An official website of the United States government Here’s how you know

- Translations |

- Service Centers |

- Local Dashboard

Farmers.gov is not optimized for this browser. Please use the latest versions of Chrome, Edge, or Safari for the best experience. Dismiss

Find your state/county's agriculture data and USDA resources on your farmers.gov Local Dashboard !

How to Start a Farm: Plan Your Operation

Think about your operation from the ground up and start planning for your business. A good farm business plan is your roadmap to start-up, profitability, and growth, and provides the foundation for your conversation with USDA about how our programs can complement your operation.

Keep reading about planning your business below, get an overview of the beginning farmer's journey , or jump to a different section of the farmer's journey.

On This Page

Why you need a farm business plan.

A comprehensive business plan is an important first step for any size business, no matter how simple or complex. You should create a strong business plan because it:

- Will help you get organized . It will help you to remember all of the details and make sure you are taking all of the necessary steps.

- Will act as your guide . It will help you to think carefully about why you want to farm or ranch and what you want to achieve in the future. Over time, you can look back at your business plan and determine whether you are achieving your goals.

- Is required to get a loan . In order to get an FSA loan, a guarantee on a loan made by a commercial lender, or a land contract, you need to create a detailed business plan . Lenders look closely at business plans to determine if you can afford to repay the loan.

How USDA Can Help

Whether you need a good get-started guide, have a plan that you would like to verify, or have a plan you’re looking to update for your next growth phase, USDA can help connect you to resources to help your decisions.

Your state's beginning farmer and rancher coordinator can connect you to local resources in your community to help you establish a successful business plan. Reach out to your state's coordinator for one-on-one technical assistance and guidance. They can also connect you with organizations that specifically serve beginning farmers and ranchers.

It is important to know that no single solution fits everyone, and you should research, seek guidance, and make the best decision for your operation according to your own individual priorities.

Build a Farm Business Plan

There are many different styles of business plans. Some are written documents; others may be a set of worksheets that you complete. No matter what format you choose, several key aspects of your operation are important to consider.

Use the guidelines below to draft your business plan. Answering these kinds of questions in detail will help you create and develop your final business plan. Once you have a business plan for your operation, prepare for your visit to a USDA service center. During your visit, we can help you with the necessary steps to register your business and get access to key USDA programs.

Business History

Are you starting a new farm or ranch, or are you already in business? If you are already in business:

- What products do you produce?

- What is the size of your operation?

- What agricultural production and financial management training or experience do you, your family members, or your business partners have?

- How long have you been in business?

Mission, Vision, and Goals

This is your business. Defining your mission, vision and goals is crucial to the success of your business. These questions will help provide a basis for developing other aspects of your business plan.

- What values are important to you and the operation as a whole?

- What short- and long-term goals do you have for your operation?

- How do you plan to start, expand, or change your operation?

- What plans do you have to make your operation efficient or more profitable ?

- What type of farm or ranch model (conventional, sustainable, organic, or alternative agricultural practices) do you plan to use?

Organization and Management

Starting your own business is no small feat. You will need to determine how your business will be structured and organized, and who will manage (or help manage) your business. You will need to be able to convey this to others who are involved as well.

- What is the legal structure of your business? Will it be a sole proprietorship, partnership, corporation, trust, limited liability company, or other type of entity?

- What help will you need in operating and managing your farm or ranch?

- What other resources, such as a mentor or community-based organization , do you plan to use?

Marketing is a valuable tool for businesses. It can help your businesses increase brand awareness, engagement and sales. It is important to narrow down your target audience and think about what you are providing that others cannot.

- What are you going to produce ?

- Who is your target consumer ?

- Is there demand for what you are planning to produce?

- What is the cost of production?

- How much will you sell it for and when do you expect to see profit ?

- How will you get your product to consumers ? What are the transportation costs and requirements?

- How will you market your products?

- Do you know the relevant federal, state, and local food safety regulations? What licensing do you need for your operation?

Today there are many types of land, tools, and resources to choose from. You will need to think about what you currently have and what you will need to obtain to achieve your goals.

- What resources do you have or will you need for your business?

- Do you already have access to farmland ? If not, do you plan to lease, rent, or purchase land?

- What equipment do you need?

- Is the equipment and real estate that you own or rent adequate to conduct your operation? If not, how do you plan to address those needs?

- Will you be implementing any conservation practices to sustain your operation?

- What types of workers will you need to operate the farm?

- What additional resources do you need?

Now that you have an idea of what you are going to provide and what you will need to run your operation you will need to consider the finances of your operation.

- How will you finance the business?

- What are your current assets (property or investments you own) and liabilities (debts, loans, or payments you owe)?

- Will the income you generate be sufficient to pay your operating expenses, living expenses, and loan payments?

- What other sources of income are available to supplement your business income?

- What business expenses will you incur?

- What family living expenses do you pay?

- What are some potential risks or challenges you foresee for your operation? How will you manage those risks?

- How will you measure the success of your business?

Farm Business Plan Worksheets

The Farm Business Plan Balance Sheet can help gather information for the financial and operational aspects of your plan.

Form FSA-2037 is a template that gathers information on your assets and liabilities like farm equipment, vehicles and existing loans.

- FSA-2037 - Farm Business Plan - Balance Sheet

- FSA-2037 Instructions

Planning for Conservation and Risk Management

Another key tool is a conservation plan, which determines how you want to improve the health of your land. A conservation plan can help you lay out your plan to address resource needs, costs and schedules.

USDA’s Natural Resources Conservation Service (NRCS) staff are available at your local USDA Service Center to help you develop a conservation plan for your land based on your goals. NRCS staff can also help you explore conservation programs and initiatives, such as the Environmental Quality Incentives Program (EQIP) .

Conservation in Agriculture

Crop insurance, whole farm revenue protection and other resources can help you prepare for unforeseen challenges like natural disasters.

Disaster Recovery

Special Considerations

Special considerations for businesses.

There are different types of farm businesses each with their own unique considerations. Determine what applies to your operation.

- Organic Farming has unique considerations. Learn about organic agriculture , organic certification , and the Organic Certification Cost Share Program to see if an organic business is an option for you. NRCS also has resources for organic producers and offers assistance to develop a conservation plan.

- Urban Farming has special opportunities and restrictions. Learn how USDA can help farmers in urban spaces .

- Value-Added Products . The Agricultural Marketing Resource Center (AgMRC) is a national virtual resource center for value-added agricultural groups.

- Cooperative. If you are interested in starting a cooperative, USDA’s Rural Development Agency (RD) has helpful resources to help you begin . State-based Cooperative Development Centers , partially funded by RD, provide technical assistance and education on starting a cooperative.

Special Considerations for Individuals

Historically Underserved Farmers and Ranchers: We offer help for the unique concerns of producers who meet the USDA definition of "historically underserved," which includes farmers who are:

- socially disadvantaged

- limited resource

- military veterans

Women: Learn about specific incentives, priorities, and set asides for women in agriculture within USDA programs.

Heirs' Property Landowners: If you inherited land without a clear title or documented legal ownership, learn how USDA can help Heirs’ Property Landowners gain access to a variety of programs and services

Business Planning

Creating a good business plan takes time and effort. The following are some key resources for planning your business.

- Farm Answers from the University of Minnesota features a library of how-to resources and guidance, a directory of beginning farmer training programs, and other sources of information in agriculture. The library includes business planning guides such as a Guide to Developing a Business Plan for Farms and Rural Businesses and an Example Business Plan .

