How Zara became the undisputed king of fast fashion?

Zara is one of the biggest international apparel brands. Zara invites customers from around 93 markets to its organization of 2000+ stores in upscale markets on the planet’s biggest urban communities. With these stores, Zara generates 18 billion Euros annually.

The brand has been fruitful in keeping up its central goal to give quick and reasonable designs in the world of fashion. Zara’s way to deal with configuration is firmly connected to its clients. This story is about how Zara became the undisputed king of Fast fashion.

Fashion is the imitation of a given example and satisfies the demand for social adaptation. . . . The more an article becomes subject to rapid changes of fashion, the greater the demand for cheap products of its kind. — Georg Simmel, “Fashion” (1904)

History of Zara: The Long Story Cut Short

Amancio Ortega launched the first Zara store in 1975 in Central Street in downtown A Coruna, Galicia, Spain. The main Store included low-value look-a-like designs of famous and better-quality dress styles. The store ended up being a triumph and Ortega Began opening more Zara stores throughout Spain.

During the 1980s, Ortega began changing the plan, assembling and dissemination cycle to diminish lead times and respond to new patterns in a snappier manner in what they called “Moment Fashions”.

In 1980 the company started its international expansion through Porto, Portugal in the 1990s, with Mexico in 1992. Since then Ortega has continued to grow and create brands such as Pull & Bear, Bershka , and Oysho . It has acquired groups like Massimo Dutti and Stradivarius . Even though these brands have been contributors to their parent group Inditex’s success, Zara is still the principal growth driver.

Zara’s Customer-driven Value Chain

Product line-up:.

Unlike other Inditex chains, Zara has focused on manufacturing fashion-sensitive products internally. The latest designs were continuously in production as per changing customer’s preferences. Many competitors were producing just a few thousand SKUs whereas Zara was producing several hundred of thousands of SKUs in a year. These SKUs varied as per color, size, and fabric.

Zara’s designs are not dependent on design maestros. Instead, its designers carefully observe the catwalk trends and try to implement them for the mass market. The design team continuously creates variations in a particular season. Thereafter expanding on successful designs.

Fast Supply Chain:

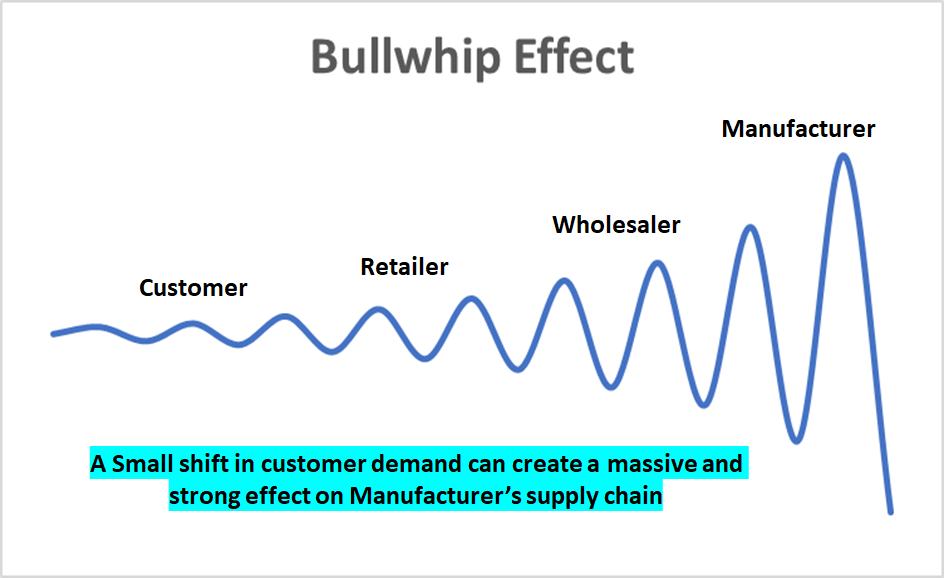

Zara’s flexible supply chain allows it to dispatch new ranges to shops two times per week from its central distribution center that is an approximately 400,000-square-meter facility located in Arteixo, Spain. This kind of business system called vertical integration eliminated the need for local warehouses. The strategy here was to reduce the “bullwhip effect”. Let’s see what the bullwhip effect is:

The bullwhip effect is a distribution channel phenomenon in which demand forecasts yield supply chain inefficiencies. It refers to increasing swings in inventory in response to shifts in consumer demand as one moves further up the supply chain. Wikipedia

It was a matter of a few weeks and a new design was on the shelf for the customers. Isn’t cool? These designs of clothes and accessories were quickly moved to fancy stores in prime locations but at a cheap price. This strategy has attracted a lot of fashion yet money conscious customers.

We want our customers to understand that if they like something, they must buy it now because it won’t be in the shops the following week. It is all about creating a climate of scarcity and opportunity. Luis Blanc, one of the former Inditex’s international directors

Zara’s Retailing Strategy

Zara instead of focusing on improving its manufacturing efficiency focused on improving its retail strategy. This retailing strategy was about following fashion trends quickly even it means there is an unmet demand. As was previously discussed, this also helped Zara in creating a FOMO for its products. The two components of its retailing strategy were dependent on its upstream operations: Merchandizing and Stores.

Read: The Torchbearers of Sustainable Fashion

Merchandising.

Merchandising is the promotion of goods and/or services that are available for retail sale. It includes the determination of quantities, setting prices for goods and services, creating display designs, developing marketing strategies, and establishing discounts or coupons. Investopedia

- Zara placed emphasis on the freshness of its designs. It wanted to create a sense of exclusivity. It never focused on creating bulk items of one design. Zara had confidence in its fast supply chain of twice a week shipment to the store with the latest designs. Thre quarter of its merchandise gets replaced in just a month. How about that?

The success of your business is based in principle on the idea of offering the latest fashions at low prices, in turn creating a formula for cutting costs: an integrated business in which it is manufactured, distributed, and sold. Amancio Ortega

Fun Fact : An average customer visits a Zara store 17 times in a year where the number is 3-4 times for its competitors.

- Zara understood the importance of store locations very well. Zara prices are not expensive but its store location and design made its products look expensive. The brand wanted its customers to have a premium feel at a reasonable price.

We invest in prime locations. We place great care in the presentation of our storefronts. That is how we project our image. We want our clients to enter a beautiful store, where they are offered the latest fashions. Luis Blanc, one of the former Inditex’s international directors

Store Operations

Zara has stores in most upscale markets and shopping centers in the world. You name it and they have a store there. Champs Elysées in Paris, Regent Street in London, and Fifth Avenue in New York to name a few. As per its latest annual report the value of these properties is valued at almost 8 billion Euros. But the way these stores are managed is a strategy to learn for all retailers.

- We all love grand stores with a lot of variety. Zara has emphasized on creating a grand image of its stores. Imagine a big store at a posh location. How much impressed you would be. The average size of Zara stores has continuously increased over the years. In 2001 the average store size was 910 sq.m whereas in 2018 the size has more than doubled.

Zara’s average store size has increased by 50%: from 1,452m2 in 2012 to 2,184m2 in 2018. That growth has been driven by new store openings – larger flagship stores – as well as the fact that many of the new openings have entailed the absorption of one or more older, smaller units in the same catchment area. Inditex Annual Report

- Zara has tried to standardize the in-store experience with its store window displays and interior presentations. As the season progresses, Zara consistently evolves its interior themes, color schemes, and product placements. All these ideas come from the central team in Spain and regional teams implement with necessary region-based adaptations. So much so that the uniforms of the staff were selected twice in a season by a store manager from the latest collection.

Anti-Marketing Approach of Zara

Zara has able to maintain profitability ~13% whereas its major competitor like H&M is at 6% . This has been possible not only because of its efficient supply chain we discussed above but also because of its no advertising or limited advertising policy.

This is what makes Zara really one of a kind. The organization just spends about 0.3% of deals on promoting and does not have a lot of advertising to discuss. The usual trend in the industry is to spend 3.5% on advertising. Zara never shows its clothes at expensive fashion shows also. It first shows its designs at stores directly. But why does not Zara believe in advertising? There are primarily two reasons:

- First, as we discussed it saves Zara a lot of money. So much so that it has now one of the highest profitability.

- Second, it brings exclusivity and prevents overexposure of a design. Customers feel like if they purchase a shirt at Zara, five others won’t have that equivalent shirt at work or school.

Read: Viral Marketing over the Long-Haul ft. Burger King

Zara is a perfect case study to learn the perfect operations strategy, perfect marketing strategy, perfect pricing strategy, and whatnot. It’s all strategies are so perfect. It is also a perfect example to understand how a traditional brand is evolving itself with time to stay relevant.

As per its annual report , In 2018, Zara launched its global online store, marking a milestone in its commitment to having all of its brands available online worldwide by 2020. Zara continued to earn global accolades for its collections and initiatives, its integrated shopping experience, and its commitment to sustainability, with over 90 million garments put on sale under the Join Life label.

Zara is just not a brand of fast fashion. Its much more than that now. And that’s why it’s actually the true king of fast fashion.

Interested in reading our Advanced Strategy Stories . Check out our collection.

Also check out our most loved stories below

IKEA- The new master of Glocalization in India?

IKEA is a global giant. But for India the brand modified its business strategies. The adaptation strategy by a global brand is called Glocalization

Why do some companies succeed consistently while others fail?

What is Adjacency Expansion strategy? How Nike has used it over the decades to outperform its competition and venture into segments other than shoes?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Microsoft – How to Be Cool by Making Others Cool

Microsoft CEO Satya Nadella said, “You join here, not to be cool, but to make others cool.” We decode the strategy powered by this statement.

A marketing aggregator, business story teller, freelancer. I'm pursuing my PGPM, and is a 2nd year marketing student at MDI.

Related Posts

AI is Shattering the Chains of Traditional Procurement

Revolutionizing Supply Chain Planning with AI: The Future Unleashed

Is AI the death knell for traditional supply chain management?

Merchant-focused Business & Growth Strategy of Shopify

Business, Growth & Acquisition Strategy of Salesforce

Hybrid Business Strategy of IBM

Strategy Ingredients that make Natural Ice Cream a King

Investing in Consumer Staples: Profiting from Caution

Storytelling: The best strategy for brands

How Acquisitions Drive the Business Strategy of New York Times

Rely on Annual Planning at Your Peril

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

How Zara’s strategy made her the queen of fast fashion

Table of contents, here’s what you’ll learn from zara's strategy study:.

- How to come up with disruptive ideas for your industry.

- How finding the right people is more important than developing the best strategy.

- How best to address the sustainability question.

