It includes fixed cost, variable cost, capital costs, and non-operating expenses. Although this budget is a high-level summary report, each line item is backed up with relevant details. This information is useful for checking whether the business is spending according to its plans.

In most organizations, the management prepares this budget at the beginning of each year. The document is updated throughout the year, either monthly or quarterly, and can be used as a forecast for consecutive years.

3. Cash budget

A cash flow budget gives you an estimate of the money that comes in or goes out of a business for a specific period in time. Organizations create cash budgets using inferences from sales forecasts and production, and by estimating the payables and receivables.

The information in this budget can help you evaluate whether you have enough liquid cash for operating, whether your money is being used productively, and whether there is and whether you are on track to earn a profit .

4. Financial budget

Businesses draft this budget to understand how much capital they’ll need and at what times for fulfilling short-term and long-term needs. It factors in assets, liabilities, and stakeholder’s equity—the important components of a balance sheet , which give you an overall idea of your business health.

5. Labor budget

For any business that is planning on hiring employees to achieve its goals, a labor budget will be important. It helps you determine the workforce you will require to achieve your goals so you can plan the payroll for all of those employees. In addition to planning regular staffing, it also helps you allocate expenses for seasonal workers.

6. Static budget

As the name suggests, this budget is an estimate of revenue and expenses that will remain fixed throughout the year. The line items in this budget can be used as goals to meet regardless of any increases or decreases in sales. Static budgets are usually prepared by nonprofits, educational institutions, or government bodies that have been allocated a fixed amount to use for their activities in each area.

Components of a budget

If you are starting a new business, the first budget you create might be a challenge, but it is a good learning experience and a good way to understand what works best for your business. The best place to start is getting to know your budget components. Initially you may need to make several assumptions to get your budget started.

1. Estimated revenue

This is the money you expect your business to make from the sale of goods and services. There are two main components of estimated revenue: sales forecast and estimated cost of goods sold or services rendered. If your business is more than a year old, then your experience will guide you in estimating these components. If your business is new, you can check the revenue of similar local businesses and use those figures to conservatively create some estimated revenue numbers. But whether your business is new or old, it is important to stay realistic to avoid over-estimating.

2. Fixed cost

When your business pays the same amount regularly for a particular expense, that is classified as a fixed cost . Some examples of fixed costs include building rent, mortgage/utility payments, employee salaries, internet service, accounting services, and insurance premiums. Factoring these expenses into the budget is important so that you can set aside the exact amount of money required to cover these expenses. They can also be a good reference point to check for problems if your business finances aren’t going as planned.

3. Variable costs

This category includes the cost of goods or services that can fluctuate based on your business success. For example, let us assume you have a product in the market that is gaining popularity. The next thing you would like to do is manufacture more of that product. The costs of the raw materials required for production, the distribution channels used for supplying the product, and the production labor will all change when you increase production, so they will all be considered variable expenses.

4. One-time expenses

These are one-off, unexpected costs that your business might incur in any given year. Some examples of these costs include replacing broken furniture or purchasing a laptop.

Since it is difficult to predict these expenses, there is no certain way to estimate for them. But it’s wise to set aside some cash for this category to stay prepared.

5. Cash flow

This is the money that travels in and out of the business. You can get an idea of it from your previous financial records and use that information to forecast your earnings for the year you’re budgeting for. You’ll want to pay attention not only to how much money is coming in, but also when. If your business has a peak season and a dry season, knowing when your cash flow is highest will help you plan when to make large purchases or investments.

The final budget component is profit, which is a number you arrive at by subtracting your estimated cost from revenue. An increase in profit means your business is growing, which is a good sign. Once you have projected how much profit you are likely to make in a year, you’ll be able to decide how much to invest in each functional area of your organization. For example, will you use your profit to invest in advertising or marketing to drive more sales?

A budget is a road map for your business. It helps you predict cash flow, identify functional areas that need improvement, and run your operations smoothly. Successful businesses invest a lot of time and effort into creating realistic budgets, because they’re an efficient way of tracking the extent to which the business has achieved its goals. Creating a budget can get a bit overwhelming for new businesses as there are no previous figures to guide their budget estimates, but with some estimates based on the performance of competitors and an understanding of the components of a budget, you can complete your first budget and have a good road map for future budgets.

