Banking Resume - Examples & How-to Guide for 2024

As someone who works in banking, you’re a trusted professional who knows their way around the finance world.

You give financial advice and guidance to your clients.

But when it comes to creating a job-winning resume, you’re the one who needs advice.

What does a good banking resume look like, anyway?

With so many people competing for the top banking jobs, you can’t afford to leave any questions unanswered.

But don’t worry! Our field-tested resume examples and tips will get your feet through the door of employment.

- A job-winning banking resume example

- How to create a banking resume that hiring managers love

- Specific tips and tricks for the banking industry

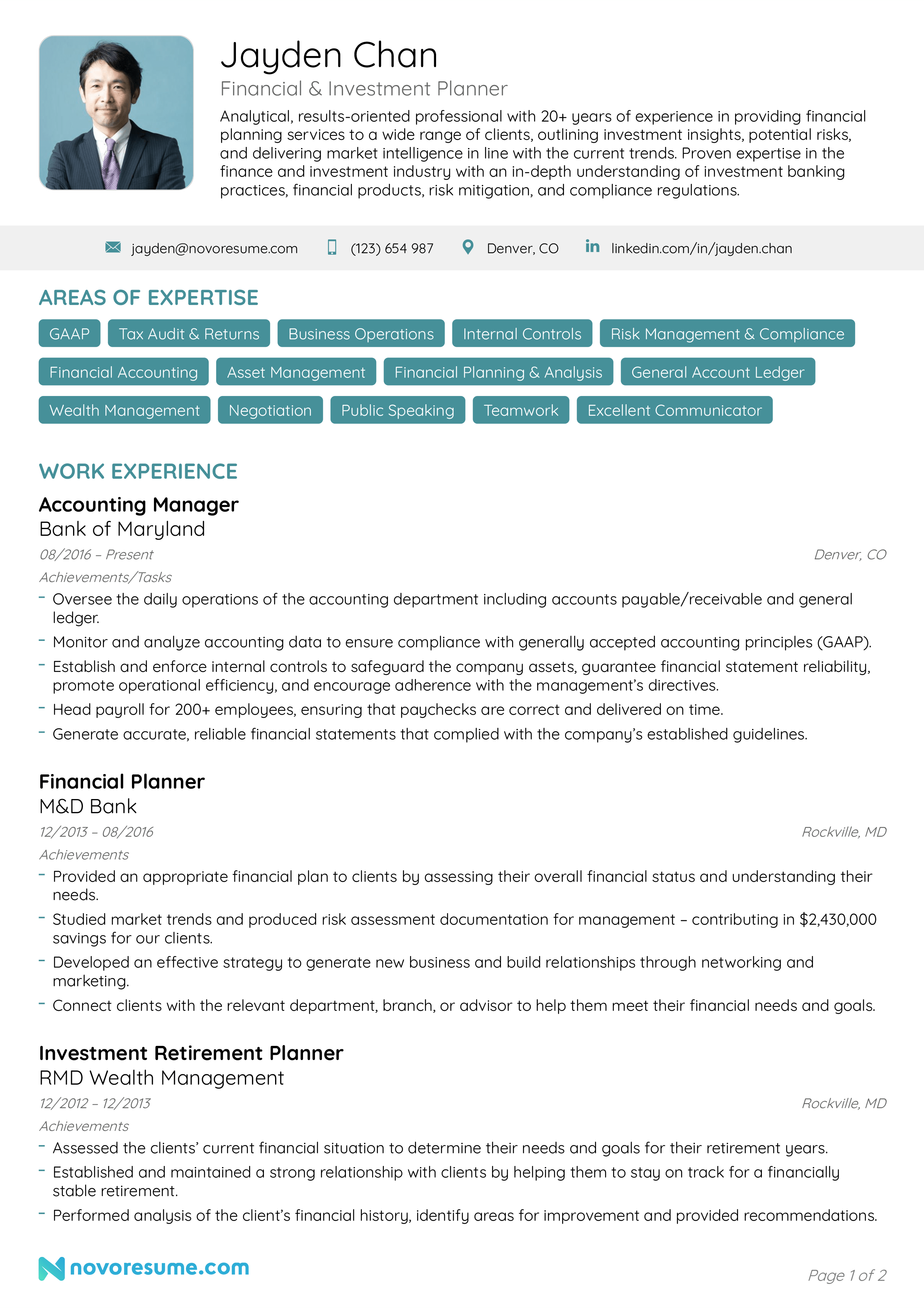

Here’s a banking resume example, built with our own resume builder :

Follow the steps below to create a banking resume of your own.

Are you looking for a resume example for a different job position? Head on over to one of our related resume examples instead:

- Bank Teller Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Financial Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

How to Format a Banking Resume

Banking is one of the fiercest industries you can enter.

As such, you really need to put your money where your mouth is.

This involves creating a resume that stands out from the competition.

But before you can get writing, you need to choose the correct format.

You see, even the richest of experience won’t impress a hiring manager that is struggling to read the content.

Have relevant banking experience? Then you’ll want to use the most popular format, known as the “ reverse-chronological ” format. It starts with your most recent work experience and then works backward through your banking history and skills.

You may also want to try these two popular formats:

- Functional Resume - This format focuses on your banking skills, which makes it the best format for those who have the relevant skills, but don’t a wealth of experience as a banker.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, making it perfect for those with both the relevant skills AND banking work experience.

- For a professional and precise resume, keep your banking resume to one-page. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins – Use one-inch margins on all sides

- Font - Pick a professional font that stands out

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As professional banker, the recruiter expects to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Banking Resume Template

Word is great for a lot of things.

Well, except for building resumes.

You see, you need a banking resume with a professional structure.

Those who have used word to create their own resume will know that one tiny change can ruin the whole structure.

For a professional banking resume, you can use a resume template .

What to Include in a Banking Resume

The main sections in a banking resume are:

- Contact Information

- Work Experience

For a banking resume that rises above the other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

So that’s a general overview, now it’s time to get specific about each of the sections.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a banker, you know that accuracy is vital.

And it’s no different than with your contact information section.

In fact, just one digit out of place can render your whole application useless.

For your resume contact information section, include:

- Title – Make this specific to the exact job you’re applying for

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Hannah Atkinson - Banker. 101-358-6095. [email protected]

- Hannah Atkinson - Banking Angel. 101-358-6095. [email protected]

How to Write a Banking Resume Summary or Objective

Creating a professional resume that stands out is the #1 goal .

But HOW is this done?

By using an opening paragraph that brings home the bacon!

These opening paragraphs come in two types: resume summary or objective.

Although slightly different, both are introductory paragraphs that sum up the main points of your resume.

The difference between a summary and objective is that:

A resume summary summarizes your most notable banking experiences and achievements. It’s designed for individuals who have multiple years of finance industry experience.

- Experienced banking professional with five years of experience at YZX BANK, where I used analytical and interpersonal skills to maintain a 99.60% customer satisfaction rating. Seeking a chance to leverage my banking skills to maximize the operations and quality of service at BANK XYZ.

A resume objective gives a quick breakdown of your professional goals and aspirations, which makes it perfect for junior bankers. Now, even though you’re talking about your own goals, it’s important to align your message to what the employer wants.

- Enthusiastic finance student looking for a banking role at BANK XYZ. Two years of experience at a local accounting firm. Excellent organization, communication, and analytical skills. Keen to support your banking team, where my interpersonal skills can be leveraged to achieve the best quality of service.

So, which one is best for bankers?

Well, a summary is suited for bankers who have been crunching the numbers for a few years, whereas an objective is suited for individuals who are new to the banking world (student, graduate, or switching careers).

