As a Medical Biller, the better you understand the medical insurance payment process, the better you can care for your patients. Your understanding of what a patient will owe and what will be covered can help them navigate the confusing world of medical insurance.

One term that can be very confusing for patients (and for doctors as well) is ‘Accepting Assignment’.

Essentially, ‘assignment’ means that a doctor, (also known as provider or supplier) agrees (or is required by law) to accept a Medicare-approved amount as full payment for covered services.

This amount may be lower or higher than an individual’s insurance amount, but will be on par with Medicare fees for the services.

If a doctor participates with an insurance carrier, they have a contract and agree that the provider will accept the allowed amount, then the provider would check “yes”.

If they do not participate and do not wish to accept what the insurance carrier allows, they would check “no”. It is important to note that a provider who does not participate can still opt to accept assignment on just a particular claim by checking the “yes” box just for those services.

In other words by saying your office will accept assignment, you are agreeing to the payment amount being covered by the insurer, or medicare, and the patient has no responsibility.

Copyright 2020 © liveClinic

FREE virtual consultation with trained medical professional

Run by volunteer physicians and nurse practitioners.

Keep non-critical medical attention at home, preserve scarce medical resources, and help protect patients and healthcare workers.

Speak with a Licensed Insurance Agent

- (888) 335-8996

Medicare Assignment

Home / Medicare 101 / Medicare Costs / Medicare Assignment

Summary: If a provider accepts Medicare assignment, they accept the Medicare-approved amount for a covered service. Though most providers accept assignment, not all do. In this article, we’ll explain the differences between participating, non-participating, and opt-out providers. You’ll also learn how to find physicians in your area who accept Medicare assignment. Estimated Read Time: 5 min

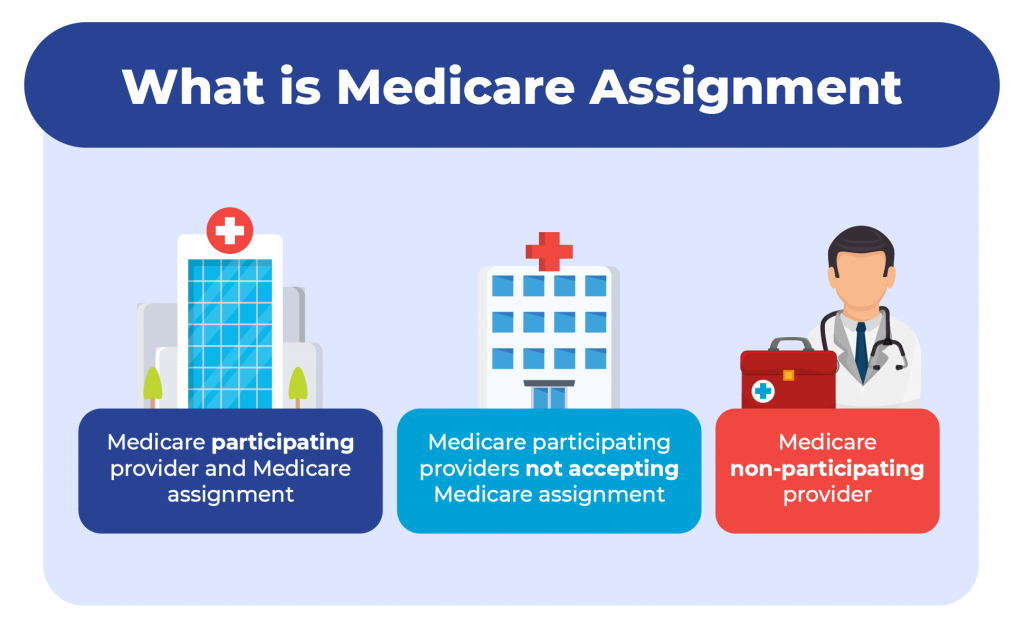

What is Medicare Assignment

Medicare assignment is an agreement by your doctor or other healthcare providers to accept the Medicare-approved amount as the full cost for a covered service. Providers who “accept assignment” bill Medicare directly for Part B-covered services and cannot charge you more than the applicable deductible and coinsurance.

Most healthcare providers who opt-in to Medicare accept assignment. In fact, CMS reported in its Medicare Participation for Calendar Year 2024 announcement that 98 percent of Medicare providers accepted assignment in 2023.

Providers who accept Medicare are divided into two groups: Participating providers and non-participating providers. Providers can decide annually whether they want to participate in Medicare assignment, or if they want to be non-participating.

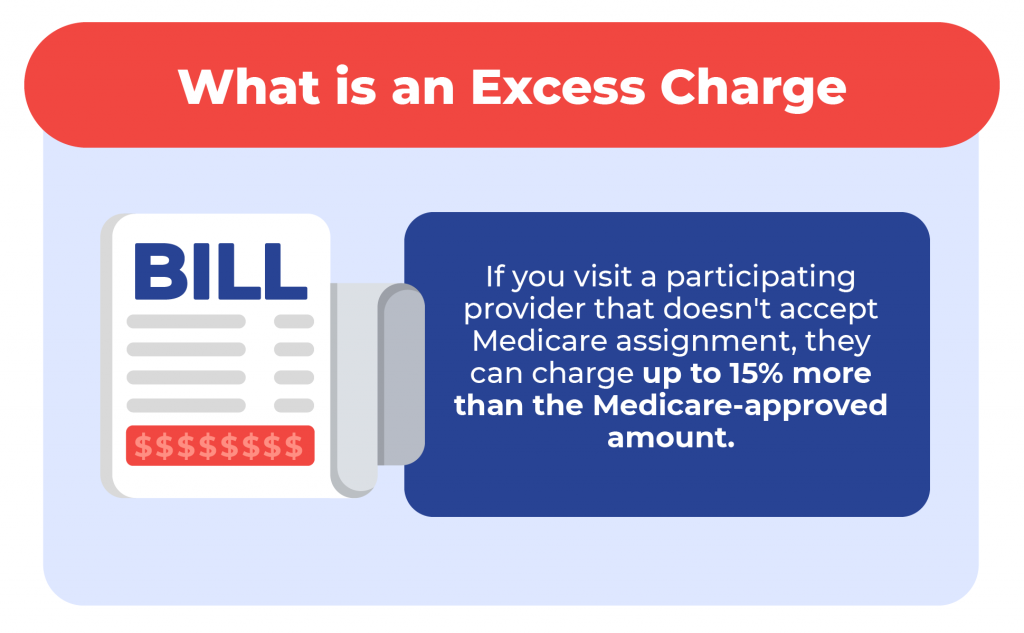

Providers who do not accept Medicare Assignment can charge up to 15% above the Medicare-approved cost for a service. If this is the case, you will be responsible for the entire amount (up to 15%) above what Medicare covers.

Below, we’ll take a closer look at participating, non-participating, and opt-out physicians.

Medicare Participating Providers: Providers Who Accept Medicare Assignment

Healthcare providers who accept Medicare assignment are known as “participating providers”. To participate in Medicare assignment, a provider must enter an agreement with Medicare called the Participating Physician or Supplier Agreement. When a provider signs this agreement, they agree to accept the Medicare-approved charge as the full charge of the service. They cannot charge the beneficiary more than the applicable deductible and coinsurance for covered services.

Each year, providers can decide whether they want to be a participating or non-participating provider. Participating in Medicare assignment is not only beneficial to patients, but to providers as well. Participating providers get paid by Medicare directly, and when a participating provider bills Medicare, Medicare will automatically forward the claim information to Medicare Supplement insurers. This makes the billing process much easier on the provider’s end.

Medicare Non-Participating Providers: Providers Who Don’t Accept Assignment

Healthcare providers who are “non-participating” providers do not agree to accept assignment and can charge up to 15% over the Medicare-approved amount for a service. Non-participating Medicare providers still accept Medicare patients. However they have not agreed to accept the Medicare-approved cost as the full cost for their service.

