Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- Sample Business Plans

- Retail, Consumers & E-commerce

Pawn Shop Business Plan

The pawn business is definitely a lucrative and profitable business opportunity for someone with a solid network and financial resources. With a proper plan in action, you can start a pawn shop from scratch and grow it into a rewarding business.

Don’t limit the grounds of a profitable business idea. A well-structured strategic business plan will be your powerful ally in attracting stakeholders and investments when scaling your pawn business.

Need help writing a business plan for your pawn shop business? You’re at the right place. Our pawn shop business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write A Pawn Shop Business Plan?

Writing a pawn shop business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

This section includes basic details of your business such as the name of your pawn shop business, year of establishment, address, the type of pawn shop business (e.g., general pawn shop, luxury pawn shop, electronics pawn shop, auto pawn shop, online pawn shop), etc.

Market Opportunity:

Products and services:.

List down all the products and services offered by your pawn shop. Highlight any products or services that could act as a differentiator or USP.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Briefly explain your pawn shop business in this section.

There are different types of pawn shop businesses in the market. Describe the type of pawn shop you are running or planning to start.

Online Pawn Shop

Traditional pawn shop, luxury pawn shop, electronics pawn shop, vintage pawn shop.

- Describe the legal structure of your pawn shop company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established pawn shop business, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Competitive analysis:, market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your pawn shop business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your services:

Mention the services you will offer with your pawn shop business. The different services could be,

- Instant pawn loans

- Expert advisory

- Repair and cleaning

- Installment and deferred payment schemes

Describe each service:

Describe your services in detail. Explain the process and offer oddly specific details involved in it. Layaway services, for instance, include:

- Verifying the documents of the buyer and signing a contract.

- Transferring the ownership once all the installments are paid.

- Selling the product to another buyer, in case of breach of agreement.

Quality measures:

Briefly explain quality measures undertaken by you to consistently offer the highest quality services.

Additional Services:

In short, this section of your pawn shop plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your pawn shop business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your pawn shop business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & machinery:.

This should include a list of equipment and machinery for your pawn shop business.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your pawn shop business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Team members:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your pawn shop business, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the pawn shop industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your pawn shop business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample pawn shop business plan will provide an idea for writing a successful pawn shop plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our pawn shop business plan pdf .

Related Posts

Cannabis Business Plan

Google Docs Business Plan Template

Business Location Selection Guide

Cover Page Design of Business Plan

AI Business Plan Creator

How do you write a Confidentiality Statement

Frequently asked questions, why do you need a pawn shop business plan.

A business plan is an essential tool for anyone looking to start or run a successful pawn shop business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your pawn shop company.

How to get funding for your pawn shop business?

There are several ways to get funding for your pawn shop business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your pawn shop business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your pawn shop business plan and outline your vision as you have in your mind.

What is the easiest way to write your pawn shop business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any pawn shop business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

We earn commissions if you shop through the links below. Read more

Back to All Business Ideas

How to Start a Pawn Shop

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on January 17, 2022 Updated on May 21, 2024

Investment range

$11,850 - $38,600

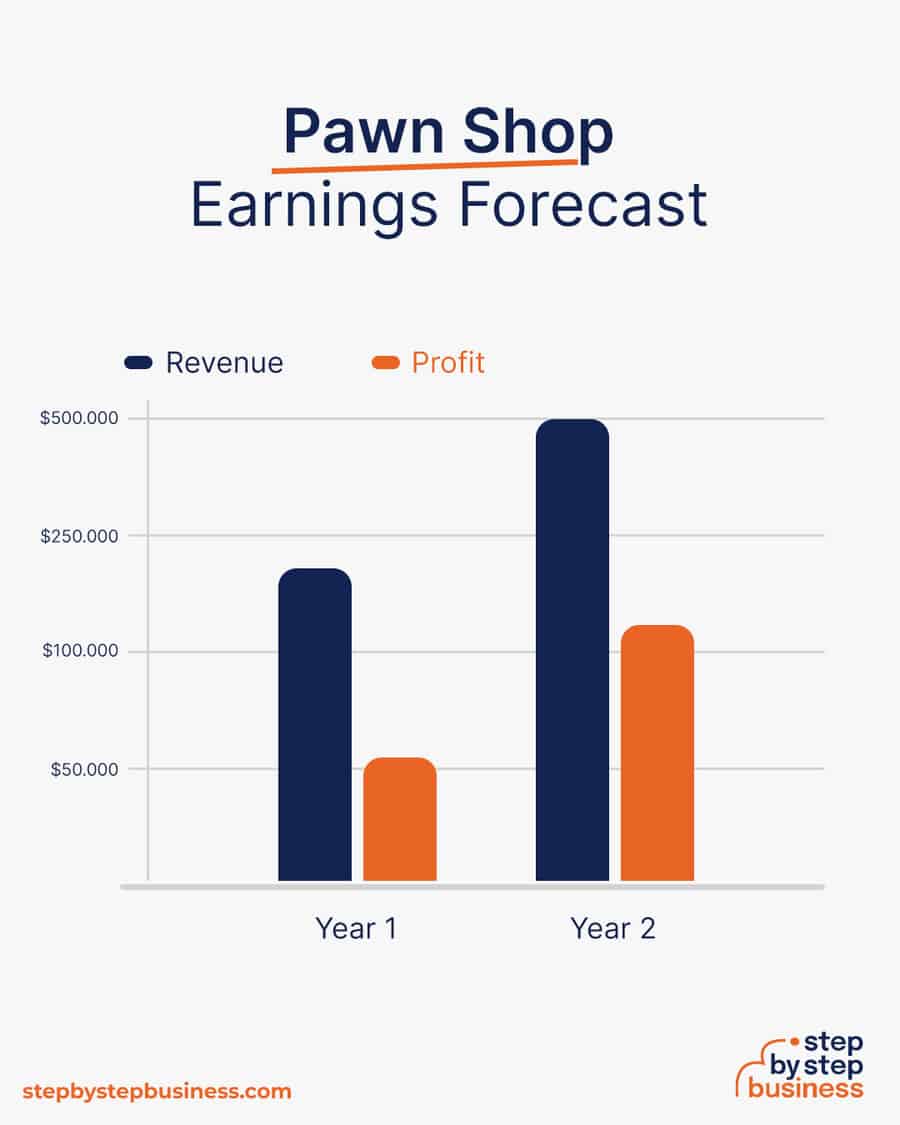

Revenue potential

$210,000 - $500,000 p.a.

Time to build

1 – 3 months

Profit potential

$50,000 - $125,000 p.a.