Related Posts

- Cash Flow Statement - Definition and Importance

- How to Create a Business Budget for Your Small Business

- Income statement - Definition, Importance and Example

Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

may I have more materials for budgeting?

Hey Patricia,

While we appreciate suggestions from our readers, we just wanted to let you know there’s more coming up on budgeting. However, besides this article, there’s another one on – How to create a business budget for your small business. Hope it’s insightful.

Has helped me learn a few things about types of budgets

I love this article. It is very helpful. I am interested in knowing which budgeting softwares are efficient when you say,” Smaller businesses often use spreadsheets to create their master budgets, but replacing the spreadsheets with efficient budgeting software typically reduces errors.” I am looking for one software for my company!

Thank you. Respectfully,

Hi Nilamba!

Budgeting is one of the important features in Zoho Books.

A few key highlights of Zoho Books include: 1. Management of vendors and customers. 2. Creating Estimates, Sales orders and Invoices. 3. Managing your Expenses, Bills, Purchase Orders. 4. Collaborative Client Portal through which your clients can easily view all their transactions and also make payments. 5. Integrations with other Zoho apps. 6. Integrations with Online payment gateways 7. Automated Bank feeds. 8. Exhaustive Reports and much more… It is available as a mobile app on Android, iOS and Windows as well. Please do write to us at [email protected] and we will be happy to explain how Zoho Books will be a great fit for your business.

Thanks you for the level of understanding on this topic but I need new materials as technology advance.

Thank you for the information, it’s great help.

Excellent and easily elaborated..

You might also like

Switch to smart accounting. try zoho books today.

Please note that the contents of this site are not being updated since October 1, 2023.

As of October 2, 2023, Acclr Business Information Services (Info entrepreneurs) will be delivered directly by CED’s Business Information Services . To find out more about CCMM’s other Acclr services, please visit this page: Acclr – Business Services | CCMM.

- Advice and guidance

- Starting a business

- Personalized Guidance

- Seminars on Business Opportunities

- Certification of Export Documents

- Market Studies

- Export Financing

- International Trade Training

- Connection with the World Bank

- Trade Missions

- SME Passport

- Export Resources

- Import Resources

- Networking Activities

- Networking Training

- CCMM Member Directory

- Market Studies and Research Services

- Business plan

- Registration and legal structures

- Guidance for Drafting a Business Plan

- Help in Seeking Funding

- News, Grants, and Competitions

- Funding Meet-and-Greet

- Resources for Drafting a Business Plan

- Regulations / Permits / Licences

- Personalized Market Information Research

- Personalized Meetings with Guest Experts

- Government Subsidies and Programs

- Training for your employees

- Employee Management

- Interconnection Program

- Wage Subsidies

- French courses

- Merchant-Student Pairing

- Intellectual property

- Marketing and sales

- Operations management

- Hiring and managing human resources

- Growth and innovation

- Importing and exporting

- Calls for tenders

- Support organizations

- Sale / Closure / Bankruptcy

- Business intelligence

- Business lists and profiles

- Market data

- Market trends

- Business advice

- Business plan management consultant

- Legal structures consultant

- Accounting consultant

- Legal consultant

- Export certification

- Resource centre

Budgeting and business planning

Once your business is operational, it's essential to plan and tightly manage its financial performance. Creating a budgeting process is the most effective way to keep your business - and its finances - on track.

This guide outlines the advantages of business planning and budgeting and explains how to go about it. It suggests action points to help you manage your business' financial position more effectively and ensure your plans are practical.

Planning for business success

The benefits, what to include in your annual plan, a typical business planning cycle, budgets and business planning, benefits of a business budget, creating a budget, key steps in drawing up a budget, what your budget should cover, what your budget will need to include, use your budget to measure performance, review your budget regularly.

When you're running a business, it's easy to get bogged down in day-to-day problems and forget the bigger picture. However, successful businesses invest time to create and manage budgets, prepare and review business plans and regularly monitor finance and performance.

Structured planning can make all the difference to the growth of your business. It will enable you to concentrate resources on improving profits, reducing costs and increasing returns on investment.