Doctors who do not sign an assignment agreement with Medicare can still choose to accept assignment on a case-by-case basis. When non-participating providers do add on excess charges , they cannot charge more than 15% over the Medicare-approved amount. It’s worth noting that providers do not have to charge the maximum 15%; they may only charge 5% or 10% over the Medicare-approved amount.

When you receive a Medicare-covered service at a non-participating provider, you may need to pay the full amount at the time of your service; a claim will need to be submitted to Medicare for you to be reimbursed. Prior to receiving care, your provider should give you an Advanced Beneficiary Notice (ABN) to read and sign. This notice will detail the services you are receiving and their costs.

Non-participating providers should include a CMS-approved unassigned claim statement in the additional information section of your Advanced Beneficiary Notice. This statement will read:

“This supplier doesn’t accept payment from Medicare for the item(s) listed in the table above. If I checked Option 1 above, I am responsible for paying the supplier’s charge for the item(s) directly to the supplier. If Medicare does pay, Medicare will pay me the Medicare-approved amount for the item(s), and this payment to me may be less than the supplier’s charge.”

This statement basically summarizes how excess charges work: Medicare will pay the Medicare-approved amount, but you may end up paying more than that.

Your provider should submit a claim to Medicare for any covered services, however, if they refuse to submit a claim, you can do so yourself by using CMS form 1490S .

Opt-Out Providers: What You Need to Know

Opt-out providers are different than non-participating providers because they completely opt out of Medicare. What does this mean for you? If you receive supplies or services from a provider who opted out of Medicare, Medicare will not pay for any of it (except for emergencies).

Physicians who opt-out of Medicare are even harder to find than non-participating providers. According to a report by KFF.org, only 1.1% of physicians opted out of Medicare in 2023. Of those who opted out, most are physicians in specialty fields such as psychiatry, plastic and reconstructive surgery, and neurology.

How to Find A Doctor Who Accepts Medicare Assignment

Finding a doctor who accepts Medicare patients and accepts Medicare assignment is generally easier than finding a provider who doesn’t accept assignment. As we mentioned above, of all the providers who accept Medicare patients, 98 percent accept assignment.

The easiest way to find a doctor or healthcare provider who accepts Medicare assignment is by visiting Medicare.gov and using their Compare Care Near You tool . When you search for providers in your area, the Care Compare tool will let you know whether a provider is a participating or non-participating provider.

If a provider is part of a group practice that involves multiple providers, then all providers in that group must have the same participation status. As an example, we have three doctors, Dr. Smith, Dr. Jones, and Dr. Shoemaker, who are all part of a group practice called “Health Care LLC”. The group decides to accept Medicare assignment and become a participating provider. Dr. Smith decides he does not want to accept assignment, however, because he is part of the “Health Care LLC” group, he must remain a participating provider.

Using Medicare’s Care Compare tool, you can select a group practice and see their participation status. You can then view all providers who are part of that group. This makes finding doctors who accept assignment even easier.

To ensure you don’t end up paying more out-of-pocket costs than you anticipated, it’s always a good idea to check with your provider if they are a participating Medicare provider. If you have questions regarding Medicare assignment or are having trouble determining whether a provider is a participating provider, you can contact Medicare directly at 1-800-633-4227. If you have questions about excess charges or other Medicare costs and would like to speak with a licensed insurance agent, you can contact us at the number above.

Announcement About Medicare Participation for Calendar Year 2024, Centers for Medicare & Medicaid Services. Accessed January 2024

https://www.cms.gov/files/document/medicare-participation-announcement.pdf

Annual Medicare Participation Announcement, CMS.gov. Accessed January 2024

https://www.cms.gov/medicare-participation

Does Your Provider Accept Medicare as Full Payment? Medicare.gov. Accessed January 2024

https://www.medicare.gov/basics/costs/medicare-costs/provider-accept-Medicare

Kayla Hopkins

Ashlee Zareczny

- Medicare Eligibility Requirements

- Medicare Enrollment Documents

- Apply for Medicare While Working

- Guaranteed Issue Rights

- Medicare by State

- Web Stories

- Online Guides

- Calculators & Tools

© 2024 Apply for Medicare. All Rights Reserved.

Owned by: Elite Insurance Partners LLC. This website is not connected with the federal government or the federal Medicare program. The purpose of this website is the solicitation of insurance. We do not offer every plan available in your area. Currently we represent 26 organizations which offer 3,740 products in your area. Please contact Medicare.gov or 1-800-MEDICARE or your local State Health Insurance Program to get information on all of your options.

Let us help you find the right Medicare plans today!

Simply enter your zip code below

Explore your options for easing the burden of student loan repayments with Savi.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

LIMITED TIME OFFER: Labor Day Sale!

Join AARP for just $9 per year with a 5-year membership and get a FREE Gift!

Get instant access to members-only products, hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

- AARP en Español

- Membership & Benefits

- Members Edition

- AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

AARP Hearing Center

Advice on Tinnitus and Hearing Loss

Get Happier

Creating Social Connections

Brain Health Resources

Tools and Explainers on Brain Health

Your Health

8 Major Health Risks for People 50+

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Beach Vacation Ideas

Fun Beach Vacations

Road Trips For Every Personality

Passport Access

Passports Can Be Renewed Online

AARP National Park Guide

Black Canyon of the Gunnison

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

Movies for Grownups

Summer Movie Preview

Jon Bon Jovi’s Long Journey Back

Looking Back

50 World Changers Turning 50

Sex & Dating

7 Dating Dos and 7 Don'ts

Friends & Family

Veterinarians May Use AI to Treat Pets

Home Technology

Caregiver’s Guide to Smart Home Tech

Virtual Community Center

Join Free Tech Help Events

Creative Ways to Store Your Pets Gear

Meals to Make in the Microwave

Wearing Shoes Inside: Pros vs. Cons

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Clean Your Car

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

What is Medicare assignment and how does it work?

Kimberly Lankford,

Because Medicare decides how much to pay providers for covered services, if the provider agrees to the Medicare-approved amount, even if it is less than they usually charge, they’re accepting assignment.

A doctor who accepts assignment agrees to charge you no more than the amount Medicare has approved for that service. By comparison, a doctor who participates in Medicare but doesn’t accept assignment can potentially charge you up to 15 percent more than the Medicare-approved amount.

That’s why it’s important to ask if a provider accepts assignment before you receive care, even if they accept Medicare patients. If a doctor doesn’t accept assignment, you will pay more for that physician’s services compared with one who does.

Join AARP for just $9 per year with a 5-year membership and get a FREE Gift!

How much do I pay if my doctor accepts assignment?

If your doctor accepts assignment, you will usually pay 20 percent of the Medicare-approved amount for the service, called coinsurance, after you’ve paid the annual deductible. Because Medicare Part B covers doctor and outpatient services, your $240 deductible for Part B in 2024 applies before most coverage begins.

All providers who accept assignment must submit claims directly to Medicare, which pays 80 percent of the approved cost for the service and will bill you the remaining 20 percent. You can get some preventive services and screenings, such as mammograms and colonoscopies , without paying a deductible or coinsurance if the provider accepts assignment.

What if my doctor doesn’t accept assignment?

A doctor who takes Medicare but doesn’t accept assignment can still treat Medicare patients but won’t always accept the Medicare-approved amount as payment in full.

This means they can charge you up to a maximum of 15 percent more than Medicare pays for the service you receive, called “balance billing.” In this case, you’re responsible for the additional charge, plus the regular 20 percent coinsurance, as your share of the cost.

How to cover the extra cost? If you have a Medicare supplement policy , better known as Medigap, it may cover the extra 15 percent, called Medicare Part B excess charges.

All Medigap policies cover Part B’s 20 percent coinsurance in full or in part. The F and G policies cover the 15 percent excess charges from doctors who don’t accept assignment, but Plan F is no longer available to new enrollees, only those eligible for Medicare before Jan. 1, 2020, even if they haven’t enrolled in Medicare yet. However, anyone who is enrolled in original Medicare can apply for Plan G.