- The Small Business Administration (SBA) offers information about starting, managing, and transitioning a business.

SCORE is a nonprofit organization with a network of volunteers who have experience in running and managing businesses. The Score Mentorship Program partners with USDA to provide:

- Free, local support and resources, including business planning help, financial guidance, growth strategies.

- Mentorship through one-on-one business coaching -- in-person, online, and by phone.

- Training from subject matter experts with agribusiness experience.

- Online resources and step-by-step outlines for business strategies.

- Learn more about the program through the Score FAQ .

Training Opportunities

Attend field days, workshops, courses, or formal education programs to build necessary skills to ensure you can successfully produce your selected farm products and/or services. Many local and regional agricultural organizations, including USDA and Cooperative Extension, offer training to beginning farmers.

- Cooperative Extension offices address common issues faced by agricultural producers, and conduct workshops and educational events for the agricultural community.

- extension.org is an online community for the Cooperative Extension program where you can find publications and ask experts for advice.

Now that you have a basic plan for your farm operation, prepare for your visit to a USDA service center.

2. Visit Your USDA Service Center

How to Start a Farm with USDA

Get an overview of the beginning farmer's journey or jump to a specific page below.

Find Your Local Service Center

USDA Service Centers are locations where you can connect with Farm Service Agency, Natural Resources Conservation Service, or Rural Development employees for your business needs. Enter your state and county below to find your local service center and agency offices. If this locator does not work in your browser, please visit offices.usda.gov.

Learn more about our Urban Service Centers . Visit the Risk Management Agency website to find a regional or compliance office or to find an insurance agent near you.

Farm Business Planning

Farm Business Planning is key to beginning farmer success.

It helps beginning farmers :

- Plan for the economic sustainability of a new farm enterprise.

- Obtain funding to purchase land, equipment and other resources from lending institutions, investors and/or grant making agencies.

- Articulate what their farm will look like.

On this page, we compiled free farm business planning resources to help you understand what a formal business plan is, and how to start planning your farm business. Sections include:

- Developing a Farm Business Plan

- Enterprise Budgeting

Enterprise budget resources are included on the farm business planning page because such tools are usually essential in helping you to develop your business plan.

Planning your farm business involves more than is outlined on this page alone. You’ll probably also be interested in funding (loans/grants) , farm incorporation , and risk management . Our starting a farm page is worth visiting first. Also, you might find the following article helpful, because it touches on many farm business planning topics: Farm Products, What to Charge: Marketing, Price, Calculating Costs, Strategy and Much More .

1. Developing a Farm Business Plan

A business plan is a decision making tool that takes the form of a formal document. It states your business goals, why you think you can achieve them, and lays out your plan for doing so. Farm business planning is also a process, not an end product. A business plan is a work in progress, which farm business owners or operators will want to revisit regularly.

Planning and Funding Your Farm Business from the Cornell University Small Farms Project has lots of important and useful farm business planning resources.

Rural Businesses is a web and print publication from the Minnesota institute for Sustainable Agriculture (MISA).

Building a Business Plan for Your Farm: Important First Steps is a 20 page farm business planning publication that discusses the initial steps to help you move toward writing a formal business plan.

The Center for Agroecology has a Small Farm Business Planning publication that goes over many of the basics in a step by step format.

Building a Sustainable Business: A Guide to Developing a Business Plan for Farms and Rural Businesses is a farm business planning publication available from SARE.

Do I need a Business Plan for my Farm? is a web resource from the New England Small Farm Institute. It’s a great place to get started.

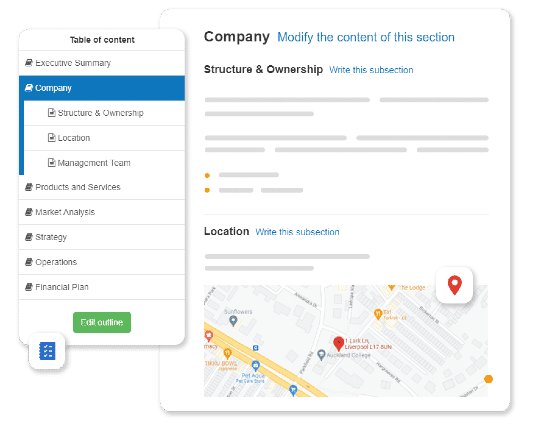

AgPlan from the University of Minnesota helps rural business owners develop a business plan for free, while also offering sample business plans for ideas, and a way to print or download your plan.

Developing a Farm Business Plan includes several helpful resources from the USDA National Agricultural Library’s Rural Information Center.

Organic Farm Business Planning Page from North Carolina State University features a number of publications and links related to financial planing for organic farmers.

Agricultural Business Planning Templates and Resources is an ATTRA publication most relevant to smaller-scale or alternative agricultural entrepreneurs.

Beginning Farmer and Rancher Resources offers comprehensive resources on Bookkeeping and Other Basics ; Cash Flow Budgeting and Managing Debt ; Small Farm and Ranch Income Taxes , and more.

Purdue University’s Center for Food and Agricultural Business has educational resources to explore, such as the New Ventures in Food and Agriculture in Indiana , which offers business planning assistance.

Purdue University Cooperative Extension offers strategic farm business planning tools for commercial farm producers.

Penn State University College of Agricultural Sciences has many Business Planning tools and information. Penn State Cooperative Extension has a Developing a Business Plan page. Penn State also has a Farm Business Plan Template that allows you to plug in your information and create a basic business plan.

The U.S. Small Business Administration works with local partners to counsel, mentor and train small businesses. It is worth getting to know their programs and connect with your local office.

The Martindale Center Reference Desk has an extensive compilation of links to calculators, applets, spreadsheets, courses, manuals, handbooks, simulations, animations, videos and more. Martindale’s Agriculture Center can be of great use to farmers making business plans.

2. Enterprise Budgets

Enterprise budgets project costs and returns for a particular farm production practice. You can use enterprise budgets to make smart business management decisions, and to help you develop a viable business plan.

Enterprise Budgeting Tools of all sorts from the Agricultural Marketing Resource Center, including organic crop budgeting tools, many vegetable budgeting tools, the crop conversion tool for side-by-side crop comparisons, specialty crop and livestock budgets, hydroponics budgets, wind calculators, composting calculators, manure calculators, distillers grain budgets, biomass calculators and specialty foods calculators.

Introduction to Farm Planning Budgets for New and Beginning Farmers (Virginia Tech)

Importance and Use of Enterprise Budgets in Agriculture (University of Nevada)

Enterprise Budgeting (Kerr Center)

Organic Specific Enterprise Budgets

- Enterprise Budgets and Production Costs for Organic Production (ATTRA)

- Organic Crop Production Enterprise Budgets and Information (Iowa State)

- Organic Enterprise Budget (Kansas Rural Center)

More Enterprise Budget Pages and Information

- Enterprise Budgets List (Virginia Cooperative Extension)

- Dairy Sheep Enterprise Budget (Center for Integrated Ag Systems, UW-Madison)

- Crop Budgets (University of Maryland)

- Farm Management Enterprise Budgets (Ohio State)

- Alabama Enterprise Budget Summaries (Alabama A&M and Auburn)

- Start developing your business plan with the resources at https://www.beginningfarmers.org/farm-business-planning/

- You can find more gr eat farming resources at https://www.beginningfarmers.org/additional-farming-resources/

- Farm Operating Loans

- Farm Equipment Loans

- Financing By State

- Calculators

- Become a Partner

How to Write a Farming Business Plan: Template and Guide

americanfarmfi

May 22, 2023

Starting and running a successful farming business requires careful planning and strategic decision-making. One essential tool that every farmer should have is a well-crafted farming business plan. A comprehensive business plan serves as a roadmap for your agricultural venture, guiding you through the various stages of development and ensuring that you stay focused on your goals. We will provide you with a step-by-step guide on how to write an effective farming business plan and start you off with a template.