Zara is a privately held multinational clothing retail chain with a focus on fast fashion. It was founded by Amancio Ortega in 1975 and it’s the largest company of the Inditex group.

Amancio Ortega was Inditex’s Chairman until 2011 and Zara’s CEO until 2005. The current CEO of Zara is Óscar García Maceiras and Marta Ortega Pérez, daughter of the founder, is the current Chairwoman of Inditex.

Zara's market share and key statistics:

- Brand value of $25,4 billion in 2022

- Net sales of $19,6 billion in 2021

- 1,939 stores worldwide in 2021

- Over 4 billion annual visits to its website

- Inditex employee count of 165,042 in 2021

{{cta('ba277e9c-bdee-47b7-859b-a090f03f4b33')}}

Humble beginnings: How did Zara start?

Most people date Zara’s birth to 1975, when Amancio Ortega and Rosalia Mera, his then-wife, opened the first shop. But, it’s impossible to study the company’s first steps, its initial competitive advantage, and strategic approach by starting at that point in time.

When the first Zara shop opened, Amancio Ortega already had 22 years of industry experience, ten years as a clever and hard-working employee, and 12 years as a business owner. Rosalia Mera also had 20 years of industry experience.

As an employee , Ortega worked in the clothing industry, first as a gofer and then as a delivery boy. He quickly demonstrated great talent for recognizing fabrics, understanding and serving customers, and making sound business suggestions. Soon, he decided to use his insights to develop his own business instead of his boss’s.

As a business owner , he started GOA Confecciones in 1963, along with his siblings, his wife, and a close friend. They started with a humble workshop making women’s quilted dressing gowns, following a trend at the time Amancio had noticed. Within ten years, that workshop had grown to support a workforce of 500 people.

And then, the couple opened the first Zara shop.

Zara’s competitive positioning strategy in its first year

The opening of the first Zara shop in 1975 wasn’t just a new store to sell clothes. It was the final big move of a carefully planned vertical integration strategy.

To understand how the strategy was formulated , we need to understand Amancio’s first steps. His first business, GOA Confecciones, was a manufacturing business. He was supplying small stores and businesses with his products, and he wasn’t in contact with the end customer.

That brought two challenges:

- A lack of insight into market trends and no direct consumer feedback about preferences.

- Very low-profit margins compared to the 70-80% profit margin of retailers.

Amancio developed several ideas to improve distribution and get a direct relationship with the final purchaser. And he was always updating his factories with the latest technological advancements to offer the highest quality of products at the lowest possible price. But he was missing one essential part to reap the benefits of his distribution practices: a store .

So, in 1972 he opened one under the brand name Sprint . An experiment that quickly proved unsuccessful and, seven years later, was shut down. Although it’s unknown the extent to which Amancio put his ideas to the test, Sprint was a private masterclass in the retail world that gave Amancio insights that would later turn Zara into a global success.

Despite Sprint’s failure, Amancio didn’t abandon the idea of opening his own store mainly because he believed that his advanced production model was vulnerable and the rise of a competitor who could replicate and improve his system was imminent.

Adding a store to his vertical integration strategy would have a twofold effect:

- The store would operate as a direct feedback source. The company would be able to test design ideas before going into mass production while simultaneously getting an accurate pulse of the needs, tastes, and fancies of the customers. The store would simultaneously reduce risk and increase opportunity spotting.

- The company would have reduced operating costs as a retailer. Since the group would control all aspects of the process (from manufacturing to distribution to selling), it would solve key retail challenges with stocking. The savings would then be passed on to the customer. The store would have an operational competitive advantage and become a potential cash cow for the company.

The idea was to claim his spot in prime commercial areas (a core and persistent strategic move for Zara) and target the rising middle class. The market conditions were tough, though, with many family-owned businesses losing their customer base, giant players owning a huge market share, and Benetton’s franchising shops stealing great shop locations and competent potential managers.

So the first Zara store had these defining characteristics that made it the successful final piece of Amancio’s strategy:

- It was located near the factory = delivery of products was optimized

- It was in the city’s commercial heart = more expensive, but with access to affluence

- It was located in the city where Ortegas had the most customer experience = knowing thy customer

- It was visibly attractive = expensive, but a great marketing trick

Amancio’s team lacked experience and expertise in one key factor: display window designing . The display window was a massive differentiator and had to be bold and attractive. So, Amancio hired Jordi Bernadó, a designer with innovative ideas whose work transformed display windows and the sales process.

The Zara shop was a success, laying the foundations for the international expansion of the Inditex group.

Key Takeaway #1: Challenge your industry’s conventional wisdom to create a disruptive strategy

Disrupting an industry isn’t an easy task nor a frequent occurrence.

To do it successfully, you need to:

- Understand the prominent business mode of your industry and the forces that contributed to its development.

- Challenge the assumptions behind it and design a radically different business model.

- Develop ample space for experimentation and failures.

The odds of instantly conquering the industry might be low (otherwise, someone would have already done it), but you’ll end up with out-of-the-box ideas and a higher sensitivity to potential disruptors in your competitive arena.

Recommended reading: How To Write A Strategic Plan + Example

How Zara’s supply chain strategy is at the core of its business strategy

According to many analysts, the Zara supply chain strategy is its most important innovative component.

Amancio Ortega and other senior members of the group disagree. Nevertheless, the Inditex logistics strategy is extraordinarily efficient and plays a crucial role in sustaining its competitive advantage. Most companies in the clothing retail industry take an average of 4-8 weeks between inception and putting the product on the shelf. The group achieves the same in an average of two weeks. That’s nothing short of extraordinary.

Let’s see how Zara developed its logistics and business strategy.

Innovative logistics: how Zara’s supply chain evolved

The logistics methods developed by companies are highly dependent on external factors.

Take, for example, infrastructure. In the early days of Zara, when it was expanding through Spain, the company considered using trains as a transportation system. However, the schedule couldn’t keep up with Zara’s needs, which had the goal of distributing products twice a week to its shops. So transportation by road was the only way.

However, when efficiency is a high priority, it shapes logistics processes more than anything else.

And for Zara, efficient logistics was – and still is – of the highest priority.

Initially, leadership tried outsourcing logistics, but the experiment failed and the company assigned a member of the house with a thorough knowledge of the company's operating philosophy to take charge of the project. The tactic of entrusting important big projects to employees imbued with the company’s philosophy became a defining characteristic.

So, one of Zara’s early strategic decisions was that each shop would make orders twice a week. Since the first store was opened, the company has had the shortest stock rotation times in the industry. That’s what drove the development of its logistics methods. The whole strategy behind Zara relied on quick production and distribution. And the proximity of manufacturing and distribution was essential for the model to work. So Zara had these two centers in the same place.

Even when the brand was expanding around the world, its logistics center remained in Arteixo, Spain, despite being a less-than-ideal location for international distribution. At some point, the growth of the brand, and Inditex as a whole, outpaced Arteixo’s capacity, and the decentralization question came up.

The debate was tough among leadership, but the arguments were strong. Decentralization was necessary because of:

- Safety and security. If there was a fire or any other crippling disaster there (especially on a distribution day), then the company would face serious troubles on multiple fronts.

- Arteixo’s limitations. The company’s center in Arteixo was reaching its capacity limits.

So the company decided to decentralize the manufacturing and distribution of its brands.

Initially, the group made the decision to place differentiated logistics centers where the management of its chain of stores was based, i.e. Bershka would have a different logistics center than Pull&Bear, although they were both part of the Inditex Group. That idea emerged after Massimo Dutti and Stradivarius became part of Inditex. Those brands already had that geographical structure, and since the group integrated them successfully into its strategy and logistics model, it made sense to follow the same pattern with its other brands.

Besides, the proximity of the distribution centers to the headquarters of each brand allowed them to consolidate them based on the growth strategy and purpose of each brand (more on this later).

But just a few years after that, the group decided to build another production center for Zara that forced specialization between the two Zara centers. The specialization was based on location, i.e. each center would manufacture products that would stock the shelves of stores in specific locations.

Zara’s supply chain strategy is so successful because it’s constantly evolving as the group adapts to external circumstances and its internal needs. And just like its iconic fashion, the company always stays ahead of the logistics curve.

Zara’s business strategy transcends its logistics innovations

Zara’s business strategy relies on four key pillars:

- Flexibility of supply

- Instant absorption of market demand

- Response speed

- Technological innovation

Zara is the only brand in the Inditex group that is concerned with manufacturing. It’s the first brand in the clothing sector with a complete vertical organization. And the production model requires the adoption or development of the latest technological innovations.

This requirement is counterintuitive in the clothing sector.

Most people believe that making big investments in a market as mature as clothing is a bad idea. But the Zara production model is very capital and labor intensive. The technological edge derived from that investment gave the company, in the early days, the capability to manufacture over 50% of its own products while maintaining an extremely high stock rotation frequency.

Zara might be one of the best logistics companies in the world, but that particular excellence is a supporting factor, or at least a highly contributing factor, to its successful business strategy.

Zara’s business strategy is so much more than its supply chain strategy.

The company created the “fast fashion” term and industry. When other companies were manufacturing their collections once per season, Zara was adapting its collection to suit what people asked for on a weekly basis. The idea was to offer fashionable items at a fair price and faster than everybody else.

Part of its cost-cutting strategic priority was its marketing strategy. Zara didn’t – and still doesn’t – advertise like the rest of the clothing industry. Its marketing strategy starts with choosing the location of the stores and ends with advertising that the sales period has started. In the early years of the brand’s expansion, Amancio would visit potential store locations himself and choose the site to build the Zara shop.

The price was never an issue. If the location was in a commercial center, Zara would build its store there no matter how high the cost was because the company expected to recoup it quickly with increased sales.

Zara’s marketing is its own stores.

The strategy of Zara and her Inditex sisters

Despite Zara’s success (or because of it), Amancio Ortega created – or bought – multiple other brands that he included in the Inditex group, each one with a specific purpose.

- Zara was targeting middle-class women.

- Pull&Bear was targeting young people under twenty-five years old with casual clothing.

- Bershka was targeting rebel teens, especially girls, with hip-hop-style clothing.

- Massimo Dutti was targeting both sexes with more affluence.

- Stradivarius was competing with Bershka, giving Inditex two major brands in the teenage market.

- Oysho was concentrating on women's lingerie.

- Zara Home manufactures home textiles and decor.

Pull&Bear was initially targeting young males between the ages of 14 and 28. Later it extended to young females of the same age and focused on selling leisure and sports clothing. It has the slowest stock turnaround time in the group.