Remember that Medigap policies only cover excess charges for doctors who accept Medicare but don’t accept assignment, and they won’t cover costs for doctors who opt out of Medicare entirely.

Good to know. A few states limit the amount of excess fees a doctor can charge Medicare patients. For example, Massachusetts and Ohio prohibit balance billing, requiring doctors who accept Medicare to take the Medicare-approved amount. New York limits excess charges to 5 percent over the Medicare-approved amount for most services, rather than 15 percent.

AARP NEWSLETTERS

%{ newsLetterPromoText }%

%{ description }%

Privacy Policy

ARTICLE CONTINUES AFTER ADVERTISEMENT

How do I find doctors who accept assignment?

Before you start working with a new doctor, ask whether he or she accepts assignment. About 98 percent of providers billing Medicare are participating providers, which means they accept assignment on all Medicare claims, according to KFF.

You can get help finding doctors and other providers in your area who accept assignment by zip code using Medicare’s Physician Compare tool .

Those who accept assignment have this note under the name: “Charges the Medicare-approved amount (so you pay less out of pocket).” However, not all doctors who accept assignment are accepting new Medicare patients.

AARP® Vision Plans from VSP™

Vision insurance plans designed for members and their families

What does it mean if a doctor opts out of Medicare?

Doctors who opt out of Medicare can’t bill Medicare for services you receive. They also aren’t bound by Medicare’s limitations on charges.

In this case, you enter into a private contract with the provider and agree to pay the full bill. Be aware that neither Medicare nor your Medigap plan will reimburse you for these charges.

In 2023, only 1 percent of physicians who aren’t pediatricians opted out of the Medicare program, according to KFF. The percentage is larger for some specialties — 7.7 percent of psychiatrists and 4.2 percent of plastic and reconstructive surgeons have opted out of Medicare.

Keep in mind

These rules apply to original Medicare. Other factors determine costs if you choose to get coverage through a private Medicare Advantage plan . Most Medicare Advantage plans have provider networks, and they may charge more or not cover services from out-of-network providers.

Before choosing a Medicare Advantage plan, find out whether your chosen doctor or provider is covered and identify how much you’ll pay. You can use the Medicare Plan Finder to compare the Medicare Advantage plans and their out-of-pocket costs in your area.

Return to Medicare Q&A main page

Kimberly Lankford is a contributing writer who covers Medicare and personal finance. She wrote about insurance, Medicare, retirement and taxes for more than 20 years at Kiplinger’s Personal Finance and has written for The Washington Post and Boston Globe . She received the personal finance Best in Business award from the Society of American Business Editors and Writers and the New York State Society of CPAs’ excellence in financial journalism award for her guide to Medicare.

Unlock Access to AARP Members Edition

Already a Member? Login

More on Medicare

How Do I Create a Personal Online Medicare Account?

You can do a lot when you decide to look electronically

I Got a Medicare Summary Notice in the Mail. What Is It?

This statement shows what was billed, paid in past 3 months

Understanding Medicare’s Options: Parts A, B, C and D

Making sense of the alphabet soup of health care choices

Recommended for You

Benefits recommended for you.

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

What You Need to Know About Medicare Assignment

If you are one of the more than 63 million Americans enrolled in Medicare and are on the lookout for a new provider, you may wonder what your options are. A good place to start? Weighing the pros and cons of choosing an Original Medicare plan versus a Medicare Advantage plan—both of which have their upsides.

Let’s say you decide on an Original Medicare plan, which many U.S. doctors accept. In your research, however, you come across the term “Medicare assignment.” Cue the head-scratching. What exactly does that mean, and how might it affect your coverage costs?

What is Medicare Assignment?

It turns out that Medicare assignment is a concept you need to understand before seeing a new doctor. First things first: Ask your doctor if they “accept assignment”—that exact phrasing—which means they have agreed to accept a Medicare-approved amount as full payment for any Medicare-covered service provided to you. If your doctor accepts assignment, that means they’ll send your whole medical bill to Medicare, and then Medicare pays 80% of the cost, while you are responsible for the remaining 20%.

A doctor who doesn’t accept assignment, however, could charge up to 15% more than the Medicare-approved amount for their services, depending on what state you live in, shouldering you with not only that additional cost but also your 20% share of the original cost. Additionally, the doctor is supposed to submit your claim to Medicare, but you may have to pay them on the day of service and then file a reimbursement claim from Medicare after the fact.

Worried that your doctor will not accept assignment? Luckily, 98% of U.S. physicians who accept Medicare patients also accept Medicare assignment, according to the U.S. Centers for Medicare & Medicaid Services (CMS). They are known as assignment providers, participating providers, or Medicare-enrolled providers.

It can be confusing. Here’s how to assess whether your provider accepts Medicare assignment, and what that means for your out-of-pocket costs:

The 3 Types of Original Medicare Providers

1. participating providers, or those who accept medicare assignment.

These providers have an agreement with Medicare to accept the Medicare-approved amount as full payment for their services. You don’t have to pay anything other than a copay or coinsurance (depending on your plan) at the time of your visit. Typically, Medicare pays 80% of the cost, while you are responsible for the remaining 20%, as long as you have met your deductible.

2. Non-participating providers

“Most providers accept Medicare, but a small percentage of doctors are known as non-participating providers,” explains Caitlin Donovan, senior director of public relations at the National Patient Advocate Foundation (NPAF) in Washington D.C. “These may be more expensive,” she adds. Also known as non-par providers, these physicians may accept Medicare patients and insurance, but they have not agreed to take assignment Medicare in all cases. That means they’re not held to the Medicare-approved amount as payment in full. As a reminder, a doctor who doesn’t accept assignment can charge up to 15% more than the Medicare-approved amount, depending on what part of the country you live in, and you will have to pay that additional amount plus your 20% share of the original cost.

What does that mean for you? Besides being charged more than the Medicare-approved amount, you might also be required to do some legwork to get reimbursed by Medicare.

- You may have to pay the entire bill at the time of service and wait to be reimbursed 80% of the Medicare-approved amount. In most cases, the provider will submit the claim for you. But sometimes, you’ll have to submit it yourself.

- Depending on the state you live in, the provider may also charge you as much as 15% more than the Medicare-approved amount. (In New York state, for example, that add-on charge is limited to 5%.) This is called a limiting charge—and the difference, called the balance bill, is your responsibility.

There are some non-par providers, however, who accept Medicare assignment for certain services, on a case-by-case basis. Those may include any of the services—anything from hospital and hospice care to lab tests and surgery—available from any assignment-accepting doctor, with a key exception: If a non-par provider accepts assignment for a particular service, they cannot bill you more than the regular Medicare deductible and coinsurance amount for that specific treatment. Just as it’s important to confirm whether your doctor accepts assignment, it’s also important to confirm which services are included at assignment.

3. Opt-out providers

A small percentage of providers do not participate in Medicare at all. In 2020, for example, only 1% of all non-pediatric physicians nationwide opted out, and of that group, 42% were psychiatrists. “Some doctors opt out of providing Medicare coverage altogether,” notes Donovan.“In that case, the patient would pay privately.” If you were interested in seeing a physician who had opted out of Medicare, you would have to enter a private contract with that provider, and neither you nor the provider would be eligible for reimbursement from Medicare.

How do I know if my doctor accepts Medicare assignment?

The best way to find out whether your provider accepts Medicare assignment is simply to ask. First, confirm whether they are participating or non-participating—and if they are non-participating, ask whether they accept Medicare assignment for certain services.

Also, make sure to ask your provider exactly how they will be billing Medicare and what charges you might expect at the time of your visit so that you’re on the same page from the start.

Is seeing a non-participating provider who accepts Medicare assignment more expensive?

The short answer is yes. There are usually out-of-pocket costs after you’re reimbursed. But it may not cost as much as you think, and it may not be much more than if you see a participating provider. Still, it could be challenging if you’re on a fixed income.