- The hiring manager wants to see the benefits you will bring to the bank, not what it will do for your career. Also, banks want employees who have strong quantitative and communication skills, so use powerful action verbs and be as specific as possible.

How to Make Your Banking Work Experience Stand Out

What’s the best way to impress a recruiter?

Work experience!

Sure, the recruiter wants to hear about your education and skill-set, but nothing proves your talents like a wealth of banking experience.

Use this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

02/2017 - 01/2020

- Voted “Banker of the Year” in 2018 and 2019

- Followed best practises to process over 1000 loan applications

- Studied market trends and produced risk assessment documentation for management – contributing in $430,000 savings for our clients

- Trained and empowered a team of eight new bank tellers

For a resume that shows your best qualities, make sure to mention your achievements, rather than your daily responsibilities.

Instead of saying:

“Risk assessment”

“Studied market trends and produced risk assessment documentation for management – contributing to $430,000 in savings for our clients”

So, how exactly do the two differ?

Well, the second statement goes into much greater detail. It’s a clear example of how your abilities will have a direct impact on the success of the bank.

What if You Don’t Have Work Experience?

Maybe you’ve got a finance degree but have yet to work in a bank?

Or maybe you’re transitioning from a junior position at a competing bank?

Whatever your personal situation, you have options.

You see, despite a lack of bank experience, you are still able to include relevant skills and experiences from other previous jobs.

For example, if you’ve worked as a junior accountant, you can talk about the crossover experiences. Just like a banker, you would have to pay great attention to detail, work with customers, and enjoy working with numbers.

For the students reading this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Banking Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these exact words on nearly all banking resumes.

And since you need your banking resume stand out, we’d recommend using some power words instead:

- Spearheaded

- Conceptualized

How to List Your Education Correctly

Up next in your banker resume comes the education section.

Now, there’s more than one educational path to becoming a bank employee.

The bank manager just wants to know your education to date.

Follow this format:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Chicago State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Financial Management, Risk Analysis, Finance and Economics, Bank Lending and the Legal Environment, Quantitative Methods for Banking, and more]

Still have questions? If so, here are the most frequently asked questions:

What if I’m still studying?

- No matter if you’re still studying or not, you should still mention every year that you have studied to date

Is my high school education important?

- Only list your high school education if that is your highest form of education

What is more important for a banker, education or experience?

- If you’re an experienced banker, your work experience should be listed before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 16 Skills for a Banking Resume

Being a successful banker requires a certain set of skills.

And the bank manager needs to know you have what it takes!

Now, you could be the most skilled banker in the world, but they still need to be clearly displayed on your resume – not locked away in a bank vault!

Here are the main skills a hiring manager wants to see from a banker:

Hard Skills for a Banker:

- Balancing Ledgers

- Risk Assessment

- Mortgages and Loans

- Deposits and Withdrawals

- Account Maintenance

- Foreign Currency Exchange

- Investment Management

- Safety Deposit Boxes

- Cash Handling

Soft Skills for a Banker:

- Excellent Communicator

- Problem Solving

- Confident & Professional Manner

- Organization

- Negotiation

- Time Management

- Although bankers need soft skills, we recommend only including the main skills on your resume. It is also wise to only include soft skills that you posses, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have a resume that’ll get you through the doors of any bank.

Your #1 goal is a resume that stands above the competition.

And this is not the time to leave your future to chance!

The following sections will set you apart from the other candidates.

Awards & Certifications

Have you been awarded at your previous place of work?

Did you win any competitions at university?

Have you completed any certifications to enhance your expertise?

Whatever your case may be, the manager will want to see any relevant awards and certifications.

Awards & Certificates

- Certified Financial Planner (CFP)

- Certified Financial Analyst (CFA)

- “Learning How to Learn” - Coursera Certificate

- “Banker of the Year” 2019 - XYZ Bank

Able to speak other languages?

Whether or not the job description specifically requires it, the ability to speak another language is an impressive skill.

So if you’re able to speak another language, even to a basic standard, feel free to include it inside your resume, but only if there is space.

Order the languages by proficiency:

- Intermediate

Now, you may be wondering, “ why does the bank manager need to know about my love of golf? ”

Well, the manager doesn’t need to know, but it does show them more about who you really are.

And this is great, as banks want an employee who they’ll get along with.

As such, listing your hobbies and interests can be a good idea, especially if it involves social interaction.

If you want some ideas of hobbies & interests to put on your banking resume , we have a guide for that!

Match Your Cover Letter with Your Resume

You don’t need us to tell you how competitive the finance job market is.

And when competing with experienced professionals, you need an edge.

But HOW can you get one?

Well, with a convincing cover letter!

You see, a letter is the perfect tool for communicating with more depth and personality.

Oh, and it shows that you want THIS banking position in THIS bank.

Just like when building the resume, your cover letter also needs the correct structure.

Here’s how to do that:

We recommend writing the following for each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website.

Hiring Manager’s Contact Information

Their full name, position, location, email

Opening Paragraph

Create a powerful introduction that hooks the reader. Make sure to mention:

- The specific position you’re applying for – Banker

- An impactful summary of your most notable experiences achievements

Once you’ve impressed the hiring manager with your opener, you can delve deeper into the rest of your working history. Some of the points you can mention here are:

- Why you want to work for this specific bank

- What you know about the bank’s culture and vision

- Your most notable experiences and how they relate to this job

- If you’ve worked in similar positions at other banks

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragraph

- Thank the hiring manager for reading

- End with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “ Sincerely ” or “ Best regards. ”

Now, if you’re not a professional wordsmith, creating a job-winning cover letter is a difficult task. But don’t worry, you can use our how to write a cover letter article for guidance.

Key Takeaways

You’ve now unlocked the bank vault and discovered how to create a job-winning resume.

Let’s quickly review everything we’ve covered:

- Based on your specific circumstances, choose the correct format. We recommend starting with a reverse-chronological format, and then following the best layout practices

- Use a captivating resume summary or objective

- In the work experience section, highlight your most notable achievements, not your daily duties

- Match your banking resume with a convincing cover letter

Suggested Reading:

- How to Write a Bank Teller Resume in 2024

- How to Ace Interviews with the STAR Method [9+ Examples]

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Banking Resume Examples That Made the Cut in 2024

Banking Resume

- Banking Resume by Experience

- Banking Resumes by Role

- Write Your Banking Resume

Whether you’re an entry-level bank teller or you’ve climbed the ladder all the way to being a manager, working in banking means one thing—you definitely know your stuff. Thanks to your in-depth knowledge of the financial landscape, interpersonal skills, and keen eye for numbers, the customers of your bank walk away happy after each visit.

Between various legal regulations, keeping up to date with the latest banking software, and studying new products, you’ve got your hands full on a daily basis. However, you’ll need to find the time to create an effective resume to advance your career.