Bershka’s target group was girls between 13 and 23 years of age with highly individualized tastes. Prices were low, but the quality average. Almost a fiasco in the beginning, it underwent a successful strategic turnaround becoming today one of the biggest growth opportunities for the group. And out of all the Inditex chains, Bershka has the most creative designs.

Massimo Dutti was the first retail brand Amancio bought and didn’t create himself. Its strategy is very different from Zara, producing high-quality products and selling them at a high price. It’s an extension of the group’s offer to the higher end of the price spectrum in the fashion industry. It’s also the only Inditex chain brand that advertises regularly.

Stradivarius was the second acquired brand, with the purchase being a defensive move. The chain shares the same target group with Bershka, making it, to this day, a direct competitor.

Oysho started as an underwear and lingerie company. Its product lines evolved to include comfortable night and homewear along with swimwear and a very young children’s line. The brand’s strategy was aggressive from its conception, opening 286 stores in its first six years of existence.

Zara Home is the youngest brand in the Group and the only one outside the clothing sector, though still in the fashion industry. It was launched with the least confidence and with immense prior research. An experiment to extend the Zara brand beyond clothing, it was based on the conservative view that Zara could extend its product categories only to textile items for the home. But it turned out that customers were more accepting of Zara Home selling a wide variety of domestic items. So the brand made a successful strategic pivot.

Key Takeaway #2: The right people are more important than the best strategy

It might not be obvious in the story, but a key reason for Zara's and Inditex’s success has been the people behind them.

For example, a vast number of people in various positions from inside the group claim that Inditex cannot be understood without Amancio Ortega. Additionally, major projects like the development of Zara’s logistics systems and the group's international expansion had such a success precisely because of the people in charge of them.

Zara’s radically different model was a breakthrough because:

- Its leadership had a clear vision and a real strategy to execute it.

- People with a deep understanding of the company’s philosophy led Its largest projects.

Sustainability: Zara’s strategy to make fast fashion sustainable

Building a sustainable business in the fast fashion industry is a tough nut to crack.

To achieve it, Inditex has made sustainability a cornerstone of its business model. Its strategy revolves around the values of collaboration , transparency, and innovation . The group’s ambition is to make a positive impact with a vision of prosperity for the planet and its people by transforming its value chain and industry.

Inditex’s sustainability commitments and strategy to achieve them

Inditex has developed a sustainability roadmap that extends up to 2040 with ambitious goals. Specifically, it has committed to

- 100% consumption of renewable energy in all of its facilities by 2022 (report pending).

- 100% of its cotton to originate from more sustainable sources by 2023.

- 100% of its man-made cellulosic fibers to originate from more sustainable sources by 2023.

- Zero waste from its facilities by 2023.

- 100% elimination of single-use plastic for customers by 2023.

- 100% collection of packaging material for recycling or reuse by 2023.

- 100% of its polyester to originate from more sustainable sources by 2025.

- 100% of its linen to originate from sustainable sources by 2025.

- 25% reduction of water consumption in its supply chain by 2025.

- Net zero emissions by 2040.

The group’s commitments extend beyond environmental issues to how its manufacturing and supplying partners conduct their business . To bring its strategy to fruition, it has set up a new governance and management structure.

The Board of Directors is responsible for approving Inditex’s sustainability strategy. The Sustainability Committee oversees and controls all the proposals around the social, environmental, health, and safety impact of the group’s products, while the Ethics Committee makes sure operations are compliant with the rules of conduct. There is also a Social Advisory Board that includes external independent experts that advises Inditex on sustainability issues.

Finally, Javier Losada, previously the group’s Chief Sustainability Officer and now promoted to Chief Operations Officer, will be leading the sustainability transformation of the group. Javier Losada first joined Inditex back in 1993 and ascended its rank to reach the C-suite.

Inditex is dedicated to its commitment to reducing its environmental impact and seems to be headed in the right direction. The only question is whether it’s fast enough.

Key Takeaway #3: Integrating sustainability with business strategy is a present-day necessity

Governments and international bodies around the world are implementing more stringent environmental regulations, forcing companies to commit to ambitious goals and developing a realistic strategy to achieve them.

The companies that are impacted the least are those that always had sustainability as a high priority .

From the companies that require significant changes in their operations to comply with the new regulations, only those who integrate sustainability into their business strategy and model will succeed.

Why is Zara so successful?

Zara is the biggest Spanish clothing retailer in the world based on sales value. Its success is due to its fast fashion strategy that is based on a strong supply chain and quick market feedback loops.

Zara's customer-centric approach places a strong emphasis on understanding and responding to customer needs and preferences. This is reflected in the company's product design, marketing, and customer service strategies.

Zara made fashionable clothes accessible to the middle class.

Zara’s vision guides its future

Zara's vision, as part of the Inditex Group, is to create a sustainable fashion industry by promoting responsible consumption and production, respecting the environment and people, and contributing to the communities in which it operates.

The company aims to offer the latest fashion trends to its customers at accessible prices while continuously innovating and improving its operations and processes.

Growth by numbers (Inditex)

|

|

|

|

|

| $12,5 billion | $27,72 billion |

|

| 100,138 | 165,042 |

|

| 5,044 | 6,477 |

|

| $46.44 billion | $98.10 billion (Feb, 2023) |

Zara Case Study: How Zara Lead The Fast Fashion Market?

Supti Nandi

Updated on: April 8, 2024

You asked, and we listened! Get ready to dive into the fascinating world of Zara with our highly requested Zara Case Study.

Recently, Zara has been trending in Instagram reels and YouTube shorts for its funky model poses. You must have seen it too! Have you wondered what made this Spanish brand so famous?

You may say that Zara works on the concept of fast fashion, which makes it win in the competitive market.

Well, that’s true but it is not the only reason. Let’s uncover the secrets behind Zara’s success through the Zara Case Study.

Let’s begin!

(A) Zara: A Brief Overview

Zara, a notable name in the fashion industry, is a Spanish retailer known for its distinctive approach to clothing and accessories. Operating on a fast fashion model, Zara excels in swiftly adapting to evolving fashion trends, setting it apart in the market. With a vertically integrated process, the brand manages everything from design to production in-house, allowing for efficient and responsive operations.

You’ll find Zara stores globally, each offering a diverse range of trendy and affordable clothing for men, women, and children. The brand’s commitment to delivering fashion-forward pieces at accessible prices caters to a broad audience, reflecting its significance in the industry.

Do you know what is fast fashion?

Fast fashion is a business model characterized by quickly producing affordable, trendy clothing items to meet rapidly changing consumer demands.

Zara works in the same way. We will look into its details in the upcoming section. Before that, let’s go through the profile of Zara-

| Zorba | |

| Retail | |

| 1975 | |

| Amancio Ortega, Rosalia Mera | |

| Arteixo (Galicia, Spain) | |

| 2,007 | |

| Worldwide | |

| Clothing | |

| €23.9 billion | |

| Inditex | |

| Forever 21, Mango, Gap, Marks & spencer |

What makes Zara stand out is its ability to balance responsiveness in manufacturing, a well-structured supply chain, and a keen understanding of consumer preferences. This combination has established Zara as a trendsetting and influential player in the fashion landscape. Its adaptability and dedication to making fashion trends accessible have solidified Zara’s place as a recognizable and influential name in the fashion industry.

(B) Zara Case Study: History & Evolution

Zara’s journey began with a dress-making factory called Inditex, established by Ortega in 1963. Over the years, Zara expanded its presence from Spain to Portugal and eventually to other European countries, the United States, and France.

Today, Zara boasts nearly 6,500 stores across 88 countries worldwide.

Let’s dive into the history of Zara in detail-

| Zara was founded by Amancio Ortega in A Coruña, Spain, initially named ‘Zorba’ but later changed to ‘Zara’ due to a nearby bar with a similar name. | |

| Ortega transforms Zara’s design, manufacturing, and distribution process, emphasizing “instant fashions” using information technology and collaborative design groups. | |

| Zara opens its first international store in Porto, Portugal. | |

| Expansion into the United States, followed by entry into France in 1990. | |

| Further expansion to Mexico (1992), Greece, Belgium, Sweden (1993), and Israel (1997). | |

| Zara expands globally, entering Brazil (2000), Japan, Singapore (2002), Ireland, Venezuela, Russia, Malaysia (2003), China, Morocco, Estonia, Hungary, Romania (2004), Philippines, Costa Rica, Indonesia (2005), South Korea (2008), India (2010), Taiwan, South Africa, Australia (2011), and Peru (2012). | |

| Zara launched its online boutique, initially in Jordan. | |

| Zara Online extends services to Austria, Ireland, Netherlands, Belgium, and Luxembourg. | |

| Online stores commence operations in the United States. | |

| Zara introduces RFID technology in stores, using chips in security tags for inventory management. | |

| Zara ranks #30 on Interbrand’s list of best global brands. | |

| Zara updated its logo, designed by the French agency Baron & Baron. Despite a global decline in textile commerce, Zara’s business has risen by 2.17%. CEO Persson mentions plans to cut retail locations in Europe due to global rent considerations. | |

| Zara exits Russia, selling its business and rebranding to Maag. | |

| Zara operates nearly 3000 stores in over 96 countries, including kids and home stores, continuing its global expansion. |

Zara is the flagship brand of the Inditex group, which is one of the world’s largest fashion retail conglomerates.

The head office of Zara is located in Arteixo, in the province of A Coruña, Galicia, Spain. Inditex also owns other popular brands like Massimo Dutti, Pull&Bear, Bershka, and Stradivarius.

(C) Brand Philosophy of Zara

Do you know why Zara stands out among its competitors? Due to its brand philosophy! Sara’s success hinges on several key principles-

| It keeps up with the latest trends, ensuring that its collections are always fresh and relevant. | |

| Despite being affordable, Zara maintains high-quality standards in its clothing and accessories. | |

| Zara strikes a balance between style and price, making it accessible to a wide range of consumers. | |

| Leveraging primary information technology, Zara swiftly replicates fashion trends. | |

| Teams of designers collaborate on products, enhancing productivity. | |

| Zara uses affordable materials without compromising quality. | |

| Outsourcing production to countries with cost-effective labor. |

Zara’s strategy is strikingly different from traditional fashion retailers. Reason? Fast fashion concept and in-house production of clothes! Go through the next section for detailed information.