For example, let’s say you’re seeing a physical therapist who accepts Medicare patients but not Medicare assignment. Medicare will pay $95 per visit to the provider; but your provider bills the service at $115. In most states, you’re responsible for a 15% limiting charge above $95. In this case, your bill would be 115% of $95, or $109.25.

Once you get your $95 reimbursement back from Medicare, your cost for the visit—the balance bill—would be $14.25 (plus any deductibles or copays) .

In some states, the maximum cap on the limiting charge is less than 15%. As mentioned earlier, New York state, for instance, allows only a 5% surcharge, which means that physical therapy appointment would cost you just $4.75 extra.

Bottom line: Medicare assignment providers and non-participating providers who agree to accept Medicare assignment are both viable options for patients. So if you want to see a particular provider, don’t rule them out just because they’re non-par.

While seeing a non-participating provider may still be affordable, ultimately, the biggest headache may be keeping track of claims and reimbursements, or simply setting aside the right amount of money to pay for your visit up front.

Before you schedule a visit, be sure to ask how much the service will cost. You can also estimate the payment amount based on Medicare-approved charges. A good place to start is this out-of-pocket expense calculator provided by the CMS.

What if I see a provider who opts out of Medicare altogether?

An opt-out provider will create a private contract with you, underscoring the terms of your agreement. But Medicare will not reimburse either of you for services.

Seeing a provider who does not accept Medicare will likely be more expensive. And your visits won’t count toward your deductible. But you may be able to work out paying reduced fees on a sliding scale for that provider’s services, all of which would be laid out in your contract.

Medicare Assignment: Understanding How It Works

Medicare assignment is a term used to describe how a healthcare provider agrees to accept the Medicare-approved amount. Depending on how you get your Medicare coverage, it could be essential to understand what it means and how it can affect you.

What is Medicare assignment?

Medicare sets a fixed cost to pay for every benefit they cover. This amount is called Medicare assignment.

You have the largest healthcare provider network with over 800,000 providers nationwide on Original Medicare . You can see any doctor nationwide that accepts Medicare.

Understanding the differences between your cost and the difference between accepting Medicare and accepting Medicare assignment could be worth thousands of dollars.

Doctors that accept Medicare

Your healthcare provider can fall into one of three categories:

Medicare participating provider and Medicare assignment

Medicare participating providers not accepting medicare assignment, medicare non-participating provider.

More than 97% of healthcare providers nationwide accept Medicare. Because of this, you can see almost any provider throughout the United States without needing referrals.

Let’s discuss the three categories the healthcare providers fall into.

Participating providers are doctors or healthcare providers who accept assignment. This means they will never charge more than the Medicare-approved amount.

Some non-participating providers accept Medicare but not Medicare assignment. This means you can see them the same way a provider accepts assignment.

You need to understand that since they don’t take the assigned amount, they can charge up to 15% more than the Medicare-approved amount.

Since Medicare will only pay the Medicare-approved amount, you’ll be responsible for these charges. The 15% overcharge is called an excess charge. A few states don’t allow or limit the amount or services of the excess charges. Only about 5% of providers charge excess charges.

Opt-out providers don’t accept Original Medicare, and these healthcare providers are in the minority in the United States. If healthcare providers don’t accept Medicare, they won’t be paid by Medicare.

This means choosing to see a provider that doesn’t accept Medicare will leave you responsible for 100% of what they charge you. These providers may be in-network for a Medicare Advantage plan in some cases.

Avoiding excess charges

Excess charges could be large or small depending on the service and the Medicare-approved amount. Avoiding these is easy. The simplest way is to ask your provider if they accept assignment before service.

If they say yes, they don’t issue excess charges. Or, on Medicare.gov , a provider search tool will allow you to look up your healthcare provider and show if they accept Medicare assignment or not.

Medicare Supplement and Medicare assignment

Medigap plans are additional insurance that helps cover your Medicare cost-share . If you are on specific plans, they’ll pay any extra costs from healthcare providers that accept Medicare but not Medicare assigned amount. Most Medicare Supplement plans don’t cover the excess charges.

The top three Medicare Supplement plans cover excess charges if you use a provider that accepts Medicare but not Medicare assignment.

Medicare Advantage and Medicare assignment

Medicare assignment does not affect Medicare Advantage plans since Medicare Advantage is just another way to receive your Medicare benefits. Since your Medicare Advantage plan handles your healthcare benefits, they set the terms.

Most Medicare Advantage plans require you to use network providers. If you go out of the network, you may pay more. If you’re on an HMO, you’d be responsible for the entire charge of the provider not being in the network.

Do all doctors accept Medicare Supplement plans?

All doctors that accept Original Medicare accept Medicare Supplement plans. Some doctors don’t accept Medicare. In this case, those doctors won’t accept Medicare Supplements.

Where can I find doctors who accept Medicare assignment?

Medicare has a physician finder tool that will show if a healthcare provider participates in Medicare and accepts Medicare assignments. Most doctors nationwide do accept assignment and therefore don’t charge the Part B excess charges.

Why do some doctors not accept Medicare?

Some doctors are called concierge doctors. These doctors don’t accept any insurance and require cash payments.

What is a Medicare assignment?

Accepting Medicare assignment means that the healthcare provider has agreed only to charge the approved amount for procedures and services.

What does it mean if a doctor does not accept Medicare assignment?

The doctor can change more than the Medicare-approved amount for procedures and services. You could be responsible for up to a 15% excess charge.

How many doctors accept Medicare assignment?

About 97% of doctors agree to accept assignment nationwide.

Is accepting Medicare the same as accepting Medicare assignment?

No. If a doctor accepts Medicare and accepts Medicare assigned amount, they’ll take what Medicare approves as payment in full.

If they accept Medicare but not Medicare assignment, they can charge an excess charge of up to 15% above the Medicare-approved amount. You could be responsible for this excess charge.

What is the Medicare-approved amount?

The Medicare-approved amount is Medicare’s charge as the maximum for any given medical service or procedure. Medicare has set forth an approved amount for every covered item or service.

Can doctors balance bill patients?

Yes, if that doctor is a Medicare participating provider not accepting Medicare assigned amount. The provider may bill up to 15% more than the Medicare-approved amount.

What happens if a doctor does not accept Medicare?

Doctors that don’t accept Medicare will require you to pay their full cost when using their services. Since these providers are non-participating, Medicare will not pay or reimburse for any services rendered.

Get help avoiding Medicare Part B excess charges

Whether it’s Medicare assignment, or anything related to Medicare, we have licensed agents that specialize in this field standing by to assist.

Give us a call, or fill out our online request form . We are happy to help answer questions, review options, and guide you through the process.

Related Articles

- What are Medicare Part B Excess Charges?

- How to File a Medicare Reimbursement Claim?

- Medicare Defined Coinsurance: How it Works?

- Welcome to Medicare Visit

- Guide to the Medicare Program

CALL NOW (833) 972-1339

What Does It Mean for a Doctor to Accept Medicare Assignment?

Written by: Malini Ghoshal, RPh, MS

Reviewed by: Malinda Cannon, Licensed Insurance Agent

Key Takeaways

Doctors who accept Medicare assignment are paid agreed-upon rates for services.

It’s important to verify that your doctor accepts assignment before receiving services to avoid high out-of-pocket costs.

A doctor or clinician may be “non-participating” but can still agree to accept Medicare assignment for some services.

If you visit a doctor or clinician who has opted out (doesn’t accept Medicare), you may have to pay for your entire visit cost unless it’s a medical emergency.

Medigap Supplemental insurance (Medigap) plans won’t pay for service costs from doctors who don’t accept assignment.

One of the things that Original Medicare beneficiaries often enjoy about their coverage is that they can use it anywhere in the country. Unlike plans with provider networks, they can visit doctors either at home or on the road; both are covered the same.

But do all doctors accept Medicare patients?

Truth is, this wide-ranging coverage area only applies to doctors who accept Medicare assignment. Fortunately, most do. If you’re eligible for Medicare, it’s important to visit doctors and clinicians who accept Medicare assignment. This will help keep your out-of-pocket costs within your control. Doctors who agree to accept Medicare assignment sign an agreement that they’re willing to accept payment from Medicare for their services.