Overview of a Farming Business Plan

Before diving into the specifics, let’s take a moment to understand what a farming & agriculture business plan entails. Essentially, a farm business plan is a written document that outlines your farming objectives, strategies, and financial forecasts. It serves as a blueprint for your farm’s operations, helping you make informed decisions and communicate your vision to potential investors, lenders, or partners.

The Purpose of a Farming Business Plan

The farming business plan is going to define and communicate your farm’s mission and goals. It helps provide a clear direction for your operations, resources, and ensures that everyone involved in the business is on the same page. Additionally, a well-crafted business plan is often required when seeking financing or partnerships. Lenders and investors use it to evaluate the viability and profitability of your farming venture.

Key Elements of a Farming Business Plan

Let’s explore the elements that make up the Farming Business Plan.

Executive Summary

The executive summary is a brief overview of your entire plan. It should summarize your farm’s mission, goals, target market, and competitive advantage. While it appears at the beginning of your plan, it is often written last to ensure that it accurately reflects the content of the document.

Market Analysis

A thorough market analysis is crucial for understanding your target market, identifying potential customers, and evaluating your competition. This section should provide detailed information about market trends, customer demographics, and demand for your products or services. Conducting market research and gathering data from reliable sources will strengthen the credibility of your analysis.

Products and Services

In this section, describe the specific products or services your new farm will offer. Provide details about their features, benefits, and how they meet the needs of your target market. Discuss any unique selling points or competitive advantages that set your offerings apart from others in the industry.

Marketing and Sales

Outline the strategies for promoting and selling farm products. Explain how you plan to promote your farm and reach your target market. Include information about your pricing strategy, distribution channels, and any partnerships or collaborations that may enhance your marketing efforts. Developing a comprehensive marketing plan will help you attract customers and generate sales.

Describe the operational processes and workflows involved in running the farm, including land preparation, planting, harvesting, livestock care, and post-harvest handling. Highlight the management structure, key personnel, and their roles and responsibilities.

Financial Plan

The financial plans are a critical component of your farming business plan as it demonstrates the financial viability and sustainability of your farm. It should include projected income statements, cash flow statements, and balance sheets for the next three to five years. Additionally, outline your funding requirements and any existing or potential sources of financing.

American Farm Financing offers many financing options to fit your needs: operating loans, cash rent loans, farm mortgages, refinances, and equipment loans. See all AFF loan options .

Setting Financial Goals

Forecasting expenses is critical when starting a farming operation. List out the main buckets of expenses (inputs, machinery, labor, land, interest, and consulting services). Where possible, get pricing quotes to formalize your expenses as much as possible for what you would like to grow.

After you’ve forecasted expenses, you can set a goal for how much profit, or margin, you intend to make. Use futures sales prices to project what you can sell your crop for. The difference between your sales price and your expenses will become your profit. Ensure that this income matches your expectations and can cover any personal expenses you hope the money will be used for.

While a one-year operating plan is critical to get started, remember that farming is a long-term pursuit. Depending on how many upfront expenses you need to make, it may take multiple farming seasons to turn a significant profit.

Conducting Market Research

Before you can develop a solid business plan for a farm, it is essential to conduct detailed market research. Conduct an analysis of the target market, including its size, growth potential, and trends. Identify the target customers, their needs, preferences, and buying behavior. This assessment will allow you to be an expert on the market and differentiate you from the rest of the competition.

Writing a Farming Business Plan

Now that we have covered the key elements of a farming business plan, let’s dive into the process of writing one.

Creating a Timeline for Implementation

This timeline can be as specific to your needs as possible. You want to make sure that every necessary box is checked before launching your farming operation. This is a suggested timeline for implementing your plan, but coordinate as you see fit and adapt to things that may pop up:

Preparation: 1-6 Months

- Complete all sections of the farming business plan, including market analysis, financial projections, and operational strategies.

- Seek funding options, such as loans, grants, or investors, and secure the necessary financing for your farming venture.

- Identify suitable land for your farm and negotiate the purchase or lease agreement.

- Conduct necessary soil testing and prepare the land for farming activities.

- Source and purchase farming equipment, machinery, and inputs (seeds, fertilizers, livestock, etc.) required for your chosen agricultural activities.

- Hire key personnel, such as farm managers, laborers, and administrative staff, as per your business plan’s organizational structure.

- Establish relationships with suppliers and vendors to ensure a steady supply of inputs.

Operations: 6-12 Months

- Initiate planting or livestock management based on the farming plan.

- Implement appropriate cultivation techniques, crop rotation, or livestock management practices.

- Monitor and adjust farming operations to optimize production.

- Develop marketing strategies to promote farm products to target customers.

- Implement sales channels, such as direct sales, farmers’ markets, online platforms, or partnerships with retailers or small restaurants.

Below is a helpful template from fsa.usda.gov to get you started. Download your farming business plan template here.

Ready to find financing that works for you? Begin your application below.

Recent Posts

Top Tips for Preparing a Winning Loan Application for Your Farm November 13, 2023

American Farm Financing is attending Tech Hub Live: July 24-26th. July 21, 2023

Equipment Needed to Start a Farm July 3, 2023

Subscribe To Our Newsletter

Stay up to date with the latest blog posts, offerings, and AFF news.

- Loan Products

- Learning Center

- Privacy Policy

- Terms & Conditions

© 2023 American Farm Financing

12: Business Plans

What is a business plan.

A business plan is a document that helps you to organize and succinctly summarize the vision you have for your business. The plan contains the operational and financial objectives of a business, the detailed plans and budgets showing how the objectives are to be realized.

A good business plan will contain the following:

- Your business vision, mission statement, key values, and goals

- Description of the product(s) you intend to produce

- Strengths, Weaknesses, Opportunities and Threats the business may experience are described

- Production plans

- Marketing plans

- Estimated start-up costs

- Information on your legal structure and management team

- Current financial statements or projected financial statements.

- Resume or brief explanation of your background and relevant experience

- Less than 10 total pages so that people actually read it

Helpful Publications for Writing a Business Plan

General Business Resource Publications:

- Starting an Ag-Business? A Pre-Planning Guide http://publications.dyson.cornell.edu/outreach/extensionpdf/2004/Cornell_AEM_eb0408.pdf

- Business Transfer Guide: Junior Generation http://publications.dyson.cornell.edu/outreach/extensionpdf/2016/Cornell-Dyson-eb1605.pdf

- Producing a Business Plan for Value-Added Agriculture http://publications.dyson.cornell.edu/outreach/extensionpdf/2007/Cornell_AEM_eb0708.pdf

- Business Planning for the Agriculture Sector: A Guide to Business Plan Development for Start-up to Mid-size Operations http://publications.dyson.cornell.edu/outreach/extensionpdf/2010/Cornell_ pdf

- Building a Sustainable Business (Sustainable Agricultural Research Education (SARE)Publications) sare.org/publications/business.htm 280 pages of education and practical exercises to guide you through the financial, management, and interpersonal skills needed to start a successful farm business. Order hard copy for $17 or download PDF online for free.

