- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Renewable Energy Market Size, Share, Competitive Landscape and Trend Analysis Report by Type and End Use : Global Opportunity Analysis and Industry Forecast, 2021-2030

EP : Green/Alternative/ Renewable Energy

Report Code: A00060

Tables: 184

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

Renewable Energy Market Outlook - 2030

The global renewable energy market was valued at $881.7billion in 2020, and is projected to reach $1,977.6 billion by 2030, growing at a CAGR of 8.4% from 2021 to 2030. Renewable energy, even referred as clean energy, is usually derived from natural sources that are constantly replenished. Wind energy, a type of renewable energy, is used to generate electric energy from kinetic energy source. Wind turbine converts the wind energy into mechanical energy, which is further converted into electrical energy through generator. Wind energy can be generated offshore and onshore. Onshore wind energy is associated with onshore turbines that are located on land, whereas offshore wind turbines are found in ocean or sea.

Renewable energy is derived from natural sources such as wind and sunlight. Solar, geothermal, wind, bioenergy, hydropower, and ocean power are some of the major sources of renewable energy. Currently, renewable energy is utilized in heating, electricity, cooling, and transport sectors. Renewable energy collectively provides around 7% of the world’s energy demand. Renewable energy is relatively more expensive than fossil fuel. Several factors are responsible to drive the usage of renewable energies, the most crucial being the attribution of global warming due to carbon dioxide (CO2) emission from the combustion of fossil fuels. The concern about the reduction of greenhouse gas emissions, increase in search for energy security along with the aversion to traditional nuclear power, and lack of progression in the application of the nuclear power are expected to drive the demand for geothermal power market during the forecast period. Governments of various developing and developed countries have focused on promoting renewable energy sources due to increase in output efficiency, less pollution, and low maintenance costs. All these factors collectively surge the demand for renewable energy, thereby augmenting the global renewable energy market growth.

However, developing new resources requires large initial investments to build infrastructure. These investments increase the cost of providing electricity, especially during early years. Initially, the developers need to find publicly acceptable sites with good resources and with access to transmission lines. Finding a potential solar site requires several years of monitoring to determine whether they are suitable or not. In addition, the workers need to be trained to install, operate, and maintain the new technologies. Some require operating experiences in certain climatic conditions, before the performance can be optimized. This factor is likely to restrain the growth of the renewable energy market during the forecast period.

On the contrary, economies such as China and India are expected to drive the demand for geothermal power sector. A significant increase in energy demand owing to surge in investment in renewable energy projects has been witnessed in countries such as China and India. The residential and industrial sectors are expected to consume more energy during the forecast period in Asia-Pacific. Furthermore, India has significant growth potential; however, due to its inconsistent policy and business environment in past, the renewable energy share in total energy production was less. There has been an increase in investments in renewable energy projects in India, owing to which it is one of the countries experiencing rapid growth in the Asia-Pacific market.

For instance, a shift in trend toward use of localized energy procurement can be seen in the recent years. Various government bodies in countries such as India have taken the advantage of community choice aggregation (CCA) policies, which permits government to procure renewable energy resources on behalf of their constituents while retaining their existing electricity provider for transmission and distribution services. All these factors are expected to offer future growth opportunities to the global renewable energy market.

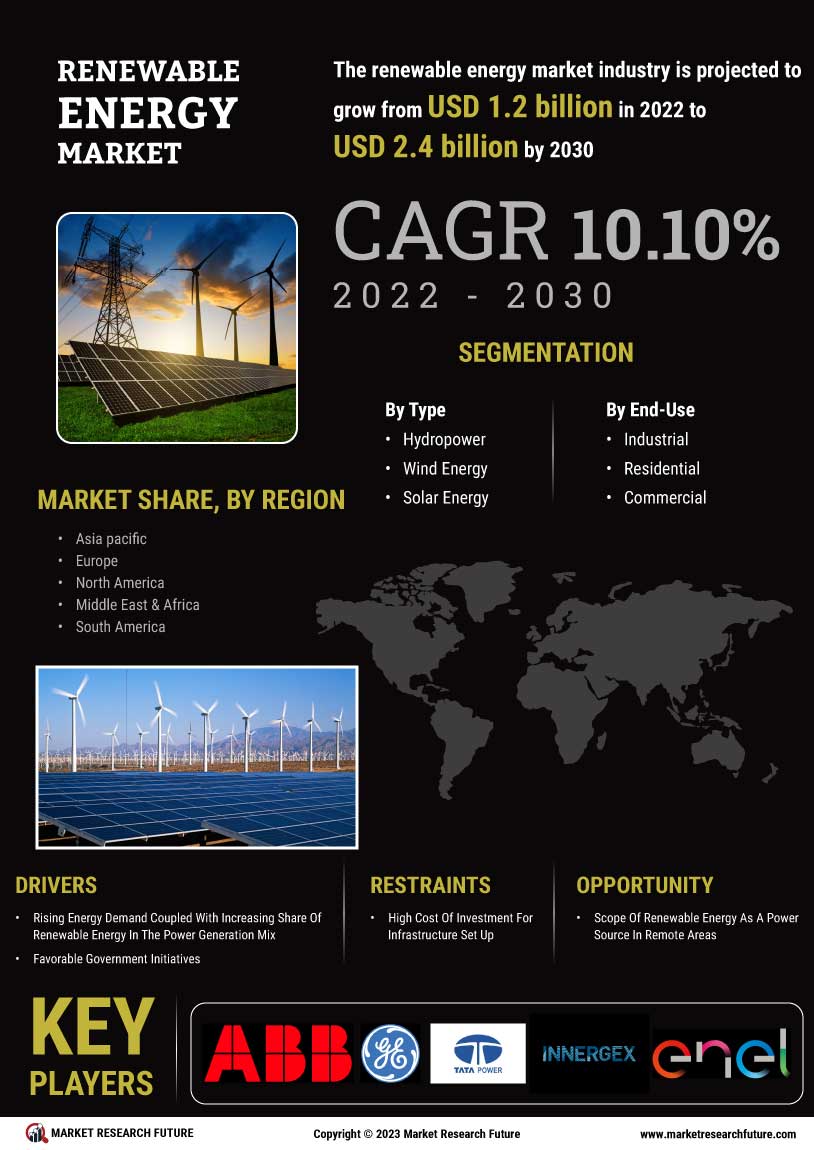

The renewable energy market analysis is done on the basis of type, end-use, and region. On the basis of type, the market is categorized into hydroelectric power, wind power, bioenergy, solar energy, and geothermal energy. The end-user covered in the study includes residential, commercial, industrial, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. The major companies profiled in this report include ABB, Acciona, EDF, Enel Spa, General Electric, Innergex, Invenergy, National Grid Renewables, The Tata Power Company Limited (Tata Power), and Xcel Energy Inc.

The global market analysis covers in-depth information of the major renewable energy industry participants.

Renewable Energy Market, by Region

Asia-Pacific renewable energy market size is projected to grow at a CAGR of 9.6% during the forecast period and accounted for 35.2% of renewable energy market share in 2020. The region accounts for more than half of the global energy consumption, owing to rise in industrialization as well increase in population. The renewable energy market has grown considerably in countries such as China and India. China became the world’s largest producer of bioelectricity in 2017 and now it is one the key players in hydropower, onshore, wind power and solar photovoltaic, and.

Asia-Pacific would exhibit highest CAGR of 9.6% during 2021-2030.

Renewable Energy Market, by Type

In 2020, the hydroelectric power segment was the largest revenue generator, and it is anticipated to grow at a CAGR of 6.5% during the forecast period. A significant amount of hydropower development took place in Brazil. An increase in activity has been witnessed across the continent, with notable projects in Colombia and Peru. Surge in investments for off-grid energy generation and rural electrification across developing countries, such as India, China, Brazil, and Vietnam, has increased the demand for small hydropower plants. In addition, initiatives such as the Small Hydropower Programme by the Ministry of New and Renewable Energy and Rajiv Gandhi Grameen Vidyutikaran Yojana taken by the Government of India to electrify rural areas and promote the utilization of small hydropower energy for off-grid and mini-grid is expected to drive the growth of the market.