(D) Zara Business Model: Effective Working Strategies

In this section, we will dive into the business model of Zara to determine its working strategies that played a huge role in its success-

| At the core of Zara’s business model is its commitment to fast fashion. Unlike traditional retailers, Zara rapidly responds to the latest trends, ensuring that new designs hit the shelves at record speed. This approach allows you, the customer, to access the most current styles without the typical delays in the fashion industry. | |

| Zara takes control of every step in the production process, from design to manufacturing and distribution. By keeping everything in-house, Zara maintains a high level of flexibility, enabling quick adjustments based on customer feedback and emerging trends. This vertical integration contributes to the brand’s agility in the ever-evolving fashion landscape. | |

| Zara deliberately produces limited quantities of each design. This intentional scarcity creates a sense of exclusivity, driving demand. As a result, you encounter a frequently changing inventory, enhancing the allure of finding unique and in-demand pieces during every visit. | |

| The “just-in-time” manufacturing approach ensures that Zara produces items only when there’s demand. This minimizes excess inventory and reduces the need for heavy markdowns, allowing you to enjoy reasonable pricing for trendy fashion items. | |

| Zara leverages data and customer feedback to inform its design and production decisions. By closely monitoring what resonates with you, the brand tailors its offerings to match your preferences, creating a more personalized and customer-centric shopping experience. | |

| Zara synchronizes its operations globally, ensuring that the latest trends reach stores worldwide simultaneously. This synchronized approach reinforces the brand’s image of offering cutting-edge fashion on a global scale, catering to diverse customer tastes and preferences. |

Let’s dive into the details-

(D.1) Fast Fashion Model

Zara is known for its “ Fast Fashion ” approach. It releases new collections frequently, sometimes launching over 22 new product lines per year. This agility allows Zara to respond swiftly to changing trends and customer preferences.

- Rapid Trend Replication: Harnessing cutting-edge information technology, Zara excels at swiftly replicating prevailing fashion trends. This enables the brand to stay ahead of the curve, delivering the latest styles to customers promptly.

- Group Design Approach: Departing from the conventional individual designer model, Zara adopts a collaborative approach. Teams of designers work in synergy, fostering enhanced creativity and efficiency in product development. This collective effort ensures a diverse range of products aligned with dynamic market demands.

- Cost-Effective Materials: Zara strategically utilizes affordable materials without compromising on quality. This approach allows the brand to maintain competitive pricing while delivering products that meet or exceed industry standards. The focus on cost-effective yet quality materials contributes to Zara’s accessibility and broad customer appeal.

- Competitive Pricing: Zara optimizes its production costs by outsourcing to countries with cost-effective labor. This global approach not only supports competitive pricing but also facilitates the brand’s ability to swiftly adapt to market demands. The combination of efficient production and competitive pricing reinforces Zara’s position as a leader in the fast fashion landscape.

(D.2) Product Range

Let’s briefly look at its product range too-

- Clothing: From chic dresses and tailored suits to casual wear and activewear.

- Accessories: Including bags, shoes, belts, and jewelry.

- Beauty Products: Fragrances and cosmetics.

- Perfumes: Zara has its line of fragrances.

(D.3) Vertical Integration: In-House Operations & Logistics

Zara’s way of doing business centers on something called vertical integration. Here is how it works-

- Design: Zara takes charge of creating its designs, meaning it controls how its clothes look and stay on-trend. This ensures that what you find in Zara stores reflects the latest fashion trends.

- Manufacturing: Zara doesn’t just design; it also makes its clothes in-house. This is a big deal because it lets Zara make changes to its products fast. If there’s a new trend or customer feedback, Zara can respond quickly, which is pretty cool.

- Shipping and Distribution: Zara doesn’t stop at making the clothes; it handles everything from getting them to the store to making sure they’re sent to the right places. This full control of the supply chain ensures that the clothes you see in Zara are not only stylish but also reach the stores efficiently.

In short, the fast fashion concept, vertical integration, and supply chain efficiency helped Zara to achieve impressive milestones.

(E) Revenue Model of Zara: How does Zara make money?

Do you know Zara earned Rs.2,562.50 crore in India? That’s not all. It earned over 23 billion euros from its stores worldwide.

That’s quite amazing! Isn’t it?

But how does Zara earn such a whopping amount of money? Due to its impressive revenue model.

Let’s go through them one by one-

| Zara rakes in a substantial portion of its revenue through the operation of a whopping 2,007 stores spread across 96 countries. This massive retail network allows customers worldwide to access and purchase Zara’s trendy offerings. | |

| Zara doesn’t limit itself to physical stores. The brand has a robust online presence, catering to a global audience through its e-commerce platform. This avenue expands Zara’s reach, enabling customers to shop conveniently from anywhere | |

| Zara is under the ownership of Inditex, the world’s largest fast-fashion group. This means that Zara is part of a significant player in the global fashion industry, benefiting from shared resources and expertise within the Inditex umbrella. | |

| In 2020, Inditex, Zara’s parent company, held a market capitalization of an impressive $73.7 billion. This substantial valuation highlights Inditex’s influential position in the market. | |

| As of 2022, Zara’s value soared to nearly $13 billion. This showcases the brand’s standalone worth within the larger Inditex portfolio, emphasizing its contribution to the group’s overall success. |

Let’s briefly dive into Zara’s finances for the years 2022 & 2021-

| 23.9 | 19.7 | |

| 4.0 | 2.8 | |

| 31 | 25 | |

| 24.8 | 23.6 | |

| 2,312 | 2,489 | |

| 13 | 12 |

That’s how Zara is going through its purple patch in terms of revenues!

(F) Zara Marketing Strategies

Zara, the renowned Spanish fashion retailer, has crafted a distinctive marketing strategy that contributes to its global success. In this section, we will delve into the key elements of Zara’s marketing approach-

(F.1) Fast Fashion Strategy

The fast fashion model functions as a highly effective marketing strategy for Zara in several ways. First and foremost, the rapid turnover of collections, with over twenty product lines per year, creates a sense of urgency and novelty for customers. This continual introduction of fresh styles not only keeps Zara top-of-mind but also fosters a dynamic shopping experience, encouraging frequent visits to discover the latest trends.

Moreover, the quick response to changing trends and customer preferences positions Zara as a trendsetter, appealing to fashion-conscious consumers. The ability to swiftly translate runway trends into accessible and affordable pieces reinforces Zara’s image as a go-to destination for staying in vogue.

Additionally, the limited production batches contribute to an atmosphere of exclusivity, prompting customers to make timely purchases to secure unique and in-demand items. This scarcity-driven approach enhances the perceived value of Zara’s offerings.

In essence, the fast fashion model serves as a powerful marketing tool for Zara by creating a sense of immediacy, exclusivity, and trend relevance, fostering customer loyalty and consistently attracting a diverse audience seeking the latest in fashion.

(F.2) In-Store Experience

Zara places a strong emphasis on crafting an exceptional in-store experience, carefully curating showrooms to exude an atmosphere that is both exclusive and professional. The meticulous design choices contribute to an ambiance that goes beyond a mere shopping space, creating an environment where customers feel engaged and inspired.

The meticulous attention to detail is aimed at ensuring that every aspect of the in-store setting is carefully considered, from layout to lighting.

This focus on the in-store ambiance goes beyond aesthetics—it becomes a vital part of Zara’s marketing strategy. The thoughtfully designed physical stores act as powerful marketing tools in themselves, drawing in customers by providing a memorable and immersive shopping environment.

By enticing shoppers to explore the latest trends in this carefully curated setting, Zara not only enhances the overall customer experience but also reinforces its brand image as a trendsetting and sophisticated fashion destination!

(F.3) Affordability & Differentiation

Zara strategically positions itself by prioritizing affordable pricing while maintaining a commitment to quality. This dual emphasis allows the brand to resonate with a wide range of customers. By providing stylish clothing at reasonable prices, Zara ensures accessibility, making fashion-forward designs attainable for a diverse audience.

The effectiveness of this marketing strategy lies in Zara’s ability to differentiate itself in the market. The brand stands out not only for its trendsetting designs but also for its adept balance of fashion-forward aesthetics and accessible costs.

This unique blend positions Zara as a go-to destination for those seeking both style and value, enhancing the brand’s appeal and solidifying its market presence. The affordability and differentiation strategy contribute to Zara’s ability to capture a broad customer base and maintain its status as a leading player in the competitive fashion landscape.

(F.4) Word of Mouth and Limited Advertising

Zara strategically leverages the power of word of mouth and customer recommendations as primary drivers of its marketing efforts. In a departure from traditional advertising-heavy approaches, Zara relies on the subtlety of customer satisfaction and positive experiences to promote its brand.

This unique strategy involves cultivating a strong and positive buzz around Zara’s collections, encouraging customers to share their experiences and recommendations. The reliance on word of mouth creates an authentic and organic promotion of the brand, fostering a sense of trust and credibility among potential customers.

The limited advertising approach doesn’t diminish Zara’s impact; rather, it aligns with the brand’s commitment to providing an outstanding in-store experience and quality products. The positive buzz generated by satisfied customers becomes a powerful force, driving foot traffic to Zara’s stores and contributing to the brand’s sustained success in the competitive fashion market.

(F.5) Social Media Marketing

Zara actively embraces social media platforms as a crucial component of its marketing strategy. The brand leverages platforms like Instagram, Facebook, and Twitter to engage directly with its audience, creating a dynamic online presence.

The strategy involves regular updates across these platforms, keeping followers informed about the latest arrivals, ongoing trends, and behind-the-scenes glimpses into Zara’s fashion world. By maintaining an active and visually appealing presence, Zara not only stays connected with its audience but also cultivates a sense of anticipation and excitement around its offerings.

In addition to direct engagement, Zara strategically collaborates with influencers. These collaborations amplify Zara’s reach, tapping into the influencers’ follower base and creating a ripple effect of brand awareness.

Through this multi-faceted approach, Zara effectively utilizes social media not just as a promotional tool but as a means to foster a dynamic and interactive relationship with its audience, contributing to the brand’s overall success in the digital landscape.

(F.6) Personalization & Community Engagement

Zara adopts a customer-centric strategy by customizing its offerings to cater to local tastes and preferences. This personalization ensures that Zara’s collections resonate with diverse communities, creating a more inclusive and relatable shopping experience.

Community engagement takes center stage in Zara’s approach. Events like fashion shows or store openings play a pivotal role in fostering a sense of belonging among customers. By actively involving the community in these events, Zara goes beyond being a retailer and becomes an integral part of the local fabric.

Crucially, Zara prioritizes customer feedback. Actively listening to what customers have to say, the brand adapts and evolves its offerings based on this valuable input. This responsiveness not only enhances the overall customer experience but also reinforces a sense of collaboration between Zara and its community.

In essence, Zara’s commitment to personalization and community engagement contributes to a brand image rooted in customer satisfaction and a genuine connection with the diverse communities it serves.