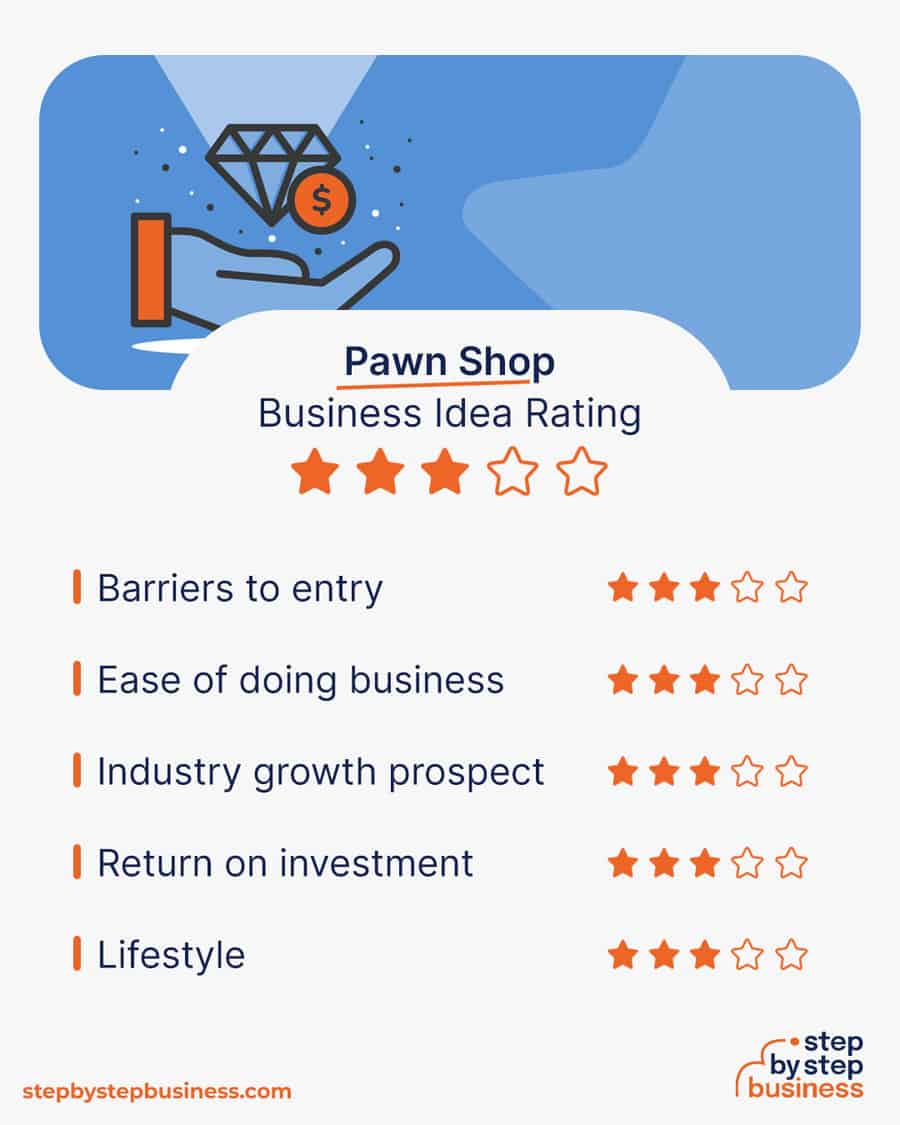

Industry trend

Pawn shops have been around globally for centuries and are a $3 billion industry in the United States alone. Pawn shops make loans to individuals using items such as jewelry or electronics as collateral. They charge interest on the loan, and if the customer doesn’t pay the loan plus interest, the pawn shop sells the item. Pawn shops also buy items from customers and resell them at a markup. Starting your own pawn shop could be a lucrative opportunity for you to make some good money.

The pawn shop business, however, takes preparation and work, and you need to be educated about the process. Lucky for you, you’ve come to the right place, as this step-by-step guide has everything you need to know to become a pawn star.

Looking to register your business? A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple.

Form your business immediately using ZenBusiness LLC formation service or hire one of the Best LLC Services .

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a pawn shop has pros and cons to consider before deciding if it’s right for you.

- High Demand – 30 million Americans use pawn shops each year

- Recurring Income – Interest on loans bring predictable income

- Meet Interesting People – Pawn shop customers come in all shapes and sizes

- Rules to Comply With – Pawn shops are regulated by the government

- Loss of Value – Items purchased may decrease in value before they’re sold

Pawn shop industry trends

Pawn shops have mixed consequences during economic downturns. More people pawn or sell their items when they have less income, but they are more likely to default on their loans, and people are less likely to buy items.

Industry size and growth

- Industry size and past growth – The pawn shop industry in the United States was valued at $3 billion in 2021.(( https://www.ibisworld.com/industry-statistics/market-size/pawn-shops-united-states/ ))

- Growth forecast – There’s opportunity for growth as the National Pawnbrokers’ Association says pawn shops are an important lending option for nearly 40 million unbanked or underbanked Americans.(( https://www.nationalpawnbrokers.org/assets/2020/09/MediaFactsAboutPawn-3.pdf ))

- Number of businesses – There are over 9,000 pawn shops in the US.(( https://www.ibisworld.com/industry-statistics/number-of-businesses/pawn-shops-united-states/ ))

- Number of people employed – More than 70,000 people are employed in pawn shops.(( https://www.ibisworld.com/industry-statistics/employment/pawn-shops-united-states/ ))

Trends and challenges

Trends in the industry include:

- Electronics are the most commonly pawned items, followed by antiques and collectibles. In some southern and western states, guns are pawned at high rates, while in states like Colorado and Florida, cars are frequently pawned.

- Currently, most pawn shop customers pawn their items for loans, rather than selling them to the pawn shop. This means that for pawn shop owners, interest income is their most important source of revenue.

Some challenges exist in the industry which include:

- Pawn shop revenue has been unstable over the last five years as the economy has had ups and downs. The economic sensitivity of the industry presents a risk for pawn shop owners.

- The future of pawn shops due to economic fluctuations may depend on buying and selling items, particularly online, rather than providing loans, which may be challenging. Having your own website to sell your pawn shop items is competitive due to sites like eBay, so it may be advisable for pawn shop owners to use eBay and Amazon or other marketplaces to sell items.