Solar energy type is the most lucrative segment

Renewable Energ Market, by End Use

By end use, the ryesidential segment acquired the top position of the global market in 2020, and it is anticipated to grow at a CAGR of 8.4% during the forecast period. Increase in use of geothermal heat pump in residential heating application is expected to drive the growth of the market. The requirement of geothermal power is expected to increase significantly with rise in demand for electricity. This factor is expected to drive the growth of the market. Several companies in the market offer geothermal power to the residential sectors. Enel Green Power is one such company that owns the power plants at a complex and serves approximately two million families, 8,700 residential & business customers, and 25ha of greenhouses. Implementation of government initiatives in developed as well as developing economies to curb carbon emission and to reduce the usage of conventional fuels to generate energy has increased the usage of rooftop solar energy systems to generate electricity for household purposes.

Industrial end use is projected as the fastest growing segment

Key Benefits for Stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current renewable energy market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The Global Renewable Energy Market

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and economy around the globe.

- The renewable energy market has been negatively impacted due to the wake of COVID-19 pandemic. The pandemic severely impacted the wind turbine manufacturing in countries such as China and Germany.

- For instance, in 2020, Germany's Nordex SE reported negative EBITDA of $86.5 million down from positive EBITDA of $21 million in previous financial year (2019). The limited availability of spares and manpower for maintenance due to the pandemic is a major problem that affects the market growth.

- During high wind season, planned maintenance has become a major issue for industry players, owing to reduced labor force and social distancing norms. Furthermore, project delays and cancellation of orders has affected the key markets for both blade production and wind turbine installations.

- For instance, Siemens Gamesa Renewable Energy SA accounted for a net loss of $577 million during its fiscal third quarter in 2020. However, a shift in trend toward domestic supply chain may reduce the reliance on foreign imports and encourage domestic production of wind turbines. In addition, implementation of digitization is expected to aid in remote monitoring of project execution; thus, limiting the labor force as much as possible.

Renewable Energy Market Report Highlights

Analyst Review

The global renewable energy market is expected to exhibit high growth potential owing to its use in residential, commercial, industrial, and others. There is a significant increase in energy demand in the residential sector owing to rise in population in Asia-Pacific. Renewable energy technologies that can be installed in building energy systems comprise: solar electric, or photovoltaic systems, solar thermal, including solar hot water and solar ventilation air preheating, geothermal heat pump, wind turbines, and biomass systems. Geothermal power is used in residential for heating and cooling, and electricity generation. In residential sector, geothermal energy is a good alternative of fossil fossils and can be used to produce electricity. Increasing use of geothermal heat pump in a residential heating application is expected to drive the growth of the market. As demand for electricity increases, it is expected that the requirement of geothermal power will increase significantly. This factor is expected to drive the growth of the market. Several companies in the market are offering geothermal power to the residential sectors. Enel Green Power is one such company that owns the power plants at the complex serving approximately two million families, 8,700 residential and business customers, and 25ha of greenhouses, which is predicted to offer lucrative growth opportunities in the future.

There has been a significant amount of hydropower development in Brazil. There is increase in activity across the continent, with notable projects in Colombia and Peru is the key market trend. Surge in investments in off-grid energy generation and rural electrification across the developing countries such as India, China, Brazil, and Vietnam have surged the demand for small hydropower plants.

In addition, initiatives such as the Small Hydropower Programme by the Ministry of New and Renewable Energy and Rajiv Gandhi Grameen Vidyutikaran Yojana taken by the Government of India to electrify rural areas and promote the utilization of small hydropower energy for off-grid and mini-grid is expected to drive the growth of the market. Significant surge in demand for renewable power sources is expected to drive the floating wind turbine market growth which further propels the growth of the renewable energy market. In addition, such turbines reduce carbon emission, unlike conventional power sources. Furthermore, the floating wind turbine technology, a type of offshore turbine, removes the constraint of water depth which aids in selecting the best site possible for power generation.

- Hydro Power

- Wind Energy

- Solar Power

- Clean Energy

- Green Energy

- Waste To Energy

- Biomass Energy

- Geothermal Energy

Hydroelectric power segment holds the maximum share of the Renewable Energy Market.

Residential are the potential customers of Renewable Energy industry.

To get latest version of Renewable Energy market report can be obtained on demand from the website.

Acquisition, Partnership, Agreement, and Business Expansion are the key growth strategies of Renewable Energy Market players.

Europe region will provide more business opportunities for Renewable Energy in future.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Rise in demand for renewable energy, surge in electricity consumption, and increase in legislative & financial initiatives are the driving factors in the renewable energy market. Emerging economies such as India and China are driving the demand of renewable energy is the opportunity in the global market.

ABB, Acciona, EDF, Enel Spa, General Electric, Innergex, Invenergy, National Grid Renewables, The Tata Power Company Limited (Tata Power), and Xcel Energy Inc. are the leading global players in the Renewable Energy Market

It outlines the current trends and future estimations of the market from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets are the key benefits of the Renewable Energy Market report.

The development of photovoltaic (PV) storage systems is essential to increase the ability of PV systems to replace the existing conventional sources. The demand for storage grids is expected to augment in the coming years with increase in demand for PV installations. Rise in need for grid systems for residential application further propels the demand for lithium ion-powered batteries for solar energy storage. In addition, market assisting programs and schemes are expected to play a significant role in boosting the demand for solar storage technologies. This current trends will influence the Renewable Energy Market in the next few years.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Renewable Energy Market

Global Opportunity Analysis and Industry Forecast, 2021-2030

- Energy & Power

- Renewable Energy Market

"Actionable Insights to Fuel Your Growth"

Renewable Energy Market Size, Share & Industry Analysis, By Type (Solar Energy, Wind Energy, Bioenergy, Hydro Energy, Geothermal Energy), By End-User (Residential, Commercial, Industrial, Utility) And Regional Forecast, 2024-2032

Region :Global | Report ID: FBI105511 | Status : Ongoing

- Request PDF Brochure

KEY MARKET INSIGHTS

Key Market Driver -

Growing concern of rising carbon emissions and depletion of renewable resources

Key Market Restraint -

High Initial Cost

Key Players Covered:

Regional analysis:.

To gain extensive insights into the market, Request for Customization

Segmentation

Key industry developments.

- On Mar 10, 2021, Orange signed a corporate power purchase agreement (CPPA) with Total Quadran, which will supply Orange with 100 GWh/y of solar-generated electricity over 20 years and will enable the development of 12 new solar power plants in France, with a total capacity of 80 MW.

- On Mar 10, 2021, The Inter-American Development Bank (IDB) Energy Hub and the International Renewable Energy Agency (IRENA) Climate Investment Platform signed a partnership to drive the energy transition from petroleum to renewable in Latin America and the Caribbean under the 2030 Agenda for Sustainable Development and the Paris Agreement.

- PUBLISHING STATUS: Ongoing

- BASE YEAR: 2023

- HISTORICAL DATA: 2019-2022

Personalize this Research

- Granular Research on Specified Regions or Segments

- Companies Profiled based on User Requirement

- Broader Insights Pertaining to a Specific Segment or Region

- Breaking Down Competitive Landscape as per Your Requirement

- Other Specific Requirement on Customization

Energy & Power Clients

Client Testimonials

“We are quite happy with the methodology you outlined. We really appreciate the time your team has spent on this project, and the efforts of your team to answer our questions.”

“Thanks a million. The report looks great!”

“Thanks for the excellent report and the insights regarding the lactose market.”

“I liked the report; would it be possible to send me the PPT version as I want to use a few slides in an internal presentation that I am preparing.”

“This report is really well done and we really appreciate it! Again, I may have questions as we dig in deeper. Thanks again for some really good work.”