If you’re a current beneficiary or nearing enrollment, you may have other questions. Do all doctors accept Medicare Advantage plans? What about Medicare Supplement insurance (Medigap)? Read on to learn how to find doctors that accept Medicare assignment and how this keeps your healthcare costs down.

Find the Medicare Plan that works for you.

What Is Medicare Assignment of Benefits?

When you’re eligible for Medicare, you have the option to visit doctors and clinicians who accept assignment. This means they are Medicare-approved providers who agree to receive Medicare reimbursement rates for covered services. This helps save you money.

If you have Original Medicare (Part A and B), your doctor visits are covered by your Part B plan. Inpatient services such as hospital stays and some skilled nursing care are covered by Part A .

In order for a participating doctor (or facility) to bill Medicare and be reimbursed, you must authorize Medicare to reimburse your doctor directly for your covered services. This is called the Medicare assignment of benefits. You transfer your right to receive Medicare payment for a covered service to your doctor or other provider.

Note: If you have a Medicare Supplement insurance ( Medigap ) plan to pay for out-of-pocket costs, you may also need to sign a separate assignment of benefits form for Medigap reimbursement. More on Medigap below.

How Can I Find Doctors Near Me That Accept Medicare?

There are several ways to find doctors and other clinicians who accept Medicare assignment close to you.

First, let’s take a look at the different types of Medicare providers.

They include:

Participating providers: Medicare-participating doctors and providers sign a participation agreement stating they will accept Medicare reimbursement rates for their services.

Non-participating providers: Doctors or providers who are non-participating providers are eligible to accept Medicare assignment but haven’t signed a Medicare agreement. They may choose to accept assignment on a case-by-case basis. If you visit a non-participating provider, make sure to ask if they accept assignment for your particular service. Also get a copy of their fees. They will need to select “yes” on Centers for Medicare & Medicaid Services CMS Form 1500 to accept assignment for the service.

Opt-out providers: Some doctors and other providers choose not to accept Medicare. If they choose to opt out, the period is two years (based on Medicare guidelines). The opt-out automatically renews if the provider doesn’t request a change in their status. You would be responsible for paying all costs for services received from an opt-out provider. You cannot bill Medicare for reimbursement unless the service was an urgent or emergency medical need. According to a report from KFF , roughly 1% of non-pediatric physicians opted out of Medicare in 2023.

Visiting a doctor who doesn’t accept assignment may cost you more. These providers can charge you up to 15% more than the Medicare-approved rate for a given service. This 15% charge is called the limiting charge. Some states limit this extra charge to a certain percent. This may also be called the Part B excess charge.

Here are some tips for finding doctors and providers who accept Medicare assignment:

- The easiest way to find a doctor who accepts Medicare assignment is to contact their office and ask them directly.

- If you’re looking for a new doctor, you can use the Medicare search tool to find clinicians and doctors that accept Medicare assignment.

- You can also ask a state health insurance assistance program (SHIP) representative for help in locating a doctor that accepts Medicare assignment.

- Don’t assume that having a longstanding relationship with your doctor means nothing will ever change. Check in with them to make sure they still accept Medicare assignment and whether they’re planning to opt out.

Note: Your doctor can choose to become a non-participating provider or opt out of participating in Medicare. It’s important to verify they accept Medicare assignment before receiving any services.

Your Ideal Medicare Plan is out there.

Do Doctors Who Accept Medicare Have to Accept Supplement Plans?

If your doctor accepts Medicare assignment and you have Original Medicare (Medicare Part A and Part B) with a Medicare Supplement (Medigap) plan, they will accept the supplemental insurance. Depending on your Medigap plan coverage , it may pay all or part of your out-of-pocket costs such as deductibles, copayments and coinsurance.

However, if you have a Medicare Advantage plan (Part C), you may have a network of covered doctors under the plan. If you visit an out-of-network doctor, you may need to pay all or part of the cost for your services.

Keep in mind that you can’t have a Medigap supplemental plan if you have a Medicare Advantage plan.

If you have questions or want to learn more about different Medicare plans like Original Medicare with Medigap versus Medicare Advantage, GoHealth has licensed insurance agents ready to help. They can shop your different options and offer impartial guidance where you need it.

Do Most Doctors Accept Medicare Advantage Plans?

Many doctors accept Medicare Advantage (Part C) plans, but these plans often use provider networks. These networks are groups of doctors and providers in an area that have agreed to treat an insurance company’s customers. If you have a Part C plan, you may be required to see in-network doctors with few exceptions. However, these types of plans are popular options for all-in-one coverage for your health needs. Plans must offer Part A and B coverage, plus a majority also include Part D , or prescription drug coverage. But whether a doctor accepts a Medicare Advantage plan may depend on where you live and the type of Medicare Advantage plan you have.

There are several types of Medicare Advantage plans including:

- Health Maintenance Organization (HMO): These plans have a network of covered providers, as well as a primary care physician to manage your care. If you visit a doctor outside your plan network, you may have to pay the full cost of your visit.

- Preferred Provider Organization (PPO): You’ll probably still have a primary care physician, but these are more flexible plans that allow you to go out of network in some cases. But you may have to pay more.

- Private Fee for Service (PFFS): You may be able to visit any doctor or provider with these plans, but your costs may be higher.

- Special Needs Plan (SNP): This type of plan is only for certain qualified individuals who either have a specific health condition ( C-SNP ) or who qualify for both Medicaid and Medicare insurance ( D-SNP ).

Get real Medicare answers and guidance — no strings attached.

What Are Medicare Assignment Codes?

Medicare assignment codes help Medicare pay for covered services. If your doctor or other provider accepts assignment and is a participating provider, they will file for reimbursement for services with a CMS-1500 form and the code will be “assigned.”

But non-participating providers can select “not assigned.” This means they are not accepting Medicare-assigned rates for a given service. They can charge up to 15% over the full Medicare rate for the service.

If you go to a doctor or provider who accepts assignment, you don’t need to file your own claim. Your doctor’s office will directly file with Medicare. Always check to make sure your doctor accepts assignment to avoid excess charges from your visit.

Health Insurance Claim Form . CMS.gov.

Lower costs with assignment . Medicare.gov.

How Many Physicians Have Opted-Out of the Medicare Program? KFF.org.

Joining a plan . Medicare.gov.

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Let's see if you're missing out on Medicare savings.

We just need a few details.

Related Articles

What Is Medicare IRMAA?

What Is an IRMAA in Medicare?

How to Report Medicare Fraud

Medicare Fraud Examples & How to Report Abuse

How to Change Your Address with Medicare

Reporting a Change of Address to Medicare

Can I Get Medicare if I’ve Never Worked?

Can You Get Medicare if You've Never Worked?

Why Are Some Medicare Advantage Plans Free?

Why Are Some Medicare Advantage Plans Free? $0 Premium Plans Explained

What Is Medicare Assignment?

Am I Enrolled in Medicare?

When and How Do I Enroll?

When and How Do I Enroll in Medicare?

Medicare Frequently Asked Questions

Let’s see if you qualify for Medicare savings today!

Sixty-Five Incorporated

Sponsored by interim healthcare ®.

- When Can I Sign Up For Medicare

- i65 Resources

What does ‘accepting assignment’ mean?

Accepting assignment is a real concern for those who have Original Medicare coverage. Physicians (or any other healthcare providers or facilities) who accept assignment agree to take Medicare’s payment for services. They cannot bill a Medicare beneficiary in excess of the Medicare allowance, which is the copayment or coinsurance. While providers who participate in the Medicare program must accept assignment on all Medicare claims, they do not have to accept every Medicare beneficiary as a patient.

There are basically three Medicare options for physicians.

- Physicians may sign a participating agreement and accept Medicare’s allowed charge as payment-in-full for all of their Medicare patients. Use the Physician Compare database to find physicians who accept assignment.