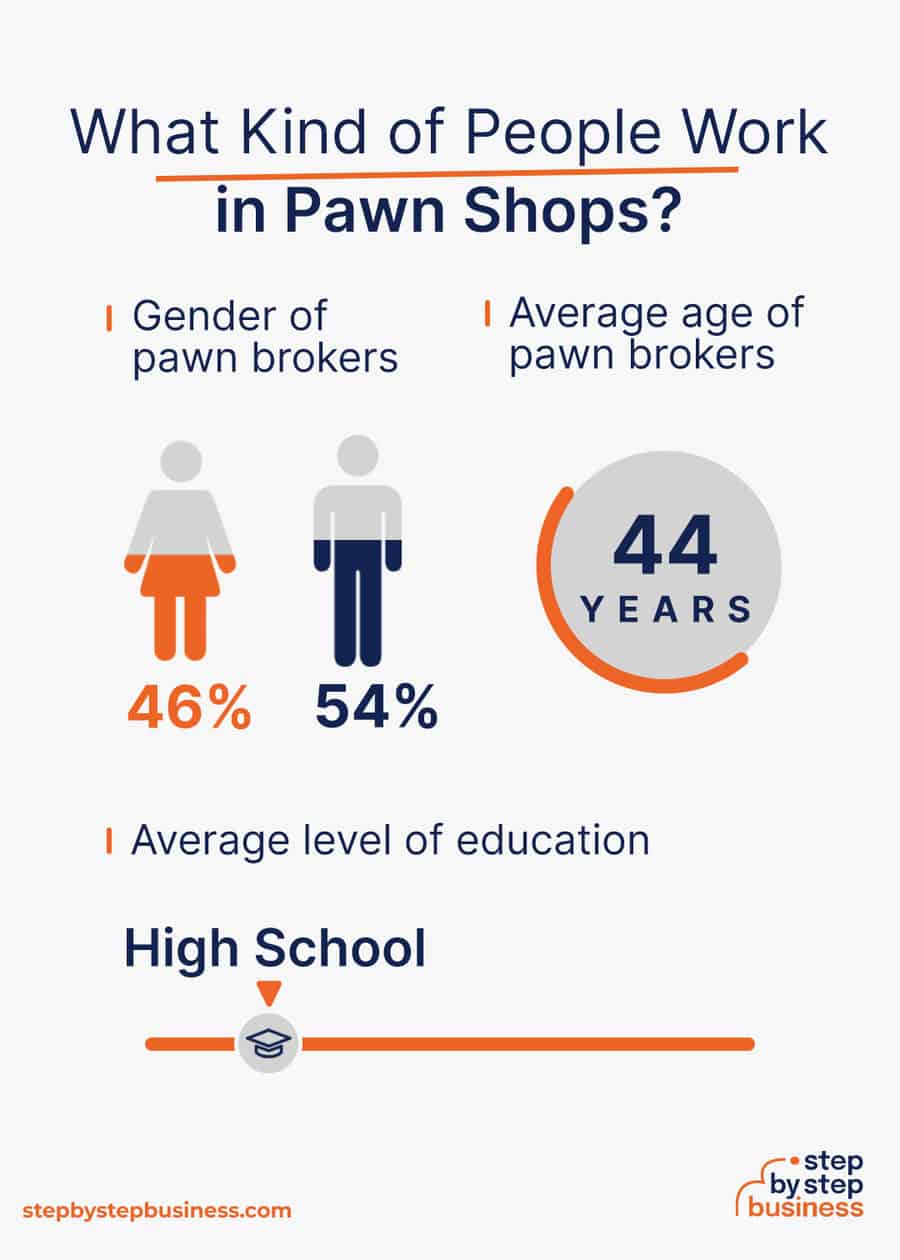

What kind of people work in pawn shops?

- Gender – More than 46% of pawn brokers are female, while nearly 54% are male.(( https://www.zippia.com/pawn-broker-jobs/demographics/#gender-statistics ))

- Average level of education – 47% of pawn brokers finished high school while 21% hold an associate degree.(( https://www.zippia.com/pawn-broker-jobs/education/ ))

- Average age – Most pawn brokers are under 44 years old.(( https://www.zippia.com/pawn-broker-jobs/demographics/#age-statistics ))

How much does it cost to start a pawn shop business?

Startup costs for a pawn shop range from about $20,000 to nearly $40,000. The main costs are for a shop rental deposit, shop preparation, and cash to make loans and to purchase items for inventory. Also included is the cost of a pawnbroker’s license.

You’ll need a handful of items to successfully launch your pawn shop business, including:

- Counter and cabinets that lock

- Jewelry testing equipment

- Computer and POS system

- Security system

How much can you earn from a pawn shop business?

Pawn shop revenue is difficult to predict. The maximum interest rate that you can charge on pawn loans varies by state and could be anywhere from 3% per month to 25% per month. Markups on sold items are generally between 50% and 100%. You should expect a profit margin of about 25% overall. Use our markup calculator to calculate your sale price and how much revenue and profit you will earn with different markup percentages.

In your first year or two if you bring in $2,500 per month in interest and sell $500 worth of items per day, you’ll be bringing in over $210,000 in annual revenue. This would mean over $50,000 in profit, assuming that 25% margin. As your brand gains recognition, you could bring in $10,000 in interest per month and sell $1,000 worth of items per day. With expected annual revenue of nearing $500,000, you would make close to $125,000.

What barriers to entry are there?

There are a few barriers to entry for a pawn shop. Your biggest challenges will be:

- It takes some money to get started

- You need to find a shop to rent in your area where you don’t have close competition

Related Business Ideas

How to Start a Credit Repair Business

How to Start a Check Cashing Business

How to Start a Money Lending Business

Step 2: hone your idea.

Now that you know what’s involved in starting a pawn shop, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research pawn shops in your area to examine their products and services, price points, customer reviews, and what sells best. You’re looking for a market gap to fill. For instance, maybe the local market is missing a pawn shop in a certain area.

You might consider targeting a niche market by specializing in a certain aspect of your industry such as jewelry.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine your products

Your products will be based on what people bring to you unless you decide to specialize in a certain item like jewelry.

How much should you charge for pawn shop items and loans?

The interest rate you charge will depend on the maximum allowed by your state. On items that you purchase and sell, you should buy them at prices you can mark up 50% to 100%. You should aim for a profit margin of 25%.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price point. Remember, the price you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Your target market will be very broad, so you should market yourself on a variety of social media sites including Facebook, Instagram, and TikTok.

Where? Choose your pawn shop location

The location of your pawn shop is crucial to attracting customers and ensuring its success. Look for a spot in a busy commercial district with high foot traffic, such as a shopping mall or a popular downtown area. Consider accessibility and convenience, ensuring that the location is easily reachable by public transportation and has ample parking.

Depending on the type of pawn shop you plan to start, you may also want to consider the proximity to complementary businesses, such as antique stores or jewelers.