Cornell Cooperative Extension Publications for Specific Commodities:

- Landscape Business Planning Guide http://publications.dyson.cornell.edu/outreach/extensionpdf/2003/Cornell_AEM_eb0313.pdf

- Writing a Business Plan: A Guide for Small Premium Wineries http://publications.dyson.cornell.edu/outreach/extensionpdf/2002/Cornell_AEM_eb0206.pdf

- Writing a Business Plan: An Example for a Small Premium Winery https://ageconsearch.umn.edu/bitstream/122203/2/Cornell_AEM_eb0207.pdf

Getting Help Writing a Business Plan

How to open a farm equipment rental company?

Want to start a farm equipment rental company but don't know where to begin? Then you've come to the right place!

Our comprehensive guide covers everything related to opening a farm equipment rental company - from choosing the right concept to setting out your marketing plan and financing your business.

You'll also learn how to assess the profitability of your business idea and decide whether or not it can be viable from a financial perspective.

Ready to kickstart your entrepreneurial journey? Let's begin!

In this guide:

- What is the business model of a farm equipment rental company?

- What is the ideal founding team for my farm equipment rental company?

- Is there room for another farm equipment rental company on the market?

How should I position my farm equipment rental company on the market?

Where should i base my farm equipment rental company.

- What legal form should I choose for my farm equipment rental company?

How much money do I need to start a farm equipment rental company?

- How will I promote my farm equipment rental company's?

How do I build my farm equipment rental company financial forecast?

- How do I choose a name and register my farm equipment rental company?

- What corporate identity do I want for my farm equipment rental company?

- What legal steps are needed to start a farm equipment rental company?

- How do I write a business plan for a farm equipment rental company?

How to raise finance for my farm equipment rental company?

- What to do after launching my farm equipment rental company?

Key takeaways

Learn how a farm equipment rental company works.

Before you can start a farm equipment rental company, you need to have a solid understanding of how the business works and what are its main revenue streams.

This will give you a glimpse into the profitability potential of your venture, whilst allowing you to decide whether or not it is a good fit for your situation (current skill set, savings and capital available to start the business, and family responsibilities).

It may be that creating a farm equipment rental company is an excellent idea, but just not the right one for you.

Before starting their own company, successful entrepreneurs typically:

- Consult with and take advice from experienced farm equipment rental company owners

- Acquire hands-on experience by working in an operational farm equipment rental company

Take relevant training courses

Let's explore each option in a bit more detail.

Consulting with and taking advice from experienced farm equipment rental company owners

Having "seen it all", established business owners can offer valuable insights and hands-on advice drawn from their own experiences.

This is because, through both successes and failures, they've gained a more informed and practical understanding of what it takes to build and sustain a successful farm equipment rental company over the long term.

Acquiring hands-on experience by working in an operational farm equipment rental company

If you want to open a farm equipment rental company, having industry-specific experience is imperative because it equips you with the knowledge, network, and acumen necessary to navigate challenges and make informed decisions critical to the success of your future business.

You'll also be able to judge whether or not this business idea is suitable for you or if there might be conflicts of interest with your personal life (for example, long working hours could be incompatible with raising young children).

This work experience will also help you to make contacts in the industry and familiarise yourself with customers and their expectations, which will prove invaluable when you set up your farm equipment rental company.

Taking a training course is another way of familiarising yourself with the business model of your future activity before you decide to make the jump.

You may choose to complete a training course to obtain a certificate or degree, or just take online courses to acquire practical skills.

Before going any further in setting up your venture

Before you go any further with your plans to open a farm equipment rental company, make sure you have a clear vision of what it will take in terms of:

- What skills are needed to run the business successfully (do you have some or all of these skills?)

- What a standard working week looks like (does it suit your personal commitments?)

- What sales potential and long-term growth prospects the farm equipment rental company has (compare this with your level of ambition)

- What options you'll have once you decide to retire (or move on and inevitably sell the company)

This analysis of the business model and the constraints of the business should help you to check that your idea of launching a farm equipment rental company fits your entrepreneurial profile.

If there is a match, it will then be time to look at assembling the founding team of your business.

Create your business plan online!

Think your business idea could be profitable? Find out how with a business plan

Assemble your farm equipment rental company's founding team

The next step to start your farm equipment rental company is to think about the ideal founding team, or to go in alone (which is always an option).

Setting up a business with several partners is a way of reducing the (high) risk of launching a farm equipment rental company since it allows the financial risk of the project to be shared between the co-founders.

This also allows the company to benefit from a greater diversity of profiles in the management team and to spread the burden of decision-making over several shoulders.

But, running a business with multiple co-founders brings its own challenges. Disagreements between co-founders are quite common, and these can pose risks to the business. That's why it's crucial to consider all aspects before starting your business.

To make an informed decision, we suggest asking yourself these questions:

How many co-founders would increase the project's chances of success?

Do you and your potential partners share the same aspirations for the project, what is your plan b in case of failure.

Let's examine each of these questions in detail.

The answer to this question will depend on a number of factors, including:

- Your savings compared with the amount of initial capital needed to launch the farm equipment rental company

- The skills you have compared with those needed to make a success of such a project

- How you want key decisions to be taken in the business (an odd number of partners or a majority partner is generally recommended to avoid deadlock)

Put simply, your partners contribute money and/or skills, and increasing the number of partners is often a good idea when one of these resources is in short supply.

One of the key questions when selecting your potential partners will be their expectations. Do you want to create a small or large business? What are your ambitions for the next 10 or 15 years?

It's better to agree from the outset on what you want to create to avoid disagreements, and to check that you stay on the same wavelength as the project progresses to avoid frustration.

Of course, we wish you every success, but it's wise to have a plan B when setting up a business.

How you handle the possibility of things not working out can depend a lot on the kind of relationship you have with your co-founders (like being a close friend, spouse, former colleague, etc.) and each person's individual situation.

Take, for instance, launching a business with your spouse. It may seem like a great plan, but if the business doesn't succeed, you could find yourself losing the entire household income at once, and that could be quite a nerve-wracking situation.

Similarly, starting a business partnership with a friend has its challenges. If the business doesn't work out or if tough decisions need to be made, it could strain the friendship.

It's essential to carefully evaluate your options before starting up to ensure you're well-prepared for any potential outcomes.

Conducting market research for a farm equipment rental company

The next step in launching a farm equipment rental company is to carry out market research. Let's take a look at what this involves.

The objectives of market research

The objective here is very simple: to assess the level of demand for your business and whether there is an opportunity for it to thrive in your chosen location.

The first step will be to check that the market is not saturated with competing offers and that there is room for a new player: your farm equipment rental company.

Your market analysis will also help you identify a concept and market positioning that has every chance of being successful in your target market, thereby helping increase your business's chances of success.

Carrying out market research for your farm equipment rental company will also enable you to better understand the expectations of your future customers and the most effective ways to communicate with them in your marketing plan.

Analyse key trends in the industry

Your market research should start with an industry analysis in order to gain a good understanding of the main players and current trends in your sector.

Once you've delved into the current state of the market, it will be time to assess what proportion of your target market can be seized by your farm equipment rental company. To do this, you will need to consider both the demand and supply side of the market.