- They may elect to be non-participating, in which case, they make decisions about accepting Medicare assignment on a case-by-case basis. They can bill patients up to 15% more than the Medicare allowance. Some Medigap policies offer a benefit to cover this amount, known as Part B excess charges.

- Or, they may opt out of Medicare entirely and become private contracting physicians. They establish contracts with their patients to bill them directly. Neither the physicians nor the patients would receive any payments from Medicare.

Accepting assignment can also be a concern for beneficiaries with coverage other than Original Medicare, including those:

- in a Medicare Advantage Private Fee-for-service (PFFS) plan who get services outside the network.

- in a Medicare Advantage Medical Savings Account (MSA) plan because this plan does not utilize networks.

Learn the “Lingo” of Medicare Part D

Comparing Medicare Part D drug plans is useless – unless you know the lingo . What is Catastropic Coverage and the Coverage Gap? What are tiers and quantity limits? Find out!

Get the FREE Part D Lingo whitepaper.

Medicare Interactive Medicare answers at your fingertips -->

Participating, non-participating, and opt-out providers, outpatient provider services.

You must be logged in to bookmark pages.

Email Address * Required

Password * Required

Lost your password?

If you have Original Medicare , your Part B costs once you have met your deductible can vary depending on the type of provider you see. For cost purposes, there are three types of provider, meaning three different relationships a provider can have with Medicare . A provider’s type determines how much you will pay for Part B -covered services.

- These providers are required to submit a bill (file a claim ) to Medicare for care you receive. Medicare will process the bill and pay your provider directly for your care. If your provider does not file a claim for your care, there are troubleshooting steps to help resolve the problem .

- If you see a participating provider , you are responsible for paying a 20% coinsurance for Medicare-covered services.

- Certain providers, such as clinical social workers and physician assistants, must always take assignment if they accept Medicare.

- Non-participating providers can charge up to 15% more than Medicare’s approved amount for the cost of services you receive (known as the limiting charge ). This means you are responsible for up to 35% (20% coinsurance + 15% limiting charge) of Medicare’s approved amount for covered services.

- Some states may restrict the limiting charge when you see non-participating providers. For example, New York State’s limiting charge is set at 5%, instead of 15%, for most services. For more information, contact your State Health Insurance Assistance Program (SHIP) .

- If you pay the full cost of your care up front, your provider should still submit a bill to Medicare. Afterward, you should receive from Medicare a Medicare Summary Notice (MSN) and reimbursement for 80% of the Medicare-approved amount .

- The limiting charge rules do not apply to durable medical equipment (DME) suppliers . Be sure to learn about the different rules that apply when receiving services from a DME supplier .

- Medicare will not pay for care you receive from an opt-out provider (except in emergencies). You are responsible for the entire cost of your care.

- The provider must give you a private contract describing their charges and confirming that you understand you are responsible for the full cost of your care and that Medicare will not reimburse you.

- Opt-out providers do not bill Medicare for services you receive.

- Many psychiatrists opt out of Medicare.

Providers who take assignment should submit a bill to a Medicare Administrative Contractor (MAC) within one calendar year of the date you received care. If your provider misses the filing deadline, they cannot bill Medicare for the care they provided to you. However, they can still charge you a 20% coinsurance and any applicable deductible amount.

Be sure to ask your provider if they are participating, non-participating, or opt-out. You can also check by using Medicare’s Physician Compare tool .

Update your browser to view this website correctly. Update my browser now

Everything PTs Need to Know About Accepting Medicare Assignment

There's no one-size-fits-all answer as to whether or not a PT should accept Medicare assignment, but you can better understand your options.

There's no one-size-fits-all all answer as to whether or not a PT should accept Medicare assignment, but you can better understand your options.

Get the latest news and tips directly in your inbox by subscribing to our monthly newsletter

Discuss any topic within rehab therapy, and chances are that Medicare will come up at some point. Whether it’s talking about Medicare and direct access or Medicare supervision requirements , it’s hard to avoid discussing the ins and outs of the program, given its prominence in healthcare at large. However, there’s one question that probably doesn't get asked enough: do providers have to participate in Medicare? We’re going to dive into the specifics of what rehab therapists can and can’t do when it comes to accepting Medicare assignment, and the pros and cons of each.

What it means to “accept Medicare assignment”

In short, accepting Medicare assignment means signing a contract to accept whatever Medicare pays for a covered service as full payment. Participating and non-participating status only applies to Medicare Part B; Medicare Advantage plans operate with contracts similar to commercial insurance with in-network and out-of-network providers.

Participating Providers

If you’re accepting Medicare assignment for all covered services, you are considered to be a participating provider under Medicare and may not charge patients above and beyond what Medicare agrees to pay. In this case, you can charge 100% of the Medicare Physician Fee Schedule (MPFS) and are paid at 80% of that rate, minus the Multiple Procedure Payment Reduction (MPPR) and the 2% sequestration adjustment.

You may, however, collect patient deductibles and coinsurances—although, as explained in the Medicare payer guide , these providers typically ask Medicare to pay its share before collecting anything from the patient. Per the same resource, these providers are required to submit claims directly to Medicare for reimbursement and cannot charge patients for the claim submission. As Dr. Jarod Carter, PT, DPT, MTC, writes in Medicare and Cash-Pay PT Services , “This is the most common and best-understood relationship that physical therapists have with Medicare.”

Because Medicare beneficiaries often pay less out-of-pocket costs when receiving care from a provider who accepts assignment, patients may be more willing to work with these providers. Thus, if you accept assignment, you may have access to not only more Medicare patients but also more potential referral partners who only work with assignment-accepting providers.

You must accept whatever Medicare deems appropriate compensation, and as we know, that’s below market value more often than not. Given the recently announced cuts to assistant-provided services and the 8% cut to all physical therapy services , accepting assignment may be increasingly less appealing to physical therapists. That said, if you serve a large Medicare population, the volume of patients you see may make it financially beneficial for you to continue playing by Medicare’s rules.

If you don’t want to accept Medicare assignment, what are your other options?

Non-participating providers.

As Meredith Castin explains in 4 Things to Know About Billing for Cash-Pay PT , Medicare also allows physical therapists to be non-participating providers (a.k.a. non-enrolled providers), which simply means that, while they are still in a contractual relationship with Medicare (and thus, are eligible to provide covered services to Medicare beneficiaries), they have not agreed to accept assignment across the board.

If a non-participating provider opts to accept assignment for a case, they can charge 95%.

If they do not accept assignment but still treat the patient, these providers may charge up to what Medicare calls “the limiting charge” for a service—which is 15% above the Medicare allowed amount. Non-participating providers may choose to accept assignment for some services, but not others —or no services at all. For services that are not under assignment, the provider may collect payment directly from the patient; however, he or she must still bill Medicare, so that Medicare may reimburse the patient.

Non-participating providers are still eligible to serve Medicare beneficiaries, but they maintain some degree of freedom when it comes to pricing their services. In other words, if you are a non-participating provider, you are less beholden to what Medicare deems as appropriate payment than you are as a participating provider.

That said, you do still have to charge within Medicare’s limit, which means your freedom is far from total. Additionally, because patients may have to pay more out of pocket for your services and/or pay and wait for reimbursement from Medicare, you may have to work harder to convince them that you’re worth the financial investment. With the right data and marketing , it’s definitely doable; it may just require more effort.

No Relationship with Medicare

Physicians are eligible to “opt-out” of Medicare, which means that even if they are neither participating nor non-participating providers, they can still see Medicare beneficiaries on a cash-pay basis. Physical therapists do not enjoy the same privilege. So, if you decide not to be a Medicare participating provider or non-participating provider, then you effectively have no relationship with Medicare. Thus, you are not able to provide Medicare-covered services to Medicare beneficiaries.

That said, all physical therapists, regardless of their relationship with Medicare, may provide never-covered services to Medicare beneficiaries, including wellness services. According to Castin, though, providers who go down that route, “need to be very clear about Medicare’s definition of ‘wellness services’ versus ‘physical therapy services.’” According to cash-pay PT Jarod Carter , it’s imperative for your documentation to clearly support that the services were indeed wellness as opposed to therapy.