When selecting a location, ensure that it meets all necessary safety and regulatory requirements for pawn shops. By strategically choosing the right location, you can establish a profitable and successful pawn shop that provides high-quality services to customers and stands out in the competitive retail industry.

Find commercial space to rent in your area on sites such as Craigslist , Crexi , and Instant Offices .

Step 3: Brainstorm a Pawn Shop Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “pawn” or “pawn shop”, boosts SEO

- Name should allow for expansion, for ex: “Gold Rush Pawn” over “Antique Pawn”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Pawn Shop Business Plan

Here are the key components of a business plan:

- Executive Summary: A brief overview of your pawn shop business, summarizing key points and objectives.

- Business Overview: Detailed information about the nature of your pawn shop, its mission, vision, and the problem it aims to solve in the market.

- Product and Services: Clearly outline the range of items your pawn shop will accept and the services you’ll provide, such as pawn loans and retail sales.

- Market Analysis: Research on the local market, target customer demographics, and trends affecting the pawn industry.

- Competitive Analysis: Identification and evaluation of key competitors in the pawn industry, highlighting your shop’s unique selling points.

- Sales and Marketing: Strategies for attracting customers, building brand awareness, and promoting your pawn services and inventory.

- Management Team: Introduce the key individuals responsible for running the pawn shop and their relevant skills and experience.

- Operations Plan: Details on day-to-day operations, from accepting items to managing inventory and security measures.

- Financial Plan: Projections of expenses, revenue, and profit, including startup costs, operating expenses, and expected income from pawn transactions and sales.

- Appendix: Additional supporting documents and information, such as legal documents, permits, and any other relevant materials.

If you’ve never created a business plan before, it can be an intimidating task. You might consider finding and hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to pawn shops

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your pawn shop will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC , which just need to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that most new business owners choose an LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your Articles of Organization and be on hand to answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number , or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans : This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans : The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants : A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Friends and Family : Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding : Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal : Self-fund your business via your savings or the sale of property or other assets.

Bank loans or SBA loans are probably the best option for funding a pawn shop business.

Step 8: Apply for Pawn Shop Business Licenses and Permits

Starting a pawn shop business requires obtaining a number of licenses and permits from local, state, and federal governments.

Most states will require you to have a pawnbroker’s license which involves meeting certain educational requirements. States also have specific rules related to pawn shops that you need to be familiar with. Check with your state for requirements.

Federal regulations, licenses, and permits associated with starting your business include doing business as, health license and permit from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level licenses and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account . Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your pawn shop business as a sole proprietorship.

Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability : The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property : Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance : Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation : Provides compensation to employees injured on the job.

- Property : Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto : Protection for your company-owned vehicle.

- Professional liability : Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP) : This is an insurance plan that acts as an all-in-one insurance policy, a combination of any of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You can use industry-specific software, such as PawnMaster , PawnMate , or Bravo , to manage your purchases and sales, inventory, loans, and customers.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using services like WordPress, Wix, or Squarespace . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are practical strategies to boost your pawn shop business:

- Community Engagement: Engage with local events, sponsorships, and community initiatives to build trust and visibility, emphasizing your commitment to supporting the community.

- Local SEO — Regularly update your Google My Business and Yelp profiles to strengthen your local search presence.

- Unique Promotions: Create enticing promotions such as discounted interest rates, special deals on certain items, or loyalty programs to attract and retain customers.

- Social Media Presence: Leverage social media platforms to showcase unique items, share success stories, and engage with your audience, creating an online community around your pawn shop.

- Educational Content: Develop content that educates customers on the pawn process, value of items, and tips for securing loans, establishing your shop as a reliable source of information.

- Strategic Signage: Use clear and attractive signage to communicate your services, values, and any ongoing promotions, ensuring that passersby are aware of what your pawn shop offers.

- Cross-Promotions: Partner with local businesses to cross-promote services, providing mutual benefits and expanding your reach within the community.

- Customer Testimonials: Showcase positive customer experiences through testimonials, both online and within your physical store, to build trust and credibility.

- Themed Events: Host themed events or sales, such as “Jewelry Week” or “Tech Tuesday,” to create excitement and draw in customers with specific interests.

- Referral Programs: Implement a referral program that rewards existing customers for referring new clients, encouraging word-of-mouth marketing.

- Dynamic Merchandising: Regularly update your merchandise display to keep the inventory fresh and interesting, encouraging repeat visits from customers curious about new arrivals.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that sets it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your pawn shop meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your pawn shop business could be:

- Guaranteed loans for less

- Pawn your fine jewelry for the lowest rates in town

- Sell your gold and silver for top dollar

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a pawn shop business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in pawn shops for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in pawn shops. You’ll probably generate new customers or find companies with which you could establish a partnership.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a pawn shop business would include:

- Pawn Shop Clerks – buy and sell items, make loans, customer service

- General Manager – scheduling, staff management, accounting

- Marketing Lead – SEO strategies, social media, other marketing

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Pawn Shop – Start Making Money!

Pawn shops can be big business and are a $3 billion industry in the United States. If you start a pawn shop you can make good money and eventually open multiple locations and have a pawn empire. You’ll never have a dull day in the pawn business either since you’ll never know who or what might be coming in.

Now that you have armed yourself with a load of information, you’re ready to start your entrepreneurial journey to becoming a pawn star!

- Pawn Shop Business FAQs

You can make money from interest on loans, and from buying items and selling them at a markup. You can also sell the pawned items if loans with interest are not made on time. You should buy items at a price that you can markup at least 50% to 100%. That part of your business alone can make you a healthy profit.

Offer unique services like online pawn options or specialized expertise in certain types of items, and provide transparent pricing and fair valuations to differentiate your pawn shop.

Starting a pawn shop on the side is possible, but it requires thorough understanding of local regulations, licensing requirements, and the ability to dedicate time and resources to manage the business effectively.

Use targeted marketing strategies, such as local advertising, social media promotions, and partnerships with complementary businesses, to attract new clients to your pawn shop.

Implement strict verification procedures, maintain detailed records of transactions, and collaborate with law enforcement agencies to minimize the risk of fraud or dealing with stolen items in your pawn shop.

Pawn shops can accept a wide range of items as collateral, including jewelry, watches, electronics, musical instruments, firearms, and valuable collectibles. The specific items accepted may vary depending on local laws and the policies of your pawn shop.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Decide if the Business Is Right for You

- Hone Your Idea

- Brainstorm a Pawn Shop Name

- Create a Pawn Shop Business Plan

- Register Your Business

- Register for Taxes

- Fund your Business

- Apply for Pawn Shop Business Licenses and Permits

- Open a Business Bank Account

- Get Business Insurance

- Prepare to Launch

- Build Your Team

- Run a Pawn Shop - Start Making Money!