(G) Sustainability Efforts: Crucial Part of Zara Case Study

Do you know what Zara is famous for apart from fashion? Its sustainability efforts to preserve mother nature! Let’s look at the sustainability efforts of Zara-

| Launched the Join Life movement to enhance sustainability. | ||

| Set goals for 2030, focusing on areas like water conservation and reducing waste in landfills | ||

| Actively working to ban harmful chemicals* from production processes. | ||

| Transparency score of 14%. | ||

| Parent company Inditex shares supply chain traceability reports and conducts safety audits. | ||

| Zara-specific details are often linked to Inditex, making it challenging to find specific information. Factory lists and audit results are not publicly available. | ||

| 15/33 | ||

| While progress has been made in improving working conditions, the size and profitability of Zara should allow for better results. | ||

| Enforces a solid code of conduct and conducts audits to ensure compliance. | ||

| Scores below 50% for environmental sustainability. | ||

| It includes achieving net-zero emissions by 2040, adopting sustainable procurement for materials like cellulose fibers, cotton, and linen, and actively working on reducing waste in landfills. |

Thus, Zara is increasingly conscious of sustainability. The brand aims to reduce its environmental impact by using eco-friendly materials and promoting recycling. Such initiatives resonate with socially aware consumers.

(H) Challenges Faced by Zara

The journey of Zara was not free of challenges. Let’s look at some of the major challenges of Zara-

| Zara embraces its fast fashion model but faces challenges in managing production speed. To address this, the brand invests in robust data analytics to predict trends accurately and streamline production processes, ensuring agility without compromising quality. | |

| Zara manages a vertically integrated supply chain. By owning and controlling every aspect, from design to manufacturing and distribution, Zara ensures flexibility and responsiveness, mitigating challenges related to external suppliers and logistics. | |

| Zara’s global expansion poses challenges in understanding diverse market preferences. To address this, the brand tailors its offerings to local tastes, engages in community events, and actively listens to customer feedback, ensuring relevance and resonance in varied markets. | |

| The rise of online retail intensifies competition. Zara counters this by investing in a robust online presence, regularly updating social media platforms, and collaborating with influencers to amplify reach and engage a digitally savvy audience. | |

| Growing expectations for ethical fashion practices pose challenges. Zara addresses this by incorporating a code of conduct, conducting audits, and continuously improving working conditions. The brand actively communicates its efforts to enhance transparency and traceability, aligning with evolving consumer expectations. | |

| Zara faces the challenge of balancing sustainability goals with profitability. The brand addresses this by setting clear sustainability objectives, such as achieving net-zero emissions by 2040 and sustainable procurement, while also investing in technology and innovation to ensure long-term financial viability. |

Zara brilliantly addressed those challenges to produce effective results that ultimately helped them grow their business.

(I) Summing Up: Zara Case Study

Zara’s remarkable success in leading the fashion market can be attributed to its unique blend of rapid fashion cycles, vertical integration, and a customer-centric approach. By staying ahead of trends with its fast fashion model, ensuring control over the entire production process, and tailoring offerings to local tastes, Zara captures a diverse and loyal customer base.

The brand’s commitment to affordability, engaging in-store experiences, and strategic use of social media further solidify its market leadership. Zara’s story showcases the power of adaptability, responsiveness, and a strong connection with customers in navigating the dynamic landscape of the fashion industry!

Related Posts:

Apart from selling clothes and accessories at higher prices, still it is among the favourite ones for many!

Contact Info: Axponent Media Pvt Ltd, 706-707 , 7th Floor Tower A , Iris Tech Park, Sector 48, Sohna Road, Gurugram, India, Pin - 122018

© The Business Rule 2024

Digital Innovation and Transformation

Mba student perspectives.

- Assignments

- Assignment: Data and Analytics as…

ZARA: Achieving the “Fast” in Fast Fashion through Analytics

How does fast fashion make any business sense? Zara uses intensive data and analytics to manage a tight supply chain and give customers exactly what they want.

Introduction

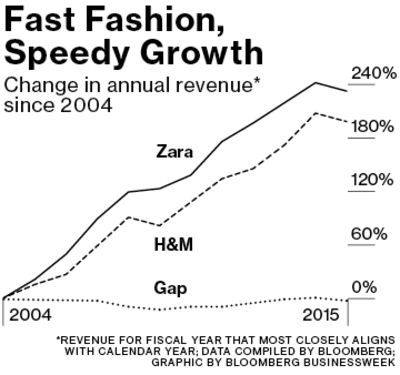

Zara’s parent company Inditex has managed to thrive in the last decade while several other fashion retailers have faced declining sales or stagnant growth. Inditex has grown over 220% in annual revenue since 2004, more than its key competitors like H&M, Gap, or Banana Republic (1).

The value of a fast fashion brand is to bring the latest designs and “trendiest trends” into the market as quickly as possible, preferably as soon as they became hot on the catwalk, and to provide these at a reasonable price. The traditional fashion industry is not well equipped to provide such value as it operates on a bi-annual or seasonal basis, with long production lead times due to outsourced manufacturing to low cost-centers. Zara has turned the industry on its head by using data and analytics to track demand on a real-time, localized basis and push new inventory in response to customer pull. This enables them to manage one of the most efficient supply chains in the fashion industry, and to create the fast fashion category as a market leader.

Pathways to a Just Digital Future

How Zara Uses Data

Inditex is a mammoth retailer, producing over 840 million garments in a year, the majority of which are sold by Zara (2). Every item of clothing is tagged with an RFID microchip before it leaves a centralized warehouse, which enables them to track that piece of inventory until it is sold to a customer (3). The data about the sale of each SKU, inventory levels in each store, and the speed at which a particular SKU moves from the shelf to the POS is sent on a real time basis to Inditex’s central data processing center (see picture below). This center is open 24 hours a day and collects information from all 6000+ Inditex stores across 80+ countries and is used by teams for inventory management, distribution, design and customer service improvements (4).

Zara’s Data Processing Center receives real-time data from around the world (4).

When the apparel arrives in store, RFID enables the stockist to determine which items need replenishing and where they are located, which has made their inventory and stock takes 80% faster than before (3). If a customer needs a particular SKU, salespeople are able to serve them better by locating it immediately in store or at a nearby location. Moreover, every Zara location receives inventory replenishments twice a week, which is tailored to that stores real-time updates on SKU-level inventory data.

The sales tracking data is critical in enabling Zara to serve its customers with trends that they actually want, and eliminate designs that don’t have customer pull. Zara’s design team is an egalitarian team of over 350 designers that use inspiration from the catwalk to design apparel on daily basis. Every morning, they dive through the sales data from stores across the world to determine what items are selling and accordingly tailor their designs that day. They also receive qualitative feedback from empowered sales employees that send in feedback and customer sentiment on a daily basis to the central HQ e.g., “customers don’t like the zipper” or “she wishes it was longer” (1).

At the start of the planning process, Zara orders very small batches of any given design from their manufacturers (even just 4-6 of a shirt per store). The majority of Zara’s factories are located proximally in Europe and North Africa, enabling them to manufacture new designs close to home and ship them to their stores within 2-3 weeks. They then test these designs in store, and if the data suggests the designs take off, Zara can quickly order more inventory in the right sizes, in the locations that demanded it. Such store-level data allows Zara to be hyper-local in serving their customer’s needs – as tastes can vary on a neighborhood level. As Inditex’s communication director told the New York Times,

“ Neighborhoods share trends more than countries do. For example, the store on Fifth Avenue in Midtown New York is more similar to the store in Ginza, Tokyo, which is an elegant area that’s also touristic. And SoHo is closer to Shibuya, which is very trendy and young.” (5)

Unlike other retailers that may order inventory based on their hypotheses about tastes at a regional level, Zara is tailors its collections based on the exact zip code and demographic that a given location serves (5).

Zara’s Results vs. Competitors

Zara sells over 11,000 distinct items per year versus its competitors that carry 2,000 to 4,000. However Zara also boasts the lowest year-end inventory levels in the fashion industry. This lean working capital management offsets their higher production costs and enables them to boast rapid sales turnover rates.

At Zara, only 15% to 25% of a line is designed ahead of the season, and over 50% of items are designed and manufactured in the middle of a season based on what becomes popular (2). This is in direct contrast to a close competitor like H&M where 80% of designs are made ahead of the season, and 20% is done in real-time during the season (6). Most other retailers commit 100% of their designs ahead of a season, and are often left with excess inventory that they then have to discount heavily at season-end. Instead, Zara’s quick replenishment cycles create a sense of scarcity which might actually generate more demand:

“With Zara, you know that if you don’t buy it, right then and there, within 11 days the entire stock will change. You buy it now or never.” (5)

- https://www.bloomberg.com/news/articles/2016-11-23/zara-s-recipe-for-success-more-data-fewer-bosses

- http://www.digitalistmag.com/digital-supply-networks/2016/03/30/zaras-agile-supply-chain-is-source-of-competitive-advantage-04083335

- http://static.inditex.com/annual_report_2015/en/our-priorities/innovation-in-customer-services.php

- http://www.refinery29.com/2016/02/102423/zara-facts?utm_campaign=160322-zara-secrets&utm_content=everywhere&utm_medium=editorial&utm_source=email#slide-11

- http://www.nytimes.com/2012/11/11/magazine/how-zara-grew-into-the-worlds-largest-fashion-retailer.html?pagewanted=all

- https://erply.com/in-the-success-stories-of-hm-zara-ikea-and-walmart-luck-is-not-a-key-factor/

Student comments on ZARA: Achieving the “Fast” in Fast Fashion through Analytics

Great post Ravneet – I had never read about Zara’s extremely quick supply chain or hyper-local testing. I have a question for you about fast fashion in general, but especially for Zara since it produces and sells more distinct items than its competitors: it seems that many designers are not fond of the “runway-inspired” fashions sold at these stores and some have even sued stores for copying their designs. Do you think Zara and other brands like it are doing anything wrong, and if not, what recourse do designers have for “imitations” of their work?

Thanks for the post Ravneet. Zara and H&M are beacons of hope for a mostly distressed industry. Do you think Zara’s advantage could be sustained in the event of a full-on assault by the Amazons of the world?

Leave a comment Cancel reply

You must be logged in to post a comment.

Detailed SWOT Analysis of ZARA – World’s Largest Fast Fashion Brand

By Aditya Shastri

Previously we looked into the SWOT Analysis of the world’s most famous sports apparel brand, Nike . This time, we will tackle the SWOT Analysis of ZARA in-depth.

ZARA is one of the largest fashion apparel companies in the world. They opened their gates during the late 1900s, in Spain, followed by a speedy global expansion. Their market focuses is on minimal and party fashion for women and men. They have created their name in the market for their non-toxic clothing.