That’s where we come in. Our banking resume examples and handy resume tips helped hundreds of banking professionals land their next jobs, and now, it’s your turn!

or download as PDF

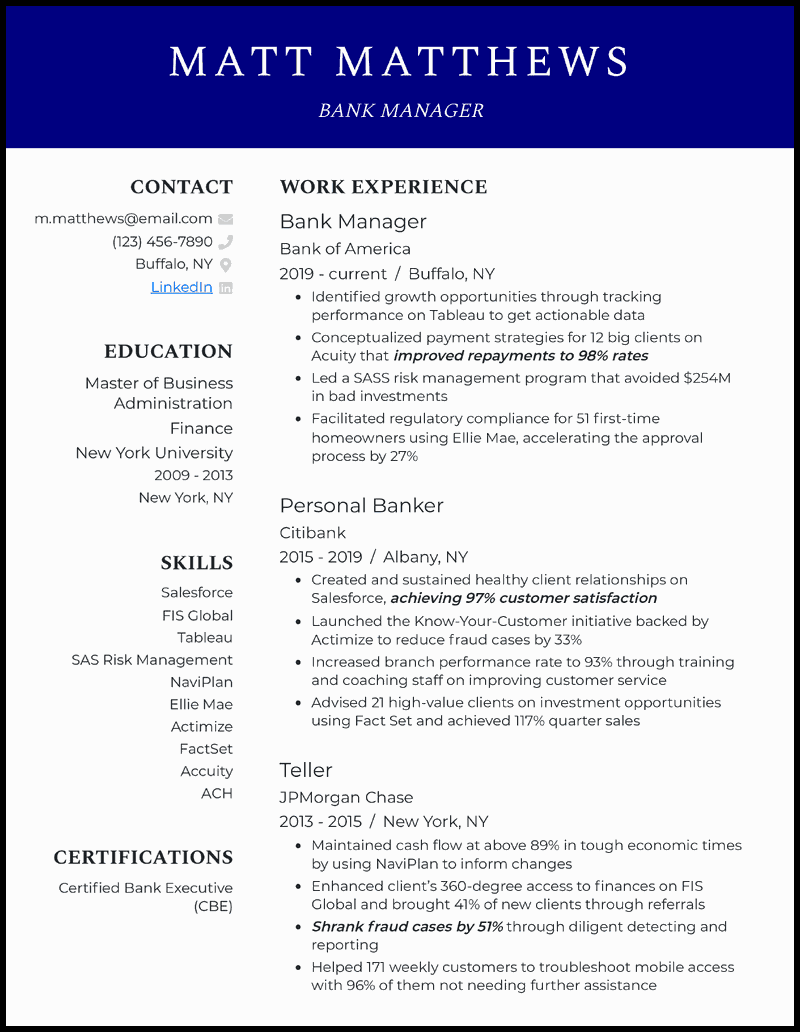

Why this resume works

- Show your workplace impact in your banking resume by detailing your numbers in driving customer satisfaction, solving problems, and cutting down process time to optimize profits.

Experienced Banker Resume

- On top of your achievements, including a certification such as a Certified Bank Teller further lends credibility to your application and gets you closer to the door.

Bank Branch Manager Resume

- To do this, display how you’ve streamlined processes, led teams, and boosted customer satisfaction. Now is great time to introduce metrics such as cutting administrative overhead, spearheading staff training, and more.

Personal Banker Resume

- Integrate your measurable achievements such as meeting sales quotas, solving customer problems, driving up profits, and so on in your personal banker resume .

Bank Manager Resume

- Impress potential employers by showing your sales performance, customer service, and business growth metrics in your bank manager resume .

Related resume examples

- Investment Banking

- Bank Teller

- Financial Analyst

Create a Banking Resume that Matches the Job Description Perfectly

The key to crafting an irresistible application is to match the job description as closely as you can.

For instance, if you’re applying for a senior bank teller role, include a good mix of skills that point to your banking proficiency as well as a couple of your interpersonal abilities. That includes things like conflict resolution and cross-selling, but also knowledge of anti-fraudulent measures and Oracle Flexcube.

In any case, try to check some of the most important boxes in the job listing. Keep things specific—instead of a vague “team player,” use more descriptive skills like “relationship building.”

Want some inspiration?

15 popular banking skills

- Fiserv Signature

- Loan Processing

- Banking Regulations

- Credit Analysis

- Oracle Flexcube

- Microsoft Dynamics

- Fraud Detection

- Basic Accounting

- Customer Service

- Sales Strategies

- FIS Horizon

- Crisis Management

- Temenos T24 Transact

Your banking work experience bullet points

You’re no stranger to various kinds of data, be it financial figures or customer satisfaction metrics. Data will be your best friend as you work on this part of your resume and discuss your greatest achievements.

Refrain from simply listing off every single task from your past jobs—instead, frame your work as accomplishments and back it up with metrics.

In banking, money speaks volumes. Talk about the types of client accounts you’ve handled, investments you’ve guided, or branch budgets you’ve handled. There are many equally useful metrics, from reducing customer complaints to lowering the average wait times at your branch.

- Discuss your success in driving profits for the bank and its clients with financial metrics, such as revenue growth, ROI, and cost-to-income ratio.

- Mention any increases in efficiency, such as the branch performance rate, directing customers to other channels to free up more tellers, or optimizing client documentation.

- Take a customer-centric approach and talk about customer satisfaction ratings, retention, and engagement.

- Sales play a big part in banking, so show off metrics related to cross-selling, up-selling, handling loans, credit cards, and investments.

See what we mean?

- Fixed minor jam errors on NCR Selfserv that decreased customer wait time by 67%

- Detected 91% of fraud cases on Verafin and thwarted them without escalation to the supervisor

- Built 101 long-term client relationships, exceeding annual sales quota by 117%

- Conceptualized payment strategies for 12 big clients on Acuity that improved repayments to 98% rates

9 active verbs to start your banking work experience bullet points

- Facilitated

3 Tips for Writing a Banking Resume if You’re Starting Your Career

- You may be new to banking, but as long as you have any experience in working with customers, you’ve got a lot to talk about. Highlight past jobs where you worked with people, such as retail or tech support, but also college projects and internships.

- Banking requires a great deal of attention to detail, so don’t make the mistake of sending out a resume that’s tailored to a different job. Take the time to read the job description and update your work experience and skills accordingly.

- Pick a resume template that lets you add courses or certifications and include them to increase your credibility. The Certified Bank Teller (CBT) certification is great, but so is the Anti-Money Laundering (AML).

3 Tips for Writing a Banking Resume for a Seasoned Financial Expert

- As you advance in your career, leadership becomes a key skill, whether it is training new colleagues or managing an entire branch. Provide examples of times when you were in charge, such as assigning tasks or handling performance appraisals.

- Don’t be afraid to flaunt your financial acumen by talking about your ability to manage budgets, control costs, or drive growth. For instance, discuss the kinds of budgets you managed for your branch or for particular business accounts, making sure to mention ROI to showcase your impact.

- A successful banker is one who leaves a trail of happy customers behind. Underscore this in your resume by including metrics like customer retention, cross-selling, or satisfaction ratings, as well as mentioning how you helped your staff stick to bank policies.

Unless your career spans over 10 years, we recommend sticking to a one-page resume . Much the way customers only skim the contracts they sometimes sign, recruiters only spend a few seconds scanning your resume, so it’s best to keep it short and sweet.

A resume summary or objective can be an effective way to quickly highlight a career-defining achievement or describe why you’re the right fit for this particular banking job. Use it to mention a couple of key skills, such as your risk management, and include the name of the company you’re applying to.

You can, but it’s better to show them through your work experience bullet points. If you do add some, make them relevant to the job—for instance, employee engagement for a bank manager position.

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game New

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Job Application Documents

- Resume Preparation

How to Write a Resume for a Banking Job

Last Updated: January 10, 2024 References

This article was co-authored by Kent Lee . Kent Lee is a Career and Executive Coach and the Founder of the Perfect Resume, a career development services company based in Phoenix, Arizona. Kent specializes in creating customized resumes, LinkedIn profiles, cover letters, and thank you letters. Kent has over 15 years of career coaching and consulting experience. Previously, he has worked as a Career Consultant for Yahoo and has worked with thousands of clients including Fortune 500 executives from around the world. His work and career advice have been featured in ABC, NBC, CBS, Yahoo, Career Builder, and Monster.com. There are 7 references cited in this article, which can be found at the bottom of the page. This article has been viewed 229,503 times.