“Kudos to your team. Thank you very much for your support and agility to answer our questions.”

“We appreciate you and your team taking out time to share the report and data file with us, and we are grateful for the flexibility provided to modify the document as per request. This does help us in our business decision making. We would be pleased to work with you again, and hope to continue our business relationship long into the future.”

“I want to first congratulate you on the great work done on the Medical Platforms project. Thank you so much for all your efforts.”

“Thank you very much. I really appreciate the work your team has done. I feel very comfortable recommending your services to some of the other startups that I’m working with, and will likely establish a good long partnership with you.”

“We received the below report on the U.S. market from you. We were very satisfied with the report.”

“I just finished my first pass-through of the report. Great work! Thank you!”

“Thanks again for the great work on our last partnership. We are ramping up a new project to understand the imaging and imaging service and distribution market in the U.S.”

“We feel positive about the results. Based on the presented results, we will do strategic review of this new information and might commission a detailed study on some of the modules included in the report after end of the year. Overall we are very satisfied and please pass on the praise to the team. Thank you for the co-operation!”

“Thank you very much for the very good report. I have another requirement on cutting tools, paper crafts and decorative items.”

“We are happy with the professionalism of your in-house research team as well as the quality of your research reports. Looking forward to work together on similar projects”

“We appreciate the teamwork and efficiency for such an exhaustive and comprehensive report. The data offered to us was exactly what we were looking for. Thank you!”

“I recommend Fortune Business Insights for their honesty and flexibility. Not only that they were very responsive and dealt with all my questions very quickly but they also responded honestly and flexibly to the detailed requests from us in preparing the research report. We value them as a research company worthy of building long-term relationships.”

“Well done Fortune Business Insights! The report covered all the points and was very detailed. Looking forward to work together in the future”

“It has been a delightful experience working with you guys. Thank you Fortune Business Insights for your efforts and prompt response”

“I had a great experience working with Fortune Business Insights. The report was very accurate and as per my requirements. Very satisfied with the overall report as it has helped me to build strategies for my business”

“This is regarding the recent report I bought from Fortune Business insights. Remarkable job and great efforts by your research team. I would also like to thank the back end team for offering a continuous support and stitching together a report that is so comprehensive and exhaustive”

“Please pass on our sincere thanks to the whole team at Fortune Business Insights. This is a very good piece of work and will be very helpful to us going forward. We know where we will be getting business intelligence from in the future.”

“Thank you for sending the market report and data. It looks quite comprehensive and the data is exactly what I was looking for. I appreciate the timeliness and responsiveness of you and your team.”

Get in Touch with Us

+1 424 253 0390 (US)

+44 2071 939123 (UK)

+91 744 740 1245 (APAC)

[email protected]

- Request Sample

Sharing this report over the email

Renewable Energy Market Report Summaries Detailed Information By Top Key players include Ocean Power Technologies, Inc., Ørsted, GE, NextEra Energy, Inc., Enel Group, On Power, among others

Read More at:-

Certified Global Research Member

Key Questions Answered

- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

Why Choose Market Research Future?

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Renewable Energy Market Research Report Information By Type (Hydropower, Wind Energy, Solar Energy, Bioenergy, Geothermal Energy and Ocean Energy), By End-Use (Industrial, Residential and Commercial), and By Region (North America, Europe, Asia-Pacific, and Rest Of The World) - Industry Size, Share, Trends & Forecast to 2030

- Segmentation

- Table of Content

- Methodology

- Infographic

- Download PDF

Renewable Energy Market Overview:

Renewable Energy Market Size was valued at USD 1.1 trillion in 2021. The renewable energy market industry is projected to grow from USD 1.2 trillion in 2022 to USD 2.4 Trillion by 2030, exhibiting a compound annual growth rate (CAGR) of 10.10% during the forecast period (2024 - 2030). It is anticipated that main market drivers for market expansion over the projection period would include worries about decreasing greenhouse gas emissions, a rise in the hunt for power security, opposition to conventional nuclear energy, and a lack of advancement in nuclear power application.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

- Renewable Energy Market Trends

Rising investments by government of various countries to propel the renewable energy growth

Over the course of the forecast period, expanding investments in renewable energy sources and advantageous government policies are anticipated to propel market expansion. The first offshore wind farm in the United States was built by the National Ocean Industries Association in 2017. With 9,000 MW of additional capacity added in 2019, the United States' wind power additions are expanding rapidly. This increased the U.S.'s overall capacity to 105.6 GW. 2019 saw the installation of 2,166 units, or 18 M.W., of highly scalable wind capacity throughout 17 states, for a total cost of $67 million. From Pennsylvania to California, distributed wind systems have been developed to serve consumers in the agricultural, commercial, governmental, industrial, institutional, residential, and municipal sectors. The U.K. government also established a $1.2 billion package in September 2021 for public and private investment in India's green programmes and renewable energy. In order to raise private funding for environmentally friendly infrastructure in India, they have launched a Climate Finance Leadership Initiative (CFLI) India collaboration. These investments would aid India in achieving its 2030 goal of 450 Gw of renewable energy. Therefore, during the anticipated term, the government's investment in renewable energy sources will help the industry flourish. Thus, this factor is driving the market CAGR.

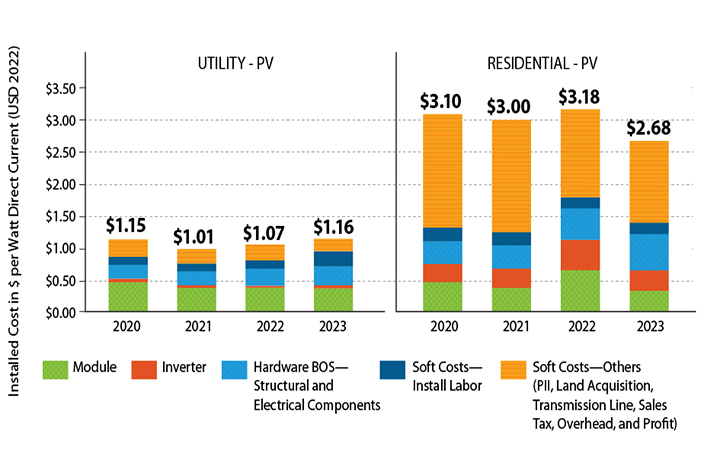

Furthermore, numerous governments have enacted laws to encourage the development and use of renewable energy sources. Policies that fit under this category include mandates, tax breaks, and subsidies. Solar photovoltaic installations will reach 143 GW by 2020, accounting for 43% of all renewable energy capacity worldwide. By the time it reaches 175 GW in 2023, this percentage is predicted to increase to 49%. The installed capacity of wind power will reach 103 GW in 2020 and 126 GW by 2023. The latter figure increased from the prior one by 24%.

However, the market for renewable energy is expanding in part as a result of decreasing costs. Direct writing or lithography can be used to produce 14-nm wafers instead of the older and more laborious 29-nm process lines. As a result of these advancements, processing times are being slashed and yield rates are rising, lowering the price of creating a PV module. These price reductions have made renewable energy more competitive with traditional fossil fuels. The steadily falling cost of renewable technology is another aspect that makes it more affordable for businesses and people. The Renewable Energy Market is projected to grow as a result of these trends, which are expected to last for the foreseeable future.

Furthermore, the cost of renewable energy is decreasing as a result of technological breakthroughs, and the competitiveness of battery storage systems is increasing, which is good for the growth of the renewable energy market. Additionally, due to mounting concerns about environmental, social, and governance (ESG) issues and global climate change, financing for renewable energy sources is surging. Governments in both developed and developing nations are giving subsidies to the corporate sector to encourage a shift toward clean and green energy in an effort to promote sustainability and protect the environment. The market for renewable energy is primarily driven by these factors. Thus, it is anticipated that this aspect will accelerate renewable energy market revenue globally.

Renewable Energy Market Segment Insights:

Renewable energy type insights.