Assess the demand

After checking out the industry, let's shift our focus to figuring out what your potential customers want and how they like to buy.

A classic mistake made by first-time entrepreneurs is to assess demand on the global or national market instead of concentrating on their target market. Only the market share that can be captured by your company in the short term matters.

Your demand analysis should seek to find answers to the following questions:

- Who are your target customers?

- How many are there?

- What are their expectations?

- What are their buying habits?

- How much budget do they have?

- What are the different customer segments and their characteristics?

- What are the main distribution channels and means of communication for reaching each segment?

The aim of the demand analysis is to identify the customer segments that could be targeted by your farm equipment rental company and what products and services you need to offer to meet their expectations.

Analyse the supply side

You will also have to familiarize yourself with the competing farm equipment rental companies on the market targeted by your future business.

Amongst other things, you’ll need to ask yourself:

- Who are the main competitors?

- How many competitors are already present?

- Where are they located?

- How many people do they employ?

- What is their turnover?

- How do they set their prices?

- Are they small independent businesses or national players?

- Do they seem to be in difficulty or are they flourishing?

- What is their market positioning?

- What types of products and services do they offer?

- What do customers seem to like about them?

The aim of the competitive analysis is to identify who your competitors will be and to gather information that will help you find a differentiating commercial positioning (more on that later in this guide).

Regulations

Conducting market research is also an opportunity to look at the regulations and conditions required to do business.

You should ask yourself the following questions:

- Do you need to have a specific degree to open a farm equipment rental company?

- Do you need specific licences or permits?

- What are the main regulations applicable to your future business?

Given that your project is at an early stage, your focus should be to ensure that there are no roadblocks from a regulatory standpoint before you deep dive into the planning process.

Once your project is more advanced, you will have the opportunity to talk about regulation more in-depth with your lawyer.

Concluding your market research

By the time your market research is completed, you should have either:

- Pinpointed an untapped business opportunity,

- Or arrived at the realisation that the market is saturated, prompting the search for alternative business ideas or models.

If the conclusion is that there is an opportunity in the market to cater to one or more customer segments currently underserved by competitors, that's great!

Conversely, if you come to the conclusion that the market is already saturated, don’t panic! The good news is that you won’t spend several years working hard on a project that has little chance of success. There is no shortage of business ideas either - at The Business Plan Shop, we have identified more than 1,300 potential business ideas!

The next step to start your farm equipment rental company is to define precisely the market positioning your company will adopt in order to capitalise on the opportunity identified during your market research.

Market positioning refers to the place your product and service offering occupies in customers' minds and how they differ from the competition. Being perceived as a low-cost solution, for example.

To find a concept and a market positioning that will resonate with your customers, you need to address the following issues:

How can you differentiate yourself from your competitors?

Is it better to start or buy a farm equipment rental company already in operation, how will you validate your concept and market positioning before investing in the business.

Let's look at these aspects in more detail.

Opening a farm equipment rental company means starting with a major disadvantage compared with competitors already active on the market.

While you will have to create everything from scratch, your competitors already have everything in place.

Your competitors' teams know the business well, whereas yours has only just been recruited, their customers are loyal and they benefit from word of mouth that you don't yet have.

So you're going to need a solid plan to succeed in taking market share from your competitors and making your mark.

There are a number of aspects to consider in order to try to avoid direct confrontation if possible:

- Can you target a different customer base than your competitors?

- Can you offer products or services that are different from or complementary to what your competitors already sell?

- How will your competitors react to your farm equipment rental company entering their market?

- Can you build a sustainable competitive advantage that will enable you to compete with your current and future competitors?

The alternative to setting up a new independent business is to buy out and take over a farm equipment rental company already in operation.

A takeover is a good way of reducing the risk of your project compared with a pure start-up.

Taking over a business has two enormous advantages over setting up a new one: you start out on an equal footing with your competitors since you take over the team and the customer base, and you don't increase the supply on the market enabling you to maintain the existing balance on the market where the business operates.

However, the capital requirements for a takeover are higher because the business will have to be bought from its previous owners.

However you decide to set up your business, you will need to ensure that there is a good fit between what you sell and what customers are looking to buy.

To do this, you'll need to meet your target customers to present your products or services and check that they meet their expectations.

The next step in our guide on starting a farm equipment rental company involves making a key choice about where you want your business to be located.

Picking the ideal location for your business is like selecting the perfect canvas for a painting. Without it, your business might not showcase its true colors.

We recommend that you take the following factors into account when making your decision:

- Visibility and foot traffic - This is important for a farm equipment rental company as it can attract potential customers who may be in need of equipment for their own farms or construction projects.

- Parking space, road and public transport accessibility - This is crucial for a farm equipment rental company as customers will need to transport the equipment to their farms or construction sites, making it important to have ample parking space and easy access to roads and public transport.

- Proximity to target customers - Being close to the target customers, such as farmers or construction companies, will make it more convenient for them to rent equipment from the company.

- Availability of skilled labor - A farm equipment rental company may require skilled labor to maintain and repair the equipment, making it important to have access to a pool of skilled workers in the area.

This list is not comprehensive and will have to be adjusted based on the details of your project.

The parameters to be taken into account will also depend on whether you opt to rent premises or buy them. If you are a tenant, you will need to consider the conditions attached to the lease: duration, rent increase, renewal conditions, etc.

Lease agreements differ widely from country to country, so it's essential to review the terms that apply to your situation. Before putting pen to paper, consider having your lawyer look carefully at the lease.

Choosing your farm equipment rental company's legal form

The next step to open a farm equipment rental company is to choose the legal form of your business.

The legal form of a business simply means the legal structure it operates under. This structure outlines how the business is set up and defines its legal obligations and responsibilities.

Why is your farm equipment rental company's legal form important?

Choosing the legal form for your farm equipment rental company is an important decision because this will affect your tax obligations, your personal exposure to risk, how decisions are made within the business, the sources of financing available to you, and the amount of paperwork and legal formalities, amongst other things.

The way you set up your business legally will impact your taxes and social contributions, both at a personal level (how much your income is taxed) and at the business level (how much the business's profits are taxed).

Your personal exposure to risk as a business owner also varies based on the legal form of your business. Certain legal forms have a legal personality (also called corporate personality), which means that the business obtains a legal entity which is separate from the owners and the people running it. To put it simply, if something goes wrong with a customer or competitor, for example, with a corporate personality the business gets sued, whereas without it is the entrepreneur personally.

Similarly, some legal forms benefit from limited liability. With a limited liability the maximum you can lose if the business fails is what you invested. Your personal assets are not at risk. However, not all structures protect you in such a way, some structures may expose your personal assets (for example, your creditors might try to go after your house if the business incurs debts and then goes under without being able to repay what it owed).

How decisions are made within the business is also influenced by the legal form of your farm equipment rental company, and so is the amount of paperwork and legal formalities: do you need to hold general assemblies, to produce annual accounts, to get the accounts audited, etc.

The legal form also influences what sources of financing are available to you. Raising capital from investors requires having a company set up, and they will expect limited liability and corporate personality.

What are the most common legal structures?

It's important to note that the actual names of legal structures for businesses vary from country to country .

But they usually fall within two main types of structures:

Individual businesses

Individual businesses, such as sole traders or sole proprietorships, are legal structures with basic administrative requirements.

They primarily serve self-employed individuals and freelancers rather than businesses with employees.