Stick to standard formatting.

- People reviewing your resume only spend an average of 30 seconds looking it at. If the page is too crowded, they might not see all the important info that you want to highlight.

Put your name and contact information at the top.

- Feel free to give your resume a unique look by selecting a fun font for your name. Just make sure it’s easy to read and looks professional. Stay away from calligraphy-style fonts or cartoony fonts, for example.

Write an executive summary below your contact info.

- An example of an executive summary is: Finance graduate with a strong foundation in economics and investment analysis, as well as practical experience managing assets. Academic experience in international finance, corporate finance, and financial reporting.

Include a section for your education.

- It is not typically necessary to include high school education, unless you are just beginning your career or it was the only degree you received.

- If your college GPA is not as high as you would like, you can include with it your major-specific GPA or with your 3rd and 4th year GPAs. If these are much higher, it shows either that you improved considerably over time or that your general GPA does not adequately convey how adept you are at your specific career.

Add your relevant work experience.

- Include the name of your employer, when you worked for them, and the location of the job. [7] X Research source

- Even if you haven’t worked in finance before, other jobs can still be relevant to working in a bank. For instance, if you were a cashier at a retail store, you handled money and dealt with customers, which is exactly what bank tellers do!

Use active verbs to describe tasks you've performed.

- For example, use active verbs to describe your experience and responsibilities while you worked at a past job.

- You might write something like “Supervised a team of 10 sales reps.” Or, “Managed a portfolio of 7 commercial clients.”

List any other applicable skills.

- Some examples of skills to include are: communication, financial analysis, retirement investing, collaboration, management, and client relations.

Highlight social abilities and salesmanship.

- Working in a bank often requires you to interact with customers all day and make them feel comfortable, as well as sell them services like mortgages and loans.

Emphasize attention to detail and mathematical ability.

- Highlight any academic awards that are suggestive of mathematical ability. If any of your prior jobs required the counting of money or other mathematical skills, describe these in detail.

- List instances in which you followed stringent workplace rules precisely, proofread text, managed large databases, or in any other way reviewed the work of a coworker to verify accuracy.

Spotlight your computer literacy.

- Make sure to list any formal credentials you might have earned for specific software programs.

Show achievements using numbers.

- For instance, in your work experience section, underneath the title of your role, the company, and the location, you might write something like: “Sold an average of $15,000 in software packages per month, generated over $300,000 of revenue during my employment.”

Limit your resume to 1 page.

- There are lots of free 1-page resume templates online and in Microsoft Office that you can use to help you fit all your info on a single page.

Proofread your resume when you finish it.

- For example, be on the lookout for words that are spelled correctly, but are the wrong choice of word, such as “complaint” and “compliant.”

- Get a friend or a family member to give your resume a look as well as they might notice mistakes that you missed.

Expert Q&A

You Might Also Like

- ↑ Kent Lee. Career & Executive Coach. Expert Interview. 2 April 2020.

- ↑ https://www.mergersandinquisitions.com/free-investment-banking-resume-template/

- ↑ http://www.forbes.com/sites/investopedia/2013/07/31/how-to-write-an-effective-investment-banking-resume/

- ↑ http://www.investopedia.com/articles/financialcareers/10/investment-banking-resume.asp

- ↑ https://www.theguardian.com/careers/careers-blog/banking-cv

- ↑ http://www.mergersandinquisitions.com/investment-banking-resumes/

- ↑ https://www.randstadusa.com/jobs/career-resources/resumes/resume-tips-part-10-proofreading-tips/497/

About This Article

To write a resume for a bank teller job, start by putting together your name and contact information, an executive summary, and your education, work experience, and skills. Try to write up your work experience and skills so that they focus on mathematical ability, computer literacy, and attention to detail, since these are critical to being a teller. Additionally, work on conveying good social skills, which are essential when working with the public. Then, use details to support your claims, and provide evidence of your success in these areas. For tips on how to include "hard" skills like computer proficiency in your resume, read on! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Dec 2, 2019

Did this article help you?

Nitin Gamit

Jul 12, 2017

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

wikiHow Tech Help Pro:

Develop the tech skills you need for work and life

- Career Blog

Banking Resume Writing Tips and Examples for 2024

A banking resume is a document that summarizes a candidate’s qualifications and experiences related to the field of banking, including knowledge of financial services, banking operations, and customer service skills. It highlights the individual’s professional achievements, education, work experience, and relevant skills with the aim of persuading the hiring manager to invite the candidate for an interview.

Why is it important to have a well-written resume?

A well-written banking resume can significantly increase the candidate’s chances of being invited to an interview. For one, it signals the candidate’s competence, attention to detail, and professionalism, which are important traits in banking jobs. A poorly written resume, on the other hand, can reflect negatively on the candidate and end up overlooked by the recruiter or hiring manager.

How to format a banking resume?

The format of a banking resume should be targeted and relevant to the specific job being applied for. It should be concise and structured, making it easy for the recruiter or hiring manager to skim and quickly identify key information. A banking resume should start with a summary statement – a brief overview of the candidate’s career objectives and highlight their most relevant experiences and qualifications.

The chronological format is the most common approach for banking resumes. In this format, the candidate should list their professional experiences in reverse chronological order, starting with the most recent experience first. The candidate must include relevant experiences, accomplishments, and specific tasks performed when describing their work experience.

In addition to work experience, a banking resume should include a relevant education section, highlighting relevant coursework, and academic achievements. The candidate can choose to include additional sections such as certifications, relevant skills, and volunteer work.

A well-drafted banking resume positions the candidate to stand out from the competition, increase their chances of being selected for an interview, and ultimately secure their dream banking job.

Decoding the Job Description

When it comes to writing a successful banking resume, it’s essential to understand the job description and tailor your resume accordingly.

A. What to look for in a job posting?

Before you start crafting your resume, carefully analyze the job posting. Pay particular attention to:

- Required qualifications: Determine what specific skills, education, and experience are essential for the role.

- Key responsibilities: Identify the primary duties and responsibilities of the job. What duties will you be performing daily, weekly, and monthly?

- Company culture: Understand the company’s values, goals, and mission. Does your experience and passion align with their culture?

B. How to tailor your resume based on a job description?

Once you have analyzed the job posting, tailor your resume to emphasize your relevant experience and qualifications.

- Use job-specific keywords: Incorporate keywords from the job posting into your resume’s summary, skills, and experience sections.

- Highlight relevant achievements: Identify and showcase specific accomplishments that relate to the job’s requirements, using measurable results and data where possible.

- Emphasize transferrable skills: If you lack specific qualifications or experience, highlight transferable skills and relevant job experiences that demonstrate your ability to learn and adapt quickly.

C. Understanding the role of a banking professional.

To craft a successful banking resume, it’s crucial to understand the role of a banking professional.

Bankers are responsible for managing financial transactions and the overall financial health of individuals, businesses, and organizations. They handle day-to-day transactions such as deposits, withdrawals, and wire transfers, and may also offer investment advice, loans, and lines of credit.

Key skills for a banking professional include attention to detail, financial analysis, customer service, risk management, and regulatory compliance.

When writing your banking resume, emphasize your knowledge of financial products and services, experience handling financial transactions, and any certifications or licenses relevant to the industry.

Carefully analyzing job postings, tailoring your resume accordingly, and understanding the role of a banking professional are key to crafting a successful banking resume.