Subscribe to Our Newsletter

Featured resources.

57 Best Service Business Ideas

David Lepeska

Published on December 1, 2022

The services sector is undoubtedly the biggest economic sector in the US as it accounts for nearly 70% of the country’s gross domestic product. It ...

16 Profitable Retail Business Ideas

Carolyn Young

The world of retail is huge, and lucrative opportunities are many. Retail offers endless areas for a budding entrepreneur to explore ideas for newbu ...

No thanks, I don't want to stay up to date on industry trends and news.

How to Start a Pawn Shop

A pawn shop offers customers collateral loans and buys, sells and trades items of value. Pawn shops allow customers to pawn (or hock) something valuable in exchange for a short-term loan. If the customer returns the money, and the interest due on the loan, the item is returned. But when the customer cannot pay back the loan, the person who owns the pawn shop, or the pawnbroker, sells the item for a profit.

Learn how to start your own Pawn Shop and whether it is the right fit for you.

Ready to form your LLC? Check out the Top LLC Formation Services .

Start a pawn shop by following these 10 steps:

- Plan your Pawn Shop

- Form your Pawn Shop into a Legal Entity

- Register your Pawn Shop for Taxes

- Open a Business Bank Account & Credit Card

- Set up Accounting for your Pawn Shop

- Get the Necessary Permits & Licenses for your Pawn Shop

- Get Pawn Shop Insurance

- Define your Pawn Shop Brand

- Create your Pawn Shop Website

- Set up your Business Phone System

We have put together this simple guide to starting your pawn shop. These steps will ensure that your new business is well planned out, registered properly and legally compliant.

Exploring your options? Check out other small business ideas .

STEP 1: Plan your business

A clear plan is essential for success as an entrepreneur. It will help you map out the specifics of your business and discover some unknowns. A few important topics to consider are:

What will you name your business?

- What are the startup and ongoing costs?

- Who is your target market?

How much can you charge customers?

Luckily we have done a lot of this research for you.

Choosing the right name is important and challenging. If you don’t already have a name in mind, visit our How to Name a Business guide or get help brainstorming a name with our Pawn Shop Name Generator

If you operate a sole proprietorship , you might want to operate under a business name other than your own name. Visit our DBA guide to learn more.

When registering a business name , we recommend researching your business name by checking:

- Your state's business records

- Federal and state trademark records

- Social media platforms

- Web domain availability .

It's very important to secure your domain name before someone else does.

Want some help naming your pawn shop?

Business name generator, what are the costs involved in opening a pawn shop.

It is possible to open a pawn shop for as little as $10,000 dollars, but most cost much more. Since pawn shops make most of their profit from providing loans to customers, possible income is limited by the amount of money available to loan out, so it makes sense to have a significant amount of capital before opening a pawn shop.

Rent: Your largest fixed-cost is rent. Most pawn shops find it better not to choose locations in the high-rent business district, but it is still important to find a location convenient for your customers. Pawn shops need enough space to display, test, and securely store items.

Operating capital: Reserve the bulk of your budget as operating capital. This is the money you will use to make loans and to cover the expenses of running a pawn shop.

Security: Pawn shops have a lot of valuable items and tend to keep a lot of cash on hand. This makes them attractive targets for thieves. Installing a top-of-the-line security system is important for preventing loss and reducing the cost of insurance.

Insurance: Pawn shops need comprehensive insurance to protect themselves from loss and legal liability. The amount of insurance a pawn shop must carry depends on the state where it operates.

Initial inventory: While an extensive inventory is not advisable, an empty showroom does not give the best impressions to customers. Make sure you have at least some inventory in stock before opening the doors but don't spend too much of your entire budget.

Computer system: You will need a computer system for keeping records, printing receipts and researching. Any low-end computer and printer will more than suit your needs.

What are the ongoing expenses for a pawn shop?

Rent, utilities, salaries, and security are all part of ongoing expenses associated with owning a pawn shop.

Who is the target market?

Since a pawn shop makes money in multiple ways, it needs to attract more than one type of customers to be successful. In order to make money off short-term collateral loans, the shop must have customers who need cash to pay for something immediately, do not have or do not want to use other forms of credit, and has a source of income to pay off the loan and interest to redeem the item. To make a profit by selling items, the pawn shop needs customers who want to save money buying secondhand items.

How does a pawn shop make money?

Pawn shops make money in two ways. The first way is to offer collateral loans and to make money on the interest rate. The second way is to sell items at a profit.

The maximum amount pawn shops can charge customers on a loan is controlled by the state. According to the National Pawnbrokers Association, charging $15 on a 30-day, $150 loan is typical. Pawn shops usually mark up items they sell between 15 and 45 percent.

How much profit can a pawn shop make?

The amount of money a pawn shop owner makes varies greatly by region. According to PayScale.com the average salary for a pawnshop owner is just over $32,000 a year.

How can you make your business more profitable?

Many pawnshop owners add sideline businesses to increase their profitability. Some common side businesses include check cashing, storage, online sales, and appraisal services.

Want a more guided approach? Access TRUiC's free Small Business Startup Guide - a step-by-step course for turning your business idea into reality. Get started today!

STEP 2: Form a legal entity

The most common business structure types are the sole proprietorship , partnership , limited liability company (LLC) , and corporation .

Establishing a legal business entity such as an LLC or corporation protects you from being held personally liable if your pawn shop is sued.

Form Your LLC

Read our Guide to Form Your Own LLC

Have a Professional Service Form your LLC for You

Two such reliable services:

You can form an LLC yourself and pay only the minimal state LLC costs or hire one of the Best LLC Services for a small, additional fee.

Recommended: You will need to elect a registered agent for your LLC. LLC formation packages usually include a free year of registered agent services . You can choose to hire a registered agent or act as your own.

STEP 3: Register for taxes

You will need to register for a variety of state and federal taxes before you can open for business.

In order to register for taxes you will need to apply for an EIN. It's really easy and free!

You can acquire your EIN through the IRS website . If you would like to learn more about EINs, read our article, What is an EIN?

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides.

STEP 4: Open a business bank account & credit card

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil .

Open a business bank account

Besides being a requirement when applying for business loans, opening a business bank account:

- Separates your personal assets from your company's assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Recommended: Read our Best Banks for Small Business review to find the best national bank or credit union.

Get a business credit card

Getting a business credit card helps you:

- Separate personal and business expenses by putting your business' expenses all in one place.