The Renewable Energy Market segmentation has been segmented by type into Hydropower, Wind Energy, Solar Energy, Bioenergy, Geothermal Energy and Ocean Energy. The solar energy renewable segment dominated the market growth in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. Due to their ability to turn sunlight directly into power, solar panels are a fantastic solution for residences and businesses in sunny regions. Solar panels require a big amount of space to perform effectively, and the original cost and continuous maintenance of solar panels can be significant.

Renewable Energy Trends - End-Use Insights

The Renewable Energy Market segmentation, based on end-use is divided into Industrial, Residential and Commercial. The residential segment dominated the renewable energy market data in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. The market is anticipated to expand due to the rising popularity of geothermal heat pumps for home heating applications. Along with the rise in electricity demand, there will likely be a major increase in the need for geothermal energy. This element will likely fuel the market's expansion.

Figure 2: Renewable Energy Market by End-Use, 2024 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Renewable Energy Forecast - Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia Pacific renewable energy market accounted for USD 0.5 billion in 2021 and is expected to exhibit a 43.60% CAGR during the study period. The region's increasing industrialization and urbanization were to blame for the sharp rise in pollution levels. The need for electricity is also being fueled by the region's rapidly growing population and residential development.

Further, the major countries studied in the market report are: The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: Renewable Energy Market Share By Region 2021 (%)

North America renewable energy market accounts for the fastest growing market share. The cooperation of the nations in the development of new power sources is accelerating regional growth. For instance, the United States and India resolved to structure their strategic power relationship in March 2021 to cooperate in cleaner power fields such as hydrogen generation and biofuels. The two nations would intensify their efforts to take advantage of cutting-edge American technologies and India's quickly growing electricity industry. Moreover, US renewable energy market held the largest market share, and the Canada renewable energy market was the fastest-growing market in this region.

Europe renewable energy market is expected to grow at a substantial CAGR from 2022 to 2030. Due to the market's availability of increasingly effective solar cells, power output from industrial sector solar cells has improved over time. Additionally, the industry's escalating competitiveness has aided in expanding solar panel options and lowering the cost of electricity production. Over the course of the projection period, these variables are anticipated to increase demand for renewable energy in the area. Further, the UK renewable energy market held the largest market share, and the Germany renewable energy market was the fastest-growing market in the region.

Renewable Energy Business Key Market Players & Competitive Insights

Major market players are spending a lot on R&D to increase their product lines, which will help the renewable energy industry grow even more. Market participants are also taking various strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, market developments and collaboration with other organizations. Competitors in the industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market industry.

One of the primary business strategies manufacturers adopt in the global renewable energy industry to benefit clients and expand the sector is manufacturing locally to reduce operating costs. In recent years, renewable energy industry has provided medicine with some of the most significant benefits. The renewable energy market major player such as ABB Ltd., General Electric (GE), The Tata Power Company Limited (Tata Power), Innergex, Enel Spa (Enel), Xcel Energy Inc. (Xcel Energy), EDF, Geronimo Energy and Invenergy.

With its headquarters in Boulogne-Billancourt, Greater Paris, France, General Electric's American wind turbine manufacturing company, GE Renewable Electricity, focuses on the generation of energy from renewable sources. Its product line comprises power generating solutions for wind, hydropower, and solar energy. In June 2021, a contract for the procurement and installation of wind turbines for the 148.5 megawatts (MW) Bhuj wind park in Gujarat was given to GE Renewable Energy.

Also, an international power generation development and operations corporation with an American base is called Invenergy. In the Americas, Europe, and Asia, the firm develops, constructs, owns, and runs power production and energy storage projects, including wind, solar, and natural gas power generation and energy storage facilities.

List of the Key companies in the renewable energy sector includes

- General Electric (GE)

- The Tata Power Company Limited (Tata Power)

- Enel Spa (Enel)

- Xcel Energy Inc. (Xcel Energy)

- Geronimo Energy

Renewable Energy Analytics - Industry Developments

- August 2023- Adani Energy Solutions, on 7th August, declared the successful financial closure for its USD1 billion Green HVDC link project, which will allow the supply of more renewable power to the city and support it's ascending electricity demand. The credit facility is part of the USD 700 million revolving project finance initiative tied up in October 2021 for AESL's continuing transmission assets portfolio. This unique platform infrastructure financing framework guarantees consistent access to capital for future projects in AESL's transmission portfolio by utilizing funds paid back by other projects.

- April 2021: Walmart said that it had installed 6.5 MW of solar power systems, created by Sol Customer Solutions, at seven of its stores in California. Additionally, Bank of America (BOA) was the tax-equity partner, and the portfolio included a combination of solar power systems installed on parking lot rooftops and carports that cost around US$10 million.

- April 2020: Engie and Eocycle-XANT formed a collaboration so that Engie could offer wind turbines in Belgium. Engie is tasked for gathering customer demands and requirements and transmitting them to Eocycle-XANT, who will handle the installation and upkeep of the wind turbines the customer is provided.

Global Renewable Power Industry Scenario

The International Renewable Energy Agency (IRENA) estimates that 90 percent of the world’s electricity can and should come from renewable energy by 2050. Renewables offer a way out of import dependency, allowing countries to diversify their economies and protect them from the unpredictable price swings of fossil fuels, while driving inclusive economic growth, new jobs, and poverty alleviation. About 80% of the global population lives in countries that are net-importers of fossil fuels -- that’s about 6 billion people who are dependent on fossil fuels from other countries, which makes them vulnerable to geopolitical shocks and crises.

Renewable Energy World Sources –

A large chunk of the greenhouse gases that blanket the Earth and trap the sun’s heat are generated through energy production, by burning fossil fuels to generate electricity and heat. Fossil fuels, such as coal, oil and gas, are by far the largest contributor to global climate change, accounting for over 75% of global greenhouse gas emissions and nearly 90% of all carbon dioxide emissions. The science is clear: to avoid the worst impacts of climate change, emissions need to be reduced by almost half by 2030 and reach net-zero by 2050. about $4 trillion a year needs to be invested in renewable energy until 2030 – including investments in technology and infrastructure – to allow us to reach net-zero emissions by 2050. The reduction of pollution and climate impacts alone could save the world up to $4.2 trillion/year by 2030.

Geo Energy - Geothermal energy utilizes the accessible thermal energy from the Earth’s interior. Reservoirs that are naturally sufficiently hot and permeable are called hydrothermal reservoirs, whereas reservoirs that are sufficiently hot but that are improved with hydraulic stimulation are called enhanced geothermal power systems. The technology for electricity generation from hydrothermal reservoirs is mature and reliable and has been operating for more than 100 years.

Solar Energy - The cost of manufacturing solar panels has plummeted dramatically in the last decade, making them not only affordable but often the cheapest form of electricity. Solar energy is the most abundant of all energy resources and can even be harnessed in cloudy weather. Solar technologies convert sunlight into electrical energy either through photovoltaic panels or through mirrors that concentrate solar radiation. Although not all countries are equally endowed with solar energy, a significant contribution to the energy mix from direct solar energy is possible for every country. (More Details on - www.un.org)

Renewable Energy Market Segmentation

Renewable energy type outlook (usd billion, 2024-2030).

- WIND ENERGY

- Solar Energy

- Geothermal Energy

- Ocean Energy

Renewable Energy End-Use Outlook (USD Billion, 2024-2030)

- Residential

Renewable Energy Regional Outlook (USD Billion, 2024-2030)

- Rest of Europe

- South Korea

- Rest of the World

- Middle East

- Latin America

Renewable Energy Market Highlights:

- Renewable Energy Market Size

- Renewable Energy Market Analysis

- Renewable Energy Market Share

- US Renewable Energy Market

- Renewable Energy Companies

Frequently Asked Questions (FAQ) :

The Renewable Energy market size was expected to be USD 1.1 Trillion in 2021.

The Renewable Energy market is expected to register a CAGR of 10.10% over the next ten years.

Asia Pacific held the largest market share in the Renewable Energy sources market.