Essential Banking Resume Sections

When writing a banking resume, there are certain essential sections that you should include to make a good impression on potential employers. Here are the main sections that you should include:

A. Personal Information

The personal information section should include your full name, email address, phone number, and mailing address. You can also include your LinkedIn profile or other relevant social media profiles.

B. Objective or Summary Statement

The objective or summary statement is a brief statement that highlights your career goals and key skills. This section should be tailored to the specifics of the job you are applying for.

C. Education

The education section should include the name of the institution, the degree or certification earned, the date of graduation, and any relevant coursework or honors.

D. Professional Experience

The professional experience section should include your work history dating back to your most recent job. Include the job title, employer name, dates of employment, and bulleted details of your responsibilities and achievements during your time in each role.

The skills section should include your technical and soft skills relevant to the banking industry. Examples of technical skills in banking include financial analysis, risk management, and credit analysis. Soft skills might include strong communication or leadership abilities.

F. Certifications and Licenses

The certifications and licenses section should include any relevant professional certifications, such as the Chartered Financial Analyst (CFA) designation.

G. Awards and Achievements

The awards and achievements section should highlight any formal awards or recognition you have received for your work in banking or related fields.

H. Extracurricular Activities or Volunteering

The extracurricular activities or volunteering section is a great way to show that you are well-rounded and have interests outside of work. This section can include any relevant activities, such as volunteering at a local bank or financial literacy organization.

I. Hobbies and Interests

The hobbies and interests section isn’t always necessary, but it can help give potential employers a sense of your personality and interests. This section should be brief and only include relevant information that might set you apart from other candidates.

By including these essential sections in your banking resume, you can make a great first impression and increase your chances of landing an interview. Be sure to tailor your resume to the specifics of each job posting and highlight how your skills and experience make you a great fit for the position.

Crafting an Effective Personal Information Section

When it comes to writing a banking resume, the personal information section is an essential part. It is the first thing that recruiters see, and it is what can make or break their interest in your application. In this section, you need to provide specific details about yourself that are relevant to the banking job you are applying for. In this article, we will be discussing five important elements of a personal information section.

A. Contact Information

Contact information is perhaps the most crucial part of the personal information section. Without this information, recruiters cannot contact you if they are interested in your application. It is vital to make sure that all information provided is accurate, so double-check your contact details before submitting your resume.

The contact information should include your full name, current address, phone number, and email address. Make sure that you use a professional email address, and avoid using nicknames or any other informal language.

B. Professional Headline

A professional headline is a brief statement that summarizes your skills and experience. It should be placed right after your name and contact information. The headline should be catchy, short, and impactful. Consider using phrases like “Experienced Banking Professional” or “Financial Analyst with 10 Years of Experience.” The headline should make a statement about your expertise and experience in banking.

C. LinkedIn Profile

LinkedIn is a professional social media platform that allows you to showcase your skills, experience, and career aspirations. Having a LinkedIn profile is essential for any job seeker, including those in banking. Recruiters often use LinkedIn to find potential candidates, so it is crucial to include a link to your LinkedIn profile in the personal information section.

Your LinkedIn profile should be complete with a professional profile picture, a summary of your skills and experience, and recommendations from previous employers. Make sure that your LinkedIn profile aligns with the skills and experience mentioned in your resume.

Your address may not seem like an essential part of your personal information section, but it can be useful for recruiters. For example, if you are applying for a job in a specific location, having an address in that area can increase your chances of getting the job. Therefore, it is recommended to include your current address in your resume.

E. Photo or No Photo?

When it comes to adding a photo to your resume, there are different opinions on this matter. Some recruiters prefer resumes with a photo, while others believe that it is not necessary. Ultimately, the decision to include a photo in your resume is up to you.

If you decide to include a photo in your resume, make sure that it is a professional headshot. Avoid using casual photos or selfies. A professional photo will help to create a positive first impression and will make your application more memorable.

Writing an Engaging Objective or Summary Statement

When it comes to writing a strong banking resume, an engaging objective or summary statement can make all the difference. But before you start crafting this section of your resume, it’s important to understand the difference between an objective statement and a summary statement.

A. What’s the difference between an objective and a summary statement?

An objective statement is a brief statement that highlights your career goals and the type of position you are seeking. It should be specific and relevant to the job you are applying for. On the other hand, a summary statement provides a brief overview of your skills, strengths, and previous experience. It should be tailored to the specific job you are applying for, highlighting what you can bring to the table and what sets you apart from other candidates.

B. How to write an objective or summary statement that stands out?

When it comes to writing an objective or summary statement that stands out, there are a few key things to keep in mind. First, it’s important to make it clear what you can offer the employer. This means highlighting your unique skills, strengths, and experience that make you a good fit for the job. It’s also important to use specific, measurable language that shows the impact you have made in previous roles.

Another important factor is tailoring your objective or summary statement to the specific job you are applying for. This means doing your research on the company and the position to understand what they are looking for in a candidate. Use the language and keywords they use in the job description to make your statement more relevant and compelling.

Finally, make sure your objective or summary statement is concise and impactful. It should be no more than two to three sentences, and should highlight the most important information about you and your qualifications without including unnecessary details.

C. Dos and Don’ts of writing an effective statement.

To ensure that your objective or summary statement is effective, there are a few dos and don’ts to keep in mind.

- Use specific, measurable language that shows your impact in previous roles.

- Tailor your statement to the specific job and company you are applying to.

- Keep it concise and impactful, focusing on the most important information about you and your qualifications.

- Use keywords and language from the job description to make your statement more relevant.

- Include unnecessary details or information that is not directly relevant to the job.

- Use vague language or cliches that don’t add value to your statement.

- Be too generic or broad in your statement, making it unclear what you are looking for in a position.

By following these tips and guidelines, you can create an objective or summary statement that stands out to potential employers and helps you land your next banking job.

Highlighting Your Education Background

Your educational background is an important aspect of your banking resume. It showcases your academic achievements and demonstrates your qualifications for the job. Here are some tips on how to effectively highlight your education background.

A. How to display your educational qualifications?

When it comes to displaying your educational qualifications, there are a few things you should keep in mind. First, make sure to list your degrees in chronological order, starting with the most recent. Second, be sure to include the institution name, the degree earned, and the date of graduation. Third, consider including any academic honors or awards you received.

It is also important to tailor your education section to the specific job you are applying for. For example, if you are applying for a position in investment banking, highlighting relevant coursework such as finance or accounting would be beneficial.

B. What to include in the education section?

When it comes to what to include in the education section of your banking resume, there are several key pieces of information to consider. These include:

- Institution name

- Degree earned (e.g. Bachelor of Science, Master of Business Administration)

- Field of study

- Date of graduation

- Academic honors or awards (optional)

Additionally, if you have any certifications or licenses relevant to the banking industry, you may want to include those in a separate section or as part of your education background.

C. Should you include your GPA?

Whether or not to include your GPA depends on several factors. If you have a high GPA, you may want to include it to demonstrate your academic excellence. However, if your GPA is lower, you may want to leave it off. It is also important to consider the requirements of the job posting – if the employer specifically requests a GPA, be sure to include it.

Effectively highlighting your education background is an important aspect of creating a strong banking resume. Be sure to list your degrees in chronological order, include relevant coursework, and consider including academic honors or awards. When it comes to including your GPA, carefully consider whether or not it is relevant to the position and job requirements.

Showcasing Your Professional Experiences

When it comes to writing a banking resume, showcasing your professional experiences is essential. This section is where you highlight your work history and demonstrate your proficiency in the field. To write an engaging work experience section, you need to follow the tips listed below.