Another aspect supporting ZARA’s successful stance is its marketing efforts . Marketing changes over the years, catering to the needs and trends of the current times, and now, the majority of successful campaigns have moved on to various digital platforms. If you are interested in learning how to create successful digital marketing strategies today, check out our Free MasterClass on Digital Marketing 101 by the CEO and Founder of IIDE, Karan Shah, to learn more about today’s successful marketing.

Do you want to learn about the key to ZARA’s success in the fashion apparel industry? In this case study, we will learn about the SWOT Analysis of ZARA and answer the same. To gain a better understanding you can also check out ZARA’s Business Model. Now, let us learn more about ZARA, its founding, products, financial status, and competitors.

Zara is a Spanish brand, based in Galicia, Spain. It is one of the leading fashion apparel merchants in the world. Since 1975, Zara has expanded globally and has maintained its supremacy in the fashion industry.

They manage to bring up to 20 clothing collections and fashion trends as of the research done in 2017. Zara is very popular for the “instant fashion” they bring to the market. These improvements were because of the new technologies and group of new-age designers.

Zara is also known for its fast-fashion approach, with new designs hitting its stores every two weeks! They are located strategically in prime shopping districts, often in historic buildings that have been renovated to match the brand’s aesthetic. With its innovative approach to fashion, it’s no wonder that Zara has become a beloved brand.

Zara is one such reputed clothing brand that is very much loved by its consumers. Thus, they capitalize on the market expansion. Zara contributes up to 70% of Inditex’ s Revenue.

| Founder | Amancio Ortega and Rosalia Mera |

|---|---|

| Year Founded | 1975 |

| Origin | Artexio, Spain |

| No. of Employees | 75,000 |

| Company Type | Public |

| Market Cap | $115.09 Billion |

| Annual Revenue | €18.021 Million |

| Net Profit | €14.129 Million |

Products of Zara

Zara has been successfully rising in the fashion apparel market for half a century by selling –

- Accessories

Competitors of Zara

They are a boatload of fashion brands in the industry. However, the top 5 major competitors are as follows –

- Marks and Spencers

Now that we have tackled the areas that give us insight into the company’s core business. Let’s look into the SWOT Analysis of Zara