- Build your company's credit history , which can be useful to raise money later on.

Recommended: Apply for an easy approval business credit card from BILL and build your business credit quickly.

STEP 5: Set up business accounting

Recording your various expenses and sources of income is critical to understanding the financial performance of your business. Keeping accurate and detailed accounts also greatly simplifies your annual tax filing.

Make LLC accounting easy with our LLC Expenses Cheat Sheet.

STEP 6: Obtain necessary permits and licenses

Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down.

State & Local Business Licensing Requirements

Certain state permits and licenses may be needed to operate a pawn shop business. Learn more about licensing requirements in your state by visiting SBA’s reference to state licenses and permits .

Most businesses are required to collect sales tax on the goods or services they provide. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses .

Certificate of Occupancy

A pawn shop is generally run out of a storefront. Businesses operating out of a physical location typically require a Certificate of Occupancy (CO). A CO confirms that all building codes, zoning laws and government regulations have been met.

- If you plan to lease a location :

- It is generally the landlord’s responsibility to obtain a CO.

- Before leasing, confirm that your landlord has or can obtain a valid CO that is applicable to a pawn shop.

- After a major renovation, a new CO often needs to be issued. If your place of business will be renovated before opening, it is recommended to include language in your lease agreement stating that lease payments will not commence until a valid CO is issued.

- If you plan to purchase or build a location :

- You will be responsible for obtaining a valid CO from a local government authority.

- Review all building codes and zoning requirements for your business’ location to ensure your pawn shop will be in compliance and able to obtain a CO.

Services Contract

Pawn shops should require clients to sign a services agreement before starting a new project. This agreement should clarify client expectations and minimize risk of legal disputes by setting out payment terms and conditions, service level expectations, and intellectual property ownership. Here is an example of one such services agreement.

STEP 7: Get business insurance

Just as with licenses and permits, your business needs insurance in order to operate safely and lawfully. Business Insurance protects your company’s financial wellbeing in the event of a covered loss.

There are several types of insurance policies created for different types of businesses with different risks. If you’re unsure of the types of risks that your business may face, begin with General Liability Insurance . This is the most common coverage that small businesses need, so it’s a great place to start for your business.

Another notable insurance policy that many businesses need is Workers’ Compensation Insurance . If your business will have employees, it’s a good chance that your state will require you to carry Workers' Compensation Coverage.

FInd out what types of insurance your Pawn Shop needs and how much it will cost you by reading our guide Business Insurance for Pawn Shop.

STEP 8: Define your brand

Your brand is what your company stands for, as well as how your business is perceived by the public. A strong brand will help your business stand out from competitors.

If you aren't feeling confident about designing your small business logo, then check out our Design Guides for Beginners , we'll give you helpful tips and advice for creating the best unique logo for your business.

Recommended : Get a logo using Truic's free logo Generator no email or sign up required, or use a Premium Logo Maker .

If you already have a logo, you can also add it to a QR code with our Free QR Code Generator . Choose from 13 QR code types to create a code for your business cards and publications, or to help spread awareness for your new website.

How to promote & market a pawn shop

One of the best ways to promote your pawn shop is online. You should invest the time and money to create a Facebook page and a website. If you tend to deal with one type of item more than others, like gold or guns, you should consider advertising on sites which cater to people who buy these items.

How to keep customers coming back

Many loan customers come back multiple times a years, so it is in your best interest to provide good service and a fair price. It is important that you avoid alienating anyone and that you make your store as inviting as possible for everyone.

STEP 9: Create your business website

After defining your brand and creating your logo the next step is to create a website for your business .

While creating a website is an essential step, some may fear that it’s out of their reach because they don’t have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn’t delay building your website:

- All legitimate businesses have websites - full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don’t need to hire a web developer or designer to create a website that you can be proud of.

Recommended : Get started today using our recommended website builder or check out our review of the Best Website Builders .

Other popular website builders are: WordPress , WIX , Weebly , Squarespace , and Shopify .

STEP 10: Set up your business phone system

Getting a phone set up for your business is one of the best ways to help keep your personal life and business life separate and private. That’s not the only benefit; it also helps you make your business more automated, gives your business legitimacy, and makes it easier for potential customers to find and contact you.

There are many services available to entrepreneurs who want to set up a business phone system. We’ve reviewed the top companies and rated them based on price, features, and ease of use. Check out our review of the Best Business Phone Systems 2023 to find the best phone service for your small business.

Recommended Business Phone Service: Phone.com

Phone.com is our top choice for small business phone numbers because of all the features it offers for small businesses and it's fair pricing.

Is this Business Right For You?

Many people view pawn shops as operating in the gray area between being legal and illegal. While this is mostly untrue, it is important for successful pawnbrokers to maintain a good reputation in the community. Due to the nature of the business, it is helpful if an owner of a pawn shop is someone who is able to get along with a wide variety of people.

Want to know if you are cut out to be an entrepreneur?

Take our Entrepreneurship Quiz to find out!

Entrepreneurship Quiz

What happens during a typical day at a pawn shop?

An owner of a pawn shop usually spends a lot of time maintaining records, filing reports, and doing inventory. At other times, the owner is responsible for making appraisals, buying, and selling items.

What are some skills and experiences that will help you build a successful pawn shop?

An owner of a pawn shop needs to be highly organized to keep perfect records and to adhere to all the laws and regulations related to pawn shops. In addition, an owner should be able to assess the value of a wide range of items and deal with people in potentially high-stress situations. As online sales continue to chip away at brick and mortar stores, the ability for a pawn shop owner to sell online will increase your pawn shop's profits.

What is the growth potential for a pawn shop?

According to Pawn Shops Today, the number of defaults on collateral loans is increasing, while the ability to resell pawned items is decreasing.

TRUiC's YouTube Channel

For fun informative videos about starting a business visit the TRUiC YouTube Channel or subscribe to view later.

Take the Next Step

Find a business mentor.

One of the greatest resources an entrepreneur can have is quality mentorship. As you start planning your business, connect with a free business resource near you to get the help you need.

Having a support network in place to turn to during tough times is a major factor of success for new business owners.

Learn from other business owners

Want to learn more about starting a business from entrepreneurs themselves? Visit Startup Savant’s startup founder series to gain entrepreneurial insights, lessons, and advice from founders themselves.

Resources to Help Women in Business

There are many resources out there specifically for women entrepreneurs. We’ve gathered necessary and useful information to help you succeed both professionally and personally:

If you’re a woman looking for some guidance in entrepreneurship, check out this great new series Women in Business created by the women of our partner Startup Savant.