ABB Ltd., General Electric (GE), The Tata Power Company Limited (Tata Power), Innergex, Enel Spa (Enel), Xcel Energy Inc. (Xcel Energy) are the key players in the Renewable Energy Market.

The solar energy category led the segment in the market.

The residential category had the largest market share in the renewable energy market.

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

We do not share your information with anyone. However, we may send you emails based on your report interest from time to time. You may contact us at any time to opt-out.

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.

Get Free Sample

Priya Nagrale

Senior Research Analyst With an experience of over five years in market research industry (chemicals & materials domain), i gather and analyze market data from diverse sources to produce results, which are then presented back to a client. also, provide recommendations based on the findings. as a senior research analyst, i perform quality checks (qc) for market estimations, qc for reports, and handle queries and work extensively on client customizations. also, handle the responsibilities of client proposals, report planning, report finalization, and execution

Free Sample Request

Leading companies partner with us for data-driven Insights.

© 2024 Market Research Future ® (Part of WantStats Reasearch And Media Pvt. Ltd.)

Global Energy Perspective 2023

This article was updated on november 21, 2023.

Global Energy Perspective 2023 – Executive Summary

The Global Energy Perspective 2023 offers a detailed demand outlook for 68 sectors, 78 fuels, and 146 geographies across a 1.5° pathway, as well as four bottom-up energy transition scenarios with outcomes ranging in a warming of 1.6°C to 2.9°C by 2100.

As the world accelerates on the path toward net-zero, achieving a successful energy transition may require a major course correction to overcome bottlenecks and reach the goals aligned with the Paris Agreement.

View overview

For leaders seeking greater granularity on the most significant trends, challenges, and opportunities facing their sectors, we are complementing our macro perspective with a series of deep dives across the energy value chain.

Wide-ranging scenarios point to an unclear path ahead

The energy transition has gathered pace, but the path ahead is full of uncertainty in everything from technology trends to geopolitical risk and consumer behavior—making it difficult to shape resilient investment strategies that work in multiple scenarios. It is therefore increasingly challenging for decision makers to address multiple objectives at once, such as meeting long-term goals for decarbonization as well as short-term expectations for economic returns.

The Global Energy Perspective 2023 explores the outlook for demand and supply of energy commodities across a 1.5° pathway (modelled as part of McKinsey’s Climate Math effort) and four bottom-up energy transition scenarios. These scenarios sketch a range of outcomes based on varying underlying assumptions—for example, about the pace of technological process and the level of policy enforcement. Despite significant reductions in carbon emissions, all energy transition scenarios remain above the 1.5° pathway and result in warming of between 1.6° and 2.9°C.

These estimates include non-CO 2 emissions, building in assumptions on non-energy emissions from sectors like agriculture, forestry, and waste.

To stay within the carbon budget necessary for the 1.5° pathway, a much steeper reduction in emissions would be required, particularly in the next ten years.

Fossil fuel demand is projected to peak soon, but the outlook remains uncertain

Total demand for fossil fuels is projected to peak by 2030 in all scenarios. Although a sharp decline in coal demand is expected under all scenarios, natural gas and oil are expected to grow further in the next few years and then remain a core part of the world’s energy mix for decades to come.

Total natural gas demand to 2040 is projected to increase under most scenarios, driven in large part by the balancing role that gas is expected to play for renewables-based power generation until batteries are deployed at scale. In the decade to 2050, the outlook for gas demand differs widely by scenario, from a steady increase under slower transition scenarios to a steep decline under scenarios in which renewables and electrification advance faster.

For oil, total demand is projected to continue growing for much of this decade and then to fall after 2030—but the extent of the decline differs significantly across scenarios. In the Achieved Commitments scenario, oil demand almost halves by 2050, mainly driven by the slowdown in car-parc growth, enhanced engine efficiency in road transport, and the continued electrification of transport. In the Fading Momentum scenario, oil demand would decline by just 3 percent over the same period; this reflects much slower electrification of the global car parc and lower penetration of alternative fuels in the aviation, maritime, and chemicals sectors as bottlenecks on materials and infrastructure limit their growth.

Renewables will make up the bulk of the power mix by 2050

Renewables are expected to continue their rapid growth, driven in part by their cost competitiveness—in many regions they are already the lowest-cost option for incremental new-build power generation. Renewable energy sources are expected to provide between 45 and 50 percent of global generation by 2030, and between 65 and 85 percent by 2050. In all scenarios, solar is the biggest contributor of renewable energy, followed by wind.

The ramp-up of renewables could see emissions from power generation reduced by between 17 and 71 percent by 2050 compared to present levels, despite a doubling or even tripling of demand. However, the renewables build-out faces challenges, from supply-chain issues to slow permitting and grid build-out implications.

The uptake of nuclear and carbon capture, utilization, and storage (CCUS) technologies could lower the burden on the renewables build-out, but depends on the political landscape and future cost development.

Coal (without CCUS) is expected to be phased out gradually. Power generation from hydrogen-ready gas plants—which support grid stability—is likely to increase.

Major investments in the energy sector will be needed, but remain stable as a share of GDP

Total annual investments in the energy sector are projected to grow by between 2 and 4 percent per annum—roughly in line with global GDP growth—to reach between $2 trillion and $3.2 trillion in 2040.

Despite the increasing regulatory push for decarbonization and a declining demand for fossil fuels, between 25 and 40 percent of energy investments in 2040 will still be deployed in fossil fuels and conventional power generation to meet demand, offset declines in existing production fields, and balance the energy system.

There will be a gradual but continued shift of investment focus from fossil fuels to green technologies and electric transmission and distribution. In 2015, power renewables and decarbonization technologies accounted for only 20 percent of total investments, while that figure is projected to reach 40 to 50 percent by 2040.

Decarbonization technologies show the highest growth at between 6 and 11 percent per annum, mainly driven by the strong uptake of EV charging infrastructure and CCUS, which together are projected to account for the bulk of decarbonization investments by 2040.

In the more progressive scenarios, higher energy investments are mostly offset by lower total operating expenditure for fuels like coal and gas due to the shift towards more capital expenditure-intensive technologies like renewables.

Despite the absolute increase, energy investments as a share of GDP remain stable at between 1.2 and 2.2 percent across all years and scenarios.

Achieving a successful energy transition would require a major course correction to overcome bottlenecks and reach the goals aligned with the Paris Agreement

To deliver on the steep climate commitments made globally, substantial pivots are needed across industries and geographies. Even the more modest transition scenarios require that multiple bottlenecks are overcome.

Potential bottlenecks include land availability, energy infrastructure, manufacturing capacity, consumer affordability, investment willingness, and material availability.

The adoption of green hydrogen faces steep challenges mainly due to infrastructure needs and the high investments required to achieve large-scale deployment.

Rare materials are required for most energy transition technologies, with EVs and wind generation both highly impacted by materials bottlenecks.

Costs continue to be a barrier, but EVs and heat pumps are expected to become economically viable. Despite the big upfront investments needed, renewables become cost competitive in the Further Acceleration and Achieved Commitments scenarios.

While these bottlenecks could limit growth of some of the technologies known today, shortages are also likely to lead to price spikes that create additional investment opportunities and innovation.

The energy transition is well underway, but how it will unfold in the decades ahead is difficult to predict. Decision makers in government and business face a challenging time planning for a future energy mix that remains unclear.

Leaders might be tempted to “wait and see”, but this approach would be a big risk. Even if the exact trajectory of the energy transition is unknown, the changes ahead will be immense—and faster than many expect. A look at the past two years underscores this: despite massive and unprecedented uncertainties, the growth in several low-carbon technologies has continued and even accelerated.

Organizations can work now to shape transition strategies that account for uncertainty and are robust under a range of future scenarios. Those strategies, aggregated across countries and sectors, will determine how the global energy landscape takes shape in the years ahead. They will also be crucial in driving progress on sustainability while safeguarding energy security, affordability, and industrial competitiveness.