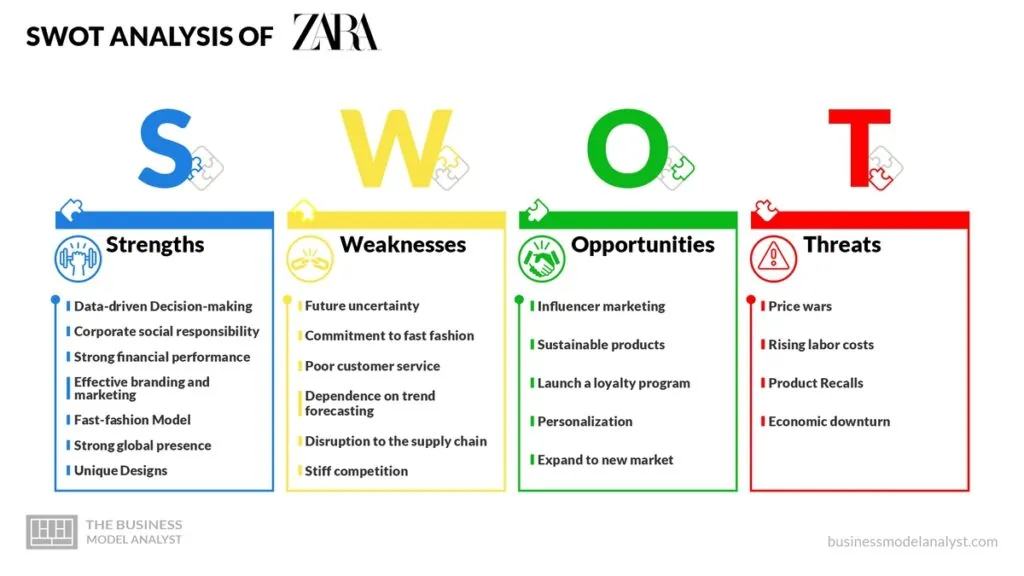

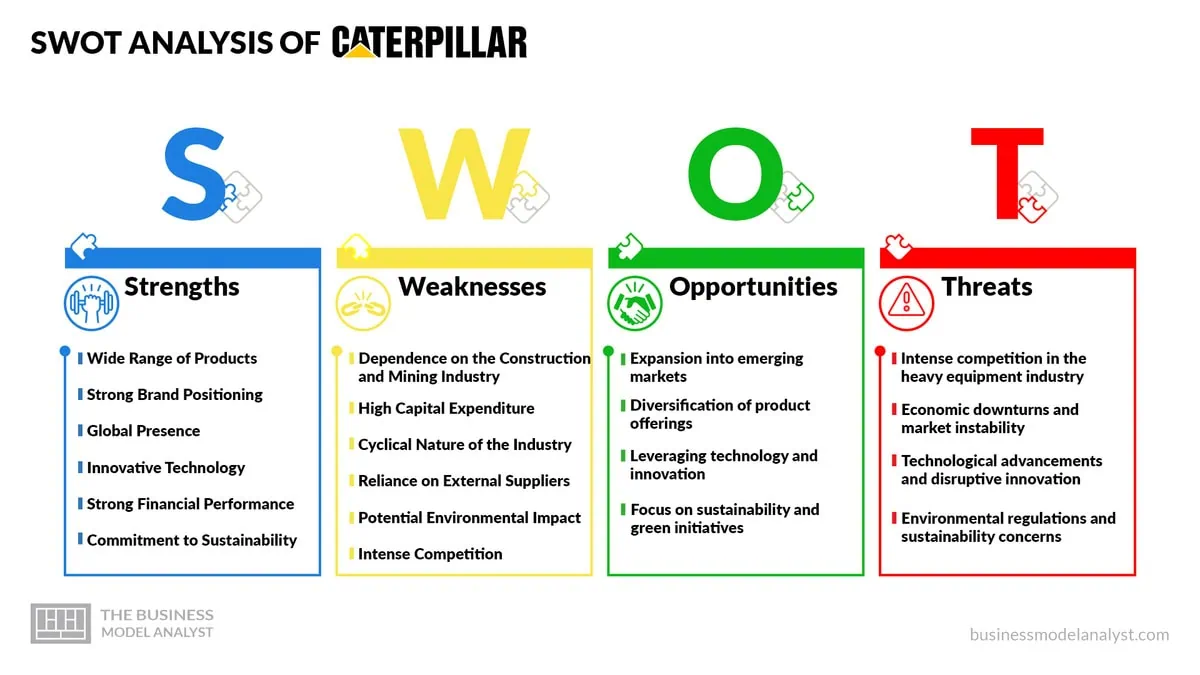

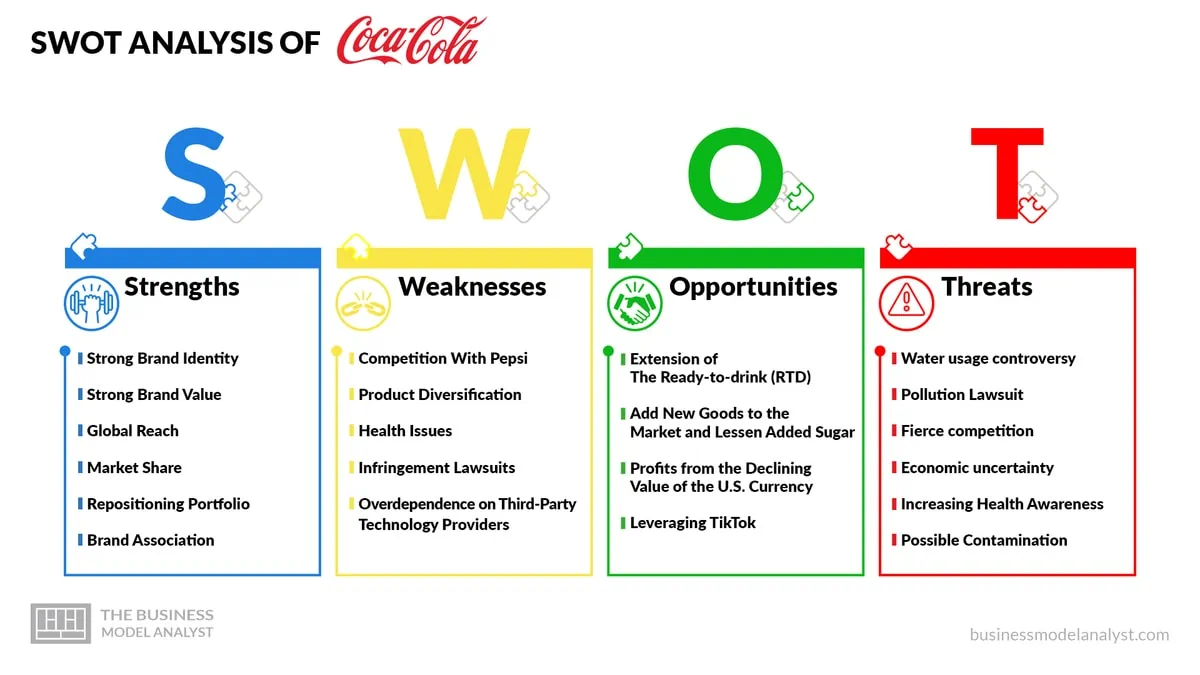

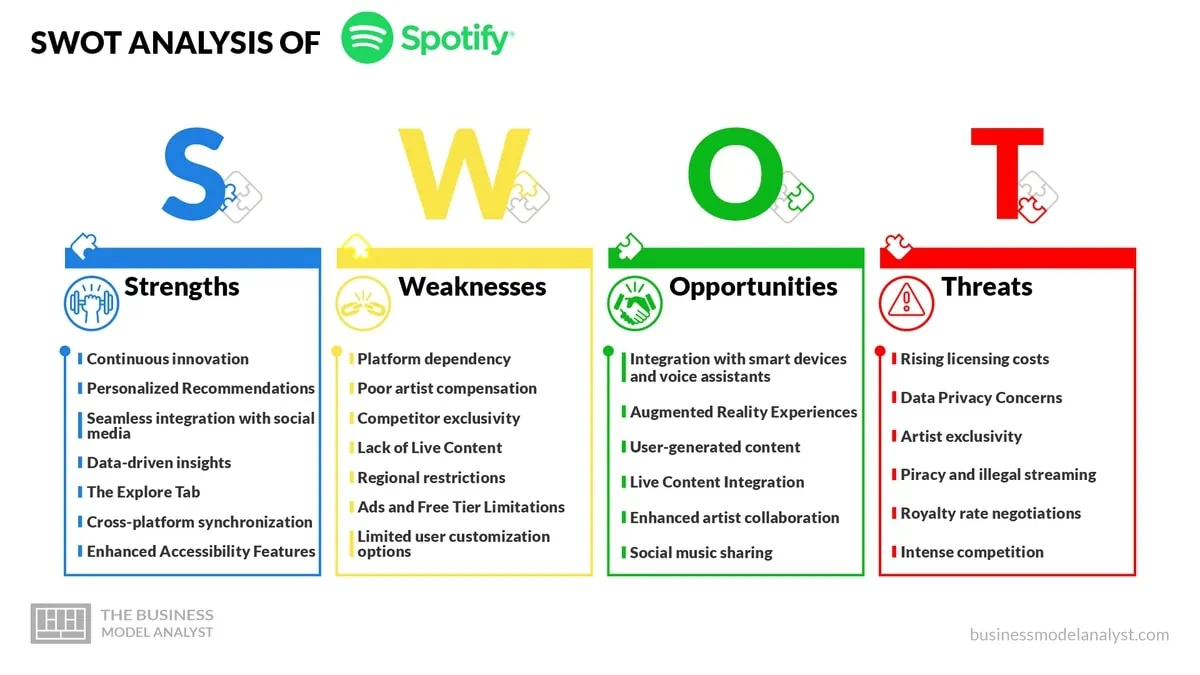

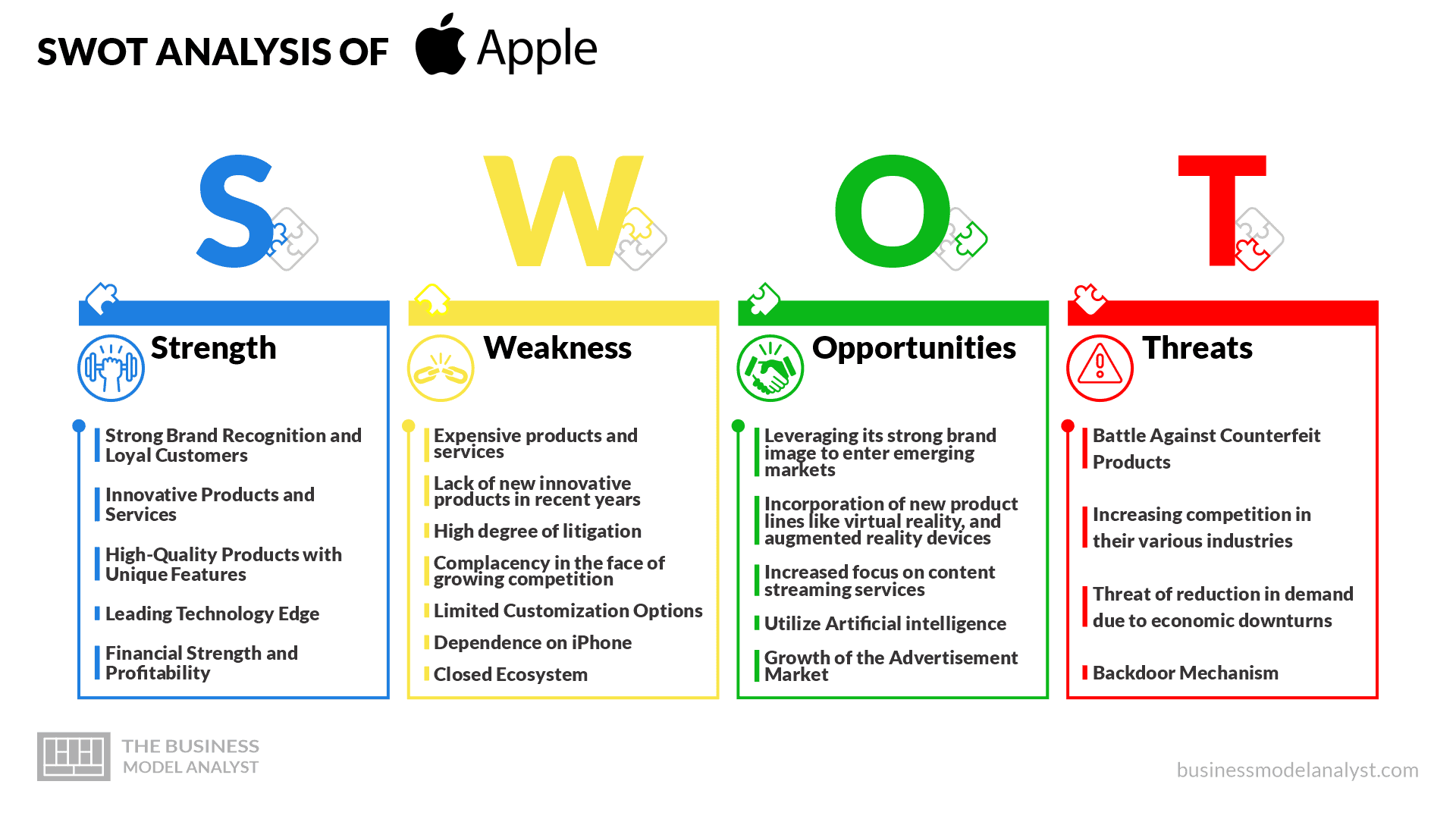

SWOT Analysis of Zara

SWOT Analysis of a brand is a study of its Strength, Weakness, Threat, and Opportunities. Learning the SWOT Analysis of Zara will help you in upgrading your knowledge about their business and increase your own regular problem-solving skills.

Let’s get into the details:

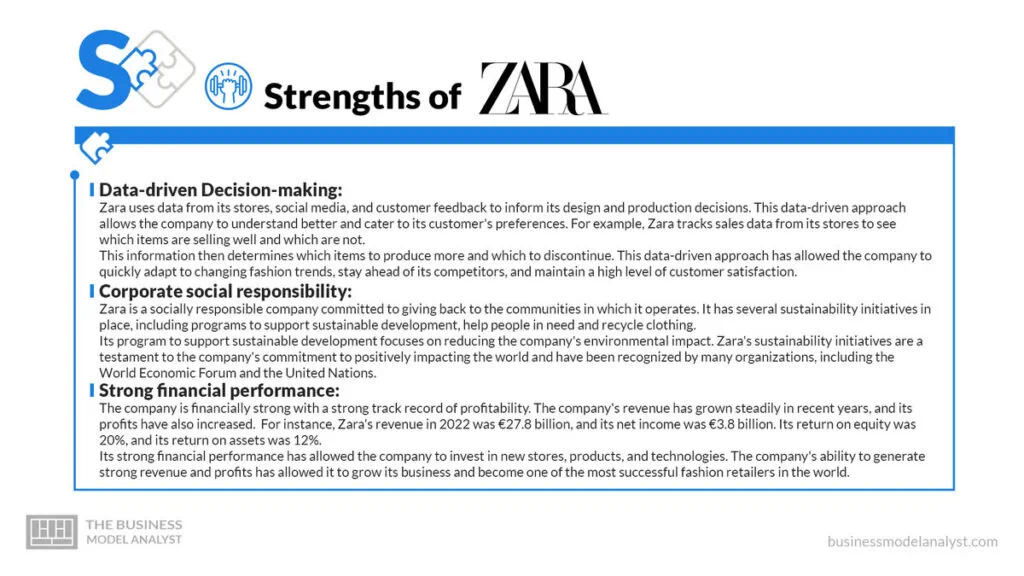

1. Strengths of Zara

Starting off the SWOT Analysis of Zara, we have its Strengths. In this sub-section, we will learn about the organization’s unique capabilities that give it an advantage in capturing more market share, attracting more customers, and maximizing profits.

- Pioneer Advantage : The focal point of instant fashion is to design, produce and sell at a fast rate. Conventionally, this procedure is lengthy; but for Zara, it is only a matter of 3 weeks. As pioneers, Zara has the most developed, strategic practices in supply network management.

- Stores: Zara has outlets in 96 out of the 202 countries it sells in. Zara has the most fashion retail stores in the world, with 2249 locations. The number of retail stores is about double that of Nike, which has the second-highest number of retail stores.

- Supply Chain : Zara’s supply chain updates its online and retail collections twice a week. Zara’s ten logistic centers deliver within 48 hours to any region on the planet. Inditex also has an in-house software development team that is working to increase the company’s order fulfillment speed.

- Team of Designers: Zara has a design team of 700 trained designers who turn customers’ desires into designs. Each year, the design team produces 50,000 pieces of work. It also takes them only three weeks to get the designs from the drawing board to the shelves.

- Investing in Online Retail: Inditex is investing $3 billion to boost its online sales. The money will go into creating a fun online shopping experience and integrating the current physical infrastructure. By 2022, the corporation wants to generate a quarter of its income from online sales.

Zara’s success can be attributed to its mastery of the digital marketing game. Fast fashion, however, is proving to be a double-edged sword as environmental and ethical issues mount. In our next part on Zara’s weaknesses, we’ll go over this and more.

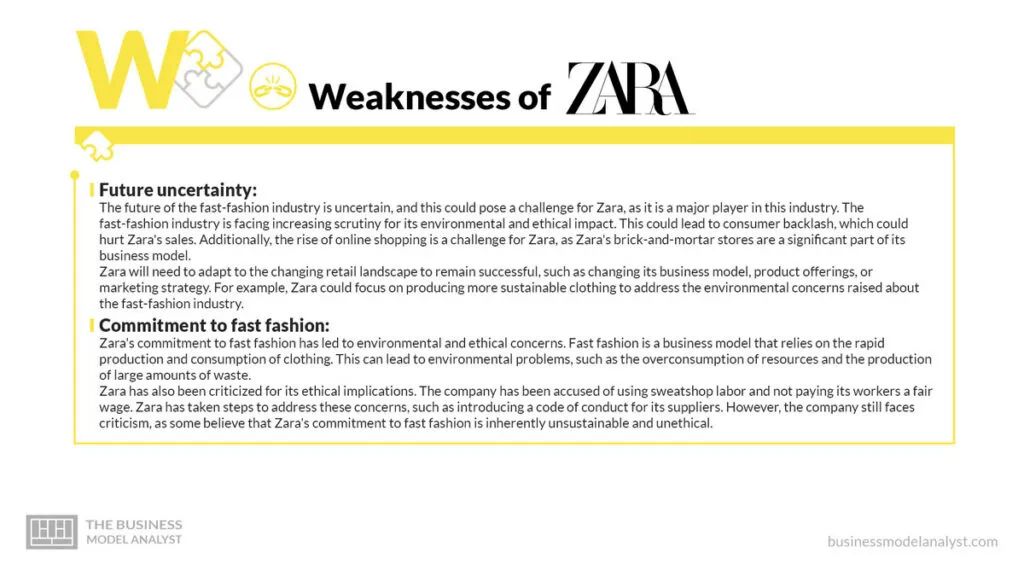

2. Weaknesses of Zara

Zara’s commitment to revising its collection every three weeks sets it apart from other fashion houses. Zara’s dedication has earned it a spot on the top of the industry. However, the advantage comes at a cost. Here’s some more information on Zara’s weaknesses:

- Instant-fashion Trends: Surprisingly, the movement that propelled Zara to the top is also the source of its most serious flaw. Zara’s issue is to find a way of balancing sustainability with instant fashion, which is becoming more popular among buyers and policymakers .