What are some insider tips for jump starting a pawn shop?

A pawn shop is first and foremost a moneylender. New pawnbrokers should concentrate on building this aspect of the business over buying, selling, and trading secondhand goods. This means instead of spending your limited capital to fill your shop with secondhand items, it is better to keep enough money on hand to lend and to pay rent and utilities for the first few months.

Learn as much as you can before opening, and always continue learning more every day. Spending time learning how to correctly appraise the value of an item is critical to staying in business. Join a regional or national pawnbrokers' association like the National Pawnbrokers Association to help you.

How and when to build a team

Many pawn shops are family-owned and operated, but larger stores will need to hire employees. Hiring employees who have a background working in pawn shops or auction houses is usually a good idea. Make sure to do a thorough background check on any employee before you hire anyone. This will help you avoid potential problems in the future.

Useful Links

Industry opportunities.

- National Pawnbrokers Association

- Money Mizer Franchise opportunity

Real World Examples

- Michigan business

- Atlanta business

Further Reading

- Getting Your Pawn Shop Started

Have a Question? Leave a Comment!

How to Start a Pawn Shop

Starting a pawn shop can be very profitable. With proper planning, execution and hard work, you can enjoy great success. Below you will learn the keys to launching a successful pawn shop.

Importantly, a critical step in starting a pawn shop is to complete your business plan. To help you out, you should download Growthink’s Ultimate Business Plan Template here .

Download our Ultimate Business Plan Template here

14 Steps To Start a Pawn Shop :

- Choose the Name for Your Pawn Shop

- Develop Your Pawn Shop Business Plan

- Choose the Legal Structure for Your Pawn Shop

- Secure Startup Funding for Your Pawn Shop (If Needed)

- Secure a Location for Your Business

- Register Your Pawn Shop with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Pawn Shop

- Buy or Lease the Right Pawn Shop Equipment

- Develop Your Pawn Shop Marketing Materials

- Purchase and Setup the Software Needed to Run Your Pawn Shop

- Open for Business

1. Choose the Name for Your Pawn Shop

The first step to starting a pawn shop is to choose your business’ name.

This is a very important choice since your company name is your brand and will last for the lifetime of your business. Ideally you choose a name that is meaningful and memorable. Here are some tips for choosing a name for your own pawn shop:

- Make sure the name is available . Check your desired name against trademark databases and your state’s list of registered business names to see if it’s available. Also check to see if a suitable domain name is available.

- Keep it simple . The best names are usually ones that are easy to remember, pronounce and spell.

- Think about marketing . Come up with a name that reflects the desired brand and/or focus of your new business.

2. Develop Your Pawn Shop Business Plan

One of the most important steps in starting a pawn shop is to develop your business plan . The process of creating your plan ensures that you fully understand your market and your business strategy. The plan also provides you with a roadmap to follow and if needed, to present to funding sources to raise capital for your business.

Your business plan should include the following sections:

- Executive Summary – this section should summarize your entire business plan so readers can quickly understand the key details of your pawn shop.

- Company Overview – this section tells the reader about the history of your pawn shop and what type of pawn shop you operate. For example, are you a traditional, big-box, or a luxury pawn shop?

- Industry Analysis – here you will document key information about the pawn industry. Conduct market research and document how big the industry is and what trends are affecting it.

- Customer Analysis – in this section, you will document who your ideal or target audience are and their demographics. For example, how old are they? Where do they live? What do they find important when purchasing products or services like the ones you will offer?

- Competitive Analysis – here you will document the key direct and indirect competitors you will face and how you will build competitive advantage.

- Marketing Plan – your marketing plan should address the 4Ps: Product, Price, Promotions and Place.

- Product : Determine and document what products/services you will offer

- Prices : Document the prices of your products/services

- Place : Where will your business be located and how will that location help you increase sales?

- Promotions : What promotional methods will you use to attract customers to your pawn shop? For example, you might decide to use pay-per-click advertising, public relations, search engine optimization and/or social media marketing.

- Operations Plan – here you will determine the key processes you will need to run your day-to-day operations. You will also determine your staffing needs. Finally, in this section of your plan, you will create a projected growth timeline showing the milestones you hope to achieve in the coming years.

- Management Team – this section details the background of your company’s management team.

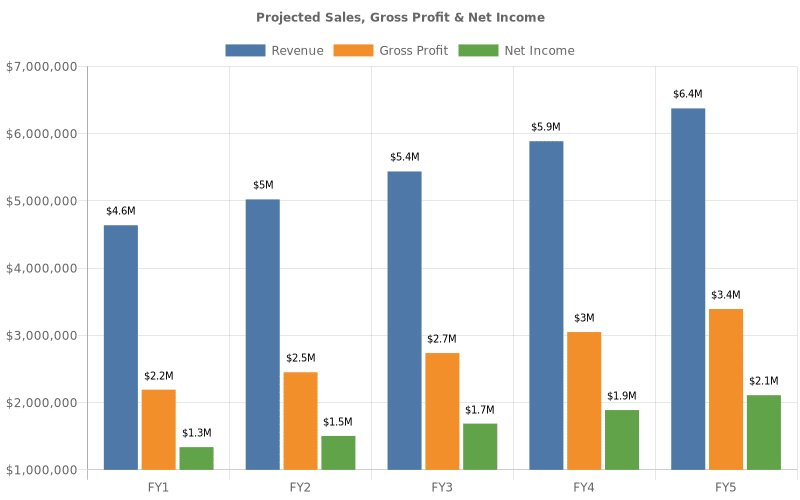

- Financial Plan – finally, the financial plan answers questions including the following:

- What startup costs will you incur?

- How will your pawn shop make money?

- What are your projected sales and expenses for the next five years?

- Do you need to raise funding to launch your business?

Finish Your Business Plan Today!

3. choose the legal structure for your pawn shop.

Next you need to choose a legal structure for your pawn shop and register it and your business name with the Secretary of State in each state where you operate your business.

Below are the five most common legal structures:

1) Sole proprietorship

A sole proprietorship is a business entity in which the pawn shop owner and the business are the same legal person. The business owner of a sole proprietorship is responsible for all debts and obligations of the business. There are no formalities required to establish a sole proprietorship, and it is easy to set up and operate. The main advantage of a sole proprietorship is that it is simple and inexpensive to establish. The main disadvantage is that the owner is liable for all debts and obligations of the business.

2) Partnerships

A partnership is a legal structure that is popular among small businesses. It is an agreement between two or more people who want to start a pawn shop together. The partners share in the pawn shop’s profits and losses of the business.