A. How to Write an Engaging Work Experience Section?

To make your work experience section more engaging, you need to focus on your accomplishments instead of just listing your job responsibilities. Start each bullet point with an action verb and quantify your achievements wherever possible.

For example, instead of saying “Responsible for customer service,” say “Provided exceptional customer service resulting in a 95% satisfaction rate.”

Another tip is to tailor your work experience section to the job you’re applying for. Highlight the skills and experiences that are relevant to the position.

B. Choosing the Right Action Verbs

Action verbs are powerful because they help demonstrate the impact of your work. Some examples of action verbs you can use in your work experience section include:

- Implemented

- Coordinated

Avoid using passive language and focus on using action verbs that show initiative and leadership.

C. What to Include in the Job Description?

When writing your job descriptions, make sure to include specific details about your role and responsibilities. Highlight your achievements and the impact they had on your team or company. The job description should also include:

- Company name

- Employment dates

- Job responsibilities

- Achievements

- Skills utilized

- Projects worked on

Quantify as many of your achievements as possible, and use data to show the impact of your work.

D. Formatting Your Work Experience Section

Formatting your work experience section is crucial for readability and professionalism. Use reverse chronological order, starting with your most recent position, and work your way backward. Use bullet points to break up your job responsibilities and achievements. Also, make sure you separate each job with clear headings, including the company name, job title, and employment dates.

When it comes to showcasing your professional experiences, the key is to focus on demonstrating your achievements and tailoring your descriptions to the job you’re applying for. Use powerful action verbs, quantify your accomplishments, and format your work experience section for maximum readability.

Highlighting Your Skills and Qualifications

Hiring managers want to know what you bring to the table in terms of skills and qualifications. To ensure that you are considered for the job, you need to highlight both your technical and soft skills.

A. Technical skills vs. soft skills

Technical skills refer to job-specific knowledge or abilities, such as proficiency in specific software, programming languages, or financial models. Having strong technical skills is essential in the banking industry, where employees are expected to be fully trained and knowledgeable on the latest financial products and services.

In contrast, soft skills are non-technical abilities that are equally important in banking. These may include communication, leadership, teamwork, problem-solving, and time management. Soft skills are necessary for building relationships with clients, resolving conflicts, and working effectively with colleagues.

B. Identifying your transferable skills

As you update your banking resume, it’s important to identify both your technical and soft skills. But, keep in mind that you may have transferable skills, too. Transferable skills are those you can apply across different roles or industries. These might include research, project management, or problem-solving skills, which can be valuable assets in a variety of professions.

Make a list of all the skills you have, whether technical or soft, and consider what skills may be transferable. After you complete this exercise, you may find you have a broader range of skills than you first realized.

C. How to match your skills with job requirements?

When looking at job postings, you’ll notice that most have a list of desired qualifications or skills. To land the job, you’ll need to make sure your skills align with what the employer is seeking.

The first step is to read the job description carefully and take note of the required qualifications. Some employers may prioritize specific technical skills, while others may focus on soft skills or transferable skills. Highlight these qualifications on your resume to show the recruiter that you have what it takes to be successful in the role.

It’s also important to include specific examples of how you have applied your skills in the past. Provide quantifiable results that demonstrate your successes and achievements. Doing so will help you stand out from other applicants and show that you have the necessary experience to excel in the role.

Highlighting your skills and qualifications is crucial to the success of your banking resume. Be sure to include both technical and soft skills, consider transferable skills, and align your skills with the job requirements. By doing so, you’ll increase your chances of landing the job of your dreams.

Listing Your Certificates and Licenses

If you have obtained relevant certificates or licenses, it is vital to include them in your banking resume. Employers in the banking industry look for candidates who have the necessary certifications and licenses needed to perform specific roles. Here are tips for displaying your certificates and licenses accurately:

A. How to display your certifications and licenses?

- Separate Section: Certificates and licenses should have a dedicated section in your resume. This section should come after your education and work experience and before other additional skills.

- Use Bold: Use boldface for the certificate or license name, with the issuing organization in normal font beside it. For example, Certified Financial Planner (CFP) , CFP Board.

- Mention Date and Expiry: Mention when you received the certificate and when it will expire.

- Add Descriptions: You may add descriptions or additional information about the certification or license if it is relevant to the job you are applying for.

B. What to include and exclude?

Here’s what you should include and exclude when mentioning your certificates and licenses in your banking resume:

- Relevancy: Only include certifications and licenses that are relevant to the job you are applying for. For example, if you are applying for a position in investment banking, then the Chartered Financial Analyst (CFA) certification would be highly relevant.

- Credentials that have formal recognition: Include only those certifications and licenses that are recognized by professional bodies or institutions. For example, ACLS (Advanced Cardiac Life Support) is a certification recognized by the American Heart Association.

- Recent Certifications: Include only the most recent certifications and licenses. Employers usually prioritize recent certifications over older ones.

- Expired Certificates: If a certificate or license has expired, exclude it from your resume. It’s best to renew the certification before mentioning it in your resume.

- Irrelevant Certifications: Certifications and licenses that are unrelated to banking or the job you are applying for should be excluded from your resume.

- Incomplete Certifications: If you have started a certification or license program and have not completed it, exclude it from your resume.

Displaying your certificates and licenses accurately and concisely is essential in banking resumes. Only mention relevant, recognized, and up-to-date certifications and licenses in your resume to improve your chances of landing your desired job in banking.

Showcasing Your Awards and Achievements

A. how to highlight your awards and achievements.

Highlighting your awards and achievements is an important aspect of a strong banking resume. Not only does it show your competency and dedication to your job, but it also sets you apart from other applicants. Here are some tips to effectively highlight your awards and achievements:

Use bullet points: Using bullet points is an effective way to make your accomplishments stand out. It also makes it easier for the recruiter to read and absorb the information.

Focus on the most recent and relevant awards: When listing your awards and achievements, it’s important to focus on the most recent and relevant ones. This will showcase your current skillset and expertise, and give the recruiter an idea of how you can contribute to their organization.

Use metrics and numbers: Use metrics and numbers to quantify your achievements. This will show the recruiter the actual impact you have made in your previous roles. For example, instead of saying “Increased customer satisfaction”, you can say “Increased customer satisfaction by 25% in 6 months”.

Provide context: Provide context for each award or achievement. This will help the recruiter understand the situation and the impact you made. For example, instead of saying “Received Employee of the Month Award”, you can say “Received Employee of the Month Award for exceptional performance in driving sales and exceeding targets for 3 consecutive months”.

B. Mistakes to avoid while listing your accomplishments.

While listing your accomplishments is crucial to make your resume stand out, there are some mistakes you should avoid:

Listing irrelevant awards: Listing irrelevant awards can distract the recruiter from the important ones. Make sure to focus on the most recent and relevant ones.

Using vague language: Using vague language such as “Improved customer satisfaction” or “Increased revenue” without providing any context or metrics doesn’t give the recruiter a clear understanding of your accomplishments. Make sure to use specific metrics and provide context for each award or achievement.

Including personal achievements: While personal achievements such as winning a sports tournament or participating in a charity event are admirable, they don’t belong on a professional resume. Include only professional achievements that pertain to the job you’re applying for.

Listing duties as accomplishments: Listing duties such as “Processed customer transactions” or “Managed customer complaints” as accomplishments doesn’t show any additional value or impact you made. Make sure to list only achievements that show your competency and dedication to your job.