- Physical Store Dependence : Zara’s efforts to reduce the number of physical stores were pushed by the pandemic. Zara was able to recover from a large reduction in sales due to COVID-19-related issues thanks to online sales. Even with the increase in online sales, sales are still only 89% of what they were in 2019.

- Expansion to the US and Asia-Pacific : Zara has a total of 99 stores in the United States, out of the total 2249 outlets, US stores only account for barely 4.4% of the total. However, the United States is the world’s largest apparel market. In addition, Asia-Pacific accounts for 38% of the global apparel market. Zara has a little presence in both geographies.

- Ethical Workplace Standards: Inditex works with 1520 different suppliers across 7108 different plants. Although Inditex deserves respect for developing a strict code of conduct, there is a significant gap in its enforcement. This gap is highlighted by an article in Buzzfeed about the treatment of employees in Myanmar.

- Prediction Aided by AI Systems: Zara is actively working with AI and Big Data companies to develop an AI-enabled market trend prediction system. On the other hand, the current system is still being tested. Once such a system is in place, Zara will have an unrivalled ability in forecasting and satisfy client wants.

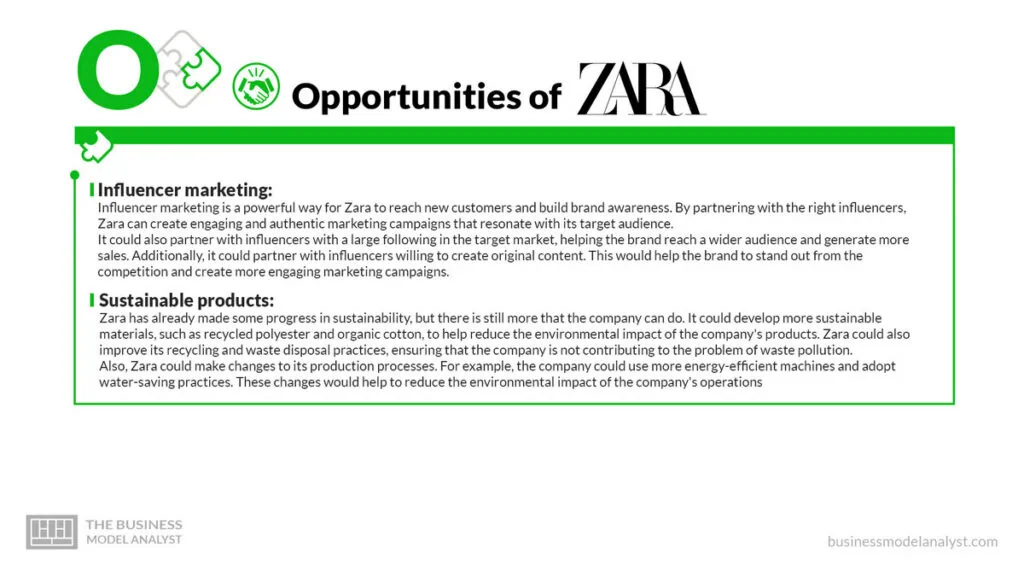

3. Opportunities For Zara:

Zara’s ability to quickly capitalize on fashion trends is one of its most significant assets. Zara is in a good position to take advantage of upcoming changes because of this edge. These are some of the opportunities:

- Rapid Cycle: Customers visit Zara’s stores an average of 17 times each year, indicating a rapid delivery cycle. This is due to the company’s proclivity for reacting to trends as soon as they emerge. Zara currently creates a trend from start to finish in about two to three weeks. The brand should be able to continue these cycles even further in the future.

- Personalization : Thanks to AI, collecting data and segmenting the client base after evaluating it is easier than ever before. This enables clients to receive customized recommendations. Zara should use this technology to its advantage.

- Sustainability: More than a third of Millennials and Gen Z look for “sustainable” and “environmentally friendly” labels on clothing, according to the Sourcing General. The two groups together account for half of the population. As a result, Zara must pay attention to and respond to this expanding need.

- Reselling: The resale market, which is currently worth $28 billion, is expected to expand to $64 billion in the next five years. Customers would be able to buy more with less waste if they included a resale plan into their present platform. This promotes consumerism while promoting environmental sustainability.

- Influencer Marketing: Influential marketing is the most effective technique for promoting lifestyle companies, according to Unbox Social. Zara’s #DearSouthAfrica campaign, which involved 60 micro-influencers, reached an audience of 8 million people. This should serve as a blueprint for the future. They can always go bang by investing in social media marketing for their brand. Here are a few SMM strategies they can opt for as fashion brand.

4. Threats For Zara

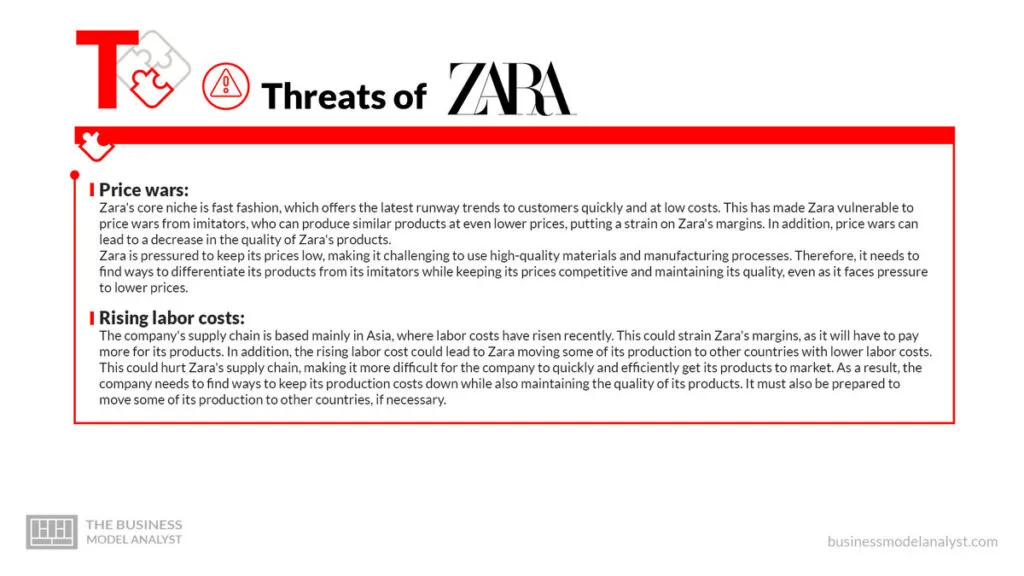

In the last segment of SWOT Analysis of Zara, we will delve into the problems the brand might face. In the traditional sense, Zara’s largest competitor is H&M, on the other hand, the brand is now also facing a slew of internet-based competitors. But these rivalries are only part of Zara’s problems.

- Competition: Shein, the world’s largest apparel shop with an entirely online presence, is China’s fast-fashion behemoth. The Shein app received 10.3 million downloads in September while Zara got only 2 million downloads in the same period, spelling danger for the brand’s future.

- War of Prices: Zara’s core niche is fast-fashion, which offers the latest runway trends to clients swiftly and at a low cost. Imitators are conducting pricing wars to drain off Zara’s line, but the sector is vulnerable.

- COVID-19 Pandemic: Inditex reported a 44% reduction in revenues in the first quarter of 2020. According to Inditex’s report, the closure of 88% of its outlets due to the Coronavirus was the primary cause of the reduction in sales.

- Regulations And Restrictions: In Spain, Inditex has 13 factories. Only three of the 13 factories were operational in the early months of the epidemic due to the Spanish government’s lockdown efforts. The company can expect similar restrictions as Europe and India prepare for a Third wave.

With this, we come to the end of the SWOT Analysis of Zara. Let’s conclude this case study in the section below.

Zara’s current focus is on recovering from the COVID-19 situation and strengthening its web presence. Inditex’s financials are improving, and the company’s management is hopeful about increasing online sales. For the time being, we can say Zara has everything under control. But what about outside influences?

Zara uses multiple channels of digital marketing such as SEO , Emailing, and Content Marketing , and uses it to promote and educate its clients about newer products. Zara benefits from Digital Marketing because it is cost-effective and helps it connect to its target audience of young adults (18-30 years)

Getting the right knowledge about Digital Marketing and Completing Certified Courses may get you a chance to work with top companies including Zara. There are many online digital marketing courses in India that can help you gain the right knowledge and skills in this field. By completing these courses, you can open doors to numerous opportunities with top companies, including Zara.

If you want to get up to speed with digital marketing in just 5 days, check out IIDE’s short-term certification courses include courses on Social Media Marketing , Media Planning, Search Engine Optimization, and more.

If you like such in-depth analyses of companies, find more such insightful case studies on our IIDE Knowledge portal .

Thank you for taking the time to read this, and do share your thoughts on this case study in the comments section below.

Author's Note: My name is Aditya Shastri and I have written this case study with the help of my students from IIDE's online digital marketing courses in India . Practical assignments, case studies & simulations helped the students from this course present this analysis. Building on this practical approach, we are now introducing a new dimension for our online digital marketing course learners - the Campus Immersion Experience. If you found this case study helpful, please feel free to leave a comment below.

IIDE Course Recommendation

" * " indicates required fields

Get Syllabus

By providing your contact details, you agree to our Terms of Use & Privacy Policy

Aditya Shastri

Lead Trainer & Head of Learning & Development at IIDE

Leads the Learning & Development segment at IIDE. He is a Content Marketing Expert and has trained 6000+ students and working professionals on various topics of Digital Marketing. He has been a guest speaker at prominent colleges in India including IIMs...... [Read full bio]

“Excited to explore the SWOT Analysis of ZARA! Their innovative marketing strategies and focus on non-toxic clothing have set them apart in the fashion industry. Looking forward to learning more about their success factors and business model.