The advantages of a partnership are that it is easy to set up, and the partners share in the profits and losses of the business. The disadvantages of a partnership are that the partners are jointly liable for the debts of the business, and disagreements between partners can be difficult to resolve.

3) Limited Liability Company (LLC)

A limited liability company, or LLC, is a type of business entity that provides limited liability to its owners. This means that the owners of an LLC are not personally responsible for the debts and liabilities of the business. The advantages of an LLC for a pawn shop include flexibility in management, pass-through taxation (avoids double taxation as explained below), and limited personal liability. The disadvantages of an LLC include lack of availability in some states and self-employment taxes.

4) C Corporation

A C Corporation is a business entity that is separate from its owners. It has its own tax ID and can have shareholders. The main advantage of a C Corporation for a pawn shop is that it offers limited liability to its owners. This means that the owners are not personally responsible for the debts and liabilities of the business. The disadvantage is that C Corporations are subject to double taxation. This means that the corporation pays taxes on its profits, and the shareholders also pay taxes on their dividends.

5) S Corporation

An S Corporation is a type of corporation that provides its owners with limited liability protection and allows them to pass their business income through to their personal income tax returns, thus avoiding double taxation. There are several limitations on S Corporations including the number of shareholders they can have among others.

Once you register your pawn shop, your state will send you your official “Articles of Incorporation.” You will need this among other documentation when establishing your banking account (see below). We recommend that you consult an attorney in determining which legal structure is best suited for your company.

Incorporate Your Business at the Guaranteed Lowest Price

We are proud to have partnered with Business Rocket to help you incorporate your business at the lowest price, guaranteed.

Not only does BusinessRocket have a 4.9 out of 5 rating on TrustPilot (with over 1,000 reviews) because of their amazing quality…but they also guarantee the most affordable incorporation packages and the fastest processing time in the industry.

4. Secure Startup Funding for Your Pawn Shop (If Needed)

In developing your pawn shop business plan, you might have determined that you need to raise funding to launch your business.

If so, the main sources of funding for a pawn shop to consider are personal savings, family and friends, credit card financing, bank loans, crowdfunding and angel investors. Angel investors are individuals who provide capital to early-stage businesses. Angel investors typically will invest in a pawn shop that they believe has high potential for growth.

5. Secure a Location for Your Business

There are a few things you’ll want to keep in mind when looking for a location for your pawn shop. First, you’ll want to make sure that the location is accessible and visible to customers. You’ll also want to make sure that the location is in a safe and busy area.

The following is a list of recommended locations:

– Strip malls or retail centers with high customer traffic

– Commercial buildings with proper utility connections

– Industrial areas where a pawn shop is permitted

Commercial zones, strip malls, and retail centers are the most popular locations because they typically have large signage that can be seen from a distance, have a high volume of customers, and have relatively low rent and utility costs.

6. Register Your Pawn Shop with the IRS

Next, you need to register your business with the Internal Revenue Service (IRS) which will result in the IRS issuing you an Employer Identification Number (EIN).

Most banks will require you to have an EIN in order to open up an account. In addition, in order to hire employees, you will need an EIN since that is how the IRS tracks your payroll tax payments.

Note that if you are a sole proprietor without employees, you generally do not need to get an EIN. Rather, you would use your social security number (instead of your EIN) as your taxpayer identification number.

7. Open a Business Bank Account

It is important to establish a bank account in your pawn shop’s name. This process is fairly simple and involves the following steps:

- Identify and contact the bank you want to use

- Gather and present the required documents (generally include your company’s Articles of Incorporation, driver’s license or passport, and proof of address)

- Complete the bank’s application form and provide all relevant information

- Meet with a banker to discuss your business needs and establish a relationship with them

8. Get a Business Credit Card

You should get a business credit card for your pawn shop to help you separate personal and business expenses.

You can either apply for a business credit card through your bank or apply for one through a credit card company.

When you’re applying for a business credit card, you’ll need to provide some information about your business. This includes the name of your business, the address of your business, and the type of business you’re running. You’ll also need to provide some information about yourself, including your name, Social Security number, and date of birth.

Once you’ve been approved for a business credit card, you’ll be able to use it to make purchases for your business. You can also use it to build your credit history which could be very important in securing loans and getting credit lines for your business in the future.

9. Get the Required Business Licenses and Permits

A pawn shop is a business that allows customers to pawn or sell items in order to receive a loan. In order to start a pawn shop, you will need a business license and a pawnbroker’s license. You may also need a pawn shop license, a precious metal dealer license, a secondhand dealer license or a federal firearms license.

Contact your city hall to learn the different licenses you need to start your business and how to obtain them.

10. Get Business Insurance for Your Pawn Shop

The type of insurance you need to operate a pawn shop will depend on your location and the type of business you are running.

Some business insurance policies you should consider for your pawn shop include:

- General liability insurance : This covers accidents and injuries that occur on your property. It also covers damages caused by your employees or products.

- Auto insurance : If a vehicle is used in your business, this type of insurance will cover if a vehicle is damaged or stolen.

- Workers’ compensation insurance : If you have employees, this type of policy works with your general liability policy to protect against workplace injuries and accidents. It also covers medical expenses and lost wages.

- Commercial property insurance : This covers damage to your property caused by fire, theft, or vandalism.

- Business interruption insurance : This covers lost income and expenses if your business is forced to close due to a covered event.

- Professional liability insurance : This protects your business against claims of professional negligence.

Find an insurance agent, tell them about your business and its needs, and they will recommend policies that fit those needs.

11. Buy or Lease the Right Pawn Shop Equipment

To run a pawn shop, you will need the following equipment: cash register, safe, security system, display cases, and signage.

12. Develop Your Pawn Shop Marketing Materials

Marketing materials will be required to attract and retain customers to your pawn shop.

The key marketing materials you will need are as follows:

- Logo : Spend some time developing a good logo for your pawn shop. Your logo will be printed on company stationery, business cards, marketing materials and so forth. The right logo can increase customer trust and awareness of your brand.

- Website : Likewise, a professional pawn shop website provides potential customers with information about the products and/or services you offer, your company’s history, and contact information. Importantly, remember that the look and feel of your website will affect how customers perceive you.

- Social Media Accounts : establish social media accounts in your company’s name. Accounts on Facebook, Twitter, LinkedIn and/or other online platforms will help customers and others find and interact with your pawn shop.

13. Purchase and Setup the Software Needed to Run Your Pawn Shop

To run a pawn shop, you need software that can manage transactions, track inventory, and report on financials. Some of the most popular accounting software for managing transactions and accounting include QuickBooks and Xero.

14. Open for Business