C. Why highlight your achievements in a resume?

Highlighting your achievements in a resume is important for several reasons:

Differentiates you from other applicants: Listing your accomplishments sets you apart from other applicants who only list their job duties. It shows that you’re competent and dedicated to your job.

Shows your skills and expertise: Listing your accomplishments shows the skills and expertise you have, and gives the recruiter an idea of how you can contribute to their organization.

Including Your Extracurricular Activities or Volunteering

As a banking professional, you may have a wealth of knowledge in the industry, but employers are not just looking for a technical expert. They also want to know that you are a well-rounded individual who can contribute to the community. That’s where extracurricular activities and volunteering experience come in.

A. How to portray your community service and volunteering experience?

When it comes to including your extracurricular activities and volunteering experience in your resume, it’s essential to stay focused on the skills relevant to the banking industry. Here’s how to do it:

Focus on transferable skills : Your community service and volunteering experience can demonstrate your abilities to manage people, organize events, or fundraise. Consider how these skills can apply to the banking industry and highlight them in your resume.

Quantify your achievements : Show your impact by including measurable results in your resume. For example, if you organized a fundraising event, mention how much money you raised and the number of participants you attracted.

Include only relevant experiences : While it’s important to mention your extracurricular activities and volunteering experience, remember to only include those that are relevant to the job you are applying for. For instance, if your volunteering experience involves working with children, it may not be relevant to a banking position.

B. The importance of including your extrac

Including your extracurricular activities and volunteering experience in your banking resume can make you stand out from other candidates. Here are some reasons why:

Shows your personality : Your extracurricular activities can provide a glimpse of who you are beyond your technical skills. It shows that you have interests and passions outside of work, which can make you a more well-rounded employee.

Demonstrates transferable skills : As mentioned earlier, your community service and volunteering experience can demonstrate transferable skills that are relevant to the banking industry, such as communication, leadership, and teamwork.

Illustrates your commitment : Volunteering and participating in extracurricular activities require time and effort, which shows that you are committed and responsible. This trait is particularly important in the banking industry, where accuracy and attention to detail are critical.

Including your extracurricular activities and volunteering experience in your banking resume can help showcase your abilities beyond the technical skills required for the job. Make sure to focus on transferable skills, quantify your achievements, and only include relevant experiences. Doing so can make you stand out from other candidates and demonstrate your commitment to the community and the banking industry.

Related Articles

- 110 Expert Resume Tips for Landing More Interviews

- Student Counselor Job Description: A Complete Guide

- Interview Follow-Up: How to Do It Right

- Preparing for an Online Job Interview: Tips and Strategies

- Pharmacy Technician Resume: Sample and Writing Tips

Rate this article

0 / 5. Reviews: 0

More from ResumeHead

- Skip to main content

- Skip to "About this Web application"

Language selection

- Français fr

Name of Web application

How to write a good resume.

Your resume must clearly, concisely and strategically present your qualifications to get a recruiter interested in meeting you. It should convey your skills, work experience and assets. The resume is used to describe what you can accomplish professionally in a manner that also illustrates what you can do for an employer. Job opportunities can arise unexpectedly. An updated modern resume is the key to a successful job search. Here are some do's and don'ts of how to write a good resume and what to include.

Resume Writing Do's

An employer takes an average of 30 seconds to skim a resume. You want them to see right away that you are qualified for the position.

Be sure there are no spelling or grammar mistakes. Have someone else read it over as well. A simple spelling mistake on a resume can give a negative impression to the employer. It can even prevent you from getting the job.

Place the emphasis of your resume on your most recent experience. Older jobs and experience that are more than 15 years old should either be cut out or minimized. This way, the employer can focus on more relevant information.

Specify work experience or achievements that are related to the position you are applying to. This can be done by reviewing the job description or the employer website.

You want to be able to identify the best examples of where you demonstrated your skills. These examples should speak to what you achieved in your role, and should demonstrate what kind of employee you are. It is best to include this information in the "Work experience" section of the resume.

Lying on your resume is never a good idea. You don't want to overstate your skills or results as it will mislead the employer. Have confidence in what you have to offer.

Use firm numbers that the employer will understand and be impressed by. For example, how many people you supervised, how many products you sold, by what percentage you increased sales, etc.

The person reading your resume might not always be the employer. Resumes can be reviewed by recruiters or Human Resources specialists who may not be familiar with your specific field. Use simple and plain language, but also persuasive verbs such as handled, managed, led, developed, increased, accomplished, leveraged, etc.

If you have volunteered with a well-known organization or worked for an important cause, put it in your resume. You should include these experiences under the "Work experience" or the "Volunteer work" section, especially if they are related to the position you are applying for.

Your resume should list your name, address, email and phone number. This information should be placed at the top of the first page. Also, make sure this information is accurate. Otherwise, the employer won't be able to contact you.

Resume Writing Don'ts

Make sure your email is easy to read, easy to type, professional and non offensive. In general, your email address should be based on your name. Exclude any nicknames, numbers, or special characters.

It is best to leave out any personal details such as age, weight, height, marital status, religious preference, political views, or any other personal attributes that could be controversial. This will prevent any potential bias. Most importantly, never include your Social Insurance Number in your resume.

Although in some countries it may be acceptable to include a photo, it is not the norm in Canada. It can actually lower your chances of obtaining a position and divert the whole focus of your resume. You want the employer to focus on your skills and experience, not what you look like.

Make your resume easy to read by limiting each resume section or sub section to 5-7 bullet points. This will make it easier for the employer to scan your resume and identify your potential. Each bullet point should be used wisely by keeping the information relevant and concise.

Do not use "I," "my," or "me". Write your resume in the third person, as if it's being written by someone else.

Your job duties will be obvious from your job title. Instead, highlight your achievements by putting a personal spin on your job duties and providing specific examples.

Steer clear from vague statements that don't highlight your actual contribution. Unclear statements such as, "Responsible for improving efficiencies and making cost savings", does not provide any information to an employer. Personalize your experience!

The main purpose of your resume is to promote you, your skills, experience and achievements. It should be entirely positive, and therefore should not include reasons for leaving as it does not add any value to you as a candidate.

An employer only requires references if they are seriously considering hiring you. Keep references on a separate sheet and provide them only when they are specifically requested.

It is not recommended to mention hobbies because of the judgments potential employers can make. However, if your hobbies relate to the position, you may include them as they can demonstrate to the employer why you are a good fit.

Want to create a professional resume in a few minutes? Sign up for a Job Bank account to use our free Resume Builder tool.

- About Amazon (English)

- About Amazon (日本語)

- About Amazon (Français)

- About Amazon (Deutsch)

- Newsroom (Deutsch)

- About Amazon (Italiano)

- About Amazon (Polski)

- About Amazon (Español)

- Press Center (English)

- About Amazon (Português)

Applying for a job at Amazon? Here are 4 ways to improve your resume.

- Facebook Share

- Twitter Share

- LinkedIn Share

- Email Share

- Copy Link copied

Amazon receives tens of thousands of resumes a year—so it’s critical that you submit one that really stands out from the crowd. We know that creating the “perfect” resume is easier said than done. The entire process can be nerve-racking and filled with a list of never-ending questions, like “One page or two?”; “Am I providing enough information?”; or “How do I explain professional gaps?” Most people struggle with crafting their resume, but with a bit of guidance, anyone can learn how to best present themselves on paper.

With this in mind, we reached out to several Amazon recruiters to get their best tips. Here’s what they had to say.

While it may seem counterintuitive to lean into design simplicity when you are hoping to create a resume that stands out, it’s truly in your best interest.