The main downside of being a sole trader is that there's usually no legal separation between the business and the person running it. Everything the person owns personally is tied up with the business, which can be risky.

This means that if there are problems or the business goes bankrupt, the entrepreneur's personal assets could be taken by creditors. So, there's a risk of personal liability in case of disputes or financial issues.

It is also not possible to raise equity from investors with these structures as there is no share capital.

Despite the downsides, being a sole proprietorship has some advantages. There is usually very little paperwork to get started, simpler tax calculations and accounting formalities.

Companies are all rounders which can be set up by one or more individuals, working on their own or with many employees.

They are recognized as a distinct entity with their own legal personality, and the liability is usually limited to the amount invested by the owners (co-founders and investors). This means that you cannot lose more than you have invested in the business.

This separation ensures that in legal disputes or bankruptcy, the company bears primary responsibility, protecting the personal assets of the founder(s) and potential investor(s).

How should I choose my farm equipment rental company's legal structure?

Deciding on the legal structure is usually quite straightforward once you know how many co-founders you'll have, whether you'll have employees, and the expected revenues for the business.

A good business idea will be viable whatever the legal form you choose. How businesses are taxed changes every year, therefore one cannot rely on specific tax benefits tied to a particular structure when deciding to go into business.

One easy way to proceed is to take note of the legal structures used by your top five competitors, and assume you're going with the most commonly chosen option. Once your idea is mature and you're prepared to formally register the business, you can validate this assumption with a lawyer and an accountant.

Can I switch my farm equipment rental company's legal structure if I get it wrong?

You can switch your legal setup later on, even if it involves selling the old one to a new entity in some cases. However, this comes with extra costs, so it's better to make the right choice from the beginning if you can.

To answer this key question, we first need to look at the resources you'll need to launch your farm equipment rental company and keep it running on a daily basis. Let's take a look at what that entails.

Since each venture is distinct, providing an average budget for starting a farm equipment rental company is impossible.

We strongly advise careful consideration when reading estimates on the web. It’s best to ask yourself the following questions:

- Is my project similar (location, concept, planned size, etc.)?

- Can I trust where this information is coming from?

- Is the data fresh or stale?

Your thinking behind the investments and human resources required to launch and operate the business will then enable you to cost each item and include them in your financial forecast (which we'll look at later in this guide).

Once complete, the forecast will give you a precise idea of the initial investment required and profitability potential for your business idea.

Startup costs and investments to start a farm equipment rental company

Let's start with the investments. To set up a farm equipment rental company, initial working capital and investments can include the following items:

- Tractors: As a farm equipment rental company, you will need to purchase or lease tractors for your clients to use. These can range from small utility tractors for basic farm tasks to larger, more powerful tractors for heavy-duty farming operations.

- Harvesting Equipment: Depending on the type of crops your clients will be growing, you may need to invest in harvesting equipment such as combines, forage harvesters, or cotton pickers. These machines can be expensive but are essential for efficient and timely harvesting.

- Irrigation Systems: Many farms require irrigation to ensure consistent water supply for their crops. As a farm equipment rental company, you may need to purchase or lease irrigation systems such as sprinklers, drip irrigation, or center pivot systems.

- Storage Facilities: Farms often need storage facilities for their harvested crops and equipment. You may need to invest in grain silos, hay barns, or machinery sheds to provide your clients with a secure and convenient place to store their belongings.

- Livestock Handling Equipment: If your clients have livestock, you may need to provide them with equipment such as cattle chutes, sheep pens, or horse trailers. This will allow them to safely and efficiently handle their animals, making their farming operations smoother.

Of course, you will need to adapt this list to your company's specific needs.

Staffing requirements to operate a farm equipment rental company

You'll also need to think about the staff required to run the business on a day-to-day basis.

The human resources required will vary according to the size of your company.

Once again, this list is only indicative and will need to be adjusted according to the specifics of your farm equipment rental company.

Operating expenses of a farm equipment rental company

The final point to consider when analyzing the resources required is the question of operating costs.

Operating expenses for a farm equipment rental company may include:

- Staff Costs: This includes salaries, wages, and benefits for employees such as rental coordinators, maintenance technicians, and administrative staff.

- Accountancy Fees: You will need to hire an accountant to manage your financial records, tax filings, and other financial duties.

- Insurance Costs: It is important to have insurance coverage for your rental equipment, as well as liability insurance for your business.

- Software Licenses: You may need to purchase licenses for software programs used for managing reservations, tracking inventory, and other business operations.

- Banking Fees: You may incur fees for bank transactions, wire transfers, and other financial services.

- Marketing Expenses: It is important to promote your business through various channels such as online advertising, print materials, and trade shows.

- Rent/Lease Payments: If you are renting or leasing a physical location for your business, this will be an ongoing expense.

- Vehicle Expenses: You may need to purchase or lease vehicles for transporting equipment to and from rental locations, as well as for maintenance and repairs.

- Supplies and Materials: This includes items such as cleaning supplies, office supplies, and other materials needed to maintain and operate your business.

- Utility Costs: You will need to cover expenses for utilities such as electricity, water, and gas for your business location.

- Taxes and Licenses: You will need to pay taxes and obtain necessary licenses and permits for your business.

- Training and Education: Your staff may require training and education to operate and maintain the equipment, as well as to provide quality customer service.

- Equipment Maintenance and Repairs: As a rental company, it is important to regularly maintain and repair your equipment to ensure it is in good working condition.

- Legal Fees: You may need to hire a lawyer for legal advice and assistance with contracts, leasing agreements, and other legal matters.

- Travel Expenses: If you need to travel for business purposes, such as to attend trade shows or meet with clients, these expenses will need to be accounted for.

Here also, this list will need to be tailored to the specifics of your farm equipment rental company but should be a good starting point for your budget.

Creating a sales & marketing plan for your farm equipment rental company

The next step to start a farm equipment rental company is to think about how you are going to attract and retain customers.

You need to ask yourself the following questions:

- What actions can be leveraged to attract as many customers as possible?

- How will you then retain customers?

- What resources do you need to allocate for each initiative (human and financial)?

- How many sales and what turnover can you expect to generate in return?

How you will attract and retain customers depends on your ambition, the size of your startup and the nature of your exact concept, but you could consider the following initiatives.

Your sales forecast may also be influenced by seasonality related to your business type, such as fluctuations during busy holiday periods, and your competitive environment.

Let's now look at the financial projections you will need to prepare in order to open a farm equipment rental company.

What is a farm equipment rental company's financial projection?

Your financial forecast will help you budget your project so that you can evaluate:

- Its expected sales and growth potential

- Its expected profitability, to ensure that the business will be viable

- Its cash generation and financing requirements

Making your financial forecast is the only way to determine the amount of initial financing required to create your farm equipment rental company.

There are lots of business ideas out there, but very few of them are viable, and making a financial forecast is the only way to ensure that your project makes economic and financial sense.

Creating a farm equipment rental company financial projection is an iterative process, as you'll need to refine your figures as your business idea matures.

You'll start with a first high-level version to decide whether or not to continue working on the project.

Then, as your project takes shape, your forecasts will become increasingly accurate. You'll also need to test different assumptions to ensure that your idea of starting a farm equipment rental company holds up even if your trading environment deteriorates (lower sales than expected, difficulties in recruiting, sudden cost increases or equipment failure problems, for example).

Your financial forecast will be part of your overall business plan, which we'll look at in more detail later. Your financial partners will use your business plan to decide if they want to finance you.