As a provider with no relationship with Medicare, you’re not required to play by Medicare’s rules when it comes to reporting requirements or (lowball) payments. You’re also not at all affected by Medicare’s most recent cuts, which, quite frankly, is a big bonus.

However, as of 2007 , 15% of the US population was enrolled in Medicare; that’s 44 million people—most of whom could benefit from seeing a physical therapist to improve function and mobility and decrease pain. And that number is projected to grow to 79 million people by 2030. As such, choosing not to play ball with Medicare means you’re walking away from a very large market of patients who need your services.

It’s your decision.

Deciding on accepting Medicare assignment—and what type of relationship you’d like to have with Medicare—is not an easy decision to make, and there are a lot of factors to take into consideration before getting involved or breaking it off with this substantial federal payer. That said, it is important to know that you have options. Have more questions about what it means to accept assignment as a PT? Ask them below, and we’ll do our best to find you an answer.

Related posts

Founder Letter: How WebPT is Investing in our Members and their Practices

What’s in a Brand? Previewing Ascend 2024 with Jamey Schrier

How to Correctly Use CPT Code 97535

Medicare and Cash-Pay PT Services, Part 1: The Must-Know Concepts to Avoid Legal Issues and Capitalize on Opportunities

Medicare and Direct Access

The Medicare Maintenance Care Myth

Learn how WebPT’s PXM platform can catapult your practice to new heights.

Hospital Billers.com

Improving your hospital revenue cycle, what does accept assignment mean.

admin / December 12, 2012 Leave a Comment

What does it mean to accept assignment on the CMS 1500 claim form – also called the HCFA 1500 claim form.? Should I accept assignment or not? What are the guidelines for accepting assignment in box 27 of the 1500 claim?

These commonly asked questions should have a simple answer, but the number of court cases indicates that it is not as clear cut as it should be. This issue is documented in the book “Problems in Health Care Law” by Robert Desle Miller. The definition appears to be in the hands of the courts. However, we do have some helpful guidelines for you.

One major area of confusion is the relationship between box 12, box 13 and box 27. These are not interchangeable boxes and they are not necessarily related to each other.

According to the National Uniform Claim Committee (NUCC), the “Accept Assignment” box indicates that the provider agrees to accept assignment. It simply says to enter an X in the correct box. It does NOT define what accepting assignment might or might not mean.

It is important to understand that if you are a participating provider in any insurance plan or program, you must first follow the rules according to the contract that you sign. That contract superceeds any guidelines that are included here.

Medicare Instructions / Guidelines

PARTICIPATING providers MUST accept assignment according to the terms of their contract. The contract itself states:

“Meaning of Assignment – For purposes of this agreement, accepting assignment of the Medicare Part B payment means requesting direct Part B payment from the Medicare program. Under an assignment , the approved charge, determined by the Medicare carrier, shall be the full charge for the service covered under Part B. The participant shall not collect from the beneficiary or other person or organization for covered services more than the applicable deductible and coinsurance.”

By law, the providers or types of services listed below MUST also accept assignment:

- Clinical diagnostic laboratory services;

- Physician services to individuals dually entitled to Medicare and Medicaid;

- Services of physician assistants, nurse practitioners, clinical nurse specialists, nurse midwives, certified registered nurse anesthetists, clinical psychologists, and clinical social workers;

- Ambulatory surgical center services for covered ASC procedures;

- Home dialysis supplies and equipment paid under Method II;

- Ambulance services;

- Drugs and biologicals; and

- Simplified Billing Roster for influenza virus vaccine and pneumococcal vaccine.

NON-PARTICIPATING providers can choose whether to accept assignment or not, unless they or the service they are providing is on the list above.

The official Medicare instructions regarding Boxes 12 and 13 are:

“Item 12 – The patient’s signature authorizes release of medical information necessary to process the claim. It also authorizes payments of benefits to the provider of service or supplier when the provider of service or supplier accepts assignment on the claim.” “Item 13 – The patient’s signature or the statement “signature on file” in this item authorizes payment of medical benefits to the physician or supplier. The patient or his/her authorized representative signs this item or the signature must be on file separately with the provider as an authorization. However, note that when payment under the Act can only be made on an assignment-related basis or when payment is for services furnished by a participating physician or supplier, a patient’s signature or a “signature on file” is not required in order for Medicare payment to be made directly to the physician or supplier.”

Regardless of the wording on these instructions stating that it authorizes payments to the physician, this is not enough to ensure that payment will come directly to you instead of the patient.To guarantee payment comes to you, you MUST accept assignment.

Under Medicare rules, PARTICIPATING providers are paid at 80% of the physician fee schedule allowed amount and NON-participating providers are paid at 80% of the allowed amount, which is 5% less than the full Allowed amount for participating providers. Only NON-participating providers may “balance bill” the patient for any amounts not paid by Medicare, however, they are subject to any state laws regarding balance billing.

NON-MEDICARE Instructions / Guidelines

PARTICIPATING providers MUST abide by the terms of their contract. In most cases, this includes the requirement to accept assignment on submitted claims.

NON-PARTICIPATING providers have the choice to accept or not accept assignment.

YES means that payment should go directly to you instead of the patient. Generally speaking, even if you have an assignment of benefits from the patient (see box 12 & 13), payment is ONLY guaranteed to go to you IF you accept assignment.

NO is appropriate for patients who have paid for their services in full so they may be reimbursed by their insurance. It generally means payment will go to the patient.

Share this:

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Recent Posts

- E/M changes

- National Rural Health Center

- Clean Claim Rate (CCR) and First Pass Rate (FPR)

- IDN definition

- MCH sees major issues with Cerner medical record system conversion

Recent Comments

Text widget.

This is an example of a widget which can be used to describe a product or service. An example of a widget which can be used to describe a product or service. This is an example of a widget.

Image Credits

What Is Medicare Assignment?

There are many terms and acronyms when you start learning about Medicare, and “Medicare assignment” is one that may come up for you.

If you don’t find a doctor that accepts Medicare assignment, your costs for medical care could be higher, even with a Medicare Supplement. Here’s what you need to know about Medicare assignment and non-participating providers.

Free Medicare 101 Email Course

From a mailbox bursting with Medicare flyers to penalties, you don’t want to miss a thing. This 5-day course features simple explanations & easy action items, so you can take control of your own Medicare plan.

What does Medicare assignment mean?

Have you ever noticed on an Explanation of Benefits that the price a doctor charges is not what you actually end up paying?

For example, your doctor may charge $350 for an office visit, but the insurance company may re-price that to $95. When the doctor decided to accept this insurance, they agreed to accept the lower payment amount.

Medicare does the same thing.

Every year, Medicare sets the amounts they’ll agree to pay for covered services. If a doctor, provider, or supplier accepts “assignment,” it means they agree to accept the Medicare-approved amount as full payment for covered services.

What does it mean when a doctor does not accept Medicare assignment?

Any provider that doesn’t sign an agreement to accept assignment for all Medicare-covered services is called a non-participating provider .

These providers can still choose to accept assignment for individual services. As an example, a provider may accept Medicare assignment for a preventative office visit, but not for a diagnostic office visit.

In these situations, a non-participating provider is allowed to charge you more than the Medicare-approved amount. However, there’s a limit called a “limiting charge” or “excess charge.” The provider is only allowed to charge up to 15% over the Medicare-approved amount.

If a provider chooses to completely opt-out of Medicare, that means they don’t want to work with the Medicare program at all. In these cases, you’d be paying out of pocket for any services you receive, except in the case of an emergency.

What if I have a Medicare Supplement?

If you have a Medicare Supplement, you are still allowed to see non-participating providers . Plus, if you have a Plan F or Plan G, the potential limiting charge – or excess charge – is covered by your supplemental plan.

If you have a Plan N, you would be responsible for that excess charge, which is up to 15% over the Medicare-approved amount.