At Amazon, we are looking for resumes that are well-organized, use straightforward language, highlight measurable data, and are streamlined for maximum readability. A concise resume allows a recruiter to get a clear idea of who you are as a candidate and what you have to offer through your professional experiences, strengths, and education.

Anna Duong, manager of Americas Stores Tech Talent Acquisition, recommends sticking to the basics. Duong said, “While there are no hard rules, it’s best to keep a resume text-forward, black and white, and simple.” Remember we’re most interested in your accomplishments and less concerned about font styles, decorative borders, and non-essential information.

“A successful resume should focus on your actions and results,” said Bhavishya Lingam, senior recruiting business partner at Amazon Stores. Whenever possible, ensure you are including relevant data to help quantify your success and show how you have been able to drive impact at scale for the business. Focusing on quantifiable actions strengthens your resume significantly.

For example, instead of saying, “Responsible for introducing new tech stack into our organization,” you can make this stronger by saying, “Successfully led the acquisition and integration of innovative efficiency software that reduced errors by 25%, resulting in a reduction of customer complaints by 37% YoY.” We understand that every bullet point on your resume might not have a quantifiable measurement, but Amazon is a data-driven company so the more ways you’re able to quantify your success the better.

“You don’t need a completely different resume for each role you apply to, but it is a good rule of thumb to take the opportunity to align your professional accomplishments with the key elements of the role you’re pursuing,” said Patti Cudney, senior recruiting business partner. To do this, we suggest that you look at the key words and phrases within the “Basic and Preferred Qualifications” sections, and use this as a guide to help you determine what you should focus on in your resume.

Remember that not all experiences and skills are equally relevant to every job opportunity that you will eventually apply to, so continually reference the job description to make sure you’re prioritizing the right information. By taking the additional time to tailor your resume to match the job requirements, you demonstrate your genuine interest and suitability for the position.

Jen Paradise, RC manager talent acquisition, suggests you detail how you made a difference in previous positions. “Be sure to include specific stand-out accomplishments of what you’ve been able to achieve in each role,” she said.

Job responsibilities highlight what you do, while accomplishments showcase the tangible outcomes and results you achieved while fulfilling those responsibilities. At Amazon, we are a company of builders who bring varying backgrounds, ideas, and points of view to decisions and innovations on behalf of our customers. It’s this type of culture that encourages us to seek talented people who are invested in the outcomes of their work and want to deliver results.

Highlighting your accomplishments gives you the opportunity to tell the hiring manager something they don’t already know about you. In most cases, we can easily determine what are the associated responsibilities for a particular job description, but that doesn’t tell us anything about you as a candidate. However, when you provide accomplishments instead of responsibilities, we’re able to clearly see a snapshot of your strengths and ability to drive impact at scale.

Sign up for the weekly Amazon newsletter

Once you understand how to make your resume stand out, it's time to start crafting the best resume to land your dream job at Amazon! For more information, find interviewing tips and FAQs on Amazon.jobs .

Next, learn about 8 unique benefits and perks available to Amazon employees .

I’ve spent 16 years working inside Amazon fulfillment centers. Here are some of the ways we support our employees.

I'm one of the first multi-site environmental managers at Amazon. Here are 4 tips I used to grow my career.

Amazon’s safety performance continues to improve year over year

How Amazon employees are driving to new careers in transportation through our Career Choice program

I’m an Amazon apprentice. Here are my top 3 tips for making the most of your career.

I’m an Amazon director who’s held 12 different roles in my 23 years at the company. Here are 4 tips to making a successful career change.

Amazon named among the world’s most admired companies for the eighth year in a row by ‘Fortune’ magazine

Everything you should know about Amazon’s hourly wage and benefits offerings for fulfillment employees

An Amazon recruiting manager offers his 3 best tips for a successful job interview

IMAGES

VIDEO

COMMENTS

Banking Resume Summary Example: Experienced banking professional with five years of experience at YZX BANK, where I used analytical and interpersonal skills to maintain a 99.60% customer satisfaction rating. Seeking a chance to leverage my banking skills to maximize the operations and quality of service at BANK XYZ.

3 Tips for Writing a Banking Resume if You're Starting Your Career. Lean into transferable skills. You may be new to banking, but as long as you have any experience in working with customers, you've got a lot to talk about. Highlight past jobs where you worked with people, such as retail or tech support, but also college projects and ...

Here are five skills that you may want to include on your banker resume: 1. Financial analysis. Working as a banker involves researching economic accounts and market trends. When writing your resume, listing your financial analysis skills is an important part of demonstrating your financial literacy.

This is how to write a job-winning banking resume: 1. Use the Best Format for Your Banking Resume. Bankers work for banks or other financial institutions to service and counsel individual and corporate clients in their financial needs. The purpose of your banking resume is to show that you have the skills and experience it takes to fulfill both ...

If you don't have any banking experience, write a resume targeting entry-level Teller I positions. 4. Write a targeted bank teller resume objective. Start your resume with an introduction that catches the hiring manager's eye with your skills and qualifications that best fit their teller job description.

Center your full name at the very top of the resume in size 20 to 24 font. Below it, in size 11 or 12 font, type your up-to-date contact information, including your phone number, your email address, and your home address. [3] Feel free to give your resume a unique look by selecting a fun font for your name. Just make sure it's easy to read ...

Applying for a job position as a bank teller is easier when you know what professional attributes to include in your resume. Whether you already have previous experience as a teller or it's your first time applying for the position, you can learn how to write a successful bank teller resume using a template designed to showcase your relevant ...

This is a basis for Resume.io's ever-expanding collection of tips and tools. It includes more than 350 occupation-specific resume writing guides, plus corresponding resume examples that job seekers are welcome to customize. This guide, along with sample wording from a banker resume example, is designed to help anyone in the banking industry ...

And just as a loan application targets a specific banking product, a great banking resume targets a specific job posting. Here's how to write a targeted job description for a banking resume: Read the job ad carefully. Pay attention to the resume keywords. All skills and requirements you need to show to get the job are listed in the ad.

To create a resume suited for a banking professional, you should use the chronological format with a clean, one-page layout.. An attention-grabbing summary or objective will increase the chances that recruiters will carefully examine your resume.. Your work history should be the focal point of your resume. If you're an entry-level candidate, you can put more emphasis on your skills and ...

Here, you'll learn to write an impressive resume for a banking job in minutes. In this guide, you'll find: A selection of popular banking resume examples. Step-by-step instructions on how to write a banking resume in 2024. Banking resume examples for every experience level. Stats and facts about the banking industry.

Banking jobs typically involve working for banks at the local, regional, or national level. There is a wide range of job titles found in public sector banks, such as bank teller, loan officer, mortgage consultant, investment representative, credit analyst, etc. With so many people competing for the top banking jobs, an outstanding banking resume is an essential tool in your job hunt that can ...

The future job growth in banking will vary depending on the position. According to the U.S. Bureau of Labor Statistics, an overall prediction of business and financial occupations is a 5% increase between 2019 and 2029.. Jobs in loan and mortgage banking are expected to increase 3%, which is as fast as the national average job growth. Financial analyst positions will also increase a solid 5%.

Resume Builder offers free, HR-approved resume templates to help you create a professional resume in minutes. Start Building. 1. Write a dynamic profile summarizing your banking qualifications. The first section of your resume is one of the most important because it's what hooks the hiring manager and makes them interested enough to keep reading.

After your personal statement, the first section you should include on your banking CV is your professional work experience in reverse chronological order. Include your job title, company name, date of employment and your job responsibilities. Try to write the responsibilities using strong action words when possible. 5.