Once you've launched your business, you can compare your actual accounting figures with your forecasts, to analyze where the discrepancies come from, and then update your forecasts to maintain visibility over your future cash flows.

Financial forecasts are, therefore, a financial management tool that will be with you throughout the life of your company.

What does a financial projection look like?

Your farm equipment rental company forecast will be presented using the following financial tables.

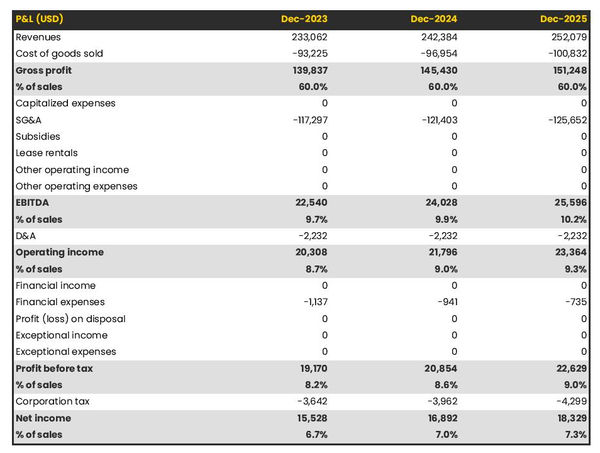

The projected P&L statement

The projected P&L statement for a farm equipment rental company shows how much revenue and profits your business is expected to generate in the future.

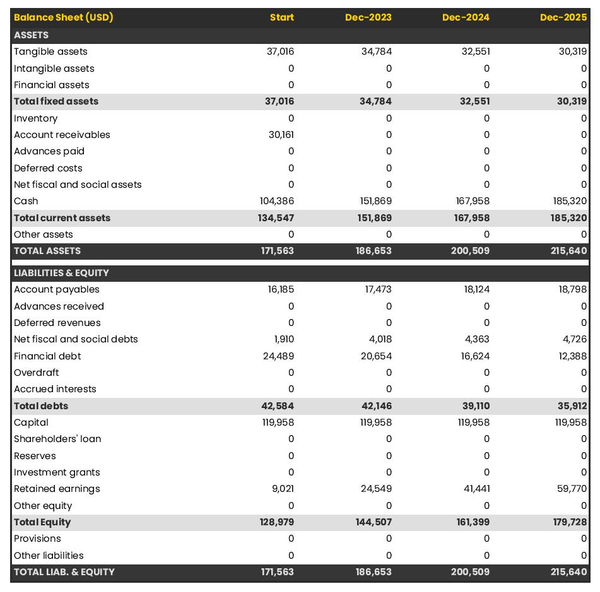

The projected balance sheet of your farm equipment rental company

Your farm equipment rental company's projected balance sheet provides a snapshot of your business’s financial position at year-end.

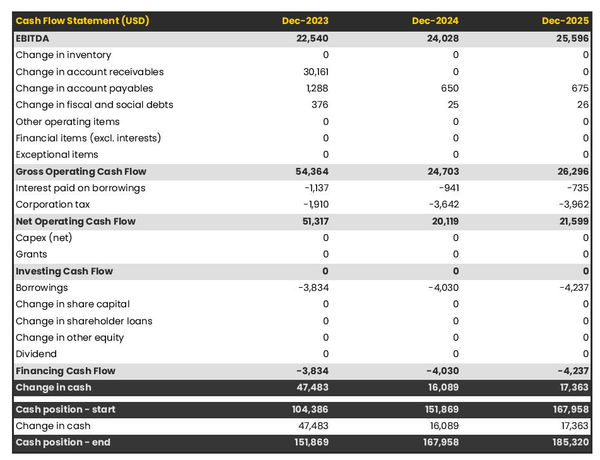

The cash flow forecast

A projected cash flow statement for a farm equipment rental company is used to show how much cash the business is expected to consume or generate in the years to come.

Which solution should you use to make a financial forecast for your farm equipment rental company?

The easiest and safest way to create your farm equipment rental company forecasts is to use an online financial forecasting software , like the one we offer at The Business Plan Shop.

There are several advantages to using professional software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You have access to complete financial forecast templates

- You get a complete financial forecast ready to be sent to your bank or investors

- The software helps you identify and correct any inconsistencies in your figures

- You can create scenarios to stress-test your forecast's main assumptions to stress-test the robustness of your business model

- After you start trading, you can easily track your actual financial performance against your financial forecast, and recalibrate your forecast to maintain visibility on your future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you are interested in this type of solution, you can try our forecasting software for free by signing up here .

Choose a name and register your farm equipment rental company

The next phase in launching your farm equipment rental company involves selecting a name for your company.

This stage is trickier than it seems. Finding the name itself is quite fun; the difficulty lies in finding one that is available and being the first to reserve it.

You cannot take a name that is similar to a name already used by a competitor or protected by a registered trademark without inevitably risking legal action.

So you need to find a name that is available, and be able to register it before someone else can.

In addition, you will probably want to use the same name for:

- Your company’s legal name - Example LTD

- Your business trading name - Example

- The trademark - Example ®

- Your company’s domain name - Example.com

The problem is that the procedures for registering these different names are carried out in different places, each with their own deadlines:

- Registering a domain name takes only a few minutes

- Registering a new trademark takes at least 12 weeks (if your application is accepted)

- The time taken to register a new business depends on the country, but it's generally fast

You will therefore be faced with the choice of: either registering everything at once and hoping that your name will be accepted everywhere, or proceeding step by step in order to minimise costs, but taking the risk that someone else will register one of the names you wanted in the meantime.

Our advice is to discuss strategy with your legal counsel (see further down in this guide) and prioritise your domain names and registered trademarks. You'll always have the option of using a trade name that's different from your company's legal name, and that's not a big deal.

To check that the name you want is not already in use, you should consult:

- Your country's business register

- The relevant trademark registers depending on which countries you want to register your trade mark in

- A domain name reservation company such as GoDaddy

- An Internet search engine

In this area too, your legal counsel will be able to help with the research and formalities.

Deciding upon the corporate identity of your farm equipment rental company

The next step in opening a farm equipment rental company is to look at your company's visual identity.

Your company's “visual identity” plays a crucial role in shaping your brand image. It helps you to be recognizable and to stand out from your competitors.

Although you can define your visual identity yourself, it is generally advisable to call on the services of a designer or marketing agency to achieve a professional result.

At a minimum, you will need to define the following elements:

Brand guidelines

Business cards, website theme.

Your farm equipment rental company's logo allows others to quickly identify your company. It will be used on all your communication media (website, social networks, business cards, etc.) and official documents (invoices, contracts, etc.).

In addition to its design, it's important that your logo is available in a variety of colors, so that it can be seen on all media (white, dark background, etc.).

Having brand guidelines enables you to maintain consistency in formatting across all your communications media and official documents.

Brand guidelines define the font (family and size), design and colours used by your brand.

In terms of fonts, for example, you may use Roboto in size 20 for your titles and Lato in size 14 for your texts.

The colours used to represent your brand should generally be limited to five:

- The main colour,

- A secondary colour (the accent),

- A dark background colour (blue or black),

- A grey background colour (to vary from white),

- Possibly another secondary colour.

Designing business cards for your farm equipment rental company is a must, as they will allow you to communicate your contact details to your customers, suppliers, partners, potential recruits, etc.

In principle, they will include your logo and the brand guidelines that we mentioned above.