In fact, even without a formal process, many businesses carry out the majority of the activities associated with business planning, such as thinking about growth areas, competitors, cashflow and profit.

Converting this into a cohesive process to manage your business' development doesn't have to be difficult or time-consuming. The most important thing is that plans are made, they are dynamic and are communicated to everyone involved. See the page in this guide on what to include in your annual plan.

The key benefit of business planning is that it allows you to create a focus for the direction of your business and provides targets that will help your business grow. It will also give you the opportunity to stand back and review your performance and the factors affecting your business. Business planning can give you:

- a greater ability to make continuous improvements and anticipate problems

- sound financial information on which to base decisions

- improved clarity and focus

- a greater confidence in your decision-making

The main aim of your annual business plan is to set out the strategy and action plan for your business. This should include a clear financial picture of where you stand - and expect to stand - over the coming year. Your annual business plan should include:

- an outline of changes that you want to make to your business

- potential changes to your market, customers and competition

- your objectives and goals for the year

- your key performance indicators

- any issues or problems

- any operational changes

- information about your management and people

- your financial performance and forecasts

- details of investment in the business

Business planning is most effective when it's an ongoing process. This allows you to act quickly where necessary, rather than simply reacting to events after they've happened.

- Review your current performance against last year/current year targets.

- Work out your opportunities and threats.

- Analyse your successes and failures during the previous year.

- Look at your key objectives for the coming year and change or re-establish your longer-term planning.

- Identify and refine the resource implications of your review and build a budget.

- Define the new financial year's profit-and-loss and balance-sheet targets.

- Conclude the plan.

- Review it regularly - for example, on a monthly basis - by monitoring performance, reviewing progress and achieving objectives.

- Go back to 1.

New small business owners may run their businesses in a relaxed way and may not see the need to budget. However, if you are planning for your business' future, you will need to fund your plans. Budgeting is the most effective way to control your cashflow, allowing you to invest in new opportunities at the appropriate time.

If your business is growing, you may not always be able to be hands-on with every part of it. You may have to split your budget up between different areas such as sales, production, marketing etc. You'll find that money starts to move in many different directions through your organisation - budgets are a vital tool in ensuring that you stay in control of expenditure.

A budget is a plan to:

- control your finances

- ensure you can continue to fund your current commitments

- enable you to make confident financial decisions and meet your objectives

- ensure you have enough money for your future projects

It outlines what you will spend your money on and how that spending will be financed. However, it is not a forecast. A forecast is a prediction of the future whereas a budget is a planned outcome of the future - defined by your plan that your business wants to achieve.

There are a number of benefits of drawing up a business budget, including being better able to:

- manage your money effectively

- allocate appropriate resources to projects

- monitor performance

- meet your objectives

- improve decision-making

- identify problems before they occur - such as the need to raise finance or cash flow difficulties

- plan for the future

- increase staff motivation

Creating, monitoring and managing a budget is key to business success. It should help you allocate resources where they are needed, so that your business remains profitable and successful. It need not be complicated. You simply need to work out what you are likely to earn and spend in the budget period.

Begin by asking these questions:

- What are the projected sales for the budget period? Be realistic - if you overestimate, it will cause you problems in the future.

- What are the direct costs of sales – i.e. costs of materials, components or subcontractors to make the product or supply the service?

- What are the fixed costs or overheads?

You should break down the fixed costs and overheads by type, e.g.:

- cost of premises, including rent, municipal taxes and service charges

- staff costs –e.g. wages, benefits, Québec Parental Insurance Plan (QPIP) premiums, contributions to the Québec Pension Plan (QPP) and to the financing of the Commission des normes du travail (CNT)

- utilities – e.g. heating, lighting, telephone

- printing, postage and stationery

- vehicle expenses

- equipment costs

- advertising and promotion

- travel and subsistence expenses

- legal and professional costs, including insurance

Your business may have different types of expenses, and you may need to divide up the budget by department. Don't forget to add in how much you need to pay yourself, and include an allowance for tax.

Your business plan should help in establishing projected sales, cost of sales, fixed costs and overheads, so it would be worthwhile preparing this first. See the page in this guide on planning for business success.