To request access to the data and analytics related to our Global Energy Perspective, or to speak to our team, please contact us .

Notification: View the latest site access restrictions, updates, and resources related to the coronavirus (COVID-19) »

NREL gathers data sets, conducts analysis, and develops tools to inform the efficient, sustainable, and equitable adoption and integration of solar energy.

NREL Tracks U.S. Solar PV and Energy Storage Costs in Annual Benchmarks

Read the news story

Leap Into New Capabilities: REopt Offers Enhanced Energy Solutions

Feb. 29, 2024

Making Solar Work for Everybody—How NREL Helps Envision a More Just Energy System

Feb. 12, 2024

Announcing the Teams Racing to the Finish in the Solar District Cup

Jan. 30, 2024

Publications

Energy and Carbon Payback Times for Modern U.S. Utility Photovoltaic Systems , NREL Fact Sheet (2024)

Winter 2024 Solar Industry Update , NREL Presentation (2024)

Addressing Regulatory Challenges to Tribal Solar Development , NREL Technical Report (2023)

Subscribe to Email Updates

For updates related to NREL's solar market research and analysis, join our email list.

View previous campaigns

Your personal data will not be shared and will be used only to manage your subscription for as long as you are subscribed. For more information, please review the NREL security and privacy policy .

Share Your Feedback

We welcome your feedback on the Solar Market Research and Analysis website and publications. It should only take you 1–2 minutes.

Share Feedback

- [email protected]

- +1 718 618 4351 (International)

- +91 78878 22626 (Asia)

Home ➤ Energy and Power

Energy and Power Market Research Reports

The global Energy and Power sector was valued at USD 995.5 billion by the end of 2022 and is expected to increase to USD 2,701.87 billion by 2032. This growth was projected at a CAGR of 10.5% during the period 2022-2032.

We assist utilities, renewable groups, new entrants, start-ups, and developers, as well as oil majors and power-generation companies, in accelerating sustainable and inclusive growth during the energy transition. Companies can realize this through digitization, automation, AI, and other means to gain lasting value and keep up with consumer trends and market dynamics.

The Energy and Power sector is highly regulated and commercially competitive. The world is constantly changing and engineers and large organizations are crucial in managing that change. They can implement short-term solutions quickly, and safely, or develop long-term solutions.

The Energy and Power industry is seeing a lot of growth thanks to trends like decarbonization, distributed energy generation on-site, and digital service solutions.

The Energy and Power industry has three main priorities: affordability, security, and decarbonization. However, most energy sources can’t meet all three.

This is where Market.us comes into play.

We use the power of analytics and research for our clients to create and implement platform-based business models, along with making informed decisions.

Market.us has established itself as a reliable source of verifiable business information. We offer extensively valuable insights on various business data needs that professionals in Energy and Power may then use to address potential challenges, thus positively influencing the growth trajectory of their respective organizations or business.

We analyze and comprehend the key trends and developments in the sector to support our clients’ key strategic plans and business decisions. We can provide the right help which our clients can leverage. They can then gain the right business intelligence needed and build more efficient and economically-sound strategies.

We utilize primary and secondary information sources when formulating comprehensively quantifiable strategies that address our clients’ areas of interest.

Market.us provides a short gist on this Energy and Power Industry.

Many governments have been preparing their energy sector to transition to emissions-free sources in recent years. The demand for sustainable energy is increasing as the public becomes more aware of the environmental impact of human activities.

Multiple commodities have seen price increases as a result of the economic recovery following the COVID-19 pandemic. The conflict in Ukraine has triggered an increase in energy prices and security of supply concerns. The transition to a lower carbon energy system is continuing and accelerating. In the next decade, we will likely witness a rapidly changing energy landscape.

Our Energy and Power category segmentation encompasses:

Green/ Renewable Energy Non-Renewable/Conventional Energy Power Equipment and Devices Transmission, Storage, and Distribution Energy Efficiency and Conservation Utility

Report Categories

- Automotive and Transportation

- Chemicals & Materials

- Consumer Goods

- Energy and Power

- Food and Beverage

- Information and Communications Technology

- Life Science

- Manufacturing

- Semiconductor and Electronics

Latest Reports

Global elastomeric infusion pumps market by type(continuous rate elastomeric pumps, variable rate elastomeric pumps), by treatment(pain management, antibiotic/antiviral, chemotherapy, others), by application(hospitals, clinics, ambulatory surgical centres, home care, others), by region and key companies - industry segment outlook, market assessment, competition scenario, trends and forecast 2024–2033.

Report Overview The global Elastomeric Infusion Pumps Market size is expected to be worth around USD 2153.4 Million by 2033, from USD 1016.1 Million in 2023, growing at a CAGR of 7.8...

- ★★★★★ ★★★★★

- US $3,499 Onwards

Global Printed Circuit Heat Exchangers Market By Type(Stainless Steel, Nickel, Cobalt Based Alloys, Copper, Titanium), By Application(Hydrocarbon Processing, Petrochemical, Refining Industries, Others), By End-Use(Industrial, Commercial, Residential), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Printed Circuit Heat Exchangers Market size is expected to be worth around USD 1118 Million by 2033, from USD 654 Million in 2023, growing at a CAGR of 5.5...

Global Environmental Technology Market By Component(Solutions, Services), By Technological(Waste Valorization/Recycling and Composting, Greentech/Renewable Energy (Wind Energy, Photovoltaics, and Geothermal Energy), Desalination, Bioremediation, Green Hydrogen, Carbon Capture, Utilization and Storage (CCUS), Other Technological Solutions), By Application(Wastewater Treatment, Water Purification Management, Sewage Treatment, Pollution Monitoring, Dust Emissions, Dry Steaming, Gas Dissolution, Precision Cooling, Solid Waste Treatment, Other Applications), By End-use(Industrial, Residential, Commercial), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Environmental Technology Market size is expected to be worth around USD 995.2 Billion by 2033, from USD 622.7 Billion in 2023, growing at a CAGR of 4.8% du...

Global Transformers Market By Type(Power Transformer, Distribution Transformer, Instrument Transformer, Others), By Power Rating, Small( Medium, Large, By Cooling Type(Air Cooled, Oil Cooled), By Insulation(Dry, Liquid Immersed), By Phase(Three Phase, Single Phase), By Application(Utility, Industrial, Commercial, Residential), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

Report Overview The global Transformer market size is expected to be worth around USD 123 Billion by 2033, from USD 68 Billion in 2023, growing at a CAGR of 6.2% during the forecast ...

Global High Voltage Battery Market By Battery Capacity(75 kWh–150 kWh, 151 kWh–225 kWh, 226 kWh–300 kWh, >300 kWh), By Battery Type(Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt Oxide, Lithium Nickel Cobalt Aluminium Oxide, Others), By Voltage(400–600V, >600V, By Driving Range, 100–250 miles, 251–400 miles, 401–550 miles, >550 miles), By Applications(Passenger cars, Bus, Trucks, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global High Voltage Battery Market size is expected to be worth around USD 642 Billion by 2033, from USD 30 Billion in 2023, growing at a CAGR of 35.9% during the...

Global Perovskite Solar Cells Module Market By Type(Flexible PSCs, Hybrid PSCs, Multi-Junction PSCs), By Structure(Planar Perovskite Solar Cells, Mesoporous Perovskite Solar Cells), By Method(Solution Method, Vapor-Assisted Solution Method, Vapor-Deposition Method), By Application(Smart Glass, Perovskite in Tandem Solar Cells, Solar Panel, Portable Devices, Utilities, BIPV (Building-Integrated Photovoltaics)), By End-Use(Energy, Aerospace, Industrial Automation, Consumer Electronics, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

Report Overview The global Perovskite Solar Cells Module Market size is expected to be worth around USD 13934.0 Million by 2033, from USD 175.2 Million in 2023, growing at a CAGR of ...