For all individuals with a Medicare Supplement, you’ll want to avoid seeing providers who have opted out of Medicare. If you do see a provider who has opted out, you’d be responsible for all medical bills unless it’s an emergency.

How do I know if my doctor accepts Medicare assignment?

Most doctors accept Medicare assignment , so rest easy! It’s pretty rare to come across a doctor that doesn’t accept Medicare.

However, finding out is easy: just ask. Plus, if a provider does not accept Medicare, they are required to have you sign a form stating that you understand this.

Finally, you can use Medicare’s Care Compare tool to double-check if your provider, doctor, or supplier accepts Medicare. We still recommend double-checking with a quick phone call, though.

What percentage of doctors accept Medicare assignment?

Depending on which source you use, anywhere from 93-99% of physicians accept Medicare assignment . If you’re going to run into a provider that doesn’t accept Medicare assignment, they’re most likely to be a specialist, such as a psychiatrist or neurologist ( Kaiser Family Foundation report ).

In general, dealing with a non-participating provider or a provider who has completely opted out of Medicare will be rare .

However, if you do run into this situation or want extra help, don’t hesitate to reach out to our office at 217-423-8000. Our licensed insurance agents can assist you with your questions.

There’s always something new to learn about Medicare! If you ever come across the term “Medicare assignment,” we hope this article helps clear things up.

As always, you do not need to learn everything about the confusing Medicare program. Please remember you can lean on our team of Medicare experts to help answer your questions and clear up the complexities.

We read the fine print so you don’t have to.

More Related Reading

- Medicare & Telehealth in Decatur, Illinois

- If You Don’t Understand Medicare At All, Start Here

- Medicare Supplement Plan G – Our Most Popular Plan

Schedule an Appointment

Book time right on our agents' calendars using our online scheduling system.

Get our newsletter

Here's what our clients say…, meet our agents.

Luke Hockaday

We don't just sell insurance - we're there to assist you with the claims process, which can be complicated and confusing.

Office: Sams/Hockaday & Associates 122 W. Prairie Ave, #201 Decatur, Illinois 62523

Call Us: 217-423-8000 or 800-284-7267

Site Navigation

- New to Medicare

Latest Posts

Get our newsletter.

Add your info below, and we'll send occasional insurance news and tips to help you make sure you're safely covered.

By clicking the "Add In" button, I expressly consent by electronic signature to receive communications by telephone, by email, or by text message from Sams/Hockaday at the telephone number above (even if my number is currently listed on any state, federal, local, or corporate Do Not Call list) including my wireless number if provided. Carrier message and data rates may apply. I understand that my consent is not required as a condition of purchasing any goods or services and that I may revoke my consent at any time. I also acknowledge that I have read and agree to the Privacy Policy and Terms & Conditions. If you do not want to share your information, please click on Do Not Sell My Information for more details.

IMAGES

VIDEO

COMMENTS

Essentially, 'assignment' means that a doctor, (also known as provider or supplier) agrees (or is required by law) to accept a Medicare-approved amount as full payment for covered services. This amount may be lower or higher than an individual's insurance amount, but will be on par with Medicare fees for the services. If a doctor ...

Medicare assignment is an agreement by your doctor or other healthcare providers to accept the Medicare-approved amount as the full cost for a covered service. Providers who "accept assignment" bill Medicare directly for Part B-covered services and cannot charge you more than the applicable deductible and coinsurance.

All providers who accept assignment must submit claims directly to Medicare, which pays 80 percent of the approved cost for the service and will bill you the remaining 20 percent. You can get some preventive services and screenings, such as mammograms and colonoscopies, without paying a deductible or coinsurance if the provider accepts assignment.

You can get the lowest cost if your doctor or other health care provider accepts the Medicare-approved amount as full payment for a covered service. This is called "accepting assignment." If a provider accepts assignment, it's for all Medicare-covered Part A and Part B services.

Medicare assignment is a fee schedule agreement between the federal government's Medicare program and a doctor or facility. When Medicare assignment is accepted, it means your doctor agrees to the payment terms of Medicare. Doctors that accept Medicare assignment fall under one of three designations: a participating doctor, a non ...

A medical provider that accepts Medicare assignment must submit claims directly to Medicare on your behalf. They will be paid the agreed upon amount by Medicare, and you will pay any copayments or deductibles dictated by your plan. If your doctor is non-participating, they may accept Medicare assignment for some services but not others.

If your doctor accepts assignment, that means they'll send your whole medical bill to Medicare, and then Medicare pays 80% of the cost, while you are responsible for the remaining 20%. A doctor who doesn't accept assignment, however, could charge up to 15% more than the Medicare-approved amount for their services, depending on what state ...

Medicare Assignment: Understanding How It Works. Medicare assignment is a term used to describe how a healthcare provider agrees to accept the Medicare-approved amount. Depending on how you get your Medicare coverage, it could be essential to understand what it means and how it can affect you.

Medicare assignment means a doctor or other healthcare provider will charge no more than the Medicare-approved amount for a particular service. This usually means lower out-of-pocket costs for patients who are covered by Medicare. It also means the provider will bill Medicare rather than expecting the patient to pay the full amount at the time ...

Summary: Medicare Assignment is an agreement between healthcare providers and Medicare, where providers accept the Medicare-approved amount as full payment, preventing them from charging beneficiaries extra. This benefits Medicare beneficiaries by controlling their costs and ensuring they only pay deductibles and copayments.

Medicare assignment codes help Medicare pay for covered services. If your doctor or other provider accepts assignment and is a participating provider, they will file for reimbursement for services with a CMS-1500 form and the code will be "assigned.". But non-participating providers can select "not assigned.".

Accepting assignment is a real concern for those who have Original Medicare coverage. Physicians (or any other healthcare providers or facilities) who accept assignment agree to take Medicare's payment for services. They cannot bill a Medicare beneficiary in excess of the Medicare allowance, which is the copayment or coinsurance.

This means that while non-participating providers have signed up to accept Medicare insurance, they do not accept Medicare's approved amount for health care services as full payment. Non-participating providers can charge up to 15% more than Medicare's approved amount for the cost of services you receive (known as the limiting charge). This ...

What it means to "accept Medicare assignment". In short, accepting Medicare assignment means signing a contract to accept whatever Medicare pays for a covered service as full payment. Participating and non-participating status only applies to Medicare Part B; Medicare Advantage plans operate with contracts similar to commercial insurance ...

According to the Medicare website: Assignment means that your doctor, provider, or supplier agrees (or is required by law) to accept the Medicare-approved amount as full payment for covered services. This means that for Medicare to cover the entire cost of a covered service, you'll need to go to a service provider who accepts assignment.

Medicare "participation" means you agree to accept claims assignment for all Medicare-covered services to your patients. By accepting assignment, you agree to accept Medicare-allowed amounts as payment in full. You may not collect more from the patient than the Medicare deductible and coinsurance or copayment. Participating Provider or ...

According to the National Uniform Claim Committee (NUCC), the "Accept Assignment" box indicates that the provider agrees to accept assignment. It simply says to enter an X in the correct box. It does NOT define what accepting assignment might or might not mean. It is important to understand that if you are a participating provider in any ...

A: If your doctor doesn't "accept assignment," (ie, is a non-participating provider) it means he or she might see Medicare patients and accept Medicare reimbursement as partial payment, but wants to be paid more than the amount that Medicare is willing to pay. As a result, you may end up paying the difference between what Medicare will ...

Nonassignment of Benefits. The second reimbursement method a physician/supplier has is choosing to not accept assignment of benefits. Under this method, a non-participating provider is the only provider that can file a claim as non-assigned. When the provider does not accept assignment, the Medicare payment will be made directly to the beneficiary.

Non-participating doctors can choose to either accept or not accept Medicare assignment. If the doctor does not accept Medicare assignment, you might have to pay a 15% additional charge above the cost of the service, known as a Medicare excess charge. You would then be responsible for up to 35% of the reduced Medicare-approved amount instead of ...