Once you've got figures for income and expenditure, you can work out how much money you're making. You can look at costs and work out ways to reduce them. You can see if you are likely to have cash flow problems, giving yourself time to do something about them.

When you've made a budget, you should stick to it as far as possible, but review and revise it as needed. Successful businesses often have a rolling budget, so that they are continually budgeting, e.g. for a year in advance.

There are a number of key steps you should follow to make sure your budgets and plans are as realistic and useful as possible.

Make time for budgeting

If you invest some time in creating a comprehensive and realistic budget, it will be easier to manage and ultimately more effective.

Use last year's figures - but only as a guide

Collect historical information on sales and costs if they are available - these could give you a good indication of likely sales and costs. But it's also essential to consider what your sales plans are, how your sales resources will be used and any changes in the competitive environment.

Create realistic budgets

Use historical information, your business plan and any changes in operations or priorities to budget for overheads and other fixed costs.

It's useful to work out the relationship between variable costs and sales and then use your sales forecast to project variable costs. For example, if your unit costs reduce by 10 per cent for each additional 20 per cent of sales, how much will your unit costs decrease if you have a 33 per cent rise in sales?

Make sure your budgets contain enough information for you to easily monitor the key drivers of your business such as sales, costs and working capital. Accounting software can help you manage your accounts.

Involve the right people

It's best to ask staff with financial responsibilities to provide you with estimates of figures for your budget - for example, sales targets, production costs or specific project control. If you balance their estimates against your own, you will achieve a more realistic budget. This involvement will also give them greater commitment to meeting the budget.

Decide how many budgets you really need. Many small businesses have one overall operating budget which sets out how much money is needed to run the business over the coming period - usually a year. As your business grows, your total operating budget is likely to be made up of several individual budgets such as your marketing or sales budgets.

Projected cash flow -your cash budget projects your future cash position on a month-by-month basis. Budgeting in this way is vital for small businesses as it can pinpoint any difficulties you might be having. It should be reviewed at least monthly.

Costs - typically, your business will have three kinds of costs:

- fixed costs - items such as rent, salaries and financing costs

- variable costs - including raw materials and overtime

- one-off capital costs - purchases of computer equipment or premises, for example

To forecast your costs, it can help to look at last year's records and contact your suppliers for quotes.

Revenues - sales or revenue forecasts are typically based on a combination of your sales history and how effective you expect your future efforts to be.

Using your sales and expenditure forecasts, you can prepare projected profits for the next 12 months. This will enable you to analyse your margins and other key ratios such as your return on investment.

If you base your budget on your business plan, you will be creating a financial action plan. This can serve several useful functions, particularly if you review your budgets regularly as part of your annual planning cycle.

Your budget can serve as:

- an indicator of the costs and revenues linked to each of your activities

- a way of providing information and supporting management decisions throughout the year

- a means of monitoring and controlling your business, particularly if you analyse the differences between your actual and budgeted income

Benchmarking performance

Comparing your budget year on year can be an excellent way of benchmarking your business' performance - you can compare your projected figures, for example, with previous years to measure your performance.

You can also compare your figures for projected margins and growth with those of other companies in the same sector, or across different parts of your business.

Key performance indicators

To boost your business' performance you need to understand and monitor the key "drivers" of your business - a driver is something that has a major impact on your business. There are many factors affecting every business' performance, so it is vital to focus on a handful of these and monitor them carefully.

The three key drivers for most businesses are:

- working capital

Any trends towards cash flow problems or falling profitability will show up in these figures when measured against your budgets and forecasts. They can help you spot problems early on if they are calculated on a consistent basis.

To use your budgets effectively, you will need to review and revise them frequently. This is particularly true if your business is growing and you are planning to move into new areas.

Using up to date budgets enables you to be flexible and also lets you manage your cash flow and identify what needs to be achieved in the next budgeting period.

Two main areas to consider

Your actual income - each month compare your actual income with your sales budget, by:

- analysing the reasons for any shortfall - for example lower sales volumes, flat markets, underperforming products

- considering the reasons for a particularly high turnover - for example whether your targets were too low

- comparing the timing of your income with your projections and checking that they fit