Global Fuel Cell Powertrain Market By Component(Fuel Cell Systems, Battery Systems, Drive Systems, Hydrogen Storage Systems, Others), By Drive Type(Rear-Wheel Drive (RWD), Front-Wheel Drive (FWD), All-Wheel Drive (AWD)), By Vehicle Type(Passenger Vehicles, Light Commercial Vehicles (LCVs), Buses, Trucks), By Power Output(250kW), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Fuel Cell Powertrain Market size is expected to be worth around USD 93679 Million by 2033, from USD 481.4 Million in 2023, growing at a CAGR of 69.4% durin...

Hydropower Market By Type(Public, Private), By Capacity(Micro Hydropower, Small Hydropower, Large Hydropower), By Technology(Reservoir, Pumped Storage, Run-of-River, Others), By Component(Civil Construction, Electrical, Mechanical Equipment, Power Infrastructure, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

Report Overview The global Hydropower Market size is expected to be worth around USD 383.4 billion by 2033, from USD 244.5 billion in 2023, growing at a CAGR of 4.6% during the forec...

Global Hydrogen Fuel Cells Market By Technology (Proton Exchange Membrane Fuel cells (PEMFC)), By Application (Stationary, Transportation), By End-User(Fuel Cell Vehicles, Utilities, Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

Report Overview The global Hydrogen Fuel Cells Market size is expected to be worth around USD 22.7 billion by 2033, from USD 3.6 billion in 2023, growing at a CAGR of 20.2% during th...

Global Direct Air Capture Market By Technology(Solid-DAC (S-DAC), Liquid-DAC (L-DAC), Electrochemical-DAC (E-DAC)), By Application(Carbon Capture, and Storage (CCS), Carbon Capture Utilization and Storage (CCUS)), By Source(Electricity, Heat), By Number of Collectors(Less than 10 collectors, More than 10 collectors), By End-Use Industry(Oil & Gas, Food and beverage, Automotive, Chemicals, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Direct Air Capture Market size is expected to be worth around USD 10081.1 Million by 2033, from USD 96.4 Million in 2023, growing at a CAGR of 59.2% during...

Global Lithium Ion Battery for Energy Storage Systems Market By Battery Type (Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Lithium Titanate Oxide (LTO), Lithium Manganese Iron Phosphate - LMFP, and Lithium Manganese Nickel Oxide - LMNO), By Capacity (Below 100 MWh, 100 to 500 MWh, and Above 500 MWh), By Connection Type (On-grid, and Off-grid) By End-use (Utility, Commercial & Industrial, and Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The Global Lithium Ion Battery for Energy Storage Systems Market size is expected to be worth around USD 61337 billion by 2033, from USD 5,575.3 Million in 2023, grow...

Global Residential Lithium-ion Battery Energy Storage Systems Market By System Type(On-Grid Systems, Off-Grid Systems, Hybrid Systems), By Capacity(Less than 3kW, 3 kW to 5 kW, Above 5kW), By Application(Solar Energy Storage, Backup Power, Load Balancing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Residential Lithium-ion Battery Energy Storage Systems Market size is expected to be worth around USD 68.9 billion by 2033, from USD 5.7 billion in 2023, g...

Global Organic Photovoltaics (OPV) Market By Type(Dye-sensitized Nano Crystalline Solar Cells, PN Junction Structure), By Application(Building-integrated Photovoltaic (BIPV), Portable Electronics, Defense Application, Conventional Solar, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Organic Photovoltaics (OPV) Market size is expected to be worth around USD 1454.4 Million by 2033, from USD 185 Million in 2023, growing at a CAGR of 22.9%...

Global Radar-Absorbing Materials Market By Type(Magnetic, Dielectric, Hybrid), By Technology(Impedance Matching, Resonant Absorbers, Circuit Analog RAM, Magnetic RAM, Adaptive RAM), By Material(Carbon, Metal, Metal Particles, Conducting Polymers, Tubules and Filaments, Chiral Materials and Shielding), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Radar-Absorbing Materials Market size is expected to be worth around USD 2390.6 Million by 2033, from USD 834.4 Million in 2023, growing at a CAGR of 11.1%...

Global Autonomous Power Systems Market By Component(Software, Hardware), By Technology( Wireline, Wireless), By Application(Generation, Transmission, Distribution, Consumption), By End-User(Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Autonomous Power Systems Market size is expected to be worth around USD 95 billion by 2033, from USD 21 billion in 2023, growing at a CAGR of 16.4% during ...

Global Solar Tracker Market By Product Type(Single-Axis Solar Tracker, Dual-Axis Solar Tracker), By Technology(Photovoltaic (PV), Concentrated Solar Power (CSP), Concentrated Photovoltaic (CPV)), By Tracking Mechanism(Active Solar Trackers, Passive Solar Trackers), By Installation Type( Ground-Mounted, Roof-Mounted), By Application(Utility-Scale, Commercial and Industrial, Residential), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Solar Tracker Market size is expected to be worth around USD 27.2 billion by 2033, from USD 7.2 billion in 2023, growing at a CAGR of 14.2% during the fore...

Global Smart Grid Market By Component(Hardware, Software, Services), By Technology(Advanced Metering Infrastructure (AMI), Distribution Automation (DA), Demand Response (DR), Grid Optimization, Others), By Application(Generation, Transmission, Distribution, Consumption), By End-Use(Utility, Industrial, Residential, Commercial), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Smart Grid Market size is expected to be worth around USD 261.9 billion by 2033, from USD 49.2 billion in 2023, growing at a CAGR of 18.2% during the forec...

Global LNG Bunkering Market By Type(Truck-to-Ship (TTS), Terminal-to-Ship (TTS), Ship-to-Ship (STS)), By Vessel Type(Container Ships, Tankers, Ferries, Cruise Ships, Offshore Support Vessels, Others), By Application (Industrial and Commercial, Defense, Others) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global LNG Bunkering market size is expected to be worth around USD 27.7 billion by 2033, from USD 1.2 billion in 2023, growing at a CAGR of 36.9% during the fore...

Solid State Battery Market By Type(Thin Film Battery, Bulk Solid-State Battery), By Capacity(Below 20mAh, 20mAh-500mAh, Above 500mAh), By Application(Wearables, Medical Devices, Military, industrial sensors, Special Semiconductor, IoT, RFID, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Solid State Battery Market size is expected to be worth around USD 14.9 billion by 2033, from USD 1 billion in 2023, growing at a CAGR of 31.0% during the ...

Global Carbon Trading Market By Type(Compliance, Voluntary), By Project Type(Avoidance/Reduction Projects, Removal/Sequestration Projects), By End-Use(Power, Energy, Aviation, Transportation, Industrial, Others) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Carbon Trading Market size is expected to be worth around USD 9446.1 billion by 2033, from USD 469.8 billion in 2023, growing at a CAGR of 35.0% during the...

Global Battery Separator Market By Battery Type(Lithium-Ion (Li-Ion), Lead Acid, Nickel-Cadmium, Nickel Metal, Others), By Seperater Type(Coated separator, Non-coated separator), By Material(Polyethylene (PE), Polypropylene (PP), Nylon, Ceramic, Others), Thickness(5μM-10μM, 10μM-20μM), By Technology(Dry Battery Separator, Wet Battery Separator), By End-Use(Automotive, Consumer Electronics, Industrial, Energy Storage, Aerospace and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Battery Separator Market size is expected to be worth around USD 20.5 billion by 2033, from USD 5.1 billion in 2023, growing at a CAGR of 14.9% during the ...

Microgrid Market By Service Type(Asset Management, Network Monitoring, Meter Data Management, Remote Metering, Others), By Component(Smart Solar Panels, Smart Inverters, Energy Management Systems, Communication and Networking Devices, Others), By Deployment(On-Grid, Off-Grid), By Application(Utility, Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Microgrid Market size is expected to be worth around USD 246.4 billion by 2033, from USD 31.6 billion in 2023, growing at a CAGR of 22.8% during the foreca...