In the same way, the theme of your farm equipment rental company website will be based on your logo and the brand guidelines we mentioned above.

This involves defining the look and feel of your site's main graphic elements:

Understanding the legal and regulatory steps involved in opening a farm equipment rental company

The next step in opening a farm equipment rental company is to take the necessary legal and regulatory steps.

We recommend that you be accompanied by a law firm for all of the steps outlined below.

Registering a trademark and protecting the intellectual property of your farm equipment rental company

The first step is to protect your company's intellectual property.

As mentioned earlier in this guide, you have the option to register a trademark. Your lawyer can assist you with a thorough search to ensure your chosen trademark is unique and doesn't conflict with existing ones and help select the classes (economic activities) and jurisdictions in which to register your trademark.

Your lawyer will also be able to advise you on other steps you could take to protect your company's other intellectual property assets.

Drafting the contractual documents for your farm equipment rental company

Your farm equipment rental company will rely on a set of contracts and legal documents for day-to-day operations.

Once again, we strongly recommend that you have these documents drawn up by a lawyer.

Your exact needs will depend on the country in which you are launching your farm equipment rental company and the size of the company you are planning.

However, you may wish to consider the following documents at a minimum:

- Employment contracts

- General terms and conditions of sale

- General terms and conditions of use for your website

- Privacy Policy for your website

- Cookie Policy for your website

Applying for licences and permits and registering for various taxes

The licenses and permits needed for your business will depend on the country where you are establishing it. Your lawyer can guide you on the regulations relevant to your activity.

Similarly, your chartered accountant will be able to help you register for taxes and take the necessary steps to comply with the tax authorities.

Writing a business plan for your farm equipment rental company

The next step in opening a farm equipment rental company is to draw up your business plan.

What is a farm equipment rental company's business plan?

A business plan serves as a comprehensive roadmap outlining the objectives, strategies, and key components of your venture.

There are two essential parts to a business plan:

- A numerical part, the financial forecast we mentioned earlier in this guide, which highlights the amount of initial financing needed to launch the business and its potential profitability over the next 3 to 5 years,

- A written part, which presents in detail the project of creating a farm equipment rental company and provides the necessary context to enable the reader of the business plan to judge the relevance and coherence of the figures included in the forecast.

Your business plan helps guide decision-making by showcasing your vision and financial potential in a coherent manner.

Your business plan will also be essential when you're looking for financing, as your financial partners will ask you for it when deciding whether or not to finance your project to open a farm equipment rental company. So it's best to produce a professional, reliable, and error-free business plan.

In essence, your business plan is the blueprint to turn your idea into a successful reality.

What tool should you use to create your farm equipment rental company business plan?

If you want to write a convincing business plan quickly and efficiently, a good solution is to use an online business plan software for business start-ups like the one we offer at The Business Plan Shop.

Using The Business Plan Shop to create a business plan for a farm equipment rental company has several advantages :

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete startup business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can create scenarios to stress test your forecast's main assumptions

- You can easily track your actual financial performance against your financial forecast by importing accounting data

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

If you're interested in using our solution, you can try The Business Plan Shop for free by signing up here .

Once your business plan has been drafted, you’ll need to think about how you might secure the financing necessary to open your farm equipment rental company.

The amount of initial financing required will obviously depend on the size of your farm equipment rental company and the country in which you wish to set up.

Businesses have access to two main categories of financing: equity and debt. Let's take a closer look at how they work and what sources are available.

Equity funding

At a high level, the equity of your farm equipment rental company will consist of the money that founders and potential investors will invest to launch the company.

Equity is indispensable as it provides the company with a source of long-term (often permanent) financing and demonstrates the founders' conviction in the company's chances of success, since their investments would be lost in the event of bankruptcy.

Equity investors can generate a return on their investment through dividends (which can only be paid out if the company is profitable) or capital gains on the resale of their shares (if the company is attractive enough to attract a buyer).

As you can see, the equity investors' position is extremely risky, since their capital is at risk and can be lost in the event of bankruptcy, and the company must be profitable or resellable before they can hope to generate a return on their investment.

On the other hand, the return on investment that equity investors can expect to generate by investing in a farm equipment rental company can be very substantial if the company is successful.

This is why equity investors look for start-up ideas with very high growth or profitability potential, in order to offset their risk with a high potential return on investment.

In technical terms, equity includes:

- Share capital and premiums: which represent the amount invested by the shareholders. This capital is considered permanent as it is non-refundable. In return for their investment, shareholders receive shares that entitle them to information, decision-making power (voting in general assembly), and the potential to receive a portion of any dividends distributed by the company.

- Director loans: these are examples of non-permanent capital advanced to the company by the shareholders. This is a more flexible way of injecting some liquidity into your company than doing so as you can repay director loans at any time.

- Reserves: these represent the share of profits set aside to strengthen the company's equity. Allocating a percentage of your profits to the reserves can be mandatory in certain cases (legal or statutory requirement depending on the legal form of your company). Once allocated in reserves, these profits can no longer be distributed as dividends.

- Investment grants: these represent any non-refundable amounts received by the company to help it invest in long-term assets.

- Other equity: which includes the equity items which don't fit in the other categories. Mostly convertible or derivative instruments. For a small business, it is likely that you won't have any other equity items.

The main sources of equity are as follows:

- Money put into the business from the founders' personal savings.

- Money invested by private individuals, which can include business angels, friends, and family members.

- Funds raised through crowdfunding, which can take the form of either equity or donations (often in exchange for a reward).

- Government support to start-ups, for example, loans on favourable terms to help founders build up their start-up capital.

Debt funding

The other way to finance your farm equipment rental company is to borrow. From a financial point of view, the risk/return profile of debt is the opposite of that of equity: lenders' return on investment is guaranteed, but limited.

When it borrows, your company makes a contractual commitment to pay the lenders by interest, and to repay the capital borrowed according to a pre-agreed schedule.

As you can see, the lenders' return on investment is independent of whether or not the company is profitable. In fact, the only risk taken by lenders is the risk of the company going bankrupt.

To avoid this risk, lenders are very cautious, only agreeing to finance when they are convinced that the borrowing company will be able to repay them without problems.

From the point of view of the company and its stakeholders (workforce, customers, suppliers, etc.), debt increases the risk of the venture, since the company is committed to repaying the capital whether or not it is profitable. So there's a certain distrust towards heavily indebted companies.

Companies borrow in two ways:

- Against their assets: this is the most common way of borrowing. The bank finances a percentage of the price of an asset (a vehicle or a building, for example) and takes the asset as collateral. If the company cannot repay, the bank seizes the asset and sells it to limit its losses.

- Against their future cash flows: the bank reviews the company's financial forecast to estimate how much the company can comfortably borrow and repay, and what terms (amount, interest rate, term, etc.) the bank is prepared to offer given the credit risk posed by the company.

When creating a farm equipment rental company, the first option is often the only one available, as lenders are often reluctant to lend on the basis of future cash flows to a structure that has no track record.

The type of assets that can be financed using the first method is also limited. Lenders will want to be sure that they can dispose of foreclosed assets if needed, so they need to be assets that have an established second-hand market.

That being said, terms and conditions also depend on the lender: some banks are prepared to finance riskier projects, and not all have the same view of your company's credit risk. It also depends on the collateral you can offer to reduce risk, and on your relationship with the bank.

In terms of possible sources of borrowing, the main sources here are banks and credit institutions.