Global Airborne Wind Energy Market By Technology(Larger Turbines (above 3 MW), Smaller Turbines (Less than 3 MW)), By Application(Offshore, Onshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Market Overview The Airborne wind energy market size is expected to be worth around USD 485.2 Mn by 2033, from USD 183.7 MN in 2023, growing at a CAGR of 10.2% during the forecast pe...

Global Marine Mining Market By Mining Method(Remote Operated Vehicles (ROVs), Autonomous Underwater Vehicles (AUVs), Dredging Systems, Hydraulic Suction Systems, Others), By Resource Type(Polymetallic Nodules, Polymetallic Sulphides, Cobalt-Rich Ferromanganese Crusts, Phosphorite Deposits, Rare Earth Elements (REEs), Others), By Depth(Shallow Water Mining, Deep-Sea Mining), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Marine Mining Market size is expected to be worth around USD 50.0 billion by 2033, from USD 2.7 billion in 2023, growing at a CAGR of 33.9% during the fore...

Global Portable Solar Charger Market By Type(Small Portable Charger, Foldable Portable Charger, Backpack Solar Chargers, Others), By Panel Type(Mono- Crystalline, Amorphous, Poly-Crystalline, Hybrid, Others), By Panel Size(Less than 20W, 21W to 60W, More than 60W), By Portability(Small Portable, Foldable, Backpack, Others), By Application(Individual, Defense, Transportation, Others), By Distribution Channel(Supermarkets/Hypermarkets, Specialty Stores, Online, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The global Portable Solar Charger Market size is expected to be worth around USD 1637 Million by 2033, from USD 361.6 Million in 2023, growing at a CAGR of 16.3% duri...

Global Power Purchase Agreement Market By Type (Physical Delivery PPA, Virtual PPA, Portfolio PPA, Block Delivery PPA, and Others), By Location (On-site and Off-site), By Category (Corporate, Government, and Others), By Deal Type (Wholesale, Retail, and Others), By Capacity (Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW), By Application, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The Global Power Purchase Agreement Market size is expected to be worth around USD 35.3 billion by 2033, from USD 28.3 billion in 2023, growing at a CAGR of 31.7% dur...

Global Marine Engine Market By Fuel Type(Diesel Engines, Gasoline Engines, Natural Gas Engines, Others), By Capacity(0 - 10000 HP, 10000 - 20000 HP, 20000 - 30000 HP, 30000 - 40000 HP, 40000 - 50000 HP, More than 50000 HP), By Stroke(2 Strokes, 4 Strokes), By RPM(Less than 1,000 RPM, 1,000 - 2,000 RPM, Above 2,000 RPM), By Ship Typ(Oil Tankers, Bulk Carriers, Cargo Ships, Gas Carriers, Tankers, Support Vessel, Ferriers and Passenger ships, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Market Overview The Marine Engine Market size is expected to be worth around USD 18.5 billion by 2033, from USD 12.6 Bn in 2023, growing at a CAGR of 3.9% during the forecast period ...

Global Solid-State Car Battery Market, Component(Cathode Materials, Electrolyte, Anode Materials), Material Type(BEV (Battery Electric Vehicle), PHEV (Plug-in Hybrid Electric Vehicle), Technology(Ceramic Electrolytes, Polymer Electrolyte, Sulfide Electrolyte), Vehicle Type(Passenger Electric Vehicle, Electric Two-Wheelers, Commercial Vehicles), and by Regionand Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Market Overview The Solid-State Car Battery Market size is expected to be worth around USD 16.8 billion by 2033, from USD 1.1 Bn in 2023, growing at a CAGR of 31.1% during the foreca...

Global Sodium-Sulfur Battery Market By Product(Private Portable, Industrial), By Power(Up To 10 MW, 11 MW-25 MW, 2 /6 MW-50 MW, 2Above 50 MW), By Application(Ancillary Services, Load Leveling, Renewable Energy Stabilization, Others), By End-Use(Grid and Standalone Systems, Space, Transport & Heavy Machinery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Market Overview The Sodium-Sulfur Battery Market size is expected to be worth around USD 2323.4 Mn by 2033, from USD 232.2 Mn in 2023, growing at a CAGR of 25.9% during the forecast ...

Global Solar Charge Controller Market By Type(Pulse Width Modulation, Maximum Power Point Tracking (MPPT), Others), By Battery Compatibility(Lead-Acid, Lithium-Ion, Nickel-Cadmium, Others), Application(Industrial, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Market Overview The Solar Charge Controller Market size is expected to be worth around USD 10.1 billion by 2033, from USD 2.4 Bn in 2023, growing at a CAGR of 15.5% during the foreca...

Global Energy Retrofit Systems Market; By Product(Envelope, LED Retrofit Lighting, HVAC Retrofit, Appliances), By Type(Quick Win Retrofit, Deep Retrofit), By Application(Residential, Non-Residential) as well as By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2024-2033

Report Overview The Energy Retrofit Systems Market size is expected to be worth around USD 293 billion by 2033, from USD 159 Bn in 2023, growing at a CAGR of 6.3% during the forecast...

Global Industrial Agitators Market By Product Type(Top Entry, Side Entry, Bottom Entry, Portable, Static), By Model Type(Large Tank, Portable, Drum, Others), By Mounting(Top Mounting, Side Mounting, Bottom Mounting), By Form(Solid Sloid Mixture, Solid-liquid Mixture, Liquid Gas Mixture, Liquid Liquid Mixture), By Application(Chemical, Water and Wastewater Treatment, Oil, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Market Overview The Industrial Agitators Market size is expected to be worth around USD 4 billion by 2033, from USD 3 Bn in 2023, growing at a CAGR of 4% during the forecast period f...

Global Natural Gas Generator Market By Power Rating (Medium Power Genset, High Power Genset and Low Power Genset) By Application (Standby, Peak Shaving and Prime/Continuous) By End-use (Commercial, Industrial and Residential) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

Market Overview The Global Natural Gas Generator Market size is expected to be worth around USD 26 Billion by 2033, from USD 8.8 Billion in 2023, growing at a CAGR of 11.4% during th...

Global Green Hydrogen Market By Technology (Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, and Solid Oxide Electrolyzer), By Application(Power Generation, Transport), By End-User(Food & Beverages, Medical, Chemical, Petrochemicals, Glass), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

Report Overview The Green Hydrogen Market size is expected to be worth around USD 62.9 Billion by 2032 from USD 0.7 Billion in 2022, growing at a CAGR of 58.6% during the forecast p...

Global Floating Power Plant Market By Power Source [Non-renewable (Gas Turbines, IC Engines) Renewable (Solar and Wind)] By Power Rating (Low-power FPP, Medium-power FPP and High-power FPP) By Type (Ships, Barges and Others (Platforms. Etc.)), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Market Overview The Global Floating Power Plant Market size is expected to be worth around USD 2 Billion by 2033, from USD 1 Billion in 2023, growing at a CAGR of 9.3% during the for...

Global Coin Cell Batteries Market By Type(LR (Alkaline)/ Alkaline Watch Batteries, SR (Silver Oxide) / Silver Oxide Cell, CR (Lithium) / Lithium cells battery, ZnAir, Other Types), Category(Non Rechargeable, Rechargeable), By Application(Hearing Aid, TWS Bluetooth Headset, Medical Device, Traditional Watch, Other applications), By Distribution Channel(OEM Demand, Retail, Other Distribution Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Report Overview The Coin Cell Batteries Market size is expected to be worth around USD 6.3 billion by 2033, from USD 4.5 Bn in 2023, growing at a CAGR of 3.5% during the forecast per...

Global Steam Turbine Market Capacity(Up to 150 MW, 151 to 300 MW, More than 300 MW), Design(Reaction, Impulse), Fuel Type(Fossil Fuel, Biomass, Geothermal), End-user(Power and Utility, Industrial, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

Market Overview The Steam Turbine Market size is expected to be worth around USD 23.5 billion by 2033, from USD 17.8 billion in 2023, growing at a CAGR of 2.8% during the forecast pe...